UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-9082 |

| M Fund, Inc. |

| (Exact name of registrant as specified in charter) |

M Financial Plaza 1125 NW Couch Street, Suite 900, Portland, Oregon | 97209 |

| (Address of principal executive offices) | (Zip code) |

Bridget McNamara-Fenesy, President, M Fund, Inc.

M Financial Plaza, 1125 NW Couch Street, Suite 900, Portland, Oregon 97209 |

| (Name and address of agent for service) |

with a Copy to:

Cynthia Beyea

Eversheds Sutherland LLP

700 Sixth Street, N.W.

Washington, D.C. 20001-3980

| Registrant's telephone number, including area code: | (503) 232-6960 | |

| Date of fiscal year end: | 12/31 | |

| | | |

| Date of reporting period: | 12/31/2021 | |

Item 1. Reports to Stockholders.

| (a) | A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”), for the period January 1, 2021 through December 31, 2021 is filed herewith. |

M FUND, INC.

M International Equity Fund

M Large Cap Growth Fund

M Capital Appreciation Fund

M Large Cap Value Fund

Annual Report

December 31, 2021

M Fund, Inc.

PRESIDENT'S LETTER

Dear Contract Owners:

We are pleased to share the financial condition of M Fund, Inc. (the "Corporation") as presented in the following Annual Report dated December 31, 2021. Total assets under management at year end 2021 were $884.6 million.

Sub-Advisers to the portfolios, under the direction of M Financial Investment Advisers, Inc., the investment adviser to the Corporation, have prepared the attached discussion of results for each portfolio of the Corporation for the year ended December 31, 2021.

Sub-Advisers to the portfolios of the Corporation are: DFA LP for the M International Equity Fund, DSM Capital Partners LLC for the M Large Cap Growth Fund, Frontier Capital Management Company, LLC for the M Capital Appreciation Fund and Brandywine Global Investment Management, LLC for the M Large Cap Value Fund.

On behalf of the Corporation's Board of Directors, M Financial Investment Advisers, Inc. and the Corporation's participating insurance carriers, we thank you for your business and remain committed to providing opportunities that add value to our investors in the upcoming year.

Sincerely,

BRIDGET MCNAMARA-FENESY

President

M Fund, Inc.

M INTERNATIONAL EQUITY FUND

Performance

For the twelve months ended December 31, 2021, the M International Equity Fund had a return of 11.05% (net of management fees) versus a total return (including reinvestment of dividends) of 7.82% for its benchmark, the MSCI ACWI (All Country World Index) ex USA Index1.

Market Environment/Conditions

In US dollar terms, global ex US equity markets returned 8.53%, as reflected by the MSCI All Country World ex USA IMI (net dividends), for the year. Developed ex US markets returned 12.40% as measured by the MSCI World ex USA IMI (net dividends) and emerging markets returned -0.28% as measured by the MSCI Emerging Markets IMI (net dividends). In developed markets, most currencies depreciated versus the US dollar. In emerging markets, most currencies also depreciated versus the US dollar, but some, notably the Chinese renminbi and the Taiwan dollar, appreciated.

Theoretical and empirical research suggests that investors can systematically pursue higher expected returns by targeting the size, relative price, and profitability dimensions in equity markets. Dimensional Fund Advisors integrates these dimensions to emphasize stocks with smaller market capitalizations, lower relative prices, and higher profitability.

Along the market capitalization dimension, small caps (MSCI All Country World ex USA Small Cap Index, net dividends) outperformed large caps (MSCI All Country World ex USA Index, net dividends) by 5.10% for the year. Mid caps (MSCI All Country World ex USA Mid Cap Index, net dividends), a subset of the MSCI All Country World ex USA Index universe, underperformed small caps (MSCI All Country World ex USA Small Cap Index, net dividends) by 5.02% and performed in line with large caps (MSCI All Country World ex USA Index, net dividends).

Along the relative price dimension, large cap value stocks (MSCI All Country World ex USA Value Index, net dividends) outperformed large cap growth stocks (MSCI All Country World ex USA Growth Index, net dividends) by 5.36%%, and small cap value stocks (MSCI All Country World ex USA Small Cap Value Index, net dividends) outperformed small cap growth stocks (MSCI All Country World ex USA Small Cap Growth Index, net dividends) by 2.63%.

High profitability stocks outperformed low profitability stocks within both large caps and small caps.2

Performance of the premiums may vary depending on the particular segment of the market under analysis.

Fund Review/Current Positioning

The M International Equity Fund outperformed the MSCI All Country World ex USA Index (net dividends) by 3.23% for the period. The Fund's inclusion of and emphasis on small cap stocks had a positive impact on performance relative to the benchmark (which is composed primarily of large and mid cap stocks), as small caps outperformed large caps. With low relative price (value) stocks outperforming high relative price (growth) stocks, the Fund's greater emphasis on value stocks also contributed positively to performance relative to the benchmark. Additionally, the Fund's emphasis on high profitability stocks contributed positively to performance relative to the benchmark.

2

Dimensional Fund Advisors LP

Investment Sub-Adviser to the M International Equity Fund

Performance represented is net of fees. The foregoing reflects the thoughts and opinions of Dimensional Fund Advisors LP exclusively and is subject to change without notice. The information provided in this material should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any security transactions, holdings, or sectors discussed were or will be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance discussed herein. Strategies discussed are subject to change at any time by the investment manager in its discretion due to market conditions or opportunities. Market conditions may impact performance. The performance results presented were achieved in particular market conditions which may not be repeated. Moreover, the current market volatility and uncertain regulatory environment may have a negative impact on future performance. Portfolio characteristics are as of December 31, 2021. Please note that all indices are unmanaged and are not available for direct investment.

This commentary may include statements that constitute "forward looking statements" under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Fund, market or regulatory developments.The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are subject to change at any time based upon economic, market, or other conditions and the subadvisory firm undertakes no obligation to update the views expressed herein. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. The views expressed above (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Fund's trading intent. Information about the Fund's holdings, asset allocation or country diversification is historical and is not an indication of future Fund composition, which may vary. Direct investment in any index is not possible. The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. In addition, the returns do not reflect additional fees charged by separate accounts or variable insurance contracts that an investor in the Fund may pay. If these additional fees were reflected, performance would have been lower.

3

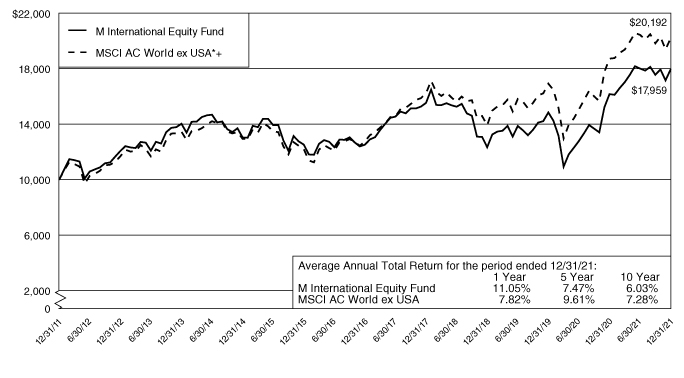

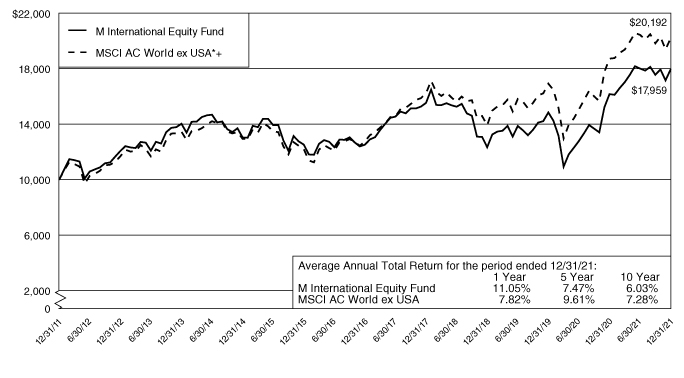

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN

THE M INTERNATIONAL EQUITY FUND, MSCI AC WORLD ex USA

The M International Equity Fund's total return is calculated net of Investment Advisory Fees and operating expenses. Performance figures represent past performance and are not indicative of future performance of the M International Equity Fund or Index. Share value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original investment. Please note that all indices are unmanaged, do not incur expenses, and are not available for direct investment. Persons who invest in the M International Equity Fund through a variable annuity or variable life insurance contract should note this graph does not reflect separate account expenses deducted by the insurance company.

* 12/31/11 to 12/31/21

+ MSCI EAFE—Effective May 1, 2014, the Fund changed its benchmark index from the MSCI EAFE Index to the MSCI AC World ex US Index. The MSCI AC World ex US Index is more representative of the Fund's investment portfolio than its previous index.

MSCI ACWI (ALL COUNTRY WORLD INDEX) ex USA INDEX

1 The MSCI ACWI (All Country World Index) ex USA Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets excluding the US. Investors cannot invest directly in an Index.

2 Profitability is measured as operating income before depreciation and amortization minus interest expense, scaled by book.

4

M LARGE CAP GROWTH FUND

Performance

For the twelve months ended December 31, 2021, the M Large Cap Growth Fund had a return of 21.5% (net of management fees) versus a total return (including reinvestment of dividends) of 27.6% for its benchmark, the Russell 1000 Growth Index1.

Market Environment/Conditions

In 2021 the strong performance of major US and global developed market equity indices continued. Once again, US markets led the way driven by the strength of "New Era" technology companies such as Apple, Meta Platforms (Facebook), Alphabet (Google), Microsoft, Netflix, NVIDIA and Tesla. These US-based, New Era technology companies are among the largest businesses in the world. They continue to grow as they opportunistically enter new markets, often of their own creation. It is readily apparent that the technological revolution is ongoing and will remain a critical driver of global economies and equity markets.

Many investors anticipate a return to Value's outperformance of Growth. However, DSM believes the ongoing competitive dynamics of digital/internet technologies will prove a disadvantage to both Value and most non-US businesses, as revenue and profit pressures build from competing new digital technologies. Additionally, Value stocks are generally more cyclical, operate in more competitive industries and have greater capital requirements. Finally, in a very low interest rate world, Value stocks in both Europe and the US often have high P/Es due to their dividend yield, yet these valuations are often not justified by the underlying business fundamentals of those companies.

Similarly, investors seem to expect a return to EU and/or EM outperformance over the United States. DSM continues to believe that America's technology-laden indices will outperform the Rest-of-World indices which generally exclude New Era technology giants, with the notable exception of China. In short, DSM believes Growth/United States will outperform Value/Rest-of-World going forward.

While "Old Era" Value names may recover and possibly outperform Growth over a limited period of time, DSM believes this trend will be short-lived. Similarly, a rally in bank stocks caused by a significant rise in interest rates as the global economy recovers would be a big plus for the Russell 1000 Value Index, the MSCI Europe and EM indices, all of which are more heavily exposed to financials than Growth indices. However, DSM believes this too would not last.

In recent years America's technology leadership has been challenged by Chinese technology companies such as Alibaba, Tencent and JD.com who have proved themselves to be credible competitors and technology innovators. Without question, Chinese companies will continue to challenge the US's dominance in tech going forward. However, it is possible that the punitive regulatory actions instituted by the Chinese government over this past year may cause China's leading technology companies to be less competitive going forward, while also disincentivizing the risk taking and entrepreneurial psychology of China's entrepreneurs across their entire economy. As a result, American technology companies may well find themselves better positioned on a relative basis.

Fund Review/Current Positioning

Over the last several quarters earnings have been quite strong across the Fund's holdings, however, turnover has increased. One of the factors behind the increased turnover is the risk of persistently higher inflation. If inflation remains above 3% for an extended period of time, interest rates may rise higher than currently expected. If rates do go up more than expected, DSM believes positions with loftier P/Es will be at a greater risk of a significant correction. Accordingly, DSM has trimmed or sold higher P/E names and purchased or added to positions with

5

lower P/Es. The majority of the Fund is invested in the information technology and communication services sectors, with smaller weightings in health care, financials, consumer discretionary, consumer staples, industrials and materials.

For the year, the M Large Cap Growth Fund underperformed the benchmark primarily as a result of stock selection in the consumer discretionary and information technology sectors. DSM's stock selection in financials and underweight of the industrials sector versus the benchmark benefitted performance. By security, the top five contributors to the Fund's performance for the year included Alphabet, Microsoft, NVIDIA, Intuit and EPAM Systems. The five positions which contributed the least in the period were Alibaba Group, Global Payments, PayPal Holdings, Tencent Holdings and JD.com. It is worth noting that the performance of the benchmark in 2021 was again helped by holding Apple, whose long-term growth prospects DSM sees as moderate, and Tesla, which has an extremely high valuation.

Given its reasonable valuation, solid expected revenue and earnings growth, and a recovering global economy, DSM believes the portfolio has significant appreciation potential. Over time, businesses appreciate in value as their earnings grow. Portfolio earnings have grown largely as expected before the pandemic, remained strong (albeit a bit less than expected) during the pandemic and DSM believes growth in the mid-to-high teens or perhaps more is possible in the years ahead.

DSM Capital Partners LLC

Investment Sub-Adviser to the M Large Cap Growth Fund

Performance represented is net of fees. The foregoing reflects the thoughts and opinions of DSM Capital Partners LLC exclusively and is subject to change without notice. The information provided in this material should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any security transactions, holdings, or sectors discussed were or will be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance discussed herein. Strategies discussed are subject to change at any time by the investment manager in its discretion due to market conditions or opportunities. Market conditions may impact performance. The performance results presented were achieved in particular market conditions which may not be repeated. Moreover, the current market volatility and uncertain regulatory environment may have a negative impact on future performance. Portfolio characteristics are as of 12/31/21. Please note that all indices are unmanaged and are not available for direct investment.

This commentary may include statements that constitute "forward looking statements" under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Fund, market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are subject to change at any time based upon economic, market, or other conditions and the subadvisory firm undertakes no obligation to update the views expressed herein. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. The views expressed above (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Fund's trading intent. Information about the Fund's holdings, asset allocation or country diversification is historical and is not an indication of future Fund composition, which may vary. Direct investment in any index is not possible. The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. In addition, the returns do not reflect additional fees charged by separate accounts or variable insurance contracts that an investor in the Fund may pay. If these additional fees were reflected, performance would have been lower.

6

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN

THE M LARGE CAP GROWTH FUND AND THE RUSSELL 1000 GROWTH INDEX (Unaudited)

The M Large Cap Growth Fund's total return is calculated net of Investment Advisory Fees and operating expenses. Performance figures represent past performance and are not indicative of future performance of the M Large Cap Growth Fund or Index. Share value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original investment. Please note that all indices are unmanaged, do not incur expenses, and are not available for direct investment. Persons who invest in the M Large Cap Growth Fund through a variable annuity or variable life insurance contract should note this graph does not reflect separate account expenses deducted by the insurance company.

* 12/31/11 to 12/31/21

RUSSELL 1000 GROWTH INDEX

1 The Russell 1000 Growth Total Return Index includes dividends reinvested in the Russell 1000 Growth Index as reported by the Russell Company. The Russell 1000 Growth Index is a capitalization weighted index containing over 600 widely held securities with growth characteristics. DSM uses the Russell 1000 Growth Index as a benchmark because its average market capitalization is similar to that of the M Large Cap Growth Fund, and it is an industry standard. Characteristics of any benchmark may differ materially from accounts managed by DSM. Investors cannot invest directly in an Index.

7

M CAPITAL APPRECIATION FUND

Performance

For the twelve months ended December 31, 2021, the M Capital Appreciation Fund had a return of 17.7% (net of management fees) versus a total return (including reinvestment of dividends) of 18.2% for its benchmark, the Russell 2500® Index1.

Market Environment/Conditions

U.S. equities ended the year with a record setting rally. Value stocks led the market with a Russell 2500® Value Index return of 27.8% compared to the Russell 2500® Growth return of 5.0% for 2021. Toward the end of 2020, we noted a shift in behavior of the market away from "Growth At Any Price" investing to more fundamental drivers and that shift continued in earnest in 2021. In general, a market focused on stock fundamentals as opposed to price momentum is positive for Capital Appreciation's performance.

As the world began to stabilize and recover from the initial impact of the COVID-19 pandemic, equity markets faced a number of opportunities and hurdles. Year-over-year comparisons of earnings and revenue growth were robust as pent-up demand coupled with extraordinary fiscal and monetary stimulus drove results higher than expectations across most industries. Many areas of the market continued to rebound from their prior lows with the growing evidence that the global economy was returning to some sense of normalcy. While the unexpected emergence of the Delta and Omicron variants created some temporary setbacks, stocks with exposure to a global reopening largely outperformed expensive, story-driven stocks that had dominated the markets in prior years. Growth did not come without its challenges, however, as supply and labor shortages constrained the ability of most companies to meet demand. Furthermore, these shortages combined with the magnitude of monetary stimulus drove inflation to multi-year highs culminating with the Federal Reserve's admission toward the end of 2021 that inflation pressures are no longer "transitory" and an expectation that rates are likely to be raised sooner than originally anticipated as a countermeasure.

As we enter 2022, we are encouraged by the behavior of the equity markets and the return to a focus on stock fundamentals. While inflationary pressures continue to be an area of concern, the Fund is well positioned by owning companies with pricing power at valuations less susceptible to multiple compression as rates increase. We believe the broadening of the market and flight from excessive valuations should be good for relative performance of the Fund. We remain focused on purchasing stocks that will generate long-term earnings power selling at an attractive valuation.

Fund Review/Current Positioning

The Fund's outperformance for the year can be attributed almost entirely to stock selection. Industry allocation was mostly neutral as the positive effect of being overweight industrials and basic materials was offset by the Fund's overweight position in technology, and underweight positions in real estate and energy.

Technology generated the largest amount of stock selection, gaining 24% versus 12% for the index, and represented three of the top ten contributors for the year. The Fund's semiconductor holdings, most notably MACOM Technology (+42%), performed well with strong fundamentals across the board. The sector continues to capitalize on the long-term benefits of consolidation, increasing technological complexity and secular demand trends across a broad spectrum of end markets from automobiles to data centers. Global supply chain issues and manufacturing bottlenecks also highlighted the value of contract manufacturers such as Jabil Inc. (+66%), that were able to emerge essentially unscathed due to global reach and scale. Finally, Rogers Corporation (+76%), a long-term holding of

8

the Fund, was acquired by Dupont for a 46% premium to its 1-month volume weighted average share price. The company has long been a natural acquisition target given its dominant niche in the specialty materials markets.

Health care was the second-best performing industry in the Fund, returning 3% versus a decline of 7% for the index. While we had a number of outperforming stocks in the group, none of the Fund's health care holdings was a top contributor for the year. What the Fund did not own had a much more pronounced impact on the overall results. For example, biotechnology stocks were down over 20% for the year. We entered the year materially underweight this group and remain underweight as they are typically binary outcome investments and subject to heavy speculation.

Positive industrial stock selection can primarily be attributed to the performance of Builders FirstSource (+110%), a building products distributor and the largest position in the Fund. In addition to reporting better-than-expected earnings and guidance throughout the year, Builders has continued to make meaningful strides toward structurally improving the profitability of the business by growing its services and value-added product sales. The building products distribution market is highly fragmented, which should set the stage for Builders to grow profitably well into the future. KBR, Inc. (+56%), a government services provider, also was a top contributor as the company delivered on its multi-year strategy of diversifying away from fixed price engineering and construction (E&C) to more predictable, recurring revenue government contracts. In addition to registering important customer wins, KBR has developed its proprietary technologies business, which is being accessed increasingly by the market for the development of hydrogen and ammonia based renewable energy.

Positive stock selection from these three areas was partially offset by weakness in consumer discretionary and basic materials stocks. The combination of labor shortages, supply chain bottlenecks and the uncertainties associated with the emergence of COVID-19 variants through the course of the year resulted in some volatility in both production and demand, particularly among consumer discretionary stocks. For example, Cheesecake Factory (-37%) and Azul (-42%) both traded down despite what we believe to be a structural improvement in their competitive positions during the pandemic as demand for leisure activities was disrupted. We therefore added to both of these positions. 2U, Inc. (-50%) witnessed a sudden decline in enrollment for online education programs as the tight labor market resulted in fewer people looking to return to school in the short term. And Cardlytics (-54%) experienced a slowing in advertising spend by its customer base as brand owners attempted to balance promotion with the ability to meet the needs of customers. In each of these cases, we believe these companies are well positioned for long-term secular growth as the world normalizes.

Finally, after strong performance in the prior 12 months, Pan American Silver Corp (-27%) gave back some of its returns as investors began to focus on the growing likelihood of interest rate increases in 2022. While precious metals have been a safe haven against inflationary pressures, they are also negatively correlated to speculation on interest rates, as higher rates increase holding cost. We lowered the size of our position entering 2021 but have maintained ownership as the company is beginning to harvest the value of the portfolio it has built over the past several years, and controls some of the lowest cost gold and silver deposits in the world. The mining industry also has become more disciplined with capital deployment in recent years, which should result in accruing value to equity holders over time.

9

Frontier Capital Management Co., LLC

Investment Sub-Adviser to the M Capital Appreciation Fund

Performance represented is net of fees. The foregoing reflects the thoughts and opinions of Frontier Capital Management Co., LLC exclusively and is subject to change without notice. The information provided in this material should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any security transactions, holdings, or sectors discussed were or will be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance discussed herein. Strategies discussed are subject to change at any time by the investment manager in its discretion due to market conditions or opportunities. Market conditions may impact performance. The performance results presented were achieved in particular market conditions which may not be repeated. Moreover, the current market volatility and uncertain regulatory environment may have a negative impact on future performance. Portfolio characteristics are as of December 31, 2021. Please note that all indices are unmanaged and are not available for direct investment.

This commentary may include statements that constitute "forward looking statements" under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Fund, market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are subject to change at any time based upon economic, market, or other conditions and the subadvisory firm undertakes no obligation to update the views expressed herein. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. The views expressed above (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Fund's trading intent. Information about the Fund's holdings, asset allocation or country diversification is historical and is not an indication of future Fund composition, which may vary. Direct investment in any index is not possible. The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. In addition, the returns do not reflect additional fees charged by separate accounts or variable insurance contracts that an investor in the Fund may pay. If these additional fees were reflected, performance would have been lower.

10

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN

THE M CAPITAL APPRECIATION FUND AND RUSSELL 2500 STOCK INDEX (Unaudited)

The M Capital Appreciation Fund's total return is calculated net of Investment Advisory Fees and operating expenses. Performance figures represent past performance and are not indicative of future performance of the M Capital Appreciation Fund or Index. Share value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original investment. Please note that all indices are unmanaged, do not incur expenses, and are not available for direct investment. Persons who invest in the M Capital Appreciation Fund through a variable annuity or variable life insurance contract should note this graph does not reflect separate account expenses deducted by the insurance company.

* 12/31/11 to 12/31/21

RUSSELL 2500® INDEX

1 The Russell 2500® Index measures the performance of the small to mid-cap segment of the U.S. equity universe, commonly referred to as "smid" cap. The Russell 2500® Index is a subset of the Russell 3000® Index. It includes approximately 2500 of the smallest securities based on a combination of their market cap and current index membership. Investors cannot invest directly in an Index.

11

M LARGE CAP VALUE FUND

Performance

For the twelve months ended December 31, 2021, the Fund had a return of 30.0% (net of management fees) versus a total return of 25.2% for its benchmark, the Russell 1000® Value Index1.

Market Environment/Conditions

Broad U.S. equity markets posted another strong year despite surging COVID-19 infections. Virus fears receded in part as data from earlier affected regions suggested the more highly transmissible omicron variant is milder and is positive for broader immunity. Therefore, this current infection wave has the potential to hasten the transition from epidemic to endemic. The continued expansion of the economy, evidenced by solid corporate earnings and economic data, also helped drive strong returns for a second consecutive year as profit margins at many companies expanded further despite inflationary pressures. Unemployment claims, recently falling below pre-pandemic levels, showed that the labor market continued to tighten throughout the year. Job creation has been less than expected, the recently released December unemployment report also reflected a tight labor market as the unemployment rate fell to 3.9% and wages rose 4.7% for the year. Consumer confidence ended the year substantially higher despite the Omicron variant and persistent inflation. On the negative side, consumer prices rose at the fastest annual rate since 1982 as consumer demand remained high and supply chain disruptions continued. Additionally, more forward-looking pending home sales weakened as very low inventory and elevated prices weighed on sales.

The highest levels of inflation in nearly 40 years and a strong economy are pressuring the Federal Reserve (Fed) to accelerate the pace of tapering monthly bond purchases and tightening the monetary policy. The odds of a rate hike earlier in the year are rising. In addition to supply chain bottlenecks, energy prices were another source of inflation in 2021. Globally, the more transmissible variant is making it difficult for China to maintain its zero COVID policy, which further exacerbates the global supply chain with shipping ports as regional flare-ups lead to manufacturing shutdowns.

Fund Review/Current Positioning

The Fund outperformed during another year of robust equity returns. In large cap equities, growth showed up strong enough to flip the script for the full year ending with another year of growth outperforming. Value factors were weaker among large caps to end the year but generally did better among smaller companies. Interestingly growth did not work as well within value as higher valuation and negative earning companies underperformed. From a factor perspective, price momentum was a tailwind during the year and the factor with the biggest positive impact for the portfolio. Share change was strong for the full year and as expected given the annual returns, higher beta stocks did well for the year.

The biggest detraction to the strategy was from real estate and health care. Self-storage and residential REITs were particularly strong performers that led the sector higher during the year. We do not invest in REITs in this strategy. Within the healthcare sector the shortfall was from being overweight some of the poorer performing biotechnology stocks. We bought Biogen late in the summer after the stock dropped approximately 30% from the highs. However increased scrutiny and challenges to its recently approved and highly touted blockbuster Alzheimer's drug has sent the stock lower. Amgen was sold earlier in the year at much higher levels than where the stock ended the year which helped avoid further losses, however we were substantially overweight versus the benchmark when we held the position. There was also a small detraction within the energy sector from a small underweight in the best performing sector as crude oil rose sharply, up over 50% for the year.

12

The biggest relative benefit to the portfolio was from higher momentum consumer discretionary holdings in auto manufacturing as well as home improvement and auto retailing. We added substantially to a slight overweight versus the benchmark at the start of the year and maintained more than twice the benchmark weight since the annual rebalance of the benchmark in June despite consistently selling out of some of the poorer sector performers from the price momentum factor discipline.The majority of the benefit to the portfolio was from strong stock selection within specialty retailers such as Lowe's, AutoZone and O'Reilly Auto as well as Ford and General Motors. This sector accounted for forty percent of the overall outperformance for the year.

Telecommunication and wireless companies languished running into delays with the very expensive roll out of 5G technology while at-home entertainment companies continued to underperform throughout the year after performing so well at the beginning of the pandemic shutdowns in 2020. We continued to avoid owning Disney which lost nearly 15% of its value during a very strong year for equities. Both industries weighed down the communication services sector which was big benefit to our strategy from being markedly underweight over the past 15 months. After starting the year off with a strong first quarter, the technology sector consistently lagged thereafter and yet the portfolio holdings managed to continue to outperform consistently throughout the year. Despite being overweight in a lagging sector, outperformance was derived from system software companies which led the sector for the first three quarters, hardware and equipment companies came on stronger near the end of the year and semiconductor equipment companies which benefited from the global chip shortage.

For the first time in six years the portfolio was underweight in health care. We sold underperforming biotech companies and outperforming health care providers that rose in value quicker than their earnings were growing. It was short lived and are back to being essentially in line with the benchmark. We currently have large overweights in consumer discretionary and the financial sector. The underperformance over the last three quarters in the Technology sector, not surprisingly led to many lower valuation holdings being sold from the price momentum factor. We ended the year underweight the sector for the first time in 8 years and it is no longer among the four largest sectors from an absolute basis. We consistently added food companies to the consumer staples sector throughout the year. The relative underweight was essentially cut in half in both this sector as well as the industrials sector from a combination of new positions and adding to existing holdings. Finally, new positions in the utilities sector brought the portfolio to be nearly in line with the benchmark effectively ending a 14 year stretch of maintaining a substantial underweight. We begin the new year with five other sectors with larger underweights than what we have in utilities. We began the year discussing how periods of narrow market leadership eventually give way to a broadening out and a return to focusing on valuations. We closed 2021 with a rally in small cap value and higher quality and a strong performance reversal. Personal, business, and economic anxiety over COVID still remains even after broad vaccination in the US. While COVID infections are high, the hospitalization and survivability are greatly improved. The past year of high-quality value outperformance supports our research and belief in maintaining high quality companies in our portfolios even when low quality surges for a short period. Last year we also questioned the temporary nature of the pronounced inflation from both the changes in government policies and supply chain challenges. We currently see on the economic front mixed concerns and expectations of increased interest rates, inflation, labor challenges and market volatility. While we do not have clarity as to what these factors will deliver by year end 2022, we trust that our disciplined investment process will guide us to the proper value portfolio for the long term. We thank you for your continued support and wish you a healthy and prosperous year ahead.

13

Brandywine Global Investment Management, LLC

Investment Sub-Adviser to M Large Cap Value Fund

Performance represented is net of fees. The foregoing reflects the thoughts and opinions of Brandywine Global Investment Management, LLC exclusively and is subject to change without notice. The information provided in this material should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any security transactions, holdings, or sectors discussed were or will be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance discussed herein. Strategies discussed are subject to change at any time by the investment manager in its discretion due to market conditions or opportunities. Market conditions may impact performance. The performance results presented were achieved in particular market conditions which may not be repeated. Moreover, the current market volatility and uncertain regulatory environment may have a negative impact on future performance. Portfolio characteristics are as of December 31, 2021. Please note that all indices are unmanaged and are not available for direct investment.

This commentary may include statements that constitute "forward looking statements" under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Fund, market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are subject to change at any time based upon economic, market, or other conditions and the subadvisory firm undertakes no obligation to update the views expressed herein. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. The views expressed above (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Fund's trading intent. Information about the Fund's holdings, asset allocation or country diversification is historical and is not an indication of future Fund composition, which may vary. Direct investment in any index is not possible. The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. In addition, the returns do not reflect additional fees charged by separate accounts or variable insurance contracts that an investor in the Fund may pay. If these additional fees were reflected, performance would have been lower.

14

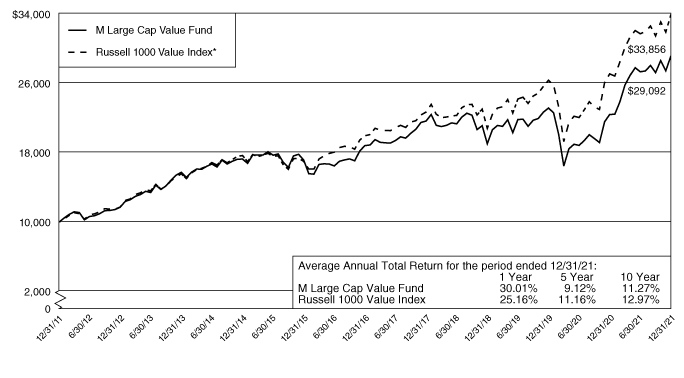

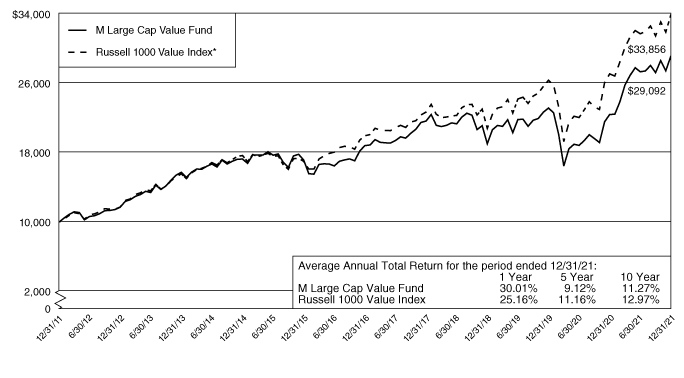

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN

THE M LARGE CAP VALUE FUND AND THE RUSSELL 1000 VALUE INDEX (Unaudited)

The M Large Cap Value Fund's total return is calculated net of Investment Advisory Fees and operating expenses. Performance figures represent past performance and are not indicative of future performance of the M Large Cap Value Fund or Index. Share value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original investment. Please note that all indices are unmanaged, do not incur expenses, and are not available for direct investment. Persons who invest in the M Large Cap Value Fund through a variable annuity or variable life insurance contract should note this graph does not reflect separate account expenses deducted by the insurance company.

* 12/31/11 to 12/31/21

RUSSELL 1000 VALUE INDEX

1 Russell 1000 companies with lower price-to-book ratios and lower forecasted growth. Investors cannot invest directly in an Index.

15

M International Equity Fund

SCHEDULE OF INVESTMENTS

December 31, 2021

Shares | | | | Value

(Note 1) | |

| | | COMMON STOCKS—69.8% | |

| | | Australia—4.4% | |

| | 5,596 | | | Adbri Ltd. | | $ | 11,481 | | |

| | 271 | | | Afterpay Ltd.* | | | 16,367 | | |

| | 3,733 | | | AGL Energy Ltd. | | | 16,676 | | |

| | 4,474 | | | Allkem Ltd.* | | | 33,853 | | |

| | 5,481 | | | ALS Ltd. | | | 52,159 | | |

| | 1,335 | | | Altium Ltd. | | | 43,892 | | |

| | 23,001 | | | Alumina Ltd. | | | 31,210 | | |

| | 24,812 | | | AMP Ltd.* | | | 18,232 | | |

| | 2,797 | | | Ampol Ltd. | | | 60,357 | | |

| | 1,231 | | | Ansell Ltd. | | | 28,221 | | |

| | 8,493 | | | APA Group† | | | 62,162 | | |

| | 1,172 | | | ARB Corp. Ltd. | | | 44,775 | | |

| | 16,116 | | | Ardent Leisure Group Ltd.*,† | | | 15,829 | | |

| | 3,393 | | | Aristocrat Leisure Ltd. | | | 107,556 | | |

| | 785 | | | ASX Ltd. | | | 53,058 | | |

| | 5,956 | | | Atlas Arteria Ltd. | | | 29,986 | | |

| | 1,347 | | | AUB Group Ltd. | | | 25,245 | | |

| | 27,196 | | | Aurizon Holdings Ltd. | | | 69,055 | | |

| | 16,206 | | | AusNet Services Ltd. | | | 30,302 | | |

| | 9,677 | | | Austal Ltd.† | | | 13,729 | | |

| | 16,565 | | | Australia & New Zealand Banking

Group Ltd. | | | 331,547 | | |

| | 2,559 | | | Australian Ethical Investment Ltd. | | | 25,674 | | |

| | 23,353 | | | Australian Pharmaceutical

Industries Ltd. | | | 29,394 | | |

| | 10,095 | | | Bank of Queensland Ltd. | | | 59,418 | | |

| | 5,183 | | | Bapcor Ltd. | | | 26,434 | | |

| | 36,897 | | | Beach Energy Ltd.† | | | 33,824 | | |

| | 4,696 | | | Bega Cheese Ltd.† | | | 19,372 | | |

| | 6,079 | | | Bendigo & Adelaide Bank Ltd.† | | | 40,247 | | |

| | 19,147 | | | BHP Group Ltd.† | | | 578,112 | | |

| | 1,146 | | | BHP Group Ltd., ADR† | | | 69,161 | | |

| | 177 | | | Blackmores Ltd.† | | | 11,755 | | |

| | 7,397 | | | BlueScope Steel Ltd. | | | 112,477 | | |

| | 12,498 | | | Brambles Ltd. | | | 96,658 | | |

| | 849 | | | Breville Group Ltd.† | | | 19,581 | | |

| | 1,779 | | | Brickworks Ltd. | | | 31,271 | | |

| | 2,848 | | | carsales.com Ltd. | | | 51,988 | | |

| | 6,463 | | | Challenger Ltd. | | | 30,705 | | |

| | 2,711 | | | Champion Iron Ltd.* | | | 10,730 | | |

| | 5,238 | | | City Chic Collective Ltd.* | | | 20,960 | | |

| | 16,096 | | | Cleanaway Waste Management Ltd. | | | 36,654 | | |

| | 444 | | | Cochlear Ltd. | | | 69,814 | | |

| | 748 | | | Codan Ltd. | | | 5,077 | | |

Shares | | | | Value

(Note 1) | |

| | | Australia (Continued) | |

| | 8,123 | | | Coles Group Ltd. | | $ | 106,023 | | |

| | 9,619 | | | Commonwealth Bank of Australia | | | 706,829 | | |

| | 5,942 | | | Computershare Ltd. | | | 86,462 | | |

| | 34,520 | | | Cooper Energy Ltd.*,† | | | 7,032 | | |

| | 1,259 | | | Corporate Travel

Management Ltd.*,† | | | 20,161 | | |

| | 5,529 | | | Costa Group Holdings Ltd. | | | 12,189 | | |

| | 496 | | | Credit Corp. Group Ltd. | | | 12,082 | | |

| | 2,419 | | | Crown Resorts Ltd.*,† | | | 21,049 | | |

| | 2,681 | | | CSL Ltd. | | | 567,067 | | |

| | 9,383 | | | CSR Ltd. | | | 40,140 | | |

| | 2,536 | | | Data#3 Ltd. | | | 10,849 | | |

| | 4,714 | | | Deterra Royalties Ltd.† | | | 14,748 | | |

| | 617 | | | Domino's Pizza Enterprises Ltd. | | | 52,983 | | |

| | 8,535 | | | Downer EDI Ltd. | | | 37,009 | | |

| | 4,688 | | | Eagers Automotive Ltd. | | | 45,841 | | |

| | 13,551 | | | Eclipx Group Ltd.* | | | 21,788 | | |

| | 2,597 | | | Elders Ltd. | | | 23,165 | | |

| | 9,649 | | | Endeavour Group Ltd. | | | 47,316 | | |

| | 7,109 | | | Estia Health Ltd.† | | | 11,896 | | |

| | 1,597 | | | EVENT Hospitality and

Entertainment Ltd.*,† | | | 17,173 | | |

| | 13,941 | | | Evolution Mining Ltd. | | | 41,180 | | |

| | 1,312 | | | Flight Centre Travel

Group Ltd.*,† | | | 16,819 | | |

| | 17,313 | | | Fortescue Metals Group Ltd. | | | 241,971 | | |

| | 20,944 | | | G8 Education Ltd.* | | | 16,914 | | |

| | 9,874 | | | Genworth Mortgage Insurance

Australia Ltd. | | | 16,666 | | |

| | 10,754 | | | Gold Road Resources Ltd. | | | 12,284 | | |

| | 3,873 | | | GrainCorp Ltd., Class A | | | 23,275 | | |

| | 9,346 | | | GWA Group Ltd. | | | 18,699 | | |

| | 7,543 | | | Harvey Norman Holdings Ltd.† | | | 27,110 | | |

| | 15,902 | | | Healius Ltd. | | | 61,087 | | |

| | 10,246 | | | Humm Group Ltd.*,† | | | 6,709 | | |

| | 877 | | | IDP Education Ltd. | | | 22,109 | | |

| | 9,401 | | | IGO Ltd. | | | 78,451 | | |

| | 4,268 | | | Iluka Resources Ltd. | | | 31,362 | | |

| | 11,076 | | | Imdex Ltd. | | | 23,772 | | |

| | 21,765 | | | Incitec Pivot Ltd. | | | 51,306 | | |

| | 11,778 | | | Infomedia Ltd. | | | 13,111 | | |

| | 5,200 | | | Inghams Group Ltd.† | | | 13,241 | | |

| | 10,589 | | | Insurance Australia Group Ltd. | | | 32,819 | | |

| | 1,626 | | | InvoCare Ltd.† | | | 13,912 | | |

| | 15,570 | | | IOOF Holdings Ltd. | | | 41,007 | | |

The accompanying notes are an integral part of these financial statements.

16

M International Equity Fund

SCHEDULE OF INVESTMENTS (Continued)

December 31, 2021

Shares | | | | Value

(Note 1) | |

| | | Australia (Continued) | |

| | 2,813 | | | IPH Ltd. | | $ | 17,969 | | |

| | 3,090 | | | IRESS Ltd. | | | 28,102 | | |

| | 2,351 | | | James Hardie Industries PLC | | | 94,589 | | |

| | 2,408 | | | JB Hi-Fi Ltd. | | | 84,654 | | |

| | 2,838 | | | Johns Lyng Group Ltd. | | | 18,851 | | |

| | 5,029 | | | Lendlease Corp. Ltd. | | | 39,113 | | |

| | 1,418 | | | Lifestyle Communities Ltd. | | | 21,438 | | |

| | 10,522 | | | Link Administration Holdings Ltd. | | | 42,640 | | |

| | 1,516 | | | Lovisa Holdings Ltd. | | | 22,159 | | |

| | 7,511 | | | Lynas Rare Earths Ltd.* | | | 55,575 | | |

| | 2,554 | | | Macquarie Group Ltd. | | | 381,667 | | |

| | 1,209 | | | Magellan Financial Group Ltd.† | | | 18,683 | | |

| | 22,423 | | | Mayne Pharma Group Ltd.*,† | | | 4,813 | | |

| | 1,182 | | | McMillan Shakespeare Ltd. | | | 10,388 | | |

| | 33,345 | | | Medibank Pvt Ltd. | | | 81,272 | | |

| | 13,978 | | | Metcash Ltd.† | | | 45,764 | | |

| | 1,851 | | | Mineral Resources Ltd.† | | | 75,415 | | |

| | 1,365 | | | Monadelphous Group Ltd.† | | | 9,583 | | |

| | 21,227 | | | National Australia Bank Ltd. | | | 445,396 | | |

| | 879 | | | Netwealth Group Ltd. | | | 11,313 | | |

| | 10,216 | | | New Hope Corp. Ltd.† | | | 16,575 | | |

| | 6,467 | | | Newcrest Mining Ltd. | | | 115,180 | | |

| | 2,652 | | | NEXTDC Ltd.* | | | 24,678 | | |

| | 5,984 | | | nib holdings Ltd. | | | 30,519 | | |

| | 932 | | | Nick Scali Ltd. | | | 10,408 | | |

| | 33,934 | | | Nine Entertainment Co.

Holdings Ltd. | | | 71,844 | | |

| | 10,155 | | | Northern Star Resources Ltd. | | | 69,524 | | |

| | 12,393 | | | NRW Holdings Ltd. | | | 15,914 | | |

| | 6,389 | | | Nufarm Ltd. | | | 22,544 | | |

| | 11,530 | | | oOh!media Ltd.* | | | 14,177 | | |

| | 1,802 | | | Orica Ltd. | | | 17,948 | | |

| | 13,491 | | | Origin Energy Ltd. | | | 51,433 | | |

| | 7,294 | | | Orora Ltd. | | | 18,574 | | |

| | 6,797 | | | OZ Minerals Ltd. | | | 139,552 | | |

| | 38,627 | | | Paladin Energy Ltd.* | | | 24,731 | | |

| | 3,852 | | | Pendal Group Ltd. | | | 15,610 | | |

| | 12,923 | | | Perenti Global Ltd.† | | | 8,697 | | |

| | 1,594 | | | Perpetual Ltd. | | | 41,715 | | |

| | 43,898 | | | Perseus Mining Ltd.* | | | 51,740 | | |

| | 1,933 | | | Pinnacle Investment Management

Group Ltd. | | | 21,953 | | |

| | 3,992 | | | Platinum Asset Management Ltd. | | | 7,842 | | |

| | 2,030 | | | Premier Investments Ltd. | | | 44,780 | | |

| | 1,044 | | | Pro Medicus Ltd.† | | | 47,427 | | |

Shares | | | | Value

(Note 1) | |

| | | Australia (Continued) | |

| | 4,109 | | | Qantas Airways Ltd.* | | $ | 14,977 | | |

| | 8,115 | | | QBE Insurance Group Ltd. | | | 67,011 | | |

| | 10,685 | | | Qube Holdings Ltd. | | | 24,643 | | |

| | 17,985 | | | Ramelius Resources Ltd. | | | 20,543 | | |

| | 1,186 | | | Ramsay Health Care Ltd. | | | 61,695 | | |

| | 355 | | | REA Group Ltd. | | | 43,298 | | |

| | 1,390 | | | Reece Ltd. | | | 27,335 | | |

| | 10,111 | | | Regis Resources Ltd. | | | 14,345 | | |

| | 6,796 | | | Reliance Worldwide Corp. Ltd. | | | 31,002 | | |

| | 26,531 | | | Resolute Mining Ltd.* | | | 7,528 | | |

| | 3,796 | | | Rio Tinto Ltd. | | | 276,482 | | |

| | 10,554 | | | Sandfire Resources Ltd. | | | 50,525 | | |

| | 32,253 | | | Santos Ltd. | | | 148,068 | | |

| | 2,007 | | | SEEK Ltd. | | | 47,865 | | |

| | 3,220 | | | Select Harvests Ltd. | | | 14,548 | | |

| | 6,012 | | | Senex Energy Ltd.† | | | 20,208 | | |

| | 1,184 | | | Seven Group Holdings Ltd. | | | 18,607 | | |

| | 62,916 | | | Seven West Media Ltd.* | | | 29,525 | | |

| | 11,474 | | | Silver Lake Resources Ltd.* | | | 14,818 | | |

| | 4,361 | | | Sims Ltd.† | | | 50,956 | | |

| | 4,280 | | | SmartGroup Corp. Ltd. | | | 24,133 | | |

| | 4,234 | | | Sonic Healthcare Ltd. | | | 143,641 | | |

| | 21,815 | | | South32 Ltd. | | | 63,645 | | |

| | 3,457 | | | Southern Cross Media Group Ltd. | | | 4,879 | | |

| | 9,141 | | | SpeedCast International Ltd.*,†,§ | | | — | | |

| | 9,514 | | | St. Barbara Ltd. | | | 10,141 | | |

| | 13,525 | | | Star Entertainment Grp Ltd.* | | | 36,212 | | |

| | 10,471 | | | Steadfast Group Ltd. | | | 39,995 | | |

| | 7,077 | | | Suncorp Group Ltd. | | | 56,998 | | |

| | 4,830 | | | Super Retail Group Ltd. | | | 43,785 | | |

| | 24,332 | | | Superloop Ltd.* | | | 21,066 | | |

| | 9,346 | | | Sydney Airport* | | | 59,021 | | |

| | 14,863 | | | Tabcorp Holdings Ltd. | | | 54,284 | | |

| | 6,444 | | | Tassal Group Ltd. | | | 16,362 | | |

| | 4,562 | | | Technology One Ltd. | | | 42,517 | | |

| | 48,961 | | | Telstra Corp. Ltd. | | | 148,898 | | |

| | 2,964 | | | TPG Telecom Ltd. | | | 12,702 | | |

| | 14,998 | | | Transurban Group | | | 150,801 | | |

| | 5,229 | | | Treasury Wine Estates Ltd. | | | 47,098 | | |

| | 4,434 | | | United Malt Grp Ltd. | | | 14,065 | | |

| | 5,028 | | | Uniti Group Ltd.* | | | 16,279 | | |

| | 14,458 | | | Viva Energy Group Ltd.# | | | 24,719 | | |

| | 3,525 | | | Webjet Ltd.*,† | | | 13,259 | | |

| | 6,301 | | | Wesfarmers Ltd. | | | 271,849 | | |

| | 24,722 | | | West African Resources Ltd.* | | | 23,742 | | |

The accompanying notes are an integral part of these financial statements.

17

M International Equity Fund

SCHEDULE OF INVESTMENTS (Continued)

December 31, 2021

Shares | | | | Value

(Note 1) | |

| | | Australia (Continued) | |

| | 7,396 | | | Western Areas Ltd.* | | $ | 18,457 | | |

| | 22,518 | | | Westpac Banking Corp. | | | 349,776 | | |

| | 19,506 | | | Whitehaven Coal Ltd.* | | | 37,040 | | |

| | 7,694 | | | Woodside Petroleum Ltd. | | | 122,759 | | |

| | 9,649 | | | Woolworths Group Ltd. | | | 266,835 | | |

| | 4,639 | | | Worley Ltd. | | | 35,877 | | |

| | 647 | | | Xero Ltd.* | | | 66,579 | | |

| | | | 10,754,746 | | |

| | | Austria—0.3% | |

| | 984 | | | ANDRITZ AG | | | 50,839 | | |

| | 1,218 | | | AT&S Austria Technologie &

Systemtechnik AG | | | 60,044 | | |

| | 371 | | | BAWAG Group AG*,# | | | 22,893 | | |

| | 133 | | | DO & Co. AG* | | | 11,220 | | |

| | 1,848 | | | Erste Group Bank AG | | | 86,998 | | |

| | 614 | | | EVN AG | | | 18,594 | | |

| | 1,377 | | | FACC AG*,† | | | 11,052 | | |

| | 1,233 | | | IMMOFINANZ AG† | | | 31,641 | | |

| | 332 | | | Lenzing AG* | | | 46,114 | | |

| | 463 | | | Oesterreichische Post AG† | | | 19,925 | | |

| | 1,311 | | | OMV AG | | | 74,554 | | |

| | 3,082 | | | Raiffeisen Bank International AG | | | 90,809 | | |

| | 1,417 | | | S IMMO AG | | | 35,088 | | |

| | 127 | | | Schoeller-Bleckmann Oilfield

Equipment AG* | | | 4,475 | | |

| | 1,874 | | | Telekom Austria AG* | | | 16,258 | | |

| | 4,149 | | | UNIQA Insurance Group AG | | | 38,120 | | |

| | 252 | | | Verbund AG | | | 28,375 | | |

| | 884 | | | Vienna Insurance Group AG

Wiener Versicherung Gruppe | | | 25,060 | | |

| | 1,881 | | | voestalpine AG | | | 68,529 | | |

| | 921 | | | Wienerberger AG | | | 33,910 | | |

| | | | 774,498 | | |

| | | Belgium—0.6% | |

| | 366 | | | Ackermans & van Haaren NV | | | 70,296 | | |

| | 2,082 | | | Ageas SA/NV | | | 107,970 | | |

| | 5,568 | | | AGFA-Gevaert NV* | | | 24,025 | | |

| | 5,947 | | | Anheuser-Busch InBev SA/NV | | | 359,996 | | |

| | 127 | | | Argenx SE* | | | 45,589 | | |

| | 851 | | | Barco NV | | | 18,563 | | |

| | 1,086 | | | Bekaert SA | | | 48,393 | | |

| | 991 | | | bpost SA* | | | 8,654 | | |

| | 105 | | | Cie d'Entreprises CFE | | | 14,680 | | |

Shares | | | | Value

(Note 1) | |

| | | Belgium (Continued) | |

| | 333 | | | D'ieteren Group | | $ | 65,057 | | |

| | 196 | | | Elia Group SA/NV | | | 25,818 | | |

| | 609 | | | Etablissements Franz Colruyt NV | | | 25,834 | | |

| | 1,410 | | | Euronav NV | | | 12,521 | | |

| | 2,756 | | | Euronav SA*,† | | | 24,501 | | |

| | 548 | | | EVS Broadcast Equipment SA | | | 12,915 | | |

| | 1,400 | | | Fagron | | | 23,590 | | |

| | 415 | | | Gimv NV | | | 25,183 | | |

| | 1,602 | | | KBC Group NV | | | 137,630 | | |

| | 9 | | | Lotus Bakeries NV | | | 57,278 | | |

| | 216 | | | Melexis NV | | | 25,772 | | |

| | 2,034 | | | Ontex Group NV*,† | | | 16,187 | | |

| | 1,080 | | | Orange Belgium SA | | | 24,468 | | |

| | 1,637 | | | Proximus SADP | | | 31,944 | | |

| | 207 | | | Shurgard Self Storage SA | | | 13,551 | | |

| | 214 | | | Sipef NV | | | 13,863 | | |

| | 1,145 | | | Solvay SA | | | 133,226 | | |

| | 449 | | | Telenet Group Holding NV | | | 16,388 | | |

| | 688 | | | Tessenderlo Group SA* | | | 26,123 | | |

| | 852 | | | UCB SA | | | 97,340 | | |

| | 1,277 | | | Umicore SA | | | 51,975 | | |

| | | | 1,559,330 | | |

| | | Canada—7.6% | |

| | 1,800 | | | Absolute Software Corp.† | | | 16,877 | | |

| | 757 | | | Aclara Resources, Inc.* | | | 862 | | |

| | 6,700 | | | Advantage Energy Ltd.*,† | | | 39,248 | | |

| | 1,679 | | | Aecon Group, Inc.† | | | 22,405 | | |

| | 607 | | | Ag Growth International, Inc. | | | 15,202 | | |

| | 1,651 | | | Agnico-Eagle Mines Ltd. | | | 87,728 | | |

| | 5,042 | | | Aimia, Inc.* | | | 19,730 | | |

| | 1,100 | | | Air Canada*,† | | | 18,375 | | |

| | 7,338 | | | Alamos Gold, Inc., Class A | | | 56,444 | | |

| | 891 | | | Algonquin Power & Utilities Corp. | | | 12,869 | | |

| | 5,308 | | | Alimentation Couche-Tard, Inc. | | | 222,399 | | |

| | 2,174 | | | AltaGas Ltd.† | | | 46,936 | | |

| | 685 | | | Altus Group Ltd.† | | | 38,432 | | |

| | 18,656 | | | ARC Resources Ltd.† | | | 169,607 | | |

| | 989 | | | Aritzia, Inc.* | | | 40,930 | | |

| | 700 | | | Atco Ltd., Class I | | | 23,629 | | |

| | 600 | | | ATS Automation Tooling

Systems, Inc.* | | | 23,830 | | |

| | 84 | | | Aurora Cannabis, Inc.*,† | | | 455 | | |

| | 16,677 | | | B2Gold Corp. | | | 65,656 | | |

The accompanying notes are an integral part of these financial statements.

18

M International Equity Fund

SCHEDULE OF INVESTMENTS (Continued)

December 31, 2021

Shares | | | | Value

(Note 1) | |

| | | Canada (Continued) | |

| | 850 | | | Badger Infrastructure

Solutions Ltd.† | | $ | 21,362 | | |

| | 5,855 | | | Bank of Montreal | | | 630,397 | | |

| | 8,200 | | | Bank of Nova Scotia | | | 580,505 | | |

| | 12,285 | | | Barrick Gold Corp. | | | 233,443 | | |

| | 3,183 | | | Bausch Health Cos., Inc.* | | | 87,920 | | |

| | 1,208 | | | BCE, Inc. | | | 62,847 | | |

| | 9,500 | | | Birchcliff Energy Ltd.† | | | 48,516 | | |

| | 4,601 | | | BlackBerry Ltd.*,† | | | 42,993 | | |

| | 7,300 | | | Bombardier, Inc., Class B* | | | 9,695 | | |

| | 862 | | | Boralex, Inc., Class A† | | | 23,633 | | |

| | 18 | | | Brookfield Asset Management

Reinsurance Partners Ltd.,

Class A*,† | | | 1,129 | | |

| | 1,680 | | | Brookfield Asset Management, Inc.,

Class A | | | 101,455 | | |

| | 1,336 | | | Brookfield Asset Management, Inc.,

Class A† | | | 80,668 | | |

| | 717 | | | Brookfield Infrastructure Corp.,

Class A† | | | 48,934 | | |

| | 785 | | | BRP, Inc.† | | | 68,760 | | |

| | 4,802 | | | Cameco Corp. | | | 104,699 | | |

| | 1,985 | | | Canaccord Genuity Group, Inc. | | | 23,664 | | |

| | 400 | | | Canada Goose Holdings, Inc.*,† | | | 14,824 | | |

| | 4,735 | | | Canadian Imperial Bank of

Commerce | | | 551,929 | | |

| | 4,408 | | | Canadian National Railway Co.† | | | 541,456 | | |

| | 14,634 | | | Canadian Natural Resources Ltd. | | | 618,354 | | |

| | 4,315 | | | Canadian Pacific Railway Ltd. | | | 310,351 | | |

| | 532 | | | Canadian Tire Corp. Ltd., Class A | | | 76,308 | | |

| | 1,300 | | | Canadian Utilities Ltd., Class A | | | 37,707 | | |

| | 1,880 | | | Canadian Western Bank | | | 53,950 | | |

| | 1,876 | | | Canfor Corp.* | | | 47,547 | | |

| | 700 | | | Canopy Growth Corp.*,† | | | 6,111 | | |

| | 2,194 | | | Capital Power Corp.† | | | 68,442 | | |

| | 4,800 | | | Capstone Mining Corp.* | | | 21,174 | | |

| | 6,100 | | | Cardinal Energy Ltd.*,† | | | 20,591 | | |

| | 6,100 | | | Cascades, Inc. | | | 67,368 | | |

| | 1,637 | | | CCL Industries, Inc., Class B† | | | 87,780 | | |

| | 6,166 | | | Celestica, Inc.* | | | 68,730 | | |

| | 6,625 | | | Cenovus Energy, Inc. | | | 81,231 | | |

| | 5,235 | | | Centerra Gold, Inc. | | | 40,350 | | |

| | 9,000 | | | CES Energy Solutions Corp.† | | | 14,443 | | |

| | 1,621 | | | CGI, Inc.* | | | 143,333 | | |

| | 2,739 | | | CI Financial Corp. | | | 57,251 | | |

Shares | | | | Value

(Note 1) | |

| | | Canada (Continued) | |

| | 190 | | | Cogeco Communications, Inc.† | | $ | 15,130 | | |

| | 300 | | | Cogeco, Inc. | | | 19,265 | | |

| | 325 | | | Colliers International Group, Inc. | | | 48,400 | | |

| | 122 | | | Constellation Software, Inc. | | | 226,354 | | |

| | 5,812 | | | Corus Entertainment, Inc.,

Class B† | | | 21,871 | | |

| | 3,354 | | | Crescent Point Energy Corp. | | | 17,898 | | |

| | 322 | | | Descartes Systems Group, Inc.* | | | 26,623 | | |

| | 1,840 | | | Dollarama, Inc. | | | 92,091 | | |

| | 1,821 | | | Dorel Industries, Inc., Class B* | | | 29,497 | | |

| | 1,100 | | | DREAM Unlimited Corp.,

Class A† | | | 33,767 | | |

| | 6,100 | | | Dundee Precious Metals, Inc. | | | 37,711 | | |

| | 4,100 | | | ECN Capital Corp. | | | 17,308 | | |

| | 3,501 | | | Eldorado Gold Corp.* | | | 32,825 | | |

| | 9,925 | | | Element Fleet Management Corp.† | | | 101,059 | | |

| | 2,163 | | | Emera, Inc. | | | 108,103 | | |

| | 879 | | | Empire Co. Ltd., Class A | | | 26,781 | | |

| | 9,507 | | | Enbridge, Inc. | | | 371,435 | | |

| | 3,515 | | | Endeavour Mining PLC† | | | 77,055 | | |

| | 2,494 | | | Enerflex Ltd. | | | 15,103 | | |

| | 7,134 | | | Enerplus Corp. | | | 75,234 | | |

| | 882 | | | Enghouse Systems Ltd.† | | | 33,768 | | |

| | 7,100 | | | Ensign Energy Services, Inc.* | | | 9,430 | | |

| | 700 | | | ERO Copper Corp.* | | | 10,680 | | |

| | 700 | | | Exchange Income Corp.† | | | 23,319 | | |

| | 4,400 | | | Extendicare, Inc.† | | | 25,392 | | |

| | 316 | | | Fairfax Financial Holdings Ltd. | | | 155,443 | | |

| | 2,600 | | | Fiera Capital Corp.† | | | 21,561 | | |

| | 2,098 | | | Finning International, Inc. | | | 52,875 | | |

| | 4,880 | | | First Quantum Minerals Ltd. | | | 116,777 | | |

| | 547 | | | FirstService Corp. | | | 107,502 | | |

| | 3,042 | | | Fortis, Inc.† | | | 146,767 | | |

| | 10,041 | | | Fortuna Silver Mines, Inc.*,† | | | 39,213 | | |

| | 406 | | | Franco-Nevada Corp. | | | 56,147 | | |

| | 3,500 | | | Freehold Royalties Ltd.† | | | 32,234 | | |

| | 1,045 | | | George Weston Ltd. | | | 121,159 | | |

| | 1,500 | | | Gibson Energy, Inc.† | | | 26,586 | | |

| | 1,871 | | | Gildan Activewear, Inc. | | | 79,316 | | |

| | 5,700 | | | Gran Tierra Energy, Inc.* | | | 4,326 | | |

| | 1,406 | | | Great-West Lifeco, Inc. | | | 42,193 | | |

| | 1,700 | | | Home Capital Group, Inc.*,† | | | 52,507 | | |

| | 7,321 | | | Hudbay Minerals, Inc.† | | | 53,014 | | |

| | 2,998 | | | Hydro One Ltd.# | | | 77,998 | | |

| | 1,352 | | | iA Financial Corp., Inc. | | | 77,361 | | |

The accompanying notes are an integral part of these financial statements.

19

M International Equity Fund

SCHEDULE OF INVESTMENTS (Continued)

December 31, 2021

Shares | | | | Value

(Note 1) | |

| | | Canada (Continued) | |

| | 3,400 | | | IAMGOLD Corp.*,† | | $ | 10,590 | | |

| | 511 | | | IGM Financial, Inc. | | | 18,429 | | |

| | 800 | | | Imperial Oil Ltd. | | | 28,852 | | |

| | 600 | | | Imperial Oil Ltd.† | | | 21,660 | | |

| | 1,017 | | | Innergex Renewable Energy, Inc.† | | | 14,954 | | |

| | 706 | | | Intact Financial Corp. | | | 91,767 | | |

| | 2,045 | | | Interfor Corp. | | | 65,491 | | |

| | 2,087 | | | Intertape Polymer Group, Inc.† | | | 43,424 | | |

| | 1,600 | | | Invesque, Inc.*,† | | | 3,280 | | |

| | 3,868 | | | Ivanhoe Mines Ltd., Class A* | | | 31,557 | | |

| | 700 | | | Jamieson Wellness, Inc.#,† | | | 22,213 | | |

| | 500 | | | K-Bro Linen, Inc. | | | 13,518 | | |

| | 7,152 | | | Kelt Exploration Ltd.*,† | | | 27,252 | | |

| | 2,848 | | | Keyera Corp.† | | | 64,234 | | |

| | 17,698 | | | Kinross Gold Corp. | | | 102,694 | | |

| | 4,203 | | | Kirkland Lake Gold Ltd. | | | 176,134 | | |

| | 3,700 | | | Knight Therapeutics, Inc.* | | | 15,503 | | |

| | 600 | | | Labrador Iron Ore Royalty Corp.† | | | 17,801 | | |

| | 800 | | | Laurentian Bank of Canada† | | | 25,405 | | |

| | 562 | | | LifeWorks, Inc. | | | 11,343 | | |

| | 889 | | | Linamar Corp. | | | 52,660 | | |

| | 1,322 | | | Loblaw Cos. Ltd. | | | 108,314 | | |

| | 8,900 | | | Lucara Diamond Corp.*,† | | | 4,151 | | |

| | 13,050 | | | Lundin Mining Corp. | | | 101,928 | | |

| | 3,572 | | | Magna International, Inc. | | | 289,019 | | |

| | 4,800 | | | Major Drilling Group

International, Inc.* | | | 31,344 | | |

| | 10,315 | | | Manulife Financial Corp. | | | 196,627 | | |

| | 1,530 | | | Maple Leaf Foods, Inc.† | | | 35,391 | | |

| | 1,800 | | | Martinrea International, Inc. | | | 16,364 | | |

| | 1,895 | | | Medical Facilities Corp.† | | | 14,007 | | |

| | 4,700 | | | MEG Energy Corp.* | | | 43,472 | | |

| | 1,000 | | | Methanex Corp.† | | | 39,559 | | |

| | 1,382 | | | Metro, Inc. | | | 73,549 | | |

| | 470 | | | MTY Food Group, Inc.† | | | 23,512 | | |

| | 2,700 | | | Mullen Group Ltd.† | | | 24,824 | | |

| | 2,600 | | | National Bank of Canada† | | | 198,224 | | |

| | 14,800 | | | New Gold, Inc.* | | | 22,113 | | |

| | 1,740 | | | NFI Group, Inc.† | | | 27,869 | | |

| | 721 | | | North American Construction

Group Ltd.† | | | 10,938 | | |

| | 1,126 | | | North West Co., Inc. | | | 30,479 | | |

| | 2,509 | | | Northland Power, Inc.† | | | 75,273 | | |

| | 6,090 | | | Nutrien Ltd. | | | 457,945 | | |

| | 11,800 | | | OceanaGold Corp.*,† | | | 20,523 | | |

Shares | | | | Value

(Note 1) | |

| | | Canada (Continued) | |

| | 793 | | | Onex Corp. | | $ | 62,239 | | |

| | 2,715 | | | Open Text Corp. | | | 128,866 | | |

| | 1,829 | | | Osisko Gold Royalties Ltd. | | | 22,383 | | |

| | 3,696 | | | Pan American Silver Corp.† | | | 92,214 | | |

| | 4,549 | | | Parex Resources, Inc.† | | | 77,714 | | |

| | 700 | | | Park Lawn Corp. | | | 22,965 | | |

| | 1,907 | | | Parkland Corp. | | | 52,418 | | |

| | 1,760 | | | Pason Systems, Inc. | | | 16,056 | | |

| | 1,360 | | | Pembina Pipeline Corp.† | | | 41,253 | | |

| | 2,624 | | | Pembina Pipeline Corp. | | | 79,586 | | |

| | 4,630 | | | Peyto Exploration &

Development Corp.† | | | 34,589 | | |

| | 900 | | | PrairieSky Royalty Ltd.† | | | 9,698 | | |

| | 580 | | | Precision Drilling Corp.* | | | 20,491 | | |

| | 300 | | | Premium Brands Holdings Corp.† | | | 29,987 | | |

| | 1,959 | | | Primo Water Corp.† | | | 34,566 | | |

| | 1,764 | | | Quebecor, Inc., Class B | | | 39,814 | | |

| | 1,200 | | | Real Matters, Inc.* | | | 7,874 | | |

| | 700 | | | Recipe Unlimited Corp.* | | | 9,806 | | |

| | 1,900 | | | Restaurant Brands International, Inc. | | | 115,224 | | |

| | 1,345 | | | Richelieu Hardware Ltd. | | | 46,391 | | |

| | 1,489 | | | Ritchie Bros Auctioneers, Inc.† | | | 91,121 | | |

| | 3,204 | | | Rogers Communications, Inc.,

Class B | | | 152,565 | | |

| | 5,300 | | | Rogers Sugar, Inc.† | | | 24,930 | | |

| | 12,900 | | | Royal Bank of Canada | | | 1,369,086 | | |

| | 1,740 | | | Russel Metals, Inc.† | | | 46,260 | | |

| | 2,900 | | | Sandstorm Gold Ltd.*,† | | | 17,980 | | |

| | 1,204 | | | Saputo, Inc.† | | | 27,127 | | |

| | 4,547 | | | Secure Energy Services, Inc. | | | 18,908 | | |

| | 4,613 | | | Shaw Communications, Inc.,

Class B | | | 140,000 | | |

| | 1,968 | | | ShawCor Ltd.*,† | | | 7,639 | | |

| | 170 | | | Shopify, Inc., Class A* | | | 239,595 | | |

| | 1,794 | | | Sienna Senior Living, Inc.† | | | 21,316 | | |

| | 1,359 | | | Sleep Country Canada

Holdings, Inc.# | | | 40,320 | | |

| | 1,519 | | | SNC-Lavalin Group, Inc.† | | | 37,118 | | |

| | 4,381 | | | SSR Mining, Inc. | | | 77,545 | | |

| | 1,600 | | | Stantec, Inc.† | | | 89,894 | | |

| | 700 | | | Stelco Holdings, Inc. | | | 22,810 | | |

| | 1,100 | | | Stella-Jones, Inc. | | | 34,793 | | |

| | 999 | | | Sun Life Financial, Inc.† | | | 55,607 | | |

| | 1,100 | | | Sun Life Financial, Inc. | | | 61,259 | | |

| | 16,316 | | | Suncor Energy, Inc. | | | 408,317 | | |

The accompanying notes are an integral part of these financial statements.

20

M International Equity Fund

SCHEDULE OF INVESTMENTS (Continued)

December 31, 2021

Shares | | | | Value

(Note 1) | |

| | | Canada (Continued) | |

| | 3,579 | | | Superior Plus Corp. | | $ | 36,782 | | |

| | 7,700 | | | Tamarack Valley Energy Ltd.*,† | | | 23,436 | | |

| | 2,442 | | | TC Energy Corp.† | | | 113,572 | | |

| | 3,539 | | | TC Energy Corp. | | | 164,705 | | |

| | 3,772 | | | Teck Resources Ltd., Class B | | | 108,648 | | |

| | 1,544 | | | TFI International, Inc. | | | 173,167 | | |

| | 287 | | | Thomson Reuters Corp. | | | 34,321 | | |

| | 3,200 | | | Timbercreek Financial Corp.† | | | 24,311 | | |

| | 698 | | | TMX Group Ltd. | | | 70,768 | | |

| | 2,171 | | | Torex Gold Resources, Inc.* | | | 22,569 | | |

| | 1,339 | | | Toromont Industries Ltd. | | | 121,055 | | |

| | 11,275 | | | Toronto-Dominion Bank | | | 864,421 | | |

| | 5,111 | | | Tourmaline Oil Corp. | | | 165,013 | | |

| | 7,036 | | | TransAlta Corp. | | | 78,150 | | |

| | 2,812 | | | TransAlta Renewables, Inc.† | | | 41,681 | | |

| | 3,800 | | | Transcontinental, Inc., Class A† | | | 61,013 | | |

| | 12,242 | | | Trican Well Service Ltd.* | | | 26,808 | | |

| | 3,001 | | | Tricon Residentia, Inc. | | | 45,930 | | |

| | 1,570 | | | Turquoise Hill Resources Ltd.* | | | 25,816 | | |

| | 1,000 | | | Uni-Select, Inc.* | | | 20,349 | | |

| | 2,344 | | | Vermilion Energy, Inc.* | | | 29,463 | | |

| | 1,800 | | | Wajax Corp. | | | 34,536 | | |

| | 872 | | | Waste Connections, Inc. | | | 118,833 | | |

| | 2,200 | | | Wesdome Gold Mines Ltd.* | | | 20,018 | | |

| | 2,070 | | | West Fraser Timber Co. Ltd. | | | 197,484 | | |

| | 12,500 | | | Western Forest Products, Inc. | | | 20,851 | | |

| | 1,100 | | | Westshore Terminals

Investment Corp.† | | | 23,323 | | |

| | 1,533 | | | Wheaton Precious Metals Corp. | | | 65,782 | | |

| | 18,463 | | | Whitecap Resources, Inc.† | | | 109,323 | | |

| | 400 | | | Winpak Ltd.† | | | 11,754 | | |

| | 752 | | | WSP Global, Inc. | | | 109,166 | | |

| | 19,921 | | | Yamana Gold, Inc. | | | 83,782 | | |

| | | | 18,459,882 | | |

| | | Denmark—1.7% | |

| | 102 | | | ALK-Abello A/S* | | | 53,560 | | |

| | 24,690 | | | Alm Brand A/S | | | 48,155 | | |

| | 827 | | | Ambu A/S, Class B | | | 21,903 | | |

| | 20 | | | AP Moller—Maersk A/S, Class A | | | 66,687 | | |

| | 30 | | | AP Moller—Maersk A/S, Class B | | | 107,700 | | |

| | 2,721 | | | Bang & Olufsen A/S* | | | 11,622 | | |

| | 713 | | | Bavarian Nordic A/S* | | | 29,341 | | |

| | 749 | | | Carlsberg AS, Class B | | | 129,515 | | |

| | 930 | | | Chr Hansen Holding A/S | | | 73,380 | | |

Shares | | | | Value

(Note 1) | |

| | | Denmark (Continued) | |

| | 568 | | | Coloplast A/S, Class B | | $ | 100,086 | | |

| | 805 | | | D/S Norden A/S | | | 20,507 | | |

| | 3,111 | | | Danske Bank A/S | | | 53,794 | | |

| | 816 | | | Demant A/S* | | | 41,861 | | |

| | 778 | | | Dfds A/S* | | | 41,568 | | |

| | 68 | | | Drilling Co. of 1972 A/S* | | | 2,667 | | |

| | 1,168 | | | DSV A/S | | | 273,133 | | |

| | 1,244 | | | FLSmidth & Co. A/S | | | 46,526 | | |

| | 330 | | | Genmab A/S* | | | 132,868 | | |

| | 1,611 | | | GN Store Nord A/S | | | 101,439 | | |

| | 771 | | | H Lundbeck A/S | | | 19,930 | | |

| | 818 | | | H+H International A/S, Class B* | | | 28,803 | | |

| | 3,142 | | | ISS A/S* | | | 60,127 | | |

| | 958 | | | Jyske Bank A/S, Registered* | | | 49,425 | | |

| | 1,970 | | | Matas A/S | | | 37,548 | | |

| | 432 | | | Netcompany Group A/S# | | | 46,592 | | |

| | 266 | | | Nilfisk Holding A/S* | | | 8,755 | | |

| | 257 | | | NKT A/S* | | | 12,417 | | |

| | 362 | | | NNIT A/S# | | | 6,362 | | |

| | 12,082 | | | Novo Nordisk A/S, Class B | | | 1,359,492 | | |

| | 1,696 | | | Novozymes A/S, Class B | | | 139,480 | | |

| | 831 | | | Orsted A/S# | | | 106,253 | | |

| | 1,611 | | | Pandora A/S | | | 201,102 | | |

| | 376 | | | Per Aarsleff Holding A/S | | | 17,585 | | |

| | 576 | | | Ringkjoebing Landbobank A/S | | | 77,423 | | |

| | 80 | | | Rockwool International A/S,

Class A | | | 29,393 | | |

| | 137 | | | Rockwool International A/S,

Class B | | | 59,984 | | |

| | 1,007 | | | Royal Unibrew A/S | | | 113,649 | | |

| | 1,644 | | | Scandinavian Tobacco Group A/S,

Class A# | | | 34,556 | | |

| | 336 | | | Schouw & Co. A/S | | | 29,269 | | |

| | 638 | | | SimCorp A/S | | | 69,816 | | |

| | 1,256 | | | Spar Nord Bank A/S | | | 16,075 | | |

| | 1,818 | | | Sydbank A/S | | | 57,557 | | |

| | 676 | | | Topdanmark A/S | | | 37,981 | | |

| | 1,813 | | | Tryg A/S | | | 44,825 | | |

| | 6,155 | | | Vestas Wind Systems A/S | | | 188,455 | | |

| | 615 | | | Zealand Pharma A/S* | | | 13,661 | | |

| | | | 4,222,827 | | |

The accompanying notes are an integral part of these financial statements.

21

M International Equity Fund

SCHEDULE OF INVESTMENTS (Continued)

December 31, 2021

Shares | | | | Value

(Note 1) | |

| | | Finland—1.0% | |

| | 510 | | | Cargotec Oyj, Class B | | $ | 25,455 | | |

| | 1,769 | | | Elisa Oyj | | | 108,998 | | |

| | 25,135 | | | Finnair Oyj*,† | | | 17,032 | | |

| | 425 | | | Fiskars Oyj Abp | | | 11,129 | | |

| | 2,973 | | | Fortum Oyj | | | 91,355 | | |

| | 971 | | | Huhtamaki Oyj | | | 42,992 | | |

| | 1,799 | | | Kemira Oyj | | | 27,302 | | |

| | 1,396 | | | Kesko Oyj, Class A | | | 43,151 | | |

| | 3,349 | | | Kesko Oyj, Class B | | | 111,869 | | |

| | 2,038 | | | Kojamo Oyj | | | 49,282 | | |

| | 1,938 | | | Kone Oyj, Class B | | | 139,092 | | |

| | 1,119 | | | Konecranes Oyj | | | 44,793 | | |

| | 3,137 | | | Metsa Board Oyj, Class B | | | 30,750 | | |

| | 9,643 | | | Metso Outotec Oyj | | | 102,627 | | |

| | 3,866 | | | Neles Oyj | | | 137,881 | | |

| | 14,612 | | | Nokia Oyj* | | | 92,728 | | |

| | 19,449 | | | Nokia Oyj, ADR* | | | 120,973 | | |

| | 1,922 | | | Nokian Renkaat Oyj | | | 72,867 | | |

| | 12,077 | | | Nordea Bank Abp | | | 148,304 | | |

| | 281 | | | Olvi Oyj, Class A | | | 16,380 | | |

| | 7,100 | | | Oriola Oyj, Class B | | | 16,207 | | |

| | 727 | | | Orion Oyj, Class A | | | 29,880 | | |

| | 1,558 | | | Orion Oyj, Class B | | | 64,778 | | |

| | 10,116 | | | Outokumpu Oyj* | | | 63,344 | | |

| | 7,476 | | | Raisio Oyj , Class V† | | | 28,683 | | |

| | 873 | | | Revenio Group Oyj | | | 55,212 | | |

| | 2,447 | | | Sampo Oyj, Class A | | | 122,747 | | |

| | 7,584 | | | Stora Enso Oyj, Class R | | | 139,359 | | |

| | 1,519 | | | Terveystalo Oyj# | | | 20,476 | | |

| | 1,860 | | | TietoEVRY Oyj | | | 58,192 | | |

| | 1,633 | | | Tokmanni Group Corp. | | | 36,533 | | |

| | 4,923 | | | UPM-Kymmene Oyj | | | 187,538 | | |

| | 775 | | | Uponor Oyj | | | 18,476 | | |

| | 559 | | | Vaisala Oyj, Class A† | | | 33,921 | | |

| | 1,446 | | | Valmet Oyj | | | 62,097 | | |

| | 5,634 | | | Wartsila Oyj Abp | | | 79,281 | | |

| | 6,293 | | | YIT Oyj† | | | 30,908 | | |

| | | | 2,482,592 | | |

| | | France—6.1% | |