QuickLinks -- Click here to rapidly navigate through this document

EXHIBIT 1

Annual Information Form of Falconbridge Limited dated March 24, 2005

FALCONBRIDGE LIMITED

2004 ANNUAL INFORMATION FORM

March 24, 2005

TABLE OF CONTENTS

| | Page

|

|---|

| TECHNICAL GLOSSARY | | 3 |

| MINERAL RESERVE AND RESOURCE ESTIMATION | | 5 |

| CURRENCY | | 6 |

| METRIC/IMPERIAL CONVERSION TABLE | | 6 |

| FALCONBRIDGE LIMITED | | 7 |

| | Overview | | 7 |

| | Corporate Strategy and Business Developments | | 8 |

| | Three Year History | | 8 |

| | Organizational Chart | | 12 |

| BUSINESS OF FALCONBRIDGE | | 13 |

| | Integrated Nickel Operations | | 14 |

| | Sudbury Operations | | 14 |

| | | Sudbury Mines/Mill | | 14 |

| | | Sudbury Smelter | | 16 |

| | Raglan | | 17 |

| | Montcalm | | 19 |

| | Nikkelverk | | 20 |

| | FIL | | 21 |

| | Falcondo | | 22 |

| | Kidd Creek Operations | | 23 |

| | | Kidd Mining Division | | 23 |

| | | Kidd Metallurgical Division | | 25 |

| | Compañia Minera Doña Inés de Collahuasi | | 27 |

| | Compañia Minera Falconbridge Lomas Bayas | | 28 |

| | Corporate | | 31 |

| | Exploration | | 31 |

| | Sudbury Operations | | 32 |

| | Raglan | | 32 |

| | Kidd Creek Operations | | 32 |

| | Greenfield Exploration | | 32 |

| | Environment. Health and Safety | | 33 |

| | Koniambo Project, New Caledonia | | 33 |

| | Business Development | | 34 |

| | Technology | | 34 |

| | Employees | | 35 |

| PRINCIPAL PRODUCTS | | 36 |

| | Nickel | | 36 |

| | Copper | | 38 |

| | Zinc | | 40 |

| | Cobalt | | 41 |

| | Other Metals and Products | | 42 |

| | Sales Volumes, Average Prices and Revenue | | 44 |

| ENVIRONMENT, HEALTH AND SAFETY | | 45 |

| | Environment | | 45 |

| | Safety and Health | | 49 |

| TRENDS, RISKS AND UNCERTAINTIES | | 49 |

| DIVIDEND POLICY | | 55 |

| CAPITAL STRUCTURE OF THE CORPORATION | | 55 |

| CREDIT RATINGS | | 56 |

1

| |

|

|---|

| MARKET FOR SECURITIES OF THE CORPORATION | | 57 |

| DIRECTORS AND EXECUTIVE OFFICERS | | 58 |

| | Directors | | 58 |

| | Executive Officers | | 59 |

| AUDIT COMMITTEE | | 62 |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | | 63 |

| TRANSFER AGENT AND REGISTRAR | | 65 |

| EXPERTS | | 65 |

| MATERIAL CONTRACTS | | 65 |

| ADDITIONAL INFORMATION | | 65 |

| SCHEDULE | | 67 |

| | Audit Committee — Terms of Reference | | 67 |

2

TECHNICAL GLOSSARY

austenitic stainless steel: stainless steel with a nickel content of between 4% and 22%.

bankable feasibility study: means a comprehensive study of a deposit in which all geological, engineering, operating, economic and other relevant factors are considered in sufficient detail that it could reasonably serve as a basis for a financial decision by a financial institution to finance the development of the deposit for mineral production.

by-product credits: all revenues received from by-products.

capacity: the design number of units which can be produced in a given time period based on operations with a normal number of shifts and maintenance interruptions.

CIS: the Commonwealth of Independent States.

Comex: The New York Commodity Exchange.

concentrate: a product containing valuable minerals from which most of the waste material in the ore has been separated.

copper cathode: flat plate of pure (approximately 99.9%) copper that is the product of electrolytic copper refining or the solvent extraction/electrowinning process.

Defence Logistics Agency: a United States of America Department of Defence, defence agency. One of the responsibilities of the Defence Logistics Agency is the Defence National Stockpile.

Defence National Stockpile: the United States of America Strategic and Critical Materials Stock Piling Act mandates that a stockpile of strategic and critical materials be maintained to decrease and preclude, where possible, dependence upon foreign sources of supply in times of national emergency. Authority for management of the operational aspects of the National Defence Stockpile has been delegated to the Defence Logistics Agency, Defence National Stockpile Center.

Eastern Bloc: Albania, Bulgaria, the CIS, Cuba, the Czech Republic, Hungary, Mongolia, North Korea, the People's Republic of China, Poland, Romania and Slovakia.

Falcondo: Falconbridge Dominicana, C. por A. The Corporation owns 85.26% of the outstanding shares of Falcondo.

ferronickel: an alloy containing nickel and iron (approximately 38% nickel and 62% iron in the case of ferronickel produced by Falcondo). The volumes produced and prices realized by Falconbridge set forth in this annual information form are expressed in terms of nickel contained in ferronickel.

LME: the London Metal Exchange.

matte: a mixture of metal sulphides enriched with nickel, copper, cobalt, silver, gold and platinum group metals.

mill: a plant where ore is ground and undergoes physical or chemical treatment to extract and produce a concentrate of the valuable minerals.

mineral reserve: the economically mineable part of a measured or indicated mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A mineral reserve includes diluting materials and allowances for losses that may occur when the material is mined. Mineral reserves are categorized as follows:

- •

- A"proven mineral reserve" is the economically mineable part of a measured mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified.

3

- •

- A"probable mineral reserve" is the economically mineable part of an indicated, and in some circumstances a measured mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified.

mineral resource: a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the Earth's crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge. Mineral resources are categorized as follows:

- •

- A"measured mineral resource" is that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity.

- •

- An"indicated mineral resource" is that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

- •

- An"inferred mineral resource" is that part of a mineral resource for which quantity, grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

National Instrument 43-101: National Instrument 43-101, Standards of Disclosure for Mineral Projects enacted by the Canadian Securities Administrators.

off-warrant nickel stocks: nickel stocks not held in LME registered warehouses.

ounce: troy ounce.

platinum group metals: platinum, palladium, rhodium and related metals present in some nickel/copper ores.

preliminary feasibility study: a comprehensive study of the viability of a mineral project that has advanced to a stage where a mining method, in the case of underground mining, or a pit configuration, in the case of an open pit, has been established, and where an effective method of mineral processing has been determined, includes a financial analysis based on reasonable assumptions of technical, engineering, operating, economic factors and the evaluation of other relevant factors which are sufficient for a "qualified person", (as defined in National Instrument 43-101), acting reasonably, to determine if all or part of the mineral resource may be classified as a mineral reserve.

primary nickel: the nickel contained in products of smelters and refineries which are in a form ready for use by consumers.

refinery: a plant where concentrates or matte are processed into one or more refined metals.

smelter: a plant where concentrates are processed into an upgraded product.

tonne: 1,000 kilograms.

Western World: all countries other than those in the Eastern Bloc.

4

MINERAL RESERVE AND RESOURCE ESTIMATION

The definitions of mineral reserve, proven mineral reserve, probable mineral reserve, mineral resource, measured mineral resource, indicated mineral resource and inferred mineral resource used in this annual information form are from the definitions adopted by the Canadian Institute of Mining, Metallurgy and Petroleum on November 14, 2004 and which are incorporated in National Instrument 43-101. The disclosure contained in this annual information form with respect to mineral reserves and mineral resources has been compiled in accordance with National Instrument 43-101 under the direction of and verified by Chester M. Moore, the Corporation's Director, Mineral Reserve Estimation and Reporting. Mr. Moore is a member of the Professional Geoscientists of Ontario, with over 30 years of experience as a geologist and is a "qualified person" as defined in National Instrument 43-101. The mineral reserve and mineral resource estimates have been prepared using geostatistical and/or classical methods plus economic and mining parameters appropriate to each deposit. Falconbridge is not aware of any environmental, permitting, legal, taxation, political, marketing or other relevant issue that would materially affect the estimates of the mineral reserves. The mineral resources which are not reserves have reasonable prospects for economic extraction but have not yet had complete formal evaluation, and do not have demonstrated economic viability.

The economic and mining parameters used in estimating the mineral reserves and mineral resources disclosed in this annual information form include:

Bulk Density: The factor used to convert volume into tonnage. This factor is a function of the mineralogy and physical characteristics of a deposit. Formulae are developed using regression analyses on a suitably large number of individual determinations.

Cut-Off Grade: The grade that ensures that the revenue from the metal content of the lowest grade parcel included in a deposit will be at least equal to the anticipated prime operating costs of producing this revenue. These costs include mining, milling, smelting, refining, selling and all transportation and administration costs. The cut-off grade will vary greatly from property to property due to a range of factors including deposit size and shape, metal content and prime cost structure.

Exchange Rate (US$ to Cdn$): 1.50

Long-Term Metal Prices (US$ per pound): Nickel $3.25, Copper $0.90, Zinc $0.50

Minimum Mining Width: The smallest horizontal thickness used in an estimation based on the selected mining method and the minimum opening size required by mining equipment used. The grade across this minimum width must equal or exceed the cut-off grade.

Mining Dilution1: All external material with grades lower than the cut-off grade that must be removed with the ore. The amount of this diluting material can vary considerably and depends upon mining method and the location, attitude, size, shape and wall rocks of the ore zone.

Mining Recovery1: The proportion of the ore that is extracted after accounting for mining losses. The mining recovery can vary widely both within a single mine and from property to property due to a range of factors including deposit geometry and mining method.

Note:

1 Used for mineral reserve estimation only.

5

CURRENCY

All references in this annual information form to "dollars" or "$" are to United States dollars, unless otherwise indicated.

METRIC/IMPERIAL CONVERSION TABLE

The imperial equivalents of the metric units of measurement used in this annual information form are as follows:

Metric Unit

| | Imperial Equivalent

|

|---|

| gram | | 0.03215 troy ounces |

| hectare | | 2.4711 acres |

| kilogram | | 2.2046223 pounds |

| kilometre | | 0.62139 miles |

| metre | | 3.2808 feet |

| tonne | | 1.1023 short tons |

6

FALCONBRIDGE LIMITED

Overview

Falconbridge Limited (the "Corporation") is the continuing corporation resulting from the amalgamation under theBusiness Corporations Act (Ontario) on June 22, 1994 of several companies including a company also named Falconbridge Limited. Predecessors of the Corporation have carried on business under the Falconbridge Limited name since 1928. The registered and head office of the Corporation is at BCE Place, Suite 200, 181 Bay Street, Toronto, Ontario, M5J 2T3. The principal operations office of the Corporation is at Queen's Quay Terminal, 207 Queen's Quay West, Suite 800, Toronto, Ontario, M5J 1A7.

On December 31, 2004, Noranda Inc. ("Noranda") owned, directly and indirectly, approximately 58.8% and public shareholders owned approximately 41.2% of the outstanding common shares of the Corporation. There were 179,770,190 common shares issued and outstanding at December 31, 2004.

The Corporation's articles of amalgamation were amended on March 5, 1997 to provide for the issuance of cumulative preferred shares series 1, 2 and 3. On March 7, 1997 the Corporation completed the issue of 8,000,000 units, each unit consisting of one cumulative preferred share series 1 and one cumulative preferred share series 2 purchase warrant. The holder of a unit was entitled, on each of September 1, 1998, December 1, 1998 and March 1, 1999, to acquire one cumulative preferred share series 2 upon the exercise of the warrant and the payment of Cdn$15.00 and the concurrent conversion of the cumulative preferred share series 1 into a cumulative preferred share series 2. On March 1, 2004, the holders of 3,122,882 cumulative preferred shares series 2 elected to convert their shares into an equal number of cumulative preferred shares series 3. On December 31, 2004, there were 89,835 cumulative preferred shares series 1, 4,787,283 cumulative preferred shares series 2 and 3,122,882 cumulative preferred shares series 3, issued and outstanding.

The Corporation and its subsidiaries (collectively, "Falconbridge") are engaged in the exploration, development, mining, processing and marketing of metals and minerals. Falconbridge is also engaged in the custom feed business through the processing and recycling of third-party materials. Falconbridge has mining and mineral processing facilities in Canada (Sudbury Operations, Raglan, Kidd Creek Operations, Montcalm), Norway (Nikkelverk), the Dominican Republic (Falcondo) and Chile (Collahuasi and Lomas Bayas).

Falconbridge's principal products are nickel, ferronickel, copper, zinc and cobalt. Other products include silver, gold, platinum group metals, cadmium, indium and sulphuric acid. Falconbridge markets and sells nickel and cobalt and certain other products through marketing and sales offices in Canada, the United States, Belgium and Japan. Noranda acts as sales agent for all products from the Kidd Creek Operations. Falconbridge markets copper concentrate and cathode from the Chilean operations through a marketing group in Santiago, Chile to customers around the world. In 2004, approximately 46% of Falconbridge's revenues were from sales of nickel and ferronickel, 38% from sales of copper, 5% from sales of zinc, 6% from sales of cobalt and 5% from sales of other products.

The Corporation believes that Falconbridge is the third-largest producer of refined nickel in the world. Approximately 36% of Falconbridge's combined nickel and ferronickel sales by volume are used in the manufacture of stainless steel. Approximately 48% of Falconbridge's 2004 combined nickel and ferronickel sales by volume were to customers in Europe, 22% to customers in the United States and the balance to customers in Japan, Canada, Mexico, Latin America, Southeast Asia and Korea.

7

Corporate Strategy and Business Developments

Falconbridge is focused on the production of nickel and copper, two metals which have positive long-term fundamentals and positive near-term outlook. Historically, both metals have competitive attributes which have led to diversified usage in the world's economy and have had an average annual consumption growth rate of over 3% for copper and 4% for nickel. Falconbridge is positioned in these markets as one of the world's largest producers of both metals and is supported by substantial operational, technical, exploration and development experience. In addition, the Corporation has the potential to increase its production as a result of a number of expansion opportunities and new projects currently under development.

Falconbridge's focus is to increase returns to shareholders as measured by returns on net assets and on shareholders' equity. To achieve this goal, Falconbridge maximizes the value of existing operations, redeploys capital profitably and maintains a conservative financial structure and significant liquidity to support its operations and growth initiatives.

Three Year History

On Wednesday, March 9, 2005, Noranda announced an offer (the "Falconbridge Offer") to acquire all of the outstanding common shares ("Falconbridge Shares") of Falconbridge not owned by Noranda or any of its affiliates in exchange for Noranda common shares ("Noranda Common Shares") on the basis of 1.77 Noranda Common Shares for each Falconbridge Share.

In connection with the Falconbridge Offer, Falconbridge and Noranda entered into a support agreement (the "Support Agreement") dated March 8, 2005, pursuant to which Noranda agreed to make the Falconbridge Offer and, subject to the satisfaction of certain conditions, to take up the Falconbridge Shares tendered thereto.

For a full description of the Falconbridge Offer, please refer to Falconbridge's material change report dated March 10, 2005, which is incorporated by reference in this AIF and is available on SEDAR at www.sedar.com. Upon request, the Corporation will promptly provide a copy of the material change report free of charge to any of its securityholders.

2004

Falconbridge reported consolidated net earnings for the year ended December 31, 2004 of $672 million. Major developments in 2004 included:

- •

- Completion of construction of the Montcalm nickel project near Timmins, Ontario and the Ujina-Rosario transition and expansion project at Collahuasi, Chile, both ahead of schedule and under budget;

- •

- The launch of an underground definition program at Nickel Rim South, an inferred resource containing 13.4 million tonnes of 1.8% nickel, 3.3% copper and significant platinum and palladium;

8

- •

- The successful ramp-up at Lomas Bayas following completion of the crusher expansion project ahead of schedule and under budget;

- •

- Further exploration at the Fraser Morgan deposit in Sudbury, Ontario, reporting intersections with significant mineralization;

- •

- Completion of the bankable feasibility study for the Koniambo ferronickel project in New Caledonia;

- •

- The commissioning of the Block One ore-handling system at Kidd Mine D, with first ore hoisted ahead of schedule;

- •

- Completion of scoping studies for expansions at Raglan, Falcondo, Collahuasi and Lomas Bayas;

- •

- The initiation of Phase I of the Raglan Optimization Program; and

- •

- The signing by Falconbridge of a new collective agreement after a three-week strike at Sudbury Operations and Mill, and successful post-strike ramp-up and settlement of other collective agreements.

2003

Falconbridge reported consolidated net earnings for the year ended December 31, 2003 of $191 million. Major developments in 2003 included:

- •

- The advancement of important development programs at Collahuasi and Kidd Creek, ensuring copper production levels are maintained;

- •

- The shut down of the zinc refining operations located at the Kidd Metallurgical site in Timmins, Ontario for 13 weeks during the summer for market and supply-related reasons;

- •

- The continued drilling program at Nickel Rim South with results better than anticipated;

- •

- The appointment of David W. Kerr as Chairman of the Board, succeeding Alex G. Balogh, who continued on as a member of the Board of Directors;

- •

- The reduction of workforce by 85 positions at the Kidd Metallurgical site in Timmins, Ontario aimed at improving its overall economic performance and to further assist in offsetting the weak market;

- •

- The public offering by the Corporation of $250 million aggregate amount of its 5.375% 12-year Notes due June 1, 2015;

- •

- The continued progress securing the necessary operating permits to start the construction and operation of the Montcalm nickel project in Timmins, Ontario; and

- •

- Advancement on the work at the Koniambo Project in New Caledonia including the mobilization of the project team to begin the bankable feasibility study and financing discussions progression with the French government.

9

2002

Falconbridge reported consolidated net earnings for the year ended December 31, 2002 of $52 million. Major developments in 2002 included:

- •

- The signing of a collective agreement in respect of operations at Kidd Metallurgical Division;

- •

- Completion of the second phase on the Kidd Mining Division's No. 3 mine development; ongoing development work on the Kidd Mining Division's Mine D and expansion of the copper refinery capacity at the Kidd Metallurgical division;

- •

- The Venezuelan national strike interrupting supplies of crude oil to the Falcondo operation in the Dominican Republic;

- •

- The public offering by the Corporation of $250 million aggregate amount of its 7.35% 10-year Notes due June 5, 2012;

- •

- The scheduling of various maintenance and vacation shutdowns during the summer months at both its Sudbury Smelter and Nikkelverk Refinery;

- •

- The announcement that surface diamond drilling on the Nickel Rim South property continues to intersect significant mineralization at the main contact of the Sudbury Igneous Complex and in the underlying footwall rocks;

- •

- The appointment of Aaron Regent as President and Chief Executive Officer and Michael F. Doolan as Senior Vice-President and Chief Financial Officer; and

- •

- The appointment of Fernando E. Porcile to the position of Senior Vice-President, Copper.

Since January 1, 2002, Falconbridge's capital and project expenditures have totaled $1,177.8 million, including $341.9 million at the Kidd Creek Operations, $286.1 million at Collahuasi, $79.6 million at Raglan, $170.1 million at the Sudbury Operations, $76.5 at the Montcalm mine, $111.8 million on the Koniambo project, $46.5 million at Falcondo, $23.7 million at Nikkelverk, $39.4 million at Lomas Bayas, and $2.2 million at other locations. For the same period, Falconbridge spent $64.5 million on exploration and $33.1 million on research and development.

10

The Corporation believes that a conservative financial structure and financial flexibility are important in order to accommodate the capital intensive and cyclical nature of the business. In 2004, the Corporation's balance sheet improved as the ratio of net debt to net debt plus equity was reduced to 24% from 37% in 2003. ("Net debt" is a non-GAAP financial measure. Please refer to page 52 of the Corporation's management's discussion and analysis for the year ended December 31, 2004 for the reconciliation to the most directly comparable Canadian GAAP measure — Debt to debt plus equity.) Cash and cash equivalents were $645 million as at December 31, 2004. The Corporation has significant liquidity and financial flexibility, including unused bank lines of credit totaling $457 million, resulting in unused credit and cash available to the Corporation in excess of $1 billion.

Falconbridge is a proponent of sustainable development where economic prosperity, environmental quality and social equity drive business activities. This commitment is reflected in the Corporation's Sustainable Development Policy.

The Corporation's operations continue to implement effective safety training programs and management systems and safety performance is supported and reviewed on a regular basis by senior management and the board of directors. Under the 2004 Safety, Health and Leadership program, four Falconbridge operations were visited by senior management to assess, promote and reinforce the importance of a safe workplace. These initiatives, among others, have resulted in enhanced safety performance in 2004 as the lost-time injury frequency (a measure of the number of compensable injuries per 200,000 hours worked) declined to 1.12 from 1.26 in 2003. The reportable injury frequency (a measure of the number of compensable injuries and modified work assignments per 200,000 hours worked) declined from 3.89 in 2003 to 3.54 in 2004.

11

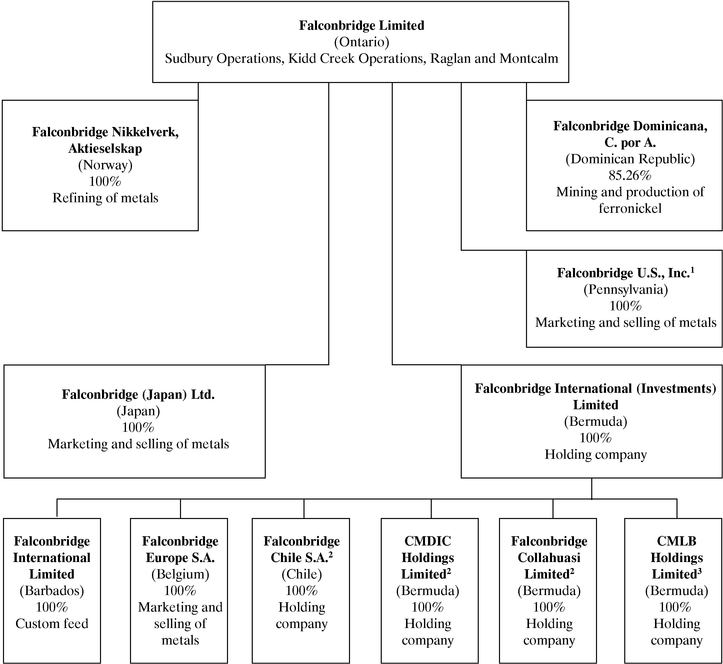

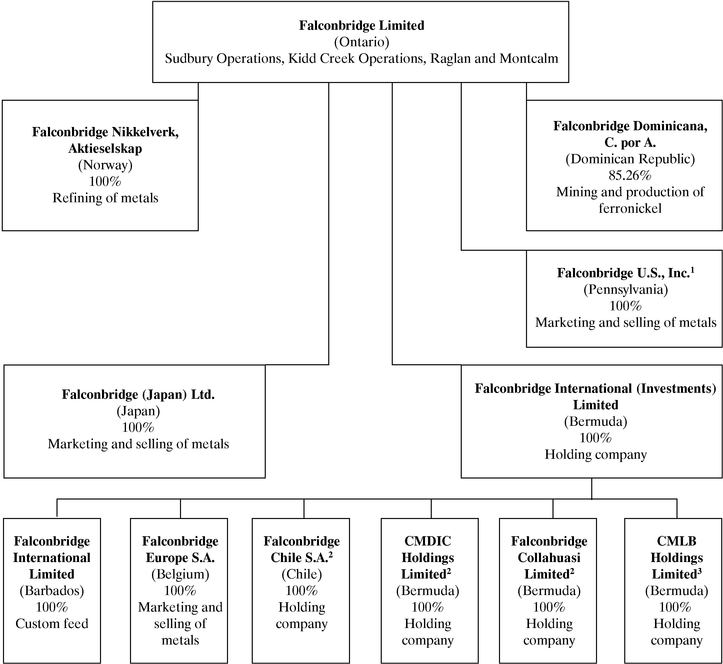

Organizational Chart

The principal direct and indirect subsidiaries of the Corporation and the jurisdictions in which they were incorporated or organized are set out below:

Notes:

- 1

- The Corporation owns 100% of the shares of Natresco Incorporated which, in turn, owns 100% of the shares of Falconbridge U.S., Inc.

- 2

- Falconbridge Chile S.A., CMDIC Holdings Limited and Falconbridge Collahuasi Limited own 19.93%, 20.09% and 3.98%, respectively, and 44%, collectively, of the shares of Compañia Minera Doña Inés de Collahuasi S.C.M. ("Collahuasi"), which owns 100% of Collahuasi.

- 3

- CMLB Holdings Limited owns 100% of the shares of Compañia Minera Falconbridge Lomas Bayas ("Lomas Bayas"), which owns 100% of Lomas Bayas.

12

BUSINESS OF FALCONBRIDGE

Falconbridge operates in one industry — the exploration, development, mining, processing and marketing of mineral products. These activities are conducted through six segments — the Integrated Nickel Operations, Falcondo, Kidd Creek Operations, Collahuasi, Lomas Bayas and Corporate. All are 100% owned except for Falcondo and Collahuasi which are 85.26% and 44% owned, respectively.

- •

- Integrated Nickel Operations ("INO")

- •

- Sudbury Operations — mines, mills and smelts its own nickel/copper ores and smelts Raglan and Montcalm concentrates and custom feed from other sources.

- •

- Raglan Mine ("Raglan") — mines and mills its own nickel/copper ores from a deposit in northwestern Quebec.

- •

- Montcalm Mine ("Montcalm") — mines nickel/copper ores from the Montcalm deposit near Timmins, Ontario.

- •

- Falconbridge Nikkelverk, Aktieselskap ("Nikkelverk") — refines matte produced by the Sudbury Operations and custom feed from other sources.

- •

- Falconbridge International Limited ("FIL") — manages and develops the INO's custom feed business outside Canada.

- •

- Falconbridge U.S., Inc. — markets and sells nickel, cobalt and other products throughout the United States, Canada, Mexico and Latin America.

- •

- Falconbridge Europe S.A. — markets and sells nickel, cobalt and other products throughout Europe, India and Africa, and silver, gold and platinum group metals throughout the world. Falconbridge Europe S.A. also sells all the copper cathode produced at the Nikkelverk refinery.

- •

- Falconbridge (Japan) Ltd. — markets and sells nickel, cobalt and other products throughout Japan and Asia.

- •

- Falconbridge Dominicana, C. por A. ("Falcondo") — mines, mills, smelts and refines its own nickel laterite ores.

- •

- Kidd Creek Operations

- •

- Kidd Mining Division — mines its own copper/zinc ores.

- •

- Kidd Metallurgical Division — mills, smelts and refines copper/zinc ores from the Kidd Mining Division, mills nickel/copper ores from Montcalm deposit and processes Sudbury Operations' and Montcalm copper concentrate; smelts and refines custom feed from other sources including some Collahuasi feed.

13

- •

- Compañia Minera Doña Inés de Collahuasi S.C.M. ("Collahuasi") — mines and mills its own copper sulphide ores into concentrate; mines and leaches its own copper oxide ores to produce copper cathode.

- •

- Compañia Minera Falconbridge Lomas Bayas ("Lomas Bayas") — mines and processes its own copper oxide ores to produce copper cathode.

- •

- Corporate

- •

- Exploration — conducts exploration worldwide.

- •

- Business Development — searches worldwide for attractive investment and development opportunities to support Falconbridge's growth strategy.

- •

- Marketing and Sales — provides marketing and sales support to all sales offices and markets.

- •

- Technology — conducts research, development and engineering.

Integrated Nickel Operations

Sudbury Operations

The Sudbury Operations consist of the Sudbury Mines/Mill and Sudbury Smelter.

Sudbury Mines/Mill

Properties and Mines

The Corporation has been mining nickel/copper ores in the Sudbury area of northern Ontario since 1929. The Sudbury Mines/Mill principal nickel/copper producing properties in the Sudbury area are located in the Townships of Falconbridge, Levack, Garson, Dowling, Blezard and Denison. The properties comprise 2,670 hectares owned by the Corporation and 14 hectares held under two licences of occupation of mining rights from the Province of Ontario. The licences of occupation are held in perpetuity.

Sudbury Mines/Mill operates four underground nickel/copper mines in the Sudbury area: the Craig, Fraser, Lindsley and Lockerby mines. In 2004, the Craig mine provided 38% of Sudbury Mines/Mill's ore production and the Lockerby mine was closed.

At planned operating rates, the mineral reserves at Sudbury Mines/Mill are equal to approximately six years of production. Production is expected to be extended as it is anticipated that a significant portion of the mineral resources will be converted to mineral reserves and will lengthen the life of the operation. It is anticipated that a significant portion of Nickel Rim South's inferred resources grading 1.8% nickel, 3.3% copper, 0.04% cobalt, 1.8 grams per tonne platinum and 2.0 grams per tonne palladium will be converted to reserves and extend the life of the mining operations in the next 13 to 15 years.

14

The annual production of the Sudbury Mines/Mill for the years ended December 31, 2004 and 2003 was as follows:

| | 2004

| | 2003

|

|---|

| | (tonnes)

|

|---|

| Ore milled from all sources | | 2,258,772 | | 2,260,964 |

| Mine output in concentrate — nickel | | 22,602 | | 24,143 |

| | — copper | | 24,694 | | 29,161 |

| | — cobalt | | 565 | | 611 |

Mineral Reserves and Mineral Resources

The Sudbury Mines/Mill's mineral reserves and mineral resources as at December 31, 2003 and December 31, 2004 were as follows:

| |

| |

| |

| | Changes in 2004 (tonnes)

| |

| |

| |

|

|---|

| | December 31, 2003

| | December 31, 2004

|

|---|

| | Tonnes

milled

| | Revisions/

Discoveries

|

|---|

Category

| | Tonnes

| | Nickel

| | Copper

| | Tonnes

| | Nickel

| | Copper

|

|---|

| | (000's)

| | %

| | %

| | (000's)

| | (000's)

| | (000's)

| | %

| | %

|

|---|

| Mineral Reserves | | |

| Proven | | 5,588 | | 1.40 | | 1.34 | | (1,753 | ) | 719 | | 4,554 | | 1.32 | | 1.59 |

| Probable | | 8,503 | | 1.22 | | 1.24 | | (236 | ) | (957 | ) | 7,310 | | 1.12 | | 1.17 |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| Total | | 14,091 | | 1.29 | | 1.28 | | (1,989 | ) | (238 | ) | 11,864 | | 1.20 | | 1.33 |

| | |

| |

| |

| |

| |

| |

| |

| |

|

Mineral Resources (in addition to Mineral Reserves) |

|

|

| Measured | | 683 | | 1.31 | | 0.80 | | — | | 3,317 | | 4,000 | | 1.77 | | 0.63 |

| Indicated | | 20,477 | | 2.27 | | 0.99 | | — | | (2,707 | ) | 17,770 | | 2.36 | | 1.04 |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| Total | | 21,160 | | 2.24 | | 0.98 | | — | | 610 | | 21,770 | | 2.25 | | 0.97 |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| Inferred | | 28,200 | | 1.7 | | 2.7 | | — | | 1,500 | | 29,700 | | 1.8 | | 2.6 |

The Corporation's exploration successes in the Sudbury basin over the course of the last few years have significantly increased the overall mineral resources available for the INO Sudbury Mines Mill Business Unit. Total Mineral Reserves in Sudbury now include 11.9 million tonnes in the Proven and Probable categories averaging 1.20% nickel and 1.33% copper. There are 21.8 million tonnes of Measured and Indicated Mineral Resources with an average grade of 2.25% nickel and 0.97% copper and 29.7 million tonnes of Inferred Mineral Resources grading 1.8% nickel and 2.6% copper. Measured and Indicated Resources increased by 0.6 million tonnes in 2004 and Inferred Resources by 1.5 million tonnes during the same period.

Approximately 1.7 million tonnes were added to the Inferred Resource at Nickel Rim South in 2004, a high-grade deposit discovered in 2001. As of December 31, 2004, Nickel Rim South is estimated to contain 13.4 million tonnes grading 1.8% nickel and 3.3% copper. Drilling at Fraser Morgan Zones 8, 9, 10 and a newly discovered Zone 11 upgraded the geological confidence and added to the available Mineral Resources. The Fraser Morgan Mineral Resource as of December 31, 2004, totals 3.33 million tonnes of measured resources grading 1.85% nickel and 0.61% copper, 1.55 million tonnes of indicated resources grading 1.69% nickel, 0.46% copper and 2.1 million tonnes of inferred resources grading 1.8% nickel, 0.5% copper.

15

Mineral Resources are reported using short-term and long-term price forecasting, cut-off grades and minimum mining widths appropriate to the particular deposit, production forecast and mining method. Engineering design, dilution and mining recoveries are applied to the Mineral Resource to arrive at the Mineral Reserve.

Approximately two million tonnes of Proven and Probable Mineral Reserves were milled in 2004. At planned operating rates, existing Proven and Probable Mineral Reserves, not including new Mineral Resources largely anticipated to be converted to Mineral Reserves in the future, represent approximately five years of production. The upgrade of Mineral Resources to Reserves by planned future work would result in an extension of the operating life of the Sudbury mines, mill and smelter. The Nickel Rim South deposit currently under development is projected to support mining operations until approximately 2021.

The ore from the Sudbury Mines/Mill's mines is crushed and ground and the nickel/copper-bearing sulphide minerals contained in the ore are separated from waste materials at the Sudbury Mines/Mill's Strathcona mill to produce nickel/copper concentrate and copper concentrate. The Strathcona mill has a capacity of approximately 10,000 tonnes of ore per day.

The copper concentrate from the Strathcona mill is delivered to the Kidd Metallurgical Division's mineral processing facilities for smelting and refining. See "Kidd Creek Operations — Kidd Metallurgical Division". The nickel/copper concentrate from the Strathcona mill is delivered to Sudbury Smelter for smelting.

The mineral processing facilities operated by Sudbury Smelter include a smelter and a sulphuric acid plant. The smelter processes concentrates and other feed material containing nickel, copper, cobalt, silver, gold and platinum group metals. In 2004, the smelter treated all of the nickel/copper concentrates from the Sudbury Mines/Mill and all the concentrate from Raglan, as well as a variety of metal bearing, secondary, recyclable and intermediate feedstocks from third parties and smaller amounts of concentrates from third parties. The Smelter commenced treating Montcalm nickel concentrate in the fourth quarter of 2004. This is an additional concentrate feed from a Falconbridge-owned property located near Timmins, Ontario. This feed source is expected to have a production life of seven years.

Sudbury Smelter produces a matte containing nickel, copper and cobalt, as well as silver, gold and platinum group metals. The Sudbury Smelter has the capacity to produce approximately 130,000 tonnes of matte per year. The roaster gas from the smelter operation is treated in an adjacent plant to produce sulphuric acid thereby reducing sulphur dioxide emissions to the natural environment. The sulphuric acid plant has the capacity to produce approximately 300,000 tonnes of sulphuric acid per year. The Sudbury Smelter's output of sulphuric acid is purchased for resale by a subsidiary of Noranda (which is partly owned by Falconbridge) that markets, transports and distributes sulphuric acid in North America.

The matte produced by the Sudbury Smelter is shipped by rail to Quebec City and by sea to the Nikkelverk refinery for further processing. See "Business of Falconbridge — Integrated Nickel Operations — Nikkelverk".

16

The annual production of the Sudbury Smelter for the years ended December 31, 2004 and 2003 was as follows:

| | 2004

| | 2003

|

|---|

| | (tonnes)

|

|---|

| Smelter output of nickel | | | | |

| | Sudbury mines | | 18,700 | | 24,700 |

| | Raglan | | 23,800 | | 28,700 |

| | Montcalm | | 1,800 | | — |

| | Custom feed | | 8,300 | | 6,400 |

| | |

| |

|

| | Total | | 52,600 | | 59,800 |

| | |

| |

|

| Smelter output of copper | | | | |

| | Sudbury mines | | 5,800 | | 8,100 |

| | Raglan | | 6,300 | | 7,700 |

| | Montcalm | | 400 | | — |

| | Custom feed | | 5,900 | | 5,000 |

| | |

| |

|

| | Total | | 18,400 | | 20,800 |

| | |

| |

|

| Smelter output of cobalt | | | | |

| | Sudbury mines | | 430 | | 660 |

| | Raglan | | 310 | | 460 |

| | Montcalm | | 50 | | — |

| | Custom feed | | 1,050 | | 1,080 |

| | |

| |

|

| | Total | | 1,840 | | 2,200 |

| | |

| |

|

| Copper concentrate — nickel | | 75 | | 110 |

| | — copper | | 17,600 | | 21,900 |

| Sulphuric acid | | 244,600 | | 245,500 |

Raglan

On January 1, 2004, the Corporation dissolved the wholly-owned subsidiary Société minière Raglan du Québec ltée ("Raglan"), and transferred all assets, liabilities and business operations of Raglan to the Corporation.

Commercial production at Raglan began in 1998. Raglan's annual production capacity is 1,000,000 tonnes per year of ore milled.

The Raglan property is located 105 kilometres south of the northern tip of the Ungava (Nunavik) Peninsula in the Province of Quebec, approximately 1,800 kilometres north of Montreal. The property comprises 1,226 map-designated claims covering 48,149 hectares and nine 20-year mining leases covering 947 hectares. The first of the leases expires in June 2016. All are renewable for three 10-year terms, provided that mining has taken place for at least two of the preceding 10 years. In 2004, application was made for two additional mining leases covering 48 hectares.

17

Falconbridge has explored the Raglan property since the 1960s. Development of the Raglan mine site at Katinniq began in 1996 following receipt of environmental approvals and the conclusion of agreements with Makivik Corporation (the representative of the local Inuit population) and the Province of Quebec regarding infrastructure funding. The Raglan facilities include underground mines and open pits, a concentrator, a power plant, accommodation and administration buildings, two exploration camps, fresh water supply and fuel storage tanks. The facilities are linked by all-weather roads to an airstrip at Donaldson and to concentrate storage and ship-loading facilities at Deception Bay, 100 kilometres from Katinniq. Raglan concentrate is transported by ship to unloading, storage and rail load-out facilities in Quebec City.

Mineral Reserves and Mineral Resources

Raglan's mineral reserves and mineral resources as at December 31, 2003 and December 31, 2004 were as follows:

| |

| |

| |

| | Changes in 2004 (tonnes)

| |

| |

| |

|

|---|

| | December 31, 2003

| | December 31, 2004

|

|---|

| |

| | Revisions/

Discoveries

|

|---|

Category

| | Tonnes

| | Nickel

| | Copper

| | Production

| | Tonnes

| | Nickel

| | Copper

|

|---|

| | (000's)

| | %

| | %

| | (000's)

| | (000's)

| | (000's)

| | %

| | %

|

|---|

| Mineral Reserves1 | | |

| Proven | | 8,308 | | 2.86 | | 0.77 | | (935 | ) | (1,103 | ) | 6,270 | | 2.63 | | 0.74 |

| Probable | | 9,355 | | 2.86 | | 0.80 | | — | | 27 | | 9,382 | | 2.95 | | 0.81 |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| Total | | 17,663 | | 2.86 | | 0.78 | | (935 | ) | (1,076 | ) | 15,652 | | 2.82 | | 0.78 |

| | |

| |

| |

| |

| |

| |

| |

| |

|

Mineral Resources (in addition to Mineral Reserves)2 |

|

|

| Measured | | 228 | | 1.47 | | 0.37 | | — | | (173 | ) | 55 | | 3.93 | | 1.11 |

| Indicated | | 2,972 | | 2.18 | | 0.76 | | — | | 738 | | 3,710 | | 2.19 | | 0.73 |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| Total | | 3,200 | | 2.13 | | 0.74 | | — | | 565 | | 3,765 | | 2.22 | | 0.74 |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| Inferred | | 4,000 | | 2.9 | | 0.9 | | — | | 1,200 | | 5,200 | | 2.9 | | 0.8 |

Notes:

- 1

- Mineral reserves decreased by 2.0 million tonnes as a result of annual production, write-downs and re-classification to resources.

- 2

- Mineral resources were increased by 1.8 million tonnes, primarily as a result of discoveries and additions at Zones 3, Zone 5-8, West Boundary and Donaldson through exploration.

At planned operating rates, the mineral reserves at Raglan are equal to approximately 17 years of production, not including 3.8 million tonnes of measured and indicated resources and 5.2 million tonnes of inferred resources. In addition, an active exploration program continues in this prospective nickel belt.

The ore from the Raglan mine is crushed, ground and treated at the Raglan mill in Katinniq to produce nickel/copper concentrate. The current capacity of the mill is 3,000 tonnes of ore throughput per day.

Raglan concentrate is trucked to Deception Bay for marine shipment to Quebec City and then transported by rail to the Sudbury Smelter for treatment. There were six shipments from Deception Bay during 2004. No shipping occurs from mid-March to early-June.

18

Raglan's annual production for the years ended December 31, 2004 and 2003 was as follows:

| | 2004

| | 2003

|

|---|

| | (tonnes)

|

|---|

| Ore milled | | 935,000 | | 834,000 |

| Mine output in concentrate — nickel | | 26,600 | | 25,100 |

| | — copper | | 6,900 | | 6,600 |

| | — cobalt | | 400 | | 380 |

Montcalm

The Montcalm mine, a nickel-copper property located 70 kilometres Northwest of Timmins, Ontario, reached its designed production capacity of 750,000 tonnes annually during the fourth quarter of 2004. This included conversion of a redundant mill line at the Kidd concentrator to handle the Montcalm ores. Two concentrates are produced, a copper concentrate which is treated at the Kidd Metallurgical Complex and a nickel concentrate which is transported to Falconbridge's smelter in Sudbury.

During 2004 the Montcalm mine produced 214,392 tonnes of ore grading 1.32% nickel and 0.68% copper. The initial 73,148 tonnes of ore produced were hauled to the Strathcona concentrator in Sudbury while construction at the Kidd concentrator was taking place.

At year-end 2004 the Moncalm reserves (proven & probable) totaled 4,900,000 tonnes grading 1.51% nickel and 0.73% copper. Montcalm is expected to contribute up to 9,000 tonnes annually to refined nickel output.

The Montcalm Nickel mine was brought into production in 2004. It is located 100 kilometres east of the Kidd Metallurgical Site in Montcalm Township in the Province of Ontario and comprises four 21 year leases covering mining and surface rights over 831 hectares.

19

Mineral Reserves and Mineral Resources

Montcalm's mineral reserves and mineral resources as at December 31, 2003 and December 31, 2004 were as follows:

| |

| |

| |

| | Changes in 2004 (tonnes)

| |

| |

| |

|

|---|

| | December 31, 2003

| | December 31, 2004

|

|---|

| |

| | Revisions/

Discoveries

|

|---|

Category

| | Tonnes

| | Nickel

| | Copper

| | Production

| | Tonnes

| | Nickel

| | Copper

|

|---|

| | (000's)

| | %

| | %

| | (000's)

| | (000's)

| | (000's)

| | %

| | %

|

|---|

| Mineral Reserves1 | | |

| Proven | | — | | — | | — | | (214 | ) | 3,376 | | 3,162 | | 1.56 | | 0.75 |

| Probable | | 5,113 | | 1.46 | | 0.71 | | — | | (3,389 | ) | 1,724 | | 1.44 | | 0.70 |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| Total | | 5,113 | | 1.46 | | 0.71 | | (214 | ) | (13 | ) | 4,886 | | 1.51 | | 0.73 |

| | |

| |

| |

| |

| |

| |

| |

| |

|

Mineral Resources (in addition to Mineral Reserves) |

|

|

| Measured | | — | | — | | — | | — | | — | | — | | — | | — |

| Indicated | | — | | — | | — | | — | | — | | — | | — | | — |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| Total | | — | | — | | — | | — | | — | | — | | — | | — |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| Inferred | | 700 | | 1.7 | | 0.7 | | — | | — | | 700 | | 1.7 | | 0.7 |

| | |

| |

| |

| |

| |

| |

| |

| |

|

Note:

- 1

- The mineral reserves decreased from 5.1 million tonnes to 4.9 million tonnes due to the start of production in 2004.

At planned operating rates, the mineral reserves at Montcalm are equal to approximately seven years of production.

Montcalm's annual production for the years ended December 31, 2004 and 2003 was as follows:

| | 2004

| | 2003

|

|---|

| | (tonnes)

|

|---|

| Ore milled | | 220,000 | | — |

| Mine output in concentrate — nickel | | 2,200 | | — |

| | — copper | | 1,200 | | — |

| | — cobalt | | 70 | | — |

Nikkelverk

Nikkelverk owns and operates a refinery and sulphuric acid plant at Kristiansand, Norway. The refinery processes the matte produced by the Sudbury Smelter as well as custom feed from other sources. The Corporation believes that the Nikkelverk refinery is among the lowest-cost nickel refineries in the western world.

The Nikkelverk refinery uses a chlorine leach and electrowinning process developed by Falconbridge to separate and recover component metals. The process is cost-efficient in the treatment of complex raw materials and achieves high productivity and recoveries. This efficiency allows greater flexibility in the sourcing and treatment of custom feed. The refinery has an annual capacity of approximately 85,000 tonnes of nickel, 39,000 tonnes of copper and 4,800 tonnes of cobalt. Expansion of the refinery to 100,000 tonnes of nickel, 60,000 tonnes of copper and 5,000 tonnes of cobalt per year or higher is possible when market conditions warrant. The sulphuric acid plant has a capacity of approximately 115,000 tonnes of sulphuric acid per year.

20

The Nikkelverk refinery also treats the silver, gold and platinum group metals contained in the matte produced by Sudbury Smelter and the custom feed from other sources. Mattes from Sudbury Smelter and from BCL Limited ("BCL") in Botswana were the main sources of nickel/copper feed materials for the Nikkelverk refinery in 2004. See "FIL — Custom Feed".

The production of platinum group metals grew in importance during 2004 as production volumes expanded. The Nikkelverk refinery produced approximately 438,000 ounces of platinum group metals in 2004, compared with approximately 396,000 ounces in 2003.

The Nikkelverk refinery's annual production for the years ended December 31, 2004 and 2003 was as follows:

| | 2004

| | 2003

|

|---|

| | (tonnes)

|

|---|

| Nickel | | 71,410 | | 77,183 |

| Copper | | 35,643 | | 35,852 |

| Cobalt | | 4,670 | | 4,556 |

| Sulphuric acid | | 95,199 | | 102,133 |

All product lines at the Nikkelverk refinery were operated for 12 months throughout 2004.

FIL

FIL, through its offices in Bridgetown, Barbados and Brussels, Belgium, is responsible for managing the INO's custom feed business outside Canada. Custom feed, or third-party primary smelter mine production (concentrate), primary smelter production (matte) and secondary raw materials, provides a significant source of feed to the Sudbury Smelter and the Nikkelverk refinery. The availability of and profit margins associated with the custom feed processed at the Sudbury Smelter and the Nikkelverk refinery are largely a function of metal grade and the level and relationship of nickel, copper, cobalt, silver, gold and platinum group metals prices and competition for such materials.

The custom feed processed at the Sudbury Smelter consists largely of nickel/copper/cobalt secondary raw materials and nickel concentrates. Most secondary raw materials are sourced on a spot basis or under contracts of one to three years' duration. Concentrates are sourced on a spot basis and multi-year contracts. In 2004, Sudbury Smelter's output from all third-party feeds included 8,300 tonnes of nickel, 5,800 tonnes of copper and 1,050 tonnes of cobalt.

In 1985, FIL entered into a long-term agreement with BCL to treat complex nickel/copper matte from BCL's smelter in Botswana. The BCL matte represented approximately 57% of the nickel and copper-bearing custom feeds processed at the Nikkelverk refinery in 2004. Under the agreement, which was extended in 2002 to the end of 2015, BCL has agreed to deliver approximately 10,000 tonnes of nickel in matte per year.

21

In 2004, custom feed represented approximately 29% of the nickel, 59% of the copper and 83% of the cobalt output at the Nikkelverk refinery.

Falcondo

The Corporation owns 85.26% of the outstanding shares of Falcondo. Of the balance, the Government of the Dominican Republic owns approximately 10%, Redstone Resources Inc. owns approximately 4.1% and various individuals own the remainder. Falcondo holds a mining concession and owns mining and mineral processing facilities for the production of ferronickel located near the town of Bonao, approximately 80 kilometres northwest of Santo Domingo, Dominican Republic.

Falcondo has been mining and processing nickel laterite ore in the Dominican Republic since 1971. Falcondo's mining concession covers approximately 21,830 hectares. Falcondo owns 4,831 hectares, 4,802 of which are inside the mining concession and include the mining areas and the mineral processing facilities, and 29 of which are outside the mining concession and include the townsite at Bonao. The term of the mining concession is for an unlimited period.

Mining at Falcondo is carried out from the surface using bulldozers, loaders and trucks. Falcondo's total mine production for the year ended December 31, 2004, as obtained through a metallurgical balance calculation, was 3,736,815 dry tonnes of ore at an average nickel grade of 1.23%.

Mineral Reserves and Mineral Resources

Falcondo's mineral reserves and mineral resources as at December 31, 2003 and December 31, 2004 were as follows:

| | December 31, 2003

| | Changes in 2004 (tonnes)

| | December 31, 2004

|

|---|

| |

| | Revisions/

Discoveries

|

|---|

Category

| | Tonnes

| | Nickel

| | Production

| | Tonnes

| | Nickel

|

|---|

| | (000's)

| | %

| | (000's)

| | (000's)

| | (000's)

| | %

|

|---|

| Mineral Reserves1 | | |

| Proven | | 49,271 | | 1.19 | | (3,737 | ) | 2,312 | | 47,846 | | 1.21 |

| Probable | | 11,656 | | 1.16 | | — | | (2,099 | ) | 9,557 | | 1.20 |

| | |

| |

| |

| |

| |

| |

|

| Total | | 60,927 | | 1.18 | | (3,737 | ) | 213 | | 57,403 | | 1.21 |

| | |

| |

| |

| |

| |

| |

|

Mineral Resources (in addition to Mineral Reserves) |

|

|

| Indicated | | 13,840 | | 1.53 | | — | | — | | 13,840 | | 1.53 |

| Inferred | | 6,400 | | 1.4 | | — | | — | | 6,400 | | 1.4 |

22

Note:

- 1

- The mineral reserves showed a total decrease of 3.5 million tonnes after production of 3.7 million tonnes in 2004. The decrease is basically due to mining, with most adjustments in the proven and probable categories due to a drilling campaign on the Barmac Reject stockpile.

At planned operating rates, mineral reserves at Falcondo are equal to approximately 16 years of production, not including 13.8 million tonnes of indicated resources and 6.4 million tonnes of inferred resources that are in large part anticipated to be converted into reserves.

Milling, Smelting, Refining and Marketing

The ore mined at Falcondo is milled, smelted and refined at Falcondo's mineral processing facilities, which have a capacity of approximately 29,000 tons of nickel contained in ferronickel per year. The facilities include a metallurgical treatment plant, a crude oil processor and a 200-megawatt thermal power plant. In 2004, Falcondo rented a backup power generator to provide energy during the period of maintenance of the three owned units. Falcondo has dock facilities and a crude oil tank farm at the port of Haina (near Santo Domingo) and a 70-kilometre crude oil pipeline from the port to its mineral processing facilities. Falcondo's production of nickel in ferronickel for the two years ended December 31, 2004 and 2003 was 29,477 tonnes and 27,227 tonnes, respectively.

Marketing and sales of ferronickel produced at Falcondo are conducted through Falconbridge U.S., Inc., Falconbridge Europe S.A. and Falconbridge (Japan) Ltd.

Kidd Creek Operations

The Kidd Creek Operations consist of the Kidd Mining Division and the Kidd Metallurgical Division.

Kidd Mining Division

Properties and Mines

The Corporation has been mining the Kidd Creek copper/zinc orebody in Timmins, Ontario since 1966. The Kidd Mining Division's principal copper/zinc properties in the Timmins area are located in Kidd Township, Porcupine Mining Division, Ontario. The properties owned by the Corporation comprise 14 patented half lots covering 896 hectares of freehold mining land.

The Kidd Creek orebody is mined through two separate shafts, accessing mining areas known as the No. 1, 2, 3 and D (Deep) mines, which access progressively deeper levels. In 2004, the No. 1 and 2 mines accounted for 32%, the No. 3 mine accounted for 58% and D Mine accounted for 10% of the Kidd Mining Division's mine ore production.

Ore production has been decreasing as mining has progressed to deeper levels of the orebody. The Corporation anticipates that the Kidd Mining Division's annual ore production will increase from 2.1 million tonnes in 2004 to approximately 2.35 million tonnes in 2005 and approximately 2.4 million tonnes in 2006.

In 2000, the Corporation approved the development of Mine D, the depth extension of the Kidd Creek orebody beyond the limits of the No. 3 mine at 6,800 feet (2,070 meters) to a depth of 10,200 feet (3,100 meters). Production from Mine D commenced in the third quarter of 2004 with production increasing in 2005 and 2006. Stage I of the project is scheduled to be completed in mid 2006.

23

The Kidd Creek orebody is intersected by a number of major faults and other discontinuities. Mining and the resulting stress redistribution cause periodic ground adjustment along these faults resulting in seismic activity. The Corporation has taken steps to minimize the impact of seismic activity on its Kidd Creek mining operations. These steps include the use of seismic monitoring equipment and the development and use of safe and cost-effective mining systems and procedures. On occasion, a seismic event will occur which has the potential to cause personal injury, equipment damage or production interruption. Such events have been infrequent.

The Kidd Mining Division's annual production for the years ended December 31, 2004 and 2003 was as follows:

| | 2004

| | 2003

|

|---|

| | (tonnes unless otherwise noted)

|

|---|

| Ore hoisted | | 2,093,660 | | 2,108,493 |

| Mine output in concentrate — copper | | 41,029 | | 46,409 |

| | — zinc | | 87,847 | | 75,528 |

| | — silver (ounces) | | 3,849,000 | | 2,676,000 |

Mineral Reserves and Mineral Resources

The Kidd Mining Division's mineral reserves and mineral resources as at December 31, 2003 and December 31, 2004 were as follows:

| |

| |

| |

| |

| | Changes in 2004 (tonnes)

| |

| |

| |

| |

|

|---|

| | December 31, 2003

| | December 31, 2004

|

|---|

| | Tonnes

milled

| | Revisions/

Discoveries

|

|---|

Category

| | Tonnes

| | Copper

| | Zinc

| | Silver

| | Tonnes

| | Copper

| | Zinc

| | Silver

|

|---|

| | (000's)

| | %

| | %

| | (grams/

tonne)

| | (000's)

| | (000's)

| | (000's)

| | %

| | %

| | (grams/

tonne)

|

|---|

| Mineral Reserves1 | | | | | | |

| Proven | | 12,585 | | 1.86 | | 5.60 | | 71 | | (2,080 | ) | 3,781 | | 14,286 | | 1.91 | | 5.64 | | 62 |

| Probable | | 8,239 | | 2.23 | | 7.00 | | 53 | | — | | (4,459 | ) | 3,780 | | 1.35 | | 7.52 | | 47 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Total | | 20,824 | | 2.01 | | 6.15 | | 64 | | (2,080 | ) | (678 | ) | 18,066 | | 1.80 | | 6.03 | | 58 |

Mineral Resources (in addition to Mineral Reserves) |

|

|

|

|

|

|

| Measured | | 276 | | 1.34 | | 6.00 | | 47 | | — | | 34 | | 310 | | 1.32 | | 6.08 | | 43 |

| Indicated | | 77 | | 2.82 | | 8.54 | | 52 | | — | | 1 | | 78 | | 2.82 | | 8.54 | | 52 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Total | | 353 | | 1.66 | | 6.55 | | 48 | | — | | 354 | | 388 | | 1.62 | | 6.57 | | 45 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Inferred | | 14,200 | | 3.4 | | 4.9 | | 91 | | — | | 1,100 | | 15,300 | | 3.0 | | 4.6 | | 82 |

Note:

- 1

- Mineral reserves decreased by 2.8 million tonnes resulting from production of 2.1 million tonnes and downward revisions of 678,000 tonnes mainly the result of stope design revisions and the temporary re-categorization of 370,000 of copper stringer ore to Inferred resources until diamond drilling is completed in the lower part of the mine.

At planned operating rates, the mineral reserves at Kidd Mining Division are equal to approximately seven years of production (averaging 2.4 Mt/yr), not including the inferred resources which, if converted to reserves, could provide up to an additional six years of operations. The inferred resources could make possible a modified plan averaging 2.7 Mt/yr.

24

Kidd Metallurgical Division

Milling, Smelting and Refining

The ore from the Kidd Mining Division is transported by a company-owned railway to the Kidd Metallurgical Division's mineral processing facilities located 27 kilometres southeast of the minesite. These facilities include a concentrator, a copper smelter and refinery, a zinc plant, a cadmium plant, a dust treatment plant (which recovers indium, copper and zinc) and two sulphuric acid plants. The Kidd Metallurgical Division also operates a liquid sulphur dioxide plant with a sales marketing agreement with Chemtrade Logistics Ltd. In 2004, a new agreement was reached with Chemtrade which saw the ownership of the plant revert to Falconbridge.

The concentrator produces copper and zinc concentrates as well as nickel concentrates. All of the ores from the Kidd Mining Division are treated in two of four available grinding/flotation circuits. For 2004, 2,062,741 tonnes of Kidd ore were processed. In 2004, a third circuit was rehabilitated and converted to process nickel ore from the Corporation's Montcalm nickel project, located approximately 100 kilometres west of the Kidd Metallurgical Division site. The circuit began processing the first tonnes of Montcalm ore by mid-October, and treated a total of 143,062 tonnes by year end. The circuit capacity for 2005 is approximately 750,000 tonnes. In 2004, approximately 13,734 tonnes of nickel bearing concentrate were shipped to the Sudbury Smelter and 1,477 tonnes of by-product copper concentrate were produced for processing at the Kidd facilities by the Montcalm circuit. The fourth remaining circuit is available to process custom ore.

The copper concentrate produced at Kidd from the Kidd and Montcalm ores, together with that shipped from the Sudbury Strathcona mill and other copper custom feeds, are fed into the smelter, which has the capacity to produce 150,000 tonnes of blister copper per year. Custom feeds originating outside of the Corporation's Ontario operations comprised approximately 54% of copper smelter feed in 2004 and are expected to make up approximately 42% of feed in 2005.

The blister copper produced at the smelter is either treated in the refinery, which currently has the capacity to produce 147,000 tonnes of copper cathode per year, or sold to outside refineries, including Noranda's Canadian Copper Refinery ("CCR"). In addition to copper, the refinery produces anode slimes containing substantial amounts of silver and gold that are further toll refined by outside refineries, including CCR, for precious metal recovery.

The zinc plant has the capacity to produce 147,000 tonnes of zinc per year. In October 2004, the construction of a new precious metal recovery circuit was completed. This new circuit provides the plant with the ability to process gold and silver bearing zinc concentrates and to recover the gold and silver as a precious metals/lead residue. The residue will be sent to Noranda's Brunswick Smelter for further processing. Custom feed comprised approximately 40% of the total zinc plant feed in 2004 and is expected to be at similar levels in 2005. With the expected volumes of LaRonde (see custom fee section below) concentrates in 2005, it is anticipated that surplus Kidd zinc concentrates will be available for sale to Noranda and shipped to the Noranda Income Fund's CEZ refinery.

The Corporation has an agreement with Noranda, whereby Noranda acts as the sales agent for all products, other than sulphuric acid, indium and liquid sulphur dioxide, produced by the Kidd Metallurgical Division. Under this agreement, which may be terminated on 12 months' notice, an annual marketing fee is paid. In addition, all of the sulphuric acid produced by Kidd Metallurgical Division is purchased for resale by a subsidiary of Noranda (which is partly owned (35%) by Falconbridge). In 2005, the bulk of the anode slimes produced will be sold to Noranda's CCR Division.

25

The Kidd Metallurgical Division purchases a variety of primary and secondary copper and zinc-bearing materials on both a long-term and short-term basis. Suppliers of these materials include Noranda and its subsidiaries.

In April 2004, the Corporation signed a Memorandum of Agreement for a life-of-mine zinc concentrate supply and processing agreement with Agnico-Eagle Limited. Under the terms of the agreement the Kidd Metallurgical Division will process 60% to 75%, up to a maximum of 125,000 tonnes per year, of the precious metal bearing zinc concentrate production from Agnico-Eagle's LaRonde mine, located south-east of Rouyn-Noranda, Quebec. The Kidd Metallurgical Division also has agreements to process copper concentrate shipped from Collahuasi, and sources additional concentrates from Minera Escondida Limitada, Minera Alumbrera Limitada and others. In 2004, the Kidd operations began processing Antamina Bornite concentrates.

The Kidd Metallurgical Division's production for 2004 and 2003 was as follows:

| | 2004

| | 2003

|

|---|

| | (tonnes)

|

|---|

| Zinc refinery output | | 121,560 | | 94,700 |

| Copper output (115,578 t cathode + 1,942 t of spent anode sold) | | 117,520 | | 132,400 |

| Blister copper | | 118,240 | | 131,400 |

| Sulphuric acid (net of internal consumption) | | 480,530 | | 472,100 |

In 2004, a five-week maintenance outage and vacation shutdown was planned to begin in July 2004 for the copper operations in light of depressed terms for custom concentrates earlier in the year. The shutdown was advanced by six weeks to mid-May and extended by approximately 10 days as a result of operating problems with one of the smelter's furnaces. The copper smelter's operating rate for the year excluding the shutdown was 90.6%, compared to 93.3% in 2003, due to start-up problems following the plant's scheduled maintenance shutdown and other equipment failures. Consequently, copper smelter feed throughput volumes, blister copper output and copper cathode production were negatively affected. For 2005, cathode production is anticipated to increase to approximately 130,000 tonnes due to improvements to acid plant equipment and only 4 weeks of maintenance outage.

Over July and August 2004, the zinc operations underwent a seven-week maintenance and vacation shutdown. The originally scheduled 13-week shutdown period was reduced to seven weeks as a result of improved market conditions and custom feed availability. Total saleable zinc production for 2005 is expected to increase to approximately 135,000 tonnes as a result of the shutdown period being reduced to only two weeks.

Sulphuric acid production in 2004 was slightly higher than the volume produced in 2003.

26

Compañia Minera Doña Inés de Collahuasi

Falconbridge owns a 44% interest in Compañía Minera Doña Inés de Collahuasi S.C.M., an independent corporation which owns the mining and water rights and other assets comprising the Collahuasi operation, together with Anglo American Plc which also holds a 44% interest, and a Japanese consortium holding the remaining 12% interest.

A capital investment of $1,792 million was required to bring Collahuasi into commercial production. The financing requirement, including working capital, was approximately $1,870 million.

The property is located in northern Chile, about 180 kilometres southeast of the port of Iquique, at an elevation of 4,300 metres. It contains two separate porphyry copper deposits, known as Ujina and Rosario: the Ujina high grade secondary enrichment has been mined already but an important reserve of primary copper ore remains; Rosario has large tonnages of high grade primary ore and important secondary enrichment zones. The Huinquintipa oxide copper deposit is located downstream from the Rosario deposit. In addition, the property contains high-grade copper/molybdenum vein systems at the adjacent La Grande deposit.

Commercial production at the Collahuasi operation began in January 1999. Production is expected to average 350,000 tonnes per year of copper in concentrates and 50,000 tonnes per year of copper cathode during the initial 10 years of mine life. The mine site is serviced under a 20-year power supply contract with Empresa Nacional de Electricidad S.A., a Chilean electric utility company.

During 2004, 165.6 million tonnes of material was mined (2003 — 145.9 million tonnes), 34.8 million tonnes of ore was milled at the concentrator (2003 — 24.4 million tonnes) and 6.6 million tonnes of ore was processed at the copper oxide leaching plant (2003 — 6.4 million tonnes). Falconbridge's share of copper produced by Collahuasi during 2004 was 25,610 tonnes of cathode copper and 179,506 payable tonnes (186,017 contained tonnes) of copper in concentrate (2003 — 173,680 copper tonnes was produced considering cathodes and concentrates).

The Ujina pit was practically depleted during the year 2004 and ore extraction ramped-up in the Rosario Pit during the year 2004. In the last months of 2004, production at the Rosario Pit had achieved its full capacity. Ore coming from the Ujina pit operation has been replaced by higher grade ore from the Rosario Pit. Ujina will remain without operation for the next 10 years according to the mine plan.

The transition to the Rosario orebody, which included the construction of an overland conveyor to transport sulphide ore to the concentrator, and increasing the concentrator throughput from 70,000 tonnes to 110,000 tonnes per day, was completed in third Quarter 2004, five weeks ahead of schedule and under the $654 million budget.

27

Mineral Reserves and Mineral Resources

Collahuasi's mineral reserves and mineral resources as at December 31, 2003 and December 31, 2004 were as follows:

| |

| |

| | Changes in 2004 (tonnes)

| |

| |

|

|---|

| | December 31, 2003

| | December 31, 2004

|

|---|

| |

| | Revisions/

Discoveries

|

|---|

Category

| | Tonnes

| | Copper

| | Production

| | Tonnes

| | Copper

|

|---|

| | (000's)

| | %

| | (000's)

| | (000's)

| | (000's)

| | %

|

|---|

| Mineral Reserves | | |

| Proven | | 254,146 | | 1.01 | | (34,406 | ) | 90,763 | | 310,503 | | 1.09 |

| Probable | | 1,554,075 | | 0.90 | | (7,047 | ) | (7,926 | ) | 1,539,102 | | 0.87 |

| | |

| |

| |

| |

| |

| |

|

| Total | | 1,808,221 | | 0.91 | | (41,453 | ) | 82,837 | | 1,849,605 | | 0.90 |

| | |

| |

| |

| |

| |

| |

|

Mineral Resources (in addition to Mineral Reserves) |

|

|

| Measured | | 48,102 | | 0.57 | | — | | 2,693 | | 50,795 | | 0.55 |

| Indicated | | 429,564 | | 0.63 | | — | | 467 | | 430,031 | | 0.65 |

| | |

| |

| |

| |

| |

| |

|

| Total | | 477,666 | | 0.63 | | — | | 3,160 | | 480,826 | | 0.64 |

| | |

| |

| |

| |

| |

| |

|

| Inferred | | 1,840,000 | | 0.72 | | — | | (20,000 | ) | 1,820,000 | | 0.80 |

Note:

- 1

- The mineral reserves and resources at Collahuasi are estimated and classified to industry standards following the Australasian Institute of Mining and Metallurgy's Joint Ore Reserve Committee code. These estimates have been restated to conform to the definitions adopted by National Instrument 43-101.

Proven and probable mineral reserves are based on the mineral resource model after applying open-pit design and cut-off criteria. Proven and probable mineral reserves are reported using a 0.45% copper cut-off for sulphide ore, 0.40% cut-off for oxide ore and 0.50% copper for mixed ore, and include all stockpiled material above the cut-off grade. The assumed metal price was $0.95 per lb. of copper. Mineral resources are in addition to mineral reserves and are estimated using an average 0.40% copper cut-off grade. Measured and indicated mineral resources consist of material inside an encompassing pit outline based on a copper price of $1.15 but excluding the mineral reserves contained in the interior pit outline. Inferred resources were estimated for material contained in both pit designs.

At planned operating rates, the proven and probable mineral reserves are equal to more than 40 years of production; not including substantial measured and indicated mineral resources of 480.8 million tonnes and 1.8 billion tonnes of inferred resources. The December 31, 2004 total proven and probable mineral reserves were increased by 41.4 million tonnes after production of 41.5 million tonnes. The overall increase of 82.9 million tonnes is due to revision of the resource models (76.5 million tonnes) based on new drill information and the addition of new oxide copper orebodies (6.4 million tonnes).

Compañía Minera Falconbridge Lomas Bayas

In July 2001, Falconbridge acquired 100% of the Lomas Bayas copper mine and adjacent Fortuna de Cobre copper deposit from Boliden Limited for a cash payment of $66 million. Falconbridge is also required to pay $15 million if it exercises its right to retain the Fortuna de Cobre deposit before the fifth anniversary of closing.

28

The Lomas Bayas mine comprises seven exploitation concessions covering approximately 2,022 hectares. The Fortuna de Cobre deposit comprises 11 exploitation concessions covering approximately 1,216.5 hectares. Falconbridge also holds 25 exploitation concessions and one exploitation concession application covering approximately 4,387 hectares between the Lomas Bayas mine and the Fortuna de Cobre deposit as well as 70 exploration concessions covering an area around the Fortuna de Cobre deposit.

The Lomas Bayas mine is located in the Second Region of Chile, approximately 110 kilometres north-east of the port city of Antofagasta. The mine is situated at an altitude of 1,500 metres in the Atacama Desert. The Fortuna de Cobre deposit is situated 3 kilometres to the south of the Lomas Bayas mine.

Lomas Bayas currently operates one open pit mine. Heap-leach grade ore is crushed and placed on leach pads by a series of portable conveyors and a stacking system. Lower-grade ore that does not economically justify the cost of crushing and additional handling is placed directly on separate leach pads by mine haulage trucks. Solutions containing sulphuric acid are then applied to leach the ores and copper recovery occurs by a solvent extraction-electrowinning process. The copper cathode is transported by truck and rail to the port at Antofagasta and shipped to customers overseas. Lomas Bayas is serviced by the electrical grid of northern Chile under long-term contracts with a local electricity supplier.

In 2004, Lomas Bayas mined 30.4 million tonnes (30.9 million tonnes in 2003) of ore from which 62,041 tonnes of cathode copper were produced (60,427 tonnes were produced in 2003).

29

Mineral Reserves and Mineral Resources

Lomas Bayas' mineral reserves and mineral resources as at December 31, 2003 and December 31, 2004 were as follows:

| |

| |

| | Changes in 2004 (tonnes)

| |

| |

|

|---|

| | December 31, 2003

| | December 31, 2004

|

|---|

| |

| | Revisions/

Discoveries

|

|---|

Category

| | Tonnes

| | Copper

| | Production

| | Tonnes

| | Copper

|

|---|

| | (000's)

| | %

| | (000's)

| | (000's)

| | (000's)

| | %

|

|---|

| Mineral Reserves | | |

| Proven | | 54,760 | | 0.40 | | (12,930 | ) | (650 | ) | 41,180 | | 0.40 |

| Probable | | 309,171 | | 0.33 | | (16,682 | ) | 9,032 | | 301,521 | | 0.33 |

| | |

| |

| |

| |

| |

| |

|