As filed with the Securities and Exchange Commission on November 29, 2021

Registration Nos. 333-[—], 333-[—] and 333-[—]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SF-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

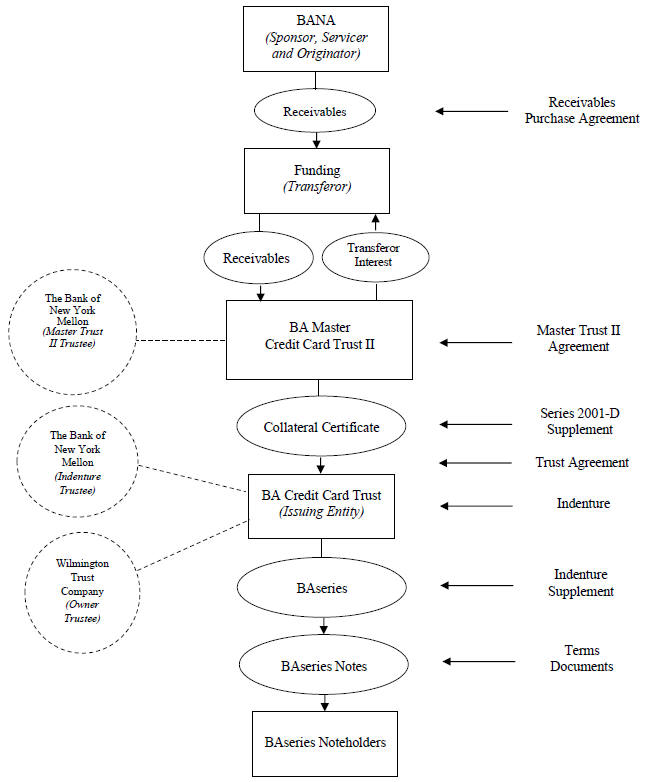

BA CREDIT CARD TRUST

(Issuing entity in respect of the Notes)

BA MASTER CREDIT CARD TRUST II

(Issuing entity in respect of the Collateral Certificate)

BA CREDIT CARD FUNDING, LLC

(Depositor)

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 01-0864848 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

Commission File Number of depositor: 333-136122

Central Index Key Number of depositor: 0001370238

BA Credit Card Funding, LLC

(Exact name of depositor as specified in its charter)

Central Index Key Number of sponsor: 0001102113

Bank of America, National Association

(Exact name of sponsor as specified in its charter)

BA Credit Card Funding, LLC

1020 North French Street

DE5-002-01-05

Wilmington, Delaware 19884

(980) 683-4915

(Address, Including zip code, and telephone number, including area code, of registrant’s principal executive offices)

David Sobul, Esq.

Assistant General Counsel

Bank of America, National Association

150 N. College Street

NC1-028-28-02

Charlotte, North Carolina 28255

(980) 387-0204

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | | | |

Michael H. Mitchell, Esq. Orrick, Herrington & Sutcliffe LLP 1152 15th Street, NW Washington, D.C. 20005 (202) 339-8456 | | Mitchell Naumoff, Esq. Orrick, Herrington & Sutcliffe LLP 1152 15th Street, NW Washington, D.C. 20005 (202) 339-8412 | | Joseph Topolski, Esq. Katten Muchin Rosenman LLP 575 Madison Avenue New York, New York 10022 (212) 940-6312 |

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective as determined by market conditions.

If any of the securities being registered on this Form SF-3 are to be offered pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☒

If this Form SF–3 is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form SF–3 is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

CALCULATION OF REGISTRATION FEE(a)

| | | | | | | | |

|

Title of each class of securities to be registered | | Amount to be

registered(b)(c) | | Proposed maximum offering price per unit(d) | | Proposed maximum aggregate offering price(d) | | Amount of

registration fee |

Notes | | — | | — | | — | | — |

Collateral Certificate(e) | | — | | — | | — | | — |

|

|

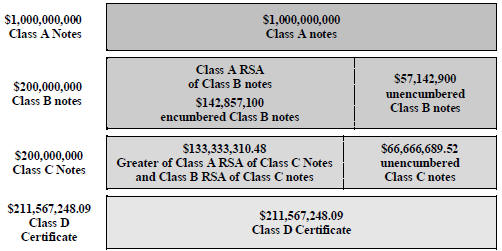

| (a) | Pursuant to Rule 415(a)(6) under the Securities Act of 1933, this Registration Statement and the prospectus included herein relate to $17,498,899,022 aggregate principal amount of Notes that were previously registered, but which remain unsold, under a registration statement on Form SF-3 (File nos. 333-228572, 333-228572-01 and 333-228572-02), initially filed on November 28, 2018 with an initial effective date of December 6, 2018. A filing fee of $537,216.20 was previously paid in connection with such unsold Notes. |

| (b) | With respect to any securities issued with original issue discount, the amount to be registered is calculated based on the initial public offering price thereof. |

| (c) | With respect to any securities denominated in any foreign currency, the amount to be registered shall be the U.S. dollar equivalent thereof based on the prevailing exchange rate at the time such security is first offered. |

| (d) | Estimated solely for the purpose of calculating the registration fee. |

| (e) | This Registration Statement and the prospectus included herein also relate to a Collateral Certificate, which is pledged as security for the Notes, and which, pursuant to Commission regulations, is deemed to constitute part of any distribution of the Notes. No additional consideration will be paid by the purchasers of the Notes for the Collateral Certificate and, pursuant to Rule 457(t) under the Securities Act, no separate registration fee for the Collateral Certificate is required to be paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall subsequently become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.