UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-09054 |

|

CREDIT SUISSE OPPORTUNITY FUNDS |

(Exact name of registrant as specified in charter) |

|

Eleven Madison Avenue, New York, New York | | 10010 |

(Address of principal executive offices) | | (Zip code) |

|

J. Kevin Gao, Esq. Credit Suisse Opportunity Funds Eleven Madison Avenue New York, New York 10010 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (212) 325-2000 | |

|

Date of fiscal year end: | October 31st | |

|

Date of reporting period: | November 1, 2007 to October 31, 2008 | |

| | | | | | | | | |

Item 1. Reports to Stockholders.

CREDIT SUISSE FUNDS

Annual Report

October 31, 2008

n CREDIT SUISSE

HIGH INCOME FUND

The Fund's investment objectives, risks, charges and expenses (which should be considered carefully before investing), and more complete information about the Fund, are provided in the Prospectus, which should be read carefully before investing. You may obtain additional copies by calling 800-927-2874 or by writing to Credit Suisse Funds, P.O. Box 55030, Boston, MA 02205-5030.

Credit Suisse Asset Management Securities, Inc., Distributor, is located at Eleven Madison Avenue, New York, NY 10010. Credit Suisse Funds are advised by Credit Suisse Asset Management, LLC.

Investors in the Credit Suisse Funds should be aware that they may be eligible to purchase Common Class and/or Advisor Class shares (where offered) directly or through certain intermediaries. Such shares are not subject to a sales charge but may be subject to an ongoing service and distribution fee of up to 0.50% of average daily net assets. Investors in the Credit Suisse Funds should also be aware that they may be eligible for a reduction or waiver of the sales charge with respect to Class A, B or C shares (where offered). For more information, please review the relevant prospectuses or consult your financial representative.

The views of the Fund's management are as of the date of the letter and Fund holdings described in this document are as of October 31, 2008; these views and Fund holdings may have changed subsequent to these dates. Nothing in this document is a recommendation to purchase or sell securities.

Fund shares are not deposits or other obligations of Credit Suisse Asset Management, LLC ("Credit Suisse") or any affiliate, are not FDIC-insured and are not guaranteed by Credit Suisse or any affiliate. Fund investments are subject to investment risks, including loss of your investment.

Credit Suisse High Income Fund

Annual Investment Adviser's Report

October 31, 2008 (unaudited)

December 10, 2008

Dear Shareholder:

Performance Summary

11/1/07 – 10/31/08

| Fund & Benchmark | | Performance | |

| Common Class1 | | | (26.98 | )% | |

| Class A1, 2 | | | (27.08 | )% | |

| Class B1, 2 | | | (27.77 | )% | |

| Class C1, 2 | | | (27.72 | )% | |

| Merrill Lynch US High-Yield Master II Constrained Index3 | | | (26.23 | )% | |

Performance shown for the Fund's Class A, Class B and Class C shares do not reflect sales charges which are a maximum of 4.75%, 4.00% and 1.00%, respectively.2

Market Review: Spreads widen to record levels

For the twelve months ended October 31, 2008, credit markets, including high yield, continued to be volatile. Concerns over subprime mortgages and shelved leveraged buyout deals in 2007 expanded to become questions on overall credit conditions.

The market experienced significant sell-offs in September and October of this year as financial market weakness deepened and losses were experienced across the board from equities to bonds. According to Merrill Lynch, roughly half of the global asset indexes they track posted their worst-ever returns during the month of October. The high yield sector was no exception as the Merrill Lynch US High Yield Master II Constrained Index posted unprecedented losses of -8.11% and -16.46% for September and October, respectively. All told, the Merrill Lynch US High Yield Master II Constrained benchmark posted returns of -26.23% for the annual period ended in October.

High yield spreads widened 1127 basis points versus the Treasury market, and ended the year at +1567 bps, the widest-ever month-end spread level in the history of the Merrill Lynch index. Yields ended the period at 18.80%.

Securities in all ratings classes posted negative returns during the twelve month period ended October 31, 2008. CCC-rated securities continued to underperform, returning -36.62% for the period, while BB-rated securities outperformed the broad market, despite returning -21.79%.

Corporate bond default rates, as reported by Moody's Investor Services, rose from 1.07% to 2.82%. In conjunction with high yield spreads, the Merrill Lynch distress ratio (defined as a proportion of bonds trading over 1,000 bps) also increased, reaching 71.8%. Finally, in the most recent Federal Loan

1

Credit Suisse High Income Fund

Annual Investment Adviser's Report (continued)

October 31, 2008 (unaudited)

Officers Survey, the net percentage of respondents reporting tightening standards increased to 74.5% for small companies, and 83.6% for large and medium size firms.

Strategic Review and Outlook: We will remain selective going forward

For the annual period ended October 31, 2008, the Fund's Common share class slightly underperformed the benchmark. Superior security selection in consumer products and an underweight in the banking sector contributed to returns. Conversely, holdings in auto loans, buildings & construction and gaming hurt relative returns.

Recent market conditions were characterized by unprecedented volatility as valuation considerations continued to take a backseat to the unwinding of risk positions across the financial markets. Additionally, while valuations have certainly become more attractive, the process of recapitalizing banks and brokers will take some time. Furthermore, uncertainty over this process has weighed heavily on the global macroeconomic environment.

While we believe recent policy initiatives should ultimately help to stabilize the financial markets, we expect conditions to stay volatile as liquidity remains limited and balance sheet repair continues. Going forward, we anticipate that our portfolio strategy will remain selective — paring back riskier issuers where possible and conserving cash. We remain relatively positive on several issuers in the industrial and commercial space sectors. In contrast, we remain cautious with respect to consumer-driven and more cyclical industries, and have sought to limit our exposures in those sectors.

The Credit Suisse High Yield Management Team

Martha Metcalf

Wing Chan

High yield bonds are lower-quality bonds that are also known as "junk bonds." Such bonds entail greater risks than those found in higher-rated securities.

In addition to historical information, this report contains forward-looking statements that may concern, among other things, domestic and foreign market, industry and economic trends and developments and government regulation and their potential impact on the Fund's investments. These statements are subject to risks and uncertainties and actual trends, developments and regulations in the future, and their impact on the Fund could be materially different from those projected, anticipated or implied. The Fund has no obligation to update or revise forward-looking statements.

2

Credit Suisse High Income Fund

Annual Investment Adviser's Report (continued)

October 31, 2008 (unaudited)

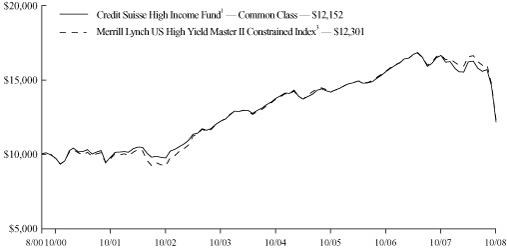

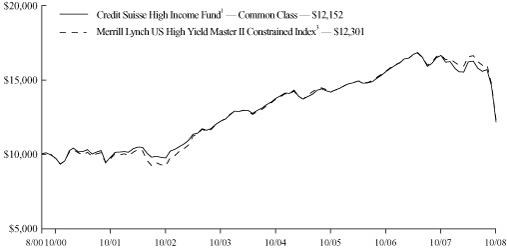

Comparison of Change in Value of $10,000 Investment in the

Credit Suisse High Income Fund1 Common Class shares and the

Merrill Lynch US High Yield Master II Constrained

Index3 from Inception (08/01/00).

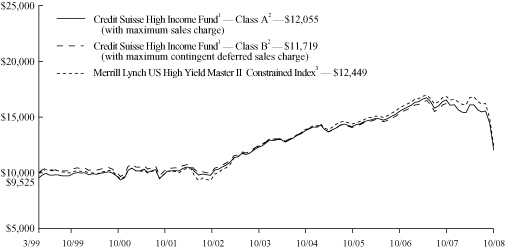

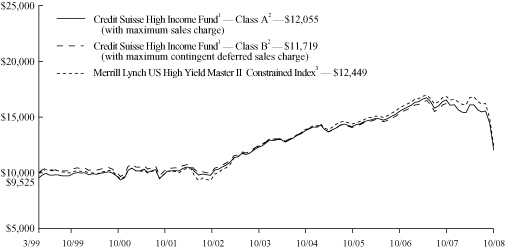

Comparison of Change in Value of $10,000 Investment in the

Credit Suisse High Income Fund1 Class A shares2, Class B

shares2 and the Merrill Lynch US High Yield Master II Constrained

Index3 from Inception (03/08/99).

3

Credit Suisse High Income Fund

Annual Investment Adviser's Report (continued)

October 31, 2008 (unaudited)

Comparison of Change in Value of $10,000 Investment in the

Credit Suisse High Income Fund1 Class C shares2 and the

Merrill Lynch US High Yield Master II Constrained

Index3 from Inception (02/28/00).

Average Annual Returns as of September 30, 20081

| | | 1 Year | | 5 Years | | Since

Inception | |

| Common Class | | | (11.48 | )% | | | 3.98 | % | | | 4.74 | % | |

| Class A Without Sales Charge | | | (11.78 | )% | | | 3.74 | % | | | 4.47 | % | |

| Class A With Maximum Sales Charge | | | (15.95 | )% | | | 2.73 | % | | | 3.94 | % | |

| Class B Without CDSC | | | (12.32 | )% | | | 2.98 | % | | | 3.66 | % | |

| Class B With CDSC | | | (15.46 | )% | | | 2.98 | % | | | 3.66 | % | |

| Class C Without CDSC | | | (12.29 | )% | | | 2.99 | % | | | 3.60 | % | |

| Class C With CDSC | | | (13.08 | )% | | | 2.99 | % | | | 3.60 | % | |

4

Credit Suisse High Income Fund

Annual Investment Adviser's Report (continued)

October 31, 2008 (unaudited)

Average Annual Returns as of October 31, 20081

| | | 1 Year | | 5 Years | | Since

Inception | |

| Common Class | | | (26.98 | )% | | | (0.11 | )% | | | 2.39 | % | |

| Class A Without Sales Charge | | | (27.08 | )% | | | (0.35 | )% | | | 2.47 | % | |

| Class A With Maximum Sales Charge | | | (30.52 | )% | | | (1.31 | )% | | | 1.96 | % | |

| Class B Without CDSC | | | (27.77 | )% | | | (1.12 | )% | | | 1.66 | % | |

| Class B With CDSC | | | (30.35 | )% | | | (1.12 | )% | | | 1.66 | % | |

| Class C Without CDSC | | | (27.72 | )% | | | (1.11 | )% | | | 1.38 | % | |

| Class C With CDSC | | | (28.37 | )% | | | (1.11 | )% | | | 1.38 | % | |

Returns represent past performance and include change in share price and reinvestment of dividends and capital gains. Past performance cannot guarantee future results. The current performance of the Fund may be lower or higher than the figures shown. Returns and share price will fluctuate, and redemption value may be more or less than original cost. The performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance information current to the most recent month-end is available at www.credit-suisse.com/us.

The annualized gross expense ratios are 1.31% for Common Class shares, 1.57% for Class A shares, 2.32% for Class B shares, and 2.31% for Class C shares. The annualized net expense ratios after fee waivers and/or expense reimbursements are 0.85% for Common Class shares, 1.10% for Class A shares, 1.85% for Class B shares, and 1.85% for Class C shares.

1 Fee waivers and/or expense reimbursements may reduce expenses for the Fund, without which performance would be lower. Waivers and/or reimbursements may be discontinued at any time.

2 Total return for the Fund's Class A shares for the reporting period, based on offering price (including maximum sales charge of 4.75%), was -30.52%. Total return for the Fund's Class B shares for the reporting period, based on redemption value (including maximum contingent deferred sales charge of 4%), was -30.35%. Total return for the Fund's Class C shares for the reporting period, based on redemption value (including maximum contingent deferred sales charge of 1%), was -28.37%.

3 The Merrill Lynch US High Yield Master II Constrained Index is an unmanaged index that tracks the performance of below investment-grade U.S. dollar-denominated corporate bonds issued in the U.S. domestic market, where each issuer's allocation is limited to 2% of the index. Investors cannot invest directly in an index.

5

Credit Suisse High Income Fund

Annual Investment Adviser's Report (continued)

October 31, 2008 (unaudited)

Information About Your Fund's Expenses

As an investor of the Fund, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees, distribution and service (12b-1) fees and other Fund expenses. Examples of transaction costs include sales charges (loads), redemption fees and account maintenance fees, which are not shown in this section and which would result in higher total expenses. The following table is intended to help you understand your ongoing expenses of investing in the Fund and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. The table is based on an investment of $1,000 made at the beginning of the six month period ended October 31, 2008.

The table illustrates your Fund's expenses in two ways:

• Actual Fund Return. This helps you estimate the actual dollar amount of ongoing expenses paid on a $1,000 investment in the Fund using the Fund's actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the "Expenses Paid per $1,000" line under the share class you hold.

• Hypothetical 5% Fund Return. This helps you to compare your Fund's ongoing expenses with those of other mutual funds using the Fund's actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs, such as sales charges (loads) or redemption fees. If these transaction costs had been included, your costs would have been higher. The "Expenses Paid per $1,000" line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expenses of owning different funds.

6

Credit Suisse High Income Fund

Annual Investment Adviser's Report (continued)

October 31, 2008 (unaudited)

Expenses and Value for a $1,000 Investment

for the six month period ended October 31, 2008

| Actual Fund Return | | Common

Class | | Class A | | Class B | | Class C | |

| Beginning Account Value 5/1/08 | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | |

| Ending Account Value 10/31/08 | | $ | 749.70 | | | $ | 749.60 | | | $ | 745.20 | | | $ | 746.70 | | |

| Expenses Paid per $1,000* | | $ | 3.74 | | | $ | 4.84 | | | $ | 8.12 | | | $ | 8.12 | | |

| Hypothetical 5% Fund Return | |

| Beginning Account Value 5/1/08 | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | |

| Ending Account Value 10/31/08 | | $ | 1,020.86 | | | $ | 1,019.61 | | | $ | 1,015.84 | | | $ | 1,015.84 | | |

| Expenses Paid per $1,000* | | $ | 4.32 | | | $ | 5.58 | | | $ | 9.37 | | | $ | 9.37 | | |

| | | Common

Class | | Class A | | Class B | | Class C | |

| Annualized Expense Ratios* | | | 0.85 | % | | | 1.10 | % | | | 1.85 | % | | | 1.85 | % | |

* Expenses are equal to the Fund's annualized expense ratio for each share class, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year period, then divided by 366.

The "Expenses Paid per $1,000" and the "Annualized Expense Ratios" in the tables are based on actual expenses paid by the Fund during the period, net of fee waivers and/or expense reimbursements. If those fee waivers and/or expense reimbursements had not been in effect, the Fund's actual expenses would have been higher.

For more information, please refer to the Fund's prospectus.

7

Credit Suisse High Income Fund

Annual Investment Adviser's Report (continued)

October 31, 2008 (unaudited)

Credit Quality Breakdown*

Ratings

S&P | |

| BBB | | | 2.5 | % | |

| BB | | | 31.1 | % | |

| B | | | 49.5 | % | |

| CCC | | | 14.3 | % | |

| CC | | | 0.1 | % | |

| D | | | 0.3 | % | |

| NR | | | 0.4 | % | |

| Subtotal | | | 98.2 | % | |

| Short-Term Investments | | | 1.8 | % | |

| Total | | | 100.0 | % | |

* Expressed as a percentage of total investments (excluding securities lending collateral if applicable) and may vary over time.

8

Credit Suisse High Income Fund

Schedule of Investments

October 31, 2008

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS (89.1%) | | | |

| Aerospace & Defense (2.1%) | | | |

| $ | 200 | | | BE Aerospace, Inc., Senior Unsecured Notes

(Callable 07/01/13 @ $104.25) | | (BB+, Ba3) | | 07/01/18 | | | 8.500 | | | $ | 172,500 | | |

| | 50 | | | DRS Technologies, Inc., Company Guaranteed

Notes (Callable 02/01/11 @ $103.81) | | (BBB-, B3) | | 02/01/18 | | | 7.625 | | | | 49,750 | | |

| | 50 | | | DRS Technologies, Inc., Global

Senior Subordinated Notes

(Callable 12/08/08 @ $103.44) | | (BBB-, B3) | | 11/01/13 | | | 6.875 | | | | 49,750 | | |

| | 175 | | | Hawker Beechcraft Acquisition Co.,

Global Company Guaranteed Notes

(Callable 04/01/12 @ $104.88) | | (B-, Caa1) | | 04/01/17 | | | 9.750 | | | | 98,875 | | |

| | 150 | | | Hawker Beechcraft Acquisition Co., Series WI,

Global Senior Unsecured Notes

(Callable 04/01/11 @ $104.25) | | (B-, B3) | | 04/01/15 | | | 8.500 | | | | 90,750 | | |

| | 50 | | | Hexcel Corp., Global Senior Subordinated Notes

(Callable 02/01/10 @ $103.38) | | (B+, B1) | | 02/01/15 | | | 6.750 | | | | 38,250 | | |

| | 300 | | | L-3 Communications Corp., Global

Senior Subordinated Notes

(Callable 01/15/10 @ $102.94) | | (BB+, Ba3) | | 01/15/15 | | | 5.875 | | | | 247,500 | | |

| | 175 | | | TransDigm, Inc., Global Company Guaranteed

Notes (Callable 07/15/09 @ $105.81) | | (B-, B3) | | 07/15/14 | | | 7.750 | | | | 140,875 | | |

| | | | 888,250 | | |

| Agriculture (0.2%) | | | |

| | 100 | | | Southern States Cooperative, Inc., Rule 144A,

Senior Notes (Callable 11/01/08 @ $104.00)‡ | | (B-, B3) | | 11/01/10 | | | 11.000 | | | | 96,500 | | |

| Auto Loans (3.9%) | | | |

| | 275 | | | Ford Motor Credit Co. LLC, Global Senior

Unsecured Notes | | (B-, B2) | | 06/15/10 | | | 7.875 | | | | 184,828 | | |

| | 750 | | | Ford Motor Credit Co. LLC, Global Senior

Unsecured Notes | | (B-, B2) | | 10/01/13 | | | 7.000 | | | | 415,836 | | |

| | 175 | | | Ford Motor Credit Co. LLC, Senior

Unsecured Notes | | (B-, B2) | | 12/15/16 | | | 8.000 | | | | 95,959 | | |

| | 1,225 | | | GMAC LLC, Debentures

(Callable 12/08/08 @ $100.00) | | (B-, Caa1) | | 04/01/11 | | | 6.000 | | | | 690,416 | | |

| | 275 | | | GMAC LLC, Senior Unsecured Notes | | (B-, Caa1) | | 03/02/11 | | | 7.250 | | | | 169,307 | | |

| | 185 | | | GMAC LLC, Senior Unsecured Notes | | (B-, Caa1) | | 12/01/14 | | | 6.750 | | | | 93,521 | | |

| | | | 1,649,867 | | |

| Auto Parts & Equipment (1.8%) | | | |

| | 225 | | | Altra Industrial Motion, Inc., Global Senior

Secured Notes (Callable 12/01/08 @ $104.50) | | (B+, B1) | | 12/01/11 | | | 9.000 | | | | 203,625 | | |

| | 100 | | | American Axle & Manufacturing, Inc., Company

Guaranteed Notes (Callable 03/01/12 @ $103.94) | | (B, B2) | | 03/01/17 | | | 7.875 | | | | 31,500 | | |

| | 225 | | | Goodyear Tire & Rubber Co., Global Senior

Unsecured Notes (Callable 07/01/10 @ $104.50) | | (BB-, Ba3) | | 07/01/15 | | | 9.000 | | | | 180,000 | | |

See Accompanying Notes to Financial Statements.

9

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2008

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Auto Parts & Equipment | | | |

| $ | 150 | | | Lear Corp., Series B, Global Company Guaranteed

Notes (Callable 12/01/10 @ $104.25) | | (B-, B3) | | 12/01/13 | | | 8.500 | | | $ | 57,750 | | |

| | 215 | | | Stanadyne Corp., Series 1, Global

Senior Subordinated Notes

(Callable 08/15/09 @ $105.00) | | (B-, B3) | | 08/15/14 | | | 10.000 | | | | 166,625 | | |

| | 150 | | | Tenneco, Inc., Global Company Guaranteed Notes

(Callable 11/15/09 @ $104.31) | | (B, B3) | | 11/15/14 | | | 8.625 | | | | 71,625 | | |

| | 24 | | | Visteon Corp., Global Senior Unsecured Notes | | (CCC+, Caa2) | | 08/01/10 | | | 8.250 | | | | 14,040 | | |

| | 60 | | | Visteon Corp., Rule 144A, Senior Unsecured

Notes (Callable 12/31/13 @ $105.00)‡ | | (CCC+, Caa1) | | 12/31/16 | | | 12.250 | | | | 20,700 | | |

| | | | 745,865 | | |

| Automotive (0.9%) | | | |

| | 395 | | | Ford Motor Co., Global Senior Unsecured Notes | | (CCC, Caa1) | | 07/16/31 | | | 7.450 | | | | 126,400 | | |

| | 200 | | | General Motors Corp., Global Senior

Unsecured Notes | | (B-, Caa3) | | 01/15/11 | | | 7.200 | | | | 81,500 | | |

| | 425 | | | General Motors Corp., Senior Unsecured Notes | | (B-, Caa3) | | 07/15/13 | | | 7.125 | | | | 145,563 | | |

| | 125 | | | General Motors Corp., Senior Unsecured Notes | | (B-, Caa3) | | 07/15/33 | | | 8.375 | | | | 41,250 | | |

| | | | 394,713 | | |

| Beverages (0.5%) | | | |

| | 250 | | | Constellation Brands, Inc., Company

Guaranteed Notes | | (BB-, Ba3) | | 09/01/16 | | | 7.250 | | | | 208,750 | | |

| Brokerage (0.5%) | | | |

| | 300 | | | E*TRADE Financial Corp., Senior Unsecured

Notes (Callable 12/01/10 @ $103.94) | | (B, Ba3) | | 12/01/15 | | | 7.875 | | | | 193,500 | | |

| Building & Construction (1.3%) | | | |

| | 325 | | | Ashton Woods USA/Finance, Global Company

Guaranteed Notes (Callable 10/01/10 @ $104.75)ø | | (D, C) | | 10/01/15 | | | 9.500 | | | | 66,625 | | |

| | 275 | | | Beazer Homes USA, Inc., Global Company

Guaranteed Notes (Callable 11/24/08 @ $102.79) | | (B-, B3) | | 04/15/12 | | | 8.375 | | | | 149,875 | | |

| | 350 | | | K Hovnanian Enterprises, Inc., Global Company

Guaranteed Notes | | (CCC, Caa1) | | 01/15/16 | | | 6.250 | | | | 106,750 | | |

| | 250 | | | KB HOME, Company Guaranteed Notes | | (BB, Ba2) | | 06/15/15 | | | 6.250 | | | | 167,500 | | |

| | 275 | | | William Lyon Homes, Inc., Global Company

Guaranteed Notes (Callable 02/15/09 @ $103.75) | | (CCC+, Caa2) | | 02/15/14 | | | 7.500 | | | | 61,875 | | |

| | | | 552,625 | | |

| Building Materials (1.3%) | | | |

| | 100 | | | Building Materials Corp. of America,

Global Secured Notes

(Callable 08/01/09 @ $103.88) | | (B+, B3) | | 08/01/14 | | | 7.750 | | | | 69,500 | | |

| | 225 | | | Coleman Cable, Inc., Global Company Guaranteed

Notes (Callable 12/08/08 @ $104.94) | | (B+, B2) | | 10/01/12 | | | 9.875 | | | | 161,438 | | |

| | 175 | | | Norcraft Cos. LP, Global Company Guaranteed

Notes (Callable 11/01/08 @ $102.25) | | (B+, B1) | | 11/01/11 | | | 9.000 | | | | 153,125 | | |

See Accompanying Notes to Financial Statements.

10

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2008

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Building Materials | | | |

| $ | 175 | | | Nortek, Inc., Global Senior Subordinated Notes

(Callable 09/01/09 @ $104.25) | | (CCC, Caa1) | | 09/01/14 | | | 8.500 | | | $ | 63,875 | | |

| | 25 | | | Ply Gem Industries, Inc., Global Company

Guaranteed Notes (Callable 02/15/09 @ $102.25)§ | | (CCC+, Caa2) | | 02/15/12 | | | 9.000 | | | | 8,875 | | |

| | 125 | | | Ply Gem Industries, Inc., Global Senior Secured

Notes (Callable 04/01/11 @ $105.88) | | (B, B2) | | 06/15/13 | | | 11.750 | | | | 83,125 | | |

| | | | 539,938 | | |

| Chemicals (3.0%) | | | |

| | 25 | | | Airgas, Inc., Rule 144A, Company Guaranteed

Notes (Callable 10/01/13 @ $103.56)‡ | | (BB+, Ba2) | | 10/01/18 | | | 7.125 | | | | 20,687 | | |

| | 325 | | | Chemtura Corp., Company Guaranteed Notes | | (BB, Ba2) | | 06/01/16 | | | 6.875 | | | | 204,750 | | |

| | 250 | | | Koppers Holdings, Inc., Global Senior Discount

Notes (Callable 11/15/09 @ $104.94)+ | | (B-, B2) | | 11/15/14 | | | 0.000 | | | | 201,250 | | |

| | 200 | | | Momentive Performance Materials, Inc.,

Global Company Guaranteed Notes

(Callable 12/01/10 @ $104.88) | | (B, B3) | | 12/01/14 | | | 9.750 | | | | 113,000 | | |

| | 250 | | | Momentive Performance Materials, Inc.,

Global Company Guaranteed Notes

(Callable 12/01/11 @ $105.75)§ | | (CCC+, Caa2) | | 12/01/16 | | | 11.500 | | | | 108,750 | | |

| | 250 | | | Nalco Finance Holdings, Inc., Global Senior

Discounted Notes

(Callable 02/01/09 @ $104.50)+§ | | (B, B3) | | 02/01/14 | | | 0.000 | | | | 201,250 | | |

| | 200 | | | PolyOne Corp., Senior Unsecured Notes | | (B+, B1) | | 05/01/12 | | | 8.875 | | | | 158,000 | | |

| | 150 | | | Reichhold Industries, Inc., Rule 144A, Senior

Notes (Callable 08/15/10 @ $104.50)‡ | | (B+, B2) | | 08/15/14 | | | 9.000 | | | | 131,250 | | |

| | 175 | | | Terra Capital, Inc., Series B, Global Company

Guaranteed Notes (Callable 02/01/12 @ $103.50) | | (BB, B1) | | 02/01/17 | | | 7.000 | | | | 149,625 | | |

| | | | 1,288,562 | | |

| Computer Hardware (0.4%) | | | |

| | 250 | | | Activant Solutions, Inc., Global Company

Guaranteed Notes (Callable 05/01/11 @ $104.75) | | (CCC+, Caa1) | | 05/01/16 | | | 9.500 | | | | 153,750 | | |

| Consumer Products (1.4%) | | | |

| | 200 | | | AAC Group Holding Corp., Rule 144A, Senior

Unsecured Notes (Callable 12/08/08 @ $105.13)‡ | | (CCC+, Caa1) | | 10/01/12 | | | 10.250 | | | | 191,000 | | |

| | 250 | | | Amscan Holdings, Inc., Global Senior Subordinated

Notes (Callable 05/01/09 @ $104.38) | | (CCC+, Caa1) | | 05/01/14 | | | 8.750 | | | | 163,750 | | |

| | 150 | | | Jarden Corp., Company Guaranteed Notes

(Callable 05/01/12 @ $103.75) | | (B, B3) | | 05/01/17 | | | 7.500 | | | | 112,500 | | |

| | 150 | | | Prestige Brands, Inc., Global Senior Subordinated

Notes (Callable 11/10/08 @ $104.63) | | (B-, B3) | | 04/15/12 | | | 9.250 | | | | 140,250 | | |

| | | | 607,500 | | |

See Accompanying Notes to Financial Statements.

11

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2008

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Consumer/Commercial/Lease Financing (0.1%) | | | |

| $ | 180 | | | Residential Capital LLC, Rule 144A, Secured

Notes (Callable 05/15/10 @ $104.81)‡ | | (CCC-, Ca) | | 05/15/15 | | | 9.625 | | | $ | 45,900 | | |

| Diversified Capital Goods (1.9%) | | | |

| | 125 | | | Actuant Corp., Global Company Guaranteed

Notes (Callable 06/15/12 @ $103.44) | | (BB-, Ba2) | | 06/15/17 | | | 6.875 | | | | 107,500 | | |

| | 150 | | | Esco Corp., Rule 144A, Company Guaranteed

Notes (Callable 12/15/10 @ $104.31)‡ | | (B, B2) | | 12/15/13 | | | 8.625 | | | | 120,750 | | |

| | 175 | | | RBS Global & Rexnord Corp., Global Company

Guaranteed Notes (Callable 08/01/10 @ $104.75) | | (B-, B3) | | 08/01/14 | | | 9.500 | | | | 121,625 | | |

| | 150 | | | Sensus Metering Systems, Global Senior

Subordinated Notes

(Callable 12/15/08 @ $104.31) | | (B-, B3) | | 12/15/13 | | | 8.625 | | | | 123,750 | | |

| | 75 | | | SPX Corp., Rule 144A, Senior Notes‡ | | (BB, Ba2) | | 12/15/14 | | | 7.625 | | | | 63,094 | | |

| | 150 | | | Titan International, Inc., Global Company

Guaranteed Notes | | (B-, Caa1) | | 01/15/12 | | | 8.000 | | | | 134,250 | | |

| | 209 | | | TriMas Corp., Global Company Guaranteed Notes

(Callable 12/08/08 @ $103.29) | | (B-, B3) | | 06/15/12 | | | 9.875 | | | | 115,995 | | |

| | | | 786,964 | | |

| Electric - Generation (8.0%) | | | |

| | 300 | | | Dynegy Holdings, Inc., Global Senior

Unsecured Notes | | (B, B2) | | 06/01/15 | | | 7.500 | | | | 220,500 | | |

| | 475 | | | Dynegy Holdings, Inc., Global Senior

Unsecured Notes | | (B, B2) | | 05/01/16 | | | 8.375 | | | | 353,875 | | |

| | 175 | | | Edison Mission Energy, Global Senior

Unsecured Notes | | (BB-, B1) | | 05/15/17 | | | 7.000 | | | | 139,344 | | |

| | 417 | | | Midwest Generation LLC, Series B, Global Pass

Thru Certificates | | (BB+, Baa3) | | 01/02/16 | | | 8.560 | | | | 372,530 | | |

| | 200 | | | Mirant Americas Generation LLC, Senior

Unsecured Notes | | (B-, B3) | | 10/01/21 | | | 8.500 | | | | 141,000 | | |

| | 89 | | | Mirant Mid Atlantic LLC, Series B, Global Pass

Thru Certificates | | (BB, Ba1) | | 06/30/17 | | | 9.125 | | | | 80,508 | | |

| | 225 | | | NRG Energy, Inc., Company Guaranteed Notes

(Callable 01/15/12 @ $103.69) | | (B, B1) | | 01/15/17 | | | 7.375 | | | | 195,187 | | |

| | 275 | | | NRG Energy, Inc., Company Guaranteed Notes

(Callable 02/01/10 @ $103.63) | | (B, B1) | | 02/01/14 | | | 7.250 | | | | 241,312 | | |

| | 175 | | | Reliant Energy, Inc., Senior Unsecured Notes | | (B+, B1) | | 06/15/14 | | | 7.625 | | | | 135,625 | | |

| | 1,175 | | | Texas Competitive Electric Holdings Co. LLC,

Series A, Rule 144A, Company Guaranteed

Notes (Callable 11/01/11 @ $105.13)‡ | | (CCC, B3) | | 11/01/15 | | | 10.250 | | | | 901,812 | | |

| | 200 | | | Texas Competitive Electric Holdings Co. LLC,

Series B, Rule 144A, Company Guaranteed

Notes (Callable 11/01/11 @ $105.13)‡ | | (CCC, B3) | | 11/01/15 | | | 10.250 | | | | 153,500 | | |

| | 600 | | | The AES Corp., Global Senior Unsecured Notes | | (BB-, B1) | | 10/15/17 | | | 8.000 | | | | 465,000 | | |

| | | | 3,400,193 | | |

See Accompanying Notes to Financial Statements.

12

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2008

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Electric - Integrated (0.5%) | | | |

| $ | 100 | | | CMS Energy Corp., Senior Unsecured Notes | | (BB, Ba1) | | 07/17/17 | | | 6.550 | | | $ | 77,201 | | |

| | 125 | | | PNM Resources, Inc., Unsecured Notes | | (BB-, Ba2) | | 05/15/15 | | | 9.250 | | | | 103,125 | | |

| | 50 | | | Public Service Company of New Mexico,

Senior Unsecured Notes | | (BB+, Baa3) | | 05/15/18 | | | 7.950 | | | | 40,857 | | |

| | | | 221,183 | | |

| Electronics (1.6%) | | | |

| | 250 | | | Amkor Technology, Inc., Global Senior Notes

(Callable 12/08/08 @ $103.88) | | (B+, B1) | | 05/15/13 | | | 7.750 | | | | 155,938 | | |

| | 425 | | | Freescale Semiconductor, Inc., Global Company

Guaranteed Notes (Callable 12/15/10 @ $104.44) | | (B-, B2) | | 12/15/14 | | | 8.875 | | | | 191,250 | | |

| | 50 | | | Jabil Circuit, Inc., Global Senior Unsecured Notes | | (BB+, Ba1) | | 03/15/18 | | | 8.250 | | | | 38,250 | | |

| | 140 | | | Sanmina-SCI Corp., Global Company Guaranteed

Notes (Callable 03/01/09 @ $103.38) | | (B-, B3) | | 03/01/13 | | | 6.750 | | | | 95,900 | | |

| | 125 | | | Sanmina-SCI Corp., Senior Subordinated Notes

(Callable 03/01/11 @ $104.06) | | (B-, B3) | | 03/01/16 | | | 8.125 | | | | 79,375 | | |

| | 175 | | | Viasystems, Inc., Global Senior Unsecured Notes

(Callable 12/08/08 @ $105.25) | | (B+, Caa1) | | 01/15/11 | | | 10.500 | | | | 137,375 | | |

| | | | 698,088 | | |

| Energy - Exploration & Production (5.7%) | | | |

| | 225 | | | Berry Petroleum Co., Senior Subordinated Notes

(Callable 11/01/11 @ $104.13) | | (B+, B3) | | 11/01/16 | | | 8.250 | | | | 149,625 | | |

| | 175 | | | Chaparral Energy, Inc., Global Company

Guaranteed Notes (Callable 02/01/12 @ $104.44) | | (B-, Caa1) | | 02/01/17 | | | 8.875 | | | | 90,125 | | |

| | 125 | | | Chesapeake Energy Corp., Company

Guaranteed Notes | | (BB, Ba3) | | 12/15/18 | | | 7.250 | | | | 95,000 | | |

| | 500 | | | Chesapeake Energy Corp., Global Company

Guaranteed Notes (Callable 01/15/09 @ $103.44) | | (BB, Ba3) | | 01/15/16 | | | 6.875 | | | | 403,750 | | |

| | 225 | | | Encore Acquisition Co., Company Guaranteed

Notes (Callable 12/01/10 @ $103.63) | | (B, B1) | | 12/01/17 | | | 7.250 | | | | 149,062 | | |

| | 225 | | | Forest Oil Corp., Global Company Guaranteed

Notes (Callable 06/15/12 @ $103.63) | | (B+, B1) | | 06/15/19 | | | 7.250 | | | | 154,125 | | |

| | 25 | | | Forest Oil Corp., Rule 144A, Company Guaranteed

Notes (Callable 06/15/12 @ $103.63)‡ | | (B+, B1) | | 06/15/19 | | | 7.250 | | | | 17,125 | | |

| | 200 | | | Hilcorp Energy I, Rule 144A, Senior Unsecured

Notes (Callable 06/01/11 @ $104.50)‡ | | (BB-, B3) | | 06/01/16 | | | 9.000 | | | | 147,000 | | |

| | 125 | | | Mariner Energy, Inc., Company Guaranteed

Notes (Callable 05/15/12 @ $104.00) | | (B+, B3) | | 05/15/17 | | | 8.000 | | | | 74,375 | | |

| | 150 | | | Newfield Exploration Co., Global Senior

Subordinated Notes

(Callable 05/15/13 @ $103.56) | | (BB-, Ba3) | | 05/15/18 | | | 7.125 | | | | 106,688 | | |

| | 350 | | | Petrohawk Energy Corp., Global Company

Guaranteed Notes (Callable 07/15/10 @ $104.56) | | (B, B3) | | 07/15/13 | | | 9.125 | | | | 271,250 | | |

| | 175 | | | Plains Exploration & Production Co., Company

Guaranteed Notes (Callable 06/15/11 @ $103.88) | | (BB, B1) | | 06/15/15 | | | 7.750 | | | | 128,625 | | |

See Accompanying Notes to Financial Statements.

13

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2008

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Energy - Exploration & Production | | | |

| $ | 50 | | | Range Resources Corp., Company Guaranteed

Notes (Callable 05/01/13 @ $103.63) | | (BB, Ba3) | | 05/01/18 | | | 7.250 | | | $ | 40,625 | | |

| | 200 | | | Range Resources Corp., Global Company

Guaranteed Notes (Callable 03/15/10 @ $103.19) | | (BB, Ba3) | | 03/15/15 | | | 6.375 | | | | 162,000 | | |

| | 90 | | | SandRidge Energy, Inc., Rule 144A, Senior Notes

(Callable 06/01/13 @ $104.00)‡ | | (B-, B3) | | 06/01/18 | | | 8.000 | | | | 60,300 | | |

| | 175 | | | Southwestern Energy Co., Rule 144A,

Senior Unsecured Notes‡ | | (BB+, Ba2) | | 02/01/18 | | | 7.500 | | | | 144,375 | | |

| | 275 | | | Swift Energy Co., Senior Notes

(Callable 07/15/09 @ $101.91) | | (BB-, B1) | | 07/15/11 | | | 7.625 | | | | 233,750 | | |

| | | | 2,427,800 | | |

| Environmental (1.4%) | | | |

| | 400 | | | Allied Waste North America, Inc., Global Senior

Secured Notes (Callable 03/15/10 @ $103.63) | | (BB, B1) | | 03/15/15 | | | 7.250 | | | | 358,000 | | |

| | 275 | | | Waste Services, Inc., Global Senior Subordinated

Notes (Callable 04/15/09 @ $104.75) | | (B-, Caa1) | | 04/15/14 | | | 9.500 | | | | 221,375 | | |

| | | | 579,375 | | |

| Food & Drug Retailers (1.2%) | | | |

| | 325 | | | Duane Reade, Inc., Global Company Guaranteed

Notes (Callable 08/01/09 @ $102.44)§ | | (CCC-, Caa3) | | 08/01/11 | | | 9.750 | | | | 196,625 | | |

| | 175 | | | New Albertsons, Inc., Senior Unsecured Notes | | (B+, B1) | | 05/01/13 | | | 7.250 | | | | 147,000 | | |

| | 125 | | | Stater Brothers Holdings, Inc., Global Company

Guaranteed Notes (Callable 04/15/11 @ $103.88) | | (B+, B2) | | 04/15/15 | | | 7.750 | | | | 103,125 | | |

| | 50 | | | Stater Brothers Holdings, Inc., Global Company

Guaranteed Notes (Callable 06/15/09 @ $102.03) | | (B+, B2) | | 06/15/12 | | | 8.125 | | | | 44,750 | | |

| | | | 491,500 | | |

| Food - Wholesale (0.7%) | | | |

| | 150 | | | Dole Food Co., Inc., Global Company

Guaranteed Notes | | (B-, Caa1) | | 05/01/09 | | | 8.625 | | | | 135,750 | | |

| | 25 | | | Dole Food Co., Inc., Global Company Guaranteed

Notes (Callable 12/08/08 @ $102.22) | | (B-, Caa1) | | 03/15/11 | | | 8.875 | | | | 17,375 | | |

| | 100 | | | Smithfield Foods, Inc., Senior Unsecured Notes | | (BB-, B3) | | 07/01/17 | | | 7.750 | | | | 63,500 | | |

| | 100 | | | Smithfield Foods, Inc., Series B, Global Senior

Unsecured Notes | | (BB-, B3) | | 05/15/13 | | | 7.750 | | | | 67,500 | | |

| | | | 284,125 | | |

| Forestry & Paper (2.6%) | | | |

| | 134 | | | Boise Cascade LLC, Global Company Guaranteed

Notes (Callable 10/15/09 @ $103.56) | | (BB-, B2) | | 10/15/14 | | | 7.125 | | | | 75,710 | | |

| | 225 | | | Cellu Tissue Holdings, Inc., Global Secured Notes

(Callable 03/15/09 @ $100.00) | | (B, B2) | | 03/15/10 | | | 9.750 | | | | 181,125 | | |

| | 375 | | | Georgia-Pacific Corp., Debentures | | (B+, B2) | | 06/15/15 | | | 7.700 | | | | 262,500 | | |

| | 50 | | | Georgia-Pacific Corp., Rule 144A, Company

Guaranteed Notes (Callable 01/15/12 @ $103.56)‡ | | (BB-, Ba3) | | 01/15/17 | | | 7.125 | | | | 35,000 | | |

See Accompanying Notes to Financial Statements.

14

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2008

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Forestry & Paper | | | |

| $ | 200 | | | Graphic Packaging International Corp., Global

Senior Subordinated Notes

(Callable 08/15/09 @ $103.17) | | (B-, B3) | | 08/15/13 | | | 9.500 | | | $ | 138,000 | | |

| | 175 | | | NewPage Corp., Global Company Guaranteed

Notes (Callable 05/01/09 @ $106.00) | | (B-, B2) | | 05/01/12 | | | 10.000 | | | | 119,875 | | |

| | 100 | | | NewPage Corp., Global Company Guaranteed

Notes (Callable 05/01/09 @ $106.00)§ | | (CCC+, B3) | | 05/01/13 | | | 12.000 | | | | 59,500 | | |

| | 290 | | | Smurfit-Stone Container, Global Senior Unsecured

Notes (Callable 07/01/09 @ $101.40) | | (B-, B3) | | 07/01/12 | | | 8.375 | | | | 149,350 | | |

| | 50 | | | Verso Paper Holdings LLC, Series B, Global

Company Guaranteed Notes

(Callable 08/01/11 @ $105.69) | | (CCC+, B3) | | 08/01/16 | | | 11.375 | | | | 20,250 | | |

| | 150 | | | Verso Paper Holdings LLC, Series B, Global Senior

Secured Notes (Callable 08/01/10 @ $104.56) | | (B+, B2) | | 08/01/14 | | | 9.125 | | | | 80,250 | | �� |

| | | | 1,121,560 | | |

| Gaming (3.7%) | | | |

| | 250 | | | Buffalo Thunder Development Authority, Rule 144A,

Secured Notes (Callable 12/15/10 @ $104.69)‡ | | (B, B3) | | 12/15/14 | | | 9.375 | | | | 88,750 | | |

| | 30 | | | Caesars Entertainment, Inc., Global Company

Guaranteed Notes | | (B-, Caa2) | | 03/15/10 | | | 7.875 | | | | 17,100 | | |

| | 350 | | | Caesars Entertainment, Inc., Global Company

Guaranteed Notes | | (B-, Caa2) | | 05/15/11 | | | 8.125 | | | | 126,000 | | |

| | 200 | | | CCM Merger, Inc., Rule 144A, Notes

(Callable 08/01/09 @ $104.00)‡ | | (B-, Caa1) | | 08/01/13 | | | 8.000 | | | | 119,000 | | |

| | 187 | | | Choctaw Resort Development Enterprise,

Rule 144A, Senior Notes

(Callable 11/15/11 @ $103.63)‡ | | (BB-, B1) | | 11/15/19 | | | 7.250 | | | | 107,525 | | |

| | 75 | | | FireKeepers Development Authority,

Rule 144A, Senior Secured Notes

(Callable 05/01/12 @ $110.50)‡ | | (B, B3) | | 05/01/15 | | | 13.875 | | | | 53,625 | | |

| | 150 | | | Fontainebleau Las Vegas Capital Corp.,

Rule 144A, Second Mortgage Notes

(Callable 06/15/11 @ $105.13)‡ | | (CCC, Caa1) | | 06/15/15 | | | 10.250 | | | | 21,000 | | |

| | 45 | | | Herbst Gaming, Inc., Global Company Guaranteed

Notes (Callable 06/01/09 @ $102.03)ø | | (D, C) | | 06/01/12 | | | 8.125 | | | | 450 | | |

| | 225 | | | Inn of the Mountain Gods Resort & Casino,

Global Senior Secured Notes

(Callable 11/15/08 @ $103.00) | | (B, B3) | | 11/15/10 | | | 12.000 | | | | 100,125 | | |

| | 175 | | | Jacobs Entertainment, Inc., Global Company

Guaranteed Notes (Callable 06/15/10 @ $104.88) | | (B, B3) | | 06/15/14 | | | 9.750 | | | | 76,125 | | |

| | 125 | | | Majestic Star Casino LLC, Senior Secured Notes

(Callable 10/15/09 @ $100.00)ø | | (D, Caa3) | | 10/15/10 | | | 9.500 | | | | 49,375 | | |

| | 200 | | | Mashantucket Western Pequot Tribe, Rule 144A,

Bonds (Callable 11/15/11 @ $104.25)‡ | | (BB-, Ba2) | | 11/15/15 | | | 8.500 | | | | 111,000 | | |

| | 200 | | | MGM Mirage, Inc., Company Guaranteed Notes | | (BB-, Ba3) | | 06/01/16 | | | 7.500 | | | | 119,000 | | |

See Accompanying Notes to Financial Statements.

15

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2008

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Gaming | | | |

| $ | 475 | | | MGM Mirage, Inc., Company Guaranteed Notes | | (BB-, Ba3) | | 01/15/17 | | | 7.625 | | | $ | 285,000 | | |

| | 300 | | | MGM Mirage, Inc., Global Company

Guaranteed Notes | | (BB-, Ba3) | | 04/01/13 | | | 6.750 | | | | 189,000 | | |

| | 115 | | | Tropicana Finance Corp., Global Senior

Subordinated Notes

(Callable 12/15/10 @ $104.81)ø | | (NR, NR) | | 12/15/14 | | | 9.625 | | | | 6,038 | | |

| | 45 | | | Trump Entertainment Resorts, Inc., Senior

Secured Notes (Callable 06/01/10 @ $104.25)§ | | (CCC+, Caa2) | | 06/01/15 | | | 8.500 | | | | 11,812 | | |

| | 150 | | | Wynn Las Vegas LLC, Global First Mortgage

Notes (Callable 12/01/09 @ $103.31) | | (BBB-, Ba2) | | 12/01/14 | | | 6.625 | | | | 111,375 | | |

| | | | 1,592,300 | | |

| Gas Distribution (3.6%) | | | |

| | 175 | | | AmeriGas Partners LP, Senior Unsecured Notes

(Callable 05/20/11 @ $103.56) | | (NR, Ba3) | | 05/20/16 | | | 7.125 | | | | 129,938 | | |

| | 275 | | | El Paso Corp., Senior Unsecured Notes | | (BB-, Ba3) | | 06/01/18 | | | 7.250 | | | | 207,625 | | |

| | 750 | | | El Paso Performance-Linked Trust, Rule 144A,

Senior Unsecured Notes‡ | | (BB, Ba3) | | 07/15/11 | | | 7.750 | | | | 628,540 | | |

| | 250 | | | Inergy Finance Corp., Global Company Guaranteed

Notes (Callable 03/01/11 @ $104.13) | | (B+, B1) | | 03/01/16 | | | 8.250 | | | | 193,125 | | |

| | 125 | | | MarkWest Energy Finance Corp., Series B, Global

Senior Notes (Callable 04/15/13 @ $104.38) | | (B+, B2) | | 04/15/18 | | | 8.750 | | | | 90,625 | | |

| | 200 | | | Targa Resources Partners LP, Rule 144A, Senior

Notes (Callable 07/01/12 @ $104.13)‡ | | (B, B2) | | 07/01/16 | | | 8.250 | | | | 125,000 | | |

| | 200 | | | Williams Partners LP, Global Senior

Unsecured Notes | | (BBB-, Ba2) | | 02/01/17 | | | 7.250 | | | | 159,229 | | |

| | | | 1,534,082 | | |

| Health Services (7.0%) | | | |

| | 225 | | | Bausch & Lomb, Inc., Rule 144A, Senior

Unsecured Notes (Callable 11/01/11 @ $104.94)‡ | | (B, Caa1) | | 11/01/15 | | | 9.875 | | | | 177,750 | | |

| | 100 | | | Biomet, Inc., Global Company Guaranteed Notes

(Callable 10/15/12 @ $105.00) | | (B-, B3) | | 10/15/17 | | | 10.000 | | | | 92,500 | | |

| | 100 | | | Biomet, Inc., Global Company Guaranteed Notes

(Callable 10/15/12 @ $105.81) | | (B-, Caa1) | | 10/15/17 | | | 11.625 | | | | 87,500 | | |

| | 325 | | | Community Health Systems, Inc., Global Company

Guaranteed Notes (Callable 07/15/11 @ $104.44) | | (B, B3) | | 07/15/15 | | | 8.875 | | | | 273,812 | | |

| | 175 | | | DaVita, Inc., Global Company Guaranteed Notes

(Callable 03/15/10 @ $103.63) | | (B, B2) | | 03/15/15 | | | 7.250 | | | | 150,500 | | |

| | 800 | | | HCA, Inc., Global Secured Notes

(Callable 11/15/11 @ $104.63) | | (BB-, B2) | | 11/15/16 | | | 9.250 | | | | 682,000 | | |

| | 50 | | | HCA, Inc., Global Senior Unsecured Notes | | (B-, Caa1) | | 01/15/15 | | | 6.375 | | | | 30,000 | | |

| | 150 | | | HCA, Inc., Global Senior Unsecured Notes | | (B-, Caa1) | | 02/15/16 | | | 6.500 | | | | 88,875 | | |

| | 125 | | | HCA, Inc., Senior Unsecured Notes | | (B-, Caa1) | | 10/01/12 | | | 6.300 | | | | 86,250 | | |

| | 50 | | | HCA, Inc., Senior Unsecured Notes | | (B-, Caa1) | | 02/15/13 | | | 6.250 | | | | 32,500 | | |

| | 150 | | | Healthsouth Corp., Global Company Guaranteed

Notes (Callable 06/15/11 @ $105.38) | | (CCC+, Caa1) | | 06/15/16 | | | 10.750 | | | | 136,500 | | |

See Accompanying Notes to Financial Statements.

16

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2008

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Health Services | | | |

| $ | 150 | | | OMEGA Healthcare Investors, Inc., Global Company

Guaranteed Notes (Callable 01/15/11 @ $103.50) | | (BB+, Ba3) | | 01/15/16 | | | 7.000 | | | $ | 119,625 | | |

| | 75 | | | Service Corporation International,

Global Senior Notes | | (BB-, B1) | | 10/01/18 | | | 7.625 | | | | 59,250 | | |

| | 50 | | | Service Corporation International, Global Senior

Unsecured Notes | | (BB-, B1) | | 04/01/15 | | | 6.750 | | | | 39,625 | | |

| | 175 | | | Stewart Enterprises, Inc., Global Company

Guaranteed Notes (Callable 02/15/09 @ $103.13) | | (BB-, Ba3) | | 02/15/13 | | | 6.250 | | | | 144,813 | | |

| | 500 | | | Tenet Healthcare Corp., Global Senior

Unsecured Notes | | (B, Caa1) | | 07/01/14 | | | 9.875 | | | | 411,250 | | |

| | 125 | | | Universal Hospital Services, Inc., Global Senior

Secured Notes (Callable 06/01/09 @ $102.00)# | | (B+, B3) | | 06/01/15 | | | 6.303 | | | | 85,625 | | |

| | 50 | | | Universal Hospital Services, Inc., Global Senior

Secured Notes (Callable 06/01/11 @ $104.25) | | (B+, B3) | | 06/01/15 | | | 8.500 | | | | 40,250 | | |

| | 175 | | | Vanguard Health Holding Co., Global Senior

Subordinated Notes

(Callable 10/01/09 @ $104.50) | | (CCC+, Caa1) | | 10/01/14 | | | 9.000 | | | | 146,125 | | |

| | 150 | | | VWR Funding, Inc., Series B, Global Company

Guaranteed Notes (Callable 07/15/11 @ $105.13) | | (B-, Caa1) | | 07/15/15 | | | 10.250 | | | | 90,000 | | |

| | | | 2,974,750 | | |

| Hotels (0.6%) | | | |

| | 75 | | | Host Hotels & Resorts LP, Global Senior Secured

Notes (Callable 11/01/10 @ $103.44) | | (BBB-, NR) | | 11/01/14 | | | 6.875 | | | | 56,250 | | |

| | 225 | | | Host Hotels & Resorts LP, Global Senior Secured

Notes (Callable 12/08/08 @ $103.56) | | (BBB-, Ba1) | | 11/01/13 | | | 7.125 | | | | 177,750 | | |

| | 50 | | | Host Hotels & Resorts LP, Series Q, Global Senior

Secured Notes (Callable 06/01/11 @ $103.33) | | (BBB-, Ba1) | | 06/01/16 | | | 6.750 | | | | 36,500 | | |

| | | | 270,500 | | |

| lnvestments & Misc. Financial Services (0.1%) | | | |

| | 150 | | | Nuveen Investments, Inc., Rule 144A, Senior

Notes (Callable 11/15/11 @ $105.25)‡ | | (B-, B3) | | 11/15/15 | | | 10.500 | | | | 41,250 | | |

| Leisure (0.2%) | | | |

| | 300 | | | Six Flags, Inc., Global Senior Unsecured Notes

(Callable 06/01/09 @ $104.81) | | (CCC-, Caa3) | | 06/01/14 | | | 9.625 | | | | 88,500 | | |

| Machinery (0.8%) | | | |

| | 175 | | | Baldor Electric Co., Company Guaranteed Notes

(Callable 02/15/12 @ $104.31) | | (B, B3) | | 02/15/17 | | | 8.625 | | | | 134,750 | | |

| | 125 | | | Case New Holland, Inc., Global Company

Guaranteed Notes (Callable 03/01/10 @ $103.56) | | (BBB-, Ba3) | | 03/01/14 | | | 7.125 | | | | 93,750 | | |

| | 175 | | | Terex Corp., Senior Subordinated Notes

(Callable 11/15/12 @ $104.00) | | (B+, Ba3) | | 11/15/17 | | | 8.000 | | | | 130,375 | | |

| | | | 358,875 | | |

See Accompanying Notes to Financial Statements.

17

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2008

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Media - Broadcast (1.5%) | | | |

| $ | 125 | | | Allbritton Communications Co., Global Senior

Subordinated Notes

(Callable 12/08/08 @ $103.88) | | (B, B2) | | 12/15/12 | | | 7.750 | | | $ | 85,625 | | |

| | 250 | | | Barrington Broadcasting Capital Corp., Global

Company Guaranteed Notes

(Callable 08/15/10 @ $105.25) | | (CCC-, Caa3) | | 08/15/14 | | | 10.500 | | | | 123,750 | | |

| | 100 | | | Clear Channel Communications, Inc., Senior

Unsecured Notes | | (CCC+, Caa1) | | 09/15/14 | | | 5.500 | | | | 23,000 | | |

| | 200 | | | Fisher Communications, Inc., Global Company

Guaranteed Notes (Callable 09/15/09 @ $104.31) | | (B, B2) | | 09/15/14 | | | 8.625 | | | | 180,500 | | |

| | 175 | | | Rainbow National Services LLC, Rule 144A,

Company Guaranteed Notes

(Callable 09/01/09 @ $102.19)‡ | | (BB, B1) | | 09/01/12 | | | 8.750 | | | | 154,875 | | |

| | 150 | | | Univision Communications, Inc., Rule 144A,

Senior Notes (Callable 03/15/11 @ $104.88)‡ | | (CCC, Caa1) | | 03/15/15 | | | 9.750 | | | | 31,500 | | |

| | 325 | | | Young Broadcasting, Inc., Global Senior

Subordinated Notes

(Callable 01/15/09 @ $104.38) | | (CC, Ca) | | 01/15/14 | | | 8.750 | | | | 24,781 | | |

| | | | 624,031 | | |

| Media - Cable (4.9%) | | | |

| | 350 | | | Atlantic Broadband Finance LLC, Global Company

Guaranteed Notes (Callable 01/15/09 @ $104.69) | | (CCC+, Caa1) | | 01/15/14 | | | 9.375 | | | | 253,750 | | |

| | 350 | | | CCH I LLC, Global Secured Notes

(Callable 10/01/10 @ $105.50) | | (CCC, Caa3) | | 10/01/15 | | | 11.000 | | | | 159,250 | | |

| | 325 | | | CCH II LLC, Series B, Global Company

Guaranteed Notes (Callable 09/15/09 @ $100.00) | | (CCC, Caa2) | | 09/15/10 | | | 10.250 | | | | 221,000 | | |

| | 281 | | | Charter Communications Holdings LLC, Senior

Unsecured Notes (Callable 12/08/08 @ $100.00)§ | | (CCC, Ca) | | 04/01/11 | | | 9.920 | | | | 112,400 | | |

| | 100 | | | Charter Communications Operating LLC,

Rule 144A, Senior Secured Notes‡ | | (B-, B3) | | 04/30/12 | | | 8.000 | | | | 77,500 | | |

| | 400 | | | CSC Holdings, Inc., Global Senior Unsecured Notes | | (BB, B1) | | 04/15/12 | | | 6.750 | | | | 348,000 | | |

| | 50 | | | CSC Holdings, Inc., Rule 144A, Senior Unsecured

Notes (Callable 06/15/12 @ $104.25)‡ | | (BB, B1) | | 06/15/15 | | | 8.500 | | | | 42,500 | | |

| | 275 | | | DirecTV Holdings LLC/DirecTV Financing Co.,

Global Company Guaranteed Notes

(Callable 12/08/08 @ $104.19) | | (BB, Ba3) | | 03/15/13 | | | 8.375 | | | | 259,187 | | |

| | 75 | | | DirecTV Holdings LLC/DirecTV Financing Co.,

Rule 144A, Company Guaranteed Notes

(Callable 05/15/12 $103.81)‡ | | (BB, Ba3) | | 05/15/16 | | | 7.625 | | | | 63,375 | | |

| | 75 | | | EchoStar DBS Corp., Global Company

Guaranteed Notes | | (BB-, Ba3) | | 10/01/13 | | | 7.000 | | | | 62,625 | | |

| | 300 | | | EchoStar DBS Corp., Global Company

Guaranteed Notes | | (BB-, Ba3) | | 10/01/14 | | | 6.625 | | | | 241,500 | | |

See Accompanying Notes to Financial Statements.

18

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2008

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Media - Cable | | | |

| $ | 25 | | | Mediacom Broadband Corp., Global Senior

Unsecured Notes (Callable 10/15/10 @ $104.25) | | (B-, B3) | | 10/15/15 | | | 8.500 | | | $ | 18,625 | | |

| | 250 | | | Mediacom Capital Corp., Global Senior

Unsecured Notes (Callable 01/05/09 @ $100.00) | | (B-, B3) | | 02/15/11 | | | 7.875 | | | | 213,750 | | |

| | | | 2,073,462 | | |

| Media - Services (0.5%) | | | |

| | 150 | | | Lamar Media Corp., Series C, Global Company

Guaranteed Notes (Callable 08/15/10 @ $103.31) | | (BB-, Ba3) | | 08/15/15 | | | 6.625 | | | | 111,000 | | |

| | 175 | | | WMG Acquisition Corp., Global Senior

Subordinated Notes

(Callable 04/15/09 @ $103.69) | | (B, B3) | | 04/15/14 | | | 7.375 | | | | 109,375 | | |

| | | | 220,375 | | |

| Metals & Mining - Excluding Steel (1.5%) | | | |

| | 50 | | | Aleris International, Inc., Global Company

Guaranteed Notes (Callable 12/15/10 @ $104.50) | | (B-, B3) | | 12/15/14 | | | 9.000 | | | | 17,500 | | |

| | 225 | | | Aleris International, Inc., Global Company

Guaranteed Notes (Callable 12/15/11 @ $105.00) | | (B-, Caa1) | | 12/15/16 | | | 10.000 | | | | 74,250 | | |

| | 200 | | | Freeport-McMoRan Copper & Gold, Inc., Senior

Unsecured Notes (Callable 04/01/11 @ $104.13) | | (BBB-, Ba2) | | 04/01/15 | | | 8.250 | | | | 160,185 | | |

| | 175 | | | Freeport-McMoRan Copper & Gold, Inc., Senior

Unsecured Notes (Callable 04/01/12 @ $104.19) | | (BBB-, Ba2) | | 04/01/17 | | | 8.375 | | | | 137,565 | | |

| | 300 | | | Noranda Aluminium Acquisition Corp., Global

Company Guaranteed Notes

(Callable 05/15/09 @ $101.00)# | | (B-, B3) | | 05/15/15 | | | 6.828 | | | | 136,500 | | |

| | 150 | | | Peabody Energy Corp., Global Company

Guaranteed Notes | | (BB+, Ba1) | | 11/01/16 | | | 7.375 | | | | 127,500 | | |

| | | | 653,500 | | |

| Non-Food & Drug Retailers (2.7%) | | | |

| | 325 | | | Affinity Group, Inc., Global Company Guaranteed

Notes (Callable 02/15/09 @ $102.25) | | (CCC, Caa1) | | 02/15/12 | | | 9.000 | | | | 229,125 | | |

| | 200 | | | Asbury Automotive Group, Inc., Global Company

Guaranteed Notes (Callable 03/15/12 @ $103.81)§ | | (B, B3) | | 03/15/17 | | | 7.625 | | | | 89,000 | | |

| | 250 | | | Brookstone Company, Inc., Global Secured Notes

(Callable 10/15/09 @ $106.00)§ | | (B, Caa1) | | 10/15/12 | | | 12.000 | | | | 183,750 | | |

| | 75 | | | GameStop Corp., Global Company Guaranteed

Notes (Callable 10/01/09 @ $104.00) | | (BB+, Ba1) | | 10/01/12 | | | 8.000 | | | | 69,937 | | |

| | 70 | | | Michaels Stores, Inc., Global Company Guaranteed

Notes (Callable 11/01/10 @ $105.00) | | (CCC, Caa1) | | 11/01/14 | | | 10.000 | | | | 31,850 | | |

| | 105 | | | Michaels Stores, Inc., Global Company Guaranteed

Notes (Callable 11/01/11 @ $105.69)§ | | (CCC, Caa2) | | 11/01/16 | | | 11.375 | | | | 36,750 | | |

| | 350 | | | Neiman Marcus Group, Inc., Global Company

Guaranteed Notes (Callable 10/15/10 @ $105.19) | | (B, B3) | | 10/15/15 | | | 10.375 | | | | 234,500 | | |

| | 553 | | | PCA LLC/PCA Finance Corp., Global Company

Guaranteed Notes | | (NR, NR) | | 08/01/09 | | | 11.875 | | | | 22,120 | | |

See Accompanying Notes to Financial Statements.

19

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2008

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Non-Food & Drug Retailers | | | |

| $ | 190 | | | Susser Holdings LLC, Global Company

Guaranteed Notes (Callable 12/15/09 @ $105.31) | | (B+, B3) | | 12/15/13 | | | 10.625 | | | $ | 162,450 | | |

| | 50 | | | Yankee Acquisition Corp., Series B, Global

Company Guaranteed Notes

(Callable 02/15/11 @ $104.25) | | (B-, B3) | | 02/15/15 | | | 8.500 | | | | 28,500 | | |

| | 100 | | | Yankee Acquisition Corp., Series B, Global

Company Guaranteed Notes

(Callable 02/15/12 @ $104.88) | | (CCC+, Caa1) | | 02/15/17 | | | 9.750 | | | | 50,125 | | |

| | | | 1,138,107 | | |

| Office Equipment (0.3%) | | | |

| | 100 | | | IKON Office Solutions, Inc., Global Senior

Unsecured Notes (Callable 09/15/10 @ $103.88) | | (BB-, Ba3) | | 09/15/15 | | | 7.750 | | | | 111,500 | | |

| Oil & Gas (0.2%) | | | |

| | 100 | | | Frontier Oil Corp., Company Guaranteed Notes

(Callable 09/15/12 @ $104.25) | | (BB, Ba3) | | 09/15/16 | | | 8.500 | | | | 87,500 | | |

| Oil Field Equipment & Services (1.1%) | | | |

| | 150 | | | Bristow Group, Inc., Global Company Guaranteed

Notes (Callable 09/15/12 @ $103.75) | | (BB, Ba2) | | 09/15/17 | | | 7.500 | | | | 113,250 | | |

| | 150 | | | Key Energy Services, Inc., Global Company

Guaranteed Notes (Callable 12/01/11 @ $104.19) | | (BB-, B1) | | 12/01/14 | | | 8.375 | | | | 111,750 | | |

| | 125 | | | Parker Drilling Co., Global Company Guaranteed

Notes (Callable 10/01/09 @ $103.21) | | (B+, B2) | | 10/01/13 | | | 9.625 | | | | 105,000 | | |

| | 150 | | | Pride International, Inc., Global Senior Notes

(Callable 07/15/09 @ $103.69) | | (BB+, Ba2) | | 07/15/14 | | | 7.375 | | | | 123,750 | | |

| | | | 453,750 | | |

| Packaging (1.5%) | | | |

| | 150 | | | Berry Plastics Holding Corp., Global Company

Guaranteed Notes (Callable 03/01/11 @ $105.13) | | (CCC, Caa2) | | 03/01/16 | | | 10.250 | | | | 72,750 | | |

| | 150 | | | Berry Plastics Holding Corp., Global Senior

Secured Notes (Callable 09/15/10 @ $104.44) | | (CCC+, Caa1) | | 09/15/14 | | | 8.875 | | | | 78,750 | | |

| | 75 | | | Constar International, Inc., Company Guaranteed

Notes (Callable 12/01/08 @ $103.67) | | (CCC-, Caa3) | | 12/01/12 | | | 11.000 | | | | 14,250 | | |

| | 75 | | | Crown Americas LLC, Global Senior Notes

(Callable 11/15/10 @ $103.88) | | (B, B1) | | 11/15/15 | | | 7.750 | | | | 65,813 | | |

| | 75 | | | Crown Cork & Seal Co., Inc., Debentures

(Callable 04/15/09 @ $101.53) | | (B, B2) | | 04/15/23 | | | 8.000 | | | | 55,875 | | |

| | 175 | | | Graham Packaging Company, Inc., Global

Subordinated Notes (Callable 10/15/09 @ $104.94) | | (CCC+, Caa1) | | 10/15/14 | | | 9.875 | | | | 111,125 | | |

| | 75 | | | Owens Brockway Glass Container, Inc., Global

Company Guaranteed Notes

(Callable 05/15/09 @ $102.75) | | (BB, Ba3) | | 05/15/13 | | | 8.250 | | | | 70,500 | | |

| | 50 | | | Owens-Illinois, Inc., Debentures | | (B+, B2) | | 05/15/18 | | | 7.800 | | | | 39,250 | | |

| | 200 | | | Solo Cup Co., Global Company Guaranteed Notes

(Callable 02/15/09 @ $104.25) | | (CCC, Caa2) | | 02/15/14 | | | 8.500 | | | | 135,000 | | |

| | | | 643,313 | | |

See Accompanying Notes to Financial Statements.

20

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2008

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Printing & Publishing (1.4%) | | | |

| $ | 50 | | | Dex Media West LLC, Series B, Global Senior

Subordinated Notes

(Callable 08/15/09 @ $103.29) | | (B+, B1) | | 08/15/13 | | | 9.875 | | | $ | 18,875 | | |

| | 300 | | | Idearc, Inc., Global Company Guaranteed Notes

(Callable 11/15/11 @ $104.00) | | (CCC, B3) | | 11/15/16 | | | 8.000 | | | | 43,125 | | |

| | 600 | | | R.H. Donnelley Corp., Global Senior Unsecured

Notes (Callable 01/15/09 @ $103.44)§ | | (B-, B3) | | 01/15/13 | | | 6.875 | | | | 141,000 | | |

| | 25 | | | R.H. Donnelley, Inc., Rule 144A, Company

Guaranteed Notes (Callable 05/15/12 @ $105.88)‡ | | (B+, B1) | | 05/15/15 | | | 11.750 | | | | 9,875 | | |

| | 325 | | | The Reader's Digest Association, Inc., Global

Company Guaranteed Notes

(Callable 02/15/12 @ $104.50) | | (CCC, Caa1) | | 02/15/17 | | | 9.000 | | | | 93,438 | | |

| | 325 | | | TL Acquisitions, Inc., Rule 144A, Senior Notes

(Callable 07/15/11 @ $105.25)‡ | | (CCC+, Caa1) | | 01/15/15 | | | 10.500 | | | | 195,000 | | |

| | 155 | | | Valassis Communications, Inc., Global Company

Guaranteed Notes (Callable 03/01/11 @ $104.13) | | (B-, B3) | | 03/01/15 | | | 8.250 | | | | 84,475 | | |

| | | | 585,788 | | |

| Railroads (0.3%) | | | |

| | 150 | | | Kansas City Southern Railway, Company

Guaranteed Notes (Callable 06/01/12 @ $104.00) | | (BB-, B2) | | 06/01/15 | | | 8.000 | | | | 124,125 | | |

| Software/Services (1.3%) | | | |

| | 250 | | | First Data Corp., Global Company Guaranteed

Notes (Callable 09/30/11 @ $104.94) | | (B, B3) | | 09/24/15 | | | 9.875 | | | | 161,250 | | |

| | 75 | | | Lender Processing Services, Inc., Global Company

Guaranteed Notes (Callable 07/01/11 @ $106.09) | | (BB+, Ba2) | | 07/01/16 | | | 8.125 | | | | 64,500 | | |

| | 325 | | | SunGard Data Systems, Inc., Global Company

Guaranteed Notes (Callable 08/15/10 @ $105.13) | | (B-, Caa1) | | 08/15/15 | | | 10.250 | | | | 229,125 | | |

| | 125 | | | Unisys Corp., Senior Unsecured Notes | | (B+, B2) | | 10/15/12 | | | 8.000 | | | | 79,531 | | |

| | | | 534,406 | | |

| Steel Producers/Products (1.5%) | | | |

| | 225 | | | AK Steel Corp., Global Company Guaranteed

Notes (Callable 11/10/08 @ $102.58) | | (BB-, Ba3) | | 06/15/12 | | | 7.750 | | | | 181,125 | | |

| | 300 | | | Rathgibson, Inc., Global Company Guaranteed

Notes (Callable 02/15/10 @ $105.62) | | (B, B3) | | 02/15/14 | | | 11.250 | | | | 204,000 | | |

| | 175 | | | Ryerson, Inc., Rule 144A, Senior Secured Notes

(Callable 11/01/11 @ $106.00)‡ | | (B+, B2) | | 11/01/15 | | | 12.000 | | | | 119,875 | | |

| | 200 | | | Steel Dynamics, Inc., Rule 144A, Senior Notes

(Callable 04/15/12 @ $103.88)‡ | | (BB+, Ba2) | | 04/15/16 | | | 7.750 | | | | 133,500 | | |

| | | | 638,500 | | |

| Support-Services (3.3%) | | | |

| | 175 | | | ARAMARK Corp., Global Senior Unsecured Notes

(Callable 02/01/11 @ $104.25) | | (B, B3) | | 02/01/15 | | | 8.500 | | | | 150,500 | | |

| | 75 | | | DynCorp. International, Rule 144A, Company

Guaranteed Notes (Callable 02/15/09 @ $104.75)‡ | | (B, B2) | | 02/15/13 | | | 9.500 | | | | 64,687 | | |

See Accompanying Notes to Financial Statements.

21

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2008

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Support-Services | | | |

| $ | 150 | | | Education Management LLC, Global Company

Guaranteed Notes (Callable 06/01/10 @ $104.38) | | (CCC+, B2) | | 06/01/14 | | | 8.750 | | | $ | 110,250 | | |

| | 50 | | | Education Management LLC, Global Company

Guaranteed Notes (Callable 06/01/11 @ $105.13) | | (CCC+, Caa1) | | 06/01/16 | | | 10.250 | | | | 34,750 | | |

| | 140 | | | Hertz Corp., Global Company Guaranteed Notes

(Callable 01/01/10 @ $104.44) | | (B+, B1) | | 01/01/14 | | | 8.875 | | | | 102,900 | | |

| | 175 | | | Iron Mountain, Inc., Company Guaranteed Notes

(Callable 11/17/08 @ $103.31) | | (B+, B2) | | 01/01/16 | | | 6.625 | | | | 140,875 | | |

| | 125 | | | JohnsonDiversey Holdings, Inc., Series B, Global

Company Guaranteed Notes

(Callable 05/15/09 @ $101.60) | | (B, B2) | | 05/15/12 | | | 9.625 | | | | 111,875 | | |

| | 100 | | | JohnsonDiversey Holdings, Inc., Series B, Global

Discount Notes (Callable 05/15/09 @ $101.78) | | (CCC+, Caa1) | | 05/15/13 | | | 10.670 | | | | 74,500 | | |

| | 200 | | | Mobile Services Group, Inc., Global Company

Guaranteed Notes (Callable 08/01/10 @ $104.88) | | (B+, B2) | | 08/01/14 | | | 9.750 | | | | 151,000 | | |

| | 175 | | | Rental Service Corp., Global Company Guaranteed

Notes (Callable 12/01/10 @ $104.75) | | (B-, Caa1) | | 12/01/14 | | | 9.500 | | | | 105,875 | | |

| | 150 | | | Sotheby's, Rule 144A, Senior Notes‡ | | (BBB-, Ba3) | | 06/15/15 | | | 7.750 | | | | 89,250 | | |

| | 150 | | | Ticketmaster Entertainment,Inc., Rule 144A,

Senior Notes (Callable 08/01/12 @ $105.38)‡ | | (BB, Ba3) | | 08/01/16 | | | 10.750 | | | | 126,750 | | |

| | 170 | | | Travelport LLC, Global Company Guaranteed

Notes (Callable 09/01/10 @ $104.94) | | (B, B3) | | 09/01/14 | | | 9.875 | | | | 81,600 | | |

| | 100 | | | United Rentals North America, Inc., Global

Company Guaranteed Notes

(Callable 12/08/08 @ $103.25) | | (BB-, B1) | | 02/15/12 | | | 6.500 | | | | 70,500 | | |

| | | | 1,415,312 | | |

| Telecom - Integrated/Services (5.6%) | | | |

| | 350 | | | Cincinnati Bell, Inc., Global Senior Subordinated

Notes (Callable 01/15/09 @ $104.19) | | (B-, B2) | | 01/15/14 | | | 8.375 | | | | 254,625 | | |

| | 375 | | | Frontier Communications Corp., Global Senior

Unsecured Notes | | (BB, Ba2) | | 03/15/15 | | | 6.625 | | | | 270,000 | | |

| | 215 | | | Hughes Network Systems LLC, Global Company

Guaranteed Notes (Callable 04/15/10 @ $104.75) | | (B, B1) | | 04/15/14 | | | 9.500 | | | | 183,825 | | |

| | 450 | | | Intelsat Corp., Rule 144A, Senior Unsecured

Notes (Callable 08/15/09 @ $104.63)‡ | | (BB-, B3) | | 08/15/14 | | | 9.250 | | | | 389,250 | | |

| | 125 | | | Intelsat Subsidiary Holding Co., Ltd., Rule 144A,

Senior Unsecured Notes

(Callable 01/15/10 @ $104.44)‡ | | (BB-, B3) | | 01/15/15 | | | 8.875 | | | | 106,875 | | |

| | 425 | | | Level 3 Financing, Inc., Global Company

Guaranteed Notes (Callable 02/15/09 @ $102.00)# | | (CCC+, Caa1) | | 02/15/15 | | | 6.845 | | | | 195,500 | | |

| | 75 | | | Level 3 Financing, Inc., Global Company

Guaranteed Notes (Callable 03/15/10 @ $106.13) | | (CCC+, Caa1) | | 03/15/13 | | | 12.250 | | | | 47,813 | | |

| | 225 | | | Paetec Holding Corp., Series WI, Global Company

Guaranteed Notes (Callable 07/15/11 @ $104.75) | | (CCC+, Caa1) | | 07/15/15 | | | 9.500 | | | | 128,812 | | |

See Accompanying Notes to Financial Statements.

22

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2008

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Telecom - Integrated/Services | | | |

| $ | 500 | | | Qwest Communications International, Inc.,

Series B, Global Company Guaranteed Notes

(Callable 02/15/09 @ $103.75) | | (B+, Ba3) | | 02/15/14 | | | 7.500 | | | $ | 346,250 | | |

| | 25 | | | Qwest Corp., Global Senior Unsecured Notes | | (BBB-, Ba1) | | 06/15/15 | | | 7.625 | | | | 19,250 | | |

| | 250 | | | Time Warner Telecom Holdings, Inc., Global

Company Guaranteed Notes

(Callable 02/15/09 @ $104.62) | | (CCC+, B3) | | 02/15/14 | | | 9.250 | | | | 203,750 | | |

| | 325 | | | Windstream Corp., Global Company Guaranteed

Notes (Callable 08/01/11 @ $104.31) | | (BB, Ba3) | | 08/01/16 | | | 8.625 | | | | 247,000 | | |

| | | | 2,392,950 | | |

| Telecom - Wireless (3.0%) | | | |

| | 200 | | | Centennial Cellular Communications Corp.,

Global Company Guaranteed Notes

(Callable 06/15/09 @ $103.38) | | (B, B2) | | 06/15/13 | | | 10.125 | | | | 178,000 | | |

| | 200 | | | Cricket Communications, Inc., Global Company

Guaranteed Notes (Callable 11/01/10 @ $104.69) | | (B-, B3) | | 11/01/14 | | | 9.375 | | | | 163,500 | | |

| | 200 | | | MetroPCS Wireless, Inc., Global Company

Guaranteed Notes (Callable 11/01/10 @ $104.63) | | (B, Caa1) | | 11/01/14 | | | 9.250 | | | | 167,500 | | |

| | 550 | | | Nextel Communications, Inc., Series F, Company

Guaranteed Notes (Callable 03/15/09 @ $102.98) | | (BB, Baa3) | | 03/15/14 | | | 5.950 | | | | 297,294 | | |

| | 690 | | | Sprint Nextel Corp., Senior Unsecured Notes | | (BB, Baa3) | | 12/01/16 | | | 6.000 | | | | 478,517 | | |

| | | | 1,284,811 | | |

| Textiles & Apparel (0.5%) | | | |

| | 175 | | | Levi Strauss & Co., Global Senior Notes

(Callable 01/15/10 @ $104.88) | | (B+, B2) | | 01/15/15 | | | 9.750 | | | | 123,375 | | |

| | 100 | | | Phillips-Van Heusen Corp., Global Senior

Unsecured Notes (Callable 05/01/09 @ $102.71) | | (BB+, Ba3) | | 05/01/13 | | | 8.125 | | | | 86,500 | | |

| | | | 209,875 | | |

| Theaters & Entertainment (0.4%) | | | |

| | 250 | | | AMC Entertainment, Inc., Global Senior

Subordinated Notes

(Callable 03/01/09 @ $104.00) | | (CCC+, B2) | | 03/01/14 | | | 8.000 | | | | 178,750 | | |

| Transportation (0.6%) | | | |

| | 300 | | | Navios Maritime Holdings, Inc., Global Company

Guaranteed Notes (Callable 12/15/10 @ $104.75) | | (B+, B3) | | 12/15/14 | | | 9.500 | | | | 247,500 | | |

| TOTAL CORPORATE BONDS (Cost $55,628,994) | | | 37,854,320 | | |

| FOREIGN BONDS (6.0%) | | | |

| Aerospace & Defense (0.4%) | | | |

| | 200 | | | Bombardier, Inc., Rule 144A, Senior

Unsecured Notes (Canada)‡ | | (BB+, Ba2) | | 05/01/14 | | | 6.300 | | | | 160,000 | | |

See Accompanying Notes to Financial Statements.

23

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2008

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| FOREIGN BONDS | | | |

| Chemicals (0.2%) | | | |

| $ | 200 | | | LyondellBasell Industries AF SCA, Rule 144A,

Senior Secured Notes

(Callable 08/15/10 @ $104.19) (Luxembourg)‡ | | (CCC+, B3) | | 08/15/15 | | | 8.375 | | | $ | 71,000 | | |

| Electronics (0.9%) | | | |

| | 200 | | | Avago Technologies Finance, Global Company

Guaranteed Notes (Callable 12/01/10 @ $105.94)

(Singapore) | | (B, B3) | | 12/01/15 | | | 11.875 | | | | 163,000 | | |

| | 150 | | | Celestica, Inc., Senior Subordinated Notes

(Callable 11/10/08 @ $103.94) (Canada) | | (B, B3) | | 07/01/11 | | | 7.875 | | | | 135,750 | | |

| | 50 | | | NXP BV/NXP Funding LLC, Global Company

Guaranteed Notes (Callable 10/15/11 @ $104.31)

(Netherlands) | | (CCC+, Caa2) | | 10/15/15 | | | 8.625 | | | | 18,387 | | |

| | 125 | | | NXP BV/NXP Funding LLC, Global Senior

Secured Notes (Callable 10/15/10 @ $103.94)

(Netherlands) | | (B-, B3) | | 10/15/14 | | | 7.875 | | | | 62,500 | | |

| | | | 379,637 | | |

| Energy - Exploration & Production (0.2%) | | | |

| | 175 | | | OPTI Canada, Inc., Global Senior Secured Notes

(Callable 12/15/10 @ $104.13) (Canada) | | (BB+, B1) | | 12/15/14 | | | 8.250 | | | | 105,000 | | |

| Forestry & Paper (0.5%) | | | |

| | 475 | | | Abitibi-Consolidated, Inc., Global Company

Guaranteed Notes (Canada) | | (CCC+, Caa2) | | 06/15/11 | | | 7.750 | | | | 106,875 | | |

| | 175 | | | Smurfit Kappa Funding PLC, Global Senior

Subordinated Notes

(Callable 01/31/10 @ $103.88) (Ireland) | | (B+, B2) | | 04/01/15 | | | 7.750 | | | | 125,125 | | |

| | | | 232,000 | | |

| Media - Cable (0.9%) | | | |

| | 200 | | | NTL Cable PLC, Global Senior Notes

(Callable 08/15/11 @ $104.56) (United Kingdom) | | (B-, B2) | | 08/15/16 | | | 9.125 | | | | 133,000 | | |

| | 250 | | | Unitymedia GmbH, Rule 144A, Senior Secured

Notes (Callable 02/15/10 @ $105.06) (Germany)‡ | | (B, Caa1) | | 02/15/15 | | | 10.125 | | | | 237,759 | | |

| | | | 370,759 | | |

| Media - Diversified (0.4%) | | | |

| | 250 | | | Quebecor Media, Inc., Global Senior Unsecured

Notes (Callable 03/15/11 @ $103.88) (Canada) | | (B, B2) | | 03/15/16 | | | 7.750 | | | | 174,375 | | |

| Oil Refining & Marketing (0.4%) | | | |

| | 225 | | | Petroplus Finance, Ltd., Rule 144A, Company

Guaranteed Notes

(Callable 05/01/11 @ $103.38) (Bermuda)‡ | | (BB-, B1) | | 05/01/14 | | | 6.750 | | | | 151,875 | | |

| Pharmaceuticals (0.2%) | | | |

| | 150 | | | Elan Finance PLC, Global Company Guaranteed

Notes (Callable 12/01/10 @ $104.44) (Ireland) | | (B, B3) | | 12/01/13 | | | 8.875 | | | | 95,250 | | |

See Accompanying Notes to Financial Statements.

24

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2008

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| FOREIGN BONDS | | | |

| Support-Services (0.2%) | | | |

| $ | 125 | | | Ashtead Holdings PLC, Rule 144A, Secured

Notes (Callable 08/01/10 @ $104.31)

(United Kingdom)‡ | | (B, B1) | | 08/01/15 | | | 8.625 | | | $ | 79,375 | | |

| Telecom - Integrated/Services (0.9%) | | | |

| | 300 | | | Global Crossing UK Finance, Global Company

Guaranteed Notes (Callable 12/15/09 @ $105.38)

(United Kingdom) | | (B-, B3) | | 12/15/14 | | | 10.750 | | | | 238,500 | | |

| | 150 | | | Nordic Telephone Co. Holdings ApS, Rule 144A,

Senior Secured Notes

(Callable 11/07/08 @ $101.00) (Denmark)‡# | | (B+, B2) | | 05/01/16 | | | 10.463 | | | | 127,677 | | |

| | | | 366,177 | | |

| Telecommunications Equipment (0.2%) | | | |

| | 200 | | | Nortel Networks, Ltd., Rule 144A, Company

Guaranteed Notes

(Callable 07/15/11 @ $105.38) (Canada)‡ | | (B-, B3) | | 07/15/16 | | | 10.750 | | | | 106,500 | | |

| Textiles & Apparel (0.1%) | | | |

| | 75 | | | IT Holding Finance SA, Rule 144A, Company

Guaranteed Notes (Luxembourg)‡ | | (CCC+, B3) | | 11/15/12 | | | 9.875 | | | | 27,580 | | |

| Transportation - Excluding Air/Rail (0.5%) | | | |

| | 275 | | | Ship Finance International, Ltd., Global Company

Guaranteed Notes

(Callable 12/15/08 @ $104.25) (Bermuda) | | (B+, B1) | | 12/15/13 | | | 8.500 | | | | 218,969 | | |

| TOTAL FOREIGN BONDS (Cost $3,915,755) | | | 2,538,497 | | |

Number of

Shares | |

| |

| |

| |

| |

| |

| COMMON STOCK (0.2%) | | | |

| Chemicals (0.2%) | | | |

| | 9,785 | | | Huntsman Corp. (Cost $68,805) | | | | | | | | | | | 98,829 | | |

| SHORT-TERM INVESTMENTS (3.0%) | | | |

| | 529,103 | | | State Street Navigator Prime Portfolio§§ | | | | | | | | | | | 529,103 | | |

Par

(000) | |

| | | | | | | | | |

| $ | 757 | | | State Street Bank and Trust Co. Euro Time Deposit | | | | 11/03/08 | | | 0.010 | | | | 757,000 | | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $1,286,103) | | | 1,286,103 | | |

| TOTAL INVESTMENTS AT VALUE (98.3%) (Cost $60,899,657) | | | 41,777,749 | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES (1.7%) | | | 719,701 | | |

| NET ASSETS (100.0%) | | $ | 42,497,450 | | |

See Accompanying Notes to Financial Statements.

25

Credit Suisse High Income Fund

Schedule of Investments (continued)

October 31, 2008

INVESTMENT ABBREVIATION

NR = Not Rated

† Credit ratings given by the Standard & Poor's Division of The McGraw-Hill Companies, Inc. ("S&P") and Moody's Investors Service, Inc. ("Moody's") are unaudited.

‡ Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At October 31, 2008, these securities amounted to a value of $6,189,011 or 14.6% of net assets.

# Variable rate obligations — The interest rate is the rate as of October 31, 2008.

+ Step Bond — The interest rate stated is as of October 31, 2008 and will reset at a future date.

ø Bond is currently in default.

§ Security or portion thereof is out on loan.

§§ Represents security purchased with cash collateral received for securities on loan.

See Accompanying Notes to Financial Statements.

26

Credit Suisse High Income Fund

Statement of Assets and Liabilities

October 31, 2008

| Assets | |

Investments at value, including collateral for securities on loan of $529,103

(Cost $60,899,657) (Note 2) | | $ | 41,777,7491 | | |

| Foreign currency at value (cost $200) | | | 168 | | |

| Interest receivable | | | 1,462,317 | | |

| Receivable for fund shares sold | | | 137,646 | | |

| Receivable for investments sold | | | 61,171 | | |

| Unrealized appreciation on forward currency contracts (Note 2) | | | 38,444 | | |

| Receivable from investment adviser (Note 3) | | | 7,049 | | |

| Prepaid expenses and other assets | | | 32,848 | | |

| Total Assets | | | 43,517,392 | | |

| Liabilities | |

| Administrative services fee payable (Note 3) | | | 25,933 | | |

| Shareholder servicing/Distribution fee payable (Note 3) | | | 24,107 | | |

| Payable upon return of securities loaned (Note 2) | | | 529,103 | | |

| Dividend payable | | | 225,012 | | |

| Payable for fund shares redeemed | | | 91,721 | | |

| Due to Custodian | | | 33,941 | | |

| Payable for investments purchased | | | 27,219 | | |

| Trustees' fee payable | | | 6,297 | | |

| Other accrued expenses payable | | | 56,609 | | |

| Total Liabilities | | | 1,019,942 | | |

| Net Assets | |

| Capital stock, $.001 par value (Note 6) | | | 8,577 | | |

| Paid-in capital (Note 6) | | | 66,373,923 | | |

| Undistributed net investment income | | | 241,598 | | |

| Accumulated net realized loss on investments, swap contracts and foreign currency transactions | | | (5,040,133 | ) | |

| Net unrealized depreciation from investments and foreign currency translations | | | (19,086,515 | ) | |

| Net Assets | | $ | 42,497,450 | | |

| Common Shares | |