QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12 |

NEOPHARM, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Dear Shareholders:

On behalf of the Board of Directors, I invite you to attend the Annual Meeting of Stockholders of NeoPharm, Inc. to be held on June 5, 2003 at 10:00 a.m. local time, at the NeoPharm, Inc. Research and Development Facility, 1850 Lakeside Drive, Waukegan, Illinois.

In the materials accompanying this letter, you will find a Notice of the Meeting, a Proxy Statement relating to the proposals you will be asked to consider and vote upon at the Annual Meeting, and a Proxy Card. The Proxy Statement includes general information regarding NeoPharm as well as additional information relating to the specific proposals to be presented at the Annual Meeting. Also enclosed with the proxy materials is a copy of NeoPharm's Annual Report to Stockholders.

The formal business to be conducted at the Annual Meeting is described in the Notice of Meeting that follows this letter. In addition, at the Annual Meeting management will review the Company's progress in 2002, discuss expectations for the future and be available to answer your questions both during and after the Annual Meeting.

Your vote on the matters that are to come before the Annual Meeting is important. I urge all stockholders to execute and return their proxies promptly. Returning your proxy will not prevent you from voting in person, but will assure that your vote is counted if you are unable to attend the Annual Meeting.

| | Sincerely, |

|

|

| | James M. Hussey

Chief Executive Officer and President |

| April 28, 2003 | |

NeoPharm, Inc.

150 Field Drive

Suite 195

Lake Forest, Illinois 60045

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held June 5, 2003

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of NeoPharm, Inc., a Delaware corporation, will be held at the NeoPharm, Inc. Research and Development Facility, located at 1850 Lakeside Drive, Waukegan, Illinois on June 5, 2003, at 10:00 a.m., local time, for the following purposes:

- 1.

- To elect six directors to serve until the 2004 Annual Meeting of Stockholders.

- 2.

- To transact such other business as may properly come before the meeting.

Only stockholders of record on April 17, 2003 will be entitled to notice of and to vote at the Annual Meeting.

To assure that your interests will be represented, whether or not you plan to attend the Annual Meeting, you are urged to sign and date the enclosed proxy card and promptly return it in the pre-addressed envelope provided, which requires no postage if mailed in the United States. The enclosed proxy is revocable and will not affect your right to vote in person if you attend the Annual Meeting.

| | By Order of the Board of Directors, |

|

|

|

LAWRENCE A. KENYON

Secretary |

Lake Forest, Illinois

April 28, 2003 |

|

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

To Be Held June 5, 2003

GENERAL INFORMATION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of NeoPharm, Inc., a Delaware corporation (the "Company"), to be used at the Annual Meeting of Stockholders of the Company (the "Annual Meeting") to be held at the NeoPharm, Inc. Research and Development Facility, located at 1850 Lakeside Drive, Waukegan, Illinois on June 5, 2003 at 10:00 a.m., local time, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders and in this Proxy Statement. This Proxy Statement and the enclosed form of proxy were first sent or given to stockholders on or about April 28, 2003.

Only stockholders of record at the close of business on April 17, 2003 (the "Record Date") will be entitled to vote at the Annual Meeting or any adjournment thereof. As of the close of business on the Record Date, there were 16,371,529 shares of the Company's common stock, par value $.0002145 per share ("Common Stock"), outstanding.

The presence, either in person or by properly executed proxy, of the holders of a majority of the outstanding shares of Common Stock is necessary to constitute a quorum at the Annual Meeting. In the election of directors, each stockholder is entitled to cast one vote for each director to be elected for each share of stock held; cumulative voting is not permitted. For all matters except the election of directors, each stockholder is entitled to cast one vote for each share of stock held. Directors are elected by a plurality of the votes cast by the holders of shares of Common Stock at a meeting at which a quorum is present. In all other matters other than the election of directors, the affirmative vote of a majority of the outstanding shares of Common Stock present in person or represented by proxy at the Annual Meeting is required for the adoption of such matters. Abstentions and broker non-votes are counted for purposes of determining the presence or absence of a quorum for the transaction of business. Abstentions and broker non-votes are not counted for purposes of determining whether a proposal presented to stockholders has been approved.

A proxy may be revoked at any time before it is exercised by giving a written notice to the Secretary of the Company bearing a later date than the proxy, by submitting a later dated proxy or by voting the shares represented by the proxy in person at the Annual Meeting. Unless revoked, the shares represented by each duly executed, timely delivered proxy will be voted in accordance with the specifications made. If no specifications are made, such shares will be votedFOR Proposal 1 (election of directors), as proposed in this Proxy Statement. The Board of Directors does not intend to present any other matters at the Annual Meeting. However, should any other matters properly come before the Annual Meeting, it is the intention of the proxy holders to vote the proxy in accordance with their best judgment.

The expenses of soliciting proxies will be paid by the Company. In addition to solicitation by mail, officers, directors and employees of the Company, who will receive no extra compensation therefor, may solicit proxies personally or by telephone, telecopy or telegram. The Company will reimburse brokerage houses, custodians, nominees and fiduciaries for their expenses in mailing proxy materials to principals.

PROPOSAL ONE

ELECTION OF DIRECTORS

Six directors, constituting the entire Board of Directors, are to be elected at the Annual Meeting. Each director will hold office until the 2004 Annual Meeting of Stockholders and until his successor has been elected and qualified. The nominees named below have been selected by the Board of Directors of the Company. The Board believes that all of its present nominees will be available for election at the Annual Meeting and will serve if elected. If, due to circumstances not now foreseen, any of the nominees named below will not be available for election, the proxies will be voted for such other person or persons as the Board of Directors may select.

There follows information as to each individual nominated for election as a director at the Annual Meeting, including his age, present principal occupation, other business experience, directorships of other publicly-held companies and period of service as a director of the Company.

The persons named in the accompanying form of proxy will vote FOR the election of the nominees unless stockholders specify otherwise in their proxies.

Nominees for Director. The following information has been provided by the respective nominees for election to the Board of Directors.

Name

| | Age

| | Principal Occupation

|

|---|

| James M. Hussey, R.Ph., MBA | | 44 | | Mr. Hussey joined the Company as President, Chief Executive Officer and Director in 1998. Prior to joining the Company, Mr. Hussey formed his own company in 1994, Physicians Quality Care, Inc., a managed care organization, where he served as Chief Executive Officer until that company's sale in 1998. Previous to that, Mr. Hussey held several positions with Bristol Myers Squibb, a diversified pharmaceutical manufacturer, from 1986 to 1994, most recently as the General Manager Midwest Integrated Regional Business Unit. Mr. Hussey presently serves as a director of Option Care, Inc., a provider of home health care services. |

John N. Kapoor, Ph.D. |

|

59 |

|

Dr. Kapoor has been a Director and Chairman of the Board of the Company since its formation in 1990. Dr. Kapoor is the sole shareholder and President of EJ Financial Enterprises, Inc., a health care consulting and investment company. In addition, Dr. Kapoor serves as a director and Chairman of each of Option Care, Inc., a provider of home health care services, Akorn, Inc., a manufacturer, distributor and marketer of generic ophthalmic products and Introgen Therapeutics, Inc., a gene therapy company, and is a director of First Horizon Pharmaceutical Corporation, a distributor of pharmaceuticals. |

2

| Sander A. Flaum | | 66 | | Mr. Flaum joined the Company as a Director in 1998. Mr. Flaum is Chairman of RSCG Life, a healthcare advertising, marketing and communications company and a member of the Euro RSCG Healthcare Global Network, of which he is Co-Chairman. Mr. Flaum is also Adjunct Professor of Management at the Fordham University Graduate School of Business. From 1991 through 2002, Mr. Flaum served as CEO of Robert A. Becker EURO/RSCG, a predecessor to Euro RSCG Life. Mr. Flaum also serves on the boards of Atrix Laboratories, Inc., Fisher College of Business at The Ohio State University, Fordham University Graduate School of Business and The Conference Board. |

Erick E. Hanson |

|

56 |

|

Mr. Hanson joined the Company as a Director in 1997. Since 1998, Mr. Hanson has served as the President of Hanson and Associates, a consulting firm working with venture capital companies. From 1995 to 1998, Mr. Hanson served as President and CEO of Option Care, Inc., a provider of home health care services. Prior to joining Option Care, Mr. Hanson held a variety of executive positions with Caremark, Inc., including Vice President Sales and Marketing. Mr. Hanson served as President and Chief Operating Officer of Clinical Partners Inc. in Boston, MA from 1989 to 1991. Mr. Hanson presently serves on the board of directors of Integrity Healthcare, Inc., a privately held home healthcare provider. |

Matthew P. Rogan, M.D. |

|

57 |

|

Dr. Rogan joined the Company as a Director in 2000. Dr. Rogan is President and CEO of Unicorn Pharma Consulting, Inc., a privately held provider of customized pharmaceutical and biotechnology medical services. From 1997 to 1999, Dr. Rogan was Vice President, Medical Affairs for Sanofi Pharmaceuticals in the United States. Prior to joining Sanofi, Dr. Rogan served as Senior Medical Director, Medical Affairs for Zeneca Pharmaceuticals from 1996 to 1997, and was Director of Clinical Support at Burroughs Wellcome from 1993 to 1995. Prior to 1993, Dr. Rogan held senior positions with Bristol Myers Squibb. |

3

| Kaveh T. Safavi, M.D., J.D. | | 42 | | Dr. Safavi joined the Company as a Director in 2000. Dr. Safavi is currently Senior Vice President and General Manager of the Clinical Business Unit of Solucient, LLC, a healthcare information and business intelligence company. From 2000 until 2002, Dr. Safavi served as Vice President of Business and Strategic Development for Alexian Brothers of Illinois, Inc., a multi hospital health system in metropolitan Chicago, Illinois. Prior to that, Dr. Safavi served as Vice President, Medical Affairs for UnitedHealthcare of Illinois, Inc., a large managed care organization from 1996 to 1999 and served as President of Health Springs Medical Group of Illinois, a primary care group practice and physician practice management company from 1993 to 1995. |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR"

THE ELECTION OF ALL NOMINEES FOR DIRECTOR.

INFORMATION ABOUT THE BOARD OF DIRECTORS AND ITS COMMITTEES

Meetings

The Board of Directors held five meetings in 2002. During 2002, each of the directors participated in at least 75% of the total number of such meetings of the Board and meetings of committees of the Board on which he served.

Committees

The Board of Directors has established a Compensation Committee, an Audit Committee and a Corporate Governance Committee. The Company's bylaws provide that each such committee shall have one or more members, who serve at the pleasure of the Board of Directors.

Compensation Committee. The Compensation Committee is responsible for overseeing the Company's incentive compensation and benefit plans and for reviewing and making recommendations to the Board of Directors with respect to the administration of the salaries, incentives and other compensation of directors, officers, and other employees of the Company, including the terms and conditions of their employment and other compensation matters. The Compensation Committee currently consists of Messrs. Flaum, Hanson, Rogan and Safavi. During fiscal 2002, the Compensation Committee met once.

Audit Committee. The Audit Committee currently consists of Messrs. Hanson, Rogan and Safavi, all of whom are considered to be "independent" as defined by the current Nasdaq Stock Market listing requirements. The Audit Committee is responsible for (i) overseeing the scope of audits conducted by the Company's independent public accountants, (ii) overseeing the accounting methods and the system of internal control used by the Company, (iii) the hiring, firing and compensation of the Company's independent auditors, as well as for monitoring the independence and performance of the auditors, (iv) approval, in advance, of all audit services and permissible non-audit services to be performed by the Company's independent auditors, and (v) such other responsibilities as may be assigned by the Board of Directors or be required by law. During fiscal 2002, the Audit Committee held three meetings. The Board of Directors adopted an Audit Committee Charter on June 8, 2000.

4

Corporate Governance Committee. The Corporate Governance Committee consists of Messrs. Flaum, Hanson, Rogan and Safavi, being all of the Company's "independent" directors, as defined above. The Corporate Governance Committee is responsible for nominating individuals to serve on the Board of Directors and the various committees, for developing and recommending corporate governance guidelines applicable to the Company, including, but not limited to, policies relating to ethics and conflicts of interest, and for overseeing the Board's annual performance review. The Board of Directors adopted a Corporate Governance Committee Charter on April 25, 2003.

The Corporate Governance Committee will consider director nominations which are submitted by stockholders. Recommendations for the Company's annual meeting of stockholders to be held in 2004 must be submitted in writing addressed to: Corporate Secretary, NeoPharm, Inc., 150 Field Drive, Suite 195, Lake Forest, Illinois 60045. Such recommendations must include the name, address and principal business occupation of the candidate for the last five years and must be received by the Corporate Secretary no later than March 14, 2004.

Other Relationships

In 2002, the Company had consulting relationships with Unicorn Pharma Consulting, Inc. of which Dr. Rogan, a member of the Board and of the Compensation, Corporate Governance and Audit Committees, is the President and a principal stockholder, and with EJ Financial Enterprises, Inc., of which Dr. Kapoor, a director and Chairman of the Company, is the President and sole stockholder. See "CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS" for additional information.

Compensation of Directors

Non-employee directors ("Outside Directors"), other than Dr. Kapoor, are paid a quarterly fee of $7,500. Directors are reimbursed for reasonable out-of-pocket expenses incurred in connection with attendance at any Board or Committee meetings.

Outside Directors, other than Dr. Kapoor, are eligible to receive grants of restricted stock. Each Outside Director is granted restricted shares of the Company's common stock with an approximate value of $50,000 annually. The shares are not available for sale until the one year anniversary of the stock grant. Currently four Outside Directors are eligible to participate in this program.

Report of the Audit Committee

The Audit Committee of the Board of Directors is responsible for assisting the Board of Directors in its general oversight of the Company's financial reporting, its system of internal control and the independence and performance of its independent auditors. The Audit Committee is composed of three non-employee directors and operates under a written charter adopted and approved by the Board of Directors. The Board of Directors, in its business judgment, has determined that each Audit Committee member is "independent" as such term is defined by the current listing standards of the Nasdaq Stock Market.

The Company's management is responsible for the preparation, presentation and integrity of the Company's financial statements, the Company's accounting and financial reporting process, including the system of internal control, and procedures to assure compliance with applicable accounting standards and applicable laws and regulations. The Company's independent auditors are responsible for auditing those financial statements and expressing an opinion as to their conformity with generally accepted accounting principles. It is the Audit Committee's responsibility, on behalf of the Board of Directors, to provide independent oversight and review of the actions of management and the independent auditors. The Audit Committee members, however, are not professional accountants or auditors, and their functions are not intended to duplicate or certify the activities of management and the independent auditors.

The Audit Committee relies, without independent verification, on the information provided to it and on the representations made by management that the financial statements have been properly prepared in

5

conformity with accounting principles generally accepted in the United States and on the report of the Company's independent auditors on the Company's financial statements. Accordingly, although the Audit Committee members consult with and discuss these matters and their questions and concerns with management and the independent auditors, such oversight cannot assure that management has maintained appropriate accounting and financial reporting principles or appropriate internal control and procedures consistent with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee's considerations and discussions with management and the independent auditors cannot assure that the audit of the Company's financial statements has been carried out in accordance with generally accepted auditing standards, that the financial statements are presented in accordance with generally accepted accounting principles or that the Company's auditors are in fact "independent."

During the year ended December 31, 2002, the Audit Committee held three meetings. The meetings were designed, among other things, to facilitate and encourage communication among the Audit Committee, management, and the Company's independent auditors, KPMG LLP. The Audit Committee discussed with the Company's independent auditors, with and without management present, the results of their examination and their evaluations of the Company's internal controls.

�� The Audit Committee has reviewed and discussed the audited financial statements for the year ended December 31, 2002 with management and KPMG LLP.

The Audit Committee also discussed with KPMG LLP matters required to be discussed with audit committees under generally accepted auditing standards, including, among other things, matters related to the conduct of the audit of the Company's financial statements and the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (Communication with Audit Committees) by SASs Nos. 89 and 90. The Audit Committee's discussions also included a discussion of the background and experience of the KPMG LLP personnel assigned to the Company and the quality control procedures established by KPMG LLP.

KPMG LLP also provided to the Audit Committee the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee discussed with the independent auditors their independence from the Company. When considering KPMG LLP's independence, the Audit Committee considered whether their provision of services to the Company beyond those rendered in connection with their audit and review of the Company's financial statements was compatible with maintaining their independence. The Audit Committee also reviewed, among other things, the nature of the non-audit services provided and the amount of fees paid to KPMG LLP for their audit and non-audit services, both separately and in the aggregate.

Based on its review and these meetings, discussions and reports, and subject to the limitations on our role and responsibilities referred to above and in the Audit Committee Charter, the Audit Committee recommended to the Board of Directors that the Company's audited financial statements for the year ended December 31, 2002, be included in the Company's Annual Report on Form 10-K.

Submitted by the Audit Committee of the Board of Directors

| | Kaveh T. Safavi,Chairman,

Erick E. Hanson and

Matthew P. Rogan |

Report of the Compensation Committee

Philosophy and Objectives. The Company's executive compensation program is administered by the Compensation Committee of the Board of Directors, which consists of directors Flaum, Hanson, Rogan and Safavi. The Compensation Committee reviews, analyzes and makes recommendations to the full Board regarding the compensation of the Company's executive officers, evaluates the performance of the

6

Chief Executive Officer ("CEO") and approves and makes recommendations to the full Board on the grant of stock options under the Company's Stock Option Plan.

The Compensation Committee believes that the goal of the compensation program for the Company's executive officers should be to align executive compensation with the Company's business objectives and performance in a manner which emphasizes increasing value for stockholders and allows the Company to reward those executive officers who contribute to the Company's long-term success. Based upon this objective, the Compensation Committee's incentive compensation program is designed to pay base salaries to executives at levels that enable the Company to attract, motivate and retain capable executives. In addition, the Compensation Committee may recommend annual cash bonuses, as well as stock option grants, as a component of compensation and/or as a reward for performance based upon: (i) individual performance, (ii) the Company's operating and financial results and departmental goals, (iii) the actions of the Company's peer group, and (iv) other performance measures. Stock option grants, which are made at the fair market value of the common stock on the grant date, are intended to result in no reward if the stock price does not appreciate, but may provide substantial rewards to executives as stockholders benefit from stock price appreciation.

Components of Compensation. There are three major elements of executive officer compensation: (i) base salary, (ii) annual cash bonus awards, and (iii) equity-based incentive awards in the form of stock option grants. Executive officers also receive other standard benefits, including medical, disability and life insurance and, in certain instances, a car allowance.

The Compensation Committee uses its subjective judgment in determining executive officer compensation levels and takes into account both qualitative and quantitative factors. Among the factors considered by the Compensation Committee are the recommendations of the Company's CEO with respect to the compensation of other key executive officers.

In making compensation decisions, the Compensation Committee considers compensation practices and the financial performance of the Company's peer group. The peer group is comprised of drug delivery and biotech companies that are among those entities which participate in an annual biotechnological survey conducted by Radford Associates in conjunction with Aon Consulting Group (the "Radford Survey"). The 2002 Radford Survey included public and private companies considered to be similar to us or to be our competitors. Specific compensation for individual officers, however, will vary from these levels as a result of subjective factors considered by the Compensation Committee unrelated to compensation practices of comparable companies.

The Compensation Committee uses this information as a guide, and in general does not target total executive compensation or any component thereof to any particular point within, or outside, the range of peer group results.

Base Salary. Each Company executive receives a base salary. The Company targets base pay at the level believed necessary to attract and retain capable executives. In determining salaries, the Compensation Committee also takes into account, among other factors, individual experience and performance and specific needs particular to the Company. In determining base salaries for 2002, the Compensation Committee reviewed the peer group data with the Company's CEO for each executive position. In addition, the Compensation Committee reviewed the responsibility level of each position, together with the executive officer's individual performance for the prior year and objectives for the current year. In addition, the Company's overall performance during the past year was compared to objectives for the prior year and performance targets for the current year. In general, during 2002, the base salaries for our executive officers were adjusted between 5% and 20% depending on performance, with the average salary increase being approximately 13.75%.

Bonus. In addition to base salary, executive officers are eligible to receive an annual cash bonus. Bonuses are determined based upon the achievement of qualitative and quantitative individual, departmental and Company performance, as well as a comparison to comparable positions among peer

7

group companies. For 2002, the cash bonus provided to the Company's executive officers as a percentage of base salary was above the median level for the Company's peer group.

Stock Options. The Compensation Committee believes that it is important for executives to have an equity stake in the Company, and, toward this end, recommends to the full Board stock options grants for key executives from time to time. Stock options represent a valuable portion of the compensation program for the Company's executive officers. The exercise price of stock options is the fair market value of the shares on the date of the grant and generally only provide a benefit if the value of the shares increases. Upon a "Change of Control," as defined in the 1998 Equity Incentive Plan, all options would become vested unless otherwise provided in the Stock Option Award granting such options. In recommending option awards, the Compensation Committee reviews the needs of the Company in obtaining or retaining a particular individual's services, the recommendations of the CEO, the awards granted to other executives within the Company and the individual officer's specific role and contribution to the Company. In 2002, the Compensation Committee recommended grants of options to purchase an aggregate of 896,750 shares of common stock, including options to executive officers to purchase an aggregate of 402,500 shares.

Chief Executive Officer Compensation. Mr. Hussey's initial base salary was established under the terms of his 1998 employment contract. For 2002, Mr. Hussey was paid $326,700 in base salary, which placed him in the 60th percentile of the Radford Survey for the Company's peer group. Under the terms of his employment contract, Mr. Hussey is also eligible to receive a bonus which varies based on his achievement of various performance goals. For 2002, Mr. Hussey's bonus was $179,685, which represented 55% of his base salary. As the final component of his 2002 compensation, the Compensation Committee approved an option grant to Mr. Hussey of 250,000 options. These options, however, differ from the options given to other executive officers or the options previously granted to Mr. Hussey, as these options do not vest at a set percentage per year, but rather all vest and become exercisable on February 1, 2005. By back-loading the options, while at the same time substantially increasing the number of options granted, the Compensation Committee hopes to provide additional incentives for Mr. Hussey to continue his efforts on the Company's behalf for the next several years.

Tax Deduction for Compensation. Section 162(m) ("Section 162(m)") of the Internal Revenue Code of 1986, as amended (the "Code"), provides that no deduction for federal income tax purposes shall be allowed to a publicly held corporation, such as the Company, for applicable employee remuneration with respect to any covered employee to the extent that the amount of such remuneration for the taxable year with respect to such employee exceeds $1.0 million. For purposes of this limitation, the term "covered employee" generally includes the chief executive officer of the corporation and the four highest compensated offices of the corporation (other than the chief executive officer), and the term "applicable employee remuneration" generally means, with respect to any covered employee for the taxable year, the aggregate amount allowable as a federal income tax deduction for services performed by such employee (whether or not during the taxable year); provided, however, that applicable employee remuneration does not include, among other items, certain remuneration payable solely on account of the attainment of one or more performance goals ("performance based compensation"). It is the Company's general intention that the remuneration paid to its covered employees not exceed the deductibility limitation established by Section 162(m). While it is not anticipated that any executive officer of the Company will receive compensation in excess of the Section 162(m) limit, due to the fact that not all remuneration paid to covered employees may qualify as performance-based compensation, it is possible that the Company's deduction for remuneration paid to any covered employee during a taxable year could be limited by Section 162(m).

Submitted by the Compensation Committee of the Board of Directors

| | Sander A. Flaum,Chairman,

Erick E. Hanson,

Matthew P. Rogan and

Kaveh T. Safavi |

8

EXECUTIVE COMPENSATION

Summary of Cash and Certain Other Compensation of Executive Officers. The following table sets forth certain summary compensation information for the fiscal year ended December 31, 2002, for services rendered by each person who served as chief executive officer of the Company at any time during 2002 and for each executive officer of the Company who received more than $100,000 in salary and bonus in 2002 (the "Named Executive Officers").

| |

| | Annual Compensation

| |

| | Long-Term

Compensation Awards

| |

|

|---|

Name and

Principal Position

| | Fiscal

Year

| | Salary($)

| | Annual

Compensation

Bonus($)

| | Other Annual

Compensation

| | Restricted

Stock

Awards($)

| | Options(#)

| |

|

|---|

James M. Hussey,

Chief Executive Officer

and President | | 2002

2001

2000 | | $

| 326,700

297,000

278,700 | | $

| 179,685

148,500

400,000 | | $

| 9,000

9,000

9,000 | | $

| 0

0

0 | | 250,000

110,000

77,000 | (4)

(5)

(6) | |

Jeffrey W. Sherman, M.D.,

Chief Medical Officer and

Executive Vice President(1) |

|

2002

2001

2000 |

|

$

|

236,250

225,000

64,904 |

|

$

|

70,875

90,000

16,875 |

|

$

|

3,600

3,600

900 |

|

$

|

0

0

0 |

|

32,500

77,000

143,000 |

(7)

(5)

(8) |

|

Imran Ahmad, Ph.D.,

Chief Scientific Officer and

Senior V.P.—Research and

Development(2) |

|

2002

2001

2000 |

|

$

|

180,000

150,000

57,700 |

|

$

|

54,000

45,000

15,000 |

|

$

|

3,600

13,614

61,900 |

|

$

|

0

0

0 |

|

72,500

38,500

55,000 |

(9)

(5)

(10) |

|

Lawrence A. Kenyon,

Chief Financial Officer

and Secretary(3) |

|

2002

2001

2000 |

|

$

|

150,000

125,000

38,862 |

|

$

|

45,000

37,500

12,500 |

|

$

|

3,600

3,600

900 |

|

$

|

0

0

0 |

|

47,500

27,500

33,000 |

(11)

(5)

(12) |

|

- (1)

- Dr. Sherman joined the Company in September 2000.

- (2)

- Dr. Ahmad joined the Company in June 2000 as Director of Research and Development.

- (3)

- Mr. Kenyon joined the Company in September 2000.

- (4)

- The stock options become exercisable for 100% of the covered shares on February 1, 2005.

- (5)

- The stock options became exercisable for 25% of the covered shares on February 2, 2002 and become exercisable with respect to an additional 25% on each anniversary of such date.

- (6)

- The stock options became exercisable for 25% of the covered shares on January 3, 2001 and become exercisable with respect to an additional 25% on each anniversary of such date.

- (7)

- The stock options became exercisable for 25% of the covered shares on February 1, 2003 and become exercisable with respect to an additional 25% on each anniversary of such date.

- (8)

- The stock options became exercisable for 25% of the covered shares on August 25, 2001 and become exercisable with respect to an additional 25% on each anniversary of such date.

- (9)

- 12,500 stock options were granted on February 1, 2002. These options became exercisable for 25% of the covered shares on February 1, 2003 and will become exercisable with respect to an additional 25% on each anniversary of such date. The remaining 60,000 stock options were granted on October 24, 2002 and become exercisable for 25% of the covered shares on October 24, 2003, and will become exercisable with respect to an additional 25% on each anniversary of such date.

- (10)

- 33,000 stock options were granted on June 16, 2000. These options became exercisable for 25% of the covered shares on June 16, 2001 and will become exercisable with respect to an additional 25% on

9

each anniversary of such date. The remaining 22,000 stock options were granted on October 31, 2000 and became exercisable for 25% of the covered shares on October 31, 2001 and will become exercisable with respect to an additional 25% on each anniversary of such date.

- (11)

- 7,500 stock options were granted on February 1, 2002. These options became exercisable for 25% of the covered shares on February 1, 2003 and will become exercisable with respect to an additional 25% on each anniversary of such date. The remaining 40,000 stock options were granted on October 24, 2002 and become exercisable for 25% of the covered shares on October 24, 2003, and will become exercisable with respect to an additional 25% on each anniversary of such date.

- (12)

- The stock options became exercisable for 25% of the covered shares on August 21, 2001 and will become exercisable with respect to an additional 25% on each anniversary of such date.

Option Grants in Last Fiscal Year

The following table sets forth information with respect to grants of options to purchase shares of Common Stock granted to the Named Executive Officers during the fiscal year ended December 31, 2002:

Individual Grants

| |

| |

| |

| |

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Terms

|

|---|

| |

| | % of Total

Options Granted

to Employees in

Fiscal Year

| |

| |

|

|---|

Name

| | Number of Options Granted

| | Exercise Price

Per Share

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| James M. Hussey | | 250,000 | | 27.9 | % | $ | 15.85 | | 2/01/2012 | | $ | 2,491,995 | | $ | 6,315,204 |

Jeffrey W. Sherman |

|

32,500 |

|

3.6 |

|

|

15.85 |

|

2/01/2012 |

|

|

323,959 |

|

|

820,977 |

Imran Ahmad |

|

12,500

60,000 |

|

1.4

6.7 |

|

|

15.85

13.99 |

|

2/01/2012

10/24/2012 |

|

|

124,600

527,894 |

|

|

315,760

1,337,787 |

Lawrence A. Kenyon |

|

7,500

40,000 |

|

0.8

4.5 |

|

|

15.85

13.99 |

|

2/01/2012

10/24/2012 |

|

|

74,760

351,929 |

|

|

189,456

891,858 |

Aggregated Option Exercises in Last Fiscal

Year and Fiscal Year-End Option Values

The following table sets forth information with respect to stock options exercised during the fiscal year ended December 31, 2002, and the value at December 31, 2002, of unexercised stock options held by the Named Executive Officers:

Individual Grants

Name

| | Number of Shares Acquired

on Exercise

| | Value

Realized

$

| | Number of Unexercised Options at

Fiscal Year-End

Exercisable/Unexercisable

#

| | Value of Unexercised Options In-the-Money

at Fiscal Year-End

Exercisable/Unexercisable

$*

|

|---|

| James M. Hussey | | 0 | | $ | 0 | | 511,500/409,500 | | $1,921,200/$0 |

Jeffrey W. Sherman |

|

0 |

|

|

0 |

|

90,750/161,750 |

|

0/0 |

Imran Ahmad |

|

0 |

|

|

0 |

|

31,625/134,375 |

|

0/0 |

Lawrence A. Kenyon |

|

0 |

|

|

0 |

|

23,375/84,625 |

|

0/0 |

- *

- Represents the fair market value at December 31, 2002 of the Common Stock underlying the options minus the exercise price.

10

Equity Compensation Plans

The following table sets forth certain information as of December 31, 2002, with respect to compensation plans under which shares of NeoPharm, Inc.'s Common Stock may be issued.

Equity Compensation Plan Information

Plan category

| | Number of securities to be

issued upon exercise of

outstanding options

| | Weighted-average

exercise price of

outstanding options

| | Number of securities

remaining available

for future issuance

|

|---|

| Equity compensation plans approved by stockholders | | 2,831,950 | | $ | 14.29 | | 1,510,665 |

Equity compensation plans not approved by stockholders |

|

— |

|

|

— |

|

— |

| | |

| |

| |

|

| | Total | | 2,831,950 | | $ | 14.29 | | 1,510,665 |

| | |

| |

| |

|

1998 Equity Incentive Plan

The 1998 Equity Incentive Plan (the "1998 Plan") was approved by stockholders in July 1998, and is described in more detail in Note 4 in the Notes to Financial Statements in our Annual Report on Form 10-K for the year ended December 31, 2002, a copy of which has been mailed to stockholders along with this Proxy Statement. The 1998 Plan authorizes the grant of options to the Company's employees, officers, directors and consultants of up to 4,000,000 shares of the Company's Common Stock. Options to purchase 1,510,665 shares remain available for future grants under the 1998 Plan.

1995 Stock Option Plan

The 1995 Stock Option Plan (the "1995 Plan") was approved by stockholders in January 1995, and was replaced by the 1998 Plan upon approval of that Plan by stockholders in July 1998. The 1995 Plan authorized the grant of options to the Company's employees, officers, directors and consultants of up to 700,000 shares of the Company's common stock. No options to purchase any shares of the Company's Common Stock remain available for future grants under the 1995 Plan, however, options to purchase 571,450 shares remain outstanding under the 1995 Plan.

Employment and Other Agreements

Mr. James M. Hussey entered into an employment agreement (the "Agreement") with the Company as of March 16, 1998, pursuant to which Mr. Hussey agreed to serve as President and Chief Executive Officer of the Company. The Agreement is in effect until terminated by either party in accordance with its terms. In addition to a base salary, which is reviewed annually by the Compensation Committee of the Board and which has been increased during the term of Mr. Hussey's employment from $250,000 in 1998 to $339,768 in 2003, Mr. Hussey is also eligible for a bonus based on the Company's performance in the prior year, as well as options under the Company's stock option plan. Upon execution of the Agreement, Mr. Hussey received 400,000 options and has subsequently received additional stock options. The Agreement contains provisions requiring Mr. Hussey to refrain from disclosing any confidential information during his employment and for a period of twelve months thereafter.

11

SECURITY OWNERSHIP

Except as otherwise noted, the following table sets forth certain information regarding beneficial ownership of shares of the Common Stock as of April 15, 2003 by (i) all those known by the Company to be beneficial owners of more than 5% of its outstanding Common Stock, (ii) each director of the Company and each nominee for director, (iii) each of the Named Executive Officers, and (iv) all executives, directors and nominees for director as a group. Unless otherwise noted, each person's address is in care of NeoPharm, Inc., 150 Field Drive, Suite 195, Lake Forest, Illinois 60045.

Name

| | Amount and Nature of Beneficial Ownership(1)

| | Percent of

Class

| |

|---|

| John N. Kapoor, Ph.D. | | 4,396,048 | (2) | 26.81 | % |

Kern Capital Management LLC |

|

1,878,040 |

(3) |

11.47 |

|

John N. Kapoor 1994 A Annuity Trust |

|

1,703,118 |

(4) |

10.40 |

|

Gilder, Gagnon, Howe & Co. LLC |

|

1,276,879 |

(5) |

7.80 |

|

GAM Holding AG |

|

1,026,400 |

(6) |

6.27 |

|

EJ Financial/NEO Management, L.P. |

|

995,293 |

(7) |

6.08 |

|

Greenlight Capital LLC |

|

833,770 |

(8) |

5.09 |

|

Deutsche Bank AG |

|

824,044 |

(9) |

5.03 |

|

James M. Hussey |

|

596,750 |

(10) |

3.52 |

|

Jeffrey W. Sherman, M.D. |

|

118,125 |

(11) |

* |

|

Imran Ahmad, Ph.D. |

|

49,875 |

(12) |

* |

|

Sander A. Flaum |

|

41,950 |

(13) |

* |

|

Erick E. Hanson |

|

34,250 |

(13) |

* |

|

Lawrence A. Kenyon |

|

32,125 |

(14) |

* |

|

Matthew P. Rogan, M.D. |

|

28,750 |

(15) |

* |

|

Kaveh T. Safavi, M.D. |

|

28,750 |

(15) |

* |

|

All officers and directors as a group (9 persons) |

|

5,326,623 |

|

30.79 |

|

- *

- Indicates ownership of less than 1%.

- (1)

- Based on 16,371,529 shares of Common Stock outstanding as of April 15, 2003. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission (the "Commission") and generally includes voting or investment power with respect to securities. Shares of Common Stock subject to options or warrants exercisable or convertible within 60 days are deemed outstanding for purposes of computing the percentage of the person or group holding such options or warrants.

- (2)

- Includes 27,500 shares that may be acquired pursuant to vested options, 998,205 shares held by the John N. Kapoor Trust, dated 9/20/89 (the "JNK Trust"), of which Dr. Kapoor is the sole trustee and sole beneficiary, and 995,293 shares held by EJ Financial/NEO Management, L.P. (the "Limited Partnership") of which John N. Kapoor is Managing General Partner. The amount shown also includes: 330,000 shares which are held by the John N. Kapoor Charitable Trust (the "Charitable Trust"), of which Dr. Kapoor and his spouse are co-trustees; 1,703,118 shares which are owned by the John N. Kapoor 1994-A Annuity Trust (the "Annuity Trust") of which the sole trustee is Editha

12

Kapoor, Dr. Kapoor's spouse; and 341,932 shares which are owned by four trusts which have been established for Dr. Kapoor's children (the "Children's Trusts") of which the sole trustee is Editha Kapoor. Dr. Kapoor does not have or share voting, investment or dispositive power with respect to the shares owned by the Annuity Trust or the Children's Trusts and Dr. Kapoor disclaims beneficial ownership of these shares as well as the shares held by the Charitable Trust.

- (3)

- The address for Kern Capital Management LLC is 114 West 47th Street, Suite 1926, New York, NY 10036. Ownership is as reported by the holder on Schedule 13G on February 14, 2003.

- (4)

- The sole trustee of the John N. Kapoor 1994-A Annuity Trust (the "Annuity Trust") is Editha Kapoor, Dr. Kapoor's spouse, who also serves as trustee for four trusts which have been established for their children (the "Childrens' Trusts") and which collectively own 341,932 shares and as co-trustee with Dr. Kapoor of the John N. Kapoor Charitable Trust, which owns 330,000 shares. The shares held by the Childrens' Trusts and the Charitable Trust are not included in the reported shares. As Editha Kapoor is Dr. Kapoor's spouse, the shares held by the Annuity Trust are also shown in this table as being beneficially owned by Dr. Kapoor.

- (5)

- The address for Gilder, Gagnon, Howe & Co. LLC is 1775 Broadway, 26th Floor, New York, NY 10019. Ownership is as reported by the holder on Schedule 13G on February 12, 2003.

- (6)

- The address for GAM Holding AG is Klaustrasse 10, 8008 Zurich, Switzerland. Ownership is as reported by the holder on Schedule 13G on January 10, 2003.

- (7)

- The Managing Partner of EJ Financial/Neo Management, L.P. ("EJ/Neo") is John N. Kapoor and its address is 225 East Deerpath, Suite 250, Lake Forest, Illinois 60045. As a result of his position with EJ/Neo, these shares are also shown in this table as being beneficially owned by Dr. Kapoor.

- (8)

- The address for Greenlight Capital LLC is 420 Lexington Avenue, Suite 875, New York, NY 10017. Ownership is as reported by the holder on Schedule 13G on March 18, 2003.

- (9)

- Reflects the securities beneficially owned by the Private Clients and Asset Management Business Group of Deutsche Bank AG and its subsidiaries and affiliates as reported by Deutsche Bank AG on Schedule 13G on February 13, 2003. The address for Deutsche Bank AG is Taunusanlage 12, D-60325, Frankfurt am Main, Federal Republic of Germany.

- (10)

- Includes 596,750 shares that may be acquired pursuant to options exercisable as of April 17, 2003 or that will become exercisable within 60 days of April 17, 2003.

- (11)

- Includes 118,125 shares that may be acquired pursuant to options exercisable as of April 17, 2003 or that will become exercisable within 60 days of April 17, 2003.

- (12)

- Includes 49,875 shares that may be acquired pursuant to options exercisable as of April 17, 2003 or that will become exercisable within 60 days of April 17, 2003.

- (13)

- Includes 29,250 shares that may be acquired pursuant to options exercisable as of April 17, 2003 or that will become exercisable within 60 days of April 17, 2003.

- (14)

- Includes 32,125 shares that may be acquired pursuant to options exercisable as of April 17, 2003 or that will become exercisable within 60 days of April 17, 2003.

- (15)

- Includes 23,750 shares that may be acquired pursuant to options exercisable as of April 17, 2003 or that will become exercisable within 60 days of April 17, 2003.

13

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In 1994, the Company entered into a Consulting Agreement with EJ Financial Enterprises, Inc. ("EJ Financial"). The Consulting Agreement provides that the Company will pay EJ Financial $125,000 per year (paid quarterly) for certain management consulting services consisting primarily of consulting on strategic corporate objectives and operations, including business growth and product development opportunities for the Company. Dr. John Kapoor, the Company's Chairman of the Board, is the president and a director of EJ Financial. Unless terminated by the parties, the management services agreement with EJ Financial automatically renews in June of each year for a one-year term.

In March 2000, the Company entered into a Consulting Agreement with Unicorn Pharma Consulting, Inc. ("Unicorn"). Under the terms of the Consulting Agreement, Unicorn was paid $5,000 per week for its services, plus reimbursement of expenses. During the year ended December 31, 2000, the Company paid Unicorn a total of $90,000. Dr. Matthew P. Rogan, a member of the Board of Directors, is the President and a principal shareholder of Unicorn. The Consulting Agreement with Unicorn was terminated by mutual agreement of the parties on October 1, 2000, and the parties entered into a new consulting agreement in November 2001. Under the new consulting agreement, the Company paid Unicorn approximately $35,283 in 2001 and $39,379 through the end of the first quarter of 2002. No consulting or other services have been provided by Unicorn subsequent to March 31, 2002.

In December 2001, following approval by the Company's Board of Directors, the Company loaned $3,250,000 to Akorn, Inc., an independent publicly traded company, to assist Akorn in the completion of its lyophilized products manufacturing facility in Decatur, Illinois. The note receivable issued to Akorn is due in December 2006, and accrues interest at a rate equal to that received on the Company's investments in marketable securities, which is lower than the interest rate paid by Akorn on its other outstanding debt. In exchange, the Company has entered into a manufacturing and processing agreement that grants the Company access to at least 15% of the annual lyophilization manufacturing capacity at Akorn at a discounted price, upon completion of the facility. In December 2002, the Company recorded a non-cash charge to fully reserve for the note receivable as a result of the Company's inability to adequately assess the probability of collection of the note as of December 31, 2002. The Company has not received notification from Akorn that it will be unable to repay the note at maturity in 2006, and Akorn continues to be contractually obligated to complete the expansion of its Decatur facility, to manufacture NeoPharm's NeoLipid™ products and to repay the note.

In connection with the Company's initial public offering, the Company adopted a policy whereby any transactions between the Company and its officers, directors, principal stockholders and any affiliates of the foregoing persons will be on terms no less favorable to the Company than could reasonably be obtained in arm's length transactions with independent third parties, and that any such transactions also be approved by a majority of the Company's disinterested outside directors.

14

STOCK PERFORMANCE GRAPH

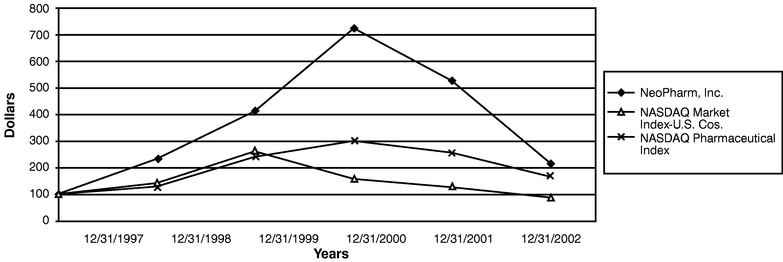

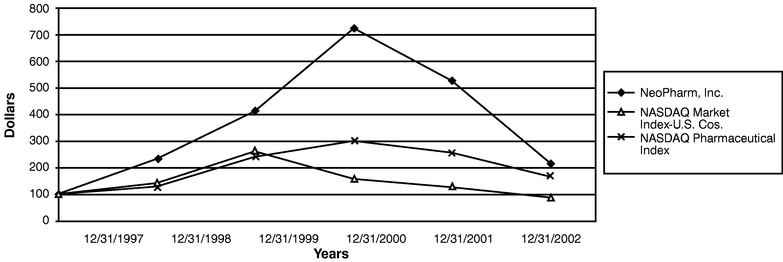

The following graph compares the percentage change in cumulative total stockholder return on the Company's Common Stock with the cumulative return on the NASDAQ Stock Market Index and the NASDAQ Pharmaceutical Stock Index during the period beginning December 31, 1997 through December 31, 2002. The price of the Common Stock as reflected in the graph has been adjusted to reflect the 10% stock dividend paid in December 2001. The comparison assumes that $100 was invested on December 31, 1997 in the Company's Common Stock and in the foregoing indices and assumes the reinvestment of dividends.

NeoPharm, Inc.

Stock Performance Graph

|

|---|

Performance Information

| | 12/31/97

| | 12/31/98

| | 12/31/99

| | 12/31/00

| | 12/31/00

| | 12/31/02

|

|---|

| NeoPharm, Inc. | | 100 | | 231 | | 411 | | 721 | | 525 | | 212 |

|

| NASDAQ Market Index-U.S. Cos. | | 100 | | 141 | | 261 | | 157 | | 125 | | 86 |

|

| NASDAQ Pharmaceutical Index | | 100 | | 127 | | 239 | | 299 | | 254 | | 164 |

|

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING

Section 16(a) of the Securities Exchange Act of 1934, requires the Company's executive officers and directors, and any persons who own more than 10% of a registered class of the Company's equity securities, to file reports of ownership and changes in ownership on Forms 3, 4 and 5 with the Securities & Exchange Commission. Executive officers, directors and greater than 10% stockholders are required by applicable regulations to furnish the Company with copies of all such Forms which they file.

Based solely on the Company's review of the copies of all Forms it has received, and any written representations made by the reporting persons to the Company, the Company believes that its directors, executive officers and 10% holders complied with the filing requirements of Section 16(a), except that: (i) Mr. Hussey, Mr. Kenyon, Dr. Rogan, Mr. Safavi and Dr. Sherman each did not file two reports on Form 5 on a timely basis to report two stock option grants made to them; (ii) Mr. Flaum and Mr. Hanson each did not file three reports on Form 5 on a timely basis to report three stock option grants made to them; (iii) Dr. Ahmad did not file one report on Form 5 on a timely basis to report one stock option grant made to him and Dr. Ahmad and Mr. Kenyon each did not file one report on Form 4 to timely report one stock option grant made to them; and (iv) Dr. Ahmad and Mr. Bergey each did not file their initial Form 3 on a timely basis. All of the foregoing transactions have been subsequently reported and the necessary Forms have been filed.

15

INDEPENDENT PUBLIC ACCOUNTANTS

In June 2002, the Board of Directors selected KPMG LLP to audit the financial statements of the Company for the fiscal year ended December 31, 2002. It is expected that a representative of KPMG LLP will be present at the Annual Meeting to respond to any appropriate questions and to make a statement on behalf of his or her firm, if such representative so desires.

On May 3, 2002, the Board of Directors of the Company, based on the recommendation of its Audit Committee, dismissed Arthur Andersen LLP ("Andersen"), as the Company's independent auditors effective May 3, 2002. Subsequently, in June 2002, the Audit Committee recommended and the Board of Directors approved, effective July 1, 2002, the engagement of KPMG LLP as the Company's independent accountants for the fiscal year ending December 31, 2002.

During the Company's fiscal years ended December 31, 2001 and 2000, and through the subsequent interim period ended May 3, 2002, there were no disagreements between the Company and Andersen on any matter of accounting principles or practices, financial statement disclosure, or auditing scope and procedures which, if not resolved to the satisfaction of Andersen, would have caused Andersen to make reference to the matter in their reports. Andersen's reports on the Company's financial statements for each of the years ended December 31, 2001 and December 30, 2000, did not contain an adverse opinion or disclaimer of opinion nor were they qualified or modified as to uncertainty, audit scope, or accounting principles.

The Company provided Andersen with a copy of the foregoing statements and a copy of Andersen's letter, dated May 13, 2002, stating their agreement with the foregoing statements was filed as Exhibit 16.1 to the Company's Form 8-K filed on May 14, 2002.

There were no "reportable events" as that term is described in Item 304(a)(1)(v) of Regulation S-K for the two fiscal years ended December 31, 2001 and December 31, 2000 or for the subsequent interim period through May 3, 2002.

During the Company's fiscal years ended December 31, 2001 and 2000, and in the subsequent interim period through July 1, 2002, neither the Company nor anyone acting on its behalf consulted KPMG LLP with respect to either (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company's consolidated financial statements, or (ii) any matter that was either the subject of a disagreement or any other matters or reportable events as set forth in Items 304(a)(2)(i) and (ii) of Regulation S-K.

In keeping with its new responsibilities, the Audit Committee will be responsible for selecting the company's independent auditors for the 2003 fiscal year. The Audit Committee intends to select the auditors once it has completed its evaluation of KPMG LLP's performance in connection with the 2002 audit.

Audit Fees

There were no 2002 professional services rendered by Andersen and therefore no fees were paid to Andersen for this period.

Fees for the 2002 annual financial statement audit and quarterly reviews for professional services rendered by KPMG LLP were $123,550. All other fees paid to KPMG LLP for 2002 were $15,000 and consisted of tax compliance services.

There were no financial information systems design and implementation fees for 2002.

The Audit Committee determined that the payments made to its independent accountants for non-audit services during 2002 were not inconsistent with maintaining KPMG LLP's independence.

16

OTHER MATTERS

The only matters which management intends to present to the meeting are set forth in the Notice of Annual Meeting. Management knows of no other matters which will be brought before the meeting by any other person. However, if any other matters are properly brought before the meeting, the persons named on the enclosed form of proxy intend to vote on such matters in accordance with their best judgment on such matters.

STOCKHOLDER PROPOSALS AND OTHER MATTERS FOR THE 2004 ANNUAL MEETING

Proposals of stockholders intended to be presented at the next Annual Meeting of Stockholders to be held in 2004 must be received by the Company on or before December 29, 2003 for inclusion in the Company's Proxy Statement and form of proxy relating to that Annual Meeting.

In order for a stockholder to bring other business before a stockholder meeting, timely notice must be received by the Company not less than 45 days before the date on which the Company mailed its Proxy Statement for the prior year's Annual Meeting of Stockholders (but if the Annual Meeting is called for a date that is not within 30 days of the anniversary date, then the notice must be received within a reasonable time before the Company mails its Proxy materials for the then current year). For the 2004 Annual Meeting the notice date would be March 14, 2004. The notice must include a description of the proposed business, the reasons therefor, and other specified matters. These requirements are separate from and in addition to the requirements a shareholder must meet to have a proposal included in the Company's Proxy Statement. These time limits also apply in determining whether notice is timely for purposes of rules adopted by the Securities and Exchange Commission relating to the exercise of discretionary voting authority by the Company.

2002 ANNUAL REPORT ON FORM 10-K

A copy of the Company's 2002 Annual Report on Form 10-K (the "Form 10-K") accompanies this Proxy Statement as part of the Company's Annual Report. Additional copies of the Form 10-K are available to stockholders without charge on request made in writing to the following address: Office of the Secretary, NeoPharm, Inc., 150 Field Drive, Suite 195, Lake Forest, Illinois 60045.

| | By Order of the Board of Directors, |

|

|

|

Lawrence A. Kenyon

Secretary |

April 28, 2003 |

|

17

Proxy Solicited on Behalf of The Board of Directors For The Annual Meeting of Stockholders — June 5, 2003

The undersigned appoints James M. Hussey, Lawrence A. Kenyon and Christopher R. Manning, and each of them, as proxies, with full power of substitution and revocation to vote, as designated on the reverse side hereof, all the Common Stock of NeoPharm, Inc. which the undersigned has power to vote, with all powers which the undersigned would possess if personally present, at the Annual Meeting of Stockholders thereof to be held on June 5, 2003, or at any adjournment thereof, and, in their or his discretion, on any other business that may properly come before such meeting.

If this Proxy is signed and returned, but no direction is indicated, this Proxy will be voted FOR the election of each of the nominees named herein.

PLEASE VOTE, SIGN, DATE AND RETURN THIS PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE.

YOUR VOTE IS IMPORTANT!

(Continued and to be signed on reverse side.)

| | 000000 0000000000 0 0000 |

| | | 000000000.000 ext

000000000.000 ext

000000000.000 ext |

| MR A SAMPLE | | 000000000.000 ext |

| DESIGNATION (IF ANY) | | 000000000.000 ext |

| ADD 1 | | 000000000.000 ext |

| ADD 2 | | 000000000.000 ext |

| ADD 3 | | |

| ADD 4 | | Holder Account Number |

| ADD 5 | | |

| ADD 6 | | C 1234567890 J N T |

|

|

o |

|

Mark this box with an X if you have made changes to your name or address details above.

|

Annual Meeting Proxy Card

|

A Election of Directors

- 1.

- The Board of Directors recommends a vote FOR the listed nominees.

01 - John N. Kapoor, 02 - James M. Hussey,

03 - Matthew P. Rogan, 04 - Kaveh T. Safavi, | | o | | Vote For

All Nominees* | | *To withhold authority to vote for any Nominee(s), write the name(s) of the Nominee(s) here: |

05 - Sander A. Flaum, 06 - Erick E. Hanson |

|

o |

|

Withhold Vote For

All Nominees |

|

|

B Authorized Signatures - Sign Here - This section must be completed for your instructions to be executed.

The undersigned acknowledges receipt of the Notice of Annual Meeting of Stockholders and of the Proxy Statement.

Please sign exactly as your name appears. Joint owners should each sign personally. Where applicable, indicate your position or representation.

Signature 1 - Please keep signature within the box

| | Signature 2 - Please keep signature within the box

| | Date (mm/dd/yyyy)

/ /

|

1UPX HHH PPPP 001962

QuickLinks

GENERAL INFORMATIONPROPOSAL ONE ELECTION OF DIRECTORSINFORMATION ABOUT THE BOARD OF DIRECTORS AND ITS COMMITTEESEXECUTIVE COMPENSATIONSECURITY OWNERSHIPCERTAIN RELATIONSHIPS AND RELATED TRANSACTIONSSTOCK PERFORMANCE GRAPHSECTION 16(a) BENEFICIAL OWNERSHIP REPORTINGINDEPENDENT PUBLIC ACCOUNTANTSOTHER MATTERSSTOCKHOLDER PROPOSALS AND OTHER MATTERS FOR THE 2004 ANNUAL MEETING2002 ANNUAL REPORT ON FORM 10-K