| FILED BY NORANDA INC. |

| PURSUANT TO RULE 425 UNDER THE SECURITIES ACT OF 1933 |

| SUBJECT COMPANY: FALCONBRIDGE LIMITED |

| COMMISSION FILE NO: 333-123547 |

| NORANDA INC. COMMISSION FILE NO. 333-123546 |

The following is the slide presentation used at the First Quarter Conference Call of Noranda Inc. on April 26, 2005.

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

| FILED BY NORANDA INC. |

| PURSUANT TO RULE 425 UNDER THE SECURITIES ACT OF 1933 |

| SUBJECT COMPANY: FALCONBRIDGE LIMITED |

| COMMISSION FILE NO: 333-123547 |

| NORANDA INC. COMMISSION FILE NO. 333-123546 |

[LOGO] |

|

First Quarter 2005

Conference Call |

|

April 26th 2005 |

|

[GRAPHIC] |

[LOGO]

Forward-Looking Statements

Noranda cautions that statements made to describe the Company’s intentions, expectations or predictions may be “forward-looking statements” within the meaning of securities laws. The Company cautions that, by their nature, forward-looking statements involve risk and uncertainty and that the Company’s actual results could differ materially from those expressed or implied in such statements. Reference should be made to the most recent Annual Information Form for a description of the major risk factors.

Investor Information

This communication is being made in respect of (a) the offer (the “Falconbridge Offer”) by Noranda Inc. to acquire all of the outstanding common shares of Falconbridge Limited (other than shares owned by Noranda) on the basis of 1.77 Noranda common shares for each Falconbridge common share and (b) the issuer bid (the “Preference Share Exchange Offer”) by Noranda to repurchase approximately 63.4 million Noranda common shares in exchange for three new series of preference shares. In connection with the Falconbridge Offer and the Preference Share Exchange Offer, Noranda filed with the U.S. Securities and Exchange Commission (the “SEC”) registration statements on Form F-8 containing a share exchange take-over bid circular to be delivered to the shareholders of Falconbridge and an issuer bid circular to be delivered to shareholders of Noranda. Noranda, if required, will be filing other documents regarding the transactions with the SEC.

INVESTORS ARE URGED TO READ CAREFULLY THE SHARE EXCHANGE TAKE-OVER BID CIRCULAR AND THE ISSUER BID CIRCULAR AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

Investors will be able to obtain documents filed with the SEC free of charge at the SEC’s website (www.sec.gov). In addition, documents filed with the SEC by Noranda may be obtained free of charge by contacting Noranda at (416) 982-7111.

3

Speakers

• Derek Pannell

President and Chief Executive Officer

• Steve Douglas

Executive Vice-President and Chief Financial Officer

[LOGO] |

|

First Quarter 2005 |

|

Derek Pannell

President and CEO |

|

April 26th 2005 |

|

[GRAPHIC] |

Q1 2005 Results

| | 1st Qtr | | Y-O-Y | |

US$ millions, except per share amounts | | 2005 | | 2004 | | Change | |

| | | | | | | |

Net income | | $ | 176 | | $ | 152 | | $ | 24 | |

| | | | | | | |

Per share - basic | | $ | 0.58 | | $ | 0.50 | | 0.08 | |

Per share - diluted | | $ | 0.57 | | $ | 0.49 | | 0.08 | |

| | | | | | | |

Income generated by operating assets | | $ | 455 | | $ | 361 | | 94 | |

| | | | | | | | | | |

• Record first quarter earnings with each business unit reporting increases

• Income generated by operating assets increased to $455 million from $361 million in the first quarter of 2004

• Operating performance, metal prices and markets remain strong

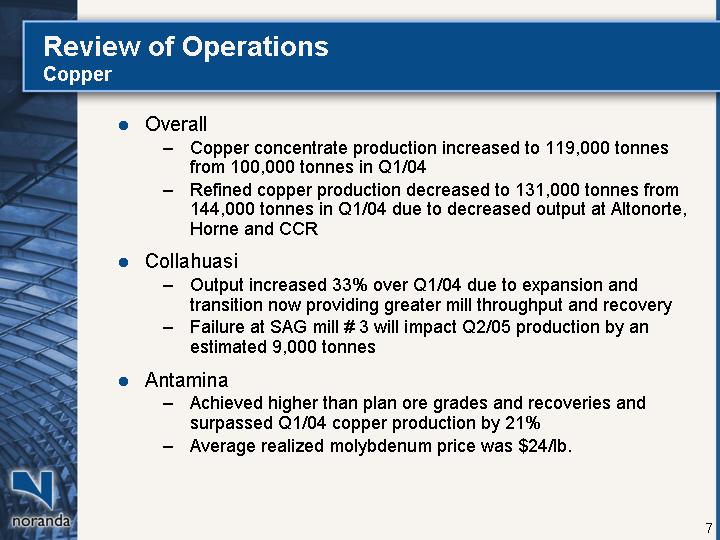

Review of Operations

Copper

• Overall

• Copper concentrate production increased to 119,000 tonnes from 100,000 tonnes in Q1/04

• Refined copper production decreased to 131,000 tonnes from 144,000 tonnes in Q1/04 due to decreased output at Altonorte, Horne and CCR

• Collahuasi

• Output increased 33% over Q1/04 due to expansion and transition now providing greater mill throughput and recovery

• Failure at SAG mill # 3 will impact Q2/05 production by an estimated 9,000 tonnes

• Antamina

• Achieved higher than plan ore grades and recoveries and surpassed Q1/04 copper production by 21%

• Average realized molybdenum price was $24/lb.

7

• Lomas Bayas

• Production was on plan and 600 tonnes greater than Q1/04

• Altonorte

• Scheduled maintenance reduced output by 6,000 tonnes versus Q1/04

• Kidd Creek

• Mine achieved 20% higher copper concentrate production and 32% greater zinc concentrate production

• Horne/CCR

• Both Horne and CCR production were lower during the quarter

• CCR production was affected by decreased production and shipping delays from Altonorte

• 2005 mine production estimate

• 496,000 tonnes of contained copper

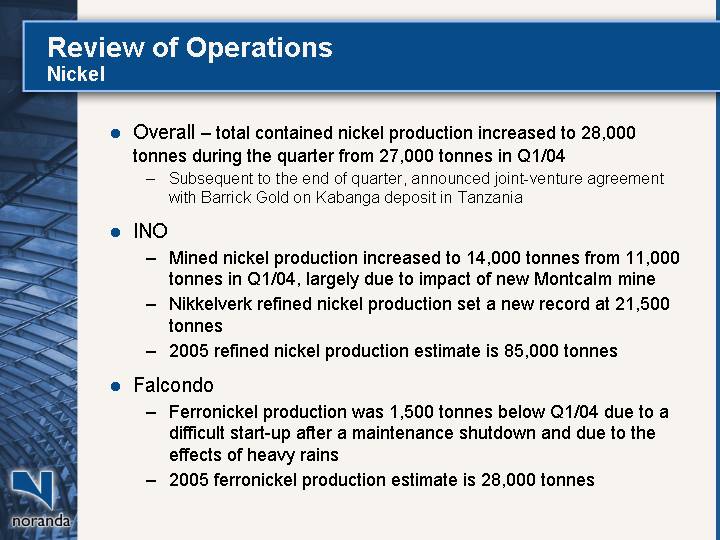

Nickel

• Overall – total contained nickel production increased to 28,000 tonnes during the quarter from 27,000 tonnes in Q1/04

• Subsequent to the end of quarter, announced joint-venture agreement with Barrick Gold on Kabanga deposit in Tanzania

• INO

• Mined nickel production increased to 14,000 tonnes from 11,000 tonnes in Q1/04, largely due to impact of new Montcalm mine

• Nikkelverk refined nickel production set a new record at 21,500 tonnes

• 2005 refined nickel production estimate is 85,000 tonnes

• Falcondo

• Ferronickel production was 1,500 tonnes below Q1/04 due to a difficult start-up after a maintenance shutdown and due to the effects of heavy rains

• 2005 ferronickel production estimate is 28,000 tonnes

Zinc

• Overall

• Total contained zinc production decreased to 117,000 tonnes during the quarter from 145,000 tonnes in Q1/04

• The decrease was mostly due to the closure of the Bell Allard mine in 2004

• Brunswick mine and smelter

• Contained zinc in concentrate decreased to 67,000 tonnes versus 74,000 tonnes a year ago

• Lead smelter production was below plan during the quarter at 22,000 tonnes due to an unplanned maintenance shutdown

• CEZ

• Produced 67,000 tonnes of refined zinc versus 69,000 tonnes in Q1/04

• 2005 mine production estimate

• 470,000 tonnes of contained zinc metal

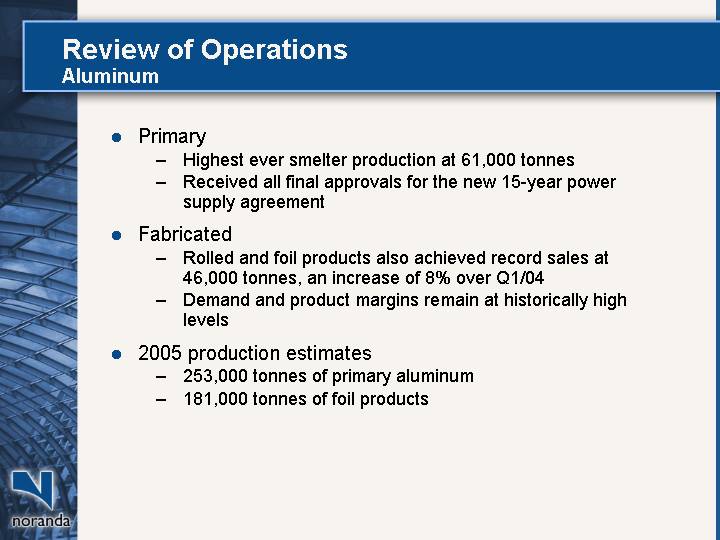

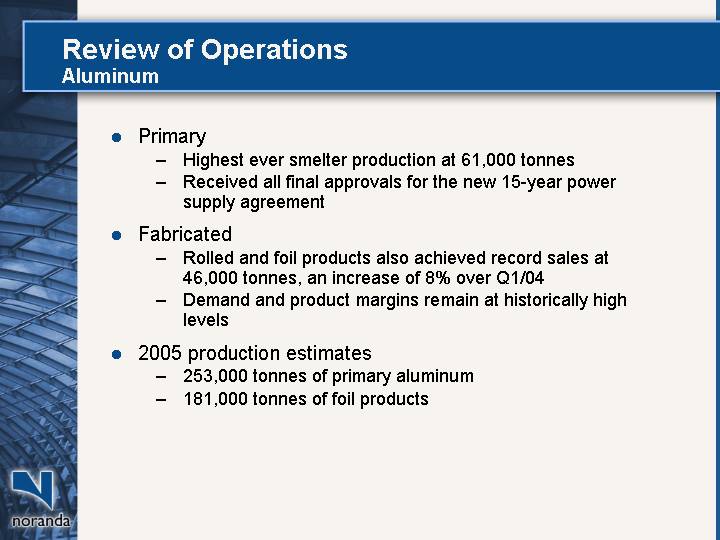

Aluminum

• Primary

• Highest ever smelter production at 61,000 tonnes

• Received all final approvals for the new 15-year power supply agreement

• Fabricated

• Rolled and foil products also achieved record sales at 46,000 tonnes, an increase of 8% over Q1/04

• Demand and product margins remain at historically high levels

• 2005 production estimates

• 253,000 tonnes of primary aluminum

• 181,000 tonnes of foil products

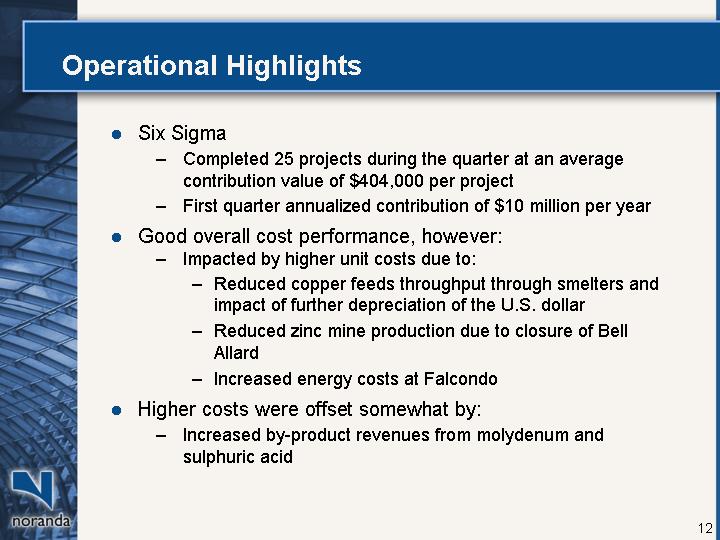

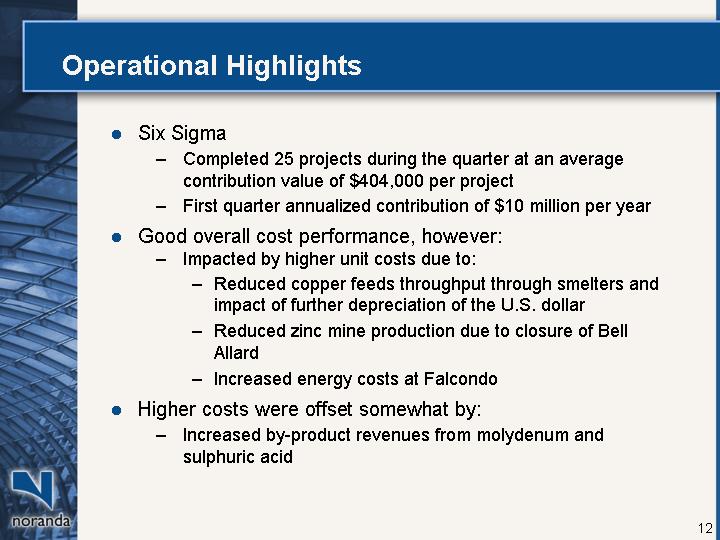

Operational Highlights

• Six Sigma

• Completed 25 projects during the quarter at an average contribution value of $404,000 per project

• First quarter annualized contribution of $10 million per year

• Good overall cost performance, however:

• Impacted by higher unit costs due to:

• Reduced copper feeds throughput through smelters and impact of further depreciation of the U.S. dollar

• Reduced zinc mine production due to closure of Bell Allard

• Increased energy costs at Falcondo

• Higher costs were offset somewhat by:

• Increased by-product revenues from molydenum and sulphuric acid

12

[LOGO] |

|

1st Quarter 2005

Financial Review |

|

Steve Douglas

Chief Financial Officer |

|

April 26th 2005 |

|

[GRAPHIC] |

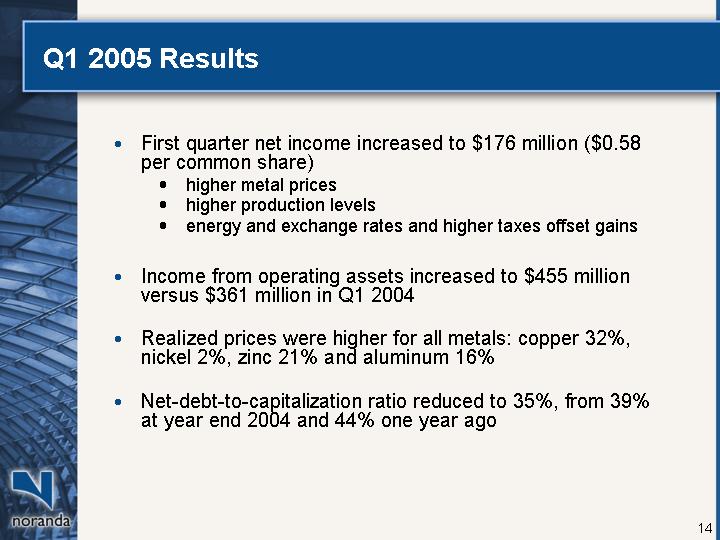

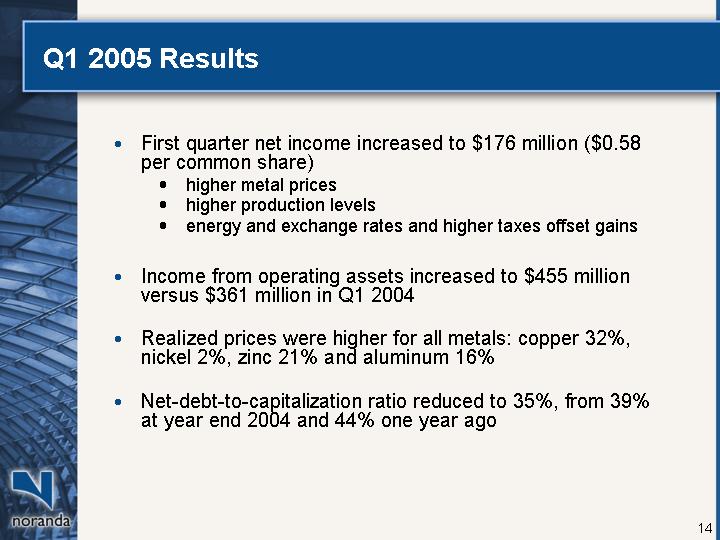

Q1 2005 Results

• First quarter net income increased to $176 million ($0.58 per common share)

• higher metal prices

• higher production levels

• energy and exchange rates and higher taxes offset gains

• Income from operating assets increased to $455 million versus $361 million in Q1 2004

• Realized prices were higher for all metals: copper 32%, nickel 2%, zinc 21% and aluminum 16%

• Net-debt-to-capitalization ratio reduced to 35%, from 39% at year end 2004 and 44% one year ago

14

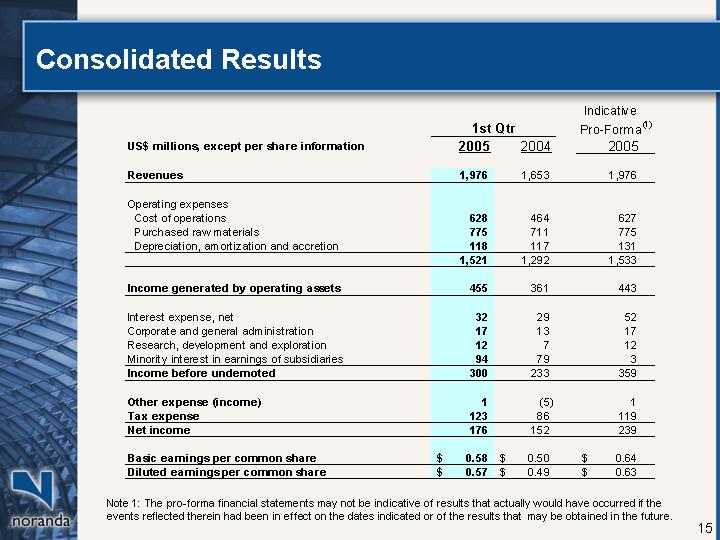

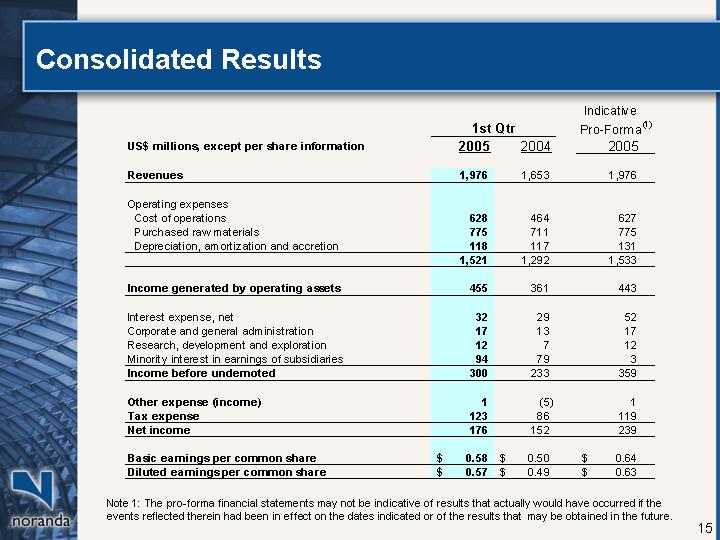

Consolidated Results

| | 1st Qtr | | Indicative

Pro-Forma(1) | |

US$ millions, except per share information | | 2005 | | 2004 | | 2005 | |

Revenues | | 1,976 | | 1,653 | | 1,976 | |

| | | | | | | |

Operating expenses | | | | | | | |

Cost of operations | | 628 | | 464 | | 627 | |

Purchased raw materials | | 775 | | 711 | | 775 | |

Depreciation, amortization and accretion | | 118 | | 117 | | 131 | |

| | 1,521 | | 1,292 | | 1,533 | |

| | | | | | | |

Income generated by operating assets | | 455 | | 361 | | 443 | |

| | | | | | | |

Interest expense, net | | 32 | | 29 | | 52 | |

Corporate and general administration | | 17 | | 13 | | 17 | |

Research, development and exploration | | 12 | | 7 | | 12 | |

Minority interest in earnings of subsidiaries | | 94 | | 79 | | 3 | |

Income before undernoted | | 300 | | 233 | | 359 | |

| | | | | | | |

Other expense (income) | | 1 | | (5 | ) | 1 | |

Tax expense | | 123 | | 86 | | 119 | |

Net income | | 176 | | 152 | | 239 | |

| | | | | | | |

Basic earnings per common share | | $ | 0.58 | | $ | 0.50 | | $ | 0.64 | |

Diluted earnings per common share | | $ | 0.57 | | $ | 0.49 | | $ | 0.63 | |

Note 1: The pro-forma financial statements may not be indicative of results that actually would have occurred if the events reflected therein had been in effect on the dates indicated or of the results that may be obtained in the future.

15

Exchange and Prices

Impact of changes

1St Qtr 2005 Vs. 1st Qtr 2004

[CHART]

16

Earnings Variance

1st Qtr 2005 vs 1st Qtr 2004

| | $ Millions | | $ Per Share | |

| | | | | |

Metal prices | | 139 | | 0.47 | |

Exchange | | (26 | ) | (0.09 | ) |

Energy costs | | (17 | ) | (0.06 | ) |

Volumes | | 82 | | 0.28 | |

Costs and other | | (84 | ) | (0.28 | ) |

Total income generated by operating assets | | 94 | | 0.32 | |

| | | | | |

Interest, admin., exploration & other | | (18 | ) | (0.06 | ) |

Minority interest | | (15 | ) | (0.05 | ) |

Tax expense | | (37 | ) | (0.13 | ) |

| | | | | |

Total | | 24 | | 0.08 | |

17

[LOGO] |

|

1st Quarter 2005

Operational Review |

|

April 26th 2005 |

|

[GRAPHIC] |

18

Income Generated by Operating Assets (EBIT)

US$ millions | | 1st Qtr | |

| | 2005 | | 2004 | |

| | | | | |

Copper | | 286 | | 187 | |

Nickel | | 223 | | 219 | |

Zinc | | 15 | | 20 | |

Aluminum | | 47 | | 25 | |

Other | | 2 | | 27 | |

Depreciation, amortization and accretion | | (118 | ) | (117 | ) |

| | | | | |

Income generated by operating assets | | 455 | | 361 | |

19

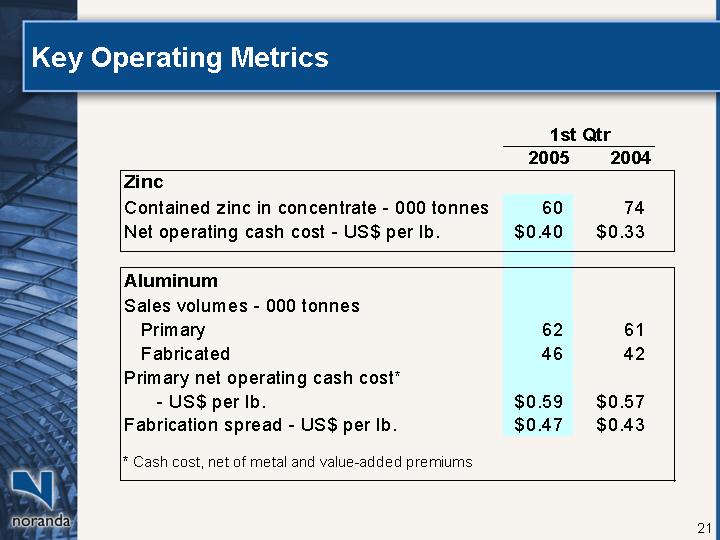

Key Operating Metrics

| | 1st Qtr | |

| | 2005 | | 2004 | |

Copper | | | | | |

Sales volumes - 000 tonnes | | | | | |

Copper concentrate | | 66 | | 41 | |

Zinc (metal and concentrate) | | 56 | | 41 | |

Copper cathode | | 117 | | 117 | |

Concentrate processed | | 445 | | 490 | |

Net operating cash cost - US$ per lb. | | $ | 0.35 | | $ | 0.25 | |

| | | | | |

Nickel | | | | | |

Sales volumes - 000 tonnes | | | | | |

Nickel | | 21 | | 18 | |

Ferronickel | | 7 | | 7 | |

Net operating cash cost - US$ per lb. | | | | | |

INO | | $ | 2.51 | | $ | 2.60 | |

Falcondo | | $ | 3.88 | | $ | 2.95 | |

20

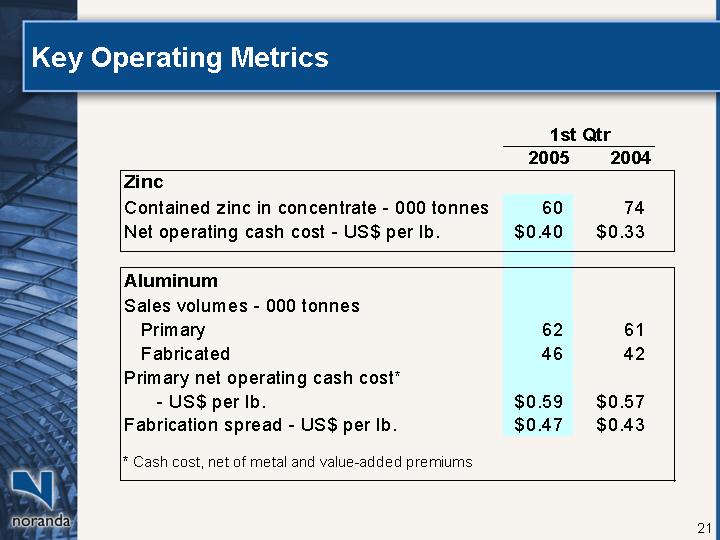

| | 1st Qtr | |

| | 2005 | | 2004 | |

Zinc | | | | | |

Contained zinc in concentrate - 000 tonnes | | 60 | | 74 | |

Net operating cash cost - US$ per lb. | | $ | 0.40 | | $ | 0.33 | |

| | | | | |

Aluminum | | | | | |

Sales volumes - 000 tonnes | | | | | |

Primary | | 62 | | 61 | |

Fabricated | | 46 | | 42 | |

Primary net operating cash cost* - US$ per lb. | | $ | 0.59 | | $ | 0.57 | |

Fabrication spread - US$ per lb. | | $ | 0.47 | | $ | 0.43 | |

* Cash cost, net of metal and value-added premiums

21

[LOGO] |

|

1st Quarter 2005

Financial Position |

|

April 26th 2005 |

|

[GRAPHIC] |

Consolidated Balance Sheet

| | | | | | Indicative

Pro-Forma(1) | |

US$ millions | | 31-Mar-05 | | 31-Dec-04 | | 31-Mar-05 | |

ASSETS | | | | | | | |

Cash and cash equivalents | | $ | 1,000 | | $ | 884 | | $ | 981 | |

Accounts receivable | | 957 | | 948 | | 973 | |

Metals and other inventories | | 1,471 | | 1,436 | | 1,530 | |

| | 3,428 | | 3,268 | | 3,484 | |

Operating capital assets | | 4,892 | | 4,870 | | 6,243 | |

Development projects | | 1,134 | | 1,166 | | 2,022 | |

Investments and other assets | | 328 | | 324 | | 275 | |

TOTAL ASSETS | | $ | 9,782 | | $ | 9,628 | | $ | 12,024 | |

| | | | | | | |

LIABILITIES AND EQUITY | | | | | | | |

Accounts and taxes payable | | $ | 1,242 | | $ | 1,265 | | $ | 1,242 | |

Debt due within one year | | 591 | | 570 | | 597 | |

| | 1,833 | | 1,835 | | 1,839 | |

Long-term debt | | 2,574 | | 2,736 | | 2,570 | |

Preferred shares | | 121 | | 122 | | 1,371 | |

Future income taxes | | 371 | | 304 | | 1,021 | |

Asset retirement obligation, pension and other provisions | | 600 | | 595 | | 697 | |

Stockholders’ interests | | | | | | | |

Interests of other shareholders | | 1,296 | | 1,197 | | 193 | |

Shareholders equity | | 2,987 | | 2,839 | | 4,333 | |

| | 4,283 | | 4,036 | | 4,526 | |

TOTAL LIABILITIES AND EQUITY | | $ | 9,782 | | $ | 9,628 | | $ | 12,024 | |

| | | | | | | | | | | |

Note 1: The pro-forma financial statements may not be indicative of results that actually would have occurred if the events reflected therein had been in effect on the dates indicated or of the results that may be obtained in the future.

23

Operating Assets

US$ millions | | 31-Mar

2005 | | 31-Dec

2004 | |

| | | | | |

Copper | | 2,858 | | 2,890 | |

Nickel | | 1,151 | | 1,078 | |

Zinc | | 150 | | 158 | |

Aluminum | | 696 | | 702 | |

Other | | 37 | | 42 | |

Total | | $ | 4,892 | | $ | 4,870 | |

| | | | | | | |

24

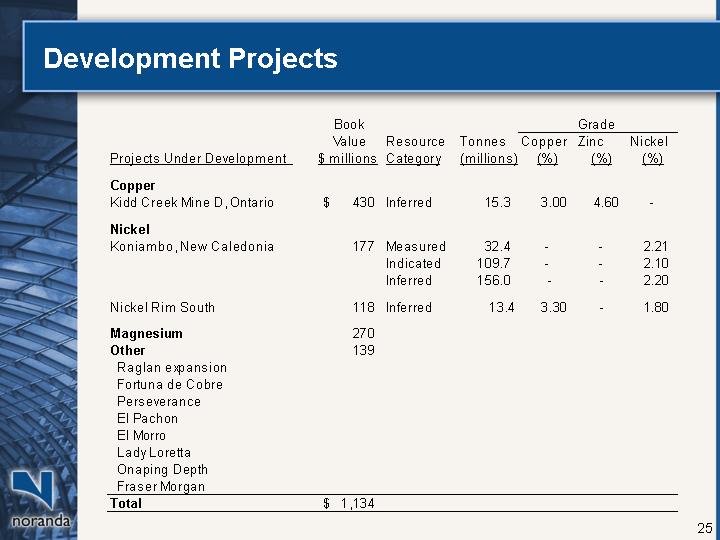

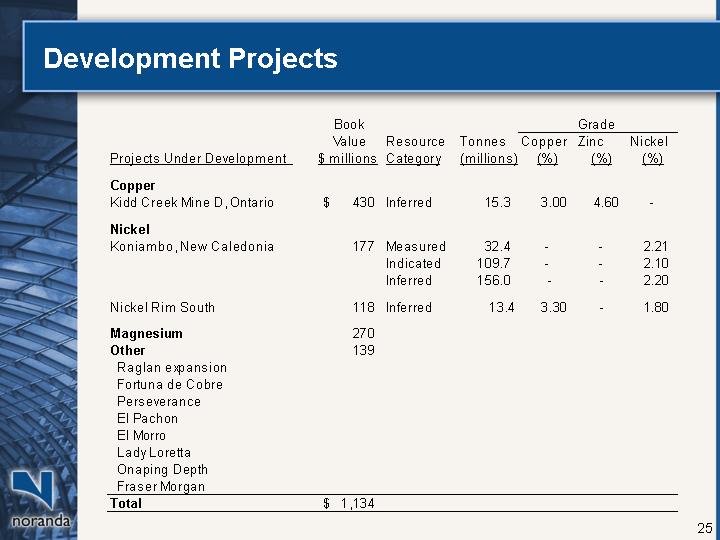

Development Projects

Projects Under Development | | Book

Value | | Resource

Category | | Tonnes | | Grade | |

Copper | | Zinc | | Nickel |

| | $ millions | | | | (millions) | | (%) | | (%) | | (%) | |

Copper | | | | | | | | | | | | | |

Kidd Creek Mine D, Ontario | | $ | 430 | | Inferred | | 15.3 | | 3.00 | | 4.60 | | — | |

| | | | | | | | | | | | | |

Nickel | | | | | | | | | | | | | |

Koniambo, New Caledonia | | 177 | | Measured | | 32.4 | | — | | — | | 2.21 | |

| | | | Indicated | | 109.7 | | — | | — | | 2.10 | |

| | | | Inferred | | 156.0 | | — | | — | | 2.20 | |

| | | | | | | | | | | | | |

Nickel Rim South | | 118 | | Inferred | | 13.4 | | 3.30 | | — | | 1.80 | |

| | | | | | | | | | | | | |

Magnesium | | 270 | | | | | | | | | | | |

Other | | 139 | | | | | | | | | | | |

Raglan expansion | | | | | | | | | | | | | |

Fortuna de Cobre | | | | | | | | | | | | | |

Perseverance | | | | | | | | | | | | | |

El Pachon | | | | | | | | | | | | | |

El Morro | | | | | | | | | | | | | |

Lady Loretta | | | | | | | | | | | | | |

Onaping Depth | | | | | | | | | | | | | |

Fraser Morgan | | | | | | | | | | | | | |

Total | | $ | 1,134 | | | | | | | | | | | |

25

Consolidated Statement of Cash Flow

| | 1st Qtr | |

US$ millions | | 2005 | | 2004 | |

| | | | | |

Cash from operations | | 451 | | 348 | |

Change in operating working capital | | (66 | ) | (88 | ) |

| | 385 | | 260 | |

Capital investments | | (110 | ) | (124 | ) |

Other investment activities | | (3 | ) | 10 | |

Sale of assets and investments | | 3 | | 2 | |

Cash before financing activities | | 275 | | 148 | |

| | | | | |

Financing activities | | | | | |

Long-term debt, including current portion | | | | | |

Issued | | 13 | | 28 | |

Repaid | | (154 | ) | (44 | ) |

Issue of common shares | | 8 | | 13 | |

Dividends | | (42 | ) | (38 | ) |

Issue of common shares - minority shareholders, net | | 16 | | 11 | |

| | (159 | ) | (30 | ) |

| | | | | |

Increase in cash and cash equivalents | | 116 | | 118 | |

Cash and cash equivalents, beginning of period | | 884 | | 501 | |

Cash and cash equivalents, end of period | | 1,000 | | 619 | |

26

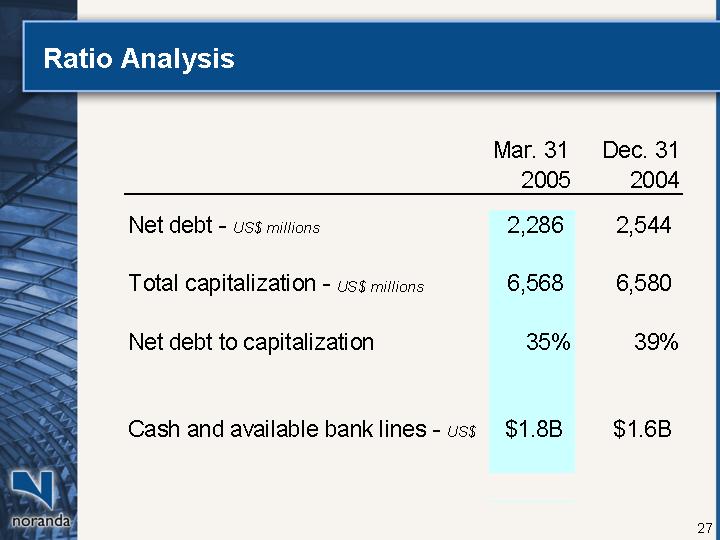

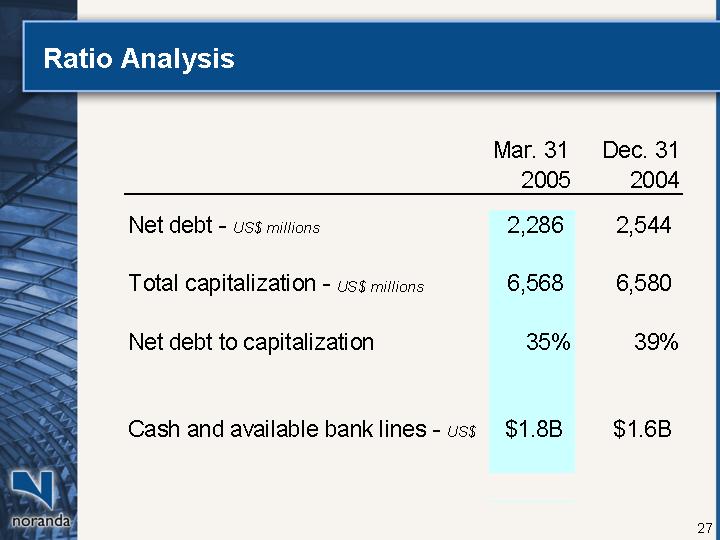

Ratio Analysis

| | Mar. 31

2005 | | Dec. 31

2004 | |

Net debt - US$ millions | | 2,286 | | 2,544 | |

| | | | | |

Total capitalization - US$ millions | | 6,568 | | 6,580 | |

| | | | | |

Net debt to capitalization | | 35 | % | 39 | % |

| | | | | |

Cash and available bank lines - US$ | | $ | 1.8 | B | $ | 1.6 | B |

| | | | | | | |

27

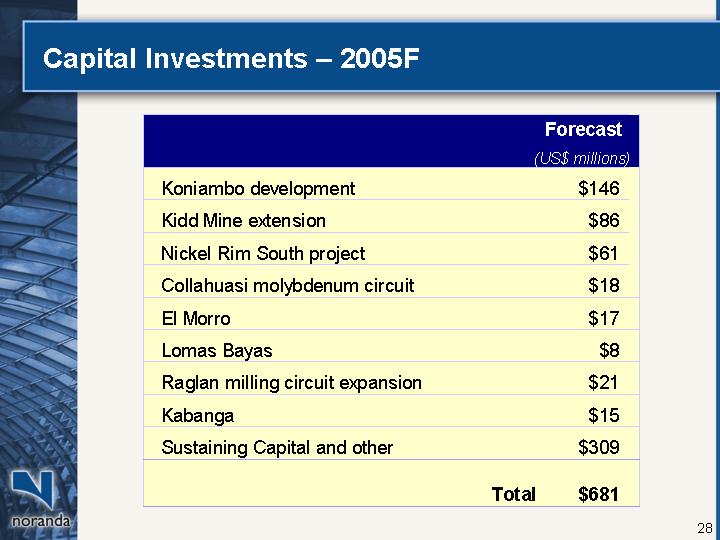

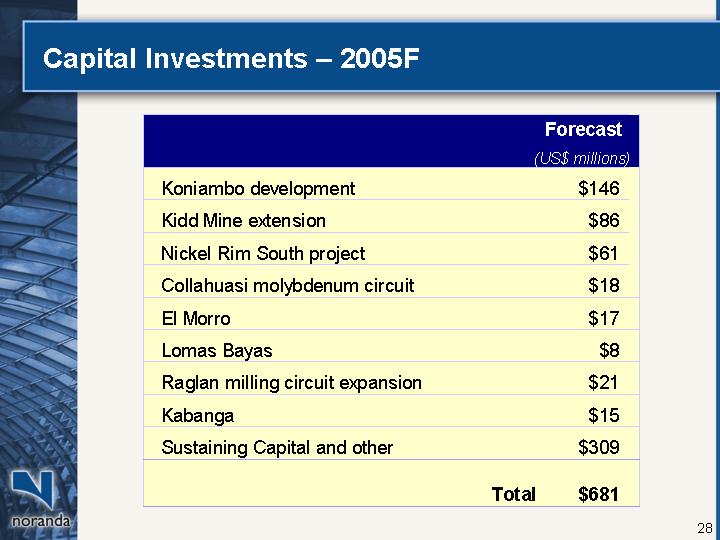

Capital Investments – 2005F

| | Forecast

(US$ millions) | |

Koniambo development | | $ | 146 | |

Kidd Mine extension | | $ | 86 | |

Nickel Rim South project | | $ | 61 | |

Collahuasi molybdenum circuit | | $ | 18 | |

El Morro | | $ | 17 | |

Lomas Bayas | | $ | 8 | |

Raglan milling circuit expansion | | $ | 21 | |

Kabanga | | $ | 15 | |

Sustaining Capital and other | | $ | 309 | |

| | | |

Total | | $ | 681 | |

28

[LOGO] |

|

1st Quarter 2005

Conference Call |

|

Concluding Remarks

April 26th 2005 |

|

DRAFT April 25, 2005 |

|

[GRAPHIC] |

Summary

• Fundamentals for base metals continue to be very strong

• Noranda remains well positioned to benefit from rise in commodity prices from expanded copper, nickel and aluminum output in 2005

Proposed Issuer Bid and Merger with Falconbridge

• Noranda issuer bid expires on April 28, 2005

• Falconbridge merger offer expires on May 5, 2005

• Recently met with over 150 large institutional investors in Canada, U.S. and Europe

• Feedback has been very encouraging

• Positive aspects for Noranda and Falconbridge have been recognized as:

• Simplification of ownership structure

• Removal of sale process uncertainty

• Increased public float and shareholder liquidity

• Opportunity for a re-rating of the company to similar trading ranges of comparable mining companies

• Will become one of the world’s largest base metals producers

• High quality portfolio of long-life, low-cost, low-risk assets and growth projects

31

[LOGO] |

|

First Quarter

Conference Call |

|

April 26th , 2005 |

|

[GRAPHIC] |