QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. 2)

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

ý |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

NEOPHARM, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

PRELIMINARY COPY DATED AS OF SEPTEMBER 23, 2004

NeoPharm, Inc.

150 Field Drive

Suite 195

Lake Forest, Illinois 60045

CONSENT REVOCATION STATEMENT

BY THE BOARD OF DIRECTORS OF NEOPHARM, INC.

IN OPPOSITION TO

A CONSENT SOLICITATION BY JOHN N. KAPOOR, Ph.D.

This Consent Revocation Statement is furnished by the Board of Directors (the "Board") of NeoPharm, Inc., a Delaware corporation (the "Company"), to the holders of outstanding shares of the Company's common stock, par value $.0002145 per share (the "common stock"), in connection with your Board's opposition to the solicitation of written stockholder consents by John N. Kapoor, Ph.D., a director and 21.7% stockholder of the Company.

On September 2, 2004, Mr. Kapoor publicly announced his intent to remove the independent directors that he had just recently agreed to nominate in April 2004 and that you elected at the 2004 Annual Meeting of Stockholders on June 17, 2004 and replace them with a slate of nominees handpicked by Mr. Kapoor without any input from the Company's independent nominating committee. Specifically, Mr. Kapoor is asking you to: (i) remove, without cause, the independent directors of the Company elected on June 17, 2004; (ii) reduce the number of directors for the Company to five (5); (iii) replace your independent directors with Mr. Kapoor's own handpicked nominees; and (iv) repeal any by-law amendments adopted after June 10, 2004. If Mr. Kapoor's proposals are adopted, his nominees would constitute a majority of the Board.

Your directors were selected for nomination through a process implemented by the Board,with Mr. Kapoor's input and approval, in keeping with good corporate governance practices. Please see the discussion in this Consent Revocation Statement under the heading "Information About the Company and its Directors and Officers—Corporate Governance Policies and Practices." In contrast, Mr. Kapoor's nominees have been selected solely by Mr. Kapoor without review by the independent governance committee or the Board.

Your Board, other than Mr. Kapoor, unanimously opposes the solicitation by Mr. Kapoor. Your Board, which is composed of a majority of independent directors and led by an independent chairman, is committed to acting in the best interests of all of the Company's stockholders and believes that it is better positioned than Mr. Kapoor's handpicked nominees to implement a responsible business plan that will maximize value for all stockholders. In particular, the members of your Board that Mr. Kapoor is seeking to remove have the benefit of over 20 years of collective experience with the Company and are familiar with the development and design of the Company's clinical trials and business strategy. On the other hand, to the Company's knowledge, none of Mr. Kapoor's nominees have any significant familiarity with the Company's operations, any experience as a director of a public company or (other than Dr. Fox) any significant experience with complex clinical trials for entirely new drug candidates.

This Consent Revocation Statement and the enclosedBLUE Consent Revocation Card are first being mailed to stockholders on or about September , 2004.

Your Board urges you not to sign any white consent card sent to you by Mr. Kapoor but instead to sign and return theBLUE card included with these materials.

If you have previously signed and returned the white consent card, you have every right to change your mind and revoke your consent. Whether or not you have signed the white consent card, we urge you to mark the "YES, REVOKE MY CONSENT" boxes on the enclosedBLUE Consent Revocation Card and to sign, date and mail the card in the postage-paid envelope provided. Although submitting a consent revocation will not have any legal effect if you have not previously submitted a consent card, it will help us keep track of the progress of the consent process. Regardless of the number of shares you own, your consent revocation is important. Please act today.

If your shares are held in "street name," only your broker or your banker can vote your shares. Please contact the person responsible for your account and instruct him or her to submit aBLUE Consent Revocation Card on your behalf today.

The Board has set September 28, 2004 as the record date (the "Record Date") for the determination of the Company's stockholders who are entitled to execute, withhold or revoke consents relating to Mr. Kapoor's consent solicitation. Only holders of record as of the close of business on the Record Date may execute, withhold or revoke consents with respect to Mr. Kapoor's consent solicitation. On September 18, 2004 the Board set the Record Date pursuant to a newly-adopted procedure established by a By-law amendment approved by your Board on September 7, 2004. The By-laws as amended to date provide that the Board will adopt a resolution setting a record date promptly, but in any case no later than ten (10) days, following receipt of a stockholder's written request to set a record date for stockholder action by written consent that is delivered to the Company by hand or by registered or certified mail. Mr. Kapoor delivered such a request on September 8, 2004. Pursuant to the requirements of the By-laws, any such record date must be set as of a date no later than ten (10) days following the Board's adoption of the resolution setting the record date.

THIS PRELIMINARY CONSENT REVOCATION STATEMENT IS BEING FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON SEPTEMBER 23, 2004.

If you have any questions about giving your consent revocation or require assistance, please call:

MORROW & COMPANY

445 Park Avenue

New York, New York 10022

Tel: 212-754-8000

Fax: 212-754-8300

Call Toll Free: 1-800-607-0088

TABLE OF CONTENTS

| Forward Looking Statements | | 1 |

| Description Of The Kapoor Consent Solicitation | | 1 |

| Reasons To Reject Mr. Kapoor's Consent Solicitation Proposals | | 2 |

| Questions And Answers About This Consent Revocation Statement | | 5 |

| The Consent Procedure | | 6 |

| | Voting Securities And Record Date | | 6 |

| | Effectiveness Of Consents | | 6 |

| | Effect Of Blue Consent Revocation Card | | 6 |

| | Results Of This Consent Revocation Solicitation | | 7 |

| Solicitation Of Consent Revocations | | 8 |

| | Cost And Method | | 8 |

| | Participants In The Solicitation | | 8 |

| Appraisal Rights | | 8 |

| Information About The Company And Its Directors And Officers | | 9 |

| | Corporate Governance Policies And Practices | | 9 |

| | Directors | | 13 |

| | Report Of The Compensation Committee | | 14 |

| | Executive Compensation | | 17 |

| | Security Ownership | | 20 |

| | Certain Relationships And Related Transactions | | 21 |

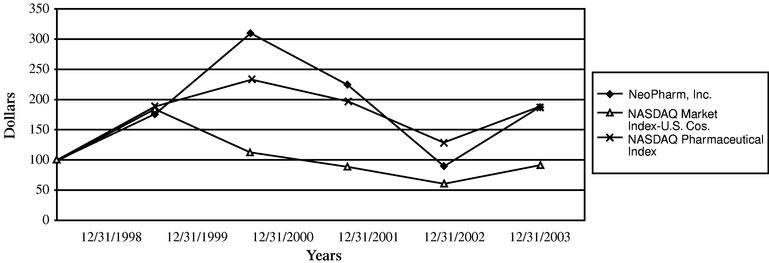

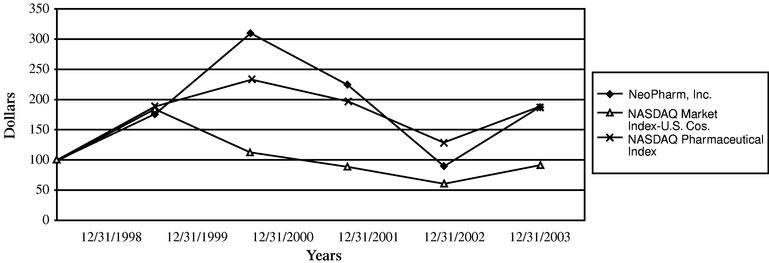

| | Stock Performance Graph | | 23 |

| | Section 16(a) Beneficial Ownership Reporting | | 24 |

| Stockholder Proposals And Other Matters For The 2005 Annual Meeting | | 24 |

| Other Matters | | 24 |

| Delivery Of Documents To Stockholders Sharing An Address | | 24 |

| Important Information Regarding Consent Revocation | | 24 |

| Annex I—Certain Information Regarding Participants In This Consent Revocation Solicitation | | |

| Annex II—Recent Trading History Of Participants In This Consent Revocation Solicitation | | |

i

FORWARD LOOKING STATEMENTS

This consent revocation statement contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. The Company has tried to identify such forward-looking statements by use of such words as "expects," "intends," "hopes," "anticipates," "believes," "could," "may," "evidences" and "estimates," and other similar expressions, but these words are not the exclusive means of identifying such statements. Such statements include, but are not limited to, any statements relating to the Company's drug development program, including, but not limited to, the initiation, progress and outcomes of clinical trials involving IL13-PE38QQR, and any other statements that are not historical facts. Such statements involve risks and uncertainties, including, but not limited to, those risks and uncertainties relating to difficulties or delays in development, testing, regulatory approval, production and marketing of the Company's drug and non-drug compounds, including, but not limited to, IL13-PE38QQR, uncertainty regarding the availability of third party lyophilization capacity, unexpected adverse side effects or inadequate therapeutic efficacy of the Company's drug and non-drug compounds that could slow or prevent products coming to market, uncertainty regarding the Company's ability to market its drug and non-drug products directly or through independent distributors, the uncertainty of patent protection for the Company's intellectual property or trade secrets and other risks detailed from time to time in filings the Company makes with the Securities and Exchange Commission including our annual reports on Form 10-K and our quarterly reports on Form 10-Q.

Such statements are based on management's current expectations, but actual results may differ materially due to various factors, including those risks and uncertainties mentioned or referred to in this consent revocation statement. Accordingly, you should not rely on these forward-looking statements as a prediction of actual future results. The Company is under no obligation (and expressly disclaims any such obligation) to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise.

DESCRIPTION OF THE KAPOOR CONSENT SOLICITATION

As set forth in his preliminary consent solicitation materials filed with the Commission, Mr. Kapoor is asking you to vote on the following proposals:

(1) To repeal each provision of NeoPharm's By-laws or any amendment thereto adopted since June 10, 2004;

(2) To remove without cause the independent members of the Company's board of directors, being, at the present time, Mr. Sander A. Flaum, Mr. Erick E. Hanson, Dr. Matthew P. Rogan and Dr. Kaveh T. Safavi;

(3) To amend the Company's By-laws to fix the number of directors of the Company at five; and

(4) To elect the following individuals, who have been selected by Mr. Kapoor, to serve as directors of the Company: Mr. Brian Tambi, Mr. Ronald Eidell, and Dr. Bernard A. Fox (collectively, the "Kapoor Nominees").

The Company's Board believes that all four of Mr. Kapoor's proposals have a single purpose: to enable Mr. Kapoor to obtain substantial influence and control over the actions, strategy and direction of your Company.

1

REASONS TO REJECT MR. KAPOOR'S CONSENT SOLICITATION PROPOSALS

On September 2, 2004, John N. Kapoor, Ph.D., commenced a process to solicit written consents from stockholders in what your Board believes is an attempt to obtain substantial influence and control over the actions, strategy and direction of your Company by removing the four independent members of the Board that you elected three months ago on June 17, 2004, and replacing them with a slate of nominees handpicked by Mr. Kapoor. We strongly urge you to oppose Mr. Kapoor's consent solicitation.

If adopted, Mr. Kapoor's proposals will prevent your Board and the Company's management from executing its business strategy that is currently being actively implemented by our management team under the leadership of Greg Young, our new President and CEO. That strategy has three primary components for increasing stockholder value as we move forward:

- •

- Conserve cash by continuing to aggressively reduce costs and exploring opportunities to monetize other assets.

Management and your Board recognize that it is imperative that we conserve as much cash as possible and we are making significant progress in our efforts in this area. Since Mr. Young joined our management team, we disclosed on August 11, 2004 that we had extended the period for which we expect our existing cash to be sufficient from the third quarter of 2005 (as reported in our 2003 annual report on Form 10-K) to the first quarter of 2006 (as reported in our most recent quarterly report on Form 10-Q), and on September 17, 2004 we announced further that we now expect our existing cash to be sufficient to fund our operations into the third quarter of 2006. We continue to aggressively pursue opportunities to reduce our cash "burn rate" without abandoning valuable pipeline assets or disrupting our critical Phase III PRECISE trials.

- •

- Enroll patients in the PRECISE trial for IL-13PE38QQR as rapidly as possible.

Continuing to rapidly enroll patients in the Company's Phase III PRECISE trial is critical to building stockholder value. As of September 3, 2004, 41 patients have been enrolled toward the trial goal of 300 patients. We expect enrollment to be completed by September 2005, assuming 20 patients per month for each of the next 13 months. Management is confident that the trial design is on target and that enrollment is on schedule. The Company is committed to working closely with the FDA to ensure rapid evaluation of all IL-13PE38QQR data, and plans to use the Company's status as a CMA Pilot 2 program at the FDA to engage the FDA in a review of the Phase I data in the fourth quarter of this year.

- •

- Value our product portfolio with the goal of out-licensing, partnering or terminating specific programs.

Each of our drug product candidates is viewed as an asset that warrants further investment, monetization, or both. The Company has spent over ten years and a great deal of money on developing products utilizing its proprietary lipid formulations. It is critical that we evaluate the potential value of each of the products under development before taking drastic action. Your Board has concluded, based on management's analysis of the potential impact of his proposal, that at Mr. Kapoor's proposed $30 million burn rate, not only will the IL-13PE38QQR Phase III PRECISE trial be jeopardized, but our other valuable product programs will need to be stopped. As a result, potentially valuable assets would be allowed to sit idle or be abandoned and the Company's entire value would depend on the success of a single product. Management and your Board does not believe that this is the right path for the Company to follow. We are moving quickly to gather the necessary data to prioritize these products, identify the best targets for out-licensing and partnering, and put projects with lesser short-term potential on hold. We anticipate that outside partnering will be required to continue the development of these other programs and while the Company has not yet entered into definitive arrangements with respect to any such

2

transactions, we are exploring opportunities to monetize some of these assets as a way to further reduce our burn rate and increase stockholder value. We expect our analysis to be completed over the next 45 days so that we can make informed decisions with respect to our portfolio pipeline. Obviously, our efforts to further reduce costs and push forward the PRECISE trial enrollment continue as we complete this important analysis.

In contrast to your Board's carefully considered plans, Mr. Kapoor has insisted that the Company cut its burn rate to $30 million per year without any detailed plans or recommendations as to how to do so. Members of your Board have requested that Mr. Kapoor provide specific recommendations as to how he proposes to achieve such an expense reduction without significantly impairing the long-term value of the Company to its stockholders, but to date, Mr. Kapoor has had no response other than to insist he be put in charge.

Unfortunately, rather than permit the Company's management to continue to implement the business strategy that management and your Board are pursuing with Mr. Kapoor's advice and input, Mr. Kapoor has decided to attempt to effect a highly disruptive change of control in your Company at this critical juncture in its development. Your Board believes that Mr. Kapoor's solicitation will be a significant distraction to our management team, potentially result in a loss of key employees and management, impose additional cash costs on the Company and, should Mr. Kapoor be successful, result in lost time and opportunities while new Board members familiarize themselves with the Company and its business and personnel. These potential disruptions come at a critical point when the Company is at the beginning stages of a large, carefully developed Phase III clinical trial that will require the focus and attention of senior management and others.

Mr. Kapoor is now soliciting consents to replace the same independent directors that he voted to re-nominate in April of this year. Although he suggests a number of reasons for his changed position so soon after he voted to nominate our current Board, the Company is already aggressively addressing many of the concerns he raises in his consent materials filed with the SEC, other than his suggestion to slash our burn rate to $30 million per year without a plan. Mr. Kapoor's actions do, however, come shortly after our independent directors took action to elect an independent Chairman in place of Mr. Kapoor.

Given the Company's financial condition, unique product pipeline, on-going pivotal Phase III clinical trial and future opportunities, Mr. Kapoor's purported goal of drastically slashing the Company's expenses without regard to the relative value of the Company's other assets or the need for management stability is not in the Company's best interest. Your Board believes that Mr. Kapoor's stated intent to reduce the Company's cash burn rate to $30 million can only be accomplished by jettisoning all other products in the Company's pipeline and cutting corners on the clinical trial design for IL-13PE38QQR that has been carefully developed over many years, at substantial cost, with the input of outside consultants and in close cooperation with the FDA. Your Board and management, while no less committed to reducing the Company's costs, do not believe Mr. Kapoor's approach is in the Company's interest; rather, the Company intends to adhere to the existing clinical trial design for IL-13PE38QQR, as it believes this gives it the greatest opportunity for successful commercialization of this product, and has engaged an outside consultant to work with management to value the Company's other products and programs so that they can be prioritized and potentially monetized to raise cash rather than simply abandoned. The Company believes that doing so will improve long-term stockholder value, preserving for development otherwise promising compounds that the Company is not prepared to develop at this time, while potentially raising cash to reduce the Company's burn rate. As we continue to implement our strategy, we expect to further reduce our costs (having recently announced fiscal year 2005 guidance projecting net losses that are 15-25% less than expected fiscal year 2004 net losses) while maximizing the value to our stockholders of all of the Company's assets and maintaining a management team under Mr. Young's leadership that is critical to the success of our clinical trials.

3

In addition, your Board is committed to implementing and promoting good corporate governance practices and to acting in the best interests of all of the Company's stockholders. A strong independent Board with an independent Chairman is an important part of that commitment.

THE BOARD OF DIRECTORS OF THE COMPANY STRONGLY BELIEVES THAT THE SOLICITATION BEING UNDERTAKEN BY MR. KAPOOR IS NOT IN THE BEST INTERESTS OF THE COMPANY'S STOCKHOLDERS.

WE URGE STOCKHOLDERS TO REJECT THE SOLICITATION AND REVOKE ANY CONSENT PREVIOUSLY SUBMITTED.

DO NOT DELAY. IN ORDER TO ENSURE THAT THE EXISTING BOARD IS ABLE TO ACT IN YOUR BEST INTERESTS, PLEASE MARK, SIGN, DATE AND RETURN THE ENCLOSED BLUE CONSENT REVOCATION CARD AS PROMPTLY AS POSSIBLE.

4

QUESTIONS AND ANSWERS ABOUT THIS CONSENT REVOCATION STATEMENT

Q: WHO IS MAKING THIS SOLICITATION?

A: Your Board of Directors.

Q: WHAT ARE WE ASKING YOU TO DO?

A: You are being asked to revoke any consent that you may have delivered in favor of the four proposals described in Mr. Kapoor's consent solicitation statement and, by doing so, retain your current Board, which will continue to act in your best interests.

Q: IF I HAVE ALREADY DELIVERED A CONSENT, IS IT TOO LATE FOR ME TO CHANGE MY MIND?

A: No. Until the requisite number of duly executed, unrevoked consents are delivered to the Company in accordance with Delaware law and the Company's organizational documents, the consents will not be effective. At any time prior to the consents becoming effective, you have the right to revoke your consent by delivering aBLUE Consent Revocation Card, as discussed in the following question.

Q: WHAT IS THE EFFECT OF DELIVERING A CONSENT REVOCATION CARD?

A: By marking the "YES, REVOKE MY CONSENT" boxes on the enclosedBLUE Consent Revocation Card and signing, dating and mailing the card in the postage-paid envelope provided, you will revoke any earlier dated consent that you may have delivered to Mr. Kapoor. Even if you have not submitted a consent card, you may submit a consent revocation as described above. Although submitting a consent revocation will not have any legal effect if you have not previously submitted a consent card, it will help us keep track of the progress of the consent process.

Q: WHAT SHOULD I DO TO REVOKE MY CONSENT?

A: Mark the "YES, REVOKE MY CONSENT" boxes next to each proposal listed on theBLUE Consent Revocation Card. Then, sign, date and return the enclosedBLUE Consent Revocation Card today to Morrow & Company in the envelope provided. It is important that you date theBLUE Consent Revocation Card when you sign it.

Q: WHAT HAPPENS IF I DO NOTHING?

A: If you do not send in any consent Mr. Kapoor may send you and do not return the enclosedBLUE Consent Revocation Card, you will effectively be voting AGAINST Mr. Kapoor's proposals.

Q: WHAT HAPPENS IF MR. KAPOOR'S PROPOSALS PASS?

A: If unrevoked consents representing a majority of our outstanding common stock are delivered to us within 60 days of the earliest-dated consent, four of the six members of your Board would be replaced with Mr. Kapoor's handpicked nominees, which your board believes will give a minority stockholder substantial influence and control over the actions, strategy and direction of your Company. Our By-laws would also be amended as described in this Consent Revocation Statement.

Q: WHAT IS YOUR BOARD'S POSITION WITH RESPECT TO MR. KAPOOR'S PROPOSALS?

A: Your Board has determined that Mr. Kapoor's proposals are not in the best interests of the Company's stockholders and that stockholders should reject the proposals. The Board's reasons and recommendations are contained in the section entitled "Reasons to Reject Mr. Kapoor's Consent Solicitation Proposals."

5

Q: WHAT DOES YOUR BOARD OF DIRECTORS RECOMMEND?

A: Your Board strongly believes that the solicitation being undertaken by Mr. Kapoor is not in the best interests of the Company's stockholders. Your Board opposes the solicitation by Mr. Kapoor and urges stockholders to reject the solicitation and revoke any consent previously submitted.

Q: WHO IS ENTITLED TO CONSENT, WITHHOLD CONSENT OR REVOKE A PREVIOUSLY GIVEN CONSENT WITH RESPECT TO MR. KAPOOR'S PROPOSALS?

A: Only the stockholders of record of the Company common stock on the record date are entitled to consent, withhold consent or revoke a previously given consent with respect to Mr. Kapoor's proposals. The Board has set a record date of September 28, 2004.

Q: WHO SHOULD I CALL IF I HAVE QUESTIONS ABOUT THE SOLICITATION?

A: Please call Morrow & Company toll free at 1-800-607-0088.

THE CONSENT PROCEDURE

VOTING SECURITIES AND RECORD DATE

The Board has set a record date of September 28, 2004 (the "Record Date") for the determination of stockholders who are entitled to execute, withhold or revoke consents relating to Mr. Kapoor's proposals. As of August 31, 2004, there were 23,294,165 shares of the Company's common stock outstanding. Each share of the Company's common stock outstanding as of the Record Date will be entitled to one consent per share.

Only stockholders of record as of the Record Date are eligible to execute, withhold and revoke consents in connection with Mr. Kapoor's proposals. Persons beneficially owning shares of the Company's common stock (but not holders of record), such as persons whose ownership of the Company's common stock is through a broker, bank or other financial institution, should contact such broker, bank or financial institution and instruct such person to execute theBLUE Consent Revocation Card on their behalf.

EFFECTIVENESS OF CONSENTS

Under Delaware law, unless otherwise provided in a corporation's certificate of incorporation, stockholders may act without a meeting, without prior notice and without a vote, if consents in writing setting forth the action to be taken are signed by the holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted. The Company's certificate of incorporation does not prohibit stockholder action by written consent. Under Section 228 of the Delaware General Corporation Law, Mr. Kapoor's proposals will become effective if valid, unrevoked consents signed by the holders of a majority of the shares of the Company's common stock outstanding as of the Record Date are delivered to the Company within 60 days of the earliest-dated consent delivered to the Company.

Because Mr. Kapoor's proposals could become effective before the expiration of the 60-day period, we urge you to act promptly to return theBLUE Consent Revocation Card.

EFFECT OF BLUE CONSENT REVOCATION CARD

A stockholder may revoke any previously signed consent by signing, dating and returning to the Company aBLUE Consent Revocation Card. A consent may also be revoked by delivery of a written revocation of your consent to Mr. Kapoor. Stockholders are urged, however, to deliver all consent revocations to Morrow & Company, 445 Park Avenue, New York, New York 10022 (Facsimile

6

No. 212-754-8300). The Company requests that if a revocation is instead delivered to Mr. Kapoor, a copy of the revocation also be delivered to the Company, c/o Morrow & Company, at the address or facsimile number set forth above, so that the Company will be aware of all revocations.

Unless you specify otherwise, by signing and delivering theBLUE Consent Revocation Card, you will be deemed to have revoked your consent to all of Mr. Kapoor's proposals.

Any consent revocation may itself be revoked by marking, signing, dating and delivering a written revocation of your Consent Revocation Card to the Company or to Mr. Kapoor or by delivering to Mr. Kapoor a subsequently dated white consent card that Mr. Kapoor sent to you.

If any shares of common stock that you owned on the Record Date were held for you in an account with a stock brokerage firm, bank nominee or other similar "street name" holder, you are not entitled to vote such shares directly, but rather must give instructions to the stock brokerage firm, bank nominee or other "street name" holder to grant or revoke consent for the shares of common stock held in your name. Accordingly, you should contact the person responsible for your account and direct him or her to execute the enclosedBLUE Consent Revocation Card on your behalf. You are urged to confirm in writing your instructions to the person responsible for your account and provide a copy of those instructions to the Company, c/o Morrow & Company, at the address set forth above so that the Company will be aware of your instructions and can attempt to ensure such instructions are followed.

YOU HAVE THE RIGHT TO REVOKE ANY CONSENT YOU MAY HAVE PREVIOUSLY GIVEN TO MR. KAPOOR. TO DO SO, YOU NEED ONLY SIGN, DATE AND RETURN IN THE ENCLOSED POSTAGE PREPAID ENVELOPE THEBLUE CONSENT REVOCATION CARD WHICH ACCOMPANIES THIS CONSENT REVOCATION STATEMENT. IF YOU DO NOT INDICATE A SPECIFIC VOTE ON THEBLUE CONSENT REVOCATION CARD WITH RESPECT TO ONE OR MORE OF MR. KAPOOR'S CONSENT PROPOSALS, THE CONSENT REVOCATION CARD WILL BE USED IN ACCORDANCE WITH THE BOARD'S RECOMMENDATION TO REVOKE ANY CONSENT WITH RESPECT TO SUCH PROPOSALS.

The Company has retained Morrow & Company to assist in communicating with stockholders in connection with Mr. Kapoor's consent solicitation and to assist in our efforts to obtain consent revocations. If you have any questions about how to complete or submit yourBLUE Consent Revocation Card or any other questions, Morrow & Company will be pleased to assist you. You may call Morrow & Company toll-free at 1-800-607-0088. You may also contact Morrow & Company at 212-754-8000.

You should carefully review this Consent Revocation Statement. YOUR TIMELY RESPONSE IS IMPORTANT. You are urged not to sign any white consent cards. Instead, reject the solicitation efforts of Mr. Kapoor by promptly completing, signing, dating and mailing the enclosed BLUE Consent Revocation Card to Morrow & Company, 445 Park Avenue, New York, New York 10022 (Facsimile No. 212-754-8300). Please be aware that if you sign a white card but do not check any of the boxes on the card, you will be deemed to have consented to Mr. Kapoor's proposals.

RESULTS OF THIS CONSENT REVOCATION SOLICITATION

The Company will retain an independent inspector of elections in connection with Mr. Kapoor's solicitation. The Company intends to notify stockholders of the results of the consent solicitation by issuing a press release, which it will also file with the Commission as an exhibit to a Current Report on Form 8-K.

7

SOLICITATION OF CONSENT REVOCATIONS

COST AND METHOD

The cost of the solicitation of revocations of consent will be borne by the Company. The Company estimates that the total expenditures relating to the Company's current revocation solicitation (other than salaries and wages of officers and employees, but including costs of litigation related to the solicitation) will be approximately $350,000, of which approximately $100,000 has been incurred as of the date hereof. In addition to solicitation by mail, directors, officers and other employees of the Company may, without additional compensation, solicit revocations by mail, in person or by telephone or other forms of telecommunication.

The Company has retained Morrow & Company as proxy solicitors, at an estimated fee of $85,000, plus expenses incurred on our behalf, to assist in the solicitation of revocations. The Company will reimburse brokerage houses, banks, custodians and other nominees and fiduciaries for out-of-pocket expenses incurred in forwarding the Company's consent revocation materials to, and obtaining instructions relating to such materials from, beneficial owners of the Company's common stock. Morrow & Company has advised the Company that approximately 50 of its employees will be involved in the solicitation of revocations by Morrow & Company on behalf of the Company. In addition, Morrow & Company and certain related persons will be indemnified against certain liabilities arising out of or in connection with the engagement.

PARTICIPANTS IN THE SOLICITATION

Under applicable regulations of the Commission, each of our directors and certain of our executive officers and other employees may be deemed to be a "participant" in this consent solicitation. Please refer to the section entitled "Information About The Company and Its Directors and Officers" and to Annex I, "Certain Information Regarding Participants in this Consent Revocation Solicitation" and Annex II, "Recent Trading History of Participants in this Consent Revocation Solicitation" for information about our directors, officers and other employees who may be deemed to be a participant in the solicitation. Except as described in this document, there are no agreements or understandings between the Company and any of its directors or executive officers relating to employment with the Company or any future transactions.

Other than the persons described above and in Annex I, no general class of employee of the Company will be employed to solicit stockholders. However, in the course of their regular duties, employees may be asked to perform clerical or ministerial tasks in furtherance of this solicitation.

APPRAISAL RIGHTS

Our stockholders are not entitled to appraisal rights in connection with Mr. Kapoor's proposals or this Consent Revocation Statement.

8

INFORMATION ABOUT THE COMPANY AND ITS DIRECTORS AND OFFICERS

CORPORATE GOVERNANCE POLICIES AND PRACTICES

Board of Directors and its Committees

The following table provides information regarding the membership of and number of meetings during 2003 of the Company's Board of Directors and its committees.

Name

| | Board

of Directors

| | Audit

Committee

| | Compensation

Committee

| | Corporate

Governance

Committee

| | Qualified

Legal

Compliance

Committee

| |

|---|

| Erick E. Hanson | | X | * | X | | X | | X | * | | |

| Sander A. Flaum | | X | | | | X | * | X | | X | |

| John N. Kapoor | | X | | | | | | | | | |

| Matthew P. Rogan | | X | | X | | X | | X | | X | * |

| Kaveh T. Safavi | | X | | X | * | X | | X | | X | |

| Gregory P. Young | | X | | | | | | | | | |

Number of 2003 Meetings |

|

12 |

|

6 |

|

2 |

|

10 |

|

None |

|

- *

- indicates Chairman

Each Director, with the exception of Mr. Flaum, attended at least 75% of the aggregate of the meetings of the Board and its committees on which they served during 2003. During the same time period, Mr. Flaum attended 75% (three out of four) of the meetings of the full Board, 100% of the meetings of the Compensation Committee (of which he is the Chairman) and 60% of the meetings of the Corporate Governance Committee. Each Director attended the Company's 2004 Annual Meeting of Stockholders and each of the Directors is expected to attend the Company's 2005 Annual Meeting of Stockholders. The Independent Directors regularly meet without members of management present and Mr. Hanson presides at these meetings.

Determinations Regarding Director Independence

The Board of Directors has determined each of the following directors to be an "independent director" as such term is defined in Marketplace Rule 4200(a)(15) of the National Association of Securities Dealers (the "NASD"): Sander A. Flaum, Erick E. Hanson, Matthew P. Rogan, M.D., and Kaveh T. Safavi, M.D., J.D.

In this consent revocation statement these four directors are sometimes referred to individually as an "Independent Director" and collectively as the "Independent Directors."

The Board of Directors has also determined that each member of the Audit, Compensation and Corporate Governance Committees of the Board meets the independence requirements applicable to those committees prescribed by the NASD, the Securities and Exchange Commission ("SEC") and the Internal Revenue Service.

With the assistance of independent legal counsel, the Corporate Governance Committee reviewed the applicable legal standards for Board member and Board committee member independence, as well as the answers to annual questionnaires completed by each of the directors. On the basis of this review, the Corporate Governance Committee delivered a report to the full Board of Directors and the Board made its independence determinations based upon the Corporate Governance Committee's report and each member's review of the information made available to the Corporate Governance Committee.

9

Committees

The Board of Directors has Audit, Compensation, Corporate Governance, and Qualified Legal Compliance Committees. The principal responsibilities of each of these committees are described generally below, and in detail in their respective Committee Charters, which are each available atwww.neophrm.com.

Audit Committee. The Audit Committee operates pursuant to a written charter, which complies with the applicable provisions of the Sarbanes-Oxley Act of 2002 and related rules of the SEC and the NASD. A copy of the Amended and Restated Audit Committee Charter was attached as Appendix A to the Company's 2004 Annual Meeting Proxy Statement. As more fully described in the Charter, the Audit Committee is responsible for overseeing the Company's accounting and financial reporting processes, including the quarterly reviews and the annual audit of the Company's financial statements by KPMG LLP, the Company's independent accountants.

The Audit Committee currently consists of Messrs. Safavi, Hanson and Rogan, each of whom served on the Committee throughout 2003. Each of these directors meets the independence criteria prescribed by applicable law and the rules of the SEC for audit committee membership and is an "independent director" as defined in NASD Marketplace Rule 4200(a)(15). While each of the current members meets the NASD's financial knowledge requirements, currently none of the Audit Committee members qualify as an "audit committee financial expert," as that term is defined in applicable SEC regulations. Under its Charter, the Audit Committee has the ability on its own and at the Company's expense to retain independent accountants or other consultants whenever is deems appropriate. While the Board of Directors believes this ability is equivalent to having access to an audit committee financial expert, the Board of Directors also recognizes that it is desirable for the Company to nominate as a director a person who would qualify as an audit committee financial expert, but only if that person also possesses the experience and qualifications that the Company is seeking in new members of the Board of Directors. Accordingly, the Corporate Governance Committee has been directed to recruit, and recommend to the Board for election to the Board, an individual who would qualify as such an audit committee financial expert.

Compensation Committee. The Compensation Committee is responsible for conducting an annual review of the Company's compensation packages for senior executive officers, including the president and chief executive officer. In connection therewith, the Compensation Committee reviews and recommends to the Board of Directors: (i) the annual base salary level, (ii) the annual cash bonus opportunity level, and (iii) the long-term incentive opportunity for each senior executive officer. The Compensation Committee's recommendations are reviewed and approved by the Board of Directors.

The Compensation Committee currently consists of Messrs. Flaum, Hanson, Rogan and Safavi, each of whom served on the Committee throughout 2003. Each director who served on the Compensation Committee during fiscal 2003 qualifies as an "outside director" under Section 162(m) of the Internal Revenue code (the "Code"), a "non-employee director" as such term is defined in Rule 16b-3 promulgated under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and an "independent director" as such term is defined in NASD Marketplace Rule 4200(a)(15).

The Board of Directors has adopted a Compensation Committee Charter, a copy of which was attached to the Company's 2004 Annual Meeting Proxy Statement as Appendix B and is available on the Company's website.

Corporate Governance Committee. The Corporate Governance Committee is responsible for developing and implementing policies and procedures that are intended to constitute and organize appropriately the Board of Directors to meet its fiduciary obligations to the Company and its stockholders on an ongoing basis. Among its specific duties, the Corporate Governance Committee makes recommendations to the Board of Directors about the Company's corporate governance

10

processes, assists in identifying and recruiting candidates for the Board, develops and recommends criteria for director nominee qualifications, considers nominations to the Board received from stockholders, makes recommendations to the Board regarding the membership and size of the Board's committees, oversees the annual evaluation of the effectiveness of the organization of the Board and of each of its committees, periodically reviews and recommends to the Board an overall compensation program for directors and develops and recommends to the Board, and annually reviews, the Company's Code of Business Conduct and Ethics.

The Corporate Governance Committee currently consists of Messrs. Hanson, Flaum, Rogan and Safavi, each of whom served on the Committee throughout 2003. The Board of Directors has determined that committee members meet NASD independence requirements. The Committee operates pursuant to an Amended and Restated Corporate Governance Committee Charter, a copy of which was attached to the Company's 2004 Annual Meeting Proxy Statement as Appendix C and is available on the Company's website.

Qualified Legal Compliance Committee. Members of the Qualified Legal Compliance Committee are Messrs. Rogan, Flaum and Safavi. The Qualified Legal Compliance Committee receives and investigates reports made to it concerning possible material violations of securities laws or breaches of fiduciary duty by the Company or any of its officers, directors, employees or agents. No such reports were made to the Qualified Legal Compliance Committee, and therefore it did not meet during 2003.

Director Nominations

The Corporate Governance Committee is responsible for identifying, screening, personally interviewing and recommending director nominee candidates to the Board. The Corporate Governance Committee considers nominees on the basis of their integrity, experience, achievements, judgment, intelligence, personal character, ability to make independent analytical inquiries, willingness to devote adequate time to Board duties, and the likelihood that they will be willing to serve on the Board for a sustained period.

The Corporate Governance Committee will consider qualified director candidates who are suggested by stockholders in written submissions to NeoPharm's Corporate Secretary at NeoPharm, Inc., 150 Field Dr., Suite 195, Lake Forest, IL 60045; Attention: Corporate Secretary's Office (fax no. 847-295-8854; email: corporatesecretary@neophrm.com). Any recommendation submitted by a stockholder must include the name of the candidate, a description of the candidate's educational and professional background, contact information for the candidate, a brief explanation of why the stockholder feels the candidate is suitable for election and a representation that the individual so proposed has consented to be nominated for consideration as a director. The Corporate Governance Committee will apply the same standards in considering director candidates recommended by stockholders as it applies to other candidates.

In addition to recommending director candidates to the Corporate Governance Committee, stockholders may also nominate one or more persons for election as a director of the Company at an annual meeting of stockholders if the stockholder complies with the notice, information and consent provisions contained in the Company's Amended and Restated By-laws, including, but not limited to, the Company's advance notice by-law provision which was adopted in 2003. Under the advance notice by-law, in order for the director nomination to be timely, a stockholder's notice to the Company's secretary must be delivered to the Company's principal executive offices not less than 120 days prior to the anniversary of the date of the Company's proxy statement was mailed to stockholders in connection with the previous year's annual meeting. In the event that the Company sets an annual meeting date that is not within 30 days before or after the date of the immediately preceding annual stockholders' meeting, notice by the stockholder must be received no later than the close of business on the later of 120 days in advance of such annual meeting and the 10th day following the day on which public

11

disclosure of the date of the annual meeting was made. Nominations, as well as other proposals for the Company's Annual Meeting of Stockholders to be held in 2005, must be submitted in writing addressed to: Corporate Secretary, NeoPharm, Inc., 150 Field Drive, Suite 195, Lake Forest, Illinois 60045. Nominations must include the name, business and residence address, principal business occupation or employment of the candidate, the class and number of shares of the Company beneficially owned by the candidate, a description of all arrangements or understandings between the nominating stockholder and the nominee pursuant to which the nomination is made and any other information relating to the nominee that is required pursuant to Regulation 14A under the Securities Exchange Act of 1934. Nominations for the 2005 Annual Meeting of Stockholders must be received by the Corporate Secretary no later than December 30, 2004.

Compensation of Directors

Directors who are employed by the Company receive no additional compensation as fees for serving as a director. Non-employee directors ("Outside Directors") are eligible to receive grants of restricted stock. Each Outside Director is granted restricted shares of the Company's common stock with an approximate value of $50,000 annually. The shares are not available for sale until the one year anniversary of the stock grant.

Mr. Hanson receives a $10,000 per month fee for his service as Chairman. Outside Directors, other than Mr. Kapoor and Mr. Hanson, are also paid a quarterly fee to serve on the various committees of the Board of Directors, as indicated in the table below. Directors are reimbursed for reasonable out-of-pocket expenses incurred in connection with attendance at any Board or Committee meetings.

Committee

| | Member Compensation

per Quarter

|

|---|

| Governance | | $ | 5,000 |

| Compensation | | $ | 2,000 |

| Audit | | $ | 2,000 |

| Legal | | $ | 2,000 |

Other Relationships

In 2003, the Company had a consulting relationship with EJ Financial Enterprises, Inc., of which Mr. Kapoor, a director and then-Chairman of the Company, is the President and sole stockholder. This relationship was terminated by mutual agreement in June 2004. See "Certain Relationships and Related Transactions" for additional information.

In December 2001, the Company loaned $3,250,000 to Akorn, Inc., of which Mr. Kapoor, a director and then-Chairman of the Company, is a director and Chairman. See "Certain Relationships and Related Transactions" for additional information.

Stockholder Communications

Stockholders may communicate directly with the Board of Directors, any of its committees or any individual director by mailing correspondence (addressed to the attention of the Board, an individual director or a committee, as appropriate), to:

NeoPharm, Inc.

150 Field Drive, Suite 195

Lake Forest, IL 60045

USA

Attn: (name of addressee)

12

DIRECTORS

The following information has been provided by the existing members of the Board of Directors.

Name

| | Age

| | Principal Occupation

|

|---|

| Gregory P. Young | | 51 | | Mr. Young joined the Company as Chief Executive Officer and President, and as a director in June 2004. Prior to joining NeoPharm, Mr. Young was most recently a Corporate Vice President at Baxter Healthcare Corporation (since 2001) and President of Baxter's Transfusion Therapies business (since 1999). From 1996 to 1999 he served as President of the Electronic Infusion Division. Mr. Young joined Baxter in 1985. |

Erick E. Hanson |

|

58 |

|

Mr. Hanson joined the Company as a Director in 1997. Since June 2004, Mr. Hanson has served as Chairman of the Board. Since 1998, Mr. Hanson has served as the President of Hanson and Associates, a consulting firm working with venture capital companies. Mr. Hanson also serves as Senior Vice President of Priority HealthCare Corporation, a publicly-traded pharmaceutical company, and as Executive Vice President of Priority's recently-acquired home healthcare subsidiary Integrity Healthcare, where he served as director until July 2004. From 1995 to 1998, Mr. Hanson served as President and CEO of Option Care, Inc., a publicly-traded provider of home health care services. Prior to joining Option Care, Mr. Hanson held a variety of executive positions with Caremark, Inc., including Vice President Sales and Marketing. Mr. Hanson served as President and Chief Operating Officer of Clinical Partners Inc. in Boston, MA from 1989 to 1991. Prior to 1989, Mr. Hanson was employed for over 20 years at Anthem, Inc., most recently as Senior Vice President. |

Sander A. Flaum |

|

67 |

|

Mr. Flaum joined the Company as a Director in 1998. Mr. Flaum is currently the Managing Director of Flaum Partners, Inc., a consulting firm working with pharmaceutical and biotechnology companies, which he founded in 2003. Mr. Flaum is also Adjunct Professor of Management at the Fordham University Graduate School of Business. Prior to the formation of Flaum Partners, Inc., Mr. Flaum was Chairman and CEO of Robert A. Becker, Inc. Euro RSCG, a healthcare advertising, marketing and communications company. From 1991 through 2002, Mr. Flaum served as CEO of Robert A. Becker EURO/RSCG, a predecessor to Euro RSCG Life. Mr. Flaum also serves on the boards of Viasys Healthcare, a manufacturer of medical devices, instruments and medical and surgical products, Fisher College of Business at The Ohio State University, Fordham University Graduate School of Business, and St. Christopher's Foundation for At-Risk Children. |

| | | | | |

13

John N. Kapoor, Ph.D. |

|

60 |

|

Mr. Kapoor has been a Director of the Board of the Company since its formation in 1990. Mr. Kapoor served as Chairman of the Board of the Company until June 2004. Mr. Kapoor is the sole stockholder and President of EJ Financial Enterprises, Inc., a health care consulting and investment company. In addition, Mr. Kapoor serves as a director and Chairman of each of Option Care, Inc., a provider of home health care services, First Horizon Pharmaceutical Corporation, a distributor of pharmaceuticals, Akorn, Inc., a manufacturer, distributor and marketer of generic ophthalmic products and of Introgen Therapeutics, Inc., a gene therapy company. |

Matthew P. Rogan, M.D. |

|

59 |

|

Dr. Rogan joined the Company as a Director in 2000. Dr. Rogan is President and CEO of Unicorn Pharma Consulting, Inc., a privately held provider of customized pharmaceutical and biotechnology medical services. From 1997 to 1999, Dr. Rogan was Vice President, Medical Affairs for Sanofi Pharmaceuticals in the United States. Prior to joining Sanofi, Dr. Rogan served as Senior Medical Director, Medical Affairs for Zeneca Pharmaceuticals from 1996 to 1997, and was Director of Clinical Support at Burroughs Wellcome from 1993 to 1995. Prior to 1993, Dr. Rogan held senior positions with Bristol Myers Squibb. |

Kaveh T. Safavi, M.D., J.D. |

|

44 |

|

Dr. Safavi joined the Company as a Director in 2000. Dr. Safavi is currently Senior Vice President and Chief Medical Officer of Solucient, LLC, a healthcare information and business intelligence company. From 2000 until 2002, Dr. Safavi served as Vice President of Business and Strategic Development for Alexian Brothers of Illinois, Inc., a multi-hospital health system in metropolitan Chicago, Illinois. Prior to that, Dr. Safavi served as Vice President, Medical Affairs for UnitedHealthcare of Illinois, Inc., a large managed care organization from 1996 to 1999 and served as President of Health Springs Medical Group of Illinois, a primary care group practice and physician practice management company from 1993 to 1995. |

REPORT OF THE COMPENSATION COMMITTEE

Philosophy and Objectives. The Company's executive compensation program is administered by the Compensation Committee of the Board of Directors, which consists of directors Flaum, Hanson, Rogan and Safavi. The Compensation Committee reviews, analyzes and makes recommendations to the full Board regarding the compensation of the Company's executive officers, evaluates the performance of the Chief Executive Officer ("CEO") and approves and makes recommendations to the full Board on the grant of stock options under the Company's Equity Incentive Plan.

The Compensation Committee believes that the goal of the compensation program for the Company's executive officers should be to align executive compensation with the Company's business objectives and performance in a manner which emphasizes increasing value for stockholders and allows

14

the Company to reward those executive officers who contribute to the Company's long-term success. Based upon this objective, the Compensation Committee's incentive compensation program is designed to pay base salaries to executives at levels that enable the Company to attract, motivate and retain capable executives. In addition, the Compensation Committee may recommend annual cash bonuses, as well as stock option grants, as a component of compensation and/or as a reward for performance based upon: (i) individual performance, (ii) the Company's operating and financial results and departmental goals, (iii) the actions of the Company's peer group, and (iv) other performance measures. Stock option grants, which are made at the fair market value of the common stock on the grant date, are intended to result in no reward if the stock price does not appreciate, but may provide substantial rewards to executives as stockholders benefit from stock price appreciation.

Components of Compensation. There are three major elements of executive officer compensation: (i) base salary, (ii) annual cash bonus awards, and (iii) equity-based incentive awards in the form of stock option grants. Executive officers also receive other standard benefits, including medical, disability and life insurance, and an automobile allowance.

The Compensation Committee uses its subjective judgment in determining executive officer compensation levels and takes into account both qualitative and quantitative factors. Among the factors considered by the Compensation Committee are the recommendations of the Company's CEO with respect to the compensation of other key executive officers.

In making compensation decisions, the Compensation Committee considers compensation practices and the financial performance of the Company's peer group. The peer group is comprised of drug delivery and biotech companies that are among those entities which participate in an annual biotechnological survey conducted by Radford Associates in conjunction with Aon Consulting Group (the "Radford Survey"). The 2003 Radford Survey included public and private companies considered to be similar to the Company or to its competitors. Specific compensation for individual officers, however, will vary from these levels as a result of subjective factors considered by the Compensation Committee unrelated to compensation practices of comparable companies.

The Compensation Committee uses this information as a guide, and in general does not target total executive compensation or any component thereof to any particular point within, or outside, the range of peer group results.

Base Salary. Each Company executive receives a base salary. The Company targets base pay at the level believed necessary to attract and retain capable executives. In determining salaries, the Compensation Committee also takes into account, among other factors, individual experience and performance and specific needs particular to the Company. In determining base salaries for 2003, the Compensation Committee reviewed the peer group data with the Company's CEO for each executive position. In addition, the Compensation Committee reviewed the responsibility level of each position, together with the executive officer's individual performance for the prior year and objectives for the current year. In addition, the Company's overall performance during the past year was compared to objectives for the prior year and performance targets for the current year. During 2003, the base salaries for each of our executive officers, other than the CEO, were adjusted 4%.

Bonus. In addition to base salary, executive officers are eligible to receive an annual cash bonus. Bonuses are determined based upon the achievement of qualitative and quantitative individual, departmental and Company performance, as well as a comparison to comparable positions among peer group companies. Examples of quantitative performance milestones include patient enrollment in clinical trials, completion of clinical trials, the production of required amounts of compounds for use in clinical trials, and operating within budget. The qualitative performance portion of the bonus is designed to compensate for outstanding performance in the discretion of the Board. Each of the executive officers other than Mr. Hussey were eligible in 2003 to earn bonuses of up to 50% of their base salary, with quantitative, milestone-based bonus amounts of up to 30% and a qualitative portion of

15

up to 20%. Mr. Hussey's bonus was entirely quantitative milestone-based, and could not exceed 60% of his base salary. As a group for 2003, the cash bonus provided to the Company's executive officers as a percentage of base salary was 27.5%, the average level for the Company's peer group. To the extent any bonus amount paid is less than the maximum amount that could be earned, it is either due to a failure of the group to achieve all of the milestones assigned to it, or due to a decision by the Board in its discretion not to award the full amount of the qualitative performance portion.

Stock Options. The Compensation Committee believes that it is important for executives to have an equity stake in the Company, and, toward this end, recommends to the full Board stock options grants for key executives from time to time. Stock options represent a valuable portion of the compensation program for the Company's executive officers. The exercise price of stock options is the fair market value of the shares on the date of the grant and generally only provide a benefit if the value of the shares increases. Upon a "Change of Control," as defined in the 1998 Equity Incentive Plan, all options would become vested unless otherwise provided in the Stock Option Award granting such options. In recommending option awards, the Compensation Committee reviews the needs of the Company in obtaining or retaining a particular individual's services, the recommendations of the CEO, the awards granted to other executives within the Company and the individual officer's specific role and contribution to the Company. In 2003, the Compensation Committee recommended grants of options to purchase an aggregate of 139,225 shares of common stock, including options to executive officers to purchase an aggregate of 69,000 shares.

Chief Executive Officer Compensation. Mr. Hussey's initial base salary was established under the terms of his 1998 employment contract. For 2003, Mr. Hussey was paid $339,768 in base salary, which placed him in the 60th percentile of the Radford Survey for the Company's peer group. No adjustment in base salary has been made for 2004. Under the terms of his employment contract, Mr. Hussey is also eligible to receive a bonus which varies based on his achievement of various performance goals. For 2003, Mr. Hussey's bonus was $111,158, which represented 32.7% of his base salary. As the final component of his 2003 compensation, the Compensation Committee approved an option grant to Mr. Hussey of 46,000 options which will vest in four equal annual installments.

Tax Deduction for Compensation. Section 162(m) ("Section 162(m)") of the Internal Revenue Code of 1986, as amended (the "Code"), provides that no deduction for federal income tax purposes shall be allowed to a publicly held corporation, such as the Company, for applicable employee remuneration with respect to any covered employee to the extent that the amount of such remuneration for the taxable year with respect to such employee exceeds $1.0 million. For purposes of this limitation, the term "covered employee" generally includes the chief executive officer of the corporation and the four highest compensated officers of the corporation (other than the chief executive officer), and the term "applicable employee remuneration" generally means, with respect to any covered employee for the taxable year, the aggregate amount allowable as a federal income tax deduction for services performed by such employee (whether or not during the taxable year); provided, however, that applicable employee remuneration does not include, among other items, certain remuneration payable solely on account of the attainment of one or more performance goals ("performance based compensation"). It is the Company's general intention that the remuneration paid to its covered employees not exceed the deductibility limitation established by Section 162(m). While it is not anticipated that any executive officer of the Company will receive compensation in excess of the Section 162(m) limit, due to the fact that not all remuneration paid to covered employees may qualify as performance-based compensation, it is possible that the Company's deduction for remuneration paid to any covered employee during a taxable year could be limited by Section 162(m).

16

Submitted by the Compensation Committee of the Board of Directors

| September 2004 | | Sander A. Flaum,Chairman,

Erick E. Hanson,

Matthew P. Rogan and

Kaveh T. Safavi |

EXECUTIVE COMPENSATION

Summary of Cash and Certain Other Compensation of Executive Officers. The following table sets forth certain summary compensation information for the fiscal year ended December 31, 2003, for services rendered by each person who served as chief executive officer of the Company at any time during 2003 and for each executive officer of the Company who received more than $100,000 in salary and bonus in 2003 or for any person currently serving in any such position for whom information would have been provided but for the fact such person was not an executive officer of the Company at the end of the fiscal year ended December 31, 2003 (the "Named Executive Officers").

| |

| | Annual Compensation

| |

| | Long-Term

Compensation Awards

| |

|---|

Name and

Principal Position

| | Fiscal

Year

| | Salary($)

| | Annual

Compensation

Bonus($)

| | Other Annual

Compensation

| | Restricted

Stock

Awards($)

| | Options(#)

| |

|---|

Gregory P. Young,

Chief Executive Officer

and President* | | 2003

2002

2001 | | $

| —

—

— | | $

| —

—

— | | $

| —

—

— | | $

| —

—

— | | —

—

— | |

James M. Hussey,

Chief Executive Officer

and President** |

|

2003

2002

2001 |

|

$

|

339,768

326,700

297,000 |

|

$

|

111,158

179,685

148,500 |

|

$

|

10,169

9,000

9,000 |

|

$

|

0

0

0 |

|

46,000

287,500

126,500 |

(1)

(2)

(3) |

Jeffrey W. Sherman, M.D.,

Chief Medical Officer and

Executive Vice President |

|

2003

2002

2001 |

|

$

|

245,700

236,250

225,000 |

|

$

|

47,631

70,875

90,000 |

|

$

|

5,760

3,600

3,600 |

|

$

|

0

0

0 |

|

23,000

37,375

88,550 |

(4)

(5)

(3) |

Imran Ahmad, Ph.D.,

Chief Scientific Officer

and Executive Vice President |

|

2003

2002

2001 |

|

$

|

187,200

180,000

150,000 |

|

$

|

66,160

54,000

45,000 |

|

$

|

4,383

3,600

13,614 |

|

$

|

0

0

0 |

|

0

83,375

44,275 |

(6)

(3) |

Lawrence A. Kenyon,

Chief Financial Officer

and Secretary |

|

2003

2002

2001 |

|

$

|

156,000

150,000

125,000 |

|

$

|

30,420

45,000

37,500 |

|

$

|

4,241

3,600

3,600 |

|

$

|

0

0

0 |

|

0

54,625

31,625 |

(7)

(3) |

- *

- Mr. Young was appointed Chief Executive Officer and President effective July 12, 2004.

- **

- Mr. Hussey resigned as Chief Executive Officer and President effective June 17, 2004.

- (1)

- The stock options became exercisable for 25% of the covered shares on March 10, 2004 and become exercisable with respect to an additional 25% on each anniversary of such date.

- (2)

- The stock options become exercisable for 100% of the covered shares on February 1, 2005.

- (3)

- The stock options became exercisable for 25% of the covered shares on February 2, 2002 and become exercisable with respect to an additional 25% on each anniversary of such date.

- (4)

- The stock options became exercisable for 25% of the covered shares on May 10, 2004 and become exercisable with respect to an additional 25% on each anniversary of such date.

- (5)

- The stock options became exercisable for 25% of the covered shares on February 1, 2003 and will become exercisable with respect to an additional 25% on each anniversary of such date.

- (6)

- 14,375 stock options were granted on February 1, 2002. These options became exercisable for 25% of the covered shares on February 1, 2003 and will become exercisable with respect to an additional 25% on each anniversary of such date. The remaining 69,000 stock options were granted on October 24, 2002 and became exercisable for 25% of the covered shares on October 24, 2003, and will become exercisable with respect to an additional 25% on each anniversary of such date.

- (7)

- 8,625 stock options were granted on February 1, 2002. These options became exercisable for 25% of the covered shares on February 1, 2003 and will become exercisable with respect to an additional 25% on each anniversary of such date. The remaining 46,000 stock options were granted on October 24, 2002 and became exercisable for 25% of the covered shares on October 24, 2003, and will become exercisable with respect to an additional 25% on each anniversary of such date.

17

Option Grants in Last Fiscal Year

The following table sets forth information with respect to grants of options to purchase shares of common stock granted to the Named Executive Officers during the fiscal year ended December 31, 2003:

Individual Grants

| |

| |

| |

| |

| | Potential Realizable Value at

Assumed Annual Rates of

Stock Price Appreciation for

Option Terms

|

|---|

| |

| | % of Total

Options Granted

to Employees in

Fiscal Year

| |

| |

|

|---|

Name

| | Granted

Options(#)

| | Exercise Price

Per Share

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Gregory P. Young* | | — | | — | % | $ | — | | — | | $ | — | | $ | — |

James M. Hussey** |

|

46,000 |

|

33.0 |

|

|

8.45 |

|

3/10/2013 |

|

|

244,451 |

|

|

619,488 |

Jeffrey W. Sherman |

|

23,000 |

|

16.5 |

|

|

13.13 |

|

5/08/2013 |

|

|

189,920 |

|

|

481,294 |

- *

- Mr. Young was appointed Chief Executive Officer and President effective July 12, 2004.

- **

- Mr. Hussey resigned as Chief Executive Officer and President effective June 17, 2004.

Aggregated Option Exercises in Last Fiscal Year, and Fiscal Year-End Option Values

The following table sets forth information with respect to stock options exercised during the fiscal year ended December 31, 2003, and the value at December 31, 2003, of unexercised stock options held by the Named Executive Officers:

Individual Grants

Name

| | Shares Acquired

on Exercise

#

| | Value

Realized

$

| | Number of Unexercised

Options at

Fiscal Year-End

Exercisable/Unexercisable

#

| | Value of Unexercised

Options In-the-Money

at Fiscal Year-End

Exercisable/Unexercisable

$*

|

|---|

| Gregory P. Young** | | — | | $ | — | | — | | — |

James M. Hussey*** |

|

0 |

|

|

0 |

|

686,261/418,888 |

|

$7,131,757/$1,751,072 |

Jeffrey W. Sherman |

|

0 |

|

|

0 |

|

176,955/136,420 |

|

41,459/241,449 |

Imran Ahmad |

|

0 |

|

|

0 |

|

90,417/100,483 |

|

256,473/406,543 |

Lawrence A. Kenyon |

|

0 |

|

|

0 |

|

57,930/66,270 |

|

159,032/264,209 |

- *

- Represents the fair market value at December 31, 2003 of the common stock underlying the options minus the exercise price.

- **

- Mr. Young was appointed Chief Executive Officer and President effective July 12, 2004.

- ***

- Mr. Hussey resigned as Chief Executive Officer and President effective June 17, 2004.

Equity Compensation Plans

1998 Equity Incentive Plan. The 1998 Equity Incentive Plan (the "1998 Plan") which was originally approved by stockholders in July 1998, and amended by stockholders in June 2002, is described in more detail in Note 6 in the Notes to Financial Statements in our Annual Report on Form 10-K for the year

18

ended December 31, 2003. Under the terms of the 1998 Plan, outstanding options would automatically vest upon a "Change of Control" as defined in the 1998 Plan. The 1998 Plan, as amended, authorizes the grant of options to the Company's employees, officers, directors and consultants of up to 4,000,000 shares of the Company's common stock. Options to purchase 1,793,750 shares remained available as of December 31, 2003.

1995 Stock Option Plan. The 1995 Stock Option Plan (the "1995 Plan") was approved by stockholders in January 1995, and was replaced by the 1998 Plan upon approval of that Plan by stockholders in July 1998. Under the terms of the 1995 Plan, the Board of Directors, or a designated committee of the Board, as the administrator of the 1995 Plan, has the discretion to allow unvested and vested options to be exercisable upon a merger or sale of the Company's assets. The 1995 Plan authorized the grant of options to the Company's employees, officers, directors and consultants of up to 1,400,000 shares of the Company's common stock. No options to purchase any shares of the Company's common stock remain available for future grants under the 1995 Plan, however, options to purchase 606,567 shares remain outstanding under the 1995 Plan.

Employment and Other Agreements

Mr. Gregory P. Young entered into an employment agreement (the "Agreement") with the Company as of June 17, 2004, as described below under the caption "Certain Relationships and Related Transactions." Mr. James M. Hussey entered into a separation agreement (the "Separation Agreement") with the Company as of June 17, 2004, as described below under the caption "Certain Relationships and Related Transactions."

Each of the Named Executive Officers, other than Mr. Young, accepted employment with the Company on the basis of a term sheet which set forth the salary and benefits to be provided by the Company, including, but not limited to, an undertaking by the Company to provide salary continuation payments upon a termination of the individual's employment with the Company, at the salary level in existence at the date of termination, for a period of six months for Dr. Sherman and Mr. Kenyon, and for a period of twelve months for Dr. Ahmad. Dr. Ahmad's and Mr. Kenyon's employment is at will, and may be terminated by the Company or the individual, at any time. Dr. Sherman's employment may be terminated by the Company or Dr. Sherman after giving two months prior notice.

Compensation Committee Interlocks and Insider Participation

Mr. James M. Hussey, the Company's Chief Executive Officer and President through June 2004, was a director and member of the compensation committee of Option Care, Inc. throughout 2003. Mr. Kapoor is also chairman of the Board of Option Care, Inc. Mr. Hussey did not stand for re-election at the end of his term in May 2004.

19

SECURITY OWNERSHIP

Except as otherwise noted, the following table sets forth certain information regarding beneficial ownership of shares of the common stock as of August 31, 2004 by (i) all those known by the Company to be beneficial owners of more than 5% of its outstanding common stock, (ii) each director of the Company and each nominee for director, (iii) each of the Named Executive Officers, and (iv) all executives, directors and nominees for director as a group. Unless otherwise noted, each person's address is in care of NeoPharm, Inc., 150 Field Drive, Suite 195, Lake Forest, Illinois 60045.

Name

| | Amount and Nature of

Beneficial Ownership(1)

| | Percent of

Class

| |

|---|

| John N. Kapoor, Ph.D. | | 5,060,793(2) | | 21.73 | % |

Kern Capital Management LLC |

|

3,466,170(3) |

|

14.88 |

|

John N. Kapoor 1994 A Annuity Trust |

|

1,958,180(4) |

|

8.41 |

|

GAM Holding AG |

|

1,665,130(5) |

|

7.15 |

|

David M. Knott |

|

1,195,738(6) |

|

5.13 |

|

S2Technology Corp. |

|

1,177,523(7) |

|

5.06 |

|

Jeffrey W. Sherman, M.D. |

|

255,299(8) |

|

1.10 |

|

Imran Ahmad, Ph.D. |

|

131,818(9) |

|

* |

|

Lawrence A. Kenyon |

|

88,980(10) |

|

* |

|

Sander A. Flaum |

|

50,652(11) |

|

* |

|

Erick E. Hanson |

|

41,797(11) |

|

* |

|

Matthew P. Rogan, M.D. |

|

35,472(12) |

|

* |

|

Kaveh T. Safavi, M.D. |

|

35,472(12) |

|

* |

|

All officers and directors as a group (8 persons) |

|

5,700,283 |

|

24.47 |

% |

- *

- Indicates ownership of less than 1%.

- (1)

- Based on 23,294,165 shares of common stock outstanding as of August 31, 2004. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission (the "Commission") and generally includes voting or investment power with respect to securities. Shares of common stock subject to options exercisable or within 60 days are deemed outstanding for purposes of computing the percentage of the person or group holding such options.

- (2)