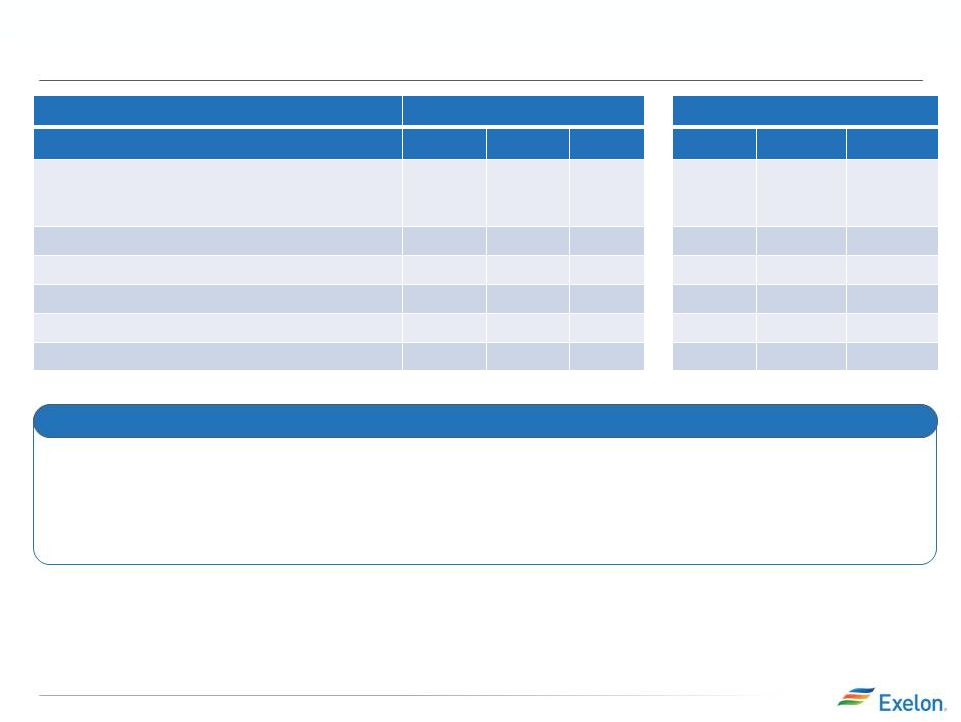

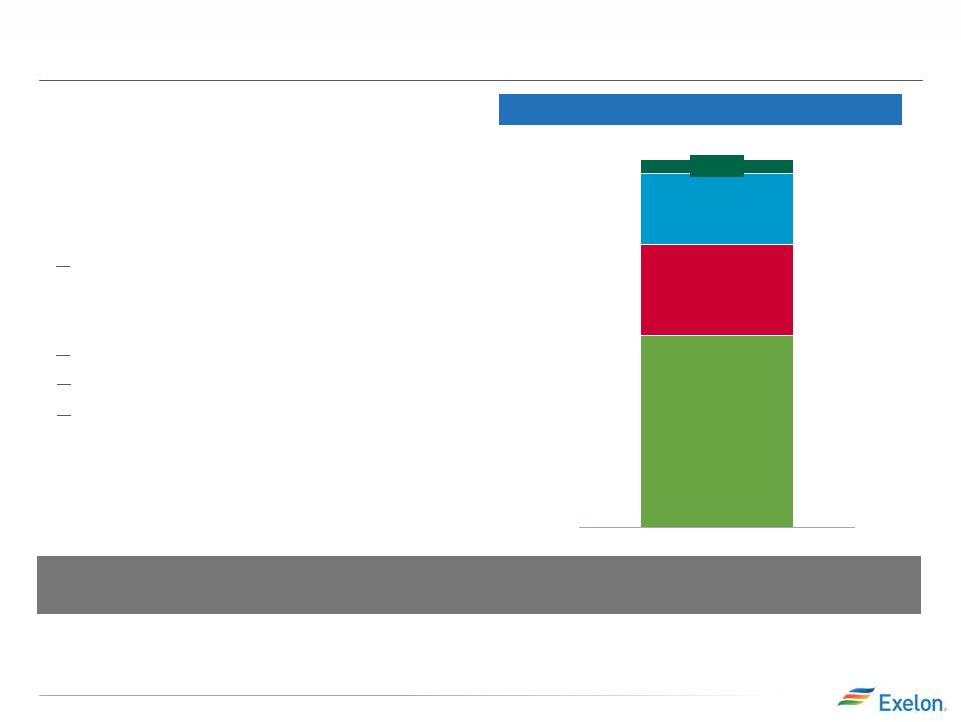

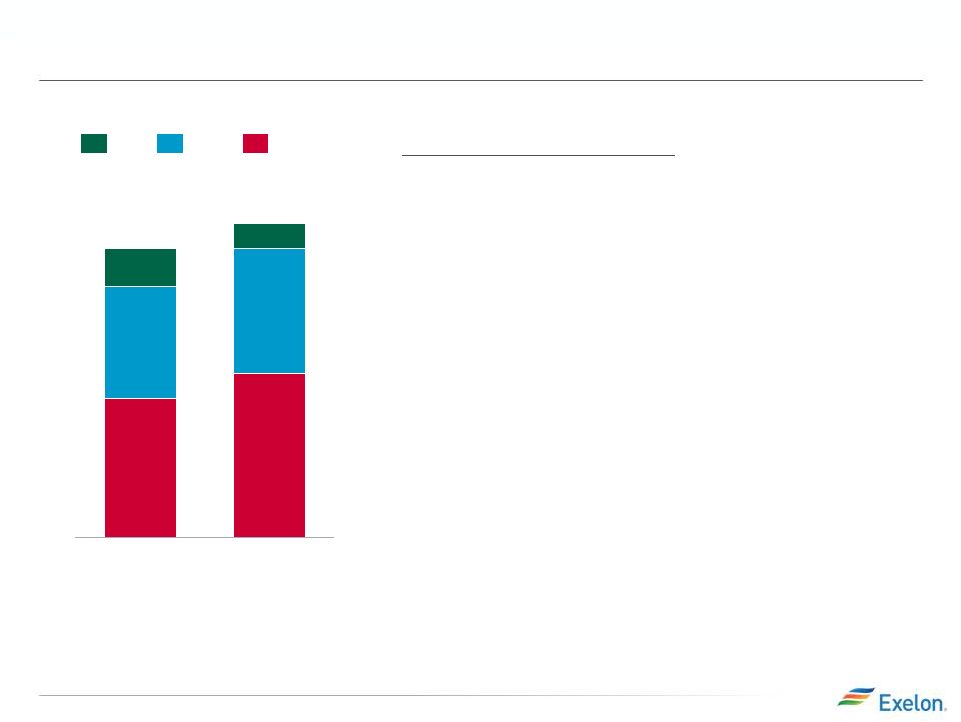

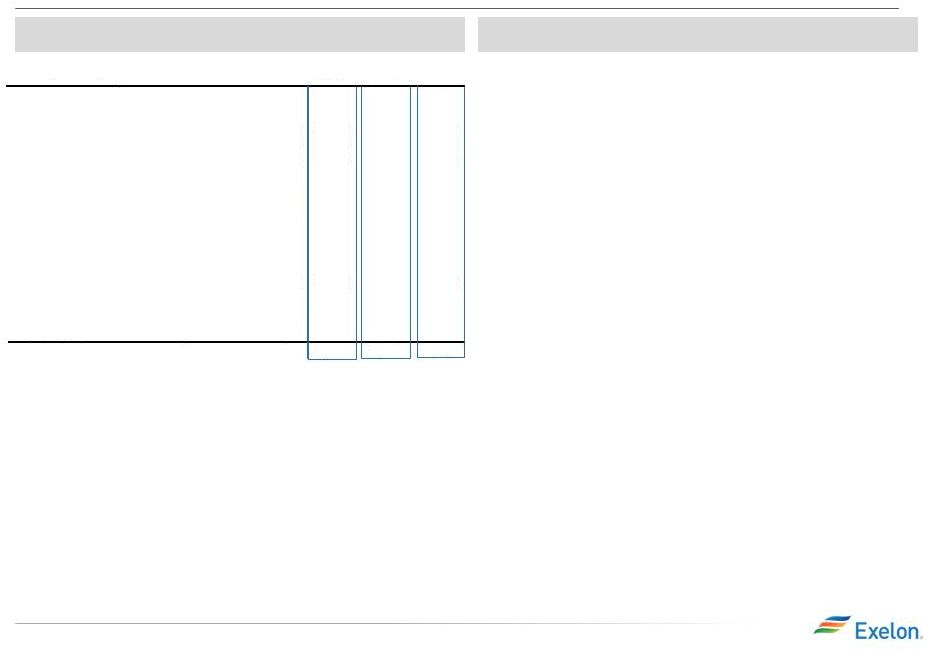

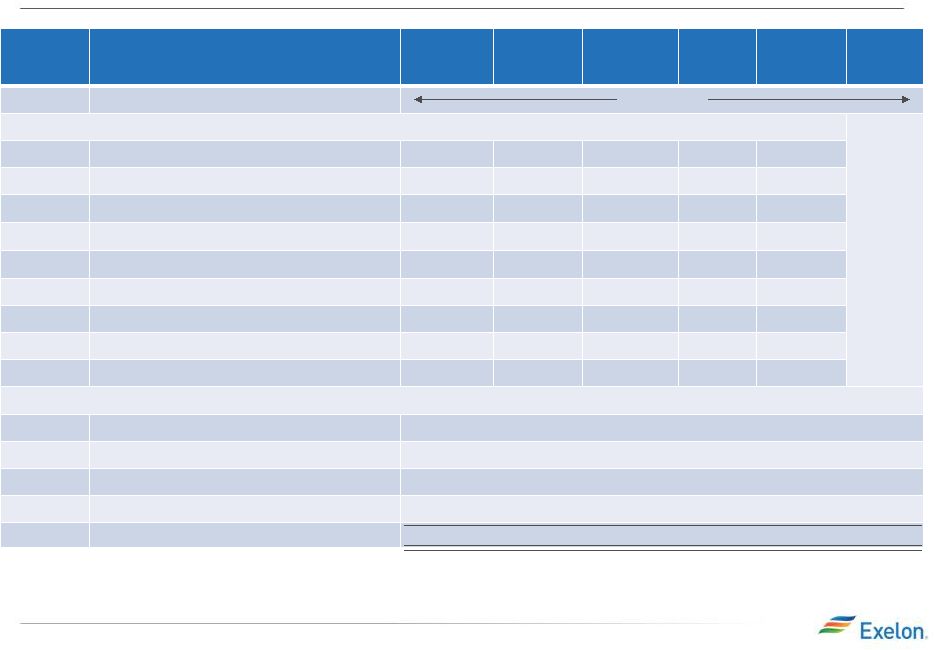

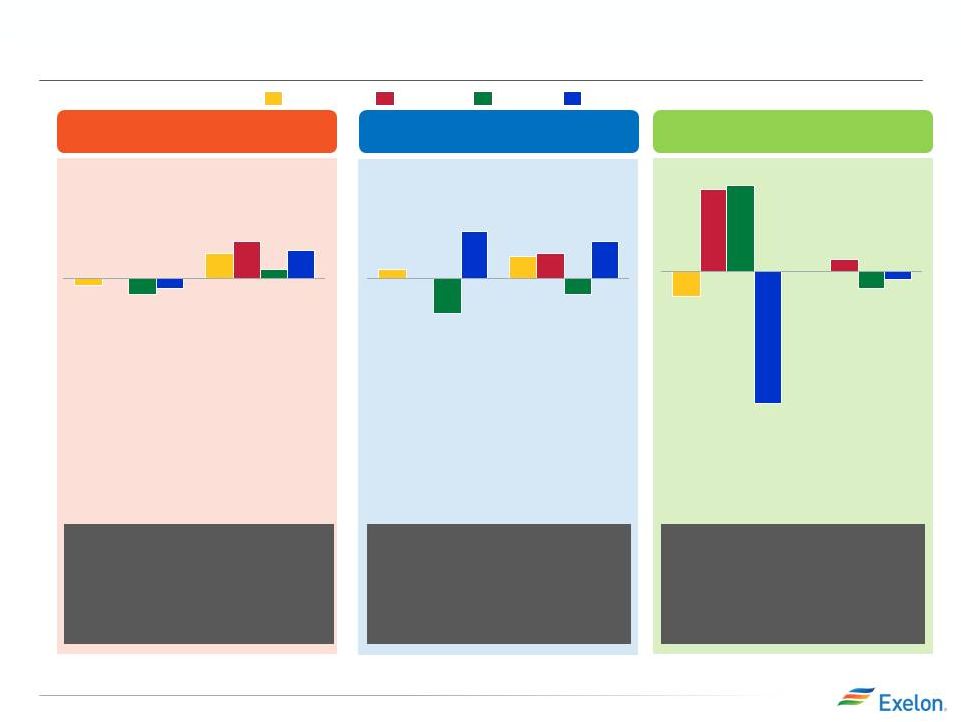

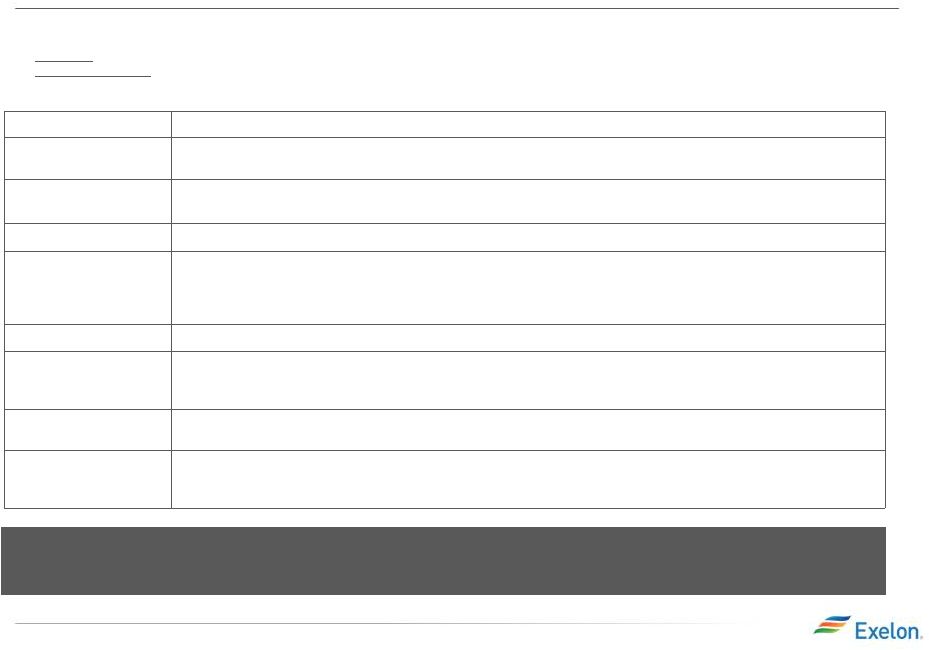

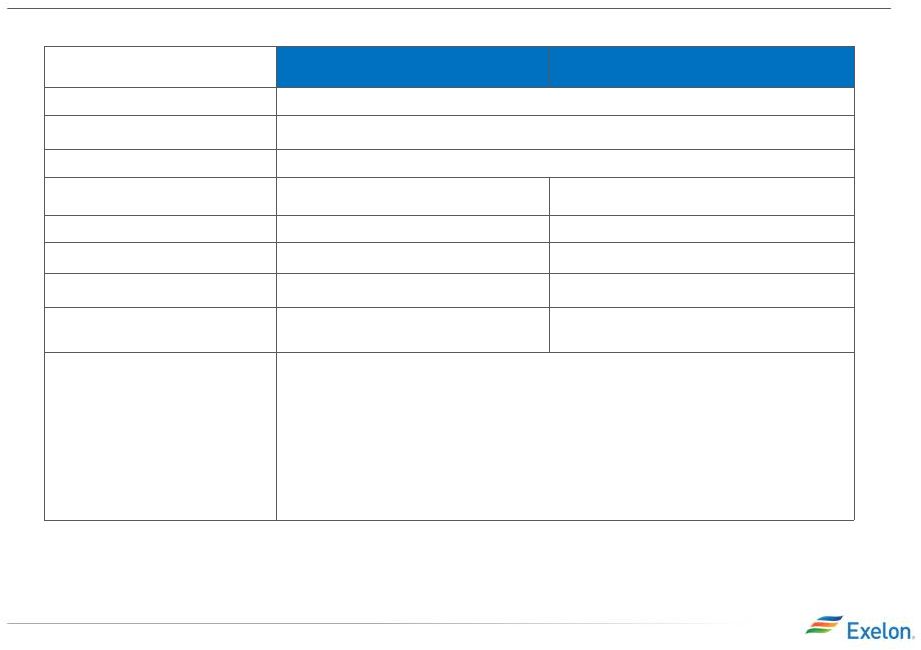

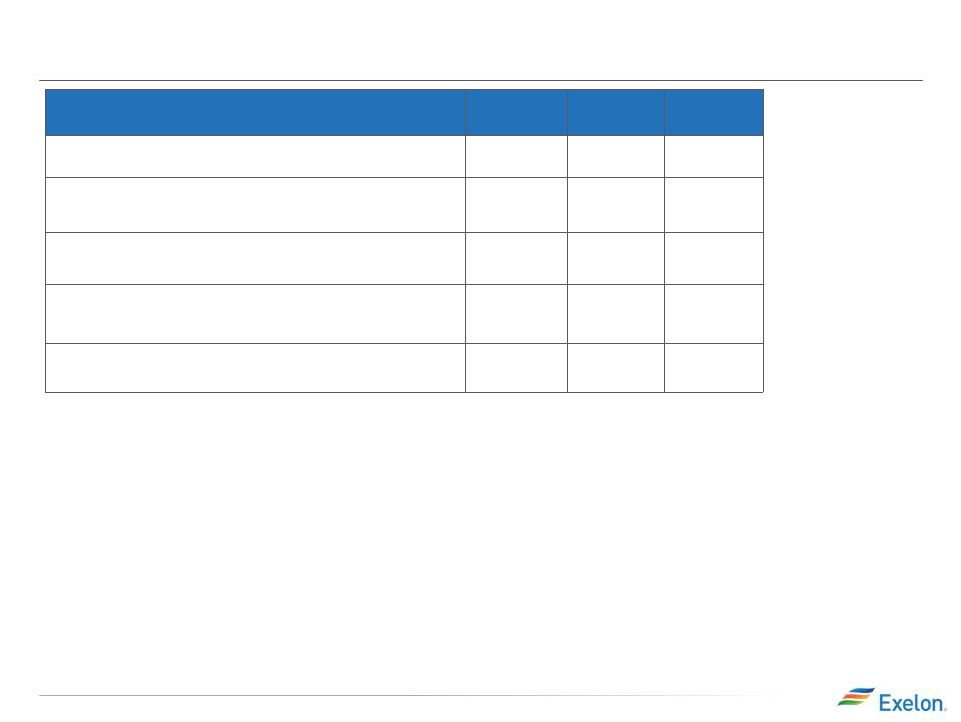

2014 Projected Sources and Uses of Cash Key Messages (1) • Cash from Operations is projected to be $6,975M vs. 1Q14E of $6,200M for a $775M variance. This variance is driven by: • Cash from Financing activities is projected to be $250M vs. 1Q14E of ($825M) for a $1,075M variance. This variance is driven by: • Cash from Investing activities is projected to be ($5,450M) vs. 1Q14E of ($5,375M) for a ($75M) variance. Projected Sources & Uses (1) (1) All amounts rounded to the nearest $25M. (2) Excludes counterparty collateral of $134 million at 12/31/2013. In addition, the 12/31/2014 ending cash balance does not include collateral. (3) Includes cash flow activity from Holding Company, eliminations, and other corporate entities. CapEx for Exelon is shown net of $325M CPS early lease termination fee. (4) Adjusted Cash Flow from Operations (non-GAAP) primarily includes net cash flows from operating activities and net cash flows from investing activities excluding capital expenditures of $5.4B for 2014. (5) Dividends are subject to declaration by the Board of Directors. (6) “Other Financing” primarily includes CENG distribution to EDF, expected changes in short-term debt, and proceeds from issuance of mandatory convertible units. ($ in millions) BGE ComEd PECO ExGen Exelon (3) As of 1Q14 Variance Beginning Cash Balance (2) 1,475 1,475 – Adjusted Cash Flow from Operations (4) 650 1,575 625 4,200 6,975 6,200 775 CapEx (excluding other items below): (525) (1,500) (525) (1,150) (3,450) (3,475) 25 Nuclear Fuel n/a n/a n/a (1,000) (1,000) (975) (25) Dividend (5) (1,075) (1,075) – Nuclear Uprates n/a n/a n/a (150) (150) (150) – Wind n/a n/a n/a (75) (75) (75) – Solar n/a n/a n/a (200) (200) (200) – Upstream n/a n/a n/a (50) (50) (50) – Utility Smart Grid/Smart Meter (75) (275) (150) n/a (525) (450) (75) Net Financing (excluding Dividend): Debt Issuances 950 300 – 1,250 1,250 – Debt Retirements – (625) (250) (525) (1,375) (1,375) – Project Finance/Federal Financing Bank Loan n/a n/a n/a 875 875 675 200 – Other Financing (6) (50) 200 125 (425) 575 (300) 875 Ending Cash Balance (2) 3,250 1,475 1,775 – 2014 2Q Earnings Release Slides 8 - $400M Net proceeds from divestitures - $300M Income taxes and settlements - $150M Decreased OPEB contributions (primarily ComEd and ExGen) - ($125M) Purchase of PHI preferred stock - $75M Working capital and regulatory assets at Utilities - $1,125 Net proceeds from issuance of mandatory convertible units - $200M Incremental project financing at ExGen - ($150M) Decrease in projected commercial paper financing |