Exhibit 99.1 TMT Conference 2011 – Bank of America London Franki D’Hoore, Director European Investor Relations June 7, 2011 |

/ Slide 2 Safe Harbor "Safe Harbor" Statement under the US Private Securities Litigation Reform Act of 1995: the matters discussed in this document may include forward-looking statements, including statements made about our outlook, realization of backlog, IC unit demand, financial results, average selling price, gross margin and expenses, dividend policy and intention to repurchase shares. These forward looking statements are subject to risks and uncertainties including, but not limited to: economic conditions, product demand and semiconductor equipment industry capacity, worldwide demand and manufacturing capacity utilization for semiconductors (the principal product of our customer base), including the impact of general economic conditions on consumer confidence and demand for our customers’ products, competitive products and pricing, the impact of manufacturing efficiencies and capacity constraints, the pace of new product development and customer acceptance of new products, our ability to enforce patents and protect intellectual property rights, the risk of intellectual property litigation, availability of raw materials and critical manufacturing equipment, trade environment, changes in exchange rates available cash, distributable reserves for dividend payments and share repurchases, uncertainty surrounding the impact of the earthquake and tsunami in Japan and its potential effect on our customers and suppliers and other risks indicated in the risk factors included in ASML’s Annual Report on Form 20-F and other filings with the US Securities and Exchange Commission. |

/ Slide 3 ASML Headquarters in Veldhoven, the Netherlands ASML: the number 2 semiconductor equipment supplier in the world in 2010 |

/ Slide 4 Agenda Business Overview Market ASML EUV update Outlook and summary |

/ Slide 5 Business Overview |

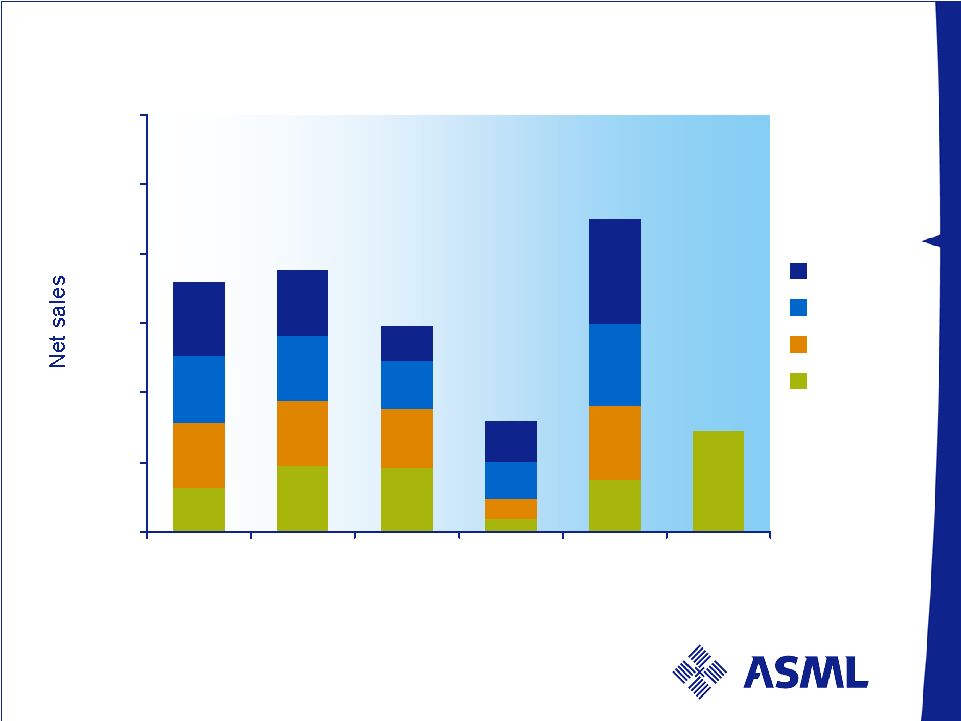

/ Slide 6 629 949 919 183 742 1,452 942 930 844 277 1,069 958 934 697 555 1,176 1,053 955 494 581 1,521 0 1,000 2,000 3,000 4,000 5,000 6,000 2006 2007 2008 2009 2010 2011 Q4 Q3 Q2 Q1 Total net sales M€ 3,582 3,768 Numbers have been rounded for readers’ convenience. 2,954 1,596 4,508 |

/ Slide 7 Q1 results - highlights Net sales of € 1,452 million, 63 systems shipped valued at € 1,284 million, service and field option sales at € 168 million Gross margin of 44.7% Operating margin of 31.0% Net system bookings of 40 systems, € 845 million Backlog at € 3,330 million, 134 systems with ASP of € 28.4 million for new tools, includes 60 immersion tools Generated € 1,1 billon cash from operations |

/ Slide 8 Key financial trends 2010 – 2011 Consolidated statements of operations M€ Q1 10 Q2 10 Q3 10 Q4 10 Q1 11 Net Sales 742 1,069 1,176 1,521 1,452 Gross profit Gross margin % 298 40.3% 459 43.0% 513 43.6% 685 45.0% 649 44.7% R&D costs 120 125 137 141 145 SG&A costs 41 42 48 50 54 Income from operations Operating income % 137 18.5% 292 27.4% 328 27.9% 494 32.4% 450 31.0% Net income Net income as a % of net sales 107 14.5% 239 22.4% 269 22.8% 407 26.7% 395 27.2% Units sold 34 43 51 69 63 ASP new systems 25.8 25.6 24.1 22.4 22.5 Net bookings value 1,165 1,342 1,391 2,315 845 Numbers have been rounded for readers’ convenience. |

/ Slide 9 Backlog in value per March 27, 2011 Numbers have been rounded for readers’ convenience. |

/ Slide 10 Market |

/ Slide 11 Business environment Semiconductor manufacturers have shown caution in assessing economic impact of Japanese earthquake on their supply chain and end-product markets Although direct impact to the electronics industry world- wide seems limited, it has caused some of our customers to review their existing equipment delivery and order plans Resulting adjustments are only affecting potential litho system demand above what is currently the analyst’s consensus We continue to expect a total revenue level for 2011 clearly above € 5 billion |

/ Slide 12 3mma IC revenue, inventory and inventory days 0 5 10 15 20 25 30 35 - 20 40 60 80 100 120 3mma IC inventory value (left) 3mma IC revenues (left) 3mma IC consumption: revenues ± inventory value change (left) 3mma Inventory days (right) Consumption decreased in March, whereas revenues increased, causing growing IC inventory level Source: VLSI Research, WSTS, ASML Last data point: March 2011 Current 3mma inventory value at around $27 B |

/ Slide 13 Source: DRAMeXchange (5/5/2011), ASML MCC Further recovery of contract prices leads tier 2/3 manufacturers at low 5x nm (closer) to profitability <Customer litho system utilizations high> DRAM |

/ Slide 14 NAND SLC spot prices slide after change in product mix in March, overall chip prices remain quite stable at healthy levels <Customer litho tool utilization remain high> Source: DRAMeXchange (5/5/2011), ASML MCC |

/ Slide 15 ASML EUV update |

/ Slide 16 Technology - EUV NXE:3100 second generation EUV Three NXE:3100 shipped to date, 3 more to go Progress ongoing to reach target throughput by year end Customer process development started Infrastructure development transitioning to optimization phase (masks, resist, metrology, etc) Revenue recognition expected in 2012 NXE:3300 third generation EUV Commitments received for 10 NXE:3300 production systems, deliveries to start H2 2012 |

/ Slide 17 Why EUV? EUV supports IC & Lithography roadmap towards <10nm Year of production start Notes: 1. R&D solution required 1.5~ 2 yrs ahead of Production 2. EUV resolution requires 7nm diffusion length resist 3. DPT = Double Patterning 4. QPT = Double Double Patterning Source: Customers, ASML |

/ Slide 18 Consumers are the winners Shrink drives manufacturing cost down Note: data iSupply, March 2009. High quality Flash |

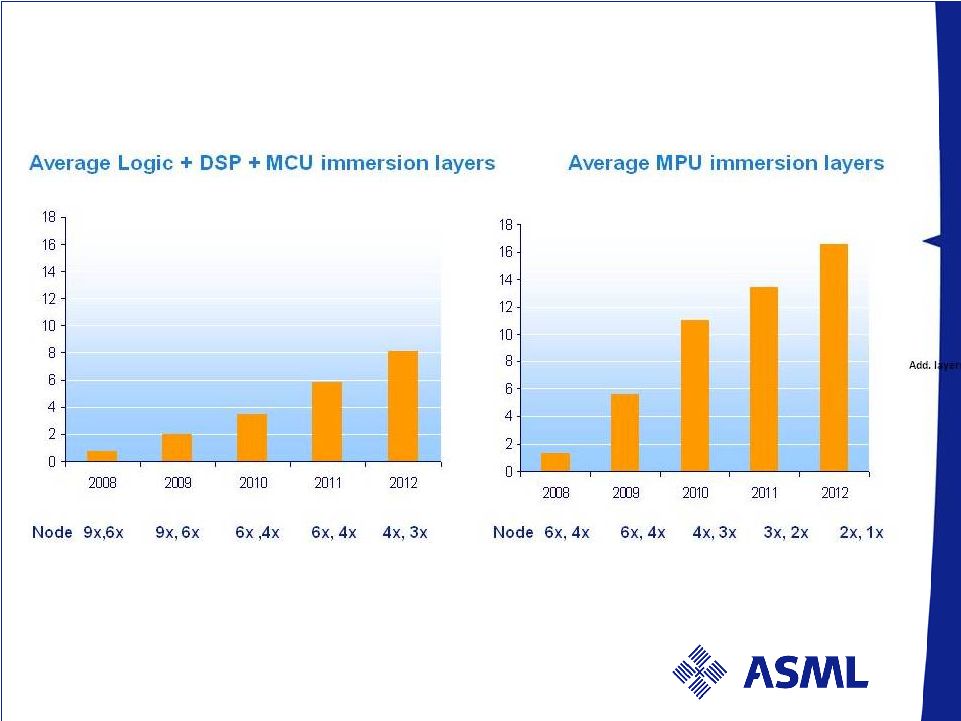

/ Slide 19 Shrink drives device complexity which drives litho opportunity due to a growing number of critical litho layers Source: ASML Marketing (03/11), 300mm wafers only |

/ Slide 20 Increasing immersion layers per node, per year with shrink in memory too Source: ASML Marketing (03/11), 300mm wafers only |

/ Slide 21 Typical Patterning Schemes for Critical Layers DPT = Double Patterning Source: ASML Strategic Marketing |

/ Slide 22 EUV lowers overall costs for customer, while increasing litho costs * Source: ASML Strategic Marketing; Cost of Technology model incl. Capex & Opex – NAND Example Cost per layer [Euro/Wafer] |

/ Slide 23 ASML’s Unique Holistic Litho Optimisation & Control of future low k1, DP and EUV litho processes |

/ Slide 24 ASML’s unique Holistic Litho optimisation & control of future low k1, DP and EUV litho processes |

/ Slide 25 Holistic Litho creating value Customers: Improved chip yield capability and cycle time improvement for semiconductors made with advanced litho process like low k1, double pattering and EUV ASML: Holistic products sold with new machines or added to existing tools in customers factories result in Higher service sales Higher average selling prices (ASP) for new machines |

/ Slide 26 Section Summary Low k1 Double Patterning Lithography enables extension of immersion Lithography bridging the gap until single patterning EUV is available However, Double Patterning presents significant Cost, Process Control, and Cycle Time manufacturing challenges Advanced Optical Metrology enables improved Scanner control and utilisation whilst integrated solutions enable improved Overlay & CD Uniformity through feedback loops & increased correction capability |

/ Slide 27 Outlook and summary |

/ Slide 28 Q2 2011 outlook Order intake between € 900 million – €1 billion Net sales around € 1.5 billion Gross margin about 45% R&D at € 150 million SG&A at € 55 million ASML expects 2011 total revenue clearly above € 5 billion |

/ Slide 29 Cash return € 2.7B cash & cash equivalents at end Q1 2011 € 1 B / 24 month share buy back program in progress 25% of program executed until wk 21 7 million shares repurchased at an average price of € 29.42 Weekly updates available on ASML’s website Dividend for 2010 of € 0.40 per ordinary share (approx. € 175 million) vs. € 0.20 per share in 2009 Week |

|