Summary of Terms

Issuer | The Bank of Nova Scotia (the “Bank”) |

Term | Approximately 24 months |

Market Measure | Shares of Invesco QQQ TrustSM, Series 1 (the “Reference Asset”) (Bloomberg Ticker: QQQ) |

Pricing Date | January 29, 2021* |

Trade Date | January 29, 2021* |

Issue Date | February 3, 2021* |

Principal Amount | $1,000 per Security |

Original Offering Price | 100.00% of the Principal Amount of each Security |

Redemption Amount at Maturity | See “How the Redemption Amount at Maturity is Calculated” on page 3 |

Maturity Date | February 3, 2023 |

Starting Price | $314.56 |

Ending Price | The Fund Closing Price of the Reference Asset on the Calculation Day |

Threshold Price | $283.104, which is equal to the Starting Price multiplied by the difference of 100.00% minus the Threshold Percentage. |

Threshold Percentage | 10.00% |

Capped Value | $1,140.00 per $1,000 Principal Amount of the Securities |

Participation Rate | 200.00% |

Percentage Change | The percentage increase or decrease in the Ending Price from the Starting Price. The Percentage Change may reflect a positive return (based on any increase in the price of the Reference Asset from the Starting Price to the Ending Price), no return, or a negative return (based on any decrease in the price of the Reference Asset from the Starting Price to the Ending Price) |

Calculation Day | January 27, 2023 |

Calculation Agent | Scotia Capital Inc., an affiliate of the Bank |

Denominations | $1,000 and any integral multiple of $1,000 |

Agent Discount | 2.84% of which dealers, possibly including those using the trade name Wells Fargo Advisors (“WFA”), will receive a selling concession of 1.75%, and WFA will receive a distribution expense fee of 0.075%. In respect of certain Securities sold in this offering, we will also pay a fee of $1.00 per Security to selected securities dealers in consideration for marketing and other services in connection with the distribution of the Securities to other securities dealers. |

CUSIP/ISIN | 064159P59 / US064159P598 |

Underwriters | Scotia Capital (USA) Inc.; Wells Fargo Securities, LLC |

*Delivery of the Securities will be made against payment therefor on the third Business Day following the Trade Date (this settlement cycle being referred to as “T+3”). Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in 2 Business Days (“T+2”), unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Securities on the Trade Date will be required, by virtue of the fact that each Security initially will settle in 3 Business Days (T+3), to specify alternative settlement arrangements to prevent a failed settlement.

Investment Description

| ● | Linked to the shares of Invesco QQQ TrustSM, Series 1 |

| Unlike ordinary debt securities, the Securities do not pay interest or repay a fixed amount of principal at maturity. Instead, the Securities provide for a payment at maturity that may be greater than, equal to or less than the Principal Amount of the Securities, depending on the performance of the Reference Asset from its Starting Price to its Ending Price. |

The payment at maturity will reflect the following terms:

| o | If the value of the Reference Asset increases: |

You will receive the Principal Amount plus 200.00% participation in the upside performance of the Reference Asset, subject to the Capped Value of $1,140.00 per $1,000 Principal Amount of the Securities;

| o | If the value of the Reference Asset decreases but the decrease is not more than 10.00%: |

You will be repaid the Principal Amount;

| o | If the value of the Reference Asset decreases by more than 10.00%: |

You will receive less than the Principal Amount and will have 1-to-1 downside exposure to the decrease in the value of the Index in excess of 10.00%.

| Investors may lose up to 90.00% of the Principal Amount. |

| All payments on the Securities are subject to the credit risk of the Bank, and you will have no right to the shares of the Reference Asset or any securities held by the Reference Asset; if The Bank of Nova Scotia defaults on its obligations, you could lose your entire investment. |

| No periodic interest payments or dividends. |

| No exchange listing; designed to be held to maturity. |

The estimated value of the Securities as determined by the Bank as of the Pricing Date is $942.75 (94.275%) per $1,000 Principal Amount. See “The Bank’s Estimated Value of the Securities” in the pricing supplement.

The Securities have complex features and investing in the Securities involves risks not associated with an investment in conventional debt securities. See “Selected Risk Considerations” in this term sheet, “Additional Risks” in the pricing supplement, “Additional Risk Factors Specific to the Notes” in the product prospectus supplement and “Risk Factors” in the prospectus supplement and prospectus.

This term sheet should be read in conjunction with the pricing supplement, product prospectus supplement, prospectus supplement, and prospectus.

NOT A BANK DEPOSIT AND NOT INSURED OR GUARANTEED BY THE FDIC OR ANY OTHER GOVERNMENTAL AGENCY

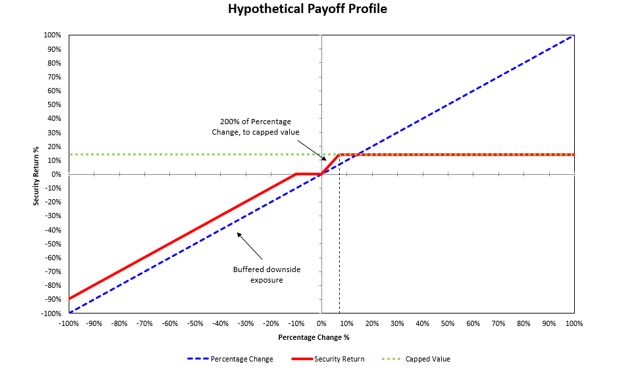

Hypothetical Payout Profile

The profile to the right is based on the Capped Value of $1,140.00 per $1,000 Principal Amount of the Securities, the Participation Rate of 200.00% and a Threshold Percentage of 10.00% (the Threshold Price equal to 90.00% of the Starting Price).

This graph has been prepared for purposes of illustration only. Your actual return will depend on the Ending Price and whether you hold your Securities to maturity.

Hypothetical Returns on the Securities

| Hypothetical Ending Price | Hypothetical Percentage Change from the hypothetical Starting Price to the hypothetical Ending Price | Redemption Amount at Maturity per Security | Pre-tax total rate of return |

| $150.00 | 50.00% | $1,140.00 | 14.00% |

| $140.00 | 40.00% | $1,140.00 | 14.00% |

| $130.00 | 30.00% | $1,140.00 | 14.00% |

| $120.00 | 20.00% | $1,140.00 | 14.00% |

| $110.00 | 10.00% | $1,140.00 | 14.00% |

| $107.00 | 7.00% | $1,140.00 | 14.00% |

| $106.00 | 6.00% | $1,120.00 | 12.00% |

| $104.00 | 4.00% | $1,080.00 | 8.00% |

| $102.00 | 2.00% | $1,040.00 | 4.00% |

| $100.00 | 0.00% | $1,000.00 | 0.00% |

| $98.00 | -2.00% | $1,000.00 | 0.00% |

| $95.00 | -5.00% | $1,000.00 | 0.00% |

| $90.00 | -10.00% | $1,000.00 | 0.00% |

| $80.00 | -20.00% | $900.00 | -10.00% |

| $70.00 | -30.00% | $800.00 | -20.00% |

| $50.00 | -50.00% | $600.00 | -40.00% |

| $25.00 | -75.00% | $350.00 | -65.00% |

| $0.00 | -100.00% | $100.00 | -90.00% |

Assumes a hypothetical Starting Price of $100.00, which has been chosen arbitrarily for illustrative purposes only, and the Capped Value of $1,140.00. Each Security has a Principal Amount of $1,000.

The above figures are for purposes of illustration only and may have been rounded for ease of analysis. The actual amount you receive on the Maturity Date and the resulting pre-tax rates of return will depend on the actual Ending Price.

How the Redemption Amount at Maturity is Calculated

The Redemption Amount at Maturity will be determined as follows:

| ● | If the Ending Price is greater than the Starting Price, then the Redemption Amount at Maturity will equal: |

the lesser of (a) the Principal Amount + (Principal Amount x Participation Rate × Percentage Change) and (b) the Capped Value

● If the Ending Price is less than or equal to the Starting Price, but greater than or equal to the Threshold Price, then the Redemption Amount at Maturity will equal: the Principal Amount |

● If the Ending Price is less than the Threshold Price, then the Redemption Amount at Maturity will equal: Principal Amount + [Principal Amount × (Percentage Change + Threshold Percentage)] If the Ending Price is less than the Threshold Price, you will have 1-to-1 downside exposure to the portion of such decrease in the Reference Asset that exceeds 10.00% and you will lose some and possibly up to 90.00% of your investment in the Securities. |

Invesco QQQ TrustSM, Series 1 Daily Closing Prices*

*The graph above illustrates the performance of the Reference Asset from January 1, 2015 through January 29, 2021. The dotted line represents the Threshold Price of $283.104, which is equal to 90.00% of $314.56, which was the closing price of the Reference Asset on January 29, 2021. Past performance of the Reference Asset is not indicative of the future performance of the Reference Asset.

Information from outside sources is not incorporated by reference in, and should not be considered part of, this term sheet, the pricing supplement, the prospectus, the prospectus supplement, or product prospectus supplement.

Selected Risk Considerations

The risks set forth below are discussed in detail in “Additional Risks” in the pricing supplement, “Additional Risk Factors Specific to the Notes” in the product prospectus supplement and “Risk Factors” in the prospectus supplement and prospectus. Please review those risk disclosures carefully.

| ● | Risk of loss at maturity: Any payment on the Securities at maturity depends on the Percentage Change of the Reference Asset. The Bank will repay you the full Principal Amount of your Securities only if the Percentage Change does not reflect a decrease in the Reference Asset of more than 10.00%. If the Percentage Change is negative by more than 10.00%, meaning the Ending Price is less than the Threshold Price, you will lose a significant portion of your initial investment in an amount equal to the Percentage Change in excess of the Threshold Percentage. You may lose up to 90.00% of your investment in the Securities. |

| ● | The Participation Rate and the Buffered Downside Market Exposure to the Reference Asset Applies Only at Maturity |

| ● | Your Potential Redemption Amount at Maturity Is Limited by the Capped Value |

| ● | The Securities Differ from Conventional Debt Instruments |

| ● | No Interest: The Securities do not bear interest and, accordingly, you will not receive any interest payments on the Securities. |

| ● | The Redemption Amount at Maturity Is Not Linked to the Price of the Reference Asset at Any Time Other Than the Calculation Day |

| ● | Holding the Securities is Not the Same as Holding the Reference Asset or the Reference Asset Constituent Stocks |

| ● | No Assurance that the Investment View Implicit in the Securities Will Be Successful |

| ● | The Securities are Subject to Market Risk |

| ● | Past Performance is Not Indicative of Future Performance |

| ● | The Securities are Subject to Risks Associated with Non-U.S. Companies |

| ● | There Are Risks Associated with a Reference Asset that is an Exchange-Traded Fund |

| ● | The Value of the Reference Asset May Fluctuate Relative to its NAV |

| ● | Changes Affecting the Reference Asset Could Have an Adverse Effect on the Value of, and any Amount Payable on, the Securities |

| ● | The Bank Cannot Control Actions by the Investment Advisor of the Reference Asset that May Adjust the Reference Asset in a Way that Could Adversely Affect the Payments on the Securities and Their Market Value, and the Investment Advisor Has No Obligation to Consider Your Interests |

| ● | The Inclusion of Dealer Spread and Projected Profit from Hedging in the Original Offering Price is Likely to Adversely Affect Secondary Market Prices |

| ● | The Bank’s Estimated Value of the Securities is Lower than the Original Offering Price of the Securities |

| ● | The Bank’s Estimated Value Does Not Represent Future Values of the Securities and may Differ from Others’ Estimates |

| ● | The Bank’s Estimated Value is not Determined by Reference to Credit Spreads for our Conventional Fixed-Rate Debt |

| ● | We May Sell an Additional Aggregate Principal Amount of the Securities at a Different Issue Price |

| ● | The Price at Which the Securities May Be Sold Prior to Maturity will Depend on a Number of Factors and May Be Substantially Less Than the Amount for Which They Were Originally Purchased |

| ● | The Securities Lack Liquidity |

| ● | If the Prices of the Reference Asset or the Reference Asset Constituent Stocks Change, the Market Value of Your Securities May Not Change in the Same Manner |

| ● | Hedging Activities by the Bank and/or the Underwriters May Negatively Impact Investors in the Securities and Cause Our Respective Interests and Those of Our Clients and Counterparties to Be Contrary to Those of Investors in the Securities |

| ● | Market Activities by the Bank or the Underwriters for Their Own Respective Accounts or for Their Respective Clients Could Negatively Impact Investors in the Securities |

| ● | The Bank, the Underwriters and Their Respective Affiliates Regularly Provide Services to, or Otherwise Have Business Relationships with, a Broad Client Base, Which Has Included and May Include the Investment Advisor and/or Reference Asset Constituent Stock Issuers |

| ● | Other Investors in the Securities May Not Have the Same Interests as You |

| ● | The Calculation Agent Can Postpone the Calculation Day for the Securities if a Market Disruption Event with Respect to the Reference Asset Occurs |

| ● | Anti-dilution Adjustments Relating To The Shares Of The Reference Asset Do Not Address Every Event That Could Affect Such Shares |

| ● | There Is No Affiliation Between Any Reference Asset Constituent Stock Issuers or the Investment Advisor and Us and We Are Not Responsible for Any Disclosure by Any of the Other Reference Asset Constituent Stock Issuers or the Investment Advisor |

| ● | A Participating Dealer or its Affiliates May Realize Hedging Profits Projected by its Proprietary Pricing Models in Addition to any Selling Concession, Creating a Further Incentive for the Participating Dealer to Sell the Securities to You |

| ● | Your Investment is Subject to the Credit Risk of the Bank |

| ● | The COVID-19 Virus May Have an Adverse Impact on the Bank |

| ● | Uncertain Tax Treatment: Significant aspects of the tax treatment of the Securities are uncertain. You should consult your tax advisor about your tax situation. See “Canadian Income Tax Consequences” and “U.S. Federal Income Tax Consequences” in the pricing supplement. |

Not suitable for all investors

Investment suitability must be determined individually for each investor. The Securities described herein are not a suitable investment for all investors. Unless market conditions and other relevant factors change significantly in your favor, a sale of the Securities prior to maturity is likely to result in sale proceeds that are substantially less than the Principal Amount per Security. The Underwriters and their respective affiliates are not obligated to purchase the Securities from you at any time prior to maturity.

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. You should read the prospectus in that registration statement and other documents, including the pricing supplement, the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the issuer, any Underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling your financial advisor or by calling Wells Fargo Securities, LLC at 866-346-7732.

Not a research report

This material is not a product of the Bank’s research department.

Consult your tax advisor

Investors should review carefully the pricing supplement and consult their tax advisors regarding the application of the U.S. federal tax laws to their particular circumstances, as well as any tax consequences arising under the laws of any state, local or non-U.S. jurisdiction.

Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.