Fourth Quarter 2018 Earnings Presentation February 26, 2019

Forward Looking Statements All statements other than statements of historical facts contained herein that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements including, in particular, the statements about our expectations for full fiscal year 2019 total, product, royalty revenues and other, GAAP earnings per diluted share and our long-term outlook; demand for our products; anticipated revenue and earnings growth; our financial condition, results of operations and business generally; expectations regarding our ability to design and deliver innovative new noninvasive technologies and reduce the cost of care; and demand for our technologies. These forward-looking statements are based on management’s current expectations and beliefs and are subject to uncertainties and factors, all of which are difficult to predict and many of which are beyond our control and could cause actual results to differ materially and adversely from those described in the forward-looking statements. These risks include, but are not limited to, those related to: our dependence on Masimo SET® and Masimo rainbow SET™ products and technologies for substantially all of our revenue; any failure in protecting our intellectual property; exposure to competitors’ assertions of intellectual property claims; the highly competitive nature of the markets in which we sell our products and technologies; any failure to continue developing innovative products and technologies; the lack of acceptance of any of our current or future products and technologies; obtaining regulatory approval of our current and future products and technologies; the risk that the implementation of our international realignment will not continue to produce anticipated operational and financial benefits, including a continued lower effective tax rate; the loss of our customers; the failure to retain and recruit senior management; product liability claims exposure; a failure to obtain expected returns from the amount of intangible assets we have recorded; the maintenance of our brand; the amount and type of equity awards that we may grant to employees and service providers in the future; our ongoing litigation and related matters; and other factors discussed in the “Risk Factors” section of our most recent periodic reports filed with the Securities and Exchange Commission (“SEC”), including our most recent Form 10-K and Form 10-Q, all of which you may obtain for free on the SEC’s website at www.sec.gov. Although we believe that the expectations reflected in our forward-looking statements are reasonable, we do not know whether our expectations will prove correct. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, even if subsequently made available by us on our website or otherwise. We do not undertake any obligation to update, amend or clarify these forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. Impact of Adoption of New Accounting Standard (ASC 606) During the first quarter of 2018, we adopted Financial Accounting Standards Board (FASB) Accounting Standards Update No. 2014-09, Revenue (Topic 606): Revenue from Contracts with Customers (ASU 2014-09). The new revenue recognition standard requires us to make numerous assumptions that are based upon historical trends and management judgment. These assumptions may change over time and may have a material impact on our revenue recognition, guidance and results of operations. In accordance with the full retrospective method of adoption, we adjusted certain amounts previously reported in our consolidated financial statements to comply with the new standard, as indicated by the notation “As Adjusted”. For additional information with respect to the impact of our adoption of this new accounting standard and reconciliations to our previously reported amounts, please reference Note 2 to our consolidated financial statements that are included in Part I, Item 1 of our Annual Report on Form 10-K (Form 10-K) filed with the Securities and Exchange Commission (SEC) on February 26, 2019.

Non-GAAP Financial Measures The non-GAAP financial measures contained herein are a supplement to the corresponding financial measures prepared in accordance with U.S. generally accepted accounting principles (GAAP). The non-GAAP financial measures presented exclude certain items that are more fully described in the Appendix. Management believes that adjustments for these items assist investors in making comparisons of period-to-period operating results and that these items are not indicative of the company’s on-going core operating performance. These non-GAAP financial measures have certain limitations in that they do not reflect all of the costs associated with the operations of the Company’s business as determined in accordance with GAAP. Therefore, investors should consider non-GAAP financial measures in addition to, and not as a substitute for, or as superior to, measures of financial performance prepared in accordance with GAAP. The non- GAAP financial measures presented by the Company may be different from the non-GAAP financial measures used by other companies. The Company has presented the following non-GAAP measures to assist investors in understanding the Company’s core net operating results on an on-going basis: (i) constant currency product revenue, (ii) non-GAAP gross margin %, (ii) non-GAAP product gross margin %, (iv) non-GAAP operating expense %, (v) non-GAAP product operating expense %, (vi) non-GAAP operating margin %, (vi) non-GAAP product operating margin %, (vii) non-GAAP earnings per diluted share, (viii) non- GAAP product earnings per diluted share and (iv) adjusted free cash flow. These non-GAAP financial measures may also assist investors in making comparisons of the company’s core operating results with those of other companies. Management believes non-GAAP product revenue, non-GAAP gross profit, non-GAAP net income and non-GAAP net income per diluted share are important measures in the evaluation of the Company’s performance and uses these measures to better understand and evaluate our business. For additional financial details, please visit the Investor Relations section of the Company’s website at www.masimo.com to access Supplementary Financial Information.

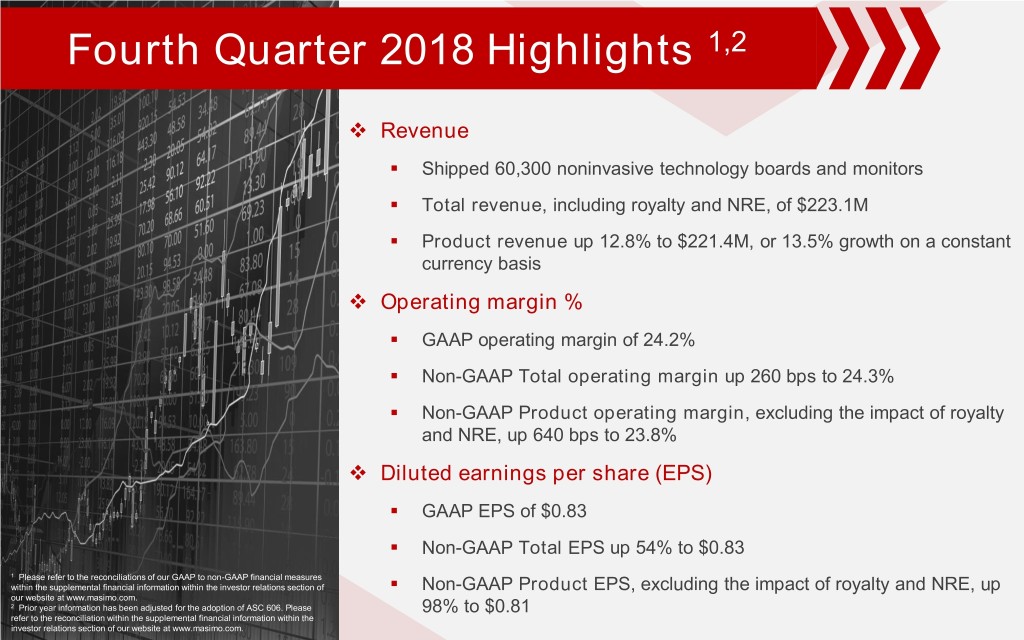

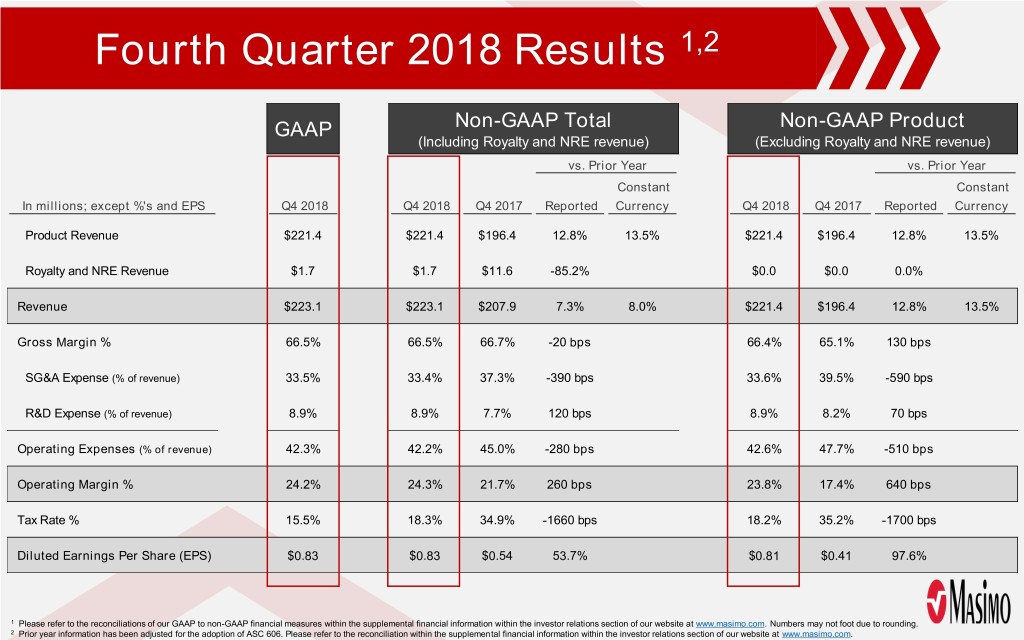

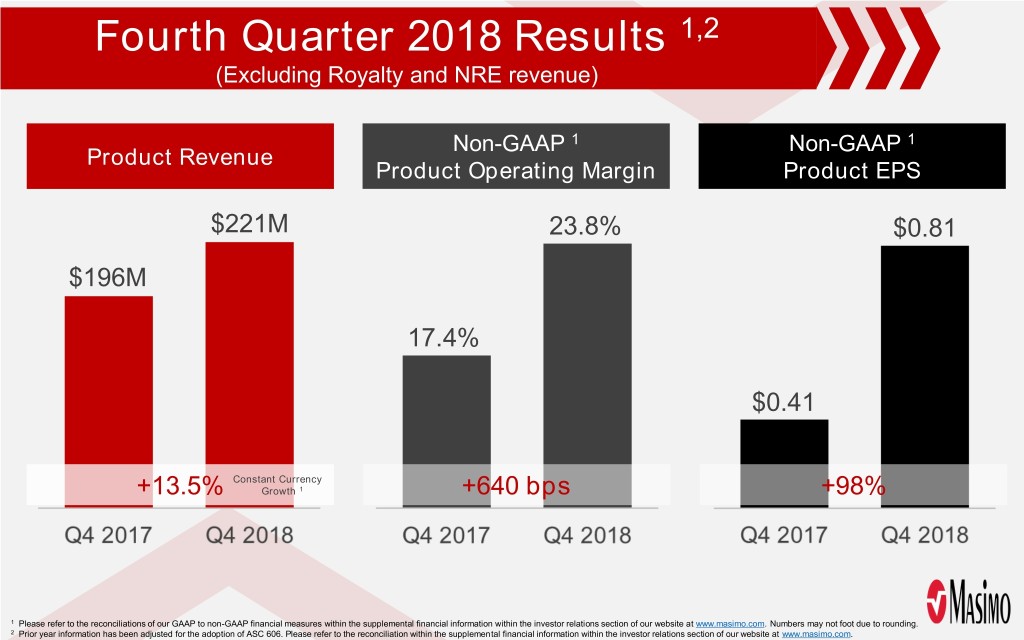

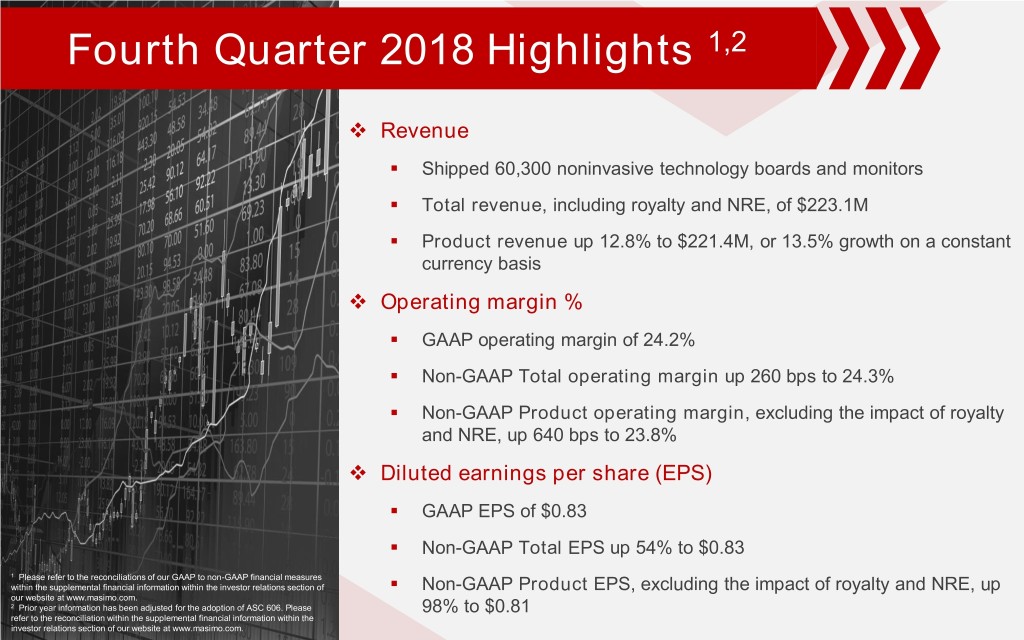

Fourth Quarter 2018 Highlights 1,2 Revenue . Shipped 60,300 noninvasive technology boards and monitors . Total revenue, including royalty and NRE, of $223.1M . Product revenue up 12.8% to $221.4M, or 13.5% growth on a constant currency basis Operating margin % . GAAP operating margin of 24.2% . Non-GAAP Total operating margin up 260 bps to 24.3% . Non-GAAP Product operating margin, excluding the impact of royalty and NRE, up 640 bps to 23.8% Diluted earnings per share (EPS) . GAAP EPS of $0.83 . Non-GAAP Total EPS up 54% to $0.83 1 Please refer to the reconciliations of our GAAP to non-GAAP financial measures . within the supplemental financial information within the investor relations section of Non-GAAP Product EPS, excluding the impact of royalty and NRE, up our website at www.masimo.com. 2 Prior year information has been adjusted for the adoption of ASC 606. Please 98% to $0.81 refer to the reconciliation within the supplemental financial information within the investor relations section of our website at www.masimo.com.

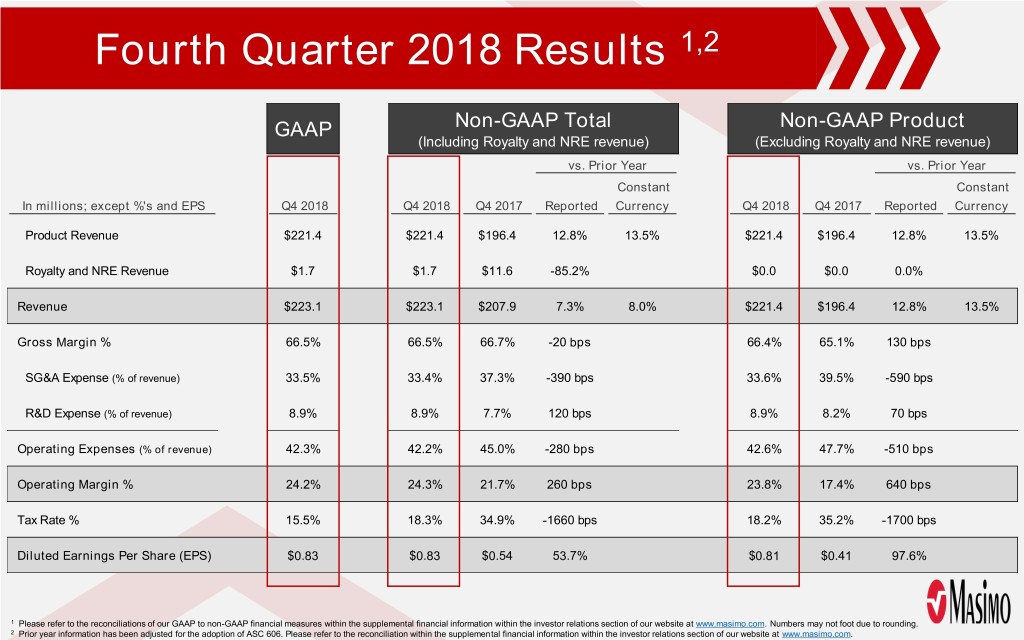

Fourth Quarter 2018 Results 1,2 GAAP Non-GAAP Total Non-GAAP Product (Including Royalty and NRE revenue) (Excluding Royalty and NRE revenue) vs. Prior Year vs. Prior Year Constant Constant In millions; except %'s and EPS Q4 2018 Q4 2018 Q4 2017 Reported Currency Q4 2018 Q4 2017 Reported Currency Product Revenue $221.4 $221.4 $196.4 12.8% 13.5% $221.4 $196.4 12.8% 13.5% Royalty and NRE Revenue $1.7 $1.7 $11.6 -85.2% $0.0 $0.0 0.0% Revenue $223.1 $223.1 $207.9 7.3% 8.0% $221.4 $196.4 12.8% 13.5% Gross Margin % 66.5% 66.5% 66.7% -20 bps 66.4% 65.1% 130 bps SG&A Expense (% of revenue) 33.5% 33.4% 37.3% -390 bps 33.6% 39.5% -590 bps R&D Expense (% of revenue) 8.9% 8.9% 7.7% 120 bps 8.9% 8.2% 70 bps Operating Expenses (% of revenue) 42.3% 42.2% 45.0% -280 bps 42.6% 47.7% -510 bps Operating Margin % 24.2% 24.3% 21.7% 260 bps 23.8% 17.4% 640 bps Tax Rate % 15.5% 18.3% 34.9% -1660 bps 18.2% 35.2% -1700 bps Diluted Earnings Per Share (EPS) $0.83 $0.83 $0.54 53.7% $0.81 $0.41 97.6% 1 Please refer to the reconciliations of our GAAP to non-GAAP financial measures within the supplemental financial information within the investor relations section of our website at www.masimo.com. Numbers may not foot due to rounding. 2 Prior year information has been adjusted for the adoption of ASC 606. Please refer to the reconciliation within the supplemental financial information within the investor relations section of our website at www.masimo.com.

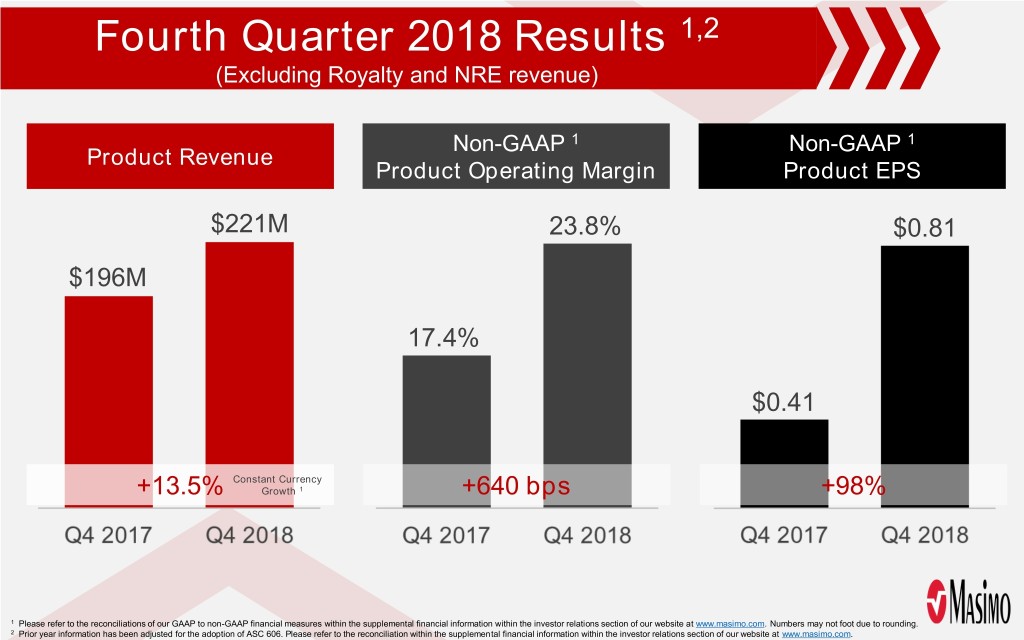

Fourth Quarter 2018 Results 1,2 (Excluding Royalty and NRE revenue) Non-GAAP 1 Non-GAAP 1 Product Revenue Product Operating Margin Product EPS $221M 23.8% $0.81 $196M 17.4% $0.41 Constant Currency +13.5% Growth 1 +640 bps +98% 1 Please refer to the reconciliations of our GAAP to non-GAAP financial measures within the supplemental financial information within the investor relations section of our website at www.masimo.com. Numbers may not foot due to rounding. 2 Prior year information has been adjusted for the adoption of ASC 606. Please refer to the reconciliation within the supplemental financial information within the investor relations section of our website at www.masimo.com.

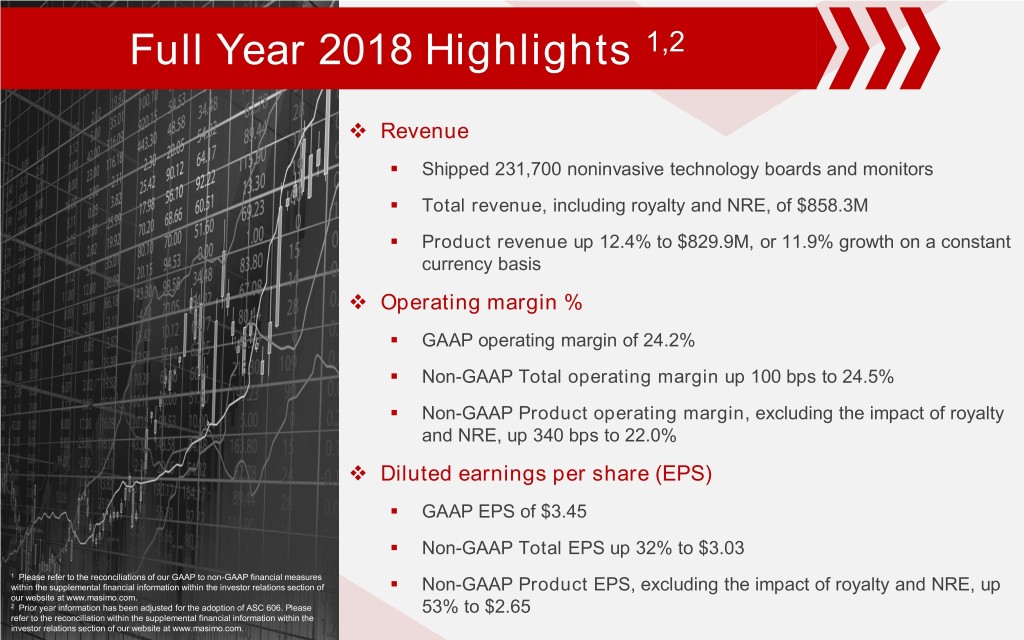

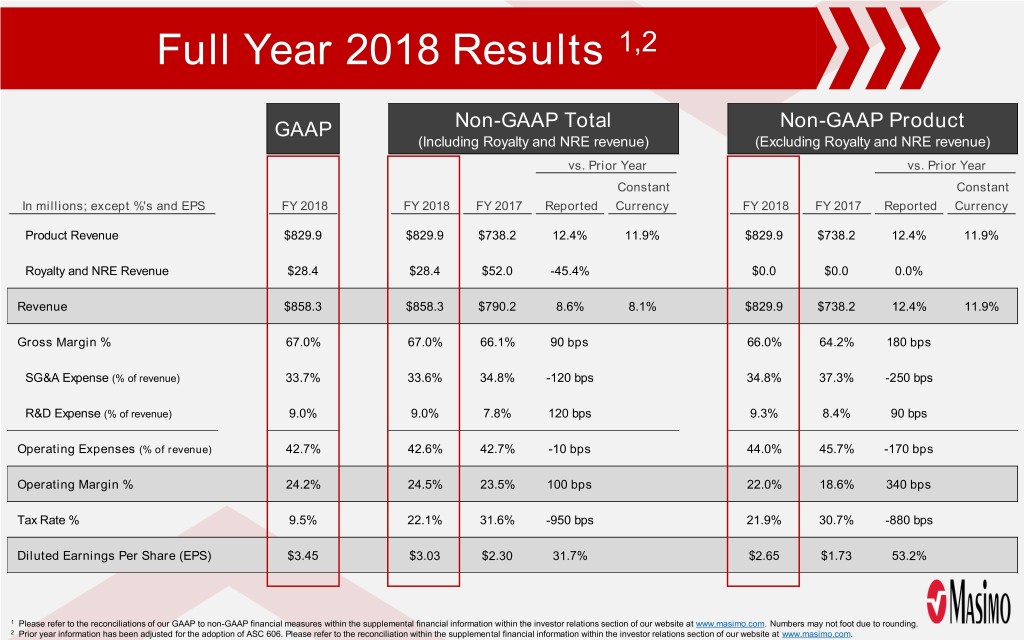

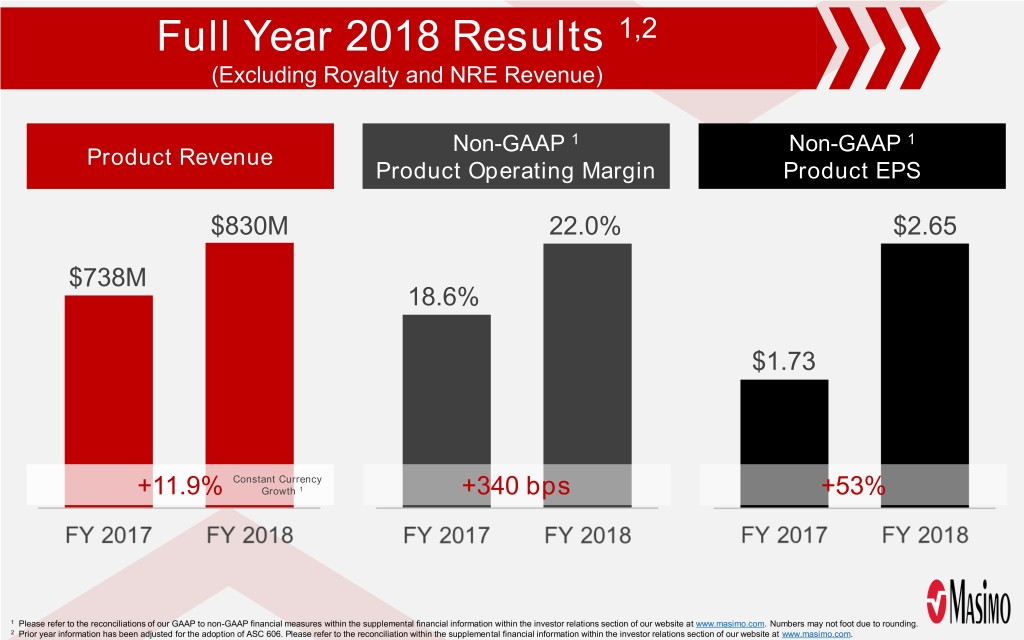

Full Year 2018 Highlights 1,2 Revenue . Shipped 231,700 noninvasive technology boards and monitors . Total revenue, including royalty and NRE, of $858.3M . Product revenue up 12.4% to $829.9M, or 11.9% growth on a constant currency basis Operating margin % . GAAP operating margin of 24.2% . Non-GAAP Total operating margin up 100 bps to 24.5% . Non-GAAP Product operating margin, excluding the impact of royalty and NRE, up 340 bps to 22.0% Diluted earnings per share (EPS) . GAAP EPS of $3.45 . Non-GAAP Total EPS up 32% to $3.03 1 Please refer to the reconciliations of our GAAP to non-GAAP financial measures . within the supplemental financial information within the investor relations section of Non-GAAP Product EPS, excluding the impact of royalty and NRE, up our website at www.masimo.com. 2 Prior year information has been adjusted for the adoption of ASC 606. Please 53% to $2.65 refer to the reconciliation within the supplemental financial information within the investor relations section of our website at www.masimo.com.

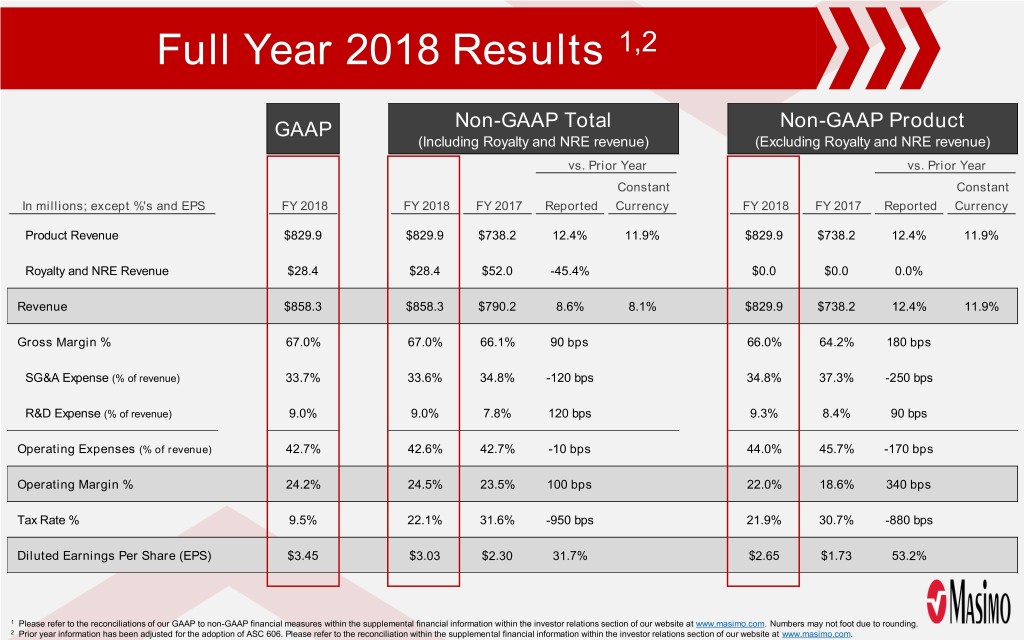

Full Year 2018 Results 1,2 GAAP Non-GAAP Total Non-GAAP Product (Including Royalty and NRE revenue) (Excluding Royalty and NRE revenue) vs. Prior Year vs. Prior Year Constant Constant In millions; except %'s and EPS FY 2018 FY 2018 FY 2017 Reported Currency FY 2018 FY 2017 Reported Currency Product Revenue $829.9 $829.9 $738.2 12.4% 11.9% $829.9 $738.2 12.4% 11.9% Royalty and NRE Revenue $28.4 $28.4 $52.0 -45.4% $0.0 $0.0 0.0% Revenue $858.3 $858.3 $790.2 8.6% 8.1% $829.9 $738.2 12.4% 11.9% Gross Margin % 67.0% 67.0% 66.1% 90 bps 66.0% 64.2% 180 bps SG&A Expense (% of revenue) 33.7% 33.6% 34.8% -120 bps 34.8% 37.3% -250 bps R&D Expense (% of revenue) 9.0% 9.0% 7.8% 120 bps 9.3% 8.4% 90 bps Operating Expenses (% of revenue) 42.7% 42.6% 42.7% -10 bps 44.0% 45.7% -170 bps Operating Margin % 24.2% 24.5% 23.5% 100 bps 22.0% 18.6% 340 bps Tax Rate % 9.5% 22.1% 31.6% -950 bps 21.9% 30.7% -880 bps Diluted Earnings Per Share (EPS) $3.45 $3.03 $2.30 31.7% $2.65 $1.73 53.2% 1 Please refer to the reconciliations of our GAAP to non-GAAP financial measures within the supplemental financial information within the investor relations section of our website at www.masimo.com. Numbers may not foot due to rounding. 2 Prior year information has been adjusted for the adoption of ASC 606. Please refer to the reconciliation within the supplemental financial information within the investor relations section of our website at www.masimo.com.

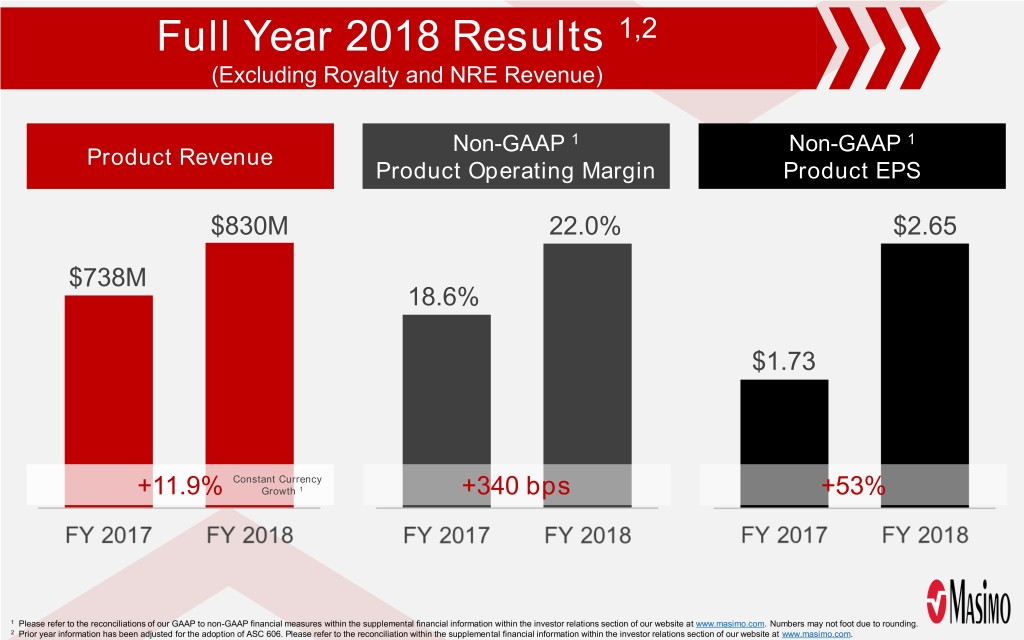

Full Year 2018 Results 1,2 (Excluding Royalty and NRE Revenue) Non-GAAP 1 Non-GAAP 1 Product Revenue Product Operating Margin Product EPS $830M 22.0% $2.65 $738M 18.6% $1.73 Constant Currency +11.9% Growth 1 +340 bps +53% 1 Please refer to the reconciliations of our GAAP to non-GAAP financial measures within the supplemental financial information within the investor relations section of our website at www.masimo.com. Numbers may not foot due to rounding. 2 Prior year information has been adjusted for the adoption of ASC 606. Please refer to the reconciliation within the supplemental financial information within the investor relations section of our website at www.masimo.com.

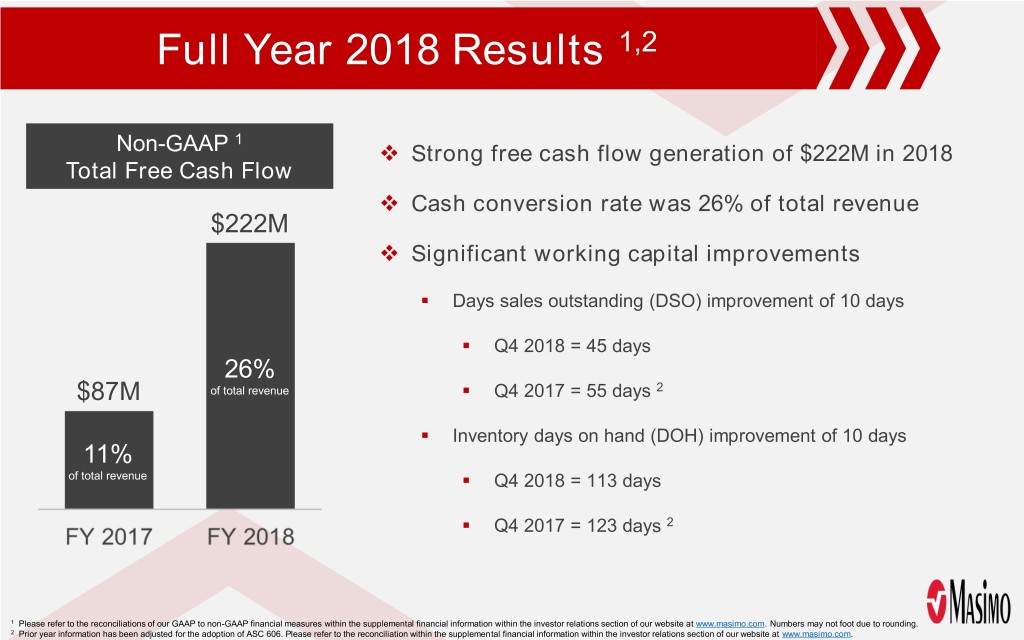

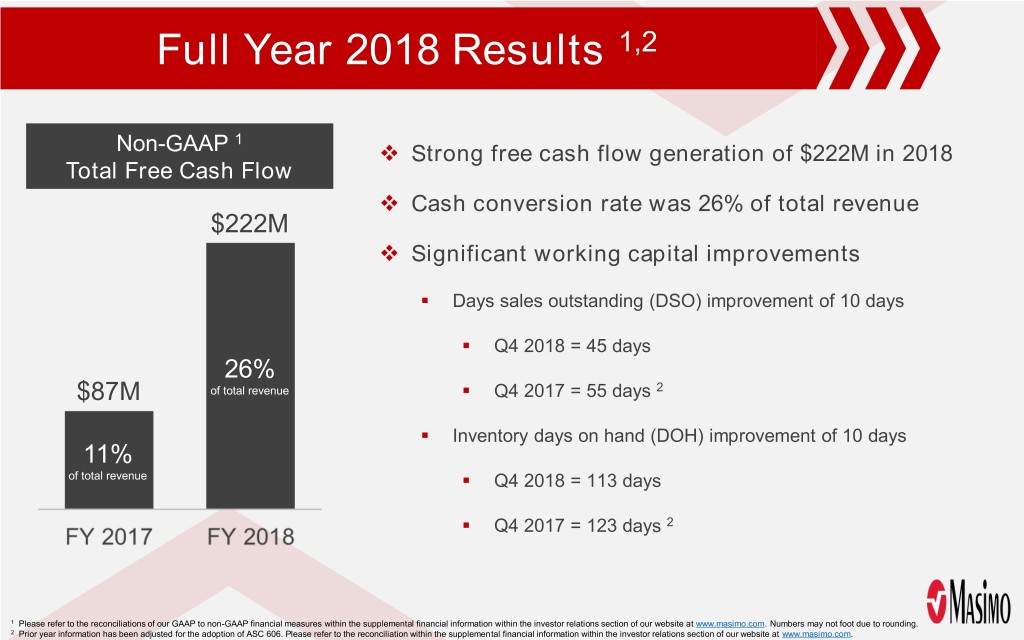

Full Year 2018 Results 1,2 1 Non-GAAP Strong free cash flow generation of $222M in 2018 Total Free Cash Flow Cash conversion rate was 26% of total revenue $222M Significant working capital improvements . Days sales outstanding (DSO) improvement of 10 days . Q4 2018 = 45 days 26% . $87M of total revenue Q4 2017 = 55 days 2 . Inventory days on hand (DOH) improvement of 10 days 11% of total revenue . Q4 2018 = 113 days . Q4 2017 = 123 days 2 1 Please refer to the reconciliations of our GAAP to non-GAAP financial measures within the supplemental financial information within the investor relations section of our website at www.masimo.com. Numbers may not foot due to rounding. 2 Prior year information has been adjusted for the adoption of ASC 606. Please refer to the reconciliation within the supplemental financial information within the investor relations section of our website at www.masimo.com.

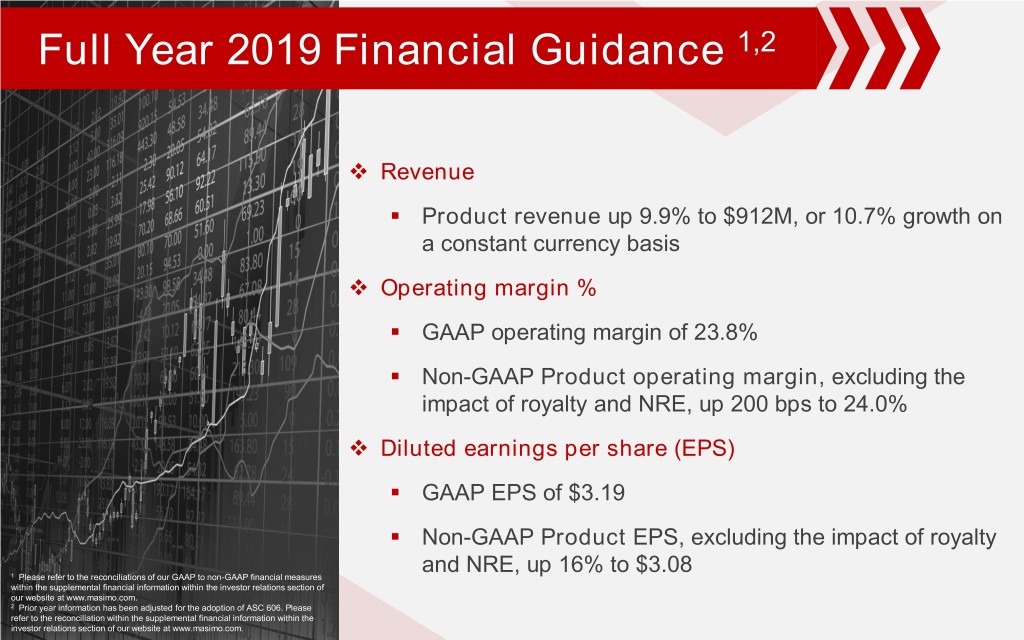

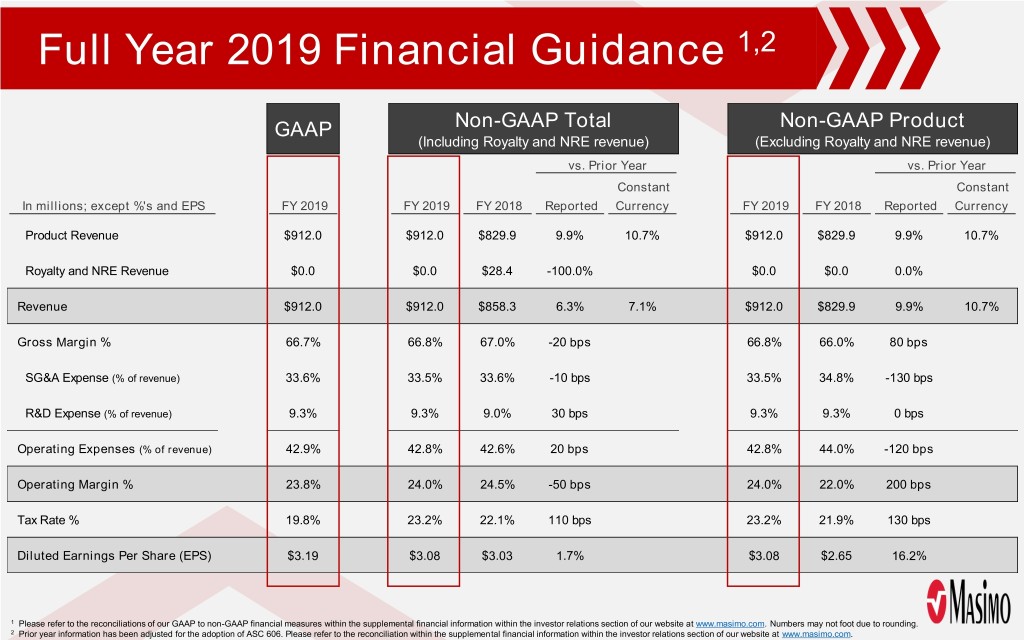

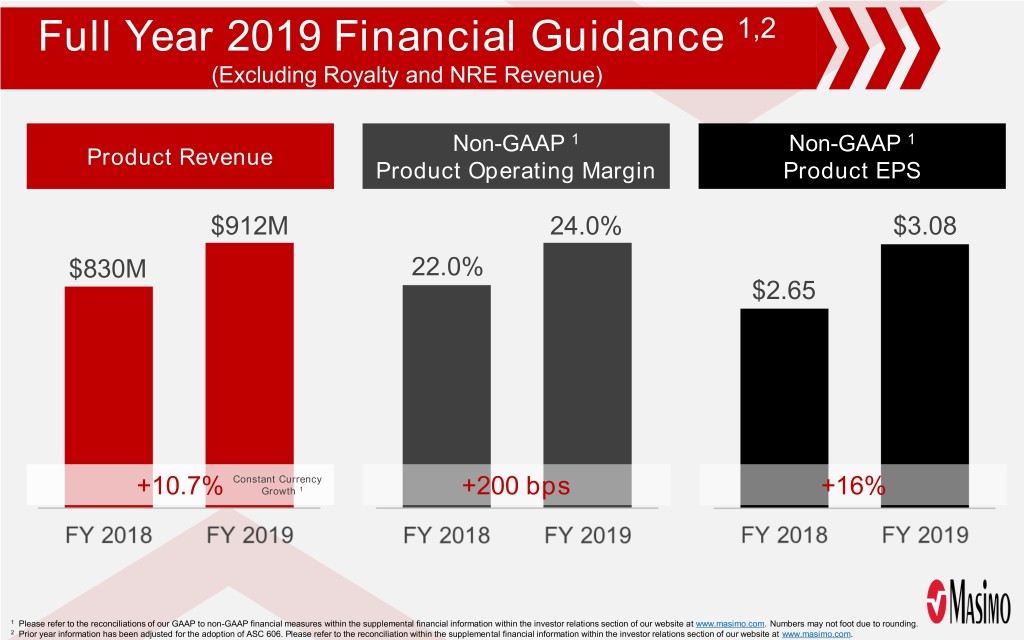

Full Year 2019 Financial Guidance 1,2 Revenue . Product revenue up 9.9% to $912M, or 10.7% growth on a constant currency basis Operating margin % . GAAP operating margin of 23.8% . Non-GAAP Product operating margin, excluding the impact of royalty and NRE, up 200 bps to 24.0% Diluted earnings per share (EPS) . GAAP EPS of $3.19 . Non-GAAP Product EPS, excluding the impact of royalty and NRE, up 16% to $3.08 1 Please refer to the reconciliations of our GAAP to non-GAAP financial measures within the supplemental financial information within the investor relations section of our website at www.masimo.com. 2 Prior year information has been adjusted for the adoption of ASC 606. Please refer to the reconciliation within the supplemental financial information within the investor relations section of our website at www.masimo.com.

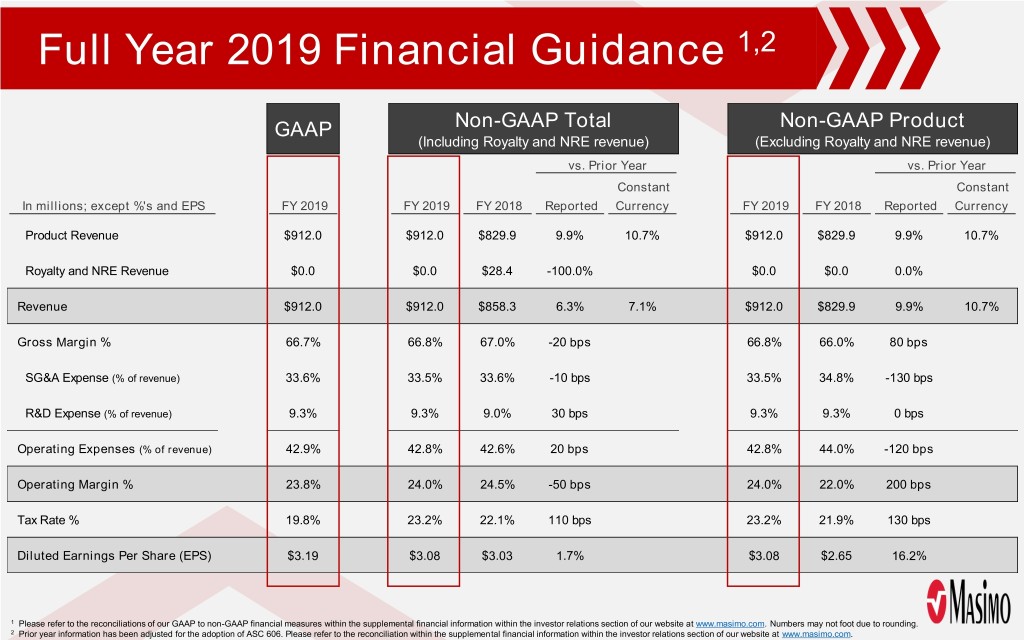

Full Year 2019 Financial Guidance 1,2 GAAP Non-GAAP Total Non-GAAP Product (Including Royalty and NRE revenue) (Excluding Royalty and NRE revenue) vs. Prior Year vs. Prior Year Constant Constant In millions; except %'s and EPS FY 2019 FY 2019 FY 2018 Reported Currency FY 2019 FY 2018 Reported Currency Product Revenue $912.0 $912.0 $829.9 9.9% 10.7% $912.0 $829.9 9.9% 10.7% Royalty and NRE Revenue $0.0 $0.0 $28.4 -100.0% $0.0 $0.0 0.0% Revenue $912.0 $912.0 $858.3 6.3% 7.1% $912.0 $829.9 9.9% 10.7% Gross Margin % 66.7% 66.8% 67.0% -20 bps 66.8% 66.0% 80 bps SG&A Expense (% of revenue) 33.6% 33.5% 33.6% -10 bps 33.5% 34.8% -130 bps R&D Expense (% of revenue) 9.3% 9.3% 9.0% 30 bps 9.3% 9.3% 0 bps Operating Expenses (% of revenue) 42.9% 42.8% 42.6% 20 bps 42.8% 44.0% -120 bps Operating Margin % 23.8% 24.0% 24.5% -50 bps 24.0% 22.0% 200 bps Tax Rate % 19.8% 23.2% 22.1% 110 bps 23.2% 21.9% 130 bps Diluted Earnings Per Share (EPS) $3.19 $3.08 $3.03 1.7% $3.08 $2.65 16.2% 1 Please refer to the reconciliations of our GAAP to non-GAAP financial measures within the supplemental financial information within the investor relations section of our website at www.masimo.com. Numbers may not foot due to rounding. 2 Prior year information has been adjusted for the adoption of ASC 606. Please refer to the reconciliation within the supplemental financial information within the investor relations section of our website at www.masimo.com.

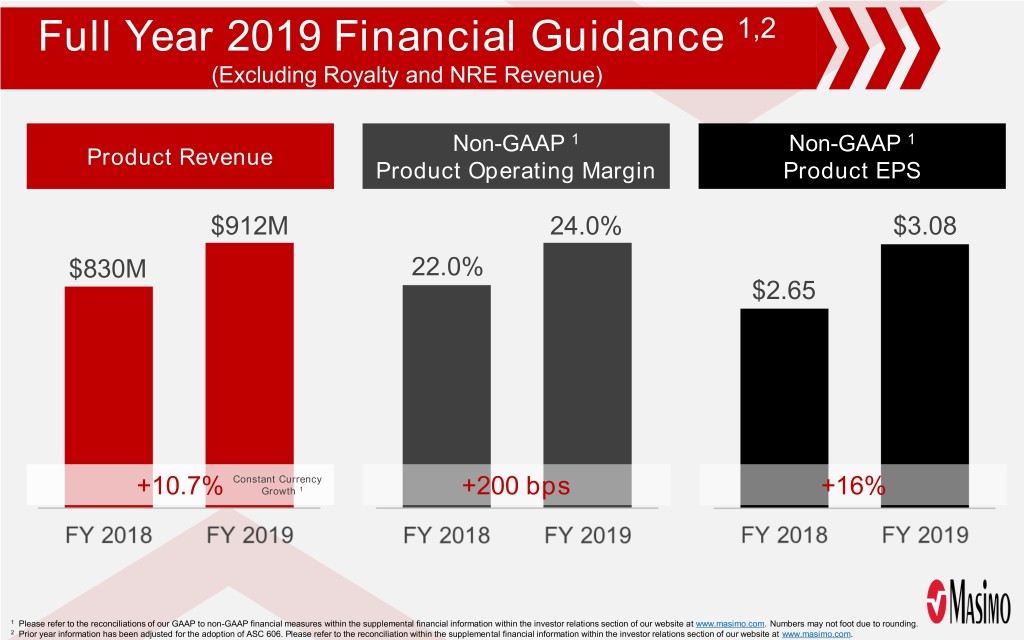

Full Year 2019 Financial Guidance 1,2 (Excluding Royalty and NRE Revenue) Non-GAAP 1 Non-GAAP 1 Product Revenue Product Operating Margin Product EPS $912M 24.0% $3.08 $830M 22.0% $2.65 Constant Currency +10.7% Growth 1 +200 bps +16% 1 Please refer to the reconciliations of our GAAP to non-GAAP financial measures within the supplemental financial information within the investor relations section of our website at www.masimo.com. Numbers may not foot due to rounding. 2 Prior year information has been adjusted for the adoption of ASC 606. Please refer to the reconciliation within the supplemental financial information within the investor relations section of our website at www.masimo.com.

APPENDICES GAAP to Non-GAAP Adjustments and Reconciliations

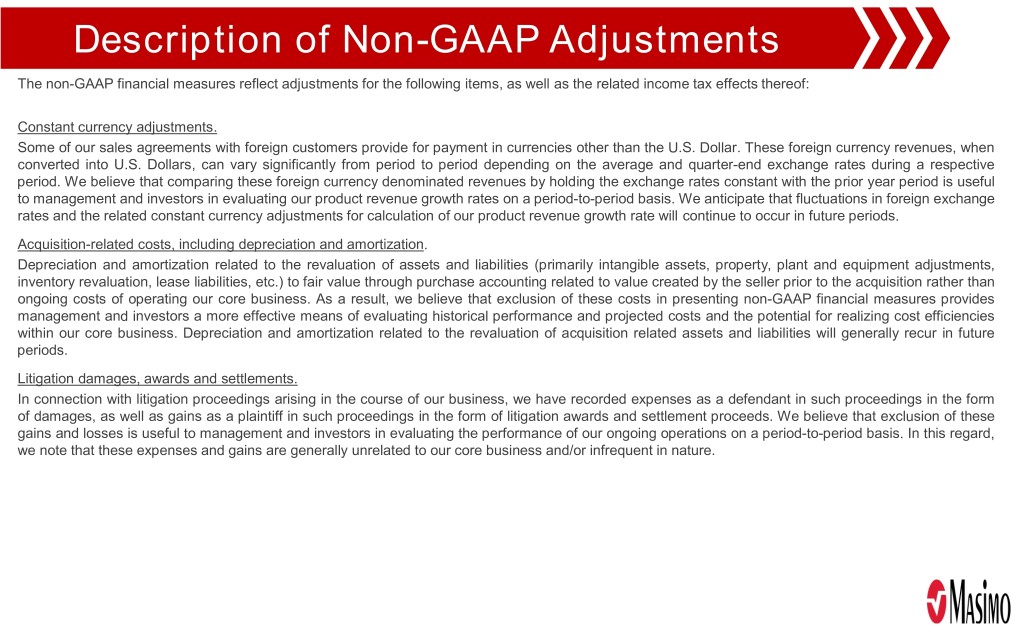

Description of Non-GAAP Adjustments The non-GAAP financial measures reflect adjustments for the following items, as well as the related income tax effects thereof: Constant currency adjustments. Some of our sales agreements with foreign customers provide for payment in currencies other than the U.S. Dollar. These foreign currency revenues, when converted into U.S. Dollars, can vary significantly from period to period depending on the average and quarter-end exchange rates during a respective period. We believe that comparing these foreign currency denominated revenues by holding the exchange rates constant with the prior year period is useful to management and investors in evaluating our product revenue growth rates on a period-to-period basis. We anticipate that fluctuations in foreign exchange rates and the related constant currency adjustments for calculation of our product revenue growth rate will continue to occur in future periods. Acquisition-related costs, including depreciation and amortization. Depreciation and amortization related to the revaluation of assets and liabilities (primarily intangible assets, property, plant and equipment adjustments, inventory revaluation, lease liabilities, etc.) to fair value through purchase accounting related to value created by the seller prior to the acquisition rather than ongoing costs of operating our core business. As a result, we believe that exclusion of these costs in presenting non-GAAP financial measures provides management and investors a more effective means of evaluating historical performance and projected costs and the potential for realizing cost efficiencies within our core business. Depreciation and amortization related to the revaluation of acquisition related assets and liabilities will generally recur in future periods. Litigation damages, awards and settlements. In connection with litigation proceedings arising in the course of our business, we have recorded expenses as a defendant in such proceedings in the form of damages, as well as gains as a plaintiff in such proceedings in the form of litigation awards and settlement proceeds. We believe that exclusion of these gains and losses is useful to management and investors in evaluating the performance of our ongoing operations on a period-to-period basis. In this regard, we note that these expenses and gains are generally unrelated to our core business and/or infrequent in nature.

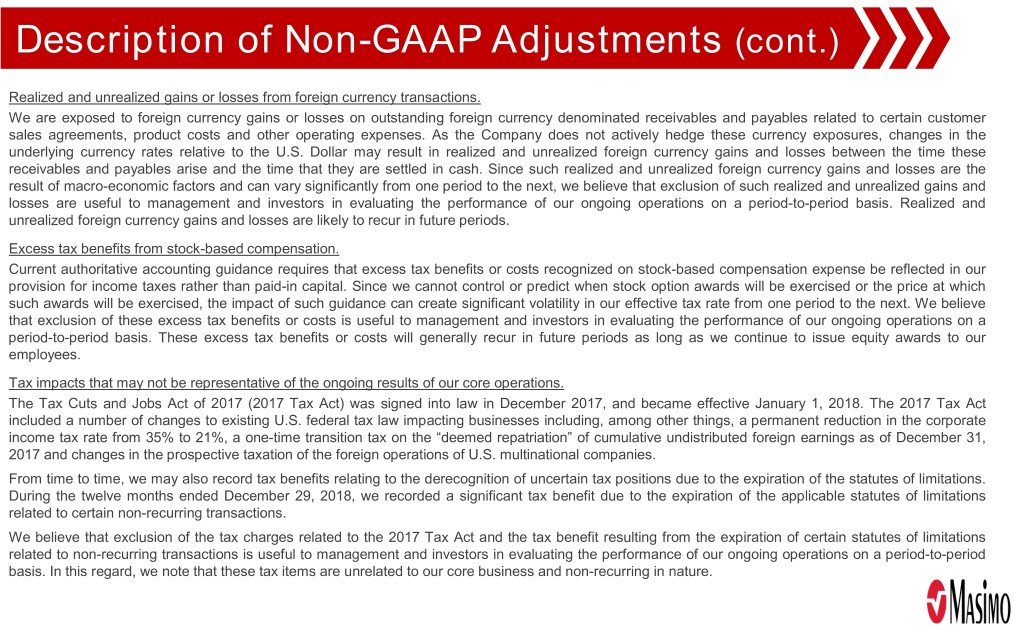

Description of Non-GAAP Adjustments (cont.) Realized and unrealized gains or losses from foreign currency transactions. We are exposed to foreign currency gains or losses on outstanding foreign currency denominated receivables and payables related to certain customer sales agreements, product costs and other operating expenses. As the Company does not actively hedge these currency exposures, changes in the underlying currency rates relative to the U.S. Dollar may result in realized and unrealized foreign currency gains and losses between the time these receivables and payables arise and the time that they are settled in cash. Since such realized and unrealized foreign currency gains and losses are the result of macro-economic factors and can vary significantly from one period to the next, we believe that exclusion of such realized and unrealized gains and losses are useful to management and investors in evaluating the performance of our ongoing operations on a period-to-period basis. Realized and unrealized foreign currency gains and losses are likely to recur in future periods. Excess tax benefits from stock-based compensation. Current authoritative accounting guidance requires that excess tax benefits or costs recognized on stock-based compensation expense be reflected in our provision for income taxes rather than paid-in capital. Since we cannot control or predict when stock option awards will be exercised or the price at which such awards will be exercised, the impact of such guidance can create significant volatility in our effective tax rate from one period to the next. We believe that exclusion of these excess tax benefits or costs is useful to management and investors in evaluating the performance of our ongoing operations on a period-to-period basis. These excess tax benefits or costs will generally recur in future periods as long as we continue to issue equity awards to our employees. Tax impacts that may not be representative of the ongoing results of our core operations. The Tax Cuts and Jobs Act of 2017 (2017 Tax Act) was signed into law in December 2017, and became effective January 1, 2018. The 2017 Tax Act included a number of changes to existing U.S. federal tax law impacting businesses including, among other things, a permanent reduction in the corporate income tax rate from 35% to 21%, a one-time transition tax on the “deemed repatriation” of cumulative undistributed foreign earnings as of December 31, 2017 and changes in the prospective taxation of the foreign operations of U.S. multinational companies. From time to time, we may also record tax benefits relating to the derecognition of uncertain tax positions due to the expiration of the statutes of limitations. During the twelve months ended December 29, 2018, we recorded a significant tax benefit due to the expiration of the applicable statutes of limitations related to certain non-recurring transactions. We believe that exclusion of the tax charges related to the 2017 Tax Act and the tax benefit resulting from the expiration of certain statutes of limitations related to non-recurring transactions is useful to management and investors in evaluating the performance of our ongoing operations on a period-to-period basis. In this regard, we note that these tax items are unrelated to our core business and non-recurring in nature.

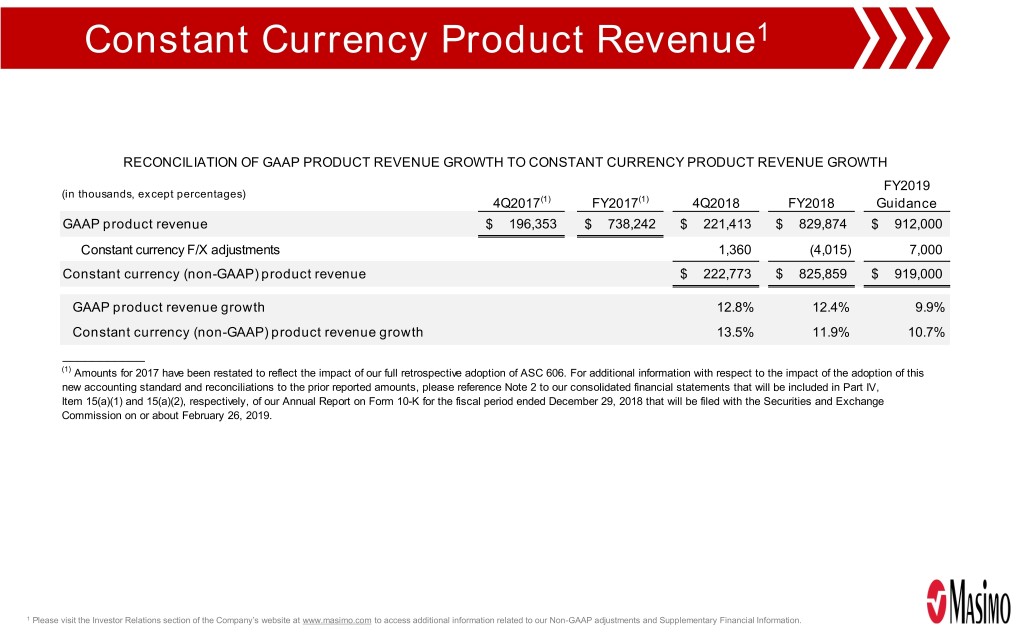

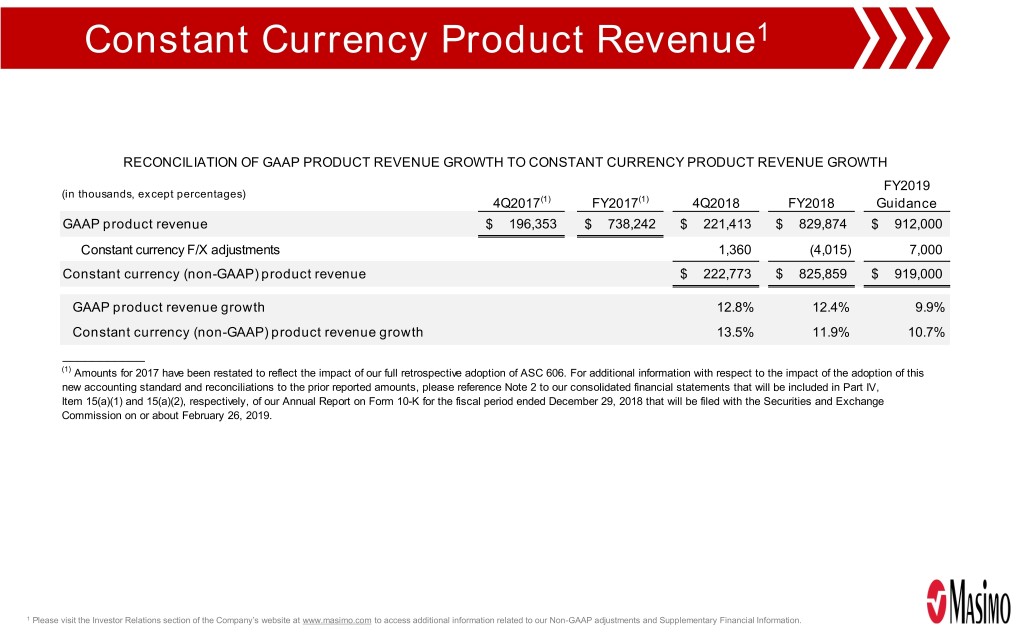

Constant Currency Product Revenue1 RECONCILIATION OF GAAP PRODUCT REVENUE GROWTH TO CONSTANT CURRENCY PRODUCT REVENUE GROWTH FY2019 (in thousands, except percentages) 4Q2017(1) FY2017(1) 4Q2018 FY2018 Guidance GAAP product revenue $ 196,353 $ 738,242 $ 221,413 $ 829,874 $ 912,000 Constant currency F/X adjustments 1,360 (4,015) 7,000 Constant currency (non-GAAP) product revenue $ 222,773 $ 825,859 $ 919,000 GAAP product revenue growth 12.8% 12.4% 9.9% Constant currency (non-GAAP) product revenue growth 13.5% 11.9% 10.7% ___________ (1) Amounts for 2017 have been restated to reflect the impact of our full retrospective adoption of ASC 606. For additional information with respect to the impact of the adoption of this new accounting standard and reconciliations to the prior reported amounts, please reference Note 2 to our consolidated financial statements that will be included in Part IV, Item 15(a)(1) and 15(a)(2), respectively, of our Annual Report on Form 10-K for the fiscal period ended December 29, 2018 that will be filed with the Securities and Exchange Commission on or about February 26, 2019. 1 Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information.

Non-GAAP Gross Margin %1 RECONCILIATION OF GAAP GROSS PROFIT/MARGIN TO NON-GAAP TOTAL AND PRODUCT GROSS PROFIT/MARGIN FY2019 (in thousands, except percentages) 4Q2017(1) FY2017(1) 4Q2018 FY2018 Guidance Product revenue $ 196,353 $ 738,242 $ 221,413 $ 829,874 $ 912,000 Royalty and other revenue 11,586 52,006 1,719 28,415 - GAAP total revenue $ 207,939 $ 790,248 $ 223,132 $ 858,289 $ 912,000 Product gross profit/margin $ 127,730 $ 473,647 $ 146,795 $ 547,187 $ 608,758 Royalty and other revenue gross profit/margin 10,922 48,385 1,536 27,705 - GAAP total gross profit/margin $ 138,652 $ 522,032 $ 148,331 $ 574,892 $ 608,758 Non-GAAP adjustments to product gross profit/margin: Acquisition-related depreciation and amortization 116 500 114 458 458 Non-GAAP product gross profit/margin 127,846 474,147 146,909 547,645 609,216 Royalty and other revenue gross profit/margin 10,922 48,385 1,536 27,705 - Non-GAAP total gross profit/margin $ 138,768 $ 522,532 $ 148,445 $ 575,350 $ 609,216 Non-GAAP total gross margin % 66.7% 66.1% 66.5% 67.0% 66.8% Non-GAAP product gross margin % 65.1% 64.2% 66.4% 66.0% 66.8% ___________ (1) Amounts for 2017 have been restated to reflect the impact of our full retrospective adoption of ASC 606. For additional information with respect to the impact of the adoption of this new accounting standard and reconciliations to the prior reported amounts, please reference Note 2 to our consolidated financial statements that will be included in Part IV, Item 15(a)(1) and 15(a)(2), respectively, of our Annual Report on Form 10-K for the fiscal period ended December 29, 2018 that will be filed with the Securities and Exchange Commission on or about February 26, 2019. 1 Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information.

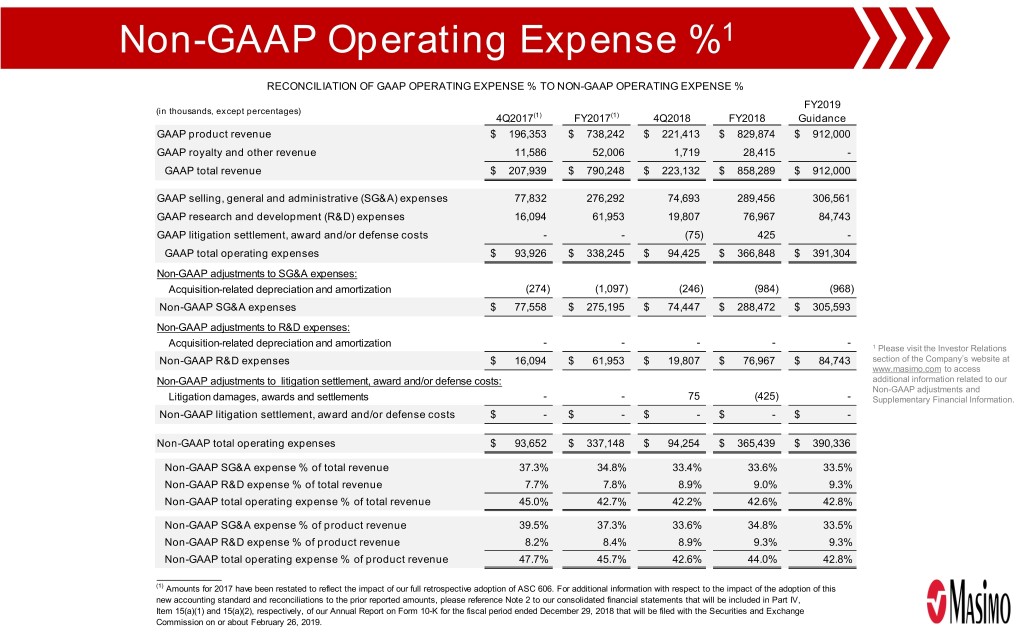

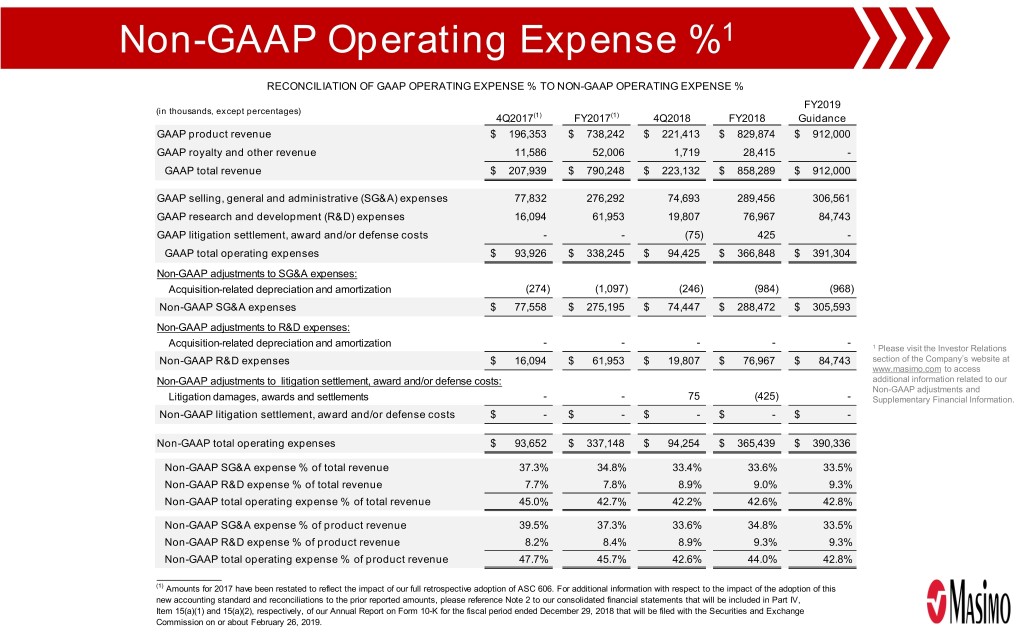

Non-GAAP Operating Expense %1 RECONCILIATION OF GAAP OPERATING EXPENSE % TO NON-GAAP OPERATING EXPENSE % FY2019 (in thousands, except percentages) 4Q2017(1) FY2017(1) 4Q2018 FY2018 Guidance GAAP product revenue $ 196,353 $ 738,242 $ 221,413 $ 829,874 $ 912,000 GAAP royalty and other revenue 11,586 52,006 1,719 28,415 - GAAP total revenue $ 207,939 $ 790,248 $ 223,132 $ 858,289 $ 912,000 GAAP selling, general and administrative (SG&A) expenses 77,832 276,292 74,693 289,456 306,561 GAAP research and development (R&D) expenses 16,094 61,953 19,807 76,967 84,743 GAAP litigation settlement, award and/or defense costs - - (75) 425 - GAAP total operating expenses $ 93,926 $ 338,245 $ 94,425 $ 366,848 $ 391,304 Non-GAAP adjustments to SG&A expenses: Acquisition-related depreciation and amortization (274) (1,097) (246) (984) (968) Non-GAAP SG&A expenses $ 77,558 $ 275,195 $ 74,447 $ 288,472 $ 305,593 Non-GAAP adjustments to R&D expenses: - - - - - Acquisition-related depreciation and amortization 1 Please visit the Investor Relations Non-GAAP R&D expenses $ 16,094 $ 61,953 $ 19,807 $ 76,967 $ 84,743 section of the Company’s website at www.masimo.com to access Non-GAAP adjustments to litigation settlement, award and/or defense costs: additional information related to our Non-GAAP adjustments and Litigation damages, awards and settlements - - 75 (425) - Supplementary Financial Information. Non-GAAP litigation settlement, award and/or defense costs $ - $ - $ - $ - $ - Non-GAAP total operating expenses $ 93,652 $ 337,148 $ 94,254 $ 365,439 $ 390,336 Non-GAAP SG&A expense % of total revenue 37.3% 34.8% 33.4% 33.6% 33.5% Non-GAAP R&D expense % of total revenue 7.7% 7.8% 8.9% 9.0% 9.3% Non-GAAP total operating expense % of total revenue 45.0% 42.7% 42.2% 42.6% 42.8% Non-GAAP SG&A expense % of product revenue 39.5% 37.3% 33.6% 34.8% 33.5% Non-GAAP R&D expense % of product revenue 8.2% 8.4% 8.9% 9.3% 9.3% Non-GAAP total operating expense % of product revenue 47.7% 45.7% 42.6% 44.0% 42.8% ___________ (1) Amounts for 2017 have been restated to reflect the impact of our full retrospective adoption of ASC 606. For additional information with respect to the impact of the adoption of this new accounting standard and reconciliations to the prior reported amounts, please reference Note 2 to our consolidated financial statements that will be included in Part IV, Item 15(a)(1) and 15(a)(2), respectively, of our Annual Report on Form 10-K for the fiscal period ended December 29, 2018 that will be filed with the Securities and Exchange Commission on or about February 26, 2019.

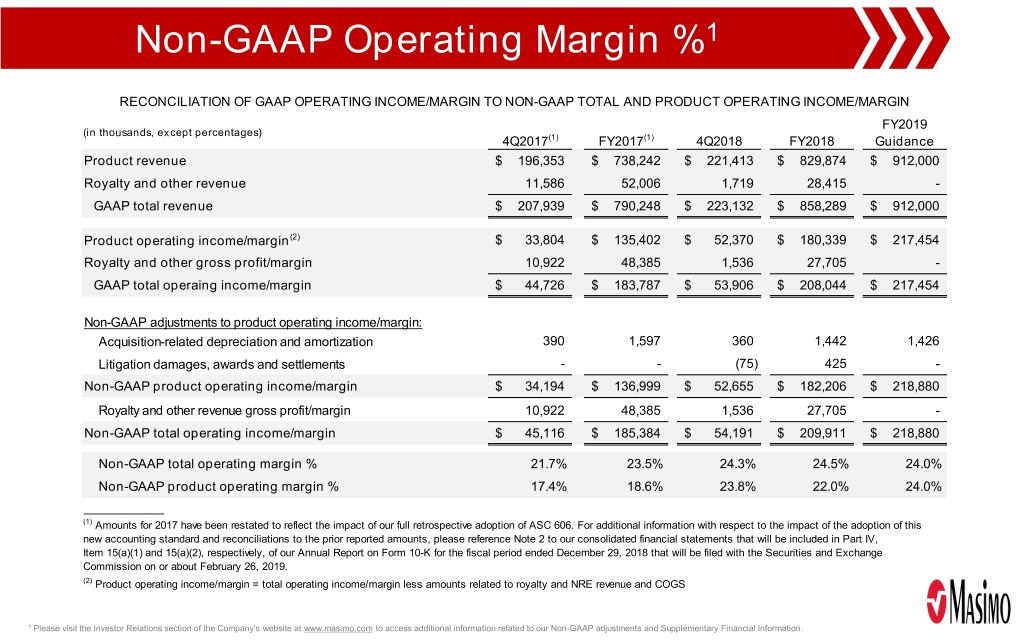

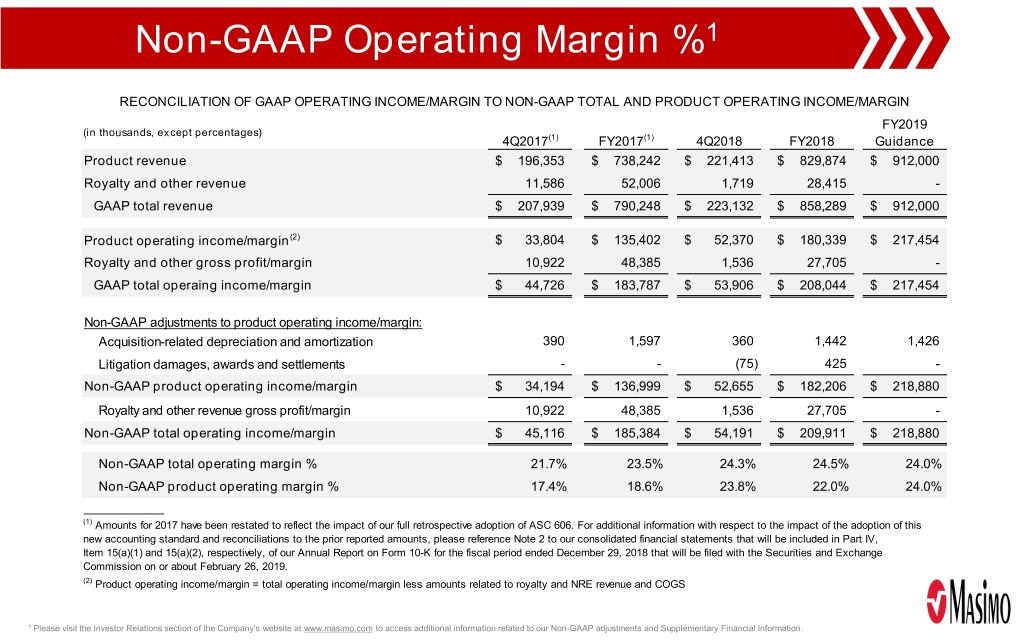

Non-GAAP Operating Margin %1 RECONCILIATION OF GAAP OPERATING INCOME/MARGIN TO NON-GAAP TOTAL AND PRODUCT OPERATING INCOME/MARGIN FY2019 (in thousands, except percentages) 4Q2017(1) FY2017(1) 4Q2018 FY2018 Guidance Product revenue $ 196,353 $ 738,242 $ 221,413 $ 829,874 $ 912,000 Royalty and other revenue 11,586 52,006 1,719 28,415 - GAAP total revenue $ 207,939 $ 790,248 $ 223,132 $ 858,289 $ 912,000 Product operating income/margin(2) $ 33,804 $ 135,402 $ 52,370 $ 180,339 $ 217,454 Royalty and other gross profit/margin 10,922 48,385 1,536 27,705 - GAAP total operaing income/margin $ 44,726 $ 183,787 $ 53,906 $ 208,044 $ 217,454 Non-GAAP adjustments to product operating income/margin: Acquisition-related depreciation and amortization 390 1,597 360 1,442 1,426 Litigation damages, awards and settlements - - (75) 425 - Non-GAAP product operating income/margin $ 34,194 $ 136,999 $ 52,655 $ 182,206 $ 218,880 Royalty and other revenue gross profit/margin 10,922 48,385 1,536 27,705 - Non-GAAP total operating income/margin $ 45,116 $ 185,384 $ 54,191 $ 209,911 $ 218,880 Non-GAAP total operating margin % 21.7% 23.5% 24.3% 24.5% 24.0% Non-GAAP product operating margin % 17.4% 18.6% 23.8% 22.0% 24.0% ___________ (1) Amounts for 2017 have been restated to reflect the impact of our full retrospective adoption of ASC 606. For additional information with respect to the impact of the adoption of this new accounting standard and reconciliations to the prior reported amounts, please reference Note 2 to our consolidated financial statements that will be included in Part IV, Item 15(a)(1) and 15(a)(2), respectively, of our Annual Report on Form 10-K for the fiscal period ended December 29, 2018 that will be filed with the Securities and Exchange Commission on or about February 26, 2019. (2) Product operating income/margin = total operating income/margin less amounts related to royalty and NRE revenue and COGS 1 Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information.

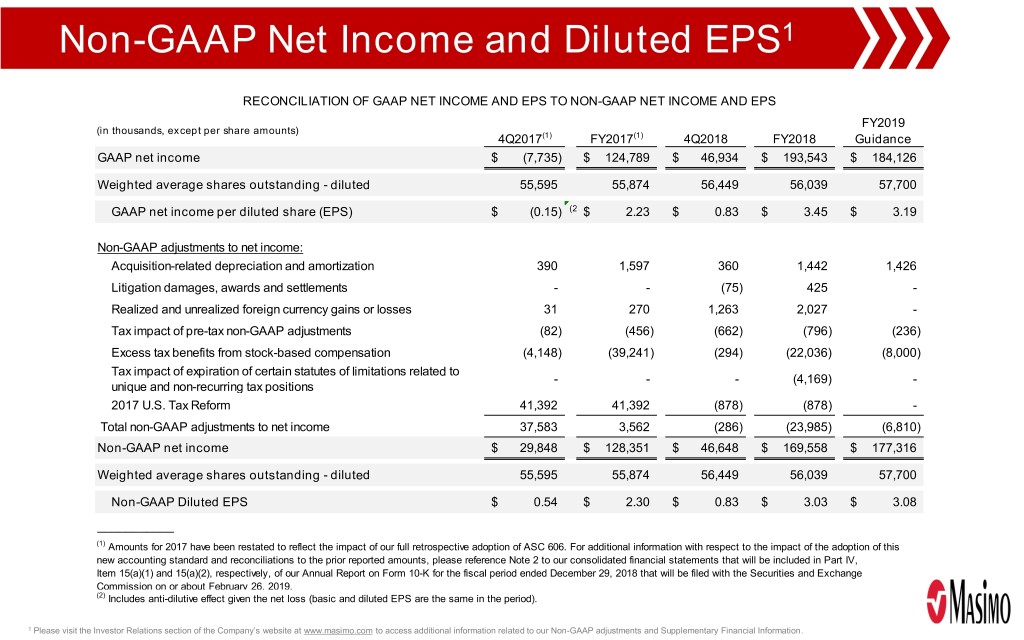

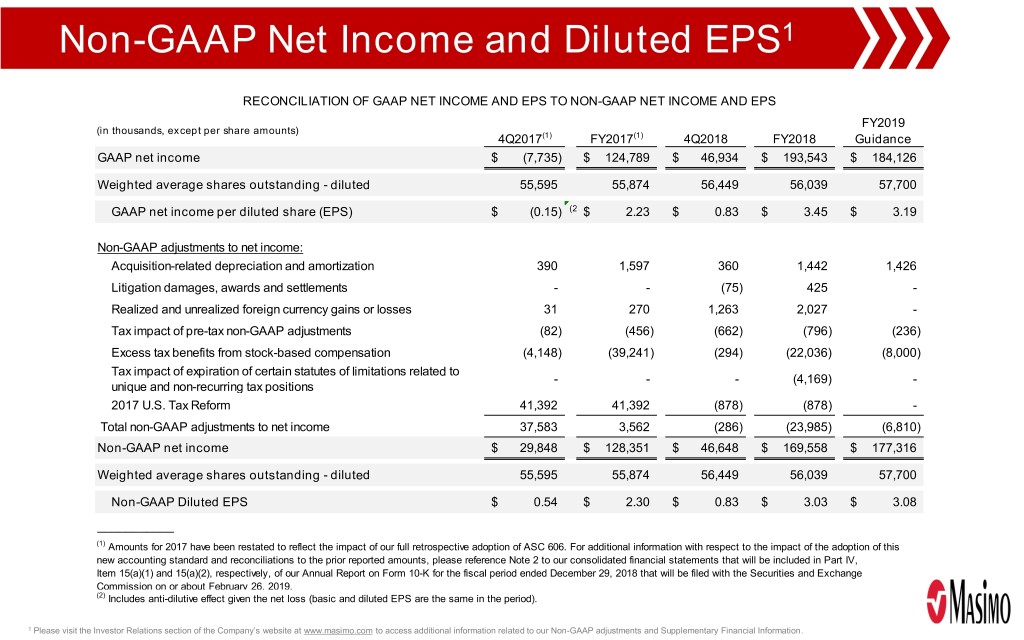

Non-GAAP Net Income and Diluted EPS1 RECONCILIATION OF GAAP NET INCOME AND EPS TO NON-GAAP NET INCOME AND EPS FY2019 (in thousands, except per share amounts) 4Q2017(1) FY2017(1) 4Q2018 FY2018 Guidance GAAP net income $ (7,735) $ 124,789 $ 46,934 $ 193,543 $ 184,126 Weighted average shares outstanding - diluted 55,595 55,874 56,449 56,039 57,700 GAAP net income per diluted share (EPS) $ (0.15) (2) $ 2.23 $ 0.83 $ 3.45 $ 3.19 Non-GAAP adjustments to net income: Acquisition-related depreciation and amortization 390 1,597 360 1,442 1,426 Litigation damages, awards and settlements - - (75) 425 - Realized and unrealized foreign currency gains or losses 31 270 1,263 2,027 - Tax impact of pre-tax non-GAAP adjustments (82) (456) (662) (796) (236) Excess tax benefits from stock-based compensation (4,148) (39,241) (294) (22,036) (8,000) Tax impact of expiration of certain statutes of limitations related to - - - (4,169) - unique and non-recurring tax positions 2017 U.S. Tax Reform 41,392 41,392 (878) (878) - Total non-GAAP adjustments to net income 37,583 3,562 (286) (23,985) (6,810) Non-GAAP net income $ 29,848 $ 128,351 $ 46,648 $ 169,558 $ 177,316 Weighted average shares outstanding - diluted 55,595 55,874 56,449 56,039 57,700 Non-GAAP Diluted EPS $ 0.54 $ 2.30 $ 0.83 $ 3.03 $ 3.08 ___________ (1) Amounts for 2017 have been restated to reflect the impact of our full retrospective adoption of ASC 606. For additional information with respect to the impact of the adoption of this new accounting standard and reconciliations to the prior reported amounts, please reference Note 2 to our consolidated financial statements that will be included in Part IV, Item 15(a)(1) and 15(a)(2), respectively, of our Annual Report on Form 10-K for the fiscal period ended December 29, 2018 that will be filed with the Securities and Exchange Commission on or about February 26, 2019. (2) Includes anti-dilutive effect given the net loss (basic and diluted EPS are the same in the period). 1 Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information.

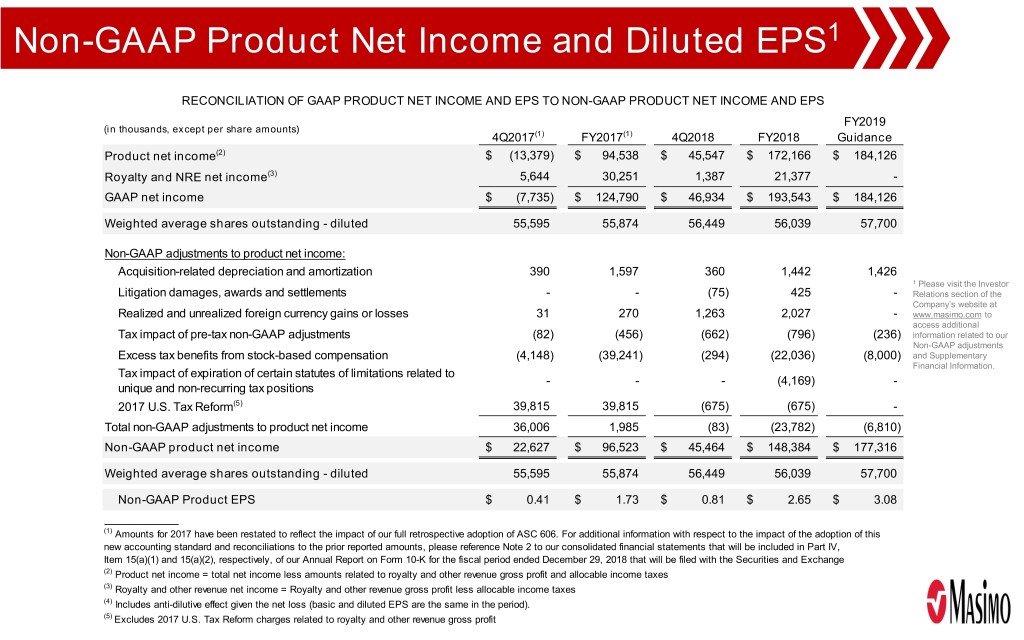

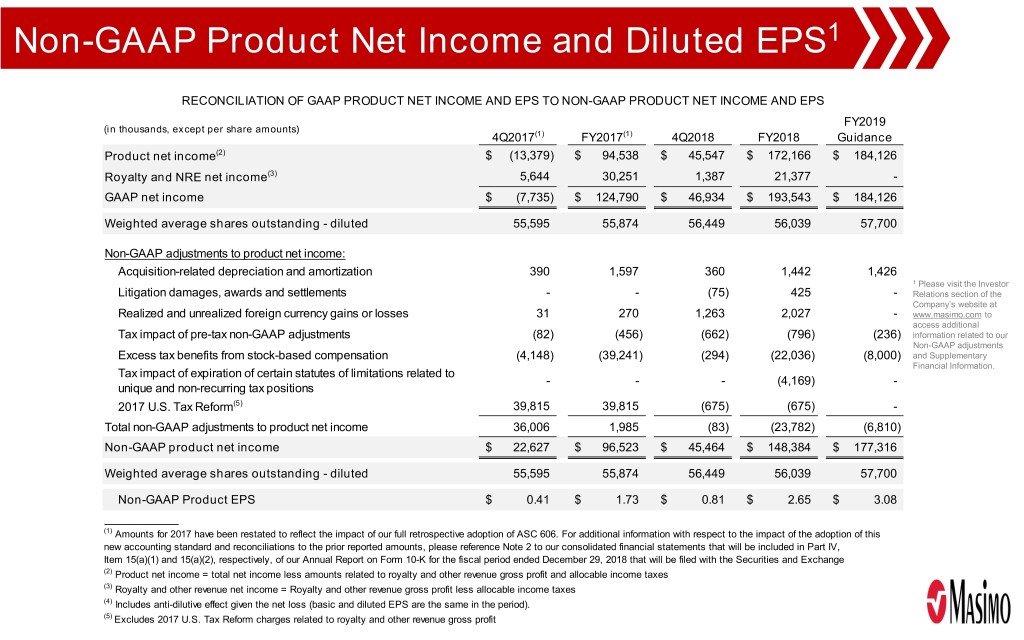

Non-GAAP Product Net Income and Diluted EPS1 RECONCILIATION OF GAAP PRODUCT NET INCOME AND EPS TO NON-GAAP PRODUCT NET INCOME AND EPS FY2019 (in thousands, except per share amounts) 4Q2017(1) FY2017(1) 4Q2018 FY2018 Guidance Product net income(2) $ (13,379) $ 94,538 $ 45,547 $ 172,166 $ 184,126 Royalty and NRE net income(3) 5,644 30,251 1,387 21,377 - GAAP net income $ (7,735) $ 124,790 $ 46,934 $ 193,543 $ 184,126 Weighted average shares outstanding - diluted 55,595 55,874 56,449 56,039 57,700 Non-GAAP adjustments to product net income: Acquisition-related depreciation and amortization 390 1,597 360 1,442 1,426 1 Please visit the Investor Litigation damages, awards and settlements - - (75) 425 - Relations section of the Company’s website at Realized and unrealized foreign currency gains or losses 31 270 1,263 2,027 - www.masimo.com to access additional Tax impact of pre-tax non-GAAP adjustments (82) (456) (662) (796) (236) information related to our Non-GAAP adjustments Excess tax benefits from stock-based compensation (4,148) (39,241) (294) (22,036) (8,000) and Supplementary Financial Information. Tax impact of expiration of certain statutes of limitations related to - - - (4,169) - unique and non-recurring tax positions 2017 U.S. Tax Reform(5) 39,815 39,815 (675) (675) - Total non-GAAP adjustments to product net income 36,006 1,985 (83) (23,782) (6,810) Non-GAAP product net income $ 22,627 $ 96,523 $ 45,464 $ 148,384 $ 177,316 Weighted average shares outstanding - diluted 55,595 55,874 56,449 56,039 57,700 Non-GAAP Product EPS $ 0.41 $ 1.73 $ 0.81 $ 2.65 $ 3.08 ___________ (1) Amounts for 2017 have been restated to reflect the impact of our full retrospective adoption of ASC 606. For additional information with respect to the impact of the adoption of this new accounting standard and reconciliations to the prior reported amounts, please reference Note 2 to our consolidated financial statements that will be included in Part IV, Item 15(a)(1) and 15(a)(2), respectively, of our Annual Report on Form 10-K for the fiscal period ended December 29, 2018 that will be filed with the Securities and Exchange (2) Product net income = total net income less amounts related to royalty and other revenue gross profit and allocable income taxes (3) Royalty and other revenue net income = Royalty and other revenue gross profit less allocable income taxes (4) Includes anti-dilutive effect given the net loss (basic and diluted EPS are the same in the period). (5) Excludes 2017 U.S. Tax Reform charges related to royalty and other revenue gross profit

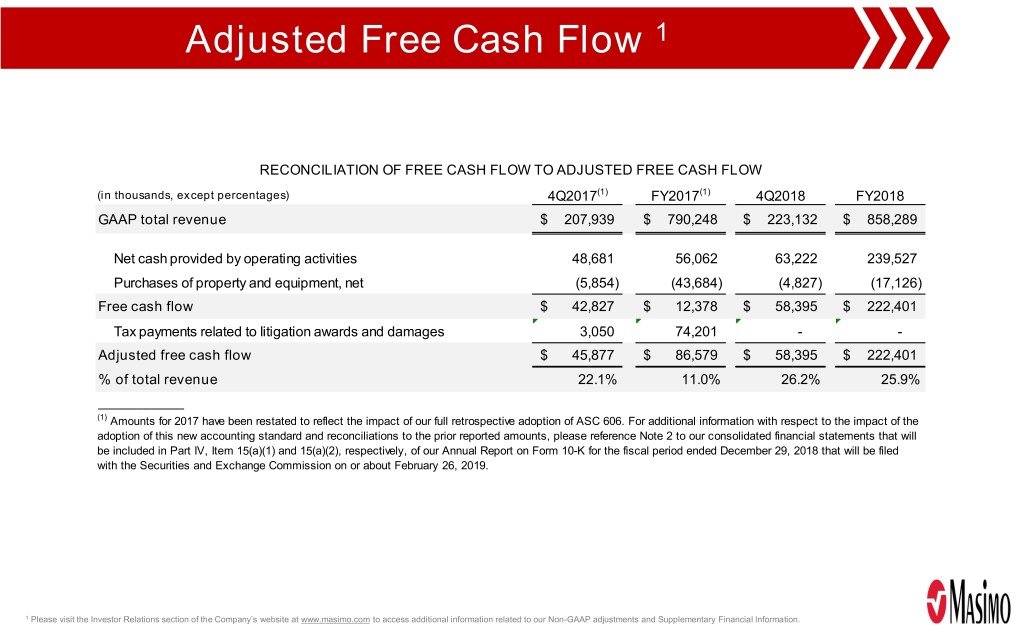

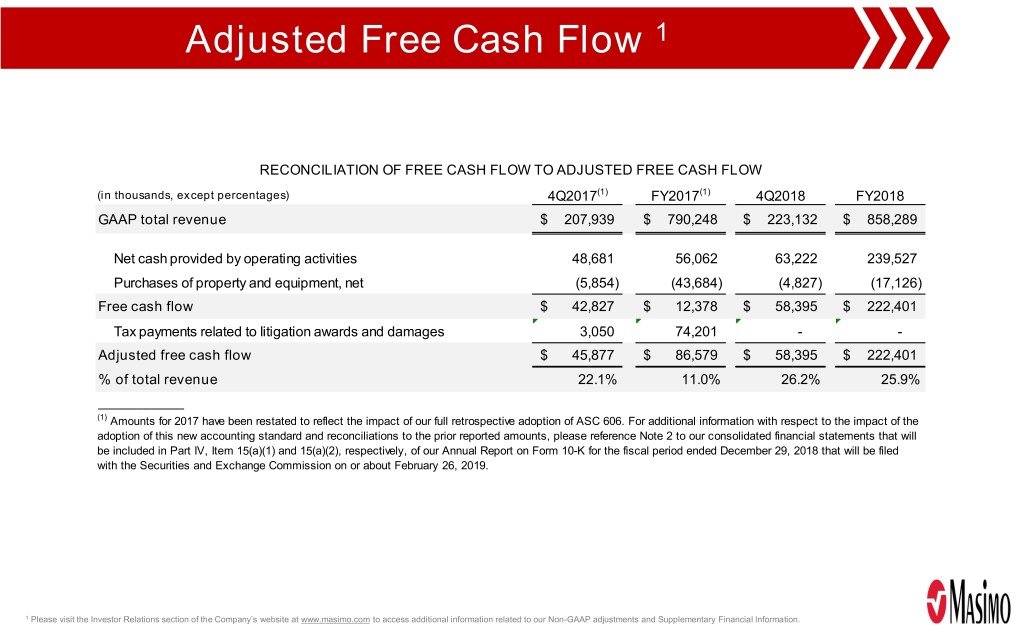

Adjusted Free Cash Flow 1 RECONCILIATION OF FREE CASH FLOW TO ADJUSTED FREE CASH FLOW (in thousands, except percentages) 4Q2017(1) FY2017(1) 4Q2018 FY2018 GAAP total revenue $ 207,939 $ 790,248 $ 223,132 $ 858,289 Net cash provided by operating activities 48,681 56,062 63,222 239,527 Purchases of property and equipment, net (5,854) (43,684) (4,827) (17,126) Free cash flow $ 42,827 $ 12,378 $ 58,395 $ 222,401 Tax payments related to litigation awards and damages 3,050 74,201 - - Adjusted free cash flow $ 45,877 $ 86,579 $ 58,395 $ 222,401 % of total revenue 22.1% 11.0% 26.2% 25.9% ___________ (1) Amounts for 2017 have been restated to reflect the impact of our full retrospective adoption of ASC 606. For additional information with respect to the impact of the adoption of this new accounting standard and reconciliations to the prior reported amounts, please reference Note 2 to our consolidated financial statements that will be included in Part IV, Item 15(a)(1) and 15(a)(2), respectively, of our Annual Report on Form 10-K for the fiscal period ended December 29, 2018 that will be filed with the Securities and Exchange Commission on or about February 26, 2019. 1 Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information.