State Street at Barclays Financial Services Conference Ron O’Hanley President and Chief Operating Officer Thursday, September 13, 2018

Preface and forward-looking statements This presentation (and the discussion accompanying it) contains forward-looking statements as defined by United States securities laws. These statements are not guarantees of future performance, are inherently uncertain, are based on assumptions that are difficult to predict and have a number of risks and uncertainties. The forward-looking statements in this presentation and the accompanying discussion speak only as of September 13, 2018, and State Street does not undertake efforts to revise forward-looking statements. See “Forward-looking statements” in the Appendix for more information, including a description of certain factors that could affect future results and outcomes. Certain financial information in this presentation is presented on both a GAAP and an adjusted (adjusted-GAAP) basis. Adjusted-GAAP basis presentations are non-GAAP presentations. Refer to the Appendix for explanations of our non-GAAP financial measures and reconciliations of our non-GAAP financial information. 2

Executive Summary Strong broad-based franchise within one global enterprise Delivering towards our 2018 financial objectives with strong first-half 2018 results compared to the first half of 2017 reflecting continued strength across our businesses Growth in fee revenue driven by increased servicing and management fees supported by ongoing growth in AUCA and AUM due to market appreciation and new business wins Continued NII growth supported by rising U.S. interest rate environment Disciplined expense management drove positive operating leverage while continuing to realize benefits from Beacon Established track record of expanding into new markets, both organically and inorganically Positioning the business to take advantage of growth opportunities and market trends Defined areas of opportunity with proactive client engagement providing clarity regarding our strategic direction 3

1H 2018 Financial Highlights All $M unless noted otherwise B Fee Revenue Net Interest Income Expenses +7% +20% +7% A A 4,736 1,302 4,415 4,433 4,472 1,219 4,117 4,152 1,085 1H17 2H17 1H18 1H17 2H17 1H18 1H17 2H17 1H18 C Pre-Tax Operating Margin Fee & Total Op Leverage Diluted EPS Total Op Leverage (%pts, vs prior yr.) Fee Op Leverage (%pts, vs prior yr.) +2.1%pts +31% 27.0% +10.9% 26.9% $3.51 +9.6% +4.9% $2.69 24.8% $2.55 +3.0% +3.1% +4.6%D +3.3%D -0.4% 1H17 2H17 1H18 1H17 2H17 1H18 1H17 2H17 1H18 A Effects of the new revenue recognition standard (ASU 2014-09) increased 1H18 Total fee revenue and Total expenses by ~$135M each. B 1H17 and 2H17 include restructuring charges of $79M and $166M, respectively. 1H18 includes repositioning charges of $77M. C Pre-tax operating margin on a historical operating-basis would have been: 1H17: 29.8%, 2H17: 33.0%, 1H18: 29.0%. Historical operating-basis is a non-GAAP presentation. Refer to the Appendix for details on non-GAAP measures and reconciliations of financial information. D 2H17 vs. 2H16 YoY total and fee operating leverage of 10.9%pts and 9.6%pts, respectively, includes $249M pre-tax acceleration of compensation expense in 4Q16. D Excluding this, total and fee operating leverage would be 4.6%pts and 3.3%pts, respectively. Refer to the Appendix for a reconciliation of this calculation, along with our 4 D other non-GAAP presentations.

State Street Today Investment Servicing Investment Management Asset Markets Information Asset Servicing & Research & Data Analytics Management • Providing customized • Delivering investment • Offering investment data • Providing access to asset servicing solutions research, foreign aggregation and investment strategies that support traditional exchange (FX) trading, indicators by leveraging and insights that help and alternative enhanced custody and big data and advanced achieve financial investments securities lending technology objectives • Largest custodian with • ~$22T in FX and • Planned acquisition of • World’s third-largest ~$34T AUCA1 interbank volume traded Charles River asset manager with in 2017 Development, approximately $2.7TA • Market leading Middle- supported by existing AUM Office provider with • #1 FX provider to asset 1 data management ~$13T AUA managers in the • World’s third-largest capabilities, will enable Euromoney Real Money ETF provider • Responsible for more a front-to-back client FX Survey 2018 with 3 than 10% of the world’s services platform 2 the best overall assets customer satisfaction rate Planned acquisition expected to close 4Q183 A Period end as of June 30, 2018. Refer to the Appendix included with this presentation for endnotes 1 to 14. 5

Organic and inorganic growth supporting business expansion Driven by technology transformation 2010 – Beyond Charles River Development3 (Planned 4Q18)* 2000s GE Asset Mgmt. (2016)* • Enhanced electronic trading venues providing increased liquidity & market access State Street Global 90s Currenex (2007)* Exchange (2013) • Data services & investment State Street Global Fund Connect (2001) analytics 4 Front Markets (1999) • Introduced electronic Office trading solutions for institutional investors Middle Office • Leading, global middle- State Street Associates office outsourcing provider (1997)5 Outsourcing (2000) with significant scale Investment Manager Services FX Connect (1996) utilizing a single system • Investment accounting provider Middle • Client reporting ~$13T AUA1 Office • Growth of core servicing • International expansion of 70s & 80s Fund Administration 7 core servicing franchise franchise & offshore • Enhanced servicing GS Admin. Services capabilities including Investors Bank & Trust (2012)* Custody & Fund (2007)* Treasury & Managed 8 Accounting Services Deutsche Bank Global Intesa Sanpaolo S.S. Back S.S.8 (2002)* (2010)* Office ~$6T AUC6 ~$34T AUCA1 Expansion of back-office Advanced growth in front, Global, multicurrency Integrating front-to-back capabilities; initial moves to middle & back office utilizing fund accounting platform technology solutions front-office technology innovation Note: This timeline is illustrative in nature, representing State Street’s growth through 1970s to 2010 and beyond, and is non-exhaustive. * Inorganic business expansion through acquisition. The years referenced on the timeline indicate the year of the acquisition announcement and not the year of completion. Refer to the Appendix included with this presentation for endnotes 1 to 14. 6

Investment services client segment revenue opportunities Top four sub-segments represent approximately 2/3rds of industry asset poolsA For illustrative purposes only High Global Giants 14 1 Global Asset Managers 2 Large, Sophisticated Asset Owners Emerging Institutions 3 Global Insurance firms 13 Largest Established Firms Sub-segments 4 Regional Asset Managers Alternative Investor 5 Regional Retirement Systems 9 6 Corporate Pension Funds Sophisticated 11 2 Global Asset Asset Owners 1 7 Regional Insurance Firms Projected Managers AUM market Global Insurance 5 Asset Focused Alternative Investors A Firms growth 3 Regional Hedge Funds 10 Allocators 8 (%) Asset Managers 9 Private Equity / Real Assets 4 12 8 15 Asset Allocators 10 Endowments & Foundations 6 Established 11 Corp Treasury Assets/Small Pensions . Firms 12 Other Insurance Firms 7 Emerging Institutions 13 Wealth Management Firms (US RIAs) Low 14 Developed Market Institutional Investors Low A 15 Boutique Asset Managers Industry revenue pool ($) High A State Street estimate. For illustrative purposes only. Refer to endnote 9 included in the Appendix of this presentation for additional details. 7

Aligning our Global Services business to client needs Strategic goal to move to a seamless asset servicing platform Global Client Services & Relations • Strengthen and deepen client North America relationships NA Asset (NA) Asset • Provide simplified single route to Owners Managers market • Enhance client focus and performance measurement Investment NA Manager Svcs Insurance (Middle Office) Enterprise end-to-end offering Global Services Information enabled platform GS EMEA State Street Global (GS) EMEA Offshore Onshore Services Open architecture integration Risk & data analytics network EMEA GS Asia Pacific Investment Svcs (APAC) ex. and operations Japan Global Delivery & Business Transformation APAC GS Japan Investment Svcs • Streamline operations and operations • Leverage scale and consistency • Innovate and develop new products 8

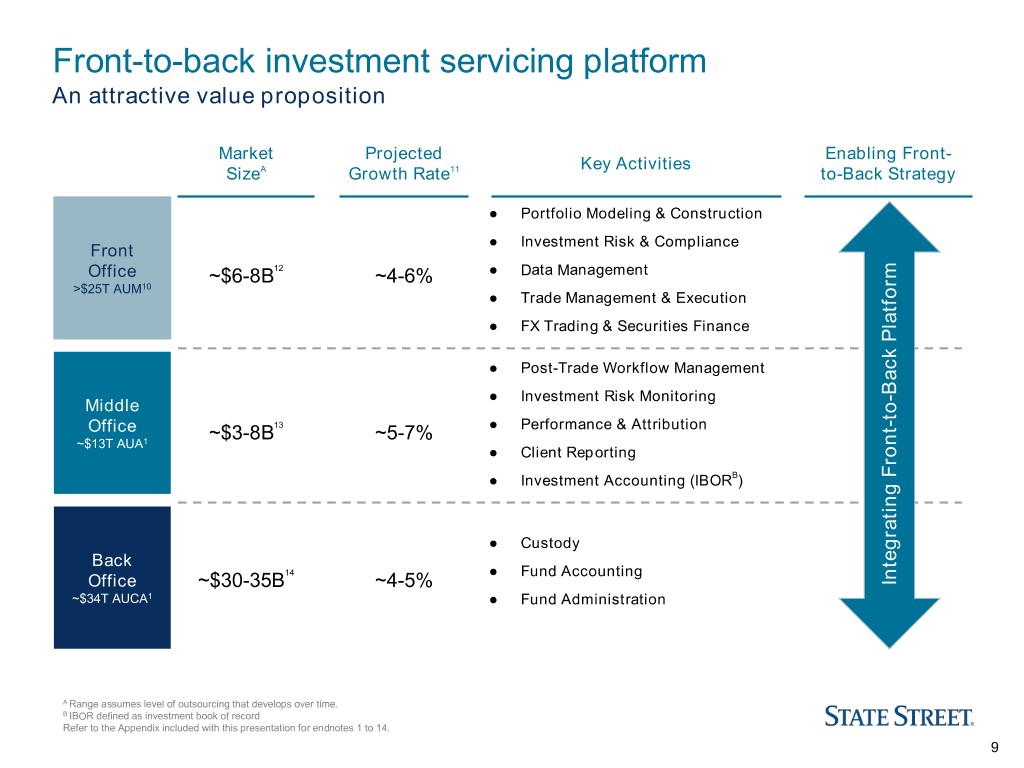

Front-to-back investment servicing platform An attractive value proposition Market Projected Enabling Front- A 11 Key Activities Size Growth Rate to-Back Strategy ● Portfolio Modeling & Construction ● Investment Risk & Compliance Front Office 12 ● Data Management ~$6-8B ~4-6% >$25T AUM10 ● Trade Management & Execution ● FX Trading & Securities Finance Platform ● Post-Trade Workflow Management Back Back ● Investment Risk Monitoring - Middle to Office 13 ● Performance & Attribution - ~$13T AUA1 ~$3-8B ~5-7% ● Client Reporting ● Investment Accounting (IBORB) ● Custody Back 14 ● Fund Accounting Office ~$30-35B ~4-5% Integrating Front ~$34T AUCA1 ● Fund Administration A Range assumes level of outsourcing that develops over time. B IBOR defined as investment book of record Refer to the Appendix included with this presentation for endnotes 1 to 14. 9

State Street at Barclays Financial Services Conference Questions and Ron O’Hanley, President and Chief Operating Officer Eric W. Aboaf, Chief Financial Officer Answers Thursday, September 13, 2018 10

Appendix Endnotes 12 Forward-looking statements 13 Non-GAAP measures 14 Reconciliations of non-GAAP 15 – 16 financial information Definitions 17 11

Slide endnotes 1 Period end as of June 30, 2018. ~$34T of AUCA includes most of the Middle Office AUA. 2 Source: State Street and McKinsey Global Institute, Global Capital Markets, December 31, 2016. This represents State Street’s AUCA ($29T) as a proportion of total global financial assets ($270T). *Updated in January 2018 per bespoke McKinsey report. 3 Agreement to acquire Charles River Development on July 20, 2018. Acquisition subject to regulatory approvals and customary closing conditions. 4 Global Markets as currently constructed to include FX, Securities Finance, Portfolio Solutions, and GlobalLink. 5 State Street Associates (SSA) is an academic affiliate of State Street Global Exchange (previously Global Markets), providing proprietary and bespoke research services for clients. 6 Period end as of December 31, 1999. 7 Includes build out of hedge fund servicing for private equity & real estate, and ETF servicing. 8 Securities Services 9 For illustrative purposes only. Compiled based on multiple industry data sources and State Street data and analysis. Client segmentation is non-exhaustive and purely directional in nature. Projected AUM market growth rate ranges from low single-digit to low double digit percentages. Industry revenue pool estimates range from high millions to high single-digit billions of dollars. Revenue pools include back office (e.g., custody, fund accounting and fund administration), middle office and value-added services (e.g., FX, securities lending). 10 Based on Charles River Development’s total client AUM size being managed on its platform as of December 31, 2017. See endnote 3 above. 11 Growth rates are internal estimates of three-year forecasted growth rates, with key assumptions and sources as follows: • Front Office: includes Order Management System (OMS), electronic trading/Execution Management System (EMS), risk technology, market surveillance, and trade compliance; industry data from TABB Group (“State of the OMS: A Time for Change”; May 2018), Aite (“Trade Surveillance and Compliance Technology: 2017 Spending Update”; https://www.aitegroup.com/report/trade-surveillance-and-compliance-technology-2017-spending-update; January 10, 2017), Greenwich Associates (“Buy Side Goes Outside for OMS/EMS Platforms”; https://www.greenwich.com/fixed-income-fx-cmds/buy-side-goes-outside-omsems-platforms; May 23, 2018), and Institutional Investor (“Institutional Investors Crank Up Their Spending on Risk Technology”; https://www.institutionalinvestor.com/article/b17r4w1mk4z5gv/institutions-crank-up-their- spending-on-risk-technology; April 12, 2018). • Middle Office: expected AUM growth 2017-2020 with internal analysis for estimates of rates of outsourcing change and fee trends; industry AUM data from PwC (“Asset & Wealth Management Revolution: Embracing Exponential Change”, 2017). • Back Office: expected AUM growth 2017-2020 and internal estimate of fee trends; industry AUM data from PwC (“Asset & Wealth Management Revolution: Embracing Exponential Change”, 2017). 12 Addressable market defined as OMS spend, electronic trading/EMS spend, risk technology spend, and market surveillance and trade compliance spend; industry data from TABB Group (“State of the OMS: A Time for Change”; May 2018), Aite (“Trade Surveillance and Compliance Technology: 2017 Spending Update”; https://www.aitegroup.com/report/trade-surveillance-and-compliance-technology-2017-spending-update; January 10, 2017), Greenwich Associates (“Buy Side Goes Outside for OMS/EMS Platforms”; https://www.greenwich.com/fixed-income-fx-cmds/buy-side-goes-outside-omsems-platforms; May 23, 2018), and Institutional Investor (“Institutional Investors Crank Up Their Spending on Risk Technology”; https://www.institutionalinvestor.com/article/b17r4w1mk4z5gv/institutions-crank-up-their-spending-on-risk-technology; April 12, 2018). Outsourcing rates based on internal analysis and industry data from Greenwich Associates (“Buy Side Goes Outside for OMS/EMS Platforms”; https://www.greenwich.com/fixed-income-fx-cmds/buy-side-goes-outside-omsems-platform; May 23, 2018). 13 Includes Middle Office operations and functions outsourced by asset managers to securities services providers; industry data from PwC (“Asset & Wealth Management Revolution: Embracing Exponential Change”, 2017) with outsourcing and fee rates based on internal analysis. 14 Global securities services industry revenue (including Custody, Accounting, Administration and Net Interest Income) with estimate of Middle Office revenue removed; industry data from BCG (“Embracing the Digital Migration”, 2018) with outsourcing rates based on internal analysis. 12

Forward-looking statements This presentation (and the discussion accompanying it) contains forward-looking statements within the meaning of United States securities laws, including statements about our goals and expectations regarding our business, financial and capital condition, results of operations, strategies, the financial and market outlook, dividend and stock purchase programs, governmental and regulatory initiatives and developments, and the business environment. Forward-looking statements are often, but not always, identified by such forward-looking terminology as “plan,” “strategy,” “objective,” “opportunity,” “trend,” “project,” “proposition,” “outlook,” “expect,” "priority," “intend,” “forecast,” “believe,” “anticipate,” “estimate,” “seek,” “may,” “will,” “target” and “goal,” or similar statements or variations of such terms. These statements are not guarantees of future performance, are inherently uncertain, are based on current assumptions that are difficult to predict and involve a number of risks and uncertainties. Therefore, actual outcomes and results may differ materially from what is expressed in those statements, and those statements should not be relied upon as representing our expectations or beliefs as of any date subsequent to September 13, 2018. Important factors that may affect future results and outcomes include, but are not limited to: the financial strength of the counterparties with which we or our clients do business and to which we have investment, credit or financial exposures as a result of our acting as agent for our clients, including as asset manager; increases in the volatility of, or declines in the level of, our NII, changes in the composition or valuation of the assets recorded in our consolidated statement of condition (and our ability to measure the fair value of investment securities) and changes in the manner in which we fund those assets; the liquidity of the U.S. and international securities markets, particularly the markets for fixed-income securities and inter-bank credits; the liquidity of the assets on our balance sheet and changes or volatility in the sources of such funding, particularly the deposits of our clients; and demands upon our liquidity, including the liquidity demands and requirements of our clients; the level and volatility of interest rates, the valuation of the U.S. dollar relative to other currencies in which we record revenue or accrue expenses and the performance and volatility of securities, credit, currency and other markets in the U.S. and internationally; and the impact of monetary and fiscal policy in the U.S. and internationally on prevailing rates of interest and currency exchange rates in the markets in which we provide services to our clients; the credit quality, credit-agency ratings and fair values of the securities in our investment securities portfolio, a deterioration or downgrade of which could lead to other-than-temporary impairment of such securities and the recognition of an impairment loss in our consolidated statement of income; our ability to attract deposits and other low-cost, short-term funding; our ability to manage the level and pricing of such deposits and the relative portion of our deposits that are determined to be operational under regulatory guidelines; and our ability to deploy deposits in a profitable manner consistent with our liquidity needs, regulatory requirements and risk profile; the manner and timing with which the Federal Reserve and other U.S. and foreign regulators implement or reevaluate the regulatory framework applicable to our operations (as well as changes to that framework), including implementation or modification of the Dodd-Frank Act and related stress testing and resolution planning requirements, implementation of international standards applicable to financial institutions, such as those proposed by the Basel Committee and European legislation (such as the AIFMD, UCITS, the Money Market Funds Regulation and MiFID II / MiFIR); among other consequences, these regulatory changes impact the levels of regulatory capital and liquidity we must maintain, acceptable levels of credit exposure to third parties, margin requirements applicable to derivatives, restrictions on banking and financial activities and the manner in which we structure and implement our global operations and servicing relationships. In addition, our regulatory posture and related expenses have been and will continue to be affected by changes in regulatory expectations for global systemically important financial institutions applicable to, among other things, risk management, liquidity and capital planning, resolution planning, compliance programs, and changes in governmental enforcement approaches to perceived failures to comply with regulatory or legal obligations; adverse changes in the regulatory ratios that we are, or will be, required to meet, whether arising under the Dodd-Frank Act or implementation of international standards applicable to financial institutions, such as those proposed by the Basel Committee, or due to changes in regulatory positions, practices or regulations in jurisdictions in which we engage in banking activities, including changes in internal or external data, formulae, models, assumptions or other advanced systems used in the calculation of our capital or liquidity ratios that cause changes in those ratios as they are measured from period to period; requirements to obtain the prior approval or non-objection of the Federal Reserve or other U.S. and non-U.S. regulators for the use, allocation or distribution of our capital or other specific capital actions or corporate activities, including, without limitation, acquisitions, investments in subsidiaries, dividends and stock purchases, without which our growth plans, distributions to shareholders, share repurchase programs or other capital or corporate initiatives may be restricted; changes in law or regulation, or the enforcement of law or regulation, that may adversely affect our business activities or those of our clients or our counterparties, and the products or services that we sell, including additional or increased taxes or assessments thereon, capital adequacy requirements, margin requirements and changes that expose us to risks related to the adequacy of our controls or compliance programs; economic or financial market disruptions in the U.S. or internationally, including those which may result from recessions or political instability; for example, the U.K.'s decision to exit from the European Union may continue to disrupt financial markets or economic growth in Europe or potential changes in trade policy and bi-lateral and multi-lateral trade agreements proposed by the U.S.; our ability to create cost efficiencies through changes in our operational processes and to further digitize our processes and interfaces with our clients, any failure of which, in whole or in part, may among other things, reduce our competitive position, diminish the cost-effectiveness of our systems and processes or provide an insufficient return on our associated investment; our ability to promote a strong culture of risk management, operating controls, compliance oversight, ethical behavior and governance that meets our expectations and those of our clients and our regulators, and the financial, regulatory, reputation and other consequences of our failure to meet such expectations; the impact on our compliance and controls enhancement programs associated with the appointment of a monitor under the deferred prosecution agreement with the DOJ and compliance consultant appointed under a settlement with the SEC, including the potential for such monitor and compliance consultant to require changes to our programs or to identify other issues that require substantial expenditures, changes in our operations, or payments to clients or reporting to U.S. authorities; the results of our review of our billing practices, including additional findings or amounts we may be required to reimburse clients, as well as potential consequences of such review, including damage to our client relationships or our reputation and adverse actions by governmental authorities; the results of, and costs associated with, governmental or regulatory inquiries and investigations, litigation and similar claims, disputes, or civil or criminal proceedings; changes or potential changes in the amount of compensation we receive from clients for our services, and the mix of services provided by us that clients choose; the large institutional clients on which we focus are often able to exert considerable market influence and have diverse investment activities, and this, combined with strong competitive market forces, subjects us to significant pressure to reduce the fees we charge, to potentially significant changes in our AUCA or our AUM in the event of the acquisition or loss of a client, in whole or in part, and to potentially significant changes in our fee revenue in the event a client re-balances or changes its investment approach or otherwise re-directs assets to lower- or higher-fee asset classes; the potential for losses arising from our investments in sponsored investment funds; the possibility that our clients will incur substantial losses in investment pools for which we act as agent, the possibility of significant reductions in the liquidity or valuation of assets underlying those pools and the potential that clients will seek to hold us liable for such losses; the possibility that our clients or regulators will assert claims that our fees with respect to such investment products are not appropriate or consistent with our fiduciary responsibilities; our ability to anticipate and manage the level and timing of redemptions and withdrawals from our collateral pools and other collective investment products; the credit agency ratings of our debt and depositary obligations and investor and client perceptions of our financial strength; adverse publicity, whether specific to State Street or regarding other industry participants or industry-wide factors, or other reputational harm; our ability to control operational risks, data security breach risks and outsourcing risks, our ability to protect our intellectual property rights, the possibility of errors in the quantitative models we use to manage our business, and the possibility that our controls will prove insufficient, fail or be circumvented; our ability to expand our use of technology to enhance the efficiency, accuracy and reliability of our operations and our dependencies on information technology and our ability to control related risks, including cyber-crime and other threats to our information technology infrastructure and systems (including those of our third-party service providers) and their effective operation both independently and with external systems, and complexities and costs of protecting the security of such systems and data; changes or potential changes to the competitive environment, including changes due to regulatory and technological changes, the effects of industry consolidation and perceptions of State Street as a suitable service provider or counterparty; our ability to complete acquisitions, joint ventures and divestitures, including our proposed acquisition of Charles River Development, and our ability to obtain regulatory approvals, the ability to arrange financing as required and the ability to satisfy closing conditions; the risks that our acquired businesses and joint ventures will not achieve their anticipated financial, operational and product innovation benefits or will not be integrated successfully, or that the integration will take longer than anticipated; that expected synergies will not be achieved or unexpected negative synergies or liabilities will be experienced; that client and deposit retention goals will not be met; that other regulatory or operational challenges will be experienced; and that disruptions from the transaction will harm our relationships with our clients, our employees or regulators; our ability to integrate Charles River Development’s front office systems with our middle and back office capabilities to offer an front to back office system that is competitive and meets our clients requirements; our ability to recognize evolving needs of our clients and to develop products that are responsive to such trends and profitable to us; the performance of and demand for the products and services we offer; and the potential for new products and services to impose additional costs on us and expose us to increased operational risk; our ability to grow revenue, manage expenses, attract and retain highly skilled people and raise the capital necessary to achieve our business goals and comply with regulatory requirements and expectations; changes in accounting standards and practices; and the impact of the U.S. tax legislation enacted in 2017, and changes in tax legislation and in the interpretation of existing tax laws by U.S. and non-U.S. tax authorities that affect the amount of taxes due. Other important factors that could cause actual results to differ materially from those indicated by any forward-looking statements are set forth in our 2017 Annual Report on Form 10-K and our subsequent SEC filings. We encourage investors to read these filings, particularly the sections on risk factors, for additional information with respect to any forward-looking statements and prior to making any investment decision. The forward-looking statements contained in this presentation should not by relied on as representing our expectations or beliefs as of any time subsequent to the time this presentation is first issued, and we do not undertake efforts to revise those forward-looking statements to reflect events after that time. 13

Non-GAAP measures In addition to presenting State Street's financial results in conformity with U.S. generally accepted accounting principles, or GAAP, management also presents certain financial information on a non-GAAP basis. In general, our non-GAAP financial results adjust selected GAAP-basis financial results to exclude the impact of revenue and expenses outside of State Street’s normal course of business or other notable items, such as acquisition and restructuring charges, repositioning charges and gains/losses on sales. Management believes that this presentation of financial information facilitates an investor's further understanding and analysis of State Street's financial performance and trends with respect to State Street’s business operations from period to period, including providing additional insight into our underlying margin and profitability, in addition to financial information prepared and reported in conformity with GAAP. Management may also provide additional non-GAAP measures. For example, we present capital ratios, calculated under regulatory standards scheduled to be effective in the future or other standards, that management uses in evaluating State Street’s business and activities and believes may similarly be useful to investors. Additionally, we may present revenue and expense measures on a constant currency basis to identify the significance of changes in foreign currency exchange rates (which often are variable) in period-to-period comparisons. Prior to 1Q18, management presented results on an operating-basis to both: (1) exclude the impact of revenue and expenses outside of State Street’s normal course of business, such as restructuring charges; and (2) present revenue from non-taxable sources, such as interest income from tax-exempt investment securities and processing fees and other revenue associated with tax-advantaged investments, on a fully-taxable equivalent basis. Beginning in 1Q18 State Street presents results only on a GAAP basis, along with certain non-GAAP measures that management believes may be useful to investors. As management has previously communicated the expected impact of State Street Beacon on pre-tax margin based on historical operating-basis results, pre-tax margin has been provided on that historical operating-basis to allow investors to assess performance with respect to State Street Beacon on a consistent basis. Non-GAAP financial measures should be considered in addition to, not as a substitute for or superior to, financial measures determined in conformity with GAAP. Refer to the reconciliations of our non-GAAP financial information later in this appendix. 14

Reconciliations of non-GAAP financial information 1H18 vs (Dollars in millions, except per share amounts) 1Q17 2Q17 1H17 3Q17 4Q17 2H17 1Q18 2Q18 1H18 1H17 Total fee revenue $ 2,198 $ 2,235 $ 4,433 $ 2,242 $ 2,230 $ 4,472 $ 2,378 $ 2,358 $ 4,736 7% Net interest income 510 575 1,085 603 616 1,219 643 659 1,302 20% Gains (losses) from sales of available-for-sale securities, net (40) — (40) 1 — 1 (2) 9 7 Total revenue 2,668 2,810 5,478 2,846 2,846 5,692 3,019 3,026 6,045 Provision for loan losses (2) 3 1 3 (2) 1 — 2 2 Total expenses 2,086 2,031 4,117 2,021 2,131 4,152 2,256 2,159 4,415 7% Income before income tax expense 584 776 1,360 822 717 1,539 763 865 1,628 Income tax expense 82 156 238 137 347 484 102 131 233 Net income $ 502 $ 620 $ 1,122 $ 685 $ 370 $ 1,055 $ 661 $ 734 $ 1,395 Diluted EPS 1.15 1.53 2.69 1.66 0.89 2.55 1.62 1.88 3.51 31% 1H18 vs (Dollars in millions, except w here otherw ise noted) 1Q17 2Q17 1H17 3Q17 4Q17 2H17 1Q18 2Q18 1H18 1H17 Total revenue, GAAP-basis $ 2,668 $ 2,810 $ 5,478 $ 2,846 $ 2,846 $ 5,692 $ 3,019 $ 3,026 $ 6,045 Tax-equivalent adjustment associated w ith tax advantaged investments 70 89 159 79 78 157 66 68 134 Tax-equivalent adjustment associated w ith tax exempt investments 43 42 85 42 40 82 21 18 39 Impact of tax legislation — — — — 20 20 — — — Total revenue, historical Operating-basis 2,781 2,941 5,722 2,967 2,984 5,951 3,106 3,112 6,218 Provision for loan losses (2) 3 1 3 (2) 1 — 2 2 Total expenses, GAAP-basis 2,086 2,031 4,117 2,021 2,131 4,152 2,256 2,159 4,415 Acquisition and restructuring costs (29) (71) (100) (33) (133) (166) — — — Total expenses, historical Operating-basis 2,057 1,960 4,017 1,988 1,998 3,986 2,256 2,159 4,415 Income before taxes, historical Operating-basis $ 726 $ 978 $ 1,704 $ 976 $ 988 $ 1,964 $ 850 $ 951 $ 1,801 Less: Repositioning Charges — — — — — — — (77) (77) Income before taxes, historical Operating-basis excluding repositioning charges $ 726 $ 978 $ 1,704 $ 976 $ 988 $ 1,964 $ 850 $ 1,028 $ 1,878 Pre-Tax Operating Margin (GAAP-basis) 21.9 % 27.6 % 24.8 % 28.9 % 25.2 % 27.0 % 25.3 % 28.6 % 26.9 % +2.1%pts Pre-Tax Operating Margin (historical Operating-basis) 26.1 % 33.3 % 29.8 % 32.9 % 33.1 % 33.0 % 27.4 % 30.6 % 29.0 % Pre-Tax Operating Margin (historical Operating-basis excluding repositioning charges) 26.1 % 33.3 % 29.8 % 32.9 % 33.1 % 33.0 % 27.4 % 33.0 % 30.2 % 15

Reconciliations of non-GAAP financial information (Dollars in millions) 1Q16 2Q16 1H16 1Q17 2Q17 1H17 1H17 vs 1H16 Operating Leverage, GAAP-Basis: Total revenue, GAAP-basis $ 2,484 $ 2,573 $ 5,057 $ 2,668 $ 2,810 $ 5,478 8.3% Total expenses, GAAP-basis 2,050 1,860 3,910 2,086 2,031 4,117 5.3% Operating leverage, GAAP-basis +3.0%pts (Dollars in millions) 3Q16 4Q16 2H16 3Q17 4Q17 2H17 2H17 vs 2H16 Operating Leverage, GAAP-Basis: Total revenue, GAAP-basis $ 2,620 $ 2,530 $ 5,150 $ 2,846 $ 2,846 $ 5,692 10.5% Total expenses, GAAP-basis 1,984 2,183 4,167 2,021 2,131 4,152 -0.4% Total expenses, GAAP-basis excluding acceleration of compensation expense 1,984 1,934 3,918 2,021 2,131 4,152 5.9% Operating leverage, GAAP-basis +10.9%pts Operating leverage, GAAP-basis excluding acceleration of compensation expense +4.6%pts (Dollars in millions) 1Q17 2Q17 1H17 1Q18 2Q18 1H18 1H18 vs 1H17 Operating Leverage, GAAP-Basis: Total revenue, GAAP-basis $ 2,668 $ 2,810 $ 5,478 $ 3,019 $ 3,026 $ 6,045 10.3% Total expenses, GAAP-basis 2,086 2,031 4,117 2,256 2,159 4,415 7.2% Operating leverage, GAAP-basis +3.1%pts (Dollars in millions) 1Q16 2Q16 1H16 1Q17 2Q17 1H17 1H17 vs 1H16 Fee Operating Leverage, GAAP-Basis: Total fee revenue, GAAP-basis $ 1,970 $ 2,053 $ 4,023 $ 2,198 $ 2,235 $ 4,433 10.2% Total expenses, GAAP-basis 2,050 1,860 3,910 2,086 2,031 4,117 5.3% Fee operating leverage, GAAP-basis +4.9%pts (Dollars in millions) 3Q16 4Q16 2H16 3Q17 4Q17 2H17 2H17 vs 2H16 Fee Operating Leverage, GAAP-Basis: Total fee revenue, GAAP-basis $ 2,079 $ 2,014 $ 4,093 $ 2,242 $ 2,230 $ 4,472 9.2% Total expenses, GAAP-basis 1,984 2,183 4,167 2,021 2,131 4,152 -0.4% Total expenses, GAAP-basis excluding acceleration of compensation expense 1,984 1,934 3,918 2,021 2,131 4,152 5.9% Fee operating leverage, GAAP-basis +9.6%pts Fee operating leverage, GAAP-basis excluding acceleration of compensation expense +3.3%pts (Dollars in millions) 1Q17 2Q17 1H17 1Q18 2Q18 1H18 1H18 vs 1H17 Fee Operating Leverage, GAAP-Basis: Total fee revenue, GAAP-basis $ 2,198 $ 2,235 $ 4,433 $ 2,378 $ 2,358 $ 4,736 6.8% Total expenses, GAAP-basis 2,086 2,031 4,117 2,256 2,159 4,415 7.2% Fee operating leverage, GAAP-basis -0.4%pts 16

Definitions AUA Assets under administration AUCA Assets under custody and/or administration AUM Assets under management Bps Basis points Diluted earnings per share (EPS) Net income available to common shareholders divided by diluted average common shares outstanding ETF Exchange-traded fund Fee operating leverage Rate of growth of total fee revenue less the rate of growth of expenses, relative to the corresponding prior year period, as applicable FX Foreign Exchange FY Full Year GAAP Generally accepted accounting principles in the United States IBOR Investment book of record Income earned on interest bearing assets less interest paid on interest bearing liabilities. Net interest income was disclosed as net interest Net interest income (NII) revenue prior to 1Q17 Net interest margin (NIM) Net interest income divided by average interest-earning assets nm Not meaningful Operating leverage Rate of growth of total revenue less the rate of growth of total expenses, relative to the corresponding prior year period, as applicable Pre-tax operating margin Income before income tax expense divided by total revenue %P ts Percentage points is the difference from one percentage value subtracted from another QoQ Sequential quarter comparison Return on equity (ROE) Net income less dividends on preferred stock divided by average common equity YoY Referenced period compared to the same period a year ago 17