QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

Ezenia! Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

April 28, 2005

Dear Shareholder:

You are cordially invited to attend the 2005 Annual Meeting of Shareholders of Ezenia! Inc., (the "Company") which will be held on Monday, June 6, 2005 at 12:00 p.m., EDT, at the offices of Bingham McCutchen LLP, 150 Federal Street, Boston, Massachusetts 02110.

The Notice of the 2005 Annual Meeting of Shareholders and Proxy Statement accompany this letter. These documents collectively describe the formal business to be conducted at the annual meeting. The Company's Annual Report on Form 10-K/A is also enclosed for your additional information.

All shareholders are invited to attend the annual meeting. To ensure your representation at the annual meeting, however, you are urged to vote by proxy by following one of these steps as promptly as possible:

- (A)

- Complete, date, sign and return the enclosed Proxy Card (a postage-prepaid envelope is enclosed for that purpose); or

- (B)

- Vote via telephone (toll free) in the United States or Canada (see instructions on the enclosed Proxy Card); or

- (C)

- Vote via the Internet (see instructions on the enclosed Proxy Card).

The telephone and Internet voting procedures are designed to authenticate shareholders' identities, to allow shareholders to vote their shares and to confirm that their instructions have been properly recorded. Specific instructions to be followed by a registered shareholder interested in voting via the telephone or Internet are set forth in the Proxy Card.Your shares cannot be voted unless you date, sign and return the enclosed Proxy Card, vote via the telephone or Internet or attend the annual meeting in person. Regardless of the number of shares you own, your careful consideration of, and vote on, the matters before the shareholders is important.

Very truly yours,

Khoa D. Nguyen

Chairman and

Chief Executive Officer

EZENIA! INC.

Northwest Park

154 Middlesex Turnpike

Burlington, Massachusetts 01803

NOTICE OF 2005 ANNUAL MEETING

OF SHAREHOLDERS

TO OUR SHAREHOLDERS:

The 2005 Annual Meeting of Shareholders (the "Meeting") of Ezenia! Inc., a Delaware corporation (the "Company"), will be held on Monday, June 6, 2005 at 12:00 p.m., EDT, at the offices of Bingham McCutchen LLP, 150 Federal Street, Boston, Massachusetts 02110. The purposes of the Meeting shall be:

- 1.

- To elect one Class I Director to hold office for a three-year term and until such Director's respective successor has been duly elected and qualified.

- 2.

- To adopt the Ezenia! Inc. 2004 Equity Incentive Plan.

- 3.

- To transact such other business as may properly come before the meeting or any adjournment thereof.

Shareholders of record on the books of the Company at the close of business on April 18, 2005 are entitled to notice of, and to vote at, the Meeting.

Please sign, date and return the enclosed Proxy Card in the enclosed envelope, or vote via telephone or the Internet (pursuant to the instructions on the enclosed Proxy Card) at your earliest convenience. If you return the Proxy Card or vote via telephone or the Internet, you may nevertheless attend the Meeting and vote your shares in person.

All shareholders of the Company are cordially invited to attend the Meeting.

| | | By Order of the Board of Directors, |

|

|

Khoa D. Nguyen

Secretary |

Burlington, Massachusetts

April 28, 2005 |

|

|

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE MEETING. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE (I) SIGN, DATE AND MAIL THE ENCLOSED PROXY CARD IN THE ENCLOSED ENVELOPE, WHICH REQUIRES NO POSTAGE IF MAILED FROM WITHIN THE UNITED STATES OR (II) OTHERWISE VOTE YOUR SHARES BY TELEPHONE OR THE INTERNET.

EZENIA! INC.

Northwest Park

154 Middlesex Turnpike

Burlington, Massachusetts 01803

PROXY STATEMENT

2005 Annual Meeting of Shareholders to be Held on June 6, 2005

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of Ezenia! Inc. (the "Company") of proxies for use at the 2005 Annual Meeting of Shareholders (the "Meeting") to be held on Monday, June 6, 2005 at 12:00 p.m., EDT, at the offices of Bingham McCutchen LLP, 150 Federal Street, Boston, Massachusetts 02110, and any adjournments thereof.

Registered shareholders can vote their shares (1) by mailing their signed Proxy Card, (2) via a toll-free telephone call from the U.S. or Canada, (3) via the Internet or (4) in person at the Meeting. The telephone and Internet voting procedures are designed to authenticate shareholders' identities, to allow shareholders to vote their shares and to confirm that their instructions have been properly recorded. The Company believes that the procedures that have been put in place are consistent with the requirements of applicable law. Specific instructions to be followed by a registered shareholder interested in voting via telephone or the Internet are set forth on the enclosed Proxy Card.

Shares represented by duly executed proxies received by the Company prior to the Meeting will be voted as instructed in the proxy on each matter submitted to the vote of shareholders. If a duly-executed proxy is returned without voting instructions with respect to one or more proposals, the persons named as proxies thereon intend to vote all shares represented by such proxy FOR each such proposal and at their discretion with respect to any other proposals that may properly come before the Meeting. The persons named as proxies are employees of the Company.

A shareholder may revoke a proxy at any time prior to its exercise by (1) delivering a later-dated proxy, (2) making an authorized telephone or Internet communication on a later date in accordance with the instructions on the enclosed Proxy Card, (3) written notice of revocation to the Secretary of the Company at the address of the Company's principal executive offices set forth above or (4) voting in person at the Meeting. If a shareholder does not intend to attend the Meeting, any written proxy or notice should be returned for receipt by the Company, and any telephonic or Internet vote should be made, not later than the close of business, 5:30 p.m., EDT, on June 5, 2005. The Company will bear the cost of solicitation of proxies relating to the Meeting.

Only shareholders of record as of the close of business on April 18, 2005 (the "Record Date") are entitled to notice of, and to vote at, the Meeting and any adjournments thereof. As of the Record Date, there were approximately 14,502,568 shares (excluding treasury shares) of the Company's Common Stock, $.01 par value (the "Common Stock"), issued and outstanding. Such shares of Common Stock are the only voting securities of the Company. Shareholders are entitled to cast one vote for each share of Common Stock held of record on the Record Date.

An Annual Report on Form 10-K/A, containing financial statements for the fiscal year ended December 31, 2004, accompanies this Proxy Statement. The mailing address of the Company's principal executive offices is Northwest Park, 154 Middlesex Turnpike, Burlington, Massachusetts 01803.

This Proxy Statement and the Proxy Card enclosed herewith are being mailed to shareholders on or about May 9, 2005.

1

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of the Company's Common Stock as of March 31, 2005 by (i) each person who is known by the Company to own beneficially more than five percent of the Company's Common Stock, (ii) each member of the Company's Board of Directors (the "Board of Directors"), (iii) each of the Named Executive Officers (as defined under "Summary Compensation" below) and (iv) all directors and executive officers as a group.

Directors, Officers and 5% Shareholders

| | Shares Beneficially Owned

|

|---|

| | Number

| | Percent

|

|---|

| Khoa D. Nguyen (1) | | 1,404,684 | | 9.28% |

Ronald L. Breland (2) |

|

7,000 |

|

* |

Gerald P. Carmen (3) |

|

7,000 |

|

* |

All executive officers and directors as a group (3 persons) (4) |

|

1,418,684 |

|

9.36% |

- *

- Less than 1%

- (1)

- Includes 735,500 shares that Mr. Nguyen has the right to acquire within 60 days of March 31, 2005 by the exercise of stock options.

- (2)

- Includes 7,000 shares that Mr. Breland has the right to acquire within 60 days of March 31, 2005 by the exercise of stock options.

- (3)

- Includes 7,000 shares that Mr. Carmen has the right to acquire within 60 days of March 31, 2005 by the exercise of stock options.

- (4)

- Includes 749,500 shares that directors and executive officers of the Company have the right to acquire within 60 days of March 31, 2005 by the exercise of stock options.

2

EXECUTIVE COMPENSATION AND OTHER INFORMATION

CONCERNING DIRECTORS AND EXECUTIVE OFFICERS

Summary Compensation

The following table sets forth information concerning the annual and long-term compensation in each of the last three fiscal years for the Company's Chief Executive Officer, who is also the Company's Chief Financial Officer, and who was the Company's sole executive officer as of December 31, 2004 (the "Named Executive Officer").

| |

| | Annual Compensation

| |

| |

| |

|---|

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | Other Annual

Compensation ($)

| | Long-Term

Compensation

Options (#)

| | All Other

Compensation ($)

| |

|---|

KHOA D. NGUYEN

President and

Chief Executive Officer (1) | | 2004

2003

2002 | | 250,000

250,000

250,000 | | 150,000

—

— | | —

—

— | | —

375,000

225,000 | | 4,125

1,250

1,112 | (2)

(2)

(2) |

- (1)

- Since August 2002, Mr. Nguyen has also served as the Company's Chief Financial Officer, Treasurer and Secretary.

- (2)

- Represents the dollar amount of the Company's matching contribution under the Company's 401(k) Plan.

Option Grants in Last Fiscal Year

There were no individual stock option grants made to the Company's sole executive officer during fiscal year 2004. In 2005, Mr. Nguyen received a grant of options to purchase 500,000 shares of Common Stock at the exercise price of $0.97 per share. These options vest over a four-year period at the rate of 25% per year and expire on the tenth anniversary of the grant date.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table sets forth information concerning each exercise of stock options by the Company's sole executive officer during fiscal year 2004 and the value of unexercised "in-the-money" options at the end of that fiscal year.

Name

| | Shares

Acquired on

Exercise (#)

| | Value

Realized ($)

| | Number of Unexercised Options at Fiscal Year-End

Exercisable/Unexercisable (#)

| | Value of Unexercised

in-the-Money

Options at Fiscal Year-End (1)

Exercisable/Unexercisable ($)

|

|---|

| Khoa D. Nguyen | | 412,500 | | 16,125 | | 916,750 / 6,250 | | 163,125 / - |

- (1)

- Based on the closing price on the Over the Counter Bulletin Board for a share of Common Stock on December 31, 2004 of $1.03.

3

Benefit Plans

The Company currently provides certain benefits to its eligible employees (including its executive officers) through the benefit plans described below:

1991 Stock Incentive Plan. The Company maintained an Amended and Restated 1991 Stock Incentive Plan (the "1991 Stock Incentive Plan") to attract and retain the best available personnel for positions of substantial responsibility and to provide additional incentives to certain employees, officers and consultants to contribute to the success of the Company. By its terms, the 1991 Stock Incentive Plan terminated in March 2001. No additional awards may be granted under the 1991 Stock Incentive Plan, but outstanding awards will continue to remain in effect in accordance with their terms.

1995 Employee Stock Purchase Plan. The Company maintains a 1995 Employee Stock Purchase Plan (the "ESPP") to provide incentive to employees and to encourage ownership of Common Stock by all eligible employees of the Company and its subsidiaries. Employees of the Company may participate in the ESPP by authorizing payroll deductions generally over a six-month period, with the proceeds being used to purchase shares of Common Stock for the participant at a discounted price. The ESPP is intended to be an "employee stock purchase plan" under Section 423 of the Internal Revenue Code. In May 2001, the shareholders of the Company authorized an increase in the number of shares issuable under the ESPP from 600,000 shares to 900,000 shares.

2001 Stock Incentive Plan. The primary purpose of the 2001 Stock Incentive Plan is to enable the Company to issue shares of the Company's Common Stock to existing personnel and to attract and retain qualified employees, officers, directors, advisors and consultants through stock option grants, restricted stock awards and/or stock grants. The Company's officers and directors may not receive a majority of the total shares issued and reserved for issuance under grants and awards made pursuant to the 2001 Stock Incentive Plan. The 2001 Stock Incentive Plan was terminated as of December 31, 2004. No additional awards may be granted under the 2001 Stock Incentive Plan, but outstanding awards will continue to remain in effect in accordance with their terms.

2004 Equity Incentive Plan. The Company recently adopted the 2004 Equity Incentive Plan. The purpose of the 2004 Equity Incentive Plan is to attract and retain the best available personnel for positions of substantial responsibility and to provide additional incentives to certain employees, officers, directors, and consultants to contribute to the success of the Company. The Company may issue stock options, restricted stock awards and/or stock grants pursuant to the 2004 Equity Incentive Plan.

Savings Plan. The Company sponsors a savings plan for its employees, which has been qualified under Section 401(k) of the Internal Revenue Code (the "401(k) Plan"). Eligible employees are permitted to contribute to the 401(k) Plan through payroll deductions within statutory and plan limits. Contributions from the Company are made at the discretion of the Board of Directors. Beginning in 1997, the Board of Directors authorized the Company to match a portion of its employees' contributions to the 401(k) Plan, and, in fiscal years 1997 through 2004, the Company made a matching contribution of thirty percent (30%) of employee contributions to the extent employee contributions equaled five percent (5%) or more of such employee's gross compensation. The Company maintains comparable plans under local laws and regulations for its non-U.S. employees.

4

Equity Compensation Plan Information

Information as of December 31, 2004 regarding equity incentive plans approved and not approved by stockholders is summarized in the following table.

Plan Category

| | Number of securities to be issued upon exercise of outstanding options, warrants and rights

| | Weighted-average exercise price of outstanding options, warrants and rights

| | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (A))

| |

|---|

| | A(#)

| | B($)

| | C(#)

| |

|---|

| Equity compensation plans approved by security holders | | 807,252 | (1) | 6.92 | | 344,919 | (2) |

| Equity compensation plans not approved by security holders | | 630,969 | (3) | 0.33 | | 7,500,000 | (4) |

| Total | | 1,438,221 | | 3.94 | | 7,844,919 | |

- (1)

- Includes 766,252 shares of common stock to be issued upon exercise of outstanding options under the Amended and Restated 1991 Stock Incentive Plan and 41,000 shares of common stock to be issued upon exercise of outstanding options under the 1994 Non-Employee Director Option Plan.

- (2)

- Includes 344,919 shares of our Common Stock remaining available for future issuance under our 1995 Employee Stock Purchase Plan.

- (3)

- Represents shares of common stock to be issued upon exercise of outstanding options under the 2001 Stock Incentive Plan.

- (4)

- Represents shares of common stock available for future issuance under the 2004 Equity Incentive Plan.

Employment Agreements

In 1998, the Company entered into an agreement with Mr. Nguyen that provides for certain benefits in the event of a termination of his employment without cause and upon the occurrence of certain events. Under the agreement, in the event the Company elects to terminate Mr. Nguyen's employment or to diminish his status, other than for cause, Mr. Nguyen shall be entitled to receive, (i) for a period of twelve months, a salary equal to the highest annualized salary rate in effect for him within the previous twelve months and (ii) his then-current targeted annual incentive bonus. The agreement also provides for certain benefits in the event of a change in control. In the event of a change in control, the outstanding options held by Mr. Nguyen under the Company's option plans shall become exercisable in full. The agreement further provides that if Mr. Nguyen is terminated or his status is diminished (other than for cause) within twenty-four months after a change in control, Mr. Nguyen is entitled to an immediate payment of two times his base compensation for the fiscal year immediately preceding the termination or change, plus two times his targeted annual bonus for the fiscal year then in effect.

Compensation Committee Report on Executive Compensation

The Company's executive compensation program is administered by the Compensation Committee of the Board of Directors (the "Compensation Committee"). The Compensation Committee is composed of Mr. Ronald L. Breland, an independent director who was appointed to the Board in September 2004, and Mr. Gerald P. Carmen, an independent director who was appointed to the Board in February 2005. During 2004, the Compensation Committee was comprised of Kevin J. Hegarty, a former director of the Company, and later, Mr. Breland. The Compensation Committee establishes and administers the Company's executive compensation policies and plans and administers the Company's stock option and

5

other equity-related employee compensation plans. The Compensation Committee considers internal and external information in determining officers' compensation, including outside survey data. Although the Company currently has only one executive officer, the following describes the Compensation Committee's approach to executive compensation generally, as well as with respect to the Company's Chief Executive Officer.

Compensation Philosophy

The Company's compensation policies for executive officers are based on the belief that the interests of executives should be closely aligned with those of the Company's shareholders. The compensation policies are designed to achieve the following objectives:

- •

- Offer compensation opportunities that attract highly qualified executives, reward outstanding initiative and achievement and retain the leadership and skills necessary to build long-term shareholder value.

- •

- Maintain a significant portion of executives' total compensation at risk, tied to both the annual and long-term financial performance of the Company and the creation of shareholder value.

- •

- Further the Company's short and long-term strategic goals and values by aligning compensation with business objectives and individual performance.

Compensation Program

The Company's executive compensation program has three major integrated components, base salary, annual incentive awards and long-term incentives.

Base Salary. Base salary levels for executive officers are determined annually by reviewing the competitive pay practices of networking companies of similar size and market capitalization, the skills, performance level, and contribution to the business of individual executives and the needs of the Company. Overall, the Compensation Committee believes that base salaries for executive officers are approximately competitive with median base salary levels for similar positions in these networking companies.

Incentive Awards. The Company's executive officers are eligible to receive cash bonus awards designed to motivate executives to attain short-term and longer-term corporate and individual management goals. The Compensation Committee establishes annual incentive opportunities for each executive officer in relation to his or her base salary. Awards under this program are based on the attainment of specific Company performance measures established by the Compensation Committee early in the fiscal year, and by the achievement of specified individual objectives and the degree to which each executive officer contributes to the overall success of the Company and the management team. In 2004, the formula for the Chief Executive Officer's bonus was based on a combination of individual objectives and Company revenue and profitability objectives.

Long-Term Incentives. The Compensation Committee believes that stock options are an appropriate vehicle for compensating its officers and employees. The Company historically provided long-term incentives through its Amended and Restated 1991 Stock Incentive Plan and 2001 Stock Incentive Plan, and continues to do so through its 2004 Equity Incentive Plan. The purpose of long-term incentive stock options is to create a direct link between executive compensation and increases in shareholder value. The Amended and Restated 1991 Stock Incentive Plan and 2001 Stock Incentive Plan terminated in March 2001 and December 2004, respectively. No additional awards may be granted

6

thereunder, but outstanding awards will continue to remain in effect in accordance with their terms. Presently, long-term incentive awards are granted under the 2004 Equity Incentive Plan. Stock options are generally granted at fair market value and vest in installments, generally over four years. When determining option awards for an executive officer, the Compensation Committee considers the executive's current contribution to Company performance, the anticipated contribution to meeting the Company's long-term strategic performance goals and industry practices and norms. Long-term incentives granted in prior years and existing levels of stock ownership are also taken into consideration. Because the receipt of value by an executive officer under a stock option is dependent upon an increase in the price of the Company's Common Stock, this portion of the executive's compensation is directly aligned with an increase in shareholder value.

Chief Executive Officer Compensation

The Chief Executive Officer's base salary, annual incentive award and long-term incentive compensation are determined by the Compensation Committee, and are based upon the same factors that would be employed by the Compensation Committee for executive officers generally. Mr. Nguyen's base salary for the year ended December 31, 2004 was $250,000. The Chief Executive Officer may also be entitled to an annual cash bonus depending on the Company's performance. The Compensation Committee at its discretion will determine any such cash bonus. For the year ended December 31, 2004, Mr. Nguyen earned a $150,000 cash bonus that was paid out in January 2005. In January 2005, the Compensation Committee approved increasing Mr. Nguyen's annual salary to $270,000 and also granted Mr. Nguyen options to purchase 500,000 shares of Common Stock at the exercise price of $0.97 per share. These options vest over a four year period at the rate of 25% per year and expire on the tenth anniversary of the grant date.

Section 162(m) of the Internal Revenue Code limits the tax deduction to $1,000,000 for compensation paid to certain executives of public companies. Historically, the combined salary and bonus of each executive officer of the Company has been well below the $1,000,000 limit. The Compensation Committee's present intention is to comply with Section 162(m) unless the Compensation Committee feels that required changes would not be in the best interest of the Company or its shareholders.

| | | Respectfully Submitted by the Compensation Committee, |

|

|

|

|

Ronald L. Breland,

Gerald P. Carmen |

NOTWITHSTANDING ANYTHING TO THE CONTRARY SET FORTH IN ANY OF THE COMPANY'S PREVIOUS FILINGS UNDER THE SECURITIES ACT OF 1933 OR THE SECURITIES EXCHANGE ACT OF 1034 THAT MIGHT INCORPORATE FUTURE FILINGS MADE BY THE COMPANY UNDER THOSE STATUTES, IN WHOLE OR IN PART, THIS REPORT SHALL NOT BE DEEMED TO BE INCORPORATED BY REFERENCE INTO ANY SUCH FILINGS, NOR WILL THIS REPORT BE INCORPORATED BY REFERENCE INTO ANY FUTURE FILINGS MADE BY THE COMPANY UNDER THOSE STATUTES.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee was formed on February 1, 1995. No current or former member of the Compensation Committee is or has been an officer or employee of the Company or any of its subsidiaries.

7

Compensation of Directors

In April 1995, the Board of Directors and shareholders approved the Amended and Restated 1994 Non-Employee Director Stock Option Plan (the "Director Plan"), which was most recently amended by the Board of Directors on June 5, 2002. The Director Plan provides that the Board of Directors, at its discretion, is permitted to grant options to non-employee directors, subject to terms and conditions as determined by the Board of Directors. No options may be granted after the tenth anniversary of the date of adoption of the Director Plan and no person may be granted options under the Director Plan to purchase more than an aggregate of 45,000 shares of Common Stock. The Director Plan terminated on November 9, 2004 and no further options are to be granted under the Director Plan subsequent to that date. On December 31, 2004, the Board of Directors approved the 2004 Equity Incentive Plan. The 2004 Equity Incentive Plan provides that the Board of Directors, at its discretion, is permitted to grant options to non-employee directors, subject to terms and conditions as determined by the Board of Directors. No options may be granted after the tenth anniversary of the date of adoption of the 2004 Equity Incentive Plan.

Under both plans, options are granted at a price equal to the fair market value on the date of grant. Unless otherwise specified by the Board of Directors at the time of grant, options granted under the Director Plan and the 2004 Equity Incentive Plan become exercisable over a four-year period, and the term of the options is ten years from the date of grant.

The Company pays each non-employee director a fee of $2,000 per official meeting of the Board of Directors attended in person by such director. No fee is paid a director for meetings attended by telephone or for periodic involvement in specific matters of the company.

Section 16(a) – Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company's officers, directors and persons who own more than ten percent (10%) of a registered class of the Company's equity securities to file reports of ownership on Forms 3, 4 and 5 with the Securities and Exchange Commission and the Company. Based on the Company's review of copies of such forms, each officer, director and ten percent (10%) holder complied with his/her obligations in a timely fashion with respect to transactions in securities of the Company during the year ended December 31, 2004.

8

Stock Performance Graph

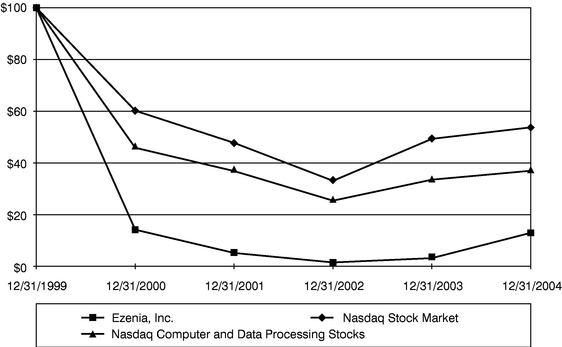

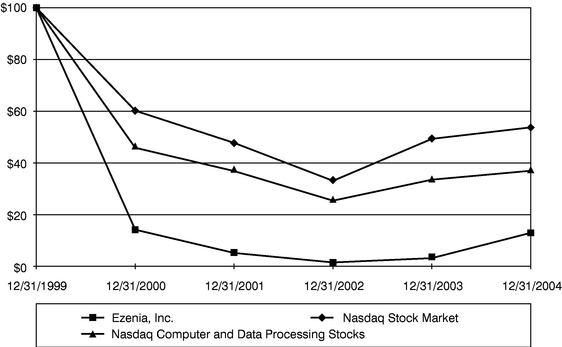

The following graph compares the change in the shareholder return on the Company's Common Stock against the return for the Nasdaq Stock Market Index, and the Nasdaq Computer and Data Processing Index (SIC Code 737), as calculated by the Center for Research in Security Prices at the University of Chicago, for the period beginning December 31, 1999 and ending December 31, 2004.

| | 12/31/1999

| | 12/31/2000

| | 12/31/2001

| | 12/31/2002

| | 12/31/2003

| | 12/31/2004

|

|---|

| Ezenia, Inc. | | 100.0 | | 14.2 | | 5.2 | | 1.6 | | 3.2 | | 13.0 |

| Nasdaq Stock Market | | 100.0 | | 60.3 | | 47.8 | | 33.1 | | 49.4 | | 53.8 |

| Nasdaq Computer and Data Processing Stocks | | 100.0 | | 45.9 | | 36.9 | | 25.5 | | 33.6 | | 37.0 |

This graph assumes the investment of $100 in the Company's Common Stock, the Nasdaq Index, and the Nasdaq Computer and Data Processing Index as of December 31, 1999 and assumes dividends were reinvested. Additional measurement points are at the remaining month ends for the years ended December 31, 2000, December 31, 2001, December 31, 2002, December 31, 2003, and December 31, 2004.

9

PROPOSAL NO. 1 - ELECTION OF DIRECTORS

The Board of Directors is divided into three classes. Each class serves a three-year term. The term of the current Class I Director will expire at the Meeting. All directors will hold office until their successors have been duly elected and qualified.

For the 2005 Annual Meeting of Shareholders, the Board of Directors has nominated Gerald P. Carmen for election as a Class I Director, to hold office until the Annual Meeting of Shareholders to be held in 2008 and until his successor is duly elected and qualified. Shares represented by all proxies received by the Board of Directors and not marked so as to withhold authority to vote for the nominee will be voted FOR the election of the nominee. The nominee has indicated his willingness to serve, if elected; however, if the nominee should be unable or unwilling to serve, the proxies may be voted for the election of a substitute nominee designated by the Board of Directors or for fixing the number of directors at a lesser number. Proxies may not be voted for a greater number of persons than the number of nominees named herein.

The table below sets forth the following information with respect to the nominee to be elected at the Meeting, and the directors whose term of office will extend beyond the Meeting: the age of each such person, the position(s) currently held by each such person within the Company, the year each such person was first elected or appointed a director, the year each such person's term will expire and the class of director of each such person.

Name of Director, Nominee

or Person Chosen to

Become a Director

| | Age

| | Position(s) Held

| | Director

Since

| | Year Term

Will Expire

| | Class of

Director

|

|---|

| Gerald P. Carmen (1) | | 74 | | Director | | 2005 | | 2008 | | I |

| Ronald L. Breland | | 55 | | Director | | 2004 | | 2006 | | II |

| Khoa D. Nguyen | | 51 | | Chairman, President, Chief Executive Officer, Chief Financial Officer, Treasurer and Secretary | | 1997 | | 2007 | | III |

- (1)

- Subject to re-appointment that is to be effective as of the Meeting.

KHOA D. NGUYEN has been a director of the Company since December 1997. Mr. Nguyen was named President and Chief Executive Officer of the Company effective April 9, 1998 and, since August 2002, he has also served as the Chief Financial Officer, Treasurer and Secretary of the Company. Previously, Mr. Nguyen had been Executive Vice President and Chief Operating Officer of the Company from September 1997 to April 1998. Prior to joining the Company, Mr. Nguyen had been employed at PictureTel Corporation, a videoconferencing company, where he served as Chief Technology Officer and General Manager of the Group Systems and Networking Products divisions from February 1994 to August 1996 and as Vice President of Engineering from January 1993 to February 1994. From August 1991 to December 1992, he was Vice President of Engineering at VTEL Corporation, a videoconferencing company. Previously, Mr. Nguyen held various research and development positions at IBM Corporation.

RONALD L. BRELAND has been a Class II Director of the Company since September 2004. Mr. Breland is currently the President and Chief Executive Officer of EC America and Selbre Associates. Prior to establishing EC America in March 1998 and Selbre Associates in June 1988, Mr. Breland was Vice President of Marketing and Sales for General Digital Corporation in Rockville, MD and prior to that Vice President of Sales for Kennedy Company, a division of Allegheny International. Mr. Breland is a Charter

10

Member of the Industry Advisory Council of the Federation of Government Information Processing Councils and the General Service Administration's Advisory Council.

GERALD P. CARMEN has been a Class I Director of the Company since February 2005. Mr. Carmen is currently an independent consultant. As one of the founding partners of the Carmen Group, Inc., Mr. Carmen served as Vice Chairman from 1990 to August 2004. In 1989, Mr. Carmen served as President and Chief Executive Officer of the Federal Asset Disposition Association, the predecessor of the current Resolution Trust Corporation. From August 1986 to May 1988 Mr. Carmen served as national Chairman for Citizens for America. Mr. Carmen was appointed by President Reagan to serve as the United States Permanent Representative to the United Nations office and other international organizations in Geneva, Switzerland, from May 1984 to August 1986. From 1981 to 1984, Mr. Carmen was the Administrator of the General Services Administration (GSA). Mr. Carmen has been a member of the Cabinet Council for Management and Administration, the White House Property Review Board, and the President's Committee on Arts and Humanities as well as served on various Boards of Directors.

Board of Directors Meetings and Committees

The Board of Directors held a total of 3 meetings during the year ended December 31, 2004. During that period, the Audit Committee of the Board of Directors held 4 meetings and the Compensation Committee of the Board of Directors held 2 meetings. Mr. Breland attended all of the meetings of the Board of Directors and the Audit and Compensation Committees since his appointment to the Board of Directors in September 2004. Mr. Robert McFarland and Mr. Kevin Hegarty attended all of the meetings of the Board of Directors and committees of the Board of Directors on which they served until their respective resignations from the Board of Directors in February and November 2004.

The Compensation and the Audit Committees are comprised of Mr. Breland and Mr. Carmen. The Compensation Committee determines the compensation of the Company's senior management and administers the Company's stock option plans. The Audit Committee recommends engagement of the Company's independent auditors, consults with the Company's auditors concerning the scope of the audit, reviews the results of their examination, reviews and approves any material accounting policy changes affecting the Company's operating results and reviews the Company's financial controls. The Audit Committee is governed by a written charter, which was adopted by the Board of Directors on April 27, 2000 and is included as an appendix to this document. Mr. Breland and Mr. Carmen are "independent directors" as defined in the National Association of Securities Dealers' listing standards.

The Board of Directors has no standing nominating committee. Instead, all of the Directors participate in the consideration of potential director candidates and are able to suggest individuals for such consideration. Security holders may also recommend director candidates and submit their recommendations to the Board of Directors for consideration. The Board of Directors has complete discretion to reject such recommendations if they believe them to be unsuitable.

Currently, the Board of Directors believes that it is appropriate not to have a nominating committee due to the relatively small size of the Board and the ability and willingness of each existing Director to undertake duties commensurate with membership on a nominating committee.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" THE ELECTION OF THE NOMINEE LISTED ABOVE.

11

PROPOSAL NO. 2

APPROVAL OF THE EZENIA! INC. 2004 EQUITY INCENTIVE PLAN

We are requesting that the stockholders vote in favor of adopting the 2004 Equity Incentive Plan (the "Plan"), which was approved by the Board of Directors of the Company (the "Board") on December 31, 2004. The essential features of the Plan are outlined below.

Purpose. The Plan is intended to encourage ownership of the Company's common stock, $0.01 par value (the "Common Stock") by employees, consultants and directors of the Company and its affiliates in order to provide additional incentive for them to promote the success of the Company's business.

Administration. The Board may delegate administration of the Plan to any committee of the Board (the "Committee"), provided that the Board may itself always exercise any of the powers and responsibilities which it assigns to the Committee. Subject to the provisions of the Plan, the Committee has discretion to determine the employee, consultant or director to receive an award, the form of award and any acceleration or extension of an award. Further, the Committee has complete authority to interpret the Plan, to prescribe, amend and rescind rules and regulations relating to it, to determine the terms and provisions of the respective award agreements (which need not be identical), and to make all other determinations necessary or advisable for the administration of the Plan. In addition, the Committee may delegate to an executive officer or officers the authority to grant awards to employees who are not officers, and to consultants, in accordance with applicable Committee guidelines.

Eligibility. Awards may be granted to any employee of or consultant to one or more of the Company and its affiliates or to non-employee members of the Board or of any board of directors (or similar governing authority) of any affiliate. However, only employees of the Company, and of any parent or subsidiary corporations of the Company, shall be eligible for the grant of an Incentive Stock Option. The maximum number of shares issuable pursuant to awards under the Plan to any one person in any one calendar year may not exceed 25% of the aggregate number of shares of Common Stock subject to the Plan.

Shares Subject to the Plan. The shares issued or to be issued under the Plan are shares of Common Stock, which may be authorized but unissued shares, treasury shares, reacquired shares, or any combination thereof. A maximum of 7,500,000 shares of Common Stock have been reserved for issuance pursuant to the Plan.

Types of Awards. Awards under the Plan include Incentive Stock Options, Nonstatutory Stock Options, Restricted Stock and Stock Grants.

Nonstatutory Stock Options and Incentive Stock Options (which are intended to meet the requirements of Section 422 of the Internal Revenue Code of 1986, as amended (the"Code") (together, "Stock Options") are rights to purchase Common Stock of the Company. Each Stock Option shall be evidenced by an instrument in such form as the Committee shall prescribe. Each such instrument shall specify (i) the exercise price, (ii) the number of shares of Common Stock subject to the Stock Option and (iii) such other terms and conditions, including, but not limited to, the method of exercise and any restrictions upon the Stock Option or the Common Stock issuable upon exercise thereof, as the Committee, in its discretion, shall establish.

A Stock Option may be immediately exercisable or become exercisable in such installments, cumulative or non-cumulative, as the Committee may determine. A Stock Option may be exercised by the participant giving written notice to the Company, accompanied by payment of an amount equal to the exercise price of the shares to be purchased. The purchase price may be paid by cash, check or, to the

12

extent not prohibited by applicable law, by delivery to the Company of an executed promissory note from the participant. Unless the Committee shall provide otherwise with respect to any Stock Option, if the participant's employment or other association with the Company and its affiliates ends for any reason, any outstanding Stock Option of that participant shall cease to be exercisable in any respect not later than 90 days following that event and, for the period it remains exercisable following that event, shall be exercisable only to the extent exercisable at the date of that event.

Incentive Stock Options may be granted only to eligible employees of the Company or any parent or subsidiary corporation, must have an exercise price of not less than 100% of the fair market value of the Company's Common Stock on the date of grant (110% for Incentive Stock Options granted to any 10% stockholder of the Company), and must have a term of not more than ten years (five years in the case of an Incentive Stock Option granted to any 10% stockholder of the Company). In the case of an Incentive Stock Option, the amount of the aggregate fair market value of Common Stock (determined at the time of grant) with respect to which Incentive Stock Options are exercisable for the first time by an employee during any calendar year (under all such plans of his employer corporation and its parent and subsidiary corporations) shall not exceed $100,000.

Awards of Restricted Stock are grants or sales of Common Stock which are subject to a risk of forfeiture. Each award of Restricted Stock shall be evidenced by a stock certificate in respect of such shares of Restricted Stock. Such certificate shall be registered in the name of each recipient, and, if applicable, shall bear an appropriate legend referring to the terms, conditions, and restrictions applicable to such award. Shares of Restricted Stock shall be subject to limitations on transferability and a risk of forfeiture arising on the basis of conditions related to the performance of services, Company or affiliate performance or otherwise as the Committee may determine and provide for in the applicable award agreement. Any such risk of forfeiture may be waived or terminated, or the period during which such risk of forfeiture is in place shortened, at any time by the Committee on such basis as it deems appropriate. Unless the Committee shall provide otherwise for any award of Restricted Stock, upon termination of a participant's employment or other association with the Company and its affiliates for any reason, all shares of Restricted Stock still subject to a risk of forfeiture shall be forfeited or otherwise subject to return to or repurchase by the Company on the terms specified in the award agreement.

A Stock Grant is a grant of shares of Common Stock not subject to restrictions or other forfeiture conditions.

Transferability. Awards shall not be transferable, and no award or interest therein may be sold, transferred, pledged, assigned, or otherwise alienated or hypothecated, other than by will or by the laws of descent and distribution. All of a participant's rights in any award may be exercised during the life of the participant only by the participant or the participant's legal representative. However, the Committee may, at or after the grant of an award of a Nonstatutory Stock Option or shares of Restricted Stock, provide that such award may be transferred by the recipient to a family member;provided, however, that any such transfer is without payment of any consideration whatsoever and that no transfer shall be valid unless first approved by the Committee, acting in its sole discretion.

Effect of Significant Corporate Event. In the event of any change in the outstanding shares of Common Stock through merger, consolidation, sale of all or substantially all the property of the Company, reorganization, recapitalization, reclassification, stock dividend, stock split, reverse stock split, or other distribution with respect to such shares of Common Stock, an appropriate and proportionate adjustment will be made in (i) the maximum numbers and kinds of shares subject to the Plan, (ii) the numbers and kinds of shares or other securities subject to the then outstanding awards, (iii) the exercise price for each share subject to then outstanding Stock Options (without change in the aggregate purchase as to which Stock Options remain exercisable), and (iv) the repurchase price of each share of Restricted Stock then

13

subject to a risk of forfeiture in the form of a Company repurchase right. In the event of a change in control, (a) any then outstanding Stock Options shall accelerate in full whether or not assumed by the acquiring entity or replaced by comparable options to purchase shares of the capital stock of the successor or acquiring entity or parent thereof, and to the extent not so assumed or replaced shall then (or after a reasonable period following the acquisition, as determined by the Committee) terminate to the extent not exercised, and (b) any then Restricted Stock shall accelerate in full, whether or not the Company's rights to reacquire such shares of Restricted Stock on occurrence of the applicable risk of forfeiture with respect to those shares are assigned to the acquiring entity. Upon dissolution or liquidation of the Company, other than as part of an acquisition or similar transaction, each outstanding Stock Option shall terminate, but the participant shall have the right, immediately prior to the dissolution or liquidation, to exercise the Stock Option to the extent exercisable on the date of dissolution or liquidation.

Amendments to and Termination of the Plan. The Board may at any time terminate the Plan or make such modifications to the Plan as it shall deem advisable. Unless the Board otherwise expressly provides, no amendment of the Plan shall affect the terms of any award outstanding on the date of such amendment. In any case, no termination or amendment of the Plan may, without the consent of any recipient of an award granted hereunder, adversely affect the rights of the recipient under such award.

Summary of Tax Consequences. The following is a brief and general discussion of the federal income tax rules applicable to awards granted under the Plan:

Nonstatutory Stock Options. There are no Federal income tax consequences to the Company or the participants upon grant of Nonstatutory Stock Options. Upon the exercise of such a Nonstatutory Stock Option, (i) the participant will recognize ordinary income in an amount equal to the amount by which the fair market value of the Common Stock acquired upon the exercise of such Nonstatutory Stock Option exceeds the exercise price, if any, and (ii) the Company will receive a corresponding deduction. A sale of Common Stock so acquired will give rise to a capital gain or loss equal to the difference between the fair market value of the Common Stock on the exercise and sale dates.

Incentive Stock Options. Except as noted at the end of this paragraph, there are no Federal income tax consequences to the Company or the participant upon grant or exercise of an Incentive Stock Option. If the participant holds shares of Common Stock purchased pursuant to the exercise of an Incentive Stock Option for at least two years after the date the Incentive Stock Option was granted and at least one year after the exercise of the Incentive Stock Option, the subsequent sale of Common Stock will give rise to a long-term capital gain or loss to the participant and no deduction will be available to the Company. If the participant sells the shares of Common Stock within two years after the date an Incentive Stock Option is granted or within one year after the exercise of an Incentive Stock Option, the participant will recognize ordinary income in an amount equal to the difference between the fair market value at the exercise date and the Incentive Stock Option exercise price, and the Company will be entitled to an equivalent deduction, and any additional gain or loss will be a capital gain or loss. Some participants may have to pay alternative minimum tax in connection with exercise of an Incentive Stock Option.

Restricted Stock. A participant will generally recognize ordinary income on receipt of an award of Restricted Stock when his or her rights in that award become substantially vested, in an amount equal to the amount by which the then fair market value of the Common Stock acquired exceeds the price he or she has paid for it, if any. Recipients of Restricted Stock may, however, within 30 days of receiving an award of Restricted Stock, choose to have any applicable risk of forfeiture disregarded for tax purposes by making an "83(b) election." If the participant makes an 83(b) election, he or she will have to report compensation income equal to the difference between

14

the value of the shares at the time of the transfer of the Restricted Stock and the price paid for the shares, if any.

Stock Grants. A participant will generally recognize ordinary income on receipt of a Stock Grant equal to the value of the Common Stock subject to such Stock Grant. A sale of Common Stock so acquired will give rise to a capital gain or loss equal to the difference between the fair market value of the Common Stock on the exercise and sale dates.

Potential Deferred Compensation. For purposes of the foregoing summary of Federal income tax consequences, we assumed that no award under the Plan will be considered "deferred compensation" as that term is defined for purposes of recent federal tax legislation governing nonqualified deferred compensation arrangements, Section 409A of the Code, or, if any award were considered to any extent to constitute deferred compensation, its terms would comply with the requirements of that legislation (in general, by limiting any flexibility in the time of payment). For example, the award of a Nonstatutory Stock Option with an exercise price which is less than the market value of the stock covered by the Nonstatutory Stock Option would constitute deferred compensation. If an award includes deferred compensation, and its terms do not comply with the requirements of the legislation, then any deferred compensation component of an award under the Plan will be taxable when it is earned and vested (even if not then payable) and the recipient will be subject to a 20% additional tax.

Section 162(m) Limitations on the Company's Tax Deduction. The Company will not be entitled to deductions in connection with awards under the Plan to certain senior executive officers to the extent that the amount of deductible income in a year to any such officer, together with his or her other compensation from the Company exceeds the $1 million dollar limitation of Section 162(m) of the Code. Compensation which qualifies as "performance-based" is not subject to this limitation, however. Any Stock Option granted under the Plan, if its exercise prices is not less than the market value of the Common Stock on the date of grant, should generally qualify as performance-based compensation.

Although the foregoing summarizes the essential features of the Plan, it is qualified in its entirety by reference to the full text of the Plan as approved, which is set forth as Exhibit A.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" THIS PROPOSAL.

Audit Committee Report

The Audit Committee is composed of Gerald P. Carmen, an independent director who was appointed to the Committee in February 2005 and Ronald Breland, an independent director who was appointed to the Committee in September 2004. During 2004, the Audit Committee comprised of Kevin Hegarty and Robert N. McFarland, former directors of the Company, and Mr. Breland. The Board of Directors has determined that Gerald P. Carmen is an "audit committee financial expert" as that term is defined by the applicable rules and regulations of the Securities and Exchange Commission.

During the fiscal year ended December 31, 2004, the Audit Committee reviewed and discussed the Company's audited financial statements with management of the Company and the Company's independent auditors, Brown & Brown LLP. The Audit Committee discussed with Brown & Brown LLP the matters required to be discussed by the Statement of Auditing Standards No. 61. These discussions included the scope of the independent auditor's responsibilities, significant accounting adjustments, any disagreements with management and discussions of the quality, not just the acceptability, of accounting principles, reasonableness of significant judgments and the clarity of disclosures in the financial statements.

15

In addition, the Audit Committee reviewed the written disclosures and the letter from Brown & Brown LLP relating to the independence of such firm as required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and discussed with Brown & Brown LLP that firm's independence. The Audit Committee satisfied itself as to Brown & Brown LLP's independence.

Based on the above referenced reviews and discussions, the Audit Committee recommended that the Board of Directors include the audited financial statements in the Company's Annual Report on Form 10-K for the year ended December 31, 2004 for filing with the Securities and Exchange Commission.

| | | Respectfully Submitted by the Audit Committee, |

| | | Gerald P. Carmen &

Ronald L. Breland |

NOTWITHSTANDING ANYTHING TO THE CONTRARY SET FORTH IN ANY OF THE COMPANY'S PREVIOUS FILINGS UNDER THE SECURITIES ACT OF 1933 OR THE SECURITIES EXCHANGE ACT OF 1934 THAT MIGHT INCORPORATE FUTURE FILINGS MADE BY THE COMPANY UNDER THOSE STATUTES, IN WHOLE OR IN PART, THIS REPORT SHALL NOT BE DEEMED TO BE INCORPORATED BY REFERENCE INTO ANY SUCH FILINGS, NOR WILL THIS REPORT BE INCORPORATED BY REFERENCE INTO ANY FUTURE FILINGS MADE BY THE COMPANY UNDER THOSE STATUTES.

Stockholder Communications with the Company

Stockholder communications with the Company should be made in accordance with the Company's existing policy, which requires a stockholder to direct all inquiries to the Company's Investor Relations Department at 781-505-2306. Stockholders also may send communications to the Investor Relations Department via email at investorrelations@ezenia.com.

Attendance of Directors at Annual Stockholder Meetings

Prior to this year, the Company had no formal policy with respect to director attendance at annual stockholder meetings. One director attended the 2004 annual stockholder meeting. Although the Company currently does not require directors to attend annual stockholder meetings, their attendance is welcome.

Certain Relationships and Related Transactions

No transactions occurring between January 1, 2004 and the date hereof are to be reported in this section, other than compensatory arrangements discussed elsewhere in this Proxy Statement.

INDEPENDENT AUDITORS

The firm of Brown & Brown LLP, certified public accountants, served as independent auditor for the fiscal year ending December 31, 2004, and the Company has selected them as independent auditor for the fiscal year ending December 31, 2005. It is not expected that a member of the firm of Brown & Brown will be present at the Meeting, but can be available upon request.

On April 30, 2003, upon the recommendation of the Audit Committee, the Company's Board of Directors accepted the resignation of Ernst & Young LLP as the Company's independent public

16

accountants. Also on April 30, 2003, the Company engaged Gray, Gray & Gray, LLP to serve as the Company's independent public accountants for the fiscal year ending December 31, 2003. On December 17, 2003, Gray, Gray & Gray, LLP informed the Audit Committee that their firm had made the decision to no longer provide audit services to public company clients, and therefore had resigned as independent auditors for the Company. On December 18, 2003, upon the approval of the Audit Committee, the Company engaged Brown & Brown, LLP to serve as the Company's independent public accountants for the fiscal year ending December 31, 2003.

During the fiscal year ending 2003, there did not occur any reportable events as defined in Item 304(a) of Regulation S-K. Specifically, there were no disagreements between the Company and Gray, Gray & Gray, LLP or Ernst & Young, LLP on any matter of accounting principles or practices, financial statement disclosure, or scope or procedures which disagreement, if not resolved to Gray, Gray & Gray, LLP's or Ernst & Young, LLP's satisfaction, would have caused them to make reference to the subject matter of the disagreement in connection with their review of the Company's financial statements.

Prior to the date of Gray, Gray & Gray, LLP's resignation, the Company did not consult with Brown & Brown, LLP with respect to the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company's consolidated financial statements, or any other matters or reportable events listed in Items 304(a) of Regulation S-K.

Audit Fees

The aggregate fees billed for professional services rendered by Brown & Brown LLP, Gray, Gray & Gray, LLP and Ernst & Young LLP for the audit of the Company's annual financial statements for the fiscal years ended December 31, 2004 and 2003 and the reviews of the financial statements included in the Company's quarterly reports on Form 10-Q filed during such fiscal years totaled approximately $122,000 and $64,500 respectively.

Tax Fees

The aggregate fees billed for professional services rendered by Brown & Brown, LLP and Gray, Gray and Gray, LLP for tax compliance, tax advice and tax planning services for the fiscal years ended December 31, 2004 and 2003 totaled approximately $10,000 and $26,500 respectively. Such services consisted of the preparation and filing of the federal and state tax returns for each of the years ended December 31, 2003, 2002, and 2001.

All Other Fees

The aggregate fees billed for all other services rendered by Brown & Brown LLP, Gray, Gray and Gray, LLP and Ernst & Young LLP for the fiscal years ended December 31, 2004 and 2003 totaled approximately $31,000 and $40,750 respectively. Such services consisted of audits of the Company's 401K plan, financial reporting related research, Sarbanes-Oxley compliance, and various matters relating to SEC compliance.

17

A summary of the fees paid to our independent public accountants is set forth below:

Fee Category

| | Fiscal Year

2004

| | % of Total

| | Fiscal Year

2003

| | % of Total

| |

|---|

| Audit Fees | | $ | 92,000 | | 57 | % | $ | 54,000 | | 41 | % |

| Audit-Related Fees | | $ | 30,000 | | 18 | % | $ | 10,500 | | 8 | % |

| Tax Fees | | $ | 10,000 | | 6 | % | $ | 26,500 | | 20 | % |

| All Other Fees | | $ | 31,000 | | 19 | % | $ | 40,750 | | 31 | % |

| | |

| |

| |

| |

| |

| Total Fees | | $ | 163,000 | | 100 | % | $ | 131,750 | | 100 | % |

| | |

| |

| |

| |

| |

VOTING PROCEDURES

The affirmative vote of a plurality of the shares of the Company's Common Stock present or represented at the Meeting and entitled to vote is required for the election of the Class I Director. The affirmative vote of a majority of the shares of the Company's Common Stock present or represented at the Meeting and entitled to vote is required for the adoption of the Ezenia! Inc. 2004 Equity Incentive Plan. In instances where brokers are prohibited from exercising discretionary authority for beneficial holders who have not returned a proxy (so-called "broker non-votes"), those shares will not be included in the vote totals and, therefore, will have no effect on the outcome of the vote. Shares that abstain or for which the authority to vote is withheld on certain matters will, however, be treated as present for quorum purposes on all matters.

OTHER BUSINESS

The Board of Directors knows of no business that will be presented for consideration at the Meeting other than that stated above. If other business should come before the Meeting, the persons named in the proxies solicited hereby, each of whom is an employee of the Company, may vote all shares subject to such proxies with respect to any such business in the best judgment of such persons.

SHAREHOLDER PROPOSALS

It is currently contemplated that the 2006 Annual Meeting of Shareholders will be held on or about May 26, 2006. Proposals of shareholders intended for inclusion in the proxy statement to be furnished to all shareholders entitled to vote at the next annual meeting of the Company and/or for inclusion in the agenda for that meeting must be received at the Company's principal executive offices not later than December 31, 2005. It is suggested that proponents submit their proposals by certified mail, return receipt requested.

Dated: April 28, 2005

18

AUDIT COMMITTEE CHARTER

EZENIA! INC.

Organization

This charter governs the operations of the audit committee. At least annually, the committee shall review and reassess the charter and obtain the board of directors' approval thereof. The committee shall be appointed by the board of directors and shall comprise at least three directors, each of whom are independent of management and the Company. Members of the committee shall be considered independent if they have no relationship that may interfere with the exercise of their independence from management and the Company. All committee members shall be financially literate, and at least one member shall have accounting or related financial management expertise.

Statement of Policy

The audit committee shall provide assistance to the board of directors in fulfilling their oversight responsibility to the shareholders, potential shareholders, the investment community, and others relating to the Company's financial statements and the financial reporting process, the systems of internal accounting and financial controls, the annual independent audit of the Company's financial statements, and the legal compliance and ethics programs as established by management and the board. In doing so, it is the responsibility of the committee to maintain free and open communication between the committee, independent auditors, and management of the Company. In discharging its oversight role, the committee is empowered to investigate any matter brought to its attention with full access to all books, records, facilities, and personnel of the Company and the power to retain outside counsel, or other experts for this purpose.

Responsibilities and Processes

The primary responsibility of the audit committee is to oversee the Company's financial reporting process on behalf of the board and report the results of its activities to the board. Management is responsible for preparing the Company's financial statements, and the independent auditors are responsible for auditing those financial statements. The committee in carrying out its responsibilities believes its policies and procedures should remain flexible, in order to best react to changing conditions and circumstances. The committee should take the appropriate actions to set the overall corporate "tone" for quality financial reporting, sound business risk practices, and ethical behavior.

The following shall be the principal recurring processes of the audit committee in carrying out its oversight responsibilities. The processes are set forth as a guide with the understanding that the committee may supplement them as appropriate.

- •

- The committee shall have a clear understanding with management and the independent auditors that the independent auditors are ultimately accountable to the board and the audit committee, as representatives of the Company's shareholders. The committee shall have the ultimate authority and responsibility to evaluate and, where appropriate, to recommend that the Board of Directors replace the independent auditors. The committee shall discuss with the auditors their independence from management and the Company and the matters included in the written disclosures required by the Independence Standards Board. Annually, the committee shall review and recommend to the board the selection of the Company's independent auditors.

A-1

- •

- The committee shall discuss with the independent auditors the overall scope and plans for the annual audit. Also, the committee shall discuss with management and the independent auditors the adequacy and effectiveness of the accounting and financial controls, including the Company's system to monitor and manage business risk, and legal and ethical compliance programs. Further, the committee shall meet separately with the independent auditors, with and without management present, to discuss the results of their examinations.

- •

- The committee shall review the interim financial statements with management and the independent auditors prior to the filing of the Company's Quarterly Report on Form 10-Q. Also, the committee shall discuss the results of the quarterly review and any other matters required to be communicated to the committee by the independent auditors under generally accepted auditing standards. The chair of the committee may represent the entire committee for the purposes of this review.

- •

- The committee shall review with management and the independent auditors the financial statements to be included in the Company's Annual Report on Form 10-K (or the annual report to shareholders if distributed prior to the filing of Form 10-K), including their judgment about the quality, not just acceptability, of accounting principles, the reasonableness of significant judgments, and the clarity of the disclosures in the financial statements. Also, the committee shall discuss the results of the annual audit and any other matters required to be communicated to the committee by the independent auditors under generally accepted auditing standards. The committee shall also prepare annually a report to the Company's stockholders.

A-2

Ezenia! INC.

2004 EQUITY INCENTIVE PLAN

TABLE OF CONTENTS

| 1. | | Purpose | | 1 |

2. |

|

Definitions |

|

1 |

3. |

|

Term of the Plan |

|

3 |

4. |

|

Stock Subject to the Plan |

|

3 |

5. |

|

Administration |

|

3 |

6. |

|

Authorization of Grants |

|

4 |

7. |

|

Specific Terms of Awards |

|

5 |

8. |

|

Adjustment Provisions |

|

7 |

9. |

|

Settlement of Awards |

|

8 |

10. |

|

Reservation of Stock |

|

10 |

11. |

|

Limitation of Rights in Stock; No Special Service Rights |

|

10 |

12. |

|

Unfunded Status of Plan |

|

11 |

13. |

|

Nonexclusivity of the Plan |

|

11 |

14. |

|

Termination and Amendment of the Plan |

|

11 |

15. |

|

Notices and Other Communications |

|

11 |

16. |

|

Governing Law |

|

11 |

EZENIA! INC.

2004 EQUITY INCENTIVE PLAN

1. Purpose

This Plan is intended to encourage ownership of Stock by employees, consultants, advisors and directors of the Company and its Affiliates and to provide additional incentive for them to promote the success of the Company's business through the grant of Awards of or pertaining to shares of the Company's Stock. The Plan is intended to be an incentive stock option plan within the meaning of Section 422 of the Code, but not all Awards are required to be Incentive Options.

2. Definitions

As used in this Plan, the following terms shall have the following meanings:

2.1. Accelerate,Accelerated, andAcceleration, means: (a) when used with respect to an Option, that as of the time of reference the Option will become exercisable with respect to some or all of the shares of Stock for which it was not then otherwise exercisable by its terms; and (b) when used with respect to Restricted Stock, that the Risk of Forfeiture otherwise applicable to the Stock shall expire with respect to some or all of the shares of Restricted Stock then still otherwise subject to the Risk of Forfeiture.

2.2. Acquisition means a merger or consolidation of the Company into another person (i.e., in which merger or consolidation the Company does not survive) or the sale, transfer, or other disposition of all or substantially all of the Company's assets to one or more other persons in a single transaction or series of related transactions, unless securities possessing more than 50% of the total combined voting power of the survivor's or acquiror's outstanding securities (or the securities of any parent thereof) are held by a person or persons who held securities possessing more than 50% of the total combined voting power of the Company immediately prior to that transaction.

2.3. Affiliate means any corporation, partnership, limited liability company, business trust, or other entity controlling, controlled by or under common control with the Company.

2.4. Award means any grant or sale pursuant to the Plan of Options, Restricted Stock, or Stock Grants.

2.5. Award Agreement means an agreement between the Company and the recipient of an Award, setting forth the terms and conditions of the Award.

2.6. Board means the Company's Board of Directors.

2.7. Change of Controlmeans any of the following transactions:

(a) any Acquisition, or

(b) any person or group of persons (within the meaning of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended and in effect from time to time), other than the Company or an Affiliate, directly or indirectly acquires, including but not limited to by means of merger or consolidation, beneficial ownership (determined pursuant to Securities and Exchange Commission Rule 13d-3 promulgated under the said Exchange Act) of securities possessing more than 50% of the total combined voting power of the Company's outstanding securities pursuant to a tender or exchange offer made directly to the Company's stockholders that the Board does not recommend such stockholders to accept, other than a person or group of persons who fall into the following categories (i) the Company or an Affiliate, (ii) an employee benefit plan of the Company or any of its Affiliates, (iii) a trustee or other fiduciary holding securities under an employee benefit

B-1

plan of the Company or any of its Affiliates, or (iv) an underwriter temporarily holding securities pursuant to an offering of such securities, or

(c) over a period of 36 consecutive months or less, there is a change in the composition of the Board such that a majority of the Board members (rounded up to the next whole number, if a fraction) ceases, by reason of one or more proxy contests for the election of Board members, to be composed of individuals who either (A) have been Board members continuously since the beginning of that period, or (B) have been elected or nominated for election as Board members during such period by at least a majority of the Board members described in the preceding clause (A) who were still in office at the time that election or nomination was approved by the Board, or

(d) a majority of the Board votes in favor of a decision that a Change in Control has occurred.

2.8. Code means the Internal Revenue Code of 1986, as amended from time to time, or any successor statute thereto, and any regulations issued from time to time thereunder.

2.9. Committee means any committee of the Board delegated the responsibility for the administration of the Plan, as provided in Section 5 of the Plan. For any period during which no such committee is in existence "Committee" shall mean the Board and all authority and responsibility assigned to the Committee under the Plan shall be exercised, if at all, by the Board.

2.10. Company means Ezenia! Inc., a corporation organized under the laws of the State of Delaware.

2.11. Grant Date means the date as of which an Option is granted, as determined under Section 7.1(a).

2.12. Incentive Option means an Option which by its terms is to be treated as an "incentive stock option" within the meaning of Section 422 of the Code.

2.13. Market Value means the value of a share of Stock on a particular date determined by such methods or procedures as may be established by the Committee. Unless otherwise determined by the Committee, the Market Value of Stock as of any date is the closing price for the Stock as reported on the OTC Bulletin Board (or on any national securities exchange or quotation system on which the Stock is then listed) for that date or, if no closing price is reported for that date, the closing price on the next preceding date for which a closing price was reported.

2.14. Nonstatutory Option means any Option that is not an Incentive Option.

2.15. Option means an option to purchase shares of Stock.

2.16. Optionee means a Participant to whom an Option shall have been granted under the Plan.

2.17. Participant means any holder of an outstanding Award under the Plan.

2.18. Plan means this 2004 Equity Incentive Plan of the Company, as amended from time to time, and including any attachments or addenda hereto.

2.19. Restricted Stockmeans a grant or sale of shares of Stock to a Participant subject to a Risk of Forfeiture.

2.20. Restriction Period means the period of time, established by the Committee in connection with an Award of Restricted Stock, during which the shares of Restricted Stock are subject to a Risk of Forfeiture described in the applicable Award Agreement.

B-2

2.21. Risk of Forfeiture means a limitation on the right of the Participant to retain Restricted Stock, including a right in the Company to reacquire shares of Restricted Stock at less than their then Market Value, arising because of the occurrence or non-occurrence of specified events or conditions.

2.22. Stock means common stock, par value $.01 per share, of the Company.

2.23. Stock Grant means the grant of shares of Stock not subject to restrictions or other forfeiture conditions.

2.24. Stockholders' Agreement means any agreement by and among the holders of at least a majority of the outstanding voting securities of the Company and setting forth, among other provisions, restrictions upon the transfer of shares of Stock or on the exercise of rights appurtenant thereto (including but not limited to voting rights).

2.25. Ten Percent Owner means a person who owns, or is deemed within the meaning of Section 422(b)(6) of the Code to own, stock possessing more than 10% of the total combined voting power of all classes of stock of the Company (or any parent or subsidiary corporations of the Company, as defined in Sections 424(e) and (f), respectively, of the Code). Whether a person is a Ten Percent Owner shall be determined with respect to an Option based on the facts existing immediately prior to the Grant Date of the Option.

3. Term of the Plan