Early Redemption of Notes

Each series, class and tranche of notes will be subject to mandatory redemption on its expected principal payment date, which will generally be 24 months before its legal maturity date; provided that, with respect to outstanding Class A notes issued prior to the Class A(2023-1) notes, the expected principal payment date is 29 months before the legal maturity date for such notes. In addition, if any other early redemption event occurs, the issuing entity will be required to redeem each series, class or tranche of the affected notes [, including the Class [•](20[•]‑[•]) notes offered hereby,] before the expected principal payment date of that series, class or tranche of notes; however, for any such affected notes with the benefit of a derivative agreement [, including the Class [•](20[•]‑[•]) notes], and subject to certain exceptions, such redemption will not occur earlier than such notes’ expected principal payment date. The issuing entity will give notice to holders of the affected notes before an early redemption date. See “The Indenture—Early Redemption Events” for a description of the early redemption events and their consequences to noteholders. See “Prospectus Summary—Early Redemption of Notes” for a description of the early redemption events relating to the Class [•](20[•]‑[•]) notes.

Whenever the issuing entity redeems a series, class or tranche of notes, it will do so only to the extent of Available Funds and Available Principal Amounts allocated to that series, class or tranche of notes, and only to the extent that the notes to be redeemed are not required to provide required subordination for senior notes. A noteholder will have no claim against the issuing entity if the issuing entity fails to make a required redemption of notes before the legal maturity date because no funds are available for that purpose or because the notes to be redeemed are required to provide subordination for senior notes. The failure to redeem before the legal maturity date under these circumstances will not be an event of default.

If determined at the time of issuance, the transferor, so long as it is an affiliate of the servicer, may direct the issuing entity to redeem the notes of any series, class or tranche before its expected principal payment date. In connection with the issuance of any notes, the issuing entity will determine at what times and under what conditions the issuing entity may exercise that right of redemption and if the redemption may be made in whole or in part, as well as other terms of the redemption. The issuing entity will give notice to holders of the affected notes before any optional redemption date. Other than as described in “Prospectus Summary—Optional Redemption by the Issuing Entity,” the Class [•](20[•]‑[•]) notes may not be redeemed at the option of the transferor before their expected principal payment date.

Issuances of New Series, Classes and Tranches of Notes

The issuing entity may issue new notes of any series, class or tranche only if the conditions of issuance are met (or waived as described below). These conditions include:

| • | first, on or before the third Business Day before a new issuance of notes, the issuing entity gives the indenture trustee[, the calculation agent] and the rating agencies written notice of the issuance; |

| • | second, on or prior to the date that the new issuance is to occur, the issuing entity delivers to the indenture trustee and each rating agency a certificate to the effect that: |

—the issuing entity reasonably believes that the new issuance will not at the time of its occurrence or at a future date (i) cause an early redemption event or event of default, (ii) adversely affect the amount of funds available to be distributed to noteholders of any series, class or tranche of notes or the timing of such distributions, or (iii) adversely affect the security interest of the indenture trustee in the collateral securing the outstanding notes;

—all instruments furnished to the indenture trustee conform to the requirements of the indenture and constitute sufficient authority under the indenture for the indenture trustee to authenticate and deliver the notes;

—the form and terms of the notes have been established in conformity with the provisions of the indenture;

—all laws and requirements relating to the execution and delivery by the issuing entity of the notes have been complied with, the issuing entity has the power and authority to issue the notes, and the notes have been duly authorized and delivered by the issuing entity, and, assuming due authentication and delivery by the indenture trustee, constitute legal, valid and binding obligations of the issuing entity enforceable in accordance with their terms (subject to certain limitations and conditions), and are entitled to the benefits of the indenture equally and ratably with all other notes, if any, of such series, class or tranche outstanding subject to the terms of the indenture, each indenture supplement and each terms document; and

—the issuing entity shall have satisfied such other matters as the indenture trustee may reasonably request;

| • | third, the issuing entity delivers to the indenture trustee and the rating agencies an opinion of counsel that for federal income tax purposes (i) the new issuance will not adversely affect the tax characterization as debt of any outstanding series or class of investor certificates issued by master trust II that were characterized as debt at the time of their issuance, (ii) following the new issuance, master trust II will not be treated as an association, or a publicly traded partnership, taxable as a corporation, and (iii) the new issuance will not cause or constitute an event in which gain or loss would be recognized by any holder of an investor certificate issued by master trust II; |

| • | fourth, the issuing entity delivers to the indenture trustee and the rating agencies an opinion of counsel that for federal income tax purposes (i) the new issuance will not adversely affect the tax characterization as debt of any outstanding series, class or tranche of notes that were characterized as debt at the time of their issuance, (ii) following the new issuance, the issuing entity will not be treated as an association, or publicly traded partnership, taxable as a corporation, (iii) such issuance will not cause or constitute an event in which gain or loss would be recognized by any holder of such outstanding notes, and (iv) except as provided in the related indenture supplement, following the new issuance of a series, class or tranche of notes, the newly issued series, class or tranche of notes will be properly characterized as debt; |

| • | fifth, the issuing entity delivers to the indenture trustee [and the calculation agent] an indenture supplement and terms document relating to the applicable series, class or tranche of notes; |

| • | sixth, no Pay Out Event with respect to Series 2001‑D has occurred or is continuing as of the date of the new issuance; |

| • | seventh, in the case of foreign currency notes, the issuing entity appoints one or more paying agents in the appropriate countries; |

| • | eighth, each rating agency that has rated any outstanding notes has provided confirmation that the new issuance of notes will not cause a reduction, qualification or withdrawal of the ratings of any outstanding notes rated by that rating agency; and |

| • | ninth, the provisions governing required subordinated amounts are satisfied [;and] |

| • | [describe any additional conditions, as applicable]. |

If the issuing entity obtains confirmation from each rating agency that has rated any outstanding notes that the issuance of a new series, class or tranche of notes will not cause a reduction, qualification or withdrawal of the ratings of any outstanding notes rated by that rating agency, then any of the conditions described above (other than the third, fourth and fifth conditions) may be waived.

The issuing entity[, the calculation agent] and the indenture trustee are not required to provide prior notice to, permit any prior review by, or obtain the consent of any noteholder of any series, class or tranche to issue any additional notes of any series, class or tranche.

There are no restrictions on the timing or amount of any additional issuance of notes of an outstanding tranche of a multiple tranche series, so long as the conditions described above are met or waived. As of the date of any additional issuance of an outstanding tranche of notes, the stated principal amount, outstanding dollar principal amount and nominal liquidation amount of that tranche will be increased to reflect the principal amount of the additional notes. If the additional notes are a tranche of notes that has the benefit of a derivative agreement, the issuing entity will enter into a derivative agreement for the benefit of the additional notes. The targeted deposits, if any, to the principal funding subaccount will be increased proportionately to reflect the principal amount of the additional notes.

The issuing entity may from time to time, without notice to, or the consent of, the registered holders of a series, class or tranche of notes, create and issue additional notes equal in rank to the previously issued series, class or tranche of notes in all respects—or in all respects except for the payment of interest accruing prior to the issue date of the further series, class or tranche of notes or the first payment of interest following the issue date of the further series, class or tranche of notes. These further series, classes or tranches of notes may be consolidated and form a single series, class or tranche with the previously issued notes and will have the same terms as to status, redemption or otherwise as the previously issued series, class or tranche of notes.

BANA or an affiliate may retain notes of a series, class or tranche upon initial issuance or upon a reopening of a series, class or tranche of notes and may sell them on a subsequent date. In addition, BANA or an affiliate may acquire notes of a series, class or tranche at any time following the initial issuance or reopening of a series, class or tranche of notes.

When issued, the additional notes of a tranche will be identical in all material respects to the other outstanding notes of that tranche and equally and ratably entitled to the benefits of the indenture and the related indenture supplement applicable to such notes as the other outstanding notes of that tranche without preference, priority or distinction.

New Issuances of BAseries Notes

The issuing entity may issue new classes and tranches of BAseries notes (including additional notes of an outstanding tranche or class), so long as:

| • | the conditions to issuance listed above are satisfied; |

| • | any increase in the targeted deposit amount of any Class C reserve subaccount caused by such issuance will have been funded on or prior to such issuance date; and |

| • | in the case of Class A or Class B BAseries notes, the required subordinated amount is available at the time of its issuance. |

See “—Required Subordinated Amount” above and “Sources of Funds to Pay the Notes—Deposit and Application of Funds for the BAseries—Targeted Deposits to the Class C Reserve Account.”

The issuing entity and the indenture trustee are not required to provide prior notice to or obtain the consent of any noteholder of any series, class or tranche to issue any additional BAseries notes.

Payments on Notes; Paying Agent

The Class [•](20[•]‑[•]) notes offered by this prospectus will be delivered in book‑entry form and payments of principal of and interest on the notes will be made in U.S. dollars as described under “—Book‑Entry Notes” below unless the stated principal amount of the notes is denominated in a foreign currency.

The issuing entity, the indenture trustee[, the calculation agent] and any agent of the issuing entity or the indenture trustee will treat the registered holder of any note as the absolute owner of that note, whether or not the note is overdue and notwithstanding any notice to the contrary, for the purpose of making payment and for all other purposes.

The issuing entity will make payments on a note to the registered holder of the note at the close of business on the record date established for the related payment date.

The issuing entity will designate the corporate trust office of The Bank of New York Mellon in New York City as its paying agent for the notes of each series. The issuing entity will identify any other entities appointed to serve as paying agents on notes of a series, class or tranche. The issuing entity may at any time designate additional paying agents or rescind the designation of any paying agent or approve a change in the office through which any paying agent acts. However, the issuing entity will be required to maintain an office, agency or paying agent in each place of payment for a series, class or tranche of notes.

After notice by publication, all funds paid to a paying agent for the payment of the principal of or interest on any note of any series which remains unclaimed at the end of two years after the principal or interest becomes due and payable will be paid to the issuing entity. After funds are paid to the issuing entity, the holder of that note may look only to the issuing entity for payment of that principal or interest.

The Class [•](20[•]‑[•]) notes offered by this prospectus will be issued in denominations of $5,000 and multiples of $1,000 in excess of that amount.

The record date for payment of the notes, including the Class [•](20[•]‑[•]) notes, will be the last day of the month before the related payment date.

The laws of the State of Delaware will govern the notes, including the Class [•](20[•]‑[•]) notes, and the indenture.

Form, Exchange and Registration and Transfer of Notes

The Class [•](20[•]‑[•]) notes offered by this prospectus will be issued in registered form. The notes will be represented by one or more global notes registered in the name of The Depository Trust Company, as depository, or its nominee. We refer to each beneficial interest in a global note as a “book‑entry note.” For a description of the special provisions that apply to book‑entry notes, see “—Book‑Entry Notes” below.

A holder of notes may exchange those notes for other notes of the same class or tranche of any authorized denominations and of the same aggregate stated principal amount, expected principal payment date and legal maturity date, and of like terms.

Any holder of a note may present that note for registration of transfer, with the form of transfer properly executed, at the office of the note registrar or at the office of any transfer agent that the issuing entity designates. Unless otherwise provided in the note to be transferred or exchanged, holders of notes will not be charged any service charge for the exchange or transfer of their notes. Holders of notes that are to be transferred or exchanged will be liable for the payment of any taxes and other governmental charges described in the indenture before the transfer or exchange will be completed. The note registrar or transfer agent, as the case may be, will effect a transfer or exchange when it is satisfied with the documents of title and identity of the person making the request.

The issuing entity will appoint The Bank of New York Mellon as the registrar for the notes. The issuing entity also may at any time designate additional transfer agents for any series, class or tranche of notes. The issuing entity may at any time rescind the designation of any transfer agent or approve a change in the location through which any transfer agent acts. However, the issuing entity will be required to maintain a transfer agent in each place of payment for a series, class or tranche of notes.

The Class [•](20[•]‑[•]) notes offered by this prospectus will be delivered in book‑entry form. This means that, except under the limited circumstances described below under “—Definitive Notes,” purchasers of notes will not be entitled to have the notes registered in their names and will not be entitled to receive physical delivery of the notes in definitive paper form. Instead, upon issuance, all the notes of a class will be represented by one or more fully registered permanent global notes, without interest coupons.

Each global note will be deposited with a securities depository named The Depository Trust Company and will be registered in the name of its nominee, Cede & Co. No global note representing book‑entry notes may be transferred except as a whole by DTC to a nominee of DTC, or by a nominee of DTC to another nominee of DTC. Thus, DTC or its nominee will be the only registered holder of the notes and will be considered the sole representative of the beneficial owners of notes for purposes of the indenture.

The registration of the global notes in the name of Cede & Co. will not affect beneficial ownership and is performed merely to facilitate subsequent transfers. The book‑entry system, which is also the system through which most publicly traded common stock is held, is used because it eliminates

the need for physical movement of securities. The laws of some jurisdictions, however, may require some purchasers to take physical delivery of their notes in definitive form. These laws may impair the ability to own or transfer book‑entry notes.

Purchasers of notes in the United States may hold interests in the global notes through DTC, either directly, if they are participants in that system—such as a bank, brokerage house or other institution that maintains securities accounts for customers with DTC or its nominee—or otherwise indirectly through a participant in DTC. Purchasers of notes in Europe may hold interests in the global notes [through Clearstream Banking, or through Euroclear Bank S.A./N.V., as operator of the Euroclear system].

Because DTC will be the only registered owner of the global notes, [Clearstream Banking and Euroclear] will hold positions through their respective U.S. depositories, which in turn will hold positions on the books of DTC.

As long as the notes are in book‑entry form, they will be evidenced solely by entries on the books of DTC, its participants and any indirect participants. DTC will maintain records showing:

| • | the ownership interests of its participants, including the U.S. depositories; and |

| • | all transfers of ownership interests between its participants. |

The participants and indirect participants, in turn, will maintain records showing:

| • | the ownership interests of their customers, including indirect participants, that hold the notes through those participants; and |

| • | all transfers between these persons. |

Thus, each beneficial owner of a book‑entry note will hold its note indirectly through a hierarchy of intermediaries, with DTC at the “top” and the beneficial owner’s own securities intermediary at the “bottom.”

The issuing entity, the indenture trustee and their agents will not be liable for the accuracy of, and are not responsible for maintaining, supervising or reviewing DTC’s records or any participant’s records relating to book‑entry notes. The issuing entity, the indenture trustee and their agents also will not be responsible or liable for payments made on account of the book‑entry notes.

Until Definitive Notes are issued to the beneficial owners as described below under “—Definitive Notes,” all references to “holders” of notes means DTC. The issuing entity, the indenture trustee and any paying agent, transfer agent or securities registrar may treat DTC as the absolute owner of the notes for all purposes.

For beneficial owners of book‑entry notes, the issuing entity will make all distributions of principal and interest on their notes to DTC and will send all required reports and notices solely to DTC as long as DTC is the registered holder of the notes. DTC and the participants are generally required by law to receive and transmit all distributions, notices and directions from the indenture trustee to the beneficial owners through the chain of intermediaries.

Similarly, the indenture trustee will accept notices and directions solely from DTC. Therefore, in order to exercise any rights of a holder of notes under the indenture, each person owning a beneficial

interest in the notes must rely on the procedures of DTC and, in some cases, [Clearstream Banking or Euroclear]. If the beneficial owner is not a participant in that system, then it must rely on the procedures of the participant through which that person owns its interest. DTC has advised the issuing entity that it will take actions under the indenture only at the direction of its participants, which in turn will act only at the direction of the beneficial owners. Some of these actions, however, may conflict with actions it takes at the direction of other participants and beneficial owners.

Notices and other communications by DTC to participants, by participants to indirect participants, and by participants and indirect participants to beneficial owners will be governed by arrangements among them.

Book‑entry notes may be more difficult to pledge by beneficial owners because of the lack of a physical note. Beneficial owners may also experience delays in receiving distributions on their notes since distributions will initially be made to DTC and must be transferred through the chain of intermediaries to the beneficial owner’s account.

The Depository Trust Company

DTC is a limited‑purpose trust company organized under the New York Banking Law and is a “banking organization” within the meaning of the New York Banking Law. DTC is also a member of the Federal Reserve System, a “clearing corporation” within the meaning of the New York Uniform Commercial Code, and a “clearing agency” registered under Section 17A of the Securities Exchange Act of 1934. DTC was created to hold securities deposited by its participants and to facilitate the clearing and settlement of securities transactions among its participants through electronic book‑entry changes in accounts of the participants, thus eliminating the need for physical movement of securities. DTC is a wholly‑owned subsidiary of The Depository Trust & Clearing Corporation (“DTCC”). DTCC is the holding company for DTC, National Securities Clearing Corporation and Fixed Income Clearing Corporation, all of which are registered clearing agencies. DTCC is owned by the users of its regulated subsidiaries. The rules applicable to DTC and its participants are on file with the SEC.

[Clearstream Banking S.A. is registered as a bank in Luxembourg and is subject to regulation by the Luxembourg Commission for the Supervision of the Financial Sector and the Banque Centrale du Luxembourg, the Luxembourg Central Bank, which supervise Luxembourg banks. Clearstream Banking is a wholly‑owned subsidiary of Deutsche Börse AG. Clearstream Banking holds securities for its customers and facilitates the clearing and settlement of securities transactions by electronic book‑entry transfers between their accounts. Clearstream Banking provides various services, including safekeeping, administration, clearing and settlement of internationally traded securities and securities lending and borrowing. [Clearstream Banking has established an electronic bridge with Euroclear Bank S.A./N.V. as the operator of the Euroclear system in Brussels to facilitate settlement of trades between Clearstream Banking and Euroclear.] Over 300,000 domestic and internationally traded bonds, equities, and investment funds are currently deposited with Clearstream Banking.

Clearstream Banking’s customers are worldwide financial institutions including underwriters, securities brokers and dealers, banks, trust companies and clearing corporations. Clearstream Banking’s U.S. customers are limited to securities brokers and dealers and banks. Currently, Clearstream Banking has approximately 2,500 customers located in over 110 countries, including all major European countries, Canada, and the United States. Indirect access to Clearstream Banking is available to other institutions that clear through or maintain a custodial relationship with an account holder of Clearstream Banking.]

[Euroclear]

[Euroclear was created in 1968 to hold securities for participants of Euroclear and to clear and settle transactions between Euroclear participants through simultaneous electronic book entry delivery against payment. This system eliminates the need for physical movement of securities and any risk from lack of simultaneous transfers of securities and cash. Euroclear includes various other services, including securities lending and borrowing and interfaces with domestic markets in several countries. The Euroclear system is operated by Euroclear Bank S.A./N.V. as the Euroclear operator. The Euroclear operator conducts all operations. All Euroclear securities clearance accounts and Euroclear cash accounts are accounts with the Euroclear operator. Euroclear participants include banks, including central banks, securities brokers and dealers and other professional financial intermediaries and may include the underwriters. Indirect access to Euroclear is also available to other firms that clear through or maintain a custodial relationship with a Euroclear participant, either directly or indirectly.

Securities clearance accounts and cash accounts with the Euroclear operator are governed by the Terms and Conditions Governing Use of Euroclear and the related Operating Procedures of the Euroclear system (the “Terms and Conditions”), and applicable Belgian law. These Terms and Conditions govern transfers of securities and cash within Euroclear, withdrawals of securities and cash from Euroclear, and receipts of payments for securities in Euroclear. All securities in Euroclear are held on a fungible basis without attribution of specific securities to specific securities clearance accounts. The Euroclear operator acts under the Terms and Conditions only on behalf of Euroclear participants, and has no record of or relationship with persons holding through Euroclear participants.

This information about DTC, [and Clearstream Banking and Euroclear] has been compiled from public sources for informational purposes only and is not intended to serve as a representation, warranty or contract modification of any kind.]

Distributions on Book‑Entry Notes

The issuing entity will make distributions of principal and interest on book‑entry notes to DTC. These payments will be made in immediately available funds by the issuing entity’s paying agent, The Bank of New York Mellon, at the office of the paying agent in New York City that the issuing entity designates for that purpose.

In the case of principal payments, the global notes must be presented to the paying agent in time for the paying agent to make those payments in immediately available funds in accordance with its normal payment procedures.

Upon receipt of any payment of principal of or interest on a global note, DTC will immediately credit the accounts of its participants on its book‑entry registration and transfer system. DTC will credit those accounts with payments in amounts proportionate to the participants’ respective beneficial interests in the stated principal amount of the global note as shown on the records of DTC. Payments by participants to beneficial owners of book‑entry notes will be governed by standing instructions and customary practices, as is now the case with securities held for the accounts of customers in bearer form or registered in “street name,” and will be the responsibility of those participants.

[Distributions on book‑entry notes held beneficially through Clearstream Banking will be credited to cash accounts of Clearstream Banking participants in accordance with its rules and procedures, to the extent received by its U.S. depository.

Distributions on book entry notes held beneficially through Euroclear will be credited to the cash accounts of Euroclear participants in accordance with the Terms and Conditions, to the extent received by its U.S. depository.]

In the event Definitive Notes are issued, distributions of principal and interest on Definitive Notes will be made directly to the holders of the Definitive Notes in whose names the Definitive Notes were registered at the close of business on the related record date.

Global Clearing and Settlement Procedures

Initial settlement for the notes will be made in immediately available funds. Secondary market trading between DTC participants will occur in the ordinary way in accordance with DTC’s rules and will be settled in immediately available funds using DTC’s Same‑Day Funds Settlement System. Secondary market trading between [Clearstream Banking participants and/or Euroclear participants] will occur in the ordinary way in accordance with the applicable rules and operating procedures of [Clearstream Banking and Euroclear] and will be settled using the procedures applicable to conventional eurobonds in immediately available funds.

Cross‑market transfers between persons holding directly or indirectly through DTC, on the one hand, and directly or indirectly through [Clearstream Banking or Euroclear participants], on the other, will be effected in DTC in accordance with DTC’s rules on behalf of the relevant European international clearing system by the U.S. depositories. However, cross‑market transactions of this type will require delivery of instructions to the relevant European international clearing system by the counterparty in that system in accordance with its rules and procedures and within its established deadlines, European time. The relevant European international clearing system will, if the transaction meets its settlement requirements, deliver instructions to its U.S. depository to take action to effect final settlement on its behalf by delivering or receiving notes in DTC, and making or receiving payment in accordance with normal procedures for same‑day funds settlement applicable to DTC. [Clearstream Banking participants and Euroclear participants] may not deliver instructions directly to DTC.

Because of time‑zone differences, credits to notes received in [Clearstream Banking or Euroclear] as a result of a transaction with a DTC participant will be made during subsequent securities settlement processing and will be credited the business day following a DTC settlement date. The credits to or any transactions in the notes settled during processing will be reported to the relevant [Euroclear or Clearstream Banking participants] on that business day. Cash received in [Clearstream Banking or Euroclear] as a result of sales of notes by or through a [Clearstream Banking participant or a Euroclear participant] to a DTC participant will be received with value on the DTC settlement date, but will be available in the relevant [Clearstream Banking or Euroclear] cash account only as of the business day following settlement in DTC.

Although DTC[, and Clearstream Banking and Euroclear] have agreed to these procedures in order to facilitate transfers of notes among participants of DTC[, and Clearstream Banking and Euroclear], they are under no obligation to perform or continue to perform these procedures and these procedures may be discontinued at any time.

Beneficial owners of book‑entry notes may exchange those notes for Definitive Notes registered in their name only if:

| • | DTC is unwilling or unable to continue as depository for the global notes or ceases to be a registered “clearing agency” and the issuing entity is unable to find a qualified replacement for DTC; |

| • | the issuing entity, in its sole discretion, elects to terminate the book‑entry system through DTC; or |

| • | any event of default has occurred relating to those book‑entry notes and beneficial owners evidencing not less than 50% of the unpaid outstanding dollar principal amount of the notes of that class advise the indenture trustee and DTC that the continuation of a book‑entry system is no longer in the best interests of those beneficial owners. |

If any of these three events occurs, DTC is required to notify the beneficial owners through the chain of intermediaries that the Definitive Notes are available. The appropriate global note will then be exchangeable in whole for Definitive Notes in registered form of like tenor and of an equal aggregate stated principal amount, in specified denominations. Definitive Notes will be registered in the name or names of the person or persons specified by DTC in a written instruction to the registrar of the notes. DTC may base its written instruction upon directions it receives from its participants. Thereafter, the holders of the Definitive Notes will be recognized as the “holders” of the notes under the indenture.

The issuing entity will replace at the expense of the holder any mutilated note upon surrender of that note to the indenture trustee. The issuing entity will replace at the expense of the holder any notes that are destroyed, lost or stolen upon delivery to the indenture trustee of evidence of the destruction, loss or theft of those notes satisfactory to the issuing entity and the indenture trustee. In the case of a destroyed, lost or stolen note, the issuing entity and the indenture trustee may require the holder of the note to provide an indemnity satisfactory to the indenture trustee and the issuing entity before a replacement note will be issued, and the issuing entity may require the payment of a sum sufficient to cover any tax or other governmental charge, and any other expenses (including the fees and expenses of the indenture trustee) in connection with the issuance of a replacement note.

Sources of Funds to Pay the Notes

The Collateral Certificate

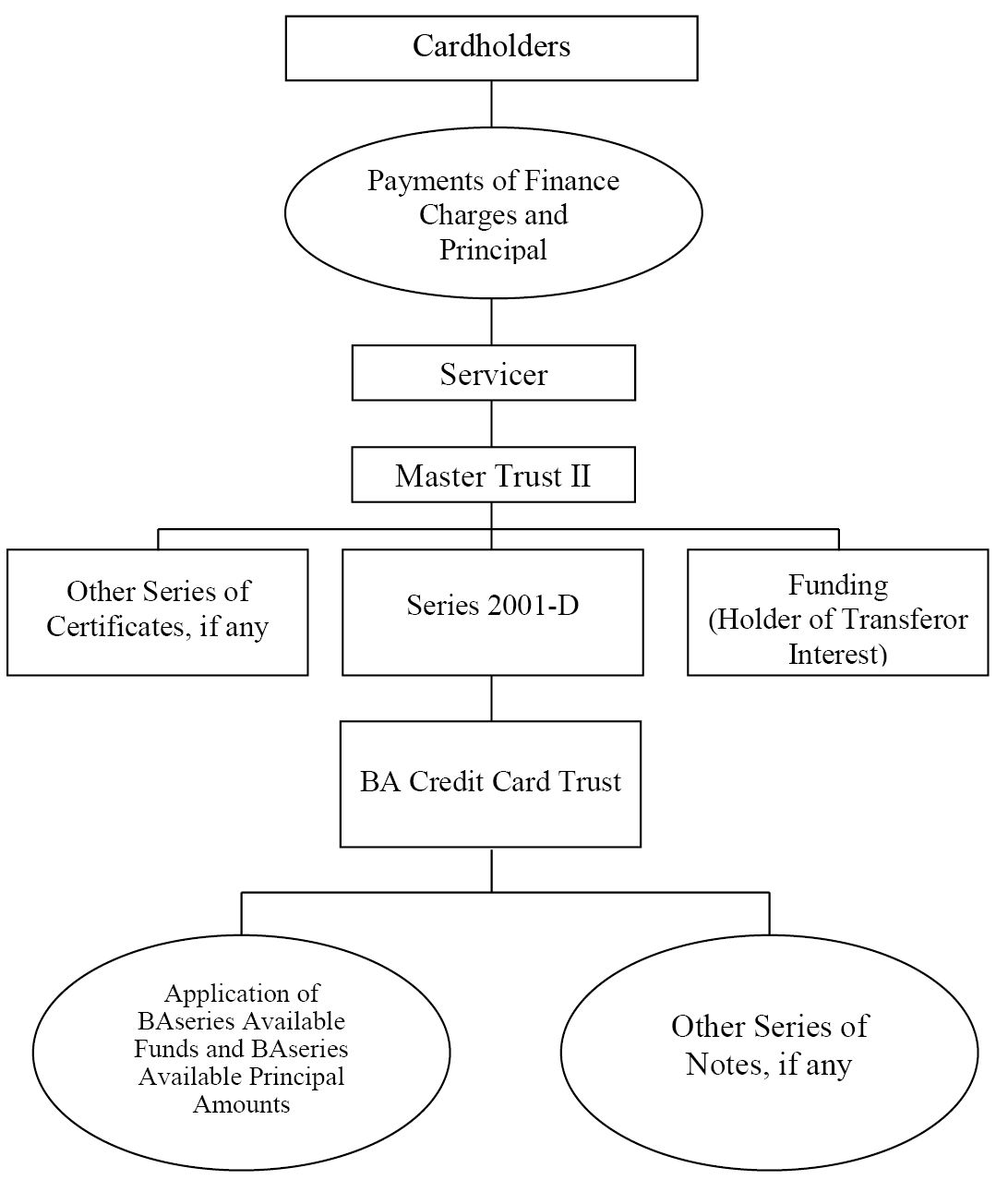

The primary source of funds for the payment of principal of and interest on the notes, including the Class [•](20[•]‑[•]) notes, will be the collateral certificate issued by master trust II to the issuing entity. The following discussion summarizes the material terms of the collateral certificate. For a description of master trust II and its assets, see “Master Trust II.” Currently, the collateral certificate and the Class D certificate are the only master trust II investor certificates issued and outstanding. Aside from Funding, as the holder of the Transferor Interest and the Class D certificate, the issuing entity is the only holder of an interest in master trust II. Holders of investor certificates in master trust II, whether currently outstanding or issued on a later date, will be allocated funds as described under “Master Trust II—Application of Collections.”

The collateral certificate represents an undivided interest in master trust II. The assets of master trust II consist primarily of credit card receivables arising in selected Mastercard and Visa revolving credit card accounts owned by BANA. The amount of credit card receivables in master trust II will fluctuate from day to day as new receivables are generated or added to or removed from master trust II and as other receivables are collected, charged off as uncollectible, or otherwise adjusted.

The collateral certificate has no specified interest rate. The issuing entity, as holder of the collateral certificate, is entitled to receive its allocable share of uncovered Investor Default Amounts and of collections of finance charge receivables and principal receivables payable by master trust II.

Finance charge receivables are all periodic finance charges, cash advance fees and late charges on amounts charged for merchandise and services and some other fees designated by BANA, annual membership fees, recoveries on receivables in Defaulted Accounts, and discount option receivables. Principal receivables are all amounts charged by cardholders for merchandise and services and amounts advanced to cardholders as cash advances. Interchange, which represents fees received by BANA from acquiring banks as partial reimbursement for the activities BANA performs, including but not limited to enabling credit card transactions, funding receivables for a limited period prior to initial billing, absorbing fraud losses and delivering network and card benefits to merchants and consumers, is treated as collections of finance charge receivables. Interchange typically varies from approximately 1% to 3% of the transaction amount, but default interchange rates may be changed by Mastercard or Visa.

Each month, master trust II will allocate collections of finance charge receivables and principal receivables and defaults to the investor certificates outstanding under master trust II, including Series 2001‑D.

Allocations of defaults and collections of finance charge receivables are made pro rata among each series of investor certificates issued by master trust II, including Series 2001‑D, based on its respective Investor Interest, and Funding, as transferor, based on the Transferor Interest. In general, the Investor Interest of each series of investor certificates (including Series 2001‑D) issued by master trust II will equal the stated dollar amount of the investor certificates (including Series 2001‑D) issued to investors in that series, less unreimbursed charge‑offs for uncovered defaults on principal receivables in master trust II allocated to those investors, reallocations of collections of principal receivables to cover certain shortfalls in collections of finance charge receivables and principal payments deposited to a master trust II principal funding account or made to those investors.

Series 2001‑D has a fluctuating Investor Interest, representing the investment of that series in principal receivables. The Investor Interest of Series 2001‑D equals the total nominal liquidation amount of the outstanding notes secured by the collateral certificate plus the Class D Investor Interest. For a discussion of Investor Interest, see the definition of “Investor Interest” in the glossary. See “Prospectus Summary—BAseries Required Subordinated Amounts and Required Class D Investor Interest,” “The Notes—Required Subordinated Amount—The Class D Certificate,” and the definition of “Class D Investor Interest” in the glossary for a description of how the amount of the Class D Investor Interest is determined. The Transferor Interest, which is owned by Funding, represents the interest in the principal receivables in master trust II not represented by any master trust II series of investor certificates. For example, if the total principal receivables in master trust II at the end of the month is 500, the Investor Interest of Series 2001‑D is 100, the Investor Interests of the other investor certificates are 200 and the Transferor Interest is 200, Series 2001‑D is entitled, in general, to 1/5—or 100/500—of the defaults and collections of finance charge receivables for the applicable month.

Collections of principal receivables are allocated similarly to the allocation of collections of finance charge receivables when no principal amounts are needed for deposit into a principal funding account or needed to pay principal to investors. However, collections of principal receivables are allocated differently when principal amounts need to be deposited into master trust II principal funding accounts or paid to master trust II investors. When the principal amount of a series of certificates other than Series 2001‑D begins to accumulate or amortize, collections of principal receivables continue to be allocated to that series as if the Investor Interest of that series had not been reduced by principal collections deposited to a master trust II principal funding account or paid to master trust II investors.

During this time, allocations of collections of principal receivables to the investors in a series of certificates issued by master trust II, other than Series 2001‑D, is based on the Investor Interest of the series “fixed” at the time immediately before the first deposit of principal collections into a principal funding account or the time immediately before the first payment of principal collections to investors.

As a part of Series 2001‑D, the collateral certificate is allocated collections of principal receivables at all times based on the Series 2001‑D Investor Interest calculation which is an aggregate of the nominal liquidation amounts for each individual class or tranche of notes plus the Class D Investor Interest. For classes and tranches of notes which do not require principal amounts to be deposited into a principal funding account or paid to noteholders, the nominal liquidation amount calculation will be “floating,” i.e., calculated as of the end of the prior month. For classes or tranches of notes which require principal amounts to be deposited into a principal funding account or paid to noteholders, the nominal liquidation amount will be “fixed” immediately before the issuing entity begins to allocate Available Principal Amounts to the principal funding subaccount for that class or tranche, i.e., calculated as of the end of the month prior to any reductions for deposits or payments of principal. Principal amounts allocated in respect of the Class D certificate will be based on the Class D Investor Interest as of the end of the prior month, plus any increases in the required Class D Investor Interest due to additional issuances of notes, and will be used to pay principal or interest amounts in respect of the notes, as described further below under “Master Trust II—The Class D Certificate.”

For a detailed description of the percentage used in allocating finance charge collections and defaults to Series 2001‑D, see the definition of “Floating Investor Percentage” in the glossary. For a detailed description of the percentage used in allocating principal collections to Series 2001‑D, see the definition of “Principal Investor Percentage” in the glossary.

If collections of principal receivables allocated to Series 2001‑D are needed for reallocation to cover certain shortfalls in Available Funds, to pay the notes, or to make a deposit into the issuing entity accounts within a month, they will be deposited into the issuing entity’s collection account. Each of these reallocations, payments and deposits will reduce the Investor Interest of Series 2001‑D. Otherwise, collections of principal receivables allocated to Series 2001‑D will be reallocated to other series of master trust II investor certificates which have principal collection shortfalls—which does not reduce the Investor Interest of Series 2001‑D—or paid to the holder of the Transferor Interest. The holder of the Transferor Interest may then use those amounts to purchase newly created receivables that are then added to master trust II to maintain the Investor Interest of Series 2001‑D. If Series 2001‑D has a shortfall in collections of principal receivables and other series of investor certificates issued by master trust II have excess collections of principal receivables, a portion of the excess collections of principal receivables allocated to other series of investor certificates issued by master trust II will be reallocated to Series 2001‑D and any other master trust II investor certificate which may have a shortfall in collections of principal receivables. Series 2001‑D’s share of the excess collections of principal receivables from the other series will be paid to the issuing entity and treated as Available Principal Amounts.

Series 2001‑D will also be allocated a portion of the net investment earnings, if any, on amounts in the master trust II finance charge account and the master trust II principal account, as more specifically described below in “—Deposit and Application of Funds.” Such net investment earnings will be treated as Available Funds.

Upon a sale of credit card receivables, or interests therein, following an insolvency of Funding, following an event of default and acceleration, or on the applicable legal maturity date for a series, class or tranche of notes, the portion of the nominal liquidation amount, and thereby the portion of the Investor Interest, related to that series, class or tranche will be reduced to zero and that series, class or tranche will no longer receive any allocations of collections of finance charge receivables or principal receivables

from master trust II and any allocations of Available Funds or Available Principal Amounts from the issuing entity.

Following a Pay Out Event with respect to Series 2001‑D, which is an early redemption event for the notes, all collections of principal receivables for any month allocated to the Investor Interest of Series 2001‑D will be used to cover principal payments on the notes.

For a detailed description of the application of collections and allocation of defaults by master trust II, see “Master Trust II—Application of Collections” and “—Defaulted Receivables; Rebates and Fraudulent Charges” in this prospectus.

Deposit and Application of Funds

Collections of finance charge receivables allocated and paid to the issuing entity, as holder of the collateral certificate, as described in “—The Collateral Certificate” above and “Master Trust II—Application of Collections” in this prospectus, will be treated as Available Funds. Those Available Funds will be allocated pro rata to each series of notes in an amount equal to the sum of:

| • | the sum of the Daily Available Funds Amounts for each day during such month for that series of notes, |

| • | that series’s pro rata portion of the net investment earnings, if any, in the master trust II finance charge account that are allocated to Series 2001‑D with respect to the related Transfer Date, based on the ratio of the aggregate amount on deposit in the master trust II finance charge account for that series of notes to the aggregate amount on deposit in the master trust II finance charge account for all series of notes, and |

| • | that series’s pro rata portion of the net investment earnings, if any, in the master trust II principal account that are allocated to Series 2001‑D with respect to the related Transfer Date, based on the ratio of the aggregate amount on deposit in the master trust II principal account for that series of notes to the aggregate amount on deposit in the master trust II principal account for all series of notes. |

Collections of principal receivables allocated and paid to the issuing entity, as holder of the collateral certificate, as described in “—The Collateral Certificate” above and “Master Trust II—Application of Collections” in this prospectus, will be treated as Available Principal Amounts. Such Available Principal Amounts, after any reallocations of Available Principal Amounts, will be allocated to each series of notes with a monthly principal payment for such month in an amount equal to:

| • | such series’s monthly principal payment; or |

| • | in the event that Available Principal Amounts for any month are less than the aggregate monthly principal payments for all series of notes, Available Principal Amounts will be allocated to each series of notes with a monthly principal payment for such month to the extent needed by each such series to cover its monthly principal payment in an amount equal to the lesser of (a) the sum of the Daily Principal Amounts for each day during such month for such series of notes and (b) the monthly principal payment for such series of notes for such month. |

If Available Principal Amounts for any month are less than the aggregate monthly principal payments for all series of notes, and any series of notes has excess Available Principal Amounts

remaining after its application of its allocation described above, then any such excess will be applied to each series of notes to the extent such series still needs to cover a monthly principal payment pro rata based on the ratio of the Weighted Average Principal Allocation Amount for the related series of notes for such month to the Weighted Average Principal Allocation Amount for all series of notes with an unpaid monthly principal payment for such month.

Deposit and Application of Funds for the BAseries

The indenture specifies how Available Funds (primarily consisting of collections of finance charge receivables allocated and paid to the collateral certificateholder) and Available Principal Amounts (primarily consisting of collections of principal receivables allocated and paid to the collateral certificateholder) will be allocated among the multiple series of notes secured by the collateral certificate. The BAseries indenture supplement specifies how BAseries Available Funds (which are the BAseries’s share of Available Funds plus other amounts treated as BAseries Available Funds) and BAseries Available Principal Amounts (which are the BAseries’s share of Available Principal Amounts plus other amounts treated as BAseries Available Principal Amounts) will be deposited into the issuing entity accounts established for the BAseries to provide for the payment of interest on and principal of BAseries notes as payments become due. In addition, the BAseries indenture supplement specifies how Investor Default Amounts and the master trust II servicing fee will be allocated to the collateral certificate and the BAseries. The following sections summarize those provisions.

BAseries Available Funds will consist of the following amounts:

| • | The BAseries’s share of collections of finance charge receivables allocated and paid to the collateral certificateholder and investment earnings on funds held in the collection account. See “—Deposit and Application of Funds” above. |

| • | Withdrawals from the accumulation reserve subaccount. If the number of months targeted to accumulate budgeted deposits of BAseries Available Principal Amounts for the payment of principal on a tranche of notes is greater than one month, then the issuing entity will begin to fund an accumulation reserve subaccount for such tranche. See “—Targeted Deposits of BAseries Available Principal Amounts to the Principal Funding Account” below. The amount targeted to be deposited in the accumulation reserve account for each month, beginning with the third month prior to the first Transfer Date on which BAseries Available Principal Amounts are to be accumulated for such tranche, will be an amount equal to 0.5% of the outstanding dollar principal amount of such tranche of notes. |

| • | On each Transfer Date, the issuing entity will calculate the targeted amount of principal funding subaccount earnings for each tranche of notes, which will be equal to the amount that the funds (other than prefunded amounts) on deposit in each principal funding subaccount would earn at the interest rate payable by the issuing entity—taking into account payments due under applicable derivative agreements—on the related tranche of notes. As a general rule, if the amount actually earned on such funds on deposit is less than the targeted amount of earnings, then the amount of such shortfall will be withdrawn from the applicable accumulation reserve subaccount and treated as BAseries Available Funds for such month. |

| • | Additional finance charge collections allocable to the BAseries. The issuing entity will notify the servicer from time to time of the aggregate prefunded amount on deposit in the principal funding account. Whenever there are any prefunded amounts on deposit in any

|

|

| principal funding subaccount, master trust II will designate an amount of the Transferor Interest equal to such prefunded amounts. On each Transfer Date, the issuing entity will calculate the targeted amount of principal funding subaccount prefunded amount earnings for each tranche of notes, which will be equal to the amount that the prefunded amounts on deposit in each principal funding subaccount would earn at the interest rate payable by the issuing entity—taking into account payments due under applicable derivative agreements—on the related tranche of notes. As a general rule, if the amount actually earned on such funds on deposit is less than the targeted amount of earnings, collections of finance charge receivables allocable to such designated portion of the Transferor Interest up to the amount of the shortfall will be treated as BAseries Available Funds. See “Master Trust II—Application of Collections” in this prospectus. |

| • | Investment earnings on amounts on deposit in the principal funding account, interest funding account, and accumulation reserve account for the BAseries. |

| • | Any shared excess available funds allocable to the BAseries. See “—Shared Excess Available Funds” below. |

| • | Amounts received from derivative counterparties. Payments received under derivative agreements for interest on notes of the BAseries payable in U.S. dollars will be treated as BAseries Available Funds. |

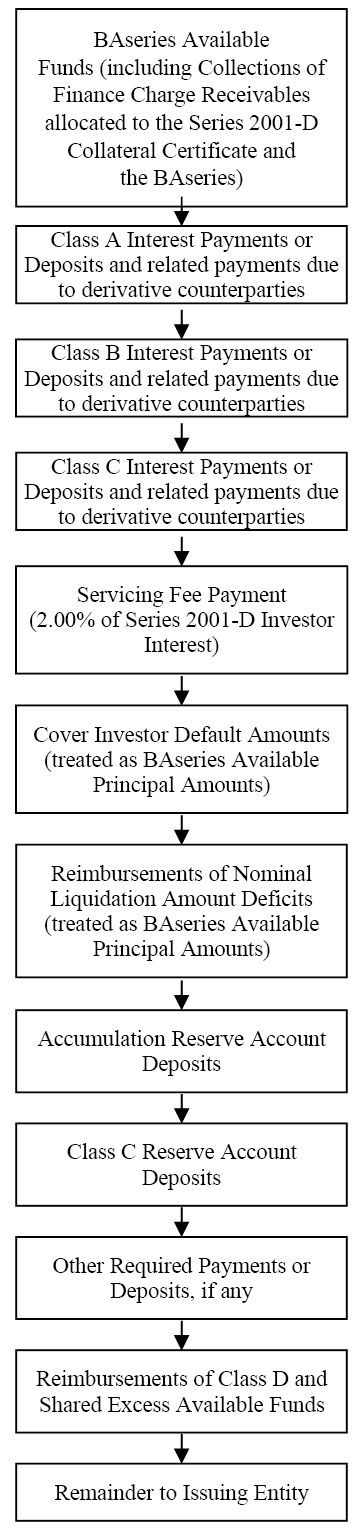

Application of BAseries Available Funds

On each Transfer Date, the indenture trustee will apply BAseries Available Funds as follows:

| • | first, to make the targeted deposits to the interest funding account to fund the payment of interest on the notes and related payments due to derivative counterparties; |

| • | second, to pay the BAseries’s share of the master trust II servicing fee, plus any previously due and unpaid master trust II servicing fee allocable to the BAseries, to the servicer; |

| • | third, to be treated as BAseries Available Principal Amounts in an amount equal to the amount of Investor Default Amounts allocated to the BAseries for the preceding month; |

| • | fourth, to be treated as BAseries Available Principal Amounts in an amount equal to the Nominal Liquidation Amount Deficits, if any, of BAseries notes; |

| • | fifth, to make the targeted deposit to the accumulation reserve account, if any; |

| • | sixth, to make the targeted deposit to the Class C reserve account, if any; |

| • | seventh, to make any other payment or deposit required by any class or tranche of BAseries notes; |

| • | eighth, to be treated as Available Principal Amounts used to reimburse any reductions in the Class D Investor Interest due to Class D Investor Charge‑Offs or reallocations of collections of principal receivables allocable to the Class D certificate to pay interest on the notes or a portion of the master trust II servicing fee allocated to Series 2001‑D; |

| • | ninth, to be treated as shared excess available funds; and |

| • | tenth, to the issuing entity. |

See the chart titled “Application of BAseries Available Funds” after the “Prospectus Summary” for a depiction of the application of BAseries Available Funds.

Targeted Deposits of BAseries Available Funds to the Interest Funding Account

The aggregate deposit targeted to be made each month to the interest funding account will be equal to the sum of the interest funding account deposits targeted to be made for each tranche of notes set forth below. The deposit targeted for any month will also include any shortfall in the targeted deposit from any prior month which has not been previously deposited.

| • | Interest Payments. The deposit targeted for any tranche of outstanding interest‑bearing notes on each Transfer Date will be equal to the amount of interest accrued on the outstanding dollar principal amount of that tranche during the period from and including the first Monthly Interest Accrual Date in the prior month to but excluding the first Monthly Interest Accrual Date for the current month. |

| • | Amounts Owed to Derivative Counterparties. If a tranche of notes has a Performing or non‑Performing derivative agreement for interest that provides for payments to the applicable derivative counterparty, in addition to any applicable stated interest as determined under the item above, the deposit targeted for that tranche of notes on each Transfer Date for any payment to the derivative counterparty will be specified in the BAseries indenture supplement. |

| • | Specified Deposits. If any tranche of notes provides for deposits in addition to or different from the deposits described above to be made to the interest funding subaccount for that tranche, the deposits targeted for that tranche each month are the specified amounts. |

| • | Additional Interest. The deposit targeted for any tranche of notes that has previously due and unpaid interest for any month will include the interest accrued on that overdue interest during the period from and including the first Monthly Interest Accrual Date in the prior month to but excluding the first Monthly Interest Accrual Date for the current month. |

Each deposit to the interest funding account for each month will be made on the Transfer Date in such month. A tranche of notes may be entitled to more than one of the preceding deposits.

A class or tranche of notes for which credit card receivables have been sold by master trust II as described below in “—Sale of Credit Card Receivables” will not be entitled to receive any of the preceding deposits to be made from BAseries Available Funds after the sale has occurred.

Allocation to Interest Funding Subaccounts

The aggregate amount to be deposited in the interest funding account will be allocated, and a portion deposited in the interest funding subaccount established for each tranche of notes, as follows:

| • | BAseries Available Funds are at least equal to targeted amounts. If BAseries Available Funds are at least equal to the sum of the deposits targeted by each tranche of notes as described above, then that targeted amount will be deposited in the interest funding subaccount established for each tranche. |

| • | BAseries Available Funds are less than targeted amounts. If BAseries Available Funds are less than the sum of the deposits targeted by each tranche of notes as described above, then BAseries Available Funds will be allocated to each tranche of notes as follows: |

—first, to cover the deposits for the Class A notes (including any applicable derivative counterparty payments),

—second, to cover the deposits for the Class B notes (including any applicable derivative counterparty payments), and

—third, to cover the deposits for the Class C notes (including any applicable derivative counterparty payments).

In each case, BAseries Available Funds allocated to a class will be allocated to each tranche of notes within such class pro rata based on the ratio of:

—the aggregate amount of the deposits targeted for that tranche of notes, to

—the aggregate amount of the deposits targeted for all tranches of notes in such class.

Payments Received from Derivative Counterparties for Interest on Foreign Currency Notes

Payments received under derivative agreements for interest on foreign currency notes in the BAseries will be applied as specified in the BAseries indenture supplement.

Deposits of Withdrawals from the Class C Reserve Account to the Interest Funding Account

Withdrawals made from any Class C reserve subaccount will be deposited into the applicable interest funding subaccount to the extent described below under “—Withdrawals from the Class C Reserve Account.”

Allocations of Reductions from Charge‑Offs

On each Transfer Date when there is a charge‑off for uncovered Investor Default Amounts allocable to the BAseries for the prior month, that reduction will be allocated (and reallocated) on that date to each tranche of notes as set forth below:

Initially, the amount of such charge‑off will be allocated to each tranche of outstanding notes pro rata based on the ratio of the Weighted Average Available Funds Allocation Amount for such tranche for the prior month to the Weighted Average Available Funds Allocation Amount for the BAseries for the prior month.

Immediately afterwards, the amount of charge‑offs allocated to the Class A notes and Class B notes will be reallocated to the Class C notes as set forth below, and the amount of charge‑offs allocated to the Class A notes and not reallocated to the Class C notes because of the Class C usage limitations set forth below will be reallocated to the Class B notes as set forth below. In addition, charge‑offs initially allocated to Class A notes which are reallocated to Class B notes because of Class C usage limitations can be reallocated to Class C notes if permitted as described below. Any amount of charge‑offs which cannot be reallocated to a subordinated class as a result of the usage limitations set forth below will reduce the nominal liquidation amount of the tranche of notes to which it was initially allocated.

“Usage” refers to the amount of the required subordinated amount of a class of BAseries notes actually utilized by a senior tranche of BAseries notes due to losses relating to charged‑off receivables and the application of subordinated BAseries notes’ principal allocations to pay interest on senior classes and servicing fees. Losses that increase usage may include (i) losses relating to charged‑off receivables that are allocated directly to a class of subordinated BAseries notes, (ii) losses relating to usage of available subordinated amounts by another class of BAseries notes that shares credit enhancement from those subordinated BAseries notes, which are allocated proportionately to the senior BAseries notes supported by those subordinated BAseries notes, and (iii) losses reallocated to the subordinated BAseries notes from the applicable tranche of senior BAseries notes. Usage may be reduced in later months if amounts are available to reimburse losses or to reinstate other amounts reallocated from the subordinated BAseries notes. The required subordinated amount of a class of subordinated BAseries notes less its usage equals the remaining available subordinated amount of that class of subordinated BAseries notes, which we refer to as the unused subordinated amount for that tranche of notes.

Limits on Reallocations of Charge‑Offs to a Tranche of Class C Notes from Tranches of Class A and Class B

No reallocations of charge‑offs from a tranche of Class A notes to Class C notes may cause that tranche’s Class A Usage of Class C Required Subordinated Amount to exceed that tranche’s Class A required subordinated amount of Class C notes.

No reallocations of charge‑offs from a tranche of Class B notes to Class C notes may cause that tranche’s Class B Usage of Class C Required Subordinated Amount to exceed that tranche’s Class B required subordinated amount of Class C notes.

The amount of charge‑offs permitted to be reallocated to tranches of Class C notes will be applied to each tranche of Class C notes pro rata based on the ratio of the Weighted Average Available Funds Allocation Amount of such tranche of Class C notes for the prior month to the Weighted Average Available Funds Allocation Amount of all Class C notes in the BAseries for the prior month.

No such reallocation of charge‑offs will reduce the nominal liquidation amount of any tranche of Class C notes below zero.

Limits on Reallocations of Charge‑Offs to a Tranche of Class B Notes from Tranches of Class A Notes

No reallocations of charge‑offs from a tranche of Class A notes to Class B notes may cause that tranche’s Class A Usage of Class B Required Subordinated Amount to exceed that tranche’s Class A required subordinated amount of Class B notes.

The amount of charge‑offs permitted to be reallocated to tranches of Class B notes will be applied to each tranche of Class B notes pro rata based on the ratio of the Weighted Average Available Funds Allocation Amount for that tranche of Class B notes for the prior month to the Weighted Average Available Funds Allocation Amount for all Class B notes in the BAseries for the prior month.

No such reallocation of charge‑offs will reduce the nominal liquidation amount of any tranche of Class B notes below zero.

For each tranche of notes, the nominal liquidation amount of that tranche will be reduced by an amount equal to the charge‑offs which are allocated or reallocated to that tranche of notes less the amount of charge‑offs that are reallocated from that tranche of notes to a subordinated class of notes.

Allocations of Reimbursements of Nominal Liquidation Amount Deficits

If there are BAseries Available Funds available to reimburse any Nominal Liquidation Amount Deficits on any Transfer Date, such funds will be allocated to each tranche of notes as follows:

| • | first, to each tranche of Class A notes, |

| • | second, to each tranche of Class B notes, and |

| • | third, to each tranche of Class C notes. |

In each case, BAseries Available Funds allocated to a class will be allocated to each tranche of notes within such class pro rata based on the ratio of:

—the Nominal Liquidation Amount Deficit of such tranche of notes, to

—the aggregate Nominal Liquidation Amount Deficits of all tranches of such class.

In no event will the nominal liquidation amount of a tranche of notes be increased above the Adjusted Outstanding Dollar Principal Amount of such tranche.

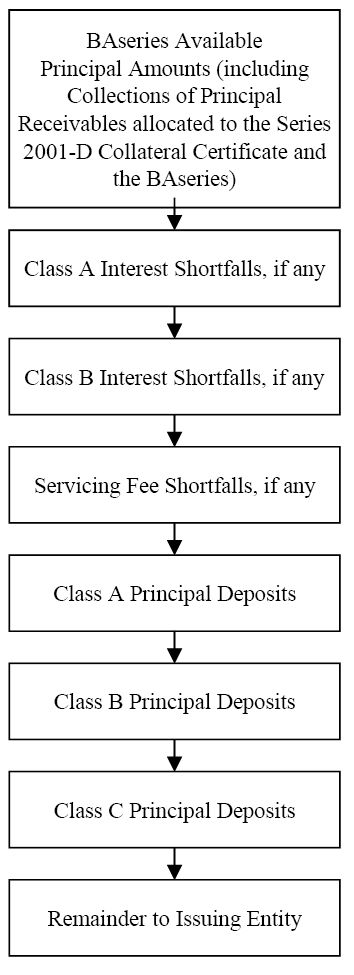

Application of BAseries Available Principal Amounts

On each Transfer Date, the indenture trustee will apply BAseries Available Principal Amounts as follows:

| • | first, for each month, if BAseries Available Funds are insufficient to make the full targeted deposit into the interest funding subaccount for any tranche of Class A notes, then BAseries Available Principal Amounts (in an amount not to exceed the sum of the investor percentage of collections of principal receivables allocated to the Class B notes and the Class C notes for each day during such month) will be allocated to the interest funding subaccount of each such tranche of Class A notes pro rata based on, in the case of each such tranche of Class A notes, the lesser of: |

—the amount of the deficiency of the targeted amount to be deposited into the interest funding subaccount of such tranche of Class A notes, and

—an amount equal to the sum of the Class A Unused Subordinated Amount of Class C notes plus the Class A Unused Subordinated Amount of Class B notes for such tranche of Class A notes (determined after giving effect to the allocation of charge‑offs for uncovered Investor Default Amounts);

| • | second, for each month, if BAseries Available Funds are insufficient to make the full targeted deposit into the interest funding subaccount for any tranche of Class B notes, then BAseries Available Principal Amounts (in an amount not to exceed the sum of the investor percentage of collections of principal receivables allocated to the Class B notes and the Class C notes for each day during such month minus the aggregate amount of BAseries Available Principal Amounts reallocated as described in the first clause above) will be allocated to the interest funding subaccount of each such tranche of Class B notes pro rata based on, in the case of each such tranche of Class B notes, the lesser of: |

—the amount of the deficiency of the targeted amount to be deposited into the interest funding subaccount of such tranche of Class B notes, and

—an amount equal to the Class B Unused Subordinated Amount of Class C notes for such tranche of Class B notes (determined after giving effect to the allocation of charge‑offs for uncovered Investor Default Amounts and the reallocation of BAseries Available Principal Amounts as described in the first clause above);

| • | third, for each month, if BAseries Available Funds are insufficient to pay the portion of the master trust II servicing fee allocable to the BAseries, then BAseries Available Principal Amounts (in an amount not to exceed the sum of the investor percentage of collections of principal receivables allocated to the Class B notes and the Class C notes for each day during such month minus the aggregate amount of BAseries Available Principal Amounts reallocated as described in the first and second clauses above) will be paid to the servicer in an amount equal to, and allocated to each such tranche of Class A notes pro rata based on, in the case of each tranche of Class A notes, the lesser of: |

—the amount of the deficiency times the ratio of the Weighted Average Available Funds Allocation Amount for such tranche for such month to the Weighted Average Available Funds Allocation Amount for the BAseries for such month, and

—an amount equal to the Class A Unused Subordinated Amount of Class C notes plus the Class A Unused Subordinated Amount of Class B notes for such tranche of Class A notes (determined after giving effect to the allocation of charge‑offs for uncovered Investor Default Amounts and the reallocation of BAseries Available Principal Amounts as described in the first and second clauses above);

| • | fourth, for each month, if BAseries Available Funds are insufficient to pay the portion of the master trust II servicing fee allocable to the BAseries, then BAseries Available Principal Amounts (in an amount not to exceed the sum of the investor percentage of collections of principal receivables allocated to the Class B notes and the Class C notes for each day during such month minus the aggregate amount of BAseries Available Principal Amounts reallocated as described in the first, second and third clauses above) will be paid to the servicer in an amount equal to, and allocated to each tranche of Class B notes pro rata based on, in the case of each such tranche of Class B notes, the lesser of: |

—the amount of the deficiency times the ratio of the Weighted Average Available Funds Allocation Amount for such tranche for such month to the Weighted Average Available Funds Allocation Amount for the BAseries for such month, and

—an amount equal to the Class B Unused Subordinated Amount of Class C notes for such tranche of Class B notes (determined after giving effect to the allocation of charge‑offs for uncovered Investor Default Amounts and the reallocation of BAseries Available Principal Amounts as described in the preceding clauses);

| • | fifth, to make the targeted deposits to the principal funding account as described below under “—Targeted Deposits of BAseries Available Principal Amounts to the Principal Funding Account;” and |

| • | sixth, to the issuing entity for reinvestment in the Investor Interest of Series 2001‑D. |

See the chart titled “Application of BAseries Available Principal Amounts” after the “Prospectus Summary” for a depiction of the application of BAseries Available Principal Amounts.

A tranche of notes for which credit card receivables have been sold by master trust II as described in “—Sale of Credit Card Receivables” below will not be entitled to receive any further allocations of BAseries Available Funds or BAseries Available Principal Amounts.

The Investor Interest of Series 2001‑D is determined in part by the sum of the nominal liquidation amounts of each tranche of notes issued by the issuing entity and outstanding and, therefore, will be reduced by the amount of BAseries Available Principal Amounts used to make deposits into the interest funding account, payments to the servicer and deposits into the principal funding account. If the Investor Interest of Series 2001‑D is reduced because BAseries Available Principal Amounts have been used to make deposits into the interest funding account or payments to the servicer or because of charge‑offs due to uncovered Investor Default Amounts, the amount of Available Funds and Available Principal Amounts allocated to the collateral certificate and the amount of BAseries Available Funds and BAseries Available Principal Amounts will be reduced unless the reduction in the Investor Interest is reimbursed from amounts described above in the fourth item in “—Application of BAseries Available Funds.”

Reductions to the Nominal Liquidation Amount of Subordinated Classes from Reallocations of BAseries Available Principal Amounts

Each reallocation of BAseries Available Principal Amounts deposited to the interest funding subaccount of a tranche of Class A notes as described in the first clause of “—Application of BAseries Available Principal Amounts” will reduce the nominal liquidation amount of the Class C notes. However, the amount of such reduction for each such tranche of Class A notes will not exceed the Class A Unused Subordinated Amount of Class C notes for such tranche of Class A notes.

Each reallocation of BAseries Available Principal Amounts deposited to the interest funding subaccount of a tranche of Class A notes as described in the first clause of “—Application of BAseries Available Principal Amounts” which does not reduce the nominal liquidation amount of Class C notes pursuant to the preceding paragraph will reduce the nominal liquidation amount of the Class B notes. However, the amount of such reduction for each such tranche of Class A notes will not exceed the Class A Unused Subordinated Amount of Class B notes for such tranche of Class A notes, and such reductions in the nominal liquidation amount of the Class B notes may be reallocated to the Class C notes if permitted as described below.

Each reallocation of BAseries Available Principal Amounts deposited to the interest funding subaccount of a tranche of Class B notes as described in the second clause of “—Application of BAseries Available Principal Amounts” will reduce the nominal liquidation amount (determined after giving effect to the preceding paragraphs) of the Class C notes.

Each reallocation of BAseries Available Principal Amounts paid to the servicer as described in the third clause of “—Application of BAseries Available Principal Amounts” will reduce the nominal liquidation amount (determined after giving effect to the preceding paragraphs) of the Class C notes. However, the amount of such reduction for each such tranche of Class A notes will not exceed the Class A Unused Subordinated Amount of Class C notes for such tranche of Class A notes (after giving effect to the preceding paragraphs).

Each reallocation of BAseries Available Principal Amounts paid to the servicer as described in the third clause of “—Application of BAseries Available Principal Amounts” which does not reduce the

nominal liquidation amount of Class C notes as described above will reduce the nominal liquidation amount (determined after giving effect to the preceding paragraphs) of the Class B notes. However, the amount of such reduction for each such tranche of Class A notes will not exceed the Class A Unused Subordinated Amount of Class B notes for such tranche of Class A notes (after giving effect to the preceding paragraphs), and such reductions in the nominal liquidation amount of the Class B notes may be reallocated to the Class C notes if permitted as described below.

Each reallocation of BAseries Available Principal Amounts paid to the servicer as described in the fourth clause of “—Application of BAseries Available Principal Amounts” will reduce the nominal liquidation amount (determined after giving effect to the preceding paragraphs) of the Class C notes.

Subject to the following paragraph, each reallocation of BAseries Available Principal Amounts which reduces the nominal liquidation amount of Class B notes as described above will reduce the nominal liquidation amount of each tranche of the Class B notes pro rata based on the ratio of the Weighted Average Available Funds Allocation Amount for such tranche of Class B notes for the related month to the Weighted Average Available Funds Allocation Amount for all Class B notes for the related month. However, any allocation of any such reduction that would otherwise have reduced the nominal liquidation amount of a tranche of Class B notes below zero will be reallocated to the remaining tranches of Class B notes in the manner set forth in this paragraph.

Each reallocation of BAseries Available Principal Amounts which reduces the nominal liquidation amount of Class B notes as described in the preceding paragraph may be reallocated to the Class C notes and such reallocation will reduce the nominal liquidation amount of the Class C notes. However, the amount of such reallocation from each tranche of Class B notes will not exceed the Class B Unused Subordinated Amount of Class C notes for such tranche of Class B notes.

Each reallocation of BAseries Available Principal Amounts which reduces the nominal liquidation amount of Class C notes as described above will reduce the nominal liquidation amount of each tranche of the Class C notes pro rata based on the ratio of the Weighted Average Available Funds Allocation Amount for such tranche of Class C notes for the related month to the Weighted Average Available Funds Allocation Amount for all Class C notes for the related month. However, any allocation of any such reduction that would otherwise have reduced the nominal liquidation amount of a tranche of Class C notes below zero will be reallocated to the remaining tranches of Class C notes in the manner set forth in this paragraph.

None of such reallocations will reduce the nominal liquidation amount of any tranche of Class B or Class C notes below zero.

For each tranche of notes, the nominal liquidation amount of that tranche will be reduced by the amount of reductions which are allocated or reallocated to that tranche less the amount of reductions which are reallocated from that tranche to notes of a subordinated class.

Limit on Allocations of BAseries Available Principal Amounts and BAseries Available Funds

Each tranche of notes will be allocated BAseries Available Principal Amounts and BAseries Available Funds solely to the extent of its nominal liquidation amount. Therefore, if the nominal liquidation amount of any tranche of notes has been reduced due to reallocations of BAseries Available Principal Amounts to cover payments of interest or the master trust II servicing fee or due to charge‑offs for uncovered Investor Default Amounts, such tranche of notes will not be allocated BAseries Available Principal Amounts or BAseries Available Funds to the extent of such reductions. However, any funds in the applicable principal funding subaccount, any funds in the applicable interest