shares of the Company’s common stock with an exercise price of $7.27 per share, which equaled the closing market value of the Company’s common stock price on the grant date.

SUBMITTED BY THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS OF ANADIGICS, INC.

Compensation of Directors

Non-management Directors receive options under the 1995 Plan. Under the 1995 Plan, a grant of options to purchase 15,000 shares of Common Stock, at an exercise price per share equal to the fair market value as determined on the date of grant, will automatically be granted on the date a non-management Director is first elected to the Board. Each option so granted will become exercisable in three equal installments commencing one year from the date of grant and annually thereafter, and will expire ten years from the date of grant. Non-management Directors also receive an annual grant of options to purchase 15,000 shares of Common Stock at the fair market value as determined on the date of grant and vesting on December 31 in the year granted. In addition, each non-management Director receives $10,000 per year for Board services, $1,000 for each Committee meeting attended, $500 for meetings attended telephonically (with a cap of $2,000 per day), and reimbursement for ordinary expenses incurred in connection with attendance at such meetings.

Executive Employment Agreements

Chief Executive Officer. In September 1998, Dr. Bami Bastani, President, Chief Executive Officer and member of the Board of Directors, entered into an employment agreement with the Company pursuant to which he was to receive an annual base salary, bonus, stock options, relocation expenses, and executive benefits. Dr. Bastani’s base salary in 2003 was $445,536. For 2003, Dr. Bastani received a bonus equal to 65% of his base salary based upon the Compensation & Human Resource Committee’s determination of the Company’s success in meeting certain of the operational, strategic, and financial goals approved by the Board of Directors during January 2003. Also, under the terms of his employment agreement with the Company, Dr. Bastani was granted non-qualified options to purchase 675,000 shares of the Company’s Common Stock in 1998 at the fair market value on the date of grant, all of which vested over the three year period following the date of grant. During 2001, 2002 and 2003, the Compensation & Human Resources Committee authorized additional grants of non-qualified options to Dr. Bastani to purchase 100,000, 100,000 and 150,000 shares, respectively, of Common Stock at the fair market value on the date of grant. Pursuant to the Company’s voluntary stock option exchange program on August 4, 2003, Dr. Bastani surrendered options to purchase 100,000 shares at an exercise price of $15.93 per share and 100,000 shares at an exercise price of $15.53 per share. In return he was issued options on February 6, 2004 to purchase 66,668 shares at an exercise price of $7.27 per share. The new options vest on February 6, 2005, one year from the date of grant.

If the Company terminates Dr. Bastani without cause or Dr. Bastani terminates his employment in connection with a change in control, he shall be entitled to (A) an amount equal to 200% of his then annual base salary plus bonus, (B) health benefits for a maximum of twenty-four months, and (C) immediate vesting of all non-qualified stock options.

Chairman of the Board. In June 1999, Ronald Rosenzweig, Chairman of the Board of Directors, entered into an employment agreement with the Company through July 2, 2002 pursuant to which he was to receive an annual base salary, bonus, stock options, and executive benefits. On May 27, 2003, that contract was extended through July 2, 2004. In 2001, Mr. Rosenzweig’s base salary was $100,000 and he received a bonus equal to 30% of his base salary. As part of his employment agreement, Mr. Rosenzweig’s annualized base salary from January 1, 2002 through July 2, 2002 was $100,000 and he received a bonus equal to $14,738. For the period from July 3, 2002 through July 2, 2003 his annualized base salary was $75,000 and he received a bonus equal to $20,700. For the period from July 3, 2003 through July 2, 2004 his annualized base salary is $75,000 and he will be entitled to a bonus of up to $37,500.

If the Company terminates Mr. Rosenzweig without cause, he shall be entitled to (A) an amount equal to the sum of his then annual base salary plus his bonus, if any, earned during the immediately preceding calendar year, (B) health benefits for a maximum of twenty-four months, and (C) immediate vesting of all non-qualified stock options.

13

Other Executive Officers. During 2000 the Company entered into employment agreements with Charles Huang, Executive Vice President, and Thomas Shields, Senior Vice President & Chief Financial Officer. The terms of each agreement provide that if the employee is terminated by the Company following a change in control or if the employee terminates employment with the Company as a result of a reduction in responsibilities and duties or a reduction in compensation following a change in control, the employee shall be entitled to receive (A) up to 12 months of base salary and bonus (at 100% of target), (B) payment of the annual bonus (at 100% of target) prorated for the number of months worked, (C) health benefits for a maximum of 12 months, and (D) immediate vesting of all stock options. In exchange for these benefits, the employees agreed (X) not to compete with the Company in certain respects, (Y) after termination of employment, not to hire or solicit for hire the employees of the Company for 12 months, and (Z) to keep confidential information about the Company.

Compensation Committee Report On Executive Compensation

The Compensation & Human Resources Committee of the Board of Directors establishes and reviews the compensation of the Company’s Executive Officers and consists entirely of non-employee Directors.

Compensation Philosophy. The Company’s executive compensation program is designed to attract and retain key Executive Officers who will enhance the performance of the Company, promote its long-term interest and build stockholders’ equity. The Compensation Committee seeks to align total compensation for executive management with corporate performance. The Company’s executive compensation package generally includes four main components:

| 1) | | A base salary which is established at levels considered appropriate for the duties and scope of responsibilities of each Executive Officer’s position. |

| 2) | | A bonus potential which is tied directly to operating objectives. |

| 3) | | A stock option award to increase stock ownership in the Company and align executive compensation with stockholder interests. |

| 4) | | Other compensation and employee benefits generally available to all employees of the Company, such as health insurance and participation in the ANADIGICS, Inc. Employee Savings and Protection Plan (“401(k) Plan”). |

The Compensation & Human Resources Committee places a particular emphasis on variable, performance based components, such as the bonus potential and stock option awards, the value of which could increase or decrease to reflect changes in corporate and individual performances.

CEO Compensation. Dr. Bastani’s base salary in 2003 was $445,536 and was determined to be competitive in order to retain Dr. Bastani. Dr. Bastani received a bonus equal to 65% of his base salary based upon the Compensation & Human Resources Committee’s determination of the Company’s success in meeting certain of the operational, strategic, and financial goals approved by the Board of Directors during January 2003.

Compliance with Internal Revenue Code Section 162(m). Section 162(m) of the Internal Revenue Code disallows a tax deduction to publicly held companies for compensation paid to certain of their Executive Officers to the extent that such compensation exceeds $1.0 million per covered officer in any fiscal year. The limitation applies only to compensation that is not qualified performance-based compensation under the Internal Revenue Code. Non-performance-based compensation paid to the Company’s Executive Officers for the 2003 Fiscal Year did not exceed the $1.0 million limit per Executive Officer, and the Compensation & Human Resources Committee plans to keep the non-performance-based compensation to be paid to the Company’s Executive Officers for the 2004 Fiscal Year within that limit.

14

It is the opinion of the Compensation & Human Resources Committee that the executive compensation policies and plans provide the necessary total remuneration program to properly align the interests of each Executive Officer with the interests of the Company’s shareholders through the use of competitive and equitable executive compensation in a balanced and reasonable manner, for both the short and long term.

SUBMITTED BY THE COMPENSATION & HUMAN RESOURCES COMMITTEE OF THE BOARD OF DIRECTORS OF ANADIGICS, INC.

Lewis Solomon

Dennis Strigl

15

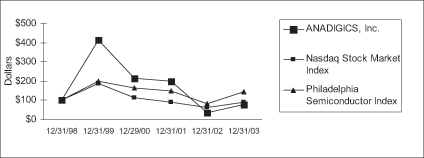

PERFORMANCE GRAPH

The following graph compares the cumulative total shareholder return on the Company’s Common Stock from December 31, 1998 through December 31, 2003 with the cumulative total return on the NASDAQ Stock Market Index and the Philadelphia Semiconductor Index, considered to be an index of the Company’s peer group, during the same period. The comparison assumes $100 was invested on December 31, 1998 in the Company’s Common Stock and in each of the foregoing indices and assumes reinvestment of dividends. The Company did not declare, nor did it pay any cash dividends during the comparison period. Notwithstanding any statement to the contrary in any of the Company’s previous or future filings with the Securities and Exchange Commission, the graph shall not be incorporated by reference into any such filings.

PROPOSAL II: RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

During fiscal year 2003, Ernst & Young LLP, independent certified public accountants, provided various audit, audit related and non-audit services to the Company as follows:

| Fee Category | | Fiscal Year 2003 | | % of Total | | Fiscal Year 2002 | | % of Total |

|---|

| Audit Fees | | | $ | 334,060 | | | | 74.8 | | | | $ | 312,100 | | | | 63.1 | |

| Audit-Related Fees (1) | | | $ | 51,748 | | | | 11.6 | | | | $ | 30,900 | | | | 6.2 | |

| Tax Fees (2) | | | $ | 48,987 | | | | 11.0 | | | | $ | 129,790 | | | | 26.3 | |

| All Other Fees (3) | | | $ | 11,455 | | | | 2.6 | | | | $ | 22,000 | | | | 4.4 | |

| Total Fees | | | $ | 446,250 | | | | 100 | | | | $ | 494,790 | | | | 100 | |

| 1) | | Audit Related Fees: Aggregate fees billed for professional services rendered during 2003 related to the filing of our $75 million shelf registration, audits of employee benefit plans, consultations on Sarbanes-Oxley and acquisitions. 2002 fees related to audits of the employee benefits plans, consultations on accounting standards, acquisitions, and the issuance of convertible security notes. |

| 2) | | Tax Fees: Aggregate fees billed for professional services rendered during 2003 related to domestic tax compliance assistance and foreign tax consulting. 2002 fees principally related to domestic tax compliance assistance, including our NOL carryback claim and foreign tax consulting. |

| 3) | | All Other Fees: Aggregate fees billed for professional services rendered during 2003 principally related to services performed at foreign locations and consultations on our option exchange program. 2002 fees related to consultations on strategic initiatives and our option exchange program. |

The Audit Committee of the Board of Directors has considered whether provision of the services described above is compatible with maintaining the independent accountant’s independence and has determined that such services have not adversely affected Ernst & Young LLP’s independence. Representatives of Ernst & Young LLP are expected to attend the Annual Meeting of Stockholders, will have an opportunity to make a statement if they so desire, and are expected to be available to answer appropriate questions. The

16

Audit Committee and the Board of Directors have appointed Ernst & Young LLP as the independent auditors of the Company for the fiscal year ending December 31, 2004.

The ratification of the appointment of the Company’s independent auditors requires the receipt of the affirmative vote of a majority of the shares of the Company’s Common Stock present in person or by proxy and voting at the Annual Meeting. If the appointment is not ratified, or if Ernst & Young LLP declines to act, or becomes incapable of action, or if their appointment is discontinued, the Audit Committee and the Board of Directors will appoint other independent auditors whose continued appointment after the next Annual Meeting of Shareholders shall be subject to ratification by the shareholders.

The Board of Directors unanimously recommends a vote “FOR” the ratification of the appointment of Ernst & Young LLP as the independent auditors of the Company for the year ending December 31, 2004.

STOCKHOLDER PROPOSALS

If a stockholder of the Company wishes to have a proposal included in the Company’s proxy statement for the 2005 Annual Meeting of Stockholders, the proposal must be received at the Company’s principal executive offices by December 22, 2004 and must otherwise comply with rules promulgated by the Securities and Exchange Commission in order to be eligible for inclusion in the proxy material for the 2005 Annual Meeting. If a stockholder desires to bring business before the meeting which is not the subject of a proposal complying with the SEC proxy rule requirements for inclusion in the proxy statement, the stockholder must follow procedures outlined in the Company’s by-laws in order to personally present the proposal at the meeting. A copy of these procedures is available upon request from the Secretary of the Company.

One of the procedural requirements in the Company’s by-laws is timely notice in writing of the business that the stockholder proposes to bring before the meeting. Notice of business proposed to be brought before the 2005 Annual Meeting or notice of a proposed nomination to the Board must be received by the Secretary of the Company no later than January 20, 2005, to be presented at the meeting. If, however, the date of next year’s Annual Meeting is earlier than April 20, 2005, or later than June 19, 2005, the earliest date will be determined by the Board of Directors. Any such notice must provide the information required by the Company’s by-laws with respect to the stockholder making the proposal, the nominee (if any) and the other business to be considered (if any). Under rules promulgated by the Securities and Exchange Commission, the Company, acting through the persons named as proxies in the proxy materials for such meeting, may exercise discretionary voting authority with respect to any proposals that do not comply with the procedures described above. Proposals may be mailed to the Company, to the attention of the Secretary, 141 Mt. Bethel Road, Warren, NJ 07059.

OTHER MATTERS

The Board of Directors knows of no other business which will be presented at the meeting. If, however, other matters are properly presented, the persons named in the enclosed proxy will vote the shares represented thereby in accordance with their judgment on such matters.

17

PROXY

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

ANADIGICS, Inc.

The undersigned hereby appoints Dr. Bami Bastani and Thomas C. Shields proxies, with power to act without the other and with power of substitution, and hereby authorizes them to represent and vote, as designated on the other side, all the shares of stock of ANADIGICS, Inc. standing in the name of the undersigned with all powers which the undersigned would possess if present at the Annual Meeting of Stockholders of the Company to be held May 20, 2004 or any adjournment thereof.

(Continued, and to be marked, dated and signed, on the other side)

Address change/Comments (Mark the corresponding box on the reverse side)

|

The Board of Directors recommends a vote FOR proposals I and II.

| Please mark | |

| your votes as | x |

| indicated in | |

| this example | |

Proposal I: | ELECTION OF DIRECTORS | | WITHHELD |

| | Nominees: | FOR | FOR ALL |

| | Ronald Rosenzweig

Lewis Solomon | o | o |

| | Garry McGuire | | |

| | | | |

| | WITHHELD FOR (Write that nominee’s name in the space provided below). |

| | |

| | _____________________________________________________________ |

| |

| | | | |

Proposal II: | APPOINTMENT OF INDEPENDENT | FOR | AGAINST | ABSTAIN |

| AUDITORS | o | o | o |

| | | | |

This proxy when properly executed will be voted in the manner directed herein by the undersigned stockholder. If no direction is made, this proxy will be voted FOR all proposals.

|

Signature(s) _______________________________________________________________ Date_________________________ |

NOTE: Please sign as name appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. |

Please check here if you expect to attend the Annual Meeting of Shareholderso

| Vote by Internet or Telephone or Mail

24 hours a day, 7 days a Week

Internet and telephone voting is available through 11PM Eastern

Time the day prior to annual meeting day

Your Internet or telephone vote authorizes the named proxies to

vote your shares in the same manner as if you marked, signed and

returned your proxy card. |

| | |

| | | |

| | | | | | |

| Internet

| | Telephone

| | Mail

| |

|

| |

| |

| |

| http://www.eproxy.com/anad

Use the internet to vote your

proxy. Have your proxy card in

hand when you access the web

site. You will be prompted to

enter your control number,

located in the box below, to

create and submit an electronic

ballot. | | 1-800-435-6710

Use any touch-tone telephone

to vote your proxy. Have

your proxy card in hand when

you call. You will be

prompted to enter your

control number, located in the

box below, and then follow

the directions given. | | Mark, sign and date your

proxy card and return it in the

enclosed postage-paid

envelope. |

| | | | | | |

If you vote your proxy by Internet or by telephone,

you do NOT need to mail back your proxy card.