UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One):

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 30, 2008

OR

| ¨ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-33515

EINSTEIN NOAH RESTAURANT GROUP, INC.

(Exact Name of Registrant as Specified in its Charter)

| | |

| Delaware | | 13-3690261 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

| 555 Zang Street, Suite 300, Lakewood, Colorado | | 80228 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (303) 568-8000

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class: | | Name of each exchange on which registered: |

| Common Stock, $.001 par value | | The NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments of this Form 10-K. ¨

Indicate by check mark whether the registrant is large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | |

| Large accelerated filer¨ | | Accelerated filerx |

Non-accelerated filer¨ (Do not check if a smaller reporting company) | | Smaller reporting company¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting common equity held by non-affiliates of the registrant as of the last business day of the second fiscal quarter, July 1, 2008 was $53,368,183 (computed by reference to the closing sale price as reported on the NASDAQ Global Market). As of February 26, 2009 there were 16,032,943 shares of the registrant’s Common Stock, par value of $0.001 per share outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III is incorporated herein by reference from the registrant’s definitive proxy statement for the 2009 annual meeting of stockholders, which will be filed with the SEC within 120 days after the close of the 2008 fiscal year.

EINSTEIN NOAH RESTAURANT GROUP, INC.

FORM 10-K

TABLE OF CONTENTS

1

PART I

General development of our Company:

Einstein Noah Restaurant Group, Inc. (the “Company”) operates primarily under the Einstein Bros. Bagels (“Einstein Bros.”), Noah’s New York Bagels (“Noah’s”) and Manhattan Bagel Company (“Manhattan Bagel”) brands. We commenced operations as an operator and franchisor of coffee cafes in 1993. Substantial growth in our restaurant counts occurred through a series of acquisitions. In 1998, we acquired the stock of Manhattan Bagel Company. In 1999, we acquired the assets of Chesapeake Bagel Bakery. Our largest acquisition was in 2001 when we acquired substantially all the assets of Einstein/Noah Bagel Corp. in an auction conducted by the bankruptcy court. To consummate this acquisition, we engaged in several rounds of financing that included the issuance of $165.0 million of debt and $65.0 million of mandatorily redeemable preferred stock. In mid-2003, we recapitalized our balance sheets with the issuance of $160.0 million of indentures and the issuance of $57.0 million of mandatorily redeemable preferred stock. In June 2007 we completed a secondary offering which provided $83.3 million which was used to pay down a substantial portion of the Company’s debt.

Financial information about segments:

We operate three business segments plus a corporate support unit:

| | • | | The company-owned restaurants segment includes our Einstein Bros. and Noah’s brands, which have similar investment criteria and economic and operating characteristics. |

| | • | | The manufacturing and commissary segment produces and distributes bagel dough and other products to our restaurants, licensees and franchisees and other third parties. Inter-company sales to our company-owned restaurants have been eliminated during consolidation. |

| | • | | The franchise and license segment earns royalties and other fees from the use of trademarks and operating systems developed for the Manhattan, Einstein Bros. and Noah’s brands. |

| | • | | Corporate support unit consists of overhead and other activities related to the prior business segments, as well as interest on our debt and depreciation on our assets. |

See Note 20 to the consolidated financial statements included in Item 8 of this 10-K for the financial results by segment for fiscal years 2006, 2007 and 2008.

Narrative description of business:

Einstein Noah Restaurant Group, Inc. is the largest owner/operator, franchisor and licensor of bagel specialty restaurants in the United States. As of December 30, 2008, we had 649 restaurants in 36 states plus the District of Columbia. As a leading fast-casual restaurant chain, our restaurants specialize in high-quality foods for breakfast, lunch and afternoon snacks in a bakery-café atmosphere with a neighborhood emphasis. Collectively, our concepts span the nation with Einstein Bros. restaurants in 26 states and in the District of Columbia, Noah’s restaurants in 3 states on the west coast and Manhattan Bagel restaurants concentrated in the Northeast. Currently, our Einstein Bros. and Noah’s restaurants are predominantly company-owned or licensed, while Manhattan Bagel restaurants are predominantly franchised, with one company-owned location.

Our product offerings include fresh bagels and other bakery items baked on-site, made-to-order breakfast and lunch sandwiches on a variety of bagels, breads or wraps, gourmet soups and salads, assorted pastries, premium coffees and an assortment of snacks. Our manufacturing and commissary operations prepare and assemble consistent, high-quality ingredients that are delivered fresh to our restaurants through our network of independent distributors.

2

We believe controlling the development, sourcing, manufacturing and distribution of our key products is an important element in ensuring both quality and profitability. To support this strategy, we have developed proprietary formulations, invested in processing technology and manufacturing capacity, and aligned ourselves with strategic suppliers.

Licensing and franchising our brands allows us to increase our geographic footprint and brand recognition. We also generate additional revenues without incurring significant additional expense, capital commitments and many of the other risks associated with opening new company-owned restaurants.

Company-owned restaurants

Approximately 91% of our 2008 total revenue was generated by restaurant sales at our Einstein Bros. and Noah’s company-owned restaurants. For the year to date period ended December 30, 2008, approximately 64% of our revenues were generated from restaurant sales during the breakfast hours, 28% were generated during the lunch hours and 8% were generated during the late afternoon hours.

| | • | | Principal products and services sold:Einstein Bros. offers a menu that specializes in high-quality foods for breakfast and lunch, including fresh-baked bagels and hot breakfast sandwiches, cream cheese and other spreads, specialty coffees and teas, creative soups, salads and sandwiches, and other unique menu offerings. During fiscal years 2006, 2007 and 2008, Einstein Bros. company-owned restaurants generated approximately 80% of our total company-owned restaurant sales. |

Noah’s is a neighborhood-based, deli-inspired restaurant that serves a variety of signature sandwiches, fresh baked breads, home-style soups, tempting sweets and our award-winning bagels. Noah’s offers a menu that specializes in high-quality foods for breakfast and lunch, including fresh-baked bagels and other baked goods, made-to-order deli-style sandwiches, including such favorites as pastrami, corned beef and roast beef on fresh breads and bagels baked on premises daily, hearty soups, innovative salads, desserts, fresh brewed premium coffees and other café beverages. During fiscal years 2006, 2007 and 2008, Noah’s company-owned restaurants generated approximately 20% of our total restaurant sales.

Manhattan Bagel offers over 17 varieties of fresh-baked bagels, as well as freshly baked muffins and other pastries, and up to 15 flavors of cream cheese, a variety of breakfast and lunch sandwiches, salads, soups, coffees and café beverages and desserts. In late 2007, we acquired a location from one of our franchisees, which made it our only company-owned Manhattan Bagel restaurant. We use this location for employee and manager training, and to test out new products and services before they are rolled out system-wide.

| | • | | Status of products/service:We are planning to open new company-owned restaurants under the Einstein Bros. and Noah’s brands within existing markets. Our expansion plans are intended to increase penetration of our restaurants in our most attractive markets. In 2008, we opened 17 new company-owned restaurants. In 2009, we plan to open six to eight new company-owned restaurants. |

We believe catering is an effective way to leverage our existing restaurant infrastructure with little or no additional capital investment and to expose more people to our food and our brands. We recognize that an effective catering program requires different skills for effectively selling to businesses that frequently utilize catering. Accordingly, we have assembled a dedicated staff of catering managers and coordinators to perform this function. We have catering operations in 22 major markets and plan on adding catering specialists in five additional markets during 2009. We are in the process of implementing the centralization and automation of the ordering process to ensure the order is routed to the restaurant best positioned to fulfill it in a timely manner.

| | • | | Product Supply:Our purchasing programs provide our company-owned restaurants and our franchise and license restaurants with high quality ingredients at competitive prices from reliable sources. Consistent product specifications, as well as purchasing guidelines, help to ensure freshness and |

3

| | quality. Because we utilize fresh ingredients in most of our menu offerings, inventory at our distributors and company-owned restaurants are maintained at modest levels. We negotiate price agreements and contracts depending on supply and demand for our products and commodity pressures. These agreements can range in duration from six months to five years. Additionally, in late 2007, we contracted with a third party advisor to manage our flour purchases for our company-owned production facility, and to advise us on commodity related purchases for our third-party contracted facility. |

| | • | | Trademarks and service marks:Our rights in our trademarks and service marks are a significant part of all segments of our business. We are the owners of the federal registration rights to the “Einstein Bros.,” “Noah’s New York Bagels” and “Manhattan Bagel” marks, as well as several related word marks and word and design marks related to our core brands. We license the rights to use certain trademarks we own or license to our franchisees and licensees in connection with their operations. Many of our core brand trademarks are also registered in numerous foreign countries. We are party to a co-existence agreement with the Hebrew University of Jerusalem (“HUJ”) which sets forth the terms under which we can use the name Einstein Bros. and the terms and restrictions under which HUJ could license the name and likenesses associated with the Estate of Albert Einstein to a business that competes with the Company. We also own numerous other trademarks and service marks related to our other business. We are aware of a number of companies that use various combinations of words in our marks, some of which may have senior rights to ours for such use, but we do not consider any of these uses, either individually or in the aggregate, to materially impair the use of our marks. It is our policy to defend our marks and their associated goodwill against encroachment by others. |

| | • | | Seasonality:Our business is subject to seasonal fluctuations. Significant portions of our net revenues and results of operations are realized during the fourth quarter of the fiscal year, which includes the December holiday season. Because of the seasonality of the business and the industry, results for any quarter are not necessarily indicative of the results that may be achieved for any other quarter or the full fiscal year. |

| | • | | Dependence on a single customer: We do not have a significant concentration of sales with any individual customer and, therefore, the loss of any one customer would not have a material impact on our business. No single customer has accounted for 10% or more of our total company-owned restaurant sales. |

| | • | | Government Regulation:Each of our restaurants is subject to licensing and regulation by a number of governmental authorities, which include health, safety, labor, sanitation, building and fire agencies in the state, county, or municipality in which the restaurant is located. A failure to comply with one or more regulations could result in the imposition of sanctions, including the closing of restaurants for an indeterminate period of time, fines or third party litigation. |

| | • | | Competition:The restaurant industry is intensely competitive. The industry is often affected by changes in demographics, consumers’ eating habits and preferences, local and national economic conditions affecting consumer spending habits, population trends, and local traffic patterns. |

We experience competition from numerous sources in our trade areas. Our restaurants compete based on guests’ needs for breakfast, lunch and afternoon snacks. Our competitors are different for each daypart. The competitive factors include brand awareness, advertising effectiveness, location and attractiveness of facilities, hospitality, environment, quality and speed of guest service and the price/value of products offered. We compete in the fast-casual segment of the restaurant industry, but we also consider other restaurants in the fast-food, specialty food and full-service segments to be our competitors.

| | • | | Associates:As of December 30, 2008, the Company had 7,698 associates, of whom 7,310 were restaurant personnel. Most restaurant personnel work part-time and are paid on an hourly basis. We have never experienced a work stoppage and our associates are not represented by a labor organization. |

4

Manufacturing and Commissaries:

Approximately 7% of our 2008 total revenue was generated by our manufacturing and commissary operations.

| | • | | Manufacturing:We currently operate a bagel dough manufacturing facility in Whittier, California and have a supply contract with a single supplier to produce bagel dough to our specifications. These facilities provide frozen dough and partially-baked frozen bagels for our company-owned restaurants, franchisees and licensees. We use excess capacity to produce bagels for sale to resellers, such as Costco Wholesale Corporation and Super Target. |

We have long-standing relationships with Costco, and Super Target. Costco sells our bagels, which are co-branded with the Kirkland® brand, and Super Target sells both bagels and cream cheese in retail kiosks. We also sell frozen dough in the U.S. to a third party foreign entity who sells that product under our Einstein Bros. brand in Asia.

| | • | | Commissaries:Currently we operate five United States Department of Agriculture (“USDA”) inspected commissaries geographically located to best serve our existing company-owned, franchise and license restaurants. We believe our commissary system provides a competitive cost advantage by buying in bulk and assembling or repacking the product into store-friendly sizes for use at our company-owned restaurants, franchise and license restaurants. These operations primarily provide our restaurants with critical food products such as sliced meats, cheeses, and pre-portioned kits that create our various salads. Our commissaries assure consistent quality, supply fresh products and improve efficiencies by reducing labor and inventory requirements at the restaurants. We distribute commissary products primarily through our regional distribution partners. |

| | • | | Status of products/service:There are currently no plans to open new commissaries or production facilities in the near future. |

| | • | | Product supply: We have developed or use proprietary recipes and production processes for our bagel dough, cream cheese and coffee to help ensure product consistency. We believe this system provides a variety of consistent, superior quality products at competitive market prices to our company-owned, franchised and licensed restaurants. |

Frozen bagel dough is shipped to all of our company-owned, franchised and licensed Einstein Bros., Noah’s and Manhattan Bagel restaurants and baked on-site. Our significant know-how and technical expertise for manufacturing and freezing mass quantities of raw dough produces a high-quality product more commonly associated with smaller bakeries.

Our cream cheese is manufactured to our specifications utilizing proprietary recipes. Our cream cheese and certain other cheese products are purchased from one supplier under a contract that has been extended through the end of 2013. We also have developed proprietary coffee blends for sale at our Einstein Bros., Noah’s and Manhattan Bagel company-owned, franchised and licensed restaurants.

We purchase other ingredients used in our restaurants, such as meat, lettuce, tomatoes and condiments, from a select group of third party suppliers. Our chicken products come from naturally raised chickens that are cared for in strict accordance with established animal care guidelines and without the use of growth accelerators such as antibiotics, steroids or hormones. Our roast beef is USDA Choice, Grade A, and comes only from corn-fed, domestic cattle. Where available, we buy high quality fruits, vegetables and specialty produce from local farmers and shippers through distributors.

| | • | | Seasonality: Seasonality related to this segment is driven by the seasonality at the restaurants. |

| | • | | Dependence on a single customer: A significant concentration of our manufacturing and commissary revenues is with several customers who resell our product; approximately half of this revenue is from one large customer; however, no single customer has accounted for 10% or more of our total Company revenues and, therefore, the loss of any one customer would not have a material impact on our business. |

5

| | • | | Backlog: Our manufacturing and commissary facilities do not have a material amount of backlog orders. |

| | • | | Government Regulation:Our manufacturing and commissary facilities are licensed and subject to regulation by either federal, state or local health and fire codes. We are subject to the regulations of keeping our facilities USDA compliant. Additionally, we are also subject to federal and state environmental regulations. |

| | • | | Competition: Our manufacturing and commissary operations are primarily ancillary and support our company-owned restaurant operations as well as our franchisees and licensees. Our competition would be from several large bakeries and from local bakeries in the states in which we operate. |

| | • | | Associates: As of December 30, 2008, the Company had 7,698 associates, of whom 155 were plant and support services personnel. We have never experienced a work stoppage and our associates are not represented by a labor organization. |

Franchise and Licensing

Approximately 2% of our 2008 total revenue was generated by our franchise and license operations.

| | • | | Einstein Bros. franchising:We are offering Einstein Bros. franchises to qualified area developers. As of December 30, 2008, we were registered to offer Einstein Bros. franchises in 49 states and are currently working to finalize our registration in the 50th state. During 2008, we actively marketed the Einstein Bros. brand franchise rights and signed several multi-location deals. We currently have seven development agreements in place for 47 restaurants that we expect will open on various dates through 2016. The first two Einstein Bros. franchise locations opened in 2008. |

Unlike past Manhattan Bagel franchises, which were sold as single franchised units, we plan to utilize a franchise area development model for the Einstein Bros. brand in which we will assign exclusive rights to develop restaurants within a defined geographic region within a specified period of time. We are targeting franchise area developers who have the existing infrastructure, operational experience and financial strength to develop several restaurants in a designated market. The franchise agreement requires an up-front fee of $35,000 per restaurant and a 5% royalty based on sales.

We intend to enter into franchise area development agreements in geographic markets where we either currently do not have Einstein Bros. restaurants or in markets that can support both franchised and company-owned restaurants. In markets where we have limited market penetration, we may also consider selling existing Einstein Bros. restaurants to a franchise area developer. In these instances, we plan to require the franchise area developer to open a minimum number of additional restaurants within a designated period of time.

| | • | | Manhattan Bagel Franchising:We currently have a franchise base in our Manhattan Bagel brand that generates a recurring revenue stream through royalty fee payments and revenue from the sale to our franchisees of products made from our proprietary recipes. The typical Manhattan Bagel franchise agreement requires an up-front fee of $25,000 per restaurant and a 5% royalty based on sales. Our Manhattan Bagel franchise base provides us with the ability to grow this brand with minimal commitment of capital by us, and creates a built-in customer base for our manufacturing operations. The core market for this brand is the northeastern United States with the majority of the Manhattan Bagel restaurants located in New Jersey, New York, and Pennsylvania. Our Manhattan Bagel franchise restaurants generally have average unit volumes of approximately $561,000. |

| | • | | Licensing:We have license relationships with Aramark, Sodexho, AAFES, HMS Host, Compass, and SSP. Our licensees are located primarily in airports, colleges and universities, hospitals and military bases and on turnpikes. Our license agreements vary by venue, but typically have a five-year term and provide that the licensee pays us an up-front license fee of $12,500 and a weighted average royalty fee of 6.2%. Our license restaurants generally have average unit volumes of approximately $495,000. |

6

| | • | | Status of development plans or expansion: We are planning to expand our presence through a significant expansion of franchise and license restaurants. This strategy allows us to generate additional revenues without incurring significant additional expense, capital commitments or many of the other risks associated with opening new company-owned restaurants. We also expect to increase our geographic footprint and guest recognition of our brands. |

At the end of 2008, we had 71 franchised locations throughout the United States. We intend to leverage our franchising experience with the Manhattan Bagel brand and to accelerate the franchising of our Einstein Bros. brand and expand the current Manhattan Bagel franchise system. We have identified specific markets in which we intend to grow through franchising and are currently in discussions with several parties to develop in these markets. We opened two franchise restaurants in 2008, and currently are planning to open six to eight more in 2009.

At the end of 2008, we had 152 license restaurants throughout the United States. We opened 32 new license restaurants in 2008 and currently are planning to open at 30 to 35 new license restaurants in 2009.

| | • | | Product Supply:Our franchisees and licensees are required to purchase proprietary products through our designated suppliers or directly from us. Our Manhattan Bagel franchisees are not required to buy all of their non-proprietary products directly from us, but rather their product sources must be approved by us. |

| | • | | Seasonality: This segment is subject to the same seasonal fluctuations as our company-owned restaurant segment. Additionally, as many of our license locations are on college and university campuses, they are impacted by school schedules which typically include a summer break and the December holiday season. Because of the seasonality of the business and the industry, results for any quarter are not necessarily indicative of the results that may be achieved for any other quarter or the full fiscal year. |

| | • | | Dependence on a single customer: A significant concentration of our franchise and licensing revenues is with several large customers who have licensed multiple locations. However, no single customer has accounted for 10% or more of our total Company revenues and, therefore, the loss of any one customer would not have a material impact on our business. |

| | • | | Government Regulation:Our franchise operations are subject to Federal Trade Commission (the “FTC”) regulation and various state laws which regulate the offer and sale of franchises. Several state laws also regulate substantive aspects of the franchisor/franchisee relationship. The FTC requires us to furnish to prospective franchisees a franchise disclosure document containing prescribed information. A number of states in which we might consider franchising also regulate the sale of franchises and require registration of the disclosure document with state authorities. Our ability to sell franchises in those states is dependent upon obtaining approval of our disclosure document by those authorities. |

| | • | | Competition:We compete against similar fast-casual and quick-casual restaurants which franchise and license their brands in the states in which we operate. |

| | • | | Associates:As of December 30, 2008, the Company had 7,698 associates, of whom 23 were corporate personnel who work primarily with franchising and licensing. In addition, there were 210 corporate personnel, many of which assist in the segment in one way or another. |

Corporate Support

| | • | | Principal products/services sold: The support center is not a profit center and is designed to manage and support all of our company-owned restaurants, the manufacturing facility and commissaries and support our franchisees and licensees as well as general corporate governance. |

| | • | | Associates:As of December 30, 2008, the Company had 7,698 associates, of whom 233 were corporate personnel. |

7

Financial information about geographic areas:

Our manufacturing operations sell bagels to a wholesaler and a distributor who take possession in the United States and sell outside of the United States. As the product is shipped FOB domestic dock, there are no international risks of loss or foreign exchange currency issues. Sales shipped internationally are included in manufacturing and commissary revenue. Approximately $2.2 million, $3.3 million and $4.8 million for 2006, 2007, and 2008 respectively, were included in manufacturing revenue for these international shipments. All other revenues were from external customers domiciled in the United States of America.

Available Information:

We are subject to the informational requirements of the Securities Exchange Act of 1934. We therefore file periodic reports, proxy statements and other information with the Securities Exchange Commission (the “SEC”). Such reports may be obtained by visiting the Public Reference Room of the SEC at 100 F Street, N.E., Washington, D.C. 20549, or by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an internet site (www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically.

Additionally, copies of our reports on Forms 10-K, 10-Q and 8-K and any amendments to such reports are available for viewing and copying through our internet site (www.einsteinnoah.com), free of charge, as soon as reasonably practicable after filing such material with, or furnishing it to the SEC. We typically post information about the Company on our website under the Financials & Media tab.

We also make available on our website and in print to any stockholder who requests it, the Charters for our Audit and Compensation Committees, as well as the Code of Conduct that applies to all directors, officers, and associates of our company. Amendments to these documents or waivers related to the Code of Conduct will be made available on our website as soon as reasonably practicable after their execution.

Executive Officers:

| | | | |

Name | | Age | | Position |

Jeffery J. O’Neill | | 52 | | President, Chief Executive Officer and Director |

Daniel J. Dominguez | | 63 | | Chief Operating Officer |

Richard P. Dutkiewicz | | 53 | | Chief Financial Officer |

Jill B.W. Sisson | | 61 | | General Counsel and Secretary |

Jeffrey J. O’Neill. Mr. O’Neill joined us in December 2008 when he was appointed President and Chief Executive Officer. Previously, from January 2008 to October 2008, Mr. O’Neill was Chief Executive Officer of Priszm Income Fund, a publicly traded Canadian restaurant income trust with a portfolio of popular brands such as Pizza Hut and Taco Bell, which is also one of the largest independent KFC franchisees in the world. Prior to that, from April 2005 until January 2008, Mr. O’Neill was President and Chief Operating Officer of Priszm. Mr. O’Neill began his career in Brand Marketing with The Quaker Oats Company. In April 1999, he joined PepsiCo as the President of Pepsi Cola Canada. In 2002 PepsiCo acquired the Quaker Oats Company and in January 2003 Mr. O’Neill returned to his old company in Chicago to help lead the integration of the Quaker Oats/Gatorade acquisition. Mr. O’Neill has an Honors Bachelor of Business degree from the University of Ottawa.

Daniel J. Dominguez. Mr. Dominguez was appointed Chief Operating Officer in December 2005. Mr. Dominguez joined us in November 1995 and served as Senior Vice President of Operations for Noah’s New York Bagels from April 1998 to December 2005. From 1995 to April 1998, Mr. Dominguez served as the Director of Operations for Einstein Bros. Midwest. Prior to joining us, Mr. Dominguez was Executive Vice President of JB Patt America, Beverly Hills, CA, dba Koo Koo Roo Restaurants, from July 1994 to October 1995. From May 1987 to July 1994, he was the Divisional Vice President of Food Services for Carter

8

Hawley Hale in San Francisco, California. From November 1976 to May 1987 he was the Vice President of Operations for Bakers Square Restaurants in California.

Richard P. Dutkiewicz. Mr. Dutkiewicz joined us in October 2003 as Chief Financial Officer. From May 2003 to October 2003, Mr. Dutkiewicz was Vice President—Information Technology of Sirenza Microdevices, Inc. In May 2003, Sirenza Microdevices, Inc. acquired Vari-L Company, Inc. From January 2001 to May 2003, Mr. Dutkiewicz was Vice President—Finance, and Chief Financial Officer of Vari-L Company, Inc. From April 1995 to January 2001, Mr. Dutkiewicz was Vice President—Finance, Chief Financial Officer, Secretary and Treasurer of Coleman Natural Products, Inc., located in Denver, Colorado. Mr. Dutkiewicz’s previous experience includes senior financial management positions at Tetrad Corporation, MicroLithics Corporation and various divisions of United Technologies Corporation. Mr. Dutkiewicz began his career as an Audit Manager at KPMG LLP. Mr. Dutkiewicz received a B.B.A. degree from Loyola University of Chicago.

Jill B. W. Sisson.Ms. Sisson joined us as a consultant in December 2003. She most recently served as General Counsel and Secretary of Graphic Packaging International Corporation from September 1992 until its merger with Riverwood Holding, Inc. in August 2003. From 1974 to September 1992, she engaged in private law practice in Denver, Colorado. She has a B.A. degree from Middlebury College and received her J.D. degree from the University of Colorado Law School.

We wish to caution our readers that the following important factors, among others, could cause the actual results to differ materially from those indicated by forward-looking statements made in this report and from time to time in news releases, reports, proxy statements, registration statements and other written communications, as well as verbal forward-looking statements made from time to time by representatives of the Company. Such forward-looking statements involve risks and uncertainties that may cause our actual results, performance or achievements to be materially different from any future performance or achievements expressed or implied by these forward-looking statements. Factors that might cause actual events or results to differ materially from those indicated by these forward-looking statements may include matters such as future economic performance, restaurant openings or closings, operating margins, the availability of acceptable real estate locations, the sufficiency of our cash balances and cash generated from operating and financing activities for our future liquidity and capital resource needs, and other matters, and are generally accompanied by words such as: believes, anticipates, plans, intends, estimates, predicts, targets, expects, contemplates and similar expressions that convey the uncertainty of future events or outcomes. An expanded discussion of some of these risk factors follows.

Risk Factors Relating to Our Business and Our Industry

General economic conditions have affected, and could continue to affect, discretionary consumer spending, particularly spending for meals prepared away from home.

International, national and local economic conditions, including credit and mortgage markets, energy costs, lay-offs, foreclosure rates, bankruptcies, and similar adverse economic news and factors affect discretionary consumer spending. These factors could reduce consumers’ discretionary spending which in turn could reduce our guest traffic or average check. In 2007 and 2008, restaurants industry-wide were adversely affected as a result of reduced consumer spending due to rising fuel and energy costs, lay-offs and general economic conditions. The conditions experienced recently also include reduced consumer confidence, on-going concerns about down-sizing and lay-offs, the housing market, concerns over the stability of financial institutions, and increased health care and energy costs. Adverse changes in consumer discretionary spending, which could be affected by many different factors which are out of our control, including those listed above, could harm our business prospects, financial condition, operating results and cash flows. Our success will depend in part upon our ability to anticipate, identify and respond to changing economic and other conditions.

9

The economic turmoil that has arisen in the credit markets and in the housing markets as well as job losses throughout various sectors of the economy during and following fiscal 2008 may continue to suppress discretionary spending and other consumer purchasing habits and, as a result, adversely affect our results of operations.

Failure to protect food supplies and adhere to food safety standards could result in food-borne illnesses.

Food safety and reputation for quality is the most significant risk to any company that operates in the restaurant industry. Food safety is the focus of increased government regulatory initiatives at the local, state and federal levels.

Failure to protect our food supply or enforce food safety policies, such as proper food temperatures and adherence to shelf life dates, could result in food-borne illnesses and/or injuries to our guests. Also, our reputation of providing high quality food is an important factor in choosing our restaurants. Instances of food borne illness, including listeriosis, salmonella and e-coli, whether or not traced to our restaurants, could reduce demand for our menu offerings. If any of our guests become ill from consuming our products, the affected restaurants may be forced to close. An instance of food contamination originating from one of our restaurants, our commissaries or suppliers, or our manufacturing plant could have far-reaching effects, as the contamination, or the perception of contamination could affect substantially all of our restaurants. In addition, publicity related to either product contamination or recalls may cause our guests to cease frequenting our restaurants based on fear of such illnesses.

Volatile commodity prices would adversely affect our gross profit.

Global demand for commodities such as wheat has resulted, and could in the future result, in higher prices for flour which would increase our costs. The prices of our main ingredients are directly associated with the changing weather conditions as well as economic factors such as supply and demand of certain commodities within the United States and other countries. Our ability to forecast and manage our commodities could significantly affect our gross margins. Any increase in the prices of the ingredients most critical to our products, such as wheat, could adversely affect our operating results.

Additionally, in the event of destruction of products such as tomatoes or peppers or massive culling of specific animals such as chickens or turkeys to prevent the spread of disease, the supply and availability of ingredients may become limited. This could dramatically increase the price of certain menu items which could decrease sales of those items or could force us to eliminate those items from our menus entirely. All of these factors could adversely affect our business, reputation and financial results.

We may not be successful in implementing any or all of the initiatives of our business strategy.

Our success depends in part on our ability to understand and satisfy the needs of our guests, franchisees and licensees. Our business strategy consists of several initiatives:

| | • | | expand sales at our existing company-owned restaurants; |

| | • | | open new company-owned restaurants; and |

| | • | | open new franchise and license restaurants. |

Our ability to achieve any or all of these initiatives is uncertain. Our success in expanding sales at company-owned restaurants through various sub-initiatives including: promoting and offering value to our customers through discounts, coupons and new menu offerings and broadening our offerings across multiple dayparts, improving our ordering and production systems, expanding our catering program and upgrading our restaurants is dependent in part on our ability to offer value to consumers, attract new customers, predict and satisfy consumer preferences and as mentioned above, consumer’s ability to respond positively in a troublesome economic

10

environment. Our success in growing our business through opening new company-owned restaurants is dependent on a number of factors, including our ability to: find suitable locations, reach acceptable lease terms, have adequate capital, find acceptable contractors, obtain licenses and permits, recruit and train appropriate staff and properly manage the new restaurant. Our success in opening new franchise and license restaurants is dependent upon, among other factors, our ability to: attract quality businesses to invest in our core brands, maintain the effectiveness of our franchise disclosure documents in target states, offer restaurant solutions for a variety of location types and the ability of our franchisees and licensees to: find suitable locations, reach acceptable lease terms, have adequate capital, secure reasonable financing, find available contractors, obtain licenses and permits, locate and train staff appropriately and properly manage the new restaurants. If we are not successful in implementing any or all of the initiatives of our business strategy, it could have a material adverse effect on our business, results of operations, and financial condition.

Competition in the restaurant industry is intense.

Our industry is highly competitive and there are many well-established competitors. While we operate in the fast-casual segment of the restaurant industry, we also consider restaurants in the fast-food and full-service segments to be our competitors. Several fast-casual and fast-food chains are focusing more on breakfast offerings and expanding their coffee offerings. This could further increase competition in the breakfast daypart. In addition to current competitors, one or more new major competitors with substantially greater financial, marketing and operating resources could enter the market at any time and compete directly against us. Also, in virtually every major metropolitan area in which we operate or expect to enter, local or regional competitors already exist. This may make it more difficult to attract and retain guests.

Numerous factors including changes in consumer tastes and preferences often affect restaurants. Shifts in consumer preferences away from our type of cuisine and/or the fast-casual style could have a material effect on our results of operations. Dietary trends, such as the consumption of food low in carbohydrate content have, in the past, and may, in the future, negatively impact our sales. Changes in our guests’ spending habits and preferences could have a material adverse effect on our sales. Our results will depend on our ability to respond to changing consumer preferences and tastes. In addition, recent local and state regulations mandating prominent disclosure of nutritional and calorie information may result in reduced demand for some of our products which could be viewed as containing too much fat or too many calories.

We occupy our company-owned restaurants under long-term non-cancelable leases, and we may be unable to renew leases at the end of their lease periods or obtain new leases on acceptable terms.

We do not own any real property, and all of our company-owned restaurants are located in leased premises. Many of our current leases are non-cancelable and typically have terms ranging from five to ten years with two three- to five-year renewal options. We believe leases that we enter into in the future likely will also be long-term and non-cancelable and have similar renewal options. Most of our leases provide that the landlord may increase the rent over the term of the lease, and require us to pay our proportionate share of the cost of insurance, taxes, maintenance and utilities. If we close a restaurant, we generally remain committed to perform our obligations under the applicable lease, which would include, among other things, payment of the base rent for the balance of the lease term. In some instances, we may be unable to close an underperforming restaurant due to continuous operation clauses in our lease agreements. Our obligation to continue making rental payments in respect of leases for closed or underperforming restaurants could have an adverse effect on our business and results of operations.

If we are unable to renew our restaurant leases, we may be forced to close or relocate a restaurant, which could subject us to construction and other costs and risks, and could have a material adverse effect on our business and results of operations. For example, closing a restaurant, even during the time of relocation, will reduce the sales that the restaurant would have contributed to our revenues. Additionally, the revenue and profit, if any, generated at a relocated restaurant may not equal the revenue and profit generated at the existing restaurant. We also face competition from both restaurants and other retailers for suitable sites for new restaurants.

11

Our operations may be negatively impacted by adverse weather conditions and natural disasters.

Adverse weather conditions and natural disasters may at times affect regions in which our company-owned, franchised and licensed restaurants are located, regions that produce raw ingredients for our restaurants, or locations of our distribution network. If adverse weather conditions or natural disasters such as fires and hurricanes affect our restaurants, we could experience closures, repair and restoration costs, food spoilage, and other significant reopening costs as well as increased food costs and delayed supply shipments, any of which would adversely affect our business. In addition, if adverse weather or natural disasters affect our distribution network, we could experience shortages or delayed shipments at our restaurants, which could adversely affect them. Additionally, during periods of extreme temperatures (either hot or cold) or precipitation, many individuals choose to stay inside. This impacts transaction counts in our restaurants and could adversely affect our business and results of operations.

The effects of hurricanes, fires, snowstorms, freezes and other adverse weather conditions are likely to affect supply of and costs for raw ingredients and natural resources, near-term construction costs for our new restaurants as well as sales in our restaurants going forward. If we are not able to anticipate or react to changing costs of food and other raw materials by adjusting our purchasing practices or menu prices, our operating margins would likely deteriorate.

We have single suppliers for most of our key products, and the failure of any of these suppliers to perform could harm our business.

We currently purchase our raw materials from various suppliers; however, we have only one supplier for most of our key products. We purchase all of our cream cheese from a single source. Also, we purchase a majority of our frozen bagel dough from a single supplier, who utilizes our proprietary processes and on whom we are dependent in the short-term. All of our remaining frozen bagel dough is produced at our dough manufacturing facility in Whittier, California. Although to date we have not experienced significant difficulties with our suppliers, our reliance on a single supplier for most of our key ingredients subjects us to a number of risks, including possible delays or interruption in supplies, diminished control over quality and a potential lack of adequate raw material capacity. Any disruption in the supply or degradation in the quality of the materials provided by our suppliers could have a material adverse effect on our business, operating results and financial condition. In addition, any such disruptions in supply or degradations in quality could have a long-term detrimental impact on our efforts to maintain a strong brand identity and a loyal consumer base.

Disruptions or supply issues could adversely affect our business and reputation.

We depend on our network of independent regional distributors to distribute frozen bagel dough and other products and materials to our company-owned, franchised and licensed restaurants. Any failure by one or more of our distributors to perform as anticipated, or any disruption in any of our distribution relationships for any reason, would subject us to a number of risks, including inadequate products delivered to our restaurants, diminished control over quality of products delivered, and increased operating costs to prevent delays in deliveries. Any of these events could harm our relationships with our franchisees or licensees, or diminish the reputation of our menu offerings or our brands in the marketplace. In addition, a negative change in the volume of products ordered from our distributors by our company-owned, franchised and/or licensed restaurants could increase our distribution costs. These risks could have a material adverse effect on our business, financial condition and results of operations.

Additionally, increased costs and distribution issues related to fuel and utilities could also materially impact our business and results of operations.

12

Increasing labor costs could adversely affect our results of operations and cash flows.

We are dependent upon an available labor pool of associates, many of whom are hourly employees whose wages may be affected by increases in the federal, state or municipal “living wage” rates. Numerous increases have been made on federal, state and local levels to increase minimum wage levels. Increases in the federal and state minimum hourly wage rates in some of the states in which we operate became effective throughout 2008 and additional increases will become effective throughout 2009. Increases in the minimum wage may create pressure to increase the pay scale for our associates, which would increase our labor costs and those of our franchisees and licensees.

A shortage in the labor pool or other general inflationary pressures or changes could also increase labor costs. Changes in the labor laws or reclassifications of associates from management to hourly employees could affect our labor cost. An increase in labor costs could have a material adverse effect on our income from operations and decrease our profitability and cash flows if we are unable to recover these increases by raising the prices we charge our guests.

We may not be able to comply with certain debt covenants or generate sufficient cash flow to make payments on our substantial amount of debt or redeem our mandatorily redeemable preferred stock when due.

Our current debt agreements contain certain covenants, which, among others, include certain financial covenants such as limitations on capital expenditures, maintenance of the business, use of proceeds from sales of assets and consolidated leverage and fixed charge coverage ratios as defined in the agreements. The covenants also preclude the declaration and payment of dividends or other distributions to holders of our common stock. We are subject to multiple economic, financial, competitive, legal and other risks that are beyond our control and could harm our future financial results. Any adverse effect on our business or financial results could affect our ability to maintain compliance with our debt covenants, and any failure by us to comply with these covenants could result in an event of default. If we were to default under our covenants and such default were not cured or waived, our indebtedness could become immediately due and payable, which could render us insolvent.

We have a considerable amount of debt and are substantially leveraged. In addition, we may, subject to certain restrictions, incur substantial additional indebtedness in the future. Our high level of debt, among other things, could:

| | • | | make it difficult for us to satisfy our obligations under our indebtedness; |

| | • | | limit our ability to obtain additional financing for working capital, capital expenditures, acquisitions and general corporate purposes; |

| | • | | increase our vulnerability to downturns in our business or the economy generally; |

| | • | | increase our vulnerability to volatility in interest rates; and |

| | • | | limit our ability to withstand competitive pressures from our less leveraged competitors. |

Economic, financial, competitive, legislative and other factors beyond our control may affect our ability to generate cash flow from operations to make payments on our indebtedness and to fund necessary working capital. A significant reduction in operating cash flow would likely increase the need for alternative sources of liquidity. If we are unable to generate sufficient cash flow to make payments on our debt, we will have to pursue one or more alternatives, such as reducing or delaying capital expenditures, refinancing our debt on terms that are not favorable to us, selling assets or issuing additional equity securities. We may not be able to accomplish any of these alternatives on satisfactory terms, if at all, and even if accomplished, they may not yield sufficient funds to service our debt.

We have $57.0 million of mandatorily redeemable preferred stock due June 30, 2009. Given the current state of the credit markets as well as the financial condition of some of our lenders, our ability to borrow

13

additional funds on our First Lien credit facility could be unlikely. Failure to redeem all of the preferred stock on June 30, 2009 will result in us paying additional redemption price to redeem the remaining shares in the future.

We face the risk of adverse publicity and litigation in connection with our operations.

We are from time to time the subject of complaints or litigation from our consumers alleging illness, injury or other food quality, health or operational concerns. Adverse publicity resulting from these allegations may materially adversely affect us, regardless of whether the allegations are valid or whether we are liable. In addition, employee claims against us based on, among other things, discrimination, harassment or wrongful termination, or labor code violations may divert financial and management resources that would otherwise be used to benefit our future performance. For example, we recently settled two class actions in California as described in Note 19 to our Consolidated Financial Statements set forth in Item 8 of this report. There is also a risk of litigation from our franchisees and licensees. We have been subject to a variety of these and other claims from time to time and a significant increase in the number of these claims or the number that are successful could materially adversely affect our business, prospects, financial condition, operating results or cash flows.

A regional or global health pandemic could severely affect our business.

A health pandemic is a disease that spreads rapidly and widely by infection and affects many individuals in an area or population at the same time. If a regional or global health pandemic were to occur, depending upon its duration and severity, our business could be severely affected. We have positioned ourselves as a “neighborhood atmosphere” between home and work where people can gather for human connection and high quality food. Customers might avoid public gathering places in the event of a health pandemic, and local, regional or national governments might limit or ban public gatherings to halt or delay the spread of disease. A regional or global pandemic might also adversely impact our business by disrupting or delaying production and delivery of products and materials in our supply chain and causing staff shortages in our restaurants. The impact of a health pandemic might be disproportionately greater on us than on other companies that depend less on the gathering of people in a neighborhood atmosphere.

Our franchisees and licensees may not help us develop our business as we expect, or could actually harm our business.

We rely in part on our franchisees and licensees and the manner in which they operate their restaurants to develop and promote our business. Although we have developed criteria to evaluate and screen prospective candidates, the candidates may not have the business acumen or financial resources necessary to operate successful restaurants in their respective areas. In addition, franchisees and licensees are subject to business risks similar to what we face such as competition, consumer acceptance, fluctuations in the cost, availability and quality of raw ingredients, and increasing labor costs. The failure of franchisees and licensees to operate successfully could have a material adverse effect on us, our reputation, our ability to collect royalties, our brands and our ability to attract prospective candidates. Potential franchisees and licensees may have difficulty obtaining proper financing as a result of the downturn in the credit markets. As we offer and grant franchises for our Einstein Bros. brand, our reliance on our franchisees is expected to increase in proportion to growth of the franchisee base. With respect to franchising our Einstein Bros. brand, we may not be able to identify franchisees that meet our criteria, or to enter into franchise area development agreements with prospective franchisee candidates that we identify. As a result, our franchise program for the Einstein Bros. brand may not grow at the rate we currently expect, or at all.

14

Our restaurants and products are subject to numerous and changing government regulations. Failure to comply could negatively affect our sales, increase our costs or result in fines or other penalties against us.

Each of our restaurants is subject to licensing and regulation by the health, sanitation, safety, labor, building and fire agencies of the respective states, counties, cities and municipalities in which it is located. A failure to comply with one or more regulations could result in the imposition of sanctions, including the closing of facilities for an indeterminate period of time, or third party litigation, any of which could have a material adverse effect on us and our results of operations.

Recently, many government bodies have begun to legislate or regulate high-fat and high sodium foods and disclosure of nutritional information as a way of combating concerns about obesity and health. In addition to the phase-out of artificial trans-fats, public interest groups have focused attention on the marketing of high-fat and high-sodium foods to children in a stated effort to combat childhood obesity. Some cities and states have recently adopted or are considering regulations requiring disclosure of nutritional facts, including calorie information, on menus and/or menu boards. Additional cities or states may propose or adopt similar regulations. The cost of complying with these regulations could increase our expenses and the possible negative publicity arising from such legislative initiatives could reduce our future sales.

Our franchising operations are subject to regulation by the Federal Trade Commission. We must also comply with state franchising laws and a wide range of other state and local rules and regulations applicable to our business. The failure to comply with federal, state and local rules and regulations would have an adverse effect on us.

Under various federal, state and local laws, an owner or operator of real estate may be liable for the costs of removal or remediation of certain hazardous or toxic substances on or in such property. Such liability may be imposed without regard to whether the owner or operator knew of, or was responsible for, the presence of such hazardous or toxic substances. Although we are not aware of any environmental conditions that require remediation by us under federal, state or local law at our properties, we have not conducted a comprehensive environmental review of our properties or operations. We may not have identified all of the potential environmental liabilities at our properties, and any such liabilities that are identified in the future may have a material adverse effect on our financial condition.

We may not be able to protect our trademarks, service marks and other proprietary rights.

We believe our trademarks, service marks and other proprietary rights are important to our success and our competitive position. Accordingly, we devote substantial resources to the establishment and protection of our trademarks, service marks and proprietary rights. However, the actions we take may be inadequate to prevent imitation of our products and concepts by others, to prevent various challenges to our registrations or applications or denials of applications for the registration of trademarks, service marks and proprietary rights in the U.S. or other countries, or to prevent others from claiming violations of their trademarks and proprietary marks. In addition, others may assert rights in our trademarks, service marks and other proprietary rights.

Our ability to use net operating loss carryforwards to offset future taxable income for U.S. federal income tax purposes is subject to limitation.

In general, under Section 382 of the Internal Revenue Code, a corporation that undergoes an “ownership change” is subject to limitations on its ability to utilize its pre-change net operating loss (“NOL”) carryforwards to offset future taxable income. A corporation generally undergoes an “ownership change” when the stock ownership percentage (by value) of its “5 percent stockholders” increases by more than 50 percentage points over any three-year testing period.

As of December 30, 2008, our NOL carryforwards for U.S. federal income tax purposes were approximately $135.4 million. As a result of prior ownership changes, approximately $29.8 million of our NOL carryforwards

15

are subject to an annual usage limitation of $2.5 million. Due to transactions involving the sale or other transfer of our stock from the date of our last ownership change through the date of the secondary public offering of our common stock, and changes in the value of our stock during that period, such offering may result in an additional ownership change for purposes of Section 382 or will significantly increase the likelihood that we will undergo an additional ownership change in the future (which could occur as a result of transactions involving our stock that are outside of our control). In either event, the occurrence of an additional ownership change would limit our ability to utilize the approximately $105.6 million of our NOL carryforwards that are not currently subject to limitation, and could further limit our ability to utilize our remaining NOL carryforwards and possibly other tax attributes. Limitations imposed on our ability to use NOL carryforwards and other tax attributes to offset future taxable income could cause us to pay U.S. federal income taxes earlier than we otherwise would if such limitations were not in effect, and could cause such NOL carryforwards and other tax attributes to expire unused, in each case reducing or eliminating the benefit of such NOL carryforwards and other tax attributes to us and adversely affecting our future cash flow. We filed a request with the Internal Revenue Service to review our methodology for determining ownership changes in accordance with Internal Revenue Code Section 382 on December 30, 2008. In the event that our request is not accepted, approximately $40.5 million of NOL carryforwards will be at risk to expire prior to utilization. Similar rules and limitations may apply for state income tax purposes as well.

Risk Factors Relating to Our Common Stock

We have a majority stockholder.

Greenlight Capital, L.L.C. and its affiliates (“Greenlight”) beneficially own approximately 67% of our common stock as of December 30, 2008. As a result, Greenlight has sufficient voting power, without the vote of any other stockholders, to determine what matters will be submitted for approval by our stockholders to elect all of the members of our board of directors, and to determine whether a change in control of our company occurs. Greenlight’s interests on matters submitted to stockholders may be different from those of other stockholders. Greenlight has voted its shares to elect our current board of directors, and the chairman of our board of directors is a current employee of Greenlight.

We have listed our common stock on the NASDAQ Global Market. NASDAQ rules require us to have an audit committee consisting entirely of independent directors. However, under NASDAQ rules, if a single stockholder holds more than 50% of the voting power of a listed company, that company is considered a controlled company, and is exempt from several other corporate governance rules, including the requirement that companies have a majority of independent directors and independent director involvement in the selection of director nominees and in the determination of executive compensation. As a result, our stockholders do not have, and may never have, the protections that these rules are intended to provide. The Company currently has a majority of independent directors on the board of directors.

Future sales of shares of our common stock by our stockholders could cause our stock price to fall.

If a substantial number of shares of our common stock are sold in the public market, the market price of our common stock could fall. The perception among investors that these sales will occur could also produce this effect. Our majority stockholder, Greenlight, beneficially owns approximately 67% of our common stock as of December 30, 2008 and sales by Greenlight or a perception that Greenlight will sell could cause a decrease in the market price of our common stock.

16

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None

Our Properties

All of our restaurants are located on leased premises. As of December 30, 2008, leases for approximately 26 restaurants are set to expire within the next 12 months and most of these leases contain a renewal option, usually with modified pricing terms to reflect current market rents. Lease terms are usually five to 10 years, with either two, three or five year renewal option periods, for total lease terms that average approximately 11 to 20 years. Our leases generally require us to pay a proportionate share of real estate taxes, insurance, common charges and other operating costs.

As of December 30, 2008, we have identified approximately 10 to 15 company-owned restaurants that we anticipate closing over the next three years as their leases expire. Generally, these restaurants have an average unit volume of less than $650,000 and contribute negative or negligible cash flow. Additionally, there are four restaurants with average unit volumes greater than $650,000 that we anticipate closing over the next three years as they are either in areas being taken over by eminent domain or the landlord is completely redeveloping the area and will not renew our lease.

The average Einstein Bros. restaurant is approximately 2,200 to 2,500 square feet in size with approximately 40 seats and is generally located in a neighborhood or regional shopping center. We design each restaurant to create a comfortable, casual environment that is consumer friendly, inviting and reflective of the brand’s personality and strong neighborhood identity.

The average Noah’s restaurant is approximately 1,800 to 2,400 square feet in size with approximately 30 to 40 seats and is located in urban neighborhoods or regional shopping centers. We use elaborate tile work and wood accents in the brand’s design to create an environment reminiscent of a Lower East Side New York deli, which reinforces the brand’s urban focus with an emphasis on the authenticity of a New York deli experience.

The average Manhattan Bagel restaurant is approximately 1,400 to 2,500 square feet with 24 to 50 seats and is primarily located in suburban neighborhoods or regional shopping centers. Manhattan Bagel restaurants are designed to combine the authentic atmosphere of a bagel bakery with the comfortable setting of a neighborhood meeting place.

Information with respect to our headquarters, production and commissary facilities is presented below:

| | | | | | |

Location | | Facility | | Square

Feet | | Lease

Expiration |

Lakewood, Colorado | | Headquarters, Support Center, Test Kitchen | | 44,574 | | 5/31/2017 |

Whittier, California | | Production Facility and USDA Approved Commissary | | 54,640 | | 11/30/2013 |

Walnut Creek, California | | Administration Office-Noah’s | | 1,672 | | 3/31/2013 |

Carrolton, Texas | | USDA Approved Commissary | | 26,820 | | 7/31/2011 |

Orlando, Florida | | USDA Approved Commissary | | 7,422 | | 10/31/2010 |

Denver, Colorado | | USDA Approved Commissary | | 9,200 | | 10/14/2013 |

Grove City, Ohio | | USDA Approved Commissary | | 20,644 | | 8/31/2012 |

17

Our Current Restaurants

As of December 30, 2008, we owned and operated, franchised or licensed 649 restaurants. Our current base of company-owned restaurants under our core brands includes 347 Einstein Bros. restaurants, 77 Noah’s restaurants and one Manhattan Bagel restaurant. Also, we franchise 69 Manhattan Bagel restaurants and two Einstein Bros. restaurants, and license 147 Einstein Bros. restaurants and five Noah’s restaurants. In addition, we have one restaurant which we own and operate under a non-core brand.

The following table details our restaurant openings and closings for each respective fiscal year:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 52 weeks ended January 1, 2008 | | | 52 weeks ended December 30, 2008 | |

| | | Company

Owned | | | Franchised | | | Licensed* | | | Total | | | Company

Owned | | | Franchised | | | Licensed * | | | Total | |

Einstein Bros. | | | | | | | | | | | | | | | | | | | | | | | | |

Beginning balance | | 341 | | | — | | | 93 | | | 434 | | | 337 | | | — | | | 121 | | | 458 | |

Opened restaurants | | 8 | | | — | | | 31 | | | 39 | | | 16 | | | 2 | | | 30 | | | 48 | |

Closed restaurants | | (12 | ) | | — | | | (3 | ) | | (15 | ) | | (6 | ) | | — | | | (4 | ) | | (10 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Ending balance | | 337 | | | — | | | 121 | | | 458 | | | 347 | | | 2 | | | 147 | | | 496 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Noah’s | | | | | | | | | | | | | | | | | | | | | | | | |

Beginning balance | | 73 | | | — | | | 3 | | | 76 | | | 77 | | | — | | | 3 | | | 80 | |

Opened restaurants | | 4 | | | — | | | — | | | 4 | | | 1 | | | — | | | 2 | | | 3 | |

Closed restaurants | | — | | | — | | | — | | | — | | | (1 | ) | | — | | | — | | | (1 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Ending balance | | 77 | | | — | | | 3 | | | 80 | | | 77 | | | — | | | 5 | | | 82 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Manhattan Bagel | | | | | | | | | | | | | | | | | | | | | | | | |

Beginning balance | | — | | | 80 | | | — | | | 80 | | | 1 | | | 69 | | | — | | | 70 | |

Opened restaurants | | 1 | | | 2 | | | — | | | 3 | | | — | | | — | | | — | | | — | |

Closed restaurants | | — | | | (13 | ) | | — | | | (13 | ) | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Ending balance | | 1 | | | 69 | | | — | | | 70 | | | 1 | | | 69 | | | — | | | 70 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Non-Core Brands | | | | | | | | | | | | | | | | | | | | | | | | |

Beginning balance | | 2 | | | 6 | | | — | | | 8 | | | 1 | | | 3 | | | — | | | 4 | |

Opened restaurants | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

Closed restaurants | | (1 | ) | | (3 | ) | | — | | | (4 | ) | | — | | | (3 | ) | | — | | | (3 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Ending balance | | 1 | | | 3 | | | — | | | 4 | | | 1 | | | — | | | — | | | 1 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Consolidated Total | | | | | | | | | | | | | | | | | | | | | | | | |

Total beginning balance | | 416 | | | 86 | | | 96 | | | 598 | | | 416 | | | 72 | | | 124 | | | 612 | |

Opened restaurants | | 13 | | | 2 | | | 31 | | | 46 | | | 17 | | | 2 | | | 32 | | | 51 | |

Closed restaurants | | (13 | ) | | (16 | ) | | (3 | ) | | (32 | ) | | (7 | ) | | (3 | ) | | (4 | ) | | (14 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total ending balance | | 416 | | | 72 | | | 124 | | | 612 | | | 426 | | | 71 | | | 152 | | | 649 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| * | We use franchise agreements to contract with qualified disadvantaged business enterprises, non-profit and other entities, either as licensees, fractional franchisees, or franchisees under a traditional franchise agreement, who do not meet the fractional franchise exemption to open restaurants in our traditional licensee venues. As of January 1, 2008 and December 30, 2008, we had five and six franchisees operating Einstein Bros. restaurants in airport locations which operationally fall under our licensing group, respectively. |

18

As of December 30, 2008, our company-owned facilities, franchisees and licensees operated in various states and in the District of Columbia as follows:

| | | | | | |

Location | | Company

Operated | | Franchised

or Licensed | | Total |

Alabama | | — | | 1 | | 1 |

Arkansas | | — | | 1 | | 1 |

Arizona | | 26 | | 6 | | 32 |

California | | 79 | | 17 | | 96 |

Colorado | | 31 | | 7 | | 38 |

Connecticut | | 1 | | — | | 1 |

Delaware | | 1 | | 1 | | 2 |

District of Columbia | | 1 | | 4 | | 5 |

Florida | | 54 | | 20 | | 74 |

Georgia | | 15 | | 12 | | 27 |

Illinois | | 31 | | 6 | | 37 |

Indiana | | 10 | | 1 | | 11 |

Kansas | | 6 | | 1 | | 7 |

Kentucky | | — | | 4 | | 4 |

Louisiana | | — | | 3 | | 3 |

Maryland | | 11 | | 3 | | 14 |

Massachusetts | | 2 | | 3 | | 5 |

Michigan | | 15 | | 5 | | 20 |

Minnesota | | 5 | | 3 | | 8 |

Mississippi | | — | | 2 | | 2 |

Missouri | | 12 | | 4 | | 16 |

Nevada | | 14 | | — | | 14 |

New Hampshire | | 1 | | — | | 1 |

New Jersey | | 5 | | 27 | | 32 |

New Mexico | | 5 | | — | | 5 |

New York | | 1 | | 7 | | 8 |

North Carolina | | 2 | | 5 | | 7 |

Ohio | | 10 | | 11 | | 21 |

Oregon | | 9 | | 1 | | 10 |

Pennsylvania | | 9 | | 27 | | 36 |

South Carolina | | — | | 6 | | 6 |

Tennessee | | — | | 8 | | 8 |

Texas | | 26 | | 13 | | 39 |

Utah | | 18 | | — | | 18 |

Virginia | | 10 | | 10 | | 20 |

Washington | | 6 | | 2 | | 8 |

Wisconsin | | 10 | | 2 | | 12 |

| | | | | | |

Total | | 426 | | 223 | | 649 |

| | | | | | |

19

We are subject to claims and legal actions in the ordinary course of business, including claims by or against our franchisees, licensees and employees or former employees and/or contract disputes. We do not believe any currently pending or threatened matter, other than as described below, would have a material adverse effect on our business, results of operations or financial condition.

On September 18, 2007, Eric Mathistad, a former store manager, filed a putative class action against the Company in the Superior Court of California for the State of California, County of San Diego. The plaintiff alleged that we failed to pay overtime wages to “salaried restaurant employees” of our California stores who were misclassified as exempt employees, and that these employees were deprived of mandated meal periods and rest breaks. On November 14, 2007, Bernadette Mejia, another former store manager, filed a similar case and these cases were subsequently consolidated. On August 27, 2008, we settled this litigation with the plaintiffs.

On February 8, 2008, Gloria Weber and Hakan Mikado, non-exempt employees, filed a putative class action against the Company in the Superior Court of California for the State of California, County of San Diego. The plaintiff alleged that we failed to pay minimum wages, failed to pay overtime and failed to provide rest periods and meal breaks, among other charges. On August 27, 2008, we settled this litigation with the plaintiffs.

These settlements provide for payment of up to an aggregate of $2.5 million by the Company. Each settlement is subject to final court approvals and other conditions. There can be no assurance that the court will approve the settlements or that these other conditions will be satisfied. The final hearings are scheduled for March 20, 2009.

We recorded a liability in accrued expenses and a charge in operating expenses during the third quarter of 2008 pursuant to SFAS No. 5,Accounting for Contingencies,in the amount of $1.9 million to satisfy these settlements. This charge represents our current estimate of the aggregate amount that is probable to be paid pursuant to these settlements, but there can be no assurance that amounts actually paid will not be more or less than the amount recorded by the Company.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

No items were submitted to a vote of security holders in the fourth quarter of the fiscal year ended December 30, 2008.

20

PART II

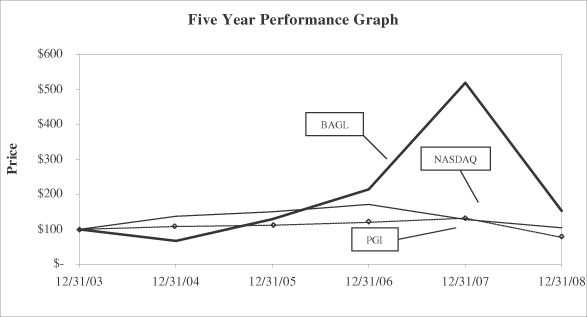

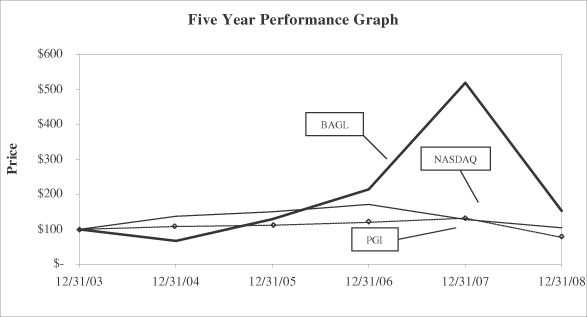

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |