UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under Rule 14a-12 |

StockerYale, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

STOCKERYALE, INC.

32 Hampshire Road

Salem, New Hampshire 03079

April [ ], 2008

Dear StockerYale Shareholders:

You are cordially invited to attend the Special Meeting being held in lieu of the 2008 Annual Meeting of Shareholders of StockerYale, Inc., which will be held on Tuesday, May 20, 2008 at 10:00 a.m., local time, at the offices of Vitale, Caturano & Company, Ltd. at 80 City Square, Boston, Massachusetts 02129. Specific details regarding admission to the meeting and the business to be conducted at the meeting are provided in the attached Notice of Special Meeting in Lieu of Annual Meeting of Shareholders and Proxy Statement. I encourage you to carefully read the attached Notice of Special Meeting and Proxy Statement, as well as the enclosed Annual Report of the Company for the fiscal year ended December 31, 2007.

Whether or not you plan to attend the meeting, it is important that your shares are represented and voted. Therefore, I urge you to complete, sign and date the enclosed proxy card and promptly return it in the enclosed envelope so that your shares will be represented and voted at the meeting. If you do attend the meeting, you may withdraw your proxy and vote in person if you so desire.

I look forward to greeting those of you who will be able to attend the meeting.

Sincerely,

Mark W. Blodgett

President, Chief Executive Officer and

Chairman of the Board

StockerYale, Inc.

32 Hampshire Road

Salem, New Hampshire 03079

NOTICE OF SPECIAL MEETING IN LIEU OF ANNUAL MEETING OF SHAREHOLDERS TO BE HELD TUESDAY, MAY 20, 2008

To the Shareholders of StockerYale, Inc.:

The Special Meeting in Lieu of Annual Meeting of Shareholders (the “Meeting”) of StockerYale, Inc., a Massachusetts corporation (the “Company”), will be held at the offices of Vitale, Caturano & Company, Ltd. at 80 City Square, Boston, Massachusetts 02129, on Tuesday, May 20, 2008 at 10:00 a.m., local time, for the following purposes:

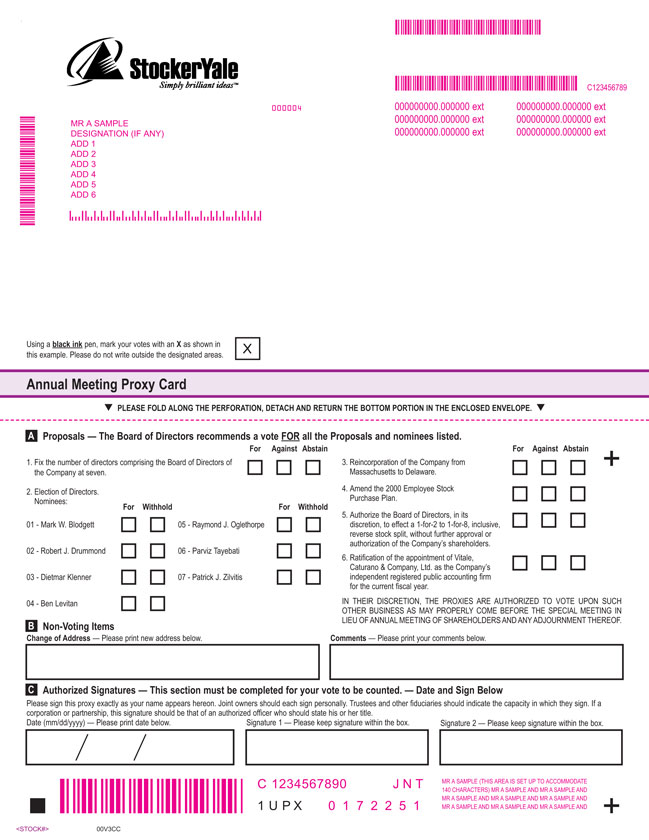

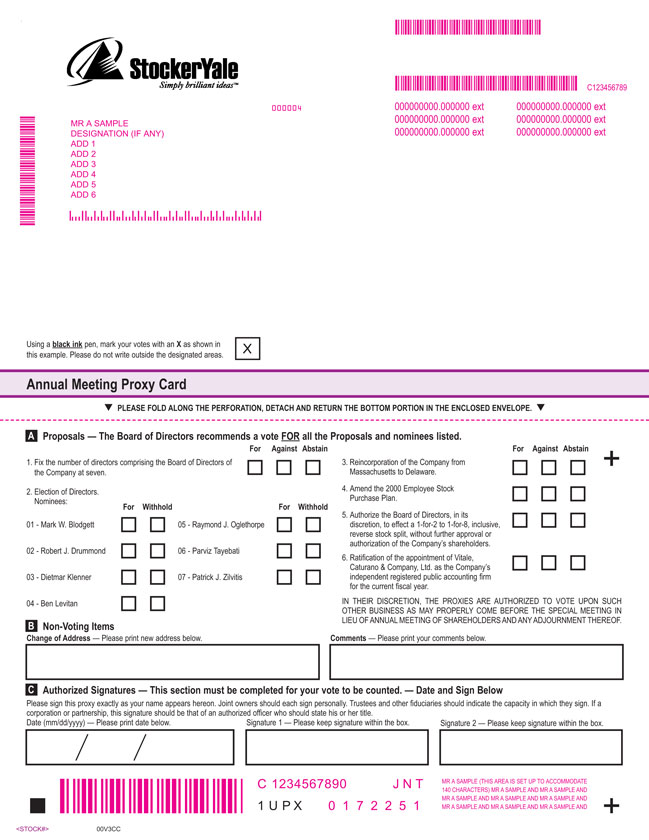

| | 1. | To fix the number of directors comprising the Board of Directors of the Company at seven; |

| | 2. | To elect seven directors to serve until the next Annual Meeting of Shareholders and until their successors are duly elected and qualified; |

| | 3. | To approve the reincorporation of the Company from Massachusetts to Delaware; |

| | 4. | To amend the Company’s 2000 Employee Stock Purchase Plan to increase the number of shares of common stock of the Company reserved thereunder from 200,000 to 300,000; |

| | 5. | To authorize the Board of Directors, in its discretion, should it deem it to be appropriate and in the best interests of the Company and its shareholders, to amend the Company’s Articles of Organization or the Company’s Certificate of Incorporation, as the case may be, to effect a reverse stock split of the Company’s issued and outstanding shares of Common Stock by a ratio of between 1-for-2 and 1-for-8, inclusive, without further approval or authorization of the Company’s shareholders; |

| | 6. | To ratify the appointment of Vitale, Caturano & Company, Ltd. as the Company’s independent registered public accounting firm for the current fiscal year; and |

| | 7. | To transact such other business that may properly come before the Meeting and any adjournments or postponements of the Meeting. |

The Board of Directors has no knowledge of any other business to be transacted at the Meeting.

Accompanying this Notice of Special Meeting and Proxy Statement is a copy of the Company’s Annual Report to Shareholders for the fiscal year ended December 31, 2007, which contains audited consolidated financial statements and other information of interest to shareholders.

Admission of shareholders to the Meeting will be on a first-come, first-served basis, and picture identification will be required to enter the Meeting. An individual arriving without picture identification will not be admitted unless it can be verified that the individual is a StockerYale shareholder. Cameras, cellular phones, recording equipment and other electronic devices will not be permitted at the Meeting. The Company reserves the right to inspect any persons or items prior to their admission to the Meeting.

Only shareholders of record at the close of business on Wednesday, March 26, 2008 are entitled to notice of, and to vote at, the Meeting. All shareholders are cordially invited to attend the Meeting.

BY ORDER OF THE BOARD OF DIRECTORS

Marianne Molleur, Clerk

Salem, New Hampshire

April [ ], 2008

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON, PLEASE COMPLETE, SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE TO ENSURE YOUR REPRESENTATION AND THE PRESENCE OF A QUORUM AT THE MEETING. NO POSTAGE NEED BE AFFIXED IF THE PROXY CARD IS MAILED IN THE UNITED STATES.

STOCKERYALE, INC.

PROXY STATEMENT

Special Meeting in Lieu of Annual Meeting of Shareholders

To Be Held on Tuesday, May 20, 2008

General

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board of Directors” or the “Board”) of StockerYale, Inc., a Massachusetts corporation (the “Company” “StockerYale” or “we”), for use at the Company’s 2008 Special Meeting in Lieu of Annual Meeting of Shareholders (the “Meeting”), which will be held on Tuesday, May 20, 2008 at 10:00 a.m., local time, at the offices of Vitale, Caturano & Company, Ltd. at 80 City Square, Boston, Massachusetts 02129, and at any adjournments thereof, for the purposes set forth in the Notice of Special Meeting in Lieu of Annual Meeting of Shareholders (the “Notice of Meeting”).

The Notice of Meeting, this Proxy Statement, the accompanying proxy card and the Company’s Annual Report to Shareholders for the fiscal year ended December 31, 2007 (the “2007 Annual Report”) are being mailed to shareholders on or about April [ ], 2008. The Company’s principal executive offices are located at 32 Hampshire Road, Salem, New Hampshire 03079 and its telephone number is (603) 893-8778.

Solicitation

The cost of soliciting proxies, including expenses incurred in connection with preparing and mailing this Proxy Statement, will be borne by the Company. The Company may engage a paid proxy solicitor to assist in the solicitation. Copies of solicitation materials will be furnished to brokerage houses, nominees, fiduciaries and custodians to forward to beneficial owners of the Company’s common stock, $.001 par value per share (the “Common Stock”), held in their names. In addition to the solicitation of proxies by mail, the Company’s directors, officers and other employees may, without additional compensation, solicit proxies by telephone, facsimile, electronic communication and personal interviews. The Company will also reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy materials to shareholders.

Record Date, Voting Securities and Votes Required

Only holders of record of the Company’s Common Stock as of the close of business on Wednesday, March 26, 2008 (the “Record Date”) will be entitled to receive notice of, and to vote at, the Meeting and any adjournments thereof. On the Record Date, the Company had approximately 38,937,907 shares of Common Stock issued and outstanding and entitled to be voted. The holders of Common Stock are entitled to one vote for each share of Common Stock held as of the Record Date on any proposal presented at the Meeting.

A majority of the shares of Common Stock issued and outstanding and entitled to be voted at the Meeting will constitute a quorum at the Meeting. Votes withheld, abstentions and shares held in “street name” by brokers or nominees who indicate on their proxies that they do not have discretionary authority to vote such shares as to a particular matter (“broker non-votes”) shall be counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Meeting.

The affirmative vote of the holders of a majority of the issued and outstanding shares of the Company’s Common Stock voting in person or by proxy and entitled to vote is required to fix the number of directors

1

comprising the Board of Directors at seven (Proposal No. 1), to amend the Company’s 2000 Employee Stock Purchase Plan (Proposal No. 4), to authorize the Board of Directors, in its discretion, should it deem it to be appropriate and in the best interests of the Company and its shareholders, to amend the Company’s Articles of Organization or the Company’s Certificate of Incorporation, as the case may be, to effect a reverse stock split of the Company’s issued and outstanding shares of Common Stock (Proposal No. 5) and to ratify the appointment of Vitale, Caturano & Company, Ltd. as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2008 (Proposal No. 6). The affirmative vote of two-thirds of all of the shares entitled to vote is required to approve the reincorporation of the Company from Massachusetts to Delaware (Proposal No. 3). The affirmative vote of the holders of a plurality of the votes cast in person or by proxy by the shares entitled to vote is required for the election of directors (Proposal No. 2).

Shares which abstain from voting on a particular matter and broker non-votes will not be counted as votes in favor of such matter and will also not be counted as votes cast or shares voting on such matter. Accordingly, neither abstentions nor broker non-votes will have any effect upon the outcome of voting with respect to any proposal in the Proxy Statement, except for the proposal to approve the reincorporation of the Company from Massachusetts to Delaware (Proposal No. 3). Abstentions and broker non-votes will have the same effect as a vote against Proposal No. 3.

An automated system administered by the Company’s transfer agent tabulates the votes. The votes on each matter are tabulated separately.

To vote by mail, complete, date and sign the enclosed proxy card and return it in the enclosed envelope as promptly as possible. No postage is necessary if the proxy card is mailed in the United States using the postage prepaid envelope provided. If you hold your shares through a bank, broker or other nominee, they will give you separate instructions for voting your shares.

Proxies

Voting by Proxy

Voting instructions are included on your proxy card. If you properly complete, sign and date your proxy card and return it to us in time to be counted at the Meeting, one of the individuals named as your proxy will vote your shares as you have directed. If you sign and timely return your proxy card but do not indicate how your shares are to be voted with respect to one or more of the proposals to be voted on at the Meeting, your shares will be voted for each of such proposals and in accordance with the judgment of the individuals named in the proxy card as the proxy holders as to any other matter that may be properly brought before the Meeting. The proxy holders will have discretionary authority to vote upon any adjournment of the Meeting.

Revoking your Proxy

You may revoke your proxy at any time before it is voted by:

| | • | | delivering a later-dated proxy or a notice of revocation in writing to the Company’s Clerk at the principal executive offices of the Company at the following address: StockerYale, Inc., 32 Hampshire Road, Salem, New Hampshire 03079, Attention: Clerk, at any time before the proxy is exercised; or |

| | • | | by attending the Meeting and voting in person at the Meeting. |

Voting in Person

If you plan to attend the Meeting and wish to vote in person, we will give you a ballot at the Meeting. However, if your shares are held in the name of your broker, bank or other nominee, you must bring a proxy from your nominee authorizing you to vote your “street name” shares held as of the Record Date.

2

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information as of February 29, 2008 (unless otherwise indicated), with respect to the beneficial ownership of the Company’s Common Stock by the following persons:

| | • | | each person known by the Company to beneficially own more than 5% of the outstanding shares of the Company’s Common Stock; |

| | • | | each of the Company’s directors and nominees for director; |

| | • | | each of the Named Executives (as defined below in the section titled “Additional Information—Executive Compensation”); and |

| | • | | all of the current executive officers and directors as a group. |

For purposes of the following table, beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission (the “SEC”) and the information is not necessarily indicative of beneficial ownership for any other purpose. Except as otherwise noted in the footnotes to the table, the Company believes that each person or entity named in the table has sole voting and investment power with respect to all shares of the Company’s Common Stock shown as beneficially owned by that person or entity (or shares such power with his or her spouse). Under the SEC’s rules, shares of Common Stock issuable under options that are exercisable on or within 60 days after February 29, 2008 (“Presently Exercisable Options”) or under warrants that are exercisable on or within 60 days after February 29, 2008 (“Presently Exercisable Warrants”) are deemed outstanding and are therefore included in the number of shares reported as beneficially owned by a person or entity named in the table and are used to compute the percentage of the Company’s Common Stock beneficially owned by that person or entity. These shares are not, however, deemed outstanding for computing the percentage of the Company’s Common Stock beneficially owned by any other person or entity. Unless otherwise indicated, the address of each person listed in the table is c/o StockerYale, Inc., 32 Hampshire Road, Salem, New Hampshire 03079.

3

The percentage of the Company’s Common Stock beneficially owned by each person or entity named in the following table is based on 38,967,407 shares of StockerYale Common Stock outstanding as of February 29, 2008 plus any shares issuable upon exercise of Presently Exercisable Options and Presently Exercisable Warrants held by such person or entity.

| | | | | | |

| | | Amount and Nature of

Beneficial Ownership | |

Name and Address of Beneficial Owner | | Number

of Shares | | | Percentage

of Class | |

5% Shareholders | | | | | | |

Lewis Asset Management, Corp. 45 Rockefeller Plaza Suite 2570 New York, NY 10111 | | 5,797,179 | (1) | | 14.9 | % |

| | |

Empire Capital Management, L.L.C. c/o Empire GP LLC 1 Gorham Island Road Westport, CT 06880 | | 5,180,000 | (2) | | 13.3 | % |

| | |

Directors, Nominees and Named Executives | | | | | | |

Mark W. Blodgett | | 3,952,727 | (3) | | 9.8 | % |

Robert J. Drummond | | 34,476 | | | * | |

Dietmar Klenner | | 129,384 | (4) | | * | |

Ben Levitan | | 50,722 | | | * | |

Raymond J. Oglethorpe | | 261,189 | (5) | | * | |

Parviz Tayebati | | 148,798 | | | * | |

Patrick J. Zilvitis | | 120,051 | (6) | | * | |

Luc Many | | 391,328 | (7) | | * | |

Marianne Molleur | | 314,500 | | | * | |

All directors and current executive officers as a group (8 persons) | | 4,847,347 | (8) | | 12.0 | % |

| (1) | Based solely on information provided in (i) Schedule 13G filed with the SEC by Lewis Asset Management, Corp. on January 4, 2007, (ii) amendments to Schedule 13G filed with the SEC by Lewis Asset Management, Corp. from January 4, 2007 through February 29, 2008 and (iii) Form 4s filed with the SEC by Lewis Asset Management, Corp. through February 29, 2008. |

| (2) | Based solely on information provided in a Form 4 filed with the SEC by Empire Capital Management, L.L.C. on March 4, 2008, this number consists of (i) 2,418,538 shares owned directly by Empire Capital Partners, L.P., (ii) 2,229,822 shares owned directly by Empire Capital Partners, Ltd., (iii) 443,033 shares owned directly by Charter Oak Partners, L.P., (iv) 70,985 shares owned directly by Charter Oak Partners II, L.P. and (v) 17,622 shares owned by Charter Oak Master Fund, L.P. Empire Capital Management, L.L.C. is the investment manager of Empire Capital Partners, Ltd., Charter Oak Partners, L.P., Charter Oak Partners II, L.P. and Charter Oak Master Fund, L.P. and Empire Capital GP, L.L.C. is the general partner of Empire Capital Partners, L.P. Based solely on information provided in an amendment to Schedule 13G filed with the SEC by Mr. Scott Fine and Mr. Peter Richards on February 14, 2008, Mr. Fine and Mr. Richards are the managing members of Empire Capital Management, L.L.C. and Empire Capital GP, L.L.C. and may be deemed to be the beneficial owners of the shares owned by Empire Capital Partners, L.P., Empire Capital Partners, Ltd., Charter Oak Partners, L.P., Charter Oak Partners II, L.P. and Charter Oak Master Fund, L.P. |

| (3) | Includes 1,234,400 shares issuable upon exercise of Presently Exercisable Options and 21,154 shares issuable upon exercise of Presently Exercisable Warrants. |

| (4) | Includes 30,000 shares issuable upon exercise of Presently Exercisable Options. |

| (5) | Includes 83,500 shares issuable upon exercise of Presently Exercisable Options and 8,462 shares issuable upon exercise of Presently Exercisable Warrants. Also includes 20,200 shares held by the Oglethorpe |

4

| | Family Limited Partnership (the “Partnership”). Mr. Oglethorpe is the General Partner of the Partnership and, by virtue of Mr. Oglethorpe’s voting and investment power over the shares held by the Partnership, Mr. Oglethorpe may be deemed to have beneficial ownership of such shares. |

| (6) | Includes 26,667 shares issuable upon exercise of Presently Exercisable Options. |

| (7) | Includes 200,850 shares issuable upon exercise of Presently Exercisable Options. |

| (8) | Includes 1,374,567 shares issuable upon exercise of Presently Exercisable Options and 29,616 shares issuable upon exercise of Presently Exercisable Warrants. |

5

PROPOSAL NO. 1

TO FIX THE NUMBER OF DIRECTORS COMPRISING THE BOARD OF DIRECTORS AT SEVEN

The Company’s Amended and Restated By-Laws (the “By-Laws”) provide that the number of directors comprising the Board of Directors shall be fixed by the shareholders of the Company at each annual meeting of shareholders. The number of directors must not be less than three or, in the event that there are less than three shareholders, must not be less than the number of shareholders. The Company is holding a special meeting of shareholders in lieu of an annual meeting of shareholders in 2008, and this matter will be acted upon by shareholders at the Meeting. At the special meeting of shareholders held last year, the number of directors comprising the Board of Directors was fixed at seven, which resulted in one vacancy on the Board of Directors. Since the special meeting of shareholders held last year, the Board of Directors, following a recommendation of the Governance, Nominating and Compensation Committee of the Board of Directors (the “GNC Committee”), elected Dr. Parviz Tayebati to the Board of Directors. By maintaining the size of the Board of Directors at seven directors, the Board of Directors will continue to be sufficiently sizeable to ensure diversity of experience and viewpoints of Board members and to be able to satisfy current and future corporate governance requirements without compromising the efficiency of the Board. The By-Laws permit the Board to expand the number of directors on the Board by vote of a majority of the directors then in office.

The Board of Directors recommends a vote FOR fixing the number of directors constituting the Board of Directors at seven.

6

PROPOSAL NO. 2

ELECTION OF DIRECTORS

Under the Company’s By-Laws, directors are elected to the Board of Directors to serve until the next annual meeting of shareholders following their election and until their successors have been chosen and qualified or until their earlier death, resignation or removal. The affirmative vote of the holders of a plurality of the votes cast in person or by proxy at an annual meeting of shareholders or special meeting held in lieu of an annual meeting by the shares entitled to vote is required for the election by shareholders of directors to the Board. The Board of Directors currently has the following seven members: Messrs. Mark W. Blodgett, Robert J. Drummond, Dietmar Klenner, Ben Levitan, Raymond J. Oglethorpe, Parviz Tayebati and Patrick J. Zilvitis.

The Board of Directors recommends that the seven nominees named below be elected to serve on the Board of Directors, each of whom is presently serving as a director. Shares of Common Stock represented by all proxies received and not marked so as to withhold authority to vote for any individual nominee or for all nominees will be voted for the election of the seven nominees named below. Each nominee has consented to being named in this Proxy Statement and has indicated his willingness to serve if elected. If for any reason any nominee should become unable or unwilling to serve, the persons named as proxies may vote the proxy for the election of a substitute nominee selected by the Board of Directors. The Board of Directors has no reason to believe that any nominee will be unable to serve. Shareholders may vote for no more than seven nominees for director.

Biographical and certain other information concerning the Company’s nominees for election to the Board of Directors is set forth below. Mark W. Blodgett, our President and Chief Executive Officer, is also the Chairman of the Board of Directors. However, the GNC Committee nominates an independent director to serve as the Lead Director if the Chairman of the Board is not an independent director. Mr. Raymond J. Oglethorpe has been designated by the independent directors to serve as Lead Director.

Information with respect to the number of shares of the Company’s Common Stock beneficially owned by each director as of February 29, 2008 appears above under the heading “Security Ownership of Certain Beneficial Owners and Management”. No director or executive officer is related by blood, marriage or adoption to any other director or executive officer.

Nominees for Election to Board of Directors

| | | | |

Name | | Position | | Age |

Mark W. Blodgett | | President, Chief Executive Officer and Chairman of the Board | | 51 |

Robert J. Drummond | | Director | | 64 |

Dietmar Klenner | | Director | | 53 |

Ben Levitan | | Director | | 46 |

Raymond J. Oglethorpe | | Director | | 63 |

Parviz Tayebati | | Director | | 47 |

Patrick J. Zilvitis | | Director | | 65 |

Additional Information Regarding Nominees and Current Directors

Mark W. Blodgett currently serves as the President, Chief Executive Officer and the Chairman of the Board of the Company. Mr. Blodgett has been a member of the Board of Directors and an executive officer of the Company since 1989. Mr. Blodgett worked for a private merchant bank from 1988 until 1989, was Corporate Vice President at Drexel Burnham Lambert, Inc. from 1980 until 1988 and was an associate in the area of mergers and acquisitions for Citibank N.A. from 1979 until 1980. Mr. Blodgett is actively involved in the Young Presidents’ Organization and is on the Board of Trustees for the Boston Ballet and Pomfret School.

7

Robert J. Drummond was a co-founder of Epsilon Data Management, Inc., a marketing services firm and pioneer in the field of database marketing. During his almost thirty-year tenure at Epsilon Data Management, Mr. Drummond served in various executive officer positions, including President and Chief Executive Officer from 1992 until 1998. After the sale of Epsilon, Mr. Drummond served as the President and Chief Executive Officer of an early-stage company offering integrated CRM and data solutions to the restaurant and hospitality markets and as an Operating Partner with Advent International, a private equity firm. Mr. Drummond currently serves on the Board of Directors of three private technology companies and is on the Board of Trustees for Drexel University. Mr. Drummond has been a member of the Board of Directors of the Company since 2007.

Dietmar Klenner is a co-founder and, since March 2004, Managing Partner, of Argus Wealth Management AG. From July 2002 until February 2006, Mr. Klenner was Managing Partner of Meridian Global Advisors, which he also co-founded. From December 1989 until June 2002, Mr. Klenner worked for KS Securities Asset Management, which he co-founded and where he served as Chief Executive Officer and Managing Partner. Mr. Klenner has been a member of the Board of Directors of the Company since 2003.

Ben Levitan is currently a partner at In-Q-Tel, Inc., a strategic investor in promising technology companies that support the mission of the CIA and the intelligence community. From 2001 until December 2005, Mr. Levitan was the Chief Executive Officer of EnvoyWorldWide, Inc., a venture backed communications and notification company. From 1999 until 2001, Mr. Levitan was the Chief Operating Officer of Viant Corporation, a publicly traded internet professional services firm. Mr. Levitan has been a member of the Board of Directors of the Company since 2006.

Raymond J. Oglethorpe is currently President of Oglethorpe Holdings, LLC, a private investment company, and has served on the Board of Trustees of The George Washington University since 1999. Mr. Oglethorpe served as President of America Online, Inc. from 2000 until his retirement in 2002. Prior to that time, Mr. Oglethorpe was a senior vice president responsible for directing the technologies and member services organizations of America Online, Inc. Mr. Oglethorpe has been a member of the Board of Directors of the Company since 2000. Mr. Oglethorpe has been designated by the independent members of the Board of Directors as Lead Director of the Company.

Parviz Tayebatiwas the founder of AZNA LLC, a provider of lasers for the telecommunications market. Dr. Tayebati served as the Chairman and Chief Executive Officer of AZNA LLC from 2002 until 2007. After the sale of AZNA LLC, Dr. Tayebati was the manager of Spectrode LLC and he is currently the manager of Camros Capital. Prior to founding AZNA LLC, Dr. Tayebati worked for CoreTek Inc., which he also co-founded and where he served as Chief Executive Officer. Dr. Tayebati has been a member of the Board of Directors of the Company since 2007.

Patrick J. Zilvitis served as a consultant with Benchmarking Partners, a Boston based industry analysis and consulting firm from September 2001 until December 2006. Mr. Zilvitis served as the Chief Information Officer for Segway LLC on a consulting basis from September 2000 until June 2004. Mr. Zilvitis was employed by The Gillette Company from 1992 until 2000, where he served as the Chief Information Officer and Corporate Vice President. Since July 2000, Mr. Zilvitis has also served as a member of the Board of Directors of ANSYS, Inc., a publicly-traded engineering software company. Mr. Zilvitis has been a member of the Board of Directors of the Company since 2004.

The Board of Directors recommends a vote FOR the election of the nominees named in the table above as directors of the Company.

8

PROPOSAL NO. 3

REINCORPORATION FROM MASSACHUSETTS TO DELAWARE

General

The Board of Directors has approved and recommends to the shareholders a proposal to change the Company’s state of incorporation from the Commonwealth of Massachusetts to the State of Delaware (the “Reincorporation”). If our shareholders approve the Reincorporation in Delaware, we will accomplish the Reincorporation by domesticating in Delaware as provided in the Delaware General Corporation Law (the “DGCL”) and the Massachusetts Business Corporation Act (the “MBCA”).

The Reincorporation will not involve any change in the business, properties, corporate headquarters or management of the Company. The directors and officers of the Company immediately prior to the Reincorporation will serve as the directors and officers of the Company following the Reincorporation, and there will be no changes in the operations, assets, liabilities and obligations of the Company as a result of the Reincorporation.

A copy of the Plan of Domestication adopted by our Board of Directors (the “Plan of Domestication”) is attached as Appendix A. Approval of this Proposal No. 3 will constitute approval of the Plan of Domestication.

When the Reincorporation becomes effective, each outstanding share of the Company’s Common Stock will continue to be an outstanding share of the Company’s Common Stock, as incorporated in Delaware. At the same time, each outstanding option, right or warrant to acquire shares of the Company’s Common Stock will continue to be an option, right or warrant to acquire an equal number of shares of the Company’s Common Stock under the same terms and conditions. Furthermore, when the Reincorporation becomes effective, the Company will be governed by the Certificate of Incorporation (the “Delaware Charter”) attached hereto as Appendix B and by the Bylaws (the “Delaware Bylaws”) attached hereto as Appendix C. Approval of this Proposal No. 3 will constitute approval of the Delaware Charter and Delaware Bylaws. Following the Reincorporation, the Company will be governed by the DGCL instead of the MBCA. The Company’s current Articles of Organization (the “Massachusetts Charter”) and By-Laws (the “Massachusetts Bylaws”) will not be applicable to the Company upon completion of the Reincorporation.

Reasons for and Advantages of the Reincorporation in Delaware

The Board of Directors has requested shareholders to approve the Reincorporation for many reasons. For many years, Delaware has followed a policy of encouraging incorporation in that state and, in furtherance of that policy, has adopted comprehensive, modern and flexible corporate laws which are periodically updated and revised to meet changing business needs. As a result, many corporations have initially chosen Delaware as their state of incorporation or have subsequently reincorporated in Delaware. Furthermore, the Delaware courts have developed considerable expertise in dealing with corporate issues, and a substantial body of case law has developed construing Delaware law and establishing public policies with respect to Delaware corporations, thereby providing greater predictability with respect to legal affairs.

In the opinion of the Board of Directors of the Company, the Reincorporation in Delaware may provide the Company with more opportunities to raise capital. Also, many of our shareholders and investors are not based in the United States and they are more familiar with Delaware laws than with Massachusetts laws.

In the opinion of the Board of Directors of the Company, underwriters and other members of the financial services industry may be more willing and better able to assist in capital-raising programs for corporations having the greater flexibility afforded by the DGCL. Reincorporation from Massachusetts to Delaware also may make it easier to attract future candidates willing to serve on our Board of Directors because many of such candidates will already be familiar with Delaware corporate law, including provisions relating to director indemnification, from their past business experience.

9

Plan of Domestication

The Plan of Domestication provides that the Company will reincorporate in Delaware and all operations, assets and liabilities of the Company, including obligations under outstanding indebtedness, contracts, options and warrants, will remain the same. Our existing Board of Directors and officers will continue to be our directors and officers following the Reincorporation for identical terms of office.

Each outstanding share of the Company’s Common Stock will remain unaffected by the Reincorporation. You will not have to exchange your existing stock certificates of the Company for new stock certificates. At the effective time of the Reincorporation, our Common Stock will continue to be traded on the Nasdaq Global Market, the Nasdaq Capital Market or other market or exchange on which shares of the Company’s Common Stock are listed or quoted for trading under the symbol “STKR.” There will be no interruption in the trading of the Company’s Common Stock as a result of the Reincorporation.

The Plan of Domestication was unanimously approved by the Board of Directors of the Company. Approval of the Reincorporation proposal (which constitutes approval of the Plan of Domestication) requires the affirmative vote of the holders of two-thirds of all of the votes entitled to be cast.

Effective Time

If approved by the requisite vote of the holders of shares of the Company’s Common Stock, it is anticipated that the Reincorporation will become effective at the time set forth in each of the Certificate of Conversion from a Non-Delaware Corporation to a Delaware Corporation to be filed with the Secretary of State of Delaware in accordance with the DGCL and the Articles of Charter Surrender to be filed with the Secretary of Commonwealth of the Commonwealth of Massachusetts in accordance with the MBCA. However, the Plan of Domestication may be terminated, deferred or abandoned by action of the Board of Directors of the Company at any time prior to the effective time of the Reincorporation, whether before or after the shareholders of the Company approve this proposal to effect the Reincorporation, if the Board of Directors of the Company determines for any reason, in its sole judgment and discretion, that the consummation of the Reincorporation would be inadvisable or not in the best interests of the Company and its shareholders.

Effect of Not Obtaining the Required Vote for Approval

If the Reincorporation proposal fails to obtain the requisite vote for approval, the Reincorporation will not be consummated and the Company will continue to be incorporated in Massachusetts.

Comparison of Shareholder Rights Before and After the Reincorporation

Because of differences between the MBCA and the DGCL, as well as differences between the Company’s charter and bylaws before and after the Reincorporation, the Reincorporation will effect some changes in the rights of the Company’s shareholders. Summarized below are the most significant differences between the rights of the shareholders of the Company before and after the Reincorporation, as a result of the differences among the MBCA and the DGCL, the Massachusetts Charter and the Delaware Charter, and the Massachusetts Bylaws and the Delaware Bylaws.

The summary below is not intended to be relied upon as an exhaustive list of all differences or a complete description of the differences between the DGCL and the Delaware Charter and Delaware Bylaws, on the one hand, and the MBCA and the Massachusetts Charter and Massachusetts Bylaws, on the other hand. The summary below is qualified in its entirety by reference to the actual text of the MBCA, the Massachusetts Charter, the Massachusetts Bylaws, the DGCL, the Delaware Charter and the Delaware Bylaws.

10

Authorized Capital Stock

Massachusetts

The Company’s Massachusetts Charter authorizes 100,000,000 shares of Common Stock, of which 38,937,907 shares were issued and outstanding as of March 26, 2008. Under the MBCA, the holders of the Company’s Common Stock are entitled to one vote per share on all matters voted on by shareholders, including the election of directors. The holders of shares of the Company’s Common Stock are not entitled to any cumulative voting, conversion, redemption or preemptive rights.

Delaware

The Delaware Charter, which will be filed as a condition to the consummation of the Reincorporation, authorizes (i) 100,000,000 shares of Common Stock, $0.001 par value, and (ii) 10,000,000 shares of Preferred Stock, $0.001 par value (the “Preferred Stock”). The Company’s Massachusetts Charter does not have any authorized preferred stock; therefore, the Company currently cannot issue shares of preferred stock unless the Company amends the Massachusetts Charter to authorize shares of preferred stock.

Under the Delaware Charter, the Board of Directors will have the authority to approve the issuance of all or any shares of the Preferred Stock in one or more series, to determine the number of shares constituting any series and to determine any voting powers, conversion rights, dividend rights, and other designations, preferences, limitations, restrictions and rights relating to such shares without any further authorization by the stockholders. The designations, preferences, limitations, restrictions and rights of any series of Preferred Stock designated by the Board of Directors will be set forth in an amendment to the Delaware Charter filed in accordance with the DGCL.

The Board of Directors elected to authorize Preferred Stock in the Delaware Charter because it believes it is advisable and in the best interests of the Company and its shareholders in order to facilitate the Company’s ability to raise capital, if and when necessary, and to pursue corporate opportunities, including acquisitions and joint ventures, without the delay and expense associated with obtaining special shareholder approval each time an opportunity requiring the issuance of shares of Preferred Stock may arise. The ability of the Board to determine the rights, preferences and limitations of the Preferred Stock, and the ability to issue the Preferred Stock, each without the need for further shareholder action, would provide the Board with flexibility in connection with possible investment activity and other corporate purposes. The Board of Directors would make a determination as to whether to approve the terms and issuance of any shares of Preferred Stock based on its judgment as to the best interests of the Company and its shareholders.

While the Company may consider issuing Preferred Stock in the future for purposes of raising additional capital or in connection with acquisition transactions or other related corporate transactions, the Company presently has no plans, agreements or understanding with any person to effect any such issuance, and the Company may never issue any Preferred Stock. Therefore, the terms of any Preferred Stock that may be issued in the future cannot be stated. However, it is likely that the terms and conditions of any Preferred Stock, as designated in an amendment to the Delaware Charter, would include preferences and rights superior to those of the holders of Common Stock. Such terms might include special voting rights, special conversion rights and redemption or other rights which may, among other things, provide the holders of Preferred Stock with a disproportionate share of earnings distributed by way of dividends or of the proceeds of a sale or liquidation of the Company as well as disproportionate rights of approval with respect to certain kinds of transactions, compared to those of the holders of Common Stock.

Under the Delaware Charter and the DGCL, the holders of shares of the Company’s Common Stock following the Reincorporation will be entitled to one vote for each share on all matters voted on by stockholders, including the election of directors. The holders of shares of the Company’s Common Stock will not have any cumulative voting, conversion, redemption or preemptive rights. The holders of shares of the Company’s

11

Common Stock will be entitled to such dividends as may be declared from time to time by the Company’s Board of Directors from funds lawfully available therefor, and upon liquidation will be entitled to receive pro rata all assets of the Company available for distribution to such holders, in each case subject to any preferential or other rights of any then outstanding Preferred Stock.

Number of Directors; Election; Removal; Filling Vacancies

Massachusetts

The Massachusetts Bylaws provide that the shareholders of the Company must fix the number of directors and elect the number of directors so fixed at each annual meeting of shareholders, and the number of directors may not be less than three, or less than the number of shareholders if the number of shareholders is less than three. The Board of Directors may be enlarged by the shareholders at any meeting or by vote of a majority of the directors then in office. Any vacancy in the Board of Directors, including a vacancy resulting from an enlargement of the Board, may be filled by the shareholders or by a majority of the Board of Directors. A director may be removed from office (i) with or without cause by vote of the holders of a majority of the shares of stock entitled to vote in the election of directors, or (ii) for cause by vote of a majority of the directors then in office. A director may be removed for cause only after reasonable notice and opportunity to be heard before the body proposing to remove him.

Delaware

The Delaware Charter and Delaware Bylaws provide that the number of directors will be fixed from time to time by action of the Board of Directors. The directors are elected by the stockholders at the annual meeting and all directors hold office until their successors are elected and qualified, or until their earlier death, resignation or removal. The Delaware Charter and Delaware Bylaws provide that any director may be removed with or without cause by the affirmative vote of the holders of at least 75% of the votes which all stockholders would be entitled to cast in an election of directors. Unlike under the Massachusetts Bylaws, the directors do not have the power to remove a director. Any vacancy created as a result of the removal of a director or a vacancy resulting from an enlargement of the board may be filled only by the vote of a majority of the remaining directors then in office. A director elected to fill a vacancy shall hold office until the next annual meeting of stockholders at which directors are elected.

Cumulative Voting for Directors

Massachusetts

Massachusetts law permits cumulative voting for directors only if provided in the articles of organization. The Massachusetts Charter does not provide for cumulative voting rights.

Delaware

Delaware law permits cumulative voting if provided in the certificate of incorporation. The Delaware Charter does not provide for cumulative voting rights.

Business Combinations with Interested Shareholders

Massachusetts

The MBCA does not have any provisions governing transactions with large or significant shareholders. However, under Chapter 110D of the Massachusetts General Laws, Massachusetts regulates “control share acquisitions”, which are defined as the acquisition by any person of beneficial ownership of shares of an issuing public corporation, which, but for the provisions of Chapter 110D, would have voting rights and which, when added to all other shares of the corporation owned by such person, would entitle the person to vote shares of the

12

corporation having voting power in the election of directors within any of the following ranges of voting power (i) one-fifth or more but less than one-third of all voting power, (ii) one-third or more but less than a majority of all voting power, or (iii) a majority or more of all voting power. A person who has made a control share acquisition may deliver to the corporation a control acquisition statement containing, among other things, the identity of the person making the control share acquisition, the number of shares of the corporation beneficially owned by such person and the number of shares of the corporation acquired or proposed to be acquired by such person pursuant to the control share acquisition.

The control share acquisition statute provides that any shares acquired in a control share acquisition will have the same voting rights as all other shares of the same class or series of the corporation only to the extent authorized by vote of the shareholders of the corporation at an annual or special meeting of shareholders. The authorization requires the affirmative vote of the holders of a majority of all of the shares entitled to vote generally in the election of directors, excluding interested shares. If the articles of organization or bylaws of the corporation provide, the corporation may redeem, without the agreement of the person making the control share acquisition, all of the shares acquired by the person in the control share acquisition for fair market value if (i) the person did not deliver a control acquisition statement to the corporation or (ii) a control acquisition statement was delivered and voting rights were not authorized for the shares by the shareholders of the corporation.

An acquisition of shares pursuant to a tender offer, merger or consolidation, if such transaction is pursuant to an agreement to which the corporation is a party, and an acquisition directly from the corporation, are not included in the definition of control share acquisition. The control share acquisition statute is only applicable to a corporation that has (i) two hundred or more shareholders of record, (ii) its principal executive office or substantial assets within Massachusetts, and (iii) either more than 10% of its shareholders of record residing in Massachusetts or more than 10% of its issued and outstanding shares owned of record by residents of Massachusetts.

Delaware

Following the Reincorporation, the Company will be governed by Section 203 of the DGCL. Section 203 of the DGCL provides that, subject to certain exceptions specified therein, a corporation shall not engage in any business combination with any “interested stockholder” for a three-year period following the date that such stockholder becomes an interested stockholder unless (i) prior to such date, the board of directors of the corporation approved either the business combination or the transaction which resulted in the stockholder becoming an interested stockholder, (ii) upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced (excluding shares held by directors who are also officers and employee stock purchase plans in which employee participants do not have the right to determine confidentially whether plan shares will be tendered in a tender or exchange offer), or (iii) on or subsequent to such date, the business combination is approved by the board of directors of the corporation and by the affirmative vote at an annual or special meeting, and not by written consent, of at least 66 2/3% of the outstanding voting stock which is not owned by the interested stockholder. Except as specified in Section 203 of the DGCL, an interested stockholder is defined to include (a) any person that is the owner of 15% or more of the outstanding voting stock of the corporation or is an affiliate or associate of the corporation and was the owner of 15% or more of the outstanding voting stock of the corporation, at any time within three years immediately prior to the relevant date, and (b) the affiliates and associates of any such person.

Under certain circumstances, Section 203 of the DGCL may make it more difficult for a person who would be an “interested stockholder” to effect various business combinations with a corporation for a three-year period, although the corporation’s certificate of incorporation or stockholders may elect to exclude a corporation from the restrictions imposed thereunder. The Delaware Charter does not exclude the Company from the restrictions imposed under Section 203 of the DGCL. It is anticipated that the provisions of Section 203 of the DGCL may encourage companies interested in acquiring the Company to negotiate in advance with the Board of Directors,

13

since the stockholder approval requirement would be avoided if a majority of the directors then in office approve either the business combination or the transaction which results in the stockholder becoming an interested stockholder.

Limitation of Liability of Directors

Massachusetts

The MBCA authorizes a Massachusetts corporation to adopt a charter provision eliminating or limiting the personal liability of directors to the corporation for monetary damages for breach of fiduciary duty as directors, provided that the provision may not eliminate or limit the liability of directors for (i) any breach of the director’s duty of loyalty to the corporation or its shareholders, (ii) any acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) any improper distributions to shareholders under Section 6.40 of the MBCA, or (iv) any transaction from which the director derived an improper personal benefit. The Massachusetts Charter limits the liability of the Company’s directors in accordance with the MBCA.

Delaware

The DGCL permits a corporation to include a provision in its certificate of incorporation eliminating or limiting the personal liability of a director to the corporation or its stockholders for damages for certain breaches of the director’s fiduciary duty. However, no such provision may eliminate or limit the liability of a director for (i) any breach of the director’s duty of loyalty to the corporation or its stockholders, (ii) acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) declaration of unlawful dividends or illegal redemptions or stock repurchases, or (iv) any transaction from which the director derived an improper personal benefit.

The Delaware Charter provides that, except to the extent that the DGCL prohibits the elimination or limitation of liability of directors for breaches of fiduciary duties, no director of the Company will be personally liable to the Company or its stockholders for monetary damages for any beach of fiduciary duty as a director. No amendment to that provision of the Delaware Charter will have any effect on the liability of any director of the Company with respect to acts occurring prior to the amendment.

Indemnification of Officers and Directors

Massachusetts

The MBCA provides that a corporation may indemnify an individual who is a party to a proceeding because he is a director or officer against liability incurred if (i) he acted in good faith, (ii) he reasonably believed his conduct was in the best interests of the corporation or was not opposed to the best interests of the corporation, and (iii) in the case of a criminal proceeding, he had no reasonable cause to believe his conduct was unlawful. The MBCA also provides that a corporation must indemnify a director or officer who was successful, on the merits or otherwise, in the defense of any proceeding to which he was a party because he was a director of the corporation against reasonable expenses incurred by him in connection with the proceeding.

The Massachusetts Charter and Massachusetts Bylaws provide that the Company must indemnify its directors and officers against all expenses incurred in any proceedings in which they were involved as a result of their service as a director or officer, except that no indemnification is allowed (i) for a matter as to which it is determined that the officer or director did not act in good faith and in the reasonable belief that his action was in the best interests of the Company, (ii) with respect to a criminal matter with respect to which the officer or director had reasonable cause to believe that his conduct was unlawful, or (iii) if the individual is adjudged to have received an improper personal benefit. In addition, the Company is required to advance expenses incurred by an officer or director in defending any proceeding in advance of final disposition of the proceeding upon receipt of a written undertaking from the officer or director to repay such amount if he is determined under the Massachusetts Charter or Massachusetts Bylaws, or adjudicated, to be ineligible for indemnification.

14

Delaware

The DGCL provides that indemnification may not be made for any matter as to which a person has been adjudged by a court of competent jurisdiction to be liable to the corporation, unless and only to the extent a court determines that the person is entitled to indemnity for such expenses as the court deems proper.

The Delaware Charter provides that the Company shall indemnify each person who is a party or threatened to be made a party to any proceeding by reason of the fact that he is a director or officer of the Company, or if he served in a similar capacity for another entity at the request of the Company, against all expenses incurred by the individual in connection with the proceeding provided that the individual acted in good faith and in a manner that he reasonably believed to be in, or not opposed to, the best interests of the Company and with respect to any criminal proceeding, he had no reasonable cause to believe his conduct was unlawful. The Company shall also indemnify an officer or director on the same terms and conditions who is made a party or threatened to be made a party to any action or suit brought by or in the right of the Company to procure a judgment in the Company’s favor. The Delaware Charter also provides that the Company must advance expenses to any officer or director who is made a party to a proceeding in his capacity as such in advance of the final disposition of the proceeding so long as the officer or director undertakes to repay all amounts so advanced in the event that it is ultimately determined that the individual is not entitled to be indemnified by the Company.

Special Meetings of Shareholders

Massachusetts

Under the MBCA, a special meeting of shareholders may be called (i) by the board of directors of the corporation, (ii) in the case of a corporation other than a public corporation, by the shareholders holding at least 10% (or a lesser percentage established in the articles of organization) of all the votes entitled to be cast on any issue to be considered at the proposed meeting, and (iii) in the case of a public corporation, unless otherwise provided in the articles of organization or bylaws, by the shareholders holding at least 40% of the votes entitled to be cast on any issue to be considered at the proposed meeting.

The Massachusetts Bylaws provide that special meetings of shareholders may be called (i) by the Chairman of the Board of Directors or a majority of the directors, and (ii) upon written application of shareholders who hold at least 50% of the outstanding capital stock entitled to vote at such meeting.

Delaware

Under the DGCL, a special meeting of stockholders may be called by the corporation’s board of directors or by such persons as may be authorized by the corporation’s certificate of incorporation or bylaws. The Delaware Bylaws provide that a special meeting may be called at any time by (i) the Company’s Board of Directors, (ii) the Chairman of the Board of Directors, (iii) the Chief Executive Officer or President, and (iv) upon the written demand of the holders of at least a majority of all the votes entitled to be cast on any issues to be considered at the proposed special meeting.

Amendment or Repeal of the Certificate of Incorporation

Massachusetts

Under the MBCA, any amendments to the articles of organization must be adopted by the board of directors and, unless a greater percentage is required by the articles of organization or the bylaws, the amendment must generally be approved by the holders of two-thirds of all the shares entitled to vote on the matter. If the amendment relates solely to (i) an increase or reduction in the corporation’s capital stock of any class or series then authorized, (ii) a change in the corporation’s authorized shares into a different number of shares or the exchange thereof pro rata for a different number of shares of the same class or series, or (iii) a change of the

15

corporation’s corporate name, the required vote shall be a majority instead of two-thirds. The Massachusetts Charter and the Massachusetts Bylaws do not contain a greater percentage requirement for the adoption of amendments to the Massachusetts Charter.

Delaware

Under the DGCL, unless the certificate of incorporation otherwise provides, amendments to the certificate of incorporation generally require the approval of the holders of a majority of the outstanding stock entitled to vote thereon, and if the amendment would increase or decrease the number of authorized shares of any class or series or the par value of such shares, or would adversely affect the rights, powers or preferences of such class or series, a majority of the outstanding stock of such class or series also would have to approve the amendment. The Delaware Charter may be amended upon the approval of the holders of a majority of the outstanding stock of the Company, provided that any amendments to Article Sixth of the Delaware Charter, which deals with amendments to the Delaware Bylaws, and Article Ninth of the Delaware Charter, which deals with the Board of Directors and the management of the Company, must be approved by the affirmative vote of the holders of at least 75% of the votes entitled to vote in an election of directors.

Amendment to Bylaws

Massachusetts

The MBCA and the Massachusetts Bylaws provide that the shareholders have the power to make, amend or repeal the bylaws. If authorized in the articles of organization, or in the bylaws pursuant to authorization in the articles or organization, the Board of Directors may also make, amend, or repeal the bylaws, except with respect to any provision of the bylaws which by virtue of an express provision in the MBCA, the articles of organization, or the bylaws, requires action by the shareholders. If the Board of Directors amends the bylaws, notice must be delivered to the shareholders explaining the amendment to the bylaws and any action taken by the Board of Directors with respect to the bylaws may be amended or repealed by the shareholders.

Delaware

Under the DGCL, directors may amend the bylaws of a corporation only if such right is expressly conferred upon the directors in its certificate of incorporation. The Delaware Charter provides that the Board of Directors has the power to adopt, amend, alter or repeal the Delaware Bylaws and that the Delaware Bylaws also may be adopted, amended, altered or repealed by the affirmative vote of the holders of at least 75% of the votes which all the stockholders would be entitled to cast in any annual election of directors.

Merger with Subsidiary

Massachusetts

The MBCA provides that a parent corporation may merge into a subsidiary of which it holds at least 90% of the voting power of each class and series of outstanding shares, and the subsidiary may merge into the parent, without the approval of the board of directors or shareholders of the subsidiary, unless the articles of organization of any of the corporations otherwise provide or, in the case of a foreign subsidiary, unless approval by the board of directors or shareholders is required by the laws under which the subsidiary is organized. If approval of a merger is not required by the subsidiary’s shareholders, the parent corporation shall, within 10 days after the merger, notify each shareholder of the subsidiary that the merger has become effective.

Delaware

The DGCL provides that a parent corporation who owns at least 90% of the outstanding shares of each class of a subsidiary may merge into the subsidiary, and the subsidiary may merge into its parent, without the approval of the stockholders of the subsidiary by filing a certificate of ownership and merger that includes a copy of the resolution of its board of directors approving the merger.

16

Committees of the Board of Directors

Massachusetts

The MBCA provides that the board of directors of a corporation may create one or more committees which may generally exercise the authority of the board of directors provided that a committee may not authorize distributions, approve or propose to shareholders action that the MBCA requires be approved by shareholders, change the number of the board of directors, remove directors from office or fill vacancies on the board of directors, amend the articles of organization, adopt, amend or repeal bylaws, or authorize or approve reacquisitions of shares, except according to a formula or method prescribed by the board of directors.

Delaware

The DGCL provides that the board of directors may delegate certain of its duties to one or more committees elected by a majority of the board. A Delaware corporation can delegate to a committee of the board of directors, among other things, the responsibility of nominating candidates for election to the office of director, to fill vacancies on the board of directors, to reduce earned or capital surplus, and to authorize the acquisition of the corporation’s own stock. In addition, if the corporation’s certificate of incorporation or bylaws, or the resolution of the board of directors creating the committee so permits, a committee of the board of directors may declare dividends and authorize the issuance of stock.

Mergers and Acquisitions

Massachusetts

Under the MBCA, a merger, share exchange and sale of all or substantially all of the assets of a corporation must be approved by the board of directors and, unless a greater percentage vote is required by the articles of organization, bylaws or the board of directors, the merger, share exchange or sale of assets must be approved by two-thirds of all the shares entitled to vote on the matter. The articles of organization may provide for a lesser vote than two-thirds but not less than a majority of the shares entitled to vote on the matter. The Massachusetts Charter does not provide for a lower voting threshold by the shareholders in the case of a merger, share exchange or sale of substantially all of the assets of the Company.

Approval of a merger or share exchange by the shareholders of a corporation is not required if (i) the corporation will survive the merger or is the acquiring corporation in a share exchange, (ii) except for certain permitted amendments, the corporation’s articles of organization will not be changed, (iii) each shareholder of the corporation whose shares were outstanding immediately before the effective date of the merger or share exchange will hold the same number of shares, with identical preferences, limitations, and relative rights, immediately after the effective date of change, and (iv) the shares of any class or series of stock of the corporation to be issued or delivered pursuant to the plan of merger does not exceed 20% of the shares of such corporation of the same class or series outstanding immediately before the effective date of the merger.

Delaware

Under the DGCL, a merger, consolidation, sale of all or substantially all of a corporation’s assets other than in the regular course of business or dissolution of a corporation must be approved by a majority of the outstanding shares entitled to vote. No vote of stockholders of a constituent corporation surviving a merger, however, is required (unless the corporation provides otherwise in its certificate of incorporation) if (i) the merger agreement does not amend the certificate of incorporation of the surviving corporation; (ii) each share of stock of the surviving corporation outstanding before the merger is an identical outstanding or treasury share after the merger; and (iii) the number of shares to be issued by the surviving corporation in the merger does not exceed 20% of the shares outstanding immediately prior to the merger.

17

Preemptive Rights

Massachusetts

Under the MBCA, the shareholders of a corporation do not have preemptive rights to acquire the corporation’s unissued shares except as provided in the articles of organization or any contract to which the corporation is a party. The Massachusetts Charter does not provide for preemptive rights.

Delaware

Under Delaware law, stockholders do not have preemptive rights unless such rights are specifically granted in the certificate of incorporation. The Delaware Charter does not provide for preemptive rights.

Transactions with Officers and Directors

Massachusetts

The MBCA provides that a transaction in which a director has a material direct or indirect interest is not voidable by the corporation solely because of the director’s interest in the transaction if any one of the following is true: (i) the material facts of the transaction and the director’s interest were disclosed or known to the board of directors or a committee of the board of directors and the board of directors or committee authorized, approved, or ratified the transaction, (ii) the material facts of the transaction and the director’s interest were disclosed or known to the shareholders entitled to vote and they authorized, approved, or ratified the transaction, or (iii) the transaction was fair to the corporation.

Delaware

The DGCL provides that contracts or transactions between a corporation and one or more of its officers or directors or an entity in which they have a financial interest is not void or voidable solely because of such interest or the participation of the director or officer in a meeting of the board of directors or a committee which authorizes the contract or transaction if (i) the material facts as to the relationship or interest and as to the contract or transaction are disclosed or are known to the board of directors or the committee, and the board of directors or committee in good faith authorizes the contract or transaction by the affirmative votes of a majority of disinterested directors, even though the disinterested directors are less than a quorum, (ii) the material facts as to the relationship or interest and as to the contract or transaction are disclosed or are known to the stockholders entitled to vote thereon, and the contract or transaction is specifically approved in good faith by vote of the stockholders, or (iii) the contract or transaction is fair as to the corporation as of the time it is authorized, approved or ratified by the board of directors, a committee thereof or the stockholders.

Stock Redemptions and Repurchases

Massachusetts

Under the MBCA, a corporation may acquire its own shares and such shares constitute authorized but unissued shares.

Delaware

Under the DGCL, a corporation may purchase or redeem its own shares of capital stock, except when the capital of the corporation is impaired or when such purchase or redemption would cause any impairment of the capital of the corporation.

18

Proxies

Massachusetts

Under the MBCA, unless otherwise provided in the appointment form, a proxy executed by a shareholder will remain valid for a period of 11 months from the date the shareholder signed the form or, if it is undated, from the date of its receipt.

Delaware

Under the DGCL, a proxy executed by a stockholder will remain valid for a period of three years unless the proxy provides for a longer period.

Consideration for Stock

Massachusetts

Under the MBCA, the board of directors may authorize shares to be issued for consideration consisting of any tangible or intangible property or benefit to the corporation, including cash, promissory notes, services performed, contracts for services to be performed, or other securities of the corporation.

Delaware

Under the DGCL, a corporation may accept as consideration for its stock a combination of cash, property or benefit to the corporation, the total of which must equal at least the par value of the issued stock, as determined by the board of directors.

Shareholders Rights to Examine Books and Records

Massachusetts

The MBCA provides that upon five business days written notice a shareholder of a corporation is entitled to inspect and copy, during regular business hours at the office where they are maintained, copies of any of the following records of the corporation: (i) articles of organization, (ii) bylaws, (iii) resolutions adopted by the board of directors creating one or more classes or series of shares and fixing their rights and preferences, (iv) minutes and written consents of all shareholders’ meetings for the past three years, (v) all written communications to shareholders generally within the past three years, including financial statements furnished to shareholders, (vi) a list of the names and business addresses of the corporation’s current directors and officers, and (vii) the corporation’s most recent annual report delivered to the secretary of state.

If the shareholder makes his demand in good faith and for a proper purpose, describes with reasonable particularity his purpose and the records he desires to inspect, the records are directly connected with his purpose, and the corporation does not determine in good faith that disclosure of the records would adversely affect the corporation in the conduct of its business or constitute material non-public information in the case of a public corporation, then a shareholder may also inspect and copy, upon five business days written notice (i) excerpts from minutes of meetings or actions without a meeting of the board of directors or shareholders, (ii) accounting records of the corporation, and (iii) a list of the shareholders of the corporation showing their names, addresses and the number and class of shares held by each.

Delaware

The DGCL provides that any stockholder of record may, upon written demand, inspect and copy during usual hours of business the corporation’s stock ledger, a list of its stockholders and its other books and records for any proper purpose. If management of the corporation refuses, the stockholder can compel release of the books and records by court order.

19

Appraisal and Dissenters’ Rights

Massachusetts

Under the MBCA, a shareholder is entitled to appraisal rights and to obtain payment of the fair value of his shares in the event of any of the following corporate actions (except for certain limited exceptions): (i) a merger, (ii) a share exchange, (iii) a sale of all or substantially all of the property of the corporation, (iv) an amendment to the articles of organization that materially and adversely affects the rights of a shareholder with respect to his shares, (v) an amendment of the articles of organization or bylaws or the entering into by the corporation of any agreement to which the shareholder is not a party that adds restrictions on the transfer or registration of the shares held by the shareholder in a manner that is materially adverse to the ability of the shareholder to transfer his shares, (vi) any corporate action taken pursuant to a shareholder vote to the extent the articles of organization, bylaws or a resolution of the board of directors provides that shareholders are entitled to appraisal, (vii) the conversion of the corporation to nonprofit status, or (viii) the conversion of the corporation into a form of other entity.

If proposed corporate action requiring appraisal rights is submitted to vote at a shareholders’ meeting, a shareholder who wishes to assert appraisal rights with respect to his shares must (i) deliver written notice to the corporation before the vote is taken of his intent to demand payment if the proposed action is effectuated, and (ii) not vote any shares in favor of the proposed action. The corporation is required to pay fair value to a shareholder exercising appraisal rights for the shares held by such shareholder. If fair value is unsettled, the MBCA provides for resolution of fair value in a single equitable proceeding in a court in the county in Massachusetts where the corporation’s principal office or registered office is located.

Delaware

Under the DGCL, stockholders have appraisal rights, in the event of certain corporate actions such as a merger or consolidation. These rights include the right to dissent from voting to approve such corporate action, and to demand fair value for the shares of the dissenting stockholder. If a proposed corporate action creating dissenters’ rights is submitted to a vote at a stockholders meeting, a stockholder who wishes to assert dissenters’ rights must (i) deliver to the corporation, before the vote is taken, written notice of his intent to demand payment for his shares if the proposed action is effected, and (ii) not vote his shares in favor of the proposed action. If fair value is unsettled, the DGCL provides for the dissenter and the company to petition the Court of Chancery.

Dividends

Massachusetts

The MBCA provides that a corporation may make distributions to its shareholders provided that no distribution may be made if after giving it effect (i) the corporation would not be able to pay its existing and reasonably foreseeable debts, liabilities and obligations as they become due, or (ii) the corporation’s total assets would be less than the sum of its total liabilities plus the amount that would be needed if the corporation would be dissolved at the time of the distribution to satisfy the preferential rights upon dissolution of shareholders whose preferential rights are superior to those receiving the distribution.

Delaware

The DGCL provides that a corporation may pay dividends out of surplus, out of the corporation’s net profits for the preceding fiscal year, or both, provided that there remains in the stated capital account an amount equal to the par value represented by all shares of the corporation’s stock having a distribution preference.

20

Corporate Action Without a Shareholder Meeting

Massachusetts

The MBCA permits corporate action without a meeting of shareholders upon the written consent of (i) all shareholders entitled to vote on the action, or (ii) to the extent permitted by the articles of organization, by shareholders having not less than the minimum number of votes necessary to take the action at a meeting at which all shareholders entitled to vote on the action are present and voting. If action is taken by written consent of shareholders without a meeting, at least seven days before the action pursuant to the consent is taken, the corporation must give notice of the action to all nonvoting shareholders and to all shareholders who did not consent to the action. The Massachusetts Bylaws provide that any action that may be taken at a meeting of shareholders may be taken by the shareholders without a meeting if all shareholders entitled to vote on the matter consent to the action in writing.

Delaware

The DGCL permits corporate action without a meeting of stockholders upon the written consent of the holders of that number of shares necessary to authorize the proposed corporate action being taken, unless the certificate of incorporation expressly provides otherwise. In the event such proposed corporate action is taken without a meeting by less than the unanimous written consent of stockholders, the DGCL requires that prompt notice of the taking of such action be sent to those stockholders who have not consented in writing. The Delaware Bylaws provide that stockholders may approve a matter without a meeting if the holders having not less than the minimum number of votes that would be necessary to authorize or take such action consent to such action in writing.

21

REGULATORY APPROVALS

The Company expects the Reincorporation to become effective upon the filing of the Delaware Charter and the Certificate of Conversion from a Non-Delaware Corporation to a Delaware Corporation with the Secretary of State of the State of Delaware and the filing of Articles of Charter Surrender with the Secretary of Commonwealth of the Commonwealth of Massachusetts.

STOCK CONSEQUENCES