EXHIBIT 99.2

AGRIUM INC.

2013

MANAGEMENT’S DISCUSSION & ANALYSIS OF

OPERATIONS AND FINANCIAL CONDITION

MANAGEMENT’S

DISCUSSION

AND ANALYSIS

FEBRUARY 21, 2014

TABLE OF CONTENTS

| | |

| AGRIUM ANNUAL REPORT 2013 // MANAGEMENT’S DISCUSSION AND ANALYSIS // PAGE 23 |

This Management’s Discussion and Analysis (“MD&A”) of operations and financial condition focuses on Agrium’s long-term vision, strategy and growth opportunities as well as its historical performance for the two years ended December 31, 2013. The board of directors of Agrium (the “Board of Directors”) carries out its responsibility for review of this disclosure and, prior to publication, approves this disclosure. In reviewing this disclosure, the reader should consider the cautionary notes regarding forward-looking statements contained in this MD&A (page 90) and the Consolidated Financial Statements and related notes (pages 92 to 150).

Throughout this MD&A, unless otherwise specified, “Agrium”, “the Company”, “we”, “our”, “us” and similar expressions refer collectively to Agrium Inc. and its subsidiaries, any partnerships involving Agrium Inc. or any of its subsidiaries, its significant equity investments and Agrium Inc.’s share of its joint ventures.

The Company’s consolidated quarterly and annual financial information and its Annual Information Form for the year ended December 31, 2013 (“AIF”) are available under Agrium’s corporate profile on SEDAR (www.sedar.com). The Company’s reports are also filed with the United States (“U.S.”) Securities and Exchange Commission on EDGAR (www.sec.gov).

All dollar amounts refer to U.S. dollars, except where otherwise stated. 2013 and 2012 financial information presented and discussed in this MD&A is prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”).

We have restated 2012 comparative figures as a result of adopting IFRS 11Joint Arrangements whereby the classification and accounting of our investment in Profertil S.A. (“Profertil”) and other joint arrangements previously accounted for using the proportionate consolidation method are accounted for using the equity method.

As a result of management intending to sell components of the Advanced Technologies business unit that were not transitioned to Wholesale. We have classified these net assets as held for sale and have classified the related results of operations (including comparative 2012 results) as discontinued.

2011 and prior years have not been restated. See notes 3 and 5 of the Notes to the Consolidated Financial Statements for further details.

FORWARD-LOOKING STATEMENTS

Certain statements and other information included in this MD&A constitute “forward-looking information” and “financial outlook” within the meaning of applicable Canadian securities legislation or “forward-looking statements” within the meaning of applicable U.S. securities legislation (collectively herein referred to as “forward-looking statements”), including the “safe harbour” provisions of provincial securities legislation and the U.S. Private Securities Litigation Reform Act of 1995, Section 21E of the U.S. Securities Exchange Act of 1934, as amended, and Section 27A of the U.S. Securities Act of 1933, as amended. Forward-looking statements are typically identified by the words “believe”, “expect”, “anticipate”, “project”, “intend”, “estimate”, “outlook”, “focus”, “potential”, “will”, “should”, “would”, “could” and other similar expressions.

Forward-looking statements in this MD&A are intended to provide Agrium shareholders and potential investors with information regarding Agrium, including management’s assessment of future financial and operational plans and outlook, and may not be appropriate for other purposes. These forward-looking statements include, but are not limited to, references to: our ability to continue

| | |

| PAGE 24 // MANAGEMENT’S DISCUSSION AND ANALYSIS // AGRIUM ANNUAL REPORT 2013 |

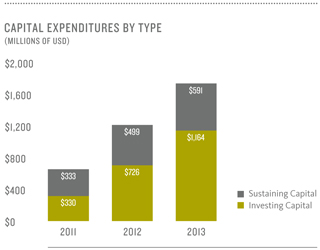

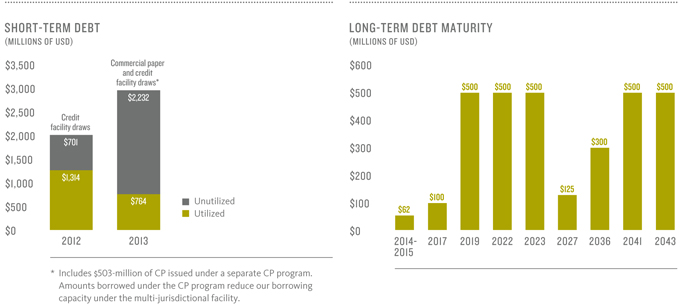

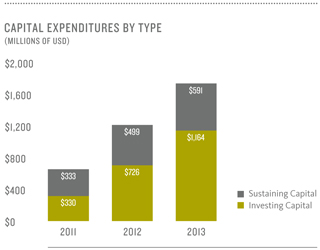

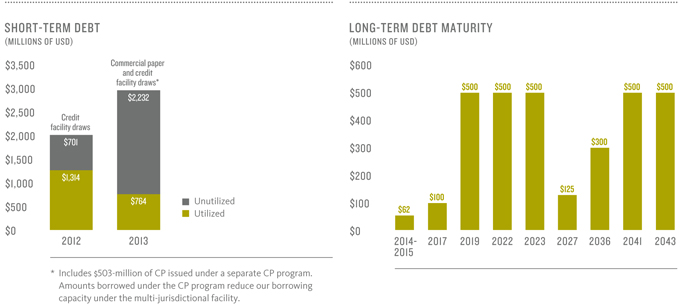

delivering value to all of our stakeholders; our adaptability to fluctuating market conditions; disclosures made under the heading“Agricultural Crop Input Overview & 2014 Outlook”; our 2014 key corporate goals, including expansion and growth of our business and operations; our core business strategies and plans for implementing them; estimates, forecasts and statements as to management’s expectations with respect to, among other things, business, growth, demand and financial prospects, financial multiples and accretion estimates, future trends, plans and objectives; key drivers for our business and global and regional industry trends; the potential for continued growth in our two business units; estimates, forecasts and statements as to management’s expectations with respect to our expansion projects, including, among others, our Vanscoy brownfield potash expansion project, our Borger brownfield expansion project, our nitrogen facility expansion project in Egypt and our brownfield expansion and efficiency project at the Profertil nitrogen facility in Argentina, and the impact of such expansion projects on Agrium’s operations; additional brownfield opportunities and greenfield expansions under evaluation, including the potential restart of our Kenai nitrogen facility in Alaska; our agreement for the long-term supply of phosphate rock and the utility of Agrium’s newly constructed import terminal on the West Coast of Canada; expectations respecting the acquisition of the majority of Viterra Inc.’s retail Agri-products assets (the “Viterra acquisition”) (as defined herein), including, among others, with respect to the final purchase price and adjustments, anticipated benefits thereof and magnitude of synergies therefrom; reserves and resource estimates relating to Agrium’s potash operations, including mine life estimates; future capital expenditures, including sustaining capital and investing capital, and capital resources; future cash requirements and long-term obligations; our expectations respecting financing of announced projects through cash provided from operating activities, existing lines of credit and funds available from new debt or equity securities offerings; anticipated tax rates; asset retirement obligations; future crop input sales and prices; availability of raw materials; risk mitigation activities; remediation and tailings management activities; the anticipated impact of emissions legislation and the implementation of emissions reduction protocols; Agrium’s emissions and emissions management activities and anticipated compliance costs; environmental and civil liabilities, including the anticipated resolution of certain legal and regulatory proceedings and the effect of such proceedings on our business; our assumptions and critical estimates in applying accounting policies; and our recently completed and proposed future acquisitions and dispositions, including the strategic dissolution of our Advanced Technologies business unit; integration plans in respect of completed and future acquisitions, any expected synergies therefrom and benefits thereof.

These forward-looking statements are based on certain assumptions and analyses made by management in light of our experience and perception of historical trends, current conditions and expected future developments, as well as other factors believed to be appropriate in the circumstances. Readers are cautioned not to place undue reliance on the forward-looking statements as such, by their nature, are subject to various known and unknown material risks and uncertainties that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Please refer to the discussion under the heading “Key Assumptions and Risks in Respect of Forward-Looking Statements” with respect to the material assumptions and risks associated with theforward-looking statements. Additional risks and uncertainties that may affect all forward-looking information included in this MD&A include, but are not limited to, the following:

| • | | changes in general economic, market, business and weather conditions, including global agricultural supply/demand factors and crop price levels; fluctuations in global and regional supply/ demand factors impacting the crop input application season and the price of crop nutrients and raw materials/feedstock; global economic and market conditions affecting availability of credit and access to capital markets; build-up of inventories in distribution channels; and shortage of labor supply; |

| • | | changes in government policies and legislation and regulation, or the interpretation, administration and enforcement thereof, in the jurisdictions in which we operate, regarding, among others, agriculture and crop input prices, safety, production processes, environment and greenhouse gas; |

| • | | actions by competitors and others that include changes to industry capacity, utilization rates and product pricing; failure of customers, suppliers and counterparties to financial instruments to perform their respective obligations thereunder; potential for expansion plans to be delayed; restrictions on our ability to transport or deliver our products to markets, including potential changes to anti-trust laws, or interpretations thereof, that could negatively impact our international marketing operations through our one-third interest in Canpotex (as defined herein), the offshore marketing agency for potash produced by us in Saskatchewan and the two other major potash producers in Canada; and other uncertainties in the potash market due primarily to the break-up of the BPC (as defined herein) potash marketing organization; |

| | |

| AGRIUM ANNUAL REPORT 2013 // MANAGEMENT’S DISCUSSION AND ANALYSIS // PAGE 25 |

| • | | changes in margins and/or levels of supplier rebates for major crop inputs, such as crop protection products, nutrients and seed, as well as crop input prices declining below cost of inventory between the time of purchase and sales; |

| • | | general operating risks associated with investment in foreign jurisdictions; the level and effectiveness of future capital expenditures; decline in performance of existing capital assets; and unfavorable fluctuations in foreign exchange and tax rates in the jurisdictions in which we operate; |

| • | | future operating rates, production costs and sustaining capital of our facilities; unexpected costs from present and discontinued mining operations and/or labor disruptions; the inherent risks associated with our mining operations; inaccuracies in reserve and resource estimates; changes to timing, construction cost and performance of other parties in respect of new facilities, including the Argentine Profertil nitrogen facility; and risks associated with civil unrest in Egypt and the impact on our interest in the Egyptian Misr Fertilizers Production Company S.A.E. facility (“MOPCO”), including the risk that MOPCO may not be allowed to proceed with the completion of the new facilities; |

| • | | changes in development plans for our expansion, efficiency, debottleneck and other major projects, including the potential for capital construction costs to be higher than expected or construction progress to be delayed due to various factors, including shortage of equipment and labor, the inadequate performance of other parties, risks associated with technology or inflationary pressure; |

| • | | environmental, health, safety and security risks typical of those found throughout the agriculture, mining and chemical manufacturing sectors and the crop inputs supply chain, including risk of injury to employees, contractors or members of the public, and possible environmental contamination; and risks associated with the transportation, storage and use of chemicals and the security of our facilities and personnel; |

| • | | integration risks that might cause anticipated synergies from our recent (including those described in this MD&A) and future acquisitions to be less than expected, including the acquired business’ actual results being different than those upon which we based our expectations, and industry factors which may affect us and the acquired business in general and thereby impact the demand for our products and services; and |

| • | | various strategic risks, including our ability to effectively implement our business strategy and our risk mitigation strategies, including hedging and insurance; our ability to complete proposed acquisitions and dispositions as anticipated, including the strategic dissolution of our Advanced Technologies business unit; our ability to integrate and achieve synergies from any recent or proposed acquisitions within expected time frames; specifically, there are risks associated with the Viterra acquisition, including potential liabilities associated with the assets acquired by Agrium and the introduction of technologies in the agricultural industry that may be disruptive to our business. |

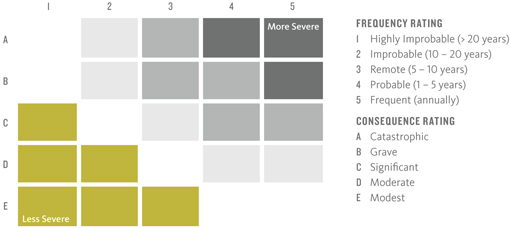

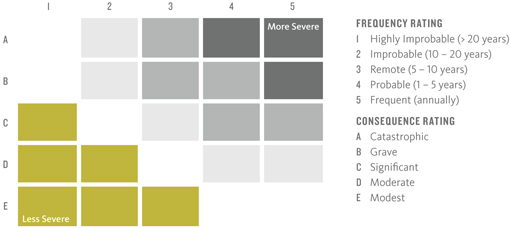

The above items and their possible impact are discussed more fully in the relevant parts of this MD&A, including the sections headed “Key Business Risks”, “Key Business Metrics” and “Enterprise Risk Management” and in our AIF. Additional information on the foregoing and other risk factors is also detailed from time to time in the reports filed by Agrium as part of our continuous disclosure on SEDAR and EDGAR.

In addition to the foregoing, all of the forward-looking statements contained in this MD&A are qualified by the cautionary statements contained herein and by stated or inherent assumptions and apply only as of the date of this MD&A. Except as required by law, Agrium disclaims any intention or obligation to update or revise any forward-looking statements as a result of new information or future events.

| | |

| PAGE 26 // MANAGEMENT’S DISCUSSION AND ANALYSIS // AGRIUM ANNUAL REPORT 2013 |

EXECUTIVE SUMMARY – YIELDING RESULTS FROM OUR INTEGRATED BUSINESS

2013 IN REVIEW

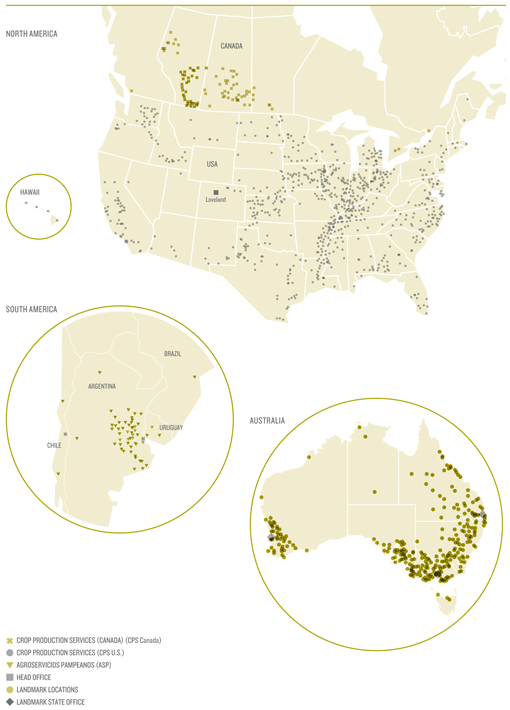

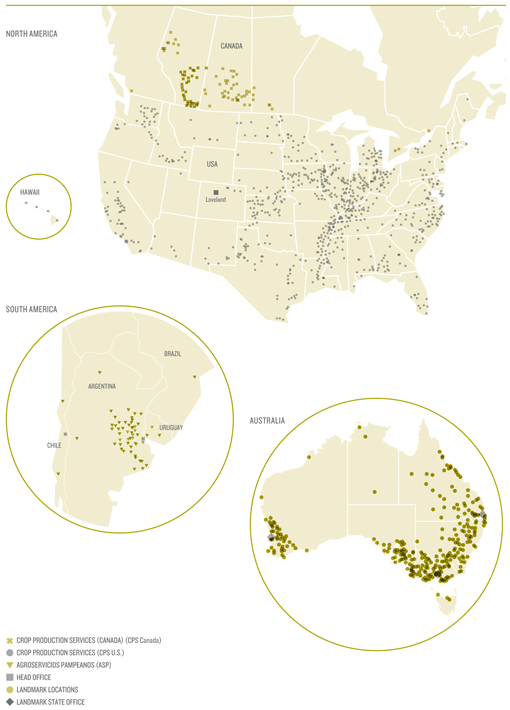

Agrium’s business spans the crop input value chain, as we produce and distribute nutrients, seed and crop protection products and services to growers. We are among the largest producers of the three major crop nutrients – nitrogen, phosphate and potash – in the world and the largest global agricultural retailer. This combination of earnings streams proved itself in 2013, a year when disruptions in the global nutrient markets caused significant volatility of earnings in the fertilizer industry. Throughout this time, our Retail business unit has performed steadily, continuing to meet growers’ needs every day. North America experienced a comparatively wet and late spring in 2013, which delayed seeding and subsequently pushed the agricultural input cycle later throughout the year. Despite these challenges, crop yields were impressive across the U.S., and Canada saw a record harvest in 2013, setting expectations for strong crop input demand in 2014.

In 2013, we continued to expand our business with the acquisition of certain retail Agri-products assets from Viterra Inc. (the “Viterra acquisition”). Agrium acquired over 200 retail locations in Western Canada, and several locations in Australia. Agrium is now the largest agricultural input retailer in Canada, complementing our leading position in the U.S., Australia and South America. During the year, significant progress was made on work at the Vanscoy potash mine expansion, and Agrium continues to evaluate other growth opportunities.

Global supply and demand imbalances in the nitrogen, potash and phosphate markets led to a year of lower crop nutrient pricing. However, we believe long-term demand fundamentals are strongly in favor of Agrium’s business. Every day, the global population grows, and with it the need for more food. Agrium is, and will continue to be, a critical link in the production chain to feed the world.

The Company also significantly increased its dividend in 2013 to its current level of $3.00 per share annually. This was in addition to the implementation of our Normal Course Issuer Bid in 2013, pursuant to which we purchased 5.8 million shares at an average price of USD$86 for a total consideration of $498-million.

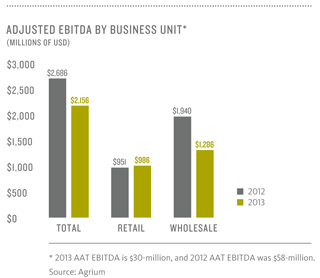

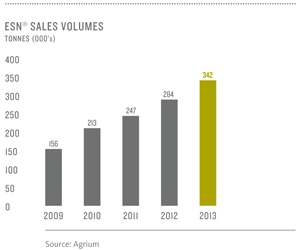

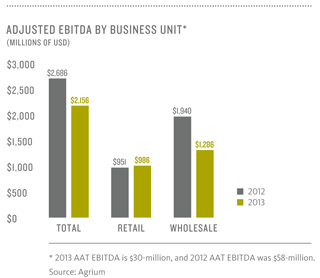

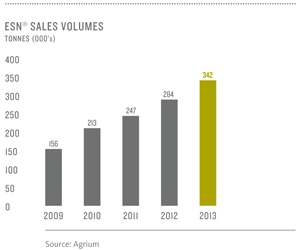

2013 CONSOLIDATED AND BUSINESS UNIT FINANCIAL PERFORMANCE

In 2013, Agrium’s net earnings from continuing operations were $1.1-billion, compared to $1.5-billion in 2012. Our 2013 EBITDA1 fell to $2.1-billion, from $2.6-billion in 2012. OurRetail business unitachieved EBITDA of $986-million in 2013, which includes Viterra for three months of operation, a $257-million one-time purchase gain from the Viterra acquisition and a $220-million goodwill impairment for the Retail – Australia operations. Integration costs from the Viterra acquisition in the fourth quarter of 2013 were $8-million. Excluding these three one-time items, Retail’s 2013 EBITDA was a record $957-million, compared to the previous record of $951-million reported in 2012. The increase was a result of the increasing balance across our input product lines (which can be seen in the sales growth across the seed category) and our continued focus on growth of our proprietary products (primarily Loveland Products (“Loveland”) and Dyna-Gro, which are expected to be further enhanced with the Viterra canola varieties). OurWholesale business unit achieved Adjusted EBITDA1 of $1.3-billion in 2013, compared to $1.9-billion in 2012, reflecting lower nutrient prices and lower nitrogen production volumes due to the extended outages at our Redwater and Carseland facilities. OurAgrium Advanced Technologies (“AAT”) business unit produced EBITDA of $30-million in 2013, with the impact of lower nutrient prices offsetting higher demand for Environmentally Smart Nitrogen® (“ESN”), compared to $58-million in 2012. Following a strategic review process, Agrium decided to dissolve the AAT business unit. The Agriculture business, which includes the ESN and Micronutrient products, will now be incorporated into Wholesale, and Management intends to sell the Turf and Ornamental and Direct Solutions businesses. These businesses have been reported within discontinued operations.

| 1 | Refer to Additional IFRS and Non-IFRS Financial Measures on page 83 of this MD&A. |

| | |

| AGRIUM ANNUAL REPORT 2013 // MANAGEMENT’S DISCUSSION AND ANALYSIS // PAGE 27 |

Every day, Agrium’s agricultural Retail business unit is focused on offering innovative crop input products and related services to our customers, including high-quality seed, crop nutrition, crop protection products and related agronomic and precision agriculture services. We are committed to being the leading provider of agricultural inputs and services in each of the key markets we serve. Retail is the largest global agricultural retailer, with close to 1,500 facilities spanning North America, Australia and much of South America.

Retail works directly with growers to help them maximize the productivity of their farms through the implementation of the best crop management practices, based on a thorough understanding of soils, climate conditions and crop requirements. We provide innovative technologies, products and experience, backed by a commitment to sound environmental practices. Retail also provides application services for the products we sell, offering the latest precision agriculture equipment and standards to meet growers’ needs. In Australia, Retail also provides livestock marketing and auction services.

Retail is focused on providing our customers with the products and services they need to grow the best crops possible. We do this farm by farm, one customer at a time, by leveraging our extensive expertise gained as a result of being in the business as part of Agrium or its predecessor companies for over 50 years and drawing on our global depth and reach. A core component of our Retail strategy is the focus we place on performance management, building on our strong grower relationships and the strength of our brands, including our proprietary Loveland crop protection and specialty nutrient products and Dyna-Gro seed. Serving customers in diverse markets requires a variety of marketing programs and we are able to effectively adapt to these different market conditions. We provide a complete offering of products and agronomic services in order to achieve greater market penetration and customer loyalty. Additionally, we strive to build strong relationships with leading growers in each of our markets, allowing us to grow along with our customers. We leverage the scale of our Retail business to minimize costs, grow sales of our proprietary products and adopt new technologies to more effectively serve our customers. Through all of these efforts, we are committed to protecting the environment and the health and safety of our employees, customers and the communities in which we operate.

| | |

| PAGE 28 // MANAGEMENT’S DISCUSSION AND ANALYSIS // AGRIUM ANNUAL REPORT 2013 |

| | |

| AGRIUM ANNUAL REPORT 2013 // MANAGEMENT’S DISCUSSION AND ANALYSIS // PAGE 29 |

RETAIL – KEY DEVELOPMENTS

One of the major developments in 2013 was the Viterra acquisition. This transaction closed on October 1, 2013, and provided Retail with over 200 new retail branches across Western Canada, adding to the approximately 63 retail branches owned in the region prior to the Viterra acquisition. As part of the Viterra acquisition, we also acquired distribution assets in Australia. Total annual sales from the Viterra acquisition are estimated at approximately $1.7-billion. During 2013, a purchase gain of $257-million was recognized to reflect the difference between the fair value of acquired net assets and the purchase price. The final purchase price allocation is expected to be completed in 2014. This acquisition positions Agrium as the largest agricultural retailer in Canada. We expect synergies from the Viterra acquisition of at least $15-million annually by the end of 2015, primarily from economies of scale and by increasing the distribution of our proprietary crop protection, nutrient and seed products. The Viterra acquisition is also expected to offer potential synergy opportunities for Agrium’s Wholesale business unit.

In addition to the Viterra acquisition, we also completed a number of acquisitions of smaller independent retail operations in 2013. This included 20 facilities, representing annual sales of approximately $115-million. It also included a few specialty or vertical integration opportunities. One of these was our acquisition of Echelon AG Inc. (“Echelon”). Echelon is a provider of precision agriculture services utilizing state-of-the-art satellite imagery technology in conjunction with proprietary algorithms to identify optimal application rates for nutrients, seed and other inputs. Based in Western Canada, Echelon has been operating since 2007, and has been working with Crop Production Services, Inc. (“CPS U.S.”) and Crop Production Services (Canada) Inc. (“CPS Canada”) since 2010, to provide precision agriculture services to our grower customers in Alberta, Saskatchewan, Manitoba, North Dakota and Montana.

Our Retail business continues to focus on opportunities to organically grow our earnings, by increasing the sales in our seed business in general and our proprietary seed, specialty nutrient and chemical businesses in particular. We also continue to focus on the optimization of our network of facilities through further implementation of our “hub and spoke” model, which may include strategic store closures. During 2013, we consolidated 43 facilities across our distribution channel.

Retail’s Landmark business in Australia remains a focus for continued improvement and additional synergies in 2014. Specific key developments include the implementation of Retail’s North American Information Technology systems in Australia and the licensing of additional Loveland products and Viterra canola in Australia, which are expected to enhance margins in that region.

In the fourth quarter of 2013, we recorded the Viterra acquisition within Retail. This resulted in a $257-million purchase gain, representing the difference between the fair value of acquired net assets and the purchase price. During the quarter, we also recorded goodwill impairment in Retail – Australia of $220-million due to synergy delays and reduced expectations for sales, gross margins and long-term growth.

| | |

| PAGE 30 // MANAGEMENT’S DISCUSSION AND ANALYSIS // AGRIUM ANNUAL REPORT 2013 |

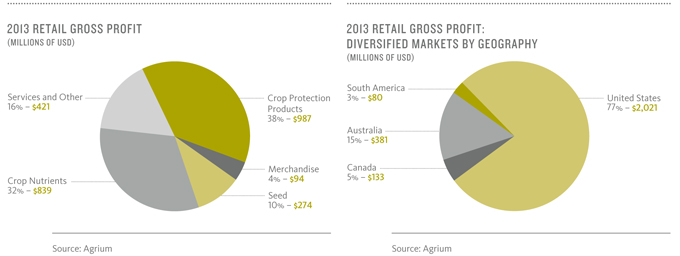

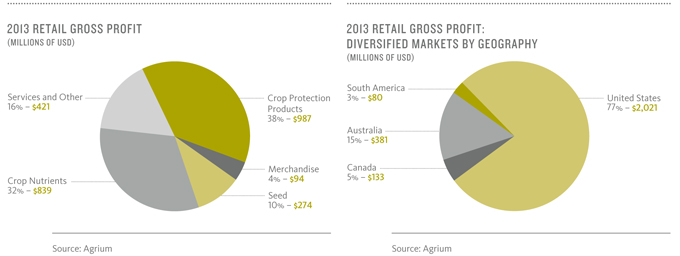

RETAIL – FINANCIAL RESULTS

Retail sales reached $11.9-billion in 2013, compared to $11.5-billion in 2012, while gross profit rose to $2.6-billion from $2.5-billion in 2012. Total EBIT in 2013 was $748-million, which included the Viterra purchase gain, Viterra operating results in the fourth quarter (which included $8-million of integration costs) and the impairment of Retail – Australia goodwill. Excluding the Viterra gain and integration costs and the Landmark impairment, EBIT was $719-milllion in 2013, compared to $757-million recorded in 2012, and EBITDA (excluding the same items) reached another historical record of $957-million in 2013, compared to $951-million in 2012.

Retail’s results this year were impacted by a comparatively late start to both the spring and fall application seasons in the U.S., particularly when compared to the very early and long spring and fall application seasons experienced in 2012.

Normalized comparable store sales1, which are normalized for changes in commodity nutrient prices, increased by 5 percent in 2013, compared to an 8 percent increase in 2012. Excluding the Viterra acquisition, all other acquisitions completed by the end of 2012 and in 2013 contributed approximately $400-million in addition to the comparable store base in sales. Depreciation and amortization expenses increased to $238-million in 2013, compared to $194-million in 2012, due to the Viterra acquisition and recent smaller acquisitions. Retail’s increased sales in 2013 were offset by a corresponding increase in cost of product sold, which was $9.3-billion in 2013, compared to $9.0-billion in 2012. Total non-cash working capital was $2.1-billion at the end of 2013, which is approximately the same as the prior year. The Viterra acquisition added working capital requirements in the fourth quarter of 2013 in a relatively low sales quarter, which was offset by lower priced year-end nutrient inventory compared to 2012. As a result, average non-cash working capital as a percentage of sales was flat year-over-year at 20 percent.

| 1 | Refer to Additional IFRS and Non-IFRS Financial Measures on page 83 of this MD&A. |

| | |

| AGRIUM ANNUAL REPORT 2013 // MANAGEMENT’S DISCUSSION AND ANALYSIS // PAGE 31 |

RETAIL – EXPENSES

Retail selling expenses increased by 11 percent to $1.8-billion in 2013. The majority of this variance was due to operating costs associated with recent acquisitions, including integration expenses for the Viterra acquisition of $8-million in the fourth quarter of 2013, partly due to severance costs. Total selling expense as a percentage of sales was 15.5 percent in 2013, an increase from the 14.5 percent recorded in 2012. Retail’s operating coverage ratio also increased to 71 percent in 2013, up from 69 percent in 2012, primarily due to higher expenses from Viterra in the fourth quarter, which is a slower sales period for that business. In 2013, EBITDA (excluding the purchase gain of $257-million for the Viterra acquisition and the $220-million goodwill impairment of Landmark) as a percentage of sales was 8.0 percent, compared to 8.3 percent in 2012. This was partly due to the addition of Viterra’s lower EBITDA margin business in the fourth quarter of 2013.

„ RETAIL PERFORMANCE

| | | | | | | | |

| | | Years ended December 31, | |

| (millions of U.S. dollars, except as noted) | | 2013 | | | 2012 | |

Sales | | | 11,913 | | | | 11,479 | |

Cost of product sold | | | 9,298 | | | | 9,001 | |

Gross profit | | | 2,615 | | | | 2,478 | |

Expenses | | | | | | | | |

Selling | | | 1,847 | | | | 1,669 | |

General and administrative | | | 116 | | | | 122 | |

Earnings from associates and joint ventures | | | (9 | ) | | | (9 | ) |

Purchase gain | | | (257 | ) | | | — | |

Goodwill impairment | | | 220 | | | | — | |

Other income | | | (50 | ) | | | (61 | ) |

EBIT | | | 748 | | | | 757 | |

EBITDA | | | 986 | | | | 951 | |

EBITDA to sales(%) | | | 8.3 | | | | 8.3 | |

Operating coverage ratio(%) | | | 71 | | | | 69 | |

Comparable store sales(%) | | | (2 | ) | | | 8 | |

Normalized comparable store sales(%) | | | 5 | | | | 8 | |

Average non-cash working capital to sales(%) | | | 20 | | | | 20 | |

CROP NUTRIENTS: PRODUCTS AND SERVICES

Retail supplies the crop nutrients that are essential to growing healthy plants, including dry and liquid nitrogen, phosphate, potash, sulfur and micronutrients. Agrium Retail acquires crop nutrient products from a wide variety of suppliers at market prices, including purchases from Agrium Wholesale. These are typically bulk blended at Agrium Retail branches, or applied using variable rate technology or conventional equipment. Our Retail branches work closely with growers to understand their goals and customize our delivery of products, agronomic advice and product application services to help achieve these goals. Agrium Retail also delivers additional value to growers through its application services, which are provided on a fee-for-service basis. Our Retail agronomists use the 4R nutrient stewardship system to help determine the right nutrient source, applied at the right time, at the right rate and in the right place. We offer a full precision agriculture service, which we rebranded under the name “Echelon” in 2013, formerly known as Nutriscription HD. The precision agriculture service provides growers with highly sophisticated tools that help growers adjust crop inputs to better recognize the differences in yield potential within a field and thereby increase yields with more effective utilization of crop inputs. Precision agriculture technologies such as Echelon can provide significant improvements to both grower profitability and environmental protection.

| | |

| PAGE 32 // MANAGEMENT’S DISCUSSION AND ANALYSIS // AGRIUM ANNUAL REPORT 2013 |

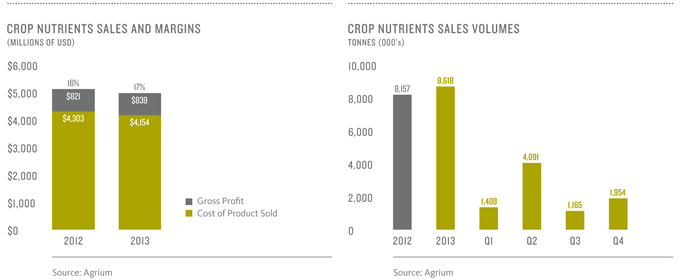

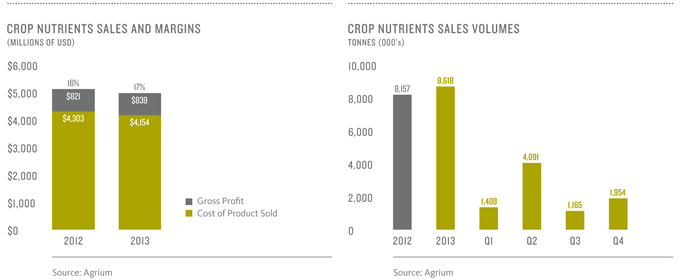

CROP NUTRIENTS: FINANCIAL RESULTS

Our crop nutrient sales were $5.0-billion in 2013, compared to $5.1-billion in 2012. The decrease was due to lower average nutrient prices offsetting higher sales volumes when compared to 2012. Average crop nutrient sales prices at the retail level were down 8 percent year-over-year due to weaker global prices for all three major nutrients: nitrogen, potash and phosphate. Total Retail nutrient sales volumes increased by 6 percent, reaching 8.6 million tonnes in 2013, compared to 8.2 million tonnes in 2012. The higher volumes were attributable to Viterra and other acquisitions in 2013 and to stronger volumes in Australia. Cost of product sold was down slightly on lower purchased nutrient prices to $4.2-billion in 2013, compared to $4.3-billion in 2012. Gross profit reached $839-million this year, compared to $821-million in 2012. Crop nutrient margins were $97 per tonne in 2013, compared to $101 per tonne in 2012. The decrease was primarily due to declining nutrient prices throughout 2013 and partly due to the higher proportion of sales in Australia and Canada, where margins tend to be lower than in the U.S. Nutrient margins in our Australian operations are lower than those in North and South America, as nutrients in this market are primarily held at port and blended by the product suppliers once Agrium arranges a sale. However, per-tonne margins in Australia showed year-over-year improvement in 2013. Total Retail gross profit as a percentage of crop nutrient sales was 16.8 percent in 2013, compared to 16.0 percent in 2012.

CROP PROTECTION PRODUCTS: PRODUCTS AND SERVICES

Agrium Retail’s crop protection business markets a broad spectrum of herbicide, fungicide, insecticide and adjuvant products that help growers minimize yield losses and protect crop quality from weeds, disease and insects. Our Retail business serves as both a retailer of crop protection products and, to a lesser extent, a wholesaler to other retail operators. We are the largest independent distributor of crop protection products in the U.S. As part of our proprietary Loveland crop protection business, we own and operate five blending and formulation facilities, including major production facilities located in Greeley, Colorado; Billings, Montana; Greenville, Mississippi; Fairbury, Nebraska; Casilda, Argentina; and we have a joint venture formulation plant based in Winnipeg, Manitoba.

| | |

| AGRIUM ANNUAL REPORT 2013 // MANAGEMENT’S DISCUSSION AND ANALYSIS // PAGE 33 |

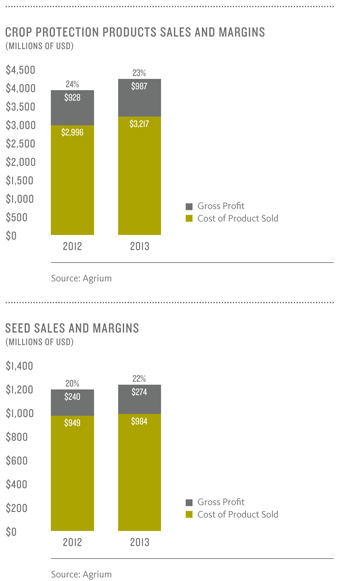

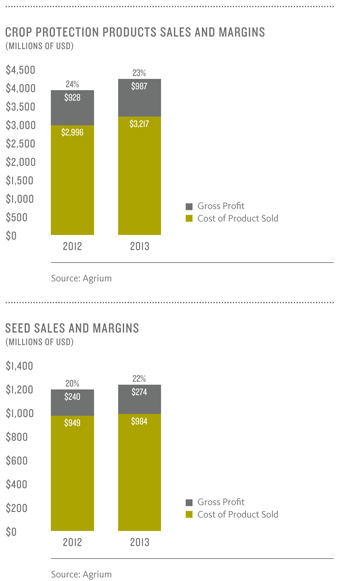

CROP PROTECTION PRODUCTS: FINANCIAL RESULTS

The crop protection product category delivered strong results in 2013. Crop protection product sales increased to $4.2-billion in 2013, compared to $3.9-billion in 2012. The cost of crop protection product sold also increased to $3.2-billion in 2013, compared to $3.0-billion in 2012. Gross profit for crop protection products reached $987-million in 2013, compared to $928-million in 2012. The increase in sales and gross profit was attributable to both higher sales volumes and prices. Increased sales volumes were partly due to recent acquisitions. In addition, higher sales were also aided by increased demand for different types of herbicides, as some weeds have become resistant to glyphosates, and by greater demand for fungicides in 2013 due to a wetter growing season and an overall upward trend in demand for these types of products. Gross margin for crop protection products was 23.5 percent compared to 23.6 percent in 2012. In North America, our proprietary Loveland crop protection products accounted for approximately 18.2 percent of our total crop protection product sales, compared to approximately 17.6 percent in 2012, and continued to contribute margins significantly higher than other crop protection products.

SEED: PRODUCTS AND SERVICES

Agrium Retail’s network provides seed and seed-related information to growers across key agricultural regions. We offer our own proprietary Dyna-Gro branded seed and also procure seed from top global suppliers. Our Dyna-Gro seed specialists license leading seed traits from major seed suppliers and match seed characteristics to local soil and growing conditions in order to achieve the best results for growers in each area. Increases in seed market share, combined with continued technological advances in seed genetics and our focus on delivering high-quality seed products to our customers, provide significant potential for continued strong growth in this key area of our business. The Viterra acquisition brought with it a significant seed canola research and development program. With laboratories in Saskatoon, Saskatchewan and Horsham, Australia, a vast germplasm bank and research farms in Saskatchewan, we have acquired significant plant breeding capabilities that will allow us to continue Viterra’s work in developing improved seed varieties. Viterra has developed and patented a number of proprietary seed genetics and varieties, and these proprietary product lines are expected to make up a significant portion of our seed sales in Canada.

SEED: FINANCIAL RESULTS

Seed sales reached $1.3-billion in 2013, compared to $1.2-billion in 2012. The increase in seed sales was primarily due to higher seed prices compared to 2012. The cost of product sold for seed also increased slightly to $984-million in 2013, compared to $949-million in 2012. Gross profit from seed was $274-million, compared to $240-million in 2012. Gross margin for 2013 was 21.8 percent, up from the 20.2 percent reported in 2012. In 2013, Agrium’s proprietary Dyna-Gro branded seed sales increased by 11 percent over the previous year and accounted for approximately 18.7 percent of our total North American seed sales versus 17.8 percent in 2012.

| | |

| PAGE 34 // MANAGEMENT’S DISCUSSION AND ANALYSIS // AGRIUM ANNUAL REPORT 2013 |

MERCHANDISE: PRODUCTS AND SERVICES

The merchandise product category includes fencing, feed supplements, livestock-related animal health products, irrigation equipment and other products. The fuel and equipment businesses acquired from Viterra in Canada are also included in the merchandise category. This product line is a much larger component of our Australian and Canadian operations than it is for Agrium’s U.S. and South American Retail operations.

MERCHANDISE: FINANCIAL RESULTS

Merchandise sales totaled $612-million in 2013, compared to $524-million in 2012. Gross profit reached $94-million in the current year, compared to $93-million in 2012. The increases in sales and gross profit are the result of the fourth quarter merchandise earnings from Viterra and improvement in animal health and other livestock-related products in Australia in the second half of 2013. The results from Viterra’s fuel business are also included in the 2013 fourth quarter results, which had the effect of increasing sales and lowering margins as a percentage of sales. The fuel business acquired through the Viterra acquisition provides Retail with another touch-point with our grower customers.

SERVICES AND OTHER: PRODUCTS AND SERVICES

Agrium delivers value to growers and earns customer loyalty through services such as product application, soil and leaf testing and crop scouting. We maintain a large fleet of application equipment in order to ensure timely applications at optimal rates. Seed treatment is another service that we provide to growers. This service involves applying products to seeds to protect them from pests and disease. Services in our Australian operations also include providing customers with livestock marketing, as well as various insurance and real estate services.

CPS U.S. offers customers a variety of specialty services in the Western U.S. to help ensure effective crop input applications aimed at optimizing yields and minimizing input losses on the region’s high-value crops. This includes the operation of our Precision Ag Lab laboratory services and a wireless network of weather stations in the region, which supply field-specific weather data and soil moisture information to proprietary software that predicts disease and infestation. CPS provides tissue and soil sampling services aimed at optimizing yields. Our Echelon precision agriculture offering includes services such as yield data mapping, record keeping, soil fertility management, variable rate fertilizer application and variable rate seeding recommendations. Agrium’s precision agriculture service is being used on over 10 million acres of growers’ land in the U.S.

SERVICES AND OTHER: FINANCIAL RESULTS

Sales of services and other were $846-million in 2013, compared to $718-million in 2012. The increase was primarily due to stronger demand for application services in North America as a result of increased crop protection sales volumes in 2013 and the growing use of precision agriculture services by growers in North America. The addition of Viterra also contributed to the increased sales of services and other. Gross profit increased to $421-million in 2013, compared to $396-million in the previous year.

„ PRODUCT LINE PERFORMANCE

| | | | | | | | |

| | | Years ended December 31, | |

| (millions of U.S. dollars, except as noted) | | 2013 | | | 2012 | |

Crop nutrients | | | | | | | | |

Sales | | | 4,993 | | | | 5,124 | |

Cost of product sold | | | 4,154 | | | | 4,303 | |

Gross profit | | | 839 | | | | 821 | |

Gross profit (%) | | | 16.8 | | | | 16.0 | |

Crop protection products | | | | | | | | |

Sales | | | 4,204 | | | | 3,924 | |

Cost of product sold | | | 3,217 | | | | 2,996 | |

Gross profit | | | 987 | | | | 928 | |

Gross profit (%) | | | 23.5 | | | | 23.6 | |

Seed | | | | | | | | |

Sales | | | 1,258 | | | | 1,189 | |

Cost of product sold | | | 984 | | | | 949 | |

Gross profit | | | 274 | | | | 240 | |

Gross profit (%) | | | 21.8 | | | | 20.2 | |

Merchandise | | | | | | | | |

Sales | | | 612 | | | | 524 | |

Cost of product sold | | | 518 | | | | 431 | |

Gross profit | | | 94 | | | | 93 | |

Gross profit (%) | | | 15.4 | | | | 17.7 | |

Services and other | | | | | | | | |

Sales | | | 846 | | | | 718 | |

Cost of product sold | | | 425 | | | | 322 | |

Gross profit | | | 421 | | | | 396 | |

Gross profit (%) | | | 49.8 | | | | 55.2 | |

Total sales | | | 11,913 | | | | 11,479 | |

Total cost of product sold | | | 9,298 | | | | 9,001 | |

Total gross profit | | | 2,615 | | | | 2,478 | |

Total gross profit(%) | | | 22.0 | | | | 21.6 | |

| | |

| AGRIUM ANNUAL REPORT 2013 // MANAGEMENT’S DISCUSSION AND ANALYSIS // PAGE 35 |

„ REGIONAL PERFORMANCE

| | | | | | | | | | | | | | | | |

| | | 2013 | | | 2012 | |

| (millions of U.S. dollars, except as noted) | | North America | | | International | | | North America | | | International | |

Sales | | | 9,329 | | | | 2,584 | | | | 8,997 | | | | 2,482 | |

Cost of product sold | | | 7,175 | | | | 2,123 | | | | 6,975 | | | | 2,026 | |

Gross profit | | | 2,154 | | | | 461 | | | | 2,022 | | | | 456 | |

Gross profit (%) | | | 23.1 | | | | 17.8 | | | | 22.5 | | | | 18.4 | |

Expenses | | | | | | | | | | | | | | | | |

Selling | | | 1,450 | | | | 397 | | | | 1,278 | | | | 391 | |

General and administrative | | | 64 | | | | 52 | | | | 58 | | | | 64 | |

Earnings from associates and joint ventures | | | (3 | ) | | | (6 | ) | | | (2 | ) | | | (7 | ) |

Purchase gain | | | (257 | ) | | | — | | | | — | | | | — | |

Goodwill impairment | | | — | | | | 220 | | | | — | | | | — | |

Other income | | | (40 | ) | | | (10 | ) | | | (31 | ) | | | (30 | ) |

EBIT | | | 940 | | | | (192 | ) | | | 719 | | | | 38 | |

EBITDA | | | 1,142 | | | | (156 | ) | | | 869 | | | | 82 | |

Sales and margins in North America increased in 2013 due to recent acquisitions and higher crop protection products sales as well as improved margins in crop nutrients and seed compared to 2012. Growth in higher margin proprietary product lines was also a significant contributor to higher gross margins in 2013. International sales and margins also increased due to increased margins per tonne in Australia and the full year results from our venture into the Brazilian market compared to 2012.

North American EBIT increased due to improved margins across the majority of the Retail product lines and to recent acquisitions. Also included in 2013 North American EBIT was a purchase gain on the Viterra acquisition of $257-million. International EBIT was lower than 2012 primarily due to a goodwill impairment charge for Retail – Australia of $220-million and challenges in the Australian livestock markets.

| | |

| PAGE 36 // MANAGEMENT’S DISCUSSION AND ANALYSIS // AGRIUM ANNUAL REPORT 2013 |

RETAIL – QUARTERLY RESULTS

Our Retail business is seasonal in nature and is strongly influenced by the North American second quarter spring application and planting season. The second quarter is also important to our Landmark operations in Australia, given that significant application occurs ahead of the winter wheat seeding that generally takes place in the second quarter. This year, the U.S. experienced a late and wet spring season and the later timing also resulted in a later harvest than last year and a compressed fall nutrient application window.

Due to the significant difference in weather patterns between 2012 and 2013, we saw some sales that were in the second quarter last year move to the third quarter this year. A compressed fall season as experienced in 2013 often results in a stronger than normal spring fertilizer application season in the following year, as growers attempt to make up for lower than expected application opportunities in the previous fall.

„ RETAIL QUARTERLY RESULTS*

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2013 | | | 2012 | |

| (millions of U.S. dollars, except as noted) | | Q4 | | | Q3 | | | Q2 | | | Q1 | | | Q4 | | | Q3 | | | Q2 | | | Q1 | |

Sales – North America* | | | 1,538 | | | | 1,531 | | | | 4,657 | | | | 1,587 | | | | 1,451 | | | | 1,249 | | | | 4,406 | | | | 1,873 | |

Sales – international* | | | 564 | | | | 578 | | | | 906 | | | | 552 | | | | 524 | | | | 585 | | | | 813 | | | | 578 | |

Total sales | | | 2,102 | | | | 2,109 | | | | 5,563 | | | | 2,139 | | | | 1,975 | | | | 1,834 | | | | 5,219 | | | | 2,451 | |

Cost of product sold | | | 1,516 | | | | 1,598 | | | | 4,421 | | | | 1,763 | | | | 1,466 | | | | 1,396 | | | | 4,115 | | | | 2,024 | |

Gross profit | | | 586 | | | | 511 | | | | 1,142 | | | | 376 | | | | 509 | | | | 438 | | | | 1,104 | | | | 427 | |

Gross profit (%) | | | 28 | | | | 24 | | | | 21 | | | | 18 | | | | 26 | | | | 24 | | | | 21 | | | | 17 | |

Gross profit by product | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Crop nutrients | | | 178 | | | | 116 | | | | 424 | | | | 121 | | | | 155 | | | | 111 | | | | 400 | | | | 155 | |

Crop protection products | | | 205 | | | | 248 | | | | 406 | | | | 128 | | | | 203 | | | | 202 | | | | 400 | | | | 123 | |

Seed | | | 60 | | | | 30 | | | | 140 | | | | 44 | | | | 43 | | | | 28 | | | | 125 | | | | 44 | |

Merchandise | | | 30 | | | | 19 | | | | 23 | | | | 22 | | | | 21 | | | | 17 | | | | 32 | | | | 23 | |

Services and other | | | 113 | | | | 98 | | | | 149 | | | | 61 | | | | 87 | | | | 80 | | | | 147 | | | | 82 | |

EBIT | | | 123 | | | | 91 | | | | 562 | | | | (28 | ) | | | 75 | | | | 69 | | | | 556 | | | | 57 | |

EBITDA | | | 195 | | | | 147 | | | | 619 | | | | 25 | | | | 124 | | | | 121 | | | | 605 | | | | 101 | |

| | |

| | | 2013 | | | 2012 | |

| (in percentages) | | Dec 31 | | | Sept 30 | | | June 30 | | | March 31 | | | Dec 31 | | | Sept 30 | | | June 30 | | | March 31 | |

Return on operating capital employed(a) | | | 17 | | | | 16 | | | | 15 | | | | 15 | | | | 18 | | | | 17 | | | | 18 | | | | 16 | |

Return on capital employed(a) | | | 9 | | | | 8 | | | | 8 | | | | 8 | | | | 9 | | | | 9 | | | | 9 | | | | 8 | |

Average non-cash working capital to sales(a) | | | 20 | | | | 20 | | | | 20 | | | | 20 | | | | 20 | | | | 20 | | | | 20 | | | | 21 | |

Operating coverage ratio(a) | | | 71 | | | | 72 | | | | 72 | | | | 72 | | | | 69 | | | | 70 | | | | 70 | | | | 72 | |

Comparable store sales(b) | | | (2 | ) | | | | | | | (3 | ) | | | | | | | 8 | | | | | | | | 15 | | | | | |

Normalized comparable store sales(b) | | | 5 | | | | | | | | 1 | | | | | | | | 8 | | | | | | | | 13 | | | | | |

| (a) | These measures are based on rolling four quarters ended. |

| (b) | These measures are based on 12 or six months ended. |

| * | Sales by location of third-party customers |

| | |

| AGRIUM ANNUAL REPORT 2013 // MANAGEMENT’S DISCUSSION AND ANALYSIS // PAGE 37 |

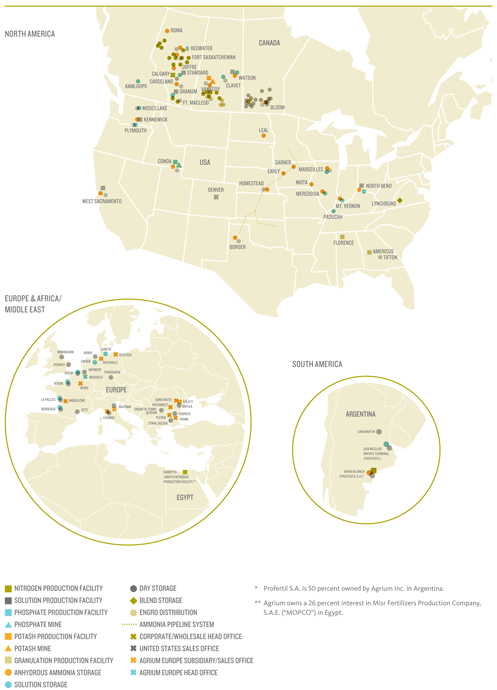

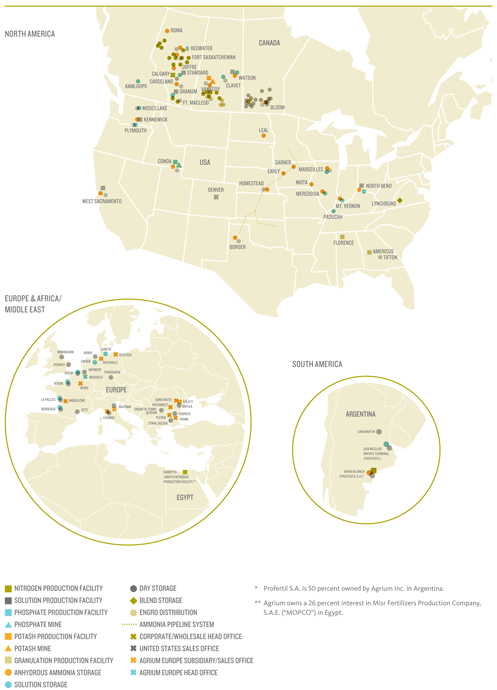

Every day, Agrium’s Wholesale business unit is focused on producing, marketing and distributing all major fertilizer products across the globe in the most efficient, safe and sustainable manner possible. We have over nine million tonnes of nutrient production capacity and significant associated distribution capability. This diverse asset mix enables us to provide the critical crop nutrients our customers need to help them optimize crop yields in order to sustain a growing world population.

Agrium Wholesale has numerous competitive advantages that drive our performance and earnings on a daily basis. The majority of our production capacity and distribution capability is located close to our key end-markets, allowing us to leverage lower freight costs and logistical synergies. These factors, combined with access to long-term, low-cost raw material inputs for the production of crop nutrients, enables us to realize some of the highest margins in North America. For nitrogen, we have access to some of the most secure and lowest cost natural gas in the world at our North American nitrogen facilities. Our potash reserves are located in Saskatchewan, Canada, representing some of the highest quality and lowest cost potash in the world. Our phosphate business benefits from a competitive cost position in sulfur, obtained as a byproduct from Canadian oil production, as well as an integrated ammonia supply from our nitrogen facilities.

| | |

| PAGE 38 // MANAGEMENT’S DISCUSSION AND ANALYSIS // AGRIUM ANNUAL REPORT 2013 |

| | |

| AGRIUM ANNUAL REPORT 2013 // MANAGEMENT’S DISCUSSION AND ANALYSIS // PAGE 39 |

Growers use the following three key crop nutrients to help replenish soil nutrient balance and enhance both crop yields and quality.

| | | | |

| N | | P | | K |

| Nitrogen | | Phosphate | | Potash |

| | | Role of nutrient | | |

| | |

| Improves crop growth, yield and protein levels | | Stimulates root development and flowering and encourages early crop development | | Regulates plant growth processes and helps protect crops from drought and disease |

| | | Our products | | |

| | |

| Ammonia, urea, urea ammonium nitrate (“UAN”) solutions, ammonium nitrate | | Monoammonium phosphate (“MAP”), superphosphoric acid (“SPA”) products | | Muriate of potash (“MOP” or “potash”) |

| | | Our advantages | | |

| | |

• Overall low North American natural gas prices and a further Western Canadian AECO gas advantage relative to NYMEX; and • Facilities located near key end-markets in the Americas and Europe. | | • Competitive cost position for sulfur and ammonia; • In-market freight advantage; and • Integrated Conda rock supply. | | • World-scale, high-quality and low-cost advantage; • High historical operating rate due to integration with Retail and a balanced geographic sales mix; • Capacity expansion initiative; and • Partner in a major international marketing and logistics company (Canpotex). |

„ 2013 WHOLESALE CAPACITY, PRODUCTION AND SALES

| | | | | | | | | | | | |

| (thousands of product tonnes) | | Capacity | | | Production (a) | | | Sales (b) | |

Nitrogen volumes | | | | | | | | | | | | |

North America | | | | | | | | | | | | |

Canada | | | 3,515 | | | | 2,499 | | | | 1,618 | |

U.S. | | | 1,333 | | | | 1,122 | | | | 1,774 | |

Total nitrogen | | | 4,848 | | | | 3,621 | | | | 3,392 | |

Potash volumes | | | | | | | | | | | | |

North America | | | | | | | | | | | | |

Canada | | | 2,035 | | | | 1,713 | | | | 143 | |

U.S. | | | — | | | | — | | | | 734 | |

International | | | — | | | | — | | | | 654 | |

Total potash | | | 2,035 | | | | 1,713 | | | | 1,531 | |

Phosphate volumes | | | | | | | | | | | | |

North America | | | | | | | | | | | | |

Canada | | | 660 | | | | 607 | | | | 544 | |

U.S. | | | 510 | (c) | | | 504 | | | | 482 | |

Total phosphate | | | 1,170 | (c) | | | 1,111 | | | | 1,026 | |

Ammonium sulfate and other volumes | | | | | | | | | | | | |

North America | | | | | | | | | | | | |

Canada | | | 355 | | | | 344 | | | | 278 | |

U.S. | | | 296 | | | | 228 | | | | 335 | |

Total other | | | 651 | | | | 572 | | | | 613 | |

Total produced product | | | 8,704 | | | | 7,017 | | | | 6,562 | |

Product purchased for resale volumes(d) | | | | | | | | | | | | |

North America | | | | | | | | | | | | |

U.S. | | | — | | | | — | | | | 526 | |

International | | | — | | | | — | | | | 2,161 | |

Total product purchased for resale | | | | | | | | | | | 2,687 | |

Total Wholesale | | | 8,704 | | | | 7,017 | | | | 9,249 | |

Wholesale equity accounted joint ventures: | | | | | | | | | | | | |

International nitrogen(e) | | | 635 | | | | 531 | | | | 540 | |

International product purchased for resale | | | — | | | | — | | | | 304 | |

| (a) | Production, net of transfers. |

| (b) | Sales represent country of sales destination, not country of production. |

| (c) | SPA and Merchant Grade Phosphoric Acid (“MGA”) are reported by cargo weight. |

| (d) | Purchase for resale includes sales of all the major crop nutrient products. |

| (e) | Represents our 50 percent joint venture interest in the capacity of Profertil, which is accounted for using the equity method. |

| | |

| PAGE 40 // MANAGEMENT’S DISCUSSION AND ANALYSIS // AGRIUM ANNUAL REPORT 2013 |

WHOLESALE – KEY DEVELOPMENTS

During 2013, Wholesale continued to progress expansion plans for potash and nitrogen, which will increase our capacity, help lower costs and grow future earnings for the Company.

Our brownfield potash expansion project at Vanscoy is on schedule for completion in the second half of 2014. The project is expected to increase our annual production capacity by one million tonnes and reduce our cash cost of production by approximately $20 per tonne by 2017, when total incremental production is fully operational. In the second half of 2014 we intend to bring the plant down for approximately 14 weeks for the final tie-in to existing production. The project is expected to exceed previous spending estimates by approximately 25 percent due to labor shortages, contractor productivity and extreme weather conditions in Saskatchewan1. Current estimates are contingent on improved contractor productivity and adherence to the current construction schedule1.

Agrium has a 50 percent interest in the Profertil nitrogen facility located in Bahia Blanca, Argentina, which currently has a total annual capacity of 1.2 million tonnes of urea and 70,000 net tonnes of merchant ammonia. A brownfield expansion and energy efficiency project is currently underway to increase the facility’s total projected annual production capacity by approximately 125,000 tonnes of urea and 10,000 net tonnes of merchant ammonia. The expansion project is designed to significantly increase gas utilization efficiency, such that no additional gas will be required to produce the additional volume, leading to significant anticipated reductions in per-tonne production costs. The expansion project is proceeding as planned and is expected to be completed in the second half of 2014.

Agrium also owns a 26 percent stake in a nitrogen facility located in Egypt, the Egyptian Misr Fertilizers Production Company S.A.E. (“MOPCO”). The 675,000 tonne urea facility has a competitive gas cost structure. An expansion project to triple the annual capacity by adding two new facilities was put on hold due to security concerns resulting from political and civil unrest. The project was over 90 percent complete when it was suspended.

The expansion project would increase production capacity to 1.95 million tonnes of urea and 150,000 net tonnes of merchant ammonia. There remains continued interest from the Egyptian government to complete the project, given the existing facility’s strong environmental and economic performance and the positive contribution the expanded facility could provide to the Egyptian economy. There was a positive development in late 2013, with the Egyptian government issuing a decree supporting the recommencement of construction and at this time MOPCO is on-site and assessing the plant condition in the anticipation of a restart of construction. However, it is too early to say whether the project will be successfully completed.

During the fourth quarter of 2013, construction was completed for Agrium’s phosphate rock import terminal at Neptune Bulk Terminals (Canada) Ltd. on the West Coast of Canada. This dedicated terminal will facilitate the handling and delivery of imported phosphate rock from Morocco for production at our facility in Redwater, Alberta. The phosphate rock supply from our mine in Kapuskasing, Ontario ceased in the second quarter of 2013, as the mine was closed due to depletion of its economic reserves.

| 1 | Exclusive of sustaining capital scope and owner’s costs. |

| | |

| AGRIUM ANNUAL REPORT 2013 // MANAGEMENT’S DISCUSSION AND ANALYSIS // PAGE 41 |

Throughout 2013, engineering and evaluation continued on the Borger brownfield expansion project, with approval by the Board of Directors received and construction started in the first quarter of 2014. The estimated cost of the project is $720-million and it is expected to add over 600,000 tonnes of new urea capacity once complete, which is estimated to be the fourth quarter of 2015.

Agrium’s nitrogen greenfield project assessment continued in 2013 but due to the risk of cost escalation, the focus has shifted to finding a potential partner and long-term gas contract for the project.

We are also evaluating whether a restart of the Kenai, Alaska nitrogen facility might be possible in the future, given the recent additional drilling in the Alaskan Cook Inlet. The Kenai facility was shut down in October 2007 due to a lack of natural gas in the region. The critical factor in determining a potential restart would be the attainment of natural gas supply contracts at an appropriate price. The capacity of the facility is just over 900,000 tonnes of saleable nitrogen.

In December 2013, Agrium announced that after a strategic review of the AAT business unit it had decided to transfer the ESN and Micronutrient products of the Agriculture business of AAT back to the Wholesale business unit. Prior to the formation of the AAT business unit, ESN production was within Wholesale. We will look to leverage the existing manufacturing and distribution capabilities of Wholesale to deliver potential synergies. The Agriculture business of AAT will be reported in Wholesale’s results commencing in the first quarter of 2014. In note 27 of the Notes to the Consolidated Financial Statements, we have modified our segment reporting to reflect the change by including AAT’s 2012 and 2013 Agriculture business results within our Wholesale business unit.

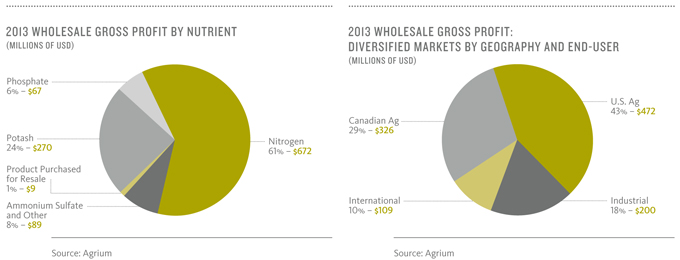

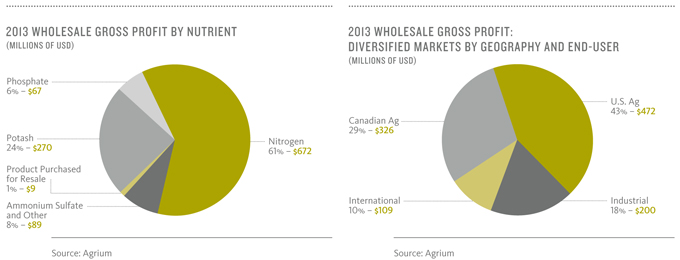

WHOLESALE – FINANCIAL RESULTS

Sales from Wholesale operations were $4.3-billion in 2013, compared to $5.1-billion in 2012. Gross profit was $1.1-billion in 2013, compared to $1.8-billion in 2012. Wholesale EBIT was $1.0-billion in 2013, compared to $1.7-billion in 2012. Adjusted EBITDA also decreased to $1.3-billion in 2013 from $1.9-billion in 2012. The decline in sales and earnings was primarily a result of lower global nutrient prices across all three major nutrients, particularly in the second half of 2013.

WHOLESALE – EXPENSES

Wholesale expenses were $77-million in 2013, compared to $57-million in 2012. The increase was primarily due to lower earnings from associates and joint ventures this year, as well as asset decommissioning and mine remediation costs associated with the closing of our Kapuskasing phosphate rock mine.

Earnings from associates and joint ventures in 2013 were $61-million, compared to $80-million in 2012. This decrease was primarily due to lower net earnings for our 50 percent investment in the Profertil nitrogen plant in Argentina. Profertil reported $43-million in equity earnings in 2013, compared to $76-million in 2012. The decrease was due to lower global urea prices in 2013 and lower urea production at the facility due to longer gas curtailments during cold weather this year. This was partly offset by higher equity earnings from our 26 percent interest in the MOPCO nitrogen facility. MOPCO reported $17-million in equity earnings in 2013, compared to a contribution of $2-million in 2012.

| | |

| PAGE 42 // MANAGEMENT’S DISCUSSION AND ANALYSIS // AGRIUM ANNUAL REPORT 2013 |

„ WHOLESALE PERFORMANCE

| | | | | | | | |

| | | Years ended December 31, | |

| (millions of U.S. dollars, except as noted) | | 2013 | | | 2012 | |

Nitrogen | | | | | | | | |

Sales | | | 1,724 | | | | 2,012 | |

Gross profit | | | 672 | | | | 1,075 | |

Potash | | | | | | | | |

Sales | | | 564 | | | | 618 | |

Gross profit | | | 270 | | | | 342 | |

Phosphate | | | | | | | | |

Sales | | | 654 | | | | 797 | |

Gross profit | | | 67 | | | | 199 | |

Ammonium sulfate and other | | | | | | | | |

Sales | | | 266 | | | | 284 | |

Gross profit | | | 89 | | | | 103 | |

Product purchased for resale | | | | | | | | |

Sales | | | 1,131 | | | | 1,347 | |

Gross profit | | | 9 | | | | 31 | |

Total sales | | | 4,339 | | | | 5,058 | |

Total gross profit | | | 1,107 | | | | 1,750 | |

Expenses | | | | | | | | |

Selling | | | 39 | | | | 38 | |

General and administrative | | | 65 | | | | 42 | |

Earnings from associates and joint ventures | | | (61 | ) | | | (80 | ) |

Other expenses | | | 33 | | | | 57 | |

EBIT | | | 1,031 | | | | 1,693 | |

EBITDA | | | 1,232 | | | | 1,883 | |

EBITDA to sales(%) | | | 28.4 | | | | 37.2 | |

Adjusted EBITDA | | | 1,286 | | | | 1,940 | |

NITROGEN [N] PRODUCTS

Nitrogen represents over 60 percent of the total volume of crop nutrients used globally, and a similar proportion of our 2013 Wholesale sales of manufactured product. Nitrogen is the one crop nutrient most likely to result in an immediate adverse impact on a crop’s yield if application rates are reduced. The foundation for virtually all nitrogen products is ammonia, which can be applied directly as a fertilizer or upgraded to products such as urea, UAN solutions or ammonium nitrate.

Agrium owns and operates five major nitrogen production facilities in North America and has a 50 percent joint venture interest in Profertil’s South American nitrogen facility, along with an additional five facilities in North America that upgrade ammonia to other nitrogen products, such as UAN and nitric acid. These facilities have a combined annual nitrogen production capacity of approximately 5.5 million tonnes. MOPCO’s Egyptian nitrogen facility has a total annual production capacity of 675,000 tonnes of urea; this represents approximately 175,000 tonnes attributable to Agrium through its 26 percent equity ownership in the facility. Collectively, these global production assets place Agrium among the world’s top four publicly traded nitrogen producers.

Our extensive North American nitrogen facilities benefit from the development of long-term, low-cost, non-conventional (shale) natural gas, which has positioned North America, and Alberta in particular, among the lowest gas cost regions in the world. Furthermore, Agrium’s numerous locations and extensive distribution network facilitate the supply of these products to our core markets in Western Canada, the U.S. Pacific Northwest and the U.S. Plains, where nitrogen prices are generally higher than in the other regions of North America. Profertil’s nitrogen facility also benefits from similar in-market advantages related to its position in Argentina’s large domestic fertilizer market.

On an annual basis, approximately 75 percent of our North American nitrogen sales are directed to agricultural markets, with the remaining 25 percent sold to industrial customers. North American demand from agricultural customers is highly seasonal in nature, while industrial demand is more evenly distributed throughout the year. A high proportion of our industrial ammonia sales are priced on a gas index-plus margin basis, thereby contributing to stability in sales and earnings throughout the year. As a result, our average sales price for ammonia in a given quarter will be influenced by the relative weighting of sales to industrial customers compared to sales to the generally higher return agricultural markets. Industrial ammonia sales volumes were approximately 467,000 tonnes in 2013, compared to 495,000 tonnes in 2012.

| | |

| AGRIUM ANNUAL REPORT 2013 // MANAGEMENT’S DISCUSSION AND ANALYSIS // PAGE 43 |

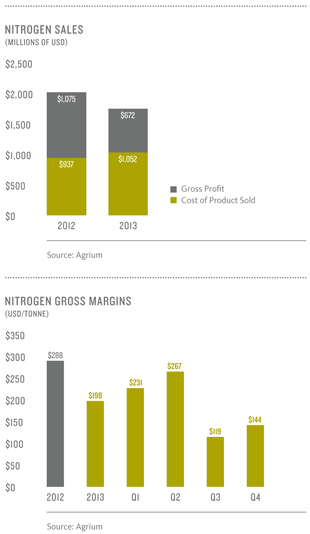

NITROGEN – FINANCIAL RESULTS

„ NITROGEN PERFORMANCE

| | | | | | | | |

| | | Years ended December 31, | |

| (millions of U.S. dollars, except as noted) | | 2013 | | | 2012 | |

Nitrogen | | | | | | | | |

Sales | | | 1,724 | | | | 2,012 | |

Cost of product sold | | | 1,052 | | | | 937 | |

Gross profit | | | 672 | | | | 1,075 | |

Tonnes sold (’000) | | | | | | | | |

Ammonia | | | 1,219 | | | | 1,188 | |

Urea | | | 1,270 | | | | 1,511 | |

Other | | | 903 | | | | 1,030 | |

Total North American tonnes sold (’000) | | | 3,392 | | | | 3,729 | |

Selling price per tonne | | | | | | | | |

Ammonia | | | 627 | | | | 627 | |

Urea | | | 490 | | | | 581 | |

Other | | | 374 | | | | 377 | |

Selling price per tonne | | | 508 | | | | 539 | |

Margin per tonne | | | 198 | | | | 288 | |

Equity accounted joint ventures: | | | | | | | | |

Nitrogen | | | | | | | | |

Sales | | | 234 | | | | 286 | |

Cost of product sold | | | 173 | | | | 166 | |

Gross profit | | | 61 | | | | 120 | |

Tonnes sold (’000) | | | 540 | | | | 556 | |

Selling price per tonne | | | 433 | | | | 514 | |

Margin per tonne | | | 113 | | | | 216 | |

Total nitrogen including equity accounted joint ventures | | | | | | | | |

Sales | | | 1,958 | | | | 2,298 | |

Cost of product sold | | | 1,225 | | | | 1,103 | |

Gross profit | | | 733 | | | | 1,195 | |

Tonnes sold (’000) | | | 3,932 | | | | 4,285 | |

Selling price per tonne | | | 498 | | | | 536 | |

Cost of product sold per tonne | | | 311 | | | | 257 | |

Margin per tonne | | | 186 | | | | 279 | |

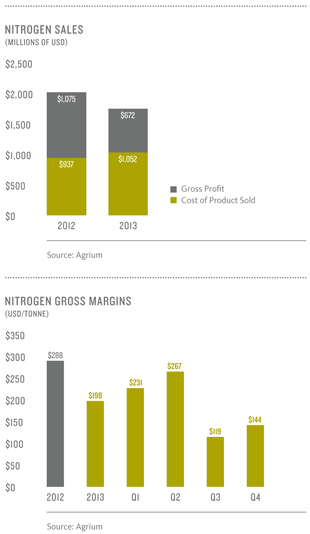

NITROGEN GROSS PROFIT

Nitrogen gross profit was $672-million in 2013, compared to $1.1-billion in 2012. The decrease was due to lower realized sales prices and volumes. We experienced extended production outages at our Redwater and Carseland nitrogen facilities this year, which impacted our volumes and raised operating costs. Our average margins on a per tonne basis were $198 per tonne in 2013, compared to $288 per tonne in 2012.

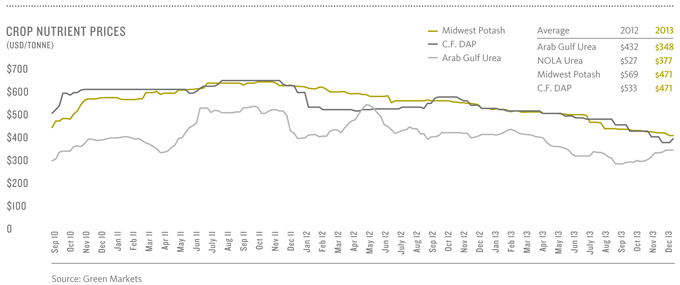

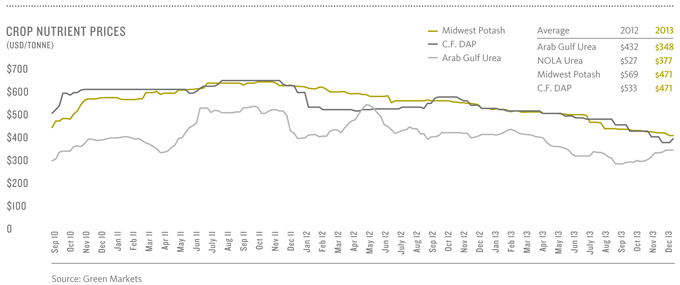

NITROGEN PRICES

Agrium’s average realized nitrogen price was $508 per tonne in 2013, compared with $539 per tonne in 2012. Benchmark U.S. Gulf (NOLA) urea prices averaged $377 per tonne in 2013, a 26 percent decrease from $512 per tonne in 2012. Agrium’s average realized urea prices were $490 per tonne in 2013, a 16 percent reduction from 2012 levels. North American ammonia prices were also lower in 2013, with average benchmark U.S. Corn Belt ammonia prices of $692 per tonne, compared to $777 per tonne in 2012. Nitrogen prices were tempered in 2013 due to higher Chinese urea exports and a decline in crop prices.

| | |

| PAGE 44 // MANAGEMENT’S DISCUSSION AND ANALYSIS // AGRIUM ANNUAL REPORT 2013 |

NITROGEN PRODUCT AND GAS COST

Nitrogen cost of product sold was $1.1-billion in 2013, somewhat higher than $937-million in 2012. On a per-tonne basis, cost of product sold averaged $310 per tonne in 2013, compared with $251 per tonne in 2012. The increase in per-tonne cost of product sold was due to higher natural gas costs in 2013 and the impact of planned and unplanned production outages at our Redwater and Carseland nitrogen facilities in the second half of 2013. Production asset depreciation and amortization expense of $23 per tonne is included in cost of product sold in 2013, compared to $16 per tonne in 2012.

Gas volumes purchased in 2013 were 113 billion cubic feet, down from 120 billion cubic feet in 2012. Agrium’s gas cost represented in nitrogen cost of product sold for 2013 was $3.45 per MMBtu (overall gas cost of $3.32 per MMBtu, including the impact of realized gains on natural gas derivatives), compared to $3.07 per MMBtu in 2012 (overall gas cost of $3.38 per MMBtu, including the impact of realized losses on natural gas derivatives). Hedging gains or losses on all gas derivatives are included in other expenses and therefore not included in cost of product sold. The average U.S. benchmark (NYMEX) natural gas price for 2013 was $3.67 per MMBtu, compared to $2.80 per MMBtu in 2012. The Alberta (AECO) basis differential was a $0.60 per MMBtu discount to NYMEX in 2013, higher than the $0.40 discount per MMBtu differential in 2012.

„ NATURAL GAS PRICES:

NORTH AMERICAN INDICES AND NORTH AMERICAN AGRIUM PRICES

| | | | | | | | |

| (U.S. dollars per MMBtu) | | 2013 | | | 2012 | |

NYMEX | | | 3.67 | | | | 2.80 | |

AECO | | | 3.07 | | | | 2.40 | |

Basis | | | 0.60 | | | | 0.40 | |

Wholesale | | | | | | | | |

Overall gas cost excluding realized hedging impact | | | 3.45 | | | | 3.07 | |

Realized hedging impact | | | (0.13 | ) | | | 0.31 | |

Overall gas cost(a) | | | 3.32 | | | | 3.38 | |

| (a) | Weighted average gas price of all gas purchases, excluding our 50 percent share of the Profertil facility. |

NITROGEN SALES VOLUMES AND OPERATING RATES

Nitrogen sales volumes were 3.4 million tonnes in 2013, compared to 3.7 million tonnes in 2012. The decrease in nitrogen sales volumes in 2013 primarily resulted from lost production at our Redwater and Carseland facilities in the second half of the year due to increased planned and unplanned outages. Overall North American demand for nitrogen was comparable to 2012, as planted acreage across most crops was similar to the levels attained in 2012.

Our nitrogen product category primarily consists of urea, ammonia, UAN and industrial grade ammonium nitrate. Urea is the highest volume nitrogen product sold globally, and accounted for over 40 percent of Agrium’s nitrogen capacity and 2013 production.

„ NATURAL GAS USE (BCF)

| | | | | | | | | | | | | | | | | | | | |

| | | Western

Canada | | | U.S.

(Borger, Texas) | | | International (Profertil) | | | Potash and other | | | Total | |

2013 | | | 78 | | | | 19 | | | | 14 | | | | 2 | | | | 113 | |

2012 | | | 84 | | | | 19 | | | | 14 | | | | 3 | | | | 120 | |

| | |

| AGRIUM ANNUAL REPORT 2013 // MANAGEMENT’S DISCUSSION AND ANALYSIS // PAGE 45 |

POTASH [K] PRODUCTS

Agrium is North America’s third largest producer of potash. Potash deposits are highly concentrated in only a few regions globally, with the world’s largest known potash deposits located in Saskatchewan, Canada, whose mines accounted for about 46 percent of 2013 global potash reserves. Additionally, Canada accounted for approximately 39 percent of the global potash trade in 2013. Agrium produces potash at our facility in Vanscoy, Saskatchewan and exports international sales through our interest in Canpotex. Canpotex is an industry association owned equally by the three major Canadian potash producers, tasked with marketing the portion of our produced potash that is sold outside of Canada and the U.S. Our share of Canpotex total sales was 9.3 percent in 2012, averaged 9.1 percent in 2013 and is expected to be 8.2 percent at the start of 2014. The downward trend is a result of recent capacity expansions by the other Canpotex producers. However, we anticipate our Canpotex allocation will rise back up above the 2012 figure of 9.2 percent once our major expansion project at our Vanscoy facility and associated test-run is completed in 2015.

POTASH – FINANCIAL RESULTS

„ POTASH PERFORMANCE

| | | | | | | | |

| | | Years ended December 31, | |

| (millions of U.S. dollars, except as noted) | | 2013 | | | 2012 | |

Potash North America | | | | | | | | |

Sales | | | 369 | | | | 437 | |

Cost of product sold | | | 201 | | | | 203 | |

Gross profit | | | 168 | | | | 234 | |

Tonnes sold (’000) | | | 877 | | | | 819 | |

Selling price per tonne | | | 421 | | | | 534 | |

Margin per tonne | | | 192 | | | | 286 | |

Potash international | | | | | | | | |

Sales | | | 195 | | | | 181 | |

Cost of product sold | | | 93 | | | | 73 | |

Gross profit | | | 102 | | | | 108 | |

Tonnes sold (’000) | | | 654 | | | | 473 | |

Selling price per tonne | | | 298 | | | | 383 | |

Margin per tonne | | | 156 | | | | 228 | |

Total potash | | | | | | | | |

Sales | | | 564 | | | | 618 | |

Cost of product sold | | | 294 | | | | 276 | |

Gross profit | | | 270 | | | | 342 | |

Tonnes sold (’000) | | | 1,531 | | | | 1,292 | |

Selling price per tonne | | | 369 | | | | 479 | |

Cost of product sold per tonne | | | 193 | | | | 214 | |

Margin per tonne | | | 176 | | | | 265 | |

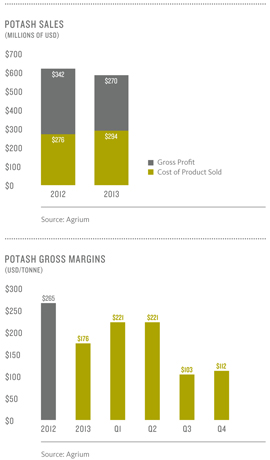

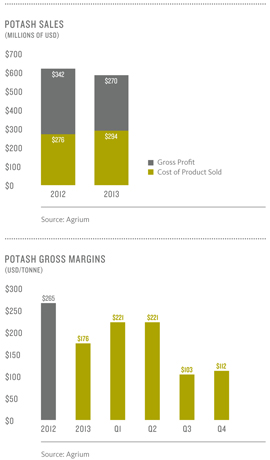

POTASH GROSS PROFIT

Our potash gross profit in 2013 was $270-million, compared to $342-million in 2012. The decrease in gross profit this year was due to substantially lower North American and international realized potash prices, resulting from significantly weaker global supply and demand fundamentals. Our sales volumes for both North American and international sales increased relative to 2012. This was a result of 2012 volumes and average per tonne costs being negatively impacted by the first of two major planned turnarounds as part of our ongoing brownfield expansion project at our Vanscoy mine. The benefits from the higher volumes in 2013, and the associated reduction in per tonne costs, were more than offset by lower prices. Our potash margins averaged $176 per tonne in 2013, compared to $265 per tonne in 2012.

| | |

| PAGE 46 // MANAGEMENT’S DISCUSSION AND ANALYSIS // AGRIUM ANNUAL REPORT 2013 |

POTASH PRICES

North American and international sales prices for potash came under pressure in 2013 due to factors such as capacity additions by a number of key producers, weaker crop prices, weak demand from India, delays in second half Chinese supply agreements and significant market uncertainty created by the break-up of the Belarusian Potash Company (“BPC”) marketing agency in the summer of 2013. Benchmark prices in the U.S. Corn Belt trended lower throughout 2013, averaging $471 per tonne in 2013 compared to $570 per tonne in 2012 and ending the 2013 year at $405 per tonne. Our realized North American selling price declined by 21 percent to $421 per tonne in 2013, compared to $534 per tonne in 2012. Our average realized international sales price was $298 per tonne in 2013, a 22 percent decline from the $383 per tonne realized in 2012. International prices are referenced at the mine site, thereby excluding transportation costs, while North American sales are referenced at delivered prices. North American sales volumes accounted for 57 percent of total potash sales in 2013, compared to 63 percent in 2012. Agrium’s realized selling price for total potash sales was $369 per tonne in 2013, compared to $479 per tonne in 2012.

POTASH PRODUCT COST

Potash cost of product sold in 2013 was $294-million, compared to $276-million in 2012. On a per-tonne basis, the average cost of product sold in 2013 was $193 per tonne, compared to $214 per tonne in 2012. The decrease in cost of product sold per tonne relative to 2012 was attributed to higher production in 2013, resulting from an eight-week turnaround in 2012 related to the Vanscoy expansion. The decrease in cost of product sold was also driven by a slightly higher proportional shift in our sales mix towards the international market. Production asset depreciation and amortization expense of $33 per tonne is included in cost of product sold in 2013, compared to $32 per tonne in 2012.

In the second half of 2014, Agrium expects to complete a 14-week turnaround to finalize the tie-in of the one million tonne brownfield expansion project. This is anticipated to lower volumes produced and increase per-tonne production costs significantly during the second half of 2014.

POTASH SALES VOLUMES AND OPERATING RATES

Potash sales volumes were 1.5 million tonnes in 2013, compared to 1.3 million tonnes in 2012. The increase in volumes was primarily due to higher production rates in 2013 as we undertook a planned eight-week turnaround at our Vanscoy facility in 2012. International sales were also higher in 2013 compared to the prior year as most major consumers purchased at higher volumes in the first half of the year compared to 2012. Sales of produced product into the North American market were 877,000 tonnes in 2013, an increase from 819,000 tonnes in 2012. International potash sales volumes accounted for 654,000 tonnes of product sales in 2013, which was significantly higher than the 473,000 tonnes sold in 2012, but remained below historic norms. Production volumes in 2013 were 1.7 million tonnes, compared to 1.4 million tonnes in 2012.

Our current annual production capacity of two million tonnes requires 5.9 million tonnes of feed at a grade of 24.6 percent K2O and a milling recovery rate of 85 percent. Our Technical Report1 gives an expected mine life of 46 years when considering Proven and Probable Mineral Reserves and Measured and Indicated Mineral Resources, with an additional 15 years estimated to be contained in Inferred Mineral Resources at our higher forecasted post-expansion rate. This is based on the estimate of 65.8 million tonnes of Proven Mineral Reserves (24.5 percent K2O), 15.2 million tonnes of Probable Mineral Reserves (22.7 percent K2O), 168.2 million tonnes of Measured Mineral Resources (22.7 percent K2O) and 113.0 million tonnes of Indicated Mineral Resources (24.9 percent K2O) as described in the Technical Report1. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

| 1 | Certain scientific and technical information regarding Vanscoy Potash Operations is based on the technical report entitled “National Instrument 43-101 Technical Report on Vanscoy Potash Operations” dated February 15, 2012 (the “Technical Report”) prepared by A. Dave Mackintosh, P Geo. of ADM Consulting Limited and Erika D. Stoner of the Company, both of whom are Qualified Persons as defined in National Instrument 43-101 –Standards of Disclosure for Mineral Projects. The Technical Report has been filed with the securities regulatory authorities in each of the provinces of Canada and with the U.S. Securities and Exchange Commission. Portions of the following information are based on assumptions, qualifications and procedures that are not fully described herein. Reference should be made to the full text of the Technical Report, which is available for review on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. |

| | |

| AGRIUM ANNUAL REPORT 2013 // MANAGEMENT’S DISCUSSION AND ANALYSIS // PAGE 47 |

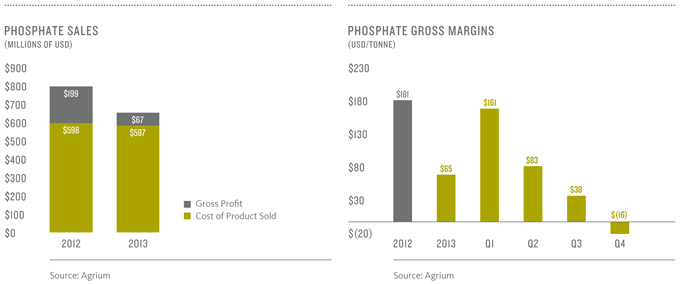

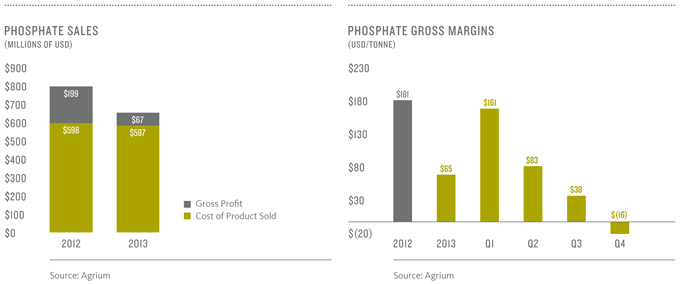

PHOSPHATE [P] PRODUCTS