QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

NEW WORLD RESTAURANT GROUP, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

$125 per Exchange Act Rules 0-11(c)(1)(ii), 14a-6(i)(1), 14a-6(i)(2) or Item 22(a)(2) of Schedule 14A. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

1687 Cole Boulevard

Golden, Colorado 80401

April 6, 2006

Dear Stockholder:

You are cordially invited to the 2006 Annual Meeting of Stockholders of New World Restaurant Group, Inc., to be held on May 9, 2006 at 9:00 a.m., Mountain Time, at our offices located at 1687 Cole Boulevard, Golden, Colorado 80401.

At the Annual Meeting, you will be asked to consider and vote upon proposals (1) to elect seven directors to serve until the 2007 Annual Meeting of Stockholders, and until their respective successors are elected and qualified; (2) to increase the authorized shares of common stock from 15 million to 25 million; and (3) to ratify the appointment of Grant Thornton LLP as our independent auditors for the fiscal year ending January 2, 2007.

Enclosed with this letter is a proxy authorizing our officers to vote your shares for you if you do not attend the Annual Meeting. Whether or not you are able to attend the Annual Meeting, I urge you to complete your proxy and return it in the enclosed addressed, postage-paid envelope, as a quorum of the stockholders must be present, either in person or by proxy, in order for the Annual Meeting to take place.

I would appreciate your immediate attention to the mailing of this proxy.

1687 Cole Boulevard

Golden, Colorado 80401

Notice of Annual Meeting of Stockholders To Be Held on May 9, 2006

You are cordially invited to attend the annual meeting of stockholders of New World Restaurant Group, Inc., which will be held at our offices at 1687 Cole Boulevard, Golden, Colorado 80401 on May 9, 2006 at 9:00 a.m., Mountain Time, for the following purposes:

- 1.

- To elect seven directors to serve until the 2007 Annual Meeting of Stockholders, and until their respective successors are elected and qualified;

- 2.

- To increase the number of common shares we are authorized to issue from 15 million to 25 million;

- 3.

- To ratify the appointment of Grant Thornton LLP as our independent auditors for the fiscal year ending January 2, 2007; and

- 4.

- To transact such other business as may properly come before the meeting.

The close of business on April 3, 2006 has been set as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and any and all adjournments.

It is important that your shares be represented at the Annual Meeting regardless of the size of your holdings. Whether or not you expect to attend the Annual Meeting, please complete, date and sign the enclosed proxy and return it in the envelope provided for that purpose, which does not require postage if mailed in the United States. The proxy is revocable at any time prior to its use.

|

|

|

Jill B.W. Sisson

Secretary |

Golden, Colorado

April 6, 2006

YOU ARE URGED TO MARK, DATE AND SIGN THE ENCLOSED

PROXY AND RETURN IT PROMPTLY. THE PROXY IS

REVOCABLE AT ANY TIME PRIOR TO ITS USE.

NEW WORLD RESTAURANT GROUP, INC.

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

May 9, 2006

The accompanying proxy is solicited by the board of directors of New World Restaurant Group, Inc., a Delaware corporation (the "Company"), for use at the 2006 Annual Meeting of Stockholders to be held at our principal executive offices located at 1687 Cole Boulevard, Golden, Colorado 80401, on May 9, 2006, at 9:00 a.m., Mountain Time, and at any and all adjournments and postponements thereof (the "Annual Meeting"). The proxy may be revoked at any time before it is voted. If no contrary instruction is received, signed proxies returned by stockholders will be voted in accordance with the board of directors' recommendations.

This proxy statement and accompanying proxy are first being sent to stockholders on or about April 6, 2006.

Shares Outstanding and Voting Rights

Our board of directors has fixed the close of business on April 3, 2006 as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting. Our only outstanding voting stock is our common stock, $0.001 par value per share, of which 10,065,072 shares were outstanding as of the close of business on the record date. Each outstanding share of common stock is entitled to one vote.

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to us (Attention: Secretary) a written notice of revocation or a duly executed proxy bearing a later date, or by attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not in itself constitute the revocation of a proxy.

At the Annual Meeting, stockholders will vote on proposals to elect seven directors to serve until the 2007 Annual Meeting of Stockholders, and until their respective successors are elected and qualified (Proposal 1); and to increase the authorized shares of common stock we may issue from 15 million shares to 25 million shares (Proposal 2); and to ratify our selection of Grant Thornton as our independent auditors for the fiscal year ending January 2, 2007 (Proposal 3).

Stockholders representing one-third in voting power of the shares of stock outstanding and entitled to vote must be present or represented by proxy in order to constitute a quorum to conduct business at the Annual Meeting. With respect to the election of directors, our stockholders may vote in favor of the nominees, may withhold their vote for all of the nominees, or may withhold their vote as to specific nominees. Under the Delaware General Corporation Law ("DGCL") and our Restated Certificate of Incorporation, the affirmative vote of the holders of a majority in voting power of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote thereon is required to approve Proposal 1. The affirmative vote of the holders of a majority of the outstanding shares of our common stock is required to approve Proposal 2. The affirmative vote of the holders of a majority of the votes cast on Proposal 3 is required to approve Proposal 3.

Abstentions may be specified on all proposals and will be counted as present for the purposes of the proposal for which the abstention is noted. A vote withheld for a nominee in the election of directors will have the same effect as a vote against the nominee. For purposes of determining whether any of the other proposals has received the requisite vote, where a stockholder abstains from voting, it will have the same effect as a vote against the proposal.

The independent tabulator appointed for the Annual Meeting will tabulate votes cast by proxy or in person at the Annual Meeting. For the purposes of determining whether a proposal has received the requisite vote of the holders of the common stock in instances where brokers are prohibited from exercising or choose not to exercise discretionary authority for beneficial owners who have not provided voting instructions (so-called "broker non-votes"), those shares of common stock will not be included in

the vote totals and, therefore, will have no effect on the vote on any of the proposals. Pursuant to the NASD Rules of Fair Practice, brokers who hold shares in street name have the authority, in limited circumstances, to vote on certain items when they have not received instructions from beneficial owners. A broker will only have such authority if:

- •

- the broker holds the shares as executor, administrator, guardian or trustee or is a similar representative or fiduciary with authority to vote; or

- •

- the broker is acting pursuant to the rules of any national securities exchange of which the broker is also a member.

Under these rules, absent authority or directions described above, brokers will not be able to vote on Proposals 2 and 3.

Costs of Solicitation

We will pay the cost of soliciting proxies for the Annual Meeting. Proxies may be solicited by our regular employees, without additional compensation, in person, or by mail, courier, telephone or facsimile. We may also make arrangements with brokerage houses and other custodians, nominees and fiduciaries for the forwarding of solicitation material to the beneficial owners of stock held of record by such persons. We may reimburse such brokerage houses, custodians, nominees and fiduciaries for reasonable out-of-pocket expenses incurred by them in connection therewith.

Annual Report

Our 2005 Annual Report on Form 10-K, including consolidated financial statements as of and for the year ended January 3, 2006, is being distributed to all stockholders entitled to vote at the Annual Meeting together with this proxy statement, in satisfaction of the requirements of the Securities and Exchange Commission (the "SEC"). Additional copies of the Annual Report are available at no charge upon request. To obtain additional copies of the Annual Report, please contact us at 1687 Cole Boulevard, Golden, Colorado 80401, Attention: Secretary, or at telephone number (303) 568-8000. The Annual Report does not form any part of the materials for the solicitation of proxies.

VOTING SECURITIES AND PRINCIPAL HOLDERS

As of April 3, 2006, we had 10,065,072 shares of common stock outstanding (excluding certain options and warrants), which are our only outstanding voting securities. In addition, we had 57,000 shares of Series Z preferred stock outstanding. The following table sets forth information regarding the beneficial ownership of our common stock as of March 22, 2006, by:

- •

- each person (or group of affiliated persons) who is known by us to own beneficially more than 5% of our common stock;

- •

- each of our executive officers;

- •

- each of our current directors; and

- •

- all directors and executive officers as a group.

2

Beneficial Owner**

| | Amount and Nature

of Beneficial

Ownership

| | Percentage

| |

|---|

Greenlight Capital, L.L.C.

420 Lexington Avenue, Suite 1740

New York, NY 10107 | | 10,041,649 | (1) | 95.1 | % |

| Paul J.B. Murphy, III | | 119,446 | (2) | 1.2 | % |

| Daniel J. Dominguez | | 19,168 | (3) | * | |

| Richard P. Dutkiewicz | | 55,051 | (4) | * | |

| Jill B.W. Sisson | | 54,168 | (4) | * | |

| Michael W. Arthur | | 21,519 | (5) | * | |

| E. Nelson Heumann | | — | (6) | 0 | % |

| James W. Hood | | 32,808 | (7) | * | |

| Frank C. Meyer | | 10,000 | (8) | * | |

| S. Garrett Stonehouse, Jr. | | 10,000 | (8) | * | |

| Leonard Tannenbaum | | 23,367 | (9) | * | |

| All directors and executive officers as a group (11 persons) | | 345,527 | (10) | 3.3 | % |

- *

- Less than one percent (1%).

- **

- The address for each officer and director is 1687 Cole Blvd., Golden, Colorado 80401.

- (1)

- Based on an amendment to a Schedule 13D filed with the SEC on October 15, 2003. The Schedule 13D was filed on behalf of Greenlight Capital, L.L.C., Greenlight Capital, L.P., of which Greenlight Capital, L.L.C. is the general partner, Greenlight Capital Offshore, Ltd., for whom Greenlight Capital, L.L.C. acts as investment advisor, Greenlight Capital Qualified, L.P., of which Greenlight Capital, L.L.C. is the general partner, and David Einhorn, the principal of Greenlight Capital, L.L.C. Includes 493,682 shares of common stock that may be acquired upon the exercise of warrants.

- (2)

- Includes 119,446 shares of common stock which may be acquired upon exercise of presently exercisable options. Does not include 105,553 shares of common stock subject to stock options which are not exercisable within 60 days.

- (3)

- Includes 19,168 shares of common stock which may be acquired upon exercise of presently exercisable options. Does not include 55,832 shares of common stock subject to stock options which are not exercisable within 60 days.

- (4)

- Includes 54,168 shares of common stock which may be acquired upon exercise of presently exercisable options. Does not include 45,832 shares of common stock subject to stock options which are not exercisable within 60 days.

- (5)

- Includes 10,000 shares of common stock which may be acquired upon exercise of presently exercisable options. Does not include 10,000 shares of common stock subject to stock options which are not exercisable within 60 days.

- (6)

- Does not include 10,041,649 shares of common stock beneficially owned by Greenlight Capital, L.L.C. and its affiliates, over which Mr. Heumann disclaims beneficial ownership. Mr. Heumann is an officer of Greenlight.

- (7)

- Includes 5,808 shares of common stock which may be acquired upon exercise of presently exercisable options. Does not include 10,000 shares of common stock subject to stock options which are not exercisable within 60 days.

3

- (8)

- Includes 10,000 shares of common stock which may be acquired upon exercise of presently exercisable options. Does not include 10,000 shares of common stock subject to stock options which are not exercisable within 60 days.

- (9)

- Includes 20,830 shares of common stock which may be acquired upon exercise of presently exercisable options. Also includes 1,163 shares of common stock which may be acquired upon exercise of presently exercisable warrants. Does not include 10,000 shares of common stock subject to stock options which are not exercisable within 60 days.

- (10)

- Includes a total of 303,588 shares of common stock which may be acquired upon exercise of presently exercisable options and a total of 1,163 shares of common stock which may be acquired upon exercise of presently exercisable warrants.

Series Z Preferred Stock

Our Series Z Preferred Stock generally is non-voting. However, under our Certificate of Designation, Preferences and Rights of Series Z Preferred Stock (the "Certificate of Designation"), we cannot take any of the following actions without the vote or written consent by the holders of at least a majority of the then outstanding shares of the Series Z Preferred Stock:

- •

- amend, alter or repeal any provision of, or add any provision to, the Certificate of Designation, whether by merger, consolidation or otherwise;

- •

- subject to the clause above, amend, alter or repeal any provision of, or add any provision to, our Certificate of Incorporation or bylaws, whether by merger, consolidation or otherwise, except as may be required to authorize a Certificate of Designation for stock junior to the Series Z Preferred Stock, or to increase the authorized amount of any junior stock, including junior stock issued to management or employees under equity incentive plans;

- •

- authorize or issue shares of any class of stock having any preference or priority as to dividends, assets or payments in liquidation superior to or on a parity with the Series Z Preferred Stock, including, without limitation, Series Z Preferred Stock, whether by merger, consolidation or otherwise;

- •

- take any action that results in us or any of our direct or indirect subsidiaries incurring or assuming indebtedness (including the guaranty of any indebtedness) in excess of the greater of $185 million or 3.75 times EBITDA for the trailing 12-month period prior to such date;

- •

- consummate any merger or change of control that does not result in the redemption of the Series Z Preferred Stock at the stated redemption price, payable in cash, at the effective time of the merger or change of control transaction;

- •

- make any restricted payment in violation of the covenant set forth in the Certificate of Designation; or

- •

- enter into any agreement to do any of the foregoing items.

All 57,000 shares of our outstanding Series Z Preferred Stock are held by Halpern Denny Fund III, L.P. These shares were issued in our equity recapitalization completed in September 2003 in exchange for 56,237,994 shares of Series F Preferred Stock, 386,427 shares of common stock and warrants to purchase 227,747 shares of common stock.

4

PROPOSAL 1

ELECTION OF DIRECTORS

Our board of directors currently consists of seven directors. Our certificate of incorporation, as amended, provides that all directors are to be elected annually. At the Annual Meeting, the stockholders will elect seven directors to serve until the 2007 Annual Meeting of Stockholders, and until their respective successors are duly elected and qualified. Stockholders are not entitled to cumulate votes in the election of directors and may not vote for a greater number of persons than the number of nominees named.

We are soliciting proxies in favor of the re-election of each of the nominees identified below. We intend that all properly executed proxies will be voted for these seven nominees unless otherwise specified. All nominees have consented to serve as directors, if elected. If any nominee is unwilling to serve as a director at the time of the Annual Meeting, the persons who are designated as proxies intend to vote, in their discretion, for such other persons, if any, as may be designated by the board of directors. The proxies may not vote for a greater number of persons than the number of nominees named. As of the date of this proxy statement, the board of directors has no reason to believe that any of the persons named below will be unable or unwilling to serve as a nominee or as a director if elected. Greenlight Capital, L.L.C. has indicated its intention to vote in favor of each of the nominees.

Information About the Nominees

The names of the nominees, their ages as of April 3, 2006, and other information about them are set forth below:

Michael W. Arthur. Mr. Arthur, 65, was appointed to the board of directors in October 2004. Since 1990, Mr. Arthur has headed Michael Arthur and Associates, a consulting and interim management firm specializing in restructurings, business development, and strategic, financial, marketing and branding strategies. During restructuring, he served as CEO of California Federal Reserve Bank and financial advisor to Long John Silver's Restaurants. Prior to 1990, Mr. Arthur served as Executive Vice President and Chief Financial Officer for Sizzler Restaurants and Pinkerton Security; Vice President of Marketing for Mattel Toys; and also served in various other management roles for D'Arcy, Masius, Benton & Bowles Advertising and Procter and Gamble. Mr. Arthur has a B.A. degree from Johns Hopkins University and attended the Wharton Graduate School of Business.

E. Nelson Heumann. Mr. Heumann, C.F.A., 48, has served as our director since May 2004 and as Chairman of the Board since October 2004. Mr. Heumann joined Greenlight Capital, Inc., an investment management firm, in March 2000 and was made a managing member of Greenlight Capital, L.L.C. in January 2002. Prior to joining Greenlight, he served as director of distressed investments at SG Cowen from January 1997 to January 2000. From 1990 to January 1997, Mr. Heumann was a director responsible for distressed debt research and trading at Schroders. Prior to that, he was vice-president of bankrupt and distressed debt research for Merrill Lynch. Earlier in his career, Mr. Heumann was employed with Claremont Group, a leveraged buyout firm, and Value Line. He graduated from Louisiana State University in 1980 with a B.S. in Mechanical Engineering and in 1985 with an M.S. in Finance.

James W. Hood. Mr. Hood, 53, was appointed to the Board of Directors in June 2005. He is the co-founder and partner in Bray+Hood+Associates (B+H+A), a marketing innovations consulting firm headquartered in Essex, Connecticut. Prior to establishing B+H+A in 2001, Mr. Hood spent twenty years in executive positions with Young & Rubicam, Inc. His roles there included chief executive officer of The Lord Group, a joint venture between Y&R and Dentsu, and director of business development at Y&R Advertising. He also served as vice president and director of marketing at Lehman Brothers Kuhn Loeb and later held the same position at The First Boston Corporation. He received a B.A.

5

degree from Cornell University and holds an M.B.A. degree in Marketing and Finance from the Harvard Business School.

Frank C. Meyer. Mr. Meyer, 62, has served as our director since May 2004 and is a private investor. He was chairman of Glenwood Capital Investments, LLC, a venture capital firm he co-founded, from January 1988 to January 2004. Since 2000, Glenwood Capital has been a wholly owned subsidiary of the Man Group, plc, an investment advisor based in England specializing in alternative investments. Mr. Meyer also serves on the board of directors of Quality Systems, Inc., which specializes in software solutions for medical and dental professionals. Mr. Meyer holds an M.B.A. from the University of Chicago and began his career at the University's School of Business as an instructor of statistics.

Paul J.B. Murphy, III. Mr. Murphy, 51, was appointed Chief Executive Officer and Acting Chairman in October 2003. He served as Acting Chairman until October 2004 and has continued to serve as a director since that time. Mr. Murphy joined us in December 1997 as Senior Vice President—Operations and had served as Executive Vice President—Operations since March 1998. Mr. Murphy was appointed our Chief Operating Officer in June 2002. From July 1996 until December 1997, Mr. Murphy was Chief Operating Officer of one of our former area developers. From August 1992 until July 1996, Mr. Murphy was Director of Operations of R&A Foods, L.L.C., an area developer of Boston Chicken. Mr. Murphy has a B.A. degree from Washington and Lee University.

S. Garrett Stonehouse, Jr. Mr. Stonehouse, 36, has served as our director since February 2004. He has been a principal and founding partner of MCG Global, LLC, a private equity investment firm in Westport, CT, since 1995. Mr. Stonehouse is also the chairman of the board of directors of Denver-based Imperial Headwear, Inc. Prior to co-founding MCG Global, he was vice president of Fidelco Capital Group. Before joining Fidelco in 1994, he held various positions with GE Capital. Mr. Stonehouse received a B.A. degree from Boston College in economics and mathematics.

Leonard Tannenbaum. Mr. Tannenbaum, C.F.A., 34, has served as our director since March 1999. In July 2004, Mr. Tannenbaum founded Fifth Street Capital LLC and is the managing partner. Prior to July 2004, Mr. Tannenbaum was the Managing Partner at MYFM Capital, LLC, a boutique investment banking firm, and a partner at BET, a capital fund, since October 1998. From 1997 until October 1998, Mr. Tannenbaum was a partner at LAR Management, a hedge fund. From 1996 until 1997, he was an assistant portfolio manager at Pilgrim Baxter and Co. From 1994 until 1996, he was an Assistant Vice President in the small company group of Merrill Lynch. Mr. Tannenbaum has an M.B.A. in Finance and a Bachelors of Science in Management from the Wharton School at the University of Pennsylvania.

Board Composition

Our board of directors has determined that Michael W. Arthur, James W. Hood, Frank C. Meyer, S. Garrett Stonehouse, Jr. and Leonard Tannenbaum, all current directors, qualify as "independent" directors under the rules promulgated by the Securities and Exchange Commission (the "SEC") under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and by the Nasdaq Stock Market. There are no family relationships among any of our executive officers, directors or nominees for director.

Greenlight Capital, L.L.C. currently owns shares of our common stock sufficient to elect all of the members of our board of directors without the approval of any other stockholder.

6

Director Compensation

Each of our non-employee independent directors receives a $15,000 annual retainer, plus $2,000 for each board meeting and $1,000 for each committee meeting attended. In addition, on January 1 of each year, each independent director receives a grant of options to purchase 10,000 shares of common stock which vest six months after the date of grant and, unless earlier terminated, or exercised, expire five years after grant date. Any director elected or appointed during the year will receive a pro rata grant of options based on his date of election. All directors are reimbursed for out-of-pocket expenses incurred by them in connection with attendance at board meetings and committee meetings.

There were no other arrangements pursuant to which any director was compensated during the fiscal year ended January 3, 2006.

DIRECTOR COMPENSATION FOR FISCAL YEAR ENDED JANUARY 3, 2006

Name

| | Annual

Retainer for

Serving as a

Director

| | Board Meeting

Attendance

Fees

| | Committee

Meeting

Attendance

Fees

| | Total Cash

Compensation

|

|---|

| Michael W. Arthur | | $ | 15,000 | | $ | 14,000 | | $ | 8,000 | | $ | 37,000 |

| E. Nelson Heumann | | | -0- | | | -0- | | | -0- | | | -0- |

| James W. Hood | | $ | 8,750 | | $ | 6,000 | | $ | 2,000 | | $ | 16,750 |

| Frank C. Meyer | | $ | 15,000 | | $ | 14,000 | | $ | 5,000 | | $ | 34,000 |

| Paul J.B. Murphy III | | | -0- | | | -0- | | | -0- | | | -0- |

| S. Garrett Stonehouse, Jr. | | $ | 15,000 | | $ | 14,000 | | $ | 8,000 | | $ | 37,000 |

| Leonard Tannenbaum | | $ | 15,000 | | $ | 14,000 | | $ | 10,000 | | $ | 39,000 |

Meetings of the Board of Directors and Committees

The board of directors held seven meetings during fiscal 2005 and took action by written consent on seven occasions. During fiscal 2005, no director then in office attended fewer than 75% of the aggregate total number of meetings of the board of directors held during the period in which he was a director and of the total number of meetings held by all of the committees of the board of directors on which he served. The two standing committees of the board of directors are the audit committee and the compensation committee.

We have not established a policy on director attendance at annual stockholders' meetings; however, one of our directors then in office attended our last Annual Meeting held in May 2005.

Our board of directors has not established a process for our stockholders to communicate directly with the board because of the fact that Greenlight owns 95.1% of the voting shares and it was not deemed necessary or appropriate. Our audit committee has established a process for communicating complaints regarding accounting or auditing matters. Any such complaints received on the established hotline or submitted to the Chief Compliance Officer are promptly forwarded to the audit committee to take such action as may be appropriate.

Michael W. Arthur (chairman), Frank C. Meyer and Leonard Tannenbaum are the current members of the audit committee. Each of them is "independent" as required by the rules promulgated by the SEC under the Exchange Act, and by the Nasdaq Stock Market. Each of them also meets the financial literacy requirements of the Nasdaq Stock Market. Our board of directors has determined that Mr. Arthur qualifies as an "audit committee financial expert" as defined by the rules promulgated by the SEC.

7

The audit committee is primarily concerned with monitoring:

- (1)

- the integrity of our financial statements;

- (2)

- our compliance with legal and regulatory requirements; and

- (3)

- the independence and performance of our auditors.

The audit committee also is responsible for handling complaints regarding our accounting, internal accounting controls or auditing matters. The audit committee's responsibilities are set forth in its charter, which was amended and restated in January 2004, was reviewed and re-approved by the audit committee in March 2005 and was reviewed and modified in March 2006. The charter is available on the New World Restaurant Group, Inc. website and is also attached hereto as Annex A. There were five meetings of the audit committee during fiscal 2005 and it took action by written consent on two occasions.

Leonard Tannenbaum (chairman), James W. Hood and S. Garrett Stonehouse, Jr. are the current members of the compensation committee. Each of them is "independent" as defined in the rules promulgated by the SEC under the Exchange Act and by the Nasdaq Stock Market. This committee is primarily concerned with determining the compensation of our employees generally and approving compensation of our executive officers. The committee does not establish or recommend compensation for our independent directors, which is approved by the board of directors as a whole.

The compensation committee's responsibilities are set forth in its charter, which was amended and restated in January 2004, and was reviewed and re-approved in March 2006 and is available on the New World Restaurant Group, Inc. website. There were five meetings of the compensation committee during fiscal 2005 and they took action by written consent on two occasions.

The nominees for re-election to our board at the Annual Meeting were formally nominated by the full Board of Directors consisting of Messrs. Arthur, Heumann, Hood, Meyer, Murphy, Stonehouse, and Tannenbaum. The Company does not have a standing nominating committee or committee performing similar functions because Greenlight owns more than 95% of our common stock and can therefore elect all of our directors without the vote of any other stockholder. Although the board will consider nominees recommended by stockholders, the board has not established any specific procedures for stockholders to follow to recommend potential director nominees for consideration. Messrs. Arthur, Heumann, Hood, Meyer, Murphy, Stonehouse, and Tannenbaum participated in the consideration of director nominees.

At this time, the Board has neither established any specific written procedures for identifying and evaluating potential director nominees nor established any minimum qualifications or skills for directors. Because of the fact that Greenlight owns more than 95% of the voting stock and, as such, the company is a "controlled company", the Board did not deem it necessary to adopt specific written procedures.

Compensation Committee Interlocks and Insider Participation

None of the members of our compensation committee is an officer or employee of New World Restaurant Group. None of our executive officers serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our board of directors or compensation committee.

8

Vote Required

Directors will be elected by a majority of the votes of the holders of shares present in person or by proxy at the Annual Meeting. Greenlight Capital, L.L.C. has indicated its intention to vote in favor of each of the nominees.

Recommendation

The board of directors recommends that stockholders vote FOR each of the nominees for director. If not otherwise specified, proxies will be voted FOR each of the nominees for director.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Several of our stockholders or former stockholders, including BET Associates LP (BET), Greenlight Capital, L.L.C. and certain of their affiliates (Greenlight), have been involved in our financings, refinancings, have purchased our debt and equity securities and were involved in our equity recapitalization. Below, we have summarized related party transactions involving these investors:

Greenlight Capital, L.L.C. and its affiliates

E. Nelson Heumann is the chairman of our board of directors and is a current employee of Greenlight. Greenlight and its affiliates beneficially own approximately 95 percent of our common stock on a fully diluted basis. As a result, Greenlight has sufficient voting power without the vote of any other stockholders to determine what matters will be submitted for approval by our stockholders, to approve actions by written consent without the approval of any other stockholders, to elect all of our board of directors, and among other things, to determine whether a change in control of our company occurs.

In July 2003, Greenlight purchased $35.0 million of our $160 Million Notes. In January 2006, we called for redemption of the $160 Million Notes, including the investment Greenlight held in those Notes. The Notes were redeemed from the proceeds of our refinancing which was completed in February 2006.

Leonard Tannenbaum, MYMF Capital LLC and BET

Leonard Tannenbaum, a director, was the Managing Director of MYFM Capital LLC until July 2004. In July 2004, Mr. Tannenbaum founded Fifth Street Capital LLC and is the managing partner. He is also a limited partner and 10% owner in BET. His father-in-law is Bruce Toll, an affiliate of BET. In 2003, BET purchased $7.5 million of our $160 Million Notes and Mr. Tannenbaum purchased an additional $0.5 million of our $160 Million Notes in the market. In January 2006, we called for redemption of the $160 Million Notes, including the investment BET and Mr. Tannenbaum held in those Notes. The Notes were redeemed from the proceeds of our refinancing which was completed in February 2006.

Jill B.W. Sisson

For information regarding our arrangement with Ms. Sisson, please see the section entitled "Employment and Other Arrangements."

9

PROPOSAL 2

APPROVAL OF AN AMENDMENT TO THE

RESTATED CERTIFICATE OF INCORPORATION

TO INCREASE THE NUMBER OF AUTHORIZED SHARES

We are asking you to approve an amendment to our restated certificate of incorporation to increase the number of shares of common stock that we are authorized to issue from 15,000,000 to 25,000,000. Our board of directors has approved the amendment, subject to the approval of our stockholders at the Annual Meeting. If the amendment is approved by our stockholders, the first paragraph of Article Fourth will be amended to read as follows:

The total number of shares which the Corporation shall have authority to issue is Twenty-seven Million (27,000,000) shares consisting of Twenty-five Million (25,000,000) shares of common stock and Two Million (2,000,000) shares of preferred stock, all of par value $0.001 per share.

As of April 3, 2006, the record date for the Annual Meeting, 10,065,072 shares of common stock were issued and outstanding. An additional 2,307,872 shares were reserved for issuance upon the exercise of stock options granted under our various equity incentive plans and upon the exercise of outstanding warrants. Accordingly, as of the record date, we have only approximately 2.6 million shares of common stock available for future issuance.

We believe that an increase in the authorized shares of our common stock will give us greater flexibility in the future by allowing us to:

- •

- declare stock dividends or stock splits;

- •

- acquire businesses or assets using our common stock as consideration;

- •

- raise additional capital through common stock offerings;

- •

- provide equity incentives to attract or retain employees, officers or directors; or

- •

- issue our common stock for other corporate purposes.

Without an increase in the number of authorized shares, the number of remaining common shares available for issuance may be insufficient to complete one or more of these transactions when and if our board deems advisable and in the best interests of our stockholders. We believe that having the additional authorized shares available for issuance upon approval of the board will be beneficial to us and our stockholders by allowing us to promptly consider and respond to future business opportunities as they arise. Due to market, industry and other factors, the delay involved in calling and holding a stockholders' meeting at the time a business opportunity presents itself may prevent us from pursuing that opportunity, or may significantly adversely affect the economic or strategic value of that opportunity.

We currently have no specific plans, arrangements or understandings to issue additional shares of our common stock, except for issuances under stockholder-approved equity incentive plans. We continually evaluate our capital structure and may consider an equity offering if, among other things, market conditions are favorable.

The issuance of shares of our common stock, including the additional shares that would be authorized if the proposed amendment is adopted, may dilute the current equity ownership position of current holders of our common stock and may be made without further stockholder approval, unless otherwise required by applicable laws or stock exchange, NASDAQ or similar regulations. Although our board of directors is motivated by business and financial considerations in proposing this amendment, stockholders should be aware that the amendment could be viewed as an anti-takeover provision. The amendment might discourage an attempt by a third party to gain control of us by acquiring a substantial number of shares of our common stock in order to complete a merger, sale of all or any

10

part of our assets, or similar transaction, because the issuance of new shares could be used to dilute the stock ownership of that third party.

All shares of our common stock, including those now authorized and those that would be authorized by the proposed amendment to our restated certificate of incorporation, are equal in rank and have the same voting, dividend and liquidation rights. Holders of our common stock do not have preemptive rights.

We are not proposing any change to our authorized preferred stock. Under our stockholder rights plan, one Series A junior participating preferred stock purchase right will be issued with each share of our common stock.

Vote Required

The affirmative vote of the holders of a majority of the outstanding shares of our common stock is required to approve Proposal 2. Greenlight Capital, L.L.C. has indicated its intention to vote in favor of Proposal 2.

Recommendation

The board of directors recommends that stockholders vote FOR the approval of Proposal 2. If not otherwise specified, proxies will be voted FOR Proposal 2.

PROPOSAL 3

RATIFICATION OF INDEPENDENT AUDITORS

A resolution will be presented at the Annual Meeting to ratify the appointment by the board of directors of the firm of Grant Thornton LLP as independent auditors, to audit our financial statements for the year ending January 2, 2007, and to perform other appropriate accounting services. Inclusion of this proposal in our proxy statement to ratify our independent auditors for year ending January 2, 2007 is not required, but is being submitted as a matter of good corporate practice.

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Fees Paid to Independent Auditors

For the fiscal years ended January 3, 2006 and December 28, 2004, Grant Thornton LLP, our independent auditor, billed the approximate fees set forth below:

Audit Fees

Aggregate fees paid to Grant Thornton LLP in connection with the audit of our consolidated financial statements as of and for the year ended January 3, 2006 and their reviews of the unaudited condensed consolidated interim financial statements during the year ended January 3, 2006 were $407,000. Aggregate fees paid to Grant Thornton LLP in connection with the audit of the consolidated financial statements as of and for the year December 28, 2004 and their reviews of the unaudited condensed consolidated interim financial statements during the year ended December 28, 2004 were $372,000.

11

Audit-Related Fees

Aggregate fees paid to Grant Thornton LLP in connection with the audit of our 401(k) plan for the year ended January 3, 2006 were $19,000. Aggregate fees paid to Grant Thornton LLP in connection with the audit of our 401(k) plan for the year ended December 28, 2004 were $16,000.

Tax Fees

Aggregate fees paid during 2005 and 2004 to Grant Thornton LLP in connection with the preparation of Form 5500 were $0 and $5,000, respectively.

All Other Fees

Grant Thornton LLP was engaged to perform services relating to refunds generated from utility tax credits during the year ended January 3, 2006 for which it was paid $7,700.

Grant Thornton LLP was engaged to perform services relating to interviewing candidates for positions in our financial reporting department during the year ended December 28, 2004 for which it was paid a total of $2,500.

Pre-Approval Policies and Procedures

Our audit committee has established procedures for pre-approval of audit and non-audit services as set forth in the audit committee charter. The services that were pre-approved by the audit committee under these procedures during the 2005 fiscal year were: review of the Registration Statement on Form S-1; the audit of the Company's 401(k) Plan; revision of the schedule for internal controls pursuant to Section 404 of the Sarbanes-Oxley Act of 2002; and the review of state tax codes regarding utility sales tax credits. The audit committee pre-approved all services performed by Grant Thornton LLP and disclosed under the headings "Audit-Related Fees," "Tax Fees" and "All Other Fees" above.

Vote Required

The affirmative vote of the holders of a majority of the votes cast on this proposal is required to approve Proposal 3. Greenlight Capital, L.L.C. has indicated its intention to vote in favor of Proposal 3.

Recommendation

The board of directors recommends that stockholders vote FOR Proposal 3. If not otherwise specified, proxies will be voted FOR Proposal 3.

12

BENEFITS UNDER EQUITY COMPENSATION PLANS AS OF JANUARY 3, 2006

The following table summarizes equity compensation plan information as of January 3, 2006:

Plan Category

| | (a)

Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights

| | (b)

Weighted-average

exercise price of

outstanding options,

warrants and rights

| | (c)

Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column (a))

| |

|---|

| Equity compensation plans approved by security holders | | | | | | | | |

1994 Employee Stock Plan |

|

17 |

|

$ |

210.71 |

|

0 |

(1) |

1995 Directors' Stock Option Plan |

|

1,328 |

|

$ |

49.08 |

|

0 |

(1) |

2003 Executive Employee Incentive Plan |

|

889,999 |

|

$ |

3.23 |

|

260,001 |

|

2004 Independent Directors' Stock Option Plan |

|

105,808 |

|

$ |

3.40 |

|

94,192 |

|

Equity compensation plans not approved by security holders |

|

|

|

|

|

|

|

|

| |

Leonard Tannenbaum(2) |

|

1,163 |

|

$ |

0.00 |

|

0 |

|

| |

Bruce Toll(3) |

|

1,628 |

|

$ |

0.00 |

|

0 |

|

Total |

|

999,943 |

|

$ |

3.30 |

|

354,193 |

|

- (1)

- During fiscal 2003, the plan was suspended by the board of directors. Accordingly, no further grants will be made under this plan.

- (2)

- Represents warrants granted to Mr. Tannenbaum, one of our directors, in 2000 for financial advisory services.

- (3)

- Represents warrants granted to Mr. Toll, Mr. Tannenbaum's father-in-law, in 2000 for financial advisory services.

For further discussion of the material features of our plans, see "Other Stock Option Plans" and "Compensation of Directors."

Stock Option Plans

Our 1994 Plan provided for the granting to employees of incentive stock options and for the granting to employees and consultants of non-statutory stock options and stock purchase rights. The 1994 Plan was suspended by our board of directors on November 21, 2003. At January 3, 2006, options to purchase 17 shares of common stock at an exercise price of $210.71 per share and a remaining contractual life of 1.48 years remained outstanding under this plan.

Our 1995 Plan was adopted by our board of directors and approved by our stockholders in August 1995. The 1995 Plan provided for the automatic grant of non-statutory stock options to our non-employee directors. On December 19, 2003, our board of directors suspended the 1995 Plan. At January 3, 2006, options to purchase 1,328 shares of common stock at a weighted average exercise price of $49.08 per share and a weighted average remaining contractual life of 3.15 years remained outstanding under this plan.

13

2003 Executive Employee Incentive Plan

On November 21, 2003, our board of directors adopted the Executive Employee Incentive Plan (2003 Plan). The 2003 Plan provides for granting incentive stock options to employees and granting non-statutory stock options to employees and consultants. Unless terminated sooner, the 2003 Plan will terminate automatically in December 2013. The board of directors has the authority to amend, modify or terminate the 2003 Plan, subject to any required approval by our stockholders under applicable law or upon advice of counsel. No such action may affect any options previously granted under the 2003 Plan without the consent of the holders. There are 1,150,000 shares issuable pursuant to options granted under the 2003 Plan. Options typically vest in part based upon the passage of time and, in part, upon our financial performance. Options that do not vest due to the failure to achieve specific financial performance criteria are forfeited. Options to purchase approximately 424,208 shares of our common stock, which are not yet exercisable, are subject to company performance and are treated as variable options. We expect that all of the non-vested awards at January 3, 2006 will eventually vest based on company performance. As of January 3, 2006, there were 260,001 shares reserved for future issuance under the 2003 Plan.

2004 Stock Option Plan for Independent Directors

On December 19, 2003, our board of directors adopted the Stock Option Plan for Independent Directors, effective January 1, 2004, (2004 Directors' Plan). Our board of directors may amend, suspend, or terminate the 2004 Directors' Plan at any time, provided, however, that no such action may adversely affect any outstanding option without the option holders consent. A total of 200,000 shares of common stock have been reserved for issuance under the 2004 Directors' Plan. The 2004 Directors' Plan provides for the automatic grant of non-statutory stock options to independent directors on January 1 of each year and a prorated grant of options for any director elected during the year. Options become exercisable six months after the grant date and are exercisable for 5 years from the date of grant unless earlier terminated. As of January 3, 2006, there were 94,192 shares reserved for future issuance under the 2004 Directors' Plan.

14

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth the total compensation awarded to, earned by or paid during our last three fiscal years to our Chief Executive Officer and our other current executive officers during the year ended January 3, 2006 ("Named Executive Officers").

Summary Compensation Table

| | Annual Compensation

| | Long-Term

Compensation

|

|---|

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)(1)

| | Total Annual

Compensation ($)

| | Securities

Underlying

Options/SARs (#)

|

|---|

Paul J.B. Murphy, III(2)

President and Chief Executive Officer | | 2005

2004

2003 | | $

$

$ | 396,435

387,885

335,000 | | $

$

$ | 157,658

—

225,647 | | $

$

$ | 554,093

387,885

560,647 | | 78,333

—

160,000 |

Daniel J. Dominguez(3)

Chief Operating Officer |

|

2005 |

|

$ |

188,875 |

|

$ |

109,450 |

|

$ |

298,325 |

|

55,750 |

Richard P. Dutkiewicz(4)

Chief Financial Officer |

|

2005

2004

2003 |

|

$

$

$ |

223,554

190,000

27,038 |

|

$

|

54,236

—

— |

|

$

$

$ |

277,790

190,000

27,038 |

|

31,250

—

75,000 |

Jill B.W. Sisson(5)

General Counsel and Secretary |

|

2005

2004

2003 |

|

$

$

|

225,000

201,747

— |

|

$

|

55,176

—

— |

|

$

$

|

280,176

201,747

— |

|

31,250

—

75,000 |

- (1)

- Bonus amounts represent amounts paid in the respective fiscal year for bonuses earned in the preceding fiscal year.

- (2)

- Mr. Murphy became Chief Executive Officer on October 1, 2003.

- (3)

- Mr. Dominguez became Chief Operating Officer on December 8, 2005.

- (4)

- Mr. Dutkiewicz was hired as Chief Financial Officer in October 2003.

- (5)

- Ms. Sisson is currently a consultant to the company under an agreement dated December 8, 2003.

15

Stock Option Grants in Last Fiscal Year

The following table sets forth information regarding stock options we granted during fiscal year 2005 to each of the Named Executive Officers:

Option Grants in Last Fiscal Year

| | Number of

securities

underlying

options

granted(a)

| | Percentage of

total options

granted to

employees in

fiscal year

| |

| |

| | Potential realizable

value at assumed annual rates of stock price appreciation for option term(b)

|

|---|

Name

| | Exercise

price

($ per share)

| | Expiration

date

|

|---|

| | 5% ($)

| | 10% ($)

|

|---|

| Paul J.B. Murphy | | 78,333 | | 12.9 | % | $ | 2.30 | | 4/7/2015 | | $ | 113,305 | | $ | 287,138 |

Daniel J. Dominguez |

|

20,755

35,000 |

|

3.4

5.8 |

%

% |

|

2.30

4.50 |

|

4/7/2015

11/10/2015 |

|

|

30,014

99,052 |

|

|

76,061

251,014 |

Richard P. Dutkiewicz |

|

31,250 |

|

5.2 |

% |

|

2.30 |

|

4/7/2015 |

|

|

45,202 |

|

|

114,550 |

Jill B.W. Sisson |

|

31,250 |

|

5.2 |

% |

|

2.30 |

|

4/7/2015 |

|

|

45,202 |

|

|

114,550 |

- (a)

- One-half of the options granted are subject to time vesting and one-half are subject to performance vesting. Options were granted under our 2003 Executive Employee Incentive Plan at the market price on the date of grant and have a ten-year term.

- (b)

- The dollar amounts in these columns are the result of calculations at stock appreciation rates specified by the Securities and Exchange Commission and are not intended to forecast actual appreciation rates of our stock price.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year End Option Values

During the fiscal year ended January 3, 2006, none of the Named Executive Officers exercised any stock options. Set forth below is information on the number of stock options covered by both exercisable and unexercisable stock options as of January 3, 2006 and the values of the "in-the-money" options, which represent the positive spread between the exercise price of any such options and the fiscal year-end value of our common stock.

Fiscal Year-End Option Values

Name

| | Number of securities

underlying unexercised options

at fiscal year-end (#)

Exercisable/Unexercisable

| | Value of unexercised

in-the-money options

at fiscal year-end ($)(a)

Exercisable/Unexercisable

|

|---|

| Paul J.B. Murphy | | 93,334 / 131,665 | | $ | 56,000 / $204,332 |

Daniel J. Dominguez |

|

12,250 / 62,750 |

|

$ |

7,350 / $49,850 |

Richard P. Dutkiewicz |

|

43,750 / 56,250 |

|

$ |

26,250 / $83,750 |

Jill B.W. Sisson |

|

43,750 / 56,250 |

|

$ |

26,250 / $83,750 |

- (a)

- Based upon the closing price of $4.50 per share of common stock as quoted on the Pink Sheets on January 3, 2006.

16

Employment and Other Arrangements

Jill B.W. Sisson. On December 8, 2003, we entered into a consulting agreement with Jill B.W. Sisson to provide legal, consulting and advisory services to us and to serve as our General Counsel and Secretary. Pursuant to the agreement, Ms. Sisson is paid $15,833 per month, which may be adjusted by the board of directors and, on December 19, 2003, was granted options to purchase 75,000 shares of common stock pursuant to the Incentive Plan. The options vest in part upon length of service, and in part upon the achievement of specified financial goals by us. Certain options were cancelled in 2005 based on 2004 financial results. In addition, Ms. Sisson is eligible to receive annual additional premium compensation based upon company performance and personal performance. Ms. Sisson will also be reimbursed for reasonable and necessary out-of-pocket expenses. The agreement provides for non-solicitation of company employees for a year after termination of the agreement, and can be terminated by either party upon 30 days' notice. In December 2004, Ms. Sisson's compensation was increased to $18,750 per month and in April 2005 she received options to purchase 31,250 shares of stock which vest in part on length of service and in part upon achievement of specified financial goals.

We have no other employment or similar contracts as of the date of this proxy statement.

Corporate Code of Conduct

We have adopted a Corporate Code of Conduct that applies to our directors, executive officers and all of our employees. We will provide any person, without charge and upon request, with a copy of our Corporate Code of Conduct. Requests should be directed to us at 1687 Cole Boulevard, Golden, Colorado 80401, Attention: Secretary. The Corporate Code of Conduct is also available on our website at www.nwrgi.com. The information on our website is not incorporated into this proxy statement.

We will disclose any amendments to or waivers of the Corporate Code of Conduct on our website atwww.nwrgi.com. We have established a confidential hotline to answer employees' questions related to the Corporate Code of Conduct and to report any concerns. Our audit committee also has established procedures to receive, retain and treat complaints regarding accounting, internal accounting controls or auditing matters, and to allow for the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters.

Notwithstanding anything to the contrary set forth in any of our filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings, including this proxy statement, in whole or in part, the following Compensation Committee Report on Executive Compensation, Audit Committee Report and Performance Graph shall not be deemed to be "Soliciting Material," are not deemed "filed" with the SEC and shall not be incorporated by reference into any filings under the Securities Act or Exchange Act whether made before or after the date of this proxy statement and irrespective of any general incorporation language in such filings.

Compensation Committee Report on Executive Compensation

The compensation committee of the board of directors consists of three non-employee independent directors, Leonard Tannenbaum, James W. Hood and S. Garrett Stonehouse, Jr.

Compensation Philosophy. Our executive compensation program is designed to attract, retain, and motivate high caliber executives and to focus the interests of the executives on objectives that enhance stockholder value. Under the 2005 Bonus Plan, these goals emphasized pay for performance by making a portion of the executive's compensation dependent upon achieving individual objective goals and ensuring the company achieved certain financial results and making another portion of the executive's compensation solely dependent on our company achieving certain financial results. In addition, we have linked executive and stockholder interests through equity-based plans. Also, we strive to make the compensation packages for our executives competitive relative to similar positions at companies of

17

comparable size in our industry. The principal elements of our executive compensation program are base salary, bonus, and stock options.

Executive Officer Salaries. Base salaries for our executives are intended to reflect the scope of each executive's responsibilities, success of our business, and individual contributions of each executive to that success. Increases in base salary may be affected by other considerations, such as geographic or market data, industry trends or internal equity. Executive salaries are adjusted only after evaluation of all of these considerations, occurring gradually over time and only as necessary to meet our operational and financial objectives.

Bonuses. The compensation committee may award cash bonuses to our executive officers. The formal 2005 bonus plan established a company financial performance threshold, which was met. The dollars exceeding this threshold created a bonus pool out of which 2005 bonuses have been calculated for participating employees. One-half of bonus dollars to be paid out are based first on the financial results of the company and then on individual performance objectives. The other one-half of bonus dollars to be paid out are based solely on the financial results of the company. The percentage payout of bonus dollars for 2005 has been established at 104.8%. Accordingly, for 2005 executive officers earned one-half of the bonus dollars to be paid out at 104.8% based solely on financial results. The remaining one-half of bonus dollars to be paid out was based on achievement of individual performance objectives as determined by the CEO for executive officers. This year, our performance was strong and on average, the individual performance objectives were awarded to executive officers at 81.8%. The executive officers' overall bonus for 2005 averaged 93.3% of the total bonus potential.

In September 2004, the compensation committee deferred a bonus pool for three executives based on carry-over financial goals from 2004. These were goals that the compensation committee believed could only be attained over the course of a two year period. Those bonuses have now been approved for payment as the goals have been successfully attained.

Stock Plan. We rely on long-term equity-based compensation as a means of compensating and incentivizing our executive officers. It is our practice to set option exercise prices at not less than 100% of the fair market value of our common stock on the date of grant. Thus, the value of the stockholders' investment in us must appreciate before an optionee receives any financial benefit from the option. Options are generally granted for a term of ten years. In determining the number of shares subject to stock option grants to executive officers, the compensation committee considers various subjective factors primarily related to the responsibilities of the individual officers and to their expected future contributions as well as the number of options previously granted to the officer or which continue to be subject to vesting under the outstanding options previously granted to such officer. In addition, the compensation committee examines the level of equity incentives held by each executive officer relative to the other executive officers' equity positions and their tenure, responsibilities, experience and value to us. In April 2005, the compensation committee granted options to purchase a total of 458,000 shares to the executive officers and other key officers and employees. One-half of each of these grants vest equally over three years and one-half vest over three years based upon the attainment of certain financial goals in each of those years. The financial goals are based on our earnings before interest, taxes, depreciation and amortization (EBITDA). In April 2006, of the 2005 option grants to employees, options to purchase 125,040 shares vested based on our 2005 financial performance.

Compensation of Current Chief Executive Officer. Paul J.B. Murphy, III has served as our Chief Executive Officer since October 2003. Mr. Murphy generally participates in the same executive compensation plans and arrangements available to other senior executives. Accordingly, his compensation also consists of an annual base salary, a potential annual cash bonus, and long-term equity-linked compensation in the form of stock options. The compensation committee's general approach in establishing Mr. Murphy's compensation is to be competitive with peer companies. Under the 2005 Bonus Plan, Mr. Murphy's bonus award is based 50% on achievement of individually-defined

18

objective performance criteria and 50% on overall company financial performance. Mr. Murphy's bonus for 2005 was 87.2% of his bonus potential.

Policy of Deductibility of Compensation. Section 162(m) of the Internal Revenue Code of 1986, as amended, limits a company's tax deduction to $1 million for compensation paid to its chief executive officer and any of its four most highly compensated executive officers. However, compensation that qualifies as "performance-based" is excluded from the $1 million limit if, among other requirements, the compensation is payable only upon attainment of pre-established, objective performance goals under a plan approved by the company's stockholders. We intend to continue to use performance-based compensation in the future, which should minimize the effect of this deduction limitation. However, we strongly believe that our primary responsibility is to provide a compensation program that will attract, retain and reward the executive talent necessary to maximize the return to stockholders, and that the loss of a tax deduction may be necessary in some circumstances.

Summary. In summary, the compensation committee believes that our compensation program is reasonable and competitive with compensation paid by other restaurant companies of similar size, revenue, and operations. The program is designed to reward managers for strong personal, company, and share value performance. The compensation committee monitors the various guidelines that make up the program and reserves the right to adjust them as necessary to continue to meet company and stockholder objectives.

Audit Committee Report

The audit committee of the board of directors consists of three non-employee independent directors, Michael W. Arthur, Chairman, Frank C. Meyer and Leonard Tannenbaum. The audit committee is a standing committee of the board of directors and operates under a written charter approved by the Board of Directors in January 2004, which is reviewed annually and which was reviewed and amended by the committee in March 2006.

Management is responsible for our system of internal controls and the financial reporting process. The independent accountants are responsible for performing an independent audit of our consolidated financial statements in accordance with auditing standards generally accepted in the United States of America and to issue a report thereon. The audit committee is responsible for monitoring (1) the integrity of our financial statements, (2) our compliance with legal and regulatory requirements, and (3) the independence and performance of our auditors.

The audit committee has reviewed with our management and the independent accountants the audited consolidated financial statements in the annual report on Form 10-K for the year ended January 3, 2006, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the consolidated financial statements. Management represented to the audit committee that our consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America. The audit committee discussed with the independent accountants matters required to be discussed by Statement of Auditing Standards No. 61, "Communication with Audit Committees."

Our independent accountants also provided to the audit committee the written disclosure required by "Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees." The audit committee discussed with the independent accountants that firm's

19

independence. The audit committee considered the non-audit services provided by the independent accountants and subsequently concluded that such services were compatible with maintaining the accountants' independence.

Based on the audit committee's discussion with management and the independent accountants, and the audit committee's review of the representation of management and the report of the independent accountants to the audit committee, the audit committee recommended that the board of directors include the audited consolidated financial statements in our Annual Report on Form 10-K for the year ended January 3, 2006 filed with the SEC.

20

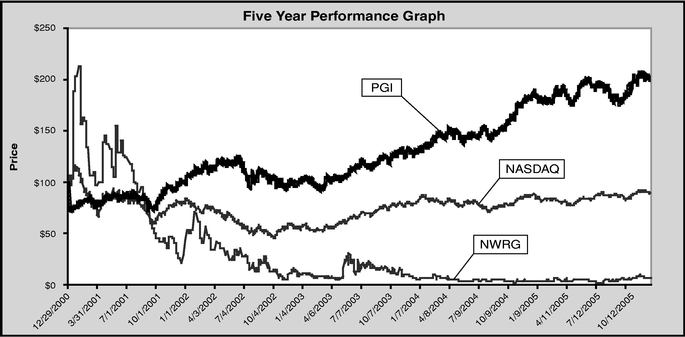

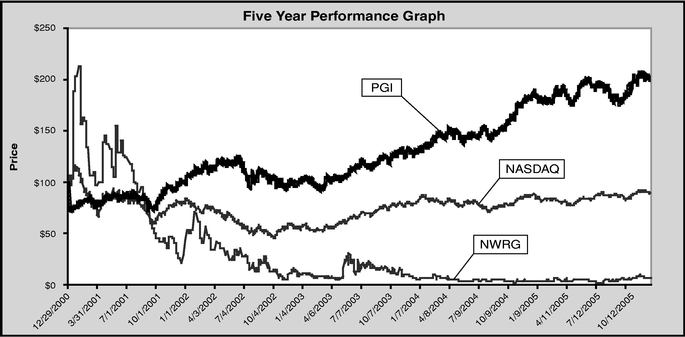

PERFORMANCE GRAPH

The included performance graph covers the fiscal five-year period from December 31, 2000 through January 3, 2006. The graph compares the total return of our common stock (NWRG) to our current peer group of companies (PGI) and the NASDAQ Composite Index. The PGI was selected representing our competitive peer group, comprised of multi-concept companies and/or companies with a similar organizational structure. The companies selected are participants of the Restaurant Industry with a sufficient period of operating history for continuous inclusion in the Index.

| | 12/31/2000

| | 1/1/2002

| | 12/31/2002

| | 12/30/2003

| | 12/28/2004

| | 1/3/2006

|

|---|

| NWRG | | $ | 100.00 | | $ | 43.02 | | $ | 10.50 | | $ | 5.81 | | $ | 3.90 | | $ | 7.48 |

| PGI(3) | | $ | 100.00 | | $ | 99.41 | | $ | 100.76 | | $ | 132.30 | | $ | 189.21 | | $ | 201.03 |

| NASDAQ | | $ | 100.00 | | $ | 78.95 | | $ | 54.06 | | $ | 81.35 | | $ | 88.13 | | $ | 90.82 |

- (1)

- Assumes all distributions to stockholders are reinvested on the payment dates.

- (2)

- Assumes $100 initial investment on December 31, 2000 in NWRG, the PGI, and the NASDAQ Composite Index.

- (3)

- The PGI is a market value-weighted index. The index includes:

Panera Bread Company

Starbucks Corporation

YUM! Brands, Inc.

Star Buffet, Inc.

Brinker International, Inc.

CBRL Group, Inc.

Darden Restaurants, Inc.

Quality Dining and Worldwide Restaurant Concepts, which were previously included in the peer group, are no longer publicly traded and, therefore, are not included in the current peer group for any of the periods covered by the graph.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our officers and directors, and persons who own more than ten percent of our common stock, to file reports of ownership and changes in ownership on Forms

21

3, 4 and 5 with the SEC. Officers, directors and greater than ten percent stockholders are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. To our knowledge, based solely on our review of the copies of such forms received by us, we believe that all Section 16(a) filing requirements applicable to our officers, directors and greater than ten percent beneficial owners have been complied with for the fiscal year ended January 3, 2006, except that James W. Hood, a director, failed timely to report certain purchases in November and December 2005, which have been reported on his Form 5, the automatic grants of director options on January 2, 2006 to Messrs. Arthur, Hood, Meyer, Stonehouse and Tannenbaum were reported two days late on January 6, 2006 and the automatic grants of director options on January 3, 2005 to Messrs. Arthur, John S. Clark II, Meyer, Stonehouse and Tannenbaum were reported 28 days late on February 2, 2005.

HOUSEHOLDING

As permitted by applicable law, we intend to deliver only one copy of certain of our documents, including proxy statements, annual reports and information statements to stockholders residing at the same address, unless such stockholders have notified us of their desire to receive multiple copies thereof. Any such request should be directed to New World Restaurant Group, Inc., 1687 Cole Boulevard, Golden, Colorado 80401, Attention: Secretary, or by telephone at (303) 568-8000. Stockholders who currently receive multiple copies of the proxy statement at their address and would like to request householding of their communications should contact their broker.

PROPOSALS OF STOCKHOLDERS

Stockholders wishing to include proposals in the proxy material in relation to the annual meeting in 2007 must submit the proposals in writing so as to be received by the Secretary at our executive offices, no later than the close of business on December 7, 2006. Such proposals must also meet the other requirements of the rules of the SEC relating to stockholders' proposals and the provisions of our Restated Certificate of Incorporation. If we are not notified of intent to present a proposal at our 2007 annual meeting by February 20, 2007, we will have the right to exercise discretionary voting authority with respect to such proposal, if presented at the meeting, without including information regarding such proposal in our proxy materials.

OTHER BUSINESS

We do not anticipate that any other matters will be brought before the annual meeting. However, if any additional matters shall properly come before the meeting, it is intended that the persons authorized under proxies may, in the absence of instructions to the contrary, vote or act thereon in accordance with their best judgment.

Golden, Colorado

April 6, 2006

22

ANNEX A

AUDIT COMMITTEE CHARTER

FOR

NEW WORLD RESTAURANT GROUP, INC.

Authority

The Audit Committee (the "Committee") of the Board of Directors (the "Board") of New World Restaurant Group, Inc. (the "Company") is established pursuant to the Company's Bylaws and Section 141(c) of the Delaware General Corporation Law.

Purpose of the Committee

The purposes of the Committee are to:

1. assist Board oversight of (a) the integrity of the Company's financial statements, (b) the Company's compliance with legal and regulatory requirements, (c) the independent auditors' qualifications and independence, and (d) the performance of the Company's internal audit function and independent auditors; and

2. prepare an annual report for inclusion in the Company's annual proxy statement in accordance with applicable rules and regulations of the Securities and Exchange Commission (the "SEC").

While the Committee has the duties and responsibilities set forth in this charter, the Committee is not responsible for planning or conducting the audit or determining whether the Company's financial statements are complete and accurate and are in accordance with generally accepted accounting principles. Such activities are the responsibility of management and the Company's independent auditors. The Committee does not itself prepare financial statements or perform audits or auditing services, and its members are not auditors, certifiers of the Company's financial statements or guarantors of the Company's independent auditors' reports. It is not the duty or responsibility of the Committee to ensure that the Company complies with all laws and regulations. Each member of the Committee shall be entitled to rely in good faith on (a) the integrity of those persons and organizations within and outside of the Company from which it receives information, (b) the accuracy of the financial and other information provided to the Committee by such persons or organizations absent actual knowledge to the contrary (which shall be promptly reported to the Board) and (c) representations made by management as to any audit and non-audit services provided by the independent auditors to the Company.

The ultimate accountability of the Company's independent auditors is to the Board of Directors and the Committee, as representatives of the stockholders.

Committee Membership

The Committee shall be comprised of at least three members of the Board each of whom has been affirmatively determined in the judgment of the Board to qualify as independent directors ("Independent Directors") under the rules of the National Association of Securities Dealers applicable to The Nasdaq Stock Market, Inc. (the "Nasdaq Listing Rules"), Section 10A(m) of the Securities Exchange Act of 1934, as amended (the "Exchange Act") and the rules and regulations promulgated thereunder by the SEC (except as otherwise permitted by the Nasdaq Listing Rules). In addition to the determination of independence, no director may serve as a member of the Committee if such director has participated in the preparation of financial statements of the Company or any subsidiary of the Company at any time during the past three years. The Board shall designate the Chairperson of the

A-1

Committee, provided that if the Board does not so designate a Chairperson, the members of the Committee, by majority vote, may designate a Chairperson.

Each member of the Committee shall be able to read and understand fundamental financial statements (including a balance sheet, income statement and cash flow statement) at the time of such director's appointment to the Committee. In addition, at least one member of the Committee should be an "audit committee financial expert," as such term is defined in the rules and regulations promulgated by the SEC. If no member qualifies as an audit committee financial expert, then at least one member of the Committee shall have had past employment experience in finance or accounting, requisite professional certification in accounting, or any other comparable experience or background which results in the individual's financial sophistication, including being or have been a chief executive officer, chief financial officer or other senior officer with financial oversight responsibilities.

No director may serve as a member of the Committee if such director serves on the audit committees of more than two other public companies unless the Board determines that such simultaneous service would not impair the ability of such director to effectively serve on the Committee.

If a member of the Committee ceases to qualify as an Independent Director for reasons outside of such member's reasonable control, such member may remain on the Committee until the earlier of the Company's next annual stockholders meeting or one year from the occurrence of the event that caused the member to cease qualifying as an Independent Director, provided that the Company complies with the applicable Nasdaq Listing Rules.

Any vacancy on the Committee shall be filled by majority vote of the Board at the next meeting of the Board following the occurrence of the vacancy. No member of the Committee shall be removed except by majority vote of the Board.

Compensation