QuickLinks -- Click here to rapidly navigate through this document

April 9, 2003

Dear Shareholder:

On behalf of management and our Board of Directors, we are pleased to invite you to attend the Annual and Special Meeting of Shareholders of Tesma International Inc. in respect of the five-month period ended December 31, 2002.

This Meeting will be held at the Design Exchange, 2nd Floor, Toronto-Dominion Centre, Ernst & Young Tower, 234 Bay Street, Toronto, Ontario, Canada, commencing at 11:00 a.m. (Toronto time) on Tuesday, May 6, 2003. The Notice of Meeting, Management Information Circular/Proxy Statement and form of proxy for our Class A Subordinate Voting Shares are enclosed with this letter.

Your shares should be represented at the Meeting. If you are unable to attend, please complete, date and sign the enclosed form of proxy, and return it in the envelope provided. Even if you plan to attend the Meeting, you may nevertheless find it convenient to express your views in advance by completing and returning the proxy form.

We look forward to seeing you at the Tesma Annual and Special Meeting of Shareholders on May 6, 2003.

Yours truly,

(Signed) "Anthony E. Dobranowski"

Anthony E. Dobranowski

President and Chief Financial Officer

TESMA INTERNATIONAL INC.

TESMA INTERNATIONAL INC.

1000 Tesma Way • Concord • Ontario • Canada • L4K 5R8 • (T) (905) 417-2100 • (F) (905) 417-2101

www.tesma.com

Exhibit 99.2

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

NOTICE is hereby given that the Annual and Special Meeting of Shareholders (the "Meeting") of Tesma International Inc. ("Tesma" or the "Corporation") will be held at the Design Exchange, 2nd Floor, Toronto-Dominion Centre, Ernst & Young Tower, 234 Bay Street, Toronto, Ontario, Canada, on Tuesday, May 6, 2003, commencing at 11:00 a.m. (Toronto time), for the following purposes:

- 1.

- to receive the consolidated financial statements of the Corporation for the five-months ended December 31, 2002 (the "fiscal 2002 stub period"), and the report of the Auditors thereon;

- 2.

- to elect directors;

- 3.

- to re-appoint the Auditors for the ensuing fiscal year and to authorize the Audit Committee of the Board of Directors to fix the Auditors' remuneration;

- 4.

- to approve the amendment and restatement of the Corporation's stock option plan to increase the maximum number of Class A Subordinate Voting Shares issuable thereunder; and

- 5.

- to transact such further or other business or matters as may properly come before the Meeting or any adjournment(s) thereof.

Only shareholders of record at the close of business on March 28, 2003 are entitled to receive notice of the Meeting.

Tesma's Report to Shareholders contains the consolidated financial statements of the Corporation for the fiscal 2002 stub period and the report of the Auditors thereon. The Management Information Circular/Proxy Statement (the "Circular") and form of proxy for the Class A Subordinate Voting Shares are provided with this Notice of Meeting. The Circular sets out additional information concerning the matters to be dealt with at the Meeting. If you are unable to be present at the Meeting in person, please complete, date and sign the enclosed proxy and return it to the Secretary of the Corporation in the envelope provided for that purpose.

By order of the Board of Directors,

|

(Signed)"STEFAN T. PRONIUK"

Vice President, Secretary

and General Counsel

TESMA INTERNATIONAL INC. |

April 9, 2003

Concord, Ontario

TESMA INTERNATIONAL INC.

1000 Tesma Way • Concord • Ontario • Canada • L4K 5R8 • (T) (905) 417-2100 • (F) (905) 417-2101

www.tesma.com

MANAGEMENT INFORMATION CIRCULAR/PROXY STATEMENT

This Management Information Circular/Proxy Statement (this "Circular") is furnished to the shareholders of Tesma International Inc. ("Tesma" or the "Corporation") in connection with thesolicitation by and on behalf of management and the board of directors of the Corporation (the "Board") of proxies to be used at the Annual and Special Meeting of Shareholders (the "Meeting") to be held at the Design Exchange, 2nd Floor, Toronto-Dominion Centre, Ernst & Young Tower, 234 Bay Street, Toronto, Ontario, Canada, on Tuesday, May 6, 2003, commencing at 11:00 a.m. (Toronto time), and at any adjournment(s) thereof, for the purposes set forth in the attached Notice of Annual and Special Meeting of Shareholders (the "Notice").

This Circular, the Notice, the accompanying form of proxy and the Tesma Report to Shareholders are being mailed, on or about April 9, 2003, to shareholders of record of the Corporation as of the close of business on March 28, 2003. The Corporation will bear all costs associated with the preparation and mailing of this Circular, the Notice, the accompanying form of proxy and the Tesma Report to Shareholders, as well as the costs of the solicitation of proxies. The solicitation will be primarily by mail; however, officers and regular employees of the Corporation may also solicit proxies (but not for additional compensation) personally, by telephone, telefax or other means of electronic transmission. Banks, brokerage houses and other custodians and nominees or fiduciaries will be requested to forward proxy solicitation material to their principals and to obtain authorizations for the execution of proxies, and will be reimbursed for their reasonable expenses in doing so.

Pursuant to the Corporation's by-laws, the Board unanimously approved the change of the Corporation's fiscal year end to December 31, effective December 31, 2002, and the change in the Corporation's financial reporting currency to the U.S. dollar commencing January 1, 2003.

For the purposes of this Circular, all references to dollar amounts are to Canadian dollars unless otherwise stated, references to the "fiscal 2002 stub period" are references to the five-month period ended December 31, 2002, and all references to "fiscal years" or "financial years" (including references to "fiscal" followed by a specific year) are references to the one year period ended on July 31 in the year specified.

APPOINTMENT AND REVOCATION OF PROXIES

Registered Holders

The persons named in the form of proxy accompanying this Circular are officers of the Corporation.A shareholder has the right to appoint a person (who need not be a shareholder of the Corporation) as nominee to attend and act for and on behalf of such shareholder at the Meeting, other than the management representatives named in the accompanying form of proxy. This right may be exercised either by striking out the names of the management representatives where they appear on the front of the form of proxy and by inserting in the blank space provided the name of the other person who the shareholder wishes to appoint, or by completing and submitting another proper form of proxy naming such other person as proxyholder.

A shareholder who has given a proxy, in addition to revocation in any other manner permitted by applicable Canadian law, may revoke the proxy within the time periods described in this Circular by an instrument in writing executed by the shareholder or by his/her attorney authorized in writing or, if the shareholder is a body corporate, by an officer or attorney thereof duly authorized.

Shareholders desiring to be represented at the Meeting by proxy or to revoke a proxy previously given, must deposit their form of proxy or revocation of proxy, addressed to the Secretary of the Corporation, at one of the following locations: (i) the principal executive offices of the Corporation at 1000 Tesma Way, Concord, Ontario, Canada L4K 5R8; (ii) the offices of Computershare Trust Company of Canada, 100 University Avenue, 9th Floor, Toronto, Ontario, Canada M5J 2Y1; or (iii) the offices of Computershare Trust Company, Inc., 350 Indiana Street, Suite 800, Golden, Colorado, USA 80401 (mailing address P.O. Box 1596, Denver, Colorado, USA 80201), in each case, at any time up to 5:00 p.m. (Toronto time) on the last business day preceding the day of the Meeting, or any adjournment(s) thereof, at which the proxy is to be used. If a shareholder who has completed a proxy attends the Meeting in person and specifically so requests, any votes cast by such shareholder on a poll will be counted and the proxy will be disregarded.

2

Non-Registered Holders

Only registered shareholders, or the persons that they appoint as their proxies, are permitted to attend and vote at the Meeting. However, in many cases, shares beneficially owned by a holder (a "Non-Registered Holder") are registered either:

- (a)

- in the name of an intermediary that the Non-Registered Holder deals with in respect of the shares, such as, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of registered plans; or

- (b)

- in the name of a depository (such as The Canadian Depository for Securities Limited) of which the intermediary is a participant.

In accordance with the requirements of National Instrument 54-101 of the Canadian securities laws, the Corporation will be distributing copies of the Notice, this Circular, the accompanying form of proxy and the Tesma Report to Shareholders (collectively, the "meeting materials") to the depository and intermediaries for further distribution to Non-Registered Holders. Due to the "non-routine" nature of the business to be conducted at the Meeting (as described in the Notice), National Instrument 54-101 requires intermediaries to forward the meeting materials to all Non-Registered Holders and receive voting instructions from them, regardless of whether a Non-Registered Holder has waived the right to receive the meeting materials. Intermediaries often use service companies to forward the meeting materials to Non-Registered Holders. Generally, Non-Registered Holders will either:

- (a)

- be given a voting instruction form which must be completed and signed by the Non-Registered Holder in accordance with the directions set out on the voting instruction form (which may, in some cases, permit the completion of the voting instruction form by telephone); or

- (b)

- less typically, be given a proxy which has already been signed by the intermediary (usually by way of a facsimile, stamped signature) which is restricted as to the number of shares beneficially owned by the Non-Registered Holder, but which is otherwise uncompleted. In this case, the Non-Registered Holder who wishes to submit the proxy should otherwise properly complete and deposit it with the Corporation, Computershare Trust Company of Canada or Computershare Trust Company Inc., as described above. This proxy need not be signed by the Non-Registered Holder.

In either case, the purpose of these procedures is to permit Non-Registered Holders to direct the voting of the shares which they beneficially own. Should a Non-Registered Holder who receives a proxy signed by the intermediary wish to attend and vote at the Meeting in person (or have another person attend and vote on behalf of the Non-Registered Holder), the Non-Registered Holder should strike out the names of the persons named in the proxy and insert the name of the Non-Registered Holder (or such other person) in the blank space provided. A Non-Registered Holder who receives a voting instruction form should follow the corresponding instructions on the form.In either case, Non-Registered Holders should carefully follow the instructions of their intermediaries and their intermediaries' service companies.

A Non-Registered Holder may revoke a voting instruction form (or proxy) given to an intermediary, at any time, by written notice to the intermediary, except that an intermediary is not required to act on a revocation of a voting instruction form (or proxy) that is not received by the intermediary at least seven days prior to the Meeting.

3

VOTING OF PROXIES

The shares represented by any valid proxy in favour of the management representatives named in the accompanying form of proxy will be voted (i) for or withheld from voting (abstain) on the election of directors, the re-appointment of the Auditors and the authorization of the Audit Committee of the Board to fix the remuneration of the Auditors, and (ii) for, against or withheld from voting (abstain) on the resolution set out in Schedule "A" to this Circular approving the amendment and restatement of the Corporation's stock option plan to increase the maximum number of Class A Subordinate Voting Shares issuable thereunder as of March 24, 2003 (the "Stock Option Plan Amendment/Restatement"), in all cases in accordance with any specific instructions given by a shareholder on the form of proxy.In the absence of such specific instructions, such shares will be voted by the management representatives as follows: FOR the election as directors of the management nominees named in this Circular; FOR the re-appointment of Ernst & Young LLP ("Ernst & Young") as the Auditors of the Corporation and the authorization of the Audit Committee of the Board to fix the Auditors' remuneration; and FOR the approval of the Stock Option Plan Amendment/Restatement.

The accompanying form of proxy confers discretionary authority upon the persons named therein with respect to amendments or variations to matters identified in the Notice and with respect to such other business or matters which may properly come before the Meeting or any adjournment(s) thereof. As of the date of this Circular, the Corporation is not aware of any such amendments or variations or any other business or matters to be raised at the Meeting.

RECORD DATE

The Board has fixed the close of business on March 28, 2003 as the record date (the"Record Date") for the Meeting. Only holders of record of Class A Subordinate Voting Shares and Class B Shares as of the close of business on the Record Date are entitled to receive notice of and to attend and vote at the Meeting, except that: (i) in accordance with applicable law, a transferee of Class A Subordinate Voting Shares or Class B Shares acquired after the Record Date shall be entitled to vote at the Meeting if such transferee produces properly endorsed share certificates or otherwise establishes ownership of such shares, and has demanded in writing, not later than 10 days before the Meeting, that the name of such transferee be included in the list of shareholders entitled to vote at the Meeting; and (ii) a holder of Class A Subordinate Voting Shares issued by the Corporation after the Record Date in connection with the exercise of stock options or conversion rights to acquire such shares shall be entitled to vote at the Meeting in person or by proxy if such holder establishes ownership of such shares to the satisfaction of the Secretary of the Corporation or the chairman of the Meeting prior to the Meeting or any adjournment(s) thereof.

VOTING SECURITIES AND PRINCIPAL HOLDERS

As of the Record Date, there were 18,110,429 Class A Subordinate Voting Shares outstanding. Holders of Class A Subordinate Voting Shares are entitled to cast one (1) vote per Class A Subordinate Voting Share held by them on each matter to be acted on at the Meeting.

As of the Record Date, there were 14,223,900 Class B Shares outstanding. Holders of Class B Shares are entitled to cast ten (10) votes per Class B Share held by them on each matter to be acted on at the Meeting. Holders of Class B Shares are entitled, at any time and from time to time, to convert each Class B Share into a Class A Subordinate Voting Share on a one-for-one basis.

The following table sets forth information with respect to the only shareholders known to the directors or officers of the Corporation to own beneficially, directly or indirectly, or exercise control or direction over, more

4

than 10% of the issued and outstanding Class A Subordinate Voting Shares or Class B Shares, as of the Record Date:

| | Class of Shares

| | Number of Shares

| | Percentage of Class

|

|---|

| Magna International Inc. (1) | | Class B | | 14,223,900 | | 100% |

- (1)

- 4,484,477 of these shares are held by 1128969 Ontario Inc., a wholly-owned subsidiary of Magna International Inc. ("Magna"). The Stronach Trust controls Magna through its right to direct the votes attached to 726,829 class B shares of Magna. Mr. Frank Stronach (the founder, chairman and a director of Magna) and Ms. Belinda Stronach (a director and the Chairman of the Corporation, and the President, Chief Executive Officer and a director of Magna), together with two other members of their family, are the trustees of the Stronach Trust. Mr. Stronach and Ms. Stronach are also two of the members of the class of potential beneficiaries of the Stronach Trust.

Magna International Inc. ("Magna") has advised the Corporation that it intends to vote its Class B Shares for the election of the management nominees named in this Circular as directors of the Corporation, for the re-appointment of Ernst & Young as the Auditors of the Corporation and the authorization of the Audit Committee of the Board to fix the Auditors' remuneration, and for the approval of the Stock Option Plan Amendment/Restatement.

BUSINESS TO BE TRANSACTED AT THE MEETING

Financial Statements and Auditors' Report

Management, on behalf of the Board, will submit to the shareholders at the Meeting the audited consolidated financial statements of the Corporation for the fiscal 2002 stub period, and the report of the Auditors thereon, but no vote by the shareholders with respect thereto is required or proposed to be taken. The audited consolidated financial statements and Auditors' report form part of the Corporation's Report to Shareholders which is being mailed to shareholders with the Notice and this Circular.

Election of Directors

Under the restated articles of incorporation of the Corporation, the Board is to consist of a minimum of three (3) and a maximum of fifteen (15) directors. A special resolution passed on July 31, 1995 authorizes the directors to determine the number of directors of the Corporation from time to time. Pursuant to that special resolution, the number of directors of the Corporation is currently fixed at seven (7). The term of office of each current director expires at the close of the Meeting unless successors are not elected, in which case the current directors remain in office until their successors are elected or appointed in accordance with applicable law and the Corporation's by-laws.

Management proposes to nominate, and the persons named in the accompanying form of proxy will vote for (in the absence of specific instructions to withhold or abstain from voting on the proxy), the election of the seven (7) persons whose names are set forth below, all of whom are now and have been directors of the Corporation for the periods indicated, but will not vote for a greater number of persons than the number of nominees named in the form of proxy.A shareholder may withhold his/her/its vote from any individual nominee by striking a line through the particular nominee's name in the form of proxy. Management does not contemplate that any of the nominees will be unable to serve as a director. If, as a result of circumstances not now contemplated, any nominee is unavailable to serve as a director of the Corporation, the proxy will be voted for the election of such other person or persons as management may select. Each director elected will hold office until the close of the next annual meeting of the shareholders of the Corporation or until his/her respective successor is elected or appointed in accordance with applicable law and the Corporation's by-laws.

The following table sets forth information with respect to each of the seven (7) management nominees for director, including the number of Class A Subordinate Voting Shares, Tesma deferred share units and Class B

5

Shares beneficially owned, directly or indirectly, or over which control or direction is exercised, by each such nominee, as of the Record Date:

Name and Address of Proposed Nominee

| | Age

| | Director Since

| | Other Positions and Offices Presently Held With the Corporation

| | Principal Occupation

| | Class A Subordinate Voting Shares/Per Cent of Class

| | Deferred Share Units (1)

| | Class B Shares/ Per Cent of Class

|

|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Manfred Gingl

Kettleby, Ontario | | 54 | | April 27, 1995 | | Vice Chairman and Chief Executive Officer | | Vice Chairman and Chief Executive Officer of the Corporation and Executive Vice Chairman, Magna International Inc. (auto parts manufacturer) | | 282,230/1.56% (2) | | Nil | | Nil |

Oscar B. Marx, III (3)

Laguna Beach, California | | 64 | | July 31, 1995 | | None | | Vice President, TMW Enterprises Inc. (private investment firm) | | 3,610 (4) (5) (6) | | 8,818.53 | | Nil |

Hon. David R. Peterson, P.C. (3) (7)

Toronto, Ontario | | 59 | | February 13, 2002 | | None | | Chairman, Cassels Brock & Blackwell LLP (Barristers and Solicitors) | | 2,000 (4) (6) | | 2,384.08 | | Nil |

Belinda Stronach (7)

Aurora, Ontario | | 36 | | December 12, 2001 | | None | | President and Chief Executive Officer, Magna International Inc. | | Nil | | Nil | | Nil (8) |

Judson D. Whiteside (3) (9)

Thornhill, Ontario | | 56 | | July 31, 1995 | | None | | Chairman and Chief Executive Officer, Miller Thomson LLP (Barristers and Solicitors) | | 5,010 (4) (6) (10) | | 5,125.67 | | Nil |

Siegfried Wolf

Weikersdorf, Austria | | 45 | | June 6, 2002 | | None | | Executive Vice Chairman, Magna International Inc. | | 1,000 (4) | | Nil | | Nil |

Hon. M. Douglas Young, P.C. (7) (9)

Ottawa, Ontario | | 62 | | July 31, 2002 | | None | | Chairman, Summa Strategies Canada Inc. (government relations agency) | | Nil (6) | | 1,740.81 | | Nil |

- (1)

- Granted pursuant to the Tesma International Inc. Non-Employee Director Share-Based Compensation Plan. See "Compensation of Directors and Executive Officers — Directors' Compensation — Directors' Deferred Compensation Plan" below.

- (2)

- 262,166 of these shares are held by Wahlheim Capital Inc., a company controlled by Mr. Gingl.

- (3)

- Member of the Audit Committee. See "Board of Directors and Committees of the Board" below.

- (4)

- These shares represent less than 1% of the class.

- (5)

- These shares are held by the OB Marx III Revocable Trust. Mr. Marx is the trustee for the OB Marx III Revocable Trust.

- (6)

- Each of Messrs. Marx and Whiteside also hold options to acquire 10,000 Class A Subordinate Voting Shares granted to them in their capacities as directors of the Corporation under the Tesma incentive stock option plan (the "Stock Option Plan") during fiscal 2000. Such options were granted for a term of ten years ending June 14, 2010, at an exercise price of $26.00, and vested as to 50% on the date of the grant (June 15, 2000) and the remaining 50% vested on August 1, 2001. Following their appointments as directors of the Corporation during fiscal 2002, each of Messrs. Peterson and Young were granted options to acquire 5,000 Class A Subordinate Voting Shares under the Stock Option Plan. Such options were granted for a term not exceeding ten years ending July 31, 2012, at an exercise price of $31.74, and vesting as to 50% on the date of the grant (August 21, 2002) with the remaining 50% vesting on August 1, 2003. Neither Ms. Stronach nor Mr. Wolf have been granted options to acquire Class A Subordinate Voting Shares. As to the options granted to Mr. Gingl (in his capacity as an officer of the Corporation) under the Stock Option Plan, see "Compensation of Directors and Executive Officers — Stock Option Plans, Grants and Exercises" below.

- (7)

- Member of the Human Resources and Compensation Committee. See "Board of Directors and Committees of the Board" below.

- (8)

- See "Voting Securities and Principal Holders" above.

- (9)

- Member of the Environmental, Health and Safety Committee. See "Board of Directors and Committees of the Board" below.

- (10)

- 600 of these shares are held by an associate of Mr. Whiteside.

All of the management nominees for director were elected to their present terms of office by the shareholders of the Corporation at the annual meeting held on December 5, 2002.

Each of the management nominees for director has held the principal occupation identified in the above table or another position with the same employer for the past five years. Ms. Stronach and Messrs. Gingl and Wolf are also directors of Magna. For biographical information relating to the Corporation's directors, please visit Tesma's website atwww.tesma.com.

There are no contracts, arrangements or understandings between any management nominee and any other person (other than the directors and officers of the Corporation acting solely in such capacity) pursuant to which the nominee has been or is to be elected as a director of the Corporation.

As of the Record Date, 1,622,236 Class A Subordinate Voting Shares, representing approximately 8.96% of the class, are held by the Tesma Canadian and U.S. Deferred Profit Sharing Plans (the "Tesma DPSPs"). Through his position as the President of the Corporation, Mr. Anthony E. Dobranowski retains the right to direct the trustees of the Tesma DPSPs in regards to voting and disposing of such shares. The trustees, absent any direction from Mr. Dobranowski, have the right to vote such shares. Mr. Dobranowski is not a beneficiary under the Tesma DPSPs.

Excluding the shares that Mr. Dobranowski may exercise control or direction over through the Tesma DPSPs and excluding the shares that Ms. Stronach may be deemed to own beneficially or exercise control or direction over as disclosed in footnote 8 to the above table, the directors and officers of the Corporation as a

6

group (13 persons) owned beneficially or exercised control or direction over 329,900 Class A Subordinate Voting Shares, or approximately 1.82% of the class, and no Class B Shares, as of the Record Date.

Re-Appointment of Auditors/Auditors' Remuneration

At the Meeting, the shareholders will be asked to re-appoint Ernst & Young as the Auditors of the Corporation, and both the Audit Committee and the Board recommend that the shareholders do so. Ernst & Young have served as the Auditors of Tesma and its predecessors since November 1987. The persons named in the accompanying form of proxy will, in the absence of specific instructions to withhold or abstain from voting on the proxy, vote for the re-appointment of Ernst & Young as the Auditors of the Corporation to hold office until the next annual meeting of shareholders of the Corporation and to authorize the Audit Committee of the Board to fix the Auditors' remuneration.

For a description of the fees billed to the Corporation by Ernst & Young for audit, audit related and non-audit services provided during the fiscal 2002 stub period, see "Board of Directors and Committees of the Board — Audit Committee — Auditors' Independence" below. Audit related services provided by Ernst & Young to the Corporation are generally closely linked to the performance of the audit of Tesma's financial statements or are recurring services that are typically performed by the external auditor. Non-audit services consist primarily of tax compliance and tax advisory services.

Representatives of Ernst & Young are expected to attend the Meeting and will have an opportunity to make a statement if they so desire. Such representatives are also expected to be available to respond to appropriate questions.

Stock Option Plan Amendment/Restatement

On July 19, 1995, Tesma adopted an incentive stock option plan (the "Stock Option Plan") in order to provide incentive stock options and, if specifically granted, stock appreciation rights in respect of its Class A Subordinate Voting Shares to eligible senior officers and employees of the Corporation and its subsidiaries. Effective October 24, 1996 and subject to shareholder approval (which was received on December 4, 1996), the Board authorized an amendment and restatement of the Stock Option Plan to: (a) extend the group of persons eligible to participate under the Stock Option Plan to include directors and persons engaged to provide management or consulting services to or for the benefit of the Corporation or its subsidiaries; and (b) specifically adopt, in the text of the Stock Option Plan, the provisions of section 630 of the rules of The Toronto Stock Exchange (the "TSX") on listed company incentive share arrangements, which effectively provide that, under the Stock Option Plan and any other share compensation arrangements of Tesma: (i) the number of shares reserved for issuance pursuant to stock options granted to insiders may not exceed 10% of Tesma's outstanding shares; (ii) the number of shares issued to insiders, within a one-year period, may not exceed 10% of Tesma's outstanding shares; or (iii) the number of shares issued to any one insider and that insider's associates, within a one-year period, may not exceed 5% of Tesma's outstanding shares. Effective June 15, 2000, the Board authorized a further amendment and restatement of the Stock Option Plan to enable members of the Human Resources and Compensation Committee (which is responsible for the administration of the Stock Option Plan) to become eligible, together with the other directors of the Corporation, to participate in the Stock Option Plan, and to permit the transfer of options by participants under the Stock Option Plan to their family members, registered retirement savings plans, family trusts or controlled corporations in accordance with the applicable policies of the TSX.

The option price for options granted under the Stock Option Plan is to be established at the time of the grant, but cannot be less than the closing price of the Class A Subordinate Voting Shares on the TSX (with respect to options denominated in Canadian dollars) or on the NASDAQ National Market (with respect to options denominated in U.S. dollars) on the trading day immediately prior to the date of the grant. Each option is exercisable in such manner as may be determined at the time of the grant, and options granted are for terms not exceeding ten years. Under the Stock Option Plan, the Corporation does not provide any financial assistance to participants in order to facilitate the purchase of Class A Subordinate Voting Shares thereunder.

The maximum number of shares for which options and stock appreciation rights may be granted under the Stock Option Plan was, up to March 24, 2003, 3,000,000 Class A Subordinate Voting Shares, subject to

7

certain customary anti-dilutive adjustments. On March 24, 2003, the Board authorized an amendment and restatement of the Stock Option Plan to increase the maximum number of Class A Subordinate Voting Shares issuable thereunder from 3,000,000 to 4,000,000, subject to the receipt of any required regulatory and other approvals (including approval by the shareholders of the Corporation at the Meeting). In its deliberations, the Board took into account a number of factors, including the following:

- •

- the Stock Option Plan is the only share compensation arrangement under which the Corporation may grant options;

- •

- the 3,000,000 Class A Subordinate Voting Shares reserved for issuance under the Stock Option Plan (unchanged since Tesma's initial public offering on July 31, 1995) represent 9.28% of Tesma's issued and outstanding Class A Subordinate Voting Shares and Class B Shares ("Tesma's Outstanding Shares") as at March 24, 2003;

- •

- from July 31, 1995 to March 24, 2003, options to purchase 1,740,150 Class A Subordinate Voting Shares were either exercised or surrendered/cancelled for consideration, thereby reducing the number of Class A Subordinate Voting Shares available for issuance under the Stock Option Plan by the same amount;

- •

- as at March 24, 2003, options to purchase 1,249,850 Class A Subordinate Voting Shares were outstanding, thereby leaving only 10,000 Class A Subordinate Voting Shares available for the grant of additional options under the Stock Option Plan;

- •

- Tesma's compensation philosophy for management of the Corporation includes low base salaries, standard basic benefits, "at risk" incentive compensation, long-term incentives and mandatory stock ownership (see "Compensation of Directors and Executive Officers — Human Resources and Compensation Committee - - Report on Executive Compensation" below);

- •

- as part of long-term incentives, stock option grants are used to encourage option recipients to remain as employees or officers of Tesma over the long-term; option grants are also considered annually for members of Tesma's management and other employees based on their respective performance/contribution to Tesma during the preceding completed fiscal period;

- •

- the increase of 1,000,000 shares (the "Additional Shares") to the maximum number of Class A Subordinate Voting Shares issuable under the Stock Option Plan represents approximately 3.09% of Tesma's Outstanding Shares as at March 24, 2003;

- •

- together with the 10,000 Class A Subordinate Voting Shares available for the grant of options under the Stock Option Plan, the Additional Shares will make 1,010,000 Class A Subordinate Voting Shares available under the Stock Option Plan or approximately 3.12% of Tesma's Outstanding Shares as at March 24, 2003; and

- •

- together with the 10,000 Class A Subordinate Voting Shares available for the grant of options and the 1,249,850 outstanding options under the Stock Option Plan, the Additional Shares will make a total of 2,259,850 Class A Subordinate Voting Shares available under the Stock Option Plan or approximately 6.99% of Tesma's Outstanding Shares as at March 24, 2003.

The full text of the resolution approving the Stock Option Plan Amendment/Restatement is attached to this Circular as Schedule "A", with the Stock Option Plan as amended and restated attached to this Circular as Schedule "B" (the "2003 Amended and Restated Incentive Stock Option Plan").

Following the approval of the Stock Option Plan Amendment/Restatement, the 2003 Amended and Restated Incentive Stock Option Plan will, effective as of March 24, 2003, permit the Corporation to grant additional options (and stock appreciation rights) for up to 1,010,000 Class A Subordinate Voting Shares (or

8

3.12% of Tesma's outstanding Class A Subordinate Voting Shares and Class B Shares as at March 24, 2003), determined as follows:

| maximum number of Class A Subordinate Voting Shares available | | 4,000,000 | |

| options to purchase Class A Subordinate Voting Shares exercised or surrendered/cancelled for consideration | | (1,740,150 | ) |

| options to purchase Class A Subordinate Voting Shares granted and outstanding | | (1,249,850 | ) |

| | |

| |

| Net balance available | | 1,010,000 | |

| | |

| |

The rules of the TSX require that an amendment to the maximum number of shares issuable under a stock option plan be approved by the shareholders at a meeting of shareholders. Accordingly, in order to approve the Stock Option Plan Amendment/Restatement, the resolution attached as Schedule "A" must be passed by a simple majority of the votes cast by the Corporation's shareholders who vote in respect of such resolution at the Meeting. Upon the passage of such resolution, the 2003 Amended and Restated Incentive Stock Option Plan shall become effective as of March 24, 2003. The Board recommends that shareholders vote in favour of the Stock Option Plan Amendment/Restatement. The persons named in the accompanying form of proxy will, in the absence of specific instructions to vote against or withhold or abstain from voting on the proxy, vote for the approval of the Stock Option Plan Amendment/Restatement.

BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD

The Board oversees the business and affairs of the Corporation, supervises the day-to-day conduct of business by senior management, establishes or approves overall corporate policies where required and involves itself jointly with management in the creation of shareholder value, the preservation and protection of the Corporation's assets and the establishment of the Corporation's strategic direction. For these purposes, the Board holds regularly scheduled meetings on a fiscal quarterly basis, with additional meetings held as required. A separate strategic planning and business plan review meeting is held at, or prior to, the commencement of each fiscal year. There were four meetings of the Board during the fiscal 2002 stub period. In addition, there is ongoing communication between senior management and Board members on an informal basis and through Committee meetings.

To assist in the discharge of its responsibilities, the Board has established three standing committees — the Human Resources and Compensation Committee, the Environmental, Health and Safety Committee and the Audit Committee — and prescribed the responsibilities and mandates or charters of each such Committee. From time to time, the Board also establishes special committees composed entirely of independent directors (i.e. "outside" or non-management and "unrelated directors" within the meaning of the TSX Corporate Governance Guidelines (the "TSX Guidelines") — see "Report on Corporate Governance" below) to review and make recommendations on specific business matters, including related party transactions. See, for example, "Interests of Management and Other Insiders in Certain Transactions - Sale/Leaseback Transaction with Magna" below. Each such special committee operates pursuant to written guidelines or the mandate set out in the Board resolutions establishing such special committee.

Human Resources and Compensation Committee

The Human Resources and Compensation Committee is comprised of three directors: Ms. Stronach (Chairman) and Messrs. Peterson and Young, all of whom are "outside" or non-management directors and, with the exception of Ms. Stronach, are "unrelated directors" within the meaning of the TSX Guidelines. In accordance with its mandate, the Human Resources and Compensation Committee meets as required to review and make recommendations to the Board with respect to all direct and indirect compensation, benefits and perquisites (cash and non-cash) for Executive Management of the Corporation (i.e. the President and any other individual employed by Tesma that the Board determines to be a member of Executive Management) and to review the compensation, benefits and perquisites of other members of Corporate Management (i.e. Executive Management and any other individual employed by Tesma that the Board determines to be a

9

member of Corporate Management) and/or senior officers of the Corporation. The Human Resources and Compensation Committee also reviews and approves the disclosure relating to the compensation of directors and officers of the Corporation contained in this Circular (and, if applicable, in other documents prior to their distribution to Tesma's shareholders), prepares the Report on Executive Compensation contained herein, administers the Stock Option Plan and performs such other functions as requested or delegated by the Board. See "Compensation of Directors and Executive Officers — Human Resources and Compensation Committee — Report on Executive Compensation" below. The Human Resources and Compensation Committee met twice during the fiscal 2002 stub period.

Environmental, Health and Safety Committee

The Environmental, Health and Safety Committee is comprised of two directors: Messrs. Young (Chairman) and Whiteside, both of whom are "outside" or non-management directors and "unrelated directors" within the meaning of the TSX Guidelines. In accordance with its mandate, the Environmental, Health and Safety Committee meets periodically to review, make recommendations and advise the Board with respect to environmental and occupational health and safety matters affecting the Corporation and its operating divisions. The Committee has oversight responsibilities over the Corporation's Health, Safety and Environmental Policy, including the periodic review of such Policy and, if deemed necessary, the recommendation to the Board for amendments or changes thereto. The Committee is also responsible for the review of the management systems in place for environmental and workplace health and safety matters, including the scheduled inspection and audit programs and other controls maintained by Tesma for its operating divisions. As the Environmental, Health and Safety Committee was only established as a standing committee of the Board in February 2003, it did not meet during the fiscal 2002 stub period. Prior to February 2003, management formally reported to the full Board on all material environmental and occupational health and safety matters affecting Tesma and its operating divisions.

Audit Committee

The Audit Committee is comprised of three directors: Messrs. Whiteside (Chairman), Marx and Peterson, all of whom are "outside" or non-management directors and "unrelated directors" within the meaning of the TSX Guidelines. The Audit Committee operates under the Corporation's by-laws, applicable law and in accordance with the Audit Committee Charter. The Committee has general authority in relation to the Corporation's financial affairs, as well as the specific responsibility to: review and approve all fees paid to the Corporation's Auditors; review the Corporation's quarterly and annual financial statements (including management's discussion and analysis of financial condition and results of operations) and report thereon to the Board; and evaluate the performance, review the independence and make recommendations to the Board as to the annual appointment or re-appointment of the Auditors of the Corporation. The Audit Committee also has certain additional responsibilities relating to internal and external audits, oversight of management reporting on internal controls and procedures, the selection and application of significant accounting principles, financial reporting and integrity, risk assessment, relations with the Auditors and other matters. Amendments to the Audit Committee Charter are currently under review by the Audit Committee and the Board to take into consideration the various corporate governance initiatives and audit committee reforms being contemplated, adopted and/or refined by securities regulatory authorities in Canada and the United States. As and when a revised Audit Committee Charter is approved by the Board, it will be disseminated as an attachment or appendix to a future management information circular. (The current Audit Committee Charter was adopted effective June 14, 2000 and was set out as an attachment to the Corporation's management information circular/proxy statement dated October 20, 2000). The Audit Committee met four times during the fiscal 2002 stub period with management and representatives of Ernst & Young. The Audit Committee also met with, and received reports on the activities of, the providers of internal audit services of the Corporation.

Auditors' Independence

The Audit Committee discusses with Ernst & Young, as the Auditors of the Corporation, their independence from management and the Corporation, and considers any services (other than audit and audit

10

related services or tax compliance and tax advisory services) intended to be provided by Ernst & Young to the Corporation. There were no such additional services contemplated or provided by Ernst & Young during the fiscal 2002 stub period. During calendar 2003, the Audit Committee intends to establish a process for the review and pre-approval of all services and related fees to be paid by the Corporation to Ernst & Young.

The aggregate fees billed by Ernst & Young for audit and audit related services provided to Tesma during the fiscal 2002 stub period were approximately $0.4 million, including performance of the audit for the five-month period ended December 31, 2002, attendance at quarterly Audit Committee meetings and the provision of related information and reports. The aggregate fees billed by Ernst & Young for non-audit services provided to Tesma during the fiscal 2002 stub period were approximately $0.1 million, substantially all of which were for tax compliance and tax advisory services (including transfer pricing assistance). During the fiscal 2002 stub period, Ernst & Young did not provide any consulting services to the Corporation or services relating to the design or implementation of the Corporation's financial information systems.

Audit Committee Report

In connection with the audited consolidated financial statements of the Corporation for the fiscal 2002 stub period, the Audit Committee has:

- (i)

- reviewed and discussed the audited consolidated financial statements with Tesma's senior management;

- (ii)

- discussed with Ernst & Young the matters required to be discussed by the Canadian Institute of Chartered Accountants and the U.S. Statement of Auditing Standards No. 61 (Communication with Audit Committees), as amended;

- (iii)

- received and reviewed with Ernst & Young the written disclosures and related letter required by the Canadian Institute of Chartered Accountants and U.S. Independence Standards Board Standard No. 1 (Independence Discussion with Audit Committees), as amended, discussed with Ernst & Young their independence as Auditors of the Corporation, and accepted Ernst & Young's confirmation of such independence; and

- (iv)

- reviewed with Ernst & Young its report to shareholders on the consolidated financial statements.

Management is responsible for the Corporation's internal controls and the financial reporting process. Ernst & Young are responsible for performing an independent audit on the Corporation's consolidated financial statements in accordance with Canadian generally accepted auditing standards and United States generally accepted auditing standards, and issuing an auditors' report thereon. The Audit Committee's responsibility is to monitor and oversee these processes in accordance with its mandate (the Audit Committee Charter).

Based on the reviews and discussions above, the Audit Committee has recommended to the Board, and the Board has approved, the inclusion of the audited consolidated financial statements in the Tesma Report to Shareholders, and other forms and reports required to be filed by the Corporation with the applicable Canadian securities regulatory authorities, the United States Securities and Exchange Commission and the applicable stock exchanges in respect of the fiscal 2002 stub period.

The members of the Audit Committee have approved the contents of this report and its inclusion in this Circular.

The foregoing report is dated as of March 24, 2003 and is submitted by the Tesma Audit Committee.

| Judson D. Whiteside (Chairman) | Oscar B. Marx, III | David R. Peterson |

11

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

Summary Compensation Table

The following table (the "Summary Compensation Table") sets forth a summary of all annual, long-term and other compensation earned for services in all capacities to the Corporation, its subsidiaries and other entities in which the Corporation has an interest, during the fiscal 2002 stub period and the last three completed fiscal years, in respect of individuals who were, as of December 31, 2002, the Chief Executive Officer and the four other most highly compensated executive officers (collectively, the "Named Executive Officers") of the Corporation.

|

|---|

| |

| | Annual Compensation

| | Long-Term Compensation Awards

| |

|

|---|

Name and Principal Position

| | Financial Year

| | Salary

| | Bonus (1)

| | Other Annual Compensation

| | Securities Under Options Granted

| | All Other Compensation

|

|---|

|

Manfred Gingl (2)

Vice Chairman and

Chief Executive Officer |

|

2002 Stub (3)

2002

2001

2000 |

|

$—

$177,000

$221,000

$200,000 |

|

$—

$1,079,038

$1,446,741

$1,482,949 |

|

—

(4)

(4)

(4) |

|

—

Nil

Nil

200,000 |

|

|

—

Nil

Nil

Nil |

|

Anthony E. Dobranowski

President and Chief Financial Officer |

|

2002 Stub (3)

2002

2001

2000 |

|

$ 72,516

$147,591

$108,750

$100,000 |

|

$ 394,356

$ 817,076

$ 723,370

$ 741,475 |

|

(4)

(4)

(4)

(4) |

|

Nil

Nil

30,000

115,000 |

|

|

Nil

Nil

Nil

Nil |

|

Paul Manners (6)

Executive Vice President and

Chief Operating Officer |

|

2002 Stub (3)

2002

2001

2000 |

|

$ 72,516

$131,875

$107,000

$100,000 |

|

$ 157,743

$ 345,031

$ 132,752

$ 100,000 |

|

(4)

(4)

(4)

(4) |

|

20,000

Nil

10,000

1,000 |

|

|

Nil

Nil

Nil

Nil |

|

Pasquale Cerullo (7)

Executive Vice President, Sales, Marketing and Corporate Development |

|

2002 Stub (3)

2002

2001

2000 |

|

U.S.$ 41,668

U.S.$117,000

U.S.$100,000

U.S.$100,000 |

|

U.S.$ 167,420

U.S.$ 440,190

U.S.$ 281,870

U.S.$ 302,881 |

|

(4)

(4)

(4)

(4) |

|

Nil

Nil

25,000

42,500 |

|

U.S.$

U.S.$

U.S.$

U.S.$ |

6,250

16,500

16,500

16,500 |

|

James L. Moulds (8)

Vice President, Finance and Treasurer |

|

2002 Stub (3)

2002

2001

2000 |

|

$ 57,083

$137,000

$107,000

$100,000 |

|

$ 157,743

$ 436,331

$ 345,517

$ 226,993 |

|

(4)

(4)

(4)

(4) |

|

Nil

Nil

17,500

25,000 |

|

|

Nil

Nil

Nil

Nil |

|

- (1)

- Incentive bonuses that are directly related to the performance of the Corporation. See "Employment Contracts" below.

- (2)

- Mr. Gingl was appointed as Vice Chairman of the Corporation (relinquishing the title of President of the Corporation) effective May 6, 2002. He retains his position as Chief Executive Officer of the Corporation but, since May 1, 2002, 100% of his compensation arrangements (including base salary, annual cash bonus and fringe benefits) have been borne by Magna (in his capacity as Executive Vice Chairman of Magna). See "Employment Contracts" below.

- (3)

- 2002 Stub is the five-month period ended December 31, 2002.

- (4)

- Perquisites and other personal benefits do not exceed the lesser of $50,000 and 10% of the total of the annual salary and bonus for the designated Named Executive Officer for such fiscal year.

- (5)

- Mr. Dobranowski was appointed as President of the Corporation (relinquishing the title of Executive Vice President of the Corporation) effective May 6, 2002. He retains his position as the Chief Financial Officer of the Corporation. See "Employment Contracts" below.

- (6)

- Mr. Manners was appointed as Executive Vice President and Chief Operating Officer of the Corporation effective May 6, 2002. Prior to that time, Mr. Manners served in various operational positions within the Corporation, including tenures as a plant manager, divisional general manager, group general manager and, most recently, as group vice president, operations for the Corporation's Fuel Technologies group. The amounts set out in the Summary Compensation Table for each of the fiscal

12

2002 stub period and fiscal 2002, 2001 and 2000 represent 100% of the compensation received by Mr. Manners from the Corporation in the fiscal 2002 stub period and each such full fiscal year. See "Employment Contracts" below.

- (7)

- Mr. Cerullo was appointed as Executive Vice President, Sales, Marketing and Corporate Development of the Corporation (relinquishing the title of Vice President, Sales and Marketing) effective March 6, 2002. Mr. Cerullo was not directly employed or compensated by the Corporation during the fiscal 2002 stub period or any of fiscal 2002, 2001 or 2000, but was employed and compensated by a Detroit-based sales representation company. During the fiscal 2002 stub period and the last three completed fiscal years, Mr. Cerullo performed services on behalf of Tesma, and the amounts set out in the Summary Compensation Table for each of the fiscal 2002 stub period and fiscal 2002, 2001 and 2000 represent 100% of Mr. Cerullo's compensation paid by the sales representation company in the fiscal 2002 stub period and each such full fiscal year. See "Employment Contracts" below.

- (8)

- Mr. Moulds was appointed as Treasurer of the Corporation (relinquishing the title of Controller of the Corporation) effective September 19, 2002. He retains his position as Vice President, Finance of the Corporation. See "Employment Contracts" below.

Stock Option Plans, Grants and Exercises

For a description of the Corporation's Stock Option Plan, see "Business to be Transacted at the Meeting — Stock Option Plan Amendment/Restatement" above.

As at December 31, 2002, options to purchase an aggregate of 1,249,850 Class A Subordinate Voting Shares were outstanding under the Stock Option Plan. The outstanding options have exercise prices of $10.50 per share (for 140,000 options), $17.25 per share (for 65,500 options), $19.00 per share (for 57,000 options), $21.70 per share (for 10,000 options), $22.50 per share (for 60,000 options), $26.00 per share (for 440,350 options), $26.45 per share (for 300,000 options), $29.40 per share (for 132,500 options) and $31.74 per share (for 44,500 options) and have expiration dates of July 30, 2005 (for 80,000 options), July 31, 2006 (for 60,000 options), July 31, 2007 (for 70,000 options), July 31, 2008 (for 65,500 options), July 31, 2009 (for 57,000 options), June 14, 2010 (for 440,350 options), July 31, 2010 (for 432,500 options) and July 31, 2012 (for 44,500 options).

No stock appreciation rights or options to purchase securities of the Corporation or its subsidiaries were granted to any of the Named Executive Officers during the fiscal 2002 stub period.

The following table sets forth certain information with respect to the options exercised or surrendered by the Named Executive Officers during the fiscal 2002 stub period, the aggregate number of unexercised options granted to the Named Executive Officers that were outstanding on December 31, 2002, and the value of such unexercised in-the-money options at such date:

|

|---|

Aggregate Option Exercises During the Five-Months Ended December 31, 2002 and Fiscal 2002 Stub Period Year-End Option Values

|

|---|

| |

| |

| | Unexercised Options at December 31, 2002

| | Value of Unexercised In-the-Money Options at December 31, 2002 (2)

|

|---|

Name

| | Class A Subordinate Voting Shares Acquired on Exercise

(#)

| | Aggregate Value Realized on Exercise (1)

($)

| | Exercisable

(#)

| | Unexercisable

(#)

| | Exercisable

($)

| | Unexercisable

($)

|

|---|

|

| Manfred Gingl | | 34,000 | | $ | 569,160 | | 120,000 | | 80,000 | | $ | 148,800 | | $ | 99,200 |

|

| Anthony E. Dobranowski | | Nil | | | Nil | | 225,000 | | 55,000 | | $ | 1,852,430 | | $ | 74,320 |

|

| Paul Manners | | Nil | | | Nil | | 10,600 | | 20,400 | | $ | 744 | | $ | 496 |

|

| Pasquale Cerullo | | Nil | | | Nil | | 126,500 | | 23,500 | | $ | 1,186,885 | | $ | 41,240 |

|

| James L. Moulds | | Nil | | | Nil | | 17,500 | | 15,000 | | $ | 40,180 | | $ | 23,920 |

|

- (1)

- Based on the difference between the closing trading price of the Class A Subordinate Voting Shares on the TSX on the trading day immediately preceding the date of exercise and the exercise price of the related options, multiplied by the number of options exercised by the Named Executive Officer.

- (2)

- Based on the difference between the closing trading price of the Class A Subordinate Voting Shares on the TSX on December 31, 2002 (being $27.24) and the exercise price of the related options, multiplied by the number of options held by the Named Executive Officer.

Pension Plans

None of the officers of the Corporation or its subsidiaries, including the Named Executive Officers, participate in any Magna or Corporation-provided pension plans.

13

Employment Contracts

On October 30, 2002, the Board elected Ms. Stronach as Chairman of the Corporation following the resignation of Mr. Frank Stronach as the Chairman and a director of the Corporation effective October 28, 2002. The Chairman of the Corporation is a non-executive position and, accordingly, Ms. Stronach (and Mr. Stronach previously) is not employed by, has no employment contract with, and receives no direct remuneration from, Tesma.

The Corporation has not entered into an employment contract with Mr. Gingl in connection with his position as Vice Chairman and Chief Executive Officer of Tesma. Since May 1, 2002, 100% of Mr. Gingl's compensation arrangements (including base salary, annual cash bonus and fringe benefits) have been borne by Magna.

The Corporation entered into an employment contract with Mr. Dobranowski in his capacity as President and Chief Financial Officer of Tesma commencing May 1, 2002 and continuing until terminated in accordance with its provisions. For the fiscal 2002 stub period, Mr. Dobranowski's employment contract provides for a base salary of U.S.$110,500 per annum (being the U.S. dollar equivalent of Canadian $173,400 per annum, converted at the average of the monthly average exchange rates during the fiscal 2002 stub period), an annual cash bonus based on a specified percentage of Tesma's adjusted pre-tax profits, the ownership of a minimum number of Class A Subordinate Voting Shares, as well as confidentiality obligations and non-competition restrictions. Mr. Dobranowski's employment contract further provides that his employment may be terminated by the Corporation either by giving advance written notice of termination for a prescribed period of time or by paying severance in lieu thereof. No notice or severance payment is required for a termination for just cause or upon Mr. Dobranowski's voluntary resignation.

The Corporation entered into an employment contract with Mr. Manners in his capacity as Executive Vice President and Chief Operating Officer of Tesma commencing May 1, 2002 and continuing until terminated in accordance with its provisions. For the fiscal 2002 stub period, Mr. Manners' employment contract provides for a base salary of U.S.$110,500 per annum (being the U.S. dollar equivalent of Canadian $173,400 per annum, converted at the average of the monthly average exchange rates during the fiscal 2002 stub period), an annual cash bonus based on a specified percentage of Tesma's adjusted pre-tax profits, the ownership of a minimum number of Class A Subordinate Voting Shares, as well as confidentiality obligations and non-competition restrictions. Mr. Manners' employment contract further provides that his employment may be terminated by the Corporation either by giving advance written notice of termination for a prescribed period of time or by paying severance in lieu thereof. No notice or severance payment is required for a termination for just cause or upon Mr. Manners' voluntary resignation.

Mr. Cerullo serves as Executive Vice President, Sales, Marketing and Corporate Development of Tesma. Mr. Cerullo has not entered into an employment contract with, nor did he receive any direct remuneration from, the Corporation during the fiscal 2002 stub period (see footnote 7 to the Summary Compensation Table above).

The Corporation entered into an employment contract with Mr. Moulds in his capacity as Vice President, Finance and Controller of Tesma commencing September 16, 1999 and continuing until terminated in accordance with its provisions. Effective September 19, 2002, Mr. Moulds relinquished his title of Controller and was named Treasurer of the Corporation. Mr. Moulds' employment contract continues to apply in his new capacity as Vice President, Finance and Treasurer of the Corporation. For the fiscal 2002 stub period, Mr. Moulds' employment contract provides for a base salary of $137,000 per annum, an annual cash bonus based on a specified percentage of Tesma's adjusted pre-tax profits, the ownership of a minimum number of Class A Subordinate Voting Shares, as well as confidentiality obligations and non-competition restrictions. Mr. Moulds' employment contract further provides that his employment may be terminated by the Corporation either by giving advance written notice of termination for a prescribed period of time or by paying severance in lieu thereof. No notice or severance payment is required for a termination for just cause or upon Mr. Moulds' voluntary resignation.

No payments are required to be made under any current employment contracts with the Named Executive Officers in the event of a change in the control of the Corporation. The maximum total amount

14

payable by the Corporation pursuant to such contracts for severance is approximately $2.4 million in the aggregate, plus any annual bonus entitlement pro rated to the date of termination.

Directors' Compensation

Directors' Fees

For the fiscal 2002 stub period, each director who was neither an employee of the Corporation nor a director or an officer of Magna (an "Eligible Director") was paid (or was eligible to be paid) as remuneration for his services as a director of the Corporation, the amounts set out below:

| Annual Board Retainer (total) | | $ | 22,500 |

| | Cash (maximum) | | $ | 17,500 |

| | Class A Subordinate Voting Shares(1) (minimum) | | $ | 5,000 |

Annual Committee Retainer |

|

$ |

2,500 |

Annual Committee Chair Retainer |

|

$ |

5,000 |

Per Meeting Fee (Board and Committee) |

|

$ |

1,000 |

Written Resolutions Fee (per resolution) |

|

$ |

250 |

Board/Committee Work Day Fee |

|

$ |

1,000 |

Travel Day Fee(2) |

|

$ |

1,000 |

- (1)

- Also payable in Tesma deferred share units.

- (2)

- Eligible Directors are also entitled to be reimbursed for travelling and other expenses incurred by them in attending meetings of the Board or any Committee.

In February 2003, the Board approved an amendment to the compensation payable to Eligible Directors to adjust such compensation to competitive levels and to reflect the responsibilities and risks involved in serving as a Board member, including the increasing demands being placed on directors' time and attention in general. Consistent with the change in the Corporation's financial reporting currency to the U.S. dollar, commencing January 1, 2003 each Eligible Director will be paid (or eligible to be paid) as remuneration for his services as a director of the Corporation, the amounts set out below:

| Annual Board Retainer (total) | | U.S.$ | 20,000 |

| | Cash (maximum) | | U.S.$ | 15,000 |

| | Class A Subordinate Voting Shares(1) (minimum) | | U.S.$ | 5,000 |

Annual Committee Retainer |

|

U.S.$ |

2,500 |

Annual Committee Chair Retainer |

|

|

|

| | Audit/Compensation Committees | | U.S.$ | 8,000 |

| | Environmental/Other Committees | | U.S.$ | 4,000 |

Per Meeting Fee (Board and Committee) |

|

U.S.$ |

1,000 |

Written Resolutions Fee (per resolution) |

|

U.S.$ |

250 |

Board/Committee Work Day Fee |

|

U.S.$ |

1,500 |

Travel Day Fee(2) |

|

U.S.$ |

1,500 |

- (1)

- Also payable in Tesma deferred share units.

- (2)

- Eligible Directors are also entitled to be reimbursed for travelling and other expenses incurred by them in attending meetings of the Board or any Committee.

15

Eligible Directors are subject to a minimum maintenance (hold) requirement in respect of any Class A Subordinate Voting Shares received from the Corporation as payment for their services as directors of the Corporation. This maintenance requirement encourages director investment in the Corporation by requiring such directors to accumulate, during their tenures as directors (in minimum annual increments of $5,000 or, commencing January 1, 2003, $5,000 U.S.), Class A Subordinate Voting Shares having a minimum market value of $50,000 (or, commencing January 1, 2003, $30,000 U.S.). The market value of any deferred share units credited to the director pursuant to the non-employee director share-based compensation plan (see "Directors' Deferred Compensation Plan" below) also applies to this $50,000 (or, commencing January 1, 2003, $30,000 U.S.) minimum maintenance requirement.

The total amount of directors fees paid to (or deferred by) Eligible Directors during the fiscal 2002 stub period was $106,208 (excluding expense reimbursements).

Directors' Deferred Compensation Plan

Effective January 1, 1999, Tesma established a non-employee director share-based compensation plan (the "Plan") which provides Eligible Directors with a choice to defer up to 100% (in increments of 25%, 50%, 75% or 100%) of their total annual remuneration as directors from Tesma (including Board and Committee retainers, Committee chair retainers, meeting attendance fees, written resolution fees and work and travel day fees), until the director ceases to be a director of the Corporation for any reason. The amounts deferred are reflected in deferred share units allocated under the Plan, each of which has an initial value equal to the market value of a Class A Subordinate Voting Share at the time that the particular payment(s) to the director would become payable. The value of a deferred share unit appreciates (or depreciates) with increases (or decreases) in the market price of the Class A Subordinate Voting Shares, and the Plan also takes into account any dividends paid on the Class A Subordinate Voting Shares. If an Eligible Director elects to participate in the Plan, the requirement to be paid a portion of the annual Board retainer (minimum of $5,000) in Class A Subordinate Voting Shares ceases to apply. Under the Plan, when an Eligible Director leaves the Board, he receives (within a prescribed period of time) a cash payment equal to the then value of his accrued deferred share units, net of withholding taxes. As of the Record Date, Messrs. Marx, Peterson, Whiteside and Young (all of whom are Eligible Directors) have elected to participate in the Plan. For details as to the number of deferred share units held by each Eligible Director as of the Record Date, see "Business to be Transacted at the Meeting — Election of Directors" above.

Human Resources and Compensation Committee

For a discussion of the composition and mandate of the Human Resources and Compensation Committee, see "Board of Directors and Committees of the Board — Human Resources and Compensation Committee" above.

Report on Executive Compensation

Tesma has adopted the organizational and operating policies and principles utilized by Magna for many years, certain of which have been embodied in the Corporate Constitution. See "Report on Corporate Governance — Corporate Constitution" below. Tesma's Corporate Constitution attempts to balance the interests of shareholders, employees and management by specifically defining the rights of employees (including management) and investors to participate in the Corporation's profits and growth, and reflects certain operational and compensation philosophies which align employee (including management) and shareholder interests. These philosophies and the Corporate Constitution assist in maintaining an entrepreneurial environment or culture at Tesma which encourages flexibility, productivity, ingenuity and innovation. Two key elements of this entrepreneurial culture are an emphasis on decentralization, which provides management with a high degree of autonomy at all levels of operation, as well as direct participation in profits by eligible employees (including variable, incentive-based compensation for management), who are also shareholders of the Corporation (either directly or indirectly by virtue of participation in the Tesma DPSPs). It is Tesma's objective to maintain its entrepreneurial culture. Accordingly, the Corporation intends to continue to apply its established compensation philosophies, which have been essential to its ability to attract,

16

retain and motivate skilled, entrepreneurial employees at all levels of the Tesma organization, while assisting in the alignment of the interests of the Corporation's shareholders and employees.

Consistent with the Corporate Constitution, certain managers who have senior operational or corporate responsibilities receive a remuneration package consisting of a base salary (which is generally lower than comparable industry standards) and an annual incentive bonus based on direct profit participation at the operating or corporate level at which such manager is involved. All other qualifying employees participate in 10% of the Corporation's "Employee Pre-Tax Profits Before Profit Sharing" (as defined in the Corporate Constitution) under the Tesma Employee Equity Participation and Profit Sharing Program which fosters employee participation in the profits and share ownership of Tesma and consists of a deferred profit sharing component (which is invested primarily in Class A Subordinate Voting Shares) and an annual cash distribution. As of the date of this report, the deferred profit sharing component of the Tesma Employee Equity Participation and Profit Program holds approximately 9% of the outstanding Class A Subordinate Voting Shares.

The Human Resources and Compensation Committee, in accordance with its mandate, considers and applies the historical operating philosophies and policies of the Corporation, including its Corporate Constitution, direct profit participation, mandatory stock ownership and the use of stock options granted under the Stock Option Plan, to align the interests of management and shareholders and to create shareholder value. The Human Resources and Compensation Committee, therefore, applies the following criteria in determining or reviewing recommendations for compensation for management, including where applicable, the executive officers of the Corporation:

Base Salaries. Base salaries should generally be below base salaries for comparable positions within North American industrial companies (including the automotive parts supplier industry) and are not customarily increased on an annual basis. As a result, fixed compensation costs are contained or reduced, with financial rewards coming principally from variable incentive compensation.

Incentive Compensation. The amount of direct profit participation and, therefore, the amount of compensation "at risk" increases with the level of performance and/or responsibility. In many cases, the incentive-based compensation component for operational and corporate management represents the majority of an individual's total compensation package. Variable incentive cash compensation for the fiscal 2002 stub period paid to the Named Executive Officers represented, on average, more than 75% of such individuals' total cash compensation and reflects the financial performance (and the overall performance of management) during the fiscal 2002 stub period. Due to the variable nature of profit participation, incentive cash compensation is generally reduced in cyclical or other down periods due to reduced profits. As a result, management (including Tesma's executive officers) are encouraged to emphasize consistent profitability over the medium to long-term to sustain stable levels of annual compensation. Under the Corporate Constitution, the aggregate incentive bonuses paid and payable to Corporate Management (which includes the Named Executive Officers) in respect of any fiscal year shall not exceed 6% of the Corporation's "Pre-Tax Profits Before Profit Sharing" (as defined in the Corporate Constitution) for such year.

Long-Term Incentives. Minimum stock ownership in the Corporation is generally required of all profit participators (including executive officers) in order to align their interests with those of shareholders and to encourage the enhancement of shareholder value. In addition, upon the grant of options under the Stock Option Plan, extended vesting and exercise periods (of up to 5 and 10 years, respectively) are frequently used to encourage option recipients to remain as employees or officers of Tesma over the long-term, thereby promoting management stability.

Written Employment Contracts. The Corporation extensively utilizes written employment contracts with its executive and senior officers and members of group or divisional management to reflect the terms of their respective employment, including compensation, severance, stock ownership, confidentiality and non-competition arrangements. Prior to the entry into, renewal and/or material amendment of employment contracts with executive or senior officers of the Corporation, the Human Resources and Compensation Committee reviews such officer's compensation in the context of Tesma's historical compensation philosophies and policies, such officer's individual performance and relevant industry

17

comparators, with the objective of ensuring that the compensation payable to such officer is, in the circumstances, commensurate with the Corporation's performance and is primarily "at risk". The fiscal 2002 stub period annual, long-term and other compensation referred to in the Summary Compensation Table for the Named Executive Officers properly reflects the compensation and benefits provided to them under their respective employment contracts.

Tesma believes that its continued growth, superior financial returns and growth in shareholder value justify meaningful financial rewards for its executive and senior officers which are contingent on the continued profitability of the Corporation.

The members of the Human Resources and Compensation Committee have approved the contents of this report and its inclusion in this Circular.

The foregoing report is dated as of March 24, 2003 and is submitted by the Tesma Human Resources and Compensation Committee.

| Belinda Stronach (Chairman) | David R. Peterson | M. Douglas Young |

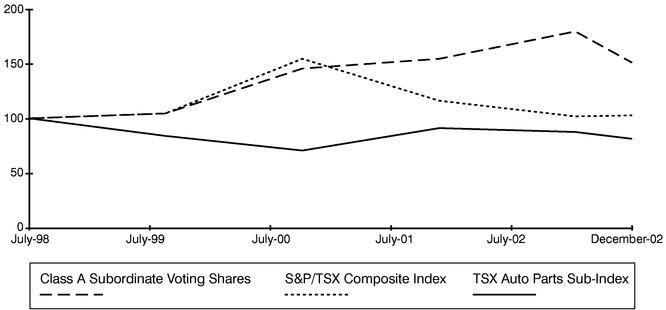

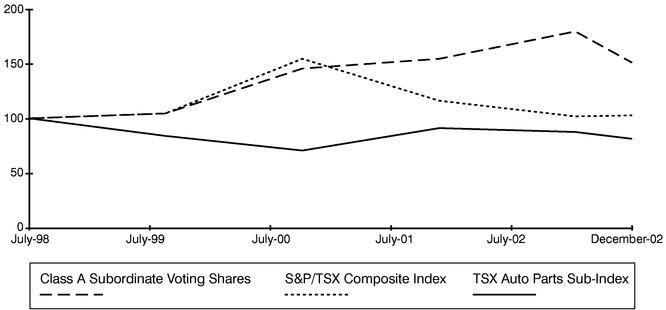

SHAREHOLDER PERFORMANCE REVIEW GRAPH

The following graph compares the yearly total cumulative return (including dividends) for $100 invested in Class A Subordinate Voting Shares on July 31, 1998, with the yearly cumulative total return of the S&P/TSX Composite Index and the TSX Auto Parts Sub-Index (a peer industry index of automotive parts suppliers) for each of Tesma's last four most recently completed full fiscal years and the fiscal 2002 stub period. The values of each investment reflected in the graph are based on share price appreciation or depreciation plus, in the case of the Class A Subordinate Voting Shares, dividend reinvestment.

Total Cumulative Return on $100 Investment made July 31, 1998

(Assuming Reinvestment of Dividends)

|

|---|

| | July 31, 1998

| | July 31, 1999

| | July 31, 2000

| | July 31, 2001

| | July 31, 2002

| | December 31, 2002

|

|---|

|

| Class A Subordinate Voting Shares | | $100.00 | | $103.81 | | $145.11 | | $153.92 | | $179.62 | | $150.84 |

|

| S&P/TSX Composite Index | | $100.00 | | $103.87 | | $154.63 | | $115.82 | | $101.17 | | $102.16 |

|

| TSX Auto Parts Sub-Index | | $100.00 | | $ 83.15 | | $ 70.31 | | $ 90.84 | | $ 86.63 | | $ 80.82 |

|

18

INDEBTEDNESS OF DIRECTORS, EXECUTIVE OFFICERS AND SENIOR OFFICERS

None of the current or former directors, executive officers, senior officers or employees of the Corporation or its subsidiaries, nor any associates of such persons, were indebted at any time during the fiscal 2002 stub period to the Corporation or its subsidiaries in connection with the purchase of securities of the Corporation or its subsidiaries. As of the Record Date, the aggregate amount of indebtedness to the Corporation or its subsidiaries incurred other than in connection with the purchase of securities of the Corporation or its subsidiaries, excluding routine indebtedness, was approximately $1.6 million in the case of current and former directors, officers (including executive and senior officers) and employees of the Corporation and its subsidiaries. The following table contains information concerning indebtedness, excluding routine indebtedness, owed to the Corporation or its subsidiaries, other than for the purchase of the Corporation's securities, by current and former directors, executive officers and senior officers of the Corporation or their associates or affiliates:

|

|---|

Table of Indebtedness of Directors, Executive Officers

and Senior Officers Other Than Under Securities Purchase Programs

|

|---|

Name and Principal Position

| | Involvement of Issuer or Subsidiary

| | Largest Amount Outstanding During Fiscal

2002 Stub Period

| | Amount Outstanding as at March 28, 2003

|

|---|

|

Manfred Gingl(1)

Vice Chairman and

Chief Executive Officer | | Subsidiary | | $0.8 million | | $1.0 million |

|

- (1)