UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under Rule 14a-12 |

StockerYale, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | | |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | | |

STOCKERYALE, INC.

32 Hampshire Road

Salem, New Hampshire 03079

Dear StockerYale Shareholders:

You are cordially invited to attend the Special Meeting being held in lieu of the 2009 Annual Meeting of Shareholders of StockerYale, Inc., which will be held on Tuesday, May 19, 2009 at 10:00 a.m., local time, at the offices of Vitale, Caturano & Company, P.C. (to be known as Caturano and Company, P.C. effective May 1, 2009) at 80 City Square, Boston, Massachusetts 02129.

Specific details regarding admission to the meeting and the business to be conducted at the meeting are provided in the attached Notice of Special Meeting in Lieu of Annual Meeting of Shareholders and Proxy Statement. Shareholders also may access the Notice of Special Meeting in Lieu of Annual Meeting of Shareholders and Proxy Statement via the Internet at www.vfnotice.com/stockeryale. I encourage you to carefully read the attached Notice of Special Meeting and Proxy Statement, as well as the enclosed Annual Report of StockerYale, Inc. for the fiscal year ended December 31, 2008.

Whether or not you plan to attend the meeting, it is important that your shares are represented and voted. Therefore, I urge you to complete, sign and date the enclosed proxy card and promptly return it in the enclosed envelope so that your shares will be represented and voted at the meeting. If you do attend the meeting, you may withdraw your proxy and vote in person if you so desire.

I look forward to greeting those of you who will be able to attend the meeting.

| | President, Chief Executive Officer and |

StockerYale, Inc.

32 Hampshire Road

Salem, New Hampshire 03079

NOTICE OF SPECIAL MEETING IN LIEU OF ANNUAL MEETING OF SHAREHOLDERS TO BE HELD TUESDAY, MAY 19, 2009

To the Shareholders of StockerYale, Inc.:

The Special Meeting in Lieu of Annual Meeting of Shareholders (the “Meeting”) of StockerYale, Inc., a Massachusetts corporation (the “Company”), will be held at the offices of Vitale, Caturano & Company, P.C. (to be known as Caturano and Company, P.C. effective May 1, 2009) at 80 City Square, Boston, Massachusetts 02129, on Tuesday, May 19, 2009 at 10:00 a.m., local time, for the following purposes:

| | 1. | To fix the number of directors comprising the Board of Directors of the Company at five; |

| | 2. | To elect the five nominees identified in the attached Proxy Statement as directors to serve until the next Annual Meeting of Shareholders and until their successors are duly elected and qualified; |

| | 3. | To ratify the appointment of Vitale, Caturano & Company, P.C. (to be known as Caturano and Company, P.C. effective May 1, 2009) as the Company’s independent registered public accounting firm for the current fiscal year; and |

| | 4. | To transact such other business that may properly come before the Meeting and any adjournments or postponements of the Meeting. |

The Board of Directors has no knowledge of any other business to be transacted at the Meeting.

Accompanying this Notice of Special Meeting in Lieu of Annual Meeting of Shareholders and Proxy Statement is a copy of the Company’s Annual Report to Shareholders for the fiscal year ended December 31, 2008, which contains audited consolidated financial statements and other information of interest to shareholders.

Admission of shareholders to the Meeting will be on a first-come, first-served basis, and picture identification will be required to enter the Meeting. An individual arriving without picture identification will not be admitted unless it can be verified that the individual is a StockerYale shareholder. Cameras, cellular phones, recording equipment and other electronic devices will not be permitted at the Meeting. The Company reserves the right to inspect any persons or items prior to their admission to the Meeting.

Only shareholders of record at the close of business on Tuesday, March 31, 2009 are entitled to notice of, and to vote at, the Meeting. All shareholders are cordially invited to attend the Meeting.

| | BY ORDER OF THE BOARD OF DIRECTORS |

| | |

| |  |

| | Thomas B. Rosedale, Secretary |

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON, PLEASE COMPLETE, SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE TO ENSURE YOUR REPRESENTATION AND THE PRESENCE OF A QUORUM AT THE MEETING. NO POSTAGE NEED BE AFFIXED IF THE PROXY CARD IS MAILED IN THE UNITED STATES.

STOCKERYALE, INC.

PROXY STATEMENT

Special Meeting in Lieu of Annual Meeting of Shareholders

To Be Held on Tuesday, May 19, 2009

General

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board of Directors” or the “Board”) of StockerYale, Inc., a Massachusetts corporation (the “Company” “StockerYale” or “we”), for use at the Company’s 2009 Special Meeting in Lieu of Annual Meeting of Shareholders (the “Meeting”), which will be held on Tuesday, May 19, 2009 at 10:00 a.m., local time, at the offices of Vitale, Caturano & Company, P.C. (to be known as Caturano and Company, P.C. effective May 1, 2009)(“Caturano”) at 80 City Square, Boston, Massachusetts 02129, and at any adjournments thereof, for the purposes set forth in the Notice of Special Meeting in Lieu of Annual Meeting of Shareholders (the “Notice of Meeting”).

The Notice of Meeting, this Proxy Statement, the accompanying proxy card and the Company’s Annual Report to Shareholders for the fiscal year ended December 31, 2008 (the “2008 Annual Report”) are first being sent to shareholders on or about April 22, 2009. The Company’s principal executive offices are located at 32 Hampshire Road, Salem, New Hampshire 03079 and its telephone number is (603) 893-8778.

Important Notice Regarding the Availability of Proxy Materials for the Meeting to Be Held on May 19, 2009: Pursuant to rules promulgated by the Securities and Exchange Commission (“SEC”), we have elected to provide access to our proxy materials both by sending you this full set of proxy materials including a proxy card, and by notifying you of the availability of our proxy materials on the Internet. This Proxy Statement, the Notice of Meeting and the 2008 Annual Report are available at www.vfnotice.com/stockeryale.

Solicitation

The cost of soliciting proxies, including expenses incurred in connection with preparing and mailing this Proxy Statement, will be borne by the Company. The Company may engage a paid proxy solicitor to assist in the solicitation. Copies of solicitation materials will be furnished to brokerage houses, nominees, fiduciaries and custodians to forward to beneficial owners of the Company’s common stock, $.001 par value per share (the “Common Stock”), held in their names. In addition to the solicitation of proxies by mail, the Company’s directors, officers and other employees may, without additional compensation, solicit proxies by telephone, facsimile, electronic communication and personal interviews. The Company will also reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy materials to shareholders.

Record Date, Voting Securities and Votes Required

Only holders of record of the Company’s Common Stock as of the close of business on Tuesday, March 31, 2009 (the “Record Date”) will be entitled to receive notice of, and to vote at, the Meeting and any adjournments thereof. On the Record Date, the Company had approximately 44,953,771 shares of Common Stock issued and outstanding and entitled to be voted. The holders of Common Stock are entitled to one vote for each share of Common Stock held as of the Record Date on any proposal presented at the Meeting.

A majority of the shares of Common Stock issued and outstanding and entitled to be voted at the Meeting will constitute a quorum at the Meeting. Votes withheld, abstentions and shares held in “street name” by brokers or nominees who indicate on their proxies that they do not have discretionary authority to vote such shares as to a particular matter (“broker non-votes”) shall be counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Meeting.

The affirmative vote of the holders of a majority of the shares of the Company’s Common Stock voting in person or by proxy and entitled to vote is required to fix the number of directors comprising the Board of Directors at five (Proposal No. 1) and to ratify the appointment of Caturano as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2009 (Proposal No. 3). The affirmative vote of the holders of a plurality of the votes cast in person or by proxy by the shares entitled to vote is required for the election of directors (Proposal No. 2).

Shares which abstain from voting on a particular matter and broker non-votes will not be counted as votes in favor of such matter and will also not be counted as votes cast or shares voting on such matter. Accordingly, neither abstentions nor broker non-votes will have any effect upon the outcome of voting with respect to any proposal in the Proxy Statement.

An automated system administered by the Company’s transfer agent tabulates the votes. The votes on each matter are tabulated separately.

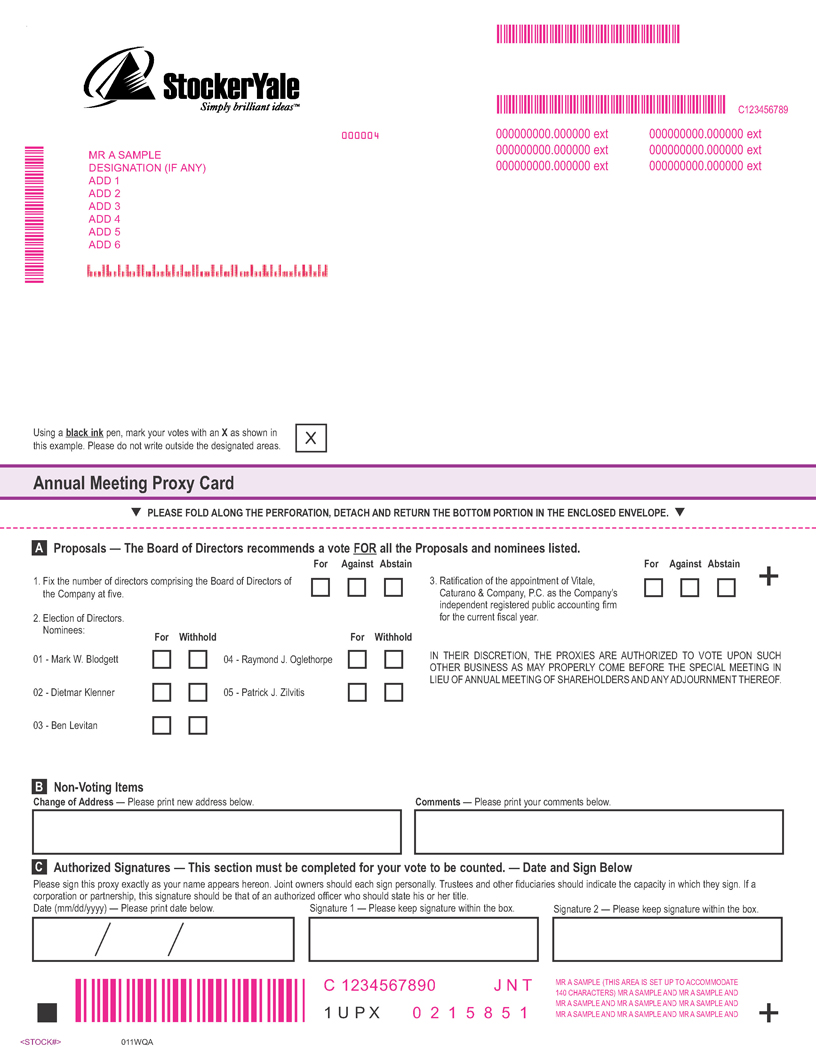

To vote by mail, complete, date and sign the enclosed proxy card and return it in the enclosed envelope as promptly as possible. No postage is necessary if the proxy card is mailed in the United States using the postage prepaid envelope provided. If you hold your shares through a bank, broker or other nominee, they will give you separate instructions for voting your shares.

Proxies

Voting by Proxy

Voting instructions are included on your proxy card. If you properly complete, sign and date your proxy card and return it to us in time to be counted at the Meeting, one of the individuals named as your proxy will vote your shares as you have directed. If you sign and timely return your proxy card but do not indicate how your shares are to be voted with respect to one or more of the proposals to be voted on at the Meeting, your shares will be voted for each of such proposals and in accordance with the judgment of the individuals named in the proxy card as the proxy holders as to any other matter that may be properly brought before the Meeting. The proxy holders will have discretionary authority to vote upon any adjournment of the Meeting.

Revoking your Proxy

You may revoke your proxy at any time before it is voted by:

| | • | delivering a later-dated proxy or a notice of revocation in writing to the Company’s Secretary at the principal executive offices of the Company at the following address: StockerYale, Inc., 32 Hampshire Road, Salem, New Hampshire 03079, Attention: Secretary, at any time before the proxy is exercised; or |

| | • | by attending the Meeting and voting in person at the Meeting. |

Voting in Person

If you plan to attend the Meeting and wish to vote in person, we will give you a ballot at the Meeting. However, if your shares are held in the name of your broker, bank or other nominee, you must bring a proxy from your nominee authorizing you to vote your “street name” shares held as of the Record Date.

Householdng of Annual Meeting Materials

Some banks, brokers and other nominee record holders may participate in the practice of “householding” proxy statements and annual reports. This means that only one copy of this Proxy Statement or the 2008 Annual Report may have been sent to multiple stockholders in your household. We will promptly deliver a separate copy of either document to you if you write or call us at the following address or telephone number: StockerYale, Inc., 32 Hampshire Road, Salem, New Hampshire 03079, Attention: Investor Relations, telephone: (603) 893-8778. If you want to receive separate copies of our proxy statements or annual reports in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker, or other nominee record holder, or you may contact the Company at the above address and telephone number.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information as of March 12, 2009 (unless otherwise indicated), with respect to the beneficial ownership of the Company’s Common Stock by the following persons:

| | • | each person known by the Company to beneficially own more than 5% of the outstanding shares of the Company’s Common Stock; |

| | • | each of the Company’s directors and nominees for director; |

| | • | each of the Named Executives (as defined below in the section titled “Additional Information—Executive Compensation”); and |

| | • | all of the current executive officers and directors as a group. |

For purposes of the following table, beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission (the “SEC”) and the information is not necessarily indicative of beneficial ownership for any other purpose. Except as otherwise noted in the footnotes to the table, the Company believes that each person or entity named in the table has sole voting and investment power with respect to all shares of the Company’s Common Stock shown as beneficially owned by that person or entity (or shares such power with his or her spouse). Under the SEC’s rules, shares of Common Stock issuable under options that are exercisable on or within 60 days after March 12, 2009 (“Presently Exercisable Options”) or under warrants that are exercisable on or within 60 days after March 12, 2009 (“Presently Exercisable Warrants”) are deemed outstanding and are therefore included in the number of shares reported as beneficially owned by a person or entity named in the table and are used to compute the percentage of the Company’s Common Stock beneficially owned by that person or entity. These shares are not, however, deemed outstanding for computing the percentage of the Company’s Common Stock beneficially owned by any other person or entity. Unless otherwise indicated, the address of each person listed in the table is c/o StockerYale, Inc., 32 Hampshire Road, Salem, New Hampshire 03079.

The percentage of the Company’s Common Stock beneficially owned by each person or entity named in the following table is based on 43,473,595 shares of the Company’s Common Stock outstanding as of March 12, 2009 plus any shares issuable upon exercise of Presently Exercisable Options and Presently Exercisable Warrants held by such person or entity.

| | | Amount and Nature of Beneficial Ownership | |

| Name and Address of Beneficial Owner | | Number of Shares | | | Percentage of Class | |

| | | | | | | |

| 5% Shareholders | | | | | | |

| | | | | | | |

Lewis Asset Management, Corp. 45 Rockefeller Plaza Suite 2570 New York, NY 10111 | | | 6,022,743 | (1) | | | 13.9 | % |

| | | | | | | | | |

Empire Capital Management, L.L.C. c/o Empire GP LLC 1 Gorham Island Road Westport, CT 06880 | | | 5,492,500 | (2) | | | 12.6 | % |

| | | | | | | | | |

Marathon Capital Management, LLC 4 North Park Drive Suite 106 Hunt Valley, MD 21030 | | | 2,539,838 | (3) | | | 5.8 | % |

| | | | | | | | | |

Valens Capital Management, LLC 335 Madison Avenue 10th Floor New York, NY 10017 | | | 2,394,037 | (4) | | | 5.5 | % |

| | | | | | | | | |

| Directors, Nominees and Named Executives | | | | | | | | |

| | | | | | | | | |

| Mark W. Blodgett | | | 3,852,727 | (5) | | | 8.6 | % |

| | | | | | | | | |

| Robert J. Drummond | | | 69,076 | (6) | | | | * |

| | | | | | | | | |

| Dietmar Klenner | | | 144,384 | (7) | | | | * |

| | | | | | | | | |

| Ben Levitan | | | 78,222 | (6) | | | | * |

| | | | | | | | | |

| Raymond J. Oglethorpe | | | 661,189 | (8) | | | 1.5 | % |

| | | | | | | | | |

| Parviz Tayebati | | | 158,798 | | | | | * |

| | | | | | | | | |

| Patrick J. Zilvitis | | | 151,051 | (9) | | | | * |

| | | | | | | | | |

| Timothy P. Losik | | | 150,000 | | | | | * |

| | | | | | | | | |

| Marianne Molleur | | | 314,500 | | | | | * |

| | | | | | | | | |

| All directors and current executive officers as a group (8 persons) | | | 5,265,447 | (10) | | | 11.5 | % |

| (1) | Based solely on information provided in (i) Schedule 13G filed with the SEC by Lewis Asset Management, Corp. on January 4, 2007, (ii) amendments to Schedule 13G filed with the SEC by Lewis Asset Management, Corp. from January 4, 2007 through March 12, 2009 and (iii) Form 4s filed with the SEC by Lewis Asset Management, Corp. through March 12, 2009. |

| (2) | Based solely on information provided in a Form 4 filed with the SEC by Empire Capital Management, L.L.C. on November 4, 2008, this number consists of (i) 2,447,835 shares owned directly by Empire Capital Partners, L.P., (ii) 2,258,146 shares owned directly by Empire Capital Partners, Ltd., (iii) 249,803 shares owned directly by Empire Capital Partners Enhanced Master Fund, LTD., (iv) 447,363 shares owned directly by Charter Oak Partners, L.P., (v) 71,544 shares owned directly by Charter Oak Partners II, L.P. and (vi) 17,809 shares owned by Charter Oak Master Fund, L.P. Empire Capital Management, L.L.C. is the investment manager of Empire Capital Partners, Ltd., Empire Capital Partners Enhanced Master Fund, LTD., Charter Oak Partners, L.P., Charter Oak Partners II, L.P. and Charter Oak Master Fund, L.P. and Empire Capital GP, L.L.C. is the general partner of Empire Capital Partners, L.P. Based solely on information provided in an amendment to Schedule 13G filed with the SEC by Mr. Scott Fine and Mr. Peter Richards on February 13, 2009, Mr. Fine and Mr. Richards are the managing members of Empire Capital Management, L.L.C. and Empire Capital GP, L.L.C. and may be deemed to be the beneficial owners of the shares owned by Empire Capital Partners, L.P., Empire Capital Partners, Ltd., Empire Capital Partners Enhanced Master Fund, LTD., Charter Oak Partners, L.P., Charter Oak Partners II, L.P. and Charter Oak Master Fund, L.P. |

| (3) | Based solely on information provided in a Schedule 13G filed with the SEC by Marathon Capital Management, LLC on January 19, 2009. |

| (4) | Based solely on information provided in an amendment to Schedule 13G filed with the SEC by Valens Capital Management, LLC on February 11, 2009, PSource Structured Debt Limited (“PSource”), Valens U.S. SPV I, LLC, (“Valens US”) and Valens Offshore SPV II, Corp. (“VOFF SPV II”, and together with PSource and Valens US, the “Investors”) collectively held (i) 2,394,037 shares and (ii) five warrants to acquire an aggregate of 1,820,000 shares (the “Warrants”). The Warrants each contain an issuance limitation prohibiting the Investors from exercising those securities to the extent that such conversion or exercise would result in beneficial ownership by the Investors of more than 4.99% of the shares then issued and outstanding (the “4.99% Issuance Limitation”). The 4.99% Issuance Limitation may be waived by the Investors upon at least 75 days prior notice to the Company and is automatically null and void upon certain events of default. PSource is managed by Laurus Capital Management, LLC. Valens US and VOFF SPV II are managed by Valens Capital Management, LLC. Eugene Grin and David Grin, through other entities, are the controlling principals of Laurus Capital Management, LLC and Valens Capital Management, LLC and share sole voting and investment power over the securities owned by the Investors. Based solely on information provided in an amendment to Schedule 13G filed with the SEC on February 11, 2009, Mr. Eugene Grin and Mr. David Grin may be deemed to be the beneficial owners of the shares owned by PSource, Valens US and VOFF SPV II. On April 8, 2009, GAM, an investment management firm, purchased the 2,394,037 shares held by the Investors and the Investors no longer own more than 5% of our outstanding Common Stock. |

| (5) | Includes 1,229,400 shares issuable upon exercise of Presently Exercisable Options and 36,154 shares issuable upon exercise of Presently Exercisable Warrants. |

| (6) | Includes 6,000 shares issuable upon exercise of Presently Exercisable Warrants. |

| (7) | Includes 30,000 shares issuable upon exercise of Presently Exercisable Options and 5,000 shares issuable upon exercise of Presently Exercisable Warrants. |

| (8) | Includes 83,500 shares issuable upon exercise of Presently Exercisable Options and 108,462 shares issuable upon exercise of Presently Exercisable Warrants. Also includes 231,100 shares held by the Oglethorpe Family Limited Partnership (the “Partnership”). Mr. Oglethorpe is the General Partner of the Partnership and, by virtue of Mr. Oglethorpe’s voting and investment power over the shares held by the Partnership, Mr. Oglethorpe may be deemed to have beneficial ownership of such shares. |

| (9) | Includes 26,667 shares issuable upon exercise of Presently Exercisable Options. |

| (10) | Includes 2,121,067 shares issuable upon exercise of Presently Exercisable Options and 161,616 shares issuable upon exercise of Presently Exercisable Warrants. |

PROPOSAL NO. 1

TO FIX THE NUMBER OF DIRECTORS COMPRISING THE BOARD OF DIRECTORS AT FIVE

The Company’s Amended and Restated By-Laws (the “By-Laws”) provide that the number of directors comprising the Board of Directors shall be fixed by the shareholders of the Company at each annual meeting of shareholders. The number of directors must not be less than three or, in the event that there are less than three shareholders, must not be less than the number of shareholders. The Company is holding a special meeting of shareholders in lieu of an annual meeting of shareholders in 2009, and this matter will be acted upon by shareholders at the Meeting.

At the special meeting in lieu of an annual meeting of shareholders held last year, the number of directors comprising the Board of Directors was fixed at seven. Since the special meeting in lieu of an annual meeting of shareholders held last year, two of the members of the Board of Directors have decided not to seek re-election. The Board of Directors recommends reducing the size of the Board of Directors to five, which is the number of directors that the Board of Directors is nominating for re-election. By reducing the size of the Board of Directors to five directors, the Board of Directors will continue to be sufficiently sizeable to ensure diversity of experience and viewpoints of Board members and to be able to satisfy current and future corporate governance requirements without compromising the efficiency of the Board.

If this proposal is approved and the number of directors is fixed at five and if the nominees for director set forth under Proposal 2 are all elected by the shareholders, there will be no vacancy on the Board of Directors that will exist following the Meeting. If, however, this proposal is not approved and the number of directors remains fixed at seven and if the nominees for director set forth under Proposal 2 are all elected by the shareholders, there will be two vacancies on the Board of Directors that will exist after the Meeting. At this time, no prospective candidates to fill any such potential vacancy have been identified. However, prospective candidates to fill any vacancy on the Board would be identified, evaluated and, as appropriate, recommended to the Board by the Governance, Nominating and Compensation Committee of the Board of Directors (the “GNC Committee”). Pursuant to the Company’s By-Laws, the Board may then elect a candidate to fill a vacancy on the Board by the affirmative vote of a majority of the Board of Directors in favor of such candidate. In addition, the By-laws permit the Board to either reduce or expand the number of directors on the Board further by vote of a majority of the directors then in office, provided that the Board may not reduce the number of directors on the Board to less than three.

The GNC Committee’s procedures for identifying and evaluating candidates are described in the Policy Governing Director Nominations and Shareholder-Board Communications, a copy of which is available on the Investor Relations section of the Company’s website at www.stockeryale.com.

The Board of Directors recommends a vote FOR fixing the number of directors constituting the Board of Directors at five.

PROPOSAL NO. 2

ELECTION OF DIRECTORS

Under the Company’s By-Laws, directors are elected to the Board of Directors to serve until the next annual meeting of shareholders following their election and until their successors have been chosen and qualified or until their earlier death, resignation or removal. The affirmative vote of the holders of a plurality of the votes cast in person or by proxy at an annual meeting of shareholders or special meeting held in lieu of an annual meeting by the shares entitled to vote is required for the election by shareholders of directors to the Board. The Board of Directors currently has the following seven members: Messrs. Mark W. Blodgett, Robert J. Drummond, Dietmar Klenner, Ben Levitan, Raymond J. Oglethorpe, Parviz Tayebati and Patrick J. Zilvitis. Two of the Company’s current directors, Robert J. Drummond and Parviz Tayebati, have decided not to seek re-election and will no longer be members of the Board of Directors after the Meeting.

The Board of Directors recommends that the five nominees named below be elected to serve on the Board of Directors, each of whom is presently serving as a director. Shares of Common Stock represented by all proxies received and not marked so as to withhold authority to vote for any individual nominee or for all nominees will be voted for the election of the five nominees named below. Each nominee has consented to being named in this Proxy Statement and has indicated his willingness to serve if elected. If, for any reason, any nominee should become unable or unwilling to serve, the persons named as proxies may vote the proxy for the election of a substitute nominee selected by the Board of Directors. The Board of Directors has no reason to believe that any nominee will be unable to serve. Shareholders may vote for no more than five nominees for director.

Biographical and certain other information concerning the Company’s current directors and the nominees for election to the Board of Directors is set forth below. Mark W. Blodgett, our President and Chief Executive Officer, is also the Chairman of the Board of Directors. However, the GNC Committee nominates an independent director to serve as the Lead Director if the Chairman of the Board is not an independent director. Mr. Raymond J. Oglethorpe has been designated by the independent directors to serve as Lead Director.

Information with respect to the number of shares of the Company’s Common Stock beneficially owned by each director as of March 12, 2009 appears above under the heading “Security Ownership of Certain Beneficial Owners and Management”. No director or executive officer is related by blood, marriage or adoption to any other director or executive officer.

Nominees for Election to Board of Directors

| Name | | Position | | Age |

| Mark W. Blodgett | | President, Chief Executive Officer and Chairman of the Board | | 52 |

| Dietmar Klenner | | Director | | 54 |

| Ben Levitan | | Director | | 47 |

| Raymond J. Oglethorpe | | Director | | 64 |

| Patrick J. Zilvitis | | Director | | 66 |

Additional Information Regarding Nominees and Current Directors

Mark W. Blodgett currently serves as the President, Chief Executive Officer and the Chairman of the Board of the Company. Mr. Blodgett has been a member of the Board of Directors and an executive officer of the Company since 1989. Mr. Blodgett worked for a private merchant bank from 1988 until 1989, was Corporate Vice President at Drexel Burnham Lambert, Inc. from 1980 until 1988 and was an associate in the area of mergers and acquisitions for Citibank N.A. from 1979 until 1980. Mr. Blodgett is a member of World Presidents’ Organization (WPO) and is on the Board of Trustees for the Boston Ballet and Pomfret School.

Robert J. Drummond, 65, was a co-founder of Epsilon Data Management, Inc., a marketing services firm and pioneer in the field of database marketing. During his almost thirty-year tenure at Epsilon Data Management, Mr. Drummond served in various executive officer positions, including President and Chief Executive Officer from 1992 until 1998. After the sale of Epsilon, Mr. Drummond served as the President and Chief Executive Officer of an early-stage company offering integrated CRM and data solutions to the restaurant and hospitality markets and as an Operating Partner with Advent International, a private equity firm. Mr. Drummond currently serves on the Board of Directors of three private technology companies and is on the Board of Trustees for Drexel University. Mr. Drummond has been a member of the Board of Directors of the Company since 2007. Mr. Drummond is not standing for re-election to the Board of Directors.

Dietmar Klenner was a co-founder and, from March 2004 to December 2008, the Managing Partner of Argus Wealth Management AG. From July 2002 until February 2006, Mr. Klenner was Managing Partner of Meridian Global Advisors, which he also co-founded. From December 1989 until June 2002, Mr. Klenner worked for KS Securities Asset Management, which he co-founded and where he served as Chief Executive Officer and Managing Partner. Mr. Klenner has been a member of the Board of Directors of the Company since 2003.

Ben Levitan is currently a partner at In-Q-Tel, Inc., a strategic investor in promising technology companies that support the mission of the CIA and the intelligence community. From 2001 until December 2005, Mr. Levitan was the Chief Executive Officer of EnvoyWorldWide, Inc., a venture backed communications and notification company. From 1999 until 2001, Mr. Levitan was the Chief Operating Officer of Viant Corporation, a publicly traded internet professional services firm. Mr. Levitan has been a member of the Board of Directors of the Company since 2006.

Raymond J. Oglethorpe is currently President of Oglethorpe Holdings, LLC, a private investment company, and has served on the Board of Trustees of The George Washington University since 1999. Mr. Oglethorpe served as President of America Online, Inc. from 2000 until his retirement in 2002. Prior to that time, Mr. Oglethorpe was a senior vice president responsible for directing the technologies and member services organizations of America Online, Inc. Mr. Oglethorpe has been a member of the Board of Directors of the Company since 2000. Mr. Oglethorpe has been designated by the independent members of the Board of Directors as Lead Director of the Company.

Parviz Tayebati, 48, is currently a private investor and was the founder of AZNA LLC, a provider of lasers for the telecommunications market. Mr. Tayebati served as the Chairman and Chief Executive Officer of AZNA LLC from 2002 until 2007. After the sale of AZNA LLC, Mr. Tayebati was the manager of Spectrode LLC and he is currently the manager of Camros Capital. Prior to founding AZNA LLC, Mr. Tayebati worked for CoreTek Inc., which he also co-founded and where he served as Chief Executive Officer. Mr. Tayebati has been a member of the Board of Directors of the Company since 2007. Mr. Tayebati is not standing for re-election to the Board of Directors.

Patrick J. Zilvitis served as a consultant with Benchmarking Partners, a Boston based industry analysis and consulting firm from September 2001 until December 2006. Mr. Zilvitis served as the Chief Information Officer for Segway LLC on a consulting basis from September 2000 until June 2004. Mr. Zilvitis was employed by The Gillette Company from 1992 until 2000, where he served as the Chief Information Officer and Corporate Vice President. Since July 2000, Mr. Zilvitis has also served as a member of the Board of Directors of ANSYS, Inc., a publicly-traded engineering software company. Mr. Zilvitis has been a member of the Board of Directors of the Company since 2004.

The Board of Directors recommends a vote FOR the election of the nominees named in the table above as directors of the Company.

PROPOSAL NO. 3

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected Caturano as the Company’s independent registered public accounting firm to audit the Company’s financial statements for the fiscal year ending December 31, 2009. Caturano has audited the financial statements of the Company for the fiscal years ending December 31, 2008, 2007, 2006, 2005, 2004, 2003 and 2002. The Board of Directors is asking the Company’s shareholders to ratify the selection of Caturano as the Company’s independent registered public accounting firm. Although ratification is not required by the Company’s By-Laws or otherwise, the Board is submitting the selection of Caturano to the shareholders for ratification as a matter of good corporate practice. If the shareholders do not ratify the selection of Caturano as the Company’s independent registered public accounting firm, the Audit Committee will reconsider its selection. Even if the appointment is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the Company’s and its shareholders’ best interests.

A representative of Caturano is expected to be present at the Meeting and will have the opportunity to make a statement if he or she desires to do so and will be available to respond to appropriate questions from shareholders. At the special meeting held in lieu of the 2008 annual meeting of shareholders on May 20, 2008, and adjourned to May 23, 2008, the shareholders of the Company ratified the selection of Caturano as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2008.

The Board of Directors recommends a vote FOR the ratification of the selection of Vitale, Caturano & Company, P.C. (to be known as Caturano & Company, P.C. effective May 1, 2009) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2009.

CORPORATE GOVERNANCE AND BOARD MATTERS

Independence of Members of Board of Directors

The Board of Directors has determined that each of Messrs. Robert J. Drummond, Ben Levitan, Dietmar Klenner, Raymond J. Oglethorpe, Parviz Tayebati and Patrick J. Zilvitis (collectively, the “Independent Directors”), constituting a majority of the directors of the Company, satisfies the criteria for being an “independent director” under the standards of the Nasdaq Stock Market, Inc. (“Nasdaq”) and has no material relationship with the Company other than by virtue of service on the Board of Directors. During the course of determining the independence of Mr. Tayebati, the Board of Directors considered the Company’s acquisition in October 2007 of substantially all of the assets of Spectrode LLC, a company controlled by Mr. Tayebati.

Board and Committee Meetings

The Board of Directors held fourteen meetings during the fiscal year ended December 31, 2008. Each incumbent director attended at least 75% of the aggregate number of meetings of the Board of Directors and of the committees on which he served during the fiscal year ended December 31, 2008 or any portion of the fiscal year during which he served. It is the policy of the Board of Directors that all directors and nominees for director are strongly encouraged to attend the annual meeting of shareholders of the Company or any special meeting held in lieu of the annual meeting. All members of the Board of Directors who were then serving attended the Special Meeting in Lieu of Annual Meeting of Shareholders held on May 20, 2008, which was adjourned to May 23, 2008. No directors attended the adjourned meeting held on May 23, 2008.

The Independent Directors met in executive session five times during the fiscal year ended December 31, 2008. Executive sessions are chaired by the Lead Director. The GNC Committee nominates an Independent Director to serve as the Lead Director if the Chairman of the Board is not an Independent Director. The nominee must be approved by a majority of the Independent Directors. The Lead Director works with the Chairman of the Board in the preparation of the agenda for Board meetings, consults with the Chairman of the Board on matters relating to corporate governance and Board performance and facilitates communications between other members of the Board and the Chairman of the Board. Mr. Oglethorpe has been designated by the Independent Directors to serve as Lead Director. Shareholders may communicate with the Independent Directors by following the procedures described under “Communication with the Board of Directors” in this Proxy Statement.

The Board of Directors has adopted Corporate Governance Guidelines to assist the Board in the exercise of its duties and responsibilities. A copy of the Corporate Governance Guidelines is available on the Investor Relations section of the Company’s website at www.stockeryale.com.

The Corporate Governance Guidelines of the Company provide (among other things) that the Board and its Committees are authorized to retain outside experts and advisors at the Company’s expense to the extent they consider it necessary, without consulting or obtaining the approval of any officer of the Company in advance. Such independent advisors may be the regular advisors to the Company.

Committees of the Board of Directors

The Board of Directors has designated the following two principal standing committees: (i) the Audit Committee of the Board of Directors (the “Audit Committee”), and (ii) the GNC Committee. The current members of the Audit Committee and the GNC Committee are identified in the following table:

| Name | | Audit Committee | | | GNC Committee | |

| | | | | | | | |

| Robert J. Drummond | | | X | | | | |

| | | | | | | | | |

| Dietmar Klenner | | | | | | | X | |

| | | | | | | | |

| Ben Levitan | | X (Chair) | | | | | |

| | | | | | | | |

| Raymond J. Oglethorpe | | | | | | X (Chair) | |

| | | | | | | | | |

| Parviz Tayebati | | | | | | | X | |

| | | | | | | | | |

| Patrick J. Zilvitis | | | X | | | | | |

Audit Committee

The Audit Committee was established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and currently consists of Messrs. Robert J. Drummond, Ben Levitan and Patrick J. Zilvitis, each of whom have been determined by the Board of Directors to be an “independent director”, as defined in Nasdaq Rule 4200(a)(15), to satisfy the heightened independence requirements of the SEC applicable to all members of a registrant’s Audit Committee and to otherwise satisfy the applicable audit committee membership requirements promulgated by the SEC and Nasdaq. In addition, the Board of Directors has determined that each of Messrs. Drummond and Levitan is an “audit committee financial expert” as such term is defined in Item 407(d) of Regulation S-K of the SEC. The Audit Committee acts pursuant to the Amended and Restated Audit Committee Charter, a copy of which is available on the Investor Relations section of the Company’s website at www.stockeryale.com. During the fiscal year ended December 31, 2008, the Audit Committee met eighteen times.

The Audit Committee assists the Board of Directors in fulfilling its responsibilities to shareholders concerning the Company’s financial reporting and internal controls, oversees the Company’s independent registered public accounting firm and facilitates open communication among the Audit Committee, the Board of Directors, the Company’s independent registered public accounting firm and management. The Audit Committee discusses with management and the Company’s independent registered public accounting firm the financial information developed by the Company, the Company’s systems of internal controls and the Company’s audit process and various matters relating to the results of the annual audit of the Company. The Audit Committee is directly responsible for appointing, evaluating, retaining, and, when necessary, terminating the engagement of the independent registered public accounting firm who will conduct the annual audit of the financial statements of the Company. The Audit Committee is also responsible for pre-approving all audit services, as well as all review, attest and non-audit services to be provided to the Company by the Company’s independent registered public accounting firm, with the exception of those services that meet the “de minimis” exception of Section 10A(i)(1)(B) of the Exchange Act, for which no Audit Committee pre-approval is required. The Audit Committee oversees investigations into complaints received by the Company regarding accounting, internal accounting controls or auditing matters. The Audit Committee reviews all related party transactions on an ongoing basis, and all such transactions must be approved by the Audit Committee. The Audit Committee is authorized, without further action by the Board of Directors, to engage such independent legal, accounting and other advisors as it deems necessary or appropriate to carry out its responsibilities.

Governance, Nominating and Compensation Committee

The GNC Committee currently consists of Messrs. Dietmar Klenner, Raymond J. Oglethorpe and Parviz Tayebati, each of whom have been determined by the Board of Directors to be an “independent director”, as defined in Nasdaq Rule 4200(a)(15), and to otherwise meet the nominating and compensation committee membership requirements promulgated by the SEC and Nasdaq. The GNC Committee acts pursuant to the Amended and Restated Governance, Nominating and Compensation Committee Charter, a copy of which is available at the Investor Relations section of the Company’s website at www.stockeryale.com. During the fiscal year ended December 31, 2008, the GNC Committee met seven times.

The GNC Committee generally assists the Board of Directors with respect to matters involving the compensation of the Company’s directors and executive officers, oversight of corporate governance matters and identifying individuals qualified to become members of the Board. The responsibilities of the GNC Committee with respect to director and executive officer compensation include determining salaries and other forms of compensation for the Chief Executive Officer and the other executive officers of the Company, reviewing and making recommendations to the Board of Directors with respect to director compensation, periodically reviewing and making recommendations to the Board with respect to the design and operation of incentive-compensation and equity-based plans and generally administering the Company’s equity-based incentive plans. The GNC Committee may form, and delegate authority to, one or more subcommittees as it deems appropriate under the circumstances. In addition, to the extent permitted by applicable law and the provisions of a given equity-based incentive plan, the GNC Committee may delegate to one or more executive officers of the Company the power to grant options or other stock awards pursuant to such plan to employees of the Company or any subsidiary of the Company who are not directors or executive officers of the Company. Historically, the Chief Executive Officer and Chief Financial Officer, in consultation with the GNC Committee and within certain per-person and per-year limits established by the GNC Committee, have been authorized to make limited stock option grants to non-executive officers of the Company.

The Company’s Chief Executive Officer generally makes recommendations to the GNC Committee regarding the compensation of other executive officers. In addition, the Chief Executive Officer is often invited to attend GNC Committee meetings and participates in discussions regarding the compensation of other executive officers, but the GNC Committee ultimately approves the compensation of all executive officers. Other than making recommendations and participating in discussions regarding the compensation of other executive officers, the Company’s Chief Executive Officer generally does not play a role in determining the amount or form of executive compensation. Except for the participation by the Chief Executive Officer in meetings regarding the compensation of other executive officers, the GNC Committee meets without the presence of executive officers when approving or deliberating on executive officer compensation. The Chief Executive Officer does not make proposals or recommendations regarding his own compensation.

The GNC Committee has the authority to retain and terminate any compensation consultant to be used to assist in the evaluation of executive officer compensation. However, the GNC Committee did not engage the services of any compensation consultants in determining or recommending the amount or form of executive and director compensation for the fiscal year ended December 31, 2008.

With respect to corporate governance matters, the GNC Committee is responsible for establishing and monitoring the adequacy of, and the Company’s compliance with, policies and processes regarding principles of corporate governance, monitoring and taking appropriate action with respect to corporate governance requirements of the SEC and Nasdaq, overseeing an annual self-evaluation of the Board and its committees, conducting an annual evaluation of the Company’s senior executives and reviewing and recommending appropriate action to the Board with respect to all shareholder proposals submitted to the Company. In addition to the annual self-evaluation of the Board overseen by the GNC Committee, the individual directors conduct annual evaluations of the other directors and the Chief Executive Officer.

With respect to director nomination matters, the GNC Committee is responsible for establishing qualifications to be considered when evaluating candidates for nomination for election to the Board of Directors and appointment to the committees thereof. In addition, the GNC Committee is responsible for identifying, evaluating and recommending qualified director candidates to the Board of Directors and its committees for nomination or appointment, as the case may be, evaluating the continued qualification of directors nominated for re-election, and annually reviewing the composition of the Board to ensure that the directors, as a group, provide a significant breadth of experience, knowledge and abilities to the Board.

Director Nomination Process

The GNC Committee is responsible for identifying individuals qualified to become members of the Board and its committees and recommending to the Board those individuals which it has determined to be qualified. The GNC Committee identifies candidates for director nominees through recommendations solicited from non-management directors, the Company’s Chairman of the Board and its executive officers and through the use of search firms or other advisors. The GNC Committee will also consider recommendations submitted by shareholders. Once candidates have been identified, the GNC Committee will evaluate such candidates in accordance with the criteria set forth in the Company’s Policy Governing Director Nominations and Shareholder-Board Communications (the “Policy”) available on the Investor Relations section of the Company’s website at www.stockeryale.com. Based upon the results of such evaluation process, the GNC Committee will recommend to the Board the candidates which it has determined to be qualified for serving on the Board. The Board evaluates all candidates in the same manner, regardless of how such candidates have been identified by the GNC Committee.

The GNC Committee, in considering whether to recommend any particular candidate to the Board, and the Board, in considering whether to include any particular candidate in the Board’s slate of recommended director nominees or to appoint a particular candidate to fill a vacancy in the Board, will consider the candidate’s integrity, education, business acumen, knowledge of the Company’s business and industry, experience, diligence, conflicts of interest and the ability to act in the interests of all shareholders. The GNC Committee and the Board also consider the number of other Boards of publicly traded companies on which the candidate serves and the candidate’s other personal and professional commitments in general. In addition, with respect to incumbent directors, the GNC Committee and the Board will consider the incumbent director’s past attendance at meetings, participation in and contributions to the activities of the Board and any committee thereof and any significant change in status. Neither the GNC Committee nor the Board assigns specific weights to particular criteria and no particular criterion is a prerequisite for prospective nominees.

Any shareholder who wishes to submit a recommendation for a director candidate to the GNC Committee must submit it to the Chair of the GNC Committee via U.S. Mail, courier or expedited delivery service to the following address: StockerYale, Inc., 32 Hampshire Road, Salem, New Hampshire 03079, Attn: Chair—Governance, Nominating and Compensation Committee. Shareholder recommendations must be submitted not later than the close of business on the 120th calendar day before the date the Company’s proxy statement was filed with the SEC in connection with the previous year’s annual meeting of shareholders or special meeting in lieu thereof. Any such recommendation must include the following information: (i) name of the shareholder making the recommendation; (ii) a statement disclosing such shareholder’s beneficial ownership of the Company’s Common Stock; (iii) name of the individual recommended for consideration as a director nominee; (iv) a statement of why such recommended candidate would be able to fulfill the duties of a director; (v) a statement of how the recommended candidate meets the independence requirements established by the Nasdaq Stock Market, Inc. or any other exchange upon which the securities of the Company are traded; (vi) a statement disclosing the recommended candidate’s beneficial ownership of the Company’s Common Stock; and (vii) a statement disclosing relationships between the recommended candidate and the Company which may constitute a conflict of interest.

Please see the Policy Governing Director Nominations and Shareholder-Board Communications available at the Investor Relations section of the Company’s website at www.stockeryale.com for the full policy regarding shareholder recommendations for director candidates.

Director Stock Ownership Guidelines

In February 2007, the Board of Directors adopted stock ownership guidelines for the directors of the Company. The guidelines provide that each director must purchase, own and hold shares of the Company’s Common Stock with a value of not less than $5,000. The minimum number of shares to be held by directors will be calculated on the first trading day of each calendar year based on the closing price of the Company’s Common Stock. Any subsequent change in the value of the shares will not affect the amount of stock directors should hold during that calendar year. The following shares are counted in determining whether a director owns the requisite number of shares: (i) shares purchased on the open market or from the Company in a financing transaction; (ii) shares obtained through option exercises; and (iii) shares owned jointly with, or separately by, a director’s immediate family members residing in the same household (including shares held in trusts and similar vehicles or entities).

All current directors are in full compliance with these guidelines. Upon the election or appointment of a new director to the Board, such director will be expected to reach full compliance with these guidelines within 12 months after such initial election or appointment. Once achieved, ownership of the guideline amount must be maintained as long as the director retains his or her seat on the Board. Compliance with the guidelines will be evaluated annually, on the first trading day of each calendar year, by the Board. If a director is not in compliance with the guidelines, he or she will have 30 days to regain compliance, but if in a blackout or in possession of material non-public information during such 30 days, the director will have 30 days from the date such restrictions end to regain compliance.

The guidelines may be waived at the discretion of the GNC Committee if compliance would place a severe hardship on a director. It is expected that these instances will be rare.

Communication with the Board of Directors

Shareholders and other interested parties may communicate with the Board of Directors, including individual directors, by sending written communication to the directors via U.S. Mail, courier or expedited delivery service to the following address: Board of Directors; c/o StockerYale, Inc., 32 Hampshire Road, Salem, NH 03079, Attn: Secretary. For more information regarding the Company’s policy on shareholder-Board communications, please see the Policy Governing Director Nominations and Shareholder-Board Communications available at the Investor Relations section of the Company’s website at www.stockeryale.com.

ADDITIONAL INFORMATION

Executive Officers

Under the Company’s By-Laws, officers of the Company are elected annually by the Board of Directors. Set forth below is information regarding the current executive officers of the Company.

| Name | | Position | | Age |

| | | | | |

| Mark W. Blodgett | | President, Chief Executive Officer and Chairman of the Board | | 52 |

| | | | | |

| Timothy P. Losik | | Chief Operating Officer and Chief Financial Officer | | 50 |

Mark W. Blodgett currently serves as the President, Chief Executive Officer and the Chairman of the Board of the Company. Mr. Blodgett has been a member of the Board of Directors and an executive officer of the Company since 1989. Mr. Blodgett worked for a private merchant bank from 1988 until 1989, was Corporate Vice President at Drexel Burnham Lambert, Inc. from 1980 until 1988 and was an associate in the area of mergers and acquisitions for Citibank N.A. from 1979 until 1980. Mr. Blodgett is a member of World Presidents’ Organization (WPO) and is on the Board of Trustees for the Boston Ballet and Pomfret School.

Timothy Losik currently serves as Chief Operating Officer and Chief Financial Officer of the Company. Mr. Losik has been an executive officer of the Company since January 14, 2008. From January 2007 to October 2007, Mr. Losik served as the Chief Financial Officer of Bluesocket, Inc. From April 2006 to July 2006, Mr. Losik served as the Vice President of Operations of Globalware Solutions, Inc. and from November 2004 to April 2006 he served as the Chief Financial Officer of Globalware Solutions, Inc. From April 2002 to September 2003, Mr. Losik served as the Chief Financial Officer of Omtool, LTD.

Executive Compensation

The following table presents compensation information for the years ended December 31, 2008 and 2007 for the person who served as our principal executive officer and each of our two other most highly compensated executive officers whose total compensation was more than $100,000 (collectively, the “Named Executives”).

SUMMARY COMPENSATION TABLE

| Name and Principal Position | | Year | | Salary ($) | | | Bonus ($) | | | Stock Awards ($)(1) | | | Option Awards ($)(1) | | | Non-Equity Incentive Plan Compensation ($) | | | All Other Compensation ($) | | | Total ($) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Mark W. Blodgett, President, Chief Executive Officer and Chairman of the Board | | 2008 | | $ $ | 410,000 410,000 | (2) | | | | | | $ $ | 161,925 124,525 | | | $ $ | 8,672 29,496 | | | | — — | | | $ $ | 12,382 23,625 | (3) (4) | | $ $ | 592,979 587,646 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Timothy Losik, | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Chief Operating Officer and | | 2008 | | $ | 188,583 | | | | — | | | $ | 24,078 | | | $ | 290 | | | | — | | | $ | 4,374 | (6) | | $ | 217,325 | |

| Chief Financial Officer (5) | | 2007 | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Marianne Molleur, | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Senior Vice President of | | 2008 | | $ | 104,715 | | | | — | | | $ | 90,175 | | | $ | 290 | | | | — | | | $ | 2,534 | (8) | | $ | 197,424 | |

Human Resources(7) | | 2007 | | $ | 174,519 | | | | — | | | $ | 47,413 | | | | — | | | | — | | | $ | 6,147 | (9) | | $ | 228,079 | |

| (1) | See Note 3 of the consolidated financial statements of the Company contained in Item 7 of the Company’s Annual Report on Form 10-K for its fiscal year ended December 31, 2008, which is included with this Proxy Statement, regarding assumptions underlying valuation of equity awards. |

| (2) | In December 2008, due to the current economic situation of the Company, Mr. Blodgett voluntarily took a paycut from $410,000 to $369,000. |

| (3) | Includes a $3,332 matching contribution paid in cash by the Company to Mr. Blodgett’s 401(k) plan and $9,050 in premiums on a Company paid executive life insurance plan. |

| (4) | Includes a $5,125 matching contribution paid in cash by the Company to Mr. Blodgett’s 401(k) plan, $9,050 in premiums on a Company paid executive life insurance plan and $9,450 paid for dues to the Young Presidents’ Organization. |

| (5) | Mr. Losik’s employment with the Company began on January 14, 2008. |

| (6) | Includes a $3,849 matching contribution paid in cash by the Company to Mr. Losik’s 401(k) plan and $525 in premiums on a Company paid executive life insurance plan. |

| (7) | Prior to January 14, 2008, Ms. Molleur served as the Senior Vice President, Chief Financial Officer and Treasurer of the Company and was considered an executive officer of the Company. |

| (8) | Consists of a $2,534 matching contribution paid in cash by the Company to Ms. Molleur’s 401(k) plan. |

| (9) | Includes a $5,018 matching contribution paid in cash by the Company to Ms. Molleur’s 401(k) plan and $1,129 in premiums on a Company paid executive life insurance plan. |

Employment Agreements and Indemnification Agreements

We do not have a written employment agreement with Mark W. Blodgett, our President, Chief Executive Officer and Chairman of the Board, other than the separation agreement described below in the section titled “Potential Payments Upon Termination or Change-in-Control.” In November 2006, in order to reward Mr. Blodgett for achieving strategic milestones, to provide a cost-of-living increase and to ensure that his compensation remains competitive, we increased Mr. Blodgett’s annual base salary from $340,000 to $410,000 and eliminated his car allowance. In December 2008, due to the current economic situation of the Company, Mr. Blodgett voluntarily took a paycut from $410,000 to $369,000.

We entered into an offer letter agreement with Timothy Losik on January 7, 2008 in connection with his employment as our Chief Operating Officer and Chief Financial Officer. In connection with Mr. Losik’s appointment as Chief Operating Officer and Chief Financial Officer, the Company set Mr. Losik’s annual base salary at $200,000 and agreed to grant to Mr. Losik 150,000 restricted shares of the Company’s common Stock under the Company’s 2007 Stock Incentive Plan (the “2007 Plan”). The terms of this restricted stock grant are set forth below in the section titled “Terms of Stock Awards and Option Awards”.

We entered into an offer letter agreement with Marianne Molleur on April 28, 2005 in connection with her initial employment as our Corporate Controller. On October 27, 2005, Ms. Molleur was appointed Senior Vice President, Chief Financial Officer, Treasurer and Clerk of the Company, and in connection with this promotion we increased Ms. Molleur’s annual base salary to $150,000. In November 2006, we increased Ms. Molleur’s annual base salary from $150,000 to $175,000 in order to reward Ms. Molleur for her hard work, provide for a cost of living increase and ensure that her compensation remains competitive. On January 14, 2008, in connection with Timothy Losik’s appointment as Chief Financial Officer as described above and under “Executive Officers,” we appointed Ms. Molleur the Senior Vice President of Human Resources and her annual base salary was appropriately adjusted.

Each of Mark Blodgett, Timothy Losik and Marianne Molleur has entered into an indemnification agreement with the Company providing that the Company shall indemnify the officer to the fullest extent authorized or permitted by applicable law in the event that the officer is involved in any threatened, pending or completed action, suit or proceeding, whether brought by or in the right of the Company or by any other party and whether of a civil, criminal, administrative or investigative nature, by reason of the fact that the officer is or was an officer of the Company, or is or was serving at the request of the Company as a director, officer, employee, trustee, partner or other agent of another organization or other enterprise, against all expenses, judgments, awards, fines and penalties, provided that (i) the officer acted in good faith and in a manner in which the officer reasonably believed to be in, or not opposed to, the best interests of the Company, (ii) in a criminal matter, the officer had no reasonable cause to believe that his or her conduct was unlawful and (iii) the officer is not adjudged liable to the Company.

Terms of Stock Awards and Option Awards

Prior to March 17, 2008, we had a policy of granting shares of restricted stock to our executive officers on July 1st of each year. This practice ensured that we were consistent from year-to-year and that the grants were made without regard to anticipated earnings or other major announcements by us. Shares of restricted stock granted under this policy vest only upon the satisfaction of a continued service requirement and therefore serve to retain key executives, as well as reward and compensate them. On July 1, 2007, we granted (i) 220,000 shares of restricted stock to Mr. Blodgett under the 2007 Plan and (ii) 130,000 shares of restricted stock to Ms. Molleur under the 2007 Plan. In addition, on January 14, 2008, we granted 150,000 shares of restricted stock to Mr. Losik under the 2007 Plan. Restrictions on all of the shares of restricted stock lapse as to 25% of the shares per annum on each of the first, second, third and fourth anniversary of the date of grant, provided that the recipient remains an employee of the Company.

On March 17, 2008, instead of issuing shares of restricted stock to executive officers and key employees, the GNC Committee voted to adopt a policy of granting performance based options to purchase shares of the Company’s Common Stock to our executive officers and certain key employees each year. This practice ensures the executive officers and key employees have a financial stake in the Company’s success and aligns their interests with those of the shareholders. All options granted to executive officers vest and become exercisable on the date we publicize our earnings press release regarding fiscal year end results if the stated performance goals are met. If the performance goals are not met, the options immediately terminate. On March 17, 2008, pursuant to this policy, the Company granted (i) a performance based option to purchase 533,300 shares of the Company’s Common Stock to Mr. Blodgett, (ii) a performance based option to purchase 200,000 shares of the Company’s Common Stock to Mr. Losik and (iii) a performance based option to purchase 80,000 shares of the Company’s Common Stock to Ms. Molleur. Since the stated performance goal was not met, these options immediately terminated and were forfeited back to the Company as of December 31, 2008.

On December 16, 2008, in recognition of Mr. Losik’s performance in 2008, the Company granted a nonqualified stock option to Mr. Losik under the 2007 Plan to purchase 100,000 shares of the Company’s Common Stock at an exercise price equal to $0.16, the closing price of the Company’s Common Stock on such date. On December 16, 2008, in recognition of Mr. Blodgett’s performance in 2008, the Company granted a nonqualified stock option to Mr. Blodgett under the 2007 Plan to purchase 168,000 shares of the Company’s Common Stock at an exercise price equal to $0.25. These options vest and become exercisable as to 25% of the shares subject to the options on each of the first, second, third and fourth anniversaries of the date of grant, provided that each recipient is an employee of the Company on each vesting date.

2009 Stock Option and Cash Incentive Plan

On January 16, 2009, the GNC Committee established the 2009 Stock Option and Cash Incentive Compensation Plan (the “2009 Plan”), for the issuance of (i) performance-based stock options to purchase shares of the Company’s Common Stock at the closing price of the Company’s Common Stock on the Nasdaq Capital Market on January 16, 2009 and (ii) cash bonuses to each of the Company’s executive officers and other senior executives. The stock options granted under this plan only vest if the Company is cash flow neutral for fiscal 2009 and will vest and become exercisable or terminate on the day the Company publicly releases its financial results for the fiscal year ending December 31, 2009, provided the recipient continues to remain employed by the Company, or a subsidiary of the Company, until such date. In addition, the cash bonuses approved under this plan will only be earned by the executive officers upon the Company (i) being cash flow neutral for fiscal 2009 and (ii) generating operating income of at least $99,000 for fiscal 2009 (before disbursement of cash bonuses). Should the operating income of the Company for fiscal 2009 be between $99,000 and $299,000, such amount (up to $200,000) will be allocated to a pool (the “Pool”). In addition, 25% of any operating income of the Company for fiscal 2009 in excess of $299,000 (before disbursement of cash bonuses) will also be allocated to the Pool. Cash bonuses will only be distributed from the Pool according to the percentage allocated to each executive officer, if at all, on the day the Company publicly releases its financial results for the fiscal year ending December 31, 2009, provided the recipient continues to remain employed by the Company, or a subsidiary of the Company, until such date. Should the Company only generate operating income of $99,000 in fiscal 2009, no cash bonuses will be distributed as the Pool will not have been funded. The cash bonuses, assuming the Company is cash flow neutral for fiscal 2009 and generates operating income of $299,000 for fiscal 2009, will equal a percentage of base salary, for each executive officer. The amount to be paid to each executive officer is subject to upward and downward adjustment based on the Company’s operating income, and, thereby, the amount which is allocated to the Pool.

2007 Management Incentive Plan

On June 30, 2007, the GNC Committee approved the StockerYale, Inc. Management Incentive Plan (the “Plan”). The Plan was designed to recognize and reward the achievement of financial, business and management goals that are essential to the success of the Company and its subsidiaries. The Plan and all grants and awards made under the Plan shall be pursuant to the 2007 Plan. The Plan covers certain executive and senior employees of the Company, as determined by the GNC Committee.

Upon satisfaction and achievement of EBITDA and cash flow targets, as determined by the Board of Directors or the GNC Committee based on the financial results of the target period, each participant shall receive a grant of fully-vested restricted shares of the Company’s Common Stock. The Company did not achieve the financial target set for fiscal 2007. The second target period ends on December 31, 2009. Mr. Blodgett was eligible to receive up to 1,012,000 shares of the Company’s Common Stock under the Plan. Ms. Molleur was eligible to receive up to 392,000 shares of the Company’s Common Stock under the Plan. On March 23, 2009, each of Mr. Blodgett and Ms. Molleur elected not to participate in the Plan so they are no longer eligible to receive any grant of restricted shares under the Plan.

Stock Option and Incentive Plans

According to the Amended and Restated 1996 Stock Option and Incentive Plan (the “1996 Plan”), upon the termination of employment or business relationship of a participant under the 1996 Plan by reason of death or disability, including Mr. Blodgett, each stock option outstanding for that participant will automatically and immediately become fully exercisable. In addition, if that should happen, any shares of restricted stock awarded will automatically and immediately become fully vested. Also under the terms of the 1996 Plan, upon the occurrence of a “Change of Control” (as defined in the 1996 Plan), all outstanding stock options granted, and all shares of restricted stock granted including those granted to Mr. Blodgett, will automatically and immediately become fully vested. Upon a merger transaction or sale of all or substantially all of the assets of the Company, the Board of Directors of the Company or of any corporation assuming the obligations of the Company may take certain actions with respect to outstanding stock options granted under the 1996 Plan.

According to the 2000 Stock Option and Incentive Plan (the “2000 Plan”), as amended, upon a “Change of Control” (as defined in the 2000 Plan), the dissolution or liquidation of the Company, the sale of all or substantially all of the assets of the Company, a merger, or other similar transactions, all outstanding stock options and all stock appreciation rights awarded under the 2000 Plan, including those granted to Mr. Blodgett, automatically and immediately become fully exercisable. In addition, all other awards made under the 2000 Plan that contain conditions and restrictions relating solely to the passage of time become fully vested and cannot be forfeited as of the effective time of the “Change of Control.”

According to the 2004 Stock Option and Incentive Plan (the “2004 Plan”), upon a “Change of Control” or a “Sale Event,” (as defined in the 2004 Plan), all outstanding stock options granted and all stock appreciation rights awarded, including those granted to Mr. Blodgett, will automatically and immediately become fully exercisable. In addition, the restrictions on all “Restricted Stock Awards”, “Deferred Stock Awards” and “Performance Share Awards” (as defined in the 2004 Plan), which relate solely to the passage of time and continued employment will automatically be removed.

According to the 2007 Plan, upon a “Reorganization Event,” (as defined in the 2007 Plan), the Board must take any one or more of the following actions as to all or any outstanding “Awards” (as defined in the 2007 Plan), including those awarded to Messrs. Blodgett and Losik, on such terms as the Board determines: (i) provide that Awards will be assumed, or substantially equivalent Awards will be substituted, by the acquiring or succeeding corporation (or an affiliate thereof), (ii) upon written notice to a participant, provide that the participant’s unexercised stock options or other unexercised Awards will become exercisable in full and will terminate immediately prior to the consummation of the Reorganization Event unless exercised by the participant within a specified period following the date of such notice, (iii) provide that outstanding Awards will become realizable or deliverable, or restrictions applicable to an Award will lapse, in whole or in part prior to or upon such Reorganization Event, (iv) in the event of a Reorganization Event under the terms of which holders of Common Stock will receive upon consummation a cash payment for each share surrendered in the Reorganization Event (the “Acquisition Price”), make or provide for a cash payment to a participant equal to (A) the Acquisition Price times the number of shares of Common Stock subject to the participant’s stock options or other Awards (to the extent the exercise price does not exceed the Acquisition Price) minus (B) the aggregate exercise price of all such outstanding stock options or other Awards, in exchange for the termination of such options or other Awards, (v) provide that, in connection with a liquidation or dissolution of the Company, Awards will convert into the right to receive liquidation proceeds (if applicable, net of the exercise price thereof) and (vi) any combination of the foregoing.

Upon the occurrence of a Reorganization Event other than a liquidation or dissolution of the Company, the repurchase and other rights of the Company under each outstanding restricted stock award will inure to the benefit of the Company’s successor and will apply to the cash, securities or other property which the Common Stock was converted into or exchanged for pursuant to such Reorganization Event in the same manner and to the same extent as they applied to the Common Stock subject to such restricted stock award. Upon the occurrence of a Reorganization Event involving the liquidation or dissolution of the Company all restrictions and conditions on all restricted stock awards then outstanding will automatically be deemed terminated or satisfied, unless otherwise provided in the applicable restricted stock agreement.

Potential Payments Upon Termination or Change-in-Control

The Company entered into a separation agreement, dated as of September 30, 2002, with Mark W. Blodgett, the Company’s President, Chief Executive Officer, and Chairman of the Board. The separation agreement provides for a one-time, lump sum severance payment equal to his annual salary upon termination of employment by the Company other than for “Cause” or termination as a result of a “Change of Control”, each as defined in the separation agreement, or upon termination of employment by Mr. Blodgett for “Good Reason”, also as defined in the separation agreement.

The following table includes certain information with respect to the value of all unexercised options and restricted stock awards previously granted to the Named Executives at December 31, 2008.

OUTSTANDING EQUITY AWARDS AT 2008 FISCAL YEAR END

| | | OPTION AWARDS | | | STOCK AWARDS | |

| Name | | Number of Securities Underlying Unexercised Options Exercisable (#) | | | Number of Securities Underlying Unexercised Options Unexercisable (#) | | | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | | | Option Exercise Price ($) | | | Option Expiration Date | | | Number of Shares or Units of Stock That Have Not Vested (#) | | | Market Value of Shares or Units of Stock That Have not Vested ($) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Mark W. Blodgett | | | 60,000 | | | | — | | | | | | $ | 0.6875 | | | 1/1/2009 | | | | 302,500 | (1) | | $ | 45,375 | |

| | | | 70,000 | | | | — | | | | | | $ | 0.8125 | | | 4/1/2009 | | | | | | | | | |

| | | | 190,000 | | | | — | | | | | | $ | 0.8465 | | | 5/20/2009 | | | | | | | | | |

| | | | 40,000 | | | | — | | | | | | $ | 3.7812 | | | 2/1/2010 | | | | | | | | | |

| | | | 310,000 | | | | — | | | | | | $ | 11.75 | | | 4/2/2011 | | | | | | | | | |

| | | | 125,400 | | | | — | | | | | | $ | 4.85 | | | 5/15/2012 | | | | | | | | | |

| | | | 74,000 | | | | — | | | | | | $ | 0.73 | | | 10/1/2012 | | | | | | | | | |

| | | | 101,000 | | | | — | | | | | | $ | 1.30 | | | 1/6/2013 | | | | | | | | | |

| | | | 99,000 | | | | — | | | | | | $ | 0.63 | | | 8/15/2013 | | | | | | | | | |

| | | | 20,000 | | | | — | | | | | | $ | 2.06 | | | 5/17/2014 | | | | | | | | | |

| | | | 200,000 | | | | — | | | | | | $ | 1.22 | | | 7/30/2014 | | | | | | | | | |

| | | | — | | | | — | | | | 533,300 | (2) | | $ | 0.48 | | | | (2 | ) | | | | | | | | |

| | | | — | | | | 168,000 | (3) | | | | | | $ | 0.25 | | | 12/16/2018 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Timothy P. Losik | | | — | | | | — | | | | 200,000 | (2) | | $ | 0.48 | | | | (2 | ) | | | 150,000 | (5) | | $ | 22,500 | |