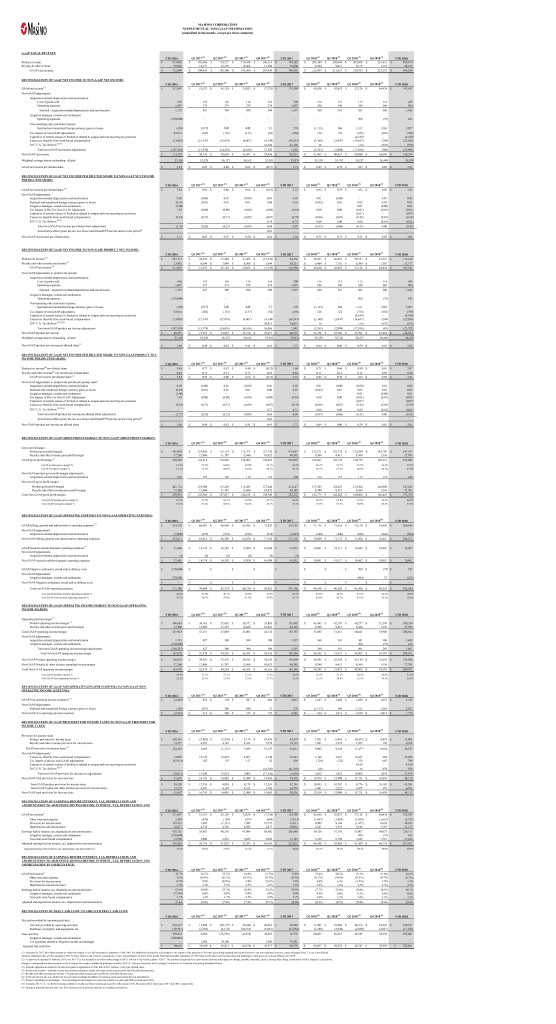

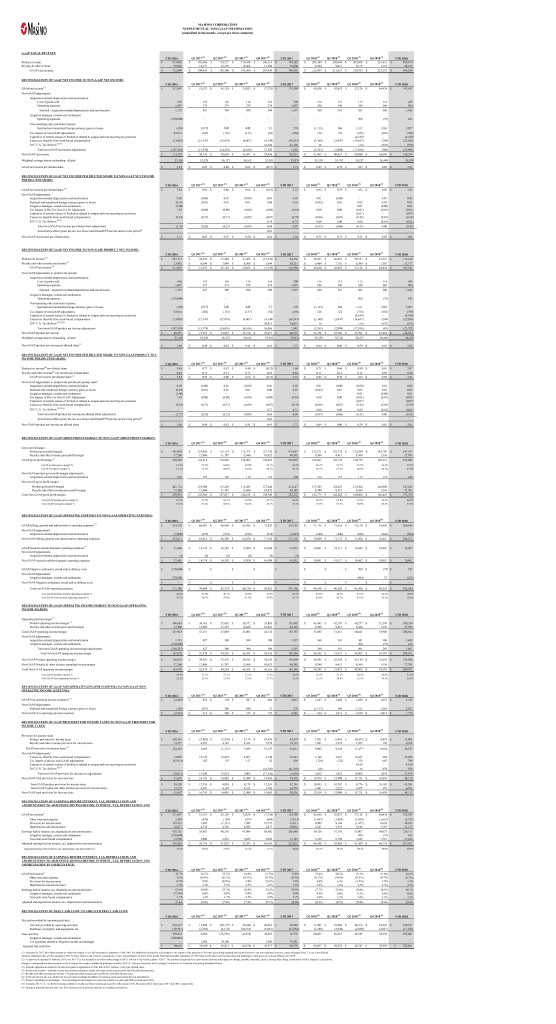

MASIMO CORPORATION SUPPLEMENTAL NON-GAAP INFORMATION (unaudited in thousands, except per share amounts) GAAP TOTAL REVENUE YTD 2016 Q1 2017 (9) Q2 2017 (9) Q3 2017 (9) Q4 2017 (9) YTD 2017 Q1 2018 (9) Q2 2018 (9) Q3 2018 (9) Q4 2018 (9) YTD 2018 Product revenue $ 673,962 $ 182,466 $ 179,727 $ 179,696 $ 196,353 $ 738,242 $ 204,389 $ 202,004 $ 202,068 $ 221,413 $ 829,874 Royalty & other revenue 38,936 14,177 12,579 13,664 11,586 52,006 8,564 9,617 8,515 1,719 28,415 GAAP total revenue $ 712,898 $ 196,643 $ 192,306 $ 193,360 $ 207,939 $ 790,248 $ 212,953 $ 211,621 $ 210,583 $ 223,132 $ 858,289 RECONCILIATION OF GAAP NET INCOME TO NON-GAAP NET INCOME: YTD 2016 Q1 2017 (9) Q2 2017 (9) Q3 2017 (9) Q4 2017 (9) YTD 2017 Q1 2018 (9) Q2 2018 (9) Q3 2018 (9) Q4 2018 (9) YTD 2018 GAAP net income (1) $ 311,097 $ 51,533 $ 45,138 $ 35,853 $ (7,735) $ 124,789 $ 45,630 $ 43,853 $ 57,126 $ 46,934 $ 193,543 Non-GAAP adjustments: Acquisition-related depreciation and amortization: Cost of goods sold 636 152 116 116 116 500 114 115 115 114 458 Operating expenses 1,097 275 274 274 274 1,097 246 246 246 246 984 Subtotal - acquisition-related depreciation and amortization 1,733 427 390 390 390 1,597 360 361 361 360 1,442 Litigation damages, awards and settlements . Operating expenses (270,000) - - - - - - - 500 (75) 425 Non-operating other (income) expense: Realized and unrealized foreign currency gains or losses (103) (557) 348 448 31 270 (1,113) 566 1,311 1,263 2,027 9803 Tax impact of non-GAAP adjustments 83,814 (102) (135) (137) (82) (456) 120 122 (376) (662) (796) Expiration of certain statues of limitation related to unique and non-recurring tax positions - - - - - - - - (4,169) - (4,169) 9800 Excess tax benefits from stock-based compensation (13,002) (15,147) (15,079) (4,867) (4,148) (39,241) (3,148) (3,947) (14,647) (294) (22,036) 2017 U.S. Tax Reform (2) (3) - - - - 41,392 41,392 16 - (16) (878) (878) Total non-GAAP net income adjustments (197,558) (15,379) 2 (14,476) (4,166) 37,583 3,562 (3,765) (2,898) (17,036) (286) (23,985) Non-GAAP net income $ 113,539 $ 36,154 $ 30,662 $ 31,687 $ 29,848 $ 128,3513 $ 41,865 $ 40,955 $ 40,090 $ 46,648 $ 169,558 Weighted average shares outstanding - diluted 53,195 55,529 56,173 56,163 55,595 55,874 55,559 55,742 56,237 56,449 56,039 GAAP net income per diluted share $ 5.85 $ 0.93 $ 0.80 $ 0.64 $ (0.15) $ 2.23 $ 0.82 $ 0.79 $ 1.02 $ 0.83 $ 3.45 RECONCILIATION OF GAAP NET INCOME PER DILUTED SHARE TO NON-GAAP NET INCOME PER DILUTED SHARE: YTD 2016 Q1 2017 (9) Q2 2017 (9) Q3 2017 (9) Q4 2017 (9) YTD 2017 Q1 2018 (9) Q2 2018 (9) Q3 2018 (9) Q4 2018 (9) YTD 2018 GAAP net income per diluted share (1) $ 5.85 $ 0.93 $ 0.80 $ 0.64 $ (0.15) $ 2.23 $ 0.82 $ 0.79 $ 1.02 $ 0.83 $ 3.45 Non-GAAP adjustments: Acquisition-related depreciation and amortization 0.03 (0.00) 0.01 (0.00) 0.01 0.03 0.01 (0.00) - 0.01 0.02 Realized and unrealized foreign currency gains or losses (0.01) (0.01) 0.01 0.01 0.00 0.01 (0.02) 0.01 0.02 0.02 0.03 Litigation damages, awards and settlements (5.08) - - - - - - - 0.01 (0.00) 0.01 Tax Impact of Pre-Tax Non-GAAP Adjustment 1.58 (0.00) (0.00) (0.00) (0.00) (0.01) 0.00 0.00 (0.01) (0.01) (0.01) Expiration of certain statues of limitation related to unique and non-recurring tax positions - - - - - - - - (0.07) - (0.07) 9800 Excess tax benefits from stock-based compensation (0.24) (0.27) (0.27) (0.09) (0.07) (0.70) (0.06) (0.07) (0.26) (0.01) (0.39) 2017 U.S. Tax Reform (2) (3) - - - - 0.74 0.74 0.00 0.00 0.00 (0.01) (0.01) Total non-GAAP net income per diluted share adjustments (3.72) (0.28) (0.25) (0.08) 0.68 0.07 (0.07) (0.06) (0.31) 0.00 (0.42) (6) Anti-dilutive effect given the net loss (basic and diluted EPS are the same) in the period - - - - 0.01 - - - - - - Non-GAAP net income per diluted share $ 2.13 $ 0.65 $ 0.55 $ 0.56 $ 0.54 $ 2.30 $ 0.75 $ 0.73 $ 0.71 $ 0.83 $ 3.03 RECONCILIATION OF GAAP NET INCOME TO NON-GAAP PRODUCT NET INCOME: YTD 2016 Q1 2017 (9) Q2 2017 (9) Q3 2017 (9) Q4 2017 (9) YTD 2017 Q1 2018 (9) Q2 2018 (9) Q3 2018 (9) Q4 2018 (9) YTD 2018 Product net income (4) $ 287,115 $ 42,934 $ 37,498 $ 27,485 $ (13,379) $ 94,538 $ 39,221 $ 36,661 $ 50,737 $ 45,547 $ 172,166 Royalty and other revenue net income (5) 23,982 $ 8,599 $ 7,640 $ 8,368 $ 5,644 30,251 $ 6,409 $ 7,192 $ 6,389 $ 1,387 21,377 (1) GAAP net income $ 311,097 $ 51,533 $ 45,138 $ 35,853 $ (7,735) $ 124,789 $ 45,630 $ 43,853 $ 57,126 $ 46,934 $ 193,543 Non-GAAP adjustments to product net income: Acquisition-related depreciation and amortization: Cost of goods sold 636 152 116 116 116 500 114 115 115 114 458 Operating expenses 1,097 275 274 274 274 1,097 246 246 246 246 984 Subtotal - acquisition-related depreciation and amortization 1,733 427 3900 390 3900 1,597 360 361 361 360 1,442 Litigation damages, awards and settlements Operating expenses (270,000) - - - - - - - 500 (75) 425 Non-operating other (income) expense: Realized and unrealized foreign currency gains or losses (103) (557) 348 448 31 270 (1,113) 566 1,311 1,263 2,027 9803 Tax impact of non-GAAP adjustments 83,814 (102) (135) (137) (82) (456) 120 122 (376) (662) (796) Expiration of certain statues of limitation related to unique and non-recurring tax positions - - - - - - - - (4,169) - (4,169) 9800 Excess tax benefits from stock-based compensation (13,002) (15,147) (15,079) (4,867) (4,148) (39,241) (3,148) (3,947) (14,647) (294) (22,036) 2017 U.S. Tax Reform (2) (3) (8) - - - - 39,815 39,815 16 - (16) (675) (675) Total non-GAAP product net income adjustments (197,558) (15,379) (14,476) (4,166) 36,006 1,985 (3,765) (2,898) (17,036) (83) (23,782) Non-GAAP product net income $ 89,557 $ 27,555 $ 23,022 $ 23,319 $ 22,627 $ 96,523 $ 35,456 $ 33,763 $ 33,701 $ 45,464 $ 148,384 2 Weighted average shares outstanding - diluted 53,195 55,529 56,173 56,163 55,595 55,874 55,559 55,742 56,237 56,449 56,039 (6) Non-GAAP product net income per diluted share $ 1.68 $ 0.49 $ 0.42 $ 0.41 $ 0.41 $ 1.73 $ 0.64 $ 0.60 $ 0.59 $ 0.81 $ 2.65 RECONCILIATION OF GAAP NET INCOME PER DILUTED SHARE TO NON-GAAP PRODUCT NET INCOME PER DILUTED SHARE: YTD 2016 Q1 2017 (9) Q2 2017 (9) Q3 2017 (9) Q4 2017 (9) YTD 2017 Q1 2018 (9) Q2 2018 (9) Q3 2018 (9) Q4 2018 (9) YTD 2018 Product net income(4) per diluted share $ 5.40 $ 0.77 $ 0.67 $ 0.49 $ (0.25) $ 1.69 $ 0.71 $ 0.66 $ 0.90 $ 0.81 $ 3.07 Royalty and other revenue(5) net income per diluted share 0.45 0.16 0.13 0.15 0.10 0.54 0.11 0.13 0.12 0.02 0.38 GAAP net income per diluted share (1) $ 5.85 $ 0.93 $ 0.80 $ 0.64 $ (0.15) $ 2.23 $ 0.82 $ 0.79 $ 1.02 $ 0.83 $ 3.45 Non-GAAP adjustments to product net income per diluted share: Acquisition-related depreciation and amortization 0.03 (0.00) 0.01 (0.00) 0.01 0.03 0.01 (0.00) (0.00) 0.01 0.02 Realized and unrealized foreign currency gains or losses (0.01) (0.01) 0.01 0.01 0.00 0.01 (0.02) 0.01 0.02 0.02 0.03 Litigation damages, awards and settlements (5.08) - - - - - - - 0.01 (0.00) 0.01 Tax Impact of Pre-Tax Non-GAAP Adjustment 1.58 (0.00) (0.00) (0.00) (0.00) (0.01) 0.00 0.00 (0.01) (0.01) (0.01) Expiration of certain statues of limitation related to unique and non-recurring tax positions - - - - - - - - (0.07) - (0.07) 9800 Excess tax benefits from stock-based compensation (0.24) (0.27) (0.27) (0.09) (0.07) (0.70) (0.06) (0.07) (0.26) (0.01) (0.39) 2017 U.S. Tax Reform (2) (3) (8) - - - - 0.71 0.71 0.00 0.00 0.00 (0.01) (0.01) Total non-GAAP product net income per diluted share adjustments (3.72) (0.28) (0.25) (0.08) 0.65 0.04 (0.07) (0.06) (0.31) 0.00 (0.42) (6) Anti-dilutive effect given the net loss (basic and diluted EPS are the same) in the period - - - - 0.01 - - - - - - Non-GAAP product net income per diluted share $ 1.68 $ 0.49 $ 0.42 $ 0.41 $ 0.41 $ 1.73 $ 0.64 $ 0.60 $ 0.59 $ 0.81 $ 2.65 RECONCILIATION OF GAAP GROSS PROFIT/MARGIN TO NON-GAAP GROSS PROFIT/MARGIN: YTD 2016 Q1 2017 (9) Q2 2017 (9) Q3 2017 (9) Q4 2017 (9) YTD 2017 Q1 2018 (9) Q2 2018 (9) Q3 2018 (9) Q4 2018 (9) YTD 2018 Gross profit/margin Product gross profit/margin $ 441,078 $ 119,428 $ 115,114 $ 111,375 $ 127,730 $ 473,647 $ 135,271 $ 132,732 $ 132,389 $ 146,795 $ 547,187 Royalty and other revenue gross profit/margin 37,260 12,986 11,787 12,690 10,922 48,385 8,390 9,415 8,364 1,536 27,705 GAAP gross profit/margin (1) 478,338 132,414 126,901 124,065 138,652 522,032 143,661 142,147 140,753 148,331 574,892 GAAP product gross margin % 65.4% 65.5% 64.0% 62.0% 65.1% 64.2% 66.2% 65.7% 65.5% 66.3% 65.9% GAAP total gross margin % 67.1% 67.3% 66.0% 64.2% 66.7% 66.1% 67.5% 67.2% 66.8% 66.5% 67.0% Non-GAAP product gross profit/margin adjustments: Acquisition-related depreciation and amortization 636 152 116 116 116 500 114 115 115 114 458 Non-GAAP gross profit/margin Product gross profit/margin 441,714 119,580 115,230 111,491 127,846 474,147 135,385 132,847 132,504 146,909 547,645 Royalty and other revenue gross profit/margin 37,260 12,986 11,787 12,690 10,922 48,385 8,390 9,415 8,364 1,536 27,705 Total Non-GAAP gross profit/margin $ 478,974 $ 132,566 $ 127,017 $ 124,181 $ 138,768 $ 522,532 $ 143,775 $ 142,262 $ 140,868 $ 148,445 $ 575,350 Non-GAAP product gross margin % 65.5% 65.5% 64.1% 62.0% 65.1% 64.2% 66.2% 65.8% 65.6% 66.4% 66.0% Non-GAAP total gross margin % 67.2% 67.4% 66.0% 64.2% 66.7% 66.1% 67.5% 67.2% 66.9% 66.5% 67.0% RECONCILIATION OF GAAP OPERATING EXPENSES TO NON-GAAP OPERATING EXPENSES: YTD 2016 Q1 2017 (9) Q2 2017 (9) Q3 2017 (9) Q4 2017 (9) YTD 2017 Q1 2018 (9) Q2 2018 (9) Q3 2018 (9) Q4 2018 (9) YTD 2018 GAAP selling, general and administrative operating expenses (1) $ 254,707 $ 66,087 $ 66,669 $ 65,704 $ 77,832 $ 276,292 $ 71,175 $ 71,418 $ 72,170 $ 74,693 $ 289,456 Non-GAAP adjustments: Acquisition-related depreciation and amortization (1,096) (275) (274) (274) (274) (1,097) (246) (246) (246) (246) (984) Non-GAAP selling, general and administrative operating expenses$ 253,611 $ 65,812 $ 66,395 $ 65,430 $ 77,558 $ 275,195 $ 70,929 $ 71,172 $ 71,924 $ 74,447 $ 288,472 GAAP research and development operating expenses (1) $ 57,686 $ 14,176 $ 16,383 $ 15,300 $ 16,094 $ 61,953 $ 18,601 $ 19,117 $ 19,442 $ 19,807 $ 76,967 Non-GAAP adjustments: Acquisition-related depreciation and amortization (1) (0) (0) (0) (0) (0) - - - - - Non-GAAP research and development operating expenses$ 57,685 $ 14,176 $ 16,383 $ 15,300 $ 16,094 $ 61,953 $ 18,601 $ 19,117 $ 19,442 $ 19,807 $ 76,967 GAAP litigation settlement, award and/or defense costs$ (270,000) $ - $ - $ - $ - $ - $ - $ - $ 500 $ (75) $ 425 Non-GAAP adjustments: Litigation damages, awards and settlements 270,000 - - - - - - - (500) 75 (425) Non-GAAP litigation settlement, award and/or defense costs$ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - Total non-GAAP operating expenses $ 311,296 $ 79,988 $ 82,778 $ 80,730 $ 93,652 $ 337,148 $ 89,530 $ 90,289 $ 91,366 $ 94,254 $ 365,439 Non-GAAP product revenue operating expense % 46.2% 43.8% 46.1% 44.9% 47.7% 45.7% 43.8% 44.7% 45.2% 42.6% 44.0% Non-GAAP total revenue operating expense % 43.7% 40.7% 43.0% 41.8% 45.0% 42.7% 42.0% 42.7% 43.4% 42.2% 42.6% RECONCILIATION OF GAAP OPERATING INCOME/MARGIN TO NON-GAAP OPERATING INCOME/MARGIN: YTD 2016 Q1 2017 (9) Q2 2017 (9) Q3 2017 (9) Q4 2017 (9) YTD 2017 Q1 2018 (9) Q2 2018 (9) Q3 2018 (9) Q4 2018 (9) YTD 2018 Operating income/margin (1) Product operating income/margin (7) $ 398,685 $ 39,165 $ 32,062 $ 30,372 $ 33,803 $ 135,402 $ 45,495 $ 42,197 $ 40,277 $ 52,370 $ 180,339 Royalty and other revenue gross profit/margin 37,260 12,986 11,787 12,689 10,923 48,385 8,390 9,415 8,364 1,536 27,705 Total GAAP operating income/margin 435,945 52,151 43,849 43,061 44,726 183,787 53,885 51,612 48,641 53,906 208,044 Non-GAAP adjustments: Acquisition-related depreciation and amortization 1,733 427 390 390 390 1,597 360 361 361 360 1,442 Litigation damages, awards and settlements (270,000) - - - - - - - 500 (75) 425 Total non-GAAP operating income/margin adjustments (268,267) 427 390 390 390 1,597 360 361 861 285 1,867 Total Non-GAAP operating income/margin $ 167,678 $ 52,578 $ 44,239 $ 43,451 $ 45,116 $ 185,384 $ 54,245 $ 51,973 $ 49,502 $ 54,191 $ 209,911 Non-GAAP Product operating income/margin $ 130,418 $ 39,592 $ 32,452 $ 30,762 $ 34,193 $ 136,999 $ 45,855 $ 42,558 $ 41,138 $ 52,655 $ 182,206 Non-GAAP Royalty & other revenue operating income/margin 37,260 12,986 11,787 12,689 10,923 48,385 8,390 9,415 8,364 1,536 27,705 Total Non-GAAP operating income/margin $ 167,678 $ 52,578 $ 44,239 $ 43,451 $ 45,116 $ 185,384 $ 54,245 $ 51,973 $ 49,502 $ 54,191 $ 209,911 Non-GAAP product income % 19.4% 21.7% 18.1% 17.1% 17.4% 18.6% 22.4% 21.1% 20.4% 23.8% 22.0% Non-GAAP total operating income % 23.5% 26.7% 23.0% 22.5% 21.7% 23.5% 25.5% 24.6% 23.5% 24.3% 24.5% RECONCILIATION OF GAAP NON-OPERATING INCOME (EXPENSE) TO NON-GAAP NON- OPERATING INCOME (EXPENSE): YTD 2016 Q1 2017 (9) Q2 2017 (9) Q3 2017 (9) Q4 2017 (9) YTD 2017 Q1 2018 (9) Q2 2018 (9) Q3 2018 (9) Q4 2018 (9) YTD 2018 GAAP Non-operating income (expense) (1) $ (2,429) $ 874 $ 158 $ 287 $ 694 $ 2,013 $ 1,647 $ 1,405 $ 1,028 $ 1,652 $ 5,732 Non-GAAP adjustments: Realized and unrealized foreign currency gains or losses (103) (557) 348 448 31 270 (1,113) 566 1,311 1,263 2,027 Non-GAAP non-operating income (expense) $ (2,532) $ 317 $ 506 $ 735 $ 725 $ 2,283 $ 534 $ 1,971 $ 2,339 $ 2,915 $ 7,759 RECONCILIATION OF GAAP PROVISION FOR INCOME TAXES TO NON-GAAP PROVISION FOR INCOME TAXES: YTD 2016 Q1 2017 (9) Q2 2017 (9) Q3 2017 (9) Q4 2017 (9) YTD 2017 Q1 2018 (9) Q2 2018 (9) Q3 2018 (9) Q4 2018 (9) YTD 2018 Provision for income taxes Product provision for income taxes $ 109,142 $ (2,895) $ (5,276) $ 3,174 $ 47,876 $ 42,879 $ 7,921 $ 6,942 $ (9,432) $ 8,474 $ 13,905 Royalty and other revenue provision for income taxes 13,277 4,387 4,145 4,321 5,279 18,132 1,981 2,222 1,975 150 6,328 GAAP provision for income taxes (1) 122,419 1,492 (1,131) 7,495 53,155 61,011 9,902 9,164 (7,457) 8,624 20,233 Non-GAAP adjustments: Excess tax benefits from stock-based compensation 13,002 15,147 15,079 4,867 4,148 39,241 3,148 3,947 14,647 294 22,036 Tax impact of pre-tax non-GAAP adjustments (83,814) 102 135 137 82 456 (120) (122) 376 662 796 Expiration of certain statues of limitation related to unique and non-recurring tax positions - - - - - - - - 4,169 - 4,169 2017 U.S. Tax Reform (2) (3) - - - - (41,392) (41,392) (16) - 16 878 878 Total non-GAAP provision for income tax adjustments (70,812) 15,249 15,214 5,004 (37,162) (1,695) 3,012 3,825 19,208 1,834 27,879 Non-GAAP total provision for income taxes $ 51,607 $ 16,741 $ 14,083 $ 12,499 $ 15,993 $ 59,316 $ 12,914 $ 12,989 $ 11,751 $ 10,458 48,112 Non-GAAP product provision for income taxes$ 38,330 $ 12,354 $ 9,938 $ 8,178 $ 12,291 $ 42,761 $ 10,933 $ 10,767 $ 9,776 $ 10,105 $ 41,581 Non-GAAP royalty and other revenue provision for income taxes 13,277 4,387 4,145 4,321 3,702 16,555 1,981 2,222 1,975 353 6,531 Non-GAAP total provision for income taxes $ 51,607 $ 16,741 $ 14,083 $ 12,499 $ 15,993 $ 59,316 $ 12,914 $ 12,989 $ 11,751 $ 10,458 48,112 RECONCILIATION OF EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND AMORTIZATION TO ADJUSTED EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND YTD 2016 Q1 2017 (9) Q2 2017 (9) Q3 2017 (9) Q4 2017 (9) YTD 2017 Q1 2018 (9) Q2 2018 (9) Q3 2018 (9) Q4 2018 (9) YTD 2018 GAAP net income (1) $ 311,097 $ 51,533 $ 45,139 $ 35,854 $ (7,736) $ 124,789 $ 45,630 $ 43,853 $ 57,126 $ 46,934 $ 193,543 Other (income) expense 2,429 (874) (158) (287) (694) (2,013) (1,647) (1,405) (1,028) (1,652) (5,732) Provision for income taxes 122,419 1,492 (1,131) 7,495 53,155 61,011 9,902 9,164 (7,457) 8,624 20,233 Depreciation and amortization 16,817 4,736 4,726 4,922 5,677 20,061 5,241 5,553 5,166 5,167 21,127 Earnings before interest, tax, depreciation and amortization 452,762 56,887 48,576 47,984 50,402 203,848 59,126 57,165 53,807 59,073 229,171 Litigation damages, awards and settlements (270,000) - - - - - - - 500 (75) 425 Non-cash stock based compensation 12,503 2,889 3,253 5,052 5,993 17,187 5,332 6,720 7,643 7,721 27,416 Adjusted earnings before interest, tax, depreciation and amortization$ 195,265 $ 59,776 $ 51,828 $ 53,035 $ 56,395 $ 221,035 $ 64,458 $ 63,885 $ 61,950 $ 66,719 $ 257,013 Adjusted earnings before interest, tax, depreciation and amortization % 27.4% 30.4% 27.0% 27.4% 27.1% 28.0% 30.3% 30.2% 29.4% 29.9% 29.9% RECONCILIATION OF EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND AMORTIZATION TO ADJUSTED EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND AMORTIZATION AS A PERCENTAGE: YTD 2016 Q1 2017 (9) Q2 2017 (9) Q3 2017 (9) Q4 2017 (9) YTD 2017 Q1 2018 (9) Q2 2018 (9) Q3 2018 (9) Q4 2018 (9) YTD 2018 GAAP net income (1) 43.7% 26.2% 23.5% 18.6% (3.7%) 15.8% 21.4% 20.7% 27.1% 21.0% 22.5% Other (income) expense 0.3% (0.4%) (0.1%) (0.1%) (0.3%) (0.3%) (0.7%) (0.6%) (0.5%) (0.7%) (0.7%) Provision for income taxes 17.2% 0.8% (0.6%) 3.9% 25.6% 7.8% 4.6% 4.3% (3.5%) 3.8% 2.4% Depreciation and amortization 2.4% 2.4% 2.5% 2.5% 2.6% 2.5% 2.4% 2.6% 2.5% 2.3% 2.5% Earnings before interest, tax, depreciation and amortization 63.6% 29.0% 25.3% 24.9% 24.2% 25.8% 27.7% 27.0% 25.6% 26.5% 26.7% Litigation damages, awards and settlements (37.9%)0.0%0.0%0.0%0.0%0.0%0.0%0.0% 0.2% 0.0% 0.0% Non-cash stock based compensation 1.7% 1.4% 1.7% 2.5% 2.9% 2.2% 2.6% 3.2% 3.6% 3.5% 3.2% Adjusted earnings before interest, tax, depreciation and amortization 27.4% 30.4% 27.0% 27.4% 27.1% 28.0% 30.3% 30.2% 29.4% 29.9% 29.9% RECONCILIATION OF FREE CASH FLOW TO ADJUSTED FREE CASH FLOW YTD 2016 Q1 2017 (9) Q2 2017 (9) Q3 2017 (9) Q4 2017 (9) YTD 2017 Q1 2018 (9) Q2 2018 (9) Q3 2018 (9) Q4 2018 (9) YTD 2018 Net cash provided by operating activities Net cash provided by operating activities $ 419,125 $ 13,898 $ (29,157) $ 22,640 $ 48,681 $ 56,062 $ 71,995 $ 55,894 $ 48,416 $ 63,222 $ 239,527 Purchases of property and equipment, net (19,707) (4,394) (4,118) (29,318) (5,854) (43,684) (3,788) (5,642) (2,869) (4,827) (17,126) Free cash flow 399,418 9,504 (33,275) (6,678) 42,827 12,378 68,207 50,252 45,547 58,395 222,401 Litigation damages, awards and settlements (300,000) - - - - - - - - - - Tax payments related to litigation awards and damages - 1,045 70,106 - 3,050 74,201 - - - - - Adjusted free cash flow $ 99,418 $ 10,549 $ 36,831 $ (6,678) $ 45,877 $ 86,579 $ 68,207 $ 50,252 $ 45,547 $ 58,395 $ 222,401 (1) Amounts for 2017 have been restated to reflect the impact of our full retrospective adoption of ASC 606. For additional information with respect to the impact of the adoption of this new accounting standard and reconciliations to the prior reported amounts, please reference Note 2 to our consolidated financial statements that will be included in Part IV, Item 15(a)(1) and 15(a)(2), respectively, of our Annual Report on Form 10-K for the fiscal period ended December 29, 2018 that will be filed with the Securities and Exchange Commission on or about February 26, 2019. (2) As previously reported in February 2018, the 2017 Tax Act resulted in an unfavorable charge of $43.5 million in the fourth quarter of 2017. The amount recognized was a provisional estimate and subject to change, possibly materially, due to, among other things, refinements of the Company’s calculations, changes in interpretations and assumptions the Company has made or additional guidance issued by the U.S. Treasury, Securities and Exchange Commission or Financial Accounting Standards Board. (3) Includes adjustments related to the full retrospective application of ASC 606 of $2.1 million, or $0.4 per diluted share. (4) Product net income = total net income less amounts related to royalty and other revenue gross profit and allocable income taxes (5) Royalty and other revenue net income = Royalty and other revenue gross profit less allocable income taxes (6) In the period of a net loss, diluted net loss per share excludes the effects of common stock equivalents that are anti-dilutive. (7) Product operating income/margin = total operating income/margin less amounts related to royalty and NRE revenue and COGS (8) Excludes 2017 U.S. Tax Reform charges related to royalty and other revenue gross profit in the amount of $1.6M and $.2M in fiscal years 2017 and 2018, respectively. (9) Quarterly reported amounts may vary from amounts previously reported due to rounding conventions.