State Street Corporation Second-Quarter 2016 Financial Highlights July 27, 2016 Exhibit 99.3

2 Forward-Looking Statements This presentation includes certain highlights of, and also material supplemental to, State Street Corporation’s (State Street’s) news release announcing its second quarter 2016 financial results. That news release contains a more detailed discussion of many of the matters described in this presentation and is accompanied by detailed financial tables. This presentation is designed to be reviewed together with that news release, which is available on State Street’s website, at www.statestreet.com/stockholder, and is incorporated herein by reference. This presentation contains forward-looking statements within the meaning of U.S. securities laws, including statements about our goals and expectations regarding our business, financial and capital condition, results of operations, strategies, investment portfolio performance and strategies, the financial and market outlook, dividend and stock purchase programs, governmental and regulatory initiatives and developments, and the business environment. Forward-looking statements are often, but not always, identified by such forward-looking terminology as “outlook,” “expect,” “priority,” “objective,” “intend,” “plan,” “forecast,” “believe,” “anticipate,” “estimate,” “seek,” “may,” “will,” “trend,” “target,” “strategy” and “goal,” or similar statements or variations of such terms. These statements are not guarantees of future performance, are inherently uncertain, are based on current assumptions that are difficult to predict and involve a number of risks and uncertainties. Therefore, actual outcomes and results may differ materially from what is expressed in those statements, and those statements should not be relied upon as representing our expectations or beliefs as of any date subsequent to July 27,2016. Important factors that may affect future results and outcomes include, but are not limited to: the structure and details of Great Britain's exit from the European Union, or "Brexit", following the recent referendum by British voters are not certain, remain subject to negotiations between Great Britain and the European Union and will be determined over the coming years; such structure and details are likely to have significant effects on financial markets and business activities, and regulatory environment, particularly in Great Britain and Europe, some or all of which effects could have a material effect on our or our clients’ or counterparties’ businesses, operations, investment activities or financial results; the financial strength and continuing viability of the counterparties with which we or our clients do business and to which we have investment, credit or financial exposure, including, for example, the direct and indirect effects on counterparties of the sovereign-debt risks in the U.S., Europe and other regions; increases in the volatility of, or declines in the level of, our net interest revenue, changes in the composition or valuation of the assets recorded in our consolidated statement of condition (and our ability to measure the fair value of investment securities) and the possibility that we may change the manner in which we fund those assets; the liquidity of the U.S. and international securities markets, particularly the markets for fixed-income securities and inter-bank credits, and the liquidity requirements of our clients; the level and volatility of interest rates, the valuation of the U.S. dollar relative to other currencies in which we record revenue or accrue expenses and the performance and volatility of securities, credit, currency and other markets in the U.S. and internationally; the credit quality, credit-agency ratings and fair values of the securities in our investment securities portfolio, a deterioration or downgrade of which could lead to other-than-temporary impairment of the respective securities and the recognition of an impairment loss in our consolidated statement of income; our ability to attract deposits and other low-cost, short-term funding, our ability to manage levels of such deposits and the relative portion of our deposits that are determined to be operational under regulatory guidelines and our ability to deploy deposits in a profitable manner consistent with our liquidity requirements and risk profile; the manner and timing with which the Federal Reserve and other U.S. and foreign regulators implement changes to the regulatory framework applicable to our operations, including implementation of the Dodd-Frank Act, the Basel III final rule and European legislation (such as the Alternative Investment Fund Managers Directive, Undertakings for Collective Investment in Transferable Securities Directives and Markets in Financial Instruments Directive II); among other consequences, these regulatory changes impact the levels of regulatory capital we must maintain, acceptable levels of credit exposure to third parties, margin requirements applicable to derivatives, and restrictions on banking and financial activities. In addition, our regulatory posture and related expenses have been and will continue to be affected by changes in regulatory expectations for global systemically important financial institutions applicable to, among other things, risk management, liquidity and capital planning and compliance programs, and changes in governmental enforcement approaches to perceived failures to comply with regulatory or legal obligations; we may not successfully implement our plans to address the deficiencies jointly identified by the Federal Reserve and the FDIC in April 2016 with respect to our 2015 resolution plan, or those plans may not be considered to be sufficient by the Federal Reserve and the FDIC, due to a number of factors, including, but not limited to challenges we may experience in interpreting and addressing regulatory expectations, failure to implement remediation in a timely manner, the complexities of development of a comprehensive plan to resolve a global custodial bank and related costs and dependencies. If we fail to meet regulatory expectations to the satisfaction of the Federal Reserve and the FDIC in our resolution plan submission due on October 1, 2016 or in any future submission, we could be subject to more stringent capital, leverage or liquidity requirements, or restrictions on our growth, activities or operations; adverse changes in the regulatory ratios that we are required or will be required to meet, whether arising under the Dodd-Frank Act or the Basel III final rule, or due to changes in regulatory positions, practices or regulations in jurisdictions in which we engage in banking activities, including changes in internal or external data, formulae, models, assumptions or other advanced systems used in the calculation of our capital ratios that cause changes in those ratios as they are measured from period to period; increasing requirements to obtain the prior approval of the Federal Reserve or our other U.S. and non-U.S. regulators for the use, allocation or distribution of our capital or other specific capital actions or programs, including acquisitions, dividends and stock purchases, without which our growth plans, distributions to shareholders, share repurchase programs or other capital initiatives may be restricted; changes in law or regulation, or the enforcement of law or regulation, that may adversely affect our business activities or those of our clients or our counterparties, and the products or services that we sell, including additional or increased taxes or assessments thereon, capital adequacy requirements, margin requirements and changes that expose us to risks related to the adequacy of our controls or compliance programs; financial market disruptions or economic recession, whether in the U.S., Europe, Asia or other regions; our ability to develop and execute State Street Beacon, our multi -year transformation program to create cost efficiencies and to fully digitize our business to support the development of new solut ions and capabilities for our clients, any failure of which, in whole or in part, may among other things, reduce our competitive position, diminish the cost-effectiveness of our systems and processes or provide an insufficient return on our associated investment; our ability to promote a strong culture of risk management, operating controls, compliance oversight and governance that meet our expectations and those of our clients and our regulators; the results of our review of our billing practices, including additional amounts we may be required to reimburse clients, as well as potential consequences of such review, including damage to our client relationships and adverse actions by governmental authorities; the results of, and costs associated with, governmental or regulatory inquiries and investigations, litigation and similar claims, disputes, or civil or criminal proceedings; the potential for losses arising from our investments in sponsored investment funds; the possibility that our clients will incur substantial losses in investment pools for which we act as agent, and the possibility of significant reductions in the liquidity or valuation of assets underlying those pools; our ability to anticipate and manage the level and timing of redemptions and withdrawals from our collateral pools and other collective investment products; the credit agency ratings of our debt and depositary obligations and investor and client perceptions of our financial strength; adverse publicity, whether specific to State Street or regarding other industry participants or industry-wide factors, or other reputational harm; our ability to control operational risks, data security breach risks and outsourcing risks, our ability to protect our intellectual property rights, the possibility of errors in the quantitative models we use to manage our business and the possibility that our controls will prove insufficient, fail or be circumvented; our ability to expand our use of technology to enhance the efficiency, accuracy and reliability of our operations and our dependencies on information technology and our ability to control related risks, including cyber-crime and other threats to our information technology infrastructure and systems and their effective operation both independently and with external systems, and complexities and costs of protecting the security of our systems and data; our ability to grow revenue, manage expenses, attract and retain highly skilled people and raise the capital necessary to achieve our business goals and comply with regulatory requirements and expectations; changes or potential changes to the competitive environment, including changes due to regulatory and technological changes, the effects of industry consolidation and perceptions of State Street as a suitable service provider or counterparty; changes or potential changes in the amount of compensation we receive from clients for our services, and the mix of services provided by us that clients choose; our ability to complete acquisitions, joint ventures and divestitures, including the ability to obtain regulatory approvals, the ability to arrange financing as required and the abili ty to satisfy closing conditions; the risks that our acquired businesses and joint ventures will not achieve their anticipated financial and operational benefits or will not be integrated successfully, or that the integration will take longer than anticipated, that expected synergies will not be achieved or unexpected negative synergies or liabilities will be experienced, that client and deposit retention goals will not be met, that other regulatory or operational challenges will be experienced, and that disruptions from the transaction will harm our relationships with our clients, our employees or regulators; our ability to recognize emerging needs of our clients and to develop products that are responsive to such trends and profitable to us, the performance of and demand for the products and services we offer, and the potential for new products and services to impose additional costs on us and expose us to increased operational risk; changes in accounting standards and practices; and changes in tax legislation and in the interpretation of existing tax laws by U.S. and non-U.S. tax authorities that affect the amount of taxes due. Other important factors that could cause actual results to differ materially from those indicated by any forward-looking statements are set forth in our 2015 Annual Report on Form 10-K and our subsequent SEC filings. We encourage investors to read these filings, particularly the sections on risk factors, for additional information with respect to any forward-looking statements and prior to making any investment decision. The forward-looking statements contained in this news release speak only as of the date hereof, July 27, 2016, and we do not undertake efforts to revise those forward-looking statements to reflect events after that date.

3 1 Long-term goals are presented on an operating-basis, a non-GAAP presentation, and do not reflect the near-term expectations. As a result, information needed to provide corresponding GAAP-basis long-term goals, which is primarily dependent on future events or conditions that may be uncertain and is difficult to predict and estimate. We are therefore unable to provide a reconciliation of our operating-basis long-term goals to a GAAP-basis presentation. Refer to the Appendix included with this presentation for explanations of our non-GAAP measures. Focused strategy supports long-term financial goals LONG-TERM SHAREHOLDER VALUE BUILDING ON OUR STRONG CORE ACHIEVING A DIGITAL ENTERPRISE INVESTING IN OPPORTUNITIES FOR GROWTH OPTIMIZING CAPITAL Aligning solutions with client needs, continuing to innovate, capturing value and improving efficiency Driving greater transformation that benefits clients and our shareholders Acting on changes in the market to fuel expansion of products and services and the markets we serve Adapting to new rules and optimizing returns for shareholders TALENT, CULTURE, INNOVATION AND RISK EXCELLENCE Operating-Basis1 Financial Goals: Revenue Growth of 8%-12%, EPS Growth of 10%-15% and ROE of 12%-15%

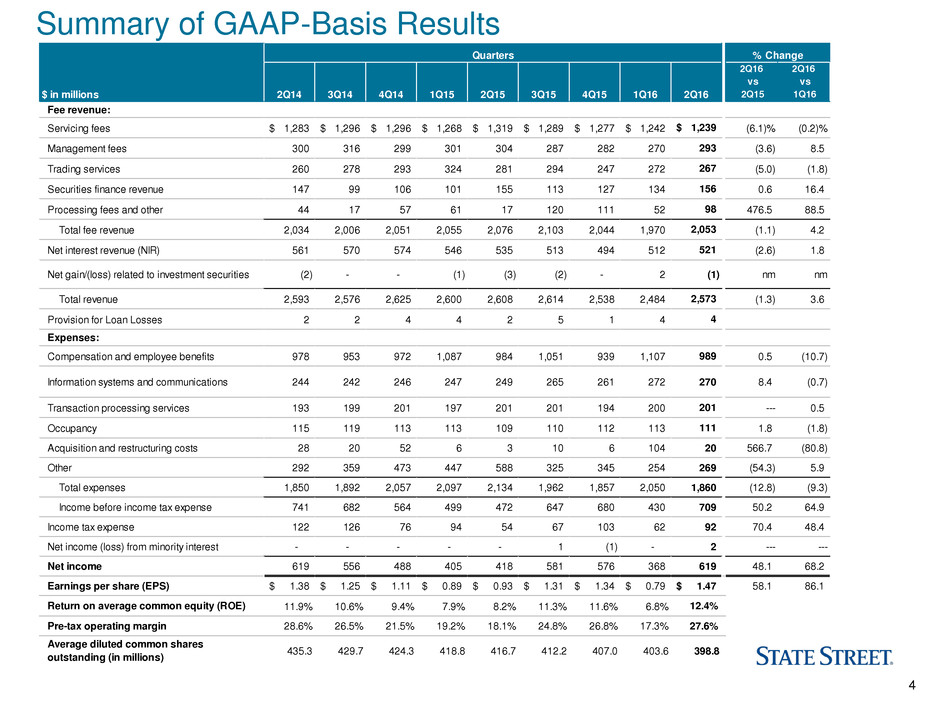

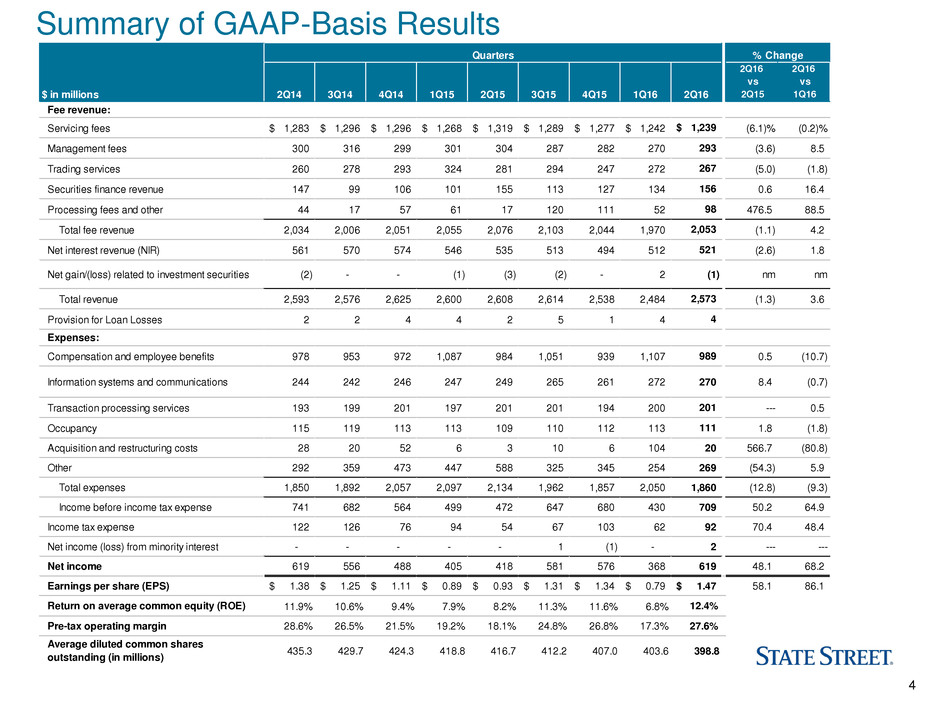

4 Summary of GAAP-Basis Results $ in millions 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 2Q16 vs 2Q15 2Q16 vs 1Q16 Fee revenue: Servicing fees 1,283$ 1,296$ 1,296$ 1,268$ 1,319$ 1,289$ 1,277$ 1,242$ 1,239$ (6.1)% (0.2)% Management fees 300 316 299 301 304 287 282 270 293 (3.6) 8.5 Trading services 260 278 293 324 281 294 247 272 267 (5.0) (1.8) Securities finance revenue 147 99 106 101 155 113 127 134 156 0.6 16.4 Processing fees and other 44 17 57 61 17 120 111 52 98 476.5 88.5 Total fee revenue 2,034 2,006 2,051 2,055 2,076 2,103 2,044 1,970 2,053 (1.1) 4.2 Net interest revenue (NIR) 561 570 574 546 535 513 494 512 521 (2.6) 1.8 Net gain/(loss) related to investment securities (2) - - (1) (3) (2) - 2 (1) nm nm Total revenue 2,593 2,576 2,625 2,600 2,608 2,614 2,538 2,484 2,573 (1.3) 3.6 Provision for Loan Losses 2 2 4 4 2 5 1 4 4 Expenses: Compensation and employee benefits 978 953 972 1,087 984 1,051 939 1,107 989 0.5 (10.7) Information systems and communications 244 242 246 247 249 265 261 272 270 8.4 (0.7) Transaction processing services 193 199 201 197 201 201 194 200 201 --- 0.5 Occupancy 115 119 113 113 109 110 112 113 111 1.8 (1.8) Acquisition and restructuring costs 28 20 52 6 3 10 6 104 20 566.7 (80.8) Other 292 359 473 447 588 325 345 254 269 (54.3) 5.9 Total expenses 1,850 1,892 2,057 2,097 2,134 1,962 1,857 2,050 1,860 (12.8) (9.3) Income before income tax expense 741 682 564 499 472 647 680 430 709 50.2 64.9 Income tax expense 122 126 76 94 54 67 103 62 92 70.4 48.4 Net income (loss) from minority interest - - - - - 1 (1) - 2 --- --- Net income 619 556 488 405 418 581 576 368 619 48.1 68.2 Earnings per share (EPS) 1.38$ 1.25$ 1.11$ 0.89$ 0.93$ 1.31$ 1.34$ 0.79$ 1.47$ 58.1 86.1 Return on average common equity (ROE) 11.9% 10.6% 9.4% 7.9% 8.2% 11.3% 11.6% 6.8% 12.4% Pre-tax operating margin 28.6% 26.5% 21.5% 19.2% 18.1% 24.8% 26.8% 17.3% 27.6% Average diluted common shares outstanding (in millions) 435.3 429.7 424.3 418.8 416.7 412.2 407.0 403.6 398.8 Quarters % Change

5 Strategic Priorities: 2016 Performance Through June 30, 20161 (Versus 2015 Through June 30, 2015 Where Applicable): 1. Become a digital leader in financial services: • Continued progress on State Street Beacon initiatives in support of digitization, including implementing NAV Oversight, Fund Insights and Enterprise Pricing Workstation solutions to support clients with improved data accuracy and easier access to information • New solutions delivering advantage to clients – straight through processing quality data/higher accuracy and fast delivery • Pre-tax restructuring charge of $13M in 2Q16 related to advancing State Street Beacon2 2. Drive growth from core franchise: • New asset servicing wins of approximately $750B, including appointment by Deka Bank and Allianz Global Investors to provide a range of investment services for $583B in assets and a custody and outsourcing mandate for Sumitomo Mitsui Asset Management Co., Ltd.’s Japanese investment trust business (together with a designation as their preferred global custodian) • Greater than $1T of servicing commitments remaining to be installed as of June 30, 2016 3. Continuous investment in new products and solutions to drive revenue and differentiation: • Closed GE Asset Management (GEAM) acquisition on July 1, 2016, which extends core investment management capabilities and advances growth in high demand areas such as OCIO outsourcing • In 2Q16 SSGA introduced 35 new products (including 15 ETFs), capturing nearly $1B AUM from initial investments or asset retention from clients • Investing in capabilities to help clients address SEC Modernization reporting requirements 4. Increased focus on expense management: • 2Q16 and 6/30/2016 YTD operating-basis total expenses1 lower compared to 2Q15 and 6/30/2015 YTD • Flat operating-basis total expenses in 2Q16 from 1Q16, excluding the impact of seasonal equity compensation for retirement-eligible employees and payroll taxes in 1Q16 of $122M • State Street Beacon2 related annualized pre-tax net fiscal expense savings for 2016 now expected to be at least $140M, which is exceeding initial first year expense reduction targets 5. Leverage strong capital position to return capital to shareholders3: • Quarterly common stock dividends declared per share of $0.34 in 2Q16 – expect 3Q16 common stock dividends declared per share of $0.38, an increase of 12% • $390M in common stock (6.5M shares) bought back in 2Q16 • Board of Directors approved a new common stock repurchase program authorizing the purchase of up to $1.4B in common stock Made substantive progress in first half of 2016 on State Street’s transformation while delivering value in the short term • YTD = year-to-date • Refer to the Appendix included with this presentation for footnotes 1 to 3.

6 • With $30T in investable assets, Europe is 35% of world AUM and is expected to grow approximately 30% by 20201 • Gross domestic product trends and economic outlook reinforce high net savings rates2 while lower-for-longer interest rates encourage a search for yield that pushes funds out of deposits into other investments, including mutual funds and cross-border investments • Investment and distribution dynamics remain drivers: ‒ Demand for alternatives, multi-asset solutions, ETFs ‒Offshore fund market supporting global distribution via Ireland and Luxembourg • In addition to Brexit, regulatory changes and cost pressures creating expanded client demand for complex services and greater outsourcing • We are geographically diverse with the potential to offer passportable EU and local specific services across Europe: ‒ 10,700+ employees in 12 European countries with an onshore footprint covering jurisdictions with >70% of total European managed assets1 ‒ ~20% of headcount in the UK, primarily operating out of a branch of our US bank ‒Europe banking operations operate out of an international bank based in Germany, which accounts for ~50% of our headcount across 9 countries3 ‒ ~30% of headcount in Luxembourg and Ireland, the main markets for offshore (internationally distributed) funds • We are well positioned to support our clients throughout Europe: ‒ Leader in offshore servicing, grew offshore AUA by 70% over last 3 years4 while gaining market share and support the global distribution of regulated products (i.e., UCITS) distributed to more than 70 countries worldwide ‒ Industry leader in European ETF servicing – 67% European ETF AUA share5 Despite the Brexit vote, Europe and the UK continue to represent a significant opportunity for us We have strengths in offshore, in the UK, and in pan-European fund structures, an on-the-ground presence in all key European domestic markets, and a demonstrated ability to partner with clients to help them navigate complexity and address change • Refer to the Appendix included with this presentation for footnotes 1 to 5.

7 1 Represents operating-basis financial information, a non-GAAP presentation. Refer to the Appendix included with this presentation for explanations of our non-GAAP financial measures and for reconciliations of our operating-basis financial information. 2Q16 fee revenues supported by improved market environment from 1Q16 and the seasonal up-tick in securities finance, while expense control reduced expenses compared to 2Q15 2Q16 highlights: • Operating-basis EPS of $1.46 increased 49.0% from 1Q16 and 7.4% from 2Q15: • Operating-basis EPS reflects a decrease in operating-basis total expenses from 1Q16 due to seasonal deferred incentive compensation for retirement-eligible employees of $122M in 2Q16 • Total fee revenue of $2.1B increased 4.8% from 1Q16 and decreased 2.0% from 2Q15 • Total revenue of $2.7B increased 3.9% from 1Q16 and decreased 1.9% from 2Q15 • Total expenses of $1.8B decreased 5.9% from 1Q16 and 2.8% from 2Q15: • Effective tax rate of 27.0% decreased 210bps from 1Q16 and 260bps from 2Q15 • Pre-tax operating margin of 31.5% increased 710bps from 1Q16 and 60bps from 2Q15 2Q16 Operating-Basis (Non-GAAP) Financial Highlights1 YTD16 compared to YTD15: • Operating-basis EPS of $2.44 decreased 3.2% • Total fee revenue of $4.2B decreased 2.8% • Total revenue of $5.2B decreased 2.8% • Total expenses of $3.8B decreased slightly • Effective tax rate of 27.9% decreased 120bps • Pre-tax operating margin of 28.0% decreased 110bps • ROE of 10.4% decreased 70bps Capital: • Purchased approximately $390M of our common stock in 2Q16 • Declared a common stock dividend during the quarter of $0.34 per share

8 2Q16 EPS increased relative to the weak 1Q15 market environment and benefited from the seasonal up-tick in securities finance, while compared to 2Q15 the share buyback and disciplined expense control drove the improvement in 2Q16 EPS 1.46 1.211.15 1.36 0.98 2Q16 vs 2Q15 +7.4% 2Q16 1Q16 4Q15 3Q15 2Q15 Operating-Basis (Non-GAAP) EPS1 ($) 1 Represents operating-basis financial information, a non-GAAP presentation. Refer to the Appendix included with this presentation for explanations of our non-GAAP financial measures and for reconciliations of our operating- basis financial information. • 2Q16 operating-basis EPS increased from 2Q15, primarily due to lower expenses (primarily associated with professional services expense) and the impact of share repurchases, partially offset by lower fee revenue

9 Generated positive fee operating leverage in 2Q16 versus 2Q15 due to strong expense management Revenue ($M) 1 Represents operating-basis financial information, a non-GAAP presentation. Refer to the Appendix included with this presentation for explanations of our non-GAAP financial measures and for reconciliations of our operating-basis financial information. 2 Operating leverage is defined as rate of growth of total revenue less the rate of growth of expenses, each as determined on an operating basis. 3 Fee operating leverage is defined as rate of growth of total fee revenue less the rate of growth of expenses, each as determined on an operating basis. Expenses ($M) Operating-Basis (Non-GAAP) Results1 1,881 -2.8% 1,828 2,174 2,130 546556 -3 -1 2Q16 2Q15 2,675 -1.9% 2,727 Total fee revenue NIR Net gain/(loss) related to investment securities Operating Leverage2 (Revenue Growth (%) less Expense Growth (%); 2Q16 vs 2Q15) -1.9 Revenue Growth Expense Growth -2.8 +91bps 2Q16 vs 2Q15 (2.0)% (1.8)% +80bps -2.8 Expense Growth -2.0 Fee Revenue Growth Fee Operating Leverage3 (Fee Revenue Growth (%) less Expense Growth (%); 2Q16 vs 2Q15) 2Q16 2Q15

10 Substantial progress on expense reductions in 2Q16 reduced the fee operating leverage gap from 1Q16 Revenue ($M) 1 Represents operating-basis financial information, a non-GAAP presentation. Refer to the Appendix included with this presentation for explanations of our non-GAAP financial measures and for reconciliations of our operating-basis financial information. 2 Operating leverage is defined as rate of growth of total revenue less the rate of growth of expenses, each as determined on an operating basis. 3 Fee operating leverage is defined as rate of growth of total fee revenue less the rate of growth of expenses, each as determined on an operating basis. Expenses ($M) Operating-Basis (Non-GAAP) Results1 -1.4% 6/30/16 YTD 3,771 6/30/15 YTD 3,823 4,282 4,163 1,0851,121 -2.8% 6/30/16 YTD 5,249 1 6/30/15 YTD 5,399 -4 Total fee revenue Net gain/(loss) related to investment securities NIR Revenue Growth -2.8 -1.4 -142bps Expense Growth 6/30/16 YTD vs 6/30/15 YTD (2.8)% (3.2)% Fee Revenue Growth -142bps -2.8 Expense Growth -1.4 Operating Leverage2 (Revenue Growth (%) less Expense Growth (%); 6/30/16 YTD vs 6/30/15 YTD) Fee Operating Leverage3 (Fee Revenue Growth (%) less Expense Growth (%); 6/30/16 YTD vs 6/30/15 YTD)

11 2Q16 Fee revenue up 5% from 1Q16 primarily due to improved market conditions and the seasonal up-tick in securities finance Operating-Basis (Non-GAAP) Revenue1 ($M) 281 272 267 304 270 288 1,319 1,242 1,287 115 155 134 115 132 156 4Q15 2Q15 3Q15 1Q16 2Q16 2Q16 vs 2Q15 -2.0% 2Q16 vs 1Q16 +4.8% 1 Represents operating-basis financial information, a non-GAAP presentation. Refer to the Appendix included with this presentation for explanations of our non-GAAP financial measures and for reconciliations of our operating-basis financial information. 2 Represents the effects of applying 1Q15 weighted average foreign exchange rates to revenue, servicing fees, management fees and NIR for 1Q16. Notable operating-basis (non-GAAP)1 variances 2Q16 vs 2Q15: • Servicing fees were down 2.4% compared to 2Q15 primarily due to lower global equity markets • Management fees were down 5.3% compared to 2Q15 primarily due to lower global equity markets • Foreign exchange trading revenue was down compared to 2Q15 primarily due to lower client-related volumes • Brokerage and other fees were down compared to 2Q15 primarily due to lower transition management revenue, partially offset by higher fees associated with the GLD ETF • Securities finance revenue was up slightly compared to 2Q15 • Processing fees and other revenue was up 14.8% compared to 2Q15 primarily due to favorable valuation adjustments and higher revenue associated with bank owned life insurance Notable operating-basis (non-GAAP)1 variances 2Q16 vs 1Q16: • Servicing fees were up 3.6% compared to 1Q16 primarily due to higher global equity markets and net new business • Management fees were up 6.7% compared to 1Q16 primarily due to higher global equity markets and favorable net new business mix • Foreign exchange trading revenue was up slightly compared to 1Q16 • Brokerage and other fees were down from 1Q16 primarily due to lower revenue related to the exit of the WM/Reuters branded foreign exchange benchmark business • Securities finance revenue increased compared to 1Q16, primarily due to seasonality • Processing fees and other revenue was up 14.8% compared to 1Q16 due to higher equity earnings from joint ventures and favorable valuation adjustments 2Q16 vs 2Q15 (2)% (5)% (5)% 1% 15% 2Q16 vs 1Q16 4% 7% (2)% 16% 15% Processing fees and other Trading services Servicing fees Management fees Securities finance revenue

12 2Q16 net interest revenue (NIR) and net interest margin (NIM) benefitted from higher Federal funds rate at end of 4Q15 and disciplined liability pricing 198194201 221 233 2Q16 vs 2Q15 -15.1% 2Q16 1Q16 4Q15 3Q15 2Q15 2Q16 vs 1Q16 +2.1% Average Earning Assets ($B) 1 Includes operating-basis (non-GAAP) financial information where noted. Refer to the Appendix included with this presentation for explanations of our non-GAAP financial measures and for reconciliations of our operating-basis financial information. Operating-Basis (Non-GAAP)1 NIR and NIM ($M, %) 546539 513529 556 1.12 1.010.950.96 1.11 0 100 200 300 400 500 600 0.00 0.50 1.00 1.50 2.00 4Q15 1Q16 2Q16 NIR 2Q16 vs 1Q16 +1.3% 3Q15 2Q15 NIR 2Q16 vs 2Q15 -1.8% NIM NIR Notable Operating-basis (non-GAAP)1 variances 2Q16 vs 2Q15: • Net interest revenue was down 1.8% primarily due to our success in reducing the size of the balance sheet in 2015, partially offset by higher U.S. market interest rates and disciplined liability pricing Notable Operating-basis (non-GAAP)1 variances 2Q16 vs 1Q16: • Net interest revenue was up 1.3% primarily due to disciplined liability pricing, higher interest earning assets and the impact of income associated with a small number of discrete security prepayments

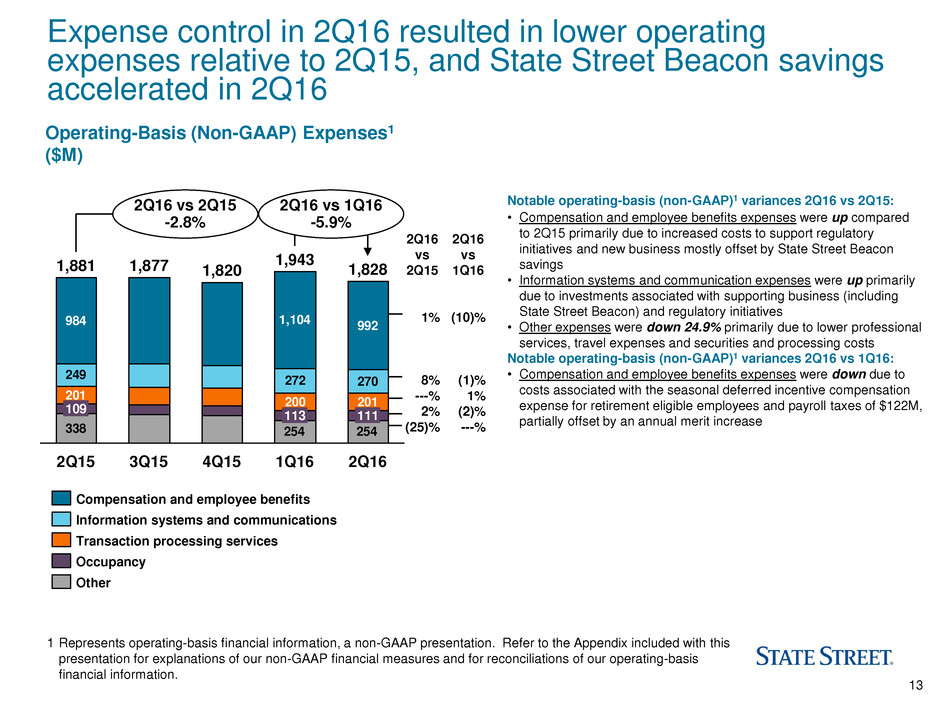

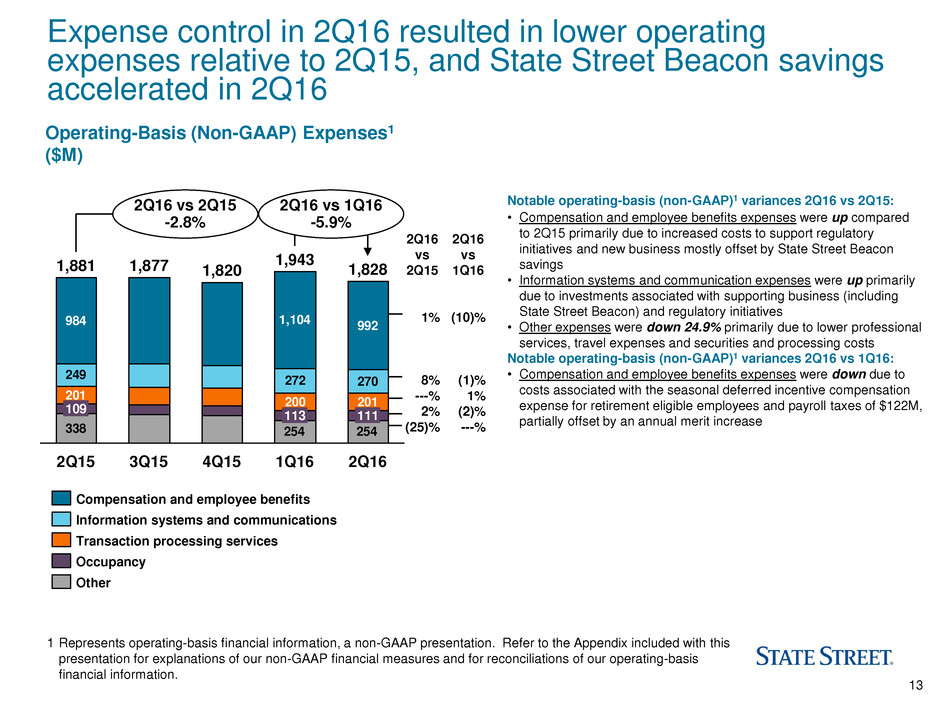

13 Expense control in 2Q16 resulted in lower operating expenses relative to 2Q15, and State Street Beacon savings accelerated in 2Q16 Operating-Basis (Non-GAAP) Expenses1 ($M) 338 201 200 201 249 272 270 984 1,104 992 254254 2Q16 vs 1Q16 -5.9% 2Q16 1,828 111 1Q16 1,943 113 4Q15 1,820 3Q15 1,877 2Q15 1,881 109 2Q16 vs 2Q15 -2.8% 1 Represents operating-basis financial information, a non-GAAP presentation. Refer to the Appendix included with this presentation for explanations of our non-GAAP financial measures and for reconciliations of our operating-basis financial information. Other Occupancy Transaction processing services Information systems and communications Compensation and employee benefits Notable operating-basis (non-GAAP)1 variances 2Q16 vs 2Q15: • Compensation and employee benefits expenses were up compared to 2Q15 primarily due to increased costs to support regulatory initiatives and new business mostly offset by State Street Beacon savings • Information systems and communication expenses were up primarily due to investments associated with supporting business (including State Street Beacon) and regulatory initiatives • Other expenses were down 24.9% primarily due to lower professional services, travel expenses and securities and processing costs Notable operating-basis (non-GAAP)1 variances 2Q16 vs 1Q16: • Compensation and employee benefits expenses were down due to costs associated with the seasonal deferred incentive compensation expense for retirement eligible employees and payroll taxes of $122M, partially offset by an annual merit increase 2Q16 vs 2Q15 1% 8% ---% 2% (25)% 2Q16 vs 1Q16 (10)% (1)% 1% (2)% ---%

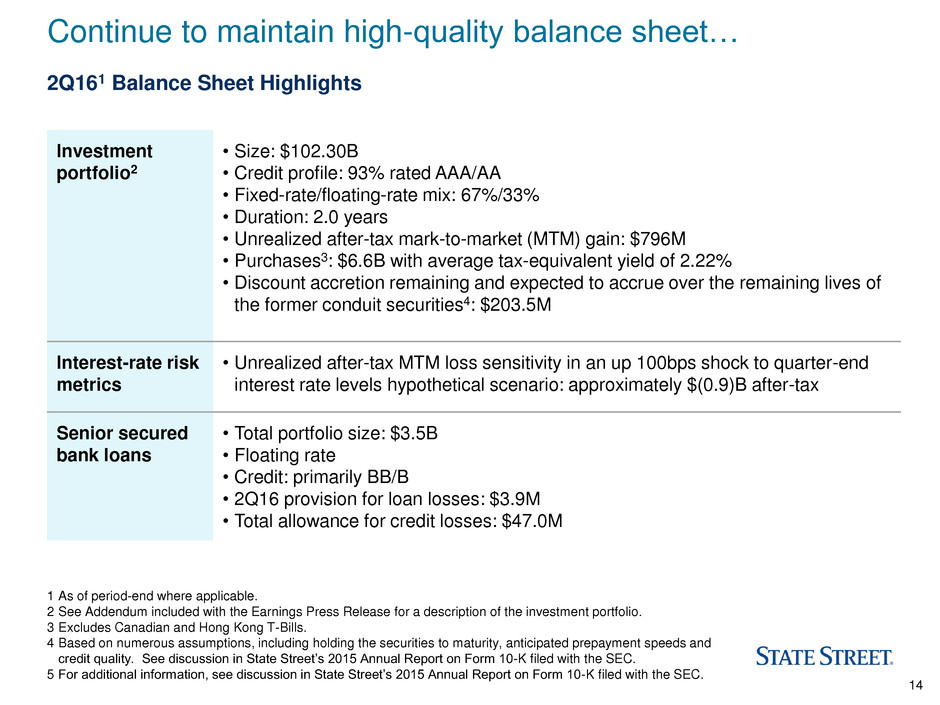

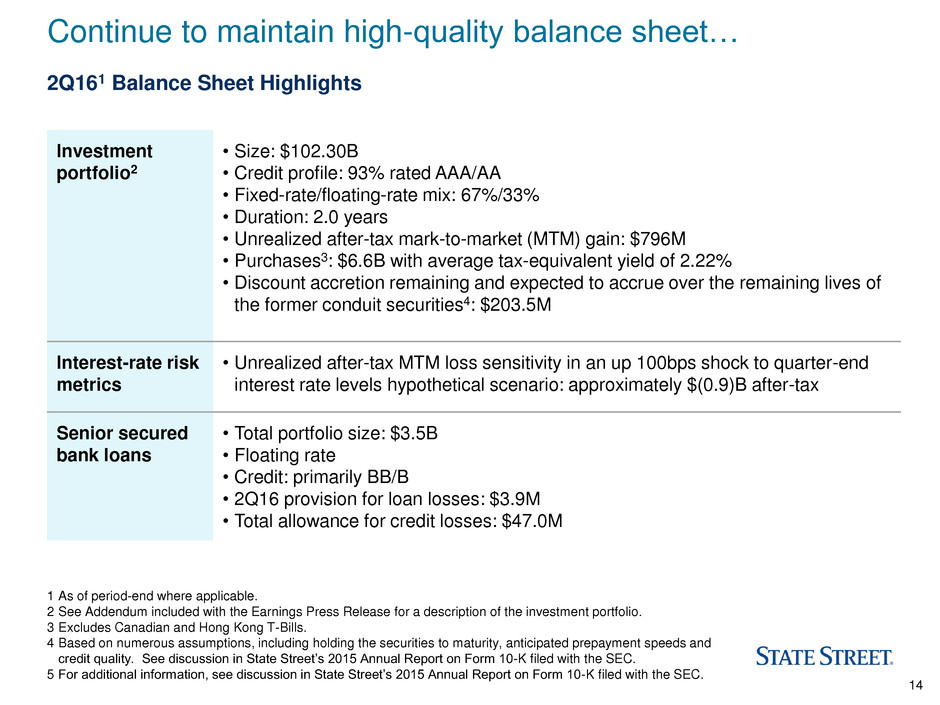

14 1 As of period-end where applicable. 2 See Addendum included with the Earnings Press Release for a description of the investment portfolio. 3 Excludes Canadian and Hong Kong T-Bills. 4 Based on numerous assumptions, including holding the securities to maturity, anticipated prepayment speeds and credit quality. See discussion in State Street’s 2015 Annual Report on Form 10-K filed with the SEC. 5 For additional information, see discussion in State Street’s 2015 Annual Report on Form 10-K filed with the SEC. Continue to maintain high-quality balance sheet… 2Q161 Balance Sheet Highlights Investment portfolio2 • Size: $102.30B • Credit profile: 93% rated AAA/AA • Fixed-rate/floating-rate mix: 67%/33% • Duration: 2.0 years • Unrealized after-tax mark-to-market (MTM) gain: $796M • Purchases3: $6.6B with average tax-equivalent yield of 2.22% • Discount accretion remaining and expected to accrue over the remaining lives of the former conduit securities4: $203.5M Interest-rate risk metrics • Unrealized after-tax MTM loss sensitivity in an up 100bps shock to quarter-end interest rate levels hypothetical scenario: approximately $(0.9)B after-tax Senior secured bank loans • Total portfolio size: $3.5B • Floating rate • Credit: primarily BB/B • 2Q16 provision for loan losses: $3.9M • Total allowance for credit losses: $47.0M

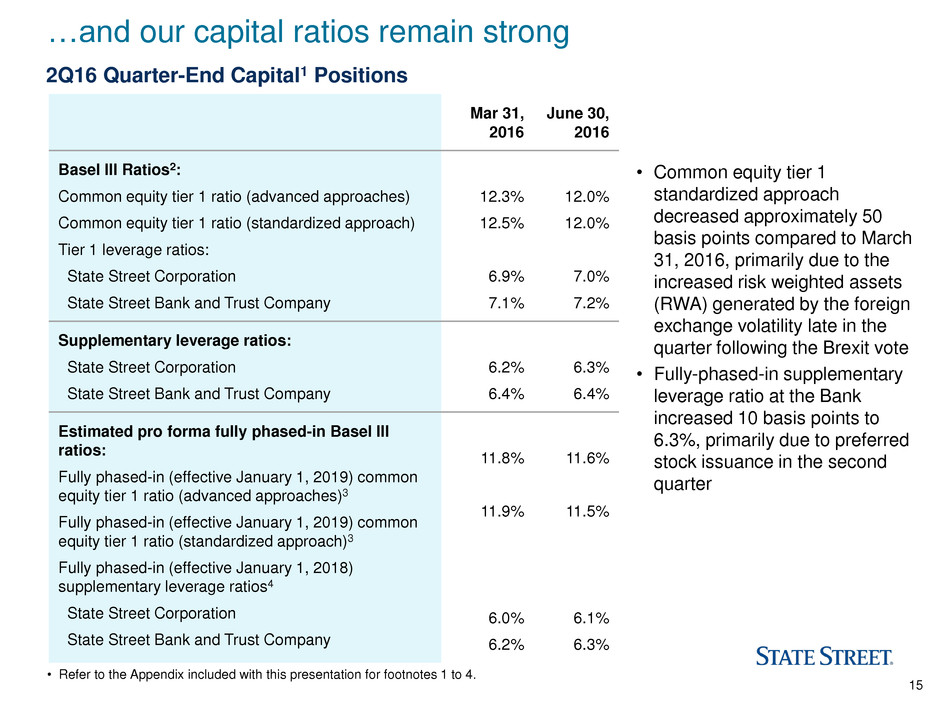

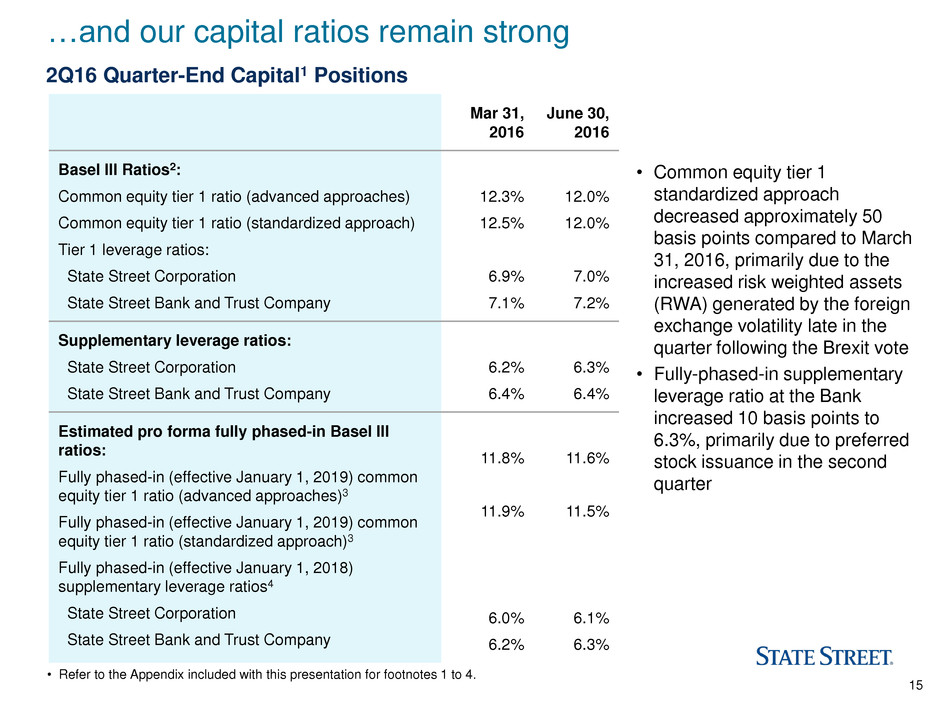

15 • Refer to the Appendix included with this presentation for footnotes 1 to 4. …and our capital ratios remain strong 2Q16 Quarter-End Capital1 Positions Mar 31, 2016 June 30, 2016 Basel III Ratios2: Common equity tier 1 ratio (advanced approaches) Common equity tier 1 ratio (standardized approach) Tier 1 leverage ratios: State Street Corporation State Street Bank and Trust Company 12.3% 12.5% 6.9% 7.1% 12.0% 12.0% 7.0% 7.2% Supplementary leverage ratios: State Street Corporation State Street Bank and Trust Company 6.2% 6.4% 6.3% 6.4% Estimated pro forma fully phased-in Basel III ratios: Fully phased-in (effective January 1, 2019) common equity tier 1 ratio (advanced approaches)3 Fully phased-in (effective January 1, 2019) common equity tier 1 ratio (standardized approach)3 Fully phased-in (effective January 1, 2018) supplementary leverage ratios4 State Street Corporation State Street Bank and Trust Company 11.8% 11.9% 6.0% 6.2% 11.6% 11.5% 6.1% 6.3% • Common equity tier 1 standardized approach decreased approximately 50 basis points compared to March 31, 2016, primarily due to the increased risk weighted assets (RWA) generated by the foreign exchange volatility late in the quarter following the Brexit vote • Fully-phased-in supplementary leverage ratio at the Bank increased 10 basis points to 6.3%, primarily due to preferred stock issuance in the second quarter

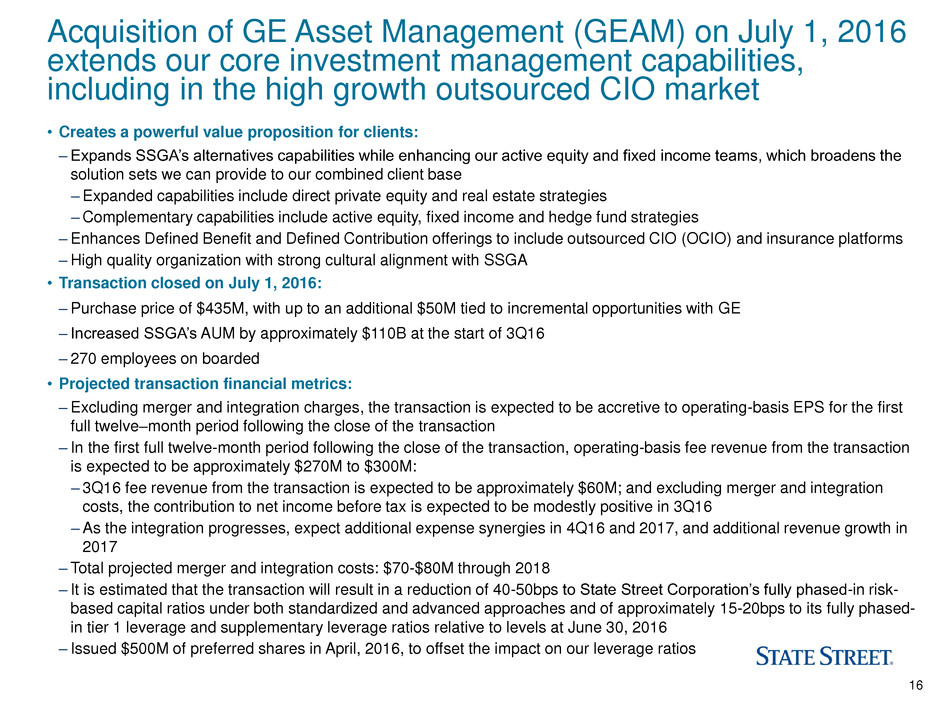

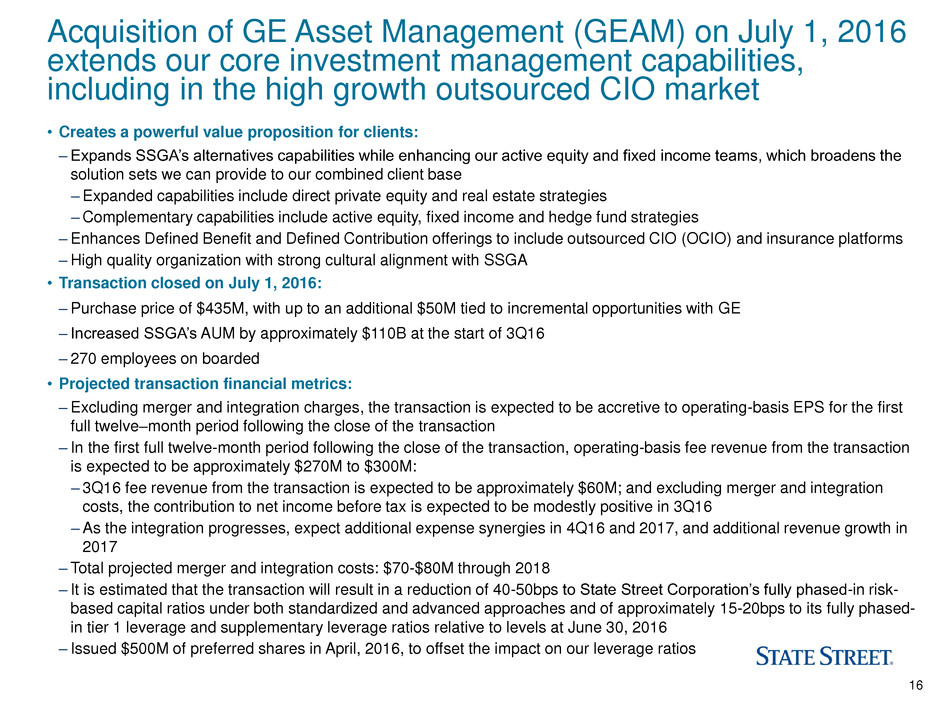

16 • Creates a powerful value proposition for clients: – Expands SSGA’s alternatives capabilities while enhancing our active equity and fixed income teams, which broadens the solution sets we can provide to our combined client base –Expanded capabilities include direct private equity and real estate strategies –Complementary capabilities include active equity, fixed income and hedge fund strategies –Enhances Defined Benefit and Defined Contribution offerings to include outsourced CIO (OCIO) and insurance platforms –High quality organization with strong cultural alignment with SSGA • Transaction closed on July 1, 2016: –Purchase price of $435M, with up to an additional $50M tied to incremental opportunities with GE – Increased SSGA’s AUM by approximately $110B at the start of 3Q16 – 270 employees on boarded • Projected transaction financial metrics: –Excluding merger and integration charges, the transaction is expected to be accretive to operating-basis EPS for the first full twelve–month period following the close of the transaction – In the first full twelve-month period following the close of the transaction, operating-basis fee revenue from the transaction is expected to be approximately $270M to $300M: – 3Q16 fee revenue from the transaction is expected to be approximately $60M; and excluding merger and integration costs, the contribution to net income before tax is expected to be modestly positive in 3Q16 –As the integration progresses, expect additional expense synergies in 4Q16 and 2017, and additional revenue growth in 2017 – Total projected merger and integration costs: $70-$80M through 2018 – It is estimated that the transaction will result in a reduction of 40-50bps to State Street Corporation’s fully phased-in risk- based capital ratios under both standardized and advanced approaches and of approximately 15-20bps to its fully phased- in tier 1 leverage and supplementary leverage ratios relative to levels at June 30, 2016 – Issued $500M of preferred shares in April, 2016, to offset the impact on our leverage ratios Acquisition of GE Asset Management (GEAM) on July 1, 2016 extends our core investment management capabilities, including in the high growth outsourced CIO market

17 Updated 2016 Outlook1: We continue to have the objective of generating positive fee operating leverage2 for 2016 relative to 2015, excluding the contributions of GEAM • Expect modest operating-basis fee revenue growth for full year 2016 compared to full year 2015 under current market conditions in July 2016 and excluding the contributions of the acquired GEAM business: –Do expect to see the traditional seasonal reduction in securities finance revenue in 3Q16 from 2Q16 –New business yet to be installed and new business pipelines support full-year fee growth expectation • Expect approximately flat operating-basis expense growth3 for full year 2016 compared to full year 2015, with variability across quarters and excluding the contributions of the acquired GEAM business: –On track to generate at least $140M in estimated annual pre-tax fiscal expense savings4 from State Street Beacon in 2016 –Expect restructuring charges as State Street Beacon progresses – first charge was $97M in 1Q16 and had a charge of $13M in 2Q16 • Expect operating-basis NIR for 2016 to modestly exceed the high end of our Static scenario of $2,025 - $2,125M5 • Expect operating-basis effective tax rate for 2016 to be 30-32% • Expect preferred dividends on present outstanding preferred shares to be $173M in 2016 ($48.6M in 1Q16, $33.6M in 2Q16, $55.2M in 3Q16 and $35.6M in 4Q16) – includes a total of $18M from issuance of $500M in April 2016 • Federal Reserve did not object to our capital plan following its review in the 2016 CCAR process: –Intend to increase quarterly common stock dividend by 12% to $0.38 per share in 3Q16, subject to Board of Directors approval6 –Board of Directors approved on June 29, 2016, a new common stock purchase program authorizing the purchase of up to $1.4B in common stock6 Refer to the Appendix included with this presentation for footnotes 1 to 6.

18 Appendix State Street Beacon 19 Footnotes to Slides 5, 6, 15 & 17 20-22 Definition of Metrics 23-24 Non-GAAP Measures, Regulatory Capital Ratios and Reconciliations 25-26

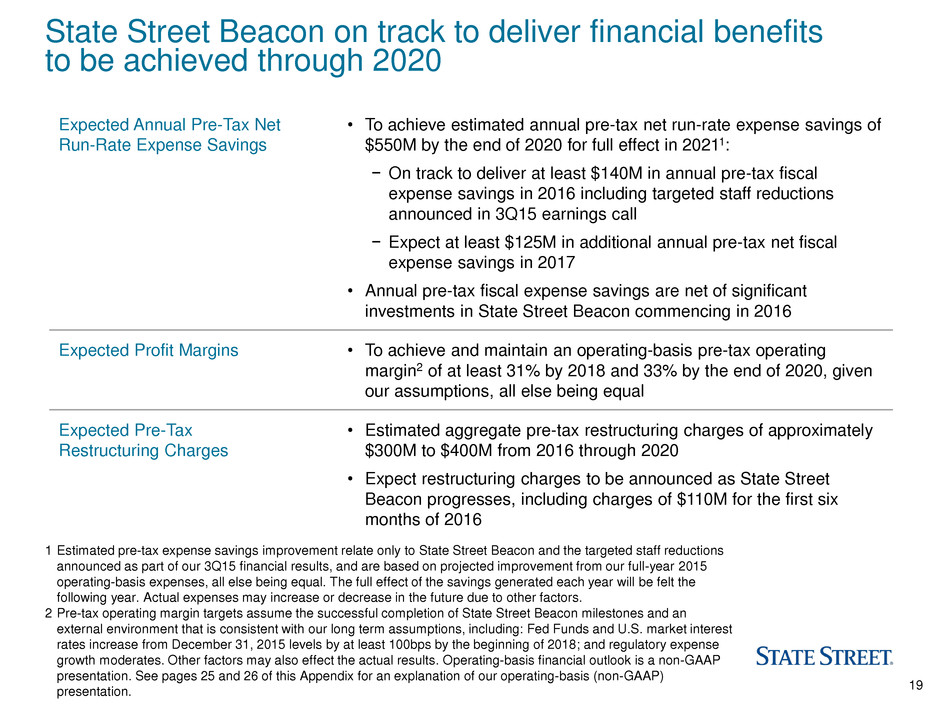

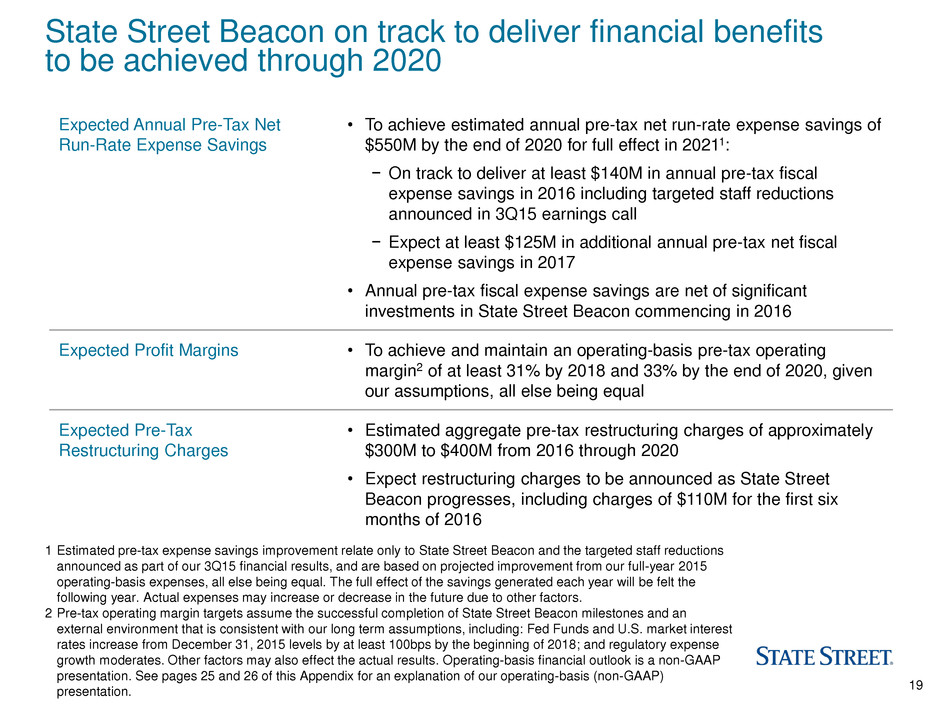

19 State Street Beacon on track to deliver financial benefits to be achieved through 2020 1 Estimated pre-tax expense savings improvement relate only to State Street Beacon and the targeted staff reductions announced as part of our 3Q15 financial results, and are based on projected improvement from our full-year 2015 operating-basis expenses, all else being equal. The full effect of the savings generated each year will be felt the following year. Actual expenses may increase or decrease in the future due to other factors. 2 Pre-tax operating margin targets assume the successful completion of State Street Beacon milestones and an external environment that is consistent with our long term assumptions, including: Fed Funds and U.S. market interest rates increase from December 31, 2015 levels by at least 100bps by the beginning of 2018; and regulatory expense growth moderates. Other factors may also effect the actual results. Operating-basis financial outlook is a non-GAAP presentation. See pages 25 and 26 of this Appendix for an explanation of our operating-basis (non-GAAP) presentation. Expected Annual Pre-Tax Net Run-Rate Expense Savings • To achieve estimated annual pre-tax net run-rate expense savings of $550M by the end of 2020 for full effect in 20211: − On track to deliver at least $140M in annual pre-tax fiscal expense savings in 2016 including targeted staff reductions announced in 3Q15 earnings call − Expect at least $125M in additional annual pre-tax net fiscal expense savings in 2017 • Annual pre-tax fiscal expense savings are net of significant investments in State Street Beacon commencing in 2016 Expected Profit Margins • To achieve and maintain an operating-basis pre-tax operating margin2 of at least 31% by 2018 and 33% by the end of 2020, given our assumptions, all else being equal Expected Pre-Tax Restructuring Charges • Estimated aggregate pre-tax restructuring charges of approximately $300M to $400M from 2016 through 2020 • Expect restructuring charges to be announced as State Street Beacon progresses, including charges of $110M for the first six months of 2016

20 Footnote to Slides 5, 6,15 & 17

21 Footnotes to slides 5 & 6 1 Includes operating-basis (non-GAAP) financial information. Operating-basis financial performance and outlook are a non-GAAP presentation. Refer to the addendum linked to this presentation for explanations of our non-GAAP financial measures and for reconciliations of our historical operating-basis financial information. 2 Estimated pre-tax expense savings improvement relate only to State Street Beacon and the targeted staff reductions announced as part of our 3Q15 financial results (includes targeted staff reductions in October 2015), and are based on projected improvement from our full-year 2015 operating-basis expenses, all else being equal. The full effect of the savings generated each year will be felt the following year. Actual expenses may increase or decrease in the future due to other factors. 3 State Street’s common stock and other stock dividends, including the declaration, timing and amount thereof, remain subject to consideration and approval by its Board of Directors at the relevant times. Stock purchases may be made using various types of mechanisms, including open market purchases or transactions off market, and may be made under Rule 10b5-1 trading programs. The timing of stock purchases, types of transactions and number of shares purchased will depend on several factors, including market conditions and State Street’s capital position, its financial performance and investment opportunities. The common stock purchase program does not have specific price targets and may be suspended at any time. Footnotes to slide 5: Footnotes to slide 6: 1 Source: Cerulli – July 7, 2016; State Street projections. 2 Euro area household net savings ratio ~1.5x U.S. by 2017. Source: OECD (2016), Household savings forecast (indicator). 3 This includes 3,000 employees in our regional operations hub in Poland, which provide support services to most of our core EMEA operating businesses, including the UK. 4 Offshore market information from Monterey Insight. Ireland data for the period June 30, 2012 to June 30, 2015, Luxembourg data from December 31, 2012 to December 31, 2015; domiciled funds only. The Monterey Insight data excludes assets under administration for the following categories: pension funds, insurance products, managed accounts and special purpose vehicles. 5 Asset figures sourced from Bloomberg as of October 30, 2015; service provider based on fund prospectuses; European stock-exchange websites.

22 Footnotes to slide 15 & 17 1 Includes operating-basis (non-GAAP) financial information. Operating-basis financial outlook is a non-GAAP presentation. Refer to the addendum linked to this presentation for explanations of our non-GAAP financial measures. 2 Fee operating leverage is defined as rate of growth of total fee revenue less the rate of growth of expenses, each as determined on an operating basis, and for these purposes, excluding any potential impact from the acquisition of GEAM. 3 Operating-basis expense growth outlook for full year 2016 compared to full year 2015 excludes any potential impact from the acquisition of GE Asset Management (GEAM). Including GEAM’s expenses, operating-basis expense growth could exceed 0% for the full year 2016 compared to 2015. 4 Estimated pre-tax expense savings improvement relate only to State Street Beacon and the targeted staff reductions announced as part of our 3Q15 financial results (includes targeted staff reductions in October 2015), and are based on projected improvement from our full-year 2015 operating-basis expenses, all else being equal. The full effect of the savings generated each year will be felt the following year. Actual expenses may increase or decrease in the future due to other factors. 5 NIR will depend on the size of our balance sheet and client deposit behavior and our expectations assume no changes by the Federal Reserve Board to reference rates in 2016. 6 State Street’s common stock and other stock dividends, including the declaration, timing and amount thereof, remain subject to consideration and approval by its Board of Directors at the relevant times. Stock purchases may be made using various types of mechanisms, including open market purchases or transactions off market, and may be made under Rule 10b5-1 trading programs. The timing of stock purchases, types of transactions and number of shares purchased will depend on several factors, including market conditions and State Street’s capital position, its financial performance and investment opportunities. The common stock purchase program does not have specific price targets and may be suspended at any time. Footnotes to slide 17: 1 Unless otherwise specified, all capital ratios referenced on slide 15 and elsewhere in this presentation refer to State Street Corporation, or State Street, and not State Street Bank and Trust Company, or State Street Bank. The lower of our capital ratios calculated under the Basel III advanced approaches and under the Basel III standardized approach are applied in the assessment of our capital adequacy for regulatory purposes. Refer to elsewhere in the Appendix to this presentation for a further description of these ratios and for reconciliations applicable to State Street’s estimated pro forma fully phased-in Basel III ratios. June 30, 2016 capital ratios are presented as of quarter-end and are preliminary estimates. 2 The advanced approaches-based ratios (actual and estimated) included in this presentation reflect calculations and determinations with respect to our capital and related matters, based on State Street and external data, quantitative formulae, statistical models, historical correlations and assumptions, collectively referred to as “advanced systems,” in effect and used by us for those purposes as of the respective date of each ratio’s first public announcement. Significant components of these advanced systems involve the exercise of judgment by us and our regulators, and these advanced systems may not, individually or collectively, precisely represent or calculate the scenarios, circumstances, outputs or other results for which they are designed or intended. Due to the influence of changes in these advanced systems, whether resulting from changes in data inputs, regulation or regulatory supervision or interpretation, State Street-specific or market activities or experiences or other updates or factors, we expect that our advanced systems and our capital ratios calculated in conformity with the Basel III framework will change and may be volatile over time, and that those latter changes or volatility could be material as calculated and measured from period to period. 3 Estimated pro forma fully phased-in ratios as of June 30, 2016 and March 31, 2016 (fully phased in as of January 1, 2019, as per Basel III phase-in requirements for capital) reflect capital calculated under the Basel III final rule and total risk-weighted assets calculated in conformity with the advanced approaches and standardized approach as the case may be, each on a fully phased-in basis under the Basel III final rule, based on our interpretations of the Basel III final rule as of July 27, 2016 and April 27, 2016, respectively as applied to our businesses and operations as of June 30, 2016 and March 31, 2016, respectively. Refer to the addendum included with this news release for reconciliations of these estimated pro forma fully phased-in ratios to our capital ratios calculated under the currently applicable regulatory requirements. 4 The estimated pro forma fully phased-in SLRs are as of June 30, 2016 and March 31, 2016 (fully phased-in as of January 1, 2018, as per the phase-in requirements of the SLR final rule) are preliminary estimates, calculated based on our interpretations of the SLR final rule as of July 27, 2016 and April 27, 2016, respectively, and as applied to our businesses and operations as of June 30, 2016 and March 31, 2016, respectively. Refer to the addendum included with this news release for reconciliations of these estimated pro forma fully phased-in SLRs to our SLRs under currently applicable regulatory requirements. Footnotes to slide 15:

23 Definition of Metrics

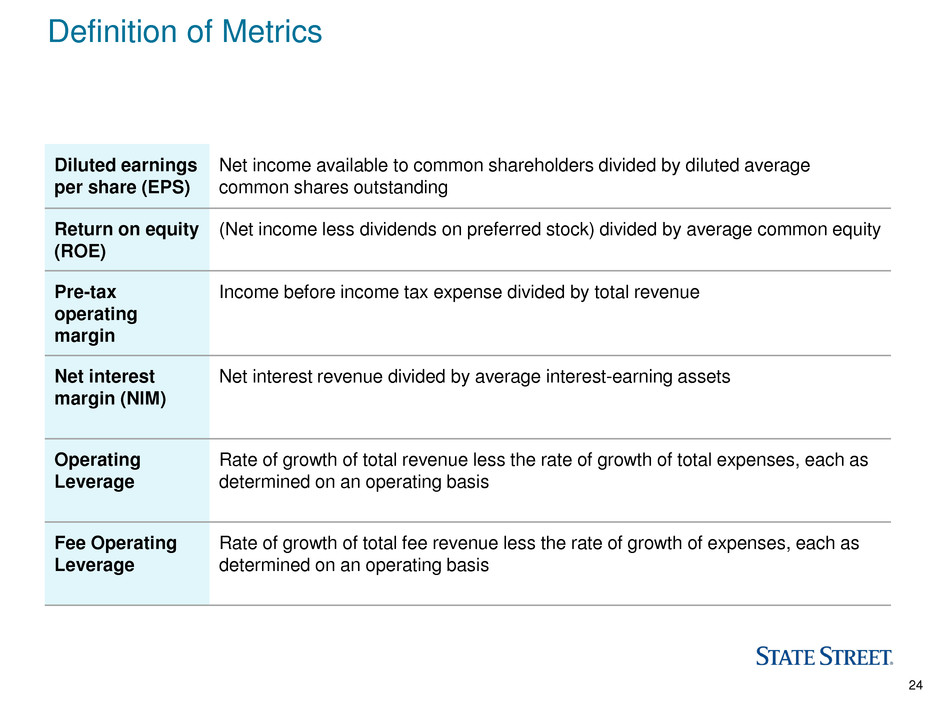

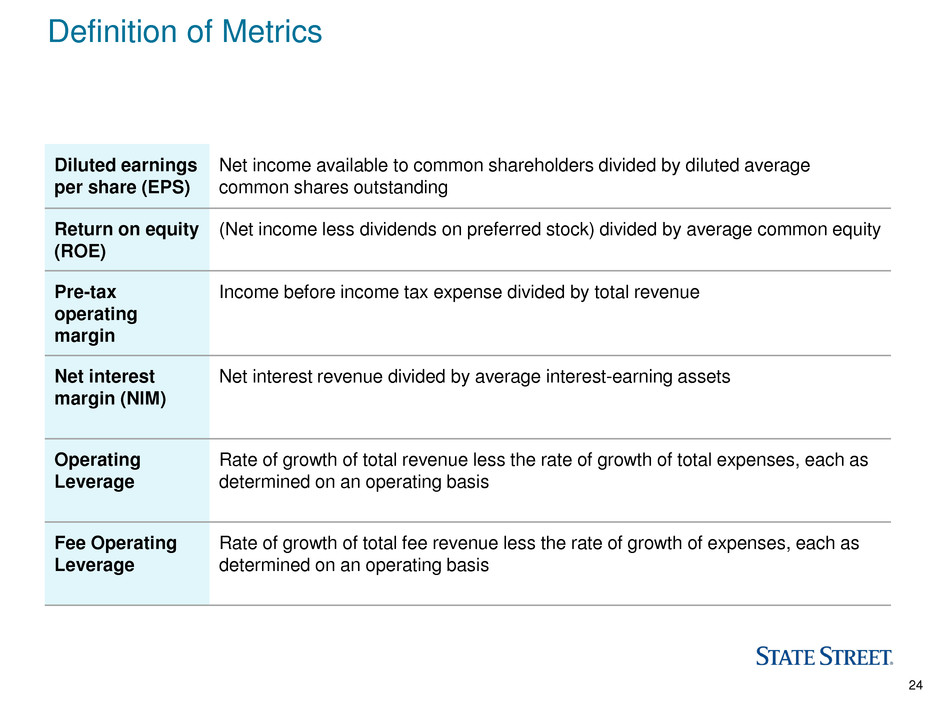

24 Definition of Metrics Diluted earnings per share (EPS) Net income available to common shareholders divided by diluted average common shares outstanding Return on equity (ROE) (Net income less dividends on preferred stock) divided by average common equity Pre-tax operating margin Income before income tax expense divided by total revenue Net interest margin (NIM) Net interest revenue divided by average interest-earning assets Operating Leverage Rate of growth of total revenue less the rate of growth of total expenses, each as determined on an operating basis Fee Operating Leverage Rate of growth of total fee revenue less the rate of growth of expenses, each as determined on an operating basis

25 Non-GAAP Measures, Regulatory Capital Ratios and Reconciliations

26 Non-GAAP measures, regulatory capital ratios and reconciliations In addition to presenting State Street’s financial results in conformity with U.S. generally accepted accounting principles, or GAAP, management also presents results on a non-GAAP, or "operating" basis, as it believes that this presentation supports meaningful analysis and comparisons of trends with respect to State Street’s normal ongoing business operations from period to period, as well as additional information (such as capital ratios calculated under regulatory standards scheduled to be effective in the future or other standards) that management uses in evaluating State Street’s business and activities. Management believes that operating-basis financial information, which excludes the impact of revenue and expenses outside of State Street's normal course of business (such as acquisition and restructuring charges), facilitates an investor's understanding and analysis of State Street's underlying financial performance and trends in addition to financial information prepared and reported in conformity with GAAP. Excluding the impact of revenue and expenses outside of State Street’s normal course of business (such as acquisition and restructuring charges) provides additional insight into our underlying margin and profitability. Our operating-basis presentation also reports revenue from non-taxable sources, such as interest revenue from tax-exempt investment securities and processing fees and other revenue associated with tax-advantaged investments, on a fully taxable-equivalent basis. Taxable-equivalent revenue allows management to provide more meaningful comparisons of yields and margins on assets and to evaluate investment opportunities with different tax profiles. Management also believes that the use of other non-GAAP financial measures in the calculation of identified capital ratios is useful to understanding State Street’s capital position and is of interest to investors. Management provides forward-looking financial estimates and expectations on an operating basis (non-GAAP) because information needed to provide corresponding GAAP-basis information is primarily dependent on future events or conditions that may be uncertain and are difficult to predict or estimate. Management is therefore, in general, unable to provide a reconciliation of our operating-basis forward-looking financial estimates and expectations to a GAAP-basis presentation. However, although the timing and ultimate recognition of the discount accretion relating to our former conduit securities depends, in part, on factors that are outside of our control, including anticipated prepayment speeds, credit quality and general economic and financial market conditions, our outlook for operating-basis net interest revenue for the second half of 2016 assumes an estimated $20 million to $25 million of such discount accretion. Non-GAAP financial measures should be considered in addition to, not as a substitute for or superior to, financial measures determined in conformity with GAAP. Refer to the addendum for reconciliations of our operating-basis financial information. To access the addendum go to www.statestreet.com/stockholder and click on “Filings & Reports – Quarterly Earnings”.