Bank of America

36th Annual Investment Conference

San Francisco, CA – Sept 20, 2006

Craig DeYoung

VP Investor Relations

Safe Harbor

“Safe Harbor” Statement under the U.S. Private Securities

Litigation Reform Act of 1995: the matters discussed in this

presentation may include forward-looking statements that are

subject to risks and uncertainties including, but not limited to:

economic conditions, product demand and semiconductor

equipment industry capacity, worldwide demand and

manufacturing capacity utilization for semiconductors (the

principal product of our customer base), competitive products

and pricing, manufacturing efficiencies, new product

development, ability to enforce patents, the outcome of

intellectual property litigation, availability of raw materials and

critical manufacturing equipment, trade environment, and

other risks indicated in the risk factors included in ASML’s

Annual Report on Form 20-F and other filings with the U.S.

Securities and Exchange Commission.

/ Slide 2

ASML today

Market Update

Lithography leadership

Long term growth trajectory

/ Slide 3

Market Update

Most business drivers point to sustained ASML

revenues mid term

IC Semiconductor unit growth

Inventory, Utilization and Lithography purchasing intensity

Balanced segmentation of customers

Market Share opportunity

/ Slide 5

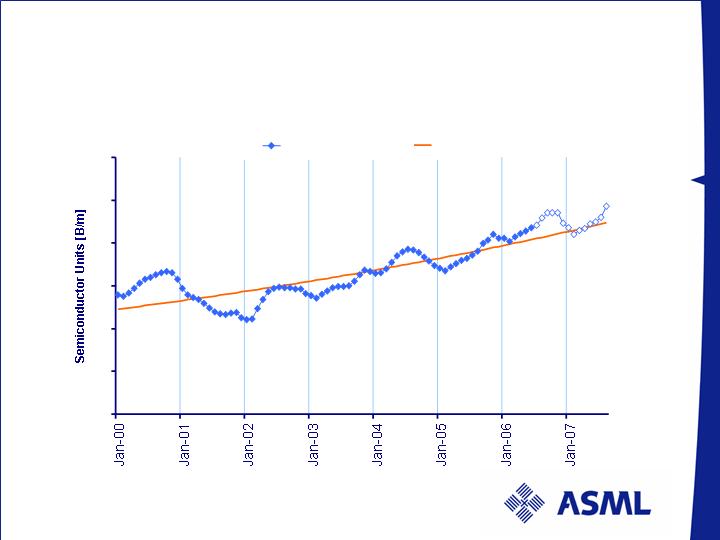

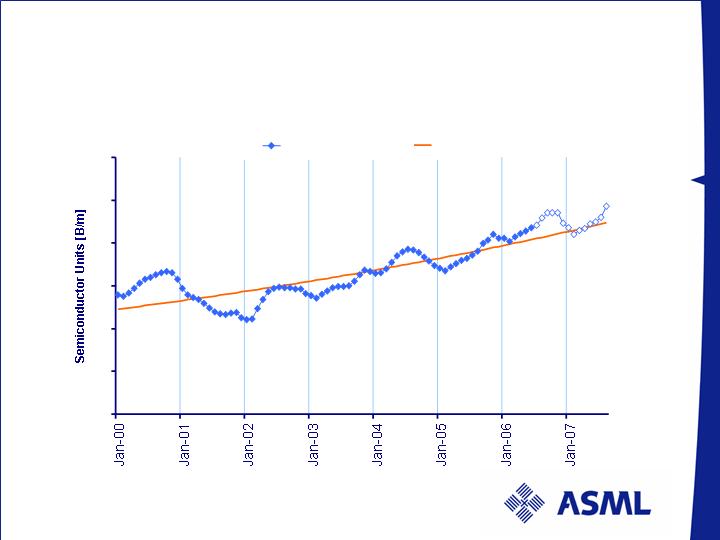

Semiconductor Units history and forecast

2006 Semiconductor growth driven by higher unit sales (+16%)

25% -21% 14% 9% 18% 4% 16% 7%

Source: ASML MCC

Semiconductor unit Forecats

0

10

20

30

40

50

60

Semiconductor Units

Unit Trend

/ Slide 6

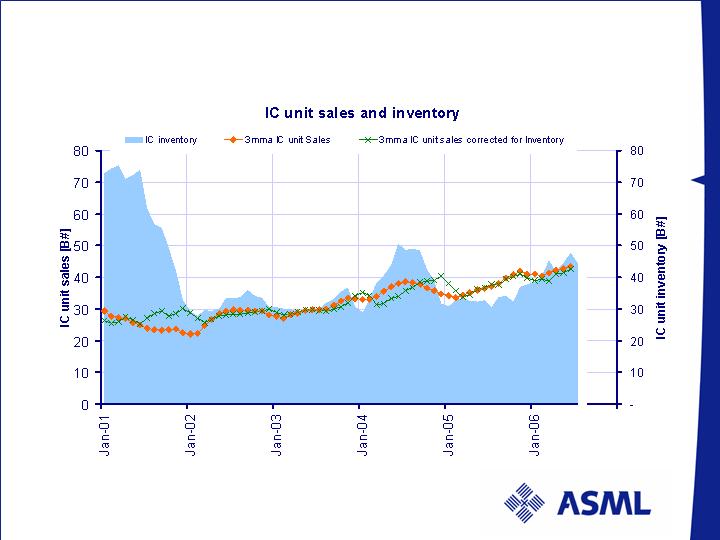

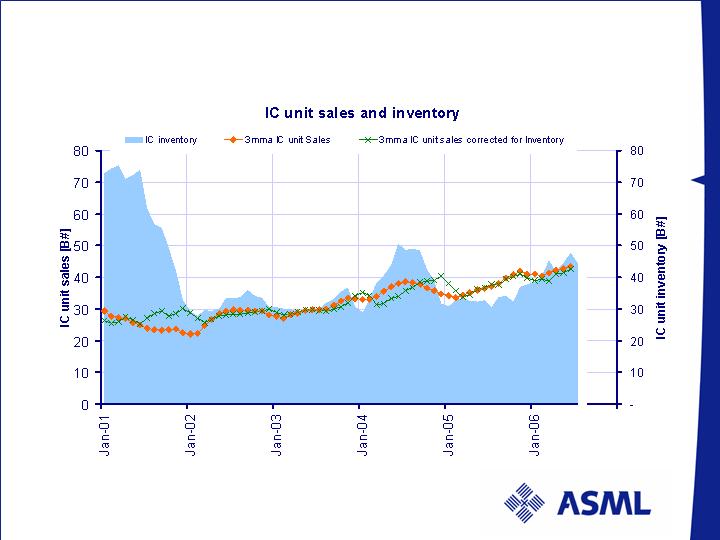

IC unit sales and inventory

Inventories reasonably under control

Source: WSTS, VLSIResearch, ASML

Last data point: June 2006

/ Slide 7

Utilization remains high and is under constant monitor

Sources: SiCAS (August 2006)

0

10

20

30

40

50

60

70

80

90

100

110

120

Quarter

Memory utilization

Foundry utilization

/ Slide 8

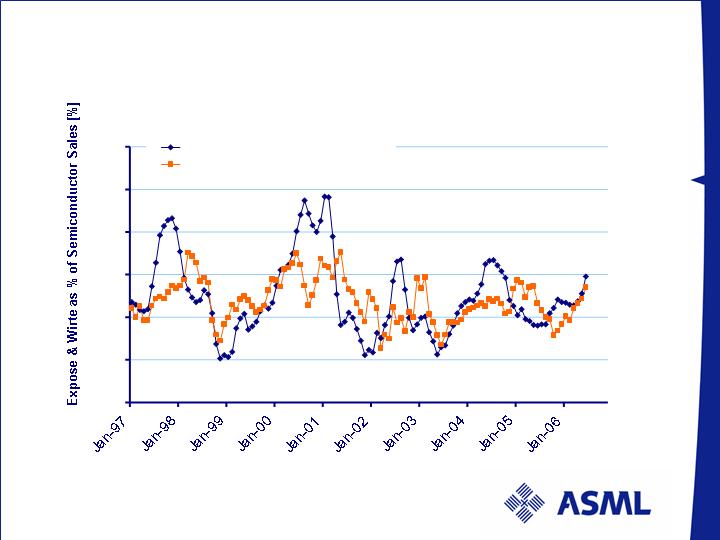

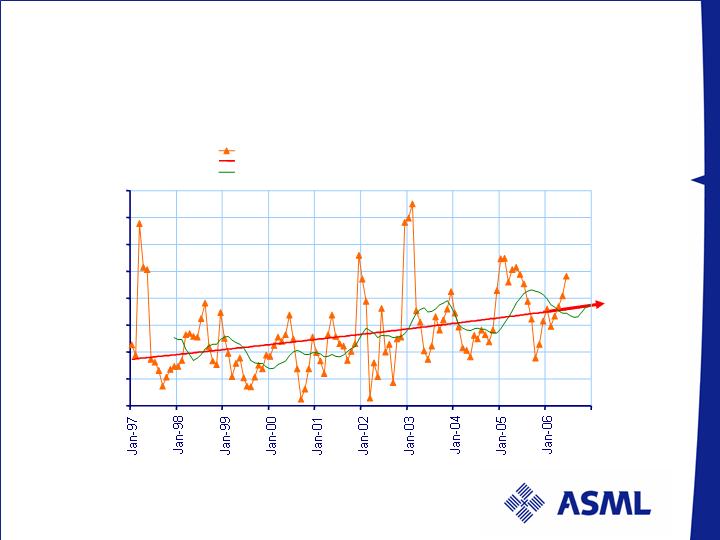

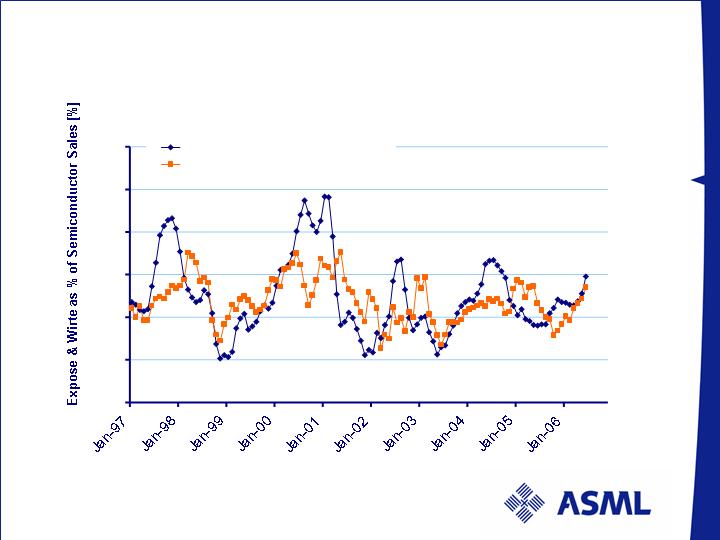

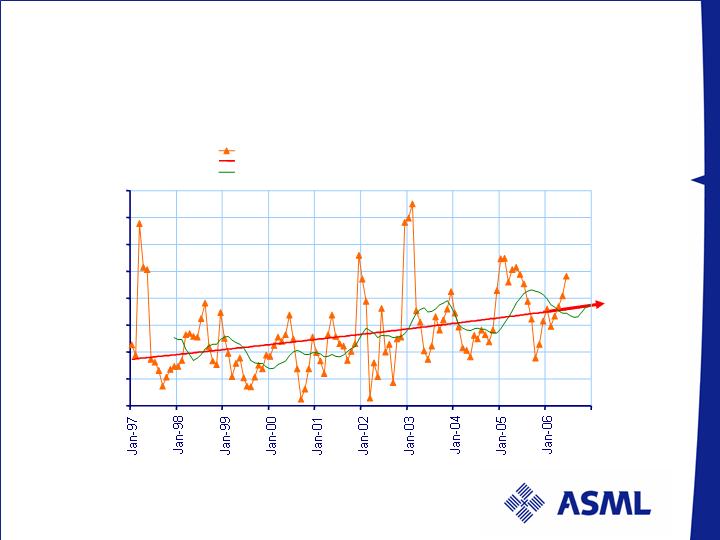

Litho Bookings and Billings as % of Semiconductor

Revenue Relative spending rising but within controlled range

Source: SEMI, WSTS, ASML

Last data point: June 2006

Expose & Write Bookings and Billings as % of Semiconductor

sales

0%

1%

2%

3%

4%

5%

6%

E&W bookings as % of Semi $Sadj 3MMA

E&W billings as % of Semi $ Sadj 3MMA

/ Slide 9

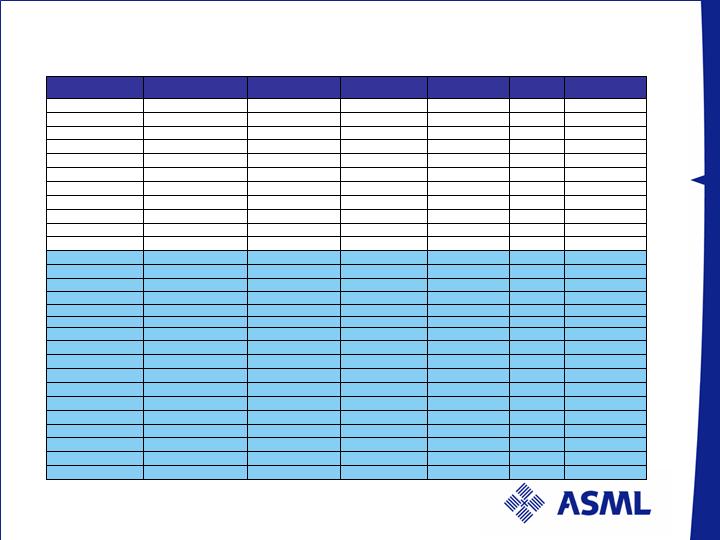

6

90/65

300

Memory/Flash

SP-1

SPANSION

Q1/2007

50

350-180

200

Logic

Fab 11

SMIC

Q1/2007

50

70/45

300

Memory/Flash

M11/R3

HYNIX

Q3/2006

25

45

300

Micro

Fab 32

INTEL

Q4/2006

52

70/55

300

Memory/Flash

Fab 2 (Lehi)

IM Flash

Q3/2006

25

90/65

300

Logic

Fab 2

HHSIS

Q3/2006

40

250/180

200

Logic

Kulim Fab

INFINEON

Q1/2006

40

65/32

300

Logic

RFab

TI

Q4/2007

30

55/45

300

Memory

SAS300

SAMSUNG

Q3/2007

20

65/32

300

Micro

Fab 38

AMD

Q3/2007

25

45

300

Micro

Fab 28

INTEL

Q3/2007

40

70

300

Memory/DRAM

Fab 4

PROMOS

Q3/2007

20

80/45

300

Memory/Flash

Fab 8

SMIC

Q1/2007

12

300

Memory others

Fab 4

MACRONIX

Q1/2007

30

70/45

300

Memory/Flash

Line 15

SAMSUNG

Q2/2006

60

90/65

300

Memory

HSSL300

HYNIX

Q2/2006

45

300

Logic

Fab 15

TSMC

Q3/2007

10

90

300

Memory others

Fukuyama Fab

SHARP

Q2/2007

175

5X/4X

300

Memory/Flash

Fab 4

TOSHIBA

Q4/2007

13

90/65

300

Logic

N3-1F

RENESAS

Q2/2006

30

55/45

300

Memory

Upgr. M11/MPS

SAMSUNG

Q3/2007

10

65

300

Logic

Fab 2

FUJITSU

Q2/2007

60

90/70

300

Memory/DRAM

Fab 12C

POWERCHIP

Q2/2007

60

70/60

300

Memory/DRAM

Fab 3

NANYA

Q2/2007

30

70/45

300

Logic

M6

STMicroelectronics

Q2/2007

50

350/250

200

Image sensors

Zilog Fab

MICRON

Q4/2006

62

90/70

300

Memory/DRAM

Fab 2

INOTERA

Q4/2006

45

110/90

200

Memory

HSSL200

HYNIX

Q1/2006

Max.Capacity

[KWSPM]

Node [nm]

Wafer size [mm]

Main application

Name of Factory

Customer

Quarter/Year

equipment take-in

28 factories planned for the 2006/07 time frame:

7 Flash fabs/9 other Memory fabs/12 Foundry IDM

Source: ASML MCC (update Aug 2006)

/ Slide 10

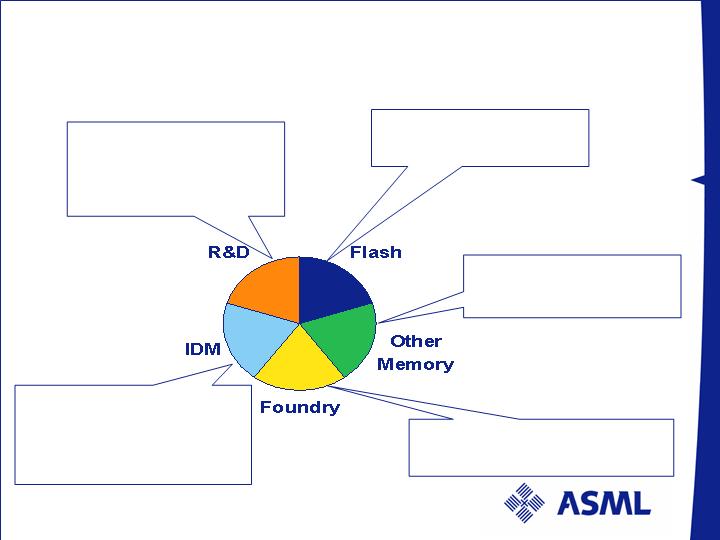

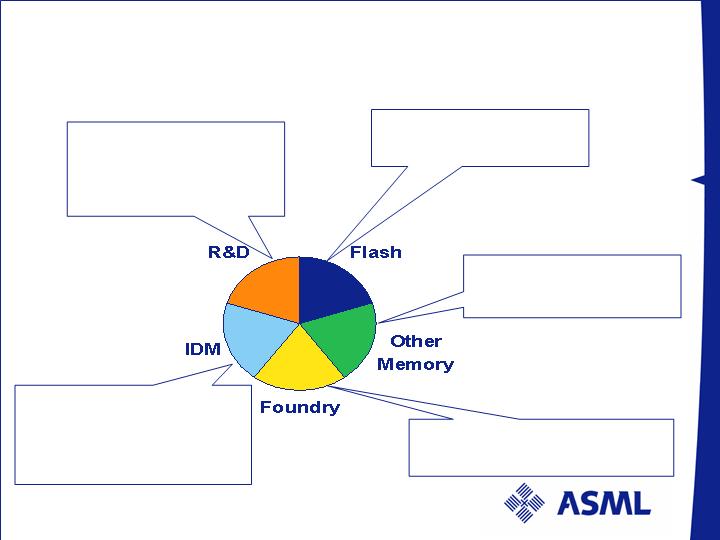

Growth from Multiple independent Segments

Each Segment with its own investment cycle

Flash shrink - 12 to 15

month investment cycle

DRAM – closely follows

Flash investment cycle

Foundries represent classic

supply/demand cycle

Moore’s law, 18 to 24

months - invest for new

product development -

volume to Foundry

Shrink for new

functionality and cost per

function - 12 to 24 month

investment cycle

/ Slide 11

Strong Drivers lead to ASML Guidance Upside (press

release 9/06/06)

Q3 ‘06 Bookings at about Q2 ‘06 order intake level -

In Q2 ASML booked 93 orders

Strong demand from memory makers

Bookings across ASML 300mm product line

Bookings support customer’s New Fab ramps

75% of new orders will be for shipments in 2007

ASML 2006 revenue growth year-on-year estimated

at approximately 40% over 2005

/ Slide 12

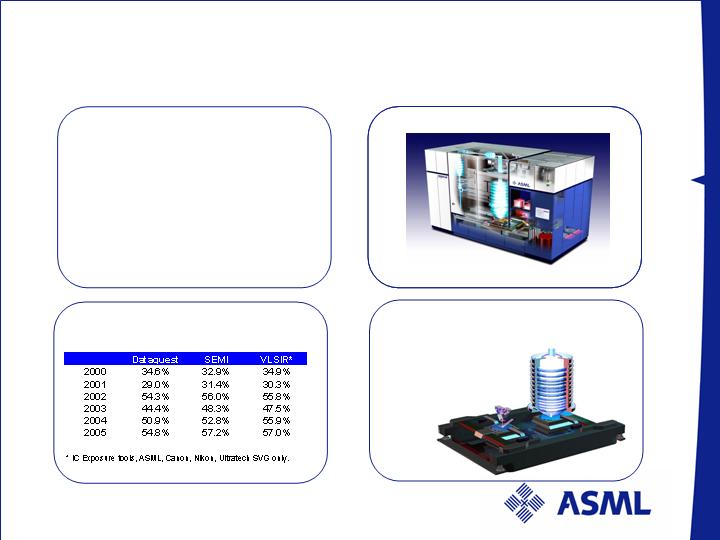

Lithography Leadership

ASML overview

The world’s leading supplier of Lithography equipment

Key facts:

Headquarters: Veldhoven,

the Netherlands

Revenue 2005 ~ €2.5 B

Market cap ~ €8.5 B

Employees 5200

Leaders in Innovation

ASML TWINSCAN

Growing market share (revs)

Dual Stage enables:

Superior T-Put

Superior Overlay

/ Slide 14

8” & i-line

6” & early i-line

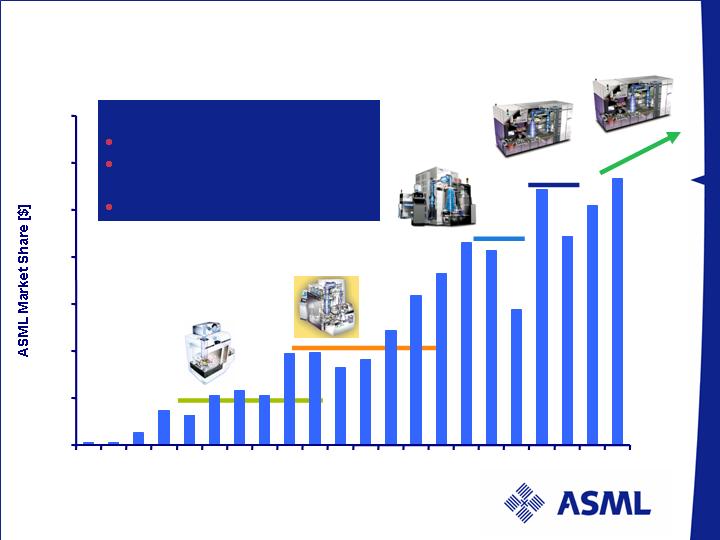

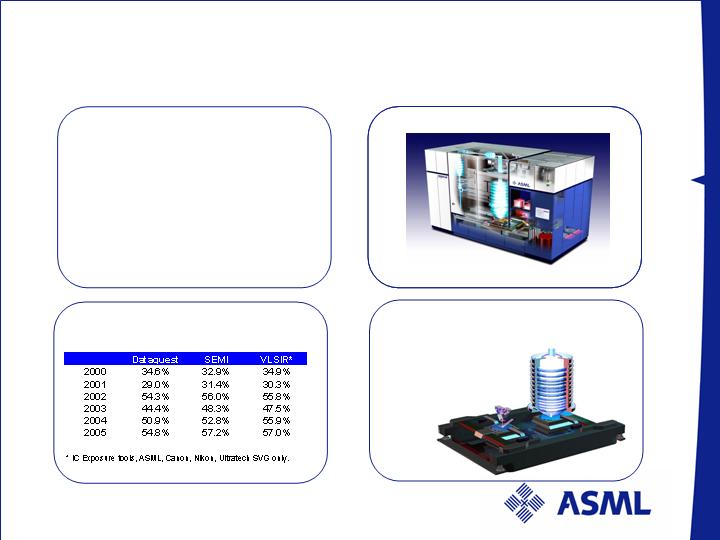

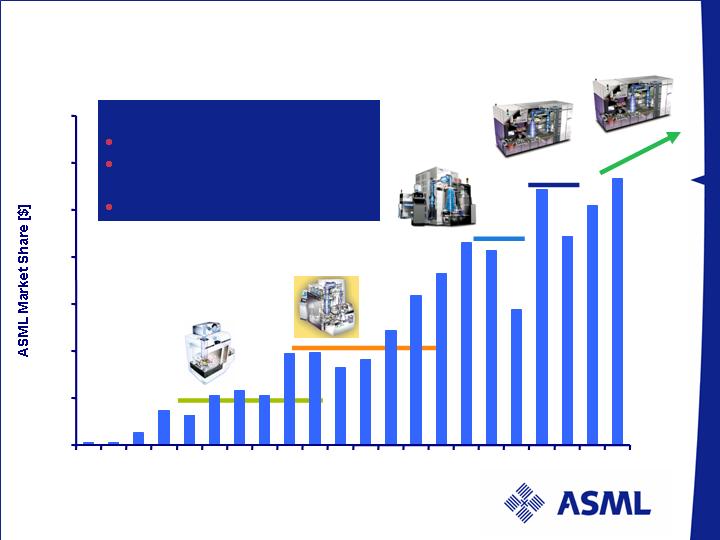

Leadership - Market share growth opportunity

Source: Gartner Dataquest, ASML

12” & ArF

KrF &

Step & Scan

Market share gains through:

Immersion lithography

Superior Value of Ownership

ArF, KrF and I-line

Japan

0%

10%

20%

30%

40%

50%

60%

70%

1984

1987

1990

1993

1996

1999

2002

2005

ArF immersion

/ Slide 15

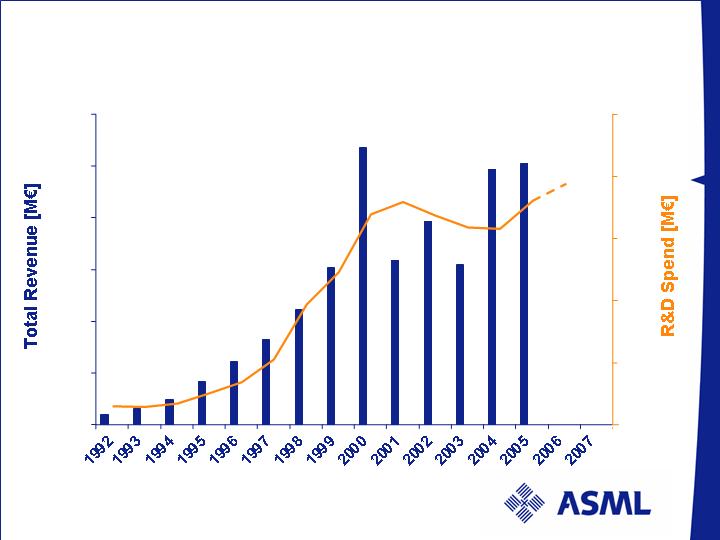

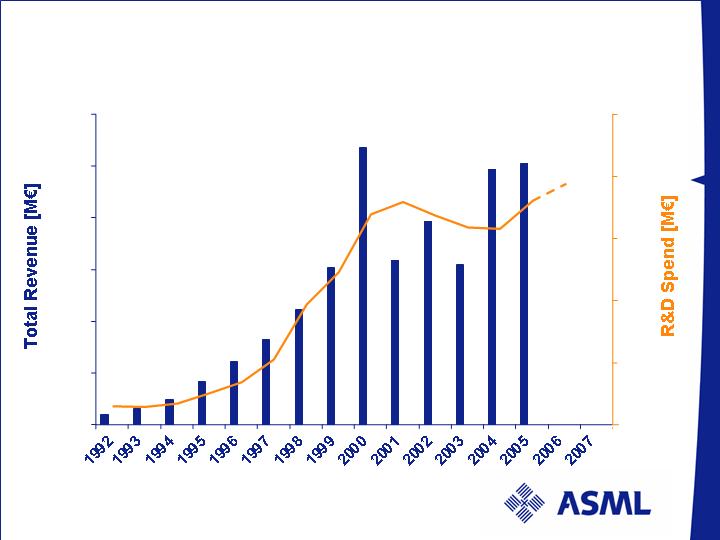

Maintaining Technology Leadership -

R&D spend versus total revenue

R&D costs exclude settlement with Nikon Corp.

in 2004 and reflect costs for continuing operations

0

500

1000

1500

2000

2500

3000

0

100

200

300

400

500

/ Slide 16

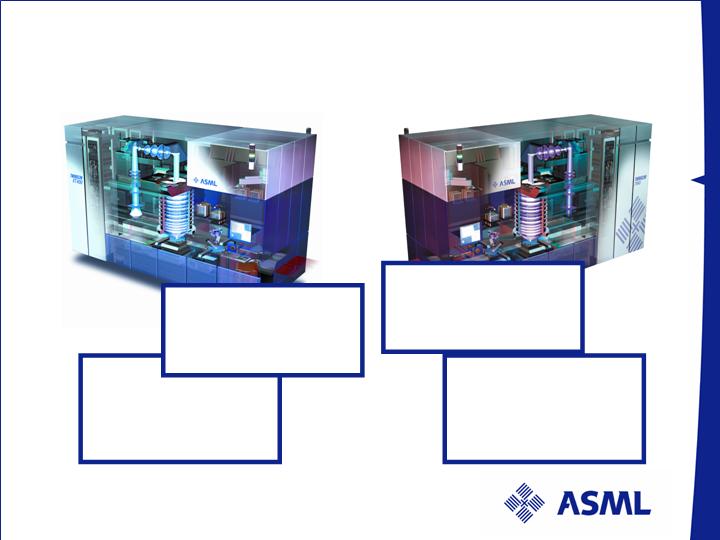

TWINSCAN XT:1700i Enabling 45nm production

ASML wet + dry ArF

market share

68%

Source: ASML – market shares are value based in 2005

/ Slide 17

TWINSCAN™ creating value in non and mid

critical applications

XT:400E

Resolution: 350nm

Throughput: 129wph

Lowest CoO in 300mm i-line

XT:760F

Resolution: 130nm

Throughput: 134wph

Superior CoO in 300mm KrF

ASML i-line

market share

29%

ASML KrF

market share

51%

Source: ASML – market shares are value based in 2005

/ Slide 18

Long-Term Trajectory

Lithography Equipment - a growing market with

three major value drivers

Accelerating roadmap

TWINSCAN 1900i

Double exposure

EUV: ADT and production tools

New architecture

Alternative shrink solutions require more litho

tools

Spacer

Tri-dimensional devices

Vertical gate

Stringent Overlay Performance -Yield

…leading to a larger % of available CAPEX

/ Slide 20

Source: SEMI

Last data point: June 2006

Expose & Write as % of Total Equipment

Litho share of equipment trend approaching 18% level !

Expose & Write Equipment Sales as % of Total Equipment Sales

10%

12%

14%

16%

18%

20%

22%

24%

26%

Expose & Write as % of Total Equipment

Expon. (Expose & Write as % of Total Equipment)

12 per. Mov. Avg. (Expose & Write as % of Total Equipment)

/ Slide 21

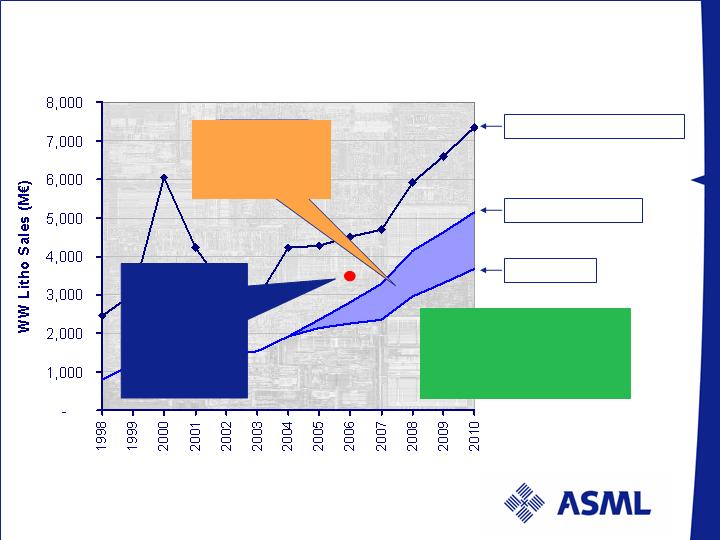

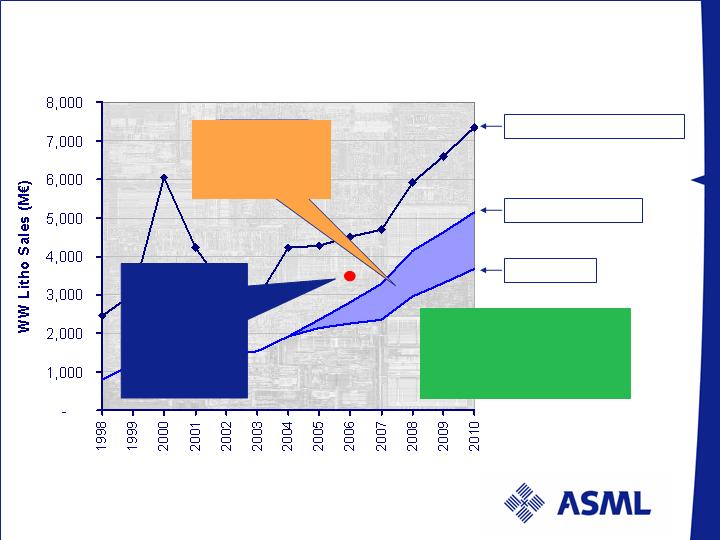

ASML’s growth potential

Source: Average of Dataquest,

VLSI Research and ASML fab based model Jan.2006 – NOT A FORECAST

Average WW litho sales

ASML’s potential

Status quo

Natural growth

potential towards

4-5 B€ range

ASML’s

opportunity

window

ASML

press

release

Revenue

2006 3.5 B€

Assumption: 9% IC unit growth/year

/ Slide 22

ASML is well positioned for value generation

Business Model based on Technology Leadership

enabled by accumulated experience and scale

Technology focus

Cost reduction

Lead time differentiation

Semiconductor cycle effect reduced by

Moderating cycles – as forecasted by analyst

community for 2006-2007

Market share gains

Variable cost structure allowing significant profitability

through the cycle

/ Slide 23

Commitment