UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07319

Fidelity Covington Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Nicole Macarchuk, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | June 30 |

|

|

Date of reporting period: | December 31, 2024 |

Item 1.

Reports to Stockholders

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF DECEMBER 31, 2024 | |

| | Fidelity® Enhanced Large Cap Core ETF Fidelity® Enhanced Large Cap Core ETF : FELC Principal U.S. Listing Exchange :NYSEArca NYSE Arca, Inc. |

| | | |

This semi-annual shareholder report contains information about Fidelity® Enhanced Large Cap Core ETF for the period July 1, 2024 to December 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Enhanced Large Cap Core ETF | $ 10 | 0.18% | |

Key Fund Statistics(as of December 31, 2024)

KEY FACTS | | |

| Fund Size | $4,261,062,790 | |

| Number of Holdings | 211 | |

| Portfolio Turnover | 55% | |

What did the Fund invest in?

(as of December 31, 2024)

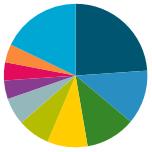

MARKET SECTORS (% of Fund's net assets) | | |

| Information Technology | 32.6 | |

| Financials | 14.2 | |

| Consumer Discretionary | 12.4 | |

| Communication Services | 10.8 | |

| Industrials | 10.0 | |

| Health Care | 9.2 | |

| Consumer Staples | 3.5 | |

| Energy | 2.8 | |

| Materials | 1.6 | |

| Real Estate | 1.0 | |

| Utilities | 0.9 | |

| |

| Common Stocks | 99.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.0 |

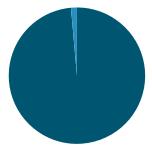

ASSET ALLOCATION (% of Fund's net assets) |

|

| | Common Stocks - 99.0 |

| | Short-Term Investments and Net Other Assets (Liabilities) - 1.0 |

| |

| United States | 99.9 |

| Mexico | 0.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| | United States - 99.9 |

| | Mexico - 0.1 |

| |

TOP HOLDINGS(% of Fund's net assets) | | |

| Apple Inc | 8.1 | |

| NVIDIA Corp | 7.1 | |

| Microsoft Corp | 5.8 | |

| Amazon.com Inc | 4.5 | |

| Meta Platforms Inc Class A | 3.0 | |

| Alphabet Inc Class A | 2.2 | |

| Berkshire Hathaway Inc Class B | 2.2 | |

| Broadcom Inc | 2.0 | |

| JPMorgan Chase & Co | 1.9 | |

| Alphabet Inc Class C | 1.9 | |

| | 38.7 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915504.100 7541-TSRS-0325 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF DECEMBER 31, 2024 | |

| | Fidelity® Enhanced Small Cap ETF Fidelity® Enhanced Small Cap ETF : FESM Principal U.S. Listing Exchange :NYSEArca NYSE Arca, Inc. |

| | | |

This semi-annual shareholder report contains information about Fidelity® Enhanced Small Cap ETF for the period July 1, 2024 to December 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Enhanced Small Cap ETF | $ 15 | 0.28% | |

Key Fund Statistics(as of December 31, 2024)

KEY FACTS | | |

| Fund Size | $1,166,157,388 | |

| Number of Holdings | 639 | |

| Portfolio Turnover | 61% | |

What did the Fund invest in?

(as of December 31, 2024)

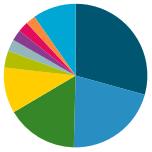

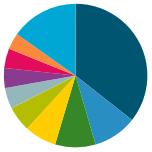

MARKET SECTORS (% of Fund's net assets) | | |

| Financials | 17.8 | |

| Industrials | 17.4 | |

| Health Care | 15.6 | |

| Information Technology | 15.5 | |

| Consumer Discretionary | 10.3 | |

| Energy | 5.3 | |

| Materials | 4.8 | |

| Real Estate | 4.4 | |

| Consumer Staples | 3.5 | |

| Communication Services | 2.9 | |

| Utilities | 0.8 | |

| |

| Common Stocks | 98.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| | Common Stocks - 98.3 |

| | Short-Term Investments and Net Other Assets (Liabilities) - 1.7 |

| |

| United States | 98.2 |

| Thailand | 0.6 |

| Canada | 0.3 |

| Ireland | 0.3 |

| Puerto Rico | 0.3 |

| Monaco | 0.1 |

| Norway | 0.1 |

| Bermuda | 0.1 |

| Panama | 0.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| | United States - 98.2 |

| | Thailand - 0.6 |

| | Canada - 0.3 |

| | Ireland - 0.3 |

| | Puerto Rico - 0.3 |

| | Monaco - 0.1 |

| | Norway - 0.1 |

| | Bermuda - 0.1 |

| | Panama - 0.0 |

| |

TOP HOLDINGS(% of Fund's net assets) | | |

| Abercrombie & Fitch Co Class A | 0.9 | |

| Q2 Holdings Inc | 0.9 | |

| Sprouts Farmers Market Inc | 0.8 | |

| Carpenter Technology Corp | 0.7 | |

| SkyWest Inc | 0.7 | |

| Primo Brands Corp Class A | 0.7 | |

| EnerSys | 0.7 | |

| Payoneer Global Inc | 0.7 | |

| Fabrinet | 0.6 | |

| AvidXchange Holdings Inc | 0.6 | |

| | 7.3 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914576.100 7545-TSRS-0325 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF DECEMBER 31, 2024 | |

| | Fidelity® Metaverse ETF Fidelity® Metaverse ETF : FMET Principal U.S. Listing Exchange :NASDAQ NASDAQ/NMS Global Market |

| | | |

This semi-annual shareholder report contains information about Fidelity® Metaverse ETF for the period July 1, 2024 to December 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Metaverse ETF | $ 19 | 0.38% | |

Key Fund Statistics(as of December 31, 2024)

KEY FACTS | | |

| Fund Size | $31,268,552 | |

| Number of Holdings | 52 | |

| Portfolio Turnover | 34% | |

What did the Fund invest in?

(as of December 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Information Technology | 53.3 | |

| Communication Services | 37.6 | |

| Real Estate | 8.2 | |

| Industrials | 0.7 | |

| |

| Common Stocks | 99.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.2 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| | Common Stocks - 99.8 |

| | Short-Term Investments and Net Other Assets (Liabilities) - 0.2 |

| |

| United States | 75.2 |

| Korea (South) | 10.8 |

| China | 6.9 |

| France | 3.1 |

| Japan | 1.4 |

| Sweden | 1.0 |

| Taiwan | 0.8 |

| United Kingdom | 0.8 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| | United States - 75.2 |

| | Korea (South) - 10.8 |

| | China - 6.9 |

| | France - 3.1 |

| | Japan - 1.4 |

| | Sweden - 1.0 |

| | Taiwan - 0.8 |

| | United Kingdom - 0.8 |

| |

TOP HOLDINGS(% of Fund's net assets) | | |

| Alphabet Inc Class A | 5.2 | |

| Apple Inc | 4.9 | |

| Meta Platforms Inc Class A | 4.5 | |

| QUALCOMM Inc | 4.5 | |

| Microsoft Corp | 4.5 | |

| Samsung Electronics Co Ltd | 4.5 | |

| NVIDIA Corp | 4.4 | |

| Equinix Inc | 4.3 | |

| Advanced Micro Devices Inc | 4.0 | |

| Adobe Inc | 3.9 | |

| | 44.7 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915178.100 6566-TSRS-0325 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF DECEMBER 31, 2024 | |

| | Fidelity® Crypto Industry and Digital Payments ETF Fidelity® Crypto Industry and Digital Payments ETF : FDIG Principal U.S. Listing Exchange :NASDAQ NASDAQ/NMS Global Market |

| | | |

This semi-annual shareholder report contains information about Fidelity® Crypto Industry and Digital Payments ETF for the period July 1, 2024 to December 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Crypto Industry and Digital Payments ETF | $ 21 | 0.38% | |

Key Fund Statistics(as of December 31, 2024)

KEY FACTS | | |

| Fund Size | $165,547,765 | |

| Number of Holdings | 49 | |

| Portfolio Turnover | 119% | |

What did the Fund invest in?

(as of December 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Financials | 52.6 | |

| Information Technology | 43.8 | |

| Communication Services | 1.9 | |

| Industrials | 1.3 | |

| |

| Common Stocks | 99.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.4 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| | Common Stocks - 99.6 |

| | Short-Term Investments and Net Other Assets (Liabilities) - 0.4 |

| |

| United States | 69.7 |

| Canada | 7.2 |

| Japan | 6.8 |

| Australia | 3.1 |

| Brazil | 2.9 |

| Netherlands | 1.7 |

| Germany | 1.6 |

| China | 1.4 |

| France | 1.4 |

| Others | 4.2 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| | United States - 69.7 |

| | Canada - 7.2 |

| | Japan - 6.8 |

| | Australia - 3.1 |

| | Brazil - 2.9 |

| | Netherlands - 1.7 |

| | Germany - 1.6 |

| | China - 1.4 |

| | France - 1.4 |

| | Others - 4.2 |

| |

TOP HOLDINGS(% of Fund's net assets) | | |

| Coinbase Global Inc Class A | 11.6 | |

| MARA Holdings Inc | 6.2 | |

| Riot Platforms Inc | 3.9 | |

| Block Inc Class A | 3.8 | |

| Cleanspark Inc | 3.7 | |

| Core Scientific Inc | 3.5 | |

| Bitdeer Technologies Group Class A | 3.2 | |

| IREN Ltd | 3.1 | |

| Terawulf Inc | 2.9 | |

| Hut 8 Corp (United States) | 2.8 | |

| | 44.7 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915177.100 6565-TSRS-0325 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF DECEMBER 31, 2024 | |

| | Fidelity® Enhanced U.S. All-Cap Equity ETF Fidelity® Enhanced U.S. All-Cap Equity ETF : FEAC Principal U.S. Listing Exchange :NYSEArca NYSE Arca, Inc. |

| | | |

This semi-annual shareholder report contains information about Fidelity® Enhanced U.S. All-Cap Equity ETF for the period November 19, 2024 to December 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

Fidelity® Enhanced U.S. All-Cap Equity ETF A | $ 2 | 0.18% | |

A Expenses for the full reporting period would be higher.

Key Fund Statistics(as of December 31, 2024)

KEY FACTS | | |

| Fund Size | $4,348,930 | |

| Number of Holdings | 360 | |

Portfolio TurnoverA | 16% | |

A Amount not annualized

What did the Fund invest in?

(as of December 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Information Technology | 31.4 | |

| Financials | 15.5 | |

| Communication Services | 10.8 | |

| Consumer Discretionary | 10.3 | |

| Health Care | 10.1 | |

| Industrials | 9.9 | |

| Energy | 3.6 | |

| Consumer Staples | 3.6 | |

| Real Estate | 1.9 | |

| Materials | 1.8 | |

| Utilities | 0.2 | |

| |

| Common Stocks | 99.1 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.9 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| | Common Stocks - 99.1 |

| | Short-Term Investments and Net Other Assets (Liabilities) - 0.9 |

| |

| United States | 99.7 |

| United Kingdom | 0.1 |

| Monaco | 0.1 |

| Thailand | 0.1 |

| Canada | 0.0 |

| Hong Kong | 0.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| | United States - 99.7 |

| | United Kingdom - 0.1 |

| | Monaco - 0.1 |

| | Thailand - 0.1 |

| | Canada - 0.0 |

| | Hong Kong - 0.0 |

| |

TOP HOLDINGS(% of Fund's net assets) | | |

| Apple Inc | 7.0 | |

| NVIDIA Corp | 6.2 | |

| Microsoft Corp | 4.8 | |

| Amazon.com Inc | 2.9 | |

| Meta Platforms Inc Class A | 2.9 | |

| Broadcom Inc | 2.5 | |

| Alphabet Inc Class A | 2.0 | |

| Exxon Mobil Corp | 1.5 | |

| Mastercard Inc Class A | 1.4 | |

| Walmart Inc | 1.4 | |

| | 32.6 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9918720.100 7725-TSRS-0325 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF DECEMBER 31, 2024 | |

| | Fidelity® Enhanced Emerging Markets ETF Fidelity® Enhanced Emerging Markets ETF : FEMR Principal U.S. Listing Exchange :NYSEArca NYSE Arca, Inc. |

| | | |

This semi-annual shareholder report contains information about Fidelity® Enhanced Emerging Markets ETF for the period November 19, 2024 to December 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

Fidelity® Enhanced Emerging Markets ETF A | $ 4 | 0.38% | |

A Expenses for the full reporting period would be higher.

Key Fund Statistics(as of December 31, 2024)

KEY FACTS | | |

| Fund Size | $9,847,801 | |

| Number of Holdings | 172 | |

Portfolio TurnoverB | 0%A | |

A Amount represents less than 1%

B Amount not annualized

What did the Fund invest in?

(as of December 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Information Technology | 27.7 | |

| Financials | 22.3 | |

| Consumer Discretionary | 15.8 | |

| Industrials | 7.6 | |

| Communication Services | 7.5 | |

| Consumer Staples | 5.5 | |

| Health Care | 5.4 | |

| Materials | 3.1 | |

| Real Estate | 2.4 | |

| Energy | 2.2 | |

| Utilities | 0.2 | |

| |

| Common Stocks | 99.6 |

| Preferred Stocks | 0.1 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| | Common Stocks - 99.6 |

| | Preferred Stocks - 0.1 |

| | Short-Term Investments and Net Other Assets (Liabilities) - 0.3 |

| |

| China | 29.3 |

| Taiwan | 21.1 |

| India | 16.1 |

| Korea (South) | 10.3 |

| Brazil | 3.8 |

| Saudi Arabia | 2.7 |

| South Africa | 2.4 |

| United Arab Emirates | 2.4 |

| Mexico | 2.2 |

| Others | 9.7 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| | China - 29.3 |

| | Taiwan - 21.1 |

| | India - 16.1 |

| | Korea (South) - 10.3 |

| | Brazil - 3.8 |

| | Saudi Arabia - 2.7 |

| | South Africa - 2.4 |

| | United Arab Emirates - 2.4 |

| | Mexico - 2.2 |

| | Others - 9.7 |

| |

TOP HOLDINGS(% of Fund's net assets) | | |

| Taiwan Semiconductor Manufacturing Co Ltd | 11.3 | |

| Tencent Holdings Ltd | 5.2 | |

| ICICI Bank Ltd ADR | 2.6 | |

| Infosys Ltd ADR | 2.5 | |

| HDFC Bank Ltd/Gandhinagar ADR | 2.4 | |

| Samsung Electronics Co Ltd | 2.1 | |

| Meituan B Shares | 1.9 | |

| MediaTek Inc | 1.8 | |

| Wipro Ltd ADR | 1.7 | |

| State Bank of India GDR | 1.7 | |

| | 33.2 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9918718.100 7726-TSRS-0325 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF DECEMBER 31, 2024 | |

| | Fidelity® Enhanced Mid Cap ETF Fidelity® Enhanced Mid Cap ETF : FMDE Principal U.S. Listing Exchange :NYSEArca NYSE Arca, Inc. |

| | | |

This semi-annual shareholder report contains information about Fidelity® Enhanced Mid Cap ETF for the period July 1, 2024 to December 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Enhanced Mid Cap ETF | $ 12 | 0.23% | |

Key Fund Statistics(as of December 31, 2024)

KEY FACTS | | |

| Fund Size | $2,128,597,717 | |

| Number of Holdings | 328 | |

| Portfolio Turnover | 48% | |

What did the Fund invest in?

(as of December 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Financials | 18.3 | |

| Industrials | 17.6 | |

| Information Technology | 15.0 | |

| Consumer Discretionary | 12.4 | |

| Health Care | 8.3 | |

| Real Estate | 6.5 | |

| Materials | 5.5 | |

| Energy | 4.4 | |

| Utilities | 4.3 | |

| Consumer Staples | 3.7 | |

| Communication Services | 2.7 | |

| |

| Common Stocks | 98.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| | Common Stocks - 98.7 |

| | Short-Term Investments and Net Other Assets (Liabilities) - 1.3 |

| |

| United States | 99.5 |

| Korea (South) | 0.4 |

| United Kingdom | 0.1 |

| Canada | 0.0 |

| Brazil | 0.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| | United States - 99.5 |

| | Korea (South) - 0.4 |

| | United Kingdom - 0.1 |

| | Canada - 0.0 |

| | Brazil - 0.0 |

| |

TOP HOLDINGS(% of Fund's net assets) | | |

| Williams Cos Inc/The | 1.2 | |

| Bank of New York Mellon Corp/The | 1.0 | |

| Allstate Corp/The | 0.9 | |

| Simon Property Group Inc | 0.9 | |

| Cummins Inc | 0.9 | |

| Block Inc Class A | 0.9 | |

| Howmet Aerospace Inc | 0.9 | |

| MSCI Inc | 0.9 | |

| AMETEK Inc | 0.8 | |

| Vistra Corp | 0.8 | |

| | 9.2 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915508.100 7546-TSRS-0325 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF DECEMBER 31, 2024 | |

| | Fidelity® Enhanced International ETF Fidelity® Enhanced International ETF : FENI Principal U.S. Listing Exchange :NYSEArca NYSE Arca, Inc. |

| | | |

This semi-annual shareholder report contains information about Fidelity® Enhanced International ETF for the period July 1, 2024 to December 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Enhanced International ETF | $ 14 | 0.28% | |

Key Fund Statistics(as of December 31, 2024)

KEY FACTS | | |

| Fund Size | $1,733,493,169 | |

| Number of Holdings | 291 | |

| Portfolio Turnover | 87% | |

What did the Fund invest in?

(as of December 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Financials | 22.7 | |

| Industrials | 19.3 | |

| Health Care | 12.5 | |

| Information Technology | 10.8 | |

| Consumer Discretionary | 10.0 | |

| Materials | 7.5 | |

| Consumer Staples | 6.5 | |

| Utilities | 3.1 | |

| Communication Services | 3.1 | |

| Energy | 1.5 | |

| Real Estate | 1.3 | |

| |

| Common Stocks | 97.8 |

| Preferred Stocks | 0.5 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| | Common Stocks - 97.8 |

| | Preferred Stocks - 0.5 |

| | Short-Term Investments and Net Other Assets (Liabilities) - 1.7 |

| |

| Japan | 23.9 |

| United States | 12.2 |

| United Kingdom | 11.2 |

| Germany | 9.1 |

| France | 7.2 |

| Australia | 6.1 |

| Switzerland | 4.2 |

| Spain | 4.1 |

| Netherlands | 4.1 |

| Others | 17.9 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| | Japan - 23.9 |

| | United States - 12.2 |

| | United Kingdom - 11.2 |

| | Germany - 9.1 |

| | France - 7.2 |

| | Australia - 6.1 |

| | Switzerland - 4.2 |

| | Spain - 4.1 |

| | Netherlands - 4.1 |

| | Others - 17.9 |

| |

TOP HOLDINGS(% of Fund's net assets) | | |

| SAP SE | 2.1 | |

| Novo Nordisk A/S Series B | 1.5 | |

| Novartis AG | 1.5 | |

| Roche Holding AG | 1.5 | |

| Siemens AG | 1.4 | |

| Sony Group Corp | 1.3 | |

| Schneider Electric SE | 1.3 | |

| ASML Holding NV | 1.3 | |

| HSBC Holdings PLC | 1.2 | |

| Recruit Holdings Co Ltd | 1.1 | |

| | 14.2 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915507.100 7544-TSRS-0325 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF DECEMBER 31, 2024 | |

| | Fidelity® Clean Energy ETF Fidelity® Clean Energy ETF : FRNW Principal U.S. Listing Exchange :CboeBZX Cboe BZX Exchange, Inc. |

| | | |

This semi-annual shareholder report contains information about Fidelity® Clean Energy ETF for the period July 1, 2024 to December 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Clean Energy ETF | $ 19 | 0.38% | |

Key Fund Statistics(as of December 31, 2024)

KEY FACTS | | |

| Fund Size | $24,294,307 | |

| Number of Holdings | 51 | |

| Portfolio Turnover | 51% | |

What did the Fund invest in?

(as of December 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Utilities | 48.1 | |

| Industrials | 31.2 | |

| Information Technology | 20.5 | |

| |

| Common Stocks | 99.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.2 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| | Common Stocks - 99.8 |

| | Short-Term Investments and Net Other Assets (Liabilities) - 0.2 |

| |

| United States | 35.6 |

| China | 9.9 |

| Canada | 9.1 |

| Denmark | 7.2 |

| Spain | 5.7 |

| Germany | 4.7 |

| New Zealand | 4.5 |

| France | 4.4 |

| Israel | 3.7 |

| Others | 15.2 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| | United States - 35.6 |

| | China - 9.9 |

| | Canada - 9.1 |

| | Denmark - 7.2 |

| | Spain - 5.7 |

| | Germany - 4.7 |

| | New Zealand - 4.5 |

| | France - 4.4 |

| | Israel - 3.7 |

| | Others - 15.2 |

| |

TOP HOLDINGS(% of Fund's net assets) | | |

| GE Vernova Inc | 4.6 | |

| First Solar Inc | 4.3 | |

| Vestas Wind Systems A/S | 4.1 | |

| Enphase Energy Inc | 3.5 | |

| EDP SA | 3.4 | |

| Orsted AS | 3.1 | |

| NEXTracker Inc Class A | 2.9 | |

| Verbund AG Class A | 2.9 | |

| Itron Inc | 2.7 | |

| Meridian Energy Ltd | 2.6 | |

| | 34.1 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915173.100 6442-TSRS-0325 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF DECEMBER 31, 2024 | |

| | Fidelity® Cloud Computing ETF Fidelity® Cloud Computing ETF : FCLD Principal U.S. Listing Exchange :CboeBZX Cboe BZX Exchange, Inc. |

| | | |

This semi-annual shareholder report contains information about Fidelity® Cloud Computing ETF for the period July 1, 2024 to December 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Cloud Computing ETF | $ 21 | 0.38% | |

Key Fund Statistics(as of December 31, 2024)

KEY FACTS | | |

| Fund Size | $85,108,801 | |

| Number of Holdings | 53 | |

| Portfolio Turnover | 38% | |

What did the Fund invest in?

(as of December 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Information Technology | 88.2 | |

| Real Estate | 7.6 | |

| Consumer Discretionary | 2.2 | |

| Industrials | 1.8 | |

| |

| Common Stocks | 99.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.2 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| | Common Stocks - 99.8 |

| | Short-Term Investments and Net Other Assets (Liabilities) - 0.2 |

| |

| United States | 93.3 |

| Israel | 2.8 |

| Taiwan | 2.0 |

| China | 1.9 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| | United States - 93.3 |

| | Israel - 2.8 |

| | Taiwan - 2.0 |

| | China - 1.9 |

| |

TOP HOLDINGS(% of Fund's net assets) | | |

| Microsoft Corp | 4.8 | |

| Servicenow Inc | 4.6 | |

| Salesforce Inc | 4.5 | |

| Oracle Corp | 4.4 | |

| Equinix Inc | 4.2 | |

| Workday Inc Class A | 3.5 | |

| Digital Realty Trust Inc | 3.4 | |

| Snowflake Inc Class A | 3.1 | |

| Datadog Inc Class A | 3.0 | |

| MicroStrategy Inc Class A | 2.9 | |

| | 38.4 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915174.100 6443-TSRS-0325 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF DECEMBER 31, 2024 | |

| | Fidelity® Digital Health ETF Fidelity® Digital Health ETF : FDHT Principal U.S. Listing Exchange :CboeBZX Cboe BZX Exchange, Inc. |

| | | |

This semi-annual shareholder report contains information about Fidelity® Digital Health ETF for the period July 1, 2024 to December 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Digital Health ETF | $ 20 | 0.38% | |

Key Fund Statistics(as of December 31, 2024)

KEY FACTS | | |

| Fund Size | $7,836,071 | |

| Number of Holdings | 51 | |

| Portfolio Turnover | 59% | |

What did the Fund invest in?

(as of December 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Health Care | 86.4 | |

| Consumer Staples | 6.5 | |

| Information Technology | 5.1 | |

| Industrials | 2.0 | |

| |

| Common Stocks | 100.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| | Common Stocks - 100.0 |

| | Short-Term Investments and Net Other Assets (Liabilities) - 0.0 |

| |

| United States | 60.6 |

| Australia | 6.8 |

| Netherlands | 5.6 |

| China | 5.0 |

| Germany | 4.8 |

| Switzerland | 4.4 |

| New Zealand | 3.4 |

| Japan | 2.6 |

| Denmark | 1.9 |

| Others | 4.9 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| | United States - 60.6 |

| | Australia - 6.8 |

| | Netherlands - 5.6 |

| | China - 5.0 |

| | Germany - 4.8 |

| | Switzerland - 4.4 |

| | New Zealand - 3.4 |

| | Japan - 2.6 |

| | Denmark - 1.9 |

| | Others - 4.9 |

| |

TOP HOLDINGS(% of Fund's net assets) | | |

| Dexcom Inc | 4.7 | |

| ResMed Inc | 4.5 | |

| Intuitive Surgical Inc | 4.5 | |

| Veeva Systems Inc Class A | 4.4 | |

| Koninklijke Philips NV | 4.1 | |

| Insulet Corp | 3.9 | |

| Sonova Holding AG | 3.7 | |

| Siemens Healthineers AG | 3.6 | |

| Fisher & Paykel Healthcare Corp Ltd | 3.4 | |

| Cochlear Ltd | 3.2 | |

| | 40.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915175.100 6444-TSRS-0325 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF DECEMBER 31, 2024 | |

| | Fidelity® Electric Vehicles and Future Transportation ETF Fidelity® Electric Vehicles and Future Transportation ETF : FDRV Principal U.S. Listing Exchange :CboeBZX Cboe BZX Exchange, Inc. |

| | | |

This semi-annual shareholder report contains information about Fidelity® Electric Vehicles and Future Transportation ETF for the period July 1, 2024 to December 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Electric Vehicles and Future Transportation ETF | $ 19 | 0.38% | |

Key Fund Statistics(as of December 31, 2024)

KEY FACTS | | |

| Fund Size | $28,162,666 | |

| Number of Holdings | 51 | |

| Portfolio Turnover | 78% | |

What did the Fund invest in?

(as of December 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Consumer Discretionary | 57.0 | |

| Information Technology | 23.3 | |

| Industrials | 16.4 | |

| Materials | 3.2 | |

| |

| Common Stocks | 99.9 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| | Common Stocks - 99.9 |

| | Short-Term Investments and Net Other Assets (Liabilities) - 0.1 |

| |

| United States | 40.5 |

| China | 29.7 |

| Japan | 6.6 |

| Bailiwick Of Jersey | 4.8 |

| Germany | 4.3 |

| Korea (South) | 3.1 |

| France | 2.7 |

| Israel | 2.2 |

| Belgium | 1.6 |

| Others | 4.5 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| | United States - 40.5 |

| | China - 29.7 |

| | Japan - 6.6 |

| | Bailiwick Of Jersey - 4.8 |

| | Germany - 4.3 |

| | Korea (South) - 3.1 |

| | France - 2.7 |

| | Israel - 2.2 |

| | Belgium - 1.6 |

| | Others - 4.5 |

| |

TOP HOLDINGS(% of Fund's net assets) | | |

| Tesla Inc | 4.9 | |

| Li Auto Inc A Shares | 4.9 | |

| Aptiv PLC | 4.8 | |

| BYD Co Ltd H Shares | 4.7 | |

| Rivian Automotive Inc Class A | 4.5 | |

| NXP Semiconductors NV | 4.3 | |

| Infineon Technologies AG | 4.3 | |

| Uber Technologies Inc | 4.2 | |

| NIO Inc A Shares | 3.8 | |

| XPeng Inc A Shares | 3.8 | |

| | 44.2 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915176.100 6445-TSRS-0325 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF DECEMBER 31, 2024 | |

| | Fidelity® Enhanced Large Cap Growth ETF Fidelity® Enhanced Large Cap Growth ETF : FELG Principal U.S. Listing Exchange :NYSEArca NYSE Arca, Inc. |

| | | |

This semi-annual shareholder report contains information about Fidelity® Enhanced Large Cap Growth ETF for the period July 1, 2024 to December 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Enhanced Large Cap Growth ETF | $ 10 | 0.18% | |

Key Fund Statistics(as of December 31, 2024)

KEY FACTS | | |

| Fund Size | $3,180,775,368 | |

| Number of Holdings | 96 | |

| Portfolio Turnover | 31% | |

What did the Fund invest in?

(as of December 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Information Technology | 46.9 | |

| Consumer Discretionary | 17.6 | |

| Communication Services | 14.0 | |

| Health Care | 6.6 | |

| Industrials | 6.1 | |

| Financials | 5.8 | |

| Consumer Staples | 1.4 | |

| Energy | 0.5 | |

| Materials | 0.1 | |

| Real Estate | 0.1 | |

| Utilities | 0.0 | |

| |

| Common Stocks | 99.1 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.9 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| | Common Stocks - 99.1 |

| | Short-Term Investments and Net Other Assets (Liabilities) - 0.9 |

| |

| United States | 99.6 |

| Brazil | 0.3 |

| Mexico | 0.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| | United States - 99.6 |

| | Brazil - 0.3 |

| | Mexico - 0.1 |

| |

TOP HOLDINGS(% of Fund's net assets) | | |

| Apple Inc | 12.7 | |

| NVIDIA Corp | 11.2 | |

| Microsoft Corp | 10.0 | |

| Amazon.com Inc | 7.3 | |

| Meta Platforms Inc Class A | 4.8 | |

| Tesla Inc | 4.3 | |

| Alphabet Inc Class A | 3.7 | |

| Broadcom Inc | 3.6 | |

| Alphabet Inc Class C | 2.7 | |

| Mastercard Inc Class A | 2.0 | |

| | 62.3 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915506.100 7543-TSRS-0325 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF DECEMBER 31, 2024 | |

| | Fidelity® Enhanced Large Cap Value ETF Fidelity® Enhanced Large Cap Value ETF : FELV Principal U.S. Listing Exchange :NYSEArca NYSE Arca, Inc. |

| | | |

This semi-annual shareholder report contains information about Fidelity® Enhanced Large Cap Value ETF for the period July 1, 2024 to December 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-FIDELITY or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Enhanced Large Cap Value ETF | $ 9 | 0.18% | |

Key Fund Statistics(as of December 31, 2024)

KEY FACTS | | |

| Fund Size | $2,133,528,408 | |

| Number of Holdings | 383 | |

| Portfolio Turnover | 46% | |

What did the Fund invest in?

(as of December 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Financials | 22.9 | |

| Industrials | 16.4 | |

| Health Care | 13.0 | |

| Information Technology | 9.8 | |

| Consumer Discretionary | 6.9 | |

| Consumer Staples | 6.9 | |

| Energy | 6.0 | |

| Communication Services | 4.7 | |

| Materials | 4.3 | |

| Real Estate | 3.9 | |

| Utilities | 3.8 | |

| |

| Common Stocks | 98.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.4 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| | Common Stocks - 98.6 |

| | Short-Term Investments and Net Other Assets (Liabilities) - 1.4 |

| |

| United States | 99.3 |

| Ireland | 0.4 |

| United Kingdom | 0.2 |

| Finland | 0.1 |

| Mexico | 0.0 |

| Canada | 0.0 |

| Bailiwick Of Jersey | 0.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| | United States - 99.3 |

| | Ireland - 0.4 |

| | United Kingdom - 0.2 |

| | Finland - 0.1 |

| | Mexico - 0.0 |

| | Canada - 0.0 |

| | Bailiwick Of Jersey - 0.0 |

| |

TOP HOLDINGS(% of Fund's net assets) | | |

| Berkshire Hathaway Inc Class B | 3.8 | |

| JPMorgan Chase & Co | 2.9 | |

| Exxon Mobil Corp | 2.3 | |

| Walmart Inc | 2.1 | |

| Bank of America Corp | 1.6 | |

| Walt Disney Co/The | 1.3 | |

| UnitedHealth Group Inc | 1.3 | |

| Procter & Gamble Co/The | 1.3 | |

| Wells Fargo & Co | 1.2 | |

| Cisco Systems Inc | 1.2 | |

| | 19.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915505.100 7542-TSRS-0325 |

Item 2.

Code of Ethics

Not applicable.

Item 3.

Audit Committee Financial Expert

Not applicable.

Item 4.

Principal Accountant Fees and Services

Not applicable.

Item 5.

Audit Committee of Listed Registrants

Not applicable.

Item 6.

Investments

(a)

Not applicable.

(b)

Not applicable

Item 7.

Financial Statements and Financial Highlights for Open-End Management Investment Companies

Fidelity® Enhanced International ETF

Fidelity® Enhanced Large Cap Core ETF

Fidelity® Enhanced Large Cap Growth ETF

Fidelity® Enhanced Large Cap Value ETF

Fidelity® Enhanced Mid Cap ETF

Semi-Annual Report

December 31, 2024

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-FIDELITY to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2025 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Funds nor Fidelity Distributors Corporation is a bank.

Item 7: Financial Statements and Financial Highlights for Open-End Management Investment Companies (Semi-Annual Report)

Fidelity® Enhanced International ETF

Schedule of Investments December 31, 2024 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks - 97.8% |

| | | Shares | Value ($) |

| AUSTRALIA - 6.1% | | | |

| Communication Services - 0.2% | | | |

| Diversified Telecommunication Services - 0.1% | | | |

| Telstra Group Ltd | | 693,793 | 1,721,987 |

| Interactive Media & Services - 0.1% | | | |

| CAR Group Ltd | | 1,367 | 30,485 |

| REA Group Ltd | | 10,245 | 1,479,452 |

| | | | 1,509,937 |

TOTAL COMMUNICATION SERVICES | | | 3,231,924 |

| | | | |

| Consumer Discretionary - 1.1% | | | |

| Broadline Retail - 0.8% | | | |

| Wesfarmers Ltd | | 304,626 | 13,486,857 |

| Hotels, Restaurants & Leisure - 0.3% | | | |

| Aristocrat Leisure Ltd | | 142,157 | 6,014,865 |

TOTAL CONSUMER DISCRETIONARY | | | 19,501,722 |

| | | | |

| Financials - 1.5% | | | |

| Banks - 1.4% | | | |

| ANZ Group Holdings Ltd | | 597,423 | 10,553,378 |

| Commonwealth Bank of Australia | | 84,137 | 7,980,738 |

| National Australia Bank Ltd | | 151,340 | 3,475,227 |

| Westpac Banking Corp | | 143,373 | 2,868,100 |

| | | | 24,877,443 |

| Insurance - 0.1% | | | |

| Medibank Pvt Ltd | | 211,952 | 497,201 |

| QBE Insurance Group Ltd | | 95,917 | 1,139,863 |

| | | | 1,637,064 |

TOTAL FINANCIALS | | | 26,514,507 |

| | | | |

| Health Care - 0.4% | | | |

| Health Care Technology - 0.4% | | | |

| Pro Medicus Ltd | | 43,617 | 6,752,425 |

| Industrials - 0.0% | | | |

| Trading Companies & Distributors - 0.0% | | | |

| Reece Ltd | | 24,303 | 336,648 |

| SGH Ltd | | 17,754 | 506,695 |

| | | | 843,343 |

| Materials - 2.9% | | | |

| Metals & Mining - 2.9% | | | |

| BHP Group Ltd | | 356,721 | 8,732,342 |

| Fortescue Ltd | | 886,558 | 10,014,415 |

| Northern Star Resources Ltd | | 542,575 | 5,185,166 |

| Rio Tinto Ltd | | 146,629 | 10,660,202 |

| Rio Tinto PLC | | 107,598 | 6,361,972 |

| Rio Tinto PLC ADR | | 149,201 | 8,774,511 |

| | | | 49,728,608 |

| Real Estate - 0.0% | | | |

| Diversified REITs - 0.0% | | | |

| GPT Group/The unit | | 138 | 373 |

| Utilities - 0.0% | | | |

| Electric Utilities - 0.0% | | | |

| Origin Energy Ltd | | 128 | 864 |

| TOTAL AUSTRALIA | | | 106,573,766 |

| AUSTRIA - 0.0% | | | |

| Financials - 0.0% | | | |

| Banks - 0.0% | | | |

| Erste Group Bank AG | | 23 | 1,421 |

| BELGIUM - 0.4% | | | |

| Financials - 0.3% | | | |

| Financial Services - 0.0% | | | |

| Groupe Bruxelles Lambert NV | | 5,341 | 365,420 |

| Insurance - 0.3% | | | |

| Ageas SA/NV | | 101,653 | 4,938,442 |

TOTAL FINANCIALS | | | 5,303,862 |

| | | | |

| Real Estate - 0.1% | | | |

| Industrial REITs - 0.1% | | | |

| Warehouses De Pauw CVA | | 73,541 | 1,447,371 |

| TOTAL BELGIUM | | | 6,751,233 |

| CHINA - 1.6% | | | |

| Consumer Discretionary - 0.9% | | | |

| Broadline Retail - 0.9% | | | |

| Prosus NV Class N | | 371,836 | 14,771,128 |

| Financials - 0.5% | | | |

| Banks - 0.5% | | | |

| BOC Hong Kong Holdings Ltd | | 2,553,500 | 8,202,999 |

| Industrials - 0.2% | | | |

| Machinery - 0.1% | | | |

| Yangzijiang Shipbuildling (Holdings) Ltd | | 1,022,300 | 2,238,258 |

| Marine Transportation - 0.1% | | | |

| SITC International Holdings Co Ltd | | 826,000 | 2,201,490 |

TOTAL INDUSTRIALS | | | 4,439,748 |

| | | | |

| TOTAL CHINA | | | 27,413,875 |

| DENMARK - 2.7% | | | |

| Consumer Discretionary - 0.0% | | | |

| Textiles, Apparel & Luxury Goods - 0.0% | | | |

| Pandora A/S | | 6,940 | 1,269,583 |

| Financials - 0.3% | | | |

| Banks - 0.3% | | | |

| Danske Bank A/S | | 165,973 | 4,696,175 |

| Health Care - 2.1% | | | |

| Biotechnology - 0.6% | | | |

| Genmab A/S (b) | | 31,054 | 6,437,951 |

| Genmab A/S ADR (b) | | 188,762 | 3,939,462 |

| | | | 10,377,413 |

| Pharmaceuticals - 1.5% | | | |

| Novo Nordisk A/S Class B ADR | | 5 | 430 |

| Novo Nordisk A/S Series B | | 301,568 | 26,147,176 |

| | | | 26,147,606 |

TOTAL HEALTH CARE | | | 36,525,019 |

| | | | |

| Industrials - 0.3% | | | |

| Building Products - 0.0% | | | |

| ROCKWOOL A/S Series B | | 1,858 | 658,631 |

| Marine Transportation - 0.3% | | | |

| AP Moller - Maersk A/S Series A | | 1,561 | 2,502,215 |

| AP Moller - Maersk A/S Series B | | 987 | 1,632,158 |

| | | | 4,134,373 |

TOTAL INDUSTRIALS | | | 4,793,004 |

| | | | |

| Materials - 0.0% | | | |

| Chemicals - 0.0% | | | |

| Novonesis (Novozymes) B Series B | | 17 | 962 |

| TOTAL DENMARK | | | 47,284,743 |

| FINLAND - 1.6% | | | |

| Financials - 0.2% | | | |

| Banks - 0.2% | | | |

| Nordea Bank Abp | | 231,247 | 2,515,141 |

| Nordea Bank Abp (Sweden) | | 63,236 | 687,581 |

| | | | 3,202,722 |

| Insurance - 0.0% | | | |

| Sampo Oyj A Shares | | 25,116 | 1,024,526 |

TOTAL FINANCIALS | | | 4,227,248 |

| | | | |

| Industrials - 1.0% | | | |

| Machinery - 1.0% | | | |

| Kone Oyj B Shares | | 188,064 | 9,155,886 |

| Wartsila OYJ Abp | | 437,958 | 7,762,102 |

| | | | 16,917,988 |

| Information Technology - 0.4% | | | |

| Communications Equipment - 0.4% | | | |

| Nokia Oyj | | 624,558 | 2,765,381 |

| Nokia Oyj ADR (c) | | 827,369 | 3,665,245 |

| | | | 6,430,626 |

| TOTAL FINLAND | | | 27,575,862 |

| FRANCE - 7.2% | | | |

| Consumer Discretionary - 0.8% | | | |

| Hotels, Restaurants & Leisure - 0.2% | | | |

| La Francaise des Jeux SACA (d)(e) | | 99,085 | 3,820,156 |

| Textiles, Apparel & Luxury Goods - 0.6% | | | |

| LVMH Moet Hennessy Louis Vuitton SE | | 15,640 | 10,295,542 |

TOTAL CONSUMER DISCRETIONARY | | | 14,115,698 |

| | | | |

| Consumer Staples - 0.3% | | | |

| Consumer Staples Distribution & Retail - 0.0% | | | |

| Carrefour SA | | 27,311 | 388,423 |

| Food Products - 0.3% | | | |

| Danone SA | | 68,703 | 4,634,330 |

| Personal Care Products - 0.0% | | | |

| L'Oreal SA | | 1,421 | 503,184 |

TOTAL CONSUMER STAPLES | | | 5,525,937 |

| | | | |

| Energy - 0.7% | | | |

| Oil, Gas & Consumable Fuels - 0.7% | | | |

| TotalEnergies SE | | 234,507 | 12,964,324 |

| Financials - 1.5% | | | |

| Banks - 1.1% | | | |

| BNP Paribas SA | | 235,047 | 14,418,497 |

| Credit Agricole SA | | 42,089 | 579,416 |

| Societe Generale SA Series A | | 113,475 | 3,192,470 |

| | | | 18,190,383 |

| Insurance - 0.4% | | | |

| AXA SA | | 209,355 | 7,442,648 |

TOTAL FINANCIALS | | | 25,633,031 |

| | | | |

| Industrials - 1.6% | | | |

| Aerospace & Defense - 0.3% | | | |

| Airbus SE | | 3,548 | 568,847 |

| Safran SA | | 20,586 | 4,522,822 |

| | | | 5,091,669 |

| Building Products - 0.2% | | | |

| Cie de Saint-Gobain SA | | 48,775 | 4,329,871 |

| Construction & Engineering - 0.6% | | | |

| Eiffage SA | | 93,213 | 8,180,114 |

| Vinci SA | | 22,648 | 2,339,894 |

| | | | 10,520,008 |

| Electrical Equipment - 0.4% | | | |

| Legrand SA | | 62,811 | 6,118,503 |

| Trading Companies & Distributors - 0.0% | | | |

| Rexel SA | | 26,383 | 672,289 |

| Transportation Infrastructure - 0.1% | | | |

| Getlink SE Series A | | 54,999 | 877,634 |

TOTAL INDUSTRIALS | | | 27,609,974 |

| | | | |

| Information Technology - 0.5% | | | |

| IT Services - 0.5% | | | |

| Capgemini SE | | 48,540 | 7,951,807 |

| Materials - 0.9% | | | |

| Chemicals - 0.9% | | | |

| Air Liquide SA | | 98,382 | 15,991,559 |

| Arkema SA | | 2,671 | 203,495 |

| | | | 16,195,054 |

| Real Estate - 0.3% | | | |

| Diversified REITs - 0.1% | | | |

| Covivio SA/France | | 39,902 | 2,015,372 |

| Office REITs - 0.2% | | | |

| Gecina SA | | 28,246 | 2,646,442 |

TOTAL REAL ESTATE | | | 4,661,814 |

| | | | |

| Utilities - 0.6% | | | |

| Multi-Utilities - 0.6% | | | |

| Engie SA | | 590,283 | 9,361,218 |

| Veolia Environnement SA | | 40,784 | 1,145,291 |

| | | | 10,506,509 |

| TOTAL FRANCE | | | 125,164,148 |

| GERMANY - 8.6% | | | |

| Communication Services - 0.1% | | | |

| Diversified Telecommunication Services - 0.1% | | | |

| Deutsche Telekom AG | | 65,055 | 1,946,817 |

| Interactive Media & Services - 0.0% | | | |

| Scout24 SE (d)(e) | | 2 | 176 |

TOTAL COMMUNICATION SERVICES | | | 1,946,993 |

| | | | |

| Consumer Discretionary - 0.8% | | | |

| Automobiles - 0.0% | | | |

| Mercedes-Benz Group AG | | 9,890 | 551,157 |

| Volkswagen AG | | 2,960 | 282,543 |

| | | | 833,700 |

| Specialty Retail - 0.0% | | | |

| Zalando SE (b)(d)(e) | | 13,305 | 446,398 |

| Textiles, Apparel & Luxury Goods - 0.8% | | | |

| adidas AG | | 51,294 | 12,581,869 |

TOTAL CONSUMER DISCRETIONARY | | | 13,861,967 |

| | | | |

| Financials - 2.7% | | | |

| Capital Markets - 0.8% | | | |

| Deutsche Bank AG | | 721,854 | 12,442,268 |

| Deutsche Boerse AG | | 3,103 | 714,848 |

| | | | 13,157,116 |

| Insurance - 1.9% | | | |

| Allianz SE | | 56,987 | 17,466,972 |

| Hannover Rueck SE | | 5,032 | 1,258,273 |

| Muenchener Rueckversicherungs-Gesellschaft AG in Muenchen | | 21,083 | 10,637,692 |

| Talanx AG | | 46,871 | 3,988,491 |

| | | | 33,351,428 |

TOTAL FINANCIALS | | | 46,508,544 |

| | | | |

| Industrials - 2.0% | | | |

| Air Freight & Logistics - 0.5% | | | |

| Deutsche Post AG | | 247,062 | 8,696,134 |

| Industrial Conglomerates - 1.4% | | | |

| Siemens AG | | 124,150 | 24,248,963 |

| Machinery - 0.1% | | | |

| Gea Group Ag | | 8 | 396 |

| Knorr-Bremse AG | | 20,160 | 1,469,100 |

| Rational AG | | 1,207 | 1,030,223 |

| | | | 2,499,719 |

TOTAL INDUSTRIALS | | | 35,444,816 |

| | | | |

| Information Technology - 2.1% | | | |

| Semiconductors & Semiconductor Equipment - 0.0% | | | |

| Infineon Technologies AG | | 132 | 4,293 |

| Software - 2.1% | | | |

| SAP SE | | 146,479 | 35,853,864 |

TOTAL INFORMATION TECHNOLOGY | | | 35,858,157 |

| | | | |

| Materials - 0.9% | | | |

| Chemicals - 0.4% | | | |

| Evonik Industries AG | | 205,665 | 3,564,127 |

| Symrise AG | | 24,157 | 2,568,614 |

| | | | 6,132,741 |

| Construction Materials - 0.5% | | | |

| Heidelberg Materials AG | | 73,098 | 9,033,225 |

TOTAL MATERIALS | | | 15,165,966 |

| | | | |

| TOTAL GERMANY | | | 148,786,443 |

| HONG KONG - 2.5% | | | |

| Communication Services - 0.0% | | | |

| Diversified Telecommunication Services - 0.0% | | | |

| HKT Trust & HKT Ltd unit | | 258,000 | 318,902 |

| Consumer Staples - 0.4% | | | |

| Food Products - 0.4% | | | |

| WH Group Ltd (d)(e) | | 9,151,455 | 7,081,592 |

| Financials - 1.2% | | | |

| Capital Markets - 0.3% | | | |

| Hong Kong Exchanges & Clearing Ltd | | 142,100 | 5,393,713 |

| Insurance - 0.9% | | | |

| AIA Group Ltd | | 1,808,832 | 13,112,120 |

TOTAL FINANCIALS | | | 18,505,833 |

| | | | |

| Industrials - 0.1% | | | |

| Industrial Conglomerates - 0.1% | | | |

| Jardine Matheson Holdings Ltd (Singapore) | | 44,700 | 1,831,359 |

| Swire Pacific Ltd A Shares | | 42,500 | 385,510 |

| | | | 2,216,869 |

| Real Estate - 0.3% | | | |

| Real Estate Management & Development - 0.3% | | | |

| Sun Hung Kai Properties Ltd | | 602,500 | 5,790,994 |

| Utilities - 0.5% | | | |

| Electric Utilities - 0.5% | | | |

| CLP Holdings Ltd | | 1,113,500 | 9,362,022 |

| TOTAL HONG KONG | | | 43,276,212 |

| ISRAEL - 0.7% | | | |

| Financials - 0.1% | | | |

| Banks - 0.1% | | | |

| Bank Leumi Le-Israel BM | | 102,406 | 1,221,098 |

| Information Technology - 0.6% | | | |

| IT Services - 0.6% | | | |

| Wix.com Ltd (b) | | 47,808 | 10,257,206 |

| TOTAL ISRAEL | | | 11,478,304 |

| ITALY - 2.2% | | | |

| Consumer Discretionary - 0.1% | | | |

| Textiles, Apparel & Luxury Goods - 0.1% | | | |

| Moncler SpA | | 23,014 | 1,215,315 |

| Consumer Staples - 0.6% | | | |

| Beverages - 0.6% | | | |

| Coca-Cola HBC AG | | 281,640 | 9,632,625 |

| Financials - 1.5% | | | |

| Banks - 1.5% | | | |

| Intesa Sanpaolo SpA | | 3,099,161 | 12,401,257 |

| UniCredit SpA | | 328,203 | 13,097,309 |

| | | | 25,498,566 |

| Insurance - 0.0% | | | |

| Generali | | 39,124 | 1,105,160 |

TOTAL FINANCIALS | | | 26,603,726 |

| | | | |

| Health Care - 0.0% | | | |

| Health Care Equipment & Supplies - 0.0% | | | |

| DiaSorin SpA | | 4,401 | 453,872 |

| Industrials - 0.0% | | | |

| Electrical Equipment - 0.0% | | | |

| Prysmian SpA | | 17 | 1,086 |

| Utilities - 0.0% | | | |

| Electric Utilities - 0.0% | | | |

| Enel SpA | | 2 | 14 |

| TOTAL ITALY | | | 37,906,638 |

| JAPAN - 23.9% | | | |

| Communication Services - 1.3% | | | |

| Entertainment - 0.1% | | | |

| Konami Group Corp | | 26,200 | 2,464,394 |

| Interactive Media & Services - 0.6% | | | |

| LY Corp | | 3,709,922 | 9,888,724 |

| Wireless Telecommunication Services - 0.6% | | | |

| SoftBank Corp | | 6,628,040 | 8,378,513 |

| SoftBank Group Corp | | 26,300 | 1,535,260 |

| | | | 9,913,773 |

TOTAL COMMUNICATION SERVICES | | | 22,266,891 |

| | | | |

| Consumer Discretionary - 4.6% | | | |

| Automobiles - 1.4% | | | |

| Honda Motor Co Ltd ADR | | 10 | 286 |

| Mazda Motor Corp | | 674,600 | 4,645,391 |

| Subaru Corp | | 266,658 | 4,780,846 |

| Suzuki Motor Corp | | 274,300 | 3,120,512 |

| Toyota Motor Corp | | 560,361 | 11,204,015 |

| | | | 23,751,050 |

| Broadline Retail - 0.0% | | | |

| Rakuten Group Inc (b) | | 159,400 | 870,118 |

| Household Durables - 2.0% | | | |

| Panasonic Holdings Corp | | 1,092,900 | 11,412,086 |

| Sony Group Corp | | 1,078,680 | 23,096,209 |

| | | | 34,508,295 |

| Specialty Retail - 0.9% | | | |

| Fast Retailing Co Ltd | | 43,942 | 15,030,401 |

| Textiles, Apparel & Luxury Goods - 0.3% | | | |

| Asics Corp | | 307,900 | 6,085,792 |

TOTAL CONSUMER DISCRETIONARY | | | 80,245,656 |

| | | | |

| Consumer Staples - 0.1% | | | |

| Consumer Staples Distribution & Retail - 0.1% | | | |

| Seven & i Holdings Co Ltd | | 101,200 | 1,599,570 |

| Financials - 3.4% | | | |

| Banks - 1.4% | | | |

| Japan Post Bank Co Ltd | | 278,000 | 2,640,510 |

| Mitsubishi UFJ Financial Group Inc | | 1,331,500 | 15,621,400 |

| Mitsubishi UFJ Financial Group Inc ADR | | 242 | 2,836 |

| Mizuho Financial Group Inc | | 134,300 | 3,305,754 |

| Sumitomo Mitsui Financial Group Inc | | 90,700 | 2,169,721 |

| | | | 23,740,221 |

| Capital Markets - 0.9% | | | |

| Daiwa Securities Group Inc | | 783,048 | 5,215,509 |

| Nomura Holdings Inc | | 1,906,000 | 11,281,311 |

| | | | 16,496,820 |

| Insurance - 1.1% | | | |

| Dai-ichi Life Holdings Inc | | 113,100 | 3,044,128 |

| Ms&Ad Insurance Group Holdings Inc | | 153,900 | 3,373,486 |

| Sompo Holdings Inc | | 162,400 | 4,251,331 |

| Tokio Marine Holdings Inc | | 234,100 | 8,522,195 |

| | | | 19,191,140 |

TOTAL FINANCIALS | | | 59,428,181 |

| | | | |

| Health Care - 2.2% | | | |

| Health Care Equipment & Supplies - 1.3% | | | |

| Hoya Corp | | 101,284 | 12,755,045 |

| Olympus Corp | | 169,300 | 2,550,609 |

| Terumo Corp | | 349,700 | 6,805,309 |

| | | | 22,110,963 |

| Pharmaceuticals - 0.9% | | | |

| Daiichi Sankyo Co Ltd | | 273,600 | 7,567,493 |

| Takeda Pharmaceutical Co Ltd | | 295,500 | 7,852,080 |

| | | | 15,419,573 |

TOTAL HEALTH CARE | | | 37,530,536 |

| | | | |

| Industrials - 6.7% | | | |

| Electrical Equipment - 0.9% | | | |

| Fujikura Ltd | | 88,000 | 3,662,169 |

| Mitsubishi Electric Corp | | 402,900 | 6,880,373 |

| NIDEC CORP | | 281,900 | 5,115,031 |

| | | | 15,657,573 |

| Ground Transportation - 0.5% | | | |

| Central Japan Railway Co | | 491,200 | 9,256,144 |

| Industrial Conglomerates - 0.9% | | | |

| Hitachi Ltd | | 657,700 | 16,456,607 |

| Machinery - 1.3% | | | |

| Daifuku Co Ltd | | 7,100 | 148,908 |

| FANUC Corp | | 284,600 | 7,551,590 |

| Komatsu Ltd | | 165,400 | 4,572,691 |

| Makita Corp | | 305,500 | 9,403,137 |

| | | | 21,676,326 |

| Marine Transportation - 0.4% | | | |

| Kawasaki Kisen Kaisha Ltd | | 540,600 | 7,745,926 |

| Professional Services - 1.1% | | | |

| Recruit Holdings Co Ltd | | 261,500 | 18,522,467 |

| Trading Companies & Distributors - 1.6% | | | |

| Mitsubishi Corp | | 48,100 | 796,037 |

| Mitsui & Co Ltd | | 682,700 | 14,366,009 |

| Toyota Tsusho Corp | | 571,000 | 10,262,722 |

| | | | 25,424,768 |

TOTAL INDUSTRIALS | | | 114,739,811 |

| | | | |

| Information Technology - 4.0% | | | |

| Electronic Equipment, Instruments & Components - 1.1% | | | |

| Murata Manufacturing Co Ltd | | 622,300 | 10,122,831 |

| TDK Corp | | 124,600 | 1,641,193 |

| Yokogawa Electric Corp | | 378,100 | 8,165,393 |

| | | | 19,929,417 |

| IT Services - 1.0% | | | |

| Fujitsu Ltd | | 595,200 | 10,589,866 |

| NEC Corp | | 71,200 | 6,208,421 |

| Obic Co Ltd | | 19,900 | 593,540 |

| | | | 17,391,827 |

| Semiconductors & Semiconductor Equipment - 1.9% | | | |

| Advantest Corp | | 232,800 | 13,608,913 |

| SCREEN Holdings Co Ltd | | 50,500 | 3,045,823 |

| Tokyo Electron Ltd | | 97,000 | 14,909,562 |

| | | | 31,564,298 |

TOTAL INFORMATION TECHNOLOGY | | | 68,885,542 |

| | | | |

| Materials - 1.0% | | | |

| Chemicals - 0.8% | | | |

| Asahi Kasei Corp | | 163,100 | 1,132,459 |

| Mitsubishi Chemical Group Corp | | 404,800 | 2,057,381 |

| Nitto Denko Corp | | 646,000 | 11,003,082 |

| | | | 14,192,922 |

| Metals & Mining - 0.2% | | | |

| Nippon Steel Corp | | 167,800 | 3,393,432 |

TOTAL MATERIALS | | | 17,586,354 |

| | | | |

| Real Estate - 0.3% | | | |

| Real Estate Management & Development - 0.3% | | | |

| Daito Trust Construction Co Ltd | | 46,600 | 5,205,091 |

| Utilities - 0.3% | | | |

| Electric Utilities - 0.1% | | | |

| Chubu Electric Power Co Inc | | 82,300 | 865,917 |

| Kansai Electric Power Co Inc/The | | 600 | 6,686 |

| | | | 872,603 |

| Gas Utilities - 0.2% | | | |

| Osaka Gas Co Ltd | | 101,900 | 2,240,770 |

| Tokyo Gas Co Ltd | | 71,300 | 1,980,241 |

| | | | 4,221,011 |

TOTAL UTILITIES | | | 5,093,614 |

| | | | |

| TOTAL JAPAN | | | 412,581,246 |

| NETHERLANDS - 4.1% | | | |

| Communication Services - 0.1% | | | |

| Diversified Telecommunication Services - 0.1% | | | |

| Koninklijke KPN NV | | 240,693 | 876,366 |

| Consumer Staples - 0.2% | | | |

| Consumer Staples Distribution & Retail - 0.2% | | | |

| Koninklijke Ahold Delhaize NV | | 128,336 | 4,186,181 |

| Financials - 0.8% | | | |

| Banks - 0.5% | | | |

| ABN AMRO Bank NV depository receipt (d)(e) | | 512,741 | 7,908,418 |

| Capital Markets - 0.0% | | | |

| Euronext NV (d)(e) | | 7,153 | 802,442 |

| Financial Services - 0.0% | | | |

| EXOR NV | | 5,970 | 547,595 |

| Insurance - 0.3% | | | |

| NN Group NV | | 120,881 | 5,267,778 |

TOTAL FINANCIALS | | | 14,526,233 |

| | | | |

| Health Care - 0.3% | | | |

| Biotechnology - 0.0% | | | |

| Argenx SE (b) | | 770 | 478,563 |

| Health Care Equipment & Supplies - 0.3% | | | |

| Koninklijke Philips NV | | 201,545 | 5,093,997 |

TOTAL HEALTH CARE | | | 5,572,560 |

| | | | |

| Industrials - 0.7% | | | |

| Professional Services - 0.7% | | | |

| Wolters Kluwer NV | | 75,978 | 12,623,771 |

| Information Technology - 2.0% | | | |

| Semiconductors & Semiconductor Equipment - 2.0% | | | |

| ASM International NV | | 21,111 | 12,219,743 |

| ASML Holding NV | | 29,269 | 20,577,026 |

| | | | 32,796,769 |

| TOTAL NETHERLANDS | | | 70,581,880 |

| NEW ZEALAND - 0.1% | | | |

| Utilities - 0.1% | | | |

| Independent Power and Renewable Electricity Producers - 0.1% | | | |

| Meridian Energy Ltd | | 661,532 | 2,187,451 |

| NORWAY - 0.5% | | | |

| Energy - 0.1% | | | |

| Oil, Gas & Consumable Fuels - 0.1% | | | |

| Equinor ASA | | 69,480 | 1,619,901 |

| Financials - 0.3% | | | |

| Banks - 0.1% | | | |

| DNB Bank ASA | | 45,305 | 903,043 |

| Insurance - 0.2% | | | |

| Gjensidige Forsikring ASA | | 184,082 | 3,250,390 |

TOTAL FINANCIALS | | | 4,153,433 |

| | | | |

| Industrials - 0.1% | | | |

| Aerospace & Defense - 0.1% | | | |

| Kongsberg Gruppen ASA | | 19,473 | 2,189,631 |

| TOTAL NORWAY | | | 7,962,965 |

| PORTUGAL - 0.0% | | | |

| Utilities - 0.0% | | | |

| Electric Utilities - 0.0% | | | |

| EDP SA | | 7 | 22 |

| SINGAPORE - 2.8% | | | |

| Communication Services - 0.7% | | | |

| Entertainment - 0.7% | | | |

| Sea Ltd Class A ADR (b) | | 121,522 | 12,893,484 |

| Financials - 1.5% | | | |

| Banks - 1.4% | | | |

| DBS Group Holdings Ltd | | 124,000 | 3,969,743 |

| Oversea-Chinese Banking Corp Ltd | | 747,200 | 9,131,745 |

| United Overseas Bank Ltd | | 396,855 | 10,557,422 |

| | | | 23,658,910 |

| Capital Markets - 0.1% | | | |

| Singapore Exchange Ltd | | 114,300 | 1,066,292 |

TOTAL FINANCIALS | | | 24,725,202 |

| | | | |

| Industrials - 0.4% | | | |

| Aerospace & Defense - 0.4% | | | |

| ST Engineering Financial I Ltd | | 1,964,300 | 6,702,770 |

| Real Estate - 0.2% | | | |

| Industrial REITs - 0.2% | | | |

| CapitaLand Ascendas REIT | | 1,910,200 | 3,594,782 |

| TOTAL SINGAPORE | | | 47,916,238 |

| SOUTH AFRICA - 0.0% | | | |

| Materials - 0.0% | | | |

| Metals & Mining - 0.0% | | | |

| Anglo American PLC | | 22,588 | 668,490 |

| SPAIN - 4.1% | | | |

| Consumer Discretionary - 0.8% | | | |

| Specialty Retail - 0.8% | | | |

| Industria de Diseno Textil SA | | 277,795 | 14,284,106 |

| Financials - 1.2% | | | |

| Banks - 1.2% | | | |

| Banco Bilbao Vizcaya Argentaria SA | | 1,045,227 | 10,233,665 |

| Banco Bilbao Vizcaya Argentaria SA ADR | | 242,597 | 2,358,043 |

| Banco Santander SA | | 1,945,836 | 8,998,620 |

| | | | 21,590,328 |

| Industrials - 0.5% | | | |

| Transportation Infrastructure - 0.5% | | | |

| Aena SME SA (d)(e) | | 42,118 | 8,612,153 |

| Utilities - 1.6% | | | |

| Electric Utilities - 1.6% | | | |

| Endesa SA | | 430,009 | 9,251,474 |

| Iberdrola SA | | 1,260,663 | 17,367,909 |

| | | | 26,619,383 |

| TOTAL SPAIN | | | 71,105,970 |

| SWEDEN - 2.8% | | | |

| Consumer Discretionary - 0.3% | | | |

| Automobiles - 0.3% | | | |

| Volvo Car AB (b)(c) | | 2,301,152 | 4,987,561 |

| Hotels, Restaurants & Leisure - 0.0% | | | |

| Evolution AB (d)(e) | | 5,747 | 442,978 |

TOTAL CONSUMER DISCRETIONARY | | | 5,430,539 |

| | | | |

| Consumer Staples - 0.2% | | | |

| Household Products - 0.2% | | | |

| Essity AB B Shares | | 127,012 | 3,394,609 |

| Financials - 0.3% | | | |

| Banks - 0.1% | | | |

| Svenska Handelsbanken AB A Shares | | 194,338 | 2,005,938 |

| Financial Services - 0.2% | | | |

| Industrivarden AB A Shares | | 76,398 | 2,412,674 |

| Industrivarden AB C Shares | | 19 | 600 |

| Investor AB B Shares | | 40 | 1,058 |

| | | | 2,414,332 |

TOTAL FINANCIALS | | | 4,420,270 |

| | | | |

| Health Care - 0.2% | | | |

| Biotechnology - 0.2% | | | |

| Swedish Orphan Biovitrum AB B Shares (b) | | 110,506 | 3,170,199 |

| Health Care Equipment & Supplies - 0.0% | | | |

| Getinge AB B Shares | | 30 | 492 |

TOTAL HEALTH CARE | | | 3,170,691 |

| | | | |

| Industrials - 1.0% | | | |

| Machinery - 1.0% | | | |

| Alfa Laval AB | | 39,271 | 1,641,993 |

| SKF AB B Shares | | 183,389 | 3,441,077 |

| Volvo AB B Shares | | 533,995 | 12,963,937 |

| | | | 18,047,007 |

| Information Technology - 0.8% | | | |

| Communications Equipment - 0.6% | | | |

| Telefonaktiebolaget LM Ericsson B Shares | | 889,518 | 7,226,226 |

| Telefonaktiebolaget LM Ericsson Class B ADR | | 458,733 | 3,697,388 |

| | | | 10,923,614 |

| Electronic Equipment, Instruments & Components - 0.2% | | | |

| Hexagon AB B Shares | | 373,832 | 3,568,076 |

TOTAL INFORMATION TECHNOLOGY | | | 14,491,690 |

| | | | |

| TOTAL SWEDEN | | | 48,954,806 |

| SWITZERLAND - 4.2% | | | |

| Financials - 2.0% | | | |

| Capital Markets - 0.9% | | | |

| UBS Group AG | | 533,235 | 16,292,884 |

| Insurance - 1.1% | | | |

| Zurich Insurance Group AG | | 30,660 | 18,202,422 |

TOTAL FINANCIALS | | | 34,495,306 |

| | | | |

| Industrials - 1.5% | | | |

| Electrical Equipment - 0.8% | | | |

| ABB Ltd | | 247,688 | 13,392,156 |

| Marine Transportation - 0.1% | | | |

| Kuehne + Nagel International AG | | 7,290 | 1,669,177 |

| Professional Services - 0.6% | | | |

| SGS SA | | 103,071 | 10,321,296 |

TOTAL INDUSTRIALS | | | 25,382,629 |

| | | | |

| Information Technology - 0.0% | | | |

| Technology Hardware, Storage & Peripherals - 0.0% | | | |

| Logitech International SA | | 25 | 2,066 |

| Materials - 0.7% | | | |

| Chemicals - 0.7% | | | |

| Givaudan SA | | 2,905 | 12,694,871 |

| Utilities - 0.0% | | | |

| Electric Utilities - 0.0% | | | |

| BKW AG | | 5,201 | 860,768 |

| TOTAL SWITZERLAND | | | 73,435,640 |

| UNITED KINGDOM - 11.2% | | | |

| Communication Services - 0.6% | | | |

| Wireless Telecommunication Services - 0.6% | | | |

| Vodafone Group PLC | | 6,673,421 | 5,706,093 |

| Vodafone Group PLC ADR (c) | | 581,848 | 4,939,890 |

| | | | 10,645,983 |

| Consumer Discretionary - 0.1% | | | |

| Broadline Retail - 0.1% | | | |

| Next PLC | | 11,058 | 1,314,857 |

| Specialty Retail - 0.0% | | | |

| Kingfisher PLC | | 317,297 | 987,896 |

TOTAL CONSUMER DISCRETIONARY | | | 2,302,753 |

| | | | |

| Consumer Staples - 3.9% | | | |

| Consumer Staples Distribution & Retail - 0.7% | | | |

| Tesco PLC | | 2,632,643 | 12,138,453 |

| Food Products - 0.3% | | | |

| Associated British Foods PLC | | 181,248 | 4,635,656 |

| Household Products - 0.4% | | | |

| Reckitt Benckiser Group PLC | | 118,737 | 7,184,102 |

| Personal Care Products - 1.3% | | | |

| Unilever PLC | | 153,022 | 8,712,523 |

| Unilever PLC ADR | | 223,345 | 12,663,662 |

| | | | 21,376,185 |

| Tobacco - 1.2% | | | |

| British American Tobacco PLC | | 103,660 | 3,737,432 |

| British American Tobacco PLC ADR (c) | | 359,153 | 13,044,438 |

| Imperial Brands PLC | | 123,706 | 3,953,768 |

| | | | 20,735,638 |

TOTAL CONSUMER STAPLES | | | 66,070,034 |

| | | | |

| Financials - 3.4% | | | |

| Banks - 2.6% | | | |

| Barclays PLC ADR | | 154,938 | 2,059,126 |

| HSBC Holdings PLC | | 1,999,743 | 19,659,815 |

| HSBC Holdings PLC ADR (c) | | 168,867 | 8,352,162 |

| Lloyds Banking Group PLC | | 2,823,970 | 1,936,652 |

| NatWest Group PLC | | 930,546 | 4,684,266 |

| NatWest Group PLC ADR | | 186,956 | 1,901,343 |

| Standard Chartered PLC | | 467,417 | 5,784,885 |

| | | | 44,378,249 |

| Capital Markets - 0.6% | | | |

| 3i Group PLC | | 150,504 | 6,715,145 |

| London Stock Exchange Group PLC | | 20,836 | 2,943,645 |

| | | | 9,658,790 |

| Financial Services - 0.0% | | | |

| M&G PLC | | 557,930 | 1,381,928 |

| Insurance - 0.2% | | | |

| Admiral Group PLC | | 16,059 | 531,557 |

| Aviva PLC | | 566,567 | 3,325,129 |

| | | | 3,856,686 |

TOTAL FINANCIALS | | | 59,275,653 |

| | | | |

| Health Care - 0.8% | | | |

| Pharmaceuticals - 0.8% | | | |

| Astrazeneca PLC | | 93,776 | 12,289,241 |

| Astrazeneca PLC ADR | | 20,834 | 1,365,044 |

| | | | 13,654,285 |

| Industrials - 1.9% | | | |

| Aerospace & Defense - 1.2% | | | |

| BAE Systems PLC | | 824,663 | 11,857,064 |

| Rolls-Royce Holdings PLC (b) | | 1,105,367 | 7,868,337 |

| | | | 19,725,401 |

| Professional Services - 0.2% | | | |

| RELX PLC ADR | | 90,476 | 4,109,420 |

| Trading Companies & Distributors - 0.5% | | | |

| Bunzl PLC | | 227,760 | 9,397,975 |

TOTAL INDUSTRIALS | | | 33,232,796 |

| | | | |

| Information Technology - 0.4% | | | |

| Electronic Equipment, Instruments & Components - 0.1% | | | |

| Halma PLC | | 47,934 | 1,613,631 |

| Software - 0.3% | | | |

| Sage Group PLC/The | | 300,311 | 4,785,962 |

TOTAL INFORMATION TECHNOLOGY | | | 6,399,593 |

| | | | |

| Real Estate - 0.1% | | | |