QuickLinks -- Click here to rapidly navigate through this document

EXHIBIT 2

The audited Consolidated Financial Statements for the fiscal year ended December 31, 2004 and the accompanying Management's Discussion and Analysis of Falconbridge Limited, appearing on pages 59 to 86 and pages 24 to 58, respectively, of the Falconbridge Limited 2004 Annual Report, which are incorporated by reference into the Annual Information Form of Falconbridge Limited as well as the Summary of Mineral Reserves and Mineral Resources appearing on pages 22 and 23 of the Falconbridge Limited 2004 Annual Report, which summary is referred to in the Management's Discussion and Analysis of Falconbridge Limited.

Summary of Mineral Reserves and Mineral Resources1

MINERAL RESERVES

| | Operation

| | Percentage Ownership

| | Category

| | Thousand Tonnes

| | % Nickel

| | % Copper

| | % Zinc

| | g/t Silver

|

|---|

| Nickel Deposits | | Sudbury | | 100% | | Proven | | 4,554 | | 1.32 | | 1.59 | | — | | — |

| | | | | | | Probable | | 7,310 | | 1.12 | | 1.17 | | — | | — |

| | | | | | | Total | | 11,864 | | 1.20 | | 1.33 | | — | | — |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| | | Raglan | | 100% | | Proven | | 6,270 | | 2.63 | | 0.74 | | — | | — |

| | | | | | | Probable | | 9,382 | | 2.95 | | 0.81 | | — | | — |

| | | | | | | Total | | 15,652 | | 2.82 | | 0.78 | | — | | — |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| | | Montcalm | | 100% | | Proven | | 3,162 | | 1.56 | | 0.75 | | — | | — |

| | | | | | | Probable | | 1,724 | | 1.44 | | 0.70 | | — | | — |

| | | | | | | Total | | 4,886 | | 1.51 | | 0.73 | | — | | — |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| | | Falcondo2 | | 85.26% | | Proven | | 47,846 | | 1.21 | | — | | — | | — |

| | | | | | | Probable | | 9,557 | | 1.20 | | — | | — | | — |

| | | | | | | Total | | 57,403 | | 1.21 | | — | | — | | — |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| Copper Deposits | | Kidd Creek | | 100% | | Proven | | 14,286 | | — | | 1.91 | | 5.64 | | 62 |

| | | | | | | Probable | | 3,780 | | — | | 1.35 | | 7.52 | | 47 |

| | | | | | | Total | | 18,066 | | — | | 1.80 | | 6.03 | | 58 |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| | | Lomas Bayas | | 100% | | Proven | | 41,180 | | — | | 0.40 | | — | | — |

| | | | | | | Probable | | 301,521 | | — | | 0.33 | | — | | — |

| | | | | | | Total | | 342,701 | | — | | 0.34 | | — | | — |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| | | Collahuasi2 | | 44% | | Proven | | 310,503 | | — | | 1.09 | | — | | — |

| | | | | | | Probable | | 1,539,102 | | — | | 0.87 | | — | | — |

| | | | | | | Total | | 1,849,605 | | — | | 0.90 | | — | | — |

MINERAL RESOURCES (IN ADDITION TO MINERAL RESERVES)

| Nickel Deposits | | Sudbury | | 100% | | Measured | | 4,000 | | 1.77 | | 0.63 | | — | | — |

| | | | | | | Indicated | | 17,770 | | 2.36 | | 1.04 | | — | | — |

| | | | | | | Total | | 21,770 | | 2.25 | | 0.97 | | — | | — |

| | | | | | | Inferred | | 29,700 | | 1.8 | | 2.6 | | — | | — |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| | | Raglan | | 100% | | Measured | | 55 | | 3.93 | | 1.11 | | — | | — |

| | | | | | | Indicated | | 3,710 | | 2.19 | | 0.73 | | — | | — |

| | | | | | | Total | | 3,765 | | 2.22 | | 0.74 | | — | | — |

| | | | | | | Inferred | | 5,200 | | 2.9 | | 0.8 | | — | | — |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| | | Montcalm | | 100% | | Measured | | — | | — | | — | | — | | — |

| | | | | | | Indicated | | — | | — | | — | | — | | — |

| | | | | | | Total | | — | | — | | — | | — | | — |

| | | | | | | Inferred | | 700 | | 1.7 | | 0.7 | | — | | — |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| | | Falcondo2 | | 85.26% | | Measured | | — | | — | | — | | — | | — |

| | | | | | | Indicated | | 13,840 | | 1.53 | | — | | — | | — |

| | | | | | | Total | | 13,840 | | 1.53 | | — | | — | | — |

| | | | | | | Inferred | | 6,400 | | 1.4 | | — | | — | | — |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| Copper Deposits | | Kidd Creek | | 100% | | Measured | | 310 | | — | | 1.32 | | 6.08 | | 43 |

| | | | | | | Indicated | | 78 | | — | | 2.82 | | 8.54 | | 52 |

| | | | | | | Total | | 388 | | — | | 1.62 | | 6.57 | | 45 |

| | | | | | | Inferred | | 15,300 | | — | | 3.0 | | 4.6 | | 82 |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| | | Lomas Bayas | | 100% | | Measured | | 5,253 | | — | | 0.28 | | — | | — |

| | | | | | | Indicated | | 239,736 | | — | | 0.27 | | — | | — |

| | | | | | | Total | | 244,989 | | — | | 0.27 | | — | | — |

| | | | | | | Inferred | | 42,000 | | — | | 0.3 | | — | | — |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| | | Collahuasi2 | | 44% | | Measured | | 50,795 | | — | | 0.55 | | — | | — |

| | | | | | | Indicated | | 430,031 | | — | | 0.65 | | — | | — |

| | | | | | | Total | | 480,826 | | — | | 0.64 | | — | | — |

| | | | | | | Inferred | | 1,820,000 | | — | | 0.8 | | — | | — |

| | |

| |

| |

| |

| |

| |

| |

| |

|

- 1.

- The mineral reserve and resource estimates are prepared in accordance with the "CIM Definition Standards On Mineral Resources and Mineral Reserves, adopted by CIM Council on November 14, 2004, and the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines", adopted by CIM Council on November 23, 2003, using geostatistical and/or classical methods, plus economic and mining parameters appropriate to each project.

- 2.

- The mineral reserves and resources at Collahuasi and Falcondo are shown on a 100% basis.

There are no known environmental, permitting, legal, taxation, political or other relevant issues that would materially affect the estimates of the mineral reserves.

The mineral resources have reasonable prospects for economic extraction but have not yet had complete formal evaluation, or do not have demonstrated economic viability under current conditions.

The mineral reserve and mineral resource estimates are compiled and verified by Chester Moore, Director, Mineral Reserve Estimation and Reporting, a member of the Professional Geoscientists of Ontario with over 30 years experience as a geologist.

The mineral reserves and resources at Collahuasi are estimated and provided by the operator of the joint venture based on a copper price of US$0.95/lb. The mineral reserves and resources are estimated and classified to industry standards following the Australasian Institute of Mining and Metallurgy's Joint Ore Reserve Committee code. These estimates have been restated to conform to CIM mineral reserve and resource definitions. The estimates are inspected annually by Chester Moore.

22

Financial Section

IN 2004, FALCONBRIDGE BENEFITED FROM IMPROVING FUNDAMENTALS FOR NICKEL, COPPER AND COBALT. IN 2005 AND BEYOND, THE COMPANY WILL CONTINUE ITS DRIVE TO MAXIMIZE PRODUCTION AT EXISTING OPERATIONS, GROW PROFITABLY WITH TIMELY AND JUDICIOUS INVESTMENTS, AND MAINTAIN A STRONG FINANCIAL POSITION.

TABLE OF CONTENTS

| |

|

|---|

| MANAGEMENT'S DISCUSSION AND ANALYSIS | | 24 |

| OVERVIEW | | 24 |

| OVERALL PERFORMANCE | | 26 |

| RESULTS OF OPERATIONS | | 27 |

| NICKEL OPERATIONS | | 28 |

| COPPER OPERATIONS | | 32 |

| CORPORATE AND OTHER | | 36 |

| BUSINESS DEVELOPMENT | | 36 |

| EXPLORATION | | 39 |

| ENERGY | | 40 |

| SUSTAINABLE DEVELOPMENT | | 40 |

| SELECTED FINANCIAL DATA | | 40 |

| SUMMARY OF QUARTERLY RESULTS | | 41 |

| LIQUIDITY AND CAPITAL RESOURCES | | 41 |

| SIGNIFICANT FUTURE OBLIGATIONS | | 42 |

| OFF-BALANCE SHEET ARRANGEMENTS | | 43 |

| TRANSACTIONS WITH RELATED PARTIES | | 43 |

| PROPOSED TRANSACTIONS | | 43 |

| FOURTH QUARTER RESULTS OVERVIEW | | 43 |

| CRITICAL ACCOUNTING ESTIMATES | | 44 |

| CHANGES IN ACCOUNTING POLICIES INCLUDING INITIAL ADOPTION | | 46 |

| FINANCIAL INSTRUMENTS AND OTHER INSTRUMENTS | | 48 |

| RECONCILIATION OF FINANCIAL MEASURES | | 50 |

| OUTSTANDING SHARE DATA | | 52 |

| MARKETS | | 52 |

| MARKET OUTLOOK | | 53 |

| TRENDS, RISKS AND UNCERTAINTIES | | 54 |

| ACCOUNTING RESPONSIBILITIES, PROCEDURES AND POLICIES | | 59 |

| AUDITORS' REPORT | | 60 |

| CONSOLIDATED FINANCIAL STATEMENTS | | 61 |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | | 65 |

| FIVE-YEAR REVIEW (UNAUDITED) | | 87 |

| CONSOLIDATED RESULTS — 2004 AND 2003 BY QUARTERS (UNAUDITED) | | 88 |

Forward-looking Statements

This discussion contains forward-looking statements that involve risks, uncertainties and assumptions. Falconbridge's actual financial condition and results of operations could differ materially from those that may be contemplated by these forward-looking statements as a result of those risks, uncertainties and assumptions. These risks include, but are not limited to, fluctuations in the prices for copper, nickel or other metals produced by Falconbridge; mining and processing risks; domestic and foreign laws, particularly environmental legislation; labour relations; geological and metallurgical assumptions and estimates; fluctuations in currency exchange rates, principally the Canadian/U.S. dollar exchange rate; interest rate and counter-party risks; energy supply and prices; foreign operations; market access; production and processing technology; legal proceedings; raw material procurement; and other risks and hazards associated with mining operations. For additional information regarding these factors, please see "Trends, Risks and Uncertainties" on page 54.

Falconbridge's consolidated financial statements are prepared in accordance with Canadian generally accepted accounting principles ("GAAP"). The Company's audited Consolidated Financial Statements for the year ended December 31, 2003 have been restated to reflect the adoption of the new Canadian Institute of Chartered Accountants (CICA) standard to account for Asset Retirement Obligations (ARO). Comparative numbers in the Management's Discussion and Analysis have also been restated to reflect this change in accounting. Effective July 1, 2003, Falconbridge's functional and reporting currency was converted to U.S. dollars. Unless otherwise noted, all amounts in this report are expressed in U.S. dollars.

In the following discussion and analysis, Falconbridge uses "net debt", "net debt plus equity" and "operating cash costs" which are non-GAAP financial measures. The most directly comparable GAAP financial measures are "total debt", "total debt plus equity" and "operating costs", respectively. Reconciliations of these non-GAAP measures to the most directly comparable financial measures presented in accordance with GAAP may be found on pages 50 to 52.

Information contained in this discussion is given as of January 31, 2005, unless otherwise indicated.

23

Management's Discussion and Analysis

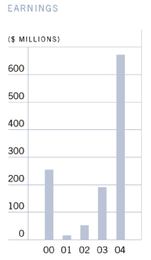

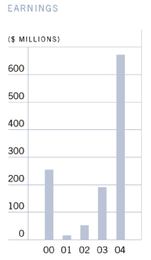

FALCONBRIDGE HAD A RECORD YEAR IN 2004, CAPITALIZING ON A BUOYANT METALS MARKET AND ACHIEVING OR EXCEEDING MOST PRODUCTION TARGETS. EARNINGS FOR 2004 WERE $672 MILLION, AN INCREASE OF 252% FROM $191 MILLION IN 2003. CASH GENERATED FROM OPERATING ACTIVITIES BEFORE WORKING CAPITAL CHANGES TOTALED $1,067 MILLION IN 2004, COMPARED TO $445 MILLION FOR 2003.

OVERVIEW

Falconbridge is an international mining company engaged in the exploration, development, mining, processing and marketing of metals and minerals, with primary focus on nickel and copper.

Falconbridge is also engaged in the custom feed business through the acquisition, processing and recycling of third-party materials. Falconbridge believes that it is the third-largest producer of refined nickel and the twelfth-largest copper producer in the world.

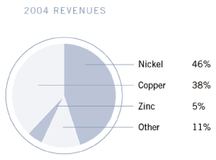

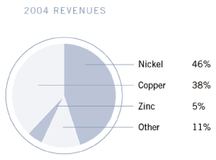

Products and Marketing

Falconbridge's principal products are nickel, ferronickel, copper, zinc and cobalt. Other products include silver, gold, platinum group metals, cadmium, indium and sulphuric acid. Falconbridge markets and sells nickel and cobalt and certain other of its products internationally through marketing and sales offices in the United States, Belgium and Japan. Noranda Inc. acts as sales agent for all products from the Kidd Creek operations. Falconbridge markets copper concentrate and cathode from the Chilean operations through a marketing group in Santiago, Chile to customers around the world.

Mining and Processing Operations

Falconbridge has mining and mineral processing facilities in Canada (Sudbury, Raglan, Montcalm and Kidd Creek operations), Norway (Nikkelverk), the Dominican Republic (Falconbridge Dominicana, C. por A. (Falcondo)) and Chile (Compañía Minera Doña Inés de Collahuasi S.C.M. (Collahuasi) and Compañía Minera Falconbridge Lomas Bayas (Lomas Bayas)).

These activities are conducted through six segments — the Integrated Nickel Operations (INO), Falcondo, Kidd Creek, Collahuasi, Lomas Bayas and Corporate.

- •

- The INO encompasses all operations engaged in the integrated operations of mining, milling, smelting, refining and marketing of metals mainly derived from Sudbury, Raglan and Montcalm nickel-copper ores and its custom feed business.

- •

- Falcondo mines, mills, smelts and refines its own nickel laterite ores.

- •

- Kidd Creek mines, mills, smelts and refines its own copper-zinc ores from Kidd Mine and processes Sudbury copper concentrate and custom feed materials. Beginning in the fourth quarter of 2004, Kidd Creek began milling Montcalm nickel-copper ore.

- •

- Collahuasi mines and mills its sulphide ores into concentrate and mines and leaches copper oxide ores to produce copper cathode. Falconbridge owns 44% of Collahuasi.

- •

- Lomas Bayas mines and refines its own copper ores.

- •

- The Corporate segment accounts for the following expenditures: general and administrative, exploration, research and process development, foreign exchange gains and losses, and other expenses/(income) items.

Exploration Activities

The Falconbridge exploration team conducts worldwide exploration focused primarily on nickel and platinum group metals. Its mandate is to discover and delineate mineral resources that ultimately merit the Board of Directors' approval to proceed to development and production. The team targets mineral resources of strategic size, in locations with acceptable country risk, with after-tax rates of return on investment of at least 15% and operating costs below the industry mid-point. Its goal is to conduct safe and environmentally responsible exploration utilizing the latest technological advances in exploration methodology to improve efficiency and the likelihood of success.

24

Joint-venture arrangements are pursued with both junior and senior mining companies to increase the level of focused activity and to share cost and risk.

Business Development

The business development function plays a critical role in several aspects of the Company's management. First, it works in tandem with the various business units, exploration group and project development teams to plan, coordinate and implement long-term strategies to replace the reserves that are depleted in the normal course of mining operations and to grow the business throughout the cycle. Business development regularly evaluates opportunities for growth. These objectives are achieved by, amongst other things, evaluating potential acquisitions of mining properties or assets, investing in junior mining companies, partnering with other companies to develop growth opportunities, developing long-term strategic, commercial relationships or examining potential brownfield expansions within the Company's existing asset base. Furthermore, the Company focuses on the development of long-term relationships, which increases the potential for identifying growth opportunities. The Company also focuses on growth opportunities that create additional synergies with its existing asset base.

Safety and Health

Providing a safe and healthy workplace is a priority at Falconbridge. Operations continue to implement effective safety training programs and management systems. Safety performance is strongly supported by senior management and the Board of Directors. Safety and health policies are in place at all Falconbridge operations and safety responsibilities are part of all job descriptions, job procedures and performance reviews.

Sustainable Development

Falconbridge is a strong proponent of sustainable development where economic prosperity, environmental quality and social equity drive business activities. This commitment is reflected in the Company'sSustainable Development Policy. See further discussion on page 40.

Focus, Objectives and Business Strategy

Falconbridge is focused on the production of nickel and copper, two metals that continue to have positive long-term fundamentals and near-term outlooks. Both of these metals have competitive attributes which have led to diversified usage in the world's economy and have had an average annual long-term consumption growth rate of over 4% for nickel and 3% for copper. Falconbridge has a unique position in these markets as one of the world's largest producers of both metals, as well as substantial operational, technical, exploration and development experience. In addition, the Company has the potential to increase its production as a result of the development of a number of new projects.

Falconbridge's objective is to increase returns to shareholders as measured by returns on net assets and on shareholders' equity. To achieve this goal, Falconbridge's business strategy is to continuously improve operating efficiencies to reduce costs, obtain maximum returns on existing assets and acquire, develop and mine high quality ore reserves. The Company believes that a conservative financial structure and financial flexibility are important in order to accommodate the capital intensive and cyclical nature of the business.

Nature of Business and Markets

Falconbridge's business is international and, in essence, is the production and marketing of a commodity and the treatment of custom feed material. As a result, profitability and cash flows from operations are determined primarily by the price of the metals sold and the Company's ability to produce at a low cost.

Price and Markets

Historically, the Company has experienced and expects to continue to be subject to volatile prices, which are influenced primarily by the world supply-demand balance for products and services, and related factors such as speculative activities, production activities by competitors, political and economic conditions, as well as production costs in major producing regions. Since the Company's products are marketed in all major geographical markets, the realized price for metals is also influenced by regional supply-demand factors, the availability and price of secondary or metal containing scrap material, and other substitute commodity products. Falconbridge generally accepts market prices and does not hedge the price it realizes on the sale of its own production.

25

A detailed analysis of relevant metal markets is discussed on page 52 — Markets.

Production Costs

The other primary determinant of profitability and cash flow from operations is the Company's ability to produce at a low cost. Production costs are largely influenced by ore grades, mine planning, processes technology and the by-product credit revenues.

Business Risks

The primary risks facing Falconbridge are:

- •

- Changes in metal prices

- •

- Reliance on third-party feed

- •

- Mining and processing risks

- •

- Environmental risks

- •

- Labour relations

- •

- Uncertainty of reserve and production estimates

- •

- Exchange rate fluctuations

- •

- Interest rate and counter-party risks

- •

- Energy supply and prices

- •

- Foreign operations

- •

- Treatment and refining charges

- •

- Legal proceedings

The nature, implications and tools used to manage these risks are discussed fully starting on page 54 — Trends, Risks and Uncertainties.

Capital

Falconbridge's business is capital intensive with significant costs involved in exploration activities, and the development of mining and metallurgical facilities. As such, securing low-cost capital is instrumental in profitability.

Historically, Falconbridge has sourced capital from common and preferred equity markets, public debt markets and bank debt.

OVERALL PERFORMANCE

Earnings, Cash Flows and Financial Condition

Falconbridge had a record year in 2004, capitalizing on a buoyant metals commodity market and achieving or exceeding most production targets. Earnings for 2004 were $672 million or $3.71 of basic earnings per common share ($3.69 per share on a diluted basis), an increase of 252% from $191 million or $1.03 of basic earnings per common share reported at the end of 2003. Operating income in 2004 was $969 million, compared to $301 million for 2003. Cash generated from operating activities before working capital changes totaled $1,067 million, compared to $445 million for 2003. All of these increases reflect higher average realized nickel, copper and zinc prices, which increased 45%, 61% and 24%, respectively, over the same period in 2003, and higher copper sales volumes, offset in part by lower nickel sales volumes and the impact of the stronger Canadian dollar, which when compared to the U.S. dollar was up 8% compared to the 2003 average.

There are many factors that influence the price received for commodities (see Markets discussion on page 52). Growing worldwide industrial production and continued strong growth from China has increased demand for metals. Falling inventories, combined with little new additional supply have been the catalyst for the rising metal prices.

The Company's balance sheet improved in 2004, as the ratio of net debt to net debt plus equity improved to 24% from 27% at September 30, 2004 and from 37% at December 31, 2003. Cash and cash equivalents were $645 million at December 31, 2004. Falconbridge believes that although metal prices will be volatile, they remain fundamentally strong; therefore its balance sheet should continue to improve and that cash flows will be sufficient to cover all of its obligations for 2005.

26

Consolidated Statement of Earnings

(AUDITED — $ MILLIONS, EXCEPT PER SHARE DATA)

Years ended December 31

| | 2004

| | 2003

| |

|---|

| |

| | Restated

| |

|---|

| Revenues | | $ | 3,070 | | $ | 2,083 | |

| | |

| |

| |

| Operating expenses | | | | | | | |

| Costs of sales | | | | | | | |

| | Costs of metal and other product sales | | | 1,682 | | | 1,413 | |

| | Depreciation and amortization of property, plant and equipment | | | 274 | | | 249 | |

| | |

| |

| |

| | | | 1,956 | | | 1,662 | |

| Selling, general and administrative | | | 108 | | | 86 | |

| Exploration | | | 20 | | | 23 | |

| Research and process development | | | 12 | | | 13 | |

| Other expenses/(income) | | | 5 | | | (2 | ) |

| | |

| |

| |

| | | | 2,101 | | | 1,782 | |

| | |

| |

| |

| Operating income | | | 969 | | | 301 | |

| | |

| |

| |

| Interest | | | 37 | | | 43 | |

| | |

| |

| |

| Earnings before taxes and non-controlling interest | | | 932 | | | 258 | |

| Income and mining taxes | | | 248 | | | 63 | |

| Non-controlling interest in earnings of subsidiary | | | 12 | | | 4 | |

| | |

| |

| |

| Earnings for the year | | $ | 672 | | $ | 191 | |

| Dividends on preferred shares | | | 7 | | | 9 | |

| | |

| |

| |

| Earnings attributable to common shares | | $ | 665 | | $ | 182 | |

| | |

| |

| |

| Basic earnings per common share | | $ | 3.71 | | $ | 1.03 | |

| Diluted earnings per common share | | $ | 3.69 | | $ | 1.02 | |

| | |

| |

| |

RESULTS OF OPERATIONS

The significant increase in operating income and earnings is attributable to the following factors:

- •

- Consolidated revenues of $3,070 million increased from $2,083 million in 2003. The increase reflects higher average realized prices of nickel, copper, zinc and silver, higher precious metal revenues from the Integrated Nickel Operations and higher volumes of copper and zinc sales. This was partially offset by lower sales volumes of nickel and silver.

- •

- Costs of metal and other product sales of $1,682 million increased by $269 million over 2003. The increase reflects higher mining costs, higher acquisition costs for custom feed, the impact of a stronger Canadian dollar and Chilean peso relative to the U.S. dollar, and higher copper and zinc sales volumes. This was partially offset by lower sales volumes of nickel and silver.

- •

- Depreciation and amortization of property, plant and equipment of $274 million increased from $249 million in 2003. The increase of $25 million is attributable to higher units of production and larger asset bases at Canadian and Chilean operations.

- •

- Selling, general and administrative costs increased to $108 million from $86 million in 2003, primarily as a result of the impact of the stronger Canadian dollar in 2004 versus 2003, and higher freight costs. Direct selling expenses were higher at Chile and Kidd in 2004, over 2003.

- •

- Exploration expenditures of $20 million decreased from $23 million in 2003. This decrease is attributable to the increased sharing of exploration costs with joint-venture partners, offset in part by the impact of a weaker U.S. dollar.

- •

- Research and process development expenditures of $12 million decreased marginally by $1 million over the corresponding period of 2003.

27

- •

- Other expenses of $5 million in 2004 compared with other income of $2 million in 2003. The $7 million change is primarily attributable to the following: metals trading generated $2 million of losses in 2004 compared to gains of $11 million in 2003. This was offset in part by the recognition of $5 million of net interest income on interest rate swaps not eligible for hedge accounting and $2 million in gains on energy positions not eligible for hedge accounting.

Income and expenses were provided from the following non-operating sources:

- •

- Net interest expense was $37 million in 2004, compared to $43 million in 2003. This decrease is attributable to higher capitalized interest related to projects and increased interest income due to higher cash balances.

- •

- Income and mining tax expense of $248 million in 2004 compared to an expense of $63 million in 2003. This $185 million increase resulted primarily from higher levels of earnings in 2004.

- •

- Non-controlling interest in earnings of subsidiary increased by $8 million, reflecting higher earnings at Falcondo.

Earnings by Segment

The following table summarizes audited segmented results of operations:

(AUDITED — $ MILLIONS)

Years ended December 31

| | 2004

| | 2003

| |

|---|

| |

| | Restated

| |

|---|

| Principal operations — | | | | | | | |

| | Integrated Nickel Operations (INO) | | $ | 442 | | $ | 224 | |

| | Falconbridge Dominicana, C. por A. | | | 181 | | | 59 | |

| | |

| |

| |

| | Nickel Operations | | | 623 | | | 283 | |

| | |

| |

| |

| | Kidd Creek Operations | | | (45 | ) | | (68 | ) |

| | Collahuasi | | | 361 | | | 115 | |

| | Lomas Bayas | | | 95 | | | 32 | |

| | |

| |

| |

| | Copper Operations | | | 411 | | | 79 | |

| | |

| |

| |

| Corporate costs | | | 65 | | | 61 | |

| | |

| |

| |

| Operating income | | | 969 | | | 301 | |

| Interest | | | 37 | | | 43 | |

| Income and mining taxes | | | 248 | | | 63 | |

| Non-controlling interest in earnings of subsidiary | | | 12 | | | 4 | |

| | |

| |

| |

| Earnings for the year | | $ | 672 | | $ | 191 | |

| Dividends on preferred shares | | | 7 | | | 9 | |

| | |

| |

| |

| Earnings attributable to common shares | | $ | 665 | | $ | 182 | |

| | |

| |

| |

NICKEL OPERATIONS

Falconbridge is the third-largest producer of refined nickel in the world, accounting for roughly 8% of world supply in 2004.

For 2004, operating income for the nickel business was $623 million, compared to $283 million for the same period in 2003. Refined nickel production was 100,887 tonnes in 2004, compared to 104,410 tonnes in the same period in 2003. The operating cash cost per pound of mined nickel for all of Falconbridge was $2.93 in 2004, compared with $2.78 in 2003.

Falconbridge has two nickel divisions. The INO produces London Metals Exchange (LME)-registered nickel and Falcondo produces ferronickel.

Integrated Nickel Operations (INO)

The INO includes mines and plants at Sudbury, Raglan and Montcalm in Canada, a smelter in Sudbury, a refinery at Kristiansand in Norway and a significant custom feed business.

The following table sets forth certain unaudited financial data with respect to Falconbridge's Integrated Nickel Operations for the years indicated.

28

Years ended December 31

| | 2004

| | 2003

| | 2002

|

|---|

| Sales (tonnes) | | | | | | |

| | Nickel | | 71,374 | | 78,978 | | 71,153 |

| | Copper | | 51,057 | | 59,208 | | 54,495 |

| | Cobalt | | 3,648 | | 3,401 | | 2,932 |

| Revenues ($ millions) | | 1,429 | | 1,046 | | 692 |

| Realized price ($/lb. of nickel) | | 6.40 | | 4.40 | | 3.14 |

| Operating cash cost ($/lb. of nickel) | | 2.57 | | 2.64 | | 1.96 |

| Operating income ($ millions) | | 442 | | 224 | | 86 |

Revenues: In 2004, sales volumes of nickel and copper decreased by 10% and 14%, respectively, as a result of lower metal deliveries resulting from the strike at Sudbury operations and reductions from custom shippers. Cobalt sales increased 7% from 2003 levels due to increases in production related to custom feeds. Realized nickel, copper and cobalt prices increased by 45%, 59% and 139%, respectively, in 2004. Precious metals revenues increased by $12 million to $99 million. In 2004, consolidated revenues for the INO increased 37%, to $1,429 million from $1,046 million in 2003.

Costs: In 2004, the operating cash cost of producing a pound of nickel from INO mines was $2.57. The $0.07, or 3%, decrease from 2003 costs was the result of increased mine production and higher by-product credits due to the increase in metal prices, which offset lower ore grades and increased costs to access the ore at Canadian operations due in part to the stronger Canadian dollar.

Operating Income: For 2004, the INO's operating income was $442 million compared with $224 million for 2003. The $218 million increase was mainly due to higher metal prices, lower unit costs, and lower depreciation and amortization charges, which were partially offset by lower sales volumes for nickel and copper and increased administrative charges, again caused in part by the strengthening of the Canadian dollar.

Production: During 2004, Sudbury mines nickel production was 22,602 tonnes, compared with 24,143 tonnes in 2003. The shortfall in nickel production was attributable to the three-week labour strike in the first quarter of 2004, which reduced the annual production by 3,500 tonnes. For 2005, nickel in concentrate production at Sudbury is forecast at 22,500 tonnes.

For 2004, Raglan's nickel in concentrate production was a record 26,552 tonnes and copper production was 6,867 tonnes, compared with 25,110 tonnes of nickel and 6,628 tonnes of copper in 2003 as increased ore tonnages offset the impact of lower ore grades. For 2005, nickel in concentrate production at Raglan is forecast to decline to 20,700 tonnes due to anticipated lower nickel grades and lower mill throughput resulting from a two-week shutdown for the conversion from an autogenous grinding mill to a semi-autogenous grinding mill.

Sudbury smelter production of nickel in matte was 52,595 tonnes in 2004, compared with 59,831 tonnes in 2003, largely as a result of the strike at Sudbury and lower concentrate grades.

At Nikkelverk, 2004 nickel production of 71,410 tonnes was lower than the 77,183 tonnes produced in 2003 due to lower shipments of material from Sudbury during the labour disruption. During the year, Nikkelverk achieved record cobalt production of 4,670 tonnes. For 2005, refined nickel and copper production forecasts at Nikkelverk are 85,000 tonnes and 37,000 tonnes, respectively. This nickel production forecast reflects expected higher volumes of available feed primarily as a result of the newly-constructed Montcalm mine.

INO Production and Sales

The following table sets forth certain segmented sales and production data with respect to Falconbridge's Integrated Nickel Operations for the periods indicated.

29

Integrated Nickel Operations

| | 2004

| | 2003

|

|---|

| | Ore tonnes (x 1,000)

| | Ni

%

| | Cu

%

| | Ore tonnes (x 1,000)

| | Ni

%

| | Cu

%

|

|---|

| Production | | | | | | | | | | | | |

| Sudbury — Mine | | | | | | | | | | | | |

| | Craig | | 807 | | 1.53 | | 0.45 | | 889 | | 1.54 | | 0.46 |

| | Fraser | | 693 | | 1.00 | | 2.39 | | 686 | | 1.05 | | 2.99 |

| | Lindsley | | 462 | | 1.14 | | 1.24 | | 429 | | 1.16 | | 1.36 |

| | Lockerby | | 187 | | 1.91 | | 0.91 | | 225 | | 1.88 | | 1.15 |

| | |

| |

| |

| |

| |

| |

|

| Total mined | | 2,149 | | | | | | 2,229 | | | | |

| | |

| |

| |

| |

| |

| |

|

| Total — ore processed | | 2,259 | | 1.31 | | 1.28 | | 2,261 | | 1.35 | | 1.48 |

| | |

| |

| |

| |

| |

| |

|

| Raglan mine | | 935 | | 3.31 | | 0.94 | | 834 | | 3.47 | | 0.99 |

| Montcalm mine | | 220 | | 1.32 | | 0.68 | | — | | — | | — |

| | |

| |

| |

| |

| |

| |

|

| | Ni

| | Cu

| | Co

| | Ni

| | Cu

| | Co

|

|---|

| Metal in concentrate (tonnes) | | | | | | | | | | | | |

| Sudbury mine output | | 22,602 | | 24,694 | | 565 | | 24,143 | | 29,161 | | 611 |

| Raglan mine output | | 26,552 | | 6,867 | | 404 | | 25,110 | | 6,628 | | 381 |

| Montcalm mine output* | | 2,152 | | 1,188 | | 66 | | — | | — | | — |

| Metal in copper concentrate | | 75 | | 17,598 | | — | | 110 | | 21,874 | | — |

| | |

| |

| |

| |

| |

| |

|

| Smelter, refinery | | | | | | | | | | | | |

| Smelter (tonnes) | | | | | | | | | | | | |

| | Mines — Sudbury | | 18,653 | | 5,806 | | 427 | | 24,687 | | 8,139 | | 658 |

| | | — Raglan | | 23,849 | | 6,331 | | 313 | | 28,708 | | 7,678 | | 463 |

| | | — Montcalm* | | 1,828 | | 403 | | 50 | | — | | — | | — |

| | Custom | | 8,265 | | 5,861 | | 1,048 | | 6,436 | | 4,962 | | 1,075 |

| | |

| |

| |

| |

| |

| |

|

| | Total | | 52,595 | | 18,401 | | 1,838 | | 59,831 | | 20,779 | | 2,196 |

| | |

| |

| |

| |

| |

| |

|

| Refinery (tonnes) | | | | | | | | | | | | |

| | Mines — Sudbury | | 19,849 | | 6,751 | | 421 | | 25,351 | | 8,862 | | 688 |

| | | — Raglan | | 26,248 | | 7,523 | | 330 | | 27,020 | | 6,895 | | 437 |

| | | — Montcalm* | | 1,131 | | 179 | | 30 | | — | | — | | — |

| | Custom | | 24,182 | | 21,190 | | 3,889 | | 24,812 | | 20,095 | | 3,431 |

| | |

| |

| |

| |

| |

| |

|

| | Total | | 71,410 | | 35,643 | | 4,670 | | 77,183 | | 35,852 | | 4,556 |

| | |

| |

| |

| |

| |

| |

|

| Sales (tonnes) | | | | | | | | | | | | |

| | Mines — Sudbury | | 19,780 | | 21,790 | | 440 | | 26,278 | | 32,767 | | 667 |

| | | — Raglan | | 26,815 | | 7,521 | | 338 | | 26,627 | | 6,820 | | 412 |

| | | — Montcalm* | | 774 | | 461 | | 12 | | — | | — | | — |

| | Custom | | 23,801 | | 21,285 | | 2,858 | | 25,775 | | 19,621 | | 2,322 |

| | Purchased product | | 204 | | — | | — | | 298 | | — | | — |

| | |

| |

| |

| |

| |

| |

|

| Total | | 71,374 | | 51,057 | | 3,648 | | 78,978 | | 59,208 | | 3,401 |

| | |

| |

| |

| |

| |

| |

|

* Includes pre-production material

In the fourth quarter of 2004, the Board of Directors approved Phase I of the Raglan Optimization program — an expansion that will increase annual production by approximately 5,000 tonnes of nickel per year. The capital cost for Phase I is estimated at $28 million and involves the conversion from autogenous to semi-autogenous grinding, which will increase the level of annual throughput to approximately 1.0 million tonnes and increase the mill's ability to process harder ore. Engineering work on Phase II is underway, with changes to the grinding circuit and other concentrator equipment to further increase annual production rates being assessed.

The development of the Montcalm nickel mine in Timmins, Ontario was completed in December 2004, under budget and two months ahead of schedule. In 2004, Montcalm produced 2,152 tonnes of nickel and reached full production by the end of the year. Beginning in 2005, production at Montcalm is expected to be 9,000 tonnes per year.

30

Reserves & Exploration: At planned operating rates, the proven and probable mineral reserves at Sudbury are equal to approximately six years of production. Production is expected to be extended as it is anticipated that a significant portion of the mineral resources will be converted to mineral reserves and will lengthen the life of the operation.

In 2004, the Sudbury division's proven and probable mineral reserves decreased by an additional 200,000 tonnes after production of 2.0 million tonnes. The loss of reserves mainly resulted from re-estimation of stopes in Zones 6 and 7 at Fraser mine. This loss was mostly offset by gains in reserves at the Thayer Lindsley mine due to a lowering of the cut-off grade. At December 31, 2004, total proven and probable reserves were 11.9 million tonnes.

Total mineral resources increased again in 2004, from 49.4 million to 51.5 million tonnes with additions at Nickel Rim South and Fraser Morgan. A small overall loss occurred in the mines. Approximately 1.7 million tonnes were added at Nickel Rim South in 2004. The Nickel Rim South deposit is now estimated to contain 13.4 million tonnes of 1.8% nickel, 3.3% copper, 1.8 grams/tonne platinum, 2.0 grams/tonne palladium and 0.8 grams/tonne gold. Fraser Morgan Zones 8, 9, 10 and 11 increased by 700,000 tonnes to measured and indicated resources of 4.9 million tonnes and inferred resources of 2.1 million tonnes.

At Raglan, the mineral reserves are equal to approximately 17 years of production at current operating rates. Mineral reserves decreased by 2.0 million tonnes as a result of annual production, write-downs and reclassification to resources. At December 31, 2004, total proven and probable reserves at Raglan were 15.7 million tonnes. Mineral resources were increased by 1.8 million tonnes, primarily a result of discoveries and additions at Zone 3, Zones 5-8, West Boundary and Donaldson through exploration.

At planned operating rates, the mineral reserves at Montcalm are equal to approximately seven years of production. Mineral reserves decreased from 5.1 million tonnes to 4.9 million tonnes due to the start of production in 2004. Inferred resources totaling 0.7 million tonnes remain as before.

Falcondo

Located in the Dominican Republic, Falcondo mines, mills, smelts and refines its own nickel laterite ores. Falconbridge owns 85.26% of Falcondo. The following table sets forth certain unaudited financial data with respect to Falcondo for the periods indicated.

Years ended December 31

| | 2004

| | 2003

| | 2002

| |

|---|

| Sales of ferronickel (tonnes) | | 28,936 | | 27,133 | | 21,446 | |

| Production (tonnes) | | 29,477 | | 27,227 | | 23,303 | |

| Revenues ($ millions) | | 406 | | 252 | | 149 | |

| Realized price ($/lb. of ferronickel) | | 6.37 | | 4.20 | | 3.16 | |

| Operating cash cost ($/lb. of ferronickel) | | 3.50 | | 3.04 | | 2.76 | |

| Operating income/(loss) ($ millions) | | 181 | | 59 | | (1 | ) |

Revenues: In 2004, revenues of $406 million at Falcondo were 61% higher compared to $252 million in 2003. Revenues were positively impacted by the 7% increase in sales volumes to 28,936 tonnes, from 27,133 tonnes in 2003 and a 52% increase in the realized ferronickel price in 2004, compared to 2003.

Costs: In 2004, Falcondo's operating cash cost per pound of ferronickel was $3.50, compared with $3.04 in 2003. The increase in costs was largely due to the increase in the oil price and costs for extra power generation during periods of power plant maintenance. Falcondo's delivered oil costs rose from $29.42 per barrel in 2003 to $36.63 in 2004, which represents a discount to West Texas Intermediate (WTI) of $1.68 and $5.15 per barrel, respectively, due to procurement strategies and partial use of low-cost heavy oil.

Operating Income: Falcondo's 2004 operating income was $181 million, compared with $59 million in 2003. The $122 million higher contribution reflects a higher ferronickel selling price and increased sales volumes reduced by the impact of higher oil costs.

31

Production: For 2004, Falcondo increased production by 8% to 29,477 tonnes of nickel in ferronickel compared to 27,227 tonnes in 2003. For 2005, production at Falcondo is forecast at 28,000 tonnes.

Reserves & Exploration: At planned operating rates, the proven and probable mineral reserves are equal to approximately 16 years of production. The proven and probable mineral reserves at Falcondo showed a total decrease of 3.5 million tonnes after production of 3.7 million tonnes in 2004. After production, most adjustments in the proven and probable reserve categories were due to a drilling campaign on the Barmac Reject Stockpile. At December 31, 2004, total proven and probable reserves were 57.4 million tonnes.

COPPER OPERATIONS

Falconbridge is also an important copper producer, ranking twelfth in the world in mined production during 2004. The Company's copper operations include Kidd Creek in Canada and Collahuasi and Lomas Bayas in Chile.

Operating income of the copper business totaled $411 million in 2004, compared with $79 million in 2003. Copper production from Kidd Creek and South American operations was 308,186 tonnes in 2004, compared with 275,414 tonnes in 2003. The operating cash cost per pound of copper was $0.58 in 2004, compared with $0.53 in 2003.

Collahuasi

Compañía Minera Doña Inés de Collahuasi S.C.M., in which Falconbridge holds a 44% interest, operates the Collahuasi mine in northern Chile. Collahuasi mines and mills copper sulphide ores into concentrate and mines and leaches copper oxide ores to produce cathodes. The following table sets forth certain unaudited financial data with respect to Collahuasi for the periods indicated.

Falconbridge's 44% share

Years ended December 31

| | 2004

| | 2003

| | 2002

|

|---|

| Sales of copper (tonnes) | | 204,636 | | 168,147 | | 187,524 |

| Production (tonnes) | | 205,116 | | 168,578 | | 185,014 |

| Revenues ($ millions) | | 566 | | 275 | | 246 |

| Realized price ($/lb. of copper) | | 1.30 | | 0.80 | | 0.71 |

| Operating cash cost ($/lb. of copper) | | 0.45 | | 0.38 | | 0.39 |

| Operating income ($ millions) | | 361 | | 115 | | 83 |

Revenues: In 2004, Falconbridge's share of Collahuasi revenues was $566 million, compared to $275 million in 2003. This $291 million increase in revenue is attributable to both higher copper prices and higher sales volumes, compared with 2003.

Costs: In 2004, the operating cash cost was $0.45/lb. of copper compared to $0.38/lb. in 2003. This increase resulted from higher realization costs, including treatment and refining charges and freight, and the strengthening of the Chilean peso against the U.S. dollar.

Operating Income: In 2004, Falconbridge's share of operating income was $361 million compared with $115 million in 2003. The positive variance is mostly attributable to higher copper prices and sales volumes, partially offset by higher production costs.

Production: In 2004, Falconbridge's share of copper production totaled 205,116 tonnes, 22% higher than the production of 168,578 tonnes in 2003. The increase was driven by the added production that resulted from the Ujina-Rosario transition and the concentrator expansion, completed during the year. Copper production in 2005 is forecast at 220,000 tonnes.

Other Developments

In 2004, the construction of a new grinding circuit at the Ujina concentrator and the shifting of mining operations from the Ujina to the Rosario orebody were completed ahead of schedule and under budget. This project increased Collahuasi's concentrator design capacity to 110,000 tonnes per day from 70,000 tonnes per day, compensating for an expected decline in ore grade and thereby enabling Collahuasi to maintain copper production at current levels. The total capital cost of the transition and concentrator expansion project was $584 million, with Falconbridge's 44% share of this cost totaling $257 million.

32

Conceptual study of the second expansion of the copper concentrator is on track. This project would involve adding a grinding line similar to the last expansion and accelerating the production rate at the Rosario pit, where grades are higher than at Ujina. This expansion would potentially increase total Collahuasi copper production by 175,000 tonnes, of which Falconbridge's share would be 77,000 tonnes. First production could be expected in 2007 at the earliest.

In the first quarter of 2005, construction of a new molybdenum flotation plant will begin at Collahuasi. Mining operations have now shifted to the Rosario orebody, which contains economic molybdenum grades at the top of the mine, with increasing molybdenum grades as the orebody deepens. The new molybdenum plant will enable Collahuasi to capture the value of the molybdenum in the ore, and take advantage of high molybdenum prices, which are currently over $30/lb. The plant's average capacity will be 12,000 tonnes of molybdenum concentrate annually. Operations will begin in late 2005, with 2006 production of molybdenum in concentrate expected to be approximately 4,000 tonnes. This production will increase over time, as a result of the increase in molybdenum grades at depth. The capital cost of the plant is forecast at $42 million, with Falconbridge's share approximating $18 million.

Reserves & Exploration: The December 31, 2004 total proven and probable mineral reserves of 1,849.6 million tonnes at Collahuasi were increased by 41.4 million tonnes after production of 41.5 million tonnes. The overall increase of 82.9 million tonnes is due to revision of the resource models (76.5 million tonnes) based on new drill information and the addition of new exotic copper orebodies (6.4 million tonnes). At planned operating rates, the proven and probable mineral reserves are equal to over 40 years of production.

In 2006, Collahuasi plans to produce a molybdenum concentrate from material mined at the Rosario deposit. At that time, the molybdenum grade of the Rosario reserves is estimated to be 0.03% molybdenum.

Lomas Bayas

Compañía Minera Falconbridge Lomas Bayas mines and leaches copper oxide ores to produce cathodes.

The following table sets forth certain unaudited financial data with respect to Lomas Bayas for the periods indicated.

Years ended December 31

| | 2004

| | 2003

| | 2002

|

|---|

| Sales of copper (tonnes) | | 60,190 | | 61,289 | | 60,265 |

| Production (tonnes) | | 62,041 | | 60,427 | | 59,304 |

| Revenues ($ millions) | | 183 | | 114 | | 97 |

| Realized price ($/lb. of copper) | | 1.38 | | 0.84 | | 0.73 |

| Operating cash cost ($/lb. of copper) | | 0.52 | | 0.47 | | 0.45 |

| Operating income ($ millions) | | 95 | | 32 | | 18 |

Revenues: In 2004, revenues were $183 million, compared to $114 million in 2003. The $69 million increase was attributable to higher copper prices.

Costs: In 2004, the operating cash cost was $0.52/lb. of copper, up from $0.47/lb. in the same period of 2003. The increase was driven by higher contract or costs (mainly maintenance and freight), higher fuel and acid costs, and the strengthening of the Chilean peso against the U.S. dollar.

Operating Income: In 2004, operating income was $95 million, up from $32 million in 2003. Higher sales prices more than offset the impact of higher production costs.

Production: In 2004, cathode production was 62,041 tonnes, compared to 60,427 tonnes in 2003. Copper production in 2005 is forecast at 62,000 tonnes.

Reserves & Exploration: At planned operating rates, the proven and probable mineral reserves are equal to approximately 10 years of production. The mineral reserves decreased by 21.2 million tonnes due to mine production of 29.6 million tonnes and positive reserve adjustments of 8.4 million tonnes due to a revised reserve estimation model and additional diamond drill information. The December 31, 2004 mineral reserves total was 342.7 million tonnes of 0.34% copper.

33

An option to purchase is held on the Fortuna de Cobre deposit which is located near Lomas Bayas and contains measured plus indicated mineral resources totaling 470.3 million tonnes of 0.29% copper. It is thought that low acid consumption and rapid leach times will compensate for the low copper grades and allow economic extraction. An evaluation of the project is underway to determine the future course of action on the property.

Consolidated Kidd Creek Operations

Kidd Creek is an integrated processing facility engaged in the mining, milling, smelting and refining of its own copper and zinc ores and in the processing of custom feed.

The following table sets forth certain unaudited financial data with respect to Falconbridge's Kidd Creek operations for the periods indicated.

Years ended December 31

| | 2004

| | 2003

| | 2002

| |

|---|

| Sales (tonnes) | | | | | | | |

| | Copper (in metal and concentrate) | | 90,286 | | 105,162 | | 110,575 | |

| | Zinc (in metal and concentrate) | | 135,259 | | 110,592 | | 148,418 | |

| Revenues ($ millions) | | 486 | | 396 | | 340 | |

| Realized copper price ($/lb. of copper) | | 1.32 | | 0.83 | | 0.74 | |

| Realized zinc price ($/lb. of zinc) | | 0.51 | | 0.41 | | 0.39 | |

| Operating cash cost ($/lb. of copper) | | 0.93 | | 0.83 | | 0.68 | |

| Operating loss ($ millions) | | (45 | ) | (68 | ) | (46 | ) |

Revenues: In 2004, revenues totaled $486 million, up 23% from revenues of $396 million for the same period of 2003. Higher metal prices, by-product revenues and zinc sales volumes largely accounted for this variance.

Costs: In 2004, operating cash costs at the Kidd Mine were $0.93/lb. of copper compared to $0.83/lb. in 2003. The majority of this increase relates to reduced tonnes milled/hoisted, combined with increased spending for contracted services and mine supplies, and the impact of the stronger Canadian dollar.

Operating Income: Kidd Creek reported an operating loss of $45 million for 2004, compared to an operating loss of $68 million in the same periods for 2003.

Production: In 2004, copper and zinc in concentrate production at Kidd Mine totaled 41,029 tonnes and 87,847 tonnes, respectively, compared to 46,409 tonnes and 75,528 tonnes, respectively, during 2003. Lower copper volumes were the result of lower tonnage and lower ore grades; mean-while, higher zinc volumes benefited from higher ore grades, partially offset by lower tonnage.

At the Kidd Mining division, ore mined and milled in 2004 was 2,094 thousand tonnes and 2,063 thousand tonnes, respectively, slightly below 2003 levels. In 2004, concentrator throughput was 3% below that of 2003, due mainly to ore availability in the first half of the year and an ore car derailment in the third quarter that damaged and closed the main haulage line for one week. Tie-ins for the Montcalm circuit also adversely impacted production. In 2004, copper and zinc head grades were 2.1% and 5.0%, respectively, compared to 2.3% and 4.3% last year. The copper and zinc mine production forecast for 2005 has been estimated at 46,000 tonnes and 100,000 tonnes, respectively.

In 2004, copper cathode and refined zinc production totaled 115,578 tonnes and 121,557 tonnes, respectively, compared to 132,364 tonnes and 94,719 tonnes, respectively, in 2003. The copper plant variance was due mainly to an extended shutdown resulting from the premature failure of the C furnace in May and restricted volumes resulting from acid plant operational issues related to the interpass tower. The zinc plant's favourable output was a function of higher throughput volumes and the reduction of the annual shutdown to seven weeks in 2004, versus 13 weeks in 2003. For 2005, refined copper production is expected to be approximately 130,000 tonnes, and zinc production approximately 135,000 tonnes.

Other Developments

In the fourth quarter of 2004, commissioning of the Montcalm nickel circuit began in the Kidd Creek concentrator. The first ore was processed on October 17 and achieved commercial operating rates several months ahead of schedule.

34

In April 2004, Falconbridge reached an agreement with Agnico Eagle for a life-of-mine contract to process the majority of its annual production of zinc concentrate from its LaRonde mine. This will ultimately provide the zinc operations at Kidd Creek with an annual supply of over 100,000 tonnes of precious metal-bearing zinc concentrate, and will enable it to run with improved margins at full capacity.

In the fourth quarter of 2004, the zinc plant successfully commissioned the precious metal recovery circuit on time and on budget. Tie-ins and equipment commissioning began in the second week of October with the first tonnes of LaRonde zinc concentrate processed before the end of October and first shipments of precious metals residue sent to Noranda's Brunswick smelter the following week.

Kidd continues to develop Mine D, the depth extension of Kidd mine orebody. At Mine D, commissioning of the ore handling system was completed in 2004, with first ore hoisted up the shaft in July, ahead of the feasibility schedule. The shaft is now below the 8800 level. The Operations group has assumed control of the Block 1 Ore Handling System.

In 2004, $127 million, including capitalized interest, was spent on Mine D development (2003 — $85 million), with a total of $404 million spent to date. Mine D will allow the mine to produce 2.4 million tonnes of ore annually once in full production. The cost of Mine D Stage I has been estimated at $500 million, excluding capitalized interest.

The following table sets forth certain segmented sales and production data with respect to Falconbridge's Kidd Creek operations for the periods indicated.

Kidd Creek Operations

| | 2004

| | 2003

|

|---|

| | Ore tonnes

(x 1,000)

| | Cu %

| | Zn %

| | Au g/t

| | Ore tonnes

(x 1,000)

| | Cu %

| | Zn %

| | Au g/t

|

|---|

| Production | | | | | | | | | | | | | | | | |

| Kidd Mining Division | | | | | | | | | | | | | | | | |

| | No. 1 and 2 Mines | | 674 | | 2.27 | | 6.63 | | 156 | | 737 | | 2.36 | | 6.12 | | 87 |

| | No. 3 Mine | | 1,210 | | 2.16 | | 4.32 | | 60 | | 1,371 | | 2.25 | | 3.20 | | 41 |

| | D Mine | | 210 | | 1.04 | | 4.69 | | 26 | | — | | — | | — | | — |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| Total mined | | 2,094 | | | | | | | | 2,108 | | | | | | |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| Total ore milled | | 2,063 | | | | | | | | 2,125 | | | | | | |

| | |

| |

| |

| |

| |

| |

| |

| |

|

(tonnes except 000 troy ounces for Ag)

| | Cu

| | Cu Cathode

| | Cu Blister

| | Zn

| | Ag

| | Cu

| | Cu Cathode

| | Cu Blister

| | Zn

| | Ag

|

|---|

| Kidd Mining Division | | | | | | | | | | | | | | | | | | | | |

| Metal in concentrate | | 41,029 | | — | | — | | 87,847 | | 3,849 | | 46,409 | | — | | — | | 75,528 | | 2,676 |

| Kidd Metallurgical Division | | | | | | | | | | | | | | | | | | | | |

| | Mines | | | | 41,331 | | 42,283 | | 79,863 | | 2,442 | | | | 51,477 | | 51,104 | | 62,126 | | 2,557 |

| | Custom — Sudbury | | | | 18,169 | | 18,587 | | — | | 465 | | | | 26,048 | | 25,860 | | — | | 380 |

| | Custom — other | | | | 56,078 | | 57,370 | | 41,694 | | 969 | | | | 54,839 | | 54,441 | | 32,593 | | 2,520 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Total | | | | 115,578 | | 118,240 | | 121,557 | | 3,876 | | | | 132,364 | | 131,405 | | 94,719 | | 5,457 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

(tonnes except 000 troy ounces for Ag)

| | Cu

| | Cu in conc.

| | Zn

| | Zn in conc.

| | Ag

| | Cu

| | Cu in conc.

| | Zn

| | Zn in conc.

| | Ag

|

|---|

| Sales | | | | | | | | | | | | | | | | | | | | |

| | Mines | | 38,990 | | — | | 71,072 | | 15,724 | | 2,849 | | 47,184 | | — | | 63,963 | | 11,964 | | 4,130 |

| | Custom — other | | 51,296 | | — | | 48,463 | | — | | 1,027 | | 57,978 | | — | | 34,665 | | — | | 1,193 |

| | Purchased metal | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Total | | 90,286 | | — | | 119,535 | | 15,724 | | 3,876 | | 105,162 | | — | | 98,628 | | 11,964 | | 5,323 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

35

Reserves: At December 31, 2004, reserves totaled 18.1 million tonnes of 1.80% copper and 6.03% zinc. Mineral reserves decreased by 2.8 million tonnes resulting from production of 2.1 million tonnes and downward revisions of 678,000 tonnes, mainly the result of stope design revisions and the temporary re-categorization of 370,000 tonnes of copper stringer ore to inferred resources until diamond drilling is completed in the lower part of the mine. At planned operating rates, the mineral reserves at Kidd Mining division are equal to approximately seven years of production (averaging 2.4 million tonnes per year), not including the inferred resources which, if converted to reserves, could provide up to an additional six years of operations.

CORPORATE AND OTHER

During the year ended December 31, 2004, corporate costs were $65 million, compared to $61 million for 2003. The increase in costs is primarily attributable to losses of $2 million on metals trading in 2004, compared to gains of $11 million in 2003, and $3 million in higher corporate general and administrative expenses, partly as a result of the stronger Canadian dollar.

These costs were offset by $3 million in lower spending on exploration due to the increased sharing of exploration costs with joint-venture partners, offset in part by the impact of the stronger Canadian dollar. In addition, $5 million of net interest income on interest rate swaps not eligible for hedge accounting and $2 million in gains on energy positions not eligible for hedge accounting were recognized in 2004.

BUSINESS DEVELOPMENT

Advanced Projects — Mineral Resources 1

The table below sets forth mineral resource estimates and certain other data with respect to Falconbridge's advanced development projects:

December 31, 2004

Project

| | Resource location

| | Percentage ownership

| | Category

| | Million tonnes

| | % Nickel

| | % Copper

| | % Cobalt

| | % Zinc

|

|---|

| Nickel deposits | | | | | | | | | | | | | | | | |

| Nickel Rim South2 | | Sudbury | | 100% | | Inferred | | 13.4 | | 1.8 | | 3.3 | | 0.04 | | — |

| | | | | | | | |

| |

| |

| |

| |

|

| Fraser Morgan2 | | Sudbury | | 100% | | Measured | | 3.3 | | 1.85 | | 0.61 | | 0.06 | | — |

| | | | | | | Indicated | | 1.6 | | 1.69 | | 0.46 | | 0.06 | | — |

| | | | | | | Total | | 4.9 | | 1.80 | | 0.56 | | 0.06 | | — |

| | | | | | | Inferred | | 2.1 | | 1.8 | | 0.5 | | 0.1 | | — |

| | | | | | | | |

| |

| |

| |

| |

|

| Onaping Depth2 | | Sudbury | | 100% | | Indicated | | 14.6 | | 2.52 | | 1.15 | | 0.06 | | — |

| | | | | | | Inferred | | 1.2 | | 3.6 | | 1.2 | | 0.07 | | — |

| | | | | | | | |

| |

| |

| |

| |

|

| Koniambo3 | | New Caledonia | | 49% | | Measured | | 32.4 | | 2.21 | | — | | — | | — |

| | | | | | | Indicated | | 109.7 | | 2.10 | | — | | — | | — |

| | | | | | | Total | | 142.1 | | 2.13 | | — | | — | | — |

| | | | | | | Inferred | | 156.0 | | 2.2 | | — | | — | | — |

| | | | | | | | |

| |

| |

| |

| |

|

| Copper deposits | | | | | | | | | | | | | | | | |

| Mine D4 | | Timmins | | 100% | | Inferred | | 15.3 | | — | | 3.0 | | — | | 4.6 |

| | | | | | | | |

| |

| |

| |

| |

|

| Fortuna de Cobre5 | | Chile | | 100% | | Measured | | 125.2 | | — | | 0.31 | | — | | — |

| | | | | | | Indicated | | 345.1 | | — | | 0.28 | | — | | — |

| | | | | | | Total | | 470.3 | | — | | 0.29 | | — | | — |

| | | | | | | Inferred | | 150.0 | | — | | 0.2 | | — | | — |

| | | | | | | | |

| |

| |

| |

| |

|

Notes:

- 1.

- The mineral resource estimates were prepared in accordance with theCIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by CIM Council on November 14, 2004, and the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines, adopted by CIM Council on November 23, 2003, using geostatistical and/or classical methods, plus economic and mining parameters appropriate to each project.

The mineral resources have been compiled under the supervision of Chester Moore, Director, Mineral Reserve Estimation and Reporting, a member of the Professional Geoscientists of Ontario with over 30 years experience as a geologist.

The mineral resources have reasonable prospects for economic extraction but have not yet had complete format evaluation, or do not have demonstrated economic viability under current conditions.

- 2.

- Also included as part of the Sudbury mineral resources on the Mineral Reserves and Mineral Resources table.

- 3.

- Option to earn. At a 2.0% nickel cut-off grade, the deposit contains Measured plus Indicated mineral resources of 75.6 million tonnes grading 2.47% nickel.

- 4.

- Also included as part of the Kidd Creek mineral resources on the Mineral Reserves and Mineral Resources table.

- 5.

- Option to purchase.

36

Growth Opportunities

Over the last decade, Falconbridge has assembled a significant portfolio of growth projects. Some are closer to its operations and easier to execute (e.g. brownfield projects); others are new projects unrelated to existing operations (e.g. greenfield projects).

Projects in Development

Kidd Mine D, Timmins, Canada — (See page 35).

Collahuasi Molybdenum Plant, Chile — (See page 33).

Brownfield projects

NICKEL

Nickel Rim South, Sudbury, Canada — This is a high-grade deposit, which was discovered in 2001, and is located close to existing operations. The updated inferred mineral resource estimate as of December 31, 2004, is 13.4 million tonnes of 1.8% nickel, 3.3% copper and significant palladium and platinum.

In the first quarter of 2004, a five-year, $368 million underground definition program was approved, and site work is now in progress in preparation for shaft sinking, which began in the first quarter of 2005. This project has progressed on schedule and within budget. Once completed, a further $185 million will be required to bring the mine into production. After taking into account pre-production revenues of $141 million, the overall net capital cost is estimated at $412 million. Full production at Nickel Rim South is expected in late 2009 or early 2010.

Fraser Morgan, Sudbury, Canada — This deposit was discovered in 2001 and is accessible from existing Fraser Mine infrastructure. Exploration results were encouraging in 2004, with diamond drilling at the Fraser Mine resulting in measured resources of 3.3 million tonnes of 1.85% nickel and 0.61% copper, indicated mineral resources of 1.6 million tonnes of 1.69% nickel and 0.46% copper and inferred mineral resources of 2.1 million tonnes of 1.8% nickel and 0.5% copper. Diamond drilling continues in 2005.

Onaping Depth, Sudbury, Canada — Onaping Depth is a high-grade resource in Sudbury with 14.6 million tonnes of indicated high-grade resources at 2.52% nickel and 1.15% copper and inferred resources of 1.2 million tonnes at 3.6% nickel and 1.2% copper. This orebody, located below the Craig Mine, is accessible using Craig Mine infrastructure by deepening the existing shaft. In 2004, Falconbridge continued research on enabling technologies to mine safely at greater depths, and continues to make substantial progress.

Raglan, Nunavik, Quebec — The Company is evaluating the possibility of increasing annual production by 20% to 1.2 million tonnes of ore per year. A scoping study for this project is in progress. A focused exploration program continues on the Company's large property holdings in the area of the Raglan mine.

COPPER

Collahuasi, Chile — Currently the fourth-largest copper mine in the world, Collahuasi has sufficient reserves and resources for further expansion. A Phase II expansion was completed in 2004, and a Phase III expansion would increase copper production by approximately 175,000 tonnes, of which Falconbridge's share would be 77,000 tonnes. This expansion would involve adding another grinding line and accelerating the production rate at the Rosario pit. A scoping study has been initiated to assess this growth opportunity, with start-up expected in 2007 at the earliest.

Lomas Bayas, Chile — The acquisition of an adjacent deposit, called Fortuna de Cobre, is being considered. If developed, total annual production would increase by 50% to 90,000 tonnes and extend mine life by five years. A decision on the option to buy the deposit must be made by mid-2006.

Greenfield projects

Kabanga, Tanzania — In early February 2004, Falconbridge and Barrick Gold Company reached a preliminary agreement under which Barrick would grant Falconbridge an option to acquire 50% of its interest in the Kabanga and Kagera nickel properties in Tanzania. Discussions on finalized terms are ongoing. Kabanga, located in western Tanzania about 1,500 kilometres from Dar Es Salaam, has a high-grade mineral resource of more than 26 million tonnes at 2.6% nickel. Depending on the additional resources found during the exploration program, a mine could produce between 30,000 and 35,000 tonnes of nickel in concentrate annually.

37

Koniambo, New Caledonia — Work continued throughout the year on the Koniambo ferronickel project in the Northern Province of New Caledonia, near the provincial capital of Koné. At a 1.5% nickel cut-off grade, the deposit contains measured plus indicated resources totaling 142.1 million tonnes at 2.13% nickel. Together with additional inferred resources of 156.0 million tonnes at 2.2% nickel, Koniambo is one of the world's largest and highest grade nickel laterite deposits. At a 2.0% nickel cut-off grade, the deposit contains measured plus indicated resources of 75.6 million tonnes at 2.47% nickel. In addition, the project has an inferred limonite resource estimated at 100 million tonnes at 1.6% nickel and 0.2% cobalt that could be developed at a later date.

In 1998, Falconbridge entered into a joint-venture agreement with Société Minière du Sud Pacifique S.A. (SMSP) and its controlling shareholder, Société de Financement et d'Investissement de la Province Nord, for the evaluation and development of the 60,000 tonne-per-year nickel in ferronickel mining and smelting complex. By signing its joint-venture agreement with SMSP, Falconbridge became SMSP's approved industrial partner under the Bercy Accord, with titles to the Koniambo orebody held in escrow until the conditions of the Bercy Accord are met. Upon satisfaction of the conditions in the Bercy Accord, SMSP and Falconbridge are to receive a 51% and 49% interest, respectively, in the project. The two conditions precedent are: 1) the completion of a positive technical study, and 2) firm orders of $100 million related to the project. These conditions must be met before the expiry of the Bercy Accord on January 1, 2006.

The Bankable Feasibility Study (BFS) on the Koniambo ferronickel project in New Caledonia has now been completed.

The BFS has increased the level of project definition, with engineering increasing from approximately 10% to 25%. Substantial analysis has been completed on many aspects of the project and included extensive third-party reviews. The project scope has remained essentially unchanged, with the work performed in the pre-feasibility study validated through the completion of the BFS. The costs of the inputs have increased as a result of changes in foreign currency exchange rates, and increased service and raw materials costs. As a result, the estimated capital cost of the project has increased to $2.2 billion. Working capital, cost escalation from 2004 to start-up, financing and arrangement fees and interest costs, for a total of approximately $500 million of other costs, are not included in the $2.2 billion. This cost estimate compares with a pre-feasibility estimate of $1.6 billion (in 2002 dollars). Estimated operating costs have increased to $1.65/lb., from $1.27/lb.

KEY ASSUMPTIONS FOR MINERAL RESOURCE AND RESERVE ESTIMATION

Refer to Summary of Mineral Reserves and Mineral Resources on page 22 and Advanced Projects on page 36.

Bulk density: The factor used to convert volume into tonnage. This factor is a function of the mineralogy and physical characteristics of a deposit. Formulae are developed using regression analyses on a suitably large number of individual determinations.

Cut-off grade: The grade that ensures the revenue from the metal content of the lowest grade parcel included in a deposit will be at least equal to the anticipated prime operating costs of producing this revenue. These costs include mining, milling, smelting, refining, selling and all transportation and administration costs. The cut-off grade will vary greatly from property to property due to a range of factors, including deposit size and shape, metal content and prime cost structure.

Exchange rate (US$ to Cdn$): 1.50

Long-term metal prices (US$ per pound): Nickel $3.25, Copper $0.90, Zinc $0.50

Minimum mining width: The smallest horizontal thickness used in an estimation based on the selected mining method and the minimum opening size required by mining equipment used. The grade across this minimum width must equal or exceed the cut-off grade.

Mining dilution*: All external material with grades lower than the cut-off grade that must be removed with the ore. The amount of this diluting material can vary considerably and depends upon mining method and the location, attitude, size, shape and wall rocks of the ore zone.

Mining recovery*: The proportion of the ore that is extracted after accounting for mining losses. The mining recovery can vary widely both within a single mine and from property to property, due to a range of factors, including deposit geometry and mining method.

* Used for mineral reserve estimation only.

38

The capital cost of $2.2 billion includes the construction of a $600 million power station with an installed generating capacity of 390 MW. The remaining $1.6 billion relates to the metallurgical plant, mine development, and other infrastructure such as the port and road facilities.

With the bankable feasibility study completed, the Company, with its partner SMSP and the French government, is focused on finalizing the financing structure for this project. The implementation approach to this project continues to be assessed, with earliest possible start-up in 2009.

If developed, Koniambo would be one of the largest nickel producers in the world with initial production of 60,000 tonnes per year. In addition, future expansion could take advantage of the large resource base, which has an estimated life in excess of 50 years.

EXPLORATION

The objectives of the exploration team are aligned with those of the nickel and copper business units and are consistent with the corporate strategy of focusing primarily on copper and nickel growth opportunities worldwide. The philosophy adopted of consistently being a fair and honest partner by exhibiting strong technical skills and a solid track record with a "win-win" philosophy is consistent with the aim of being the most valued and sought-after partner in the mining and metals business. Joint-venture arrangements are pursued with both junior and senior mining companies to increase the level of focused exploration activity, thereby sharing cost and risk and improving the likelihood of success. The exploration team has the backing of an experienced mergers and acquisitions team and a capable project engineering team with a track record of building mines around the world.

As a Founding Patron of the Association of Professional Geoscientists of Ontario and a Founding Partner of the Prospector and Developers Association's Environmental Excellence in Exploration initiative, the team of geoscientists is committed to being fully compliant with National Instrument 43-101 requirements and in consistently conducting safe and environmentally responsible exploration worldwide.

The forecast exploration expenditure for 2005 is $26 million including capitalized expenditures, compared to $25 million invested in 2004. Exploration activity is primarily focused on Canada, Brazil, Norway, Australia, and Africa.

At Sudbury, the Nickel Rim South discovery has an estimated inferred mineral resource of 13.4 million tonnes of 1.8% nickel, 3.3% copper, 0.04% cobalt, 1.8 grams/tonne platinum, 2.0 grams/tonne palladium and 0.8 grams/tonne gold. Drilling on the Fraser Morgan zones in an area east of Fraser Mine has increased the mineral resources to 4.9 million tonnes of indicated resources at 1.80% nickel, 0.56% copper and 0.06% cobalt, plus inferred resources totaling 2.1 million tonnes of 1.8% nickel, 0.5% copper and 0.1% cobalt. This increased total includes 1.1 million tonnes of inferred resources at 2.1% nickel and 0.7% copper in the new Zone 11 discovery located 600 metres to the east of Zone 9.

At Raglan, 1.9 million tonnes of mineral resources have been discovered as a result of the 2004 exploration program. This gain was offset by 2004 mine production and a mineral reserve write-down associated with the re-estimation of historical polygonal mineral reserves at Donaldson and East Lake.

In the Espedalen area, 180 kilometres north-northwest of Oslo, Norway, diamond drilling has resulted in the greenfields discovery of significant new nickel sulphide mineralization referred to as the Stormyra discovery. Diamond drill hole ES2004-08 intersected 2.7 metres of 2.07% nickel and 1.20% copper at a depth of 56 metres. It is located approximately 200 metres along strike from drill hole ES2004-09 which intersected 14.6 metres of 1.73% nickel and 0.77% copper at a depth of 93 metres. Diamond drilling will resume during the first quarter of 2005. This is a joint venture with Blackstone Ventures Inc.

At Collahuasi in Chile, diamond drilling of geophysical anomalies in the La Grande area, immediately southwest and south of the Rosario pit, has been encouraging. The immediate objectives of the ongoing exploration program are to better define La Grande mineralization to determine the economic potential of the zone and modifications, if any, to the mine plan. Assays have been received from two holes:

39

Hole

| | From

| | To

| | Metres

| | % Cu

|

|---|

| GC221 | | 130 | | 180 | | 50 | | 0.98 |

| | and | | 234 | | 631 | | 397 | | 0.85 |

| | | including | | 282 | | 458 | | 175 | | 1.15 |

| GC226 | | 405 | | 487 | | 82 | | 1.43 |

| | |

| |

| |

| |

|

ENERGY