QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrantý

|

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| ý | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

NEOPHARM, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

NeoPharm, Inc.

150 Field Drive

Suite 195

Lake Forest, Illinois 60045

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held June 6, 2002

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of NeoPharm, Inc., a Delaware corporation, will be held at the NeoPharm, Inc. Research and Development Facility, located at 1850 Lakeside Drive, Waukegan, Illinois on June 6, 2002, at 10:00 a.m., local time, for the following purposes:

- 1.

- To elect six directors to serve until the 2003 Annual Meeting of Stockholders.

- 2.

- To consider and act upon an amendment to the Company's Amended and Restated Certificate of Incorporation to increase the number of shares of common stock that the Company has authority to issue from 25,000,000 shares to 50,000,000 shares.

- 3.

- To consider and act upon an amendment to the Company's Amended and Restated Certificate of Incorporation to authorize the issuance of 15,000,000 shares of preferred stock.

- 4.

- To consider and act upon an amendment to the Company's 1998 Equity Incentive Plan to increase the number of shares of common stock available for issuance under the Plan from 2,200,000 shares to 4,000,000 shares.

- 5.

- To transact such other business as may properly come before the meeting.

Only stockholders of record on April 19, 2002 will be entitled to notice of and to vote at the Annual Meeting.

To assure that your interests will be represented, whether or not you plan to attend the Annual Meeting, you are urged to sign and date the enclosed proxy card and promptly return it in the pre-addressed envelope provided, which requires no postage if mailed in the United States. The enclosed proxy is revocable and will not affect your right to vote in person if you attend the Annual Meeting.

Lake Forest, Illinois

April 26, 2002

NeoPharm, Inc.

150 Field Drive

Suite 195

Lake Forest, Illinois 60045

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

To Be Held June 6, 2002

GENERAL INFORMATION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of NeoPharm, Inc., a Delaware corporation (the "Company"), to be used at the Annual Meeting of Stockholders of the Company (the "Annual Meeting") to be held at the NeoPharm, Inc. Research and Development Facility, located at 1850 Lakeside Drive, Waukegan, Illinois on June 6, 2002 at 10:00 a.m. for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders and in this Proxy Statement. This Proxy Statement and the enclosed form of proxy were first sent or given to stockholders on or about April 26, 2002.

Only stockholders of record at the close of business on April 19, 2002 (the "Record Date") will be entitled to vote at the Annual Meeting or any adjournment thereof. As of the close of business on the Record Date, there were XX,XXX,XXX shares of the Company's common stock, par value $.0002145 per share ("Common Stock"), outstanding.

The presence, either in person or by properly executed proxy, of the holders of a majority of the outstanding shares of Common Stock is necessary to constitute a quorum at the Annual Meeting. In the election of directors, each share is entitled to cast one vote for each director to be elected; cumulative voting is not permitted. For all matters except the election of directors, each share is entitled to one vote. Directors are elected by a plurality of the votes cast by the holders of shares of Common Stock at a meeting at which a quorum is present. In all other matters other than the election of directors, the affirmative vote of a majority of the outstanding shares of Common Stock present in person or represented by proxy at the Annual Meeting is required for the adoption of such matters. Abstentions and broker non-votes are counted for purposes of determining the presence or absence of a quorum for the transaction of business. Abstentions and broker non-votes are not counted for purposes of determining whether a proposal presented to stockholders has been approved.

A proxy may be revoked at any time before it is exercised by giving a written notice to the Secretary of the Company bearing a later date than the proxy, by submitting a later-dated proxy or by voting the shares represented by the proxy in person at the Annual Meeting. Unless revoked, the shares represented by each duly executed, timely delivered proxy will be voted in accordance with the specifications made. If no specifications are made, such shares will be votedFOR Proposal 1 (election of directors), Proposal 2 (amendment of the Amended and Restated Certificate of Incorporation to increase the authorized common stock by 25,000,000 shares), Proposal 3 (amendment of the Amended and Restated Certificate of Incorporation to authorize issuance of 15,000,000 shares of preferred stock), and Proposal 4 (increasing the number of shares available for issuance under the 1998 Equity Incentive Plan from 2,200,000 shares to 4,000,000 shares), all as proposed in this Proxy Statement. The Board of Directors does not intend to present any other matters at the Annual Meeting. However, should any other matters properly come before the Annual Meeting, it is the intention of the proxy holders to vote the proxy in accordance with their best judgment.

2

The expenses of soliciting proxies will be paid by the Company. In addition to solicitation by mail, officers, directors and employees of the Company, who will receive no extra compensation therefor, may solicit proxies personally or by telephone, telecopy or telegram. The Company will reimburse brokerage houses, custodians, nominees and fiduciaries for their expenses in mailing proxy materials to principals.

PROPOSAL ONE

ELECTION OF DIRECTORS

Six directors, constituting the entire Board of Directors, are to be elected at the Annual Meeting. Each director will hold office until the 2003 Annual Meeting of Stockholders and until his successor has been elected and qualified. The nominees named below have been selected by the Board of Directors of the Company. The Board believes that all of its present nominees will be available for election at the Annual Meeting and will serve if elected. If, due to circumstances not now foreseen, any of the nominees named below will not be available for election, the proxies will be voted for such other person or persons as the Board of Directors may select

There follows information as to each nominee for election as a director at the Annual Meeting, including his age, present principal occupation, other business experience, directorships of other publicly-held companies and period of service as a director of the Company.

The persons named in the accompanying form of proxy will vote FOR the election of the nominees unless stockholders specify otherwise in their proxies.

3

Nominees for Director. The following information has been provided by the respective nominees for election to the Board of Directors.

Name

| | Age

| | Principal Occupation

|

|---|

| James M. Hussey, R.Ph., MBA | | 43 | | Mr. Hussey joined the Company as President, Chief Executive Officer and Director in 1998. Prior to joining the Company, Mr. Hussey formed his own company in 1994, Physicians Quality Care, Inc., a managed care organization, where he served as Chief Executive Officer until the company's sale in 1998. Previous to that, Mr. Hussey held several positions with Bristol-Myers Squibb, a diversified pharmaceutical manufacturer, from 1986 to 1994, most recently as the General Manager Midwest Integrated Regional Business Unit. Mr. Hussey presently serves as a director of Option Care, Inc., a provider of home health care services. |

John N. Kapoor, Ph.D. |

|

58 |

|

Dr. Kapoor has been a Director and Chairman of the Board of the Company since its formation in 1990. Dr. Kapoor is the sole shareholder and President of EJ Financial Enterprises, Inc., a health care consulting and investment company. In addition, Dr. Kapoor serves as Chairman of Option Care, Inc., a provider of home health care services; Chairman and interim CEO of Akorn, Inc., a manufacturer, distributor and marketer of generic ophthalmic products; a director of First Horizon Pharmaceutical Corporation, a distributor of pharmaceuticals; and, a director of Introgen Therapeutics, Inc., a gene therapy company. |

Erick E. Hanson |

|

55 |

|

Mr. Hanson joined the Company as a Director in 1997. Mr. Hanson is currently President of Hanson and Associates, a consulting firm working with venture capital companies. Previously, Mr. Hanson served as President and CEO of Option Care, Inc., a provider of home health care services. Prior to joining Option Care, Mr. Hanson held a variety of executive positions with Caremark, Inc., including Vice President Sales and Marketing. Mr. Hanson served as President and Chief Operating Officer of Clinical Partners Inc. in Boston, MA from 1989 to 1991 and prior to 1989 was associated with Blue Cross and Blue Shield of Indiana for over twenty years. Mr. Hanson presently serves on the board of directors of Integrity Healthcare, Inc., a home healthcare provider. |

Sander A. Flaum |

|

65 |

|

Mr. Flaum joined the Company as a Director in 1998. Since 1991, Mr. Flaum has served as CEO of Robert A. Becker EURO/RSCG, a marketing and advertising company, where he also serves as Chairman of the Board. Mr. Flaum was Executive Vice President of Kleinter Advertising from 1984 to 1991 and prior to that served as Market Director of Lederle Laboratories, a division of American Cyanamid. Mr. Flaum also serves on the board of directors of Hollins Communications Research Institute, Atrix Laboratories and Integrity Pharmaceuticals. |

|

|

|

|

|

4

Matthew P. Rogan, M.D. |

|

56 |

|

Dr. Rogan joined the Company as a Director in 2000. Dr. Rogan is President and CEO of Unicorn Pharma Consulting, Inc., a provider of customized pharmaceutical and biotechnology medical services. From 1997 to 1999, Dr. Rogan was Vice President, Medical Affairs for Sanofi Pharmaceuticals in the United States. Prior to joining Sanofi, Dr. Rogan served as Senior Medical Director, Medical Affairs for Zeneca Pharmaceuticals from 1996 to 1997, and was Director of Clinical Support at Burroughs Wellcome from 1993 to 1995. Prior to 1993, Dr. Rogan held senior positions with Bristol-Myers Squibb. |

Kaveh T. Safavi, M.D., J.D. |

|

41 |

|

Dr. Safavi joined the Company as a Director in 2000. Dr. Safavi is Vice President of Business and Strategic Development for Alexian Brothers of Illinois, Inc., a multi-hospital health system in metropolitan Chicago, Illinois. Prior to assuming his current position in 2000, Dr. Safavi served as Vice President, Medical Affairs for UnitedHealthcare of Illinois, Inc., a large managed care organization from 1996 to 1999 and served as President of Health Springs Medical Group of Illinois, a primary care group practice and physician practice management company from 1993 to 1995. |

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE "FOR"

THE ELECTION OF ALL NOMINEES FOR DIRECTOR.

5

PROPOSAL TWO

APPROVAL OF AN AMENDMENT TO THE COMPANY'S AMENDED AND RESTATED CERTIFICATE

OF INCORPORATION TO INCREASE THE AUTHORIZED COMMON STOCK

General

On February 1, 2002, the Board of Directors voted to propose and recommend approval of an amendment to the Company's Amended and Restated Certificate of Incorporation to increase the aggregate number of authorized shares of Common Stock from 25,000,000 shares to 50,000,000 shares (the "Common Stock Amendment") and directed that the Common Stock Amendment be submitted to the stockholders at the Annual Meeting. The Amended and Restated Certificate of Incorporation presently authorizes the issuance of 25,000,000 shares of Common Stock. The Common Stock Amendment would increase the authorized number of shares of Common Stock to 50,000,000 shares. The Company is also submitting a proposal to the stockholders to approve an amendment to the Company's Amended and Restated Certificate of Incorporation to create a new class of authorized preferred stock consisting of 15,000,000 shares of preferred stock (the "Preferred Stock Amendment"). See "Proposal Three—Approval of Amendment to the Amended and Restated Certificate of Incorporation to Create a New Class of Authorized Preferred Stock".

Vote Required

The affirmative vote of the holders of a majority of the outstanding shares of Common Stock on the Record Date is required to approve the Common Stock Amendment.

Proposed Amendment

If the Common Stock Amendment is approved and the Preferred Stock Amendment (as described in "Proposal Three—Approval of Amendment to the Amended and Restated Certificate of Incorporation to Create a New Class of Authorized Preferred Stock") is approved, the text of the first paragraph of the Fourth Article of the Company's Amended and Restated Certificate of Incorporation would read in its entirety as follows:

"The total number of shares of all classes of capital stock which the Corporation shall have the authority to issue is 60,000,000 shares, consisting of 50,000,000 shares of common stock, par value $.0002145 per share (the "Common Stock"), and 15,000,000 shares of preferred stock, par value $.01 per share (the "Preferred Stock").

In the event the stockholders approve the Common Stock Amendment, but not the Preferred Stock Amendment, references to Preferred Stock in the Fourth Article would be deleted and the number of authorized shares of capital stock of the Company would be adjusted accordingly.

General Effect of the Proposed Amendment and Reasons for Approval

Of the Company's 25,000,000 currently authorized shares of Common Stock, 16,252,529 shares were issued and outstanding as of April 8, 2002. At that date, the Company had also reserved for issuance a total of 2,911,150 additional shares of Common Stock issuable upon the exercise of options under the Company's stock option plans.

Adoption of the Common Stock Amendment would increase the number of authorized shares of the Company's capital stock by 25,000,000 shares, all of which would be classified as Common Stock. Therefore, upon adoption of the Common Stock Amendment the number of shares of Common Stock available for future issuance would increase by 25,000,000. Upon adoption of the Common Stock Amendment, the Board of Directors would be authorized to issue additional shares of Common Stock

6

at such time or times, to such persons and for such consideration as it may determine without further stockholder approval, except as may be otherwise required by law or the rules of the Nasdaq National Market or any other national securities exchange on which the shares of Common Stock are at the time listed. The additional shares of Common Stock for which authorization is sought would, if and when issued, have the same rights and privileges as the presently outstanding shares of Common Stock. Holders of shares of Common Stock do not have preemptive rights to subscribe for or purchase any part of any new or additional issuance of shares of Common Stock or securities convertible into shares of Common Stock.

The Board of Directors believes that the number of authorized shares of Common Stock should be increased by 25,000,000 to provide sufficient shares for use for such corporate purposes as may be determined advisable by the Board of Directors, without further action or authorization by the stockholders. Such corporate purposes might include, but would not be limited to, the acquisition of capital funds through the sale of stock, the acquisition of other corporations, businesses or properties, the attracting of strategic partners for the development of the Company's products, the declaration of stock dividends in the nature of a stock split or use in connection with compensation plans. As of the date hereof, there are no plans, agreements or arrangements with respect to the issuance of any of the shares of Common Stock which would be authorized by the proposed amendment; however, the Board of Directors believes that the availability of shares would afford the Company flexibility in considering and implementing corporate transactions of the type enumerated above to take advantage of favorable market conditions and business opportunities without the delay and expense associated with the holding of a special meeting of its stockholders.

The issuance of additional shares of Common Stock may have a dilutive effect on earnings per share. In addition, the issuance of additional shares may have a dilutive effect on the voting power of the current stockholders because such stockholders do not have preemptive rights. Finally, while the proposed increase in the number of authorized shares of Common Stock is not intended to prevent or impede a change in control of the Company, the issuance of additional shares of Common Stock could have the effect of delaying, deferring or preventing a change of control of the Company and may discourage bids for the Common Stock at a premium over the prevailing market price.

Under Delaware law, stockholders will not have any dissenter's or appraisal rights in connection with the Common Stock Amendment. If the Common Stock Amendment is approved by the stockholders, it will become effective upon the Company's executing, acknowledging and filing a Certificate of Amendment as required by the General Corporation Law of the State of Delaware.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE APPROVAL OF THE AMENDMENT TO THE COMPANY'S AMENDED AND RESTATED CERTIFICATE OF INCORPORATION DESCRIBED ABOVE IN PROPOSAL TWO.

7

PROPOSAL THREE

APPROVAL OF AN AMENDMENT TO THE COMPANY'S AMENDED AND RESTATED CERTIFICATE

OF INCORPORATION TO CREATE A NEW CLASS OF AUTHORIZED

PREFERRED STOCK

General

On February 1, 2002, the Board of Directors voted to propose and recommend approval of an amendment to the Company's Amended and Restated Certificate of Incorporation to increase the authorized capital stock of the Company and to create a new class of authorized preferred stock, $.01 par value per share (the "Preferred Stock"), consisting of 15,000,000 shares of "blank check" Preferred Stock and directing that the Preferred Stock Amendment be submitted to the stockholders at the Annual Meeting. At the present time, the Company is not authorized to issue shares of Preferred Stock.

Vote Required

The affirmative vote of the holders of a majority of the outstanding shares of Common Stock on the Record Date is required to approve the Preferred Stock Amendment.

Description of New Class of Preferred Stock

The Preferred Stock would have such preferences, voting powers, qualifications, and special or relative rights or privileges as the Board of Directors may designate for each series thereof issued from time to time. Upon issuance, and subject to the Company's Amended and Restated Certificate of Incorporation, the Preferred Stock could rank senior to the Common Stock. The Board of Directors, without any further action by the stockholders, would be able to issue the Preferred Stock for such purposes and for such consideration as it may determine.

Proposed Amendment

If the Preferred Stock Amendment is approved, the text of the Fourth Article of the Company's Amended and Restated Certificate of Incorporation would be further amended by the addition of a second paragraph that would read in its entirety as follows:

"The Board of Directors is authorized to issue the Preferred Stock from time to time in one or more classes or series thereof, each such class or series to have such voting powers (if any), conversion rights (if any), designations, preferences and relative, participating, optional or other special rights, and such qualifications, limitations or restrictions thereof, as shall be determined by the Board of Directors and stated and expressed in a resolution or resolutions thereof providing for the issuance of such Preferred Stock."

Reasons for Approval

The Board of Directors believes it is in the Company's best interests to create the Preferred Stock. The Board of Directors believes that the creation of the Preferred Stock enhances the Company's flexibility in connection with possible future actions, such as financings, mergers, acquisitions, the attracting of strategic partners for the development of the Company's products, or other corporate purposes. The Board of Directors also believes that the creation of the Preferred Stock will better position the Company to consider and respond to future business opportunities and needs. By approving the creation of the Preferred Stock, the Company will be able to issue the Preferred Stock without the expense and delay of a special stockholders' meeting.

8

If this proposal is adopted, upon the filing of a certificate of amendment to the Company's Amended and Restated Certificate of Incorporation, the Board of Directors will be authorized to issue the Preferred Stock, from time to time, in one or more series, with such preferences, voting powers, qualifications, and special or relative rights or privileges as the Board of Directors, subject to certain limitations, may determine. The shares of Preferred Stock would be available for issuance without any further action by the stockholders, except as required by law or the rules of the Nasdaq National Market or any other national securities exchange on which the Company's shares may be traded. Shares of Preferred Stock could be issued publicly or privately, in one or more series and each series of Preferred Stock could rank senior to the Common Stock of the Company with regard to dividends and liquidation rights.

Possible Effects of Amendment Regarding Preferred Stock

Even though not intended by the Board, the possible overall effect of the Preferred Stock Amendment on the holders of Common Stock (the "Common Stockholders") may include the dilution of their ownership interests in the Company, the continuation of the current management of the Company, prevention of mergers with or business combinations by the Company and the discouragement of possible tender offers for shares of Common Stock.

Upon the conversion into Common Stock of shares of Preferred Stock issued with conversion rights, if any, the Common Stockholders' voting power and percentage ownership of the Company would be diluted and such issuances could have an adverse effect on the market price of the Common Stock. Additionally, the issuance of shares of Preferred Stock with certain rights, preferences and privileges senior to those held by the Common Stock could diminish the Common Stockholders' rights to receive dividends if declared by the Board and to receive payments upon the liquidation of the Company.

If shares of Preferred Stock are issued, approval by such shares, voting as a separate class, could be required prior to certain mergers with or business combinations by the Company. These factors could discourage attempts to purchase control of the Company even if such change in control may be beneficial to the Common Stockholders. Moreover, the issuance of Preferred Stock having general voting rights together with the Common Stock to persons friendly to the Board could make it more difficult to remove incumbent management and directors from office even if such changes would be favorable to stockholders generally.

If shares of Preferred Stock are issued with conversion rights, the attractiveness of the Company to a potential tender offeror for the Common Stock may be diminished. The purchase of the additional shares of Common Stock or Preferred Stock necessary to gain control of the Company may increase the cost to a potential tender offeror and prevent the tender offer from being made even though such offer may have been desirable to many of the Common Stockholders.

The ability of the Board, without any additional stockholder approval, to issue shares of Preferred Stock with such rights, preferences, privileges and restrictions as determined by the Board could be employed as an anti-takeover device. While the amendment is not intended for that purpose and is not proposed in response to any specific takeover threat known to the Board, issuance of shares of Preferred Stock could be used to impede a change of control of the Company. Any such issuance of Preferred Stock in the takeover context, however, would be subject to compliance by the Board with applicable principles of fiduciary duty.

The Board believes that the financial flexibility offered by the amendment outweighs any of its disadvantages. To the extent the proposal may have anti-takeover effects, the proposal may encourage persons seeking to acquire the Company to negotiate directly with the Board to consider the proposed transaction in a non-disruptive atmosphere and to discharge effectively its obligation to act on the proposed transaction in a manner that best serves all the stockholders' interests. It is also the Board's

9

view that the existence of the Preferred Stock should not discourage anyone from proposing a merger or other transaction at a price reflective of the true value of the Company and which is in the interests of its stockholders.

Under Delaware law, stockholders will not have any dissenter's or appraisal rights in connection with the Preferred Stock Amendment. If the Preferred Stock Amendment is approved by the stockholders, it will become effective upon the Company's executing, acknowledging and filing a Certificate of Amendment required by the General Corporation Law of the State of Delaware.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE APPROVAL OF THE AMENDMENT TO THE COMPANY'S AMENDED AND RESTATED CERTIFICATE OF INCORPORATION DESCRIBED ABOVE IN PROPOSAL THREE.

10

PROPOSAL FOUR

APPROVAL OF AN AMENDMENT TO THE

NEOPHARM, INC. 1998 EQUITY INCENTIVE PLAN

General

The Company's 1998 Equity Incentive Plan (the "Plan") was originally adopted by the Board of Directors in 1998 and approved by the stockholders in 1999. On February 1, 2002, the Board of Directors adopted an amendment to the Plan (the "Plan Amendment") increasing the number of shares issuable thereunder from 2,200,000 shares to 4,000,000 shares and requiring that the Plan Amendment be submitted to the stockholders for approval at the Annual Meeting.

A summary of the principal features of the Plan is provided below, but is qualified in its entirety by reference to the full text of the Plan that was filed electronically with this proxy statement with the Securities and Exchange Commission. Such text is not included in the printed version of this proxy statement. A copy of the Plan is available from the Company's Secretary at the address on the cover of this document.

Purpose Of The Proposal

The Board of Directors believes that the growth of the Company depends significantly upon the Company's ability to attract and retain key employees, directors and consultants. The Board of Directors also believes that providing key employees, directors and consultants with a proprietary interest in the growth and performance of the Company is crucial to stimulating individual performance while at the same time enhancing stockholder value. As of April 1, 2002, 2,023,075 options had been issued pursuant to the Plan, and 115,590 options remained available for future grants. The Board of Directors is proposing a 1,800,000 share increase in the number of shares issuable through the Plan in order that the Company may continue to provide an effective means to secure, motivate and retain key personnel.

The Amendment is being submitted to the shareholders for approval in order to satisfy the requirements of the Nasdaq National Market.

Administration Of The Plan

Under the Plan, the Board of Directors as a whole, or a committee designated by the Board, is authorized to award stock options, restricted stock, performance shares, performance units and bonus stock. All full-time employees, as well as consultants and directors, are eligible to receive awards. The administrators of the Plan have the discretion to determine the persons to whom awards shall be made, and subject to the terms of the Plan, the terms and conditions of each award. The administrators of the Plan may, among other things, cancel outstanding awards and grant substitute awards with an exercise price determined by reference to the value of the Company's common stock on the date of substitute awards, accelerate vesting and waive terms and conditions of outstanding awards and permit eligible employees or consultants to elect to acquire, prior to earning compensation, options in lieu of receiving such compensation. All awards become fully vested upon a change of control of the Company.

Options.

The exercise price of options issued under the Plan may not be less than 85% of the fair market value of a share of the Company's Common Stock on the grant date (100% for incentive stock options and 110% for incentive stock options granted to an individual possessing more than 10% of the Company's voting rights). Options become exercisable as to 25% of the shares subject to an award on each of the first four anniversaries of the grant date unless the administrator specifies a different vesting schedule. Options have a maximum term of 10 years. The option exercise price may be paid

11

(i) in cash or by check, (ii) in stock, (iii) in restricted stock, (iv) though a simultaneous sale through a broker of unrestricted stock acquired upon exercise of the option, (v) through a loan or loan guaranty made by the Company or (vi) any combination of the foregoing. Options may be designated by the administrator as incentive stock options for which the amount of option "spread" at the time of exercise, assuming no disqualifying disposition, is generally not to be taxable income to the grantee (except for possible alternative minimum tax liability) and is not deductible by the Company for federal income tax purposes.

Restricted Stock And Bonus Stock.

The Plan administrator determines the purchase price applicable to grants of restricted stock, which may be as low as the par value of the common stock. The administrator also determines the restrictions, if any, applicable to the restrictive stock, which may include performance goals. The administrator may also grant bonus stock.

Grant Of Performance Units And Performance Shares.

Before performance units or performance shares are granted, the administrator is required to (i) determine objective performance goals and the amount of compensation under the goals applicable to the grant, (ii) designate the measuring period of between one and seven years to ascertain the achievement of the goals and (iii) assign a performance percentage to each level of attainment of performance goals during the measuring period. The administrator may use any performance factors it deems appropriate. A grant of performance units or performance shares may, but need not, be identified with another award under the Plan.

Exercise Of Performance Units And Performance Shares.

If the minimum performance goals applicable to an award of performance units or performance shares are achieved, then the award generally becomes exercisable on the later of the first anniversary of the grant date or the first day after the end of the measuring period. The benefit of a performance unit is dependent upon the percentage of performance goals attained and the value of each performance unit (which is fixed at the time of its grant). If the minimum performance goals of a performance unit award are achieved, then the Company will deliver to the grantee (i) in the case of performance units, cash in an amount equal to the product of the number of performance units successively multiplied by the value of each performance unit and the performance percentage achieved during the measuring period, or (ii) in the case of an award of performance shares, shares of common stock equal in number to the product of the number of performance shares subject to the award multiplied by the performance percentage achieved during the measuring period, in either case except to the extent that the administrator determines that cash or common stock should be paid in lieu of some or all of such common stock or cash, as applicable. Any performance unit or performance share award with respect to which the performance goals are not achieved shall expire.

Loans And Loan Guarantees.

The administrator may allow a grantee to defer payment to the Company of all or part of the exercise price of an option, the purchase price of restricted sock or any taxes associated with any non-cash benefit under the Plan. The administrator also may cause the Company to guarantee a third-party loan to cover such amounts. The terms of any such deferral or guarantee shall include an interest rate not more favorable to the grantee than the terms applicable to funds borrowed by the Company from time to time. The administrator may forgive the repayment of any or all of the principal of or interest on any such deferred payment obligation.

12

Exercise After Termination Of Continuous Status As An Employee Or Consultant.

If a grantee's continuing status as an employee or consultant is terminated for cause, all unvested or unexercised awards will terminate and be forfeited. In the event of death or disability of a grantee, any restricted stock will become vested, any unexercised option may be exercised for twelve months following the date of termination, and any unexercised performance share or performance units may be exercised for 180 days following such date, provided that if a measuring period has not ended, the benefit will be pro-rated on the basis of the elapsed portion of the measuring period and the actual or extrapolated performance, as determined by the administrator, over the full measuring period. If a grantee's continuing status as an employee or consultant terminates for any other reason, any restricted stock will be forfeited, the then-exercisable portion of any unexercised option may be exercised for 90 days and any unexercised performance shares or performance units may be exercised if and to the extent determined by the administrator. The administrator has the discretion to extend such post-termination exercisability.

Amendments.

The Plan may be amended by the Board of Directors without stockholder approval except as may be required to permit transactions in Common Stock to be excepted from liability under Section 16 (b) of the Securities Exchange Act of 1934, or under the listing requirements of any securities exchange or national market system on which any of the Company's equity securities are listed.

Option Grants.

It is not possible to state the persons who will receive options or awards under the Plan in the future, nor the amount of options or awards that will be granted. The following table sets forth information with respect to grants of options that have been made pursuant to the Plan since January 1, 2001 to (i) the Company's chief executive officer and president, (ii) each of the other named executive officers, (iii) all current executive officers as a group, (iv) all current directors who are not executive officers as a group and, (v) all employees who are not executive officers as a group.

13

NEW PLAN BENEFITS

1998 EQUITY INCENTIVE PLAN

| | Number of

Units(1)

|

|---|

James M. Hussey

Director, President and

Chief Executive Officer | | 360,000 |

Jeffrey Sherman, M.D.

Chief Medical Officer and Executive Vice President |

|

109,500 |

Imran Ahmad

Chief Scientific Officer and Senior Vice President |

|

51,000 |

Larry Kenyon

Chief Financial Officer and Secretary |

|

35,000 |

Kirk Rosemark

Vice President—Regulatory Affairs |

|

25,300 |

Lewis Strauss

Vice President—Clinical Development |

|

5,000 |

Executive officers as a group |

|

609,900 |

All current directors who are not executive officers as a group |

|

73,000 |

Employees who are not executive officers as a group |

|

274,450 |

- (1)

- The dollar value of these options cannot be determined because they depend on the market value of the underlying shares on the date of exercise.

Certain Federal Income Tax Consequences Of The Plan Under Current Law.

The following discussion is only a summary of the principal federal income tax consequences of the grant of incentives under the Plan and is based on existing federal law, which is subject to change, in some cases retroactively. This discussion is also qualified by the particular circumstances of each optionee, which may substantially alter or modify the federal income tax consequences herein discussed.

The maximum capital gains tax rate for individuals is 20% on gains from the sales of capital assets held for more than 12 months. In contrast, the maximum individual ordinary income tax rate is 38.6%. The following discussion assumes that the shares of Common Stock acquired directly or upon exercise of an option constitute capital assets in the optionee's hands.

An optionee will recognize no taxable income at the time an incentive stock option is granted, vests or is exercised. If the optionee makes no disposition of the acquired shares within two years after the date of grant of the incentive stock option, or within one year after the transfer of such shares to the optionee, any gain or loss that is realized on a subsequent disposition of such shares will be treated as long-term capital gain or loss. As to options exercised, the excess, if any, of the fair market value of the shares on the date of exercise over the option price will be an item of tax preference for purposes of computing the optionee's alternative minimum tax.

If the foregoing holding period requirements are not satisfied, the optionee will realize (i) ordinary income for federal income tax purposes in the year of the disqualifying disposition in an amount equal to the lesser of (a) the excess, if any, of the fair market value of the shares on the date of exercise over the option price thereof, or (b) the excess, if any, of the selling price over the optionee's adjusted basis

14

of such shares (provided that the disqualifying disposition is a sale or exchange with respect to which a loss (if sustained) would be recognized by such individual) and (ii) provided that the disqualifying disposition is made more than one year after the shares are transferred to the optionee, long-term capital gain equal to the excess, if any, of the amount realized upon the disposition of shares over the fair market value of such shares on the date of exercise.

An optionee will recognize no taxable income at the time a non-qualified stock option is granted or vests. An optionee will realize ordinary income in the year of exercise of a non-qualified stock option measured by the difference between the fair market value on the exercise date of the shares transferred and the option price.

Deductions For Federal Income Tax Purposes.

The Company will be entitled (provided it satisfies certain reporting requirements) to a deduction for federal income tax purposes at the same time and in the same amount as the optionee is considered to be in receipt of compensation income in connection with the exercise of non-qualified stock options or, in the case of an incentive stock option, a disqualifying disposition of shares received upon exercise thereof. If the holding periods outlined above are met, no deduction will be available to the Company in connection with an incentive stock option.

Limitation on Compensation Deduction.

Publicly-held corporations may not deduct compensation paid to some of their executive officers in excess of $1 millions. The employees covered by the $1 million compensation deduction limitation are the chief executive officer and those employees whose annual compensation is required to be reported to the Securities and Exchange Commission because the employee is one of the company's four highest compensated employees for the taxable year (other than the chief executive officer). Ordinary income attributable to stock options generally is included in an employee's compensation for purposes of the $1 million limitation on deductibility of compensation.

There is an exception to the $1 million compensation deduction limitation for compensation paid pursuant to a qualified performance-based compensation plan. Compensation attributable to a stock option satisfies the qualified performance-based compensation exception if the following conditions are met:

- •

- the grant is made by a compensation committee comprised of outside directors,

- •

- the plan under which the options may be granted states the maximum number of shares with respect to which options may be granted during a specified period to any employee,

- •

- under the terms of the option, the amount of compensation the employee would receive is based solely on an increase in the value of the shares after the date of the grant, for example, the option is granted at an exercise price equal to or greater than fair market value as of the date of the grant, and

- •

- the individuals eligible to receive grants, the maximum number of shares for which grants may be made to any employee, the exercise price of the options and other disclosures required by SEC proxy rules are disclosed to shareholders and subsequently approved by them.

If the amount of compensation a covered employee may receive under the grant is not based solely on an increase in the value of the shares after the date of the grant (for example, an option is granted with an exercise price that is less than the fair market value of the underlying common shares as of the date of the grant), none of the compensation attributable to the grant is qualified performance-based compensation unless the grant is made subject to reaching a performance goal that

15

has been previously established and approved by our shareholders and otherwise qualifies under Section 162(m) of the Internal Revenue Code.

Market Value Of Securities Underlying Options

As of April 8, 2002, the closing price of the Company's Common Stock as reported in the Nasdaq National Market was $19.50 per share.

Approval And Termination

The Plan Amendment was approved by the Board of Directors of the Company on February 1, 2002. Unless sooner terminated by the Board of Directors, the Plan will terminate on July 23, 2008.

The text of the Plan Amendment is as follows:

The first sentence of Section 3(a) of the Plan is changed to read as follows:

"(a) Subject to Section 24, an aggregate of 4,000,000 shares of Stock are hereby made available and are reserved for delivery on account of the grant and exercise of Awards (including Restricted Stock) and the payment of benefits in connection with Awards under the Plan."

THE BOARD OF DIRECTORS CONSIDERS PROPOSAL FOUR TO BE IN THE BEST INTERESTS OF THE COMPANY AND ITS STOCKHOLDERS AND RECOMMENDS A VOTE "FOR" APPROVAL THEREOF.

16

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

The Board of Directors held five meetings in 2001. During 2001, each of the directors participated in at least 75% of the total number of such meetings of the Board and meetings of committees of the Board on which he served.

The Board of Directors has established a Compensation Committee and an Audit Committee. The Company's bylaws provide that each such committee shall have one or more members, who serve at the pleasure of the Board of Directors. The Company does not have a standing nominating committee, however, the Board of Directors will consider director nominations which are submitted by stockholders in writing addressed to: Corporate Secretary, NeoPharm, Inc., 150 Field Drive, Suite 195, Lake Forest, Illinois 60045.

Compensation Committee. The Compensation Committee is responsible for overseeing the Company's incentive compensation and benefit plans and for reviewing and making recommendations to the Board of Directors with respect to the administration of the salaries, incentives and other compensation of directors, officers, and other employees of the Company, including the terms and conditions of their employment and other compensation matters. The Compensation Committee currently consists of Messrs. Flaum, Hanson, Rogan and Safavi. During fiscal 2001, the Compensation Committee met twice.

Audit Committee. The Board of Directors adopted an Audit Committee Charter on June 8, 2000. The Audit Committee currently consists of Messrs. Hanson, Rogan and Safavi, all of whom are considered to be "independent" as defined by the National Association of Securities Dealers ("NASD") listing requirements. The Audit Committee is responsible for making an annual recommendation, based on a review of qualifications, to the Board of Directors for the appointment of independent public accountants to audit the financial statements of the Company and to perform such other duties as the Board of Directors may from time to time prescribe. The Audit Committee is also responsible for reviewing and making recommendations to the Board of Directors with respect to (i) the scope of audits conducted by the Company's independent public accountants and internal auditors and (ii) the accounting methods and the system of internal controls used by the Company. In addition, the Audit Committee reviews reports from the Company's independent public accountants and internal auditors concerning compliance by management with governmental laws and regulations and with the Company's policies relating to ethics, conflicts of interest and disbursements of funds. During fiscal 2001, the Audit Committee held two meetings.

Committee Interlocks and Insider Participation. Each of the aforementioned individuals is a non-employee director of the Company, and Messrs. Hanson, Rogan and Safavi serve on both the Compensation and Audit Committees. In 2001, the Company paid Unicorn Pharma Consulting, Inc. ("Unicorn") $35,283 pursuant to a Consulting Agreement for certain clinical development, staffing evaluation and corporate organization services, plus reimbursement of expenses. Dr. Rogan, a member of the Board and of the Compensation and Audit Committees, is the President and a principal stockholder of Unicorn. See "Certain Relationships and Related Transactions" for additional information.

COMPENSATION OF DIRECTORS

Non-employee directors ("Outside Directors"), other than Dr. Kapoor, are paid $1,000 for attendance at each directors' meeting and $500 for attendance at each committee meeting. Directors are reimbursed for reasonable out-of-pocket expenses incurred in connection with attendance at such meetings.

Outside Directors, other than Dr. Kapoor, are eligible to receive grants of nonstatutory stock options. Each Outside Director is granted an option to purchase shares of Common Stock of the

17

Company upon his or her initial and each subsequent election as a director. Options granted to Outside Directors vest one year from the date of grant. Currently four Outside Directors are eligible to participate in this program.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee of the Board of Directors has furnished the following report on its activities:

The Committee reviewed the audited financial statements in the Annual Report with management. The Committee also reviewed with management and the independent auditors the reasonableness of significant judgments and the clarity of disclosures in the financial statements, the quality, not just the acceptability, of the Company's accounting principles and such other matters as are required to be discussed with the Committee under generally accepted accounting standards. In addition, the Committee also discussed with the independent auditors the auditors' independence from management and the Company, including the matters in the written disclosure required by the Independence Standards Board, and considered the possible effect of non-audit services on the auditor's independence. Fees for the annual audit were $53,000 and all other fees were $26,500. No fees were paid to the independent auditors for financial information systems design and implementation services.

The Committee discussed and reviewed with the Company's internal and independent auditors all matters required by generally accepted auditing standards, including those described in Statement on Auditing Standards No. 61, as amended, "Communications with Audit Committees," and, with and without management present, discussed and reviewed the results of their examinations, their evaluations of the Company's internal controls, and the overall quality of the Company's financial reporting. The Committee also reviewed the Company's compliance program. The Committee held one meeting during the year.

In reliance on the reviews and discussions referred to above, the Committee recommended to the Board of Directors that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2001 filed with the Securities and Exchange Commission.

18

EXECUTIVE COMPENSATION

Summary of Cash and Certain Other Compensation of Executive Officers. The following table sets forth certain summary compensation information for the fiscal year ended December 31, 2001, for services rendered by each person who served as chief executive officer of the Company at any time during 2001 and for each executive officer of the Company who received more than $100,000 in salary and bonus in 2001 (the "Named Executive Officers").

| |

| | Annual Compensation

| |

| | Long-Term

Compensation Awards

| |

|---|

Name and

Principal Position

| | Fiscal

Year

| | Salary($)

| | Annual

Compensation

Bonus($)

| | Other Annual

Compensation

| | Restricted

Stock

Awards($)

| | Options(#)

| |

|---|

James M. Hussey,

Chief Executive Officer

and President(1) | | 2001

2000

1999 | | $

| 297,000

278,700

254,700 | | $

| 148,500

400,000

100,000 | | $

| 9,000

9,000

82,900 | | $

| 0

0

0 | | 110,000(7

77,000(8

154,000(9 | )

)

) |

Jeffrey W. Sherman, M.D.,

Chief Medical Officer and Executive Vice

President(2) |

|

2001

2000

1999 |

|

$

|

225,000

64,904

0 |

|

$

|

90,000

16,875

0 |

|

$

|

3,600

900

0 |

|

$

|

0

0

0 |

|

77,000(7

143,000(10

0 |

)

)

|

Lewis C. Strauss, M.D.,

V.P.—Clinical Development(3) |

|

2001

2000

1999 |

|

$

|

182,013

177,300

160,500 |

|

$

|

54,600

0

42,500 |

|

$

|

4,800

36,800

20,000 |

|

$

|

0

66,500

31,500 |

|

0

22,000(8

88,000(9 |

)

) |

Imran Ahmad, Ph.D.,

Chief Scientific Officer and

Senior V.P.—Research and Development(4) |

|

2001

2000

1999 |

|

$

|

150,000

57,700

0 |

|

$

|

45,000

15,000

0 |

|

$

|

13,614

61,900

0 |

|

$

|

0

0

0 |

|

38,500(7

55,000(11

0 |

)

)

|

Lawrence A. Kenyon,

Chief Financial Officer

and Secretary(5) |

|

2001

2000

1999 |

|

$

|

125,000

38,862

0 |

|

$

|

37,500

12,500

0 |

|

$

|

3,600

900

0 |

|

$

|

0

0

0 |

|

27,500(7

33,000(12

0 |

)

)

|

Kirk Rosemark,

V.P.—Regulatory Affairs(6) |

|

2001

2000

1999 |

|

$

|

109,792

0

0 |

|

$

|

41,000

0

0 |

|

$

|

0

0

0 |

|

$

|

0

0

0 |

|

22,000(13

0

0 |

)

|

- (1)

- Mr. Hussey joined the Company as President and CEO in March 1998.

- (2)

- Dr. Sherman joined the Company in September 2000.

- (3)

- Dr. Strauss joined the Company in April 1998.

- (4)

- Dr. Ahmad joined the Company in June 2000 as Director of Research and Development.

- (5)

- Mr. Kenyon joined the Company in September 2000.

- (6)

- Mr. Rosemark joined the Company in April 2001.

- (7)

- The stock options became exercisable for 25% of the covered shares on February 2, 2002 and become exercisable with respect to an additional 25% on each anniversary of such date.

- (8)

- The stock options became exercisable for 25% of the covered shares on January 3, 2001 and become exercisable with respect to an additional 25% on each anniversary of such date.

- (9)

- The stock options became exercisable for 25% of the covered shares on January 4, 2000 and become exercisable with respect to an additional 25% on each anniversary of such date.

19

- (10)

- The stock options became exercisable for 25% of the covered shares on August 25, 2001 and become exercisable with respect to an additional 25% on each anniversary of such date.

- (11)

- 33,000 stock options were granted on June 16, 2000. These options become exercisable for 25% of the covered shares on June 16, 2001 and will become exercisable with respect to an additional 7,750 shares on each anniversary of such date. The remaining 22,000 stock options were granted on October 31, 2000 and became exercisable for 25% of the covered shares on October 31, 2001 and will become exercisable with respect to an additional 5,500 shares on each anniversary of such date.

- (12)

- The stock options became exercisable for 25% of the covered shares on August 21, 2001 and will become exercisable with respect to an additional 25% on each anniversary of such date.

- (13)

- The stock options became exercisable for 25% of the covered shares on March 10, 2002 and will become exercisable with respect to an additional 25% on each anniversary of such date.

Option Grants in Last Fiscal Year

The following table sets forth information with respect to grants of options to purchase Common Stock granted to the Named Executive Officers during the fiscal year ended December 31, 2001:

Individual Grants

| |

| | % of Total

Options

Granted

to Employees

in Fiscal

Year

| |

| |

| |

| |

|

|---|

| |

| |

| |

| | Potential Realizable Value as

Assumed Annual Rates of Stock Price Appreciation for Option Term

|

|---|

Name

| | Granted

Options(#)

| | Exercise

Price

Per Share

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| James M. Hussey | | 110,000 | | 20.8% | | $ | 26.25 | | 2/02/2011 | | $ | 1,815,933 | | $ | 4,601,933 |

| Jeffrey W. Sherman | | 77,000 | | 14.5% | | $ | 26.25 | | 2/02/2011 | | $ | 1,271,153 | | $ | 3,221,352 |

| Imran Ahmad | | 38,500 | | 7.3% | | $ | 26.25 | | 2/02/2011 | | $ | 635,577 | | $ | 1,610,676 |

| Lawrence A. Kenyon | | 27,500 | | 5.2% | | $ | 26.25 | | 2/02/2011 | | $ | 453,983 | | $ | 1,150,483 |

| Kirk Rosemark | | 22,000 | | 4.2% | | $ | 16.59 | | 3/10/2011 | | $ | 229,547 | | $ | 581,716 |

20

Aggregated Option Exercises in Last Fiscal

Year, and Fiscal Year-End Option Values

The following table sets forth information with respect to stock options exercised during the fiscal year ended December 31, 2001, and the value at December 31, 2001, of unexercised stock options held by the Named Executive Officers:

Individual Grants

Name

| | Shares Acquired

on Exercise

#

| | Value

Realized

$

| | Number of Unexercised Options at Fiscal Year-End

Exercisable/Unexercisable #

| | Value of Unexercised Options In-the-Money at Fiscal Year-End

Exercisable/Unexercisable $*

|

|---|

| James M. Hussey | | 100,000 | | $ | 967,138 | | 316,250/354,750 | | $ | 5,763,470/$6,448,207 |

| Jeffrey W. Sherman | | 0 | | $ | 0 | | 35,750/184,250 | | $ | 107,412/$322,238 |

| Lewis C. Strauss | | 0 | | $ | 0 | | 66,000/66,000 | | $ | 1,014,238/$836,113 |

| Imran Ahmad | | 0 | | $ | 0 | | 13,750/74,750 | | $ | 79,162/$237,488 |

| Lawrence A. Kenyon | | 0 | | $ | 0 | | 8,250/52,250 | | $ | 60,412/$181,238 |

| Kirk Rosemark | | 0 | | $ | 0 | | 0/22,000 | | $ | 0/$186,100 |

- *

- Represents the fair market value at December 31, 2001 of the Common Stock underlying the options minus the exercise price.

Employment and Other Agreements

Mr. James M. Hussey entered into an employment agreement (the "Agreement") with the Company as of March 16, 1998, pursuant to which Mr. Hussey agreed to serve as President and Chief Executive Officer of the Company. The Agreement is in effect until terminated by either party in accordance with its terms. In addition to a base salary, which is reviewed annually by the Compensation Committee of the Board and which has been increased during the term of Mr. Hussey's employment from $250,000 in 1998 to $297,000 in 2001, Mr. Hussey is also eligible for a bonus based on the Company's performance in the prior year, as well as options under the Company's stock option plan. Upon execution of his employment agreement, Mr. Hussey received 400,000 options and has subsequently received additionally stock options. The Agreement contains provisions requiring Mr. Hussey to refrain from disclosing any confidential information during his employment and for a period of twelve months thereafter.

Compensation Committee Report

The Compensation Committee of the Board of Directors, consisting of directors Sander A. Flaum, Erick E. Hanson, Matthew P. Rogan and Kaveh T. Safavi, none of whom is an employee of the Company, annually reviews and makes recommendations to the Board of Directors regarding executive compensation. It is the philosophy of the Committee that the total executive compensation package should align the financial interests of the Company's executives with the short-term and long-term goals of the Company and consequently enhance stockholder value. The key elements of the Company's current compensation program include a base salary, an annual bonus and equity participation through a long term incentive plan.

Base Salary. As an emerging cancer research company, with 72 full time employees, it is difficult to compare salaries to any particular peer group. Rather, the Committee takes into consideration the responsibilities, experience level, individual performance levels and amount of time devoted to the

21

Company's needs. Salaries are reviewed annually by the Committee based on the foregoing criteria and are adjusted, if warranted, by the Committee.

Annual Bonus. The Committee recommends to the Board the amount of bonus awards, including who should receive them, based upon its evaluations. The awards are intended to reward excellent individual and team performance in the achievement of the Company's financial and operational goals. The Board of Directors reviews the Committee's bonus recommendations and makes its bonus determinations based on the Committee's report. Bonuses (exclusive of restrictive stock awards) paid to employees for the fiscal year 2001 amounted to 29% of base salary.

Long-term Incentives. The Company adopted the 1998 Equity Incentive Plan in July 1998. The purpose of this plan is to create an opportunity for employees, including executive officers, directors and consultants to the Company, to share in the enhancement of stockholder value. As with annual bonus payments, the Compensation Committee annually recommends to the Board the grant of incentive awards based upon its evaluation of individual contributions towards the Company's past and future success. After reviewing the recommendation of the Committee, including the executive's individual performance and level of responsibility together with the Company's achievement with respect to profitability and growth, the Board grants incentive awards. In 2001 the Committee made recommendations for the issuance of 526,850 stock options.

22

SECURITY OWNERSHIP

Except as otherwise noted, the following table sets forth certain information regarding beneficial ownership of shares of the Common Stock as of April 8, 2002 by (i) all those known by the Company to be beneficial owners of more than 5% of its outstanding Common Stock, (ii) each director of the Company and each nominee for director, (iii) each of the Named Executive Officers and (iv) all executives, directors and nominees for director as a group. Unless otherwise noted, each person's address is in care of NeoPharm, Inc., 150 Field Drive, Suite 195, Lake Forest, Illinois 60045.

Name

| | Amount and Nature of

Beneficial Ownership

| | Percent of

Class(1)

| |

|---|

| John N. Kapoor, Ph.D. | | 4,396,048 | (2) | 27.00 | % |

| John N. Kapoor 1994-A Annuity Trust | | 1,703,543 | (3) | 10.48 | |

| Kern Capital Management LLC. | | 1,147,440 | (4) | 7.06 | |

| Gilder, Gagnon, Howe & Co. LLC. | | 1,020,653 | (5) | 6.28 | |

| EJ Financial/NEO Management, L.P. | | 995,293 | (6) | 6.12 | |

| James M. Hussey | | 523,930 | (7) | 3.13 | |

| Lewis Strauss, M.D. | | 116,729 | (8) | * | |

| Jeffrey W. Sherman, M.D. | | 55,000 | (9) | * | |

| Sander A. Flaum | | 26,950 | (10) | * | |

| Imran Ahmad, Ph.D. | | 23,375 | (11) | * | |

| Erick E. Hanson | | 21,250 | (12) | * | |

| Lawrence A. Kenyon | | 15,125 | (13) | * | |

| Matthew P. Rogan, M.D. | | 13,750 | (14) | * | |

| Kaveh T. Safavi, M.D. | | 13,750 | (14) | * | |

| Kirk Rosemark | | 5,500 | (15) | * | |

| All officers and directors as a group (11 persons) | | 5,211,407 | | 30.55 | % |

- *

- Indicates ownership of less than 1%.

- (1)

- Based on 16,252,529 shares of Common Stock outstanding as of April 8, 2002, plus 805,000 shares subject to options that are considered to be beneficially owned by the persons listed. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission (the "Commission") and generally includes voting or investment power with respect to securities. Shares of Common Stock subject to options or warrants exercisable or convertible within 60 days are deemed outstanding for computing the percentage of the person or group holding such options or warrants.

- (2)

- Includes 27,500 shares that may be acquired pursuant to vested options, 997,779 shares held by the John N. Kapoor Trust, dated 9/20/89 (the "JNK Trust"), of which Dr. Kapoor is the sole trustee and sole beneficiary and 995,293 shares held by EJ Financial/NEO Management, L.P. (the "Limited Partnership") of which John N. Kapoor is Managing General Partner. The amount shown also includes: 330,000 shares which are held by the John N. Kapoor Charitable Trust (the "Charitable Trust"), of which Dr. Kapoor and his spouse are co-trustees; 1,703,544 shares of common stock which are owned by the John N. Kapoor 1994-A Annuity Trust (the "Annuity Trust") of which the sole trustee is Editha Kapoor, Dr. Kapoor's spouse; and 341,932 shares which are owned by four trusts which have been established for Dr. Kapoor's children (the "Children's Trusts") of which the sole trustee is Editha Kapoor. Dr. Kapoor does not have or share voting, investment or dispositive power with respect to the shares owned by the Annuity Trust or the Children's Trusts and Dr. Kapoor disclaims beneficial ownership of these shares as well as the shares held by the Charitable Trust.

23

- (3)

- The sole trustee of the John N. Kapoor 1994-A Annuity Trust (the "Annuity Trust") is Editha Kapoor, Dr. Kapoor's spouse, who also serves as trustee for four trusts which have been established for their children (the "Children's' Trusts") and which collectively own 341,932 shares and as co-trustee with Dr. Kapoor of the John N. Kapoor Charitable Trust. The shares held by the Children's' Trusts and the Charitable Trust are not included in the reported shares.

- (4)

- The address for Kern Capital Management LLC is 114 West 47th Street, Suite 1926, New York, NY 10036. Ownership is as reported by the holder on February 14, 2002.

- (5)

- The address for Gilder, Gagnon, Howe & Co. LLC is 1775 Broadway, 26th Floor, New York, NY 10019. Ownership is as reported by the holder on February 11, 2002.

- (6)

- The Managing Partner of EJ Financial/Neo Management, L.P. is John N. Kapoor and its address is 225 East Deerpath, Suite 250, Lake Forest, Illinois 60045.

- (7)

- Includes 511,500 shares that may be acquired pursuant to options exercisable as of April 19, 2002 or that will become exercisable within 60 days of April 19, 2002.

- (8)

- Includes 99,000 shares that may be acquired pursuant to options exercisable as of April 19, 2002 or that will become exercisable within 60 days of April 19, 2002.

- (9)

- Includes 55,000 shares that may be acquired pursuant to options exercisable as of April 19, 2002 or that will become exercisable within 60 days of April 19, 2002.

- (10)

- Includes 19,250 shares that may be acquired pursuant to options exercisable as of April 19, 2002 or that will become exercisable within 60 days of April 19, 2002.

- (11)

- Includes 23,375 shares that may be acquired pursuant to options exercisable as of April 19, 2002 or that will become exercisable within 60 days of April 19, 2002.

- (12)

- Includes 21,250 shares that may be acquired pursuant to options exercisable as of April 19, 2002 or that will become exercisable within 60 days of April 19, 2002.

- (13)

- Includes 15,125 shares that may be acquired pursuant to options exercisable as of April 19, 2002 or that will become exercisable within 60 days of April 19, 2002.

- (14)

- Includes 13,750 shares that may be acquired pursuant to options exercisable as of April 19, 2002 or that will become exercisable within 60 days of April 19, 2002.

- (15)

- Includes 5,500 shares that may be acquired pursuant to options exercisable as of April 19, 2002 or that will become exercisable within 60 days of April 19, 2002.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In 1994, the Company entered into a Consulting Agreement with EJ Financial Enterprises, Inc. ("EJ Financial"). The Consulting Agreement provides that the Company will pay EJ Financial $125,000 per year (paid quarterly) for certain management consulting services. Dr. John Kapoor, the Company's Chairman of the Board, is the president and a director of EJ Financial. These charges reflect the management consulting services provided by EJ Financial to NeoPharm. Unless terminated by the parties, the management services agreement with EJ Financial automatically renews in June of each year for a one-year term.

In March 2000, the Company entered into a Consulting Agreement with Unicorn Pharma Consulting, Inc. ("Unicorn"). Under the terms of the consulting Agreement, Unicorn was paid $5,000 per week for its services, plus reimbursement of expenses. During the year ended December 31, 2000, the Company paid Unicorn a total of $90,000. Dr. Matthew P. Rogan, a member of the Board of Directors, is the President and a principal shareholder of Unicorn. The Consulting Agreement with Unicorn was terminated by mutual agreement of the parties on October 1, 2000, and the parties

24

entered into a new consulting agreement in November 2001. Under the new consulting agreement, the Company paid Unicorn approximately $35,283 in 2001. Unicorn is paid $300.00 per hour for services performed under the agreement.

In December 2001, following approval by the Company's Board of Directors, the Company loaned $3,250,000 to Akorn, Inc., an independent publicly traded company, to assist Akorn in the completion of its manufacturing facility in Decatur, Illinois. The note receivable issued to Akorn is due in December 2006, and accrues interest at a rate equal to that received on the Company's investments in marketable securities, which is lower than the rate paid by Akorn on its other outstanding debt. In exchange, the Company has entered into a manufacturing processing agreement that grants the Company access to at least 15% of the annual lyophilization manufacturing capacity at Akorn at a discounted price, upon completion of the facility. Dr. Kapoor, the Company's Chairman, is also Chairman and Chief Executive Officer of Akorn, and holds a substantial stock position in both companies. Because of his role in both companies, Dr. Kapoor refrained from participating in the deliberations by the Company's Board of Directors.

In connection with the Company's initial public offering, the Company adopted a policy whereby any transactions between the Company and its officers, directors, principal stockholders and any affiliates of the foregoing persons will be on terms no less favorable to the Company than could reasonably be obtained in arm's length transactions with independent third parties, and that any such transactions also be approved by a majority of the Company's disinterested outside directors.

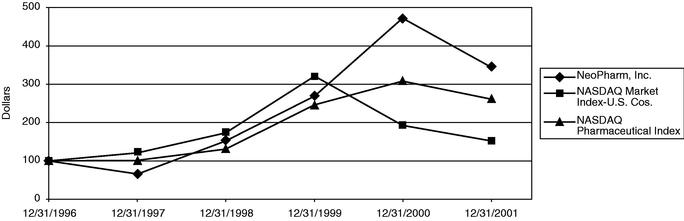

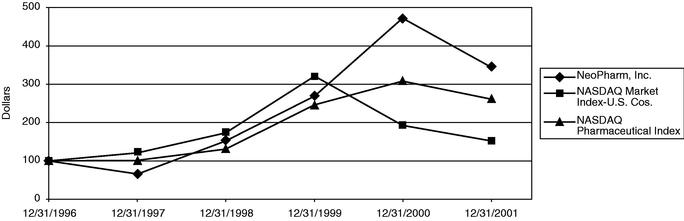

STOCK PERFORMANCE GRAPH

The following graph compares the percentage change in cumulative total stockholder return on the Company's Common Stock with the cumulative return on the NASDAQ Stock Market Index and the NASDAQ Pharmaceutical Stock Index during the period beginning December 31, 1996 through December 31, 2001. The price of the Common Stock as reflected in the graph has been adjusted to reflect the 10% stock dividend paid in December 2001. The comparison assumes that $100 was invested on December 31, 1996 in the Company's Common Stock and in the foregoing indices and assumes the reinvestment of dividends. From December 1996 to April 2000 the Company's common stock traded on the American Stock Exchange under the symbol NEO. In April 2000, the Company's common stock began trading on the Nasdaq National Market under the symbol NEOL. On April 19, 2002 the Company's common stock closed at $XX.XX per share.

NeoPharm, Inc.

Stock Performance Graph

Performance Information

| | 12/31/96

| | 12/31/97

| | 12/31/98

| | 12/31/99

| | 12/31/00

| | 12/31/01

|

|---|

| NeoPharm, Inc. | | 100 | | 66 | | 152 | | 270 | | 473 | | 344 |

NASDAQ Market

Index-U.S. Cos. | | 100 | | 122 | | 173 | | 321 | | 193 | | 153 |

NASDAQ

Pharmaceutical Index | | 100 | | 103 | | 131 | | 247 | | 308 | | 262 |

25

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING

Section 16(a) of the Securities Exchange Act of 1934 requires the Company's directors and executive officers, and persons who own more than 10% of a registered class of the Company's equity security, to file with the Securities and Exchange Commission and the applicable stock exchanges reports of ownership and changes in ownership of common stock and other equity securities of the Company. Officers, directors and greater than 10% shareholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on a review of the copies of such reports furnished to the Company or written representations that no other reports were required, the Company believes that, during the 2001 fiscal year, all filing requirements applicable to its officers, directors and greater than 10% beneficial owners were complied with.

RELATIONSHIP WITH INDEPENDENT AUDITORS

The firm of Arthur Andersen LLP was the Company's independent public accountant for the 2001 fiscal year. A representative from the Company's independent public accountants customarily attends the Annual Meeting and has the opportunity to make a statement if he so desires. This representative also is available to respond to appropriate questions. The Company has not yet selected its independent public accountants for the 2002 fiscal year.

OTHER MATTERS

The only matters which management intends to present to the meeting are set forth in the Notice of Annual Meeting. Management knows of no other matters which will be brought before the meeting by any other person. However, if any other matters are properly brought before the meeting, the persons named on the enclosed form of proxy intend to vote on such matters in accordance with their best judgment on such matters.

SHAREHOLDER PROPOSALS AND OTHER MATTERS FOR THE 2003 ANNUAL MEETING

Proposals of stockholders intended to be presented at the next Annual Meeting of Stockholders to be held in 2003 must be received by the Company on or before December 27, 2002 for inclusion in the Company's Proxy Statement and form of proxy relating to that Annual Meeting.

In order for a stockholder to bring other business before a stockholder meeting, timely notice must be received by the Company not less than 45 days before the date on which the Company mailed its Proxy Statement for the prior year's Annual Meeting of Stockholders (but if the Annual Meeting is called for a date that is not within 30 days of the anniversary date, then the notice must be received within a reasonable time before the Company mails its Proxy materials for the then current year). For the 2003 Annual Meeting the notice date would be March 12, 2003. The notice must include a description of the proposed business, the reasons therefor, and other specified matters. These requirements are separate from and in addition to the requirements a shareholder must meet to have a proposal included in the Company's Proxy Statement. These time limits also apply in determining whether notice is timely for purposes of rules adopted by the Securities and Exchange Commission relating to the exercise of discretionary voting authority by the Company.

2001 ANNUAL REPORT ON FORM 10-K

A copy of the Company's 2001 Annual Report on Form 10-K (the "Form 10-K") accompanies this Proxy Statement as part of the Company's Annual Report. Additional copies of the Form 10-K are available to stockholders without charge on request made in writing to the following address: NeoPharm, Inc., 150 Field Drive, Suite 195, Lake Forest, Illinois 60045.

April 26, 2002

26

APPENDIX A

1998 EQUITY INCENTIVE PLAN

Introduction. NeoPharm, Inc., a Delaware corporation (the "Company"), hereby establishes the NeoPharm 1998 Equity Incentive Plan (the "Plan"), effective on the Effective Date (as defined below).

1. Purpose.

The purpose of the Plan is to advance the interest of the Company by encouraging and enabling the acquisition of a larger personal financial interest in the Company by those employees and consultants upon whose judgment and efforts the Company is largely dependent on the successful conduct of its operations. An additional purpose of the Plan is to provide a means by which employees and consultants of the Company and its Subsidiaries can acquire and maintain Stock ownership, thereby strengthening their commitment to the success of the Company and their desire to remain associated with the Company and its Subsidiaries. It is anticipated that the acquisition of such financial interest and Stock ownership will stimulate the efforts of such employees and consultants on behalf of the Company, strengthen their desire to continue in the service of the Company and encourage shareholder and entrepreneurial perspectives through Stock ownership.

2. Definitions.