UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | Preliminary Proxy Statement |

| | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

x | Definitive Proxy Statement |

| | |

| o | Definitive Additional Materials |

| | |

| o | Soliciting Material Pursuant to § 240.14a-12 |

NEOPHARM, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required |

| | |

| o | Fee computed on table below per Exchange Act Rules 14a 6(i)(1) and 0-11 |

| | (1) | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | Total fee paid: |

| | | | |

| Fee paid previously with preliminary materials. |

| | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | | |

| | (3) | Filing Party: |

| | | | |

| | (4) | Date Filed: |

| | | | |

| | | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

| | | |

Dear Stockholders:

On behalf of the Board of Directors, I invite you to attend the Annual Meeting of Stockholders of NeoPharm, Inc. to be held on August 16, 2007, at 10:00 a.m. local time, at 1850 Lakeside Drive, Waukegan, Illinois.

In the materials accompanying this letter, you will find a Notice of the Meeting, a Proxy Statement relating to the proposals you will be asked to consider and vote upon at the Annual Meeting, and a Proxy Card. The Proxy Statement includes general information regarding NeoPharm as well as additional information relating to the specific proposals to be presented at the Annual Meeting. Also enclosed with the proxy materials is a copy of NeoPharm’s Annual Report to Stockholders.

The formal business to be conducted at the Annual Meeting is described in the Notice of Meeting that follows this letter. In addition, at the Annual Meeting management will review developments at the Company, discuss expectations for the future and be available to answer your questions both during and after the Annual Meeting.

Your vote on the matters that are to come before the Annual Meeting is important. I urge all stockholders to execute and return their proxies promptly. Returning your proxy will not prevent you from voting in person, but will assure that your vote is counted if you are unable to attend the Annual Meeting.

Sincerely,

Laurence P. Birch

Chief Executive Officer and President

July 2, 2007

NeoPharm, Inc.

1850 Lakeside Drive

Waukegan, Illinois 60085

___________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held August 16, 2007

___________

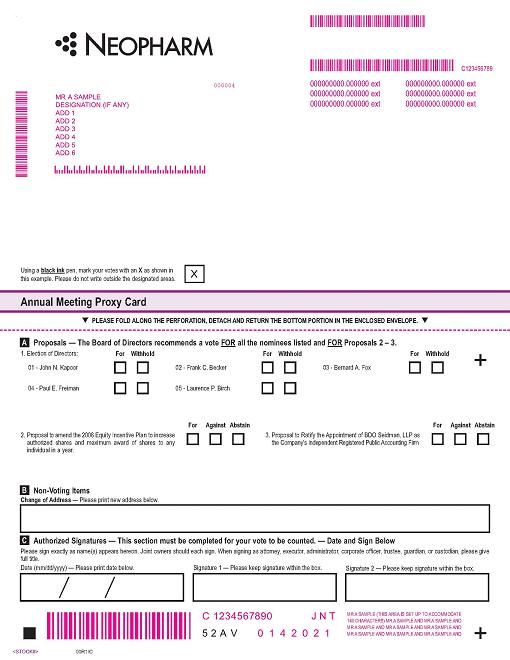

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of NeoPharm, Inc., a Delaware corporation, will be held at 1850 Lakeside Drive, Waukegan, Illinois on August 16, 2007, at 10:00 a.m., local time, for the following purposes:

| | 1. | To elect five directors to serve until the 2008 Annual Meeting of Stockholders. |

| | 2. | To approve proposed amendments to our 2006 Equity Incentive Plan to increase the number of shares of our Common Stock available for issuance under this Plan from 1,000,000 shares to 3,400,000 shares and to increase the maximum number of shares of Common Stock that may be granted to or earned by any Grantee during any calendar year from 500,000 to 750,000 shares. |

| | 3. | To ratify the appointment of BDO Seidman, LLP as the Company’s independent registered public accounting firm for 2007. |

| | 4. | To transact such other business as may properly come before the meeting. |

Only stockholders of record on June 28, 2007 will be entitled to notice of and to vote at the Annual Meeting.

To assure that your interests will be represented, whether or not you plan to attend the Annual Meeting, you are urged to sign and date the enclosed proxy card and promptly return it in the pre-addressed envelope provided, which requires no postage if mailed in the United States. The enclosed proxy is revocable and will not affect your right to vote in person if you attend the Annual Meeting.

| | By Order of the Board of Directors, |

| |  |

| | Laurence P. Birch | |

| | Secretary |

Waukegan, Illinois

July 2, 2007

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

To Be Held August 16, 2007

_________________________

GENERAL INFORMATION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of NeoPharm, Inc., a Delaware corporation (the “Company”), to be used at the Annual Meeting of Stockholders of the Company (the “Annual Meeting”) to be held at 1850 Lakeside Drive, Waukegan, Illinois on August 16, 2007 at 10:00 a.m., local time, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders and in this Proxy Statement. This Proxy Statement and the enclosed form of proxy were first sent or given to stockholders on or about July 2, 2007.

Who Can Vote At The Annual Meeting?

Only stockholders of record at the close of business on June 28, 2007 (the “Record Date”) will be entitled to vote at the Annual Meeting or any adjournment thereof. As of the close of business on the Record Date, there were 28,086,688 shares of the Company’s common stock, par value $.0002145 per share (“Common Stock”), outstanding.

What Constitutes a Quorum for the Meeting?

The presence, either in person or by properly executed proxy, of the holders of a majority of the outstanding shares of Common Stock is necessary to constitute a quorum at the Annual Meeting.

How Many Votes Do I Get To Cast?

In the election of directors, each stockholder is entitled to cast one vote for each director to be elected for each share of stock held; cumulative voting is not permitted. For all matters except the election of directors, each stockholder is entitled to cast one vote for each share of stock held.

What Is The Vote Needed For Approval Of The Various Matter?

Directors are elected by a plurality of the votes cast by the holders of shares of Common Stock at a meeting at which a quorum is present. In all matters other than the election of directors, the affirmative vote of a majority of the outstanding shares of Common Stock present in person or represented by proxy at the Annual Meeting and entitled to vote is required for the adoption of such matters.

How Are Abstentions And Non-Votes Counted?

Assuming the presence of a quorum at the Annual Meeting, each proposal will be voted on separately. With respect to the election of directors, which requires the affirmative vote of a plurality of the shares present in person or represented by proxy, abstentions and non-votes will have no effect. With respect to all other matters to be voted on, the affirmative vote of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote is required. Abstentions will have the same effect as votes against such proposals, while broker non-votes will have no effect on the result of the vote on such matters.

Can I Revoke My Proxy?

A proxy may be revoked at any time before it is exercised by giving a written notice to the Secretary of the Company bearing a later date than the proxy, by submitting a later dated proxy or by voting the shares represented by the proxy in person at the Annual Meeting. Unless revoked, the shares represented by each duly executed, timely delivered proxy will be voted in accordance with the instructions made.

What Happens If No Voting Instructions Are Given?

If no instructions are provided with respect to any matter, such shares will be voted: FOR Proposal 1 (election of directors), FOR Proposal 2 (approval of amendments to the 2006 Equity Incentive Plan), and FOR Proposal 3 (ratification of the independent registered public accounting firm), as proposed in this Proxy Statement.

Are Any Other Matters Being Presented At The Meeting?

The Board of Directors does not plan on presenting any other matters at the Annual Meeting. However, should any other matters properly come before the Annual Meeting, it is the intention of the proxy holders to vote the proxy in accordance with their best judgment.

Who Pays For Soliciting Proxies?

The expenses of soliciting proxies will be paid by the Company. In addition to solicitation by mail, officers, directors and employees of the Company, who will receive no extra compensation therefor, may solicit proxies personally or by telephone, telecopy or telegram. The Company will reimburse brokerage houses, custodians, nominees and fiduciaries for their expenses in mailing proxy materials to principals.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

In June 2007, the Board adopted a resolution decreasing the size of the Company's Board of Directors from eight to five, effective with the 2007 Annual Meeting of Stockholders. This action followed the decision of directors Ronald G. Eidell, Erick E. Hanson and Kaveh T. Safavi not to stand for re-election and to instead retire from the Board upon the new directors being elected. Accordingly, there are five nominees being presented for election at the Annual Meeting, constituting the entire Board. Each director will hold office until the 2008 Annual Meeting of Stockholders and until his successor has been elected and qualified. The Board believes that all of the present nominees will be available for election at the Annual Meeting and will serve if elected. If, due to circumstances not now foreseen, any of the nominees named below will not be available for election, the proxies will be voted for such other person or persons as the Board of Directors may select.

There follows information as to each nominee for election as a director at the Annual Meeting, including his age, present principal occupation, other business experience, directorships of other publicly-held companies and period of service as a director of the Company.

The persons named in the accompanying form of proxy will vote FOR the election of the nominees unless stockholders specify otherwise in their proxies.

Nominees for Director. The following information has been provided by the respective nominees for election to the Board of Directors.

Laurence P. Birch, age 47, director since March 2007. |

| |

Laurence P. Birch joined the Company as President, Chief Executive Officer and as a director in March 2007 and was appointed Acting Chief Financial Officer on April 16, 2007 and Secretary on June 19, 2007. Prior to joining the Company, Mr. Birch was Sr. Vice President and CFO of Ohio Medical Corporation, a supplier of medical air pumping systems from 2006 to March 2007. Before that, Mr. Birch served as Sr. Vice President and CFO, and Interim President and CEO, of AKSYS, Ltd., a hemodialysis developer and manufacturer from 2005 to 2006. Prior to that, Mr. Birch served as co-founder and managing director of Stratego Partners, a cost management consulting firm, from 2003 to 2005, Executive Vice President and CFO of Seurat, Inc., a marketing outsourcing and services company, from 2002 to 2003, Sr. Vice President - Business Development and CFO of Technology Solutions, Inc., a systems integration and consulting company, from 2000 to 2002, and CFO of Brigade, Inc., an internet support company, from 1999 to 2000. Mr. Birch began his career with Baxter Healthcare, a manufacturer and supplier of pharmaceuticals and medical devices, where, over the course of 13 years, he held a variety of positions. Mr. Birch is a director of DataTrak International, Inc., a provider of technology and services to the clinical trial industry. Mr. Birch holds a Bachelor of Science-Finance from the University of Illinois and a MBA from Northwestern University - Kellogg Graduate Business of Management. Mr. Birch is also a Certified Public Accountant.

John N. Kapoor, Ph.D., age 63, director since June 1990. |

| |

John N. Kapoor has been a Director of the Company since its formation in 1990 and has served as Chairman from 1990 to 2004 and from June 2006 to the present. Dr. Kapoor is the sole shareholder and President of EJ Financial Enterprises, Inc., a health care consulting and investment company. In addition, Dr. Kapoor serves as a director and Chairman of each of Option Care, Inc., a provider of home health care services, Akorn, Inc., a manufacturer, distributor and marketer of generic ophthalmic products, and Introgen Therapeutics, Inc., a gene therapy company. Dr. Kapoor received a Ph.D. in medicinal chemistry from the State University of New York at Buffalo and a B.S. in pharmacy from Bombay University, India.

Frank C. Becker, age 71, director since November 2004. |

| |

Frank C. Becker joined the Board in November 2004. Mr. Becker is currently the President and a partner at Greenfield Chemical, a pharmaceutical consulting and sourcing company, which he founded in January 1998. From 1999 to 2002, Mr. Becker served as President and Chief Operating Officer of Sicor Pharmaceuticals, a maker of injectable pharmaceuticals. Mr. Becker is a partner in Southport Marina Development LLC, a firm operating Southport Marina in Kenosha, Wisconsin. Prior to the foregoing relationships, Mr. Becker spent over 35 years at Abbott Laboratories, most recently as Vice President of Process Research and Chemical Manufacturing. Mr. Becker also serves on the Board of Directors of Regis Technologies, a provider of synthesis and separation services. Mr. Becker received his MBA in Finance from the University of Chicago and a B.S. degree in chemical engineering from Purdue University.

Bernard A. Fox, Ph. D., age 53, director since November 2004. |

| |

Bernard A. Fox joined the Board in November 2004. Dr. Fox has been Chief of the Laboratory of Molecular and Tumor Immunology at the Earle Chiles Research Institute at the Providence Portland Medical Center in Portland, Oregon and also Associate Professor in the Departments of Molecular Microbiology and Immunology and Environmental & Biomolecular Systems at Oregon Health and Science University School of Medicine in Portland, Oregon since 1994. Dr. Fox received his post-doctoral training as a Staff Fellow in the Surgery Branch, Division of Cancer Treatment, Clinical Oncology Program at the National Cancer Institute at the National Institutes of Health in Bethesda, Maryland from 1985 to 1987 and was a Senior Staff Fellow there from 1987 to 1990. Dr. Fox is also Vice President of The International Society for the Biological Therapy of Cancer, is a member of the scientific advisory board of the Biological Development Association (Europe), and serves as President and Chief Executive Officer of Ubivac LLC, a development stage biotechnology company.

Paul E. Freiman, age 72, director since November 2004. |

| |

Paul E. Freiman joined the Board in November 2004. Mr. Freiman is currently the President, Chief Executive Officer and a director of Neurobiological Technologies, Inc., a biotechnology company, a post he has held since May 1997. Mr. Freiman served as Chairman and Chief Executive Officer of Syntex Corporation, a pharmaceutical company, from 1990-1995. Mr. Freiman currently serves as Chairman of the Board of SciGen Pte. Ltd., and serves on the boards of Penwest Pharmaceutical Co., a pharmaceutical company, Calypte Biomedical Corporation, a developer of in vitro testing solutions, and Otsuka America Pharmaceuticals Inc., a pharmaceutical company. Mr. Freiman has been chairman of the Pharmaceutical Manufacturers Association of America (PhRMA) and has also chaired a number of key PhRMA committees. Mr. Freiman holds a B.S. degree in pharmacy from Fordham University and an honorary doctorate from the Arnold & Marie Schwartz College of Pharmacy.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

THE ELECTION OF ALL NOMINEES FOR DIRECTOR.

CORPORATE GOVERNANCE POLICIES AND PRACTICES

Board of Directors and its Committees

The following table provides information regarding the membership of and number of meetings during 2006 of the Company’s Board of Directors and its committees.

Name | Board of Directors | Audit Committee | Compensation Committee | Corporate Governance Committee |

| Frank C. Becker | X | X | X | X |

| X | X | | |

| Bernard A. Fox | X | | X | X |

| Paul E. Freiman | X | X | X* | X |

| Erick E. Hanson | X | X | X | X* |

Guillermo A. Herrera(1) | X | | | |

| John N. Kapoor | X* | | | |

| Kaveh T. Safavi | X | X* | | X |

| | | | | |

Number of 2006 Meetings | 13 | 8 | 8 | 6 |

| | | | | |

| * indicates Chairman | | | | |

| (1) Mr. Herrera left the Company in March 2007. | | | | |

Each Director attended at least 75% of the aggregate of the meetings of the Board and its committees on which he served during 2006. While the Company does not have a written policy requiring directors to attend the Annual Meeting, each of the current directors attended the 2006 Annual Meeting of Stockholders and each nominee for director is expected to attend the Company’s 2007 Annual Meeting of Stockholders.

Board Determination of Independence

Under applicable rules of the NASDAQ Stock Market, a director will only qualify as an “independent director” if, in the opinion of our Board of Directors, that person does not have a relationship which would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Our board of directors has determined that none of Frank Becker, Ronald Eidell, Bernard Fox, Paul Freiman, Erick Hanson and Kaveh Safavi has a relationship which would interfere with the exercise of his or her independent judgment in carrying out the responsibilities of a director and, therefore, that each of these directors is an “independent director” as defined under NASDAQ Rule 4200(a)(15).

In determining the independence of Mr. Eidell, our Board of Directors took into consideration NASDAQ’s recent interpretation of Rule 4200(a)(15) which no longer considers a director’s service as an interim officer of the Company for a period of less than one year, nor the receipt of cash and equity compensation for such service, as disqualifications from a determination of independence, though his assistance in the preparation of the Company’s financial statements while serving as interim President and CEO from March 2005 until October 2005 does not allow him to be considered as an independent member of the Audit Committee.

The Board of Directors has determined that each of the current members of the Compensation Committee and Corporate Governance Committee meets the independence requirements applicable to those committees prescribed by the NASDAQ. In addition, the Board of Directors has determined that each member of the Audit Committee meets the criteria for independence established by the Securities and Exchange Commission (“SEC”) and that all the members of the Audit Committee are independent directors for NASDAQ purposes, with the exception of Mr. Eidell who has been appointed to the Audit Committee pursuant to a NASDAQ approved exception. See “Committees-Audit Committee,” below.

Committees

The Board of Directors has Audit, Compensation, and Corporate Governance Committees. The principal responsibilities of each of these committees are described generally below, and in detail in their respective Committee Charters, which are each available at www.neopharm.com.

Audit Committee. The Audit Committee operates pursuant to a written charter, which complies with the applicable provisions of the Sarbanes-Oxley Act of 2002 and related rules of the SEC and NASDAQ. As more fully described in its Charter, the Audit Committee is responsible for overseeing the Company’s accounting and financial reporting processes, including the quarterly reviews and the annual audit of the Company’s financial statements by the Company’s independent auditors. In addition, the Audit Committee is responsible for overseeing the work of the independent auditors, including their appointment, reviewing their compensation, and assessing their independence. The Audit Committee is also responsible for monitoring our internal controls and reviewing related party transactions. The Audit Committee serves as the Company’s Qualified Legal Compliance Committee for purposes of Section 307 of the Sarbanes-Oxley Act.

During 2006, the Audit Committee held 8 meetings. The Audit Committee currently consists of Messrs. Safavi, Becker, Eidell, Freiman, and Hanson, with Dr. Safavi serving as chairman.

The Board of Directors has determined that each of the current members of the Audit Committee meets the independence criteria prescribed by the rules of the SEC for audit committee membership and, with the exception of Mr. Eidell’s service on the Audit Committee, is an “independent director” as defined in NASDAQ Rule 4200(a)(15). With respect to Mr. Eidell, the Board has determined that his service on the Audit Committee does not currently qualify as an Audit Committee “independent director” because of his involvement in the preparation of the Company’s financial statements while serving as interim President and CEO from March 2005 through October 2005. Nevertheless, because of Mr. Eidell’s knowledge and experience in the field of public accounting, and his prior service as Chairman of the Audit Committee, the Board elected to utilize an exception to NASDAQ Rule 4200(a)(15) that allows one director, though not qualifying as independent under NASDAQ rules, to be a member of the Audit Committee. The Board determined that the circumstances leading to Mr. Eidell’s no longer being NASDAQ independent, i.e., his willingness to provide the Company with continuity of leadership by assuming the position of President and CEO on an interim basis during the Company’s eight month executive search for a permanent President, were not sufficient to deny the Company and its stockholders the knowledge and breadth of experience that are gained from Mr. Eidell’s presence on the Audit Committee.

Additionally, the Board has determined that Mr. Eidell qualifies as an audit committee financial expert, as defined by the regulations promulgated by the SEC.

Compensation Committee. The Compensation Committee is responsible for conducting an annual review of the Company’s compensation packages for senior executive officers, including the President and Chief Executive Officer. In connection therewith, the Compensation Committee reviews and recommends to the Board the annual base salary level, and the annual cash bonus, and establishes the long-term incentive opportunity for each senior executive officer. The Compensation Committee’s recommendations are submitted to the Board for approval. The Compensation Committee also reviews and makes recommendations to the Board regarding director compensation. In addition, the Compensation Committee administers, reviews and makes recommendations to the Board regarding our incentive compensation and equity-based plans.

During 2006, the Compensation Committee held 8 meetings. The Compensation Committee currently consists of Messrs. Freiman, Becker, Fox, and Hanson, with Mr. Freiman serving as Chairman. Each of the current members of the Compensation Committee qualifies as an “outside director” under Section 162(m) of the Internal Revenue Code (the “Code”), a “non-employee director” as such term is defined in Rule 16b-3 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and an “independent director” as such term is defined in the rules of the NASDAQ Stock Market. For additional information about the processes and proceedings of the Compensation Committee in making recommendations regarding executive compensation, see “INFORMATION ABOUT EXECUTIVE AND DIRECTOR COMPENSATION.”

Corporate Governance Committee. The Corporate Governance Committee is responsible for developing and implementing policies and procedures that are intended to constitute and organize appropriately the Board of Directors to meet its fiduciary obligations to the Company and its stockholders on an ongoing basis. Among its specific duties, the Corporate Governance Committee makes recommendations to the Board about the Company’s corporate governance processes, assists in identifying and recruiting candidates for the Board, develops and recommends criteria for director nominee qualifications, considers nominations to the Board received from stockholders, makes recommendations to the Board regarding the membership and size of the Board and its’ committees, oversees the annual evaluation of the effectiveness of the organization of the Board and of each of its committees, periodically reviews and recommends to the Board an overall compensation program for directors and develops and recommends to the Board, and annually reviews, the Company’s Code of Business Conduct and Ethics.

During 2006, the Corporate Governance Committee held 6 meetings. The Corporate Governance Committee currently consists of Messrs. Hanson, Becker, Fox, Freiman and Safavi, with Mr. Hanson serving as Chairman. The Board of Directors has determined that each of the members of the committee meets NASDAQ independence requirements.

Recommending Candidates for Board Membership

The Corporate Governance Committee is responsible for identifying, screening, personally interviewing and recommending director nominee candidates to the Board, which then is responsible for nominating directors to the shareholders for election. The Corporate Governance Committee considers nominees on the basis of their integrity, experience, achievements, judgment, intelligence, personal character, ability to make independent analytical inquiries, willingness to devote adequate time to Board duties, and the likelihood that they will be willing to serve on the Board for a sustained period.

The Corporate Governance Committee will consider qualified director candidates who are suggested by stockholders in written submissions addressed to: NeoPharm, Inc., 1850 Lakeside Drive, Waukegan, Illinois 60085, Attention: Corporate Secretary’s Office (fax no. 847-887-9281; email: corporatesecretary@neopharm.com). Any recommendation submitted by a stockholder must include the name of the candidate, a description of the candidate’s educational and professional background, contact information for the candidate, a brief explanation of why the stockholder feels the candidate is suitable for election, and a representation that the individual proposed has consented to be nominated for consideration as a director. The Corporate Governance Committee will apply the same standards in considering director candidates recommended by stockholders as it applies to other candidates.

In addition to recommending director candidates to the Corporate Governance Committee, stockholders may also nominate one or more persons for election as a director of the Company at an annual meeting of stockholders if the stockholder complies with the notice, information and consent provisions contained in the Company’s Amended and Restated Bylaws, including, but not limited to, the Company’s advance notice bylaw provision. Under the advance notice bylaw, in order for the director nomination to be timely, a stockholder’s notice to the Company’s Secretary must be delivered to the Company’s principal executive offices not less than 120 days prior to the anniversary of the date the Company’s proxy statement was mailed to stockholders in connection with the previous year’s annual meeting. In the event that the Company sets an annual meeting date that is not within 30 days before or after the date of the immediately preceding annual stockholders meeting, notice by the stockholder must be received no later than the close of business on the later of 120 days in advance of such annual meeting and the tenth day following the day on which public disclosure of the date of the annual meeting was made.

Nominations, as well as other proposals for the Company’s Annual Meeting of Stockholders to be held in 2008, must be submitted in writing addressed to: Corporate Secretary, NeoPharm, Inc., 1850 Lakeside Drive, Waukegan, Illinois 60085. Nominations must include the name, business and residence address, principal business occupation or employment of the candidate, the class and number of shares of the Company beneficially owned by the candidate, a description of all arrangements or understanding between the nominating stockholder and the nominee pursuant to which the nomination is made and any other information relating to the nominee that is required pursuant to Regulation 14A under the Exchange Act. Nominations for the 2008 Annual Meeting of Stockholders must be received by the Corporate Secretary no later than March 4, 2008. Typically, however, the Company's Annual Meeting of Stockholders has been held in June with proxy materials mailed to stockholders on or about May 1. If the Company were to return to the June date for the 2008 Annual Meeting of Stockholders, the date for submitting nominations would be moved up and notification of the new earlier deadline would be provided by the Company in a 10-Q or other periodic report filed by the Company with the SEC.

NeoPharm Ethics Program.

The Company has adopted a Code of Business Conduct and Ethics for all directors, officers, employees, agents and representatives of the Company and a Code of Conduct Grievance Procedure. Links to these documents, including printable versions, are available on the NeoPharm, Inc. website at www.neopharm.com. The documents are also available in print upon request. Any waivers to the Code of Business Conduct and Ethics will, to the extent required by applicable law or regulation, be disclosed on the Company’s website.

Shareholder Communications

Shareholders may communicate directly with the Board of Directors, any of its committees or any individual director by mailing correspondence (addressed to the attention of the Board, an individual director or a committee, as appropriate), to:

| | NeoPharm, Inc. 1850 Lakeside Drive Waukegan, Illinois 60085 USA Attn: (name of addressee) |

INFORMATION ABOUT EXECUTIVE AND DIRECTOR COMPENSATION

Compensation Discussion And Analysis

Overview

The following compensation discussion describes the material elements of compensation awarded to, earned by, or paid to each of our executive officers identified in the Summary Compensation Table below as one of our named executive officers for the fiscal year ending December 31, 2006. This compensation discussion focuses on the information contained in the following tables and related footnotes and narrative for primarily the last completed fiscal year, but we also describe compensation actions taken before or after the last completed fiscal year to the extent it enhances the understanding of our executive compensation disclosure.

Our compensation and benefit program for our named executive officers aims to encourage our executive officers to continually work in the best interests of our stockholders to develop our technology while effectively managing the risks and challenges inherent in a pre-commercialization biotechnology enterprise such as the Company. Specifically, we have created a compensation package that combines short and long-term components, cash and equity, and fixed and contingent payments, in the proportions we believe are prudent, while still allowing us to attract, retain and motivate our senior management to perform with the goal of enhancing stockholder value.

Given our overriding objective to correlate individual and Company success, we seek to foster a performance-oriented culture, where individual performance is aligned with organizational objectives. We evaluate and reward our executive officers in light of the Company’s overall performance based on their achievement of pre-determined financial goals, business goals and personal goals. Performance is reviewed at least annually through processes discussed below with a focus on the Company’s overall research, clinical, regulatory, financial, and operational performance and the individual’s contributions to that performance. For the Company in 2006, the most important overriding corporate goals were to successfully conclude our Phase 3 PRECISE trial for Cintredekin Besudotox, our most advanced drug product candidate, and to advance our preparations for the possible filing of a BLA for that drug in the event the results of the clinical trial warranted such a filing.

Role of Our Compensation Committee

Our Compensation Committee approves, administers and interprets our executive compensation and benefit policies, including administration of our 2006 Equity Incentive Plan and 2006 Employee Stock Purchase Plan. The Compensation Committee provides its recommendations on executive compensation at Board meetings, seeking final approval, and, in-between Board meetings, consults with management, other committees of the Board or other members of the Board, where appropriate. Our Compensation Committee is appointed by our Board of Directors and each member qualifies as an independent director as defined under NASDAQ listing standards. Our Compensation Committee is currently comprised of Mr. Paul Freiman (Chairman), Dr. Bernard Fox, Mr. Frank Becker and Mr. Rick Hanson.

Our Compensation Committee receives significant input on compensation issues from the Company’s President and CEO and the Company’s human resources department, which it then analyzes and reviews and uses to make recommendations to our Board to ensure that our executive compensation and benefit program is consistent with our compensation philosophy and corporate governance guidelines. Our executives' base salaries, target and overachievement annual bonus levels and long-term incentive award values are set at levels believed to be competitive when measured against a peer group of biotechnology companies.

Our Compensation Committee looks to ensure that the compensation of our named executive officers is aligned with the Company's corporate strategies, business objectives and the long-term interests of the Company's stockholders, as well as its corporate governance guidelines by: taking input from management, primarily from the President and CEO, but also reviewing written information from the other members of management on their perception of the Company's goals, their performance and recommended compensation packages; conferring as a group on individual compensation packages and the Company’s goals independent of management; and taking its recommendations to the Company's Board of Directors for approval.

Use of Survey Data

In making compensation decisions, the Compensation Committee receives information that compares our executive compensation against that paid by a peer group of publicly traded companies in the biotechnology and pharmaceutical industry compiled by our human resources personnel and management from the Radford Survey of biotechnology companies. This peer group consists of companies which management believes are generally comparable to us at the time and against which the Company competes for executive talent.

We believe that information regarding pay practices at other companies is useful in two respects: First, we recognize that our compensation practices must be competitive in the marketplace; and second, this marketplace information is one of several factors that we consider in assessing the reasonableness of compensation. Accordingly, at least annually, we compare our compensation packages with those of other companies in the biotechnology and pharmaceutical industry, through reviews of this survey data. However, while such information may be a useful guide for comparative purposes, we believe that a successful compensation program also requires the application of judgment and subjective determinations of individual performance. Our review of this information and these factors forms the basis of our compensation recommendations.

Executive Compensation Program

Components of our Compensation Program

Our performance driven compensation program consists of five components: base salary, annual cash bonuses, long-term incentives, benefits, and severance payments. We have not had any formal or informal policy or target for allocating compensation between long-term and short-term compensation, between cash and non-cash compensation or among the different forms of non-cash compensation. Instead, the Compensation Committee, after reviewing information provided by management, including relevant survey data, determines subjectively what it believes to be the appropriate level and mix of the various compensation components. Ultimately, the Compensation Committee’s objective in allocating between long-term and currently paid compensation is to ensure adequate base compensation to attract and retain personnel, while providing incentives to maximize long-term value for our company and our stockholders.

Short-term Compensation.

Our short-term compensation program consists of base salary and the potential to earn cash bonuses.

Base Salary. Base salary will typically be used to recognize the experience, skills, knowledge and responsibilities required of each of our named executive officers, as well as competitive market conditions. In establishing the 2006 base salaries of the named executive officers who were employed in January 2006, our Compensation Committee took into account a number of factors, including survey data, recommendations of the President and CEO, the executive's seniority, position and functional role, accomplishments against personal and group objectives, and the demand and competitiveness for obtaining such an individual with their specific expertise and experience.

The base salary of our named executive officers is reviewed on an annual basis and, assuming overall corporate performance will permit, adjustments are made to reflect performance-based factors, for the Company as well as the executive, and analyzed in light of competitive conditions. Again, the Compensation Committee receives the recommendations of the President and CEO and analyzes those in light of its assessment of subjective performance criteria, such as an executive's ability to motivate others, to develop the skills necessary to mature with the Company, to set realistic goals to be achieved, and to recognize and pursue new business opportunities that enhance the Company's growth and success. We do not apply specific formulas to determine increases, but instead make an evaluation of each executive's contributions to the long-term success of the Company. We endeavored to have 2006 salaries that would be within the 25th and 75th percentiles for our salary levels for the group of peer companies surveyed.

Bonuses. Bonuses generally are based on corporate and individual performance compared to actual Company progress, targeted performance criteria, and various subjective performance criteria. The Compensation Committee works with our President and CEO to develop corporate and individual goals that they believe can be reasonably achieved with an appropriate level of effort over the course of the year. The factors included in our performance goals (financial, business and personal) are assigned specific weights and will vary for each named executive officer. We recognize that the relative importance of these factors may change over time in order to adapt our operations to specific business challenges and to reflect changing economic and market conditions. Based on the review of their performance, particularly with regard to the Company goals established for 2005, and the Compensation Committee’s recommendation to the Board of Directors, cash bonuses totaling $229,879 were paid in January 2006 to those of our named executive officers who were employed at the time, Messrs. Herrera, Ahmad, Sherman and Kenyon, in respect of their performance for the fiscal year ended December 31, 2005. For 2006, our President and CEO’s bonus target was set at 50% of his base salary with the potential to receive up to 100% of his base salary to the extent performance targets were exceeded. The performance targets for the other named executive officers were set at 30% of their salaries, with a potential to receive up to 50% of base salary to the extent performance targets were exceeded. The payment of bonuses is always discretionary, however, and actual amounts paid may be more or less than the targeted amount. As described in more detail below, for 2006, in light of the Company’s performance at year-end, no bonuses were paid to the named executive officers. See “Executive Compensation Decisions for 2006,” below.

Long-term Compensation

Stock Based Awards. Historically, our long-term compensation has consisted of stock options. Our option grants are designed to align management's performance objectives with the interests of our stockholders. Our Compensation Committee grants options to the named executive officers, and other selected employees, in order to enable them to participate in the long term appreciation of our stockholder value. We believe that stock options provide a means of aiding in the retention of key executives as the stock options are subject to vesting over time. We recognize, however, that for companies at NeoPharm’s stage of development, stock options represent a more speculative form of compensation which may not maintain or increase in value unless our drug product candidates ultimately reach the market and generate sales and profits.

In general, stock options are granted once per year, and are subject to vesting based on the executive's continued employment. Options granted to the named executive officers in 2006 vest at an annual rate of twenty-five percent (25%) per year over a four year period on the anniversary of the date of grant if the individual is still providing services to the Company at that time. The vesting provisions and size of the grants are designed to encourage the named executive officers to remain with the Company over a period of time. The exercise price of options is the fair market value, as determined by the terms of the applicable incentive plan, of our common stock on the date of grant. Generally, stock grants are made to our named executives at the year-end Compensation Committee meeting that has been previously calendared, but grants may be made by the Compensation Committee at other times if, for example, a new hire is made, or an equity plan that is low in available shares at the time of a grant is replenished later in the year, making available shares to which the individual would otherwise be entitled.

The factors considered in determining the size of option grants include recommendations from the President and CEO, the executive's position within the Company or the employee’s grade level, the number of shares available under the applicable plan, the grant value and Black-Scholes valuation of the grant when compared to peer group survey data, and the executive's contributions to both the creation of value and the long-term success of the Company.

In January 2006, options to purchase 75,000 shares were granted to our named executive officers employed at that time as a group based on performance in 2005. In December 2006, options to purchase 355,000 shares were granted to our then current named executive officers based on partial 2006 performance.

In addition to equity stock awards, our executive officers are eligible to participate in our 2006 Employee Stock Purchase Plan (the “ESPP”). The ESPP is available to all employees of the Company and generally permits participants to purchase shares at a discount of approximately 15% from the fair market value at the beginning or end of the applicable purchase period. In 2006, our named executive officers purchased 6,957 shares pursuant to the ESPP.

Benefits. We provide the following benefits to our executives on the same basis as the benefits provided to all employees:

| | · | Health, vision and dental insurance; |

| | · | Short-and long-term disability. |

Under our 401(k) plan, we provide an employer matching contribution in an amount equal to 3% of each participant’s compensation (up to a maximum in 2006 of $6,600 per year). The Company’s matching contribution is fully and immediately vested when made. In general, we believe these benefits are consistent with those offered by other companies and specifically with those companies with which we compete for employees.

Each of our named executive officers received an automobile allowance in 2006 that ranged from $300 to $1,000 per month. In certain circumstances, we will provide cash signing bonuses and pay relocation expenses when executives join us. Whether a signing bonus and relocation expenses are paid and the amount thereof is determined on a case-by-case basis under the specific hiring circumstances. For example, we will consider paying signing bonuses to compensate for amounts forfeited by an executive upon terminating prior employment or to create additional incentive for an executive to join our Company in a position for which there is high market demand. In 2006, we paid each of Mr. Walbert and Mr. Pauli a signing bonus of $50,000.

Severance and Change-in-Control Arrangements. Compensation for named executive officers also includes severance and change-in-control arrangements, which are reflected in the employment agreements for our President and CEO, which is the only executive officer position for which we have had formal written employment agreements, or in the term sheets pursuant to which offers are made to other executive officers. These arrangements, like other elements of executive compensation, are structured with regard to practices at comparable companies for similarly-situated officers and in a manner we believe is likely to attract and retain high quality executive talent. Changes to existing severance arrangements are also sometimes negotiated with departing executives in exchange for transition services and/or general releases. The severance and change-in-control arrangements currently in place with our current executive officers, and the severance arrangement entered into with one of our executive officers who departed in 2006, are described in greater detail below under the headings “Employment Agreements,” “Separation Agreements” and “Payments Upon Termination or Change in Control.”

Executive Compensation Decisions for 2006.

For fiscal 2006, the Compensation Committee initially recommended, and our Board initially approved, incentive compensation bonus awards to our named executive officers who were employed in December 2006 which totaled $395,700 and represented from 21% to 50% of base salary. Additionally, the Compensation Committee also initially recommended, and the Board of Directors initially approved, increases in base salaries for the named executive officers who were then employed, which increases ranged from 4% to 15.2% over the applicable prior base salaries. However, the awarding of bonuses and stock awards is always subject to the Company’s overall performance for the entire year and, shortly after the Compensation Committee and the Board met in early December 2006 with respect to bonus and salary increases, the Company learned that the Phase 3 PRECISE trial for the Company’s lead drug product candidate, Cintredekin Besudotox, had failed to meet its statistical end point. In light of this set-back to the Company’s lead drug product candidate, the Board requested that the Compensation Committee reassess its recommendations regarding bonus and salary increases. With the newly presented information regarding the PRECISE results available to it, the Compensation Committee recommended, and the Board approved, a suspension, which was later changed to a cancellation, of payment of all bonuses and salary increases for the named executive officers and other employees at the director level and above, with the result that no bonuses for 2006 or pay raises for 2007 for this group of employees, which includes the Company’s named executive officers employed at that time, were made.

Other Influences on Executive Compensation

Role of Executive Officers in Determining or Recommending Executive and Director Compensation. Management plays a significant role in the process of setting executive compensation. The most significant aspects of management’s role are:

| | · | evaluating employee performance; |

| | · | determining and assembling the survey data for the peer group of companies to which comparisons will be made; |

| | · | establishing business performance targets and objectives; and |

| | · | recommending salary and bonus levels and stock-based awards. |

Management, and in particular the President and CEO, prepares meeting information for each Compensation Committee meeting. Our President and CEO also participates in Compensation Committee meetings at the Compensation Committee’s request to provide:

| | · | background information regarding each named executive officer’s strategic objectives and progress toward the attainment of those objectives; |

| | · | his evaluation of the performance of the named executive officers, including himself; and |

| | · | compensation recommendations as to senior executive officers, including himself. |

Ultimately, however, all compensation recommendations with respect to the Company’s executive officers are made by the Compensation Committee after considering management’s recommendations, survey data, the members’ own experience in the industry, and engaging in deliberations in executive session without the presence of members of management.

Management does not play any role in setting non-employee director compensation. Recommendations with respect to non-employee director compensation are made by the Corporate Governance Committee and then approved by the Board. See “Compensation of Directors” below.

Impact of Tax Treatment on Compensation Decisions. Section 162(m) of the Code generally disallows a tax deduction for compensation in excess of $1 million paid to our named executive officers. Certain compensation is specifically exempt from the deduction limit to the extent that it does not exceed $1 million during any fiscal year or is “performance based” as defined in Section 162(m) of the Code. The Compensation Committee considers the net cost to the Company, and its ability to effectively administer executive compensation in the long-term interests of stockholders. To the extent that awards under the 2006 Equity Incentive Plan constitute performance-based awards, the awards should qualify as “performance-based compensation” for purposes of Section 162(m).

Security Ownership Requirements or Guidelines. While we believe it is important for our executives to have an equity stake in our company in order to help align their interest with those of our stockholders, we do not currently have any equity ownership guidelines for our executive officers.

Compensation Committee Report

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management. Based on this review and discussion, the Compensation Committee has recommended to the Board of Directors that the Compensation Discussion and Analysis be included our Annual Report on Form 10-K , as amended by our filing on Form 10-K/A, for the year ended December 31, 2006, and in our proxy statement for the 2007 annual meeting of shareholders.

Submitted by the Compensation Committee of the Board of Directors

| | Paul E. Freiman, Chairman, Frank C. Becker, Bernard A. Fox and Erick E. Hanson |

Executive Compensation

Summary of Compensation.

The following table sets forth certain summary compensation information for the fiscal year ended December 31, 2006, for services rendered by each person who served as the principal executive officer or principal financial officer of the Company at any time during 2006, for the executive officers of the Company who were serving as executive officers on December 31, 2006, and for one additional former executive officer who would have been among our most highly compensated executive officers if he had been serving as an executive officer on December 31, 2006. We refer to these individuals as our “named executive officers.”

2006 SUMMARY COMPENSATION TABLE

Name and Principal Position | | | | Salary($) | | Bonus($)(7) | | Stock Awards($) | | Options Awards(8) | | Non-Equity Incentive Plan Compensation | | All Other Compensation(9) | | Total | |

| | | | | | | | | | | | | | | | | | |

Guillermo A. Herrera, (1) | | | | | $ | 425,000 | | $ | —- | | | $ —- | | $ | 773,671 | | | $ —- | | $ | 19,290 | | $ | 1,217,961 | |

| Former Chief Executive Officer and President | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Jeffrey W. Sherman, M.D., (2) | | | | | $ | 275,000 | | $ | | | | $ —- | | $ | 94,400 | | | $ —- | | $ | 10,824 | | $ | 380,224 | |

| Chief Medical Officer and Executive Vice-President | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Tim Walbert, (3) | | | | | $ | 230,154 | | $ | 50,000 | | | $ —- | | $ | 153,419 | | | $ —- | | $ | 12,088 | | $ | 445,661 | |

| Executive Vice President, Commercial Operations | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Ronald Pauli, (4) | | | | | $ | 83,692 | | $ | 50,000 | | | $ —- | | $ | 24,817 | | | $ —- | | $ | 3,959 | | $ | 162,468 | |

| Former Chief Financial Officer and Secretary | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Imran Ahmad, Ph.D., (5) | | | | | $ | 99,240 | | $ | | | | $ —- | | $ | 15,121 | | | $ —- | | $ | 260,958 | | $ | 375,319 | |

| Former Chief Scientific Officer and Executive Vice President | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Lawrence A. Kenyon, (6) | | | | | $ | 160,192 | | $ | | | | $ —- | | $ | 69,246 | | | $ —- | | $ | 191,870 | | $ | 421,308 | |

| Former Chief Financial Officer and Secretary | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Mr. Herrera is the former President and Chief Executive Officer; Mr. Herrera’s employment with the Company ended March 23, 2007. |

| (2) | Dr. Sherman is the former Chief Medical Officer and Executive Vice President of the Company. Dr. Sherman’s employment with the Company ended June 18, 2007. |

| (3) | Mr. Walbert is the former Executive Vice President-Commercial Operations. He was hired on January 17, 2006 and served in that position until May 31, 2007. |

| (4) | Mr. Pauli is the former Chief Financial Officer; Mr. Pauli was hired on August 4, 2006 and left the Company’s employ on March 21, 2007. |

| (5) | Dr. Ahmad is the former Chief Scientific Officer and Executive Vice President; Dr. Ahmad resigned as of May 3, 2006; all unvested stock options were cancelled as of that date. |

| (6) | Mr. Kenyon is the former Chief Financial Officer; Mr. Kenyon separated from service as an employee as of August 31, 2006 and provided consulting services to the Company until May 31, 2007. |

| (7) | In light of the Company’s performance in 2006, bonuses for 2006 were not paid. See “Executive Compensation Decisions for 2006,” above. The amounts reported under this column for Messrs. Pauli and Walbert represent signing bonuses paid each executive upon his hire. |

| (8) | Amounts reported reflect FAS 123R expense related to option awards for 2006; no forfeiture rate assumption is applied. |

| (9) | The amount reported for Mr. Herrera represents the Company’s contribution to his 401K account ($6,600), life insurance premiums paid by the Company ($690), and a monthly car allowance ($12,000); the amount reported for Mr. Pauli represents the Company’s contribution to his 401K account ($1,845), a monthly car allowance ($2,000) and life insurance premiums paid by the Company ($114); the amount reported for Mr. Kenyon represent the Company’s contributions to his 401K account ($6,117), payments made due to his separation as an employee of the Company ($183,353), and a monthly car allowance ($2,400); the amount reported for Dr. Sherman reflects the Company’s contribution to his 401K account ($6,600), a monthly car allowance ($3,600), and life insurance premiums paid by the Company ($624); the amount reported for Mr. Walbert reflects the Company’s contributions to his 401K account ($6,150), a monthly car allowance ($5,750), and life insurance premiums paid by the Company ($188); the amount reported for Dr. Ahmad represents the Company’s contributions to his 401K account ($4,362), payments made due to his termination from the Company ($255,381), including salary continuation, and a monthly care allowance ($1,215). |

GRANTS OF PLAN-BASED AWARDS IN 2006

The following table sets forth information with respect to each grant of an award made to a named executive officer during the fiscal year ended December 31, 2006, under any plan, contract, authorization or arrangement pursuant to which cash, securities, similar instruments or other property may be received.

| | | | | Estimated Future Payouts Under Non-Equity Incentive Plan Awards(1) | | Estimated Future Payout Under Equity Incentive Plan Awards | | All Other Stock Awards; No. of Shares of Stock or Units | | All Other Option Awards; No. of Securities Underlying Option | | Aggregate Grant Date Fair Value of Stock or Option Award(3) | | Exercise or Base Price Option Awards | |

| | | | |

| | | | |

| Name | | Grant Date(2) | | Threshold | | Target | | Maximum | | Threshold | | Target | | Maximum | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Guillermo Herrera(4) | | | 12/5/06 1/1/06 | | | | | $ | 212,500 | | $ | 425,000 | | | | | | | | | | | | | | | 150,000 | | $ | 699,000 | | $ | 7.11 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Jeffrey Sherman(5) | | | 1/25/06 12/5/06 | | | | | | | | | | | | | | | | | | | | | | | | 25,000 80,000 | | $ $ | 210,500 372,800 | | $ $ | 12.46 7.11 | |

| | | | 1/1/06 | | | | | $ | 82,500 | | $ | 137,500 | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Ronald Pauli(6) | | | 8/28/06 12/5/06 | | | | | | | | | | | | | | | | | | | | | | | | 75,000 25,000 | | $ $ | 263,250 116,500 | | $ $ | 5.17 7.11 | |

| | | | 8/28/06 | | | | | $ | 72,000 | | $ | 120,000 | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Tim Walbert(7) | | | 1/17/06 12/5/06 | | | | | | | | | | | | | | | | | | | | | | | | 75,000 100,000 | | $ $ | 607,500 466,000 | | $ $ | 12.02 7.11 | |

| | | | 1/17/06 | | | | | $ | 72,000 | | $ | 120,000 | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Imran Ahmad(8) | | | 1/1/06 1/25/06 | | | | | $ | 68,100 | | $ | 113,500 | | | | | | | | | | | | | | | 25,000 | | $ | 210,500 | | $ | 12.46 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Lawrence Kenyon(9) | | | 1/25/06 | | | | | $ | 63,000 | | $ | 105,000 | | | | | | | | | | | | | | | 25,000 | | $ | 210,500 | | $ | 12.46 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | The Company does not define a threshold award level; awards reflect non-equity incentive opportunities granted at the beginning of the year or at the time of employment; an executive must be an employee of the Company at the end of the fiscal year to receive an incentive payout. |

| (2) | Grant dates of January 1, 2006 reflect timing of incentive plan awards as provided by Mr. Herrera’s employment agreement or employment terms as established in writing for Dr. Sherman and Dr. Ahmad. |

| (3) | Aggregate grant date fair value for option grants to the named executive officers are based on the Black-Scholes option values at the time of the original grant. |

| (4) | Mr. Herrera’s employment with the Company ended March 23, 2007; the vested portion of his options expired June 21, 2007, 90 days afer the date of his separation from service. |

| (5) | Dr. Sherman’s employment with the Company ended as of June 18, 2007; the vested portion of his options will expire September 16, 2007, 90 days after the date of his separation from service. |

| (6) | Mr. Pauli resigned on March 21, 2007; none of his options were vested and therefore all options were cancelled as of that date. |

| (7) | Mr. Walbert’s employment with the Company ended as of May 31, 2007; the vested portion of his options will expire August 29, 2007, 90 days after the date of his separation from service. |

| (8) | Dr. Ahmad resigned as of May 3, 2006; all unvested stock options were cancelled as of that date. |

| (9) | Mr. Kenyon separated from service as an employee as of August 31, 2006; per the terms of his separation agreement, his option grants continued to vest as a consultant until May 31, 2007; the vested portion of his options will expire on August 29, 2007, 90 days after the termination of his consulting services. |

Outstanding Equity Awards at December 31, 2006

The following table shows for the fiscal year ended December 31, 2006, certain information regarding outstanding equity awards at fiscal year end for the named executive officers. There were no Stock Awards made to any of the named executive officer for the fiscal year ended December 31, 2006.

| | | | | Option Awards(1) | |

| | | | | | | | | | | | | | |

Name | | Grant Date | | Number of Securities Underlying Unexercised Options (Exercisable) | | Number of Securities Underlying Unexercised Options (Unexercisable) | | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options | | Option Exercise Price | | Option Expiration Date | |

| | | | | | | | | | | | | | |

| Guillermo A. Herrera(2) | | | 10/28/2005 | | | 125,000 | | | 375,000 | | | | | | $9.06 | | | 10/28/2015 | |

| | | | 12/5/2006 | | | | | | 150,000 | | | | | | 7.11 | | | 12/5/2016 | |

| | | | | | | | | | | | | | | | | | | | |

| Jeffrey W. Sherman(3) | | | 8/28/2000 | | | 164,450 | | | | | | | | | $19.17 | | | 8/28/2010 | |

| | | | 2/2/2001 | | | 88,550 | | | | | | | | | 22.83 | | | 2/2/2011 | |

| | | | 2/1/2002 | | | 37,375 | | | | | | | | | 13.78 | | | 2/1/2012 | |

| | | | 5/8/2003 | | | 23,000 | | | | | | | | | 13.13 | | | 5/8/2013 | |

| | | | 2/17/2004 | | | 30,000 | | | | | | | | | 19.91 | | | 2/17/2014 | |

| | | | 4/28/2005 | | | 7,275 | | | 21,825 | | | | | | 7.95 | | | 4/28/2015 | |

| | | | 1/25/2006 | | | | | | 25,000 | | | | | | 12.46 | | | 1/25/2016 | |

| | | | 12/5/2006 | | | | | | 80,000 | | | | | | 7.11 | | | 12/5/2016 | |

| | | | | | | | | | | | | | | | | | | | |

| Imran Ahmad(4) | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Lawrence A. Kenyon(5) | | | 8/21/2000 | | | 37,950 | | | | | | | | | $15.42 | | | 8/29/2007 | |

| | | | 2/2/2001 | | | 31,625 | | | | | | | | | 22.83 | | | 8/29/2007 | |

| | | | 2/1/2002 | | | 8,625 | | | | | | | | | 13.78 | | | 8/29/2007 | |

| | | | 10/24/2002 | | | 46,000 | | | | | | | | | 12.17 | | | 8/29/2007 | |

| | | | 2/17/2004 | | | 20,000 | | | | | | | | | 19.91 | | | 8/29/2007 | |

| | | | 4/28/2005 | | | 10,775 | | | 10,775 | | | | | | 7.95 | | | 8/29/2007 | |

| | | | 1/25/2006 | | | | | | 6,250 | | | | | | 12.46 | | | 8/29/2007 | |

| | | | | | | | | | | | | | | | | | | | |

| Ronald Pauli(6) | | | 8/28/2006 | | | | | | 75,000 | | | | | | $5.17 | | | 8/28/2016 | |

| | | | 12/5/2006 | | | | | | 25,000 | | | | | | 7.11 | | | 12/5/2016 | |

| | | | | | | | | | | | | | | | | | | | |

| Tim Walbert(7) | | | 1/17/2006 | | | | | | 75,000 | | | | | | | | | 1/17/2016 | |

| | | | 12/5/2006 | | | | | | 100,000 | | | | | | 7.11 | | | 12/5/2016 | |

| (1) | All outstanding options were underwater as of December 31, 2006. |

| (2) | As a result of the termination of Mr. Herrera’s employment, the vested portion of his options expired June 21, 2007, 90 days after the date of his separation from service. |

| (3) | Dr. Sherman's employment with the Company ended June 18, 2007, with the result that the vested portion of his options will expire September 16, 2007, 90 days after the date of his separation from service. |

| (4) | All outstanding grants expired August 1, 2006, 90 days after Dr. Ahmad’s termination of employment. |

| (5) | Mr. Kenyon’s consulting services to the Company ended May 31, 2007, with the result that the vested portion of his options will expire August 29, 2007, 90 days after the termination of his consulting services. |

| (6) | Mr. Pauli’s employment with the Company terminated on March 21, 2007. None of his options were vested and therefore all options were canceled as of his termination date. |

| (7) | Mr. Walbert's employment with the Company ended on May 31, 2007, with the result that the vested portion of his options will expire August 29, 2007, 90 days after the date of his separation from service. |

Option Exercises and Stock Vested in 2006

For the fiscal year ended December 31, 2006, there were no options exercised nor any vesting of stock awards for any of the named executive officers.

Pension Benefits

We do not provide pension arrangements or post-retirement health coverage for our executive employees. Our executive officers are eligible to participate in our 401(k) defined contribution plan. At our discretion, we may contribute to each participant a matching contribution equal to 3% of the participant’s compensation that has been contributed to the plan, up to a maximum matching contribution in 2006 of $6,600. All of the named executive officers participated in our 401(k) plan during 2006 and received matching contributions.

Employment Agreements

Mr. Herrera. On October 28, 2005, the Company entered into an employment agreement (the “Herrera Employment Agreement”) with Mr. Guillermo A. Herrera in connection with Mr. Herrera’s appointment as President and Chief Executive Officer of the Company. Under the terms of the Herrera Employment Agreement, Mr. Herrera was provided with a base salary of $425,000 and a stock grant of 22,075 shares of the Company’s Common Stock (the “Stock Grant”) under the Company’s 1998 Equity Incentive Plan (the “Plan”), which had a fair market value as of the date of grant of $200,000. The shares included in the Stock Grant became fully vested upon issuance and are non-forfeitable. Additionally, upon commencing his employment, Mr. Herrera was granted an option to acquire 500,000 shares of the Company’s Common Stock at an exercise price of $9.06 per share, which was the closing price of the Company’s Common Stock on the date of grant. Mr. Herrera’s stock option was scheduled to vest in four equal annual installments of 125,000 shares on each of the first four anniversaries of the stock option grant date provided Mr. Herrera was providing services to the Company on each such date. Beginning in 2006, Mr. Herrera became eligible to receive a target bonus of up to 50% of base salary and an overachievement bonus of up to 100% of the base salary, in each case based on the achievement by the Company and Mr. Herrera of certain specific plans and goals established annually by the Compensation Committee in consultation with Mr. Herrera.

The Herrera Employment Agreement provided for automatic termination in the event of Mr. Herrera’s death or in the event that he suffered a Disability (as defined in the Herrera Employment Agreement). In the event Mr. Herrera’s employment terminated on account of his death or Disability, Mr. Herrera (or his estate) would have been entitled to receive his accrued base salary through the date of termination. Additionally, the Company could terminate Mr. Herrera’s employment at any time, with or without Cause (as defined in the Herrera Employment Agreement), effective upon written notice and Mr. Herrera could terminate his employment at anytime upon 30 days prior written notice. In the event of a termination for Cause or upon Mr. Herrera’s termination of his employment, Mr. Herrera would be entitled to receive accrued base salary through the date of termination. In the event of termination without Cause, Mr. Herrera would be entitled to receive a continuation of his then current base salary for 12 months, subject, however, to set-off for any other earned income and cessation of the salary continuance upon his accepting another full-time position or upon his providing services to a competing business or breach of the restrictive covenants set forth in the Herrera Employment Agreement. In addition, following a change of control (as defined in the Herrera Employment Agreement), if Mr. Herrera’s employment was terminated within one (1) year, or he terminated his employment for “Good Reason” (as defined in the Herrera Employment Agreement) within one year after a change in control, in addition to a continuation of his base salary for 12 months, Mr. Herrera would also have been entitled to a lump sum payment equal to the prior year’s bonus, if any, plus all of his unvested options would have immediately vested and been exercisable. Mr. Herrera’s employment was initially terminated without Cause in March 2007. and as a result, Mr. Herrera’s salary was to be continued for twelve months from the date of his termination on March 23, 2007. However, subsequent to his termination, the Company determined that Mr. Herrera’s termination should have been for Cause with the result that no salary continuance is now being paid to Mr. Herrera.

Mr. Birch. On March 23, 2007, the Company entered into an employment agreement (the “Birch Employment Agreement”) with Mr. Laurence P. Birch in connection with Mr. Birch’s appointment as President and Chief Executive Officer of the Company. Under the terms of the Birch Employment Agreement, Mr. Birch was provided with a base salary of $275,000. Additionally, upon commencing his employment, Mr. Birch was granted an option to acquire 300,000 shares of the Company’s Common Stock at an exercise price of $1.90 per share, which was the average of the high and low price of the Company’s Common Stock on the date of grant. Mr. Birch’s stock option is scheduled to vest in four equal annual installments of 75,000 shares on each of the first four anniversaries of the stock option grant date provided Mr. Birch is still providing services to the Company on each such date. Additionally, the Company committed to provide an award of 180,665 shares of restricted stock (which would vest over four years) to Mr. Birch upon sufficient shares becoming available under the 2006 Equity Incentive Plan as a result of the cancellation or termination of prior awards made to others becoming available under the plan or the stockholders approving an increase in the number of shares available under the plan. These restricted shares were awarded to Mr. Birch in June 2007. Mr. Birch is eligible to receive a target bonus of up to 50% of base salary and an overachievement bonus of up to 100% of the base salary, in each case based on the achievement by the Company and Mr. Birch of certain specific plans and goals established annually by the Compensation Committee in consultation with Mr. Birch.

The Birch Employment Agreement provides for automatic termination in the event of Mr. Birch’s death or in the event that he suffers a Disability (as defined in the Birch Employment Agreement). In the event Mr. Birch’s employment terminates on account of his death or Disability, Mr. Birch (or his estate) would be entitled to receive his accrued base salary through the date of termination. Additionally, the Company may terminate Mr. Birch’s employment at any time, with or without Cause (as defined in the Birch Employment Agreement), effective upon written notice and Mr. Birch may terminate his employment at anytime upon 30 days prior written notice. In the event of a termination for Cause or upon Mr. Birch’s election to terminate his employment, Mr. Birch would be entitled to receive accrued base salary through the date of termination. In the event of termination by the Company without Cause after Mr. Birch has been with the Company for six months, Mr. Birch would be entitled to receive a continuation of his then current base salary for 12 months, subject, however, to cessation of the salary continuance upon his accepting another full-time position or breach of the restrictive covenants set forth in the Birch Employment Agreement. In addition, following a change of control (as defined in the Birch Employment Agreement), if Mr. Birch’s employment was terminated within one (1) year, or he terminated his employment for “Good Reason” (as defined in the Birch Employment Agreement) within one year after a change in control, in addition to the 12 month’s of salary continuance, Mr. Birch would also be entitled to a lump sum payment equal to the prior year’s bonus, if any, plus all of his unvested options and restricted stock would become immediately vested and exercisable.

Other Named Executive Officers. Each of the named executive officers, other than Mr. Herrera, accepted employment with the Company on the basis of a term sheet which set forth the salary and benefits to be provided by the Company, including, but not limited to, an undertaking by the Company to provide salary continuation payments, under certain circumstances, upon a termination of the individual’s employment with the Company as a result of termination or a change of control, at the salary level in existence at the date of termination.

Pursuant to the terms of employment for Mr. Ron Pauli, our former Chief Financial Officer, he received a base salary of $240,000, a sign-on bonus of $50,000 when he was hired in 2006, and eligibility for a target bonus of up to 30% of base salary and an overachievement bonus of up to 50% of base salary. Upon a termination of employment by the Company without cause, at any time after six months of employment, or within twelve months of a change of control (as defined in the 2006 Equity Incentive Plan), Mr. Pauli would have been entitled to receive a continuation of his then current salary for six months.

Dr. Jeffrey Sherman, our former Executive Vice President and Chief Medical Officer had a base salary in 2006 of $275,000 and, in accordance with the terms of his employment, was eligible for discretionary stock options and a bonus of up to a maximum of 50% of base salary. Dr. Sherman left the Company's employ in June 2007, and, pursuant to a separation and mutual release of claims entered into with Dr. Sherman, he is receiving six months of salary continuance. See “Separation Agreements.”

Dr. Imran Ahmad, our former Executive Vice President and Chief Scientific Officer, had a base salary in 2006 of $227,000 and would have been eligible for stock options and a bonus of up to a maximum of 50% of his base salary. Upon severance of employment by either party Dr. Ahmad was eligible for continuation of salary for 12 months. See “Payments Upon Termination or Change in Control - Summary of Actual Payments Upon Termination of Employment in 2006.”

Mr. Timothy Walbert, our former Executive Vice President - Commercial Operations, was hired in 2006 at a base salary of $240,000 and a sign-on bonus of $50,000, with eligibility for stock options and a bonus of up to a maximum of 50% of base salary. Mr. Walbert left the Company’s employ in May 2007 and, pursuant to a separation and mutual release of all claims entered into with Mr. Walbert, he is receiving six months of salary continuance. See “Separation Agreements.”

Lawrence Kenyon, our former Chief Financial Officer, was paid a base salary in 2006 of $210,000 and, as provided in his employment term sheet, would have received salary continuation for six months if his employment were terminated by the Company. Upon Mr. Kenyon’s departure, the Company entered into a separation agreement and mutual release of claims which provided for nine months severance in exchange for on-going consulting services. See “Separation Agreements,” and “Payments Upon Termination or Change in Control - Summary of Actual Payments Upon Termination of Employment in 2006.”

For each of the named executive officers, our equity incentive plans provide for vesting of all unvested options upon the occurrence of a change of control as defined in the applicable plan. Each of our named executive officers was also eligible to receive the benefits generally made available to our employees and officers.

Separation Agreements.