QuickLinks -- Click here to rapidly navigate through this document

Exhibit 3

Management's discussion and analysis (MD&A) gives you management's perspective on performance of our businesses, the economy and how we manage risk and capital.

| | | |

|---|---|---|

| Management's discussion and analysis | ||

| page 10 | How we performed | |

| page 15 | Off-balance sheet arrangements | |

| page 16 | Critical accounting policies | |

| page 17 | Controls and procedures | |

| page 19 | How our businesses performed | |

| page 20 | Personal and Commercial Banking | |

| page 24 | Wholesale Banking | |

| page 27 | Wealth Management | |

| page 30 | Corporate | |

| page 31 | Corporate Management | |

| page 32 | Factors that may affect future results | |

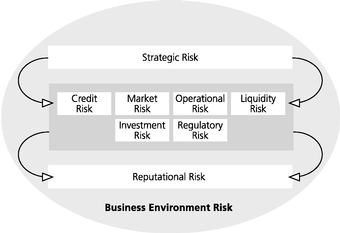

| page 33 | Managing risk | |

| page 34 | Strategic risk | |

| page 34 | Credit risk | |

| page 36 | Market risk | |

| page 38 | Asset liability management | |

| page 39 | Liquidity risk | |

| page 40 | Operational risk | |

| page 41 | Regulatory risk | |

| page 41 | Reputational risk | |

| page 42 | Managing capital | |

| page 45 | Supplementary information | |

Financial results | ||

| page 54 | Consolidated Financial Statements | |

| page 54 | Financial reporting responsibility | |

| page 54 | Auditors' report to the shareholders | |

| page 55 | Consolidated Balance Sheet | |

| page 56 | Consolidated Statement of Operations | |

| page 57 | Consolidated Statement of Changes in Shareholders' Equity | |

| page 58 | Consolidated Statement of Cash Flows | |

| page 59 | Notes to Consolidated Financial Statements | |

| page 90 | Principal Subsidiaries | |

Caution regarding forward-looking statements

From time to time, the Bank makes written and oral forward-looking statements, including in this Annual Report, in other filings with Canadian regulators or the U.S. Securities and Exchange Commission (SEC), and in other communications. All such statements are made pursuant to the "safe harbour" provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements include, among others, statements regarding the Bank's objectives and strategies to achieve them, the outlook for the Bank's business lines, and the Bank's anticipated financial performance. Forward-looking statements are typically identified by words such as "believe", "expect", "may" and "could". By their very nature, these statements are subject to inherent risks and uncertainties, general and specific, which may cause actual results to differ materially from the expectations expressed in the forward-looking statements. Some of the factors that could cause such differences include: the credit, market, liquidity, interest rate, operational and other risks discussed starting on page 33 of this report and in the MD&A section in other regulatory filings made in Canada and with the SEC; general business and economic conditions in Canada, the United States and other countries in which the Bank conducts business; the effect of changes in monetary policy; the degree of competition in the markets in which the Bank operates, both from established competitors and new entrants; legislative and regulatory developments; the accuracy and completeness of information the Bank receives on customers and counterparties; the timely development and introduction of new products and services in receptive markets; the Bank's ability to complete and integrate acquisitions; the Bank's ability to attract and retain key executives; reliance on third parties to provide components of the Bank's business infrastructure; technological changes; change in tax laws; unexpected judicial or regulatory proceedings; unexpected changes in consumer spending and saving habits; the possible impact on the Bank's businesses of international conflicts and terrorism; acts of God, such as earthquakes; and management's ability to anticipate and manage the risks associated with these factors and execute the Bank's strategies within a disciplined risk environment. Please see the discussion starting on page 32 of this report concerning the effect certain key factors could have on actual results. The preceding list and the discussion of factors starting on page 32 are not exhaustive of all possible factors. Other factors could also adversely affect the Bank's results. All such factors should be considered carefully when making decisions with respect to the Bank, and undue reliance should not be placed on the Bank's forward-looking statements. The Bank does not undertake to update any forward-looking statements, written or oral, that may be made from time to time by or on its behalf.

TD BANK FINANCIAL GROUP ANNUAL REPORT 2003 - Management's Discussion and Analysis 9

How the Bank Reports

The Bank prepares its financial statements in accordance with Canadian generally accepted accounting principles (GAAP), which are presented on pages 54 to 90 of this Annual Report. The Bank refers to results prepared in accordance with GAAP as the "reported basis".

The Bank also utilizes the "operating cash basis" to assess each of its businesses and to measure overall Bank performance against goals. The calculation of operating cash basis begins with the reported GAAP results and then excludes special items and the non-cash charge for intangible amortization and, prior to 2002, non-cash amortization of goodwill. There were no special items in fiscal 2003. For fiscal 2002, the only special item excluded was a gain on sale of the Bank's mutual fund record keeping and custody business in the first and third quarter of 2002, respectively. The Bank views special items as transactions that are not part of the Bank's normal business operations and are therefore not indicative of underlying trends. The majority of the Bank's non-cash intangible amortization charge relates to the Canada Trust acquisition in fiscal 2000. The Bank excludes amortization of intangibles as it is a non-cash charge and this approach ensures comparable treatment between periods and comparable treatment with goodwill. Consequently, the Bank believes that the operating cash basis provides the reader with an understanding of the Bank's results that can be consistently tracked from period to period.

The goodwill impairment recorded by the Bank in fiscal 2003 relating to the international unit of its wealth management business and its U.S. equity options business was not considered a special item for exclusion when determining the operating cash basis results. The restructuring charges recognized by the Bank in fiscal 2003, related to the international unit of its wealth management business and its U.S. equity options business, were not considered special items given that they were incurred as part of the rationalization of the existing businesses.

The reversal of general allowances in fiscal 2003 was not considered a special item given that the Bank views the reversal as potentially recurring. However, it may also be possible that in the future it may be necessary to increase general allowances.

As explained, operating cash basis results are different from reported results determined in accordance with GAAP. The term "operating cash basis results" is not a defined term under GAAP, and therefore may not be comparable to similar terms used by other issuers. The table below provides a reconciliation between the Bank's operating cash basis results and its reported results.

Reconciliation of operating cash basis results to reported results

| (millions of dollars) | 2003 | 2002 | 2001 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Net interest income (TEB) | $ | 5,846 | $ | 5,522 | $ | 4,636 | ||||

| Provision for credit losses | (186 | ) | (2,925 | ) | (620 | ) | ||||

| Other income | 4,424 | 4,889 | 6,097 | |||||||

| Non-interest expenses | (7,592 | ) | (6,754 | ) | (6,925 | ) | ||||

| Income before provision for income taxes and non-controlling interest in subsidiaries | 2,492 | 732 | 3,188 | |||||||

| Provision for income taxes (TEB) | (833 | ) | (133 | ) | (939 | ) | ||||

| Non-controlling interest in net income of subsidiaries | (92 | ) | (64 | ) | (82 | ) | ||||

| Net income — operating cash basis | $ | 1,567 | $ | 535 | $ | 2,167 | ||||

| Preferred dividends | (87 | ) | (93 | ) | (92 | ) | ||||

| Net income applicable to common shares — operating cash basis | $ | 1,480 | $ | 442 | $ | 2,075 | ||||

| Special increase in general provision, net of income taxes | — | — | (208 | ) | ||||||

| Gain on sale of mutual fund record keeping and custody business, net of income taxes | — | 32 | — | |||||||

| Gains on sale of investment real estate, net of income taxes | — | — | 275 | |||||||

| Restructuring costs, net of income taxes | — | — | (138 | ) | ||||||

| Income tax expense from income tax rate changes | — | — | (75 | ) | ||||||

| Net income applicable to common shares — cash basis | 1,480 | 474 | 1,929 | |||||||

| Non-cash goodwill amortization, net of income taxes | — | — | (189 | ) | ||||||

| Non-cash intangible amortization, net of income taxes | (491 | ) | (634 | ) | (440 | ) | ||||

| Net income (loss) applicable to common shares — reported basis | $ | 989 | $ | (160 | ) | $ | 1,300 | |||

| (dollars) | ||||||||||

| Basic net income per common share — operating cash basis | $ | 2.28 | $ | .69 | $ | 3.31 | ||||

| Diluted net income per common share — operating cash basis | 2.26 | .68 | 3.27 | |||||||

| Basic net income (loss) per common share — reported basis | 1.52 | (.25 | ) | 2.07 | ||||||

| Diluted net income (loss) per common share — reported basis | 1.51 | (.25 | ) | 2.05 | ||||||

Certain comparative amounts have been reclassified to conform with current year presentation.

10 TD BANK FINANCIAL GROUP ANNUAL REPORT 2003 - Management's Discussion and Analysis

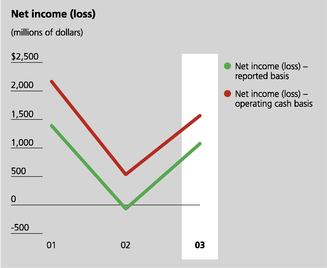

Net income (loss)

In its simplest terms, net income is revenues less expenses, loan losses and income taxes.

Reported net income was $1,076 million in 2003, compared with reported net loss of $67 million in 2002 and reported net income of $1,392 million in 2001. Reported basic earnings per share were $1.52 in 2003 compared with a loss per share of $.25 in 2002 and reported basic earnings per share of $2.07 in 2001. Reported diluted earnings per share were $1.51 in 2003 compared with a loss per share of $.25 in 2002 and reported diluted earnings per share of $2.05 in 2001. Reported return on total common equity was 8.7% in 2003 compared with (1.3)% in 2002 and 11.3% in 2001.

In 2003, operating cash basis net income was $1,567 million, compared with $535 million in 2002 and $2,167 million in 2001. On an operating cash basis, basic earnings per share were $2.28 in 2003 compared with $.69 in 2002 and $3.31 in 2001. Diluted earnings per share on an operating cash basis were $2.26 in 2003 compared with $.68 in 2002 and $3.27 in 2001. Operating cash basis return on total common equity was 13.0% compared with 3.6% in 2002 and 18.0% in 2001.

Economic profit (loss)

The Bank utilizes economic profit (loss) as a tool to measure shareholder value creation. Economic profit (loss) is operating cash basis net income (loss) applicable to common shares after a charge for average invested capital. Average invested capital is equal to average common equity plus the cumulative after-tax amount of goodwill and intangible assets amortized as of the reporting date. Average invested capital is increased by previously amortized goodwill and intangibles because this amortization is (as previously explained) excluded in operating cash basis net income. The rate used in the charge for capital is the equity cost of capital as determined by reference to the Capital Asset Pricing Model. The charge represents a required return to common shareholders. The Bank's goal is to achieve positive and growing economic profit.

Return on average invested capital (ROIC) is operating cash basis net income (loss) applicable to common shares, divided by average invested capital. ROIC is a variation on the economic profit measure that is useful in comparison to equity cost of capital. Both ROIC and the cost of capital are ratios, while economic profit is a dollar measure. When ROIC exceeds the equity cost of capital, economic profit is positive. The Bank's goal is to achieve ROIC that exceeds the equity cost of capital.

Economic profit and ROIC are not defined terms under GAAP, and therefore may not be comparable to similar terms used by other issuers. The table below provides a reconciliation between the Bank's economic profit and operating cash basis results which are discussed in the "How the Bank Reports" section.

Reconciliation of economic profit and operating cash basis results

| (millions of dollars) | 2003 | 2002 | 2001 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Average common equity | $ | 11,396 | $ | 12,144 | $ | 11,505 | ||||

| Average cumulative amount of non-cash goodwill/intangible amortization, net of income taxes | 2,396 | 1,881 | 1,196 | |||||||

| Average invested capital | $ | 13,792 | $ | 14,025 | $ | 12,701 | ||||

| Rate charged for invested capital | 10.9 | % | 11.2 | % | 12.0 | % | ||||

| Charge for invested capital1 | (1,530 | ) | (1,574 | ) | (1,526 | ) | ||||

| Net income applicable to common shares — operating cash basis | 1,480 | 442 | 2,075 | |||||||

| Economic profit (loss) | $ | (50 | ) | $ | (1,132 | ) | $ | 549 | ||

| Return on average invested capital | 10.5 | % | 3.2 | % | 16.3 | % | ||||

- 1

- Includes $26 million after-tax charge for past amortization of impaired goodwill recognized in the second quarter of 2003.

TD BANK FINANCIAL GROUP ANNUAL REPORT 2003 - Management's Discussion and Analysis 11

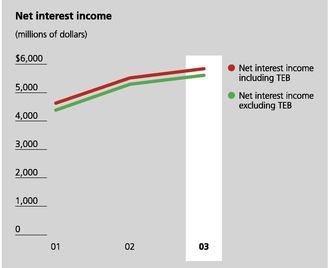

Net interest income

The Bank calculates net interest income by adding the interest and dividends it earns from loans and securities, and subtracting the interest it pays on deposits and other liabilities.

Net interest income is calculated on a taxable equivalent basis (TEB), which means that the value of non-taxable or tax-exempt income such as dividends is adjusted to its equivalent before tax value. This allows the Bank to measure income from all securities and loans consistently and makes for a more meaningful comparison of net interest income with other institutions.

See supplementary information page 45 and 46, tables 2, 3 and 4

Net interest income (TEB) was $5,846 million in 2003, a year-over-year increase of $324 million or 6%. The increase in net interest income is related to Personal and Commercial Banking where average personal loan volumes — excluding securitizations — increased $5 billion from a year ago; however this growth was partially offset by a 14 basis point reduction in the net interest margin to 3.28%. The increase is also related to higher interest income in Wealth Management due to higher cash balances in domestic operations combined with higher yields earned on the investment of the cash balances. In addition, the increase in net interest income related to interest income from income tax refunds and taxable equivalent and securitization adjustments in 2003. Net interest income excluding the TEB adjustment for 2003 was $5,616 million, an increase of $316 million compared with 2002.

Net interest income (TEB) was $5,522 million in 2002, a year-over-year increase of $886 million or 19%. Net interest income reported by Wholesale Banking increased by $607 million as compared with 2001, primarily related to an increase in interest income from trading securities. Net interest income for Personal and Commercial Banking increased by $107 million as compared with 2001. The increase in Personal and Commercial Banking was attributable to personal loan volumes, excluding securitizations, which increased by $5 billion, and the net interest margin improvement of four basis points to 3.42%. Net interest income excluding the TEB adjustment for 2002 was $5,300 million, an increase of $909 million compared with 2001.

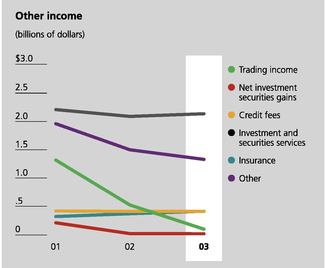

Other income

Other income represents all of our income other than net interest income. Sources of other income include revenues from trading activities, brokerage fees, mutual fund management fees, service fees, income from loan securitizations and other revenue.

See supplementary information page 47, tables 5 and 6

Other income on an operating cash basis was $4,424 million in 2003, a decrease of $465 million or 10% from 2002, after excluding the special gain from the sale of the Bank's mutual fund record keeping and custody business in 2002. In the first and third quarters of 2002, the Bank sold its mutual fund record keeping and custody business and recorded a pre-tax gain of $18 million and $22 million, respectively. The Bank has excluded these special gains in analyzing its performance as they are not recurring events. Reported other income was $4,424 million for 2003, a decrease of $505 million or 10% from 2002.

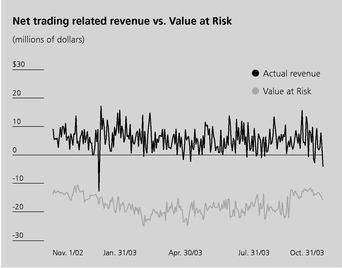

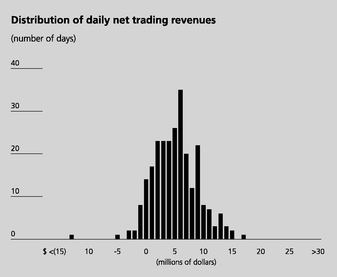

Trading income reported in other income decreased by $425 million or 80% compared with 2002, while trading-related income generated by Wholesale Banking — which is the total of trading income reported in other income and the net interest income on trading positions reported in net interest income — was $1,158 million for the year, a decrease of $195 million or 14% compared with 2002. The decrease reflects a decline in market activity levels across equity and interest rate structured products compared with last year. The investment securities portfolio realized net gains of $23 million in 2003 compared with gains of $26 million in 2002. The decrease is primarily attributable to market conditions. Overall, the investment securities portfolio has a surplus over its book value of $429 million compared with $228 million at the end of 2002. The decline in other income was also due to losses on derivative and loan sales not booked to sectoral in Wholesale Banking of $113 million. In addition, the decline in other income related to write downs of $39 million in 2003, resulting from other than temporary impairments in certain international wealth management joint ventures. Non-trading foreign exchange income decreased by $61 million in 2003 to address a previously unhedged non-trading U.S. dollar exposure arising from our U.S. dollar Visa business. Somewhat offsetting the decline in other income were increases in discount brokerage fees and commissions of $35 million or 4% and full service brokerage fees and other securities services fees of $26 million or 4% compared with last year. Also, offsetting the decline was a year-over-year increase in fees from card services and service charges of $48 million or 6%, an increase in insurance revenues of $45 million or 12% and an increase in income from loan securitizations of $32 million or 15% as compared with 2002.

Other income was $4,889 million in 2002, a decrease of $1,208 million or 20% from 2001, after excluding special gains from the sale of the Bank's mutual fund record keeping and custody business in 2002 and special gains from the sale of certain investment real estate assets in 2001. During fiscal 2001, the Bank sold certain investment real estate for a pre-tax gain on sale of $350 million, net of deferrals. The Bank has excluded these special gains in analyzing its performance as they are not recurring events. Reported other income was $4,929 million for 2002, a decrease of $1,518 million or 24% from 2001.

12 TD BANK FINANCIAL GROUP ANNUAL REPORT 2003 - Management's Discussion and Analysis

Trading income reported in other income decreased by $789 million in 2002, while trading related income generated by Wholesale Banking was $1,353 million for the year, a decrease of $184 million or 12% as compared with 2001. This was a solid performance given the decrease in market volatility, the continued slow down in corporate origination activity and weak credit markets experienced during 2002. The investment securities portfolio realized net gains of only $26 million in 2002. This represents a significant decrease from net investment securities gains of $216 million in 2001. The decrease is primarily attributable to weaker equity markets leading to fewer exit opportunities in 2002. Overall, the equity investment securities portfolio continued to have a surplus over its book value of $228 million compared with $370 million at the end of 2001. The decline in other income also reflects a decrease in self-directed brokerage revenues of $80 million, or 8%, compared with 2001. This decrease reflects a 15% drop in average trades per day to 98,900 from 116,000 in 2001. Income from loan securitizations decreased by $54 million, or 20%, as compared with 2001, as a result of lower levels of securitized assets. Partially offsetting this decline in other income was a year-over-year increase in insurance revenues of $49 million or 15%. Also contributing to the overall decline in other income was a decrease in property rental income of $52 million as the Bank sold substantially all of its investment real estate in fiscal 2001.

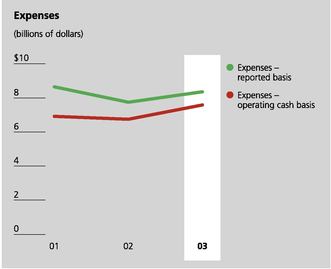

Expenses

Expenses include non-interest expenses, such as salaries, occupancy and equipment costs, and other operating expenses.

See supplementary informationpage 45 and 48, table 1 and 7

Operating cash basis expenses exclude non-cash goodwill and identified intangible amortization and restructuring costs related to acquisitions and significant business restructuring initiatives. During the fourth quarter of fiscal 2001, Wholesale Banking announced a restructuring of its operations, which resulted in pre-tax restructuring costs of $130 million, primarily related to employee severance. In fiscal 2001, the Bank incurred pre-tax restructuring costs of $54 million related to TD Waterhouse and $55 million related to the acquisition of Newcrest. Beginning in fiscal 2002, the Bank discontinued the amortization of goodwill as a result of the adoption of the new accounting standard on goodwill and intangible assets.

In 2003, operating cash basis expenses increased $838 million to $7,592 million compared with 2002. The increase in expenses is primarily a result of $624 million in goodwill write downs related to the international unit of the Bank's wealth management business and its U.S. equity options business in Wholesale Banking recognized in the second quarter of 2003. During the second quarter of 2003, the Bank reviewed the value of goodwill assigned to these businesses and determined that an impairment had occurred. In addition, during the second quarter of 2003 the Bank determined that it was necessary to restructure these operations and, as a result, recorded $87 million in restructuring costs in the second quarter and $5 million in the third quarter of 2003. The increase in expenses is also related to increased variable compensation expenses and charges related to systems write-offs, real estate downsizing, legal provisions in the non-core portfolio and costs of streamlining core operations in Wholesale Banking. On a reported basis, expenses increased by $612 million from a year ago to $8,364 million. The impact of non-cash intangible amortization on the Bank's reported expenses in 2003 was $772 million compared with $998 million last year. Beginning in fiscal 2003, the Bank has applied the fair value method of accounting for stock options and recorded an expense of $9 million.

In 2002, total operating cash basis expenses decreased by $171 million or 2% from 2001 to $6,754 million, primarily as a result of lower incentive compensation expenses in Wholesale Banking. Wealth Management also contributed to the decrease in salaries and employee benefits as a result of its discount brokerage restructuring initiatives. On a reported basis, expenses decreased by $902 million from 2001 to $7,752 million. The impact of non-cash goodwill and intangible amortization on the Bank's reported expenses in 2002 was $998 million compared with $1,490 million in 2001.

TD BANK FINANCIAL GROUP ANNUAL REPORT 2003 - Management's Discussion and Analysis 13

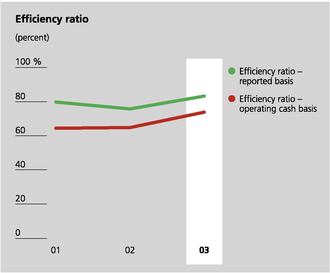

Efficiency ratio

The efficiency ratio measures the efficiency of operations. It's calculated by taking expenses as a percentage of total revenue. The lower the percentage, the greater the efficiency.

See supplementary informationpage 48, table 7

On an operating cash basis, the Bank's overall efficiency ratio weakened to 73.9% from 64.9% in 2002 and 64.5% in 2001. The Bank's consolidated efficiency ratio is impacted by shifts in its business mix. The efficiency ratio is viewed as a more relevant measure for Personal and Commercial Banking, which had an efficiency ratio of 58.8% this year compared with 60.7% in 2002 and 61.5% in 2001. During fiscal 2003, the method used to calculate the efficiency ratio for Personal and Commercial Banking was simplified to no longer exclude the funding costs for the acquisition of Canada Trust. On a reported basis, the Bank's overall efficiency ratio weakened to 83.3% from 75.8% in 2002 and 79.8% in 2001.

Taxes

The Bank carries on many businesses in many different locations with differing outcomes, resulting in a mix of tax payments and tax recoveries. The Bank continues to pay significant amounts of tax to governments across Canada. Supplementary table 8 on page 49 lists the various taxes the Bank has paid over the past five years.

Note 15 of the Bank's Consolidated Financial Statements sets out the key tax measurements under generally accepted accounting principles.

The Bank's home jurisdiction, Ontario, has announced that it will be increasing corporate income taxes and stopping the planned elimination of capital taxes. As a result, the expected rate of Canadian taxes in the future will be higher than previously thought although still lower than in 2003. The federal government has promised the phased elimination of its principal capital tax.

In 2003, the write down of some businesses added to the net future tax asset of the Bank. This was in addition to the substantial increase caused by the large sectoral loan provisions recorded in 2002. The effective use of these assets is dependent upon a continued return to ordinary levels of profitability, particularly in the Bank's U.S. operations. This increase was offset to a significant extent by the usage of a portion of the sectoral provisions against specific loans as well as the release of provisions for both sectoral and general loan losses.

Balance sheet

See Consolidated Balance Sheetpage 55

Total assets were $274 billion at the end of the year, $4 billion or 2% lower than as at October 31, 2002. A decline in investment securities activity resulted in a $4 billion decrease and business and government loans decreased by $11 billion as compared with October 31, 2002. However, securities purchased under resale agreements increased by $4 billion to $17 billion due to increased securities volumes. Also, as compared with last year, personal loans, including securitizations, increased by $6 billion to reach $49 billion. At the end of the year, residential mortgages, including securitizations, increased by $5 billion to reach $72 billion as compared with last year. Bank-originated securitized assets not included on the balance sheet amounted to $18 billion compared with $15 billion at October 31, 2002. Wholesale deposits decreased by $14 billion as compared with October 31, 2002. However, personal non-term deposits increased by $2 billion to $53 billion and personal term deposits increased by $3 billion to $53 billion compared with October 31, 2002.

Total assets were $278 billion at October 31, 2002, $10 billion or 3% lower than as at October 31, 2001. Lower volumes from trading securities contributed $13 billion to the decrease in total assets with securities purchased under resale agreements representing $7 billion of the decrease. Personal loans, including securitizations, increased by $2 billion, primarily attributable to a solid performance in real estate secured lines of credit in Personal and Commercial Banking. At the end of fiscal 2002, residential mortgages, including securitizations, increased by $1 billion from 2001 to $67 billion. As at October 31, 2002, wholesale deposits decreased by $11 billion and securities under repurchase agreements decreased by $6 billion as compared with October 31, 2001. Personal non-term deposits grew by $4 billion from October 31, 2001 to reach $51 billion at the end of fiscal 2002, with Personal and Commercial Banking accounting for the majority of this increase. Personal term deposits remained unchanged at $50 billion compared with 2001.

The Bank also enters into structured transactions on behalf of clients which result in assets recorded on the Bank's Consolidated Balance Sheet for which market risk has been transferred to third parties via total return swaps. As at October 31, 2003, assets under such arrangements amounted to $13 billion compared with $11 billion in 2002 and $10 billion in 2001. The Bank also acquires market risk on certain assets via total return swaps, without acquiring the cash instruments directly. Assets under such arrangements amounted to $6 billion as at October 31, 2003 compared with $6 billion in 2002 and $6 billion in 2001. Market risk for all such positions is tracked and monitored, and regulatory market risk capital is required. The assets sold under these arrangements are discussed in the other financial transactions section on page 15 are included in this amount. See Note 18 of the Bank's Consolidated Financial Statements for more details of derivative contracts.

14 TD BANK FINANCIAL GROUP ANNUAL REPORT 2003 - Management's Discussion and Analysis

Off-balance sheet arrangements

In the normal course of operations, the Bank engages in a variety of financial transactions that, under generally accepted accounting principles, are either not recorded on the Consolidated Balance Sheet or are recorded in amounts that differ from the full contract or notional amounts. These off-balance sheet arrangements involve, among other risks, varying elements of market, credit and liquidity risk which are discussed in the Managing risk section on pages 33 to 41 of this Annual Report. Off-balance sheet arrangements are generally undertaken for risk management, capital management and/or funding management purposes and include securitizations, commitments, guarantees and contractual obligations.

Securitizations

Securitizations are an important part of the financial markets, providing liquidity by facilitating investor access to specific portfolios of assets and risks. In a typical securitization structure, the Bank sells assets to a special purpose entity (SPE) and the SPE funds the purchase of those assets by issuing securities to investors. SPEs are typically set up for a single, discrete purpose, are not operating entities and usually have no employees. The legal documents that govern the transaction describe how the cash earned on the assets held in the SPE must be allocated to the investors and other parties that have rights to these cash flows. The Bank is involved in SPEs through the securitization of its own assets, securitization of third party assets and other financial transactions.

Securitization of bank-originated assets

The Bank securitizes residential mortgages, personal loans, credit card loans and commercial mortgages to enhance its liquidity position, diversify its sources of funding and to optimize the management of its balance sheet. Details of these securitizations are discussed below.

The Bank securitizes residential mortgages through the creation of mortgage-backed securities and transfers to SPEs. The Bank continues to service the securitized mortgages and may be exposed to the risks of the transferred loans through retained interests. There are no expected credit losses on the retained interests of the securitized residential mortgages that are government guaranteed (approximately 94% of all securitized residential mortgages). As at October 31, 2003, the Bank had outstanding securitized residential mortgages of $11.3 billion as compared with $8.1 billion in fiscal 2002.

The Bank securitizes real estate secured personal loans through sales to SPEs. The Bank provides credit enhancement through its retained interest in the excess spread of the SPEs and by funding cash collateral accounts. The Bank's interest in the excess spread of the SPEs and the cash collateral account is subordinate to the SPEs' obligations to the holders of its asset-backed securities and absorbs losses with respect to the personal loans before payments to noteholders are affected. As at October 31, 2003, the Bank had outstanding securitized personal loans of $4.6 billion as compared with $5.0 billion in fiscal 2002.

The Bank securitizes credit card loans through sales to SPEs. The Bank's credit card securitizations are revolving securitizations, with new credit card receivables transferred to the SPEs each period to replenish receivable amounts as they are repaid. The Bank provides credit enhancement to the SPEs through its retained interest in the excess spread. The Bank's interest in the excess spread of the SPEs is subordinate to the SPEs' obligations to the holders of its asset-backed securities and absorbs losses with respect to the credit card receivables before payments to the noteholders are affected. As at October 31, 2003, the Bank had outstanding securitized credit card receivables of $1.5 billion as compared with $1.5 billion in fiscal 2002.

The Bank also securitizes commercial mortgages, which in addition to providing a source of liquidity and capital efficient funding, may reduce the Bank's credit exposure. As at October 31, 2003, the Bank had outstanding securitized commercial mortgages of $1.0 billion as compared with $.3 billion in fiscal 2002.

Total bank-originated securitized assets not included on the Consolidated Balance Sheet amounted to $18.4 billion compared with $14.9 billion a year ago. Further details are provided in Note 4 of the Bank's Consolidated Financial Statements.

Securitization of third party originated assets

The Bank assists its clients in securitizing their financial assets through SPEs administered by the Bank. The Bank may provide credit enhancement or liquidity facilities to the resulting SPEs as well as securities distribution services. The Bank does not provide employees to the SPEs, nor does it have ownership interests in these SPEs and all fees earned in respect of these activities are on a market basis.

Other financial transactions

The Bank sells trading securities to SPEs in conjunction with its balance sheet management strategies. The Bank does not retain effective control over the assets sold. Assets sold under such arrangements at October 31, 2003 amounted to $5.0 billion as compared with $5.0 billion in fiscal 2002. The Bank enters into total return swaps with the sale counterparties in respect of the assets sold. Market risk for all such transactions is tracked and monitored, and market risk capital is required.

In addition, the Bank also offers financial products, including mutual funds, structured notes and other financial instruments to clients, including SPEs as counterparties. These financial products are, on occasion, created using a SPE as issuer or obligor of the financial products. The Bank may provide certain administrative services and other financial facilities to the SPEs in exchange for market rate compensation.

Commitments and guarantees

Details of the Bank's commitments and guarantees are provided in Note 19 of the Bank's Consolidated Financial Statements.

Contractual obligations

The Bank has contractual obligations to make future payments on subordinated notes and debentures, operating lease commitments, capital trust securities and certain purchase obligations. Subordinated notes and debentures and capital trust securities are reflected on the Bank's Consolidated Balance Sheets, while operating lease commitments and purchase obligations are not. Details of these contractual obligations as at October 31, 2003 are disclosed by remaining maturity in supplementary table 17 on page 53 of this Annual Report.

TD BANK FINANCIAL GROUP ANNUAL REPORT 2003 - Management's Discussion and Analysis 15

The Bank's accounting policies are essential to understanding its results of operations and financial condition. A summary of the Bank's significant accounting policies is presented in Note 1 of the Bank's Consolidated Financial Statements beginning on page 59 of this Annual Report. Some of the Bank's policies require subjective, complex judgements and estimates as they relate to matters that are inherently uncertain. Changes in these judgements or estimates could have a significant impact on the Bank's financial statements. The Bank has established procedures to ensure that accounting policies are applied consistently and that the processes for changing methodologies are well controlled and occur in an appropriate and systematic manner. In addition, the Bank's critical accounting policies are reviewed with the Audit Committee on a periodic basis. Critical accounting policies that require management's judgements and estimates include accounting for loan losses, accounting for the fair value of financial instruments held in trading portfolios, accounting for income taxes, the valuation of investment securities, accounting for securitizations, the valuation of goodwill and intangible assets and the accounting for pensions and post-retirement benefits.

Accounting for loan losses

Accounting for loan losses is an area of importance given the significant size of the Bank's loan portfolio. The Bank has three types of allowances against loan losses — specific, general and sectoral. Loan impairment is recognized when the timely collection of all contractually due interest and principal payments is no longer assured. Significant judgement is required as to the timing of designating a loan as impaired and the amount of the required specific allowance. Reviews by regulators in Canada and the U.S. bring a measure of uniformity to specific allowances recorded by banks. Sectoral allowances require ongoing judgement as to draw downs from sectorals to specific loss and the amount of periodic sectoral allowances required. General allowances also require judgement given that the level of general allowances depends upon an assessment of business and economic conditions, historical and expected loss experience, loan portfolio composition and other relevant indicators. Note 1(h) of the Bank's Consolidated Financial Statements provides more details.

Accounting for the fair value of financial instruments held in trading portfolios

The Bank's trading securities and trading derivatives are carried at fair value on the Consolidated Balance Sheet with the resulting realized and unrealized gains or losses recognized immediately in other income. The fair value of exchange traded financial instruments is based on quoted market rates plus or minus daily margin settlements. If listed prices or quotes are not available, then the Bank's management applies judgement in the determination of the fair values by using valuation models that incorporate prevailing market rates and prices on underlying instruments with similar maturities and characteristics, and takes into account factors such as counterparty credit quality, liquidity and concentration concerns. Imprecision in estimating these factors can impact the amount of revenue or loss recorded for a particular position. Notwithstanding the judgement required in fair valuing the Bank's financial instruments, the Bank believes its estimates of fair value are reasonable given the Bank's process for obtaining external market prices, internal model review, consistent application of approach from period to period and the validation of estimates through the actual settlement of contracts.

Accounting for income taxes

Accounting for current income taxes requires the Bank to exercise judgement for issues relating to certain complex transactions, known issues under discussion with tax authorities or transactions yet to be settled in court. As a result, the Bank maintains a tax provision for contingencies and regularly assesses the adequacy of this tax provision.

Future income taxes are recorded to account for the effects of future taxes on transactions occurring in the current period. The accounting for future income taxes also requires judgement in the following key situations:

- •

- Future tax assets are assessed for recoverability. The Bank records a valuation allowance when it believes based on all available evidence, that it is not more likely than not that all of the future tax assets recognized will be realized prior to their expiration. The amount of the future income tax asset recognized and considered realizable could, however, be reduced in the near term if projected income is not achieved due to various factors such as unfavourable business conditions.

- •

- Future tax assets are calculated based on tax rates to be applied in future periods. Previously recorded tax assets and liabilities need to be adjusted when the expected date of the future event is revised based on current information.

- •

- The Bank has not recognized a future income tax liability for undistributed earnings of certain international operations as it does not plan to repatriate them. Estimated taxes payable on such earnings in the event of repatriation would be $206 million at October 31, 2003.

Valuation of investment securities

Under Canadian generally accepted accounting principles (GAAP), investment securities are carried at cost or amortized cost and are adjusted to net realizable value to recognize other than temporary impairment. The determination of whether or not other than temporary impairment exists is a matter of judgement. The Bank's management reviews these investment securities regularly for possible other than temporary impairment and this review typically includes an analysis of the facts and circumstances of each investment and the expectations for that investment's performance. Specifically, impairment of the value of an investment may be indicated by conditions such as a prolonged period during which the quoted market value of the investment is less than its carrying value, severe losses by the investee in the current year or current and prior years, continued losses by the investee for a period of years, suspension of trading in the securities, liquidity or going concern problems of the investee or a current fair value of the investment that is less than its carrying value.

16 TD BANK FINANCIAL GROUP ANNUAL REPORT 2003 - Management's Discussion and Analysis

When a condition indicating an impairment in value for an investment has persisted for a period of three to four years, there is a general presumption that there has been a loss that is other than temporary in nature. This presumption can only be rebutted by persuasive evidence to the contrary.

Accounting for securitizations

There are two key determinations relating to the accounting for securitizations. For bank-originated securitized assets, a decision must be made as to whether the securitization should be considered a sale under Canadian GAAP. Canadian GAAP requires that specific criteria be met for the Bank to have surrendered control of the assets and thus recognize a gain on sale. For instance, the securitized assets must be isolated from the Bank and put beyond the reach of the Bank and its creditors, even in bankruptcy or other receivership. The second key determination is whether the special purpose entity (SPE) should be consolidated into the Bank's financial statements. Current Canadian GAAP requires consolidation of SPEs only when the Bank retains substantially all the residual risks and rewards of the SPE. In addition, if the SPE's activities are sufficiently restricted to meet certain accounting requirements, the SPE should not be consolidated by the Bank. Under current Canadian GAAP, all of the Bank-originated assets transferred to SPEs meet the criteria for sale treatment and non-consolidation. However, it should be noted that the Canadian Institute of Chartered Accountants (CICA) has issued a new accounting guideline entitled theConsolidation of Variable Interest Entities (VIEs). The guideline introduces a new consolidation model which determines control (and consolidation) based on the potential variability of gains and losses of the entity being evaluated. The guideline is effective for the Bank beginning in fiscal 2005 and may result in the consolidation of certain VIEs. See Note 26 of the Bank's Consolidated Financial Statements for more details.

Valuation of goodwill and intangible assets

Under Canadian GAAP, goodwill is not amortized, but is instead assessed for impairment at the reporting unit level on at least an annual basis. Goodwill is assessed for impairment using a two step approach with the first step being to assess whether the fair value of the reporting unit to which the goodwill is associated is less than its carrying value. When the fair value of the reporting unit is less than the carrying value, a second impairment test is performed. The second test requires a comparison of the fair value of goodwill to its carrying amount. If the fair value of goodwill is less than its carrying value, goodwill is considered impaired and a charge for impairment must be recognized immediately. The fair value of the Bank's reporting units are determined from internally developed valuation models that consider various factors such as normalized and projected earnings, price earnings multiples and discount rates. The Bank's management uses judgement in estimating the fair value of reporting units and imprecision in estimates can affect the valuation of goodwill.

Intangible assets that derive their value from contractual customer relationships or that can be separated and sold, and have a finite useful life are amortized over their estimated useful life. Determining the estimated useful life of these finite life intangible assets requires an analysis of the circumstances and judgement by the Bank's management. Finite life intangible assets are tested for impairment whenever circumstances indicate that the carrying value may not be recoverable. See Note 5 to the Bank's Consolidated Financial Statements for more details.

Accounting for pensions and post-retirement benefits

The Bank's pension and post-retirement benefits obligation and expense is dependent on the assumptions used in calculating these amounts. The actuarial assumptions are determined by management and are reviewed annually by management and the Bank's actuaries. These assumptions include the discount rate, the rate of compensation increase, the overall health care cost trend rate and the expected long-term rate of return on plan assets. Differences between actual experience and the assumptions will result in increases or decreases in the Bank's pension and post-retirement benefits expense in future years. See Note 14 to the Bank's Consolidated Financial Statements for more details.

During the year, the Bank enhanced its internal controls over financial reporting within Wholesale Banking through the creation of a new Middle Office group with the mandate to further develop cross-functional support for its derivatives businesses and to focus on enhancing infrastructure and controls. In addition, the Bank enhanced its controls in the financial reporting process through a detailed review of residual unallocated revenues and expenses in the Corporate segment. During the 2003 fiscal year, there have been no significant changes in the Bank's internal controls over financial reporting that have materially affected, or are reasonably likely to materially affect the Bank's internal controls over financial reporting. However, the Bank is continually improving its infrastructure and controls.

An evaluation was performed under the supervision and with participation of the Bank's management, including the President and Chief Executive Officer (CEO) and Chief Financial Officer (CFO), of the effectiveness of the design and operation of the Bank's disclosure controls and procedures, as defined in the rules of the U.S. Securities and Exchange Commission (SEC), as of the end of the period covered by this Annual Report. Based on that evaluation, the Bank's management, including the CEO and CFO, concluded that the Bank's disclosure controls and procedures were effective as of October 31, 2003.

TD BANK FINANCIAL GROUP ANNUAL REPORT 2003 - Management's Discussion and Analysis 17

The Bank's operations and activities are organized around the following operating business segments: Personal and Commercial Banking, Wholesale Banking and Wealth Management.

Personal and Commercial Banking is a leader in Canada with approximately 10 million personal, small business, insurance and commercial customers. Under the TD Canada Trust brand, the retail operations provide a full range of financial products and services to our personal and small business customers — anywhere, anytime — through the telephone, the web, more than 2,600 automated banking machines, and our network of 1,065 branches conveniently located across the country offering the best banking hours in the business. TD Commercial Banking provides lending, deposit, savings and investment products to Canadian businesses, plus a full range of day-to-day banking, cash management, trade and treasury services.

Wholesale Banking serves a diverse base of corporate, government and institutional clients in key financial markets around the world. Under the TD Securities brand, Wholesale Banking provides a full range of capital markets and investment banking products and services that include:

- •

- Advice on corporate strategy and mergers and acquisitions;

- •

- Underwriting and distributing loan, debt and equity products;

- •

- Structuring tailored risk management solutions; and

- •

- Executing financial transactions.

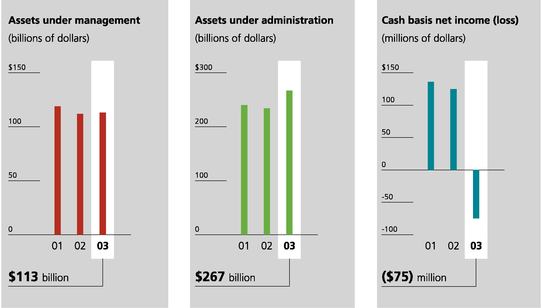

Wealth Management offers investors a wide array of investment products and services. It is one of Canada's largest asset managers, advisors and distributors of investment products; providing mutual funds, pooled funds, segregated account management, full-service brokerage services and self-directed investing to retail, mass affluent and private client segments. In addition, investment management services are provided to pension funds, corporations, institutions, endowments, and foundations. TD Waterhouse discount brokerage serves customers in Canada, the United States and the United Kingdom. Wealth Management has assets under management of $113 billion and assets under administration of $267 billion. TD Mutual Funds offers 62 retail mutual funds and 30 managed portfolios for Canadian investors.

Results of each business segment reflect revenues, expenses, assets and liabilities generated by the businesses in that segment. The Bank measures and evaluates the performance of each segment based on cash basis net income, return on average invested capital and economic profit. Cash basis results exclude non-cash charges related to goodwill and intangible amortization from business combinations. Segmented information also appears in Note 21 of the Bank's Consolidated Financial Statements.

TD BANK FINANCIAL GROUP ANNUAL REPORT 2003 - Management's Discussion and Analysis 19

Personal and Commercial Banking

A leader in personal and commercial banking in Canada with approximately 10 million personal, small business, insurance and commercial customers.

Overall business strategy

- •

- Deliver superior service and a premium brand-based customer experience.

- •

- Leverage premium customer experience to achieve superior financial results over the long-term through:

- •

- Better customer retention.

- •

- Better customer attraction.

- •

- Increased share of business from current customers.

- •

- Grow under-penetrated businesses at above average growth rates:

- •

- Commercial banking.

- •

- Small business banking.

- •

- Insurance.

- •

- Maintain a core competency in expense management.

- •

- Disciplined execution of strategy and operational excellence.

Challenges in 2003

- •

- Contraction in net interest margins due to a combination of rate environment, competitive pricing and customer preferences.

- •

- Modest decline in personal market share.

- •

- Lower branch revenue from sales of wealth management products due to instability in equity markets earlier in the year.

2003 Highlights

- •

- Earnings growth of 15% driven by a three percentage point spread between revenue and expense growth.

- •

- Completed a series of process re-engineering initiatives to permanently lower our cost base in order to meet earnings targets despite declining net interest margins.

- •

- Reduced personal lending credit losses and delinquency rates through improvements in credit adjudication and collection processes.

- •

- Achieved a new high in customer satisfaction, as measured by our Retail Customer Satisfaction Index (CSI).

- •

- Acquired 57 branches and 144,000 customers from Laurentian Bank on October 31, 2003 adding approximately $2 billion to both lending and deposit volume.

Business outlook and focus for 2004

Revenue growth is expected to continue to be challenging given the competitive environment. Accordingly, our focus for the coming year will be to:

- •

- Improve customer attraction rates and increase share of business with our current customers:

- •

- Increase focus on growing personal chequing accounts.

- •

- Improve cross-sell rates by building on early successes with a recently introduced sales-prompt system.

- •

- Grow commercial and small business deposit revenue at above average rates.

- •

- Grow insurance revenue at double-digit growth rates.

- •

- Continue to keep expense growth below revenue growth:

- •

- Continue to invest in process re-engineering to reduce errors and lower costs.

- •

- Manage everyday costs by eliminating duplication and redundancy.

- •

- Achieve expense synergies by using our extensive branch merger experience to integrate the Laurentian branches into the TD Canada Trust network.

- •

- Continue to build an enhanced retail risk management platform with a staged implementation over the next two years to further lower credit losses and improve pricing for risk.

- •

- Consider further strategic acquisitions and investments that will grow our franchise.

Review of financial performance 2003

Personal and Commercial Banking reported strong earnings growth in 2003 following modest growth in 2002. Cash basis net income of $1,277 million for 2003 increased by $163 million or 15% from the prior year. A three percentage point spread between revenue and expense growth, lower credit losses and a lower tax rate combined to improve earnings significantly year-over-year. Cash basis return on average invested capital increased to 18.5% from 16.8% last year as earnings growth exceeded the modest 4% increase in invested capital. Personal and Commercial Banking continued to drive growth in shareholder value by generating economic profit of $639 million during the year, an improvement of $201 million over last year after a one percentage point reduction in the rate charged for invested capital.

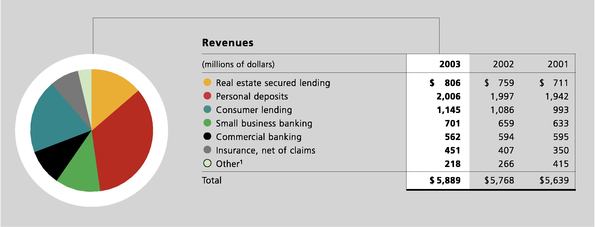

Total revenue grew 2% in 2003 compared with the prior year. Solid real estate secured lending and deposit volume growth, higher transaction-based fees, and strong growth in insurance income were the main contributors to revenue growth. Revenue growth was reduced by lower net interest margins, lower branch sales of Wealth Management products and a contraction in commercial lending volume.

20 TD BANK FINANCIAL GROUP ANNUAL REPORT 2003 - Management's Discussion and Analysis

Personal lending average volume, including securitization, grew $7 billion or 7%, primarily from real estate secured lending, and personal deposit volume grew $4 billion or 5%. Business deposits grew by $3 billion or 13% and originated gross domestic insurance premiums grew by $295 million or 27%. Business loans and acceptances contracted by $1 billion or 6%. As of August 2003, our overall personal market share (loans, deposits and mutual funds) was 21.05%, slightly lower than the 21.25% in fourth quarter of 2002. We experienced modest market share declines in personal lending and personal deposits and increased share in mutual funds.

Margin on average earning assets decreased from 3.42% to 3.28% due to a combination of rate environment, competitive pricing and customer preference. Core deposit margins narrowed from the impact of the low interest rate environment while competitive pricing has reduced margins on mortgages and term deposits. In addition, customer preference has weighted volume growth toward lower margin products such as the Guaranteed Investment Account and fixed-rate mortgages and home equity lines of credit.

Credit quality improved over last year in personal lending and remained strong in small business and commercial banking. Provision for credit losses decreased by $45 million or 9% reflecting the continued improvement in retail lending processes. Provision for credit losses as a percent of lending volume improved to .36% from .41% last year.

Cash basis expenses decreased by $38 million or 1% compared with last year. Expense synergies from branch mergers and from process improvements that were started following the branch and systems conversions in 2002 contributed to a 1,400 or 5% decrease in average full-time equivalent personnel over last year. The branch merger program is now complete with 32 mergers carried out during 2003 following 238 mergers over the previous two years. These savings in personnel costs were offset in part by increases in salaries and employee benefits, severance costs and variable expenses associated with strong volume growth in real estate secured lending and insurance products. In addition, up-front costs were incurred on the closure of 118 Wal-Mart in-store branches towards the end of the year. As a result of the actions taken to improve operational efficiency, the cash basis efficiency ratio for the year improved to 58.8%, two percentage points better than last year.

Review of financial performance 2002

Personal and Commercial Banking reported modest 2% growth in cash basis earnings in 2002 following strong growth in earnings during 2001. Total revenue grew 2% in 2002 compared with 2001. Core deposits, business deposits, credit cards and insurance were the main contributors to revenue growth. Growth in cash basis expenses was limited to 1% in 2002 compared with the prior year. Expenses in 2001 were impacted by costs associated with the conversion of the branch network and systems. During 2002, expense synergies were realized through branch mergers, however investments were made in customer service and process improvement initiatives following the conversions. Higher rates of expense growth were experienced in pension and benefit costs as well as in fast growing TD Meloche Monnex. The cash basis efficiency ratio for 2002 was 60.7%, an improvement of .8 percentage points over 2001. The provision for credit losses for 2002 of $505 million was $125 million or 33% higher than 2001. Approximately half of this increase was from small business and commercial lending returning to more normal loss levels following low losses in 2001. Losses in 2002 also included the impact of processing and collection issues that arose following conversion.

Financial results of key product segments within Personal and Commercial Banking

Real estate secured lending

- •

- Offers mortgages and home equity secured lines of credit through branches and other sales channels.

- •

- Highlights for 2003 include:

- –

- Growth of average real estate lending volumes of $6 billion, a 7% increase over 2002 average volumes. Improved new lending origination volume by 18% over 2002 and improved the mortgage retention rate by four percentage points.

- –

- Introduced industry leading automated property valuation on both mortgages and home equity lines of credit designed to both save the customer money and enhance their real estate credit experience.

- –

- Launched the new five year Best Rate Mortgage — a fixed price "no haggle" product guaranteeing a comfortable customer experience at market competitive rates.

- –

- Strong migration from mortgages to home equity lines of credit as customers responded to this superior product and service offering.

- •

- Fiscal 2003 demonstrated continued buoyancy in real estate in both home purchase and refinance activity.

- •

- The industry will continue to be extremely competitive due to historical low interest rates and the emergence of non-traditional and third party mortgage providers. Competitive pricing reduced net interest margins throughout 2003 and further compression is expected in 2004.

TD BANK FINANCIAL GROUP ANNUAL REPORT 2003 - Management's Discussion and Analysis 21

- 1

- Other revenue includes internal commissions on sales of mutual funds and other Wealth Management products, fees for foreign exchange, safety deposit box rentals and other branch services. The funding costs for the Canada Trust acquisition is also included in Other. Revenues in 2001 also include certain revenues that are of a non-recurring nature.

- •

- Objectives for 2004 are to grow volume and maximize revenue by enhancing the customer's real estate financing experience through improvements in the application and legal process and by continuing to offer customers a full range of options between traditional mortgage products and home equity lines of credit.

Personal deposits

- •

- Offers a complete range of Canadian and U.S. dollar chequing, savings and term investment vehicles designed to promote primary banking relationships, retirement savings and retirement income options.

- •

- During 2003, the industry experienced strong growth in personal deposits at a rate of over 6% with growth primarily in more liquid investment vehicles. Core deposit margins narrowed due to the impact of the low rate environment and customer preference, which weighted volume growth towards the Guaranteed Investment Account. Term deposit margins narrowed due to competitive pricing in short-term products. Further compression in term deposit margins may occur in 2004 however core deposit margins are expected to be stable.

- •

- Experienced a modest market share decline in short-term deposits in a competitive rate environment, but kept the number one position in personal deposit market share with growth in both non-term and term volumes of 7% and 4%, respectively.

- •

- Continued moderate growth in term deposit volumes in 2004 is expected. Non-term volumes are projected to grow at a slower rate. An increased emphasis will be placed on growing personal chequing acccounts to compensate for the projected slow down in volume growth.

Consumer lending

- •

- Offers Lines of Credit, Loans, Overdraft Protection products and a wide selection of Visa credit cards including Classic, Premium and Rewards cards such as the GM Visa card and the TD Gold Travel Visa card.

- •

- Revenue from credit cards grew by 9% on 7% growth in both outstandings and purchase volumes while revenues from other products were up 3% on 1% volume growth.

- •

- Credit quality improved due to better adjudication and collection processes. Provision for credit losses as a percent of consumer lending volume improved to 1.98% from 2.14% last year.

- •

- The tighter adjudication standards contributed to the relatively low volume growth in unsecured lending which in turn had a negative impact on market share.

- •

- Consumers responded positively to the TD Gold Travel "travel on your terms" rewards feature, as evidenced by both new account growth and increased card usage.

- •

- Deepening relationships with existing customers, building on the Gold Travel Visa momentum and continuing to build an enhanced risk management platform will be the key initiatives in 2004.

Small business banking and merchant services

- •

- Small business banking's focus is on quick and efficient delivery of deposit, lending and cash management services across the breadth of the entire branch network. With longer hours, any branch banking, dedicated service tellers and a top ranked internet service, superior access and service is provided to small business customers.

- •

- Merchant services is a premier debit and credit payment solution provider providing point-of-sale technology and 24/7 support service to over 85,000 merchant locations across Canada.

- •

- Revenue from small business deposits grew 7% on 10% volume growth and reduced margins while lending revenue was up 7% on 6% volume growth. Lending market share improved to 16.58% from 16.04% last year.

- •

- In 2004 focus will be on continued sales growth and retention.

Commercial banking

- •

- Offers lending, deposit, savings and investment products to medium-sized businesses plus a full range of day-to-day banking, cash management, trade and treasury services.

- •

- Continued momentum in the growth of commercial deposits, which increased by 16%.

- •

- Continued expansion of web capability that began in 2002. More than 50% of clients exclusively access cash management services through the internet.

- •

- A concerted effort to improve service quality delivered through the branch network has resulted in a substantial increase in Customer Satisfaction Index (CSI) scores based on direct customer feedback.

- •

- Average lending volumes decreased by 10% as continuing concern about the pace of economic recovery had a negative impact on business investment plans. The sale of the commercial leasing portfolio earlier in the year also reduced lending volumes.

- •

- Loan losses continue to be managed within acceptable limits and, based on our internal risk ratings, the overall risk profile of the portfolio has improved from one year ago.

22 TD BANK FINANCIAL GROUP ANNUAL REPORT 2003 - Management's Discussion and Analysis

- •

- Focus in 2004 will be to grow relationships and revenue through a more structured and accountable sales effort as well as increased referrals from retail branches.

Insurance

Offers a broad range of insurance products through the TD Insurance and TD Meloche Monnex brands, including credit protection coverage on TD Canada Trust lending products.

TD Life Group

- •

- Provides life and health insurance protection to 1.6 million customers.

- •

- Insurance cross-sell success continues to improve; more than six out of every ten new credit products sold are life insurance protected.

- •

- Premiums collected grew by 13% year-over-year.

- •

- A key priority will be continued growth in critical illness insurance.

TD Meloche Monnex

- •

- As the largest group insurer for home and automobile insurance in Canada, TD Meloche Monnex reached the billion-dollar level in written premiums in 2003, representing growth of 33% over last year. This milestone reflects the combined operations of the two brands TD Meloche Monnex and TD Insurance Home and Auto, representing over 600,000 individual clients. The company's unique business model is focused on affinity agreements with professional and university alumni organizations as well as employer groups.

- •

- Despite a difficult year for the personal property and casualty industry in 2003, TD Meloche Monnex grew net revenue by 16% over the prior year. The company also reduced its direct expense ratio to 19%, best among major insurers in Canada, resulting in further growth in underwriting profit.

- •

- For 2004, amid uncertainties in the provincial regulatory environment, the goal is to maintain above-average growth by remaining the leader in chosen markets, maintaining a low expense ratio and continuing to offer quality service and products.

TD Insurance

- •

- Under the TD Insurance brand, insurance products are provided to TD clients through a direct marketing approach based on e-commerce, direct mail and telephone.

- •

- With its web-based applications firmly in place, e-commerce is now responsible for a significant part of new automobile, home, and individual life insurance sales.

- •

- The goal for 2004 is for continued strong growth in the TD customer market and direct marketing sales, particularly benefiting from e-commerce initiatives.

Personal and Commercial Banking

| (millions of dollars) | 2003 | 2002 | 2001 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Net interest income (TEB) | $ | 4,086 | $ | 4,058 | $ | 3,951 | ||||

| Other income | 1,803 | 1,710 | 1,688 | |||||||

| Total revenue | 5,889 | 5,768 | 5,639 | |||||||

| Provision for credit losses | 460 | 505 | 380 | |||||||

| Non-interest expenses excluding non-cash goodwill/intangible amortization | 3,463 | 3,501 | 3,467 | |||||||

| Income before provision for income taxes | 1,966 | 1,762 | 1,792 | |||||||

| Provision for income taxes (TEB) | 689 | 648 | 702 | |||||||

| Net income — cash basis | $ | 1,277 | $ | 1,114 | $ | 1,090 | ||||

| Selected volumes and ratios | ||||||||||

| Average loans and acceptances (billions of dollars) | $ | 104 | $ | 98 | $ | 91 | ||||

| Average deposits (billions of dollars) | $ | 110 | $ | 103 | $ | 97 | ||||

| Economic profit (millions of dollars) | $ | 639 | $ | 438 | $ | 360 | ||||

| Return on average invested capital — cash basis | 18.5 | % | 16.8 | % | 16.7 | % | ||||

| Efficiency ratio — cash basis | 58.8 | % | 60.7 | % | 61.5 | % | ||||

| Margin on average earning assets including securitized assets | 3.28 | % | 3.42 | % | 3.38 | % | ||||

Economic outlook

A strengthening in the Canadian economy should be supportive to personal and commercial banking activities in 2004. Economic growth is expected to accelerate to around 3% next year from below 2% in 2003. This performance for the economy should bring gains in personal income and corporate profits, which should generate increased day-to-day banking activity. Rising economic activity may also increase demand for loans. However, an improvement in investor confidence may cause non-term deposits to decline, as individuals and firms redeploy some of the large cash holdings they have accumulated over the past few years into other investments.

Although some moderation is expected in housing markets, the level of activity should remain strong, which is good news for real estate secured lending and home-related insurance. Auto sales are also expected to remain firm, implying healthy demand for auto-related insurance. Lastly, small business banking is likely to benefit from the fact that small businesses tend to outperform larger businesses during the early stages of a rebound in economic growth. See page 32 for discussion of factors that may affect future results.

TD BANK FINANCIAL GROUP ANNUAL REPORT 2003 - Management's Discussion and Analysis 23

A leading Canadian wholesale bank serving corporate, government and institutional clients around the world.

Overall business strategy

- •

- Invest in businesses that support the needs of core customers and provide opportunities for increasing economic profit.

- •

- Deliver full suite of capital market services for our established customer base in Canada.

- •

- Operate as a niche investment bank outside of Canada by leveraging product capabilities or sector expertise.

- •

- Selectively use credit to support high return relationships.

- •

- Reduce non-core corporate lending risk.

Challenges in 2003

- •

- Weak business environment with lower corporate financing and structuring activity.

- •

- Poor performance of the equity options business amid difficult market conditions led to a restructuring.

- •

- Responding proactively to stronger governance requirements from investors and regulators.

2003 Highlights

- •

- Improved Canadian investment banking rankings and market share.

- •

- Strengthened global product distribution capabilities.

- •

- Used credit more effectively by focusing on client profitability while strengthening the franchise.

- •

- Significantly reduced the non-core loan portfolio.

- •

- Reduced risk in the core loan portfolio by purchasing protection.

- •

- Reduced market risk levels.

- •

- Rationalized under-performing and non-strategic businesses.

Business outlook and focus for 2004.

Credit and equity markets improved substantially in 2003 and we are optimistic that corporate activity levels will continue to recover in 2004. Our focus in 2004 is to:

- •

- Continue to increase market share in our Canadian franchise.

- •

- Continue to implement our niche product and sector based strategy globally.

- •

- Continue to enhance our risk and control infrastructure.

- •

- Continue to aggressively reduce the non-core loan portfolio.

- •

- Achieve return on average invested capital target of 18% to 20% in the core business.

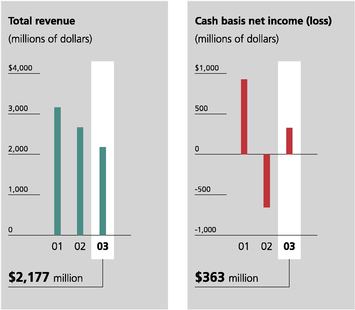

Review of financial performance 2003

Wholesale Banking reported cash basis net income of $363 million in 2003 compared with a net loss of $657 million in 2002. Return on average invested capital was 8.2% compared with (16.1)% last year. Economic loss was $193 million in 2003 compared with $1,192 million in 2002. The improved performance in 2003 is primarily a result of the significant reduction in credit losses as compared with 2002, but includes a $289 million after-tax charge for the restructuring and goodwill impairment of the equity options business and the effects of running off the non-core portfolio.

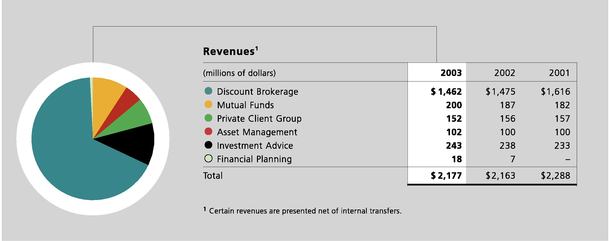

Wholesale Banking revenues are derived primarily from corporate banking, investment banking and capital markets and investing activities. Revenues declined 18% from 2002 to $2,177 million. The non-core portfolio incurred losses on asset sales and derivative positions of $113 million. Capital markets revenues, which include advisory, underwriting, trading, facilitation and execution services businesses decreased by $198 million compared with 2002. This was largely a result of reduced trading revenue from our structured products businesses.

Provisions for credit losses reversed from a $2,490 million charge in 2002 to an $80 million release of sectoral allowances in 2003. The 2002 allowance included $1,450 million of sectoral provisions relating to loans in the non-core portfolio. The sectoral allowance balance was $541 million at the end of 2003, compared with $1,285 million at the end of 2002. No credit losses were incurred in the core lending portfolio in 2003.

Non-interest expenses increased 43% to $1,761 million in 2003. The equity options business restructuring charge and goodwill write-off in 2003 had a combined impact of $422 million. The remaining increase includes costs of streamlining the core operations in Wholesale Banking, charges for systems write-offs, real estate downsizing and a legal provision in the non-core portfolio and higher variable compensation expenses compared with 2002.

Fiscal 2003 was a very satisfying year for Wholesale Banking. We repositioned the business to focus on our core strengths

24 TD BANK FINANCIAL GROUP ANNUAL REPORT 2003 - Management's Discussion and Analysis

and strategy to deliver consistent lower risk earnings, implemented stricter limits around credit exposures and industry concentrations and reduced the non-core lending portfolio with no additional negative impact on earnings.

Review of financial performance 2002

Financial results for 2002 were adversely affected by weak credit conditions and a strained operating environment resulting from heightened investor concerns over corporate governance issues and lingering geopolitical risks. On a cash basis, Wholesale Banking reported a net loss of $657 million in fiscal 2002 compared with net income of $926 million in the prior year. The decline was due primarily to an increase in provisions for credit losses, which had an after-tax impact of approximately $1,400 million. Significant declines in trading volumes, deterioration in equity markets, widening credit spreads and weak corporate activity led to lower revenues in 2002. Total revenue was $2,668 million, a decline of $495 million or 16% from revenues of $3,163 million in 2001. Provisions for credit losses rose sharply to $2,490 million in 2002, a $2,163 million increase from $327 million in 2001. The increase was mainly related to significant credit deterioration in the telecommunications and utility sectors, exposures to companies impacted by malfeasance and the fallout from the political instability in Argentina. During fiscal 2002, we established $1,450 million of sectoral provisions related to loans in the non-core portfolio. At the end of fiscal 2002, we had drawn down $185 million of the sectoral allowance to establish specific allowances. Cash basis expenses of $1,235 million in 2002 were $138 million below 2001 expenses of $1,373 million. The decline in expenses was driven by lower variable compensation, offset partially by additional investment in technology and risk management.

Financial results of key product segments within Wholesale Banking