QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

NEW WORLD RESTAURANT GROUP, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

1687 Cole Boulevard

Golden, Colorado 80401

April 11, 2005

Dear Stockholder:

You are cordially invited to the 2005 Annual Meeting of Stockholders of New World Restaurant Group, Inc., to be held on May 12, 2005 at 9:00 a.m., Mountain Time, at our offices located at 1687 Cole Boulevard, Golden, Colorado 80401.

At the Annual Meeting, you will be asked to consider and vote upon proposals (1) to elect six directors to serve until the 2006 Annual Meeting of Stockholders, and until their respective successors are elected and qualified; (2) to approve amendments to our Executive Employee Incentive Plan; (3) to approve amendments to our Stock Option Plan for Independent Directors; and (4) to ratify the appointment of Grant Thornton LLP as our independent auditors for the fiscal year ending January 3, 2006.

Enclosed with this letter is a proxy authorizing our officers to vote your shares for you if you do not attend the Annual Meeting. Whether or not you are able to attend the Annual Meeting, I urge you to complete your proxy and return it in the enclosed addressed, postage-paid envelope, as a quorum of the stockholders must be present at the Annual Meeting, either in person or by proxy.

I would appreciate your immediate attention to the mailing of this proxy.

| | | Yours truly, |

|

|

|

|

|

Paul J.B. Murphy, III

President and Chief Executive Officer |

1687 Cole Boulevard

Golden, Colorado 80401

Notice of Annual Meeting of Stockholders

To Be Held on May 12, 2005

You are cordially invited to attend the annual meeting of stockholders of New World Restaurant Group, Inc., which will be held at our offices at 1687 Cole Boulevard, Golden, Colorado 80401 on May 12, 2005 at 9:00 a.m., Mountain Time, for the following purposes:

- 1.

- To elect six directors to serve until the 2006 Annual Meeting of Stockholders, and until their respective successors are elected and qualified;

- 2.

- To approve amendments to the Executive Employee Incentive Plan;

- 3.

- To approve amendments to the Stock Option Plan for Independent Directors;

- 4.

- To ratify the appointment of Grant Thornton LLP as our independent auditors for the fiscal year ending January 3, 2006; and

- 5.

- To transact such other business as may properly come before the meeting.

The close of business on April 8, 2005 has been set as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and any and all adjournments.

It is important that your shares be represented at the Annual Meeting regardless of the size of your holdings. Whether or not you expect to attend the Annual Meeting, please complete, date and sign the enclosed proxy and return it in the envelope provided for that purpose, which does not require postage if mailed in the United States. The proxy is revocable at any time prior to its use.

| | |  |

|

|

Jill B.W. Sisson

Secretary |

Golden, Colorado

April 11, 2005

YOU ARE URGED TO MARK, DATE AND SIGN THE ENCLOSED

PROXY AND RETURN IT PROMPTLY. THE PROXY IS

REVOCABLE AT ANY TIME PRIOR TO ITS USE.

NEW WORLD RESTAURANT GROUP, INC.

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

May 12, 2005

The accompanying proxy is solicited by the board of directors of New World Restaurant Group, Inc., a Delaware corporation (the "Company"), for use at the 2005 Annual Meeting of Stockholders to be held at our offices located at 1687 Cole Boulevard, Golden, Colorado 80401, on May 12, 2005, at 9:00 a.m., Mountain Time, and at any and all adjournments and postponements thereof (the "Annual Meeting"). The proxy may be revoked at any time before it is voted. If no contrary instruction is received, signed proxies returned by stockholders will be voted in accordance with the board of directors' recommendations.

This proxy statement and accompanying proxy are first being sent to stockholders on or about April 18, 2005.

Shares Outstanding and Voting Rights

Our board of directors has fixed the close of business on April 8, 2005 as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting. Our only outstanding voting stock is our common stock, $0.001 par value per share, of which 9,848,713 shares were outstanding as of the close of business on the record date. Each outstanding share of common stock is entitled to one vote.

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to us (Attention: Secretary) a written notice of revocation or a duly executed proxy bearing a later date, or by attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not in itself constitute the revocation of a proxy.

At the Annual Meeting, stockholders will vote on proposals to elect six directors to serve until the 2006 Annual Meeting of Stockholders, and until their respective successors are elected and qualified (Proposal 1); to approve amendments to the Executive Employee Incentive Plan (Proposal 2); to approve amendments to the Stock Option Plan for Independent Directors (Proposal 3); and to ratify our selection of independent auditors for the fiscal year ending January 3, 2006 (Proposal 4).

Stockholders representing one-third in voting power of the shares of stock outstanding and entitled to vote must be present or represented by proxy in order to constitute a quorum to conduct business at the Annual Meeting. With respect to the election of directors, our stockholders may vote in favor of the nominees, may withhold their vote for all of the nominees, or may withhold their vote as to specific nominees. Under the Delaware General Corporation Law ("DGCL") and our Restated Certificate of Incorporation, the affirmative vote of the holders of a majority in voting power of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote thereon is required to approve each of Proposals 1, 2, 3 and 4.

Abstentions may be specified on all proposals and will be counted as present for the purposes of the proposal for which the abstention is noted. A vote withheld for a nominee in the election of directors will have the same effect as a vote against the nominee. For purposes of determining whether any of the other proposals has received the requisite vote, where a stockholder abstains from voting, it will have the same effect as a vote against the proposal.

The independent tabulator appointed for the Annual Meeting will tabulate votes cast by proxy or in person at the Annual Meeting. For the purposes of determining whether a proposal has received the requisite vote of the holders of the common stock in instances where brokers are prohibited from

1

exercising or choose not to exercise discretionary authority for beneficial owners who have not provided voting instructions (so-called "broker non-votes"), those shares of common stock will not be included in the vote totals and, therefore, will have no effect on the vote on any of the proposals. Pursuant to the NASD Rules of Fair Practice, brokers who hold shares in street name have the authority, in limited circumstances, to vote on certain items when they have not received instructions from beneficial owners. A broker will only have such authority if:

- •

- the broker holds the shares as executor, administrator, guardian or trustee or is a similar representative or fiduciary with authority to vote; or

- •

- the broker is acting pursuant to the rules of any national securities exchange of which the broker is also a member.

Under these rules, absent authority or directions as described above, brokers will not be able to vote on Proposals 2 and 3.

Costs of Solicitation

We will pay the cost of soliciting proxies for the Annual Meeting. Proxies may be solicited by our regular employees in person, or by mail, courier, telephone or facsimile. Arrangements also may be made with brokerage houses and other custodians, nominees and fiduciaries for the forwarding of solicitation material to the beneficial owners of stock held of record by such persons. We may reimburse such brokerage houses, custodians, nominees and fiduciaries for reasonable out-of-pocket expenses incurred by them in connection therewith.

Annual Report

Our 2004 Annual Report on Form 10-K, including consolidated financial statements as of and for the year ended December 28, 2004, is being distributed to all stockholders entitled to vote at the annual meeting together with this proxy statement, in satisfaction of the requirements of the Securities and Exchange Commission (the "SEC"). Additional copies of the Annual Report are available at no charge upon request. To obtain additional copies of the Annual Report, please contact us at 1687 Cole Boulevard, Golden, Colorado 80401, Attention: Secretary, or at telephone number (303) 568-8000. The Annual Report does not form any part of the materials for the solicitation of proxies.

VOTING SECURITIES AND PRINCIPAL HOLDERS

As of April 8, 2005, we had 9,848,713 shares of common stock outstanding (excluding certain options and warrants), which are our only outstanding voting securities. In addition, we had 57,000 shares of Series Z preferred stock outstanding. The following table sets forth information regarding the beneficial ownership of our common stock as of April 8, 2005, by:

- •

- each person (or group of affiliated persons) who is known by us to own beneficially more than 5% of our common stock;

- •

- each of our executive officers;

- •

- each of our current directors; and

- •

- all directors and executive officers as a group.

2

Beneficial Owner**

| | Amount and Nature of

Beneficial Ownership

| | Percentage

| |

|---|

Greenlight Capital, L.L.C.

420 Lexington Avenue, Suite 1740

New York, NY 10107 | | 10,041,649 | (1) | 97.1 | % |

| Paul J.B. Murphy, III | | 40,000 | (2) | * | |

| Michael J. Mrlik II | | 18,750 | (3) | * | |

| Richard P. Dutkiewicz | | 18,750 | (3) | * | |

| Jill B.W. Sisson | | 18,750 | (3) | * | |

| Susan E. Daggett | | 35,000 | (4) | * | |

| Michael W. Arthur | | 0 | (5) | 0 | % |

| John S. Clark II | | 498 | (6) | * | |

| E. Nelson Heumann | | 0 | (7) | 0 | % |

| Frank C. Meyer | | 0 | (5) | 0 | % |

| S. Garrett Stonehouse, Jr. | | 0 | (5) | 0 | % |

| Leonard Tannenbaum | | 13,367 | (8) | * | |

| All directors and executive officers as a group (11 persons) | | 126,065 | (9) | * | |

- *

- Less than one percent (1%)

- **

- The address for each officer and director is 1687 Cole Blvd., Golden, Colorado 80401.

- (1)

- Based on an amendment to a Schedule 13D filed with the SEC on October 15, 2003. The Schedule 13D was filed on behalf of Greenlight Capital, L.L.C., Greenlight Capital, L.P., of which Greenlight Capital, L.L.C. is the general partner, Greenlight Capital Offshore, Ltd., for whom Greenlight Capital, L.L.C. acts as investment advisor, Greenlight Capital Qualified, L.P., of which Greenlight Capital, L.L.C. is the general partner, and David Einhorn, the principal of Greenlight Capital, L.L.C. Includes 493,682 shares of common stock that may be acquired upon the exercise of warrants.

- (2)

- Includes 40,000 shares of common stock, which may be acquired upon exercise of presently exercisable options. Does not include 106,667 shares of common stock subject to stock options, which are not exercisable within 60 days.

- (3)

- Includes 18,750 shares of common stock, which may be acquired upon exercise of presently exercisable options. Does not include 50,000 shares of common stock subject to stock options, which are not exercisable within 60 days.

- (4)

- Includes 35,000 shares of common stock, which may be acquired upon exercise of presently exercisable options. Does not include 93,333 shares of common stock subject to stock options, which are not exercisable within 60 days.

- (5)

- Does not include 10,000 shares of common stock subject to stock options, which are not exercisable within 60 days.

- (6)

- Shares of common stock which may be acquired upon the exercise of presently exercisable options. Does not include 10,000 shares of common stock subject to stock options, which are not exercisable within 60 days.

- (7)

- Does not include 10,041,649 shares of common stock beneficially owned by Greenlight Capital, L.L.C. and its affiliates, over which Mr. Heumann disclaims beneficial ownership. Mr. Heumann is an officer of Greenlight.

- (8)

- Includes 10,830 shares of common stock, which may be acquired upon the exercise of presently exercisable options. Also includes 1,163 shares of common stock, which may be acquired upon the

3

exercise of presently exercisable warrants. Does not include 10,000 shares of common stock subject to stock options, which are not exercisable within 60 days.

- (9)

- Includes a total of 123,528 shares of common stock, which may be acquired upon the exercise of presently exercisable options and 1,163 shares of common stock, which may be acquired upon the exercise of presently exercisable warrants.

Series Z Preferred Stock

Our Series Z Preferred Stock generally is non-voting. However, under our Certificate of Designation, Preferences and Rights of Series Z Preferred Stock (the "Certificate of Designation"), we cannot take any of the following actions without the vote or written consent by the holders of at least a majority of the then outstanding shares of the Series Z Preferred Stock:

- •

- amend, alter or repeal any provision of, or add any provision to, the Certificate of Designation, whether by merger, consolidation or otherwise;

- •

- subject to the clause above, amend, alter or repeal any provision of, or add any provision to, our Certificate of Incorporation or bylaws, whether by merger, consolidation or otherwise, except as may be required to authorize a Certificate of Designation for stock junior to the Series Z Preferred Stock, or to increase the authorized amount of any junior stock, including junior stock issued to management or employees under equity incentive plans;

- •

- authorize or issue shares of any class of stock having any preference or priority as to dividends, assets or payments in liquidation superior to or on a parity with the Series Z Preferred Stock, including, without limitation, Series Z Preferred Stock, whether by merger, consolidation or otherwise;

- •

- take any action that results in us or any of our direct or indirect subsidiaries incurring or assuming indebtedness (including the guaranty of any indebtedness) in excess of the greater of $185 million or 3.75 times EBITDA for the trailing 12-month period prior to such date;

- •

- consummate any merger or change of control that does not result in the redemption of the Series Z Preferred Stock at the stated redemption price, payable in cash, at the effective time of the merger or change of control transaction;

- •

- make any restricted payment in violation of the covenant set forth in the Certificate of Designation; or

- •

- enter into any agreement to do any of the foregoing items.

All 57,000 shares of our outstanding Series Z Preferred Stock are held by Halpern Denny Fund III, L.P. These shares were issued in our equity recapitalization completed in September 2003 in exchange for 56,237,994 shares of Series F Preferred Stock, 386,427 shares of common stock and warrants to purchase 227,747 shares of common stock.

PROPOSAL 1

ELECTION OF DIRECTORS

Our board of directors currently consists of seven directors. Our certificate of incorporation, as amended, provides that all directors are to be elected annually. At the Annual Meeting, the stockholders will elect six directors to serve until the 2006 Annual Meeting of Stockholders, and until their respective successors are duly elected and qualified. There will be one vacancy which the Board intends to fill as soon as a qualified candidate is identified and agrees to serve. Stockholders are not entitled to cumulate votes in the election of directors and may not vote for a greater number of persons than the number of nominees named.

4

We are soliciting proxies in favor of the re-election of each of the nominees identified below. We intend that all properly executed proxies will be voted for these six nominees unless otherwise specified. All nominees have consented to serve as directors, if elected. If any nominee is unwilling to serve as a director at the time of the Annual Meeting, the persons who are designated as proxies intend to vote, in their discretion, for such other persons, if any, as may be designated by the board of directors. The proxies may not vote for a greater number of persons than the number of nominees named. As of the date of this proxy statement, the board of directors has no reason to believe that any of the persons named below will be unable or unwilling to serve as a nominee or as a director if elected. Greenlight Capital, L.L.C. has indicated its intention to vote in favor of each of the nominees.

Information About the Nominees

The names of the nominees, their ages as of April 8, 2005, and other information about them are set forth below:

Michael W. Arthur. Mr. Arthur, 65, was appointed to the board of directors in October 2004. Since 1990, Mr. Arthur has headed, Michael Arthur and Associates, a consulting and interim management firm specializing in restructurings, business development, and strategic, financial, marketing and branding strategies. Prior to 1990, Mr. Arthur served as Executive Vice President and Chief Financial Officer for Sizzler Restaurants and Pinkerton Security; Vice President of Marketing for Mattel Toys; and also served in various other management roles for D'Arcy, Masius, Benton & Bowles Advertising and Procter and Gamble. Mr. Arthur has a B.A. degree from Johns Hopkins University and attended the Wharton Graduate School of Business.

E. Nelson Heumann. Mr. Heumann, C.F.A., 47, has served as our director since May 2004 and as Chairman of the Board since October 2004. Mr. Heumann joined Greenlight Capital, Inc., an investment management firm, in March 2000 and was made a managing member of Greenlight Capital, L.L.C. in January 2002. Prior to joining Greenlight, he served as director of distressed investments at SG Cowen from January 1997 to January 2000. From 1990 to January 1997, Mr. Heumann was a director responsible for distressed debt research and trading at Schroders. Prior to that, he was vice-president of bankrupt and distressed debt research for Merrill Lynch. Earlier in his career, Mr. Heumann was employed with Claremont Group, a leveraged buyout firm, and Value Line. He graduated from Louisiana State University in 1980 with a B.S. in Mechanical Engineering and in 1985 with an M.S. in Finance.

Frank C. Meyer. Mr. Meyer, 61, has served as our director since May 2004 and is a private investor. He was chairman of Glenwood Capital Investments, LLC, a venture capital firm he co-founded, from January 1988 to January 2004. Since 2000, Glenwood Capital has been a wholly owned subsidiary of the Man Group, plc, an investment advisor based in England specializing in alternative investments. Mr. Meyer also serves on the board of directors of Quality Systems, Inc., which specializes in software solutions for medical and dental professionals. Mr. Meyer holds an M.B.A. from the University of Chicago and began his career at the University's School of Business as an instructor of statistics.

Paul J.B. Murphy, III. Mr. Murphy, 50, was appointed Chief Executive Officer and Acting Chairman in October 2003. He served as Acting Chairman until October 2004. Mr. Murphy joined us in December 1997 as Senior Vice President—Operations and had served as Executive Vice President—Operations since March 1998. Mr. Murphy was appointed our Chief Operating Officer in June 2002. From July 1996 until December 1997, Mr. Murphy was Chief Operating Officer of one of our former area developers. From August 1992 until July 1996, Mr. Murphy was Director of Operations of R&A Foods, L.L.C., an area developer of Boston Chicken. Mr. Murphy has a B.A. degree from Washington and Lee University.

5

S. Garrett Stonehouse, Jr. Mr. Stonehouse, 35, has served as our director since February 2004. He has been a principal and founding partner of MCG Global, LLC, a private equity investment firm in Westport, CT, since 1995. Prior to co-founding MCG Global, he was vice president of Fidelco Capital Group. Before joining Fidelco in 1994, he held various positions with GE Capital. Mr. Stonehouse received a B.A. degree from Boston College in economics and mathematics.

Leonard Tannenbaum. Mr. Tannenbaum, C.F.A., 33, has served as our director since March 1999. In July 2004, Mr. Tannenbaum founded Fifth Street Capital LLC and is the managing partner. Prior to July 2004, Mr. Tannenbaum was the Managing Partner at MYFM Capital, LLC, a boutique investment banking firm, and a partner at BET, a capital fund, since October 1998. From 1997 until October 1998, Mr. Tannenbaum was a partner at LAR Management, a hedge fund. From 1996 until 1997, he was an assistant portfolio manager at Pilgrim Baxter and Co. From 1994 until 1996, he was an Assistant Vice President in the small company group of Merrill Lynch. Mr. Tannenbaum has an M.B.A. in Finance and a Bachelors of Science in Management from the Wharton School at the University of Pennsylvania.

Board Composition

Our board of directors has determined that Michael W. Arthur, Frank C. Meyer, John S. Clark II, S. Garrett Stonehouse, Jr. and Leonard Tannenbaum, all current directors, qualify as "independent" directors under the rules promulgated by the Securities and Exchange Commission (the "SEC") under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and by the Nasdaq Stock Market. There are no family relationships among any of our executive officers, directors or nominees for director.

Mr. Clark, who serves on the Compensation Committee, will no longer serve as a director following the Annual Meeting. Following the Annual Meeting, we will reconstitute our Compensation Committee and intend that each member will be independent.

Greenlight Capital, L.L.C. currently owns shares of our common stock sufficient to elect all of the members of our board of directors without the approval of any other stockholder.

Director Compensation

Each of our non-employee independent directors receives a $15,000 annual retainer, plus $2,000 for each board meeting and $1,000 for each committee meeting attended. In addition, on January 1 of each year, each independent director receives a grant of options to purchase 10,000 shares of common stock which vest six months after the date of grant and, unless earlier terminated, or exercised, expire five years after grant date. Subject to stockholder approval of Proposal 3, any director elected or appointed during the year will receive a pro rata grant of options based on his date of election. All directors are reimbursed for out-of-pocket expenses incurred by them in connection with attendance at board meetings and committee meetings.

There were no other arrangements pursuant to which any director was compensated during the fiscal year-ended December 28, 2004.

Meetings of the Board of Directors and Committees

The board of directors held 10 meetings during fiscal 2004 and took action by written consent on two occasions. During fiscal 2004, no director then in office attended fewer than 75% of the aggregate total number of meetings of the board of directors held during the period in which he was a director and of the total number of meetings held by all of the committees of the board of directors on which he served. The two standing committees of the board of directors are the audit committee and the compensation committee.

6

We have not established a policy on director attendance at annual stockholders' meetings; however, all of our directors then in office attended our last Annual Meeting held in May 2004.

Our board of directors has not established a process for our stockholders to communicate directly with the board because of the fact that Greenlight owns 97% of the voting shares and it was not deemed necessary or appropriate.

Leonard Tannenbaum (chairman), Michael W. Arthur and Frank C. Meyer are the current members of the audit committee. Each of them is "independent" as required by the rules promulgated by the SEC under the Exchange Act, and by the Nasdaq Stock Market. Each of them also meets the financial literacy requirements of the Nasdaq Stock Market. Our board of directors has determined that Mr. Arthur qualifies as an "audit committee financial expert" as defined by the rules promulgated by the SEC.

The audit committee is primarily concerned with monitoring:

- (1)

- the integrity of our financial statements;

- (2)

- our compliance with legal and regulatory requirements; and

- (3)

- the independence and performance of our auditors.

The audit committee also is responsible for handling complaints regarding our accounting, internal accounting controls or auditing matters. The audit committee's responsibilities are set forth in its charter, which was amended and restated in January 2004, and was reviewed and re-approved by the audit committee in March 2005. The charter is available on our website atwww.nwrgi.com. The audit committee held eleven meetings and took action once by written consent during fiscal 2004.

Leonard Tannenbaum (chairman), John S. Clark II and S. Garrett Stonehouse, Jr. are the current members of the compensation committee. Each of them is "independent" as defined in the rules promulgated by the SEC under the Exchange Act and by the Nasdaq Stock Market. This committee is primarily concerned with determining the compensation of our employees generally and approving compensation of our executive officers. The committee does not establish or recommend compensation for our independent directors, which is approved by the board of directors as a whole.

The compensation committee's responsibilities are set forth in its charter, which was amended and restated in January 2004, and was reviewed and re-approved in March 2005. The charter is available on our website atwww.nwrgi.com. The compensation committee held five meetings and took action once by written consent during fiscal 2004.

Because Mr. Clark will no longer serve as a director following the Annual Meeting, we may appoint an additional director to the compensation committee. We intend that all directors appointed to the compensation committee will be independent.

The nominees for re-election to our board at the Annual Meeting were formally nominated by Messrs. Arthur, Clark, Heumann, Meyer, Murphy, Stonehouse, and Tannenbaum. The Company does not have a standing nominating committee or committee performing similar functions. Although the board will consider nominees recommended by stockholders, the board has not established any specific procedures for stockholders to follow to recommend potential director nominees for consideration. Messrs. Arthur, Clark, Heumann, Meyer, Murphy, Stonehouse, and Tannenbaum participated in the consideration of director nominees.

7

At this time, the Board has neither established any specific written procedures for identifying and evaluating potential director nominees nor established any minimum qualifications or skills for directors. Because of the fact that Greenlight owns more than 97% of the voting stock and, as such, the company is a "controlled company", the Board did not deem it necessary to adopt specific written procedures.

Compensation Committee Interlocks and Insider Participation

None of the members of our compensation committee is an officer or employee of New World Restaurant Group. None of our executive officers serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our board of directors or compensation committee.

Required Vote

Directors will be elected by a majority of the votes of the holders of shares present in person or by proxy at the Annual Meeting. Greenlight Capital, L.L.C. has indicated its intention to vote in favor of each of the nominees.

Recommendation

The board of directors recommends that stockholders vote FOR each of the nominees for director. If not otherwise specified, proxies will be voted FOR each of the nominees for director.

PROPOSAL 2

APPROVAL OF AMENDMENT TO EXECUTIVE EMPLOYEE INCENTIVE PLAN

We are asking you to approve an amendment to the New World Restaurant Group, Inc. 2004 Executive Employee Incentive Plan (the "Incentive Plan"). On November 21, 2003, our board of directors adopted the Incentive Plan. On December 19, 2003, our compensation committee amended the Incentive Plan to be effective as of December 19, 2003, subject to stockholder approval. The Incentive Plan was approved by our stockholders at the 2004 Annual Meeting. A copy of the Incentive Plan, as approved by our stockholders, is attached to this proxy statement as Annex A.

At the March 1, 2005 Compensation Committee Meeting and Board of Directors' Meeting, the Compensation Committee and the Board approved an amendment to the Incentive Plan (1) to increase the number of shares authorized under the Plan from 900,000 to 1,150,000 and (2) to provide that all options vest upon a change in control of the Company. A copy of the Amendment to the Incentive Plan incorporating these changes is attached to this proxy statement as Annex B.

Amendment Increasing Shares Authorized

The number of shares that may be issued pursuant to options granted under the Incentive Plan currently is 900,000. The amendment increases the number of shares by 250,000 shares to 1,150,000 shares. As of April 6, 2005, and prior to the amendment, there were 197,250 shares remaining for which options may be granted to existing participants to provide incentives and encourage stock ownership. One-half of the outstanding options vest upon the passage of time and one-half vest based upon meeting EBITDA (earnings before income taxes, depreciation, and amortization) targets for the first three years of the option. Options to purchase 61,250 shares have already been cancelled based on 2004 EBITDA results, and because the terms of currently outstanding options are tied to future EBITDA, a substantial portion of those options may never vest. Nonetheless, these options are considered outstanding until such time as they are actually cancelled, and as such, they count against the number of shares for which options may be granted under the Incentive Plan. The Board has

8

approved and recommends stockholder approval of the increase in available shares in order to provide flexibility in providing options as incentives and designing compensation strategies.

Amendment Vesting Options Upon Change in Control

The amendment to the Incentive Plan also provides that all options will vest and be exercisable upon a change in control of the Company. Prior to the amendment, the Incentive Plan gave the Committee the authority to vest options upon a change in control of the Company.

The amendments to the Incentive Plan are subject to stockholder approval and will become effective only if Proposal 2 is approved by the requisite vote of stockholders at the Annual Meeting

Summary of the Incentive Plan

The primary purposes of the Incentive Plan are to provide those who are selected for participation with added incentives to continue in our long term service and to create in such persons a more direct interest in the future success of our operations by relating incentive compensation to increases in stockholder value, so that the income of those participating in the Incentive Plan is more closely aligned with the income of our stockholders. The Incentive Plan is also designed to provide a financial incentive that will help us attract, retain and motivate the most qualified employees and consultants.

The Incentive Plan permits the grant of incentive and non-qualified stock options. Our eligible employees and consultants may receive options under the Incentive Plan. Currently, we have approximately 21 employees, and one consultant, who may be eligible to receive options under the Incentive Plan. The Committee has the authority to grant options under the Incentive Plan to employees and consultants, and may, under certain circumstances, delegate to our officers the authority to grant options to specified groups of employees and consultants. References in the following discussion to the Committee's power to make option grants and establish the terms of options shall include our officers to whom such power has been delegated by the Committee.

The awards that will be granted under the Incentive Plan in the future to eligible employees and consultants are not determinable because the Committee may choose to grant options or may choose to decline to grant options in accordance with the Committee's existing policies and the terms of the Incentive Plan. Options that have been granted under the Incentive Plan are set forth in the "New Plan Benefits" table below. The Incentive Plan terminates December 19, 2013. The market value of the shares of common stock that may be awarded under the Incentive Plan is approximately $3.68 million, which is based on the maximum number of shares that may be awarded under the Incentive Plan, after amendment, multiplied by $3.20, the last reported sales price of the common stock in the "pink sheets" on April 8, 2005.

Our board of directors believes it is in our best interests to approve the amendments to the Incentive Plan and recommends that our stockholders approve these amendments. The principal features of the Incentive Plan are summarized below.

Administration of the Incentive Plan

Our compensation committee (the "Committee") will administer and interpret the Incentive Plan subject to the authority of the Committee to delegate certain functions to our officers. The Committee will be structured at all times so that it satisfies the requirements for the exemption pursuant to Rule 16b-3 under the Exchange Act.

9

Authorized Shares

Our board of directors has previously reserved 900,000 shares of common stock for issuance under the Incentive Plan. The amendment of the Incentive Plan would increase the number of shares from 900,000 to 1,150,000.

Adjustments

The number of shares is subject to adjustment on account of stock splits, stock dividends, recapitalizations and other dilutive changes in our common stock. The Committee also has discretion to make adjustments in the event of an asset distribution by us, a grant to stockholders to acquire additional shares on a pro rata basis or any other changes in the outstanding common stock.

Terms of Options

The Incentive Plan provides for the grant of either incentive stock options within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended (the "Code"), or non-qualified options. Incentive options may be granted only to employees.

The Committee has the sole discretion to determine the employees and consultants to whom options may be granted, the type of options granted and the manner in which the options will vest. An incentive option, however, can vest each year with respect to no more than $100,000 in value of common stock based upon fair market value of the common stock on the date of grant of the incentive option. Options covering no more than 300,000 shares of common stock in the aggregate may be granted to a single participant during the life of the Incentive Plan unless otherwise approved by our stockholders.

The Committee determines the option term, which can be no longer than ten years (five years in case of an incentive option granted to an employee who owns 10% or more of our common stock). The Committee determines the exercise price for each option, which may be more than or equal to the fair market value of the common stock subject to the options on date of grant. Incentive options must have an exercise price that is at least equal to fair market value of the common stock on the date the incentive option is granted (at least equal to 110% of fair market value in the case of an incentive option granted to an employee who owns 10% or more of our common stock).

An option holder may exercise an option by written notice and payment of the exercise price:

- •

- in cash;

- •

- by certified, cashier's or other check acceptable to us;

- •

- by the surrender of a number of shares of common stock already owned by the option holder for at least six months and with a fair market value equal to the exercise price;

- •

- through a broker's transaction by directing the issuance of a certificate for the common stock to a broker who will sell all or a portion of such common stock to pay the exercise price or make a loan to the option holder to permit the option holder to pay the exercise price; or

- •

- in any combination of the foregoing methods.

The Committee may allow option holders who are subject to withholding of federal and state income tax as a result of exercising an option to satisfy the income tax withholding obligation through the withholding of a portion of the common stock to be received upon the exercise of the option.

10

Non-Transferability

Except as permitted by law, unless otherwise determined by the Committee and provided in the option agreement, options are non-transferable, except by will or pursuant to the laws of descent and distribution and may be exercised during the lifetime of the holder thereof only by such holder (or, in the event of incapacity, his or her guardian or legal representative).

Effect of Termination of Services

Unless the Committee specifies otherwise, the following provisions apply with respect to the exercisability of an option following the termination of the holder's services. If the holder's employment or consulting relationship terminates because the holder becomes disabled, the option will terminate one year after termination. If the holder is terminated for cause, the option is void for all purposes. If the holder dies while employed or while a consultant, or within the exercisability period described above, the option will terminate one year after the date of death. If the holder's employment or consulting relationship terminates other than for cause, disability or death, the option will expire three months from the date of termination. In all cases, the option may be exercised only to the extent it was vested at the date the employment or consulting relationship is terminated, and only if it has not expired according to its terms.

Merger and Reorganization

Upon the occurrence of:

- •

- our merger or consolidation (other than a merger or consolidation in which we are the continuing corporation and that does not result in any changes in the outstanding shares of common stock);

- •

- the sale of all or substantially all of our assets (other than a sale in which we continue as the holding company of an entity that conducts the business formerly conducted by us);

- •

- our dissolution or liquidation; or

- •

- any other transaction determined by resolution of the board to be similar,

the Committee may:

- (1)

- determine that any or all options will become fully exercisable;

- (2)

- determine that any or all options will be assumed or substituted by the successor or purchaser in the transaction; or

- (3)

- make any other provision for the options as the Committee deems appropriate.

The amendment of the Incentive Plan provides that upon the occurrence of a "change of control" of us, all options outstanding under the Incentive Plan shall be fully vested and immediately exercisable. A "change of control" means any transaction or event occurring on or after the date of the Incentive Plan as a direct or indirect result of which:

- (a)

- any person or any group in the aggregate equity interests (other than Greenlight Capital, L.L.C. and its affiliates) shall

- •

- beneficially own (directly or indirectly) more than 50% of the aggregate voting power of all of our equity interests at the time outstanding; or

- •

- have the right or power to appoint a majority of our board of directors;

- (b)

- during any period of two consecutive years, individuals who at the beginning of such period constituted our board of directors (together with any new directors whose election by such

11

Amendment and Termination

The board may amend, modify or terminate the Incentive Plan in any respect at any time, but no amendment can impair any option previously granted or deprive an option holder of any common stock acquired without the option holder's consent. We will obtain stockholder approval of amendments to the extent required by applicable laws or rules. The Incentive Plan will terminate on December 19, 2013, unless sooner terminated by the board.

Federal Income Tax Consequences

The following summary generally describes the principal federal (but not state and local) income tax consequences of option grants made pursuant to the Incentive Plan. It is general in nature and is not intended to cover all tax consequences that may apply to a particular recipient or to us. In particular, this summary is qualified in its entirety by the discussion of Section 162(m) of the Code, discussed below under "Limitations on Deductions." The provisions of the Code and the regulation thereunder relating to these matters are complicated and their impact in any one case may depend upon the particular circumstances.

Non-Qualified Options. When a non-qualified option is granted, there are no income tax consequences for the option holder or us. When a non-qualified option is exercised, in general, the option holder recognizes compensation equal to the excess of the fair market value of the common stock on the date of exercise over the exercise price. The compensation recognized by an employee is subject to income tax withholding. We are entitled to a deduction equal to the compensation recognized by the option holder for our taxable year that ends with or within the taxable year in which the option holder recognized the compensation.

Incentive Options. When an incentive option is granted, there are no income tax consequences for the option holder or us. When an incentive option is exercised, the option holder does not recognize income and we do not receive a deduction. The option holder must, however, treat the excess of the fair market value of the common stock on the date of exercise over the exercise price as an item of adjustment for purposes of the alternative minimum tax. If the option holder makes a "disqualifying disposition" of the common stock (described below) in the same taxable year that the incentive option was exercised, there are no alternative minimum tax consequences.

If the option holder disposes of the common stock after the option holder has held the common stock for at least two years after the incentive option was granted and 12 months after the incentive option was exercised, the amount the option holder receives upon disposition over the exercise price is treated as long-term capital gain for the option holder. We are not entitled to a deduction. If the option holder makes a "disqualifying disposition" of the common stock by disposing of the common stock before it has been held for at least two years after the incentive option was granted and one year

12

after the date the incentive option was exercised, the option holder recognizes compensation income equal to the excess of:

- •

- fair market value of the common stock on the date the incentive option was exercised or, if less, the amount received on the disposition over

- •

- the exercise price.

At present, we are not required to withhold. We are entitled to a deduction equal to the compensation recognized by the option holder for our taxable year that ends with or within the taxable year in which the option holder recognized the compensation.

Limitations on Deductions. Under Section 162(m) of the Code, we may be limited as to federal income tax deductions to the extent that total annual compensation in excess of $1,000,000 is paid to our chief executive officer or any one of the other four highest-paid executive officers who are employed by us on the last day of the taxable year. Certain "performance-based compensation," the material terms of which are disclosed to and approved by stockholders, is not, however, subject to this limitation on deductibility. We have structured the Incentive Plan with the intention that the compensation with respect to options would be qualified performance-based compensation and would be deductible without regard to the limitations otherwise imposed by Section 162(m) of the Code.

Vote Required

The affirmative vote of the holders of a majority of the shares of common stock present in person or by proxy and entitled to vote on this proposal is required to approve Proposal 2. Greenlight Capital, L.L.C. has indicated its intention to vote in favor of Proposal 2.

Recommendation

The board of directors recommends that stockholders vote FOR the approval of Proposal 2. If not otherwise specified, proxies will be voted FOR Proposal 2.

PROPOSAL 3

APPROVAL OF AMENDMENT TO STOCK OPTION PLAN FOR

INDEPENDENT DIRECTORS

We are also asking you to approve an amendment of the New World Restaurant Group, Inc. Stock Option Plan for (Non-Employee) Independent Directors (the "Director Plan"). On December 19, 2003, our board of directors adopted the Director Plan effective January 1, 2004, and the Director Plan was approved by stockholders at the 2004 Annual Meeting. A copy of the Director Plan, as approved by our stockholders, is attached to this proxy statement as Annex C.

At the March 1, 2005 Board of Directors' Meeting, the Board approved an amendment to the Director Plan (1) to provide for a pro rata grant of options for directors who are elected or appointed during the calendar year and (2) to provide that options expire no more than one year after an individual is no longer a director. A copy of the amendment of the Director Plan incorporating these two changes is attached to this proxy statement as Annex D. The purposes of the amendment are to provide that newly elected or appointed directors receive grants of options upon their respective election to office rather than January of the following year. This amendment is intended to enable the Company to attract directors and to provide that persons who are no longer serving as directors have a limited period (one year) in which to exercise their options. The amendment to the Director Plan is subject to stockholder approval, and will become effective only if Proposal 3 is approved by the requisite vote of stockholders at the Annual Meeting.

13

Summary

The primary purposes of the Director Plan are to provide our independent directors with an added incentive to continue in service with us and a more direct interest in the future success of our operations. Our board of directors has reserved 200,000 shares of common stock for issuance under the Director Plan.

The Director Plan permits the grant of non-qualified stock options. Directors who qualify as independent under the Sarbanes-Oxley Act of 2002 and rules promulgated by the SEC pursuant to the Exchange Act may receive options under the Director Plan. As of January 1, 2005, we had five non-employee directors who were eligible to receive options under the Director Plan.

The Director Plan provides for automatic annual option grants to independent directors on January 1 of each year. Options that have been granted under the Director Plan are set forth in the "New Plan Benefits" table below. The market value of the shares of our common stock that may be awarded under the Director Plan is approximately $0.640 million, which is based on the maximum number of shares that may be awarded under the Director Plan, multiplied by $3.20, the last reported sales price of our common stock in the "pink sheets" on April 8, 2005.

The board of directors believes it is in our best interests to approve the amendment to the Director Plan and recommends that stockholders approve these amendments. The principal features of the Director Plan are summarized below.

Administration of the Director Plan

Our board of directors will administer and interpret the Director Plan.

Terms of Options

The Director Plan provides for the grant of non-qualified stock options. On January 1 of each year, each independent director then serving on our board will automatically receive an option to acquire 10,000 shares of our common stock. Upon approval of Proposal 3 by the stockholders, if an individual is elected or appointed during the calendar year as an independent director, the independent director will be awarded an option for a number of shares equal to the pro rata portion of the 10,000 share annual grant based on the number of days the individual serves as an independent director during the calendar year. Each option will vest six months after the date of grant and will expire after five years unless earlier terminated or exercised. The exercise price for each option will be the fair market value of the common stock subject to the option on date of grant.

An option holder may exercise an option by written notice and payment of the exercise price:

- •

- in cash;

- •

- by certified, cashier's or other check acceptable to us;

- •

- by the surrender of a number of shares of common stock already owned by the option holder for at least six months and with a fair market value equal to the exercise price; or

- •

- in any combination of the foregoing methods.

Adjustments

The number of shares is subject to adjustment on account of stock splits, stock dividends, recapitalizations and other dilutive changes in our common stock. The board also has discretion to make adjustments in the event of any other changes in the outstanding common stock.

14

Non-Transferability

Except as permitted by law, options granted under the Director Plan are non-transferable, except by will or pursuant to the laws of descent and distribution and may be exercised during the lifetime of the holder thereof only by the holder (or, in the event of incapacity, his or her guardian or legal representative).

Effect of Termination of Services

If a holder is removed from the board within an option's exercisability period for cause, as determined by the board in its sole discretion, the option is void for all purposes. If the holder dies while a director and during the applicable exercisability period, the option will terminate one year after the date of death. The amendment to the Director Plan provides that if the holder is no longer serving as a director of the Company, the option may be exercised within 12 months following the date the holder is no longer a director. The option will terminate after expiration of the 12 month period.

Merger and Reorganization

Upon the occurrence of:

- •

- our merger or consolidation (other than a merger or consolidation in which we are the continuing corporation and that does not result in any changes in the outstanding shares of common stock);

- •

- the sale of all or substantially all of our assets (other than a sale in which we continue as the holding company of an entity that conducts the business formerly conducted by us);

- •

- our dissolution or liquidation;

- •

- a "change of control" of us (defined the same as under the Incentive Plan, as discussed above); or

- •

- any other transaction determined by resolution of the board to be similar, the board may determine that any or all options will:

- (1)

- become fully exercisable;

- (2)

- terminate at the closing of the transaction;

- (3)

- be cancelled in exchange for a cash payment equal to the greater of

- •

- the excess of the fair market value of our common stock over the exercise price or

- •

- the fair market value as determined by the board of the consideration for which a share of common stock is to be exchanged in the transaction, multiplied by the number of shares of common stock subject to the option;

- (4)

- be assumed or substituted by the successor or purchaser in the transaction; or

- (5)

- be dealt with in any other manner as the board deems appropriate.

Amendment and Termination

The board may amend, modify or terminate the Director Plan in any respect at any time, but no amendment can impair any option previously granted or deprive an option holder of any common stock acquired without the option holder's consent. We will obtain stockholder approval of amendments to the extent required by applicable laws or rules. The Director Plan will terminate whenever the board adopts a resolution to that effect.

15

Federal Income Tax Consequences

The following summary generally describes the principal federal (but not state and local) income tax consequences of option grants made pursuant to the Director Plan. It is general in nature and is not intended to cover all tax consequences that may apply to a particular recipient or to us. The provisions of the Code and the regulations thereunder relating to these matters are complicated and their impact in any one case may depend upon the particular circumstances.

When a non-qualified option is granted, there are no income tax consequences for the option holder or us. When a non-qualified option is exercised, in general, the option holder recognizes ordinary income equal to the excess of the fair market value of the common stock on the date of exercise over the exercise price. We are entitled to a deduction equal to the ordinary income recognized by the option holder for our taxable year that ends with or within the taxable year in which the option holder recognized the ordinary income.

Vote Required

The affirmative vote of the holders of a majority of the shares of common stock present in person or by proxy and entitled to vote on this proposal is required to approve Proposal 3. Greenlight Capital, L.L.C. has indicated its intention to vote in favor of Proposal 3.

Recommendation

The board of directors recommends that stockholders vote FOR the approval of Proposal 3. If not otherwise specified, proxies will be voted FOR Proposal 3.

PROPOSAL 4

RATIFICATION OF INDEPENDENT AUDITORS

A resolution will be presented at the Annual Meeting to ratify the appointment by the board of directors of the firm of Grant Thornton LLP as independent auditors, to audit our financial statements for the year ending January 3, 2006, and to perform other appropriate accounting services.

Representatives of Grant Thornton LLP will attend the Annual Meeting and will have the opportunity to make a statement at the Annual Meeting. In addition, representatives of Grant Thornton LLP will respond to appropriate questions.

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Fees Paid to Independent Auditors

For the fiscal years ended December 28, 2004 and December 30, 2003, Grant Thornton LLP, our independent auditor, billed the approximate fees set forth below:

Audit Fees

Aggregate fees paid to Grant Thornton LLP in connection with the audit of our consolidated financial statements as of and for the year ended December 28, 2004 and their reviews of the unaudited condensed consolidated interim financial statements during the year ended December 28, 2004 were $372,000. Aggregate fees paid to Grant Thornton LLP in connection with the audit of the consolidated financial statements as of and for the year December 30, 2003 and their reviews of the unaudited condensed consolidated interim financial statements during the year ended December 30, 2003 were $490,000.

16

Audit-Related Fees

Aggregate fees paid to Grant Thornton LLP in connection with the audit of our 401(k) plan for the year ended December 28, 2004 were $16,000. Aggregate fees paid to Grant Thornton LLP in connection with the audit of our 401(k) plan for the year ended December 30, 2003 were $8,000.

Tax Fees

Aggregate fees paid during 2004 to Grant Thornton LLP in connection with the preparation of Form 5500 were $5,000. Grant Thornton LLP was not engaged to perform any tax related services for us during the year ended December 30, 2003.

All Other Fees

Grant Thornton LLP was engaged to perform services relating to interviewing candidates for positions in our financial reporting department during the year ended December 28, 2004 for which it was paid a total of $2,500. Grant Thornton LLP was not engaged to perform and did not perform any other services during the year ended December 30, 2003.

Pre-Approval Policies and Procedures

Our audit committee has established procedures for pre-approval of audit and non-audit services as set forth in the audit committee charter. The services that were pre-approved by the audit committee under these procedures during the 2004 fiscal year were: review of the Registration Statement on Form S-1; and the audit of the Company's 401K Plan.

Vote Required

The affirmative vote of the holders of a majority in voting power of the shares of common stock present in person or by proxy and entitled to vote on this proposal is required to approve Proposal 4. Greenlight Capital, L.L.C. has indicated its intention to vote in favor of Proposal 4.

Recommendation

The board of directors recommends that stockholders vote FOR Proposal 4. If not otherwise specified, proxies will be voted FOR Proposal 4.

17

NEW PLAN BENEFITS

Benefits to Be Received Under the Incentive Plan

The benefits to be received in the future under the Incentive Plan are indeterminable as all grants are determined by the compensation committee in its discretion. However, on April 7, 2005, the compensation committee made the following grants under the Incentive Plan, which are subject to stockholders' approval of Proposal 2 increasing the number of shares under the Incentive Plan:

Name Executive Officer and Position

| | Dollar Value(1)

| | Number of Units(2)

|

|---|

Paul J.B. Murphy, III

President and Chief Executive Officer | | $ | 70,499.70 | | 78,333 |

Michael J. Mrlik II

Executive Vice President—Operations |

|

$ |

64,125.00 |

|

71,250 |

Richard P. Dutkiewicz

Chief Financial Officer |

|

$ |

28,125.00 |

|

31,250 |

Jill B. W. Sisson

General Counsel and Secretary |

|

$ |

28,125.00 |

|

31,250 |

Susan E. Daggett

Chief Operating Officer |

|

$ |

10,500.30 |

|

11,667 |

Total for Executive Group |

|

$ |

201,375.00 |

|

223,750 |

Total for Non-Executive Officer Employee Group |

|

$ |

210,825.00 |

|

234,250 |

- (1)

- Dollar values are based on the spread between the last reported sale price of our common stock on April 8, 2005 ($3.20) and the exercise price of the options ($2.30).

- (2)

- All options were granted on April 7, 2005, and have an exercise price of $2.30. Half of the options vest in three equal annual installments commencing on January 1, 2006; the other half vest, if at all, based upon our financial performance in each of the 2005, 2006 and 2007 fiscal years. The options expire ten years from the grant date.

Benefits to Be Received Under the Director Plan

The benefits to be received in the future under the Director Plan are indeterminable as they are dependent on the number of independent directors in office on January 1 of each year. As of April 8, 2005, the following grants had been made under the Director Plan:

Name

| | Dollar Value

| | No. of Units

| |

|---|

| Michael W. Arthur | | $ | 12,000.00 | (1) | 10,000 | (2) |

John S. Clark |

|

$ |

12,000.00 |

(1) |

10,000 |

(2) |

Frank C. Meyer |

|

$ |

12,000.00 |

(1) |

10,000 |

(2) |

S. Garrett Stonehouse |

|

$ |

12,000.00 |

(1) |

10,000 |

(2) |

Leonard Tannenbaum |

|

$ |

12,000.00 |

(4) |

20,000 |

(3) |

Total for Independent Director Group |

|

$ |

60,000.00 |

|

60,000 |

|

- (1)

- Dollar values for options granted in 2005 are based on the spread between the last reported sale price of our common stock on April 8, 2005 ($3.20) and the exercise price of the options ($2.00).

18

- (2)

- Options granted on January 3, 2005 (represents the first business day of 2005) at an exercise price of $2.00, vest in full on July 1, 2005 and expire five years from the grant date.

- (3)

- Includes options to purchase 10,000 shares granted on January 1, 2004 at an exercise price of $3.75, which vested in full on July 1, 2004 and expire January 1, 2009. Also includes options to purchase 10,000 shares granted on January 3, 2005 at an exercise price of $2.00, which vest in full on July 1, 2005 and expire five years from the grant date.

- (4)

- Dollar values are based on the spread between the last reported sale price of our common stock on April 8, 2005 ($3.20) and the exercise price of options considered "in-the-money." As 10,000 of the options granted have an exercise price greater than $3.20, the dollar value related to those options has been excluded from the calculation.

Benefits Under Equity Compensation Plans as of December 28, 2004

The following table summarizes equity compensation plan information as of December 28, 2004:

Plan Category

| | (a)

Number of securities to

be issued upon exercise of

outstanding options,

warrants and rights

| | (b)

Weighted-average

exercise price of

outstanding options,

warrants and rights

| | (c)

Number of securities

remaining available for future

issuance under equity

compensation plans

(excluding securities

reflected in column (a))

| |

|---|

| Equity compensation plans approved by security holders | | | | | | | | |

| 1994 Employee Stock Plan | | 17 | | $ | 210.71 | | 0 | (1) |

| 1995 Directors' Stock Option Plan | | 2,324 | | $ | 32.43 | | 0 | (1) |

| Executive Employee Incentive Plan | | 771,000 | | $ | 3.87 | | 129,000 | (2) |

| Independent Directors' Stock Option Plan | | 30,000 | | $ | 3.75 | | 170,000 | (3) |

| Equity compensation plans not approved by security holders | | | | | | | | |

| | Barry Levine(4) | | 664 | | $ | 211.62 | | 0 | |

| | Robert Williams(4) | | 664 | | $ | 211.62 | | 0 | |

| | Leonard Tannenbaum(5) | | 1,163 | | $ | 0.00 | | 0 | |

| | Bruce Toll(6) | | 1,628 | | $ | 0.00 | | 0 | |

| | B&B Ventures(7) | | 166 | | $ | 146.90 | | 0 | |

| Total | | 807,626 | | $ | 4.31 | | 299,000 | |

- (1)

- During fiscal 2003, the plan was suspended by the board of directors. Accordingly, no further grants will be made under this plan.

- (2)

- During fiscal 2005, options to purchase 61,250 shares of common stock were cancelled based on 2004 EBITDA results.

- (3)

- On January 3, 2005, options to purchase 10,000 shares of common stock were issued to each of Messrs. Arthur, Clark, Meyer, Stonehouse and Tannenbaum. The options have an exercise price of $2.00, vest in full on July 1, 2005 and expire five years from the date of grant.

- (4)

- Represents options and warrants to purchase 498 and 166 shares of common stock, respectively, granted during 1996 - 1998 for consulting services in connection with the operation of a coffee roasting facility we previously owned. The options vested immediately upon grant.

- (5)

- Represents warrants granted to Mr. Tannenbaum, one of our directors, in 2000 for financial advisory services.

19

- (6)

- Represents warrants granted to Mr. Toll, Mr. Tannenbaum's father-in-law, in 2000 for financial advisory services.

- (7)

- Represents warrants to purchase 166 shares of common stock granted during 2000 for consulting services in connection with the operation of a coffee roasting facility we previously owned.

For further discussion of the material features of our plans, see "Other Stock Option Plans" and "Compensation of Directors."

Other Stock Option Plans

Our 1994 Plan provided for the granting to employees of incentive stock options and for the granting to employees and consultants of non-statutory stock options and stock purchase rights. The 1994 Plan was suspended by our board of directors on November 21, 2003. At December 28, 2004, 17 options with an exercise price of $120.71 per share remained outstanding under this plan.

Our 1995 Plan was adopted by our board of directors and approved by our stockholders in August 1995. The 1995 Plan provided for the automatic grant of non-statutory stock options to our non-employee directors. On December 19, 2003, our board of directors suspended the 1995 Plan. At December 28, 2004, 2,324 options with a weighted average exercise price of $32.43 per share remained outstanding under this plan.

20

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth the total compensation awarded to, earned by or paid during our last three fiscal years to our Chief Executive Officer and our other current executive officers during the year ended December 28, 2004 ("Named Executive Officers").

Summary Compensation Table

| | Annual Compensation

| | Long-Term Compensation

|

|---|

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)(1)

| | Other Annual

Compensation ($)

| | Restricted

Stock Awards ($)

| | Securities

Underlying

Options/SARs (#)

|

|---|

Paul J.B. Murphy, III(2)

President and Chief Executive Officer | | 2004

2003

2002 | | $

$

$ | 387,885

335,000

320,192 | | $

$

$ | —

225,647

150,000 | | —

—

— | | —

—

— | | —

160,000

— |

Michael J. Mrlik II(3)

Chief Operating Officer | | 2004

2003 | | $

$ | 274,423

260,000 | |

$ | —

142,113 | | —

— | | —

— | | —

75,000 |

Richard P. Dutkiewicz(4)

Chief Financial Officer | | 2004

2003 | | $

$ | 190,000

27,038 | | | —

— | | —

— | | —

— | |

75,000 |

Jill B. W. Sisson(5)

General Counsel and Secretary | | 2004

2003 | | $

| 201,747

— | | | —

— | | —

— | | —

— | |

75,000 |

Susan E. Daggett

Chief Strategy Officer | | 2004

2003 | | $

$ | 297,115

225,000 | | $

$ | —

178,664 | | —

— | | —

— | | —

140,000 |

- (1)

- Bonus amounts represent amounts paid in the respective fiscal year for bonuses earned in the preceding fiscal year.

- (2)

- Mr. Murphy became Chief Executive Officer on October 1, 2003. His annual salary for 2005 has been increased to $400,000.

- (3)

- On April 11, 2005, Mr. Mrlik submitted his letter of resignation.

- (4)

- Mr. Dutkiewicz was hired as Chief Financial Officer in October 2003. His annual salary for 2005 has been increased to $225,000.

- (5)

- Ms. Sisson is currently a consultant to the company under an agreement dated December 8, 2003. Her annual consulting agreement for 2005 has been increased to $225,000.

Stock Option Grants in Last Fiscal Year

There were not any grants of stock options to the Named Executive Officers during the year ended December 28, 2004.

Fiscal Year End Option Values

During the fiscal year ended December 28, 2004, none of the Named Executive Officers exercised any stock options. Set forth below is information on the number of stock options held by the Named Executive Officers as of December 28, 2004. None of such stock options were in-the-money as of December 28, 2004.

21

Fiscal Year-End Option Values

| | Number of Securities

Underlying Unexercised

Options at Fiscal Year End (#)

| |

|---|

| | Exercisable

| | Unexercisable

| |

|---|

| Paul J.B. Murphy, III | | 0 | | 160,000 | (1) |

| Michael J. Mrlik II | | 0 | | 75,000 | (1) |

| Richard P. Dutkiewicz | | 0 | | 75,000 | (1) |

| Jill B. W. Sisson | | 0 | | 75,000 | (1) |

| Susan E. Daggett | | 0 | | 140,000 | (1) |

- (1)

- Half of the options are subject to time vesting and half to performance vesting.

Employment and Other Arrangements

Jill B.W. Sisson. On December 8, 2003, we entered into a consulting agreement with Jill B.W. Sisson to provide legal, consulting and advisory services to us and to serve as our General Counsel and Secretary. Pursuant to the agreement, Ms. Sisson is paid $15,833 per month, which may be adjusted by the board of directors and, on December 19, 2003, was granted options to purchase 75,000 shares of common stock pursuant to the Incentive Plan. The options vest in part upon length of service, and in part upon the achievement of specified financial goals by us. Certain options were cancelled in 2005 based on 2004 financial results. In addition, Ms. Sisson is eligible to receive annual additional premium compensation based upon company performance and personal performance. Ms. Sisson will also be reimbursed for reasonable and necessary out-of-pocket expenses. The agreement provides for non-solicitation of company employees for a year after termination of the agreement, and can be terminated by either party upon 30 days' notice.

We have no other employment or similar contracts as of the date of this proxy statement.

Corporate Code of Conduct

We have adopted a Corporate Code of Conduct that applies to our directors, executive officers and all of our employees. We will provide any person, without charge and upon request, with a copy of our Corporate Code of Conduct. Requests should be directed to us at 1687 Cole Boulevard, Golden, Colorado 80401, Attention: Secretary. The Corporate Code of Conduct is also available on our website at www.nwrgi.com.

We will disclose any amendments to or waivers of the Corporate Code of Conduct on our website atwww.nwrgi.com. We have established a confidential hotline to answer employees' questions related to the Corporate Code of Conduct and to report any concerns. Our audit committee also has established procedures to receive, retain and treat complaints regarding accounting, internal accounting controls or auditing matters, and to allow for the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters.

Notwithstanding anything to the contrary set forth in any of our filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings, including this proxy statement, in whole or in part, the following Compensation Committee Report on Executive Compensation, Audit Committee Report and Performance Graph shall not be deemed to be "Soliciting Material," are not deemed "filed" with the SEC and shall not be incorporated by reference into any filings under the Securities Act or Exchange Act whether made before or after the date of this proxy statement and irrespective of any general incorporation language in such filings.

22

Compensation Committee Report on Executive Compensation

The compensation committee of the board of directors consists of three non-employee directors, Leonard Tannenbaum, John S. Clark II, and S. Garrett Stonehouse, Jr.

Compensation Philosophy. Our executive compensation program is designed to attract, retain, and motivate high caliber executives and to focus the interests of the executives on objectives that enhance stockholder value. The principal elements of our executive compensation program are base salary, bonus, and stock options. These goals emphasize pay for performance by having a portion of the executive's compensation dependent upon achieving individual objective goals which have a direct impact on our business results and ensuring the company achieves certain financial results and another portion of the executive's compensation being solely dependent on our company achieving certain financial results. In addition, we have linked executive and stockholder interests through equity-based plans. Also, we strive to make the compensation packages for our executives competitive relative to similar positions at companies of comparable size in our industry.

Executive Officer Salaries. Base salaries for our executives are intended to reflect the scope of each executive's responsibilities, success of our business, and individual contributions of each executive to that success. Increases in base salary may be affected by other considerations, such as geographic or market data, industry trends and internal equity. Executive salaries are adjusted only after evaluation of all of these considerations, occurring gradually over time and only as necessary to meet our operational and financial objectives.

Bonuses. The compensation committee may award cash bonuses to our executive officers. The 2004 bonus plan established a company financial performance threshold and maximum based on EBITDA. The dollars exceeding the EBITDA threshold created a bonus pool out of which 2004 bonuses were calculated. The bonus plan has two parts, one-half is based on the EBITDA performance and achievement of individual performance goals and one-half is based solely on EBITDA. The EBITDA achieved was 55% of the maximum potential for 2004. The achievement percentage of individual performance goals was determined by the CEO for executive officers and reviewed by the Committee. The executive officers' bonus for 2004 averaged 45.0% of total bonus potential.

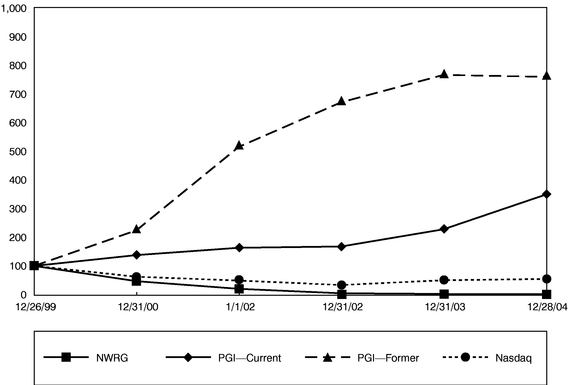

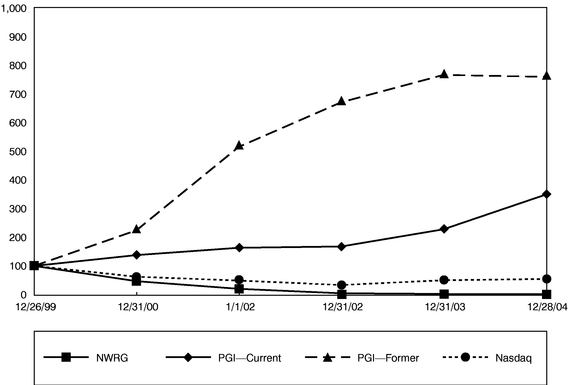

In December 2004, the compensation committee reviewed a 2005 bonus plan based on the pay for performance compensation philosophy described above. This plan was adopted on March 1, 2005. The 2005 bonus plan also sets company financial goals and requires individual goals for each executive.