QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrantý |

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

EZENIA! INC.

|

| (Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

| ý | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Dear Shareholder:

You are cordially invited to attend the 2003 Annual Meeting of Shareholders of Ezenia! Inc., (the "Company") which will be held on Thursday, May 29, 2003 at 10:00 a.m., EDT, at the offices of Bingham McCutchen LLP, 150 Federal Street, Boston, Massachusetts 02110.

The Notice of 2003 Annual Meeting of Shareholders and Proxy Statement accompany this letter. These documents collectively describe the formal business to be conducted at the annual meeting. The Company's Annual Report on Form 10-K is also enclosed for your additional information.

All shareholders are invited to attend the annual meeting. To ensure your representation at the annual meeting, however, you are urged to vote by proxy by following one of these steps as promptly as possible:

- (A)

- Complete, date, sign and return the enclosed Proxy Card (a postage-prepaid envelope is enclosed for that purpose); or

- (B)

- Vote via telephone (toll free) in the United States or Canada (see instructions on the enclosed Proxy Card); or

- (C)

- Vote via the Internet (see instructions on the enclosed Proxy Card).

The telephone and Internet voting procedures are designed to authenticate shareholders' identities, to allow shareholders to vote their shares and to confirm that their instructions have been properly recorded. Specific instructions to be followed by a registered shareholder interested in voting via the telephone or Internet are set forth in the Proxy Card.Your shares cannot be voted unless you date, sign and return the enclosed Proxy Card, vote via the telephone or Internet or attend the annual meeting in person. Regardless of the number of shares you own, your careful consideration of, and vote on, the matters before the shareholders is important.

Very truly yours,

Khoa D. Nguyen

Chairman and

Chief Executive Officer

EZENIA! INC.

Northwest Park

154 Middlesex Turnpike

Burlington, Massachusetts 01803

NOTICE OF 2003 ANNUAL MEETING

OF SHAREHOLDERS

TO OUR SHAREHOLDERS:

The 2003 Annual Meeting of Shareholders (the "Meeting") of Ezenia! Inc., a Delaware corporation (the "Company"), will be held on Thursday, May 29, 2003 at 10:00 a.m., EDT, at the offices of Bingham McCutchen LLP, 150 Federal Street, Boston, Massachusetts 02110. The purposes of the Meeting shall be:

- 1.

- To elect one Class II Director to hold office for a three-year term and until such Director's respective successor has been duly elected and qualified.

- 2.

- To transact such other business as may properly come before the meeting or any adjournment thereof.

Shareholders of record on the books of the Company at the close of business on April 22, 2003 will be entitled to notice of, and to vote at, the Meeting.

Please sign, date and return the enclosed Proxy Card in the enclosed envelope, or vote via telephone or the Internet (pursuant to the instructions on the enclosed Proxy Card) at your earliest convenience. If you return the Proxy Card or vote via telephone or the Internet, you may nevertheless attend the Meeting and vote your shares in person.

All shareholders of the Company are cordially invited to attend the Meeting.

Burlington, Massachusetts

April 24, 2003

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE MEETING. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE (I) SIGN, DATE AND MAIL THE ENCLOSED PROXY CARD IN THE ENCLOSED ENVELOPE, WHICH REQUIRES NO POSTAGE IF MAILED FROM WITHIN THE UNITED STATES OR (II) OTHERWISE VOTE YOUR SHARES BY TELEPHONE OR THE INTERNET.

EZENIA! INC.

Northwest Park

154 Middlesex Turnpike

Burlington, Massachusetts 01803

PROXY STATEMENT

2003 Annual Meeting of Shareholders to be Held on May 29, 2003

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of Ezenia! Inc. (the "Company") of proxies for use at the 2003 Annual Meeting of Shareholders (the "Meeting") to be held on Thursday, May 29, 2003 at 10:00 a.m., EDT, at the offices of Bingham McCutchen LLP, 150 Federal Street, Boston, Massachusetts 02110, and any adjournments thereof.

Registered shareholders can vote their shares (1) by mailing their signed Proxy Card, (2) via a toll-free telephone call from the U.S. or Canada, (3) via the Internet or (4) in person at the Meeting. The telephone and Internet voting procedures are designed to authenticate shareholders' identities, to allow shareholders to vote their shares and to confirm that their instructions have been properly recorded. The Company believes that the procedures that have been put in place are consistent with the requirements of applicable law. Specific instructions to be followed by a registered shareholder interested in voting via telephone or the Internet are set forth on the enclosed Proxy Card.

Shares represented by duly executed proxies received by the Company prior to the Meeting will be voted as instructed in the proxy on each matter submitted to the vote of shareholders. If a duly-executed proxy is returned without voting instructions with respect to one or more proposals, the persons named as proxies thereon intend to vote all shares represented by such proxy FOR each such proposal and at their discretion with respect to any other proposals that may properly come before the Meeting. The persons named as proxies are employees of the Company.

A shareholder may revoke a proxy at any time prior to its exercise by (1) delivering a later-dated proxy, (2) making an authorized telephone or Internet communication on a later date in accordance with the instructions on the enclosed Proxy Card, (3) written notice of revocation to the Secretary of the Company at the address of the Company's principal executive offices set forth above or (4) voting in person at the Meeting. If a shareholder does not intend to attend the Meeting, any written proxy or notice should be returned for receipt by the Company, and any telephonic or Internet vote should be made, not later than the close of business, 5:30 p.m., EDT, on May 28, 2003. The Company will bear the cost of solicitation of proxies relating to the Meeting.

Only shareholders of record as of the close of business on April 22, 2003 (the "Record Date") will be entitled to notice of, and to vote at, the Meeting and any adjournments thereof. As of the Record Date, there were 13,633,630 shares (excluding treasury shares) of the Company's Common Stock, $.01 par value (the "Common Stock"), issued and outstanding. Such shares of Common Stock are the only voting securities of the Company. Shareholders are entitled to cast one vote for each share of Common Stock held of record on the Record Date.

An Annual Report on Form 10-K, containing financial statements for the fiscal year ended December 31, 2002, accompanies this Proxy Statement. The mailing address of the Company's principal executive offices is Northwest Park, 154 Middlesex Turnpike, Burlington, Massachusetts 01803.

This Proxy Statement and the Proxy Card enclosed herewith were first mailed to shareholders on or about April 28, 2003.

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of the Company's Common Stock as of March 31, 2003 by (i) each person who is known by the Company to own beneficially more than five percent of the Company's Common Stock, (ii) each member of the Company's Board of Directors (the "Board of Directors"), (iii) each of the Named Executive Officers (as defined under "Summary Compensation" below) and (iv) all directors and executive officers as a group.

| | Shares Beneficially Owned

| |

|---|

Directors, Officers and 5% Shareholders

| |

|---|

| | Number

| | Percent

| |

|---|

| Khoa D. Nguyen(1) | | 1,156,497 | | 7.76 | % |

| John F. Keane, Jr.(2) | | 57,042 | | * | |

| John A. McMullen(3) | | 47,042 | | * | |

| Roy G. Perry(4) | | 53,042 | | * | |

| Stephen G. Bassett(5) | | 3,000 | | * | |

| Paul W. Haverstock(5) | | 0 | | * | |

| All executive officers and directors as a group (6 persons)(6) | | 1,316,623 | | 8.86 | % |

- *

- Less than 1%

- (1)

- Includes 1,087,313 shares that Mr. Nguyen has the right to acquire within 60 days of March 31, 2003 by the exercise of stock options.

- (2)

- Includes 47,042 shares that Mr. Keane has the right to acquire within 60 days of March 31, 2003 by the exercise of stock options.

- (3)

- Represents shares that Mr. McMullen has the right to acquire within 60 days of March 31, 2003 by the exercise of stock options.

- (4)

- Includes 47,042 shares that Mr. Perry has the right to acquire within 60 days of March 31, 2003 by the exercise of stock options.

- (5)

- Based on information made available to the Company as of July 31, 2002, the date on which such officer's employment with the Company terminated.

- (6)

- Includes 1,212,814 shares that directors and executive officers of the Company have the right to acquire within 60 days of March 31, 2003 by the exercise of stock options.

2

EXECUTIVE COMPENSATION AND OTHER INFORMATION

CONCERNING DIRECTORS AND EXECUTIVE OFFICERS

Summary Compensation

The following table sets forth information concerning the annual and long-term compensation in each of the last three fiscal years for the Company's Chief Executive Officer, who was the Company's sole executive officer as of December 31, 2002, and two individuals who ceased serving as executive officers of the Company prior to December 31, 2002 (the "Named Executive Officers").

| |

| | Annual Compensation

| |

| |

| |

|---|

Name and Principal Position

| | Year

| | Salary($)

| | Bonus($)

| | Other Annual

Compensation($)

| | Long-Term

Compensation

Options(#)

| | All Other

Compensation($)

| |

|---|

KHOA D. NGUYEN

President and Chief Executive Officer(1) | | 2002

2001

2000 | | 250,000

250,000

240,000 | | 0

0

132,000 | | 0

0

0 | | 225,000

100,000

250,000 | | 1,112

1,275

1,497 | (2)

(2)

(2) |

STEPHEN G. BASSETT

Chief Financial Officer, Treasurer and Secretary | | 2002

2001

2000 | (3)

| 110,833

190,000

175,000 | | 38,000

38,000

91,000 |

(4) | 0

0

0 | | 80,000

30,000

150,000 |

(5) | 0

0

0 | |

PAUL W. HAVERSTOCK

Vice President of Research and Development | | 2002

2001 | (6)

(7) | 128,333

169,231 | | 0

50,000 |

(8) | 0

0 | | 20,000

180,000 |

(9) | 1,925

688 | (2)

(2) |

- (1)

- Since August 2002, Mr. Nguyen has also served as the Company's Chief Financial Officer, Treasurer and Secretary.

- (2)

- Represents the dollar amount of the Company's matching contribution under the Company's 401(k) Plan.

- (3)

- Mr. Bassett's employment with the Company terminated on July 31, 2002.

- (4)

- Includes a $15,000 signing bonus.

- (5)

- Includes 100,000 options granted upon the commencement of employment as Chief Financial Officer.

- (6)

- Mr. Haverstock's employment with the Company terminated on July 31, 2002.

- (7)

- Mr. Haverstock originally joined the Company in March 2001.

- (8)

- Represents amount paid as a signing bonus.

- (9)

- Represents options granted upon the commencement of employment with the Company.

3

Option Grants in Last Fiscal Year

The following table sets forth information concerning individual stock option grants made to each of the Named Executive Officers during fiscal year 2002.

| |

| |

| | Individual Grants

| |

| |

|

|---|

| |

| |

| | Potential Realizable Value at

Assumed Annual Rates of Stock

Price Appreciation for Option

Term (1)

|

|---|

| |

| |

| | Percent of

Total Options

Granted to

Employees in

Fiscal Year

| |

| |

|

|---|

| | Options Granted

| |

| |

|

|---|

Name

| | Exercise

Price

($/Sh)(2)

| | Expiration

Date

|

|---|

| | Date

| | (#)

| | 5%

| | 10%

|

|---|

| Khoa D. Nguyen | | 2/6/02 | | 225,000 | | 20.7 | % | 0.29 | | 2/6/12 | | 41,035 | | 103,992 |

| Stephen G. Bassett | | 2/6/02 | | 80,000 | | 7.37 | % | 0.29 | | (3 | ) | 0 | | 0 |

| Paul W. Haverstock | | 2/6/02 | | 20,000 | | 1.84 | % | 0.29 | | (4 | ) | 0 | | 0 |

- (1)

- Potential gains are net of exercise price, but before taxes associated with exercise. These amounts represent certain assumed rates of appreciation only, based on the Securities and Exchange Commission rules. Actual gains, if any, on stock option exercises are dependent on the future performance of the Common Stock, the timing of such exercises and the option holder's continued employment through the vesting period. The amounts reflected in this table may not accurately reflect or predict the actual value of the stock options.

- (2)

- All options were granted at fair market value as determined by the Board of Directors of the Company on the date of the grant.

- (3)

- Mr. Bassett's options terminated following the cessation of his employment with the Company on July 31, 2002.

- (4)

- Mr. Haverstock's options terminated following the cessation of his employment with the Company on July 31, 2002.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table sets forth information concerning each exercise of stock options by each of the Named Executive Officers during fiscal year 2002 and the value of unexercised "in-the-money" options at the end of that fiscal year.

Name

| | Shares

Acquired on

Exercise(#)

| | Value

Realized($)

| | Number of Unexercised Options

at Fiscal Year-End

Exercisable/Unexercisable(#)

| | Value of Unexercised in-the-Money

Options at Fiscal Year-End(1)

Exercisable/Unexercisable($)

|

|---|

| Khoa D. Nguyen | | 0 | | 0 | | 908,844/276,656 | | 0/0 |

| Stephen G. Bassett | | 0 | | 0 | | 0/0 | (2) | 0/0 |

| Paul W. Haverstock | | 0 | | 0 | | 0/0 | (3) | 0/0 |

- (1)

- Based on the closing price on the Nasdaq SmallCap Market for a share of Common Stock on December 31, 2002 of $0.13.

- (2)

- Mr. Bassett's options terminated following the cessation of his employment with the Company on July 31, 2002.

- (3)

- Mr. Haverstock's options terminated following the cessation of his employment with the Company on July 31, 2002.

4

Benefit Plans

The Company currently provides certain benefits to its eligible employees (including its executive officers) through the benefit plans described below:

1991 Stock Incentive Plan. The Company maintained an Amended and Restated 1991 Stock Incentive Plan (the "1991 Stock Incentive Plan") to attract and retain the best available personnel for positions of substantial responsibility and to provide additional incentives to certain employees, officers and consultants to contribute to the success of the Company. By its terms, the 1991 Stock Incentive Plan terminated in March 2001. No additional awards may be granted under the 1991 Stock Incentive Plan, but outstanding awards will continue to remain in effect in accordance with their terms.

1995 Employee Stock Purchase Plan. The Company maintains a 1995 Employee Stock Purchase Plan (the "ESPP") to provide incentive to employees and to encourage ownership of Common Stock by all eligible employees of the Company and its subsidiaries. Employees of the Company may participate in the ESPP by authorizing payroll deductions generally over a six month period, with the proceeds being used to purchase shares of Common Stock for the participant at a discounted price. The ESPP is intended to be an "employee stock purchase plan" under Section 423 of the Internal Revenue Code. In May 2001, the shareholders of the Company authorized an increase in the number of shares issuable under the ESPP from 600,000 shares to 900,000 shares.

2001 Stock Incentive Plan. The primary purpose of the 2001 Stock Incentive Plan is to enable the Company to issue shares of the Company's Common Stock to existing personnel and to attract and retain qualified employees, officers, directors, advisors and consultants through stock option grants, restricted stock awards and/or stock grants. The Company's officers and directors may not receive a majority of the total shares issued and reserved for issuance under grants and awards made pursuant to the 2001 Stock Incentive Plan.

Savings Plan. The Company sponsors a savings plan for its employees which has been qualified under Section 401(k) of the Internal Revenue Code (the "401(k) Plan"). Eligible employees are permitted to contribute to the 401(k) Plan through payroll deductions within statutory and plan limits. Contributions from the Company are made at the discretion of the Board of Directors. Beginning in 1997, the Board of Directors authorized the Company to match a portion of its employees' contributions to the 401(k) Plan, and, in fiscal years 1997 through 2002, the Company made a matching contribution of thirty percent (30%) of employee contributions to the extent employee contributions equaled five percent (5%) or more of such employee's gross compensation. The Company maintains comparable plans under local laws and regulations for its non-U.S. employees.

Employment Agreements

In 1998, the Company entered into an agreement with Mr. Nguyen that provides for certain benefits in the event of a termination of his employment without cause and upon the occurrence of certain events. Under the agreement, in the event the Company elects to terminate Mr. Nguyen's employment or to diminish his status, other than for cause, Mr. Nguyen shall be entitled to receive, (i) for a period of twelve months, a salary equal to the highest annualized salary rate in effect for him within the previous twelve months and (ii) his then-current targeted annual incentive bonus. The agreement also provides for certain benefits in the event of a change in control. In the event of a change in control, the outstanding options held by Mr. Nguyen under the Company's option plans shall become exercisable in full. The agreement further provides that if Mr. Nguyen is terminated or his status is diminished (other than for cause) within twenty-four months after a change in control, Mr. Nguyen is entitled to an immediate payment of two times his base compensation for the fiscal year immediately preceding the termination or change, plus two times his targeted annual bonus for the fiscal year then in effect.

5

Compensation Committee Report on Executive Compensation

The Company's executive compensation program is administered by the Compensation Committee of the Board of Directors (the "Compensation Committee"). During 2002, John A. McMullen was the sole member of the Compensation Committee. The Compensation Committee establishes and administers the Company's executive compensation policies and plans and administers the Company's stock option and other equity-related employee compensation plans. The Compensation Committee considers internal and external information in determining officers' compensation, including outside survey data.

Compensation Philosophy

The Company's compensation policies for executive officers are based on the belief that the interests of executives should be closely aligned with those of the Company's shareholders. The compensation policies are designed to achieve the following objectives:

- •

- Offer compensation opportunities that attract highly qualified executives, reward outstanding initiative and achievement and retain the leadership and skills necessary to build long-term shareholder value.

- •

- Maintain a significant portion of executives' total compensation at risk, tied to both the annual and long-term financial performance of the Company and the creation of shareholder value.

- •

- Further the Company's short and long-term strategic goals and values by aligning compensation with business objectives and individual performance.

Compensation Program

The Company's executive compensation program has three major integrated components, base salary, annual incentive awards and long-term incentives.

Base Salary. Base salary levels for executive officers are determined annually by reviewing the competitive pay practices of networking companies of similar size and market capitalization, the skills, performance level, and contribution to the business of individual executives and the needs of the Company. Overall, the Compensation Committee believes that base salaries for executive officers are approximately competitive with median base salary levels for similar positions in these networking companies.

Incentive Awards. The Company's executive officers are eligible to receive cash bonus awards designed to motivate executives to attain short-term and longer-term corporate and individual management goals. The Compensation Committee establishes annual incentive opportunities for each executive officer in relation to his or her base salary. Awards under this program are based on the attainment of specific Company performance measures established by the Compensation Committee early in the fiscal year, and by the achievement of specified individual objectives and the degree to which each executive officer contributes to the overall success of the Company and the management team. In 2002, the formula for these bonuses was based on a combination of individual objectives and Company revenue and profitability objectives.

Long-Term Incentives. The Compensation Committee believes that stock options are an excellent vehicle for compensating its officers and employees. The Company historically provided long-term incentives through its Amended and Restated 1991 Stock Incentive Plan and continues to do so through its 2001 Stock Incentive Plan. The purpose of long-term incentive stock options is to create a direct link between executive compensation and increase in shareholder value. The Amended and Restated 1991 Stock Incentive Plan terminated in March 2001. No additional awards may be granted thereunder, but outstanding awards will continue to remain in effect in accordance with their terms.

6

Presently, long-term incentive awards are granted under the 2001 Stock Incentive Plan. Stock options are generally granted at fair market value and vest in installments, generally over four years. When determining option awards for an executive officer, the Compensation Committee considers the executive's current contribution to Company performance, the anticipated contribution to meeting the Company's long-term strategic performance goals and industry practices and norms. Long-term incentives granted in prior years and existing levels of stock ownership are also taken into consideration. Because the receipt of value by an executive officer under a stock option is dependent upon an increase in the price of the Company's Common Stock, this portion of the executive's compensation is directly aligned with an increase in shareholder value.

Chief Executive Officer Compensation

The Chief Executive Officer's base salary, annual incentive award and long-term incentive compensation are determined by the Compensation Committee based upon the same factors as those employed by the Compensation Committee for executive officers generally. Mr. Nguyen's base salary for the year ended December 31, 2002 was $250,000. The Chief Executive Officer may also be entitled to an annual cash bonus depending on the Company's performance. Any such cash bonus will be determined by the Compensation Committee at its discretion. For the year ended December 31, 2002, Mr. Nguyen was not paid a cash bonus. In February 2002, the Board of Directors granted Mr. Nguyen an option to purchase 225,000 shares of the Company's Common Stock at the then fair market value of $0.29 per share, of which fifty percent (50%) vested in February 2002 and the remaining fifty percent (50%) vested in March 2003.

Section 162(m) of the Internal Revenue Code limits the tax deduction to $1,000,000 for compensation paid to certain executives of public companies. Having considered the requirements of Section 162(m), the Compensation Committee believes that grants made pursuant to the Company's 2001 Stock Incentive Plan meet the requirement that such grants be "performance based" and are, therefore, exempt from the limitations on deductibility. Historically, the combined salary and bonus of each executive officer has been well below the $1,000,000 limit. The Compensation Committee's present intention is to comply with Section 162(m) unless the Compensation Committee feels that required changes would not be in the best interest of the Company or its shareholders.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee was formed on February 1, 1995. No current or former member of the Compensation Committee is or has been an officer or employee of the Company or any of its subsidiaries.

Compensation of Directors

In April 1995, the Board of Directors and shareholders approved the Amended and Restated 1994 Non-Employee Director Stock Option Plan (the "Director Plan"), which was most recently amended by the Board of Directors on June 5, 2002. The Director Plan provides that the Board of Directors, at its discretion, is permitted to grant options to non-employee directors, subject to terms and conditions as determined by the Board of Directors. No options may be granted after the tenth anniversary of the date of adoption of the Director Plan and no person may be granted options under the Director Plan to purchase more than an aggregate of 45,000 shares of Common Stock. Options are granted at a price equal to the fair market value on the date of grant. Unless otherwise specified by the Board of Directors at the time of grant, options granted under the Director Plan become exercisable over a

7

four-year period, and the term of the options is ten years from the date of grant. Two hundred thousand shares of Common Stock have been reserved for issuance under the Director Plan, of which 43,000 were available for future grant as of December 31, 2002.

The Company pays each non-employee director a fee of $2,000 per official meeting of the Board of Directors attended by such director and an additional $500 per official committee meeting attended by such director.

Section 16(a)—Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company's officers, directors and persons who own more than ten percent (10%) of a registered class of the Company's equity securities to file reports of ownership on Forms 3, 4 and 5 with the Securities and Exchange Commission and the Company. Based on the Company's review of copies of such forms, each officer, director and ten percent (10%) holder complied with his/her obligations in a timely fashion with respect to transactions in securities of the Company during the year ended December 31, 2002, except that Edward Wade, whose employment with the Company ceased on July 31, 2002, filed a late Form 5 reporting one transaction and Paul Haverstock, whose employment with the Company ceased on July 31, 2002, has not yet filed a Form 5 reporting at least one transaction.

8

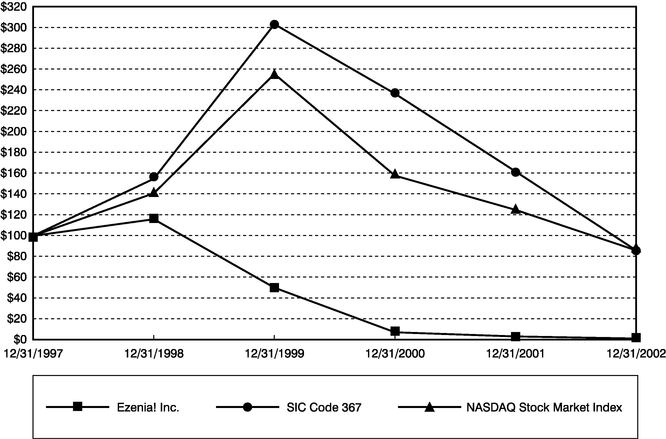

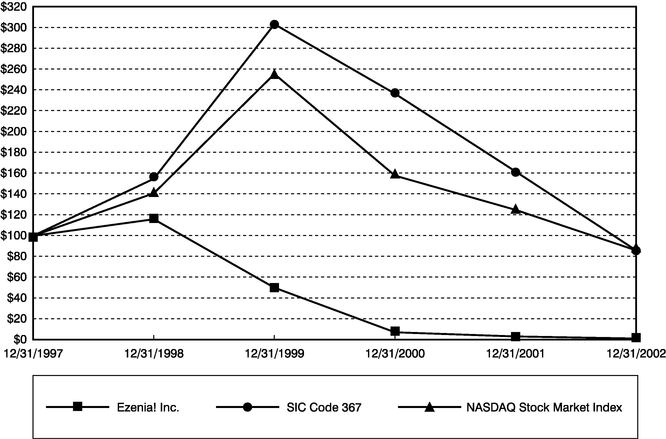

Stock Performance Graph

The following graph compares the change in the shareholder return on the Company's Common Stock against the return for the Nasdaq Stock Market Index and the Nasdaq Electronic Components Stock Index (SIC Code 367), as calculated by the Center for Research in Security Prices at the University of Chicago, for the period beginning December 31, 1997 and ending December 31, 2002.

This graph assumes the investment of $100 in the Company's Common Stock, the Nasdaq Index and the Nasdaq Electronic Components Stock Index as of December 31, 1997 and assumes dividends were reinvested. Additional measurement points are at the remaining month ends for the years ended December 31, 1998, December 31, 1999, December 31, 2000, December 31, 2001 and December 31, 2002.

9

PROPOSAL NO. 1—ELECTION OF DIRECTORS

The Board of Directors is divided into three classes. Each class serves a three-year term. The term of the current Class II Director will expire at the Meeting. All directors will hold office until their successors have been duly elected and qualified.

The Board of Directors has nominated Khoa D. Nguyen for reelection as a Class II Director, to hold office until the Annual Meeting of Shareholders to be held in 2006 and until his respective successor is duly elected and qualified. Shares represented by all proxies received by the Board of Directors and not marked so as to withhold authority to vote for the nominee will be voted FOR the election of the nominee. The nominee has indicated his willingness to serve, if elected; however, if the nominee should be unable or unwilling to serve, the proxies may be voted for the election of a substitute nominee designated by the Board of Directors or for fixing the number of directors at a lesser number. Proxies may not be voted for a greater number of persons than the number of nominees named herein.

Roy G. Perry has declined to stand for reelection as a Class II Director and John F. Keane, Jr., a Class III Director, has submitted his resignation from the Board of Directors, effective as of the Meeting. As a result, the Board of Directors has reclassified Khoa D. Nguyen from a Class III Director to a Class II Director, effective as of the Meeting.

The Company has also identified three individuals who have expressed their willingness to join the Board of Directors. Accordingly, effective as of the Meeting, the size of the Board of Directors will be increased to five directors and the following persons will be appointed as directors: S. Steven Karalekas and Robert N. McFarland as Class III Directors and Kevin P. Hegarty as a Class I Director. Upon their becoming directors of the Company, each of Mr. McFarland and Mr. Hegarty will join the Company's Audit Committee and Mr. S. Steven Karalekas will join the Company's Compensation Committee.

The table below sets forth the following information with respect to the nominee to be elected at the Meeting, the director whose term of office will extend beyond the Meeting and each person chosen to become a director: the age of each such person, the position(s) currently held by each such person within the Company, the year each such person was first elected or appointed a director, the year each such person's term will expire and the class of director of each such person.

Name of Director, Nominee

or Person Chosen to

Become a Director

| | Age

| | Position(s) Held

| | Director

Since

| | Year Term

Will Expire

| | Class of

Director

|

|---|

| John A. McMullen | | 61 | | Director | | 2000 | | 2005 | | I |

| Kevin P. Hegarty | | 47 | | Director | | 2003 | (1) | 2005 | (1) | I |

| Khoa D. Nguyen | | 49 | | Chairman, President, Chief Executive Officer, Chief Financial Officer, Treasurer and Secretary | | 1997 | | 2003 | | II |

| S. Steven Karalekas | | 60 | | Director | | 2003 | (1) | 2004 | (1) | III |

| Robert N. McFarland | | 58 | | Director | | 2003 | (1) | 2004 | (1) | III |

- (1)

- Subject to appointment that is to be effective as of the Meeting.

JOHN A. MCMULLEN joined the Board of Directors of the Company in February 2000. Since 1984, Mr. McMullen has been the Managing Principal of Cambridge Meridian Group, Inc., a management consulting and business advisory company. Mr. McMullen also serves as a director of MRO Software, Inc.

KEVIN P. HEGARTY has been appointed by the Board of Directors as a Class I Director, effective as of the Meeting. Since October 2001, Mr. Hegarty has been the Vice President and Chief

10

Financial Officer of The University of Texas at Austin. Previously, Mr. Hegarty was employed by Dell Computer Corporation, where he served as Vice President and Chief Financial Officer of Dell Financial Services from February 2000 through September 2001 and as Vice President and Company Controller from September 1997 through January 2000. Mr. Hegarty is a certified public accountant in the State of Texas.

KHOA D. NGUYEN has been a director of the Company since December 1997. Mr. Nguyen was named President and Chief Executive Officer of the Company effective April 9, 1998 and, since August 2002, he has also served as the Chief Financial Officer, Treasurer and Secretary of the Company. Previously, Mr. Nguyen had been Executive Vice President and Chief Operating Officer of the Company from September 1997 to April 1998. Prior to joining the Company, Mr. Nguyen had been employed at PictureTel Corporation, a videoconferencing company, where he served as Chief Technology Officer and General Manager of the Group Systems and Networking Products divisions from February 1994 to August 1996 and as Vice President of Engineering from January 1993 to February 1994. From August 1991 to December 1992, he was Vice President of Engineering at VTEL Corporation, a videoconferencing company. Previously, Mr. Nguyen held various research and development positions at IBM Corporation.

S. STEVEN KARALEKAS has been appointed by the Board of Directors as a Class III Director, effective as of the Meeting. Mr. Karalekas is the founding partner of the law firm of Karalekas & Noone, which was formed in March of 1993, and its predecessor, Karalekas and McCahill, which was formed in September of 1977. Karalekas & Noone provides legal, government and public relations, marketing and lobbying services to a broad range of U.S. and foreign clients. Previously, Mr. Karalekas worked as a lawyer for the law firm of Wilkinson, Cragun & Barker from 1974 to 1977. He served as Chief Assistant to Congressman Paul W. Cronin, Massachusetts, from 1973 to 1974. He served as Staff Assistant to the President of the United States of America from 1971 to 1973, where he was engaged in defense, foreign policy and legislative issues for the President. From 1969 to 1970, he served as a law clerk to Chief Justice Donald H. Hunter, Indiana Supreme Court. Mr. Karalekas was admitted to practice law in Massachusetts in 1970 and in the District of Columbia in 1974. Mr. Karalekas has served as Chairman of the Board of Visitors of the Defense Information School at Fort Benjamin Harrison, Indiana and as Senior Vice President and General Counsel of the U.S. Navy Memorial Foundation in Washington, D.C.

ROBERT N. MCFARLAND has been appointed by the Board of Directors as a Class III Director, effective as of the Meeting. Mr. McFarland has been employed by Dell Computer Corporation, a provider of computer products and services, since December 1996, where he served as Vice President, Government Relations, since August 2002, Vice President and General Manager, Government Sector, from May 2001 to August 2002, Vice President and General Manager, Large Corporate Account Sector, from February 2001 to May 2001, Vice President and General Manager, Global, from February 1999 to February 2001 and Vice President and General Manager, Federal, from December 1996 to February 1999.

Board of Directors Meetings and Committees

The Board of Directors held a total of seventeen meetings during the year ended December 31, 2002. During that period, the Audit Committee of the Board of Directors held four meetings and the Compensation Committee of the Board of Directors held two meetings. Each of the current directors, other than Mr. Perry who was unable to attend seven meetings, attended at least seventy-five percent (75%) of the meetings of the Board of Directors and committees of the Board of Directors on which the director served during the year.

Mr. McMullen is the sole member of the Compensation Committee. Effective as of the Meeting, the Compensation Committee will consist of Messrs. McMullen and Karalekas. The Compensation

11

Committee determines the compensation of the Company's senior management and administers the Company's stock option plans.

The Audit Committee currently consists of Messrs. Keane, McMullen and Perry and, effective as of the Meeting, it will consist of Messrs. McMullen, McFarland and Hegarty. The Audit Committee recommends engagement of the Company's independent auditors, consults with the Company's auditors concerning the scope of the audit, reviews the results of their examination, reviews and approves any material accounting policy changes affecting the Company's operating results and reviews the Company's financial controls. The Audit Committee is governed by a written charter, which was adopted by the Board of Directors on April 27, 2000 and was included as an appendix to the Company's proxy statement furnished in 2001. Each member of the Audit Committee is an "independent director" as defined in the National Association of Securities Dealers' listing standards.

The Board of Directors has no standing nominating committee.

Audit Committee Report

During the fiscal year ended December 31, 2002, the Audit Committee of the Board of Directors consisted of Messrs. Keane, McMullen and Perry. The Audit Committee reviewed and discussed the Company's audited financial statements with management of the Company and the Company's independent auditors, Ernst & Young LLP. The Audit Committee discussed with Ernst & Young LLP the matters required to be discussed by the Statement of Auditing Standards No. 61. These discussions included the scope of the independent auditor's responsibilities, significant accounting adjustments, any disagreements with management and discussions of the quality, not just the acceptability, of accounting principles, reasonableness of significant judgments and the clarity of disclosures in the financial statements.

In addition, the Audit Committee reviewed the written disclosures and the letter from Ernst & Young LLP relating to the independence of such firm as required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and discussed with Ernst & Young LLP that firm's independence. The Audit Committee satisfied itself as to Ernst & Young LLP's independence.

Based on the above referenced reviews and discussions, the Audit Committee recommended that the Board of Directors include the audited financial statements in the Company's Annual Report on Form 10-K for the year ended December 31, 2002 for filing with the Securities and Exchange Commission.

Respectfully Submitted by the Audit Committee,

John F. Keane, Jr.

John A. McMullen

Roy G. Perry

NOTWITHSTANDING ANYTHING TO THE CONTRARY SET FORTH IN ANY OF THE COMPANY'S PREVIOUS FILINGS UNDER THE SECURITIES ACT OF 1933 OR THE SECURITIES EXCHANGE ACT OF 1934 THAT MIGHT INCORPORATE FUTURE FILINGS MADE BY THE COMPANY UNDER THOSE STATUTES, IN WHOLE OR IN PART, THIS REPORT SHALL NOT BE DEEMED TO BE INCORPORATED BY REFERENCE INTO ANY SUCH FILINGS, NOR WILL THIS REPORT BE INCORPORATED BY REFERENCE INTO ANY FUTURE FILINGS MADE BY THE COMPANY UNDER THOSE STATUTES.

12

Certain Transactions

S. Steven Karalekas, who has been appointed a member of the Company's Board of Directors effective as of the Meeting, is a founding partner of the law firm of Karalekas & Noone, which, since November 13, 2002, has been retained by the Company. Mr. Karalekas and his firm, Karalekas & Noone, provide consulting and lobbying services to the Company in connection with securing Department of Defense and other Federal agency contracting of the Company's InfoWorkSpace collaborative products.

No other transactions occurring between January 1, 2002 and the date hereof are to be reported in this section, other than compensatory arrangements discussed elsewhere in this Proxy Statement.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" THE ELECTION OF THE NOMINEE LISTED ABOVE.

INDEPENDENT AUDITORS

The firm of Ernst & Young LLP, certified public accountants, served as independent auditor for the fiscal year ending December 31, 2002. In light of the cost of recent auditing services relative to the size and current financial condition of the Company, the Company is in the process of reviewing its existing auditor relationship and evaluating alternatives. As of the date of printing of this proxy statement, the Company has not selected an independent auditor for the fiscal year ending December 31, 2003, but expects to do so prior to the Meeting.

It is not expected that a member of the firm of Ernst & Young will be present at the Meeting or available to make a statement and respond to questions.

Audit Fees

The aggregate fees billed for professional services rendered by Ernst & Young LLP for the audit of the Company's annual financial statements for the fiscal year ended December 31, 2002 and the reviews of the financial statements included in the Company's quarterly reports on Form 10-Q filed during such fiscal year totaled $176,450.

Financial Information Systems Design and Implementation Fees

The Company did not engage Ernst & Young LLP to provide financial systems design and implementation during the fiscal year ended December 31, 2002.

All Other Fees

The aggregate fees billed for all other services rendered by Ernst & Young for the fiscal year ended December 31, 2002 totaled $89,308. All other fees primarily include tax compliance fees for U.S. federal and international tax returns, assistance with tax planning strategies, statutory audit services required by local laws in certain overseas locations in which the Company conducts business, fees for an audit of the Company's employee benefit plan and fees related to filings with the Securities and Exchange Commission.

VOTING PROCEDURES

The affirmative vote of a plurality of the shares of the Company's Common Stock present or represented at the Meeting and entitled to vote is required for the election of the Class II Director. In instances where brokers are prohibited from exercising discretionary authority for beneficial holders who have not returned a proxy (so-called "broker non-votes"), those shares will not be included in the vote totals and, therefore, will have no effect on the outcome of the vote. Shares that abstain or for

13

which the authority to vote is withheld on certain matters will, however, be treated as present for quorum purposes on all matters.

OTHER BUSINESS

The Board of Directors knows of no business which will be presented for consideration at the Meeting other than that stated above. If other business should come before the Meeting, the persons named in the proxies solicited hereby, each of whom is an employee of the Company, may vote all shares subject to such proxies with respect to any such business in the best judgment of such persons.

SHAREHOLDER PROPOSALS

It is currently contemplated that the 2004 Annual Meeting of Shareholders will be held on or about May 26, 2004. Proposals of shareholders intended for inclusion in the proxy statement to be furnished to all shareholders entitled to vote at the next annual meeting of the Company and/or for inclusion in the agenda for that meeting must be received at the Company's principal executive offices not later than December 31, 2003. It is suggested that proponents submit their proposals by certified mail, return receipt requested.

Dated: April 24, 2003

14

ANNEX

FORM OF PROXY CARD

[SIDE ONE]

PROXY

Ezenia! Inc.

This Proxy is Solicited on Behalf of the Board of Directors of the Company

for its Annual Meeting of Shareholders to be held May 29, 2003

The undersigned hereby appoints Khoa D. Nguyen and Robert E. Quinn as proxies, each with full power of substitution, and hereby authorizes them or either of them to represent and to vote as designated below all shares of Common Stock of Ezenia! Inc. (the "Company") held of record by the undersigned on April 22, 2003 at the Annual Meeting of Shareholders to be held at the offices of Bingham McCutchen LLP, 150 Federal Street, Boston, Massachusetts 02110 on May 29, 2003 at 10:00 a.m. EDT, and at any adjournments or postponements thereof.

WHEN PROPERLY EXECUTED, THIS PROXY WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED STOCKHOLDER. IF NO DIRECTION IS GIVEN, THIS PROXY WILL BE VOTED "FOR" THE PROPOSAL.

CONTINUED AND TO BE SIGNED ON REVERSE SIDE

1

[SIDE TWO]

Vote by Telephone

It's fast, convenient and immediate!

Call Toll-Free on a Touch-Tone Phone

1-877-PRX-VOTE (1-877-779-8683).

Follow these four easy steps:

- 1.

- Read the accompanying Proxy Statement and Proxy Card.

- 2.

- Call the toll-free number1-877-PRX-VOTE (1-877-779-8683).

- 3.

- Enter your Voter Control Number located on your Proxy Card above your name.

- 4.

- Follow the recorded instructions.

Your vote is important!

Call 1-877-PRX-VOTE anytime!

Vote by Internet

It's fast, convenient and your vote is immediately confirmed and posted.

Follow these four easy steps:

- 1.

- Read the accompanying Proxy Statement and Proxy Card.

- 2.

- Go to the Websitehttp://www.eproxyvote.com/ezen

- 3.

- Enter your Voter Control Number located on your Proxy Card above your name.

- 4.

- Follow the instructions provided.

Your vote is important!

Go tohttp://www.eproxyvote.com/ezen anytime!

Do not return your Proxy Card if you are voting by Telephone or Internet

- ý

- Please mark votes as in this example.

- 1.

- To elect one Class II Director to hold office for a three-year term and until his/her respective successor has been duly elected and qualified.

- 2.

- To transact such other business as may properly come before the Meeting or any adjournment thereof.

MARK HERE FOR ADDRESS CHANGE AND NOTE AT LEFT o

PLEASE MARK, SIGN, DATE AND RETURN THE PROXY FORM PROMPTLY USING THE ENCLOSED SELF-ADDRESSED ENVELOPE.

Please sign exactly as your name appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If shares are held of record by a corporation, please sign in full corporate name by president or other authorized officer. Partnerships should sign in partnership name by an authorized signatory.

Signature: |

|

|

Date: |

|

|

Signature: |

|

|

Date: |

|

| |

| | |

| | |

| | |

|

2

QuickLinks

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENTEXECUTIVE COMPENSATION AND OTHER INFORMATION CONCERNING DIRECTORS AND EXECUTIVE OFFICERSPROPOSAL NO. 1—ELECTION OF DIRECTORSINDEPENDENT AUDITORSVOTING PROCEDURESOTHER BUSINESSSHAREHOLDER PROPOSALS