Exhibit 99.1

Investor Presentation Fourth Quarter 2012 Update

2 Forward-Looking Statements & Non-GAAP Financial Measures Certain statements made by Meadowbrook Insurance Group, Inc. in this release may constitute forward-looking statements including, but not limited to, those statements that include the words “believes,” “expects,” “anticipates,” “estimates,” or similar expressions. Please refer to the Company's most recent 10-K, 10-Q, and other filings with the Securities and Exchange Commission for more information on risk factors. Actual results could differ materially. These forward-looking statements involve risks and uncertainties including, but not limited to the following: premium volume and operating leverage, the frequency and severity of claims; uncertainties inherent in reserve estimates; catastrophic events; a change in the demand for, pricing of, availability or collectibility of reinsurance; increased rate pressure on premiums and on underwriting criteria; ability to obtain rate increases in current market conditions; investment rate of return and losses (whether realized or unrealized) in the Company’s investment portfolio; changes in and adherence to insurance or other regulation; actions taken by regulators, rating agencies or lenders, including possible downgrade of the company’s current A- financial strength rating; attainment of certain processing efficiencies; changing rates of inflation; impairment of intangibles; general economic conditions; the Company’s possible ability to implement its capital raising and capital preservation strategies in a timely manner; and other risks identified in the Company’s reports and registration statements filed with the Securities and Exchange Commission, any of which may have a material and adverse effect on the Company’s results of operations and financial condition. Meadowbrook is not under any obligation to (and expressly disclaims any such obligation to) update or alter its forward-looking statements whether as a result of new information, future events or otherwise. Notes on Non-GAAP Financial Measures (1)Net operating income is a non-GAAP measure defined as net income excluding after-tax realized gains and losses. (2)Accident year combined ratio is a non-GAAP measure that represents the impact of any adverse or favorable development on prior year loss reserves. (3)Statutory surplus is a non-GAAP measure with the most directly comparable financial GAAP measure being shareholders’ equity. These non-GAAP metrics are common measurements for property and casualty insurance companies. We believe this presentation enhances the understanding of our results by highlighting the underlying profitability of our insurance business. Additionally, these measures are key internal management performance standards.

3 Overview of Meadowbrook Specialty niche focused commercial insurance underwriter and insurance administration services company •Founded in 1955, organized as holding company in 1985, IPO in 1995 •Headquartered in Southfield, MI with 28 locations throughout the U.S. and over 1,000 employees •Platform supports both risk bearing and non-risk bearing opportunities •Rated “A-” by A.M. Best, with statutory surplus of $426.3M and shareholders’ equity of $558.3M at 12/31/2012 •Full year 2012 gross written premium of $1.1B •Full year 2012 net commissions and fee revenue of $34.0M

4 Overview of Meadowbrook (continued) Key Statistics •Market Capitalization at 2/22/2013: $361.7M •Book Value at 12/31/2012: $558.3M •Tangible Book Value at 12/31/2012: $409M •Book Value per Share at 12/31/2012: $11.22 –Excluding unrealized gains/losses, net of deferred taxes: $10.24 –Tangible Book Value per Share: $8.22 •GWP to Statutory Surplus at 12/31/2012: 2.5 to 1 •NWP to Statutory Surplus at 12/31/2012: 1.9 to 1 •Price to Book at 2/22/2013: 0.65x •Dividend Yield at 2/22/2013: 1.1% •Debt to Equity 12/31/2012: 28.6%; 8.7% excluding debentures & FHLB •Debt to Total Capital 12/31/2012: 22.2%; 6.8% excluding debentures & FHLB •Insider Ownership at 2/22/2013: 6.9% –Q1 2013 Insider ownership purchases as of 2/22/2013: 39,115 shares

5 Capability Building Through Successful Acquisitions Retail Agency Only 1955: Founded as a retail insurance agency Core Capability Build Out 1985: Star Insurance Company 1990: Savers Property & Casualty Insurance Company 1994: American Indemnity Insurance Company 1996: Association Self Insurance Services 1997: Williamsburg National Insurance Company Crest Financial Services 1998: Ameritrust Insurance Corporation Florida Preferred Administrators, Inc. 1999: TPA Insurance Agency Continued Synergistic Expansion 2007: USSU 2008: Procentury Continued Synergistic Expansion Strategic Staging of Acquisitions •Meadowbrook actively reviews acquisition prospects on a strategic basis and enters into transactions that will increase long-term shareholder value •We consider a range of strategic factors when looking at acquisitions including: –Opportunity to leverage our diverse revenue platform, by expanding current distribution, servicing capabilities, and complementary product lines and classes –Ability to attract talented insurance professionals that are a good fit with Meadowbrook culture –Opportunity to create “win-win” situation by mitigating our downside risk and providing seller with opportunity to obtain fair value through deal structure

6 Book Value & Statutory Surplus Growth Over Time Book Value per Share CAGR*, ex dividends (2003 to 2012) = 8.6% CAGR*, with dividends (2003 to 2012) = 9.3% *CAGR=Compound annual growth rate (1) (1) Acquisition of Procentury occurred in 2008 $0.08 Statutory Surplus (1) $ in millions CAGR*, ex dividends (2003 to 2012) = 17.5% CAGR*, with dividends (2003 to 2012) = 21.8%

7 Diverse Revenue Sources •Earned premium from insurance operations •Fee revenue from risk management services •Flexibility to utilize multiple distribution channels Positioned to Manage Insurance Cycles Conservative Investment Philosophy Culture of Disciplined Underwriting, Claims Handling & Reserving •Product, program and geographic diversification •Admitted market capabilities contribute to stability and higher renewal retention •Non-admitted capabilities enable opportunistic response in volatile pricing environment •High-quality fixed income investment portfolio of $1.6B •Investment approach reinforces our focus on underwriting profitability •Insurance subsidiaries rated A- (Excellent) by A.M. Best •Generate cash flows from both regulated and non-regulated sources, which provides flexibility (cash flows provided by operations was $174.5M, $138.1M, and $122.0M for 2010, 2011, and 2012, respectively) •2012 Cash flows from operations, excluding the impact of the unearned premium transfer were $181.4 million •Manageable debt levels, with access to $100M line of credit ($20.0M outstanding balance at 12/31/2012) and access to FHLB borrowings at the Insurance subsidiary level. Strong Operating Cash Flow and Liquidity Position •Team of talented insurance professionals with a wide range of expertise across all functions and lines of business •Focused on achieving pricing adequacy and adherence to disciplined underwriting standards The Meadowbrook Approach Our balanced business model allows us to adapt to changing market conditions and deliver more predictable results.

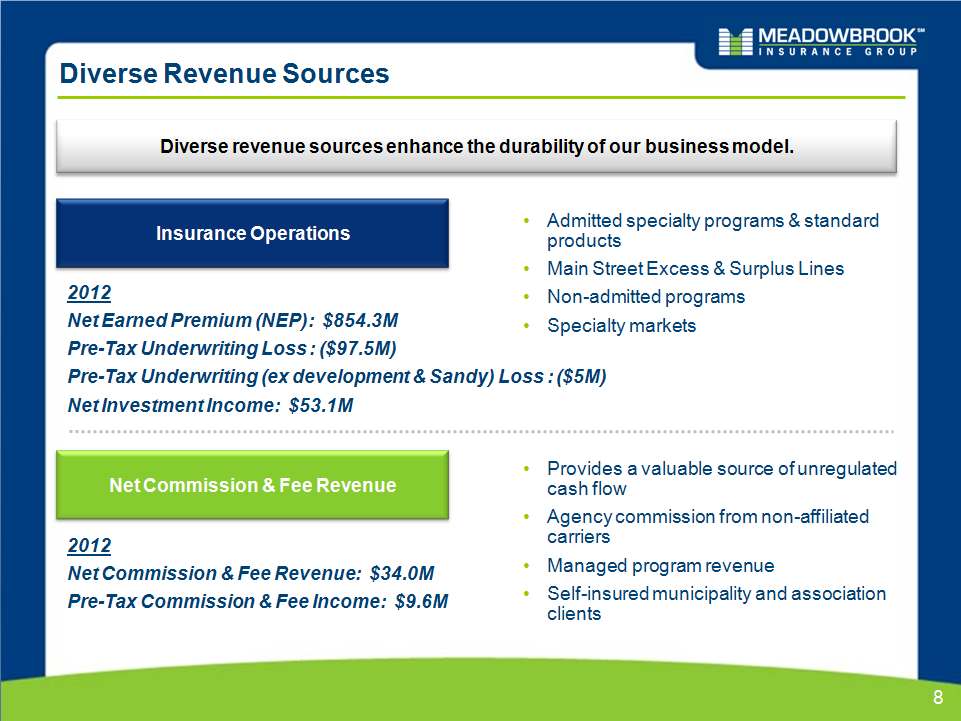

8 Diverse Revenue Sources Insurance Operations Net Commission & Fee Revenue Diverse revenue sources enhance the durability of our business model. •Admitted specialty programs & standard products •Main Street Excess & Surplus Lines •Non-admitted programs •Specialty markets •Provides a valuable source of unregulated cash flow •Agency commission from non-affiliated carriers •Managed program revenue •Self-insured municipality and association clients 2012 Net Earned Premium (NEP): $854.3M Pre-Tax Underwriting Loss : ($97.5M) Pre-Tax Underwriting (ex development & Sandy) Loss : ($5M) Net Investment Income: $53.1M 2012 Net Commission & Fee Revenue: $34.0M Pre-Tax Commission & Fee Income: $9.6M

9 Positioned to Manage Insurance Cycles A Diverse Range of Capabilities Developed to Support the Specialty Market Main Street Excess and Surplus Lines Admitted Specialty Programs & Standard Market Products Non-Admitted Programs Specialty Market Products •Specialty line, class and niche segments of business •Heterogeneous geographic centers •Utilizes specialty agents and program administrators, and retail agents •Includes standard market products •Broad classes of “Main Street” commercial risks •Utilizes general agency distribution •Limited underwriting authority delegated •Specialized programs ignored or underserved by the standard market •Promotes wholesalers with specialty underwriting authority •Requires differentiation from E&S division (either product or distribution) 2012 GWP: $597M 2011 GWP: $488M •Food service industry •Educators •Chemical distribution/mix •Small workers’ comp •Agriculture Description Examples •Apartments, hotels and motels •Contractors liability •Restaurants, bars and taverns •Garage •Oil and gas contractors •Pet-sitters •Professional liability •Excess workers’ comp •Environmental •Marine •Med Mal •Garage •Product solutions designed for specific specialty lines and market segments •Includes the use of both admitted and non-admitted carriers •Business is both primary and excess •Requires “in-house” underwriting expertise 2012 GWP: $52M 2011 GWP: $43M 2012 GWP: $130M 2011 GWP: $122M 2012 GWP: $287M 2011 GWP: $251M

10 Positioned to Manage Insurance Cycles Diverse Geographic Distribution Our regional perspective provides the infrastructure to achieve geographic diversification, while maintaining our effective local touch. Meadowbrook locations Top 10 production states (2012) 1 RankState/Stat Line of BusinessTop Line1CA All Lines34.2% Workers' compensation23.1% All other11.1% 2FL All lines9.5% Other liability - occurrence2.2% All other7.3% 3TX All lines6.5% Other liability - occurrence1.1% All other5.4% 4NJ All lines4.3% Other liability - occurrence1.3% All other3.0% 5MI All lines4.0% Workers' compensation2.4% All other1.6% 6NY All lines3.9% Other liability - occurrence1.1% All other2.8% 7IL All lines2.8% Workers' compensation1.4% All other1.4% 8MO All lines2.4% CMP (liability portion)0.7% All other1.7% 9PA All lines2.2% Workers' compensation0.7% All other1.5% 10LA All lines2.1% Other liability - occurrence0.4% All other1.7% 2012 GWP as % of Total GWP for Top 10 States

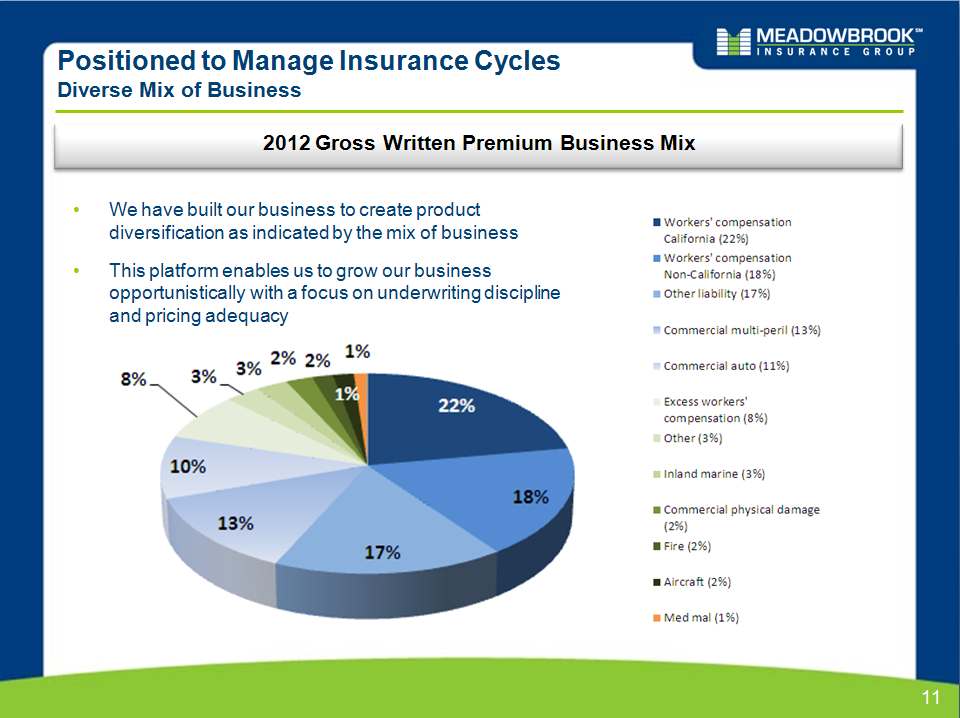

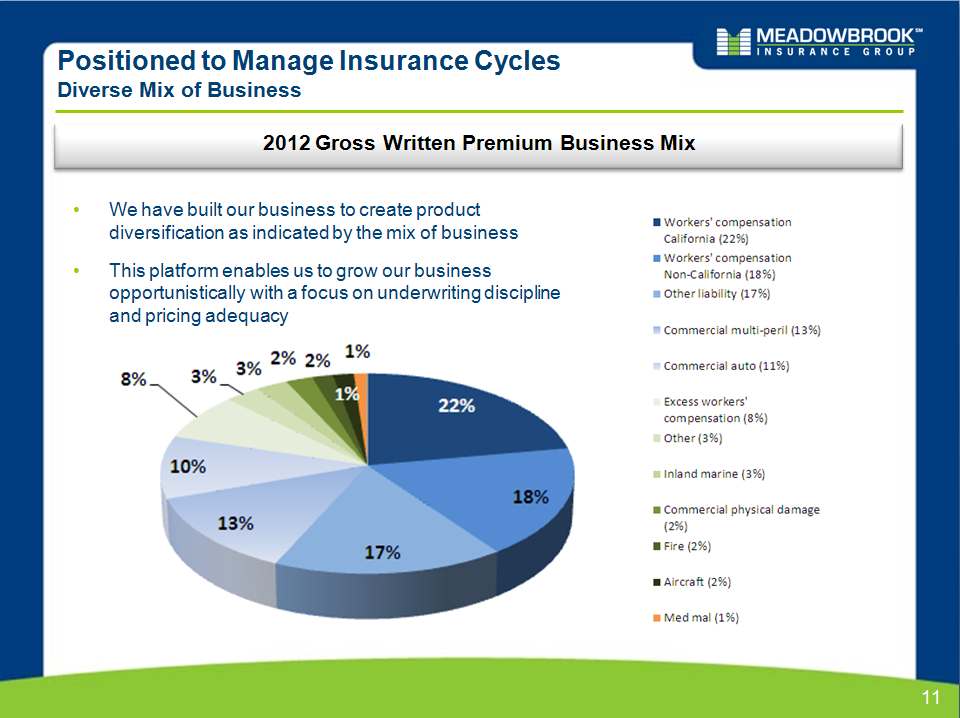

11 Positioned to Manage Insurance Cycles Diverse Mix of Business 2012 Gross Written Premium Business Mix •We have built our business to create product diversification as indicated by the mix of business •This platform enables us to grow our business opportunistically with a focus on underwriting discipline and pricing adequacy Screen Clipping Screen Clipping

Positioned to Manage Insurance Cycles – CA WC Low Hazard Mix of Business 12 How does our business mix compare to California workers’ compensation industry? •Low hazard group mix •We write 71% of our premium in hazard groups 1 & 2 vs. 55% for the industry •Almost no premium in hazard groups 6 & 7 vs. 5% for the industry •Industry group mix favorable •We write 67% of our premium in the goods and services industry vs. 37% for the industry •We write 3% of our premium in the construction industry vs. 12% for the industry •Our construction business is approximately 50% landscape contractors •Earned rate levels are now above industry (according to WCIRB) •Experience mods are almost 10% better than the industry benchmark •Avoided wholesale / aggregation production sources •Production partners “exclusivity”

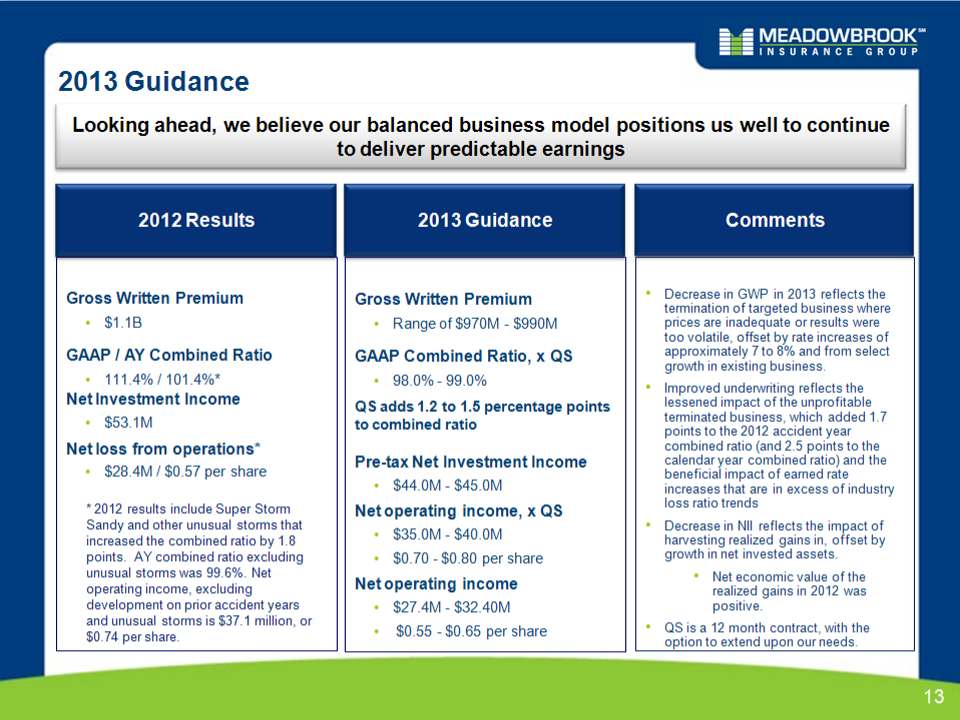

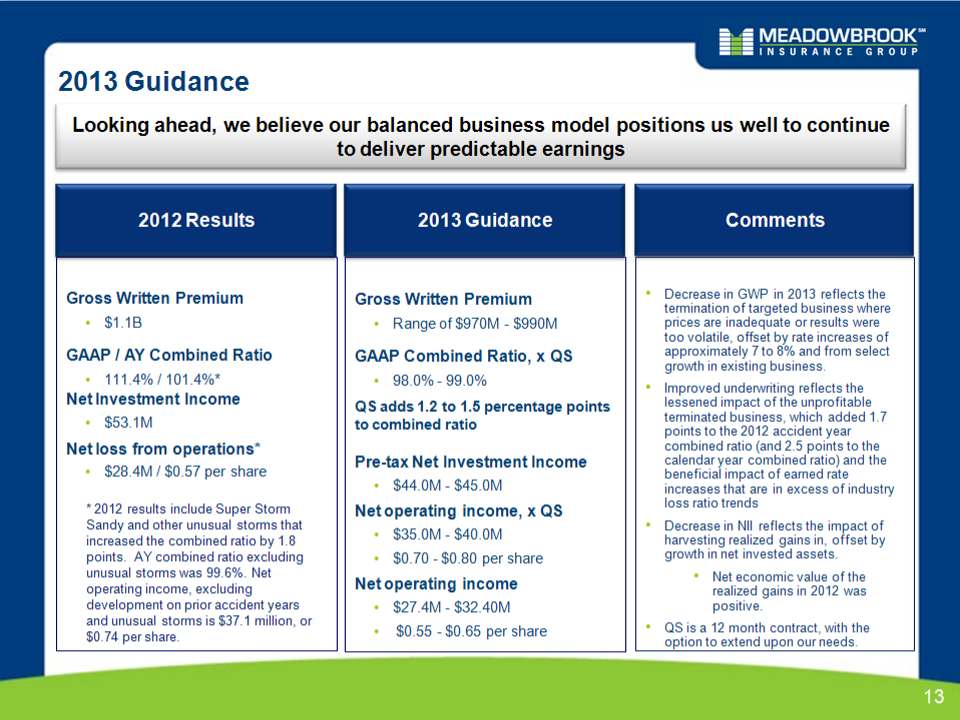

13 2013 Guidance Looking ahead, we believe our balanced business model positions us well to continue to deliver predictable earnings Gross Written Premium •$1.1B GAAP / AY Combined Ratio •111.4% / 101.4%* Net Investment Income •$53.1M Net loss from operations* •$28.4M / $0.57 per share 2012 Results •Decrease in GWP in 2013 reflects the termination of targeted business where prices are inadequate or results were too volatile, offset by rate increases of approximately 7 to 8% and from select growth in existing business. •Improved underwriting reflects the lessened impact of the unprofitable terminated business, which added 1.7 points to the 2012 accident year combined ratio (and 2.5 points to the calendar year combined ratio) and the beneficial impact of earned rate increases that are in excess of industry loss ratio trends •Decrease in NII reflects the impact of harvesting realized gains in, offset by growth in net invested assets. •Net economic value of the realized gains in 2012 was positive. •QS is a 12 month contract, with the option to extend upon our needs. Comments 2013 Guidance Gross Written Premium •Range of $970M - $990M GAAP Combined Ratio, x QS •98.0% - 99.0% QS adds 1.2 to 1.5 percentage points to combined ratio Pre-tax Net Investment Income •$44.0M - $45.0M Net operating income, x QS •$35.0M - $40.0M •$0.70 - $0.80 per share Net operating income •$27.4M - $32.40M • $0.55 - $0.65 per share * 2012 results include Super Storm Sandy and other unusual storms that increased the combined ratio by 1.8 points. AY combined ratio excluding unusual storms was 99.6%. Net operating income, excluding development on prior accident years and unusual storms is $37.1 million, or $0.74 per share.

Quota Share Quota share agreement increased statutory surplus at December 31,2012 by $20.8 million •Provides an easily integrated form of capital relief by utilizing the capital of Swiss Re •Initial term is one year with multiple extension and exit options in subsequent years at MIG’s option; provides flexibility to enhance capital as needed •Prospective reinsurance agreement •Proportional that covers a cross section of our business •$91.4 million UEP transfer in 2012 •Ceding commission (net of tax) related to the $91.4m UEP transfer increased statutory surplus by $20.8m •Performance based sliding scale commission •Anticipate ceded written premium in 2013 to be between $90.0 - $100.0 million •Based upon our 2013 underwriting expectations, •We expect ceded earned premium to be between $140.0 and $150.0 million. •We expect the impact of this agreement to add 1.2 to 1.5 percentage points on our consolidated combined ratio in 2013. •We expect the impact of this agreement to reduce our pre-tax underwriting profit between $9.0 million and $11.0 million. •We expect the impact of this agreement to reduce net operating income by approximately $0.15 per share resulting in net operating income after the Quota share of $27.4 million to $32.4 million, or between $0.55 and $0.65 per share. 14

2011 YTD – 2012 YTD GWP Bridge $1,067m GWP in 2012, or Pro forma $968m after business terminations 15 We experienced $163m or 18% of year over year GWP growth through 12/31/12 •$56m, or 6.2%, related to an increase in rate •$22m, or 2.4%, primarily related to Michigan Workers’ Comp Placement Facility •$85m, or 9%, related to an increase in the exposure base in select programs/specialties/lines We have identified lines / segments / specialties totaling $99 million in 2012 GWP that have been terminated $163 6.2% 9% (11.0%) 2.4% Gross Written Premium ($m)

2012 Actual to 2013 Guidance GWP Overview Reported $1,067m GWP in 2012, anticipating between $970m-$990m* GWP in 2013, after impact of reductions from business termination actions taken in 4Q 2012 •We have full year 2013 GWP guidance of $980m (*midpoint of range), an 8.2% reduction from 2012 •We anticipate 7.5% of rate increases on active business in 2013 (midpoint of 7 - 8% guidance range), including: •Select increases in performing areas include countrywide WC, Southeastern WC, Surety/Bail Bonds and Aviation •Target improved results with limited premium increase in Environmental, Marine, USSU- Excess WC and E&S Division •We expect $20m growth in exposure base business where pricing is strong and risk selection is favorable •We have reduced premium by terminated lines / segments / specialties ($174m) •$86m of expected premium reductions in 2013 from Q4 2012 terminations where prior corrective actions were not sufficient ($100m written premium in 2012 and $14m of run-off premium in 2013) •$88m of expected reduction in active programs related to specific underwriting actions 16 Gross Written Premium ($m) 7.5% (8.1%) (8.2%) 1.9%

Reserves Overview History of Favorable indications through 2010 •Cumulative favorable loss & LAE development of $76.4 million in calendars years 2008 – 2010. •2008 AY loss & LAE ratio has remained stable since 12/31/2010 estimate Historic claim data pattern changed for accident years 2009, 2010, & 2011, result is strengthening reserves by $85.5 million in 2012. In Q2 2012, reserve review we identified average case reserve acceleration driven primarily by three major factors (1) Claims department “Top Ten Exposure” program - Auto Liability and Liability Occurrence (2) Normalization of average case load per adjuster in CA workers’ compensation claims office (3) Public Entity Excess case reserve strengthening / acceleration Prior accident year incurred claim activity stabilized in the fourth quarter •This leveling off of prior year reserves reflects an expected trend toward a lower (than the first three quarters of 2012), historical level of claim emergence as the impacts of the factors above dissipate over time •We expect this to lead to more stable claim development patterns as well Reserves are recorded above the midpoint of our range of estimates in consideration of volatility inherent with disruptions of historical claim development patterns 17

18 Underwriting Focus Accident Year Combined Ratio (Re-Evaluated as of 12/31/2012) 2008 2009 2010 2011 ^ The Re-Evaluated AY combined ratio reflects reserve adjustments made following the accident year, for example, the 93.6% Re- Evaluated 2008 AY combined ratio reflects new loss development information gathered over the 4 years from 12/31/2008 to 12/31/2012 2012 * Represents 2009 - 2012 proforma Accident Year Combined Ratio excluding terminated programs ** Guidance without QS is 98-99%, QS adds 1.2 to 1.5 percentage points to the Combined Ratio 2013 Projected** 5.8% 4.1% 4.4% 1.7% Terminated Programs

19 Underwriting Focus 2012 Cumulative Achieved Written Rate Changes (since 2010) •Since the beginning of 2010, we have experienced the following cumulative achieved written rate changes and loss ratio trends: •We are expecting rate increases between 7% and 8% in 2013 * CMP / GL rates improving in more recent periods; 2012 rates increased 3.4%; 2013 target is 7.1% Approx. Rate IncreaseLoss Ratio TrendWorkers' Comp20%3.9% CA Workers' Comp32%7.7% Commercial Auto10%6.7% CMP / GL2%*11.6% Other5%1.5% Total11%6.3% 2012 - Cummulative since 2010Line of Business

2012 to 2013 Guidance Combined Ratio Overview – Before QS Calendar Year 2012 Combined Ratio of 111.4%. Because of strong underwriting and rate actions, we are well-positioned to achieve a 2013 Combined Ratio between 98% and 99% •Unusual storm activity contributed 1.8 points to the 2012 accident year Combined Ratio and includes 0.8 point from Superstorm Sandy •Earned rate changes of 6% - 7% in 2013 are expected to be in excess of loss ratio trend and lower the loss ratio approximately 2.4 points •Underperforming business that was cancelled as part of the 2012 underwriting actions added 1.7 points to the 2012 AY Combined Ratio •This business will run-off relatively quickly and is expected to add 0.8 points to the 2013 Combined Ratio •Our 2012 underwriting actions will lead to a decrease in 2013 premium and will deleverage some of our fixed costs 20 * Before Swiss Re Quota Share

21 Conservative Investment Philosophy Our high quality investment portfolio is well matched to our loss reserves and generates a predictable stream of income. •Net investment income grew to $53.1M from $36.6M in 2008 •Invested asset base increased to $1.3B ($1.6B including cash & equivalents) at 12/31/2012, from $1.0B ($1.1B including cash & equivalents) at 12/31/2008 •Pre-tax book yield excluding cash and cash equivalents was 3.4% at 12/31/2012 vs. 4.4% at 12/31/2008 •The duration of our portfolio increased to 5.1 years at 12/31/2012 from 4.8 years at 12/31/2008 •The duration on net reserves of $1,074M is approximately 3.8 years at 12/31/2012 •The guidance range for 2013 net investment income is $44 - $45 million. Pre-tax Net Investment Income ($ in M) and Average Investment Yield *4.8 *5.1 *5.0 *4.9 *5.1 *Effective Duration *5.2

22 Gain Harvesting Program Results Gross Realized Gains of $55.3 million, $40.2 million net of taxes Net proceeds in excess of $500 million: •The overall portfolio mix remains consistent with 99% investment grade •Minor change to security sectors with inclusion of a $50 million high dividend equity allocation •The average credit quality remains consistent with an average S&P rating of AA- and Moody’s of Aa3 •Duration remains in line with our strategic asset allocation study at 5.1 years •Interest rate risk remains consistent with the duration extension, also in line with our asset allocation study. We plan to hold securities to maturity thus mitigating the impact of interest rate risk •We observed favorable economics when comparing the present value of the realized gain benefit to the income reduction over a period of 5 years

(1) Remainder of proceeds received from the gain harvesting program to be re-invested during 1Q 2013. As of 2/26/13 $228m has been reinvested in accordance with our investment strategy. Investment Portfolio Review We continue to maintain a high-quality, low-risk investment portfolio. Portfolio Allocation and Quality Low equity risk exposure •98% fixed income •2% equity High credit quality •99% of bonds are investment grade •Average Moody’s rating of Aa3 / S&P rating of AA- Duration •Fixed income effective duration is 5.1 •Duration on Reserves is approximately 3.8 $’s in (000’s) % Allocation 12/31/2012 Fair Value Net Unrealized Gain Position Avg. Moody's Avg. S&P Fixed Income US Government and Agencies 2% $ 27,685 $ 896 Aaa AA+ Corporate 39% $ 507,001 $ 24,711 A3 A- Mortgage and Asset Backed 9% $ 120,968 $ 7,272 Aa1 AA+ Municipal 48% $ 628,973 $ 41,697 Aa2 AA+ Preferred Stock Debt 0% $ 2,179 $ 436 Ba2 BB Total Fixed Income 98% $1,286,806 $ 75,012 Aa3 AA- Equities Preferred Stock 1% $ 8,508 $ 1,578 Mutual Funds 1% $ 14,154 $ 695 Total Equities 2% $ 22,661 $ 2,273 Cash and Short term (1) $ 260,000 23

Investment Considerations 24 Flexible Business Model •Our business model focuses on product and geographic diversification and fee-based revenue, which enable us to balance our revenue sources, leverage our fixed costs and more effectively manage through market cycles Flexible Capital enhancements •We believe the capital enhancements resulting from the harvesting of the realized gains and entering into the reinsurance quota share reinsurance agreement provide the capital flexibility to allow us to take advantage of the firming pricing in our markets and to rebuild our historic track record of stable underwriting results in an efficient and effective manner Firming Insurance Market as pricing outpaces loss ratio trends •2012: Written Rate increase of 6.2%, loss ratio trend of 2.2% •2013E: Written Rate increase between 7% and 8%, loss ratio trend of 2.0% Proven history of generating book value growth •BVPS, with dividends CAGR (12/31/2003-12/31/2012): 9.3% Strong operating cash flows and liquidity •Generate cash flows from both regulated and non-regulated sources, which provides flexibility (cash flows provided by operations was $174.5M, $138.1M, and $122.0M for 2010, 2011, and 2012, respectively) •2012 Cash flows from operations, excluding the impact of the unearned premium transfer were $184.0 million High-quality, low-risk investment portfolio •99% of bonds are investment grade; Average S&P rating of AA- / Moody’s of Aa3 •98% fixed income; 2% equity Strengthened Reserve position •Added $85.5 million to prior year reserves in 2012. Claim activity began to stabilize in Q4

Closing Remarks 25 In Closing: •We experienced an improving loss ratio picture in the fourth quarter, and while not back to where we can and need to be, significant progress has been made. •We are encouraged by the improving trends in our accident year loss ratios, the stabilizing older year reserves, rate increases being achieved, and the benefit of selectively reducing premium volume in underperforming segments of the business. •We are confident that the appropriate corrective actions have been taken and that continued evidence of the targeted improvements will emerge in 2013 and beyond.

27 $100M Convertible Debt Offering •$100 million Cash Convertible Senior Notes •Underlying “Equivalent” Shares – 10.9 million •5.00% Cash Coupon •37.5% Conversion Premium ($9.19 per share) •75% High Call ($11.69 per share) •Net share settlement •Maturity of March 15, 2020 Key Terms •Supporting Meadowbrook’s “A-” A.M. Best FSR •Through increasing the BCAR score •Reduce dependence on quota share arrangement •Take advantage of firming pricing in selected markets •Offers profitable growth opportunities •Funding of HoldCo expenses Use of Proceeds $100,000,000 March 2013 5.00% Cash Convertible Senior Notes due 2020 Interest payable March 15 and September 15 (a) (a) Computed as follows: $100m Convertible Debt / $9.19 Share Price = 10.9 million shares Gross Proceeds$100.0MUse of ProceedsSurplus Enhancement$86.1MCall Spread / Warrants$9.9MFees & Expenses$4.0MTotal Proceeds$100.0M

28 MIG Convertible Note A.We have issued debt with a 5.00% coupon B.We will pay additional cash if our share price exceeds the $9.19 lower strike price (on 10.9 million “equivalent” shares) C.We have bought a bond hedge requiring counter parties to pay us the same amount we pay to the note holders in B above D.We must issue shares to the bond hedge counter parties if market price is above the upper strike price of $11.69 at maturity of the underlying bonds Convert Key Share Prices Share Price ConvertibleConvertibleClosePrice / Price / 3/11/2013Lower StrikeHigher Strike$6.68$9.19$11.6937.5%75.0% $90 $95 $100 $105 $110 $6.68 $7.00 $8.00 $9.00 $10.00 $11.00 $11.69 $12.69 $13.69 $14.69 $15.69 29 MIG Convertible Note Settlement Stock Price at Maturity Payout at Maturity ($ in millions) < $9.19 > $11.69 MIG Convertible + Call Spread Due 2020 Example if share price = $14: 10.9m 'equivalent' shares x $2.31 ($14 market price less $11.69 higher strike price) = $25.1m divided by $14 share price = 1.8m shares MIG Share Price = $9.19$9.19 = MIG Share Price = $11.69MIG Share Price = $11.69NotePay PrincipalPay Principal + Cash Value of Shares Greater than $9.19Pay Principal + Cash Value of Shares Greater than $9.19Bond HedgeNo ActionSettle Hedge; receive cash value of share price in excess of $9.19Settle Hedge; receive cash value of share price in excess of $9.19WarrantNo ActionNo ActionReflect Shares as Market Priceexceeds $11.69*