UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

ELIZABETH ARDEN, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be Held on December 2, 2015

The 2015 annual meeting of shareholders of Elizabeth Arden, Inc. will be held on Wednesday, December 2, 2015, at 10:00 a.m., local time, at our corporate office located at 2400 S.W. 145th Avenue, 2nd Floor, Miramar, Florida 33027, for the following purposes, as described in the attached proxy statement:

| | 1. | To elect as directors the five nominees named in the accompanying proxy statement to serve until the next annual meeting of shareholders, or until such person’s successor is duly elected and qualified or until his or her earlier death, resignation, retirement, disqualification or removal; |

| | 2. | To approve, on an advisory basis, the compensation of our named executive officers as disclosed in the attached proxy statement; |

| | 3. | To approve an amendment to the Elizabeth Arden, Inc. 2010 Stock Award and Incentive Plan to increase the number of shares of our common stock, par value $0.01 per share, that may be granted under the 2010 Stock Award and Incentive Plan by 3,000,000, from 2,350,000 to 5,350,000, as more specifically outlined in the attached proxy statement; |

| | 4. | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2016; and |

| | 5. | To transact such other business as may properly come before the annual meeting or any adjournment or postponement thereof. |

Only holders of record of (i) our Common Stock, par value $0.01 per share (our common stock), and (ii) our Series A Serial Preferred Stock, par value $0.01 per share (our preferred stock) as of the close of business on October 8, 2015 are entitled to notice of and to vote at the annual meeting and at any adjournment or postponement of that meeting. A majority of our outstanding shares of voting stock entitled to vote, represented in person or by proxy, will constitute a quorum for action on all matters at the annual meeting. For 10 days prior to the annual meeting and during the annual meeting, a list of shareholders entitled to vote will be available for inspection at our corporate office located at 2400 S.W. 145thAvenue, 2nd Floor, Miramar, Florida 33027.

It is important that your shares be represented at the annual meeting regardless of how many shares you own. Whether or not you intend to be present at the annual meeting in person, we urge you to complete, date and sign the enclosed proxy card and return it in the envelope provided for that purpose. If you hold your shares through a broker, bank or other nominee (that is, you hold your shares in “street name”), you will receive voting instructions from your broker or other nominee that you should follow in order to have your shares voted. Many shareholders who hold their shares in street name may have the option to vote by telephone or the Internet. We urge you to vote by telephone or the Internet, if possible, since your vote will be recorded quickly and there is no risk that postal delays will cause your vote to arrive late and therefore not be counted. See your proxy card or voting instructions from your bank, broker or other nominee for further directions on voting. Voting by mail, by telephone or through the Internet will not prevent you from voting in person at the meeting. If you attend the meeting, you may revoke a vote previously cast by proxy card and vote your shares in person. Also, you may revoke your proxy by written notice sent to the attention of Secretary, Elizabeth Arden, Inc., or by delivery of a later-dated proxy at any time before it is voted. Street name holders who wish to revoke their previous voting instructions must follow the directions provided by their bank, broker or other nominee.

|

By Order of the Board of Directors |

|

OSCAR E. MARINA,Secretary |

Miramar, Florida

October 23, 2015

YOU ARE URGED TO COMPLETE, DATE, SIGN AND PROMPTLY MAIL THE ENCLOSED PROXY IN THE ACCOMPANYING POSTAGE-FREE ENVELOPE OR TO VOTE BY TELEPHONE OR THE INTERNET WHERE POSSIBLE. THE PROXY IS REVOCABLE AT ANY TIME PRIOR TO ITS USE.

TABLE OF CONTENTS

ELIZABETH ARDEN, INC.

2015 PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

2015 Annual Meeting of Shareholders

| | |

| Time and Date: | | 10:00 a.m., December 2, 2015 |

| |

| Place: | | Corporate Office – 2400 SW 145th Ave., 2nd Floor, Miramar, Florida 33027 |

| |

| Record Date: | | October 8, 2015 |

| |

| Voting: | | Holders of our common stock and our preferred stock as of the record date are entitled to vote. Each share of common stock is entitled to one vote per share on all matters. Each share of preferred stock is entitled to 49 votes per share on all matters. |

Meeting Agenda

Proposal 1 —

Election of Directors (see page 9)

The following table provides summary information about each director nominee of Elizabeth Arden, Inc. (“the Company,” “we,” or “us”), as well as directors that have been elected by our preferred shareholders. For a director nominee to be elected, the number of votes cast in favor of each director must exceed the number of votes cast against such director. If elected, the director nominees will serve until the 2016 annual meeting, subject to earlier death, resignation, retirement, disqualification or removal. Directors identified below as “Rhône Directors” have been elected by our preferred shareholders and are not standing for election at the annual meeting. Please see the discussion under “Certain Relationships and Related Person Transactions – Rhône Transaction – Rhône Director Designation Rights” for information regarding the rights of our preferred shareholders to elect members to our board of directors.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Name | | Age | | Status | | Director Since | | Independent | | | LID | | | AC | | | CC | | | NCG | |

E. Scott Beattie | | 56 | | Director Nominee | | January 1995 | | | | | | | | | | | | | | | | | | | | |

Fred Berens | | 73 | | Director Nominee | | July 1992 | | | X | | | | | | | | X | | | | | | | | X | |

Maura J. Clark | | 56 | | Director Nominee | | August 2005 | | | X | | | | | | | | X | * | | | | | | | | |

William M. Tatham | | 56 | | Director Nominee | | July 2001 | | | X | | | | | | | | X | | | | | | | | | |

Edward D. Shirley | | 58 | | Director Nominee | | — | | | X | | | | | | | | | | | | X | * | | | X | |

M. Steven Langman | | 53 | | Rhône Director | | October 2014 | | | X | | | | X | | | | | | | | X | | | | X | * |

Franz-Ferdinand Buerstedde | | 40 | | Rhône Director | | October 2014 | | | X | | | | | | | | | | | | X | | | | | |

Board Committee Assignments (effective after the annual meeting)

| | | | | | | | | | |

| LID | | = | | Lead Independent Director | | AC | | = | | Audit Committee |

| NCG | | = | | Nominating and Corporate Governance Committee | | CC | | = | | Compensation Committee |

| *= Chairperson |

The Board of Directors recommends a voteFOR each director nominee.

1

Proposal 2 —

Advisory Vote to Approve Our Named Executive Officer Compensation (see page 41)

| • | | Our executive compensation program is designed to reflect our pay-for-performance philosophy, attract and retain the highly qualified managerial talent necessary for us to successfully pursue our strategic business plan, and align executive incentives with shareholder interests. |

| • | | For fiscal 2015, approximately 65% to 80% of our named executive officers’ target compensation consisted of annual and long-term incentives, and therefore, was linked to our financial and/or stock performance. |

| • | | Fiscal 2015 target compensation and actual total cash compensation for our executive officers each approximated the median of the composite market data provided by Mercer, our compensation committee’s consultant. |

| • | | Fiscal 2015 operating cash flow performance exceeded the “maximum” award level target for short-term and long-term incentive awards, but fiscal 2015 performance targets for EBITDA and gross margin were not achieved. |

| • | | Named executive officers received 37.5% of their annual bonus target under the fiscal 2015 Management Bonus Plan based on fiscal 2015 operating cash flow exceeding the maximum award level. |

| • | | Our CEO received equity in lieu of cash for his 2015 Management Bonus Plan payout. |

| • | | Performance-based cash and restricted stock awards granted in fiscal 2015 were earned at a 50% level based on fiscal 2015 operating cash flow exceeding the maximum award level. |

| • | | Performance improvement plans and cost savings initiatives were identified and/or implemented in fiscal 2015 that are expected to result in $47 to $50 million of annualized savings. |

| • | | Named executive officers other than the CEO received an additional cash award of 37.5% of annual bonus target based on significant retention concerns stemming from 0% bonus payouts in fiscal 2013 and fiscal 2014, 0% fiscal 2015 salary increases for most executive officers, and below target payouts of recent performance-based long-term incentive awards, and to recognize the successful completion of the 2014 Performance Improvement Plan. |

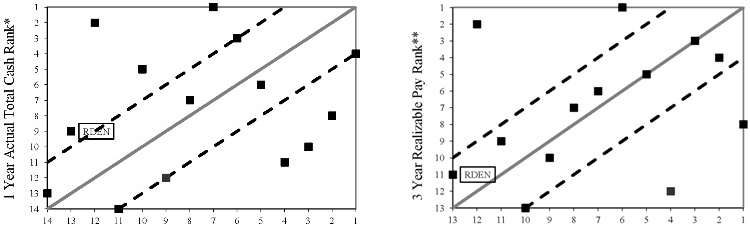

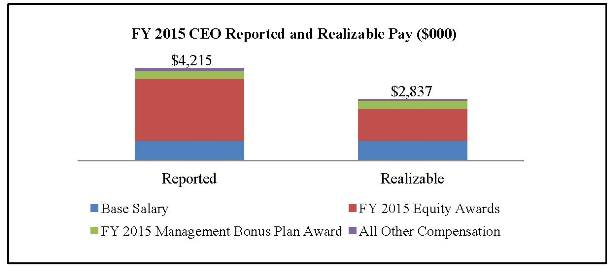

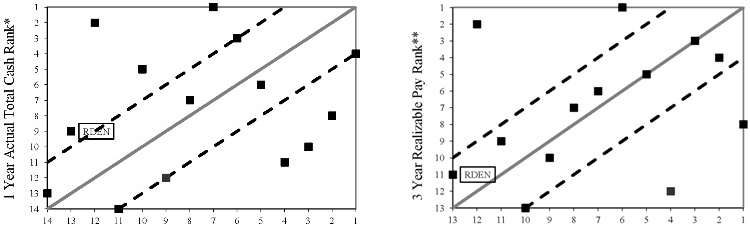

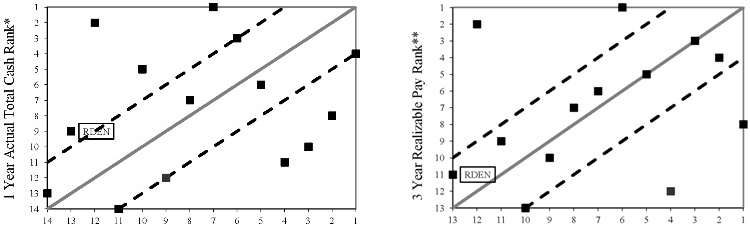

While our one-year pay and performance alignment analysis revealed actual cash compensation positioning that was slightly higher than our fiscal 2015 peer group performance ranking, our three-year realizable pay rank and three-year total shareholder return (“TSR”) rank as compared to that of our peer group indicates that the design of our executive compensation program results in proper pay-for-performance alignment.

| | | | |

1 Year TSR and Total Cash Compensation All Named Executive Officers | | | | 3 Year TSR and Realizable Pay All Named Executive Officers |

|

| | |

1 Year Performance Rank TSR Measured as of 6/30/2015 | | | | 3 Year Performance Rank*** TSR Measured as of 6/30/2015 |

| * | Actual total cash compensation for peer group based on proxy statement disclosure. |

| ** | Realizable Pay = actual total cash plus realizable value of equity as of 6/30/2015, based on peer group proxy statement disclosure |

| *** | One peer is excluded from this analysis due to an initial public offering in 2013 and lack of sufficient available data |

The “say-on-pay” proposal at our 2014 annual meeting of shareholders was approved, with over 97% of the shares voted in favor of the proposal. We believe this evidences strong shareholder support for the design of our named executive officer compensation program and our compensation philosophy, policies and practices.

2

Executive officer compensation program highlights, as described in the Compensation Discussion and Analysis starting on page 21.

| • | | Annual “say-on-pay” votes. |

| • | | Pay mix emphasizing compensation linked to our financial and/or stock performance. |

| • | | Executive compensation program generally designed to pay at market levels for target performance, reward above-target performance, and pay below market when performance targets are not achieved. |

| • | | Annual long-term equity grants in the form of stock options align shareholder and executive interests, and restricted stock units serve as a strong retention tool and an incentive to increase shareholder value. |

| • | | Stock ownership and retention guidelines |

| • | | No executive employment agreements |

| • | | Non-competition and non-solicitation provisions included in August 2015 equity awards for named executive officers |

| • | | Limited perquisites for named executive officers (below the median of our peer group in most cases) |

| • | | No tax gross-ups on perquisites or severance payments |

| • | | Restrictions on pledging and margin accounts |

The Board of Directors recommends a voteFOR this proposal.

Proposal 3 —

Approval of Amendment to the Elizabeth Arden, Inc. 2010 Stock Award and Incentive Plan(see page 41)

We are asking shareholders to approve an amendment to the Elizabeth Arden, Inc. 2010 Stock Award and Incentive Plan to increase the number of shares of our common stock, par value $0.01 per share, that may be granted under the 2010 Stock Award and Incentive Plan by 3,000,000, from 2,350,000 to 5,350,000.

Factors for consideration

(see page 42 for further details)

| • | | Due to new hire awards, an increase in fiscal 2016 equity award levels for certain named executive officers to ensure consistent incentives among our key commercial leaders, fiscal 2016 special retention awards, and a decline in stock price that increased our share utilization, no shares of our common stock remain available for grant under the 2010 Stock Award and Incentive Plan. |

| • | | Our three-year average “run rate” of 1.17% is below our targeted run rate cap of 2.25% and also below ISS’s prescribed run rate cap for our industry of 3.15%. |

| • | | Additional dilution resulting from the share increase proposal is approximately 10% of common stock outstanding. |

| • | | We estimate that the additional shares being requested should be sufficient for the next two to three annual award cycles. |

Key equity plan governance features

(see page 43 for further details)

| • | | Limitation on additional shares requested of 3,000,000, of which only 1,500,000 of the additional shares can be awarded as “full value” awards. |

| • | | No “liberal” share counting. |

| • | | No “repricings” or “cash outs” without shareholder approval. |

| • | | No “evergreen” provision. |

| • | | No “liberal” change in control definition. |

In connection with determining the appropriate number of additional shares to be added to the Elizabeth Arden, Inc. 2010 Stock Award and Incentive Plan, our lead independent director and certain members of management held discussions with several of our largest shareholders, including the Rhône Purchasers (as defined below), who together hold approximately 50% of our outstanding voting stock. These shareholders, including the Rhône Purchasers, each indicated that they are supportive of our proposal to amend the Elizabeth Arden, Inc. 2010 Stock Award and Incentive Plan to increase the number of shares available under the 2010 Plan by 3,000,000 shares, with no more than 1,500,000 of such additional shares to be granted as “full value” awards.

The Board of Directors recommends a voteFOR this proposal.

3

Proposal 4 —

Ratification of Appointment of Independent Registered Public Accounting Firm(see page 52)

Although shareholder approval is not required under applicable law or NASDAQ listing requirements, we are asking shareholders to ratify the selection of PricewaterhouseCoopers LLP as our independent auditors for the fiscal year ending June 30, 2016. Set forth below is summary information with respect to PricewaterhouseCoopers LLP’s fees for services provided in fiscal 2014 and fiscal 2015.

| | | | | | | | |

| | | Fiscal Year Ended | |

| | | June 30, 2015 | | | June 30, 2014 | |

Audit fees | | $ | 2,672,185 | | | $ | 2,854,564 | |

Audit-related fees | | | 3,851 | | | | 4,316 | |

Tax fees | | | 316,393 | | | | 643,404 | |

All other fees | | | 1,818 | | | | 1,818 | |

| | | | | | | | |

Total | | $ | 2,994,247 | | | $ | 3,504,102 | |

| | | | | | | | |

The Board of Directors recommends a voteFOR this proposal.

4

ELIZABETH ARDEN, INC.

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON DECEMBER 2, 2015

General

This proxy statement is being furnished to (i) holders of Common Stock, par value $.01 per share, of Elizabeth Arden, Inc. (our common stock), and (ii) holders of Series A Serial Preferred Stock, par value $.01 per share, of Elizabeth Arden, Inc. (our preferred stock), in connection with the solicitation of proxies by our board of directors for use at our 2015 annual meeting of shareholders to be held at our corporate office located at 2400 S.W. 145th Avenue, 2nd Floor, Miramar, Florida 33027, at 10:00 a.m., local time, on December 2, 2015 (the annual meeting), and at any adjournment or postponement of the annual meeting, for the purposes set forth in the accompanying notice of annual meeting.

It is anticipated that our annual report for the fiscal year ended June 30, 2015 (fiscal 2015), this proxy statement, and the accompanying form of proxy card will be first mailed to our shareholders on or about October 23, 2015. The annual report is not to be regarded as proxy soliciting material.

Outstanding Shares and Voting Rights

Except as required by law or otherwise provided in our articles of incorporation, the holders of shares of our common stock and the holders of shares of our preferred stock vote together as one class on all matters submitted to a vote of our shareholders. Each share of preferred stock is entitled to a number of votes (rounded down to the nearest whole number) equal to (i) the aggregate number of shares for which our outstanding warrants to purchase common stock that were issued on August 19, 2014 (the warrants) are exercisable (regardless of whether or not such warrants could legally be exercised at such time and regardless of whether the holder of the preferred stock is also the holder of warrants) divided by (ii) the number of outstanding shares of preferred stock, determined as of the record date for the determination of holders of shares entitled to vote on any such matter.

Only holders of record of our common stock and preferred stock at the close of business on the record date of October 8, 2015, are entitled to notice of and to vote at the annual meeting. On that date, there were (i) 29,921,087 shares of common stock and (ii) 50,000 shares of preferred stock (representing the voting equivalent of 2,450,000 shares of common stock), entitled to vote on each matter to be presented at the annual meeting. Based on the number of shares of common stock and preferred stock and warrants outstanding as of October 8, 2015, holders of our common stock have one vote per share on all matters, and holders of our preferred stock have 49 votes per share on all matters.

A majority of our outstanding shares of voting stock entitled to vote, represented in person or by proxy, will constitute a quorum for action on all matters at the annual meeting. Abstentions and broker non-votes are counted as present and entitled to vote for purposes of determining the presence of a quorum at the annual meeting. A “broker non-vote” occurs when a bank, broker or other holder of record holding shares for a beneficial owner does not vote on a particular proposal because that holder of record does not have discretionary voting power for that particular item and has not received voting instructions from the beneficial owner. Brokers (or other custodians with record title to your shares held in street name) that do not receive voting instructions from beneficial owners may only exercise their discretionary voting power with respect to the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for our fiscal year ending June 30, 2016, and maynot exercise their discretionary voting power with respect to any of the other proposals to be voted on at the annual meeting. Accordingly, if you do not instruct your broker or other custodian how to vote on (i) the election of directors, (ii) the advisory vote on our named executive officer compensation as disclosed herein, or (iii) the approval of the proposed amendment to the Elizabeth Arden, Inc. 2010 Stock Award and Incentive Plan, your broker or other custodian willnotvote for you.

Our by-laws provide that, if a quorum is present at a meeting of shareholders, each director nominee and each matter presented for shareholder approval is elected or approved by our shareholders, as applicable, if the votes that are cast at the meeting in favor of the director or such matter exceed the votes cast against such director or matter, except as otherwise provided in our articles of incorporation or applicable law. Consequently, votes cast at the meeting in favor of (i) the election of each director, (ii) the approval of the resolution regarding the advisory vote on our named executive officer compensation, (iii) the approval of the proposed amendment to the Elizabeth Arden, Inc. 2010 Stock Award and Incentive Plan, and (iv) the proposed ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm

5

for our fiscal year ending June 30, 2016, must exceed the number of shares voted against the approval of each such matter in order for each director to be elected and for each such proposal to be approved by our shareholders.Abstentions from voting, as well as broker non-votes, if any, are not treated as votes cast and, therefore, will have no effect on any of the proposals to be voted on at the annual meeting.

Shares represented by a properly executed proxy received in time to permit its use at the annual meeting or any adjournment or postponement of this meeting, and not revoked, will be voted in accordance with the instructions indicated therein. If no instructions are indicated, the shares represented by the proxy will be voted:

| | • | | FOR the election of all of the nominees for director named in this proxy statement (Proposal 1); |

| | • | | FOR the approval, on an advisory basis, of the compensation of our named executive officers as disclosed in this proxy statement (Proposal 2); |

| | • | | FOR the approval of the proposed amendment to the Elizabeth Arden, Inc. 2010 Stock Award and Incentive Plan (Proposal 3); |

| | • | | FOR the approval of the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for our fiscal year ending June 30, 2016 (Proposal 4); and |

| | • | | in the discretion of the proxy holders as to any other matter that may properly come before the annual meeting and any adjournment or postponement thereof. |

You are requested, regardless of the number of shares that you hold, to sign the proxy and return it promptly in the enclosed envelope, or, if permitted by your bank, brokerage firm or other custodian, to vote by telephone or through the Internet. If you are a beneficial holder of our common stock, you should follow the voting instructions you will receive with our proxy materials from your broker, bank or other custodian. If you want to change your voting instructions, you must contact your custodian as directed in the instructions they provide. Each shareholder giving a proxy has the power to revoke it at any time before it is voted by written notice sent to the attention of Secretary, Elizabeth Arden, Inc., or by delivery of a later-dated proxy. Voting by mail, by telephone or through the Internet willnot prevent you from voting in person at the meeting. If you attend the meeting, you may revoke your proxy and vote your shares in person even if you have previously completed and returned the enclosed proxy card or voted by telephone or through the Internet. If you hold shares through a bank or in a brokerage account and you plan to attend and vote in person at the annual meeting, you will need to bring valid photo identification, a copy of a statement reflecting your share ownership as of the record date, and a legal proxy from your bank, broker or other custodian. This is because shareholders who hold shares of our common stock through banks, brokers or other nominees are not entitled to vote under applicable state law and therefore need to obtain proxy voting authority from their custodians if they wish to vote in person at the meeting.

NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS

Important Notice Regarding the Availability of Proxy Materials for the 2015 Annual Meeting of Shareholders of Elizabeth Arden, Inc. to be held on December 2, 2015: This proxy statement, the notice of annual meeting of shareholders, a sample form of the proxy sent or given to our shareholders, and our 2015 annual report are available on our website athttp://annualmeeting.elizabetharden.com.

6

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of October 8, 2015 (except as noted below), (i) the ownership of common stock by all persons known by us to own beneficially more than 5% of the outstanding shares of our common stock and (ii) the beneficial ownership of common stock by (a) each of our directors and nominees for director, (b) the chief executive officer and each of the other named executive officers as set forth in the Fiscal 2015 Summary Compensation Table below, and (c) all of our directors and current executive officers as a group, without naming them. The percentage of beneficial ownership set forth below is based on 29,921,087 shares of our common stock outstanding on October 8, 2015.

| | | | | | | | |

Name and Address of Beneficial Owner(1) | | Amount and Nature

of Beneficial

Ownership(2) | | | Percentage

of

Class(2) | |

E. Scott Beattie(3) | | | 1,736,532 | | | | 5.7 | % |

M. Steven Langman | | | 0 | | | | * | |

A. Salman Amin(4) | | | 13,500 | | | | * | |

Fred Berens(5) | | | 850,072 | | | | 2.8 | % |

Franz-Ferdinand Buerstedde | | | 0 | | | | * | |

Maura J. Clark(6) | | | 54,500 | | | | * | |

Richard C. W. Mauran(7) | | | 1,557,675 | | | | 5.2 | % |

William M. Tatham(8) | | | 55,335 | | | | * | |

Edward D. Shirley | | | 0 | | | | * | |

Eric Lauzat(9) | | | 11,633 | | | | * | |

Rod R. Little(10) | | | 8,223 | | | | * | |

Pierre Pirard(11) | | | 86,143 | | | | * | |

Joel B. Ronkin(12) | | | 267,868 | | | | * | |

Rhône Capital L.L.C. and Affiliates(13) | | | 6,516,354 | | | | 20.1 | % |

Invesco Ltd.(14) | | | 5,149,659 | | | | 17.2 | % |

NWQ Investment Management Company LLC(15) | | | 3,570,802 | | | | 12.5 | % |

M&G Investment Management Limited and M&G Investment Funds 1(16) | | | 3,200,000 | | | | 10.7 | % |

All directors and current executive officers as a group (14 persons)(17) | | | 4,702,868 | | | | 15.2 | % |

| * | Less than one percent of the class. |

| (1) | Except as otherwise noted below, the address of each of the persons shown in the above table is c/o Elizabeth Arden, Inc., 2400 S.W. 145 Avenue, 2nd Floor, Miramar, Florida 33027. |

| (2) | Includes, where applicable, shares of common stock issuable upon the exercise of options or warrants to acquire common stock held by such person that may be exercised within 60 days after October 8, 2015. None of the restricted stock units listed in the footnotes below are scheduled to vest within 60 days after October 8, 2015. Unless otherwise indicated, we believe that all persons named in the table above have sole voting power and/or investment power with respect to all shares of common stock beneficially owned by them. |

| (3) | Includes (i) 1,032,437 shares of common stock, (ii) 177,729 shares of common stock held in a family trust for which Mr. Beattie’s spouse is the trustee, and (iii) 526,366 shares of common stock issuable upon the exercise of stock options. Of these shares of common stock, 918,652 shares are held by brokers in margin accounts, regardless of whether loans are outstanding. Does not include 263,410 restricted stock units. |

| (4) | Includes 13,500 shares of common stock issuable upon the exercise of stock options. Mr. Amin is not standing for re-election to the board of directors. |

| (5) | Includes (i) 805,472 shares of common stock, (ii) 100 shares of common stock held in a custodial account for one of Mr. Berens’ children, and (iii) 44,500 shares of common stock issuable upon the exercise of stock options. Of these shares of common stock, 322,000 shares are held by brokers in margin accounts, regardless of whether loans are outstanding. |

| (6) | Includes (i) 10,000 shares of common stock and (ii) 44,500 shares of common stock issuable upon the exercise of stock options. |

| (7) | Includes (i) 1,513,175 shares of common stock held in a trust of which Mr. Mauran’s spouse, adult children and other unrelated third parties are beneficiaries, and (ii) 44,500 shares of common stock issuable upon the exercise of stock options. Mr. Mauran has voting and dispositive power over shares of common stock in the trust. Mr. Mauran is not standing for re-election to the board of directors. |

| (8) | Includes (i) 8,830 shares of common stock owned individually by Mr. Tatham, (ii) 4,555 shares of common stock owned by Mr. Tatham’s spouse, (iii) 950 shares of common stock owned by a family holding company of which Mr. Tatham is president and director, and (iv) 41,000 shares of common stock issuable upon the exercise of stock options. Mr. Tatham disclaims beneficial ownership as to the shares of common stock owned by his spouse and the family holding company. |

| (9) | Includes (i) 5,200 shares of common stock, and (ii) 6,433 shares of common stock issuable upon the exercise of stock options. Does not include 68,600 restricted stock units. |

7

| (10) | Includes (i) 2,857 shares of common stock, and (ii) 5,366 shares of common stock issuable upon the exercise of stock options. Does not include 66,867 restricted stock units. |

| (11) | Includes (i) 40,212 shares of common stock, and (ii) 45,931 shares of common stock issuable upon the exercise of stock options. Does not include 77,301 restricted stock units. |

| (12) | Includes (i) 106,287 shares of common stock, (ii) 850 shares of common stock held in trusts for the benefit of two of Mr. Ronkin’s children, of which Mr. Ronkin is the trustee, and (iii) 160,731 shares of common stock issuable upon the exercise of stock options. Does not include 111,034 restricted stock units. |

| (13) | Includes 4,064,087 shares of common stock and 2,452,267 shares of common stock issuable upon the exercise of warrants held by entities affiliated with Rhône Capital L.L.C. (“Rhône Capital”) as reported in public filings available on or prior to October 8, 2015. The address of Rhône Capital is 630 Fifth Avenue, 27th Floor, New York, NY 10111. See “Certain Relationships and Related Person Transactions – Rhône Transaction” for a discussion of the transactions which resulted in the entities affiliated with Rhône Capital beneficially owning the shares indicated and their rights with respect to the election and/or nomination of directors to our board of directors. |

| (14) | Based on Amendment No. 1 to Schedule 13G dated December 31, 2014, filed by Invesco Ltd., which reflects sole voting and dispositive power with respect to 5,149,659 shares of common stock. The address of Invesco Ltd. is 1555 Peachtree Street NE, Atlanta, GA 30309. |

| (15) | Based on Amendment No. 9 to Schedule 13G dated December 31, 2014, filed by NWQ Investment Management Company, LLC, which reflects sole dispositive power with respect to 3,570,802 shares of common stock and sole voting power with respect to 3,569,718 shares of common stock. The address of NWQ Investment Management Company, LLC is 2049 Century Park East, 16th Floor, Los Angeles, CA 90067. |

| (16) | Based on Amendment No. 9 to Schedule 13G dated December 31, 2014, filed by M&G Investment Management Limited and M&G Investment Funds (1), which reflects shared voting and dispositive power held by each of M&G Investment Management Limited and M&G Investment Funds 1 with respect to 3,200,000 shares of common stock. The address of M&G Investment Management Limited and M&G Investment Funds 1 is Governor’s House, Laurence Pountney Hill, London EC4R 0HH, United Kingdom. |

| (17) | Includes (i) 3,755,710 shares of common stock and (ii) 983,293 shares of common stock issuable upon exercise of stock options. Of these shares of common stock, 1,240,652 shares are held by brokers in margin accounts, regardless of whether loans are outstanding. Does not include 646,413 restricted stock units. |

8

PROPOSAL 1 –

ELECTION OF DIRECTORS

Majority Voting for Directors

Our by-laws provide that, except as provided in our articles of incorporation with respect to our preferred stock, in an uncontested election of directors, a director must receive a majority of the votes cast at the annual meeting at which a quorum is present in order to be elected to the board, and in a contested election, a director must receive a plurality of the votes cast at the annual meeting in order to be elected to the board. In addition, our Corporate Governance Guidelines and Principles provide that the board shall nominate for election or re-election as director only candidates who agree to tender, promptly following the annual meeting at which they are elected or re-elected as a director, irrevocable resignations that will be effective upon the board’s acceptance of such resignation if the candidate fails to receive the required vote at the next annual meeting at which such candidate faces election or re-election. In such event, the nominating and corporate governance committee must then recommend to the board what actions should be taken with respect to such director, based upon the consideration of all factors deemed relevant by the committee, and the board must publicly disclose its decision within 90 days of the date of certification of the election results.

Information about the Nominees

We are nominating five directors for election at the annual meeting. Our articles of incorporation provide that the number of directors constituting the board of directors shall not be less than one person, with the exact number to be fixed by a resolution adopted by the affirmative vote of a majority of the entire board. Under the terms of the shareholders agreement entered into with Nightingale Onshore Holdings L.P. and Nightingale Offshore Holdings L.P., investment funds affiliated with Rhône Capital L.L.C. (each a “Rhône Purchaser”) on August 19, 2014 (the “Shareholders Agreement”), we cannot alter the size of the board without the written consent of the Rhône Purchasers, and we agreed that the board would not have more than five non-Rhône directors after the 2015 annual meeting of shareholders. Pursuant to these requirements, as of the date of the annual meeting the size of the board of directors will be reduced from eight to seven, including the two directors appointed by the Rhône Purchasers pursuant to their director election rights. Under the terms of the Shareholders Agreement, the Rhône Purchasers have agreed to vote in favor of the board’s director nominees. Please refer to the discussion below under “Certain Relationships and Related Person Transactions – Rhône Transaction – Rhône Director Designation Rights” for further details on Rhône’s director election rights.

Mr. Richard C.W. Mauran and Mr. A. Salman Amin, who are each currently serving as directors, are not standing for re-election. The board would like to thank both Mr. Mauran and Mr. Amin for their service on our board of directors, and Mr. Mauran, in particular, for his 23 years of dedication to the company as a founding shareholder. We have benefited greatly from their wisdom and advice.

Based on the recommendation of the nominating and corporate governance committee of the board of directors, the board of directors has nominated each of the nominees for election as directors, to serve until the next annual meeting of shareholders, or until that person’s successor is duly elected and qualified or until his or her earlier death, resignation, retirement, disqualification or removal. Four of the five nominees named below are currently serving as our directors. Mr. Edward D. Shirley, who is “independent,” as such term is defined by Rule 5605(a)(2) of Nasdaq’s Listing Rules, has been nominated to fill the single vacancy arising from the two current directors who are not standing for re-election and the reduction in the size of the board of directors, as described above. Mr. Shirley was identified as a candidate for director by our chairman and chief executive officer.

In the event that any nominee is unable or unwilling to serve, discretionary authority is reserved to the persons named in the accompanying form of proxy to vote for substitute nominees. The board of directors does not anticipate that such an event will occur.

The names of the nominees for our board of directors and information about them are set forth below.

9

| | | | |

Nominee | | Director Since | | Business Experience During Past Five Years and Other Directorships and Qualifications |

| E. Scott Beattie | | January 1995 | | Mr. Beattie, age 56, has served as Chairman of our board of directors since April 2000, as our President since 2006 and as our Chief Executive Officer since March 1998, as well as serving as a member of our board of directors since January 1995. Mr. Beattie has also previously served in other positions with us, including as Chief Operating Officer and Vice Chairman of the board of directors. He is a member of the executive committee of the board of directors of the Personal Care Products Council, the U.S. trade association for the global cosmetic and personal care products industry; a member of the executive committee of the advisory board of the Ivey School of Business; and a member of the executive committee and chairperson of the audit and finance committee of the board of directors of PENCIL, a not-for-profit organization that benefits New York City public schools. The board has nominated Mr. Beattie to serve as a director because of his proven record of leadership and his instrumental role in the growth of our company, as well as his extensive knowledge of our industry. Throughout his career with our company he has acquired valuable financial, management, operational and industry expertise that provides the board of directors with a unique and valuable perspective on the opportunities and challenges that face our company. |

| Edward D. Shirley | | Nominee | | Mr. Shirley, age 58, served as the President and Chief Executive Officer of Bacardi Limited, a global beverage and spirits company, from March 2012 to April 2014. Prior to that, he served as Vice Chairman of Global Beauty and Grooming, a business unit of The Procter & Gamble Company, a consumer goods company, from July 2008 through June 2011 and as Vice Chair on Special Assignment from July 2011 through December 2011. Prior to that, he served as Group President, North America of Procter & Gamble from April 2006 and held several senior executive positions during his 27 years with The Gillette Company, a consumer goods company that was acquired by Procter & Gamble in 2005. Mr. Shirley has served as a director of Time Warner Cable Inc. since March 2009. Subject to his election at the annual meeting, Mr. Shirley will chair the compensation committee and serve on the nominating and corporate governance committee of the board of directors. The board has nominated Mr. Shirley to serve as a director because of his substantial executive, brand development and commercial experience developed in various senior executive positions with large consumer products companies, including during more than 30 years as a senior executive at global personal care companies like Procter & Gamble and The Gillette Company. |

| Fred Berens | | July 1992 | | Mr. Berens, age 73, served as our lead independent director from February 2009 until November 2014. Mr. Berens has served in various capacities with Wells Fargo Advisors LLC (formerly known as Wachovia Securities, Inc.), an investment-banking firm, since March 1965, most recently as managing director-investments since September 2004. Mr. Berens served as a member of the board of directors of Public Broadcasting Systems from 2008 until 2014, serving as the chairman of its audit committee in 2012 and as chairman during 2013. He has also served on the board of trustees of the University of Miami since 1972 and as a member of the board of directors of Channel 2 WPBT (South Florida’s public broadcasting station) since 1981, serving as its chairman in 1988. Subject to his reelection at the annual meeting, Mr. Berens will serve on the audit and nominating and corporate governance committees of the board of directors. The board has nominated Mr. Berens to serve as a director because of his financial expertise and his knowledge of capital markets. Mr. Berens’ experience as a managing director with large investment banking firms has provided him with excellent financial and analytical skills that are valuable to the board of directors. In addition, Mr. Berens’ prior service on the board of directors and audit committees of Peninsula Federal Savings & Loan and Intercontinental Bank provided him with extensive experience in board and audit committee functions that are valuable to the board of directors. |

10

| | | | |

| Maura J. Clark | | August 2005 | | Ms. Clark, age 56, served as President, Direct Energy Business, of Direct Energy Services, LLC, an energy and energy services provider in North America and a subsidiary of United Kingdom based Centrica plc from September 2007 until her retirement in April 2014. From April 2005 to September 2007, Ms. Clark served in various other executive positions with Direct Energy Services, LLC. Among other positions held by Ms. Clark prior to April 2005, she served as a managing director at Goldman Sachs & Co., an investment-banking firm, and as Executive Vice President, Corporate Development and Chief Financial Officer for Premcor, Inc. (formerly known as Clark Refining & Marketing, Inc.), a petroleum refiner and marketer. In May 2015, Ms. Clark joined the board of directors and audit committee of Fortis, Inc., a North American electric and gas utility company traded on the Toronto Stock Exchange. Ms. Clark is a chartered accountant. Subject to her reelection at the annual meeting, Ms. Clark will chair the audit committee of the board of directors. The board has nominated Ms. Clark to serve as a director because of the financial, accounting, executive and corporate development expertise that she has developed through her various positions with Direct Energy Services LLC, Goldman Sachs & Co., and Premcor, Inc., and her qualification as a chartered accountant. |

| William M. Tatham | | July 2001 | | Mr. Tatham, age 56, has served as Chief Executive Officer of NexJ Systems, Inc., a publicly-held, Canada-based client relationship management software company, since June 2006, and as Chief Executive Officer and general managing partner of XJ Partners, Inc., a Canada-based strategy consulting company, since September 2001. From November 2000 to June 2001, Mr. Tatham served as Vice President and General Manager of Siebel Systems, Inc., an e-business applications software company. From 1990 until its acquisition by Siebel Systems in November 2000, Mr. Tatham served as the Chairman and Chief Executive Officer of Janna Systems, Inc., a publicly-held, Canada-based software development company that Mr. Tatham founded. Subject to his reelection at the annual meeting, Mr. Tatham will serve on the audit committee of the board of directors. The board has nominated Mr. Tatham to serve as a director because of the valuable executive and information technology expertise that he has developed through his various positions with Janna Systems, Inc., Siebel Systems, XJ Partners, Inc., and NexJ Systems, Inc. |

The names of the Rhône Directors and information about them are set forth below. The Rhône Directors have been elected by our preferred shareholders and are not standing for election at the annual meeting. Please see the discussion under “Certain Relationships and Related Person Transactions – Rhône Transaction – Rhône Director Designation Rights” for information regarding the rights of our preferred shareholders to elect members to our board of directors.

| | | | |

Nominee | | Director Since | | Business Experience During Past Five Years and Other Directorships and Qualifications |

| M. Steven Langman | | October 2014 | | Mr. Langman, age 53, has served as our lead independent director since December 2014. He co-founded Rhône Group L.L.C., a private equity firm (together with certain affiliates, “Rhône”), in 1996 and since that time has served as Managing Director. Prior to 1996, Mr. Langman was Managing Director of Lazard Frères & Co. LLC where he specialized in mergers and acquisitions, working in both London and New York. Mr. Langman joined Lazard in 1987. Before joining Lazard, he worked in the mergers and acquisition group of Goldman, Sachs & Co. Mr. Langman currently serves on the boards of certain companies in which Rhône or its controlled funds hold interests, including Quiksilver, Inc. Mr. Langman also served on the board of Coty Inc., which is listed on the New York Stock Exchange, from January 2011 until June 2014. Mr. Langman received a B.A. with highest honors from the University of North Carolina at Chapel Hill and an MSc from the London School of Economics. Mr. Langman serves as our lead independent director and, after the annual meeting, will chair the nominating and corporate governance committee of the board of directors and serve on the compensation committee of the board of directors. |

11

| | | | |

| Franz-Ferdinand Buerstedde | | October 2014 | | Mr. Buerstedde, age 40, joined Rhône in 2004 and has served as a Managing Director since January 2011. Prior to 2004, he worked in the mergers and acquisitions group at Citigroup in London, where he advised on numerous telecommunications transactions. Mr. Buerstedde currently serves on the boards of certain companies in which Rhône or its controlled funds hold interests, including as an observer and alternate on the board of directors of Magnesita Refratários S.A., which is listed on the BM&FBOVESPA, Brazil’s largest stock exchange. Mr. Buerstedde received a European Masters in Management with distinction from ESCP-EAP European School of Management in Paris, and a Masters in Finance with distinction from the London Business School. Mr. Buerstedde will serve on the compensation committee of the board of directors after the annual meeting. |

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE “FOR”

THE ELECTION OF EACH NOMINEE FOR DIRECTOR NAMED IN THIS PROXY STATEMENT.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Federal securities laws require our directors, executive officers and persons who beneficially own more than 10% of our common stock to file reports of initial ownership and reports of subsequent changes in ownership with the U.S. Securities and Exchange Commission (SEC) and to provide us with copies of these reports. Specific due dates have been established, and we are required to disclose any failure of these persons to file those reports on a timely basis during our fiscal year ended June 30, 2015. To the best of our knowledge, based solely upon a review of copies of reports furnished to us, filings with the SEC and written representations that no other reports were required, all of our directors, executive officers and ten percent or greater beneficial owners of our common stock made all such filings on a timely basis.

GOVERNANCE OF THE COMPANY

Corporate Governance Guidelines and Principles; Director Independence. Our Corporate Governance Guidelines and Principles set forth the responsibilities of the members of our board of directors and are intended as a component of the governance framework within which the board of directors, assisted by its committees, directs our affairs. Among other things, our Corporate Governance Guidelines and Principles provide that our independent directors have the opportunity to meet in executive session at every board and board committee meeting, with the agenda for such meetings being established by our lead independent director. The full text of our Corporate Governance Guidelines and Principles, as approved by the board, is published on our website at www.elizabetharden.com, under the section “Corporate – Investor Relations – Corporate Governance – Guidelines & Principles.”

The listing standards of the NASDAQ Global Select Market (NASDAQ) require that a majority of our board be composed of directors who are “independent,” as such term is defined by Rule 5605(a)(2) of NASDAQ’s Listing Rules. Our board has determined that each of our current directors, with the exception of Mr. Beattie, is independent under applicable NASDAQ and SEC rules. In making its independence determination, the board considered that Mr. Berens received compensation from Wells Fargo Advisors LLC of approximately $6,500 during fiscal 2015 resulting from services provided to certain of our executive officers by the financial advisory and account management group that Mr. Berens heads. Our company does not directly or indirectly reimburse Wells Fargo Advisors LLC or our executive officers for such fees. In the case of each of Messrs. Langman and Buerstedde, the board’s independence determination considered that Messrs. Langman and Buerstedde are both Managing Directors of Rhône Group L.L.C., an affiliate of Rhône Capital L.L.C., which beneficially owns all of our outstanding preferred stock and approximately 20.1% of our outstanding common stock. The board concluded that such relationships did not interfere with the ability of Messrs. Berens, Langman or Buerstedde to exercise independent judgment in carrying out the responsibilities of a director.

Shareholders may communicate with the board, individual members of the board or its committees by writing to: Secretary, Elizabeth Arden, Inc., 2400 S.W. 145th Avenue, Miramar, Florida 33027. The Secretary will then distribute such communications to the intended recipient(s).

Code of Business Conduct. All of our employees, officers and directors are required to abide by our Code of Business Conduct, which requires that they conduct our business with the utmost integrity and honesty and in a manner that adheres to the highest ethical standards and fully complies with all applicable laws and regulations. The full text of the Code of Business Conduct, as approved by our board, is published on our website, atwww.elizabetharden.com, under the section “Corporate – Investor Relations – Corporate Governance – Code of Business Conduct.”

12

Supplemental Code of Ethics. Our directors, the chief executive officer, the chief financial officer, and our other executive officers and finance officers are also required to comply with our Supplemental Code of Ethics for the Directors and Executive and Finance Officers. This Supplemental Code of Ethics is intended to cover, among other things, the avoidance and handling of conflict of interest situations and full, fair and timely disclosure, including the adequacy of disclosure controls and procedures and internal control over financial reporting. Any alleged violation of the Supplemental Code of Ethics or any violation of law must be reported to our general counsel or the chairperson of the audit committee, which may be done anonymously, in accordance with the procedures set forth in the Supplemental Code of Ethics.

The full text of this Supplemental Code of Ethics, as approved by our board, is published on our website, atwww.elizabetharden.com, under the section “Corporate – Investor Relations – Corporate Governance – Code of Ethics.”

Board Leadership Structure; Lead Independent Director

E. Scott Beattie serves as both our Chairman of the Board and Chief Executive Officer. The board has determined that the most effective leadership structure for our company at this time is for Mr. Beattie to serve as both Chairman of the Board and Chief Executive Officer. Mr. Beattie is ultimately responsible for the day-to-day operations of our company and for the execution of our business strategy. Accordingly, the board believes that Mr. Beattie’s in-depth knowledge of company operations and performance, as well as the challenges faced by our company, best positions him to identify strategic issues and risks to be considered by the board, and his leadership on the board enhances communications between management and the board. The board retains the authority to modify this structure to best address our needs, as and when appropriate, and there have been times in our history when the positions of Chairman of the Board and Chief Executive Officer were not held by the same person.

In order to enhance the board’s active and objective oversight of our management, the board established the position of lead independent director. Mr. Steven Langman currently serves as our lead independent director, and his term will end on November 30, 2016. The responsibilities of our lead independent director include, among others, (1) acting as the principal liaison between the independent directors and the Chairman of the Board; (2) developing the agenda for and presiding over executive sessions of the board’s independent directors; (3) discussing with the Chairman the agenda for board and board committee meetings and the need for special meetings of the board; (4) advising the Chairman as to the quality, quantity and timeliness of the information submitted by management that is necessary or appropriate for the independent directors to effectively and responsibly perform their duties; (5) recommending to the board the retention of advisors and consultants who report directly to the board; (6) interviewing, along with the chairperson of the nominating and corporate governance committee, board candidates, and making recommendations to the nominating and corporate governance committee, as appropriate; (7) chairing meetings of the board if the Chairman is not present, and (8) serving as a liaison for consultation and communication with shareholders, as appropriate. A copy of the charter for our lead independent director is available on our website atwww.elizabetharden.com, under the section “Corporate – Investor Relations – Corporate Governance – Lead Independent Director Charter.”

Meetings and Committees of Our Board of Directors

During fiscal 2015, the board met seven times and each director attended at least 75% of the aggregate of the total meetings of the board and the total meetings of the committees of the board on which such director served. Our independent directors generally meet in executive session after board or board committee meetings. During fiscal 2015, the board had three committees: the audit committee, the compensation committee, and the nominating and corporate governance committee. Directors are not required to attend our annual meetings. Mr. Beattie was the only director present at our 2014 annual meeting of shareholders.

The Audit Committee

The audit committee consists of Ms. Clark and Messrs. Berens and Tatham. Our board has determined that Mr. Berens and Ms. Clark are each “audit committee financial experts” for purposes of the SEC’s rules and that each of the members of our audit committee is independent, as defined by applicable SEC and NASDAQ rules. Ms. Clark chairs the audit committee, which met five times during fiscal 2015.

The audit committee oversees the quality and integrity of our accounting and financial reporting process, the adequacy of our internal controls and the integrated audits of our consolidated financial statements and internal control over financial reporting, and also carries out such other duties as directed by the board. The audit committee is responsible for, among others: (1) selecting, negotiating the compensation of, and overseeing the work of, our independent registered public accounting firm, including approving all audit, audit-related and permitted non-audit services performed for us by the independent registered public accounting firm and reviewing its independence; (2) reviewing the planning and staffing of audit engagements, including ensuring the rotation of the audit partner of the independent registered public accounting firm as required by law; (3) investigating matters brought to the attention of the audit committee; (4) reviewing our financial reporting

13

activities, including the annual and quarterly reports and the consolidated financial statements included in such reports, the accounting principles, standards, policies and practices followed by us and management’s conclusions regarding the effectiveness of our internal control over financial reporting; (5) reviewing the internal quality control review of the independent registered public accounting firm and evaluating their qualifications and performance, and otherwise making all decisions regarding our engagement of this firm; (6) approving the audit committee report included in this proxy statement; (7) reviewing the independent registered public accounting firm’s certification and report on management’s assessment of internal control over financial reporting; and (8) reviewing and approving related person transactions in accordance with our related person transaction policy described on page 16.

The responsibilities of the audit committee, as approved by the board, are set forth in the audit committee charter, a copy of which is available on our website atwww.elizabetharden.com, under the section “Corporate – Investor Relations – Corporate Governance – Audit Committee.”

The Compensation Committee

The compensation committee consists of Messrs. Amin, Langman, and Tatham. The board of directors has determined that each of Messrs. Amin, Langman, and Tatham is independent, as defined by applicable NASDAQ rules. Mr. Amin chairs the compensation committee, which met four times during fiscal 2015. Subject to his election at the annual meeting, Mr. Shirley has been appointed by the board of directors to chair the compensation committee after Mr. Amin’s current term as a director ends. In addition, Mr. Buerstedde has been appointed to replace Mr. Tatham on the compensation committee after the annual meeting.

The compensation committee is responsible for, among other things: (1) establishing an overall compensation strategy and program for our executive officers and other employees, including approving grants of equity and cash awards under our incentive plans; (2) reviewing and approving the strategy and individual elements of the compensation of our executive officers, including the chief executive officer; (3) administering our stock and cash incentive plans, and the employee stock purchase plan; (4) reviewing and discussing with management our disclosures contained in the Compensation Discussion and Analysis, and making a recommendation to the board regarding the inclusion of the Compensation Discussion and Analysis in our proxy statement; (5) reviewing and evaluating our compensation policies and practices as they relate to our risk management; (6) reviewing and approving our stock ownership and retention guidelines for executive officers, as well as any waivers thereof; and (7) reviewing and making recommendations to the board regarding non-employee director compensation.

The responsibilities of the compensation committee, as approved by the board, are set forth in the committee’s charter, a copy of which is available on our website atwww.elizabetharden.com, under the section “Corporate – Investor Relations – Corporate Governance – Compensation Committee.”

The compensation committee has the authority, pursuant to its charter, to directly engage the services of outside experts and advisors as it deems necessary and appropriate to assist the compensation committee in fulfilling its responsibilities. Since 2002, Mercer (US) Inc., a global compensation and benefits consulting firm and wholly-owned subsidiary of Marsh & McLennan Companies, Inc., has been engaged by the compensation committee to provide the compensation committee with third-party data and advice in connection with the compensation committee’s deliberations regarding executive compensation. Mercer’s fees for executive compensation consulting services provided to the compensation committee for fiscal 2015 were $203,052.

Mercer reviews and evaluates our executive compensation strategy and program to provide guidance to help us accomplish our compensation objectives, consider industry best practices, and remain competitive with the market. More specifically, at the request of the compensation committee, Mercer (1) assesses the pay competitiveness of our executive officer positions, (2) conducts a business performance analysis to gauge the relative alignment between our performance and executive officer compensation relative to our peer group, (3) reviews our bonus program design, incentive award opportunities, and long-term incentive grant practices, and (4) summarizes and reports to the compensation committee on trends, regulatory developments and other factors affecting executive officer compensation. Based on these activities, Mercer makes recommendations regarding, and proposes adjustments to, our executive officer compensation program as it deems appropriate. While Mercer works closely with the appropriate members of our executive management team in performing these activities, Mercer reports directly to and is retained by the compensation committee on all executive compensation matters. Mercer periodically attends compensation committee meetings.

During fiscal 2015, Mercer and its Marsh & McLennan affiliates were also retained by management to provide services unrelated to executive compensation, including insurance brokerage services and human resources consulting services such as providing advice regarding our benefit programs in the areas of benefit plan design, compliance, communication, administration and funding. The aggregate fees paid for those other services for fiscal 2015 were $928,343. The compensation committee and the board did not review or approve the other services provided to us by Mercer and its Marsh & McLennan affiliates, as those services were approved by management in the normal course of business.

14

We have been advised by Mercer that the reporting relationship and compensation of the Mercer consultants who perform executive compensation consulting services for our compensation committee is separate from, and is not determined by reference to, Mercer’s or Marsh & McLennan’s other lines of business or their other work for us. The compensation committee considered these separate reporting relationships and compensation structures, the provision of other services to the company by Mercer and Marsh & McLennan, the absence of any business or personal relationship between our officers and directors and the specific Mercer consultants advising the company (other than the consulting relationship with the compensation committee), Mercer’s Global Business Standards intended to address potential conflict of interests with respect to their executive compensation consulting services, and the other factors required to be considered by applicable SEC and stock exchange rules, in approving the committee’s engagement of Mercer for fiscal 2015. Based on this review, the compensation committee did not identify that Mercer had any conflicts of interest that would prevent Mercer from independently advising the compensation committee.

The Nominating and Corporate Governance Committee

The nominating and corporate governance committee consists of Messrs. Mauran, Berens and Langman. The board has determined that each of Messrs. Mauran, Berens and Langman is independent, as defined by applicable NASDAQ rules. Mr. Mauran chairs the nominating and corporate governance committee, which solely acted via unanimous written consent during fiscal 2015. Mr. Langman has been appointed by the Company’s board of directors to chair the nominating and corporate governance committee after Mr. Mauran’s current term as a director ends, and subject to this election at the annual meeting, Mr. Shirley has been appointed by the board of directors to join the nominating and corporate governance committee after the annual meeting.

The nominating and corporate governance committee is responsible for evaluating and recommending to the board candidates for nomination for election or re-election by the shareholders to the board of directors, evaluating and recommending candidates for the committees of the board, considering corporate governance issues and developing appropriate recommendations and policies for the board regarding such matters. The nominating and corporate governance committee reviews with the board the appropriate skills, characteristics and experience represented on the board of directors in light of our strategic direction, opportunities and risks, as well as the perceived needs of the board.

Subject to the Rhône Purchasers’ director designation rights as described below under “Certain Relationships and Related Person Transactions – Rhône Transaction – Rhône Director Designation Rights,” the nominating and corporate governance committee’s consideration and nomination of director candidates for election or re-election to the board includes an assessment of candidates’ experience, qualifications, competencies, judgment, and skills. Although we do not have a formal diversity policy, the nominating and corporate governance committee does consider diversity in the experience, qualifications, competencies, perspectives and skills of our directors when evaluating the composition of our board.

The nominating and corporate governance committee considers recommendations for board of directors candidates submitted by shareholders, provided that the recommendations are made in accordance with the procedure for director candidates nominated by shareholders required under our by-laws and described in this proxy statement under the heading “Shareholder Proposals and Nominations of Board Members for the 2016 Annual Meeting,” using the same criteria it applies to recommendations from its committee, directors or members of management. Shareholders may submit recommendations by writing to the nominating and corporate governance committee as follows: Nominating and Corporate Governance Committee, c/o Secretary, Elizabeth Arden, Inc., 2400 S.W. 145th Avenue, Miramar, Florida 33027. The responsibilities of the nominating and corporate governance committee, as approved by the board, are set forth in the committee’s charter, a copy of which is available on our website atwww.elizabetharden.com, under the section “Corporate – Investor Relations – Corporate Governance – Nominating Committee.”

Board’s Role in Risk Oversight

The board oversees the management of risks inherent in the operation of our business and the implementation of our business strategy. The board performs this function in part through the board’s committees, which oversee the management of company risks that fall within each committee’s area of responsibility. Each board committee has full access to company management, as well as the ability to engage independent advisors, to assist the committees in performing these oversight functions.

The audit committee oversees our policies and processes relating to our financial statements and financial reporting processes, as well as management’s assessment of key credit risks, liquidity risks, foreign currency exchange risks, contingencies arising from legal disputes, and the effectiveness of our internal control structure. The compensation committee reviews our overall compensation program and its effectiveness in linking executive pay to performance and aligning the interests of our executives and our shareholders. The compensation committee also reviews and evaluates management’s assessment of whether our compensation policies and procedures are reasonably likely to have a material adverse effect on our company. Both management of the company and the compensation committee concluded that our compensation policies and

15

procedures are not reasonably likely to have a material adverse effect on our company. The nominating and corporate governance committee oversees risks related to our governance structure and processes, and also oversees our management succession planning process. The board believes that its risk oversight role is not affected by the fact that the positions of chairman and chief executive officer are both held by Mr. Beattie.

In addition, as part of its oversight role, the board considers specific risk topics related to our business, including strategic, sales, financial and operational risks, on a regular basis and otherwise as the need arises. These topics are considered and discussed in a periodic business risk review, as well as in connection with the board’s review of the detailed management reports provided at each board meeting. The business risk review includes management’s comprehensive analysis of our risk profile and actions taken by management to manage and mitigate the risks identified.

CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS

Related Person Transaction Policy

Our written Related Person Transaction Policy requires that our board or audit committee approve or ratify all transactions involving amounts in excess of $120,000 during a fiscal year between our company or one or more of our subsidiaries and any “related person,” as defined by SEC rule to include directors, director nominees, executive officers, and their respective immediate family members, and 5% beneficial owners of our common stock (among others, as discussed below in further detail). Under the Related Person Transaction Policy, the board or audit committee reviews the relevant facts of the proposed transaction and the interest of the related person in the transaction, and either approves or rejects the proposed transaction. If a related person transaction is discovered that has not been previously approved or previously ratified, that transaction will be presented to the board or audit committee for ratification. No director can participate in the deliberation or approval of any related person transaction in which such director is the related person.

For purposes of the Related Person Transaction Policy, a “related person” means (i) any director or executive officer of ours, (ii) any nominee for director, (iii) any 5% beneficial owner of our common stock, (iv) any immediate family member of a director, nominee for director, executive officer or 5% beneficial owner of our common stock, and (v) any firm, corporation, or other entity in which any of these persons is employed or is a partner or principal or in a similar position, or in which such person has a 10% or greater beneficial ownership interest. The Related Person Transaction Policy provides that the following types of transactions are deemed to be pre-approved under the policy: (1) transactions that are available to related persons on the same terms as such transactions are available to all employees generally; (2) compensation or indemnification arrangements of any executive officer, other than an individual who is an immediate family member of a related person, if such arrangements have been approved by the board or the compensation committee; (3) transactions in which the related person’s interest derives solely from his or her ownership of less than 10% of the equity interest in another person (other than a general partnership interest) that is a party to the transaction; (4) transactions in which the related person’s interest derives solely from his or her ownership of a class of our equity securities and all holders of that class of equity securities received the same benefit on a pro rata basis; (5) director compensation arrangements, if such arrangements have been approved by the board or the compensation committee; and (6) any other transaction that is not required to be disclosed as a “related person transaction” under applicable securities regulations. The Related Person Transaction Policy defines the term “immediate family member” to mean any child, stepchild, parent, stepparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law of a director, nominee for director, executive officer, or 5% beneficial owner of our common stock, and any person (other than a tenant or employee) sharing the household of such director, nominee for director, executive officer, or 5% beneficial owner.

Rhône Transaction

Securities Purchase Agreement

On August 19, 2014, we entered into a securities purchase agreement with the Rhône Purchasers, pursuant to which we issued and sold to them, for an aggregate of $50 million in cash, the following:

| | • | | 50,000 shares of our newly designated Series A Serial Preferred Stock, par value $0.01 per share; and |

| | • | | warrants for the purchase of up to 2,452,267 shares of our common stock, par value $0.01 per share, at an exercise price of $20.39 per share, representing approximately 7.6% of our outstanding common stock on an as-exercised basis. |

We refer to the Rhône Purchasers and their affiliates in this proxy statement collectively as “Rhône.”

Pursuant to the terms of the securities purchase agreement, we also amended our amended and restated by-laws as necessary to give effect to the voting and director designation rights of the preferred stock. The securities purchase agreement contained customary representations, warranties and covenants between the parties.

16

Subsequent Common Stock Purchases by Rhône

During October 2014, the Rhône Purchasers acquired an additional 4,064,087 shares of our common stock through a partial cash tender offer and open market purchases. As a result, Rhône’s Percentage Interest (as defined below) as of October 8, 2015, was 20.2%.

Series A Serial Preferred Stock

The terms, rights, obligations and preferences of the preferred stock are set forth in the articles of amendment to our amended and restated articles of incorporation, which we filed with the Secretary of State of the State of Florida on August 19, 2014 (the articles of amendment), in connection with the issuance of the preferred stock.

Dividends on the preferred stock are payable at the per annum dividend rate of 5% of the liquidation preference, which is initially $1,000 per share. The preferred stock will also participate in dividends declared or paid, whether in cash, securities or other property, on the shares of common stock for which the outstanding warrants issued are exercisable. The preferred stock has an aggregate liquidation preference of $50 million and ranks junior to all of our liabilities and obligations to creditors with respect to assets available to satisfy claims against us and senior to all other classes of stock over which the preferred stock has preference, including our common stock.

Pursuant to the terms of the Shareholders Agreement described below, each quarter we are obligated to declare and pay in cash no less than fifty percent (50%) of each dividend to which holders of the preferred stock are entitled, unless payment of such dividend in cash (i) is prohibited by or would result in a default or event of default under the indenture for our outstanding 7 3/8% senior notes due 2021, our credit facilities or certain other debt documents, or (ii) would result in a breach of the legal or fiduciary obligations of our board, in which case we will declare and pay in cash the maximum amount permitted to be paid in cash. If and to the extent that we do not pay the entire dividend to which holders of preferred stock are entitled for a particular period in cash on the applicable dividend payment date, preferential cash dividends will accrue on such unpaid amounts (and on any unpaid dividends in respect thereof) at 5% per annum, and will compound on each dividend payment date, until paid. No cash dividend may be declared or paid on common stock or other classes of stock over which the preferred stock has preference unless full cumulative dividends have been or contemporaneously are declared and paid in cash on the preferred stock.