In July 2003, based on the recommendation of the Compensation & HR Committee, the Board approved a voluntary stock option exchange program, whereby eligible officers and employees could exchange their outstanding options having exercise prices greater than $10.00 for new options under the 1995 and 1997 Long-Term Incentive and Share Award Plans for 33 1/3% of the number of shares subject to the exchanged options. This voluntary stock option exchange program was implemented to address the substantial loss in value of the outstanding stock options held by the Company’s employees and the increasing inability of those options to serve as a meaningful performance incentive for the Company’s employees.

From the commencement of the exchange offer on July 3, 2003 to its expiration on August 4, 2003, the Company accepted for exchange and cancellation options to purchase an aggregate of 1,673,931 shares of common stock having a weighted average exercise price of $19.49. On February 6, 2004, the Company issued options to purchase 551,564 shares of the Company’s common stock with an exercise price of $7.27 per share, which equaled the closing market value of the Company’s common stock price on the grant date.

SUBMITTED BY THE COMPENSATION & HR COMMITTEE OF THE BOARD OF DIRECTORS OF ANADIGICS, INC.

Non-management Directors had previously received options under the 1995 Plan which terminated on February 28, 2005. Contingent upon stockholder adoption of the 2005 Plan, which is intended to replace the 1995 Plan, a grant of options under the 1995 Plan to purchase 15,000 shares of Common Stock, at an exercise price per share equal to the fair market value on the date of grant, will automatically be granted on the date a non-management Director is first elected to the Board. Each option so granted will become exercisable in three equal installments commencing one year from the date of grant and annually thereafter, and will expire ten years from the date of grant. Non-management Directors also receive an annual grant of options to purchase 15,000 shares of Common Stock at the fair market value on the date of grant and vesting at the end of one year. In addition, each non-management Director receives up to $20,000 per year for Board services, $1,000 for each Committee meeting attended (with a cap of $2,500 per day), and reimbursement for ordinary expenses incurred in connection with attendance at such meetings. Each committee chairperson also receives a $500 fee per meeting with the exception of the chairperson of the ad hoc Strategic Planning Committee who receives $25,000 per year.

If the Company terminates Dr. Bastani without cause or Dr. Bastani terminates his employment for good reason or for any reason following a change in control, he shall be entitled to (A) an amount equal to 200% of his then annual base salary, (B) health benefits for a maximum of twenty-four months, and (C) immediate vesting of all stock options.In exchange for these benefits, Dr. Bastani agreed (x) not to solicit employees to leave the Company for twenty-four months after termination of his employment and (y) not to solicit customers or interfere with Company suppliers for twelve months following termination of his employment.

If the Company terminates Mr. Rosenzweig without cause, he shall be entitled to (A) an amount equal to the sum of his then annual base salary plus his bonus, if any, earned during the immediately preceding calendar year, (B) health benefits for a maximum of twenty-four months, and (C) immediate vesting of all non-qualified stock options.

In exchange for these benefits, the employees agreed (X) after termination of employment, not to hire or solicit for hire the employees of the Company for 12 months, and (Y) to keep confidential information about the Company.

The objectives of the Company’s compensation program are to enhance the Company’s ability to recruit and retain qualified management, motivate executives and other employees to achieve established performance goals and ensure an element of congruity between the financial interests of the Company’s management and its stockholders.

In fiscal year 2004, the Compensation & HR Committee considered the following factors in setting the compensation of the Company’s executive officers:

The Compensation & HR Committee believes that competition for qualified executives in the broadband and wireless integrated circuit industries is extremely strong and that to attract and retain such persons, the Company must maintain an overall compensation package that is competitive with those offered by its peer companies.

Compensation arrangements under the Company’s current compensation program may include up to four components: (a) a base salary, (b) a discretionary cash bonus program, (c) the grant of equity incentives in the form of stock options and/or restricted stock awards and (d) other compensation and employee benefits generally available to all employees of the Company, such as health insurance and participation in the Company’s 401(k) plan. The Chief Executive Officer’s salary, bonus and equity incentive awards are established by the Compensation & HR Committee, subject to Dr. Bastani’s Employment Agreement. Recommendations regarding the base salary, bonuses and stock option or other equity awards of the Company’s executive officers, other than Dr. Bastani, are made to the Compensation & HR Committee by Dr. Bastani but are subject to Compensation & HR Committee review, modification and approval.

To assist it in overseeing compensation practices, the Compensation & HR Committee periodically requests Company Human Resource Department personnel to gather compensation data for Compensation & HR Committee review. The Company also is a member of certain human resources-focused industry groups that accumulate detailed data regarding position descriptions, responsibilities and compensation for all levels of employees within the semiconductor industry. This information is one of the factors applied in setting the overall base salary, bonus and other performance-based compensation levels for all Company executive officers.

Subject to existing employment agreements, individual salaries for executive officers are annually reviewed and established by the Compensation & HR Committee. In determining individual salaries, the Compensation & HR Committee considers the scope of job responsibilities, individual contributions, labor market conditions, peer data and the Company’s overall annual budget guidelines for merit and performance increases. The Company’s objective is to deliver base compensation levels for each executive officer at the median for the comparable position of the Company’s peer group. For fiscal year 2004, the Compensation & HR Committee believes that base salaries for the Company’s named Executive Officers were, as an average for the group, slightly below the median base salaries of the peer group comparable positions.

A large part of each executive officer’s potential total cash compensation is intended to be variable and dependent upon semi-annual Company performance. Annual bonus awards are determined directly from two objective performance-based measures: (a) revenues and (b) the level of operating profit (EBITDA). During fiscal year 2004, each executive officer was eligible for a cash bonus computed using a formula based on these two objective performance-based measures and the individual’s pay tier. Adjustments may be made to operating profit to eliminate the effects of generally non-recurring, one-time events that may include but are not limited to the sale of investments in securities of other companies, acquisition-related expenses and sale or disposal of assets no longer in service. The same criteria are used for executive officers as for all other employees.

The Compensation & HR Committee believes that substantial equity ownership encourages management to take actions favorable to the long-term interests of the Company and its shareholders. Accordingly, equity-based compensation makes up a significant portion of the overall compensation of executive officers. The Company grants unvested equity-based awards to most of its newly hired, full-time employees, and many employees are periodically eligible thereafter for additional awards based on management’s evaluation of their performance.

The Compensation & HR Committee may grant, and has done so in the past, additional short-term or long-term cash or equity awards to recognize increased responsibilities or special contributions to the Company, attract new employees to the Company or retain key employees.

The Compensation & HR Committee establishes the compensation of Dr. Bastani, the Chief Executive Officer of the Company, using the same criteria applicable to other executive officers of the Company subject to Dr. Bastani’s employment agreement. In addition, in setting Dr. Bastani’s compensation for fiscal year 2004, the Compensation & HR Committee focused on Dr. Bastani’s ability to communicate effectively with the Board and the Company’s key customers and suppliers, as well as his leadership effectiveness with the other members of the executive management team. During fiscal year 2004, Dr. Bastani earned a base salary of $445,536 and a cash bonus of $116,000. Dr. Bastani was awarded stock options and restricted stock awards as detailed under the headings “Summary Compensation Table” and “Option Grants in Last Fiscal Year,”. The Compensation & HR Committee believes, based on its review of publicly available information concerning the Company’s public competitors, as well as the use of the extensive data available from the compensation surveys described above, that Dr. Bastani’s compensation is well within the range of compensation provided to executives of similar rank and responsibility in the Company’s industry.

In general, compensation in excess of $1,000,000 paid to any of the named Executive Officers may be subject to limitations on deductibility by the Company under Section 162(m) of the Internal Revenue Code of 1986, as amended. The limits on deduction do not apply to performance-based compensation that satisfies certain requirements. The Company designs its compensation programs to preserve the tax deductibility of compensation paid to its executive officers to the extent possible, consistent with the need to attract and retain high-caliber executive officers.

SUBMITTED BY THE COMPENSATION & HR COMMITTEE OF THE BOARD OF DIRECTORS OF ANADIGICS, INC.

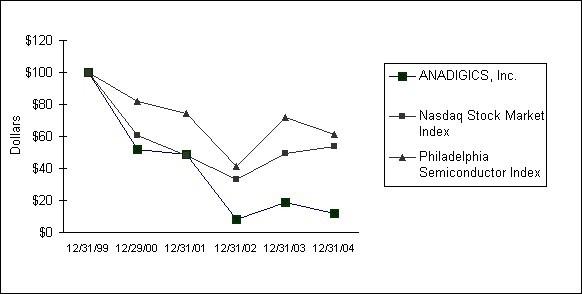

The following graph compares the cumulative total shareholder return on the Company's Common Stock from December 31, 1999 through December 31, 2004 with the cumulative total return on the NASDAQ Stock Market Index and the Philadelphia Semiconductor Index, considered to be an index of the Company’s peer group, during the same period. The comparison assumes $100 was invested on December 31, 1999 in the Company's Common Stock and in each of the foregoing indices and assumes reinvestment of dividends. The Company did not declare, nor did it pay any cash dividends during the comparison period. Notwithstanding any statement to the contrary in any of the Company's previous or future filings with the Securities and Exchange Commission, the graph shall not be incorporated by reference into any such filings.

The Board of Directors of the Company has amended and restated the ANADIGICS, Inc. Employee StockPurchase Plan (the "Stock Purchase Plan"), subject to stockholder approval, to increase the number of shares of Common Stock available for issuance thereunder by 1,000,000 to 2,693,750 in total and extend the plan through December 31, 2014. The following summary of the Stock Purchase Plan is qualified in its entirety by express reference to the text of the Stock Purchase Plan, which is attached as Appendix B hereto.

The purpose of the Stock Purchase Plan is to give employees of the Company and its subsidiaries an opportunityto purchase Common Stock through payroll deductions, thereby encouraging employees to share in the economicgrowth and success of the Company and its subsidiaries. The Stock Purchase Plan is administered by the Compensation & HR Committee.

In general, any person who has been an employee for at least one month on a given enrollment date (generally each January 1) who is scheduled to work at least 20 hours per week on a regular basis is eligible to participate in the Stock Purchase Plan. Common Stock will be purchased for each participant in the Stock Purchase Plan as of the last day of each Offering Period (generally December 31) with the money deducted from their paychecks during the Offering Period. The purchase price per share of Common Stock will be either (i) an amount equal to 85% of the fair market value of a share of Common Stock on the first day of the Offering Period or on the last day of the Offering Period, whichever is lower, or (ii) such higher price as may be set by the Compensation & HR Committee at the beginning of the Offering Period.

A participant may elect to have payroll deductions made under the Stock Purchase Plan for the purchase ofCommon Stock in an amount not to exceed the lesser of 15% of the participant's compensation or $25,000 the (limit imposed by Section 423 (b) (8) of the Internal Revenue Code of 1986, as amended). Compensation for purposes of the Stock Purchase Plan means the gross amount of the participant's base pay on the basis of the participant's regular, straight-time hourly, weekly or monthly rate for the number of hours normally worked, exclusive of overtime, bonuses, shift premiums or other compensation. Contributions to the Stock Purchase Plan will be on an after-tax basis. A participant may terminate his or her payroll deductions at any time.

A stock purchase bookkeeping account will be established for each participant in the Stock Purchase Plan. Amounts deducted from participants' paychecks will be credited to their bookkeeping accounts. No interest willaccrue with respect to any amounts credited to the bookkeeping accounts. As of the last day of each Offering Period,the amount credited to a participant's stock purchase account will be used to purchase the largest number of wholeshares of Common Stock possible at the price as determined above. The Common Stock will be purchased directlyfrom the Company. No brokerage or other fees will be charged to participants. Any balance remaining in theparticipant's account will be returned to the participant.

A participant may withdraw from participation in the Stock Purchase Plan at any time during an Offering Period by written notice to the Company. Upon withdrawal, a participant's bookkeeping account balance will be distributed as soon as practicable and no shares of Common Stock will be purchased. Rights to purchase shares of Common Stock under the Stock Purchase Plan are exercisable only by the participant and are not transferable, except by the laws of descent and distribution.

The Board of Directors of the Company may amend, suspend, or terminate the Stock Purchase Plan at any time,except that certain amendments may be made only with the approval of the shareholders of the Company. Subject to earlier termination by the Board of Directors, the Stock Purchase Plan will terminate on December 31, 2014. Unless otherwise determined by the Compensation & HR Committee, any unexpired Offering Period that commenced prior to any termination date of the Stock Purchase Plan shall continue until the last day of such Offering Period.

Federal Income Tax Consequences

The following is a summary of certain of the federal income tax consequences to participants in the StockPurchase Plan and to the Company, based upon current provisions of the Internal Revenue Code of 1986, asamended (the "Code") and the regulations and rulings thereunder, and does not address the consequences under stateor local or any other applicable tax laws.

Participants in the Stock Purchase Plan will not recognize income at the time a purchase right is granted to themat the beginning of an Offering Period or when they purchase Common Stock at the end of the Offering Period. However, participants will be taxed on amounts withheld from their salary under the Stock Purchase Plan as ifactually received, and the Company will generally be entitled to a corresponding income tax deduction.

If a participant disposes of the Common Stock purchased pursuant to the Stock Purchase Plan after one yearfrom the end of the applicable Offering Period and two years from the beginning of the applicable Offering Period,the participant must include in gross income as compensation (as ordinary income and not as capital gain) for thetaxable year of disposition an amount equal to the lesser of (a) the excess of the fair market value of the CommonStock at the beginning of the applicable Offering Period over the purchase price computed on the first day of theOffering Period or (b) the excess of the fair market value of the Ordinary Shares at the time of disposition over theirpurchase price. Thus, if the one and two year holding periods described above are met, a participant's ordinarycompensation income will be limited to the discount available to the participant on the first day of the applicableOffering Period. If the amount recognized upon such a disposition by way of sale or exchange of the Common Stockexceeds the purchase price plus the amount, if any, included in income as ordinary compensation income, suchexcess will be long-term capital gain. If the one and two year holding periods described above are met, the Company

will not be entitled to any income tax deduction.

If a participant disposes of Common Stock within one year from the end of the applicable Offering Period or two years from the beginning of the Offering Period, the participant will recognize ordinary income at the time of disposition which will equal the excess of the fair market value of the Common Stock on the date the participant purchased the Common Stock (i.e., the end of the applicable Offering Period) over the amount paid for the Common Stock. The Company will generally be entitled to a corresponding income tax deduction. The excess, if any, of the amount recognized on disposition of such Common Stock over their fair market value on the date of purchase (i.e., the end of the applicable Offering Period) will be short-term capital gain, unless the participant's holding period for the Common Stock (which will begin at the time of the participant's purchase at the end of the Offering Period) is more than one year. If the participant disposes of the Common Stock for less than the purchase price for the shares, the difference between the amount recognized and such purchase price will be a long- or short-term capital loss, depending upon the participant's holding period for the Common Stock.

New Plan Benefits

Participation in the Stock Purchase Plan is voluntary. Accordingly, at this time the Company cannot determine the amount of shares of Common Stock that will be acquired by participants or the dollar value of any such participation.

Other

The amendment and restatement of the Company's Employee Stock Purchase Plan requires the affirmative vote of a majority of the shares of the Company's Common Stock present in person or by proxy and entitled to vote at the Annual Meeting.

The Board of Directors unanimously recommends a vote "FOR" the proposal to adopt the amendment and restatement of the Employee Stock Purchase Plan.

PROPOSAL III: 2005LONG TERM INCENTIVE AND SHARE AWARD PLAN

On April 6, 2005, the Board of Directors approved the 2005 Long-Term Incentive and Share Award Plan (the “2005 Plan”), subject to stockholder approval. The 2005 Plan is intended to replace the Company’s 1995 Plan which terminated on February 28, 2005.In the absence of approval of the 2005 Plan, the Company will not be able to grant stock-based incentive compensation to its officers or directors, and the Company believes that such stock-based incentive compensation is important in order for it to attract and retain high caliber officers and directors.

The 2005 Plan is substantially similar to the 1995 Plan, with changes required to conform the plan to current legal standards and best practices. For example, the 2005 Plan includes an express prohibition on repricing of stock options without prior stockholder approval, and discount options are not allowed. Unlike the 1995 Plan, the 2005 Plan does not include formula stock option grants for non-employee directors.

The following describes the material terms of the 2005 Plan. This description does not purport to be complete and is qualified in its entirety by reference to the full text of the 2005 Plan, which is attached hereto as Appendix C.

Purpose

The 2005 Plan is intended to advance the interests of the Company and its stockholders providing a means to attract, retain and motivate employees, consultants, and directors of the Company, its subsidiaries and affiliates, to provide for competitive compensation opportunities, to encourage long term service,to recognize individual contributions and reward achievement of performance goals, and to promote the creation of long term value for stockholders by aligning the interests of such persons with those of stockholders.

Administration

The 2005 Plan will be administered by the Compensation and HR Committee (the “Committee”) of the Board of Directors or such other Board committee (which may include the entire Board) as may be designated by the Board. However, unless otherwise determined by the Board, the Committee shall consist of two or more directors of the Company, each of whom is a “non-employee director” within the meaning of Rule 16b-3 under the Exchange Act, to the extent applicable, and each of whom is an “outside director” within the meaning of Section 162(m) of the Internal Revenue Code, to the extent applicable.

The Committee shall have full and final authority to take the following actions, in each case subject to and consistent with the provisions of the Plan, including, without limitation: (i) select eligible persons to whom awards may be granted; (ii) designate affiliates; (iii) determine the type or types of awards to be granted to each eligible person; (iv) determine the type and number of awards to be granted, the number of shares to which an award may relate, the terms and conditions of any award granted under the 2005 Plan; and (v) make all other decisions and determinations as may be required under the terms of the 2005 Plan or as the Committee may deem necessary or advisable for the administration of the 2005 Plan. The Committee may delegate to other members of the Board or officers or managers of the Company or any subsidiary or affiliate the authority, subject to such terms as the Committee shall determine, to perform administrative functions and, with respect to awards granted to persons not subject to Section 16 of the Exchange Act, to perform such other functions as the Committee may determine, to the extent permitted under Rule 16b-3 (if applicable) and applicable law.

Shares Available

Under the 2005 Plan, the number of shares that may be made subject to awards under the 2005 Plan may not exceed 2,700,000 shares, provided that the total amount of shares that may be issued for awards of stock or stock units, including awards of restricted stock and restricted stock units and awards of stock appreciation rights may not exceed an aggregate of 2,400,000 shares.In addition, during a calendar year (i) the maximum number of shares with respect to which options and SARs may be granted to a participant under the 2005 Plan will be 500,000 shares, and (ii) the maximum number of shares which may be granted to a participant under the 2005 Plan with respect to Awards intended to qualify as performance-based compensation under the Internal Revenue Code of 1986, as amended (the “Code”) (other than options and SARs) will be 500,000 shares. These share amounts are subject to anti-dilution adjustments in the event of certain changes in the Company’s capital structure, as provided in the 2005 Plan.Shares to be delivered under the 2005 Plan may be either authorized, but unissued, shares of Common Stock or treasury shares.

Effective upon stockholder approval of the 2005 Plan, no further awards will be made under the 1997 Plan except to the extent that awards previously granted under such Plan are forfeited, cancelled, or terminated and become available for grant under such plan. Shares covered by the unexercised or undistributed portion of any terminated, expired or forfeited award made under the 2005 Plan will be available for further awards under the 2005 Plan. No awards may be made under the 2005 Plan after the tenth anniversary of the date that it is approved by the Board.

Awards

Awards may be granted to employees, consultants, and directors of the Company, its subsidiaries and affiliates on the terms and conditions set forth in the 2005 Plan. The following types of awards may be granted under the 2005 Plan:

Stock Options. Stock options may be non-qualified stock options or incentive stock options that comply with Section 422 of the Internal Revenue Code. Only employees of the Company or a subsidiary may be granted incentive stock options. The exercise price for any stock option will be determined by the Committee at the time of grant, but exercise price per share shall not be less than the fair market value of a share on the date of grant of the option. The 2005 Plan limits the term of any stock option to ten years from the date of grant of the option. The Committee shall determine at the date of grant or thereafter the time or times at which an stock option may be exercised in whole or in part.

Stock Appreciation Rights (“SARs”). The Committee may grant SARs to eligible persons independently of any stock option or in tandem with all or any part of a stock option granted under the 2005 Plan. Upon exercise, each SAR entitles a participant to receive an amount equal to the excess of (i) the fair market value of one share of Common Stock on the date of exercise over (ii) the exercise price per share of Common Stock of the SAR as determined by the Committee on the date the SAR is granted. The exercise price of a SAR will not be less than the fair market value of a share on the date of grant. The SARs may be settled in common stock or cash as determined by the Committee.

Restricted Shares. The Committee may grant restricted shares to eligible persons that may not be sold or otherwise disposed of, and are subject to forfeiture, during a restricted period as determined by the Committee except as otherwise provided by the Committee. During the applicable restricted period, restricted stock may be voted by the recipient and the recipient will be entitled to receive dividends thereon.

Restricted Share Units. The Committee may grant restricted share units to eligible persons. Such restricted share units may be subject to restrictions as determined by the Committee at the date of grant. An award of a restricted share unit is an award of the right to receive a share of Common Stock after expiration of the restricted period determined by the Committee. The recipient of a restricted share unit shall be entitled to receive dividend equivalents thereon, as determined by the Committee.

Performance Shares and Performance Units. Performance Shares and Performance Units are awards of a fixed or variable number of shares or of dollar-denominated units that are earned by achievement of performance goals in the performance period established by the Committee. If the applicable performance criteria are met, the shares are earned and become unrestricted with respect to Performance Shares or an amount is payable with respect to Performance Units. Amounts earned under Performance Shares or Performance Units originally awarded may be paid in shares of Common Stock, cash or a combination of both.

Dividend Equivalents. The Committee is authorized to grant Dividend Equivalents to eligible persons. The Committee may provide, at the date of grant or thereafter, that Dividend Equivalents shall be paid or distributed when accrued or shall be deemed to have been reinvested in additional shares, or other investment vehicles as the Committee may specify.

Other Share-Based Awards. The Committee may grant other types of awards which may be based in whole or in part by reference to shares of Common Stock or upon the achievement of performance goals on such other terms and conditions as the Committee may prescribe.

Performance Awards

If the Committee determines that an Award of restricted shares, restricted share units, performance shares, performance units or other share-based awards should qualify under the performance-based compensation exception to the $1,000,000 cap on deductibility under Section 162(m) of the Code, the grant, vesting, exercise and/or settlement of such awards shall be contingent upon achievement of pre-established performance goals based on one or more of the following business criteria for the Company and/or for specified subsidiaries or affiliates or other business units or lines of business of the Company: (1) earnings per share (basic or fully diluted); (2) revenues; (3) earnings, before or after taxes, from operations (generally or specified operations), or before or after interest expense, depreciation, amortization, incentives, or extraordinary or special items; (4) cash flow, free cash flow, cash flow return on investment (discounted or otherwise), net cash provided by operations, or cash flow in excess of cost of capital; (5) return on net assets, return on assets, return on investment, return on capital, or return on equity; (6) economic value added; (7) operating margin or operating expense; (8) net income; (9) share price or total stockholder return; and (10) strategic business criteria, consisting of one or more objectives based on meeting specified market penetration, geographic business expansion goals, cost targets, customer satisfaction, supervision of litigation and information technology, and goals relating to acquisitions or divestitures of subsidiaries, affiliates or joint ventures. The targeted level or levels of performance with respect to such business criteria may be established at such levels and in such terms as the Committee may determine, in its discretion, including in absolute terms, as a goal relative to performance in prior periods, or as a goal compared to the performance of one or more comparable companies or an index covering multiple companies. The maximum amount payable upon settlement of cash-settled performance units or other cash-settled awards granted under the Plan for any calendar year to any participant that is intended to satisfy the requirements of performance-based compensation under Section 162(m) of the Code shall not exceed $1,000,000.

Nontransferability

Unless otherwise set forth by the Committee in an award agreement, awards shall not be transferable by an eligible person except by will or the laws of descent and distribution (except pursuant to a beneficiary designation) and shall be exercisable during the lifetime of an eligible person only by such eligible person or his guardian or legal representative.

Amendment

The Board may amend, alter, suspend, discontinue, or terminate the 2005 Plan or the Committee’s authority to grant awards under the 2005 Plan without the consent of shareholders of the Company or participants, except that any such amendment or alteration shall be subject to the approval of the Company’s stockholders (i) to the extent such stockholder approval is required under the rules of any stock exchange or automated quotation system on which the shares may then be listed or quoted, or (ii) as it applies to incentive stock awards, to the extent such shareholder approval is required under Section 422 of the Internal Revenue Code;provided,however, that, without the consent of an affected participant, no amendment, alteration, suspension, discontinuation, or termination of the 2005 Plan may materially and adversely affect the rights of such participant under any award theretofore granted to him or her. The Committee may waive any conditions or rights under, amend any terms of, or amend, alter, suspend, discontinue or terminate, any award theretofore granted, prospectively or retrospectively;provided,however, that, without the consent of a participant, no amendment, alteration, suspension, discontinuation or termination of any award may materially and adversely affect the rights of such participant under any award theretofore granted to him or her.

Federal Income Tax Consequences

Federal Income Tax Consequences. The following is a summary of the federal income tax consequences of the 2005 Plan, based upon current provisions of the Code, the Treasury regulations promulgated thereunder and administrative and judicial interpretations thereof, and does not address the consequences under any state, local or foreign tax laws.

Stock Options

In general, the grant of an option will not be a taxable event to the recipient and it will not result in a deduction to the Company. The tax consequences associated with the exercise of an option and the subsequent disposition of shares of Common Stock acquired on the exercise of such option depend on whether the option is a nonqualified stock option or an incentive stock option.

Upon the exercise of a nonqualified stock option, the participant will recognize ordinary taxable income equal to the excess of the fair market value of the shares of Common Stock received upon exercise over the exercise price. The Company will generally be able to claim a deduction in an equivalent amount. Any gain or loss upon a subsequent sale or exchange of the shares of Common Stock will be capital gain or loss, long-term or short-term, depending on the holding period for the shares of Common Stock.

Generally, a participant will not recognize ordinary taxable income at the time of exercise of an incentive stock option and no deduction will be available to the Company, provided the option is exercised while the participant is an employee or within three months following termination of employment (longer, in the case of disability or death). If an incentive stock option granted under the 2005 Plan is exercised after these periods, the exercise will be treated for federal income tax purposes as the exercise of a nonqualified stock option. Also, an incentive stock option granted under the 2005 Plan will be treated as a nonqualified stock option to the extent it (together with other incentive stock options granted to the participant by the Company) first becomes exercisable in any calendar year for shares of Common Stock having a fair market value, determined as of the date of grant, in excess of $100,000.

If shares of Common Stock acquired upon exercise of an incentive stock option are sold or exchanged more than one year after the date of exercise and more than two years after the date of grant of the option, any gain or loss will be long-term capital gain or loss. If shares of Common Stock acquired upon exercise of an incentive stock option are disposed of prior to the expiration of these one-year or two-year holding periods (a “Disqualifying Disposition”), the participant will recognize ordinary income at the time of disposition, and the Company will generally be entitled to a deduction, in an amount equal to the excess of the fair market value of the shares of Common Stock at the date of exercise over the exercise price. Any additional gain will be treated as capital gain, long-term or short-term, depending on how long the shares of Common Stock have been held. Where shares of Common Stock are sold or exchanged in a Disqualifying Disposition (other than certain related party transactions) for an amount less than their fair market value at the date of exercise, any ordinary income recognized in connection with the Disqualifying Disposition will be limited to the amount of gain, if any, recognized in the sale or exchange, and any loss will be a long-term or short-term capital loss, depending on how long the shares of Common Stock have been held.

If an option is exercised through the use of shares of Common Stock previously owned by the participant, such exercise generally will not be considered a taxable disposition of the previously owned shares and, thus, no gain or loss will be recognized with respect to such previously owned shares upon such exercise. The amount of any built-in gain on the previously owned shares generally will not be recognized until the new shares acquired on the option exercise are disposed of in a sale or other taxable transaction.

Although the exercise of an incentive stock option as described above would not produce ordinary taxable income to the participant, it would result in an increase in the participant’s alternative minimum taxable income and may result in an alternative minimum tax liability.

Restricted Shares

A participant who receives restricted shares will generally recognize ordinary income at the time that they “vest”,i.e., when they are not subject to a substantial risk of forfeiture. The amount of ordinary income so recognized will generally be the fair market value of the Common Stock at the time the shares vest, less the amount, if any, paid for the shares. This amount is generally deductible for federal income tax purposes by the Company. Dividends paid with respect to Common Stock that is non-vested will be ordinary compensation income to the participant (and generally deductible by the Company). Any gain or loss upon a subsequent sale or exchange of the shares of Common Stock, measured by the difference between the sale price and the fair market value on the date the shares vest, will be capital gain or loss, long-term or short-term, depending on the holding period for the shares of Common Stock. The holding period for this purpose will begin on the date following the date the shares vest.

In lieu of the treatment described above, a participant may elect immediate recognition of income under Section 83(b) of the Code. In such event, the participant will recognize as income the fair market value of the restricted shares at the time of grant (determined without regard to any restrictions other than restrictions which by their terms will never lapse), and the Company will generally be entitled to a corresponding deduction. Dividends paid with respect to shares as to which a proper Section 83(b) election has been made will not be deductible to the Company. If a Section 83(b) election is made and the restricted shares are subsequently forfeited, the participant will not be entitled to any offsetting tax deduction.

SARs and Other Awards

With respect to SARs, restricted share units, performance shares, performance units, dividend equivalents and other Awards under the 2005 Plan not described above, generally, when a participant receives payment with respect to any such Award granted to him or her under the 2005 Plan, the amount of cash and the fair market value of any other property received will be ordinary income to such participant and will be allowed as a deduction for federal income tax purposes to the Company.

Payment of Withholding Taxes

The Company may withhold, or require a participant to remit to it, an amount sufficient to satisfy any federal, state, local or foreign withholding tax requirements associated with Awards under the 2005 Plan.

Deductibility Limit on Compensation in Excess of $1 Million

Section 162(m) of the Code generally limits the deductible amount of annual compensation paid (including, unless an exception applies, compensation otherwise deductible in connection with Awards granted under the 2005 Plan) by a public company to each “covered employee” (i.e., the chief executive officer and four other most highly compensated executive officers of the Company) to no more than $1 million. The Company currently intends to structure stock options granted under the 2005 Plan to comply with an exception to nondeductibility under Section 162(m) of the Code.

Other

Adoption of the 2005 plan requires the receipt of the affirmative vote of a majority of the shares of the Company's Common Stock present in person or by proxy and entitled to vote at the Annual Meeting.

The Board of Directors unanimously recommends a vote “FOR” the proposal to adopt the 2005 Plan.

PROPOSAL IV: RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

During fiscal year 2004, Ernst & Young LLP, independent registered public accountants, provided various audit, audit related and non-audit services to the Company as follows:

| Fee Category | | Fiscal Year 2004 | | % of Total | | Fiscal Year 2003 | | % of Total | |

| Audit Fees | | $ | 697,450 | | | 92.7 | % | $ | 355,860 | | | 79.7 | % |

| Audit-Related Fees (1) | | | - | | | - | | $ | 29,948 | | | 6.7 | |

| Tax Fees (2) | | $ | 42,800 | | | 7.1 | | $ | 48,987 | | | 11.0 | |

| All Other Fees (3) | | $ | 1,500 | | | 0.2 | | $ | 11,455 | | | 2.6 | |

| Total Fees | | $ | 741,750 | | | 100 | % | $ | 446,250 | | | 100 | % |

(1) Audit Related Fees: Aggregate fees billed for professional services rendered during 2003 related to audits of employee benefit plans and consultations on Sarbanes-Oxley and acquisitions.

(2) Tax Fees: Aggregate fees billed for professional services rendered during 2004 related to domestic tax compliance assistance, and during 2003 related to domestic tax compliance assistance and foreign tax consulting.

(3) All Other Fees: Aggregate fees billed for professional services rendered during 2004 related to license for accounting research software and during 2003 principally related to services performed at foreign locations and consultations on our option exchange program.

The Audit Committee of the Board of Directors has considered whether provision of the services described above is compatible with maintaining the independent registered public accountant’s independence and has determined that such services have not adversely affected Ernst & Young LLP’s independence. Representatives of Ernst & Young LLP are expected to attend the Annual Meeting of Stockholders, will have an opportunity to make a statement if they so desire, and are expected to be available to answer appropriate questions. The Audit Committee and the Board of Directors have appointed Ernst & Young LLP as the independent registered public accountants of the Company for the fiscal year ending December 31, 2005.

The ratification of the appointment of the Company's independent registered public accountants requires the affirmative vote of a majority of the shares of the Company's Common Stock present in person or by proxy and entitled to vote at the Annual Meeting. If the appointment is not ratified, or if Ernst & Young LLP declines to act, or becomes incapable of action, or if their appointment is discontinued, the Audit Committee and the Board of Directors will appoint other independent auditors whose continued appointment after the next Annual Meeting of Stockholders shall be subject to ratification by the stockholders.

The Board of Directors unanimously recommends a vote "FOR" the ratification of the appointment of Ernst & Young LLP as the independent registered public accountants of the Company for the year ending December 31, 2005.

STOCKHOLDER PROPOSALS FOR 2006 ANNUAL MEETING

If a stockholder of the Company wishes to have a proposal included in the Company's proxy statement for the 2006 Annual Meeting of Stockholders, the proposal must be received at the Company's principal executive offices by December 22, 2005 and must otherwise comply with rules promulgated by the Securities and Exchange Commission in order to be eligible for inclusion in the proxy material for the 2006 Annual Meeting. If a stockholder desires to bring business before the meeting which is not the subject of a proposal complying with the SEC proxy rule requirements for inclusion in the proxy statement, the stockholder must follow procedures outlined in the Company's by-laws in order to personally present the proposal at the meeting. A copy of these procedures is available upon request from the Secretary of the Company.

One of the procedural requirements in the Company's by-laws is timely notice in writing of the business that the stockholder proposes to bring before the meeting. Notice of business proposed to be brought before the 2006 Annual Meeting or notice of a proposed nomination to the Board must be received by the Secretary of the Company no later than January 20, 2006, to be presented at the meeting. If, however, the date of next year's Annual Meeting is earlier than April 20, 2006, or later than June 19, 2006, the earliest date will be determined by the Board of Directors. Any such notice must provide the information required by the Company's by-laws with respect to the stockholder making the proposal, the nominee (if any) and the other business to be considered (if any). Under rules promulgated by the Securities and Exchange Commission, the Company, acting through the persons named as proxies in the proxy materials for such meeting, may exercise discretionary voting authority with respect to any proposals that do not comply with the procedures described above. Proposals may be mailed to the Company, to the attention of the Secretary, 141 Mt. Bethel Road, Warren, NJ 07059.

OTHER MATTERS

The Board of Directors knows of no other business which will be presented at the meeting. If, however, other matters are properly presented, the persons named in the enclosed proxy will vote the shares represented thereby in accordance with their judgment on such matters.