UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07319

Fidelity Covington Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | July 31 |

|

|

Date of reporting period: | July 31, 2024 |

Item 1.

Reports to Stockholders

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Women's Leadership ETF Fidelity® Women's Leadership ETF : FDWM Principal U.S. Listing Exchange :NYSEArca NYSE Arca, Inc. |

| | | |

This annual shareholder report contains information about Fidelity® Women's Leadership ETF for the period August 1, 2023 to July 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Women's Leadership ETF | $ 64 | 0.59% | |

What affected the Fund's performance this period?

•U.S. equities gained for the 12 months ending July 31, 2024, driven by resilient corporate profits, a frenzy over generative artificial intelligence and the Federal Reserve's likely pivot to cutting interest rates later this year.

•Against this backdrop, security selection was the primary contributor to the fund's performance versus the benchmark for the fiscal year, led by picks in the consumer discretionary sector. Stock selection in information technology, primarily within the semiconductors & semiconductor equipment industry, also boosted the fund's relative performance.

•The fund's non-benchmark stake in Nvidia gained approximately 150% and was the top individual relative contributor. The stock was among our largest holdings. An overweight in Williams-Sonoma (+128%) also contributed, as did avoiding Unity Software, a benchmark component that returned about -64%.

•In contrast, the biggest detractor from performance versus the benchmark was stock picking in communication services, utilities and materials.

•Not owning Godaddy, a benchmark component that gained roughly 89%, was the biggest individual relative detractor. Not owning Fair Isaac, a benchmark component that gained 91%, was the second-largest relative detractor. Another notable relative detractor was an overweight in Estee Lauder (-43%).

•Notable changes in positioning include higher allocations to the consumer discretionary and communication services sectors.

•Application of FMR's environmental, social, and governance (ESG) ratings process and/or its sustainable investing exclusion criteria may affect the Fund's exposure to certain issuers, sectors, regions, and countries and may affect the Fund's performance.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

June 15, 2021 through July 31, 2024.

Initial investment of $10,000.

Fidelity® Women's Leadership ETF | $10,000 | $10,253 | $8,803 | $9,945 |

MSCI USA Women's Leadership Index | $10,000 | $10,293 | $8,844 | $9,658 |

Russell 3000® Index | $10,000 | $10,297 | $9,540 | $10,746 |

| | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | Life of Fund |

Fidelity® Women's Leadership ETF - NAV A | 15.82% | 4.62% |

Fidelity® Women's Leadership ETF - Market Price B | 16.09% | 4.79% |

MSCI USA Women's Leadership Index A | 11.28% | 2.33% |

Russell 3000® Index A | 21.07% | 8.78% |

A From June 15, 2021

B From June 17, 2021, date initially listed on the NYSE Arca, Inc. exchange

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of July 31, 2024)

KEY FACTS | | |

| Fund Size | $3,942,372 | |

| Number of Holdings | 106 | |

| Total Advisory Fee | $21,836 | |

| Portfolio Turnover | 59% | |

What did the Fund invest in?

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Information Technology | 29.1 | |

| Health Care | 13.9 | |

| Consumer Discretionary | 13.2 | |

| Financials | 12.5 | |

| Industrials | 11.5 | |

| Communication Services | 5.8 | |

| Materials | 4.0 | |

| Consumer Staples | 3.3 | |

| Energy | 3.0 | |

| Utilities | 2.0 | |

| Real Estate | 1.0 | |

| |

| Common Stocks | 99.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 95.9 |

| Ireland | 2.0 |

| China | 1.5 |

| Canada | 0.6 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Amazon.com Inc | 4.4 | |

| Apple Inc | 4.2 | |

| Microsoft Corp | 3.8 | |

| NVIDIA Corp | 3.2 | |

| Alphabet Inc Class C | 2.8 | |

| Accenture PLC Class A | 2.0 | |

| Walt Disney Co/The | 2.0 | |

| Hologic Inc | 1.9 | |

| Cigna Group/The | 1.8 | |

| Salesforce Inc | 1.6 | |

| | 27.7 | |

| |

How has the Fund changed?

This is a summary of certain changes to the Fund since August 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by November 29, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

The fund changed its classification form non-diversified to diversified and modified its principal investment strategies and risks to reflect the change during the reporting period. | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913572.100 6416-TSRA-0924 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Blue Chip Value ETF Fidelity® Blue Chip Value ETF : FBCV Principal U.S. Listing Exchange :CboeBZX Cboe BZX Exchange, Inc. |

| | | |

This annual shareholder report contains information about Fidelity® Blue Chip Value ETF for the period August 1, 2023 to July 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Blue Chip Value ETF | $ 63 | 0.59% | |

What affected the Fund's performance this period?

•U.S. equities gained for the 12 months ending July 31, 2024, driven by resilient corporate profits, a frenzy over generative artificial intelligence and the Federal Reserve's likely pivot to cutting interest rates later this year.

•Against this backdrop, both security selection and sector positioning detracted from the fund's performance versus the Russell 1000 Value Index for the fiscal year, especially in consumer staples. Subpar stock picks in communication services also hampered the fund's result. Investment choices and an underweight in industrials, primarily within the capital goods industry, hurt as well.

•The largest individual relative detractor was an outsized stake in Lamb Weston Holdings (-36%). An overweight in Kenvue (-9%), where we increased our position this period, also was detrimental to performance. Larger-than-benchmark exposure to Comcast (-6%), one of our biggest holdings, was another challenge.

•In contrast, the biggest contributors to performance versus the benchmark were stock picks and an underweight among consumer discretionary firms. Investment choices and outsized exposure to financials - banks in particular - also boosted the fund's relative performance. Comparatively light exposure to the real estate sector, especially the equity real estate investment trusts industry, proved advantageous as well.

•The top individual relative contributor was an overweight in H&R Block (+77%). An outsized stake in Constellation Energy (+90%) was another plus, though the stock was not held at period end. An underweight in ConocoPhillips (-3%) helped as well. The stock was not held at period end.

•Notable changes in positioning include higher allocations to the consumer discretionary and industrials sectors.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

June 2, 2020 through July 31, 2024.

Initial investment of $10,000.

Fidelity® Blue Chip Value ETF | $10,000 | $10,123 | $14,459 | $14,642 | $15,426 |

Russell 1000® Value Index | $10,000 | $10,170 | $14,169 | $13,967 | $15,124 |

Russell 1000® Index | $10,000 | $10,678 | $14,731 | $13,719 | $15,496 |

| | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | Life of Fund |

Fidelity® Blue Chip Value ETF - NAV A | 11.22% | 13.84% |

Fidelity® Blue Chip Value ETF - Market Price B | 11.33% | 12.97% |

Russell 1000® Value Index A | 14.80% | 14.17% |

Russell 1000® Index A | 21.50% | 16.41% |

A From June 2, 2020

B From June 4, 2020, date initially listed on the Cboe BZX Exchange, Inc. exchange

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of July 31, 2024)

KEY FACTS | | |

| Fund Size | $125,357,284 | |

| Number of Holdings | 84 | |

| Total Advisory Fee | $712,115 | |

| Portfolio Turnover | 33% | |

What did the Fund invest in?

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Financials | 24.8 | |

| Health Care | 17.0 | |

| Industrials | 10.7 | |

| Consumer Staples | 10.4 | |

| Energy | 8.4 | |

| Information Technology | 7.3 | |

| Utilities | 6.7 | |

| Communication Services | 5.1 | |

| Consumer Discretionary | 4.4 | |

| Materials | 2.4 | |

| Real Estate | 1.2 | |

| |

| Common Stocks | 98.4 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.6 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 94.0 |

| United Kingdom | 4.0 |

| Canada | 1.1 |

| Norway | 0.7 |

| China | 0.2 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Exxon Mobil Corp | 4.6 | |

| JPMorgan Chase & Co | 4.1 | |

| Bank of America Corp | 2.9 | |

| Cigna Group/The | 2.9 | |

| UnitedHealth Group Inc | 2.9 | |

| Comcast Corp Class A | 2.9 | |

| Travelers Cos Inc/The | 2.8 | |

| Berkshire Hathaway Inc Class B | 2.7 | |

| PG&E Corp | 2.3 | |

| Walt Disney Co/The | 2.2 | |

| | 30.3 | |

| |

How has the Fund changed?

This is a summary of certain changes to the Fund since August 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by November 29, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

The fund changed its classification from non-diversified to diversified and modified its principal investment strategies and risks to reflect the change during the reporting period. | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913566.100 6190-TSRA-0924 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Quality Factor ETF Fidelity® Quality Factor ETF : FQAL Principal U.S. Listing Exchange :NYSEArca NYSE Arca, Inc. |

| | | |

This annual shareholder report contains information about Fidelity® Quality Factor ETF for the period August 1, 2023 to July 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Quality Factor ETF | $ 20 | 0.18% | |

What affected the Fund's performance this period?

•U.S. equities gained for the 12 months ending July 31, 2024, driven by resilient corporate profits, a frenzy over generative artificial intelligence and the Federal Reserve's likely pivot to cutting interest rates later this year.

•Against this backdrop, information technology gained 31% and contributed most to the fund's performance for the fiscal year. Health care, which gained 25%, also helped, benefiting from the pharmaceuticals, biotechnology & life sciences industry (+29%), as did financials, which advanced about 23%. The communication services sector rose 29%, boosted by the media & entertainment industry (+28%), while industrials gained about 11% and utilities advanced about 25%. Other contributors included the energy (+12%), consumer staples (+7%), consumer discretionary (+4%), materials (+13%) and real estate (+9%) sectors.

•Turning to individual stocks, the top contributor was Nvidia (+61%), from the semiconductors & semiconductor equipment category. From the same group, Broadcom gained 81% and helped. Microsoft, within the software & services group, gained approximately 25% and contributed. Alphabet, within the media & entertainment industry, gained about 29%. Lastly, Apple (+14%), from the technology hardware & equipment industry, also helped.

•In contrast, the biggest detractor was Tesla (-26%), from the automobiles & components group. Starbucks, within the consumer services category, returned about -16% and hurt the fund. Another notable detractor was United Parcel Service (-18%), a stock in the transportation industry. In software & services, Palo Alto Networks (-11%) hurt the fund. Lastly, ZoomInfo Technologies (-35%), a stock in the media & entertainment industry, hindered the fund.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

September 12, 2016 through July 31, 2024.

Initial investment of $10,000.

Fidelity® Quality Factor ETF | $10,000 | $11,613 | $13,581 | $14,551 | $16,044 | $21,820 | $20,776 | $22,948 | $27,615 |

Fidelity U.S. Quality Factor Index℠ | $10,000 | $11,648 | $13,664 | $14,681 | $16,233 | $22,144 | $21,143 | $23,416 | $28,228 |

Russell 1000® Index | $10,000 | $11,635 | $13,519 | $14,600 | $16,357 | $22,568 | $21,017 | $23,739 | $28,843 |

| | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | 5 Year | Life of Fund |

Fidelity® Quality Factor ETF - NAV A | 20.34% | 13.67% | 13.74% |

Fidelity® Quality Factor ETF - Market Price B | 20.47% | 13.67% | 13.79% |

Fidelity U.S. Quality Factor Index℠ A | 20.55% | 13.97% | 14.06% |

Russell 1000® Index A | 21.50% | 14.59% | 14.37% |

A From September 12, 2016

B From September 15, 2016, date initially listed on the NYSE Arca, Inc. exchange

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of July 31, 2024)

KEY FACTS | | |

| Fund Size | $1,028,550,951 | |

| Number of Holdings | 128 | |

| Total Advisory Fee | $1,048,929 | |

| Portfolio Turnover | 34% | |

What did the Fund invest in?

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Information Technology | 31.1 | |

| Financials | 13.1 | |

| Health Care | 12.0 | |

| Consumer Discretionary | 9.7 | |

| Industrials | 9.1 | |

| Communication Services | 8.5 | |

| Consumer Staples | 5.5 | |

| Energy | 3.9 | |

| Utilities | 2.4 | |

| Real Estate | 2.3 | |

| Materials | 2.3 | |

| |

| Common Stocks | 99.9 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Apple Inc | 7.0 | |

| NVIDIA Corp | 6.8 | |

| Microsoft Corp | 6.7 | |

| Alphabet Inc Class A | 4.0 | |

| Meta Platforms Inc Class A | 2.3 | |

| Broadcom Inc | 2.2 | |

| Berkshire Hathaway Inc Class B | 2.2 | |

| Eli Lilly & Co | 2.1 | |

| Abbvie Inc | 1.5 | |

| Johnson & Johnson | 1.4 | |

| | 36.2 | |

| |

How has the Fund changed?

This is a summary of certain changes to the Fund since August 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by November 29, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes: - •Management fee

- •Operating expenses

The fund's contractual management fee was reduced during the reporting period. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913543.100 2857-TSRA-0924 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | |

| | Fidelity® Real Estate Investment ETF Fidelity® Real Estate Investment ETF : FPRO Principal U.S. Listing Exchange :CboeBZX Cboe BZX Exchange, Inc. |

| | | |

This annual shareholder report contains information about Fidelity® Real Estate Investment ETF for the period August 1, 2023 to July 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Real Estate Investment ETF | $ 62 | 0.59% | |

What affected the Fund's performance this period?

•U.S. equities gained for the 12 months ending July 31, 2024, driven by resilient corporate profits, a frenzy over generative artificial intelligence and the Federal Reserve's likely pivot to cutting interest rates later this year.

•Against this backdrop, industry positioning was the primary detractor from the fund's performance versus the MSCI US IMI Real Estate 25/50 Index for the fiscal year, especially a lack of exposure to regional malls. Stock picks in the infrastructure category also hampered the fund's result, as did investment choices and an overweight in apartments.

•The largest individual relative detractor was an outsized stake in SBA Communications (+2%). This period we decreased our position in the stock, making it one of the fund's largest holdings this period. Avoiding Simon Property Group, an index component that gained roughly 30%, proved detrimental to performance as well. A larger-than-index position in Mid-America Apartment Communities (-3%) also hurt.

•In contrast, the primary contributor to performance versus the real estate index was security selection in health care. Stock picking and an underweight in the diversified segment of the market also boosted the fund's relative performance. Favorable investment choices among freestanding real estate stocks helped as well.

•The top individual relative contributor was our timely positioning in Costar (-7%), followed by an overweight stake in Ventas (+17%). The latter was one of the fund's biggest holdings. Comparatively light exposure to Realty Income (-1%) was another plus.

•Notable changes in positioning include increased exposure to the self storage industry and a lower allocation to lodging resorts.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

February 2, 2021 through July 31, 2024.

Initial investment of $10,000.

Fidelity® Real Estate Investment ETF | $10,000 | $12,517 | $12,307 | $11,086 |

MSCI US IMI Real Estate 25/50 Index | $10,000 | $12,325 | $11,803 | $10,663 |

S&P 500® Index | $10,000 | $11,570 | $11,033 | $12,469 |

| | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | Life of Fund |

Fidelity® Real Estate Investment ETF - NAV A | 10.20% | 5.90% |

Fidelity® Real Estate Investment ETF - Market Price B | 10.47% | 5.93% |

MSCI US IMI Real Estate 25/50 Index A | 10.73% | 4.87% |

S&P 500® Index A | 22.15% | 12.80% |

A From February 2, 2021

B From February 4, 2021, date initially listed on the Cboe BZX Exchange, Inc. exchange

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of July 31, 2024)

KEY FACTS | | |

| Fund Size | $12,851,950 | |

| Number of Holdings | 41 | |

| Total Advisory Fee | $76,515 | |

| Portfolio Turnover | 45% | |

What did the Fund invest in?

(as of July 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Specialized REITs | 38.4 | |

| Residential REITs | 17.1 | |

| Industrial REITs | 15.0 | |

| Retail REITs | 12.7 | |

| Health Care REITs | 8.2 | |

| Real Estate Management & Development | 6.1 | |

| Hotel & Resort REITs | 1.4 | |

| |

| Common Stocks | 98.9 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Prologis Inc | 11.0 | |

| American Tower Corp | 9.1 | |

| Equinix Inc | 6.7 | |

| Ventas Inc | 5.6 | |

| Public Storage Operating Co | 5.4 | |

| CBRE Group Inc Class A | 4.0 | |

| Kimco Realty Corp | 4.0 | |

| NNN REIT Inc | 3.6 | |

| Digital Realty Trust Inc | 3.5 | |

| CubeSmart | 3.4 | |

| | 56.3 | |

| |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913569.100 6341-TSRA-0924 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Fundamental Large Cap Core ETF Fidelity® Fundamental Large Cap Core ETF : FFLC Principal U.S. Listing Exchange :CboeBZX Cboe BZX Exchange, Inc. |

| | | |

This annual shareholder report contains information about Fidelity® Fundamental Large Cap Core ETF for the period August 1, 2023 to July 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Fundamental Large Cap Core ETF | $ 53 | 0.47% | |

What affected the Fund's performance this period?

- •U.S. equities gained for the 12 months ending July 31, 2024, driven by resilient corporate profits, a frenzy over generative artificial intelligence and the Federal Reserve's likely pivot to cutting interest rates later this year.

- •Against this backdrop, security selection was the primary contributor to the fund's performance versus the S&P 500® index for the fiscal year, especially within industrials. Stock selection and an underweight in consumer discretionary and picks and an overweight in utilities also boosted the fund's relative performance.

- •Not owning Tesla, a benchmark component that returned -13%, was the top individual relative contributor. The second-largest relative contributor was an overweight in Constellation Energy (+97%). This period we increased our position in the stock. Another notable relative contributor was an overweight in Eli Lilly (+78%), which was one of the fund's biggest holdings this period.

- •In contrast, stock picking and an underweight in financials notably detracted from the fund's performance versus the benchmark. An overweight in materials also hampered the fund's result, as did our stock picks in consumer staples, primarily within the household & personal products industry.

- •The biggest individual relative detractor was an overweight in Boeing (-20%). This period we increased our stake. The second-largest relative detractor was our stake in ON Semiconductor (-29%), a stock that was not held at period end. Another notable relative detractor was our holding in Broadcom (+24%). This was an investment we established this period. The company was one of our biggest holdings at period end.

- •Notable changes in positioning include decreased exposure to the materials sector and a higher allocation to financials.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

June 2, 2020 through July 31, 2024.

Initial investment of $10,000.

Fidelity® Fundamental Large Cap Core ETF | $10,000 | $10,195 | $14,786 | $14,933 | $18,122 |

S&P 500® Index | $10,000 | $10,645 | $14,525 | $13,851 | $15,654 |

| | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | Life of Fund |

Fidelity® Fundamental Large Cap Core ETF - NAV A | 27.19% | 22.20% |

Fidelity® Fundamental Large Cap Core ETF - Market Price B | 27.46% | 21.42% |

S&P 500® Index A | 22.15% | 16.84% |

A From June 2, 2020

B From June 4, 2020, date initially listed on the Cboe BZX Exchange, Inc. exchange

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of July 31, 2024)

KEY FACTS | | |

| Fund Size | $386,344,630 | |

| Number of Holdings | 103 | |

| Total Advisory Fee | $982,378 | |

| Portfolio Turnover | 63% | |

What did the Fund invest in?

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Information Technology | 29.3 | |

| Health Care | 12.6 | |

| Financials | 12.5 | |

| Industrials | 11.7 | |

| Communication Services | 9.9 | |

| Consumer Discretionary | 7.3 | |

| Energy | 5.5 | |

| Consumer Staples | 4.4 | |

| Utilities | 3.9 | |

| Materials | 1.2 | |

| Real Estate | 1.1 | |

| |

| Common Stocks | 99.4 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.6 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 94.7 |

| Netherlands | 1.2 |

| Germany | 1.1 |

| Taiwan | 1.0 |

| United Kingdom | 0.4 |

| Canada | 0.4 |

| Denmark | 0.3 |

| Zambia | 0.3 |

| China | 0.3 |

| Others | 0.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Microsoft Corp | 7.6 | |

| NVIDIA Corp | 6.2 | |

| Meta Platforms Inc Class A | 4.3 | |

| Apple Inc | 4.0 | |

| Alphabet Inc Class A | 3.6 | |

| Exxon Mobil Corp | 3.2 | |

| Amazon.com Inc | 3.0 | |

| Bank of America Corp | 2.5 | |

| Wells Fargo & Co | 2.0 | |

| Broadcom Inc | 2.0 | |

| | 38.4 | |

| |

How has the Fund changed?

This is a summary of certain changes to the Fund since August 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by November 29, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes: - •Management fee

- •Operating expenses

The fund's contractual management fee was reduced during the reporting period. | Effective February 26, 2024, the fund has operated in reliance on Rule 6c-11 rather than pursuant to an exemptive order from the Securities and Exchange Commission. The fund changed its classification from non-diversified to diversified and modified its principal investment strategies and risks to reflect the change during the reporting period. |

The fund's name changed from Fidelity New Millennium ETF to Fidelity Fundamental Large Cap Core ETF during the reporting period. | The fund modified its principal investment strategies to include adopting a policy of investing at least 80% of assets in equity securities of companies with large market capitalizations. |

The fund modified its investment process and principal investment risks pursuant to the change in its principal investment strategies. | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913564.100 6079-TSRA-0924 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Sustainable U.S. Equity ETF Fidelity® Sustainable U.S. Equity ETF : FSST Principal U.S. Listing Exchange :NYSEArca NYSE Arca, Inc. |

| | | |

This annual shareholder report contains information about Fidelity® Sustainable U.S. Equity ETF for the period August 1, 2023 to July 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Sustainable U.S. Equity ETF | $ 66 | 0.59% | |

What affected the Fund's performance this period?

•U.S. equities gained for the 12 months ending July 31, 2024, driven by resilient corporate profits, a frenzy over generative artificial intelligence and the Federal Reserve's likely pivot to cutting interest rates later this year.

•Against this backdrop, security selection was the primary contributor to the fund's performance versus the benchmark for the fiscal year, led by information technology. Security selection in consumer discretionary and health care also boosted the fund's relative performance.

•The top individual relative contributor was our stake in Nvidia (+153%). The stock was one of our biggest holdings. The second-largest relative contributor was an overweight in Sprouts Farmers Market (+145%). An underweight in Tesla (-13%) also helped.

•In contrast, security selection in communication services, primarily within the media & entertainment industry, detracted.

•The biggest individual relative detractor was an overweight in ON Semiconductor (-27%). This period we increased our position in ON Semiconductor. The second-largest relative detractor this period was avoiding Broadcom, a benchmark component that gained 82%.

•Notable changes in positioning include decreased exposure to the consumer staples sector and a higher allocation to communication services.

•Application of FMR's environmental, social, and governance (ESG) ratings process and/or its sustainable investing exclusion criteria may affect the Fund's exposure to certain issuers, sectors, regions, and countries and may affect the Fund's performance.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

June 15, 2021 through July 31, 2024.

Initial investment of $10,000.

Fidelity® Sustainable U.S. Equity ETF | $10,000 | $10,399 | $9,670 | $11,048 |

MSCI USA IMI ESG Leaders Index | $10,000 | $10,375 | $9,716 | $10,983 |

Russell 3000® Index | $10,000 | $10,297 | $9,540 | $10,746 |

| | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | Life of Fund |

Fidelity® Sustainable U.S. Equity ETF - NAV A | 21.14% | 9.76% |

Fidelity® Sustainable U.S. Equity ETF - Market Price B | 21.39% | 9.99% |

MSCI USA IMI ESG Leaders Index A | 22.55% | 9.96% |

Russell 3000® Index A | 21.07% | 8.78% |

A From June 15, 2021

B From June 17, 2021, date initially listed on the NYSE Arca, Inc. exchange

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of July 31, 2024)

KEY FACTS | | |

| Fund Size | $14,374,224 | |

| Number of Holdings | 69 | |

| Total Advisory Fee | $69,263 | |

| Portfolio Turnover | 52% | |

What did the Fund invest in?

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Information Technology | 27.5 | |

| Health Care | 12.7 | |

| Financials | 11.3 | |

| Industrials | 10.6 | |

| Consumer Discretionary | 10.3 | |

| Communication Services | 8.2 | |

| Materials | 4.3 | |

| Consumer Staples | 3.2 | |

| Energy | 2.8 | |

| Utilities | 1.9 | |

| Real Estate | 1.5 | |

| |

| Common Stocks | 94.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 5.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 97.6 |

| Ireland | 1.9 |

| China | 0.5 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Apple Inc | 6.9 | |

| Microsoft Corp | 6.0 | |

| NVIDIA Corp | 5.1 | |

| Amazon.com Inc | 4.2 | |

| Alphabet Inc Class A | 3.5 | |

| Procter & Gamble Co/The | 2.7 | |

| Cigna Group/The | 2.6 | |

| Moody's Corp | 2.5 | |

| Merck & Co Inc | 2.5 | |

| Walt Disney Co/The | 2.2 | |

| | 38.2 | |

| |

How has the Fund changed?

This is a summary of certain changes to the Fund since August 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by November 29, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

The fund changed its classification form non-diversified to diversified and modified its principal investment strategies and risks to reflect the change during the reporting period. | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913571.100 6415-TSRA-0924 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Stocks for Inflation ETF Fidelity® Stocks for Inflation ETF : FCPI Principal U.S. Listing Exchange :CboeBZX Cboe BZX Exchange, Inc. |

| | | |

This annual shareholder report contains information about Fidelity® Stocks for Inflation ETF for the period August 1, 2023 to July 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Stocks for Inflation ETF | $ 22 | 0.19% | |

What affected the Fund's performance this period?

- •U.S. equities gained for the 12 months ending July 31, 2024, driven by resilient corporate profits, a frenzy over generative artificial intelligence and the Federal Reserve's likely pivot to cutting interest rates later this year.

- •Against this backdrop, information technology - the ETF's largest sector weighting - gained 31% and contributed most to the fund's performance for the fiscal year. Health care, which gained 27%, also helped, benefiting from the pharmaceuticals, biotechnology & life sciences industry (+29%), as did consumer discretionary, which advanced 45%. The financials sector rose approximately 27%, while utilities gained about 38% and energy advanced 21%. Other contributors included the consumer staples (+12%), industrials (+35%), real estate (+20%), communication services (+30%) and materials (+1%) sectors.

- •Turning to individual stocks, the top contributor was Nvidia (+171%), from the semiconductors & semiconductor equipment group. From the same category, Broadcom gained roughly 97%. Vistra (+75%), from the utilities sector, also contributed. In pharmaceuticals, biotechnology & life sciences, Eli Lilly (+79%) helped, as did Microsoft (+26%), from the software & services industry.

- •Conversely, the biggest detractor was Alpha Metallurgical Resources (-21%), from the materials sector. Pfizer (-21%) and Bristol-Myers Squibb (-18%), within the pharmaceuticals, biotechnology & life sciences category, also hindered the fund. Molina Healthcare (-15%), from the health care equipment & services industry, further hurt the fund, as did BellRing Brands, in household & personal products.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

November 5, 2019 through July 31, 2024.

Initial investment of $10,000.

Fidelity® Stocks for Inflation ETF | $10,000 | $9,812 | $12,930 | $13,580 | $14,635 | $18,380 |

Fidelity Stocks for Inflation Factor Index℠ | $10,000 | $9,844 | $13,016 | $13,712 | $14,821 | $18,629 |

Russell 1000® Index | $10,000 | $10,850 | $14,969 | $13,941 | $15,746 | $19,132 |

| | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | Life of Fund |

Fidelity® Stocks for Inflation ETF - NAV A | 25.59% | 13.70% |

Fidelity® Stocks for Inflation ETF - Market Price B | 25.56% | 13.64% |

Fidelity Stocks for Inflation Factor Index℠ A | 25.69% | 14.03% |

Russell 1000® Index A | 21.50% | 14.67% |

A From November 5, 2019

B From November 7, 2019, date initially listed on the Cboe BZX Exchange, Inc. exchange

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of July 31, 2024)

KEY FACTS | | |

| Fund Size | $180,247,155 | |

| Number of Holdings | 102 | |

| Total Advisory Fee | $263,531 | |

| Portfolio Turnover | 76% | |

What did the Fund invest in?

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Information Technology | 25.0 | |

| Health Care | 17.2 | |

| Consumer Staples | 10.4 | |

| Financials | 8.4 | |

| Energy | 8.3 | |

| Consumer Discretionary | 5.9 | |

| Materials | 5.7 | |

| Utilities | 5.6 | |

| Real Estate | 5.5 | |

| Industrials | 4.4 | |

| Communication Services | 3.4 | |

| |

| Common Stocks | 99.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.2 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 99.6 |

| Ireland | 0.4 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Apple Inc | 5.4 | |

| Microsoft Corp | 5.2 | |

| NVIDIA Corp | 5.0 | |

| Vistra Corp | 3.4 | |

| Eli Lilly & Co | 2.5 | |

| National Fuel Gas Co | 2.2 | |

| Cheniere Energy Inc | 2.2 | |

| CF Industries Holdings Inc | 2.2 | |

| Procter & Gamble Co/The | 2.1 | |

| Chord Energy Corp | 2.1 | |

| | 32.3 | |

| |

How has the Fund changed?

This is a summary of certain changes to the Fund since August 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by November 29, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes: - •Management fee

- •Operating expenses

The fund's contractual management fee was reduced during the reporting period. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913562.100 5027-TSRA-0924 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | |

| | Fidelity® Magellan℠ ETF Fidelity® Magellan℠ ETF : FMAG Principal U.S. Listing Exchange :CboeBZX Cboe BZX Exchange, Inc. |

| | | |

This annual shareholder report contains information about Fidelity® Magellan℠ ETF for the period August 1, 2023 to July 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Magellan℠ ETF | $ 69 | 0.59% | |

What affected the Fund's performance this period?

•U.S. equities gained for the 12 months ending July 31, 2024, driven by resilient corporate profits, a frenzy over generative artificial intelligence and the Federal Reserve's likely pivot to cutting interest rates later this year.

•Against this backdrop, security selection was the primary contributor to the fund's performance versus the S&P 500® index for the fiscal year, led by the information technology sector. Picks among industrials stocks, primarily within the capital goods industry, also helped. Investment choices in health care further boosted the fund's relative performance.

•The top individual relative contributor was an overweight in Nvidia (+151%). The company was one of our largest holdings. Not owning Tesla, a benchmark component that returned -13%, was another plus. Outsized exposure to Eli Lilly (+79%) also helped. The stock was one of the fund's biggest holdings.

•In contrast, the biggest detractor from performance versus the benchmark was a sizable overweight in industrials. Larger-than-benchmark exposure to materials and consumer discretionary also hurt, especially within the consumer services industry.

•The largest individual relative detractor was an overweight in ON Semiconductor (-28%), though the stock was not held at period end. Untimely positioning in Zoetis (-17%) and Uber Technologies (-20%) also proved detrimental to performance.

•Notable changes in positioning include increased exposure to the communication services and consumer discretionary sectors.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

February 2, 2021 through July 31, 2024.

Initial investment of $10,000.

Fidelity® Magellan℠ ETF | $10,000 | $11,565 | $10,466 | $11,221 |

S&P 500® Index | $10,000 | $11,570 | $11,033 | $12,469 |

| | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | Life of Fund |

Fidelity® Magellan℠ ETF - NAV A | 32.40% | 12.00% |

Fidelity® Magellan℠ ETF - Market Price B | 32.45% | 11.70% |

S&P 500® Index A | 22.15% | 12.80% |

A From February 2, 2021

B From February 4, 2021, date initially listed on the Cboe BZX Exchange, Inc. exchange

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of July 31, 2024)

KEY FACTS | | |

| Fund Size | $115,822,790 | |

| Number of Holdings | 57 | |

| Total Advisory Fee | $426,548 | |

| Portfolio Turnover | 62% | |

What did the Fund invest in?

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Information Technology | 35.8 | |

| Industrials | 15.9 | |

| Financials | 10.9 | |

| Health Care | 9.9 | |

| Consumer Discretionary | 9.6 | |

| Communication Services | 8.4 | |

| Materials | 5.3 | |

| Consumer Staples | 1.8 | |

| Utilities | 1.2 | |

| |

| Common Stocks | 98.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.2 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 96.8 |

| Canada | 1.2 |

| Netherlands | 1.0 |

| Denmark | 1.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Microsoft Corp | 7.9 | |

| NVIDIA Corp | 7.3 | |

| Amazon.com Inc | 4.8 | |

| Meta Platforms Inc Class A | 3.4 | |

| Alphabet Inc Class A | 3.4 | |

| Broadcom Inc | 2.8 | |

| Eli Lilly & Co | 2.4 | |

| UnitedHealth Group Inc | 2.4 | |

| Visa Inc Class A | 2.1 | |

| Mastercard Inc Class A | 2.0 | |

| | 38.5 | |

| |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913568.100 6340-TSRA-0924 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Fundamental Small-Mid Cap ETF Fidelity® Fundamental Small-Mid Cap ETF : FFSM Principal U.S. Listing Exchange :CboeBZX Cboe BZX Exchange, Inc. |

| | | |

This annual shareholder report contains information about Fidelity® Fundamental Small-Mid Cap ETF for the period August 1, 2023 to July 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Fundamental Small-Mid Cap ETF | $ 56 | 0.51% | |

What affected the Fund's performance this period?

•U.S. equities gained for the 12 months ending July 31, 2024, driven by resilient corporate profits, a frenzy over generative artificial intelligence and the Federal Reserve's likely pivot to cutting interest rates later this year.

•Against this backdrop, security selection was the primary contributor to the fund's performance versus the Russell 2500 Index for the fiscal year, especially within the industrials sector, capital goods firms in particular. Stock picking in consumer discretionary and energy also boosted the fund's relative performance.

•The top individual relative contributor was an overweight in TechnipFMC (+63%), the fund's largest position. Outsized exposure to Vertiv Holdings (+205%) and EMCOR Groups (+75%) helped as well. This period we increased our stake in the latter, making it one of the portfolio's biggest holdings.

•In contrast, the biggest detractors from performance versus the benchmark were subpar picks and an underweight in utilities. Investment choices in materials and information technology, primarily within the software & services industry, also hurt.

•On a stock-specific basis, a non-benchmark stake in ON Semiconductor (-27%) was the biggest relative detractor. An overweight in O-I Glass (-48%), where we decreased our position this period, also was detrimental to performance. A comparatively large holding in Chemours (-32%) was another negative.

•Notable changes in positioning include a lower allocation to information technology stocks.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

February 2, 2021 through July 31, 2024.

Initial investment of $10,000.

Fidelity® Fundamental Small-Mid Cap ETF | $10,000 | $11,436 | $10,534 | $11,484 |

Russell 2500™ Index | $10,000 | $10,827 | $9,607 | $10,380 |

Russell 3000® Index | $10,000 | $11,395 | $10,557 | $11,893 |

| | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | Life of Fund |

Fidelity® Fundamental Small-Mid Cap ETF - NAV A | 19.70% | 9.54% |

Fidelity® Fundamental Small-Mid Cap ETF - Market Price B | 20.03% | 8.92% |

Russell 2500™ Index A | 13.06% | 4.69% |

Russell 3000® Index A | 21.07% | 11.00% |

A From February 2, 2021

B From February 4, 2021, date initially listed on the Cboe BZX Exchange, Inc. exchange

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of July 31, 2024)

KEY FACTS | | |

| Fund Size | $75,562,094 | |

| Number of Holdings | 177 | |

| Total Advisory Fee | $248,027 | |

| Portfolio Turnover | 38% | |

What did the Fund invest in?

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Industrials | 22.5 | |

| Financials | 16.3 | |

| Consumer Discretionary | 13.7 | |

| Information Technology | 11.4 | |

| Health Care | 10.6 | |

| Energy | 6.8 | |

| Materials | 6.7 | |

| Consumer Staples | 4.3 | |

| Real Estate | 4.0 | |

| Utilities | 1.8 | |

| Communication Services | 0.9 | |

| |

| Common Stocks | 99.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 91.8 |

| Canada | 3.1 |

| United Kingdom | 2.3 |

| Thailand | 1.1 |

| Israel | 0.6 |

| Netherlands | 0.5 |

| Puerto Rico | 0.4 |

| Japan | 0.2 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| TechnipFMC PLC | 1.7 | |

| EMCOR Group Inc | 1.6 | |

| Tempur Sealy International Inc | 1.5 | |

| AutoZone Inc | 1.4 | |

| Murphy USA Inc | 1.4 | |

| Universal Health Services Inc Class B | 1.4 | |

| BJ's Wholesale Club Holdings Inc | 1.4 | |

| Antero Resources Corp | 1.3 | |

| Arch Capital Group Ltd | 1.2 | |

| TFI International Inc (United States) | 1.2 | |

| | 14.1 | |

| |

How has the Fund changed?

This is a summary of certain changes to the Fund since August 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by November 29, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

The fund changed its classification form non-diversified to diversified and modified its principal investment strategies and risks to reflect the change during the reporting period. | The fund changed its name from Fidelity Small-Mid Cap Opportunities ETF to Fidelity Fundamental Small-Mid Cap ETF. |

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes: - •Management fee

- •Operating expenses

- •Expense reductions

The fund's contractual management fee was reduced during the reporting period. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913570.100 6342-TSRA-0924 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | |

| | Fidelity® Blue Chip Growth ETF Fidelity® Blue Chip Growth ETF : FBCG Principal U.S. Listing Exchange :CboeBZX Cboe BZX Exchange, Inc. |

| | | |

This annual shareholder report contains information about Fidelity® Blue Chip Growth ETF for the period August 1, 2023 to July 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Blue Chip Growth ETF | $ 69 | 0.59% | |

What affected the Fund's performance this period?

•U.S. equities gained for the 12 months ending July 31, 2024, driven by resilient corporate profits, a frenzy over generative artificial intelligence and the Federal Reserve's likely pivot to cutting interest rates later this year.

•Against this backdrop, security selection was the primary contributor to the fund's performance versus the benchmark for the fiscal year, led by information technology. Security selection and an underweight in industrials and picks and an overweight in communication services, primarily within the media & entertainment industry, also boosted the fund's relative performance.

•The top individual relative contributor by far was an overweight in Nvidia (+151%), the fund's biggest holding. A non-benchmark stake in Abercrombie & Fitch (+268%) and an overweight in Amazon.com (+40%), two positions we increased this period, also helped. Amazon.com was among the fund's biggest holdings.

•In contrast, the biggest detractor from relative performance was an overweight in consumer discretionary, primarily within the consumer durables & apparel industry. Security selection in consumer staples, especially within the consumer staples distribution & retail industry, also hampered the fund's result, as did an underweight in information technology. The fund's position in cash also weighed on relative performance.

•The biggest individual relative detractor was an underweight in Broadcom (+82%), a position we established this period. A non-benchmark stake in ON Semiconductor (-28%) and an overweight in Marvell Technology (+3%) also detracted. This period we increased our investment in ON Semiconductor and Marvell was one of our biggest holdings.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

June 2, 2020 through July 31, 2024.

Initial investment of $10,000.

Fidelity® Blue Chip Growth ETF | $10,000 | $11,368 | $16,387 | $12,467 | $15,639 |

Russell 1000® Growth Index | $10,000 | $11,108 | $15,182 | $13,371 | $15,685 |

Russell 1000® Index | $10,000 | $10,678 | $14,731 | $13,719 | $15,496 |

| | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | Life of Fund |

Fidelity® Blue Chip Growth ETF - NAV A | 31.18% | 18.83% |

Fidelity® Blue Chip Growth ETF - Market Price B | 31.23% | 18.93% |

Russell 1000® Growth Index A | 26.94% | 17.98% |

Russell 1000® Index A | 21.50% | 16.41% |

A From June 2, 2020

B From June 4, 2020, date initially listed on the Cboe BZX Exchange, Inc. exchange

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of July 31, 2024)

KEY FACTS | | |

| Fund Size | $1,975,020,161 | |

| Number of Holdings | 225 | |

| Total Advisory Fee | $7,203,240 | |

| Portfolio Turnover | 42% | |

What did the Fund invest in?

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Information Technology | 44.3 | |

| Consumer Discretionary | 19.9 | |

| Communication Services | 16.0 | |

| Health Care | 8.6 | |

| Industrials | 3.9 | |

| Financials | 3.9 | |

| Consumer Staples | 1.3 | |

| Energy | 1.1 | |

| Materials | 0.7 | |

| Real Estate | 0.2 | |

| |

| Common Stocks | 99.9 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 95.6 |

| China | 1.6 |

| Taiwan | 0.8 |

| Denmark | 0.6 |

| Canada | 0.5 |

| Netherlands | 0.3 |

| Singapore | 0.1 |

| Israel | 0.1 |

| United Kingdom | 0.1 |

| Others | 0.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| NVIDIA Corp | 13.7 | |

| Apple Inc | 10.9 | |

| Microsoft Corp | 9.1 | |

| Amazon.com Inc | 9.0 | |

| Alphabet Inc Class A | 6.8 | |

| Meta Platforms Inc Class A | 4.9 | |

| Eli Lilly & Co | 3.0 | |

| Netflix Inc | 2.4 | |

| Snap Inc Class A | 1.4 | |

| NXP Semiconductors NV | 1.3 | |

| | 62.5 | |

| |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913565.100 6157-TSRA-0924 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® U.S. Multifactor ETF Fidelity® U.S. Multifactor ETF : FLRG Principal U.S. Listing Exchange :NYSEArca NYSE Arca, Inc. |

| | | |

This annual shareholder report contains information about Fidelity® U.S. Multifactor ETF for the period August 1, 2023 to July 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® U.S. Multifactor ETF | $ 20 | 0.18% | |

What affected the Fund's performance this period?

- •U.S. equities gained for the 12 months ending July 31, 2024, driven by resilient corporate profits, a frenzy over generative artificial intelligence and the Federal Reserve's likely pivot to cutting interest rates later this year.

- •Against this backdrop, information technology - the ETF's largest sector weighting - gained 27% and contributed most to the fund's performance for the fiscal year. Financials, which gained 30%, also helped, as did consumer discretionary, which advanced about 27%. The health care sector rose approximately 20%, boosted by the pharmaceuticals, biotechnology & life sciences industry (+24%), while communication services gained 31% and industrials advanced 19%. Other contributors included the utilities (+38%), consumer staples (+11%), energy (+14%) and real estate (+8%) sectors.

- •In contrast, materials returned about -2% and detracted.

- •Turning to individual stocks, the top contributor was Nvidia (+61%), from the semiconductors & semiconductor equipment group. From the same category, Broadcom gained 97%. Microsoft (+25%), from the software & services industry, also boosted the fund. In media & entertainment, Meta Platforms gained 68%. Lastly, in pharmaceuticals, biotechnology & life sciences, Eli Lilly (+79%) also helped.

- •Conversely, the biggest detractor was Pfizer (-21%), from the pharmaceuticals, biotechnology & life sciences industry. From the same category, Bristol-Myers Squibb returned -18%, and Louisiana Pacific (-22%), from the materials sector, also detracted. Hershey, within the food, beverage & tobacco group, returned -16%. Lastly, Molina Healthcare (-12%), from the health care equipment & services industry, also hindered the fund.

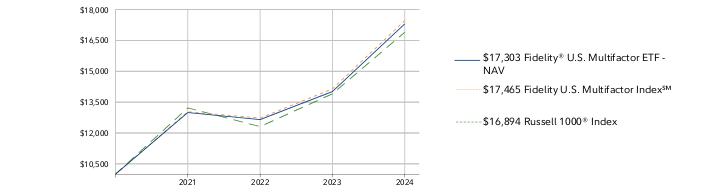

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

September 15, 2020 through July 31, 2024.

Initial investment of $10,000.

Fidelity® U.S. Multifactor ETF | $10,000 | $12,994 | $12,651 | $14,015 | $17,303 |

Fidelity U.S. Multifactor Index℠ | $10,000 | $13,032 | $12,726 | $14,143 | $17,465 |

Russell 1000® Index | $10,000 | $13,219 | $12,310 | $13,904 | $16,894 |

| | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | Life of Fund |

Fidelity® U.S. Multifactor ETF - NAV A | 23.46% | 15.19% |

Fidelity® U.S. Multifactor ETF - Market Price B | 23.66% | 15.64% |

Fidelity U.S. Multifactor Index℠ A | 23.49% | 15.47% |

Russell 1000® Index A | 21.50% | 14.48% |

A From September 15, 2020

B From September 17, 2020, date initially listed on the NYSE Arca, Inc. exchange

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of July 31, 2024)

KEY FACTS | | |

| Fund Size | $121,738,768 | |

| Number of Holdings | 102 | |

| Total Advisory Fee | $123,002 | |

| Portfolio Turnover | 42% | |

What did the Fund invest in?

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Information Technology | 29.9 | |

| Financials | 13.2 | |

| Health Care | 12.0 | |

| Consumer Discretionary | 10.1 | |

| Industrials | 9.4 | |

| Communication Services | 8.4 | |

| Consumer Staples | 5.6 | |

| Energy | 3.7 | |

| Utilities | 2.9 | |

| Real Estate | 2.5 | |

| Materials | 2.1 | |

| |

| Common Stocks | 99.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.2 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 99.4 |

| Ireland | 0.6 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Apple Inc | 6.5 | |

| Microsoft Corp | 6.2 | |

| NVIDIA Corp | 6.0 | |

| Alphabet Inc Class A | 3.8 | |

| Meta Platforms Inc Class A | 2.3 | |

| Eli Lilly & Co | 2.0 | |

| Vistra Corp | 1.8 | |

| Broadcom Inc | 1.6 | |

| Visa Inc Class A | 1.5 | |

| Mastercard Inc Class A | 1.5 | |

| | 33.2 | |

| |

How has the Fund changed?

This is a summary of certain changes to the Fund since August 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by November 29, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes: - •Management fee

- •Operating expenses

The fund's contractual management fee was reduced during the reporting period. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913563.100 6044-TSRA-0924 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Fundamental Large Cap Growth ETF Fidelity® Fundamental Large Cap Growth ETF : FFLG Principal U.S. Listing Exchange :CboeBZX Cboe BZX Exchange, Inc. |

| | | |

This annual shareholder report contains information about Fidelity® Fundamental Large Cap Growth ETF for the period August 1, 2023 to July 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Fundamental Large Cap Growth ETF | $ 55 | 0.48% | |

What affected the Fund's performance this period?

- •U.S. equities gained for the 12 months ending July 31, 2024, driven by resilient corporate profits, a frenzy over generative artificial intelligence and the Federal Reserve's likely pivot to cutting interest rates later this year.

- •Against this backdrop, market selection was the primary contributor to the fund's performance versus the Russell 1000 Growth Index for the fiscal year, helped by an underweight in consumer discretionary, where an underweight in automobiles & components helped most. Stock selection in industrials and information technology also boosted the fund's relative performance.

- •The top individual relative contributor was a sizable underweight in Apple (+14%). This period we increased our stake in Apple, and the stock was among the fund's biggest holdings at period end. The second-largest relative contributor was an overweight in Nvidia (+151%), which was the fund's largest holding as of July 31. Another notable relative contributor was an underweight in Tesla (-13%). The stock was not held at the end of the period.

- •In contrast, the biggest detractor from performance versus the benchmark was stock picking in communication services, primarily within the media & entertainment industry. Stock picks in financials also hampered the fund's result.

- •The largest individual relative detractor was an overweight in Roku (-38%). This period we decreased our position. A non-benchmark stake in ON Semiconductor returned -28%. An underweight in Broadcom (+82%) also hurt. This was an investment we established this period.

- •Notable changes in positioning include increased exposure to the consumer discretionary and industrials sectors.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

February 2, 2021 through July 31, 2024.

Initial investment of $10,000.

Fidelity® Fundamental Large Cap Growth ETF | $10,000 | $10,582 | $7,245 | $8,970 |

Russell 1000® Growth Index | $10,000 | $11,336 | $9,984 | $11,712 |

Russell 1000® Index | $10,000 | $11,471 | $10,683 | $12,066 |

| | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | Life of Fund |

Fidelity® Fundamental Large Cap Growth ETF - NAV A | 28.10% | 4.06% |

Fidelity® Fundamental Large Cap Growth ETF - Market Price B | 28.29% | 3.36% |

Russell 1000® Growth Index A | 26.94% | 12.02% |

Russell 1000® Index A | 21.50% | 11.57% |

A From February 2, 2021

B From February 4, 2021, date initially listed on the Cboe BZX Exchange, Inc. exchange

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of July 31, 2024)

KEY FACTS | | |

| Fund Size | $317,130,502 | |

| Number of Holdings | 93 | |

| Total Advisory Fee | $1,192,982 | |

| Portfolio Turnover | 52% | |

What did the Fund invest in?

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Information Technology | 46.1 | |

| Communication Services | 15.5 | |

| Consumer Discretionary | 14.1 | |

| Health Care | 9.6 | |

| Industrials | 7.2 | |

| Financials | 3.4 | |

| Consumer Staples | 2.0 | |

| Energy | 1.1 | |

| Real Estate | 0.4 | |

| Utilities | 0.3 | |

| Materials | 0.1 | |

| |

| Common Stocks | 99.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.2 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 92.4 |

| Taiwan | 2.0 |

| Netherlands | 1.8 |

| China | 1.8 |

| France | 0.6 |

| Denmark | 0.4 |

| Canada | 0.3 |

| India | 0.3 |

| Singapore | 0.2 |

| Others | 0.2 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| NVIDIA Corp | 13.0 | |

| Microsoft Corp | 10.5 | |

| Apple Inc | 9.7 | |

| Amazon.com Inc | 7.5 | |

| Meta Platforms Inc Class A | 4.6 | |

| Alphabet Inc Class C | 4.4 | |

| Alphabet Inc Class A | 2.7 | |

| Uber Technologies Inc | 2.0 | |

| Taiwan Semiconductor Manufacturing Co Ltd ADR | 2.0 | |

| Mastercard Inc Class A | 1.9 | |

| | 58.3 | |

| |

How has the Fund changed?

This is a summary of certain changes to the Fund since August 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by November 29, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes: The fund's contractual management fee was reduced during the reporting period. | Effective February 26, 2024, the fund has operated in reliance on Rule 6c-11 rather than pursuant to an exemptive order from the Securities and Exchange Commission. |

The fund's name changed from Fidelity Growth Opportunities ETF to Fidelity Fundamental Large Cap Growth ETF during the reporting period. | The fund modified its principal investment strategies to include adopting a policy of investing at least 80% of assets in equity securities of companies with large market capitalizations. |

The fund modified its investment process and principal investment risks pursuant to the change in its principal investment strategies. | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913567.100 6339-TSRA-0924 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Momentum Factor ETF Fidelity® Momentum Factor ETF : FDMO Principal U.S. Listing Exchange :NYSEArca NYSE Arca, Inc. |

| | | |