STATE STREET INVESTOR AND ANALYST MEETING

NOVEMBER 2, 2004

[LOGO]

DELIVERING PROFITABLE GROWTH

RONALD E. LOGUE

CHAIRMAN AND CHIEF EXECUTIVE OFFICER

REMINDER

This presentation includes discussion of State Street Corporation’s financial and business goals and strategies, which may be perceived as “forward-looking statements” as defined by federal securities laws. Actual results could differ materially, and there can be no assurance that goals will be achieved. For a discussion of some of the factors that may affect State Street’s results, please see the Corporation’s 2003 annual report on Form 10-K, especially the section captioned “Financial Goals and Factors That May Affect Them,” and any subsequent Securities and Exchange Commission filings. Presentations used today are based upon the Corporation’s “operating basis” results. For a reconciliation of the Corporation’s results on an operating basis to results of operations in accordance with accounting principles generally accepted in the United States, please refer to investorrelations.statestreet.com.

AGENDA

Who We Are and What Are Our Goals | Ron Logue |

| |

Financial Update and Outlook | Ed Resch |

| |

Strategies For Growth | Jay Hooley |

| |

Q&A | |

WHO WE ARE

• Our Annual Financial Goals

A Consistent Earner Operating EPS growth of 10%-15%

A Top-line Revenue Generator Operating revenue growth of 8%-12%

A Prudent Allocator of Capital Operating ROE of 14%-17%

HOW WILL WE REACH THESE GOALS ?

Generate positive operating leverage

Deliver a consistent high level of service

Sell on value, not price

Bring product to market faster than others

Actively manage the balance sheet

Target 50% of revenue from outside of the U.S.

ACHIEVING OUR GOALS

• Operating EPS Growth Model

Impact on operating EPS growth:

Operating revenue growth | | 8%-12% | |

| | | |

+ Positive operating leverage | | | |

| | | |

+ Capital management | | ~1% | |

| | | |

= Diluted EPS growth | | 10%-15% | |

Operating results as defined in State Street Corporation SEC filings.

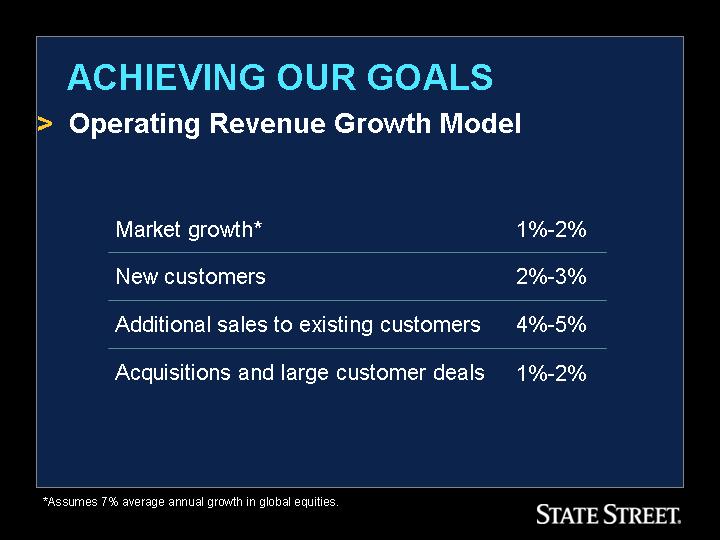

• Operating Revenue Growth Model

Market growth* | | 1%-2% | |

| | | |

New customers | | 2%-3% | |

| | | |

Additional sales to existing customers | | 4%-5% | |

| | | |

Acquisitions and large customer deals | | 1%-2% | |

*Assumes 7% average annual growth in global equities.

• Operating ROE: 14%-17%

• Improve earnings growth

• Support a consistent dividend program

• Repurchase shares

• Maintain credit rating

• Meet regulatory requirements, including Basel II

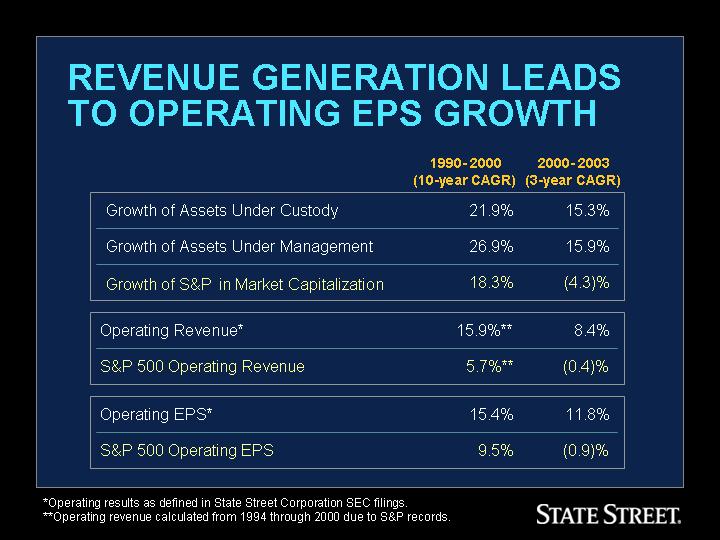

REVENUE GENERATION LEADS TO OPERATING EPS GROWTH

| | 1990- 2000

(10-year CAGR) | | 2000-2003

(3-year CAGR) | |

Growth of Assets Under Custody | | 21.9 | % | 15.3 | % |

| | | | | |

Growth of Assets Under Management | | 26.9 | % | 15.9 | % |

| | | | | |

Growth of S&P in Market Capitalization | | 18.3 | % | (4.3 | )% |

| | | | | |

Operating Revenue* | | 15.9 | %** | 8.4 | % |

| | | | | |

S&P 500 Operating Revenue | | 5.7 | %** | (0.4 | )% |

| | | | | |

Operating EPS* | | 15.4 | % | 11.8 | % |

| | | | | |

S&P 500 Operating EPS | | 9.5 | % | (0.9 | )% |

*Operating results as defined in State Street Corporation SEC filings.

**Operating revenue calculated from 1994 through 2000 due to S&P records.

BUILDING ON OUR STRENGTHS

STATE STREET OPERATING STRENGTHS

• Long-standing

• High value placed on revenue generation

• Innovative culture

• Commitment to our business

• Strong global franchise

• New

• More disciplined expense management

• More focused strategy for allocating resources

GROWING IN A SLOW GROWTH ENVIRONMENT

3-year CAGR 8.4%

Revenues from $3.4B (2000) to $4.4B (2003)

All data reflects operating revenues as defined in State Street Corporation’s SEC filings.

TOTAL REVENUE GROWTH

• U.S. and Non-U.S.

2000-2004: 4-year CAGR

Total Corporation: 9.5%

U.S.: 6.3%

Non-U.S.: 16.8%

[CHART]

Operating results as defined in State Street Corporation SEC filings.

*2004 annualized 9 months.

WE ARE A PROFITABLE GROWTH COMPANY BECAUSE…

• We benefit from long-term secular trends.

• We have a strong global franchise.

• We have a proven ability to integrate large books of business.

• We consistently deliver high revenue growth.

• We are committed to expense management.

• We have a deep and experienced worldwide management team.