UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File No. 811-09054

---------------------------------------------------------------------

CREDIT SUISSE OPPORTUNITY FUNDS

- ---------------------------------------------------------------------

(Exact Name of Registrant as Specified in Charter)

Eleven Madison Avenue, New York, New York 10010

- ---------------------------------------------------------------------

(Address of Principal Executive Offices) (Zip Code)

J. Kevin Gao, Esq.

Credit Suisse Opportunity Funds

Eleven Madison Avenue

New York, New York 10010

Registrant’s telephone number, including area code: (212) 325-2000

Date of fiscal year end: October 31st

Date of reporting period: November 1, 2006 to October 31, 2007

Item 1. Reports to Stockholders.

CREDIT SUISSE FUNDS

Annual Report

October 31, 2007

n CREDIT SUISSE

HIGH INCOME FUND

The Fund's investment objectives, risks, charges and expenses (which should be considered carefully before investing), and more complete information about the Fund, are provided in the Prospectus, which should be read carefully before investing. You may obtain additional copies by calling 800-927-2874 or by writing to Credit Suisse Funds, P.O. Box 55030, Boston, MA 02205-5030.

Credit Suisse Asset Management Securities, Inc., Distributor, is located at Eleven Madison Avenue, New York, NY 10010. Credit Suisse Funds are advised by Credit Suisse Asset Management, LLC.

Investors in the Credit Suisse Funds should be aware that they may be eligible to purchase Common Class and/or Advisor Class shares (where offered) directly or through certain intermediaries. Such shares are not subject to a sales charge but may be subject to an ongoing service and distribution fee of up to 0.50% of average daily net assets. Investors in the Credit Suisse Funds should also be aware that they may be eligible for a reduction or waiver of the sales charge with respect to Class A, B or C shares (where offered). For more information, please review the relevant prospectuses or consult your financial representative.

The views of the Fund's management are as of the date of the letter and the Fund holdings described in this document are as of October 31, 2007; these views and Fund holdings may have changed subsequent to these dates. Nothing in this document is a recommendation to purchase or sell securities.

Fund shares are not deposits or other obligations of Credit Suisse Asset Management, LLC ("Credit Suisse") or any affiliate, are not FDIC-insured and are not guaranteed by Credit Suisse or any affiliate. Fund investments are subject to investment risks, including loss of your investment.

Credit Suisse High Income Fund

Annual Investment Adviser's Report

October 31, 2007 (unaudited)

November 30, 2007

Dear Shareholder:

Performance Summary

11/01/06 – 10/31/07

| Fund & Benchmarks | | Performance | |

| Common1 | | | 7.02 | % | |

| Class A1,2 | | | 6.74 | % | |

| Class B1,2 | | | 6.01 | % | |

| Class C1,2 | | | 6.02 | % | |

| Merrill Lynch US High-Yield Master II Constrained Index3 | | | 6.96 | % | |

Performance for the Fund's Class A, Class B and Class C shares is without the maximum sales charge of 4.75%, 4.00% and 1.00%, respectively.2

Market Review: Market rallies in response to Federal Reserve rate cuts

Although the high yield market posted positive returns for the twelve months ended October 31, 2007, the period was one of contrasts. Initially, a solid economic backdrop, strong credit fundamentals, and growing demand for yield all contributed to the market's strength. However, concerns over sub-prime mortgages, tougher credit conditions, and shelved leveraged buyout deals weighed heavily on the market during the summer months — resulting in a significant sell off. Finally, in response to the Federal Reserve's reduction in interest rates, the market rallied considerably and liquidity improved, along with the pace of the new issue volume. More recently, momentum has slowed amidst liquidity headlines and their potential to cause additional market volatility.

All told, the Merrill Lynch US High Yield Master II Constrained benchmark posted returns of 6.96% for the annual period ended October 31, 2007. Lower rated securities outperformed the broader market with returns of 8.08%, while the more interest rate sensitive BB-rated securities underperformed, returning about 6.18%. The average yield spread between high yield bonds and Treasury securities widened 102 basis points to +440, after reaching historical lows (+252) in June.

Apart from the homebuilding sector, credit fundamentals have remained sound against this more volatile backdrop. Defaults, as reported by Moody's Investor Services (at 1.13% for October), continue to hover near ten-year lows.

Technical concerns relating to an overhang in new issue supply continue to weigh on the market although the pace of new issuance has picked up in the last two months. Issuers have selectively participated in the new issue market with a total of $25 billion priced during September and October.

1

Credit Suisse High Income Fund

Annual Investment Adviser's Report (continued)

October 31, 2007 (unaudited)

Strategic Review and Market Outlook: In general, credit fundamentals appear intact

Both an overweight to lower rated securities and an underweight to BB-rated securities contributed to performance. Further, superior sector and/or security selection in diversified capital goods, media-cable, and integrated telecommunications also contributed to performance. Security selection in retailers and electric-generation hurt returns relative to the benchmark.

Over the period, the Fund had emphasized the B-rated and CCC-rated issuers. However, while corporate balance sheets are strong, we expect growth to be slower in the year ahead. The distress ratio, which had been supportive of low defaults, now points to a modest increase in default rates for 2008. As a result, we have used periods of volatility to add to positions in the names we like — particularly in the higher rated issuers. At the sector level, we remain constructive on corporate spending and the commercial cycle broadly. In contrast, we are cautious with respect to consumer driven industries and have sought to limit exposures to them given high energy prices and weak housing data.

In our opinion, the risk of sub-prime contagion to other sectors of the economy still remains. Credit fundamentals, outside of the housing sector, appear intact but third quarter earnings have been volatile. Furthermore, while new issuance has been well received and we expect the new issue calendar to be well-managed, the continuing supply overhang may cap returns in the near-term. In the coming months we expect continued volatility and will look to selectively add higher quality issuers in the secondary market and take advantage of new issue opportunities.

The Credit Suisse High Yield Management Team

Martha Metcalf

Wing Chan

High yield bonds are lower-quality bonds that are also known as "junk bonds." Such bonds entail greater risks than those found in higher-rated securities.

In addition to historical information, this report contains forward-looking statements that may concern, among other things, domestic and foreign market, industry and economic trends and developments and government regulation and their potential impact on the Fund's investments. These statements are subject to risks and uncertainties and actual trends, developments and regulations in the future, and their impact on the Fund could be materially different from those projected, anticipated or implied. The Fund has no obligation to update or revise forward-looking statements.

2

Credit Suisse High Income Fund

Annual Investment Adviser's Report (continued)

October 31, 2007 (unaudited)

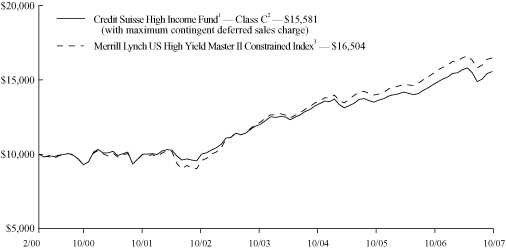

Comparison of Change in Value of $10,000 Investment in the

Credit Suisse High Income Fund1 Common Class shares and the

Merrill Lynch US High Yield Master II Constrained

Index3 from Inception (08/01/00).

Comparison of Change in Value of $10,000 Investment in the

Credit Suisse High Income Fund1 Class A shares2 and Class B

shares2 and the Merrill Lynch US High Yield Master II Constrained

Index3 from Inception (03/08/99).

3

Credit Suisse High Income Fund

Annual Investment Adviser's Report (continued)

October 31, 2007 (unaudited)

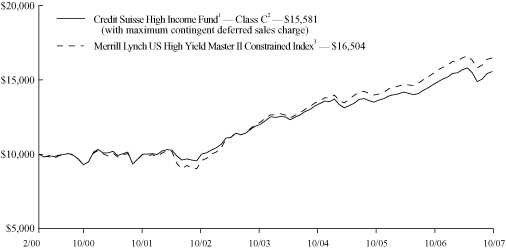

Comparison of Change in Value of $10,000 Investment in the

Credit Suisse High Income Fund1 Class C shares2 and the

Merrill Lynch US High Yield Master II Constrained

Index3 from Inception (02/28/00).

Average Annual Returns as of September 30, 20071

| | | 1 Year | | 5 Years | | Since

Inception | |

| Common Class | | | 7.68 | % | | | 11.01 | % | | | 7.22 | % | |

| Class A Without Sales Charge | | | 7.53 | % | | | 10.80 | % | | | 6.55 | % | |

| Class A With Maximum Sales Charge | | | 2.39 | % | | | 9.74 | % | | | 5.94 | % | |

| Class B Without CDSC | | | 6.66 | % | | | 9.97 | % | | | 5.70 | % | |

| Class B With CDSC | | | 2.71 | % | | | 9.97 | % | | | 5.70 | % | |

| Class C Without CDSC | | | 6.66 | % | | | 9.96 | % | | | 5.90 | % | |

| Class C With CDSC | | | 5.67 | % | | | 9.96 | % | | | 5.90 | % | |

4

Credit Suisse High Income Fund

Annual Investment Adviser's Report (continued)

October 31, 2007 (unaudited)

Average Annual Returns as of October 31, 20071

| | | 1 Year | | 5 Years | | Since

Inception | |

| Common Class | | | 7.02 | % | | | 11.31 | % | | | 7.28 | % | |

| Class A Without Sales Charge | | | 6.74 | % | | | 11.07 | % | | | 6.58 | % | |

| Class A With Maximum Sales Charge | | | 1.68 | % | | | 9.99 | % | | | 5.98 | % | |

| Class B Without CDSC | | | 6.01 | % | | | 10.26 | % | | | 5.75 | % | |

| Class B With CDSC | | | 2.09 | % | | | 10.26 | % | | | 5.75 | % | |

| Class C Without CDSC | | | 6.02 | % | | | 10.26 | % | | | 5.95 | % | |

| Class C With CDSC | | | 5.04 | % | | | 10.26 | % | | | 5.95 | % | |

Returns represent past performance and include change in share price and reinvestment of dividends and capital gains. Past performance cannot guarantee future results. The current performance of the Fund may be lower or higher than the figures shown. Returns and share price will fluctuate, and redemption value may be more or less than original cost. The performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance information current to the most recent month-end is available at www.credit-suisse.com/us.

1 Fee waivers and/or expense reimbursements may reduce expenses for the Fund, without which performance would be lower. Waivers and/or reimbursements may be discontinued at any time.

2 Total return for the Fund's Class A shares for the reporting period, based on offering price (including maximum sales charge of 4.75%), was 1.68%. Total return for the Fund's Class B shares for the reporting period, based on redemption value (including maximum contingent deferred sales charge of 4%), was 2.09%. Total return for the Fund's Class C shares for the reporting period, based on redemption value (including maximum contingent deferred sales charge of 1%), was 5.04%.

3 The Merrill Lynch US High Yield Master II Constrained Index is an unmanaged index that tracks the performance of below investment-grade U.S. dollar-denominated corporate bonds issued in the U.S. domestic market, where each issuer's allocation is limited to 2% of the index. Investors cannot invest directly in an index.

5

Credit Suisse High Income Fund

Annual Investment Adviser's Report (continued)

October 31, 2007 (unaudited)

Information About Your Fund's Expenses

As an investor of the Fund, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees, distribution and service (12b-1) fees and other Fund expenses. Examples of transaction costs include sales charges (loads), redemption fees and account maintenance fees, which are not shown in this section and which would result in higher total expenses. The following table is intended to help you understand your ongoing expenses of investing in the Fund and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. The table is based on an investment of $1,000 made at the beginning of the six month period ended October 31, 2007.

The table illustrates your Fund's expenses in two ways:

• Actual Fund Return. This helps you estimate the actual dollar amount of ongoing expenses paid on a $1,000 investment in the Fund using the Fund's actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the "Expenses Paid per $1,000" line under the share class you hold.

• Hypothetical 5% Fund Return. This helps you to compare your Fund's ongoing expenses with those of other mutual funds using the Fund's actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs, such as sales charges (loads) or redemption fees. If these transaction costs had been included, your costs would have been higher. The "Expenses Paid per $1,000" line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expenses of owning different funds.

6

Credit Suisse High Income Fund

Annual Investment Adviser's Report (continued)

October 31, 2007 (unaudited)

Expenses and Value of a $1,000 Investment

for the six month period ended October 31, 2007

| Actual Fund Return | | Common

Class | | Class A | | Class B | | Class C | |

| Beginning Account Value 5/1/07 | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | |

| Ending Account Value 10/31/07 | | $ | 996.90 | | | $ | 994.50 | | | $ | 992.00 | | | $ | 992.00 | | |

| Expenses Paid per $1,000* | | $ | 4.28 | | | $ | 5.53 | | | $ | 9.29 | | | $ | 9.29 | | |

| Hypothetical 5% Fund Return | |

| Beginning Account Value 5/1/07 | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | |

| Ending Account Value 10/31/07 | | $ | 1,020.92 | | | $ | 1,019.66 | | | $ | 1,015.88 | | | $ | 1,015.88 | | |

| Expenses Paid per $1,000* | | $ | 4.33 | | | $ | 5.60 | | | $ | 9.40 | | | $ | 9.40 | | |

| | | Common

Class | | Class A | | Class B | | Class C | |

| Annualized Expense Ratios* | | | 0.85 | % | | | 1.10 | % | | | 1.85 | % | | | 1.85 | % | |

* Expenses are equal to the Fund's annualized expense ratio for each share class, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year period, then divided by 365.

The "Expenses Paid per $1,000" and the "Annualized Expense Ratios" in the tables are based on actual expenses paid by the Fund during the period, net of fee waivers and/or expense reimbursements. If those fee waivers and/or expense reimbursements had not been in effect, the Fund's actual expenses would have been higher.

For more information, please refer to the Fund's prospectus.

7

Credit Suisse High Income Fund

Annual Investment Adviser's Report (continued)

October 31, 2007 (unaudited)

Credit Quality Breakdown*

Ratings

S&P | |

| BBB | | | 1.4 | % | |

| BB | | | 21.4 | % | |

| B | | | 48.9 | % | |

| CCC | | | 25.7 | % | |

| CC | | | 0.8 | % | |

| NR | | | 1.8 | % | |

| Total | | | 100.0 | % | |

* Expressed as a percentage of total investments (excluding security lending collateral) and may vary over time.

8

Credit Suisse High Income Fund

Schedule of Investments

October 31, 2007

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS (87.0%) | | | |

| Aerospace & Defense (1.7%) | | | |

| $ | 100 | | | DRS Technologies, Inc., Company Guaranteed

Notes (Callable 02/01/11 @ $103.81) | | (B, B3) | | 02/01/18 | | | 7.625 | | | $ | 102,750 | | |

| | 100 | | | DRS Technologies, Inc., Global Senior

Subordinated Notes (Callable 11/01/08 @

$103.44) | | (B, B3) | | 11/01/13 | | | 6.875 | | | | 100,500 | | |

| | 300 | | | Hawker Beechcraft Acquisition Co., Rule 144A,

Senior Notes (Callable 04/01/11 @ $104.25)‡ | | (B-, B3) | | 04/01/15 | | | 8.500 | | | | 306,000 | | |

| | 275 | | | Hawker Beechcraft Acquisition Co., Rule 144A,

Senior Subordinated Notes (Callable 04/01/12 @

$104.88)ठ| | (B-, Caa1) | | 04/01/17 | | | 9.750 | | | | 280,500 | | |

| | 350 | | | L-3 Communications Corp., Global Senior

Subordinated Notes (Callable 01/15/10 @

$102.94) | | (BB+, Ba3) | | 01/15/15 | | | 5.875 | | | | 343,000 | | |

| | 250 | | | TransDigm, Inc., Global Company Guaranteed

Notes (Callable 07/15/09 @ $105.81) | | (B-, B3) | | 07/15/14 | | | 7.750 | | | | 255,625 | | |

| | | | 1,388,375 | | |

| Agriculture (0.3%) | | | |

| | 250 | | | Southern States Cooperative, Inc., Rule 144A,

Senior Notes (Callable 11/01/08 @ $104.00)‡ | | (B, Caa1) | | 11/01/10 | | | 10.500 | | | | 263,750 | | |

| Auto Loans (4.4%) | | | |

| | 275 | | | Ford Motor Credit Co. LLC, Global Notes | | (B, B1) | | 06/15/10 | | | 7.875 | | | | 265,262 | | |

| | 675 | | | Ford Motor Credit Co. LLC, Senior Unsecured

Notes§ | | (B, B1) | | 12/15/16 | | | 8.000 | | | | 625,887 | | |

| | 800 | | | Ford Motor Credit Co., Global Notes§ | | (B, B1) | | 10/01/13 | | | 7.000 | | | | 718,935 | | |

| | 225 | | | Ford Motor Credit Co., Notes | | (B, B1) | | 06/16/08 | | | 6.625 | | | | 224,028 | | |

| | 675 | | | General Motors Acceptance Corp., Global Notes | | (BB+, Ba1) | | 12/01/14 | | | 6.750 | | | | 598,922 | | |

| | 1,250 | | | GMAC LLC, Senior Unsubordinated Notes | | (BB+, Ba1) | | 12/15/11 | | | 6.000 | | | | 1,110,045 | | |

| | 150 | | | Navios Maritime Holdings, Inc., Global Company

Guaranteed Notes (Callable 12/15/10 @ $104.75) | | (B, B3) | | 12/15/14 | | | 9.500 | | | | 159,563 | | |

| | | | 3,702,642 | | |

| Auto Parts & Equipment (1.6%) | | | |

| | 350 | | | Altra Industrial Motion, Inc., Global Secured

Notes (Callable 12/01/08 @ $104.50)# | | (CCC+, B2) | | 12/01/11 | | | 9.000 | | | | 353,500 | | |

| | 100 | | | American Axle & Manufacturing, Inc., Company

Guaranteed Notes (Callable 03/01/12 @ $103.94) | | (BB, Ba3) | | 03/01/17 | | | 7.875 | | | | 98,000 | | |

| | 600 | | | Goodyear Tire & Rubber Co., Global Senior

Notes (Callable 07/01/10 @ $104.50)§ | | (B, Ba3) | | 07/01/15 | | | 9.000 | | | | 659,250 | | |

| | 225 | | | Visteon Corp., Global Senior Notes§ | | (CCC+, Caa2) | | 08/01/10 | | | 8.250 | | | | 210,375 | | |

| | | | 1,321,125 | | |

| Automotive (2.3%) | | | |

| | 495 | | | Ford Motor Co., Global Notes | | (CCC+, Caa1) | | 07/16/31 | | | 7.450 | | | | 393,525 | | |

| | 875 | | | General Motors Corp., Global Debentures§ | | (B-, Caa1) | | 07/15/33 | | | 8.375 | | | | 800,625 | | |

| | 750 | | | General Motors Corp., Global Senior Notes§ | | (B-, Caa1) | | 07/15/13 | | | 7.125 | | | | 697,500 | | |

| | | | 1,891,650 | | |

See Accompanying Notes to Financial Statements.

9

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2007

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Beverages (0.3%) | | | |

| $ | 275 | | | Constellation Brands, Inc., Company Guaranteed

Notes | | (BB-, Ba3) | | 09/01/16 | | | 7.250 | | | $ | 278,438 | | |

| Brokerage (0.3%) | | | |

| | 300 | | | E*TRADE Financial Corp., Senior Unsecured

Notes (Callable 12/01/10 @ $103.94)§ | | (BB-, Ba2) | | 12/01/15 | | | 7.875 | | | | 286,500 | | |

| Building & Construction (1.6%) | | | |

| | 325 | | | Ashton Woods USA/Finance, Global Company

Guaranteed Notes (Callable 10/01/10 @

$104.75) | | (B-, Caa1) | | 10/01/15 | | | 9.500 | | | | 243,750 | | |

| | 275 | | | Beazer Homes USA, Inc., Global Company

Guaranteed Notes (Callable 04/15/08 @ $102.79)§ | | (B+, B1) | | 04/15/12 | | | 8.375 | | | | 226,188 | | |

| | 350 | | | K Hovnanian Enterprises, Inc., Global Company

Guaranteed Notes§ | | (BB-, Ba3) | | 01/15/16 | | | 6.250 | | | | 271,250 | | |

| | 250 | | | KB Home, Senior Notes§ | | (BB+, Ba1) | | 06/15/15 | | | 6.250 | | | | 226,250 | | |

| | 125 | | | Technical Olympic USA, Inc., Rule 144A,

Senior Notes‡#§ | | (CC, Caa3) | | 04/01/11 | | | 9.250 | | | | 69,375 | | |

| | 125 | | | WCI Communities, Inc., Global Company

Guaranteed Notes (Callable 03/15/10 @

$103.31) | | (CCC-, Caa3) | | 03/15/15 | | | 6.625 | | | | 84,375 | | |

| | 275 | | | William Lyon Homes, Inc., Global Senior Notes

(Callable 02/15/09 @ $103.75) | | (B, Caa1) | | 02/15/14 | | | 7.500 | | | | 174,625 | | |

| | 50 | | | William Lyon Homes, Inc., Global Senior Notes

(Callable 12/15/08 @ $103.81) | | (B, Caa1) | | 12/15/12 | | | 7.625 | | | | 32,000 | | |

| | | | 1,327,813 | | |

| Building Materials (1.7%) | | | |

| | 100 | | | Building Materials Corp., Global Company

Guaranteed Notes (Callable 08/01/09 @ $103.88) | | (BB-, B2) | | 08/01/14 | | | 7.750 | | | | 86,500 | | |

| | 300 | | | Coleman Cable, Inc., Global Company Guaranteed

Notes (Callable 10/01/08 @ $104.94) | | (B, B2) | | 10/01/12 | | | 9.875 | | | | 297,000 | | |

| | 150 | | | Goodman Global Holding Company, Inc., Global

Senior Subordinated Notes (Callable 12/15/08 @

$103.94)§ | | (B-, B3) | | 12/15/12 | | | 7.875 | | | | 157,500 | | |

| | 275 | | | Norcraft Companies, Global Senior Subordinated

Notes (Callable 11/01/08 @ $102.25) | | (B-, B1) | | 11/01/11 | | | 9.000 | | | | 283,250 | | |

| | 325 | | | Nortek, Inc., Global Senior Subordinated Notes

(Callable 09/01/09 @ $104.25) | | (CCC+, B3) | | 09/01/14 | | | 8.500 | | | | 289,250 | | |

| | 375 | | | Ply Gem Industries, Inc., Global Senior

Subordinated Notes (Callable 02/15/08 @

$104.50)§ | | (CCC+, Caa1) | | 02/15/12 | | | 9.000 | | | | 307,500 | | |

| | | | 1,421,000 | | |

| Chemicals (3.9%) | | | |

| | 525 | | | Chemtura Corp., Company Guaranteed Notes | | (BB+, Ba2) | | 06/01/16 | | | 6.875 | | | | 504,000 | | |

| | 325 | | | KI Holdings, Inc., Global Senior Discount Notes

(Callable 11/15/09 @ $104.94)+ | | (B-, B3) | | 11/15/14 | | | 0.000 | | | | 280,313 | | |

| | 350 | | | Lyondell Chemical Co., Global Company

Guaranteed Notes (Callable 06/01/08 @ $105.25)§ | | (BB+, Ba2) | | 06/01/13 | | | 10.500 | | | | 378,875 | | |

See Accompanying Notes to Financial Statements.

10

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2007

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Chemicals | | | |

| $ | 675 | | | Lyondell Chemical Co., Global Company

Guaranteed Notes (Callable 09/15/10 @ $104.00) | | (B+, B1) | | 09/15/14 | | | 8.000 | | | $ | 750,937 | | |

| | 250 | | | Momentive Performance Materials, Inc.,

Rule 144A, Senior Subordinated Notes

(Callable 12/01/11 @ $105.75)ठ| | (CCC+, Caa2) | | 12/01/16 | | | 11.500 | | | | 242,500 | | |

| | 200 | | | Momentive Performance, Rule 144A, Company

Guaranteed Notes (Callable 12/01/10 @ $104.88)‡ | | (B-, B3) | | 12/01/14 | | | 9.750 | | | | 196,000 | | |

| | 200 | | | Mosaic Co., Rule 144A, Senior Notes

(Callable 12/01/11 @ $103.81)‡ | | (BB-, Ba1) | | 12/01/16 | | | 7.625 | | | | 216,500 | | |

| | 250 | | | Nalco Finance Holdings, Inc., Global Senior Notes

(Callable 02/01/09 @ $104.50)+§ | | (B-, B3) | | 02/01/14 | | | 0.000 | | | | 228,750 | | |

| | 150 | | | Reichhold Industries, Inc., Rule 144A,

Senior Notes (Callable 08/15/10 @ $104.50)‡ | | (BB-, B2) | | 08/15/14 | | | 9.000 | | | | 153,000 | | |

| | 300 | | | Terra Capital, Inc., Series B, Global Company

Guaranteed Notes (Callable 02/01/12 @ $103.50) | | (BB-, B1) | | 02/01/17 | | | 7.000 | | | | 301,500 | | |

| | | | 3,252,375 | | |

| Computer Hardware (0.3%) | | | |

| | 250 | | | Activant Solutions, Inc., Global Company

Guaranteed Notes (Callable 05/01/11 @ $104.75) | | (CCC+, Caa1) | | 05/01/16 | | | 9.500 | | | | 229,375 | | |

| Consumer Products (1.5%) | | | |

| | 500 | | | AAC Group Holding Corp., Global Senior Discount

Notes (Callable 10/01/08 @ $105.13)+§ | | (CCC+, B3) | | 10/01/12 | | | 0.000 | | | | 445,000 | | |

| | 325 | | | Amscan Holdings, Inc., Global Senior Subordinated

Notes (Callable 05/01/09 @ $104.38) | | (CCC+, Caa1) | | 05/01/14 | | | 8.750 | | | | 308,750 | | |

| | 275 | | | Del Laboratories, Inc., Global Company Guaranteed

Notes (Callable 02/01/08 @ $104.00) | | (CCC, Caa2) | | 02/01/12 | | | 8.000 | | | | 265,375 | | |

| | 75 | | | Jarden Corp., Company Guaranteed Notes

(Callable 05/01/12 @ $103.75) | | (B-, B3) | | 05/01/17 | | | 7.500 | | | | 71,625 | | |

| | 200 | | | Prestige Brands, Inc., Global Senior Subordinated

Notes (Callable 04/15/08 @ $104.63) | | (B-, B3) | | 04/15/12 | | | 9.250 | | | | 203,000 | | |

| | | | 1,293,750 | | |

| Consumer/Commercial/Lease Financing (0.4%) | | | |

| | 300 | | | Residential Capital LLC, Company Guaranteed

Notes | | (BB+, Ba3) | | 02/22/11 | | | 6.000 | | | | 219,148 | | |

| | 200 | | | Residential Capital LLC, Company Guaranteed

Notes | | (BB+, Ba3) | | 06/01/12 | | | 6.500 | | | | 146,129 | | |

| | | | 365,277 | | |

| Diversified Capital Goods (2.1%) | | | |

| | 150 | | | Actuant Corp., Rule 144A, Senior Notes

(Callable 06/15/12 @ $103.44)‡ | | (BB-, Ba2) | | 06/15/17 | | | 6.875 | | | | 150,750 | | |

| | 200 | | | Esco Corp., Rule 144A, Senior Notes

(Callable 12/15/10 @ $104.31)‡ | | (B, B2) | | 12/15/13 | | | 8.625 | | | | 204,500 | | |

| | 325 | | | RBS Global & Rexnord Corp., Global Company

Guaranteed Notes (Callable 08/01/10 @ $104.75) | | (CCC+, B3) | | 08/01/14 | | | 9.500 | | | | 337,187 | | |

See Accompanying Notes to Financial Statements.

11

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2007

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Diversified Capital Goods | | | |

| $ | 325 | | | Sensus Metering Systems, Global Senior

Subordinated Notes (Callable 12/15/08 @

$104.31) | | (B-, B3) | | 12/15/13 | | | 8.625 | | | $ | 320,531 | | |

| | 300 | | | Stanadyne Corp., Series 1, Global Senior

Subordinated Notes (Callable 08/15/09 @

$105.00) | | (CCC+, Caa1) | | 08/15/14 | | | 10.000 | | | | 306,000 | | |

| | 100 | | | Titan International, Inc., Global Company

Guaranteed Notes | | (B, B3) | | 01/15/12 | | | 8.000 | | | | 100,500 | | |

| | 309 | | | TriMas Corp., Global Company Guaranteed Notes

(Callable 06/15/08 @ $103.29) | | (B-, B3) | | 06/15/12 | | | 9.875 | | | | 319,043 | | |

| | | | 1,738,511 | | |

| Electric - Generation (4.4%) | | | |

| | 500 | | | AES Corp., Rule 144A, Senior Notes‡ | | (B, B1) | | 10/15/17 | | | 8.000 | | | | 506,875 | | |

| | 300 | | | Calpine Generating Company LLC, Global Secured

Notes (Callable 04/01/08 @ $103.50)#ø | | (D, NR) | | 04/01/10 | | | 11.070 | | | | 81,000 | | |

| | 575 | | | Dynegy Holdings, Inc., Global Senior Unsecured

Notes§ | | (B-, B2) | | 05/01/16 | | | 8.375 | | | | 579,312 | | |

| | 300 | | | Dynegy Holdings, Inc., Rule 144A, Senior Notes‡ | | (B-, B2) | | 06/01/15 | | | 7.500 | | | | 288,000 | | |

| | 475 | | | Edison Mission Energy, Rule 144A, Senior Notes‡ | | (BB-, B1) | | 05/15/17 | | | 7.000 | | | | 466,687 | | |

| | 438 | | | Midwest Generation LLC, Series B, Global Pass

Thru Certificates | | (BB+, Baa3) | | 01/02/16 | | | 8.560 | | | | 471,140 | | |

| | 325 | | | NRG Energy, Inc., Company Guaranteed Notes

(Callable 01/15/12 @ $103.69) | | (B, B1) | | 01/15/17 | | | 7.375 | | | | 324,188 | | |

| | 275 | | | NRG Energy, Inc., Company Guaranteed Notes

(Callable 02/01/10 @ $103.63) | | (B, B1) | | 02/01/14 | | | 7.250 | | | | 275,688 | | |

| | 200 | | | NRG Energy, Inc., Company Guaranteed Notes

(Callable 02/01/11 @ $103.69) | | (B, B1) | | 02/01/16 | | | 7.375 | | | | 200,000 | | |

| | 100 | | | Reliant Energy, Inc., Secured Notes

(Callable 12/15/09 @ $103.38) | | (B, B2) | | 12/15/14 | | | 6.750 | | | | 102,250 | | |

| | 400 | | | Reliant Energy, Inc., Senior Notes§ | | (B-, B3) | | 06/15/14 | | | 7.625 | | | | 405,500 | | |

| | | | 3,700,640 | | |

| Electric - Integrated (1.2%) | | | |

| | 125 | | | Mirant Americas Generation, LLC., Senior

Unsecured Notes | | (B-, Caa1) | | 05/01/11 | | | 8.300 | | | | 127,031 | | |

| | 100 | | | Mirant Americas Generation, LLC., Senior

Unsecured Notes | | (B-, Caa1) | | 10/01/21 | | | 8.500 | | | | 98,750 | | |

| | 150 | | | Sierra Pacific Resources, Global Senior Notes

(Callable 03/15/09 @ $104.31) | | (B, Ba3) | | 03/15/14 | | | 8.625 | | | | 159,346 | | |

| | 650 | | | Texas Competitive Electric Holdings Company LLC,

Rule 144A, Company Guaranteed Notes

(Callable 11/01/11 @ $105.13)‡ | | (CCC, B3) | | 11/01/15 | | | 10.250 | | | | 656,500 | | |

| | | | 1,041,627 | | |

See Accompanying Notes to Financial Statements.

12

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2007

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Electronics (1.9%) | | | |

| $ | 450 | | | Amkor Technology, Inc., Global Senior Notes

(Callable 05/15/08 @ $103.88)§ | | (B, B1) | | 05/15/13 | | | 7.750 | | | $ | 437,063 | | |

| | 625 | | | Freescale Semiconductor, Inc., Global Company

Guaranteed Notes (Callable 12/15/10 @ $104.44) | | (B, B1) | | 12/15/14 | | | 8.875 | | | | 594,531 | | |

| | 162 | | | GrafTech Finance, Inc., Global Company

Guaranteed Notes (Callable 02/15/08 @ $103.42) | | (B, B2) | | 02/15/12 | | | 10.250 | | | | 170,100 | | |

| | 300 | | | Spansion, Inc., Rule 144A, Senior Notes

(Callable 01/15/11 @ $105.62)ठ| | (B, Caa1) | | 01/15/16 | | | 11.250 | | | | 289,875 | | |

| | 75 | | | Viasystems, Inc., Global Senior Unsecured Notes

(Callable 01/15/08 @ $105.25) | | (B-, Caa1) | | 01/15/11 | | | 10.500 | | | | 75,750 | | |

| | | | 1,567,319 | | |

| Energy - Exploration & Production (3.1%) | | | |

| | 675 | | | Chesapeake Energy Corp., Senior Notes

(Callable 01/15/09 @ $103.44) | | (BB, Ba2) | | 01/15/16 | | | 6.875 | | | | 675,000 | | |

| | 275 | | | Encore Acquisition Co., Company Guaranteed

Notes (Callable 12/01/10 @ $103.63)§ | | (B, B1) | | 12/01/17 | | | 7.250 | | | | 264,688 | | |

| | 225 | | | Forest Oil Corp., Rule 144A, Senior Notes

(Callable 06/15/12 @ $103.63)‡ | | (B+, B1) | | 06/15/19 | | | 7.250 | | | | 226,125 | | |

| | 200 | | | Hilcorp Energy I, Rule 144A, Senior Notes

(Callable 06/01/11 @ $104.50)ठ| | (B, B3) | | 06/01/16 | | | 9.000 | | | | 208,500 | | |

| | 350 | | | Petrohawk Energy Corp., Global Company

Guaranteed Notes (Callable 07/15/10 @ $104.56) | | (B, B3) | | 07/15/13 | | | 9.125 | | | | 373,187 | | |

| | 375 | | | Plains Exploration & Production, Co., Company

Guaranteed Notes (Callable 06/15/11 @ $103.88) | | (BB-, B1) | | 06/15/15 | | | 7.750 | | | | 375,000 | | |

| | 225 | | | Range Resources Corp., Global Company

Guaranteed Notes (Callable 03/15/10 @ $103.19) | | (B+, Ba3) | | 03/15/15 | | | 6.375 | | | | 220,500 | | |

| | 275 | | | Swift Energy Co., Senior Notes (Callable

07/15/08 @ $103.81) | | (BB-, B1) | | 07/15/11 | | | 7.625 | | | | 279,125 | | |

| | | | 2,622,125 | | |

| Environmental (1.3%) | | | |

| | 625 | | | Allied Waste North America, Inc., Series B, Global

Senior Notes (Callable 04/15/09 @ $103.69)§ | | (B+, B2) | | 04/15/14 | | | 7.375 | | | | 634,375 | | |

| | 425 | | | Waste Services, Inc., Global Senior Subordinated

Notes (Callable 04/15/09 @ $104.75) | | (CCC+, Caa1) | | 04/15/14 | | | 9.500 | | | | 427,125 | | |

| | | | 1,061,500 | | |

| Food & Drug Retailers (1.4%) | | | |

| | 325 | | | Albertson's LLC, Senior Notes | | (B, B1) | | 05/01/13 | | | 7.250 | | | | 338,951 | | |

| | 450 | | | Duane Reade, Inc., Global Senior Subordinated

Notes (Callable 08/01/08 @ $104.88)§ | | (CC, Caa3) | | 08/01/11 | | | 9.750 | | | | 438,750 | | |

| | 125 | | | Stater Brothers Holdings, Inc., Global Company

Guaranteed Notes (Callable 04/15/11 @ $103.88) | | (B+, B2) | | 04/15/15 | | | 7.750 | | | | 125,312 | | |

| | 225 | | | Stater Brothers Holdings, Inc., Global Senior

Notes (Callable 06/15/08 @ $104.06)§ | | (B+, B2) | | 06/15/12 | | | 8.125 | | | | 228,375 | | |

| | | | 1,131,388 | | |

See Accompanying Notes to Financial Statements.

13

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2007

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Food - Wholesale (0.6%) | | | |

| $ | 200 | | | Dole Food Co., Debentures§# | | (B-, Caa1) | | 07/15/13 | | | 8.750 | | | $ | 197,000 | | |

| | 200 | | | National Beef Packing Company LLC, Global

Senior Unsecured Notes (Callable

08/01/08 @ $102.63) | | (B-, Caa1) | | 08/01/11 | | | 10.500 | | | | 202,000 | | |

| | 75 | | | Smithfield Foods, Inc., Senior Unsecured Notes§ | | (BB, Ba3) | | 07/01/17 | | | 7.750 | | | | 77,625 | | |

| | | | 476,625 | | |

| Forestry & Paper (2.6%) | | | |

| | 225 | | | Boise Cascade LLC, Global Company Guaranteed

Notes (Callable 10/15/09 @ $103.56) | | (B+, B2) | | 10/15/14 | | | 7.125 | | | | 222,750 | | |

| | 250 | | | Cellu Tissue Holdings, Inc., Global Secured Notes

(Callable 03/15/08 @ $103.67) | | (B, B2) | | 03/15/10 | | | 9.750 | | | | 246,875 | | |

| | 475 | | | Georgia-Pacific Corp., Debentures | | (B, B2) | | 06/15/15 | | | 7.700 | | | | 470,250 | | |

| | 50 | | | Georgia-Pacific Corp., Rule 144A, Company

Guaranteed Notes (Callable 01/15/12 @ $103.56)‡ | | (B, Ba3) | | 01/15/17 | | | 7.125 | | | | 49,000 | | |

| | 200 | | | Graphic Packaging International Corp., Global

Senior Subordinated Notes

(Callable 08/15/08 @ $104.75) | | (B-, B3) | | 08/15/13 | | | 9.500 | | | | 211,000 | | |

| | 175 | | | NewPage Corp., Global Company Guaranteed

Notes (Callable 05/01/09 @ $106.00) | | (B, B2) | | 05/01/12 | | | 10.000 | | | | 185,937 | | |

| | 75 | | | NewPage Corp., Global Company Guaranteed

Notes (Callable 05/01/09 @ $106.00)§ | | (CCC+, B3) | | 05/01/13 | | | 12.000 | | | | 81,375 | | |

| | 465 | | | Smurfit-Stone Container, Global Senior Notes

(Callable 07/01/08 @ $102.79) | | (CCC+, B3) | | 07/01/12 | | | 8.375 | | | | 467,325 | | |

| | 50 | | | Verso Paper Holdings LLC/ Inc., Series B, Global

Company Guaranteed Notes (Callable

08/01/11 @ $105.69)§ | | (CCC, B3) | | 08/01/16 | | | 11.375 | | | | 53,250 | | |

| | 150 | | | Verso Paper Holdings LLC/ Inc., Series B, Global

Secured Notes (Callable 08/01/10 @ $104.56) | | (B+, B2) | | 08/01/14 | | | 9.125 | | | | 155,625 | | |

| | | | 2,143,387 | | |

| Gaming (4.2%) | | | |

| | 250 | | | Buffalo Thunder Development Authority,

Rule 144A, Secured Notes (Callable

12/15/10 @ $104.69)‡ | | (B, B2) | | 12/15/14 | | | 9.375 | | | | 235,000 | | |

| | 200 | | | CCM Merger, Inc., Rule 144A, Notes (Callable

08/01/09 @ $104.00)‡ | | (CCC+, B3) | | 08/01/13 | | | 8.000 | | | | 193,000 | | |

| | 193 | | | Choctaw Resort Development Enterprise,

Rule 144A, Senior Notes (Callable 11/15/11 @

$103.63)‡ | | (BB-, Ba2) | | 11/15/19 | | | 7.250 | | | | 189,140 | | |

| | 150 | | | Fontainebleau Las Vegas, Rule 144A,

Second Mortgage Notes (Callable 06/15/11 @

$105.13)‡ | | (CCC+, Caa1) | | 06/15/15 | | | 10.250 | | | | 141,000 | | |

| | 250 | | | Herbst Gaming, Inc., Global Senior Subordinated

Notes (Callable 06/01/08 @ $104.06) | | (B-, B3) | | 06/01/12 | | | 8.125 | | | | 225,625 | | |

See Accompanying Notes to Financial Statements.

14

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2007

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Gaming | | | |

| $ | 225 | | | Inn of the Mountain Gods, Global Senior Notes

(Callable 11/15/07 @ $106.00)§ | | (B, B3) | | 11/15/10 | | | 12.000 | | | $ | 238,500 | | |

| | 275 | | | Jacobs Entertainment, Inc., Global Company

Guaranteed Notes (Callable 06/15/10 @ $104.88) | | (B-, B3) | | 06/15/14 | | | 9.750 | | | | 279,125 | | |

| | 125 | | | Majestic Star Casino LLC, Company Guaranteed

Notes (Callable 10/15/08 @ $102.38) | | (B+, B1) | | 10/15/10 | | | 9.500 | | | | 123,750 | | |

| | 100 | | | Majestic Star LLC, Global Senior Unsecured

Notes (Callable 10/15/08 @ $104.88) | | (CCC, Caa2) | | 01/15/11 | | | 9.750 | | | | 85,500 | | |

| | 200 | | | MGM Mirage, Inc., Company Guaranteed Notes | | (BB, Ba2) | | 06/01/16 | | | 7.500 | | | | 199,750 | | |

| | 650 | | | MGM Mirage, Inc., Company Guaranteed Notes§ | | (BB, Ba2) | | 01/15/17 | | | 7.625 | | | | 653,250 | | |

| | 300 | | | MGM Mirage, Inc., Global Company Guaranteed

Notes | | (BB, Ba2) | | 04/01/13 | | | 6.750 | | | | 294,000 | | |

| | 300 | | | Trump Entertainment Resorts, Inc., Secured

Notes (Callable 06/01/10 @ $104.25) | | (B, Caa1) | | 06/01/15 | | | 8.500 | | | | 255,750 | | |

| | 425 | | | Wimar Opco LLC, Rule 144A, Senior

Subordinated Notes (Callable 12/15/10 @

$104.81)ठ| | (CCC+, Caa1) | | 12/15/14 | | | 9.625 | | | | 320,875 | | |

| | 100 | | | Wynn Las Vegas LLC, Global First Mortgage

Notes (Callable 12/01/09 @ $103.31) | | (BBB-, Ba2) | | 12/01/14 | | | 6.625 | | | | 98,750 | | |

| | | | 3,533,015 | | |

| Gas Distribution (2.8%) | | | |

| | 275 | | | Amerigas Partners/Eagle Finance Corp., Senior

Notes (Callable 05/20/11 @ $103.56) | | (NR, B1) | | 05/20/16 | | | 7.125 | | | | 270,188 | | |

| | 750 | | | El Paso Performance-Link, Rule 144A, Notes‡ | | (BB, Ba3) | | 07/15/11 | | | 7.750 | | | | 777,013 | | |

| | 350 | | | Inergy LP/Inergy Finance Corp., Global Company

Guaranteed Notes (Callable 03/01/11 @ $104.13) | | (B, B1) | | 03/01/16 | | | 8.250 | | | | 367,500 | | |

| | 275 | | | Williams Companies, Inc., Global Senior

Unsecured Notes# | | (BB, Ba2) | | 03/15/12 | | | 8.125 | | | | 297,688 | | |

| | 625 | | | Williams Partners LP, Global Senior

Unsecured Notes | | (BBB, Ba3) | | 02/01/17 | | | 7.250 | | | | 647,656 | | |

| | | | 2,360,045 | | |

| Health Services (6.0%) | | | |

| | 105 | | | Bausch & Lomb, Inc., Rule 144A, Senior

Unsecured Notes (Callable 11/01/11 @

$104.94)ठ| | (B-, Caa1) | | 11/01/15 | | | 9.875 | | | | 108,413 | | |

| | 450 | | | Community Health Systems, Inc., Rule 144A,

Senior Notes (Callable 07/15/11 @ $104.44)‡ | | (B-, B3) | | 07/15/15 | | | 8.875 | | | | 457,875 | | |

| | 275 | | | DaVita, Inc., Global Company Guaranteed Notes

(Callable 03/15/10 @ $103.63)§ | | (B, B2) | | 03/15/15 | | | 7.250 | | | | 279,469 | | |

| | 825 | | | HCA, Inc., Global Secured Notes

(Callable 11/15/11 @ $104.63) | | (BB-, B2) | | 11/15/16 | | | 9.250 | | | | 870,375 | | |

| | 50 | | | HCA, Inc., Global Senior Unsecured Notes | | (B-, Caa1) | | 01/15/15 | | | 6.375 | | | | 42,938 | | |

| | 1,100 | | | HCA, Inc., Global Senior Unsecured Notes§ | | (B-, Caa1) | | 02/15/16 | | | 6.500 | | | | 944,625 | | |

| | 50 | | | HCA, Inc., Senior Unsecured Notes | | (B-, Caa1) | | 02/15/13 | | | 6.250 | | | | 44,625 | | |

See Accompanying Notes to Financial Statements.

15

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2007

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Health Services | | | |

| $ | 250 | | | Healthsouth Corp., Global Company Guaranteed

Notes (Callable 06/15/11 @ $105.38)§ | | (CCC+, Caa1) | | 06/15/16 | | | 10.750 | | | $ | 265,000 | | |

| | 175 | | | Iasis Healthcare/Capital Corp., Global Senior

Subordinated Notes (Callable 06/15/09 @

$104.38) | | (CCC+, B3) | | 06/15/14 | | | 8.750 | | | | 177,625 | | |

| | 225 | | | OMEGA Healthcare Investors, Inc., Global

Company Guaranteed Notes (Callable

01/15/11 @ $103.50) | | (BB, Ba3) | | 01/15/16 | | | 7.000 | | | | 226,687 | | |

| | 100 | | | Senior Housing Properties Trust, Senior Notes | | (BB+, Ba2) | | 01/15/12 | | | 8.625 | | | | 108,500 | | |

| | 50 | | | Service Corporation International, Global Senior

Notes | | (BB-, B1) | | 10/01/14 | | | 7.375 | | | | 51,375 | | |

| | 75 | | | Service Corporation International, Global Senior

Notes | | (BB-, B1) | | 10/01/18 | | | 7.625 | | | | 77,250 | | |

| | 50 | | | Service Corporation International, Global Senior

Unsecured Notes | | (BB-, B1) | | 04/01/15 | | | 6.750 | | | | 50,125 | | |

| | 175 | | | Stewart Enterprises, Inc., Global Senior Notes

(Callable 02/15/09 @ $103.13) | | (BB-, Ba3) | | 02/15/13 | | | 6.250 | | | | 169,312 | | |

| | 700 | | | Tenet Healthcare Corp., Global Senior Notes§ | | (CCC+, Caa1) | | 07/01/14 | | | 9.875 | | | | 640,500 | | |

| | 125 | | | Universal Hospital Services, Inc., Rule 144A,

Secured Notes (Callable 06/01/09 @ $102.00)‡# | | (B+, B3) | | 06/01/15 | | | 8.759 | | | | 125,937 | | |

| | 150 | | | Universal Hospital Services, Inc., Rule 144A,

Secured Notes (Callable 06/01/11 @ $104.25)‡ | | (B+, B3) | | 06/01/15 | | | 8.500 | | | | 153,375 | | |

| | 225 | | | Vanguard Health Holding Co., Global Senior

Subordinated Notes (Callable 10/01/09 @

$104.50) | | (CCC+, Caa1) | | 10/01/14 | | | 9.000 | | | | 220,500 | | |

| | | | 5,014,506 | | |

| Hotels (0.7%) | | | |

| | 100 | | | Host Hotels & Resorts LP, Global Secured Notes

(Callable 11/01/10 @ $103.44)§ | | (BB, NR) | | 11/01/14 | | | 6.875 | | | | 101,250 | | |

| | 225 | | | Host Marriott LP, Global Senior Notes

(Callable 11/01/08 @ $103.56) | | (BB, Ba1) | | 11/01/13 | | | 7.125 | | | | 229,500 | | |

| | 275 | | | Host Marriott LP, Series Q, Global Company

Guaranteed Notes (Callable 06/01/11 @

$103.33) | | (BB, Ba1) | | 06/01/16 | | | 6.750 | | | | 276,375 | | |

| | | | 607,125 | | |

| Household & Leisure Products (0.1%) | | | |

| | 40 | | | Sealy Mattress Co., Global Senior Subordinated

Notes (Callable 06/15/09 @ $104.13)§ | | (B, B2) | | 06/15/14 | | | 8.250 | | | | 40,000 | | |

| | 75 | | | Simmons Bedding Co., Global Senior

Subordinated Notes (Callable 01/15/09 @

$103.94) | | (CCC+, B2) | | 01/15/14 | | | 7.875 | | | | 72,188 | | |

| | | | 112,188 | | |

See Accompanying Notes to Financial Statements.

16

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2007

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Leisure (0.9%) | | | |

| $ | 263 | | | Bally Total Fitness Holding Corp., Secured

Notes (Callable 07/15/08 @ $106.50) | | (NR, NR) | | 07/15/11 | | | 13.000 | | | $ | 265,756 | | |

| | 175 | | | Six Flags, Inc., Global Senior Notes (Callable

02/01/08 @ $101.48)§ | | (CCC, Caa1) | | 02/01/10 | | | 8.875 | | | | 150,063 | | |

| | 400 | | | Six Flags, Inc., Global Senior Notes (Callable

06/01/09 @ $104.81)§ | | (CCC, Caa1) | | 06/01/14 | | | 9.625 | | | | 315,500 | | |

| | | | 731,319 | | |

| Machinery (0.3%) | | | |

| | 275 | | | Baldor Electric Co., Company Guaranteed Notes

(Callable 02/15/12 @ $104.31) | | (B, B3) | | 02/15/17 | | | 8.625 | | | | 288,063 | | |

| Media - Broadcast (2.5%) | | | |

| | 250 | | | Barrington Broadcasting, Global Company

Guaranteed Notes (Callable 08/15/10 @ 105.25) | | (CCC+, B3) | | 08/15/14 | | | 10.500 | | | | 260,625 | | |

| | 200 | | | Fisher Communications, Inc., Global Senior

Notes (Callable 09/15/09 @ $104.31) | | (B-, B2) | | 09/15/14 | | | 8.625 | | | | 207,750 | | |

| | 325 | | | ION Media Networks, Inc., Rule 144A, Secured

Notes (Callable 01/15/08 @ $102.00)‡# | | (CCC-, Caa2) | | 01/15/13 | | | 11.493 | | | | 331,500 | | |

| | 200 | | | Local TV Finance LLC, Rule 144A, Senior

Unsecured Notes (Callable 06/15/11 @

$104.63)‡ | | (CCC+, Caa1) | | 06/15/15 | | | 9.250 | | | | 192,500 | | |

| | 250 | | | Nexstar Finance Holdings LLC, Global Senior

Discount Notes (Callable 04/01/08 @ $105.69)+ | | (CCC+, Caa1) | | 04/01/13 | | | 0.000 | | | | 250,000 | | |

| | 250 | | | Rainbow National Services LLC, Rule 144A,

Senior Notes (Callable 09/01/08 @ $104.38)‡ | | (B+, B2) | | 09/01/12 | | | 8.750 | | | | 261,250 | | |

| | 350 | | | Univision Communications, Inc., Rule 144A,

Senior Notes (Callable 03/15/11 @ $104.88)ठ| | (CCC+, B3) | | 03/15/15 | | | 9.750 | | | | 344,750 | | |

| | 325 | | | Young Broadcasting, Inc., Global Senior

Subordinated Notes (Callable 01/15/09 @

$104.38)§ | | (CCC-, Caa1) | | 01/15/14 | | | 8.750 | | | | 281,937 | | |

| | | | 2,130,312 | | |

| Media - Cable (4.4%) | | | |

| | 425 | | | Atlantic Broadband Finance LLC, Global Company

Guaranteed Notes (Callable 01/15/09 @ $104.69) | | (CCC+, Caa1) | | 01/15/14 | | | 9.375 | | | | 418,625 | | |

| | 250 | | | CCH I Holdings LLC, Global Company Guaranteed

Notes (Callable 12/24/07 @ $100.00)§ | | (CCC, Caa3) | | 04/01/14 | | | 9.920 | | | | 205,000 | | |

| | 725 | | | CCH I LLC, Global Secured Notes (Callable

10/01/10 @ $105.50) | | (CCC, Caa2) | | 10/01/15 | | | 11.000 | | | | 706,875 | | |

| | 325 | | | CCH II LLC, Series B, Global Senior Unsecured

Notes (Callable 09/15/08 @ $105.13) | | (CCC, Caa1) | | 09/15/10 | | | 10.250 | | | | 332,313 | | |

| | 281 | | | Charter Communications Holdings LLC, Senior

Discount Notes (Callable 12/24/07 @ $100.00)§ | | (CCC, Ca) | | 04/01/11 | | | 9.920 | | | | 255,710 | | |

| | 525 | | | CSC Holdings, Inc., Global Senior Unsecured Notes | | (B+, B2) | | 04/15/12 | | | 6.750 | | | | 510,562 | | |

| | 300 | | | DirecTV Holdings/Finance, Global Senior Notes

(Callable 03/15/08 @ $104.19) | | (BB-, Ba3) | | 03/15/13 | | | 8.375 | | | | 315,000 | | |

See Accompanying Notes to Financial Statements.

17

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2007

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Media - Cable | | | |

| $ | 350 | | | EchoStar DBS Corp., Global Company

Guaranteed Notes | | (BB-, Ba3) | | 10/01/14 | | | 6.625 | | | $ | 357,875 | | |

| | 315 | | | Insight Midwest/Insight Capital Corp., Senior

Notes (Callable 12/24/07 @ $100.00)§ | | (B, B3) | | 10/01/09 | | | 9.750 | | | | 316,181 | | |

| | 25 | | | Mediacom Broadband LLC, Global Senior Notes

(Callable 10/15/10 @ $104.25) | | (B, B3) | | 10/15/15 | | | 8.500 | | | | 24,750 | | |

| | 250 | | | Mediacom LLC/Capital Corp., Senior Notes

(Callable 02/15/08 @ $100.00)§ | | (B, B3) | | 02/15/11 | | | 7.875 | | | | 243,125 | | |

| | | | 3,686,016 | | |

| Media - Services (0.4%) | | | |

| | 125 | | | Lamar Media Corp., Rule 144A, Senior

Subordinated Notes (Callable 08/15/10 @

$103.31)‡ | | (B, Ba3) | | 08/15/15 | | | 6.625 | | | | 120,313 | | |

| | 250 | | | WMG Holdings Corp., Global Company Guaranteed

Notes (Callable 12/15/09 @ $104.75)+ | | (B, B2) | | 12/15/14 | | | 0.000 | | | | 185,000 | | |

| | | | 305,313 | | |

| Metals & Mining - Excluding Steel (2.1%) | | | |

| | 100 | | | Aleris International, Inc., Global Company

Guaranteed Notes (Callable 12/15/10 @ $104.50) | | (B-, B3) | | 12/15/14 | | | 9.000 | | | | 90,750 | | |

| | 225 | | | Aleris International, Inc., Global Company

Guaranteed Notes (Callable 12/15/11 @ $105.00) | | (B-, Caa1) | | 12/15/16 | | | 10.000 | | | | 199,125 | | |

| | 500 | | | Freeport - McMoRan Copper & Gold, Inc.,

Senior Unsecured Notes

(Callable 04/01/11 @ $104.13) | | (BB, Ba3) | | 04/01/15 | | | 8.250 | | | | 541,250 | | |

| | 250 | | | Freeport - McMoRan Copper & Gold, Inc.,

Senior Unsecured Notes

(Callable 04/01/12 @ $104.19) | | (BB, Ba3) | | 04/01/17 | | | 8.375 | | | | 274,375 | | |

| | 325 | | | Noranda Aluminum Acquisition, Rule 144A,

Senior Unsecured Notes

(Callable 05/15/08 @ $102.00)‡# | | (CCC+, B3) | | 05/15/15 | | | 9.360 | | | | 301,437 | | |

| | 200 | | | Peabody Energy Corp., Global Company

Guaranteed Notes | | (BB, Ba1) | | 11/01/16 | | | 7.375 | | | | 209,000 | | |

| | 125 | | | PNA Intermediate Holding Corp., Rule 144A,

Senior Notes (Callable 02/15/08 @ $102.00)‡# | | (B-, Caa1) | | 02/15/13 | | | 12.558 | | | | 123,438 | | |

| | | | 1,739,375 | | |

| Mortgage Banks & Thrifts (0.5%) | | | |

| | 410 | | | Countrywide Home Loans, Inc.,

Series MTNK, Global Notes§ | | (BBB+, Baa3) | | 12/19/07 | | | 4.250 | | | | 405,153 | | |

| Non-Food & Drug Retailers (3.1%) | | | |

| | 325 | | | Affinity Group, Inc., Global Senior Subordinated

Notes (Callable 02/15/08 @ $104.50) | | (CCC+, B2) | | 02/15/12 | | | 9.000 | | | | 326,625 | | |

| | 200 | | | Asbury Automotive Group, Inc., Global Company

Guaranteed Notes (Callable 03/15/12 @ $103.81) | | (B, B3) | | 03/15/17 | | | 7.625 | | | | 188,000 | | |

See Accompanying Notes to Financial Statements.

18

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2007

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Non-Food & Drug Retailers | | | |

| $ | 250 | | | Brookstone Company, Inc., Global Secured

Notes (Callable 10/15/09 @ $106.00)§ | | (B, Caa1) | | 10/15/12 | | | 12.000 | | | $ | 251,250 | | |

| | 275 | | | Claire's Stores, Inc., Rule 144A, Company

Guaranteed Notes (Callable 06/01/11 @

$104.81)‡ | | (CCC+, Caa1) | | 06/01/15 | | | 9.625 | | | | 226,187 | | |

| | 200 | | | Finlay Fine Jewelry Corp., Global Senior Notes

(Callable 06/01/08 @ $104.19)§ | | (B-, Caa1) | | 06/01/12 | | | 8.375 | | | | 161,000 | | |

| | 150 | | | GameStop Corp., Global Company Guaranteed

Notes (Callable 10/01/09 @ $104.00)§ | | (BB, Ba3) | | 10/01/12 | | | 8.000 | | | | 157,313 | | |

| | 70 | | | Michaels Stores, Inc., Global Company Guaranteed

Notes (Callable 11/01/10 @ $105.00)§ | | (CCC, B2) | | 11/01/14 | | | 10.000 | | | | 70,875 | | |

| | 305 | | | Michaels Stores, Inc., Global Company Guaranteed

Notes (Callable 11/01/11 @ $105.69)§ | | (CCC, Caa1) | | 11/01/16 | | | 11.375 | | | | 305,762 | | |

| | 350 | | | Neiman Marcus Group, Inc., Global Company

Guaranteed Notes (Callable 10/15/10 @

$105.19)§ | | (B, B3) | | 10/15/15 | | | 10.375 | | | | 382,375 | | |

| | 553 | | | PCA LLC/PCA Finance Corp., Global Company

Guaranteed Notesø | | (NR, NR) | | 08/01/09 | | | 11.875 | | | | 32,489 | | |

| | 265 | | | Susser Holdings LLC, Global Company Guaranteed

Notes (Callable 12/15/09 @ $105.31) | | (B+, B2) | | 12/15/13 | | | 10.625 | | | | 276,925 | | |

| | 150 | | | Yankee Acquisition Corp., Series B, Global Company

Guaranteed Notes (Callable 02/15/11 @

$104.25) | | (CCC+, B3) | | 02/15/15 | | | 8.500 | | | | 141,375 | | |

| | 100 | | | Yankee Acquisition Corp., Series B, Global Company

Guaranteed Notes (Callable 02/15/12 @

$104.88)§ | | (CCC+, Caa1) | | 02/15/17 | | | 9.750 | | | | 93,000 | | |

| | | | 2,613,176 | | |

| Office Equipment (0.3%) | | | |

| | 250 | | | IKON Office Solutions, Inc., Global Senior Notes

(Callable 09/15/10 @ $103.88)§ | | (BB, Ba3) | | 09/15/15 | | | 7.750 | | | | 255,625 | | |

| Oil Field Equipment & Services (0.4%) | | | |

| | 325 | | | Pride International, Inc., Global Senior Notes

(Callable 07/15/09 @ $103.69) | | (BB-, Ba2) | | 07/15/14 | | | 7.375 | | | | 334,750 | | |

| Oil Refining & Marketing (0.5%) | | | |

| | 275 | | | Chaparral Energy, Inc., Rule 144A, Senior Notes

(Callable 02/01/12 @ $104.44)‡ | | (CCC+, Caa1) | | 02/01/17 | | | 8.875 | | | | 258,500 | | |

| | 175 | | | Tesoro Corp., Rule 144A, Senior Notes

(Callable 06/01/12 @ $103.25)‡ | | (BB+, Ba1) | | 06/01/17 | | | 6.500 | | | | 173,688 | | |

| | | | 432,188 | | |

| Packaging (2.5%) | | | |

| | 125 | | | Ball Corp., Company Guaranteed Notes (Callable

03/15/11 @ $103.31) | | (BB, Ba1) | | 03/15/18 | | | 6.625 | | | | 124,063 | | |

| | 75 | | | Berry Petroleum Co., Senior Subordinated Notes

(Callable 11/01/11 @ $104.13) | | (B, B3) | | 11/01/16 | | | 8.250 | | | | 76,875 | | |

See Accompanying Notes to Financial Statements.

19

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2007

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Packaging | | | |

| $ | 175 | | | Berry Plastics Holding Corp., Global Company

Guaranteed Notes (Callable 03/01/11 @ $105.13) | | (CCC+, Caa2) | | 03/01/16 | | | 10.250 | | | $ | 168,875 | | |

| | 225 | | | Berry Plastics Holding Corp., Global Secured

Notes (Callable 09/15/10 @ $104.44) | | (B-, B3) | | 09/15/14 | | | 8.875 | | | | 231,750 | | |

| | 400 | | | Constar International, Inc., Senior Subordinated

Notes (Callable 12/01/07 @ $105.50)§ | | (CCC, Caa2) | | 12/01/12 | | | 11.000 | | | | 302,000 | | |

| | 105 | | | Crown Americas LLC, Global Senior Notes

(Callable 11/15/10 @ $103.88) | | (B, B1) | | 11/15/15 | | | 7.750 | | | | 108,675 | | |

| | 350 | | | Graham Packaging Company, Inc., Global

Subordinated Notes (Callable 10/15/09 @

$104.94)§ | | (CCC+, Caa1) | | 10/15/14 | | | 9.875 | | | | 348,250 | | |

| | 100 | | | Owens-Brockway Glass Containers, Inc.,

Rule 144A, Senior Notes (Callable 05/15/08 @

$104.13)‡ | | (B, B3) | | 05/15/13 | | | 8.250 | | | | 104,500 | | |

| | 100 | | | Owens-Illinois, Inc., Debentures§ | | (B, Caa1) | | 05/15/18 | | | 7.800 | | | | 100,750 | | |

| | 225 | | | Pliant Corp., Global Company Guaranteed Notes

(Callable 06/01/08 @ $102.78)§ | | (CCC, Caa1) | | 09/01/09 | | | 11.125 | | | | 195,750 | | |

| | 375 | | | Solo Cup Co., Global Senior Subordinated Notes

(Callable 02/15/09 @ $104.25)§ | | (CCC-, Caa2) | | 02/15/14 | | | 8.500 | | | | 339,375 | | |

| | | | 2,100,863 | | |

| Printing & Publishing (2.7%) | | | |

| | 200 | | | American Media Operations, Inc., Series B,

Global Company Guaranteed Notes§ | | (CCC-, Caa2) | | 05/01/09 | | | 10.250 | | | | 192,000 | | |

| | 200 | | | Dex Media, Inc., Global Discount Notes

(Callable 11/15/08 @ $104.50)+ | | (B, B2) | | 11/15/13 | | | 0.000 | | | | 190,500 | | |

| | 150 | | | Dex Media, Inc., Global Senior Unsecured Notes

(Callable 11/15/08 @ $104.00) | | (B, B2) | | 11/15/13 | | | 8.000 | | | | 151,125 | | |

| | 250 | | | Idearc, Inc., Global Company Guaranteed Notes

(Callable 11/15/11 @ $104.00) | | (B+, B2) | | 11/15/16 | | | 8.000 | | | | 251,875 | | |

| | 325 | | | R. H. Donnelley Corp., Rule 144A, Senior Notes

(Callable 10/15/12 @ $104.44)‡ | | (B, B3) | | 10/15/17 | | | 8.875 | | | | 326,625 | | |

| | 300 | | | R.H. Donnelley Corp., Global Senior Unsecured

Notes (Callable 01/15/09 @ $103.44)§ | | (B, B3) | | 01/15/13 | | | 6.875 | | | | 283,500 | | |

| | 25 | | | R.H. Donnelley Corp., Series A-2, Global Senior

Discount Notes (Callable 01/15/09 @ $103.44) | | (B, B3) | | 01/15/13 | | | 6.875 | | | | 23,625 | | |

| | 50 | | | R.H. Donnelley Corp., Series A-3, Global Senior

Notes (Callable 01/15/11 @ $104.44) | | (B, B3) | | 01/15/16 | | | 8.875 | | | | 50,250 | | |

| | 275 | | | Reader's Digest Association, Inc., Rule 144A,

Senior Subordinated Notes (Callable

02/15/12 @ $104.50)‡ | | (CCC+, Caa1) | | 02/15/17 | | | 9.000 | | | | 246,469 | | |

| | 300 | | | TL Acquisitions, Inc., Rule 144A, Senior Notes

(Callable 07/15/11 @ $105.25)‡ | | (CCC+, Caa1) | | 01/15/15 | | | 10.500 | | | | 300,000 | | |

| | 255 | | | Valassis Communications, Inc., Global Company

Guaranteed Notes (Callable

03/01/11 @ $104.13)§ | | (B-, B3) | | 03/01/15 | | | 8.250 | | | | 216,112 | | |

| | | | 2,232,081 | | |

See Accompanying Notes to Financial Statements.

20

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2007

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Restaurants (0.4%) | | | |

| $ | 250 | | | Buffets, Inc., Global Company Guaranteed Notes

(Callable 11/01/10 @ $106.25)§ | | (CC, Caa3) | | 11/01/14 | | | 12.500 | | | $ | 163,125 | | |

| | 125 | | | Denny's Corp., Global Company Guaranteed Notes

(Callable 10/01/08 @ $105.00) | | (B-, B3) | | 10/01/12 | | | 10.000 | | | | 129,063 | | |

| | 75 | | | OSI Restaurant Partners, Inc., Rule 144A, Senior

Notes (Callable 06/15/11 @ $105.00)ठ| | (CCC+, Caa1) | | 06/15/15 | | | 10.000 | | | | 64,875 | | |

| | | | 357,063 | | |

| Software/Services (1.2%) | | | |

| | 375 | | | First Data Corp., Rule 144A, Company Guaranteed

Notes (Callable 09/30/11 @ $104.94)ठ| | (B-, B3) | | 09/24/15 | | | 9.875 | | | | 359,531 | | |

| | 600 | | | SunGard Data Systems, Inc., Global Company

Guaranteed Notes (Callable 08/15/10 @

$105.13)§ | | (B-, Caa1) | | 08/15/15 | | | 10.250 | | | | 628,500 | | |

| | | | 988,031 | | |

| Steel Producers/Products (1.0%) | | | |

| | 250 | | | AK Steel Corp., Global Company Guaranteed

Notes (Callable 06/15/08 @ $102.58) | | (B+, B1) | | 06/15/12 | | | 7.750 | | | | 256,250 | | |

| | 275 | | | PNA Group, Inc., Global Senior Unsecured

Notes (Callable 09/01/11 @ $105.38) | | (B-, B3) | | 09/01/16 | | | 10.750 | | | | 282,562 | | |

| | 300 | | | Rathgibson, Inc., Global Company Guaranteed

Notes (Callable 02/15/10 @ $105.62) | | (B-, B3) | | 02/15/14 | | | 11.250 | | | | 311,250 | | |

| | 0 | | | WCI Steel Acquisition, Inc., Senior Notes1 | | (NR, NR) | | 05/01/16 | | | 8.000 | | | | 331 | | |

| | | | 850,393 | | |

| Support - Services (5.3%) | | | |

| | 400 | | | Allied Security Escrow Corp., Global Senior

Subordinated Notes (Callable 07/15/08 @

$105.69) | | (CCC+, Caa1) | | 07/15/11 | | | 11.375 | | | | 384,000 | | |

| | 300 | | | Aramark Corp., Global Company Guaranteed Notes

(Callable 02/01/11 @ $104.25) | | (B-, B3) | | 02/01/15 | | | 8.500 | | | | 305,250 | | |

| | 125 | | | Ashtead Capital, Inc., Rule 144A, Notes

(Callable 08/15/11 @ $104.50)‡ | | (B, B1) | | 08/15/16 | | | 9.000 | | | | 121,875 | | |

| | 150 | | | Education Management LLC, Global Company

Guaranteed Notes (Callable 06/01/10 @ $104.38) | | (CCC+, B2) | | 06/01/14 | | | 8.750 | | | | 155,625 | | |

| | 175 | | | Education Management LLC, Global Company

Guaranteed Notes (Callable 06/01/11 @

$105.13)§ | | (CCC+, Caa1) | | 06/01/16 | | | 10.250 | | | | 184,625 | | |

| | 300 | | | Hertz Corp., Global Company Guaranteed Notes

(Callable 01/01/10 @ $104.44) | | (B, B1) | | 01/01/14 | | | 8.875 | | | | 310,500 | | |

| | 275 | | | Iron Mountain, Inc., Company Guaranteed Notes

(Callable 07/01/08 @ $103.31)§ | | (B, B3) | | 01/01/16 | | | 6.625 | | | | 262,625 | | |

| | 250 | | | Johnsondiversey Holdings, Inc., Global Discount

Notes (Callable 05/15/08 @ $103.56)# | | (CCC+, Caa1) | | 05/15/13 | | | 10.670 | | | | 260,000 | | |

See Accompanying Notes to Financial Statements.

21

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2007

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Support - Services | | | |

| $ | 225 | | | Johnsondiversey, Inc., Series B, Global Company

Guaranteed Notes (Callable 05/15/08 @

$103.21)§ | | (CCC+, B3) | | 05/15/12 | | | 9.625 | | | $ | 234,563 | | |

| | 225 | | | Kar Holdings, Inc., Rule 144A, Senior Notes

(Callable 05/01/10 @ $104.38)ठ| | (CCC, B3) | | 05/01/14 | | | 8.750 | | | | 218,250 | | |

| | 100 | | | Kar Holdings, Inc., Rule 144A, Senior

Subordinated Notes (Callable 04/01/11 @

$105.00)‡ | | (CCC, Caa1) | | 05/01/15 | | | 10.000 | | | | 96,000 | | |

| | 325 | | | Mobile Mini, Inc., Global Company Guaranteed

Notes (Callable 05/01/11 @ $103.44) | | (BB-, B1) | | 05/01/15 | | | 6.875 | | | | 310,375 | | |

| | 200 | | | Mobile Services Group, Inc., Rule 144A, Senior

Notes (Callable 08/01/10 @ $104.88)‡ | | (B-, B3) | | 08/01/14 | | | 9.750 | | | | 202,000 | | |

| | 300 | | | Neff Corp., Global Company Guaranteed Notes

(Callable 06/01/11 @ $105.00)§ | | (B-, Caa2) | | 06/01/15 | | | 10.000 | | | | 217,500 | | |

| | 350 | | | Rental Service Corp., Global Company Guaranteed

Notes (Callable 12/01/10 @ $104.75)§ | | (B-, Caa1) | | 12/01/14 | | | 9.500 | | | | 338,187 | | |

| | 100 | | | Travelport LLC, Global Company Guaranteed Notes

(Callable 09/01/11 @ $105.94)§ | | (CCC+, Caa1) | | 09/01/16 | | | 11.875 | | | | 108,500 | | |

| | 270 | | | Travelport LLC., Global Company Guaranteed Notes

(Callable 09/01/10 @ $104.94) | | (CCC+, B3) | | 09/01/14 | | | 9.875 | | | | 279,450 | | |

| | 325 | | | United Rentals North America, Inc., Global Senior

Subordinated Notes (Callable 02/15/09 @

$103.50) | | (B, B3) | | 02/15/14 | | | 7.000 | | | | 346,125 | | |

| | 100 | | | Varietal Distribution, Rule 144A, Company

Guaranteed Notes (Callable 07/15/11 @

$105.13)‡ | | (CCC+, Caa1) | | 07/15/15 | | | 10.250 | | | | 98,500 | | |

| | | | 4,433,950 | | |

| Telecom - Fixed Line (0.9%) | | | |

| | 575 | | | Level 3 Financing, Inc., Global Company

Guaranteed Notes (Callable 02/15/09 @

$102.00)# | | (CCC+, Caa1) | | 02/15/15 | | | 9.150 | | | | 521,812 | | |

| | 250 | | | Time Warner Telecom Holdings, Inc., Global

Company Guaranteed Notes (Callable 02/15/09 @

$104.62) | | (CCC+, B3) | | 02/15/14 | | | 9.250 | | | | 260,938 | | |

| | | | 782,750 | | |

| Telecom - Integrated/Services (2.4%) | | | |

| | 350 | | | Cincinnati Bell, Inc., Global Senior Subordinated

Notes (Callable 01/15/09 @ $104.19) | | (B-, B2) | | 01/15/14 | | | 8.375 | | | | 352,625 | | |

| | 275 | | | Citizens Communications Co., Senior Notes | | (BB+, Ba2) | | 01/15/13 | | | 6.250 | | | | 271,563 | | |

| | 25 | | | Hawaiian Telcom Communications, Inc., Series B,

Global Company Guaranteed Notes (Callable

05/01/10 @ $106.25)§ | | (CCC, Caa1) | | 05/01/15 | | | 12.500 | | | | 27,250 | | |

See Accompanying Notes to Financial Statements.

22

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2007

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Telecom - Integrated/Services | | | |

| $ | 175 | | | Hughes Network Systems LLC, Global Company

Guaranteed Notes (Callable 04/15/10 @

$104.75) | | (B-, B1) | | 04/15/14 | | | 9.500 | | | $ | 180,469 | | |

| | 200 | | | Paetec Holding Corp., Rule 144A, Company

Guaranteed Notes (Callable 07/15/11 @

$104.75)‡ | | (CCC+, Caa1) | | 07/15/15 | | | 9.500 | | | | 206,000 | | |

| | 50 | | | Qwest Communications International, Inc., Global

Company Guaranteed Notes (Callable

02/15/08 @ $103.63) | | (B+, Ba3) | | 02/15/11 | | | 7.250 | | | | 50,750 | | |

| | 525 | | | Qwest Communications International, Inc.,

Series B, Global Company Guaranteed Notes

(Callable 02/15/09 @ $103.75) | | (B+, Ba3) | | 02/15/14 | | | 7.500 | | | | 534,187 | | |

| | 50 | | | Windstream Corp., Global Company Guaranteed

Notes (Callable 03/15/12 @ $103.50) | | (BB-, Ba3) | | 03/15/19 | | | 7.000 | | | | 49,500 | | |

| | 325 | | | Windstream Corp., Global Company Guaranteed

Notes (Callable 08/01/11 @ $104.31) | | (BB-, Ba3) | | 08/01/16 | | | 8.625 | | | | 349,375 | | |

| | | | 2,021,719 | | |

| Telecom - Wireless (1.5%) | | | |

| | 200 | | | Centennial Cellular Communications Corp.,

Global Company Guaranteed Notes (Callable

06/15/08 @ $105.06) | | (CCC+, B2) | | 06/15/13 | | | 10.125 | | | | 213,500 | | |

| | 175 | | | Cricket Communications, Inc., Global Company

Guaranteed Notes (Callable 11/01/10 @

$104.69) | | (CCC, Caa1) | | 11/01/14 | | | 9.375 | | | | 174,563 | | |

| | 300 | | | Metro PCS Wireless, Inc., Rule 144A, Senior Notes

(Callable 11/01/10 @ $104.63)‡ | | (CCC, Caa1) | | 11/01/14 | | | 9.250 | | | | 299,250 | | |

| | 125 | | | Rural Cellular Corp., Global Senior Unsecured

Notes (Callable 01/15/08 @ $101.63) | | (CCC, B3) | | 02/01/10 | | | 9.875 | | | | 130,938 | | |

| | 125 | | | Rural Cellular Corp., Rule 144A, Senior

Subordinated Notes (Callable 06/01/08 @

$102.00)‡# | | (CCC, Caa2) | | 06/01/13 | | | 8.621 | | | | 128,281 | | |

| | 250 | | | SunCom Wireless Holdings, Inc., Global Company

Guaranteed Notes (Callable 06/01/08 @

$104.25)§ | | (CCC, Caa2) | | 06/01/13 | | | 8.500 | | | | 263,437 | | |

| | | | 1,209,969 | | |

| Textiles & Apparel (0.4%) | | | |

| | 300 | | | Levi Strauss & Co., Global Senior Notes

(Callable 01/15/10 @ $104.88) | | (B+, B2) | | 01/15/15 | | | 9.750 | | | | 314,625 | | |

| Theaters & Entertainment (0.4%) | | | |

| | 350 | | | AMC Entertainment, Inc., Global Senior

Subordinated Notes (Callable 03/01/09 @

$104.00) | | (CCC+, B2) | | 03/01/14 | | | 8.000 | | | | 343,875 | | |

See Accompanying Notes to Financial Statements.

23

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2007

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Transportation - Excluding Air/Rail (0.2%) | | | |

| $ | 150 | | | Bristow Group, Inc., Rule 144A, Senior Notes

(Callable 09/15/12 @ $103.75)‡ | | (BB, Ba2) | | 09/15/17 | | | 7.500 | | | $ | 155,250 | | |

| TOTAL CORPORATE BONDS (Cost $74,064,823) | | | 72,843,930 | | |

| FOREIGN BONDS (7.8%) | | | |

| Chemicals (0.7%) | | | |

| | 350 | | | Basell AF SCA, Rule 144A, Company Guaranteed

Notes (Callable 08/15/10 @ $104.19)

(Luxembourg)ठ| | (B, B2) | | 08/15/15 | | | 8.375 | | | | 315,000 | | |

| | 275 | | | Ineos Group Holdings PLC, Rule 144A, Company

Guaranteed Notes (Callable 02/15/11 @

$104.25) (United Kingdom)ठ| | (B-, B3) | | 02/15/16 | | | 8.500 | | | | 262,625 | | |

| | | | 577,625 | | |

| Electronics (0.8%) | | | |

| | 175 | | | Avago Technologies Finance, Global Company

Guaranteed Notes (Callable 12/01/09 @

$105.06) (Singapore)# | | (B, B2) | | 12/01/13 | | | 10.125 | | | | 189,875 | | |

| | 175 | | | NXP BV/NXP Funding LLC, Global Company

Guaranteed Notes (Callable 10/15/11 @

$104.75) (Netherlands)§ | | (B, B3) | | 10/15/15 | | | 9.500 | | | | 165,813 | | |

| | 350 | | | NXP BV/NXP Funding LLC, Global Secured Notes

(Callable 10/15/10 @ $103.94) (Netherlands)§ | | (BB, Ba3) | | 10/15/14 | | | 7.875 | | | | 343,437 | | |

| | | | 699,125 | | |

| Energy - Exploration & Production (0.3%) | | | |

| | 275 | | | OPTI Canada, Inc., Rule 144A, Company

Guaranteed Notes (Callable 12/15/10 @

$104.13) (Canada)‡ | | (BB+, B1) | | 12/15/14 | | | 8.250 | | | | 277,062 | | |

| Forestry & Paper (0.7%) | | | |

| | 250 | | | Abitibi-Consolidated, Inc., Global Notes (Canada)§ | | (B, B3) | | 06/15/11 | | | 7.750 | | | | 208,750 | | |

| | 325 | | | Bowater Canada Finance Corp., Global Company

Guaranteed Notes (Canada)§ | | (B, B3) | | 11/15/11 | | | 7.950 | | | | 280,312 | | |

| | 50 | | | Smurfit Kappa Funding PLC, Global

Senior Subordinated Notes (Callable

01/31/10 @ $103.88) (Ireland)§ | | (B, B2) | | 04/01/15 | | | 7.750 | | | | 49,500 | | |

| | | | 538,562 | | |

| Leisure (0.4%) | | | |

| | 300 | | | NCL Corp., Global Senior Notes

(Callable 07/15/09 @ $105.31) (Bermuda)# | | (B, B3) | | 07/15/14 | | | 10.625 | | | | 305,250 | | |

| Media - Cable (0.8%) | | | |

| | 300 | | | NTL Cable PLC, Global Senior Notes

(Callable 08/15/11 @ $104.56) (United Kingdom) | | (B-, B2) | | 08/15/16 | | | 9.125 | | | | 318,000 | | |

See Accompanying Notes to Financial Statements.

24

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2007

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| FOREIGN BONDS | | | |

| Media - Cable | | | |

| $ | 250 | | | Unity Media GmbH, Rule 144A, Secured Notes

(Callable 02/15/10 @ $105.06) (Germany)‡ | | (CCC+, Caa2) | | 02/15/15 | | | 10.125 | | | $ | 386,102 | | |

| | | | 704,102 | | |

| Media - Diversified (0.2%) | | | |

| | 200 | | | Quebecor Media, Inc., Rule 144A, Notes (Canada)‡ | | (B, B2) | | 03/15/16 | | | 7.750 | | | | 194,000 | | |

| Metals & Mining - Excluding Steel (0.0%) | | | |

| | 350 | | | International Utility Structures, Inc., Yankee Senior

Subordinated Notes (Canada)ø^ | | (NR, NR) | | 02/01/08 | | | 10.750 | | | | 0 | | |

| Oil Refining & Marketing (0.2%) | | | |

| | 75 | | | Petroplus Finance, Ltd., Rule 144A, Company

Guaranteed Notes (Callable 05/01/11 @

$103.38) (Bermuda)‡ | | (BB-, B1) | | 05/01/14 | | | 6.750 | | | | 71,625 | | |

| | 75 | | | Petroplus Finance, Ltd., Rule 144A, Company

Guaranteed Notes (Callable 05/01/12 @

$103.50) (Bermuda)‡ | | (BB-, B1) | | 05/01/17 | | | 7.000 | | | | 70,875 | | |

| | | | 142,500 | | |

| Pharmaceuticals (0.3%) | | | |

| | 225 | | | Elan Finance PLC, Global Company Guaranteed

Notes (Callable 12/01/10 @ $104.44) (Ireland) | | (B, B3) | | 12/01/13 | | | 8.875 | | | | 226,688 | | |

| Printing & Publishing (0.1%) | | | |

| | 100 | | | Quebecor World, Inc., Rule 144A, Senior Notes

(Callable 01/15/11 @ $104.88) (Canada)‡ | | (B, Caa1) | | 01/15/15 | | | 9.750 | | | | 98,000 | | |

| Support-Services (0.4%) | | | |

| | 350 | | | Ashtead Holdings PLC, Rule 144A, Secured Notes

(Callable 08/01/10 @ $104.31)

(United Kingdom)‡ | | (B, B1) | | 08/01/15 | | | 8.625 | | | | 336,000 | | |

| Telecom - Integrated/Services (2.0%) | | | |

| | 400 | | | Global Crossing UK Finance, Global Company

Guaranteed Notes (Callable 12/15/09 @

$105.38) (United Kingdom) | | (B-, B3) | | 12/15/14 | | | 10.750 | | | | 426,000 | | |

| | 250 | | | Intelsat Bermuda, Ltd., Global Company

Guaranteed (Callable 01/15/08 @ $102.00)

(Bermuda)# | | (B, Caa1) | | 01/15/15 | | | 8.886 | | | | 255,000 | | |

| | 50 | | | Intelsat Bermuda, Ltd., Global Senior Unsecured

Notes (Bermuda) | | (B, Caa1) | | 11/01/13 | | | 6.500 | | | | 39,500 | | |

| | 700 | | | Intelsat, Ltd., Global Senior Unsecured Notes

(Callable 06/15/11 @ $105.62) (Bermuda) | | (B-, Caa1) | | 06/15/16 | | | 11.250 | | | | 756,000 | | |

| | 150 | | | Nordic Telephone Co. Holdings, Rule 144A,

Secured Notes (Callable 05/01/08 @ $101.00)

(Denmark)‡# | | (B, B2) | | 05/01/16 | | | 9.752 | | | | 222,438 | | |

| | | | 1,698,938 | | |

See Accompanying Notes to Financial Statements.

25

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2007

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| FOREIGN BONDS | | | |

| Telecommunication Equipment (0.2%) | | | |

| $ | 150 | | | Nortel Networks, Ltd., Rule 144A, Company

Guaranteed Notes (Canada)‡# | | (B-, B3) | | 07/15/11 | | | 9.493 | | | $ | 148,875 | | |

| Textiles & Apparel (0.1%) | | | |

| | 75 | | | IT Holding Finance SA, Rule 144A, Company

Guaranteed Notes (Luxembourg)‡ | | (CCC, B3) | | 11/15/12 | | | 9.875 | | | | 110,676 | | |

| Transportation - Excluding Air/Rail (0.6%) | | | |

| | 250 | | | Ship Finance International, Ltd., Global Company

Guaranteed Notes (Callable 12/15/08 @

$104.25) (Bermuda) | | (B+, B1) | | 12/15/13 | | | 8.500 | | | | 256,875 | | |

| | 250 | | | Stena AB, Global Senior Notes

(Callable 12/01/09 @ $103.50) (Sweden) | | (BB-, Ba3) | | 12/01/16 | | | 7.000 | | | | 247,500 | | |

| | | | 504,375 | | |

| TOTAL FOREIGN BONDS (Cost $6,663,063) | | | 6,561,778 | | |

Number of

Shares | |

| |

| |

| |

| |

| |

| COMMON STOCKS (1.0%) | | | |

| Chemicals (0.3%) | | | |

| | 9,785 | | | Huntsman Corp. | | | | | | | | | | | 257,835 | | |

| Electric - Integrated (0.4%) | | | |

| | 8,575 | | | Mirant Corp.*§ | | | | | | | | | | | 363,237 | | |

| Steel Producers/Products (0.3%) | | | |

| | 6,215 | | | WCI Steel Acquisition, Inc.* | | | | | | | | | | | 217,525 | | |

| TOTAL COMMON STOCKS (Cost $356,878) | | | 838,597 | | |

| WARRANTS (0.0%) | | | |

| Telecom - Fixed Line (0.0%) | | | |

| | 100 | | | GT Group Telecom, Inc., Rule 144A, strike price $0.00, expires 02/01/10*‡^ (Cost $2,500) | | | | | | | | | | | 0 | | |

| SHORT-TERM INVESTMENT (26.6%) | | | |

| | 22,309,276 | | | State Street Navigator Prime Portfolio§§‡‡ (Cost $22,309,276) | | | | | | | | | | | 22,309,276 | | |

| TOTAL INVESTMENTS AT VALUE (122.4%) (Cost $103,396,540) | | | 102,553,581 | | |

| LIABILITIES IN EXCESS OF OTHER ASSETS (-22.4%) | | | (18,769,471 | ) | |

| NET ASSETS (100.0%) | | $ | 83,784,110 | | |

See Accompanying Notes to Financial Statements.

26

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2007

INVESTMENT ABBREVIATIONS

MTNK = Medium Term Notes, Series K

NR = Not Rated

† Credit ratings given by the Standard & Poor's Division of The McGraw-Hill Companies, Inc. ("S&P") and Moody's Investors Service, Inc. ("Moody's") are unaudited.

‡ Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At October 31, 2007, these securities amounted to a value of $15,230,312 or 18.2% of net assets.

^ Not readily marketable security; security is valued at fair value as determined in good faith by, or under the direction of, the Board of Trustees.

# Variable rate obligations — The interest rate shown is the rate as of October 31, 2007.

+ Step Bond — The interest rate stated is as of October 31, 2007 and will reset at a future date.

ø Bond is currently in default.

* Non-income producing security.

1 Par value of security held is less than 1,000.

§ Security or portion thereof is out on loan.

§§ Represents security purchased with cash collateral received for securities on loan.

‡‡ Collateral segregated for swap contracts.

See Accompanying Notes to Financial Statements.

27

Credit Suisse High Income Fund

Statement of Assets and Liabilities

October 31, 2007

| Assets | |

Investments at value, including collateral for securities on loan of $22,309,276

(Cost $103,396,540) (Note 2) | | $ | 102,553,5811 | | |

| Foreign currency at value (cost $61) | | | 62 | | |

| Receivable for fund shares sold | | | 3,088,608 | | |

| Interest receivable | | | 1,911,919 | | |