Exhibit 99.1

Investor PresentationFirst Quarter 2013 Update

* Positioned to Manage Insurance Cycles Diverse Geographic Distribution Our regional perspective provides the infrastructure to achieve geographic diversification, while maintaining our effective local touch. Meadowbrook locations Top 10 production states (2012) 1

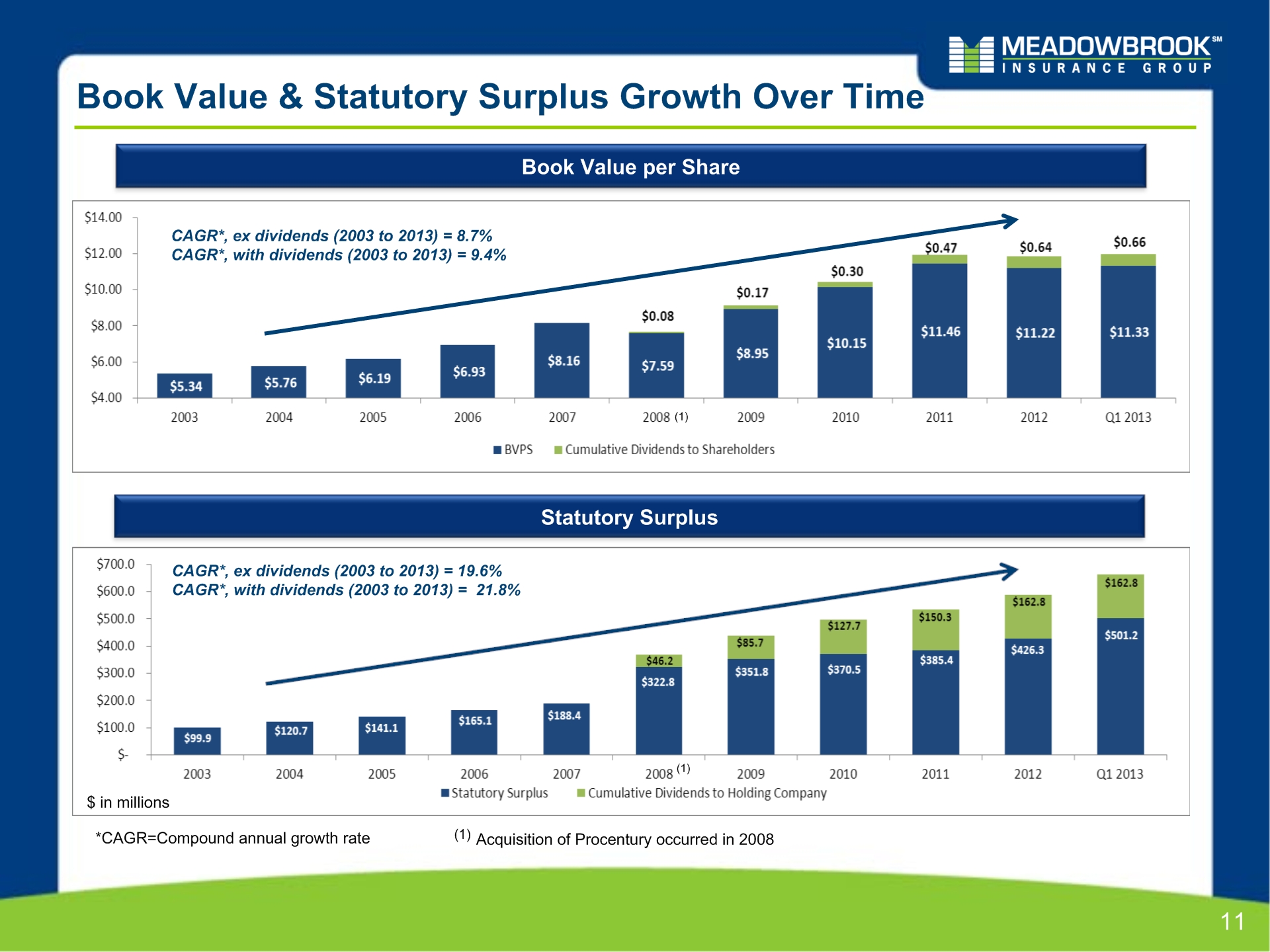

* Book Value & Statutory Surplus Growth Over Time Book Value per Share CAGR*, ex dividends (2003 to 2013) = 8.7%CAGR*, with dividends (2003 to 2013) = 9.4% *CAGR=Compound annual growth rate (1) (1) Acquisition of Procentury occurred in 2008 Statutory Surplus (1) $ in millions CAGR*, ex dividends (2003 to 2013) = 19.6% CAGR*, with dividends (2003 to 2013) = 21.8%

* Q4 2012 Gain Harvesting Program Results Gross Realized Gains of $51m, $37m net of taxes Net proceeds in excess of $500 million:The overall portfolio mix remains consistent with 99% investment gradeMinor change to security sectors with inclusion of a $50 million high dividend equity allocationThe average credit quality remains consistent with an average S&P rating of AA- and Moody’s of Aa3The tax-adjusted duration remains in line with our strategic asset allocation study at 4.7 years at Q1 2013Interest rate risk remains consistent with the duration extension, also in line with our asset allocation study. We plan to hold securities to maturity thus mitigating the impact of interest rate riskWe observed favorable economics when comparing the present value of the realized gain benefit to the income reduction over a period of 5 yearsThe book yield excluding cash & cash equivalents at Q1 2013 is 3.8% (3.3% pre-tax)

* Underwriting Focus Accident Year Combined Ratio (Re-Evaluated as of 12/31/2012) 2008 2009 2010 2011 ^ The Re-Evaluated AY combined ratio reflects reserve adjustments made following the accident year, for example, the 93.6% Re-Evaluated 2008 AY combined ratio reflects new loss development information gathered over the 4 years from 12/31/2008 to 12/31/2012 2012 * Represents 2009 - 2012 pro forma Accident Year Combined Ratio excluding terminated programs ** Guidance without QS is 98-99%, QS adds 1.2 to 1.5 percentage points to the Combined Ratio 2013 Projected** 5.8% 4.1% 4.4% 1.7% Terminated Programs

* Available Levers to Strengthen ROE Elimination of the Swiss Re Quota ShareContinue to demonstrate stable reservesContinue to achieve rate increases in excess of loss ratio trendsExplore low-risk investment opportunities that enhance the tax-equivalent yields Operating and Capital Initiatives Optimize net underwriting leverage, enhance underwriting profits and net investment income to increase ROE contribution from premiums writtenReduce the capital charge associated with the overall reserve risk, reducing our overall required capitalExpand underwriting margins to increase ROE contribution from premiums writtenMaximize investment returns while optimizing asset and credit risk capital charges to increase ROE contribution from invested assets. Optimize capital charge and enhance statutory surplus Operating targets become more achievable as underwriting results improve, cost of capital decreases and investment environment becomes more favorable Impact on ROE

Closing Remarks * In Closing:Our first quarter results were consistent with our expectations. We are committed to our business plan and returning to our historic levels of underwriting profitability in the near term. We have enhanced our statutory surplus, stabilized reserves, continued to achieve rate increases in excess of loss ratio trends, and terminated underperforming programs and business. With these actions, we have returned to operating profitability and increased statutory surplus by $74.9 million during the quarter. We are also pleased that A.M. Best has affirmed our “A-“(excellent) financial strength rating.