UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07319

Fidelity Covington Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | July 31 |

Date of reporting period: | July 31, 2024 |

Item 1.

Reports to Stockholders

ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

| | Fidelity® Women's Leadership ETF Fidelity® Women's Leadership ETF : FDWM Principal U.S. Listing Exchange : NYSEArca NYSE Arca, Inc. | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Fidelity® Women's Leadership ETF | $ 64 | 0.59% |

Fidelity® Women's Leadership ETF | $10,000 | $10,253 | $8,803 | $9,945 |

MSCI USA Women's Leadership Index | $10,000 | $10,293 | $8,844 | $9,658 |

Russell 3000® Index | $10,000 | $10,297 | $9,540 | $10,746 |

| 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | Life of Fund | |

Fidelity® Women's Leadership ETF - NAV A | 15.82% | 4.62% |

Fidelity® Women's Leadership ETF - Market Price B | 16.09% | 4.79% |

MSCI USA Women's Leadership Index A | 11.28% | 2.33% |

Russell 3000® Index A | 21.07% | 8.78% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $3,942,372 | |

| Number of Holdings | 106 | |

| Total Advisory Fee | $21,836 | |

| Portfolio Turnover | 59% |

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 29.1 | |

| Health Care | 13.9 | |

| Consumer Discretionary | 13.2 | |

| Financials | 12.5 | |

| Industrials | 11.5 | |

| Communication Services | 5.8 | |

| Materials | 4.0 | |

| Consumer Staples | 3.3 | |

| Energy | 3.0 | |

| Utilities | 2.0 | |

| Real Estate | 1.0 | |

| Common Stocks | 99.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 95.9 |

| Ireland | 2.0 |

| China | 1.5 |

| Canada | 0.6 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Amazon.com Inc | 4.4 | |

| Apple Inc | 4.2 | |

| Microsoft Corp | 3.8 | |

| NVIDIA Corp | 3.2 | |

| Alphabet Inc Class C | 2.8 | |

| Accenture PLC Class A | 2.0 | |

| Walt Disney Co/The | 2.0 | |

| Hologic Inc | 1.9 | |

| Cigna Group/The | 1.8 | |

| Salesforce Inc | 1.6 | |

| 27.7 | ||

The fund changed its classification form non-diversified to diversified and modified its principal investment strategies and risks to reflect the change during the reporting period. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913572.100 6416-TSRA-0924 | |

ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

| | Fidelity® Blue Chip Value ETF Fidelity® Blue Chip Value ETF : FBCV Principal U.S. Listing Exchange : CboeBZX Cboe BZX Exchange, Inc. | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Fidelity® Blue Chip Value ETF | $ 63 | 0.59% |

Fidelity® Blue Chip Value ETF | $10,000 | $10,123 | $14,459 | $14,642 | $15,426 |

Russell 1000® Value Index | $10,000 | $10,170 | $14,169 | $13,967 | $15,124 |

Russell 1000® Index | $10,000 | $10,678 | $14,731 | $13,719 | $15,496 |

| 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | Life of Fund | |

Fidelity® Blue Chip Value ETF - NAV A | 11.22% | 13.84% |

Fidelity® Blue Chip Value ETF - Market Price B | 11.33% | 12.97% |

Russell 1000® Value Index A | 14.80% | 14.17% |

Russell 1000® Index A | 21.50% | 16.41% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $125,357,284 | |

| Number of Holdings | 84 | |

| Total Advisory Fee | $712,115 | |

| Portfolio Turnover | 33% |

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Financials | 24.8 | |

| Health Care | 17.0 | |

| Industrials | 10.7 | |

| Consumer Staples | 10.4 | |

| Energy | 8.4 | |

| Information Technology | 7.3 | |

| Utilities | 6.7 | |

| Communication Services | 5.1 | |

| Consumer Discretionary | 4.4 | |

| Materials | 2.4 | |

| Real Estate | 1.2 | |

| Common Stocks | 98.4 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.6 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 94.0 |

| United Kingdom | 4.0 |

| Canada | 1.1 |

| Norway | 0.7 |

| China | 0.2 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Exxon Mobil Corp | 4.6 | |

| JPMorgan Chase & Co | 4.1 | |

| Bank of America Corp | 2.9 | |

| Cigna Group/The | 2.9 | |

| UnitedHealth Group Inc | 2.9 | |

| Comcast Corp Class A | 2.9 | |

| Travelers Cos Inc/The | 2.8 | |

| Berkshire Hathaway Inc Class B | 2.7 | |

| PG&E Corp | 2.3 | |

| Walt Disney Co/The | 2.2 | |

| 30.3 | ||

The fund changed its classification from non-diversified to diversified and modified its principal investment strategies and risks to reflect the change during the reporting period. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913566.100 6190-TSRA-0924 | |

ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

| | Fidelity® Quality Factor ETF Fidelity® Quality Factor ETF : FQAL Principal U.S. Listing Exchange : NYSEArca NYSE Arca, Inc. | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Fidelity® Quality Factor ETF | $ 20 | 0.18% |

Fidelity® Quality Factor ETF | $10,000 | $11,613 | $13,581 | $14,551 | $16,044 | $21,820 | $20,776 | $22,948 | $27,615 |

Fidelity U.S. Quality Factor Index℠ | $10,000 | $11,648 | $13,664 | $14,681 | $16,233 | $22,144 | $21,143 | $23,416 | $28,228 |

Russell 1000® Index | $10,000 | $11,635 | $13,519 | $14,600 | $16,357 | $22,568 | $21,017 | $23,739 | $28,843 |

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | Life of Fund | |

Fidelity® Quality Factor ETF - NAV A | 20.34% | 13.67% | 13.74% |

Fidelity® Quality Factor ETF - Market Price B | 20.47% | 13.67% | 13.79% |

Fidelity U.S. Quality Factor Index℠ A | 20.55% | 13.97% | 14.06% |

Russell 1000® Index A | 21.50% | 14.59% | 14.37% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $1,028,550,951 | |

| Number of Holdings | 128 | |

| Total Advisory Fee | $1,048,929 | |

| Portfolio Turnover | 34% |

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 31.1 | |

| Financials | 13.1 | |

| Health Care | 12.0 | |

| Consumer Discretionary | 9.7 | |

| Industrials | 9.1 | |

| Communication Services | 8.5 | |

| Consumer Staples | 5.5 | |

| Energy | 3.9 | |

| Utilities | 2.4 | |

| Real Estate | 2.3 | |

| Materials | 2.3 | |

| Common Stocks | 99.9 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 100.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Apple Inc | 7.0 | |

| NVIDIA Corp | 6.8 | |

| Microsoft Corp | 6.7 | |

| Alphabet Inc Class A | 4.0 | |

| Meta Platforms Inc Class A | 2.3 | |

| Broadcom Inc | 2.2 | |

| Berkshire Hathaway Inc Class B | 2.2 | |

| Eli Lilly & Co | 2.1 | |

| Abbvie Inc | 1.5 | |

| Johnson & Johnson | 1.4 | |

| 36.2 | ||

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes:

|

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913543.100 2857-TSRA-0924 | |

ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | ||

| | Fidelity® Real Estate Investment ETF Fidelity® Real Estate Investment ETF : FPRO Principal U.S. Listing Exchange : CboeBZX Cboe BZX Exchange, Inc. | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Fidelity® Real Estate Investment ETF | $ 62 | 0.59% |

Fidelity® Real Estate Investment ETF | $10,000 | $12,517 | $12,307 | $11,086 |

MSCI US IMI Real Estate 25/50 Index | $10,000 | $12,325 | $11,803 | $10,663 |

S&P 500® Index | $10,000 | $11,570 | $11,033 | $12,469 |

| 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | Life of Fund | |

Fidelity® Real Estate Investment ETF - NAV A | 10.20% | 5.90% |

Fidelity® Real Estate Investment ETF - Market Price B | 10.47% | 5.93% |

MSCI US IMI Real Estate 25/50 Index A | 10.73% | 4.87% |

S&P 500® Index A | 22.15% | 12.80% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $12,851,950 | |

| Number of Holdings | 41 | |

| Total Advisory Fee | $76,515 | |

| Portfolio Turnover | 45% |

(as of July 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) | ||

| Specialized REITs | 38.4 | |

| Residential REITs | 17.1 | |

| Industrial REITs | 15.0 | |

| Retail REITs | 12.7 | |

| Health Care REITs | 8.2 | |

| Real Estate Management & Development | 6.1 | |

| Hotel & Resort REITs | 1.4 | |

| Common Stocks | 98.9 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 100.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Prologis Inc | 11.0 | |

| American Tower Corp | 9.1 | |

| Equinix Inc | 6.7 | |

| Ventas Inc | 5.6 | |

| Public Storage Operating Co | 5.4 | |

| CBRE Group Inc Class A | 4.0 | |

| Kimco Realty Corp | 4.0 | |

| NNN REIT Inc | 3.6 | |

| Digital Realty Trust Inc | 3.5 | |

| CubeSmart | 3.4 | |

| 56.3 | ||

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913569.100 6341-TSRA-0924 | |

ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

| | Fidelity® Fundamental Large Cap Core ETF Fidelity® Fundamental Large Cap Core ETF : FFLC Principal U.S. Listing Exchange : CboeBZX Cboe BZX Exchange, Inc. | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Fidelity® Fundamental Large Cap Core ETF | $ 53 | 0.47% |

- •U.S. equities gained for the 12 months ending July 31, 2024, driven by resilient corporate profits, a frenzy over generative artificial intelligence and the Federal Reserve's likely pivot to cutting interest rates later this year.

- •Against this backdrop, security selection was the primary contributor to the fund's performance versus the S&P 500® index for the fiscal year, especially within industrials. Stock selection and an underweight in consumer discretionary and picks and an overweight in utilities also boosted the fund's relative performance.

- •Not owning Tesla, a benchmark component that returned -13%, was the top individual relative contributor. The second-largest relative contributor was an overweight in Constellation Energy (+97%). This period we increased our position in the stock. Another notable relative contributor was an overweight in Eli Lilly (+78%), which was one of the fund's biggest holdings this period.

- •In contrast, stock picking and an underweight in financials notably detracted from the fund's performance versus the benchmark. An overweight in materials also hampered the fund's result, as did our stock picks in consumer staples, primarily within the household & personal products industry.

- •The biggest individual relative detractor was an overweight in Boeing (-20%). This period we increased our stake. The second-largest relative detractor was our stake in ON Semiconductor (-29%), a stock that was not held at period end. Another notable relative detractor was our holding in Broadcom (+24%). This was an investment we established this period. The company was one of our biggest holdings at period end.

- •Notable changes in positioning include decreased exposure to the materials sector and a higher allocation to financials.

Fidelity® Fundamental Large Cap Core ETF | $10,000 | $10,195 | $14,786 | $14,933 | $18,122 |

S&P 500® Index | $10,000 | $10,645 | $14,525 | $13,851 | $15,654 |

| 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | Life of Fund | |

Fidelity® Fundamental Large Cap Core ETF - NAV A | 27.19% | 22.20% |

Fidelity® Fundamental Large Cap Core ETF - Market Price B | 27.46% | 21.42% |

S&P 500® Index A | 22.15% | 16.84% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $386,344,630 | |

| Number of Holdings | 103 | |

| Total Advisory Fee | $982,378 | |

| Portfolio Turnover | 63% |

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 29.3 | |

| Health Care | 12.6 | |

| Financials | 12.5 | |

| Industrials | 11.7 | |

| Communication Services | 9.9 | |

| Consumer Discretionary | 7.3 | |

| Energy | 5.5 | |

| Consumer Staples | 4.4 | |

| Utilities | 3.9 | |

| Materials | 1.2 | |

| Real Estate | 1.1 | |

| Common Stocks | 99.4 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.6 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 94.7 |

| Netherlands | 1.2 |

| Germany | 1.1 |

| Taiwan | 1.0 |

| United Kingdom | 0.4 |

| Canada | 0.4 |

| Denmark | 0.3 |

| Zambia | 0.3 |

| China | 0.3 |

| Others | 0.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Microsoft Corp | 7.6 | |

| NVIDIA Corp | 6.2 | |

| Meta Platforms Inc Class A | 4.3 | |

| Apple Inc | 4.0 | |

| Alphabet Inc Class A | 3.6 | |

| Exxon Mobil Corp | 3.2 | |

| Amazon.com Inc | 3.0 | |

| Bank of America Corp | 2.5 | |

| Wells Fargo & Co | 2.0 | |

| Broadcom Inc | 2.0 | |

| 38.4 | ||

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes:

| Effective February 26, 2024, the fund has operated in reliance on Rule 6c-11 rather than pursuant to an exemptive order from the Securities and Exchange Commission. The fund changed its classification from non-diversified to diversified and modified its principal investment strategies and risks to reflect the change during the reporting period. |

The fund's name changed from Fidelity New Millennium ETF to Fidelity Fundamental Large Cap Core ETF during the reporting period. | The fund modified its principal investment strategies to include adopting a policy of investing at least 80% of assets in equity securities of companies with large market capitalizations. |

The fund modified its investment process and principal investment risks pursuant to the change in its principal investment strategies. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913564.100 6079-TSRA-0924 | |

ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

| | Fidelity® Sustainable U.S. Equity ETF Fidelity® Sustainable U.S. Equity ETF : FSST Principal U.S. Listing Exchange : NYSEArca NYSE Arca, Inc. | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Fidelity® Sustainable U.S. Equity ETF | $ 66 | 0.59% |

Fidelity® Sustainable U.S. Equity ETF | $10,000 | $10,399 | $9,670 | $11,048 |

MSCI USA IMI ESG Leaders Index | $10,000 | $10,375 | $9,716 | $10,983 |

Russell 3000® Index | $10,000 | $10,297 | $9,540 | $10,746 |

| 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | Life of Fund | |

Fidelity® Sustainable U.S. Equity ETF - NAV A | 21.14% | 9.76% |

Fidelity® Sustainable U.S. Equity ETF - Market Price B | 21.39% | 9.99% |

MSCI USA IMI ESG Leaders Index A | 22.55% | 9.96% |

Russell 3000® Index A | 21.07% | 8.78% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $14,374,224 | |

| Number of Holdings | 69 | |

| Total Advisory Fee | $69,263 | |

| Portfolio Turnover | 52% |

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 27.5 | |

| Health Care | 12.7 | |

| Financials | 11.3 | |

| Industrials | 10.6 | |

| Consumer Discretionary | 10.3 | |

| Communication Services | 8.2 | |

| Materials | 4.3 | |

| Consumer Staples | 3.2 | |

| Energy | 2.8 | |

| Utilities | 1.9 | |

| Real Estate | 1.5 | |

| Common Stocks | 94.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 5.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 97.6 |

| Ireland | 1.9 |

| China | 0.5 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Apple Inc | 6.9 | |

| Microsoft Corp | 6.0 | |

| NVIDIA Corp | 5.1 | |

| Amazon.com Inc | 4.2 | |

| Alphabet Inc Class A | 3.5 | |

| Procter & Gamble Co/The | 2.7 | |

| Cigna Group/The | 2.6 | |

| Moody's Corp | 2.5 | |

| Merck & Co Inc | 2.5 | |

| Walt Disney Co/The | 2.2 | |

| 38.2 | ||

The fund changed its classification form non-diversified to diversified and modified its principal investment strategies and risks to reflect the change during the reporting period. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913571.100 6415-TSRA-0924 | |

ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

| | Fidelity® Stocks for Inflation ETF Fidelity® Stocks for Inflation ETF : FCPI Principal U.S. Listing Exchange : CboeBZX Cboe BZX Exchange, Inc. | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Fidelity® Stocks for Inflation ETF | $ 22 | 0.19% |

- •U.S. equities gained for the 12 months ending July 31, 2024, driven by resilient corporate profits, a frenzy over generative artificial intelligence and the Federal Reserve's likely pivot to cutting interest rates later this year.

- •Against this backdrop, information technology - the ETF's largest sector weighting - gained 31% and contributed most to the fund's performance for the fiscal year. Health care, which gained 27%, also helped, benefiting from the pharmaceuticals, biotechnology & life sciences industry (+29%), as did consumer discretionary, which advanced 45%. The financials sector rose approximately 27%, while utilities gained about 38% and energy advanced 21%. Other contributors included the consumer staples (+12%), industrials (+35%), real estate (+20%), communication services (+30%) and materials (+1%) sectors.

- •Turning to individual stocks, the top contributor was Nvidia (+171%), from the semiconductors & semiconductor equipment group. From the same category, Broadcom gained roughly 97%. Vistra (+75%), from the utilities sector, also contributed. In pharmaceuticals, biotechnology & life sciences, Eli Lilly (+79%) helped, as did Microsoft (+26%), from the software & services industry.

- •Conversely, the biggest detractor was Alpha Metallurgical Resources (-21%), from the materials sector. Pfizer (-21%) and Bristol-Myers Squibb (-18%), within the pharmaceuticals, biotechnology & life sciences category, also hindered the fund. Molina Healthcare (-15%), from the health care equipment & services industry, further hurt the fund, as did BellRing Brands, in household & personal products.

Fidelity® Stocks for Inflation ETF | $10,000 | $9,812 | $12,930 | $13,580 | $14,635 | $18,380 |

Fidelity Stocks for Inflation Factor Index℠ | $10,000 | $9,844 | $13,016 | $13,712 | $14,821 | $18,629 |

Russell 1000® Index | $10,000 | $10,850 | $14,969 | $13,941 | $15,746 | $19,132 |

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | Life of Fund | |

Fidelity® Stocks for Inflation ETF - NAV A | 25.59% | 13.70% |

Fidelity® Stocks for Inflation ETF - Market Price B | 25.56% | 13.64% |

Fidelity Stocks for Inflation Factor Index℠ A | 25.69% | 14.03% |

Russell 1000® Index A | 21.50% | 14.67% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $180,247,155 | |

| Number of Holdings | 102 | |

| Total Advisory Fee | $263,531 | |

| Portfolio Turnover | 76% |

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 25.0 | |

| Health Care | 17.2 | |

| Consumer Staples | 10.4 | |

| Financials | 8.4 | |

| Energy | 8.3 | |

| Consumer Discretionary | 5.9 | |

| Materials | 5.7 | |

| Utilities | 5.6 | |

| Real Estate | 5.5 | |

| Industrials | 4.4 | |

| Communication Services | 3.4 | |

| Common Stocks | 99.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.2 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 99.6 |

| Ireland | 0.4 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Apple Inc | 5.4 | |

| Microsoft Corp | 5.2 | |

| NVIDIA Corp | 5.0 | |

| Vistra Corp | 3.4 | |

| Eli Lilly & Co | 2.5 | |

| National Fuel Gas Co | 2.2 | |

| Cheniere Energy Inc | 2.2 | |

| CF Industries Holdings Inc | 2.2 | |

| Procter & Gamble Co/The | 2.1 | |

| Chord Energy Corp | 2.1 | |

| 32.3 | ||

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes:

|

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913562.100 5027-TSRA-0924 | |

ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | ||

| | Fidelity® Magellan℠ ETF Fidelity® Magellan℠ ETF : FMAG Principal U.S. Listing Exchange : CboeBZX Cboe BZX Exchange, Inc. | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Fidelity® Magellan℠ ETF | $ 69 | 0.59% |

Fidelity® Magellan℠ ETF | $10,000 | $11,565 | $10,466 | $11,221 |

S&P 500® Index | $10,000 | $11,570 | $11,033 | $12,469 |

| 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | Life of Fund | |

Fidelity® Magellan℠ ETF - NAV A | 32.40% | 12.00% |

Fidelity® Magellan℠ ETF - Market Price B | 32.45% | 11.70% |

S&P 500® Index A | 22.15% | 12.80% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $115,822,790 | |

| Number of Holdings | 57 | |

| Total Advisory Fee | $426,548 | |

| Portfolio Turnover | 62% |

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 35.8 | |

| Industrials | 15.9 | |

| Financials | 10.9 | |

| Health Care | 9.9 | |

| Consumer Discretionary | 9.6 | |

| Communication Services | 8.4 | |

| Materials | 5.3 | |

| Consumer Staples | 1.8 | |

| Utilities | 1.2 | |

| Common Stocks | 98.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.2 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 96.8 |

| Canada | 1.2 |

| Netherlands | 1.0 |

| Denmark | 1.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Microsoft Corp | 7.9 | |

| NVIDIA Corp | 7.3 | |

| Amazon.com Inc | 4.8 | |

| Meta Platforms Inc Class A | 3.4 | |

| Alphabet Inc Class A | 3.4 | |

| Broadcom Inc | 2.8 | |

| Eli Lilly & Co | 2.4 | |

| UnitedHealth Group Inc | 2.4 | |

| Visa Inc Class A | 2.1 | |

| Mastercard Inc Class A | 2.0 | |

| 38.5 | ||

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913568.100 6340-TSRA-0924 | |

ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

| | Fidelity® Fundamental Small-Mid Cap ETF Fidelity® Fundamental Small-Mid Cap ETF : FFSM Principal U.S. Listing Exchange : CboeBZX Cboe BZX Exchange, Inc. | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Fidelity® Fundamental Small-Mid Cap ETF | $ 56 | 0.51% |

Fidelity® Fundamental Small-Mid Cap ETF | $10,000 | $11,436 | $10,534 | $11,484 |

Russell 2500™ Index | $10,000 | $10,827 | $9,607 | $10,380 |

Russell 3000® Index | $10,000 | $11,395 | $10,557 | $11,893 |

| 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | Life of Fund | |

Fidelity® Fundamental Small-Mid Cap ETF - NAV A | 19.70% | 9.54% |

Fidelity® Fundamental Small-Mid Cap ETF - Market Price B | 20.03% | 8.92% |

Russell 2500™ Index A | 13.06% | 4.69% |

Russell 3000® Index A | 21.07% | 11.00% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $75,562,094 | |

| Number of Holdings | 177 | |

| Total Advisory Fee | $248,027 | |

| Portfolio Turnover | 38% |

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Industrials | 22.5 | |

| Financials | 16.3 | |

| Consumer Discretionary | 13.7 | |

| Information Technology | 11.4 | |

| Health Care | 10.6 | |

| Energy | 6.8 | |

| Materials | 6.7 | |

| Consumer Staples | 4.3 | |

| Real Estate | 4.0 | |

| Utilities | 1.8 | |

| Communication Services | 0.9 | |

| Common Stocks | 99.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 91.8 |

| Canada | 3.1 |

| United Kingdom | 2.3 |

| Thailand | 1.1 |

| Israel | 0.6 |

| Netherlands | 0.5 |

| Puerto Rico | 0.4 |

| Japan | 0.2 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| TechnipFMC PLC | 1.7 | |

| EMCOR Group Inc | 1.6 | |

| Tempur Sealy International Inc | 1.5 | |

| AutoZone Inc | 1.4 | |

| Murphy USA Inc | 1.4 | |

| Universal Health Services Inc Class B | 1.4 | |

| BJ's Wholesale Club Holdings Inc | 1.4 | |

| Antero Resources Corp | 1.3 | |

| Arch Capital Group Ltd | 1.2 | |

| TFI International Inc (United States) | 1.2 | |

| 14.1 | ||

The fund changed its classification form non-diversified to diversified and modified its principal investment strategies and risks to reflect the change during the reporting period. | The fund changed its name from Fidelity Small-Mid Cap Opportunities ETF to Fidelity Fundamental Small-Mid Cap ETF. |

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes:

|

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913570.100 6342-TSRA-0924 | |

ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | ||

| | Fidelity® Blue Chip Growth ETF Fidelity® Blue Chip Growth ETF : FBCG Principal U.S. Listing Exchange : CboeBZX Cboe BZX Exchange, Inc. | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Fidelity® Blue Chip Growth ETF | $ 69 | 0.59% |

Fidelity® Blue Chip Growth ETF | $10,000 | $11,368 | $16,387 | $12,467 | $15,639 |

Russell 1000® Growth Index | $10,000 | $11,108 | $15,182 | $13,371 | $15,685 |

Russell 1000® Index | $10,000 | $10,678 | $14,731 | $13,719 | $15,496 |

| 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | Life of Fund | |

Fidelity® Blue Chip Growth ETF - NAV A | 31.18% | 18.83% |

Fidelity® Blue Chip Growth ETF - Market Price B | 31.23% | 18.93% |

Russell 1000® Growth Index A | 26.94% | 17.98% |

Russell 1000® Index A | 21.50% | 16.41% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $1,975,020,161 | |

| Number of Holdings | 225 | |

| Total Advisory Fee | $7,203,240 | |

| Portfolio Turnover | 42% |

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 44.3 | |

| Consumer Discretionary | 19.9 | |

| Communication Services | 16.0 | |

| Health Care | 8.6 | |

| Industrials | 3.9 | |

| Financials | 3.9 | |

| Consumer Staples | 1.3 | |

| Energy | 1.1 | |

| Materials | 0.7 | |

| Real Estate | 0.2 | |

| Common Stocks | 99.9 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 95.6 |

| China | 1.6 |

| Taiwan | 0.8 |

| Denmark | 0.6 |

| Canada | 0.5 |

| Netherlands | 0.3 |

| Singapore | 0.1 |

| Israel | 0.1 |

| United Kingdom | 0.1 |

| Others | 0.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| NVIDIA Corp | 13.7 | |

| Apple Inc | 10.9 | |

| Microsoft Corp | 9.1 | |

| Amazon.com Inc | 9.0 | |

| Alphabet Inc Class A | 6.8 | |

| Meta Platforms Inc Class A | 4.9 | |

| Eli Lilly & Co | 3.0 | |

| Netflix Inc | 2.4 | |

| Snap Inc Class A | 1.4 | |

| NXP Semiconductors NV | 1.3 | |

| 62.5 | ||

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913565.100 6157-TSRA-0924 | |

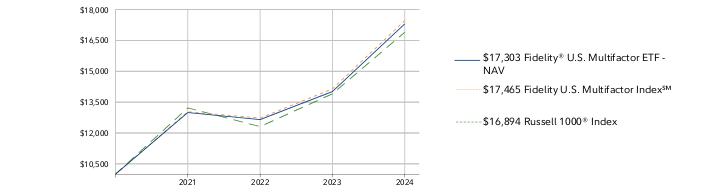

ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

| | Fidelity® U.S. Multifactor ETF Fidelity® U.S. Multifactor ETF : FLRG Principal U.S. Listing Exchange : NYSEArca NYSE Arca, Inc. | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Fidelity® U.S. Multifactor ETF | $ 20 | 0.18% |

- •U.S. equities gained for the 12 months ending July 31, 2024, driven by resilient corporate profits, a frenzy over generative artificial intelligence and the Federal Reserve's likely pivot to cutting interest rates later this year.

- •Against this backdrop, information technology - the ETF's largest sector weighting - gained 27% and contributed most to the fund's performance for the fiscal year. Financials, which gained 30%, also helped, as did consumer discretionary, which advanced about 27%. The health care sector rose approximately 20%, boosted by the pharmaceuticals, biotechnology & life sciences industry (+24%), while communication services gained 31% and industrials advanced 19%. Other contributors included the utilities (+38%), consumer staples (+11%), energy (+14%) and real estate (+8%) sectors.

- •In contrast, materials returned about -2% and detracted.

- •Turning to individual stocks, the top contributor was Nvidia (+61%), from the semiconductors & semiconductor equipment group. From the same category, Broadcom gained 97%. Microsoft (+25%), from the software & services industry, also boosted the fund. In media & entertainment, Meta Platforms gained 68%. Lastly, in pharmaceuticals, biotechnology & life sciences, Eli Lilly (+79%) also helped.

- •Conversely, the biggest detractor was Pfizer (-21%), from the pharmaceuticals, biotechnology & life sciences industry. From the same category, Bristol-Myers Squibb returned -18%, and Louisiana Pacific (-22%), from the materials sector, also detracted. Hershey, within the food, beverage & tobacco group, returned -16%. Lastly, Molina Healthcare (-12%), from the health care equipment & services industry, also hindered the fund.

Fidelity® U.S. Multifactor ETF | $10,000 | $12,994 | $12,651 | $14,015 | $17,303 |

Fidelity U.S. Multifactor Index℠ | $10,000 | $13,032 | $12,726 | $14,143 | $17,465 |

Russell 1000® Index | $10,000 | $13,219 | $12,310 | $13,904 | $16,894 |

| 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | Life of Fund | |

Fidelity® U.S. Multifactor ETF - NAV A | 23.46% | 15.19% |

Fidelity® U.S. Multifactor ETF - Market Price B | 23.66% | 15.64% |

Fidelity U.S. Multifactor Index℠ A | 23.49% | 15.47% |

Russell 1000® Index A | 21.50% | 14.48% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $121,738,768 | |

| Number of Holdings | 102 | |

| Total Advisory Fee | $123,002 | |

| Portfolio Turnover | 42% |

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 29.9 | |

| Financials | 13.2 | |

| Health Care | 12.0 | |

| Consumer Discretionary | 10.1 | |

| Industrials | 9.4 | |

| Communication Services | 8.4 | |

| Consumer Staples | 5.6 | |

| Energy | 3.7 | |

| Utilities | 2.9 | |

| Real Estate | 2.5 | |

| Materials | 2.1 | |

| Common Stocks | 99.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.2 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 99.4 |

| Ireland | 0.6 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Apple Inc | 6.5 | |

| Microsoft Corp | 6.2 | |

| NVIDIA Corp | 6.0 | |

| Alphabet Inc Class A | 3.8 | |

| Meta Platforms Inc Class A | 2.3 | |

| Eli Lilly & Co | 2.0 | |

| Vistra Corp | 1.8 | |

| Broadcom Inc | 1.6 | |

| Visa Inc Class A | 1.5 | |

| Mastercard Inc Class A | 1.5 | |

| 33.2 | ||

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes:

|

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913563.100 6044-TSRA-0924 | |

ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

| | Fidelity® Fundamental Large Cap Growth ETF Fidelity® Fundamental Large Cap Growth ETF : FFLG Principal U.S. Listing Exchange : CboeBZX Cboe BZX Exchange, Inc. | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Fidelity® Fundamental Large Cap Growth ETF | $ 55 | 0.48% |

- •U.S. equities gained for the 12 months ending July 31, 2024, driven by resilient corporate profits, a frenzy over generative artificial intelligence and the Federal Reserve's likely pivot to cutting interest rates later this year.

- •Against this backdrop, market selection was the primary contributor to the fund's performance versus the Russell 1000 Growth Index for the fiscal year, helped by an underweight in consumer discretionary, where an underweight in automobiles & components helped most. Stock selection in industrials and information technology also boosted the fund's relative performance.

- •The top individual relative contributor was a sizable underweight in Apple (+14%). This period we increased our stake in Apple, and the stock was among the fund's biggest holdings at period end. The second-largest relative contributor was an overweight in Nvidia (+151%), which was the fund's largest holding as of July 31. Another notable relative contributor was an underweight in Tesla (-13%). The stock was not held at the end of the period.

- •In contrast, the biggest detractor from performance versus the benchmark was stock picking in communication services, primarily within the media & entertainment industry. Stock picks in financials also hampered the fund's result.

- •The largest individual relative detractor was an overweight in Roku (-38%). This period we decreased our position. A non-benchmark stake in ON Semiconductor returned -28%. An underweight in Broadcom (+82%) also hurt. This was an investment we established this period.

- •Notable changes in positioning include increased exposure to the consumer discretionary and industrials sectors.

Fidelity® Fundamental Large Cap Growth ETF | $10,000 | $10,582 | $7,245 | $8,970 |

Russell 1000® Growth Index | $10,000 | $11,336 | $9,984 | $11,712 |

Russell 1000® Index | $10,000 | $11,471 | $10,683 | $12,066 |

| 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | Life of Fund | |

Fidelity® Fundamental Large Cap Growth ETF - NAV A | 28.10% | 4.06% |

Fidelity® Fundamental Large Cap Growth ETF - Market Price B | 28.29% | 3.36% |

Russell 1000® Growth Index A | 26.94% | 12.02% |

Russell 1000® Index A | 21.50% | 11.57% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $317,130,502 | |

| Number of Holdings | 93 | |

| Total Advisory Fee | $1,192,982 | |

| Portfolio Turnover | 52% |

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 46.1 | |

| Communication Services | 15.5 | |

| Consumer Discretionary | 14.1 | |

| Health Care | 9.6 | |

| Industrials | 7.2 | |

| Financials | 3.4 | |

| Consumer Staples | 2.0 | |

| Energy | 1.1 | |

| Real Estate | 0.4 | |

| Utilities | 0.3 | |

| Materials | 0.1 | |

| Common Stocks | 99.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.2 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 92.4 |

| Taiwan | 2.0 |

| Netherlands | 1.8 |

| China | 1.8 |

| France | 0.6 |

| Denmark | 0.4 |

| Canada | 0.3 |

| India | 0.3 |

| Singapore | 0.2 |

| Others | 0.2 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| NVIDIA Corp | 13.0 | |

| Microsoft Corp | 10.5 | |

| Apple Inc | 9.7 | |

| Amazon.com Inc | 7.5 | |

| Meta Platforms Inc Class A | 4.6 | |

| Alphabet Inc Class C | 4.4 | |

| Alphabet Inc Class A | 2.7 | |

| Uber Technologies Inc | 2.0 | |

| Taiwan Semiconductor Manufacturing Co Ltd ADR | 2.0 | |

| Mastercard Inc Class A | 1.9 | |

| 58.3 | ||

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes:

| Effective February 26, 2024, the fund has operated in reliance on Rule 6c-11 rather than pursuant to an exemptive order from the Securities and Exchange Commission. |

The fund's name changed from Fidelity Growth Opportunities ETF to Fidelity Fundamental Large Cap Growth ETF during the reporting period. | The fund modified its principal investment strategies to include adopting a policy of investing at least 80% of assets in equity securities of companies with large market capitalizations. |

The fund modified its investment process and principal investment risks pursuant to the change in its principal investment strategies. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913567.100 6339-TSRA-0924 | |

ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

| | Fidelity® Momentum Factor ETF Fidelity® Momentum Factor ETF : FDMO Principal U.S. Listing Exchange : NYSEArca NYSE Arca, Inc. | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Fidelity® Momentum Factor ETF | $ 21 | 0.18% |

Fidelity® Momentum Factor ETF | $10,000 | $11,408 | $13,543 | $14,614 | $16,231 | $20,708 | $19,217 | $20,950 | $27,012 |

Fidelity U.S. Momentum Factor Index℠ | $10,000 | $11,443 | $13,633 | $14,749 | $16,427 | $21,025 | $19,571 | $21,399 | $27,651 |

Russell 1000® Index | $10,000 | $11,635 | $13,519 | $14,600 | $16,357 | $22,568 | $21,017 | $23,739 | $28,843 |

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | Life of Fund | |

Fidelity® Momentum Factor ETF - NAV A | 28.94% | 13.07% | 13.43% |

Fidelity® Momentum Factor ETF - Market Price B | 29.08% | 13.02% | 13.53% |

Fidelity U.S. Momentum Factor Index℠ A | 29.22% | 13.39% | 13.76% |

Russell 1000® Index A | 21.50% | 14.59% | 14.37% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $220,921,232 | |

| Number of Holdings | 126 | |

| Total Advisory Fee | $316,309 | |

| Portfolio Turnover | 119% |

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 29.7 | |

| Financials | 13.4 | |

| Health Care | 12.2 | |

| Consumer Discretionary | 10.2 | |

| Industrials | 9.4 | |

| Communication Services | 8.4 | |

| Consumer Staples | 5.7 | |

| Energy | 3.5 | |

| Real Estate | 2.6 | |

| Materials | 2.5 | |

| Utilities | 2.2 | |

| Common Stocks | 99.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.2 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 99.6 |

| United Kingdom | 0.4 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Microsoft Corp | 7.2 | |

| NVIDIA Corp | 7.0 | |

| Alphabet Inc Class A | 3.9 | |

| Amazon.com Inc | 3.8 | |

| Broadcom Inc | 2.6 | |

| Meta Platforms Inc Class A | 2.3 | |

| Berkshire Hathaway Inc Class B | 2.1 | |

| Eli Lilly & Co | 2.0 | |

| JPMorgan Chase & Co | 1.7 | |

| Abbvie Inc | 1.5 | |

| 34.1 | ||

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes:

|

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913542.100 2856-TSRA-0924 | |

ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

| | Fidelity® High Dividend ETF Fidelity® High Dividend ETF : FDVV Principal U.S. Listing Exchange : NYSEArca NYSE Arca, Inc. | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Fidelity® High Dividend ETF | $ 21 | 0.19% |

Fidelity® High Dividend ETF | $10,000 | $10,961 | $12,739 | $13,269 | $12,667 | $18,040 | $18,839 | $21,140 | $25,581 |

Fidelity High Dividend Index℠ | $10,000 | $10,996 | $12,826 | $13,410 | $12,818 | $18,315 | $19,188 | $21,596 | $26,186 |

Russell 1000® Index | $10,000 | $11,635 | $13,519 | $14,600 | $16,357 | $22,568 | $21,017 | $23,739 | $28,843 |

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | Life of Fund | |

Fidelity® High Dividend ETF - NAV A | 21.01% | 14.03% | 12.65% |

Fidelity® High Dividend ETF - Market Price B | 21.32% | 14.01% | 12.78% |

Fidelity High Dividend Index℠ A | 21.25% | 14.32% | 12.98% |

Russell 1000® Index A | 21.50% | 14.59% | 14.37% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $3,166,847,867 | |

| Number of Holdings | 107 | |

| Total Advisory Fee | $3,934,584 | |

| Portfolio Turnover | 14% |

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 25.2 | |

| Industrials | 16.2 | |

| Consumer Staples | 12.1 | |

| Energy | 10.3 | |

| Utilities | 9.9 | |

| Real Estate | 9.1 | |

| Financials | 6.9 | |

| Health Care | 5.3 | |

| Consumer Discretionary | 3.2 | |

| Communication Services | 1.6 | |

| Common Stocks | 99.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.2 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 91.4 |

| United Kingdom | 4.3 |

| Japan | 2.8 |

| Denmark | 1.0 |

| Germany | 0.5 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Apple Inc | 5.8 | |

| NVIDIA Corp | 5.7 | |

| Microsoft Corp | 5.4 | |

| Exxon Mobil Corp | 2.1 | |

| Broadcom Inc | 2.0 | |

| Procter & Gamble Co/The | 2.0 | |

| Philip Morris International Inc | 2.0 | |

| PepsiCo Inc | 1.7 | |

| NextEra Energy Inc | 1.7 | |

| Altria Group Inc | 1.6 | |

| 30.0 | ||

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes:

|

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913539.100 2853-TSRA-0924 | |

ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

| | Fidelity® Value Factor ETF Fidelity® Value Factor ETF : FVAL Principal U.S. Listing Exchange : NYSEArca NYSE Arca, Inc. | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Fidelity® Value Factor ETF | $ 20 | 0.18% |

- •U.S. equities gained for the 12 months ending July 31, 2024, driven by resilient corporate profits, a frenzy over generative artificial intelligence and the Federal Reserve's likely pivot to cutting interest rates later this year.

- •Against this backdrop, information technology gained roughly 17% and contributed most to the fund's performance for the fiscal year. Financials, which gained about 33%, also helped, as did communication services, which advanced 28%, lifted by the media & entertainment industry (+27%). The consumer discretionary sector rose 21%, boosted by the consumer discretionary distribution & retail industry (+33%), while industrials gained about 19% and consumer staples advanced approximately 10%. Other contributors included the energy (+14%), utilities (+22%), health care (+3%), materials (+8%) and real estate (+6%) sectors.

- •Turning to individual stocks, the top contributor was Microsoft (+26%), from the software & services group. Amazon.com (+40%), from the consumer discretionary distribution & retail group, also helped. In media & entertainment, Alphabet (+29%) and Meta Platforms (+49%) further contributed.

- •Conversely, the biggest detractor was United Parcel Service (-27%), from the transportation industry. Other notable detractors included Bristol-Myers Squibb (-20%), a stock in the pharmaceuticals, biotechnology & life sciences category, and DXC Technology (-26%), a stock in the software & services industry. Financial firm PayPal Holdings (-22%) also hurt, as did Humana (-20%), in health care equipment & services.

Fidelity® Value Factor ETF | $10,000 | $11,866 | $13,777 | $14,322 | $14,769 | $21,055 | $20,241 | $22,736 | $26,698 |

Fidelity U.S. Value Factor Index℠ | $10,000 | $11,901 | $13,865 | $14,454 | $14,942 | $21,371 | $20,600 | $23,204 | $27,287 |

Russell 1000® Index | $10,000 | $11,635 | $13,519 | $14,600 | $16,357 | $22,568 | $21,017 | $23,739 | $28,843 |

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | Life of Fund | |

Fidelity® Value Factor ETF - NAV A | 17.43% | 13.27% | 13.26% |

Fidelity® Value Factor ETF - Market Price B | 17.56% | 13.24% | 13.35% |

Fidelity U.S. Value Factor Index℠ A | 17.60% | 13.55% | 13.57% |

Russell 1000® Index A | 21.50% | 14.59% | 14.37% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $809,153,121 | |

| Number of Holdings | 129 | |

| Total Advisory Fee | $1,192,232 | |

| Portfolio Turnover | 31% |

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 28.4 | |

| Financials | 14.2 | |

| Health Care | 11.6 | |

| Consumer Discretionary | 10.2 | |

| Industrials | 9.7 | |

| Communication Services | 8.6 | |

| Consumer Staples | 5.9 | |

| Energy | 3.8 | |

| Utilities | 2.5 | |

| Real Estate | 2.5 | |

| Materials | 2.4 | |

| Common Stocks | 99.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.2 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 98.8 |

| Ireland | 1.2 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Apple Inc | 7.5 | |

| Microsoft Corp | 7.2 | |

| Alphabet Inc Class A | 4.0 | |

| Amazon.com Inc | 3.9 | |

| Meta Platforms Inc Class A | 2.4 | |

| Berkshire Hathaway Inc Class B | 2.1 | |

| UnitedHealth Group Inc | 1.9 | |

| JPMorgan Chase & Co | 1.8 | |

| QUALCOMM Inc | 1.5 | |

| Applied Materials Inc | 1.5 | |

| 33.8 | ||

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes:

|

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913544.100 2858-TSRA-0924 | |

ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

| | Fidelity® Low Volatility Factor ETF Fidelity® Low Volatility Factor ETF : FDLO Principal U.S. Listing Exchange : NYSEArca NYSE Arca, Inc. | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Fidelity® Low Volatility Factor ETF | $ 20 | 0.18% |

Fidelity® Low Volatility Factor ETF | $10,000 | $11,295 | $13,203 | $15,077 | $16,176 | $20,851 | $20,618 | $22,465 | $26,124 |

Fidelity U.S. Low Volatility Factor Index℠ | $10,000 | $11,330 | $13,289 | $15,181 | $16,329 | $21,107 | $20,933 | $22,873 | $26,642 |

Russell 1000® Index | $10,000 | $11,635 | $13,519 | $14,600 | $16,357 | $22,568 | $21,017 | $23,739 | $28,843 |

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | Life of Fund | |

Fidelity® Low Volatility Factor ETF - NAV A | 16.29% | 11.62% | 12.95% |

Fidelity® Low Volatility Factor ETF - Market Price B | 16.31% | 11.62% | 13.09% |

Fidelity U.S. Low Volatility Factor Index℠ A | 16.48% | 11.91% | 13.23% |

Russell 1000® Index A | 21.50% | 14.59% | 14.37% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $1,143,576,609 | |

| Number of Holdings | 127 | |

| Total Advisory Fee | $1,550,627 | |

| Portfolio Turnover | 32% |

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 29.0 | |

| Financials | 12.9 | |

| Health Care | 12.2 | |

| Consumer Discretionary | 10.4 | |

| Industrials | 9.6 | |

| Communication Services | 8.7 | |

| Consumer Staples | 6.0 | |

| Energy | 3.7 | |

| Materials | 2.6 | |

| Real Estate | 2.5 | |

| Utilities | 2.2 | |

| Common Stocks | 99.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.2 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 98.7 |

| Ireland | 1.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Apple Inc | 7.8 | |

| Microsoft Corp | 7.4 | |

| Alphabet Inc Class A | 4.4 | |

| Amazon.com Inc | 3.9 | |

| Eli Lilly & Co | 2.0 | |

| UnitedHealth Group Inc | 1.7 | |

| Oracle Corp | 1.6 | |

| Texas Instruments Inc | 1.5 | |

| Visa Inc Class A | 1.5 | |

| Mastercard Inc Class A | 1.4 | |

| 33.2 | ||

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes:

|

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913541.100 2855-TSRA-0924 | |

ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

| | Fidelity® Small-Mid Multifactor ETF Fidelity® Small-Mid Multifactor ETF : FSMD Principal U.S. Listing Exchange : NYSEArca NYSE Arca, Inc. | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Fidelity® Small-Mid Multifactor ETF | $ 20 | 0.18% |

- •U.S. equities gained for the 12 months ending July 31, 2024, driven by resilient corporate profits, a frenzy over generative artificial intelligence and the Federal Reserve's likely pivot to cutting interest rates later this year.

- •Against this backdrop, industrials - the ETF's largest sector weighting - gained 26% and contributed most to the fund's performance for the fiscal year, driven by the capital goods industry (+30%). Financials, which gained approximately 29%, also helped, as did consumer discretionary, which advanced roughly 27%. The information technology sector rose about 13%, boosted by the technology hardware & equipment industry (+36%), while materials gained approximately 25% and energy advanced about 23%. All other sectors - including real estate (+12%), consumer staples (+20%), health care (+4%), utilities (+8%) and communication services (+1%) - also had positive results.

- •Turning to individual stocks, the biggest contributor was Super Micro Computer (+139%), from the technology hardware & equipment category. Viking Therapeutics (+307%), a stock in the pharmaceuticals, biotechnology & life sciences category, also helped. Abercrombie & Fitch, within the consumer discretionary distribution & retail industry, gained 248%. In consumer staples distribution & retail, Sprouts Farmers Market (+154%) contributed. Lastly, in consumer services, Wingstop (+121%) also boosted the fund.

- •In contrast, the biggest detractor was New York Community Bancorp (-69%), from the banks category. UiPath (-51%) and DoubleVerify Holdings (-50%), from the software & services industry, also hindered the fund. Another notable detractor was QuidelOrtho (-55%), a stock in the health care equipment & services group. Lastly, in telecommunication services, Iridium Communications returned roughly -42%.

Fidelity® Small-Mid Multifactor ETF | $10,000 | $10,335 | $9,829 | $14,174 | $13,841 | $14,937 |

Fidelity Small-Mid Multifactor Index℠ | $10,000 | $10,350 | $9,866 | $14,281 | $13,993 | $15,144 |

Dow Jones U.S. Completion Total Stock Market Index℠ | $10,000 | $10,374 | $10,905 | $16,466 | $12,868 | $14,212 |

Dow Jones U.S. Total Stock Market Index℠ | $10,000 | $10,689 | $11,843 | $16,453 | $15,173 | $17,088 |

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | Life of Fund | |

Fidelity® Small-Mid Multifactor ETF - NAV A | 19.10% | 11.47% | 11.19% |

Fidelity® Small-Mid Multifactor ETF - Market Price B | 19.39% | 11.49% | 11.20% |

Fidelity Small-Mid Multifactor Index℠ A | 19.37% | 11.80% | 11.52% |

Dow Jones U.S. Completion Total Stock Market Index℠ A | 14.96% | 9.51% | 9.46% |

Dow Jones U.S. Total Stock Market Index℠ A | 21.10% | 14.13% | 14.33% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $428,135,489 | |

| Number of Holdings | 589 | |

| Total Advisory Fee | $339,784 | |

| Portfolio Turnover | 50% |

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Industrials | 17.9 | |

| Financials | 16.9 | |

| Consumer Discretionary | 13.9 | |

| Health Care | 13.0 | |

| Information Technology | 11.6 | |

| Real Estate | 6.7 | |

| Materials | 5.7 | |

| Energy | 4.5 | |

| Consumer Staples | 3.9 | |

| Communication Services | 2.9 | |

| Utilities | 2.8 | |

| Common Stocks | 99.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.2 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 97.3 |

| Puerto Rico | 0.6 |

| Canada | 0.5 |

| Bermuda | 0.4 |

| United Kingdom | 0.4 |

| Thailand | 0.2 |

| Sweden | 0.2 |

| Monaco | 0.2 |

| Ireland | 0.1 |

| Others | 0.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Texas Pacific Land Corp | 0.5 | |

| EMCOR Group Inc | 0.5 | |

| Pure Storage Inc Class A | 0.4 | |

| Toll Brothers Inc | 0.4 | |

| United Therapeutics Corp | 0.4 | |

| Reinsurance Group of America Inc | 0.4 | |

| TechnipFMC PLC | 0.4 | |

| TopBuild Corp | 0.4 | |

| International Paper Co | 0.4 | |

| Casey's General Stores Inc | 0.4 | |

| 4.2 | ||

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes:

|

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913553.100 3356-TSRA-0924 | |

ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

| | Fidelity® Dividend ETF for Rising Rates Fidelity® Dividend ETF for Rising Rates : FDRR Principal U.S. Listing Exchange : NYSEArca NYSE Arca, Inc. | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Fidelity® Dividend ETF for Rising Rates | $ 21 | 0.19% |

Fidelity® Dividend ETF for Rising Rates | $10,000 | $11,485 | $13,098 | $13,896 | $14,154 | $19,471 | $19,264 | $20,838 | $24,558 |

Fidelity Dividend Index for Rising Rates℠ | $10,000 | $11,526 | $13,195 | $14,045 | $14,341 | $19,793 | $19,650 | $21,314 | $25,156 |

Russell 1000® Index | $10,000 | $11,635 | $13,519 | $14,600 | $16,357 | $22,568 | $21,017 | $23,739 | $28,843 |

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | Life of Fund | |

Fidelity® Dividend ETF for Rising Rates - NAV A | 17.85% | 12.06% | 12.06% |

Fidelity® Dividend ETF for Rising Rates - Market Price B | 17.95% | 12.03% | 12.11% |

Fidelity Dividend Index for Rising Rates℠ A | 18.03% | 12.36% | 12.41% |

Russell 1000® Index A | 21.50% | 14.59% | 14.37% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $544,623,603 | |

| Number of Holdings | 116 | |

| Total Advisory Fee | $961,817 | |

| Portfolio Turnover | 32% |

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 32.5 | |

| Financials | 13.6 | |

| Health Care | 11.6 | |

| Industrials | 9.2 | |

| Consumer Discretionary | 9.0 | |

| Communication Services | 7.6 | |

| Consumer Staples | 5.5 | |

| Energy | 3.5 | |

| Materials | 2.5 | |

| Real Estate | 2.4 | |

| Utilities | 2.3 | |

| Common Stocks | 99.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 93.7 |

| United Kingdom | 2.0 |

| Germany | 1.8 |

| Sweden | 1.2 |

| Japan | 0.9 |

| Denmark | 0.4 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Apple Inc | 7.5 | |

| NVIDIA Corp | 7.4 | |

| Microsoft Corp | 7.1 | |

| Broadcom Inc | 2.6 | |

| Eli Lilly & Co | 2.2 | |

| JPMorgan Chase & Co | 1.9 | |

| UnitedHealth Group Inc | 1.9 | |

| Texas Instruments Inc | 1.6 | |

| Johnson & Johnson | 1.5 | |

| Abbvie Inc | 1.4 | |

| 35.1 | ||

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes:

|

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913540.100 2854-TSRA-0924 | |

ANNUAL SHAREHOLDER REPORT | AS OF JULY 31, 2024 | ||

| | Fidelity® Fundamental Large Cap Value ETF Fidelity® Fundamental Large Cap Value ETF : FFLV Principal U.S. Listing Exchange : CboeBZX Cboe BZX Exchange, Inc. | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

Fidelity® Fundamental Large Cap Value ETF A | $ 17 | 0.38% |

KEY FACTS | ||

| Fund Size | $1,601,511 | |

| Number of Holdings | 114 | |

| Total Advisory Fee | $2,281 | |

Portfolio TurnoverA | 29% |

(as of July 31, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Financials | 23.7 | |

| Industrials | 14.2 | |

| Health Care | 13.4 | |

| Energy | 10.1 | |

| Information Technology | 9.3 | |

| Consumer Staples | 7.5 | |

| Utilities | 5.5 | |

| Consumer Discretionary | 4.5 | |

| Real Estate | 4.3 | |

| Communication Services | 3.7 | |

| Materials | 3.3 | |

| Common Stocks | 99.5 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.5 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 94.8 |

| Canada | 2.4 |

| United Kingdom | 1.1 |

| Taiwan | 0.9 |

| Spain | 0.8 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Exxon Mobil Corp | 4.6 | |

| JPMorgan Chase & Co | 4.5 | |

| Cisco Systems Inc | 3.6 | |

| Wells Fargo & Co | 3.1 | |

| Hartford Financial Services Group Inc/The | 2.6 | |

| Bank of America Corp | 2.3 | |

| Comcast Corp Class A | 2.3 | |

| UnitedHealth Group Inc | 2.2 | |

| Travelers Cos Inc/The | 2.2 | |

| Shell PLC ADR | 2.1 | |

| 29.5 | ||

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916936.100 7573-TSRA-0924 | |

Item 2.

Code of Ethics

As of the end of the period, July 31, 2024, Fidelity Covington Trust (the trust) has adopted a code of ethics, as defined in Item 2 of Form N-CSR, that applies to its President and Treasurer and its Chief Financial Officer. A copy of the code of ethics is filed as an exhibit to this Form N-CSR.

Item 3.

Audit Committee Financial Expert

The Board of Trustees of the trust has determined that Donald F. Donahue is an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Donahue is independent for purposes of Item 3 of Form N-CSR.

Item 4.

Principal Accountant Fees and Services

Fees and Services

The following table presents fees billed by Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (collectively, “Deloitte Entities”) in each of the last two fiscal years for services rendered to Fidelity Fundamental Large Cap Growth ETF, Fidelity Fundamental Small-Mid Cap ETF,

Fidelity Magellan ETF, Fidelity Real Estate Investment ETF, Fidelity Stocks for Inflation ETF, Fidelity Sustainable U.S. Equity ETF, and Fidelity Women's Leadership ETF (the “Funds”):

Services Billed by Deloitte Entities

July 31, 2024 FeesA

Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees | |

Fidelity Fundamental Large Cap Growth ETF | $16,700 | $- | $3,200 | $300 |

Fidelity Fundamental Small-Mid Cap ETF | $14,800 | $3,200 | $300 | |

Fidelity Magellan ETF | $14,800 | $- | $3,200 | $300 |

Fidelity Real Estate Investment ETF | $14,800 | $- | $3,200 | $300 |

Fidelity Stocks for Inflation ETF | $15,400 | $- | $4,100 | $400 |

Fidelity Sustainable U.S. Equity ETF | $15,100 | $- | $3,700 | $400 |

Fidelity Women's Leadership ETF | $15,100 | $- | $3,700 | $400 |

July 31, 2023 FeesA

Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees | |

Fidelity Fundamental Large Cap Growth ETF | $13,200 | $- | $3,200 | $300 |

Fidelity Fundamental Small-Mid Cap ETF | $13,200 | $- | $3,200 | $300 |

Fidelity Magellan ETF | $13,200 | $- | $3,200 | $300 |

Fidelity Real Estate Investment ETF | $13,200 | $- | $3,200 | $300 |

Fidelity Stocks for Inflation ETF | $14,000 | $- | $3,800 | $400 |

Fidelity Sustainable U.S. Equity ETF | $13,600 | $- | $3,700 | $300 |