UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

ELIZABETH ARDEN, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be Held on December 3, 2014

The 2014 annual meeting of shareholders of Elizabeth Arden, Inc. will be held on Wednesday, December 3, 2014, at 10:00 a.m., local time, at our corporate office located at 2400 S.W. 145th Avenue, 2nd Floor, Miramar, Florida 33027, for the following purposes, as described in the attached proxy statement:

| | 1. | To elect as directors the six nominees named in the accompanying proxy statement to serve until the next annual meeting of shareholders, or until such person’s successor is duly elected and qualified or until his or her earlier death, resignation, retirement, disqualification or removal; |

| | 2. | To approve, on an advisory basis, the compensation of our named executive officers as disclosed in the attached proxy statement; |

| | 3. | To approve an amendment to the Elizabeth Arden, Inc. 2010 Stock Award and Incentive Plan to (i) increase the number of shares of our common stock, par value $0.01 per share, that may be granted under the 2010 Stock Award and Incentive Plan by 1,250,000, from 1,100,000 to 2,350,000, and (ii) re-approve the business criteria and limits that may be used in establishing performance-based awards, as more specifically outlined in the attached proxy statement; |

| | 4. | To approve the Elizabeth Arden, Inc. 2014 Non-Employee Director Stock Award Plan; |

| | 5. | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2015; |

| | 6. | To transact such other business as may properly come before the annual meeting or any adjournment or postponement thereof. |

Only holders of record of (i) our common stock, par value $0.01 per share, and (ii) our Series A Serial Preferred Stock, par value $0.01 per share (our preferred stock) as of the close of business on October 3, 2014 are entitled to notice of and to vote at the annual meeting and at any adjournment or postponement of that meeting. A majority of our outstanding shares of voting stock entitled to vote, represented in person or by proxy, will constitute a quorum for action on all matters at the annual meeting. For 10 days prior to the annual meeting and during the annual meeting, a list of shareholders entitled to vote will be available for inspection at our corporate office located at 2400 S.W. 145thAvenue, 2nd Floor, Miramar, Florida 33027.

It is important that your shares be represented at the annual meeting regardless of how many shares you own. Whether or not you intend to be present at the annual meeting in person, we urge you to complete, date and sign the enclosed proxy card and return it in the envelope provided for that purpose. If you hold your shares through a broker, bank or other nominee (that is, you hold your shares in “street name”), you will receive voting instructions from your broker or other nominee that you should follow in order to have your shares voted. Many shareholders who hold their shares in street name may have the option to vote by telephone or the Internet. We urge you to vote by telephone or the Internet, if possible, since your vote will be recorded quickly and there is no risk that postal delays will cause your vote to arrive late and therefore not be counted. See your proxy card or voting instructions from your bank, broker or other nominee for further directions on voting. Voting by mail, by telephone or through the Internet will not prevent you from voting in person at the meeting. If you attend the meeting, you may revoke a vote previously cast by proxy card and vote your shares in person. Also, you may revoke your proxy by written notice sent to the attention of Secretary, Elizabeth Arden, Inc., or by delivery of a later-dated proxy at any time before it is voted. Street name holders who wish to revoke their previous voting instructions must follow the directions provided by their bank, broker or other nominee.

|

| By Order of the Board of Directors |

|

| OSCAR E. MARINA,Secretary |

Miramar, Florida

October 24, 2014

YOU ARE URGED TO COMPLETE, DATE, SIGN AND PROMPTLY MAIL THE ENCLOSED PROXY IN THE ACCOMPANYING POSTAGE-FREE ENVELOPE OR TO VOTE BY TELEPHONE OR THE INTERNET WHERE POSSIBLE. THE PROXY IS REVOCABLE AT ANY TIME PRIOR TO ITS USE.

TABLE OF CONTENTS

1

ELIZABETH ARDEN, INC.

2014 PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

2014 Annual Meeting of Shareholders

| | |

| Time and Date | | 10:00 a.m., December 3, 2014 |

| |

| Place | | Corporate Office – 2400 SW 145th Ave., 2nd Floor, Miramar, Florida 33027 |

| |

| Record Date | | October 3, 2014 |

| |

| Voting | | Holders of common stock and preferred stock as of the record date are entitled to vote. Each share of common stock is entitled to one vote per share on all matters. Each share of preferred stock in entitled to 49 votes per share on all matters. |

Meeting Agenda

Proposal 1 —

Election of Directors(see page 10)

The following table provides summary information about each director nominee of Elizabeth Arden, Inc. (“the Company,” “we,” or “us”). For a director nominee to be elected, the number of votes cast in favor of each director must exceed the number of votes cast against such director. If elected, the director nominees will serve until the 2015 annual meeting, subject to earlier death, resignation, retirement, disqualification or removal. Please see the discussion under “Certain Relationships and Related Person Transactions – Rhône Transaction – Rhône Director Designation Rights” for information regarding the rights of our preferred shareholders to elect members to our board of directors.

| | | | | | | | | | | | | | |

Name | | Age | | Director Since | | Independent | | LID | | AC | | CC | | NCG |

| E. Scott Beattie | | 55 | | January 1995 | | | | | | | | | | |

| Fred Berens | | 71 | | July 1992 | | X | | X | | X | | X | | |

| Richard C.W. Mauran | | 80 | | July 1992 | | X | | | | | | | | X* |

| Maura J. Clark | | 55 | | August 2005 | | X | | | | X* | | | | X |

| William M. Tatham | | 55 | | July 2001 | | X | | | | X | | X | | |

| A. Salman Amin | | 54 | | November 2010 | | X | | | | | | X* | | |

| | | | | | | | |

| LID = | | Lead Independent Director | | AC = | | Audit Committee | | * = Chairperson |

| CC = | | Compensation Committee | | NCG = | | Nominating and Corporate Governance Committee |

|

| The Board of Directors recommends a voteFOR each director nominee. |

Proposal 2 —

Advisory Vote to Approve Our Named Executive Officer Compensation(see page 44)

| | | | |

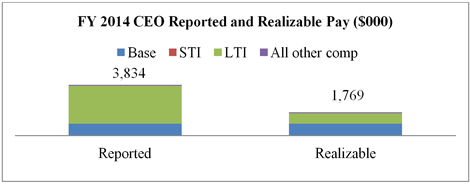

• Our executive compensation program is designed to reflect our pay-for-performance philosophy, attract and retain the highly qualified managerial talent necessary for us to successfully pursue our strategic business plan, and align executive incentives with shareholder interests. • For fiscal 2014, 70% to 80% of our named executive officers’ target compensation was in the form of annual and long-term incentives, and therefore, linked to our financial and/or stock performance. • Fiscal 2014 net sales and earnings per share performance targets for short-term and long-term incentive awards were not achieved. | | | | • Named executive officers received0% payouts under the fiscal 2014 Management Bonus Plan. • No performance-based cash or performance-based restricted stock awards made in fiscal 2014 were earned. • Fiscal 2014 actual total cash compensation (base salary plus Management Bonus Plan payout) for our executive officers wasat or below the25th percentile of composite market data provided by Mercer, our compensation committee’s consultant. • Chief executive officer target compensation for fiscal 2014 was consistent with the median, but actual total cash compensation for fiscal 2014 wasbelow the25th percentile, of the composite market data provided by Mercer. |

2

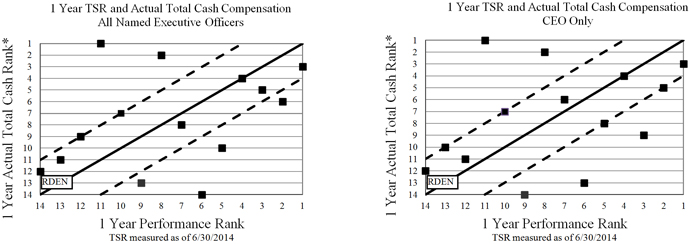

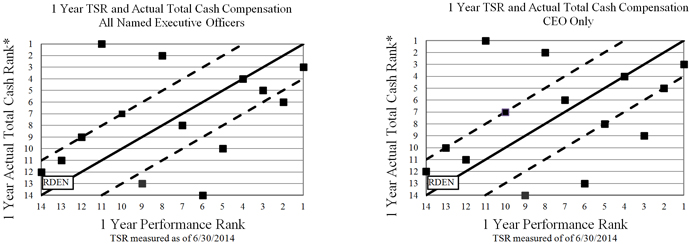

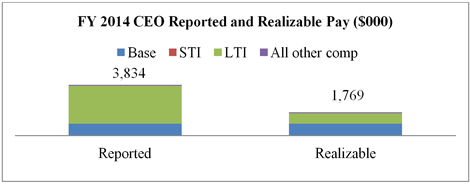

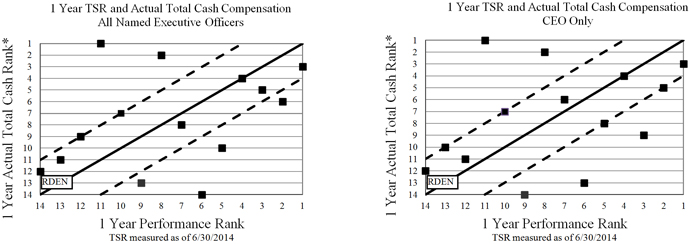

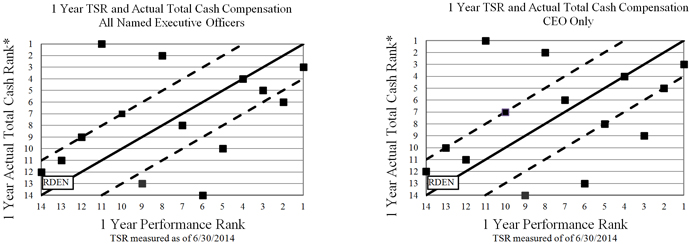

We believe that the design of our executive compensation program resulted in proper fiscal 2014 pay-for-performance alignment as evidenced by our actual total cash rank and one-year total shareholder return (“TSR”) rank as compared to that of our peer group.

* Actual total cash compensation information for peer group based on proxy statement disclosure.

The “say-on-pay” proposal at our 2013 annual meeting of shareholders was approved with over 99% of the shares voted in favor of the proposal, which we believe signals strong shareholder support for the design and implementation of our named executive officer compensation program.

| | | | |

Executive officer compensation program highlights, as described in the Compensation Discussion and Analysis starting on page 23 |

• Annual “say-on-pay” votes. • Pay mix emphasizing compensation linked to our financial and/or stock performance. • Executive compensation program designed to pay at market levels for target performance, reward above-target performance, and pay below market when performance targets are not achieved. • Annual long-term equity grants in the form of stock options align shareholder and executive interests, and restricted stock units serve as a strong retention tool and an incentive to increase shareholder value. | | | | • Limited perquisites for named executive officers (below the median as compared to our peer group). • No tax gross-ups, other than for customary relocation expenses. • Stock ownership and retention guidelines. • Anti-hedging policy. • Restrictions on pledging and margin accounts. • Clawback policy. • No executive employment agreements. |

The Board of Directors recommends a voteFOR this proposal.

Proposal 3 —

Approval of Amendment to the Elizabeth Arden, Inc. 2010 Stock Award and Incentive Plan(see page 45)

We are asking shareholders to approve an amendment to the Elizabeth Arden, Inc. 2010 Stock Award and Incentive Plan to (i) increase the number of shares of our common stock, par value $0.01 per share, that may be granted under the 2010 Stock Award and Incentive Plan by 1,250,000, from 1,100,000 to 2,350,000, and (ii) re-approve the business criteria and limits that may be used in establishing performance-based awards under the 2010 Stock Award and Incentive Plan.

| | | | |

Factors for consideration (see page 45 for further details) | | | | Key equity plan governance features (see page 46 for further details) |

• 171,526 shares of our common stock remain available for grant under the 2010 Stock Award and Incentive Plan, of which 6,357 may be granted as “full value” awards (e.g., restricted stock and restricted stock units). • Our three-year average “run rate” of 0.83% is below the three-year average run rate of our peer group listed on page 46 and is also below ISS’s prescribed run rate cap for our industry. • Additional dilution resulting from the share increase proposal is less than 5% of common stock outstanding. • We estimate that the additional shares being requested should be sufficient for the next two to three annual award cycles. | | | | • Limitation on additional shares requested of 1,250,000, of which only 625,000 of the additional shares can be awarded as “full value” awards. • No “liberal” share counting. • No repricings without shareholder approval. • No “evergreen” provision. • No “liberal” change in control definition. |

The Board of Directors recommends a voteFOR this proposal.

3

Proposal 4 —

Approval of Elizabeth Arden, Inc. 2014 Non-Employee Director Stock Award Plan(page 56)

We are asking shareholders to approve the Elizabeth Arden, Inc. 2014 Non-Employee Director Stock Award Plan.

| | | | |

Factors for consideration (see page 56 for further details) | | | | Key equity plan governance features (see page 57 for further details) |

• The prior 2004 Non-Employee Director Stock Option Plan expired in May 2014. • Three-year average “run rate” of 0.83% is below the three-year average run rate of our peer group listed on page 46 and is also below ISS’s prescribed run rate cap for our industry. • Additional dilution resulting from the 2014 Non-Employee Director Stock Award Plan is approximately 1.0% of common stock outstanding. • We estimate that the shares to be available under the 2014 Non-Employee Director Stock Award Plan should be sufficient for the next six to ten annual award cycles. | | | | • Limitation on shares requested of 350,000 shares. • Available equity award vehicles include stock options, restricted stock and restricted stock units and other stock awards. • Minimum three-year “cliff” vesting for stock options, restricted stock and restricted stock units, subject to acceleration in certain circumstances. • Dividend equivalents cannot be awarded with stock options. • No “liberal” share counting. • No repricings without shareholder approval. • No “evergreen” provision. • No “liberal” change in control definition. |

The Board of Directors recommends a voteFOR this proposal.

Proposal 5 —

Ratification of Appointment of Independent Registered Public Accounting Firm(see page 64)

Although shareholder approval is not required under applicable law or NASDAQ listing requirements, we are asking shareholders to ratify the selection of PricewaterhouseCoopers LLP as our independent auditors for the fiscal year ending June 30, 2015. Set forth below is summary information with respect to PricewaterhouseCoopers LLP’s fees for services provided in fiscal 2013 and fiscal 2014. The Board recommends a voteFOR this proposal.

| | | | | | | | |

| | | Fiscal Year Ended | |

| | | June 30, 2014 | | | June 30, 2013 | |

Audit fees | | $ | 2,854,564 | | | $ | 2,323,805 | |

Audit-related fees | | | 4,316 | | | | — | |

Tax fees | | | 643,404 | | | | 1,526,551 | |

All other fees | | | 1,818 | | | | 1,818 | |

| | | | | | | | |

Total | | $ | 3,504,102 | | | $ | 3,852,174 | |

| | | | | | | | |

The Board of Directors recommends a voteFOR this proposal.

4

ELIZABETH ARDEN, INC.

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON DECEMBER 3, 2014

General

This proxy statement is being furnished to (i) holders of common stock, par value $.01 per share, of Elizabeth Arden, Inc. (our common stock), and (ii) holders of Series A Serial Preferred Stock, par value $.01 per share, of Elizabeth Arden, Inc. (our preferred stock), in connection with the solicitation of proxies by our board of directors for use at our 2014 annual meeting of shareholders to be held at our corporate office located at 2400 S.W. 145th Avenue, 2nd Floor, Miramar, Florida 33027, at 10:00 a.m., local time, on December 3, 2014 (the annual meeting), and at any adjournment or postponement of the annual meeting, for the purposes set forth in the accompanying notice of annual meeting.

It is anticipated that our annual report for the fiscal year ended June 30, 2014 (fiscal 2014), this proxy statement, and the accompanying form of proxy card will be first mailed to our shareholders on or about October 24, 2014. The annual report is not to be regarded as proxy soliciting material.

Outstanding Shares and Voting Rights

Except as required by law or otherwise provided in our articles of incorporation, the holders of shares of our common stock and the holders of shares of our preferred stock vote together as one class on all matters submitted to a vote of our shareholders. Each share of preferred stock is entitled to a number of votes (rounded down to the nearest whole number) equal to (i) the aggregate number of shares for which our outstanding warrants to purchase common stock that were issued on August 19, 2014 (the warrants) are exercisable (regardless of whether or not such warrants could legally be exercised at such time and regardless of whether the holder of the preferred stock is also the holder of warrants) divided by (ii) the number of outstanding shares of preferred stock, determined as of the record date for the determination of holders of shares entitled to vote on any such matter.

Only holders of record of our common stock and preferred stock at the close of business on the record date of October 3, 2014, are entitled to notice of and to vote at the annual meeting. On that date, there were (i) 29,811,655 shares of common stock and (ii) 50,000 shares of preferred stock (representing the voting equivalent of 2,450,000 shares of common stock), entitled to vote on each matter to be presented at the annual meeting. Based on the number of shares of common stock and preferred stock and warrants outstanding as of October 3, 2014, holders of our common stock have one vote per share on all matters, and holders of our preferred stock have 49 votes per share on all matters.

A majority of our outstanding shares of voting stock entitled to vote, represented in person or by proxy, will constitute a quorum for action on all matters at the annual meeting. Abstentions and broker non-votes are counted as present and entitled to vote for purposes of determining the presence of a quorum at the annual meeting. A “broker non-vote” occurs when a bank, broker or other holder of record holding shares for a beneficial owner does not vote on a particular proposal because that holder of record does not have discretionary voting power for that particular item and has not received voting instructions from the beneficial owner. Brokers (or other custodians with record title to your shares held in street name) that do not receive voting instructions from beneficial owners may only exercise their discretionary voting power with respect to the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for our fiscal year ending June 30, 2015, and maynot exercise their discretionary voting power with respect to any of the other proposals to be voted on at the annual meeting. Accordingly, if you do not instruct your broker or other custodian how to vote on (i) the election of directors, (ii) the advisory vote on our named executive officer compensation as disclosed herein, (iii) the approval of the proposed amendment to the Elizabeth Arden, Inc. 2010 Stock Award and Incentive Plan, or (iv) the approval of the Elizabeth Arden, Inc. 2014 Non-Employee Director Stock Award Plan, your broker or other custodian willnotvote for you.

Our by-laws provide that, if a quorum is present at a meeting of shareholders, each director and each matter presented for shareholder approval is elected or approved by our shareholders, as applicable, if the votes entitled to vote that are cast at the meeting in favor of the director or such matter exceed the votes cast against such director or matter, except as otherwise provided in our articles of incorporation or applicable law. Consequently, votes cast at the meeting in

5

favor of (i) the election of each director, (ii) the approval of the resolution regarding the advisory vote on our named executive officer compensation, (iii) the approval of the proposed amendment to the Elizabeth Arden, Inc. 2010 Stock Award and Incentive Plan, (iv) the approval of the Elizabeth Arden, Inc. 2014 Non-Employee Director Stock Award Plan, and (v) the proposed ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for our fiscal year ending June 30, 2015, must exceed the number of shares voted against the approval of such matter in order for each director to be elected and for each such proposal to be approved by our shareholders.Abstentions from voting, as well as broker non-votes, if any, are not treated as votes cast and, therefore, will have no effect on any of the proposals to be voted on at the annual meeting.

Shares represented by a properly executed proxy received in time to permit its use at the annual meeting or any adjournment or postponement of this meeting, and not revoked, will be voted in accordance with the instructions indicated therein. If no instructions are indicated, the shares represented by the proxy will be voted:

| | • | | FOR the election of all of the nominees for director named in this proxy statement (Proposal 1); |

| | • | | FOR the approval, on an advisory basis, of the compensation of our named executive officers as disclosed in this proxy statement (Proposal 2); |

| | • | | FOR the approval of the proposed amendment to the Elizabeth Arden, Inc. 2010 Stock Award and Incentive Plan (Proposal 3); |

| | • | | FOR the approval of the Elizabeth Arden, Inc. 2014 Non-Employee Director Stock Award Plan (Proposal 4); |

| | • | | FOR the approval of the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for our fiscal year ending June 30, 2015 (Proposal 5); and |

| | • | | in the discretion of the proxy holders as to any other matter that may properly come before the annual meeting and any adjournment or postponement thereof. |

You are requested, regardless of the number of shares that you hold, to sign the proxy and return it promptly in the enclosed envelope, or, if permitted by your bank, brokerage firm or other custodian, to vote by telephone or through the Internet. If you are a beneficial holder of our common stock, you should follow the voting instructions you will receive with our proxy materials from your broker, bank or other custodian. If you want to change your voting instructions, you must contact your custodian as directed in the instructions they provide. Each shareholder giving a proxy has the power to revoke it at any time before it is voted by written notice sent to the attention of Secretary, Elizabeth Arden, Inc., or by delivery of a later-dated proxy. Voting by mail, by telephone or through the Internet willnot prevent you from voting in person at the meeting. If you attend the meeting, you may revoke your proxy and vote your shares in person even if you have previously completed and returned the enclosed proxy card or voted by telephone or through the Internet. If you hold shares through a bank or in a brokerage account and you plan to attend and vote in person at the annual meeting, you will need to bring valid photo identification, a copy of a statement reflecting your share ownership as of the record date, and a legal proxy from your bank, broker or other custodian. This is because shareholders who hold shares of our common stock through banks, brokers or other nominees are not entitled to vote under applicable state law and therefore need to obtain proxy voting authority from their custodians if they wish to vote in person at the meeting.

NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS

Important Notice Regarding the Availability of Proxy Materials for the 2014 Annual Meeting of Shareholders of Elizabeth Arden, Inc. to be held on December 3, 2014: This proxy statement, the notice of annual meeting of shareholders, a sample form of the proxy sent or given to our shareholders, and our 2014 annual report are available on our website athttp://annualmeeting.elizabetharden.com.

6

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of October 16, 2014 (except as noted below), (i) the ownership of common stock by all persons known by us to own beneficially more than 5% of the outstanding shares of our common stock and (ii) the beneficial ownership of common stock by (a) each of our directors and nominees for director, (b) the chief executive officer and each of the other named executive officers as set forth in the Fiscal 2014 Summary Compensation Table below, and (c) all of our directors and current executive officers as a group, without naming them. The percentage of beneficial ownership set forth below is based on 29,811,655 shares of our common stock outstanding on October 16, 2014.

| | | | | | | | |

Name and Address of Beneficial Owner(1) | | Amount and Nature

of Beneficial

Ownership(2) | | | Percentage of

Class(2) | |

E. Scott Beattie(3) | | | 1,709,561 | | | | 5.6 | |

Fred Berens(4) | | | 853,272 | | | | 2.9 | |

Maura J. Clark(5) | | | 51,600 | | | | | * |

Richard C. W. Mauran(6) | | | 1,554,775 | | | | 5.2 | |

William M. Tatham(7) | | | 52,435 | | | | | * |

J. W. Nevil Thomas(8) | | | 166,986 | | | | | * |

A. Salman Amin(9) | | | 10,600 | | | | | * |

Joel B. Ronkin(10) | | | 245,107 | | | | | * |

Rod R. Little | | | 0 | | | | — | |

Stephen J. Smith(11) | | | 116,603 | | | | | * |

Pierre Pirard(12) | | | 71,572 | | | | | * |

Kathleen Widmer(13) | | | 8,573 | | | | | * |

Rhône Capital L.L.C. and Affiliates(14) | | | 5,626,686 | | | | 17.4 | % |

Invesco Ltd.(15) | | | 4,215,895 | | | | 14.1 | % |

M&G Investment Management Limited and M&G Investment Funds 1(16) | | | 3,913,457 | | | | 13.1 | % |

NWQ Investment Management Company LLC(17) | | | 1,930,549 | | | | 6.5 | % |

Vaughan Nelson Investment Management, Inc.(18) | | | 1,480,204 | | | | 5.0 | % |

All directors and current executive officers as a group (12 persons)(19) | | | 4,812,949 | | | | 15.6 | % |

| * | Less than one percent of the class. |

| (1) | Except as otherwise noted below, the address of each of the persons shown in the above table is c/o Elizabeth Arden, Inc., 2400 S.W. 145 Avenue, 2nd Floor, Miramar, Florida 33027. |

| (2) | Includes, where applicable, shares of common stock issuable upon the exercise of options to acquire common stock held by such person that may be exercised within 60 days after October 16, 2014. Unless otherwise indicated, we believe that all persons named in the table above have sole voting power and/or investment power with respect to all shares of common stock beneficially owned by them. |

| (3) | Includes (i) 996,615 shares of common stock, (ii) 172,479 shares of common stock held in a family trust for which Mr. Beattie’s spouse is the trustee, and (iii) 540,467 shares of common stock issuable upon the exercise of stock options. Of these shares of common stock, 927,102 shares are held by brokers in margin accounts, regardless of whether loans are outstanding. Does not include 166,703 restricted stock units. |

| (4) | Includes (i) 811,472 shares of common stock, (ii) 200 shares of common stock held in custodial accounts for Mr. Berens’ children, and (iii) 41,600 shares of common stock issuable upon the exercise of stock options. Of these shares of common stock, 801,472 shares are held by brokers in margin accounts, regardless of whether loans are outstanding. The address of Mr. Berens is 333 Avenue of the Americas, Suite 4600, Miami, Florida 33131. |

| (5) | Includes (i) 10,000 shares of common stock and (ii) 41,600 shares of common stock issuable upon the exercise of stock options. The address of Ms. Clark is 1050 Fifth Avenue, #9B, New York, New York 10028. |

| (6) | Includes (i) 1,513,175 shares of common stock held in a trust of which Mr. Mauran’s spouse, adult children and other unrelated third parties are beneficiaries, and (ii) 41,600 shares of common stock issuable upon the exercise of stock options. Mr. Mauran has voting and dispositive power over shares of common stock in the trust. The address of Mr. Mauran is 31 Burton Court, Franklins Row, London SW3, England. |

7

| (7) | Includes (i) 8,830 shares of common stock owned individually by Mr. Tatham, (ii) 4,555 shares of common stock owned by Mr. Tatham’s spouse, (iii) 950 shares of common stock owned by a family holding company of which Mr. Tatham is president and director, and (iv) 38,100 shares of common stock issuable upon the exercise of stock options. Mr. Tatham disclaims beneficial ownership as to the shares of common stock owned by his spouse and the family holding company. The address of Mr. Tatham is 10 York Mills Road, Ste. 700, Toronto, Ontario M2P 2G4, Canada. |

| (8) | Includes (i) 9,690 shares of common stock owned individually by Mr. Thomas, (ii) 29,458 shares of common stock owned by Sandringham Capital Services Corp., a company controlled by Mr. Thomas, (iii) 86,238 shares of common stock held by Nevcorp, Inc., a company for which Mr. Thomas serves as Chief Executive Officer with voting and investment control over the shares, and which is owned by Mayfront Trust, of which Mr. Thomas and two of his children are trustees, and (iv) 41,600 shares of common stock issuable upon the exercise of stock options. Of these shares of common stock, 115,696 shares are held by brokers in margin accounts, but only the 29,458 shares of common stock owned by Sandringham Capital Services Corp. have loans outstanding against them. The address of Mr. Thomas is 130 Adelaide Street West, Oxford Tower, Suite 2900, Toronto, Ontario M5H 3P5, Canada. Mr. Thomas is not standing for re-election to the board of directors. |

| (9) | Includes 10,600 shares of common stock issuable upon the exercise of stock options. The address of Mr. Amin is 1525 Howe Street, Racine, Wisconsin 53403. |

| (10) | Includes (i) 100,157 shares of common stock, (ii) 850 shares of common stock held in trusts, of which Mr. Ronkin is the trustee, for the benefit of two of Mr. Ronkin’s children, and (iii) 144,100 shares of common stock issuable upon the exercise of stock options. Does not include 62,768 restricted stock units. |

| (11) | Information provided as of September 1, 2013, Mr. Smith’s last day with the company. |

| (12) | Includes (i) 34,872 shares of common stock, and (ii) 36,700 shares of common stock issuable upon the exercise of stock options. Does not include 47,501 restricted stock units. |

| (13) | Information provided as of August 28, 2014, Ms. Widmer’s last day with the Company. |

| (14) | Held by entities affiliated with Rhône Capital L.L.C. (“Rhône Capital”) as reported in public filings available on or prior to October 16, 2014. The address of Rhône Capital is 630 Fifth Avenue, 27th Floor, New York, NY 10111. See “Certain Relationships and Related Person Transactions – Rhône Transaction” for a discussion of the transactions which resulted in the entities affiliated with Rhône Capital beneficially owning the shares indicated and their rights with respect to the election and/or nomination of directors to our board of directors. |

| (15) | Based on Schedule 13G dated August 31, 2014, filed by Invesco Ltd., which reflects sole voting and dispositive power with respect to 4,215,895 shares of common stock. The address of Invesco Ltd. is 1555 Peachtree Street NE, Atlanta, GA 30309. |

| (16) | Based on Amendment No. 8 to Schedule 13G dated December 31, 2013, filed by M&G Investment Management Limited and M&G Investment Funds (1), which reflects (i) shared voting and dispositive power held by M&G Investment Management Limited with respect to 3,913,457 shares of common stock, and (ii) shared voting and dispositive power held by M&G Investment Funds (1) with respect to 3,820,001 shares of common stock. The address of M&G Investment Management Limited and M&G Investment Funds 1 is Governor’s House, Laurence Pountney Hill, London EC4R 0HH, United Kingdom. |

| (17) | Based on Amendment No. 7 to Schedule 13G dated December 31, 2013, filed by NWQ Investment Management Company, LLC, which reflects sole dispositive power with respect to 1,930,549 shares of common stock and sole voting power with respect to 1,718,353 shares of common stock. The address of NWQ Investment Management Company, LLC is 2049 Century Park East, 16th Floor, Los Angeles, CA 90067. |

| (18) | Based on Schedule 13G dated December 31, 2013, filed by Vaughan Nelson Investment Management, L.P. and its general partner, Vaughan Nelson Investment Management, Inc., which reflects for each reporting person sole voting power with respect to 1,148,575 shares of common stock, sole dispositive power with respect to 1,338,700 shares of common stock, and shared dispositive power with respect to 141,504 shares of common stock. The address of each reporting person is 600 Travis Street, Suite 6300, Houston TX 77002. |

| (19) | Includes (i) 3,830,749 shares of common stock and (ii) 982,200 shares of common stock issuable upon exercise of stock options. Of these shares of common stock, 1,844,270 shares are held by brokers in margin accounts, regardless of whether loans are outstanding. Does not include 315,006 restricted stock units. Also excludes shares of common stock beneficially owned by Mr. Smith and Ms. Widmer, as they are no longer with the company. |

8

PROPOSAL 1 –

ELECTION OF DIRECTORS

Majority Voting for Directors

Our by-laws provide that, except as provided in our articles of incorporation with respect to our preferred stock, in an uncontested election of directors, a director must receive a majority of the votes cast at the annual meeting at which a quorum is present in order to be elected to the board, and in a contested election, a director must receive a plurality of the votes cast at the annual meeting in order to be elected to the board. In addition, our Corporate Governance Guidelines and Principles provide that the board shall nominate for election or re-election as director only candidates who agree to tender, promptly following the annual meeting at which they are elected or re-elected as a director, irrevocable resignations that will be effective upon the board’s acceptance of such resignation if the candidate fails to receive the required vote at the next annual meeting at which such candidate faces election or re-election. In such event, the nominating and corporate governance committee must then recommend to the board what actions should be taken with respect to such director, based upon the consideration of all factors deemed relevant by the committee, and the board must publicly disclose its decision within 90 days of the date of certification of the election results. Each of our nominees for director has submitted an irrevocable, conditional letter of resignation that will be considered by the board of directors if that candidate fails to receive a majority of the votes cast at the annual meeting.

Information about the Nominees

We are nominating six directors for election at the annual meeting. Our articles of incorporation provide that the number of directors constituting the board of directors shall not be less than one person, with the exact number to be fixed by a resolution adopted by the affirmative vote of a majority of the entire board. Under the terms of the shareholders agreement entered into with the Rhône Purchasers on August 19, 2014, we cannot alter the size of the board without the written consent of the Rhône Purchasers, and we have agreed that the board will not have more than six non-Rhône directors prior to the 2015 annual meeting of shareholders. Pursuant to these requirements as of the date of the annual meeting, the size of the board of directors will be set at six, and will be subject to increase if the Rhône Purchasers exercise their director election rights. The shareholders agreement with the Rhône Purchasers requires the Rhône Purchasers to vote in favor of the board’s director nominees. Please refer to the discussion below under “Certain Relationships and Related Person Transactions – Rhône Transaction - Rhône Director Designation Rights” for further details on Rhône’s director election rights.

Based on the recommendation of the nominating and corporate governance committee of the board of directors, all six nominees have been designated by the board of directors as nominees for election as directors, to serve until the next annual meeting of shareholders, or until that person’s successor is duly elected and qualified or until his or her earlier death, resignation, retirement, disqualification or removal. The six nominees named below are currently serving as our directors.

Mr. J. W. Nevil Thomas, who is currently serving as one of our directors, is retiring and is not standing for re-election. The Board would like to thank Mr. Thomas for his dedication to the company and his invaluable contributions over the past 22 years. We have benefited greatly from his wisdom and advice.

In the event that any nominee is unable or unwilling to serve, discretionary authority is reserved to the persons named in the accompanying form of proxy to vote for substitute nominees. The board of directors does not anticipate that such an event will occur.

9

The names of the nominees for our board of directors and information about them are set forth below.

| | | | |

Nominee | | Director Since | | Business Experience During Past Five Years and Other Directorships and Qualifications |

| E. Scott Beattie | | January 1995 | | Mr. Beattie, age 55, has served as Chairman of our board of directors since April 2000, as our Chief Executive Officer since March 1998, and as one of our directors since January 1995. Mr. Beattie also has served as our President since August 2006, a position he also held from April 1997 to March 2003. In addition, Mr. Beattie served as our Chief Operating Officer from April 1997 to March 1998, and as Vice Chairman of the board of directors from November 1995 to April 1997. He is Chairman of the board of directors of the Personal Care Products Council, the U.S. trade association for the cosmetic and personal care products industry, and a member of the executive committee of the advisory board of the Ivey School of Business. In addition, he is a member of the executive committee of the board of directors, and chairperson of the audit and finance committee of the board of directors, of PENCIL, a not-for-profit organization that benefits New York City public schools. The board has selected Mr. Beattie to serve as a director because of his proven record of leadership and his instrumental role in the growth of our company, as well as his extensive knowledge of our industry. Throughout his career with our company he has acquired valuable financial, management, operational and industry expertise that provides the board of directors with a unique and valuable perspective on the opportunities and challenges that face our company. |

| | |

| Fred Berens | | July 1992 | | Mr. Berens, age 71, has served as our lead independent director since February 2009. Mr. Berens has served in various capacities with Wells Fargo Advisors LLC (formerly known as Wachovia Securities, Inc.), an investment-banking firm, since March 1965, most recently as managing director-investments since September 2004. Mr. Berens served as a member of the board of directors of Public Broadcasting Systems from 2008 until 2014, and served as the chairman of its audit committee in 2012, and as chairman during 2013. He has also served on the board of trustees of the University of Miami since 1972 and as a member of the board of directors of Channel 2 WPBT (South Florida’s public broadcasting station) since 1981, serving as its chairman in 1988. The board has selected Mr. Berens to serve as a director because of his financial expertise and his knowledge of capital markets. Mr. Berens’ experience as a managing director with large investment banking firms has provided him with excellent financial and analytical skills that are valuable to the board of directors. In addition, Mr. Berens’ prior service on the board of directors and audit committees of Peninsula Federal Savings & Loan and Intercontinental Bank provided him with extensive experience in board and audit committee functions that are valuable to the board of directors. |

| | |

| Richard C.W. Mauran | | July 1992 | | Mr. Mauran, age 80, is a retired private equity investor. Over the course of his career, Mr. Mauran founded two successful Canadian companies (FoodCorp and Industrial Growth Fund, which became Mackenzie Financial Corporation, one of Canada’s largest mutual fund management companies). In addition, he served as a director of several publicly-traded companies, including Microbix Biosystems, Inc. (Toronto Stock Exchange), Premdor, Inc. (NYSE and Toronto Stock Exchange), and US Physical Therapy, Inc. (NASDAQ). The board has selected Mr. Mauran to serve as a director because his long career as an entrepreneur, private equity investor and public company director has provided him with significant experience in successfully leading companies through growth and expansion and a unique perspective that is valuable to the board of directors. |

| | |

| Maura J. Clark | | August 2005 | | Ms. Clark, age 55, was President, Direct Energy Business, of Direct Energy Services, LLC, an energy and energy services provider in North America and a subsidiary of United Kingdom based Centrica plc from September 2007 until April 2014. From July 2006 to September 2007, Ms. Clark served as Executive Vice President, Strategy and Mergers and Acquisitions, of Direct Energy Services, LLC. From April 2005 until July 2006, Ms. Clark was the Senior Vice President, North American Strategy and Mergers and Acquisitions of Direct Energy Services, LLC. From March 2003 to April 2005, |

10

| | | | |

| | | | Ms. Clark was an independent consultant providing strategic and corporate development services. From October 2000 to February 2003, Ms. Clark was a managing director at Goldman Sachs & Co., an investment-banking firm. From August 1995 to September 2000, Ms. Clark served as the Executive Vice President, Corporate Development and Chief Financial Officer for Premcor, Inc. (formerly known as Clark Refining & Marketing, Inc.), a petroleum refiner and marketer. Ms. Clark is a chartered accountant. The board has selected Ms. Clark to serve as a director because of the financial, accounting, executive and corporate development expertise that she has developed through her various positions with Direct Energy Services LLC, Goldman Sachs & Co., and Premcor, Inc., and her qualification as a chartered accountant. |

| | |

| William M. Tatham | | July 2001 | | Mr. Tatham, age 55, has served as Chief Executive Officer of NexJ Systems, Inc., a publicly-held, Canada-based client relationship management software company, since June 2006, and as Chief Executive Officer and general managing partner of XJ Partners, Inc., a Canada-based strategy consulting company, since September 2001. From November 2000 to June 2001, Mr. Tatham served as Vice President and General Manager of Siebel Systems, Inc., an e-business applications software company. From 1990 until its acquisition by Siebel Systems in November 2000, Mr. Tatham served as the Chairman and Chief Executive Officer of Janna Systems, Inc., a publicly-held, Canada-based software development company that Mr. Tatham founded. The board has selected Mr. Tatham to serve as a director because of the valuable executive and information technology expertise that he has developed through his various positions with Janna Systems, Inc., Siebel Systems, XJ Partners, Inc., and NexJ Systems, Inc. |

| | |

| A. Salman Amin | | November 2010 | | Mr. Amin, age 54, has served as Chief Operating Officer, North America Markets, for SC Johnson & Son, Inc., since March 2013. Prior to SC Johnson, Mr. Amin was with Pepsico, Inc., serving as Chief Marketing Officer from May 2012 to March 2013, and as Executive Vice President, Sales and Marketing from September 2009 to May 2012. From 1995 through August 2009, Mr. Amin served in various management and marketing positions with PespiCo, Inc., including serving as President of PepsiCo United Kingdom and Ireland, Senior Vice-President and Chief Marketing Officer for Pepsi-Cola International, and Chief Marketing Officer and General Manager, International Marketing Development, Frito-Lay International. Prior to joining PepsiCo, Inc. in 1995, Mr. Amin spent 10 years with Procter & Gamble Company in various brand management positions of increasing responsibility. The board has selected Mr. Amin to serve as a director because of his extensive career with two leading global consumer packaged goods companies. This experience has provided him with a broad set of brand management, marketing and sales skills, developed through his postings around the world in locations such as the Middle East, Asia, Europe and the United States, which brings a valuable perspective to the board of directors. |

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE “FOR”

THE ELECTION OF EACH NOMINEE FOR DIRECTOR NAMED IN THIS PROXY STATEMENT.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Federal securities laws require our directors, executive officers and persons who beneficially own more than 10% of our common stock to file reports of initial ownership and reports of subsequent changes in ownership with the U.S. Securities and Exchange Commission (SEC) and to provide us with copies of these reports. Specific due dates have been established, and we are required to disclose any failure of these persons to file those reports on a timely basis during our fiscal year ended June 30, 2014. To the best of our knowledge, based solely upon a review of copies of reports furnished to us, filings with the SEC and written representations that no other reports were required, all of our directors, executive officers and ten percent or greater beneficial owners of our common stock made all such filings on a timely basis.

11

GOVERNANCE OF THE COMPANY

Corporate Governance Guidelines and Principles; Director Independence. Our Corporate Governance Guidelines and Principles set forth the responsibilities and qualification standards of the members of our board of directors and are intended as a component of the governance framework within which the board of directors, assisted by its committees, directs our affairs. Among other things, our Corporate Governance Guidelines and Principles provide that our independent directors have the opportunity to meet in executive session at every board and board committee meeting, with the agenda for such meetings being established by our lead independent director. The full text of our Corporate Governance Guidelines and Principles, as approved by the board, is published on our website at www.elizabetharden.com, under the section “Corporate – Investor Relations – Corporate Governance – Guidelines & Principles.”

The listing standards of the NASDAQ Global Select Market (NASDAQ) require that a majority of our board be composed of directors who are “independent,” as such term is defined by Rule 5605(a)(2) of NASDAQ’s Listing Rules. Our board has determined that each of our current directors, with the exception of Mr. Beattie, is independent under NASDAQ and SEC rules. In making its independence determination, the board considered that Mr. Berens received compensation from Wells Fargo Advisors LLC of approximately $8,500 during fiscal 2014 resulting from services provided to certain of our executive officers by the financial advisory and account management group that Mr. Berens heads. Our company does not directly or indirectly reimburse Wells Fargo Advisors LLC or our executive officers for such fees. The board concluded that such relationship did not interfere with the ability of Mr. Berens to exercise independent judgment in carrying out the responsibilities of a director.

Shareholders may communicate with the board, individual members of the board or its committees by writing to: Secretary, Elizabeth Arden, Inc., 2400 S.W. 145th Avenue, Miramar, Florida 33027. The Secretary will then distribute such communications to the intended recipient(s).

Code of Business Conduct. All of our employees, officers and directors are required to abide by our Code of Business Conduct, which requires that they conduct our business with the utmost integrity and honesty and in a manner that adheres to the highest ethical standards and fully complies with all applicable laws and regulations. The full text of the Code of Business Conduct, as approved by our board, is published on our website, atwww.elizabetharden.com, under the section “Corporate – Investor Relations – Corporate Governance – Code of Business Conduct.”

Supplemental Code of Ethics. Our directors, the chief executive officer, the chief financial officer, and our other executive officers and finance officers are also required to comply with our Supplemental Code of Ethics for the Directors and Executive and Finance Officers. This Supplemental Code of Ethics is intended to cover, among other things, the avoidance and handling of conflict of interest situations and the review of disclosure and accounting matters, including the adequacy of disclosure controls and procedures and internal control over financial reporting. Any alleged violation of the Supplemental Code of Ethics or any violation of law must be reported to our general counsel or the chairperson of the audit committee, which may be done anonymously, in accordance with the procedures set forth in the Supplemental Code of Ethics.

The full text of this Supplemental Code of Ethics, as approved by our board, is published on our website, atwww.elizabetharden.com, under the section “Corporate – Investor Relations – Corporate Governance – Code of Ethics.”

Board Leadership Structure; Lead Independent Director

E. Scott Beattie serves as both our Chairman of the Board and Chief Executive Officer. The board has determined that the most effective leadership structure for our company at this time is for Mr. Beattie to serve as both Chairman of the Board and Chief Executive Officer. Mr. Beattie is ultimately responsible for the day-to-day operations of our company and for the execution of our business strategy. Accordingly, the board believes that Mr. Beattie’s in-depth knowledge of company operations and performance, as well as the challenges faced by our company, best positions him to identify strategic issues and risks to be considered by the board, and his leadership on the board enhances communications between management and the board. The board retains the authority to modify this structure to best address our needs, as and when appropriate, and there have been times in our history when the positions of Chairman of the Board and Chief Executive Officer were not held by the same person.

In order to enhance the board’s active and objective oversight of our management, the board established the position of lead independent director in February 2009. Mr. Fred Berens currently serves as our lead independent director, and his term will end on November 30, 2014. The responsibilities of our lead independent director include (1) acting as the principal liaison between the independent directors and the Chairman of the Board; (2) developing the

12

agenda for and presiding over executive sessions of the board’s independent directors; (3) approving with the Chairman the agenda for board and board committee meetings and the need for special meetings of the board; (4) advising the Chairman as to the quality, quantity and timeliness of the information submitted by management that is necessary or appropriate for the independent directors to effectively and responsibly perform their duties; (5) recommending to the board the retention of advisors and consultants who report directly to the board; (6) interviewing, along with the chairperson of the nominating and corporate governance committee, all board candidates, and making recommendations to the nominating and corporate governance committee; (7) chairing meetings of the board if the Chairman is not present, and (8) serving as a liaison for consultation and communication with shareholders. A copy of the charter for our lead independent director is available on our website atwww.elizabetharden.com, under the section “Corporate – Investor Relations – Corporate Governance – Lead Independent Director Charter.”

Meetings and Committees of Our Board of Directors

During fiscal 2014, the board met nine times and each director attended at least 75% of the aggregate of the total meetings of the board and the total meetings of the committees of the board on which such director served. Our independent directors generally meet in executive session after board or board committee meetings. During fiscal 2014, the board had three committees: the audit committee, the compensation committee, and the nominating and corporate governance committee. Directors are not required to attend our annual meetings. Mr. Beattie was the only director present at our 2013 annual meeting of shareholders.

The Audit Committee

The audit committee consists of Ms. Clark and Messrs. Berens, Tatham and Thomas. Our board has determined that Messrs. Berens and Thomas, and Ms. Clark are each “audit committee financial experts” for purposes of the SEC’s rules and that each of them is independent, as defined by applicable SEC and NASDAQ rules. Ms. Clark chairs the audit committee, which met four times during fiscal 2014.

The audit committee oversees the quality and integrity of our accounting and financial reporting process, the adequacy of our internal controls and the integrated audits of our consolidated financial statements and internal control over financial reporting, and also carries out such other duties as directed by the board. The audit committee is responsible for, among others: (1) selecting, negotiating the compensation of, and overseeing the work of, our independent registered public accounting firm, including approving all audit, audit-related and permitted non-audit services performed for us by the independent registered public accounting firm and reviewing its independence; (2) reviewing the planning and staffing of audit engagements, including ensuring the rotation of the audit partner of the independent registered public accounting firm as required by law; (3) investigating matters brought to the attention of the audit committee; (4) reviewing our financial reporting activities, including the annual and quarterly reports and the consolidated financial statements included in such reports, the accounting principles, standards, policies and practices followed by us and management’s conclusions regarding the effectiveness of our internal control over financial reporting; (5) reviewing the internal quality control review of the independent registered public accounting firm and evaluating their qualifications and performance, and otherwise making all decisions regarding our engagement of this firm; (6) approving the audit committee report included in this proxy statement; (7) reviewing the independent registered public accounting firm’s certification and report on management’s assessment of internal control over financial reporting; and (8) reviewing and approving related person transactions in accordance with our related person transaction policy described on page 17.

The responsibilities of the audit committee, as approved by the board, are set forth in the audit committee charter, a copy of which is available on our website atwww.elizabetharden.com, under the section “Corporate – Investor Relations – Corporate Governance – Audit Committee.”

The Compensation Committee

The compensation committee consists of Messrs. Amin, Berens, and Tatham. The board of directors has determined that each of Messrs. Amin, Berens, and Tatham is independent, as defined by applicable NASDAQ rules. Mr. Amin chairs the compensation committee, which met three times during fiscal 2014.

The compensation committee is responsible for, among other things: (1) establishing an overall compensation strategy and program for our executive officers and other employees, including approving grants of restricted stock, restricted stock units, stock options and cash bonus awards under our incentive plans; (2) reviewing and approving the strategy and individual elements of the compensation of our executive officers, including the chief executive officer; (3) administering our stock and cash incentive plans, and the employee stock purchase plan; (4) reviewing and discussing

13

with management our disclosures contained in the Compensation Discussion and Analysis, and making a recommendation to the board regarding the inclusion of the Compensation Discussion and Analysis in our proxy statement; (5) reviewing and evaluating our compensation policies and practices as they relate to our risk management; (6) reviewing and approving our stock ownership and retention guidelines for executive officers, as well as any waivers thereof; and (7) reviewing and making recommendations to the board regarding non-employee director compensation.

The responsibilities of the compensation committee, as approved by the board, are set forth in the committee’s charter, a copy of which is available on our website atwww.elizabetharden.com, under the section “Corporate – Investor Relations – Corporate Governance – Compensation Committee.”

The compensation committee has the authority, pursuant to its charter, to directly engage the services of outside experts and advisors as it deems necessary and appropriate to assist the compensation committee in fulfilling its responsibilities. Since 2002, Mercer (US) Inc., a global compensation and benefits consulting firm and wholly-owned subsidiary of Marsh & McLennan Companies, Inc., has been engaged by the compensation committee to provide the compensation committee with third-party data and advice in connection with the compensation committee’s deliberations regarding executive compensation. Mercer’s fees for executive compensation consulting services provided to the compensation committee in fiscal 2014 were $244,172.

Mercer reviews and evaluates our executive compensation strategy and program to ensure that they continue to accomplish our compensation objectives, reflect industry best practices, and are competitive with the market. More specifically, at the request of the compensation committee, Mercer (1) assesses the pay competitiveness of our executive officer positions, (2) conducts a business performance analysis to gauge the relative alignment between our performance and executive officer compensation relative to our peer group, (3) reviews and validates our bonus program design, incentive award opportunities, and long-term incentive grant practices, and (4) summarizes and reports to the compensation committee on trends, regulatory developments and other factors affecting executive officer compensation. Based on these activities, Mercer makes recommendations regarding, and proposes adjustments to, our executive officer compensation program as it deems appropriate. While Mercer works closely with the appropriate members of our executive management team in performing these activities, Mercer reports directly to and is retained by the compensation committee on all executive compensation matters. Mercer periodically attends compensation committee meetings.

During fiscal 2014, Mercer and its Marsh & McLennan affiliates were also retained by management to provide services unrelated to executive compensation, including insurance brokerage services and human resources consulting services such as providing advice regarding our benefit programs in the areas of benefit plan design, compliance, communication, administration and funding. The aggregate fees paid for those other services in fiscal 2014 were $1,060,953. The compensation committee and the board did not review or approve the other services provided to us by Mercer and its Marsh & McLennan affiliates, as those services were approved by management in the normal course of business.

We have been advised by Mercer that the reporting relationship and compensation of the Mercer consultants who perform executive compensation consulting services for our compensation committee is separate from, and is not determined by reference to, Mercer’s or Marsh & McLennan’s other lines of business or their other work for us. The compensation committee considered these separate reporting relationships and compensation structures, the provision of other services to the company by Mercer and Marsh & McLennan, the absence of any business or personal relationship between our officers and directors and the specific Mercer consultants advising the company (other than the consulting relationship with the compensation committee), and the other factors required to be considered by applicable SEC and stock exchange rules, in approving the committee’s engagement of Mercer for fiscal 2014. Based on this review, the compensation committee did not identify that Mercer had any conflicts of interest that would prevent Mercer from independently advising the compensation committee.

The Nominating and Corporate Governance Committee

The nominating and corporate governance committee consists of Messrs. Mauran and Thomas and Ms. Clark. The board has determined that each of Messrs. Mauran and Thomas, and Ms. Clark is independent, as defined by applicable NASDAQ rules. Mr. Mauran chairs the nominating and corporate governance committee, which met once during fiscal 2014.

The nominating and corporate governance committee is responsible for evaluating and recommending to the board candidates for nomination for election or re-election by the shareholders to the board of directors, evaluating and recommending candidates for the committees of the board, considering corporate governance issues and developing

14

appropriate recommendations and policies for the board regarding such matters. The nominating and corporate governance committee reviews with the board the appropriate skills, characteristics and experience represented on the board of directors in light of our strategic direction, opportunities and risks, as well as the perceived needs of the board at that point in time. As part of the board’s program for succession planning and director recruitment, the nominating and corporate governance committee evaluates the current board composition in order to allow the board to focus on identifying and attracting new members that would most benefit the board at a particular point in time.

Subject to the Rhône Purchasers’ director designation rights as described below under “Certain Relationships and Related Person Transactions – Rhône Transaction – Rhône Director Designation Rights,” the nominating and corporate governance committee’s consideration and nomination of director candidates for election or re-election to the board includes an assessment of candidates’ experience, qualifications, competencies, judgment, and skills, in the context of the perceived needs of the board at the time of assessment. Although we do not have a formal diversity policy, the nominating and corporate governance committee does consider diversity in the experience, qualifications, competencies, perspectives and skills of our directors when evaluating the composition of our board.

The nominating and corporate governance committee considers recommendations for board of directors candidates submitted by shareholders, provided that the recommendations are made in accordance with the procedure for director candidates nominated by shareholders required under our by-laws and described in this proxy statement under the heading “Shareholder Proposals and Nominations of Board Members for the 2015 Annual Meeting,” using the same criteria it applies to recommendations from its committee, directors or members of management. Shareholders may submit recommendations by writing to the nominating and corporate governance committee as follows: Nominating and Corporate Governance Committee, c/o Secretary, Elizabeth Arden, Inc., 2400 S.W. 145th Avenue, Miramar, Florida 33027. The responsibilities of the nominating and corporate governance committee, as approved by the board, are set forth in the committee’s charter, a copy of which is available on our website atwww.elizabetharden.com, under the section “Corporate – Investor Relations – Corporate Governance – Nominating Committee.”

Board’s Role in Risk Oversight

The board oversees the management of risks inherent in the operation of our business and the implementation of our business strategy. The board performs this function in part through the board’s committees, which oversee the management of company risks that fall within each committee’s area of responsibility. Each board committee has full access to company management, as well as the ability to engage independent advisors, to assist the committees in performing these oversight functions.

The audit committee oversees our policies and processes relating to our financial statements and financial reporting processes, as well as management’s assessment of key credit risks, liquidity risks, foreign currency exchange risks, contingencies arising from legal disputes, and the effectiveness of our internal control structure. The compensation committee reviews our overall compensation program and its effectiveness in linking executive pay to performance and aligning the interests of our executives and our shareholders. The compensation committee also reviews and evaluates management’s assessment of whether our compensation policies and procedures are reasonably likely to have a material adverse effect on our company. Both management of the company and the compensation committee concluded that our compensation policies and procedures are not reasonably likely to have a material adverse effect on our company. The nominating and corporate governance committee oversees risks related to our governance structure and processes, and also oversees our management succession planning process. The board believes that its risk oversight role is not affected by the fact that the positions of chairman and chief executive officer are both held by Mr. Beattie.

In addition, as part of its oversight role, the board considers specific risk topics related to our business, including strategic, sales, financial and operational risks, on a regular basis and otherwise as the need arises. These topics are considered and discussed in a periodic business risk review, as well as in connection with the board’s review of the detailed management reports provided at each board meeting. The business risk review includes management’s comprehensive analysis of our risk profile and actions taken by management to manage and mitigate the risks identified.

15

CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS

Related Person Transaction Policy

Our written Related Person Transaction Policy requires that our board or audit committee approve or ratify all transactions involving amounts in excess of $120,000 between our company or one or more of our subsidiaries and any “related person,” as defined by SEC rule to include directors, director nominees, executive officers, and their respective immediate family members, and 5% beneficial owners of our common stock (among others, as discussed below in further detail). Under the Related Person Transaction Policy, the board or audit committee reviews the relevant facts of the proposed transaction and the interest of the related person in the transaction, and either approves or rejects the proposed transaction. If a related person transaction is discovered that has not been previously approved or previously ratified, that transaction will be presented to the board or audit committee for ratification. No director can participate in the deliberation or approval of any related person transaction in which such director is the related person.

For purposes of the Related Person Transaction Policy, a “related person” means (i) any director or executive officer of ours, (ii) any nominee for director, (iii) any 5% beneficial owner of our common stock, (iv) any immediate family member of a director, nominee for director, executive officer or 5% beneficial owner of our common stock, and (v) any firm, corporation, or other entity in which any of these persons is employed or is a partner or principal or in a similar position, or in which such person has a 10% or greater beneficial ownership interest. The Related Person Transaction Policy provides that the following types of transactions are deemed to be pre-approved under the policy: (1) transactions that are available to related persons on the same terms as such transactions are available to all employees generally; (2) compensation or indemnification arrangements of any executive officer, other than an individual who is an immediate family member of a related person, if such arrangements have been approved by the board or the compensation committee; (3) transactions in which the related person’s interest derives solely from his or her ownership of less than 10% of the equity interest in another person (other than a general partnership interest) that is a party to the transaction; (4) transactions in which the related person’s interest derives solely from his or her ownership of a class of our equity securities and all holders of that class of equity securities received the same benefit on a pro rata basis; (5) director compensation arrangements, if such arrangements have been approved by the board or the compensation committee; and (6) any other transaction which is not required to be disclosed as a “related person transaction” under applicable securities regulations. The Related Person Transaction Policy defines the term “immediate family member” to mean any child, stepchild, parent, stepparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law of a director, nominee for director, executive officer, or 5% beneficial owner of our common stock, and any person (other than a tenant or employee) sharing the household of such director, nominee for director, executive officer, or 5% beneficial owner.

Rhône Transaction

Securities Purchase Agreement

On August 19, 2014, we entered into a securities purchase agreement with Nightingale Onshore Holdings L.P. and Nightingale Offshore Holdings L.P., investment funds affiliated with Rhône Capital LLC (each a “Rhône Purchaser”), pursuant to which we issued and sold to the Rhône Purchasers, for an aggregate of $50 million in cash, the following:

| | • | | 50,000 shares of our newly designated Series A Serial Preferred Stock, par value $0.01 per share; and |

| | • | | warrants for the purchase of up to 2,452,267 shares of our common stock, par value $0.01 per share, at an exercise price of $20.39 per share, representing approximately 7.6% of our outstanding common stock on an as-exercised basis. |

We refer to the Rhône Purchasers and their affiliates in this proxy statement collectively as “Rhône.”

Pursuant to the terms of the securities purchase agreement, we also effected an amendment to our amended and restated by-laws as necessary to effect the voting and director designation rights of the preferred stock. The securities purchase agreement contained customary representations, warranties and covenants between the parties.

Rhône Partial Cash Tender Offer

On August 27, 2014, the Rhône Purchasers commenced an offer to purchase up to 6,442,013 shares of our common stock, constituting approximately 20% of the outstanding shares of our common stock, at a purchase price of $17.00 per

16

share. On September 9, 2014, we filed a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC in which we expressed no opinion and remained neutral with respect to the offer for the reasons described in the Schedule 14D-9. The tender offer expired on October 1, 2014, and 2,874,320 shares of common stock were validly tendered pursuant to the offer. In addition, from October 3, 2014 through October 14, 2014, Rhône purchased an additional 300,099 shares of common stock in the open market. As a result, Rhône’s Percentage Interest (as defined below) as of October 14, 2014, was 17.4%.

Series A Serial Preferred Stock

The terms, rights, obligations and preferences of the preferred stock are set forth in the articles of amendment to our amended and restated articles of incorporation, which we filed with the Secretary of State of the State of Florida on August 19, 2014 (the articles of amendment), in connection with the issuance of the preferred stock.

Dividends on the preferred stock are payable at the per annum dividend rate of 5% of the liquidation preference, which is initially $1,000 per share. The preferred stock will also participate in dividends declared or paid, whether in cash, securities or other property, on the shares of common stock for which the outstanding warrants issued are exercisable. The preferred stock has an aggregate liquidation preference of $50 million and ranks junior to all of our liabilities and obligations to creditors with respect to assets available to satisfy claims against us and senior to all other classes of stock over which the preferred stock has preference, including our common stock.

Pursuant to the shareholders agreement described below, each quarter we are obligated to declare and pay in cash no less than fifty percent (50%) of each dividend to which holders of the preferred stock are entitled, unless payment of such dividend in cash (i) is prohibited by or would result in a default or event of default under the indenture for our outstanding 7 3/8% senior notes due 2021, our credit facilities and certain other debt documents, or (ii) would result in a breach of the legal or fiduciary obligations of our board, in which case we will declare and pay in cash the maximum amount permitted to be paid in cash. If and to the extent that we do not pay the entire dividend to which holders of preferred stock are entitled for a particular period in cash on the applicable dividend payment date, preferential cash dividends will accrue on such unpaid amounts (and on any unpaid dividends in respect thereof) at 5% per annum, and will compound on each dividend payment date, until paid. No cash dividend may be declared or paid on common stock or other classes of stock over which the preferred stock has preference unless full cumulative dividends have been or contemporaneously are declared and paid in cash on the preferred stock.

The preferred stock is not convertible into common stock at any time and is redeemable at the option of the holder (i) at any time on or after August 19, 2022, at a redemption price equal to 100% of the liquidation preference of the shares of preferred stock to be redeemed plus an amount per share equal to accrued but unpaid dividends on such shares of preferred stock up to but excluding the earlier of the date of the redemption or the date of constructive redemption, and (ii) at specified times and for specified redemption prices, in the event of a change of control involving us (as defined in our articles of amendment) at a price per share of common stock below $24.00. The preferred stock is also redeemable at our option beginning on or after August 19, 2016, at specified redemption prices.

As described above under “Outstanding Shares and Voting Rights,” except as required by law or otherwise provided in our articles of amendment, the holders of shares of preferred stock and the holders of shares of our common stock vote together as one class on all other matters submitted to a vote of our shareholders. Each share of preferred stock is entitled to a number of votes (rounded down to the nearest whole number) equal to (i) the aggregate number of shares of common stock for which the outstanding warrants are exercisable (regardless of whether or not such warrants could legally be exercised at such time and regardless of whether the holder of the preferred stock is also the holder of warrants) divided by (ii) the number of outstanding shares of preferred stock, determined as of the record date for the determination of holders of common stock entitled to vote on any such matter. Based on the preferred stock and warrants outstanding on the record date of October 3, 2014, each share of preferred stock is entitled to 49 votes per share.

Warrants

The warrants are exercisable at any time on or prior to August 19, 2024, at an exercise price of $20.39 per share, by paying the exercise price in cash, by surrendering shares of preferred stock or by a combination thereof. After August 19, 2019, we may require the exercise of the warrants if the volume weighted average sale price (as defined in the warrant) for our common stock exceeds 150% of the exercise price for ten (10) consecutive trading days. In such a case, payment of the warrant price is required to be made first by surrender of shares of preferred stock held by the warrant holder.

17