MANAGEMENT’S DISCUSSION & ANALYSIS

Group Financial Performance

Net income was $1,912 million compared to $2,192 million, a decrease of 13%. The decrease was due mainly to higher provision for credit losses and

non-interest

expenses, partly offset by higher net interest income and lower provision for income taxes. Adjusted net income was $2,191 million compared to $2,207 million, a decrease of 1%. The decrease was due mainly to higher provision for credit losses and

non-interest

expenses, mostly offset by higher revenues.

Net income was $1,912 million compared to $2,092 million, a decrease of 9%. The decrease was due mainly to higher provision for credit losses and

non-interest

expenses, and lower

non-interest

income, partly offset by higher net interest income and lower provision for income taxes. Adjusted net income was $2,191 million compared to $2,105 million, an increase of 4%, due mainly to higher net interest income and lower provision for income taxes, partly offset by higher provision for credit losses.

Net income was $6,203 million compared to $6,096 million, an increase of 2%. The increase was due mainly to higher revenues and lower provision for income taxes, partly offset by higher provision for credit losses and

non-interest

expenses. Adjusted net income was $6,508 million compared to $6,720 million, a decrease of 3%, due mainly to higher provision for credit losses,

non-interest

expenses and provision for income taxes, partly offset by higher revenues.

Revenues were $8,364 million compared to $8,067 million, an increase of 4%. Adjusted revenues were $8,507 million compared to $8,067 million, an increase of 5%.

Net interest income was $4,862 million, an increase of $289 million or 6%, due primarily to asset growth inclusive of the conversion of bankers’ acceptances to loans resulting from the cessation of CDOR in June 2024, as well as a higher net interest margin. The net interest margin was 2.14%, an increase of four basis points, driven primarily by higher margins in Canadian Banking and International Banking, partly offset by a lower contribution from asset/liability management activities, as well as increased levels of high quality, lower yielding liquid assets.

Non-interest

income was $3,502 million, an increase of $8 million including the $143 million loss on the announced sale of CrediScotia Financiera. Adjusted

non-interest

income was $3,645 million, up $151 million or 4%, due primarily to higher wealth management revenues, underwriting and advisory fees, and the positive impact of foreign currency translation. This was partly offset by lower bankers’ acceptance fees related to the conversion of bankers’ acceptances to loans due to the cessation of CDOR.

Revenues were $8,364 million compared to $8,347 million. Adjusted revenues were $8,507 million compared to $8,347 million, an increase of 2%.

Net interest income increased $168 million or 4%, driven primarily by asset growth inclusive of the conversion of bankers’ acceptances to loans due to the cessation of CDOR in June 2024, and the impact of two additional days in the quarter, partly offset by a lower interest margin. The net interest margin decreased three basis points driven mainly by lower margins in International Banking and Canadian Banking, as well as higher levels of high quality, lower yielding liquid assets.

Non-interest

income was down $151 million or 4%, including the $143 million loss on the announced sale of CrediScotia Financiera. Adjusted

non-interest

income was down $8 million. Lower bankers’ acceptance fees related to the conversion of bankers’ acceptances to loans due to the cessation of CDOR, lower investment gains, and lower trading revenues were largely offset by higher wealth management revenues, other fees and commissions, and the positive impact of foreign currency translation.

Revenues were $25,144 million compared to $23,942 million, an increase of 5%. Adjusted revenues were $25,287 million compared to $23,942 million, an increase of 6%.

Net interest income was $14,329 million, an increase of $733 million or 5%, due primarily to a higher net interest margin and asset growth inclusive of the conversion of bankers’ acceptances to loans due to the cessation of CDOR in June 2024. The net interest margin was 2.17%, an increase of six basis points, driven primarily by higher margins in Canadian Banking and International Banking. This was partly offset by a lower contribution from asset/liability management activities, as well as increased levels of high quality, lower yielding liquid assets.

Non-interest

income was $10,815 million, up $469 million or 5% including the $143 million loss on the announced sale of CrediScotia Financiera. Adjusted

non-interest

income was $10,958 million, up $612 million or 6%, of which 3% relates to the positive impact of foreign currency translation. The remaining 3% increase was due primarily to higher wealth management revenues, underwriting and advisory fees, and other fees and commissions. Partly offsetting were lower trading revenues, lower investment gains, and lower bankers’ acceptance fees related to the conversion of bankers’ acceptances to loans due to the cessation of CDOR.

Provision for credit losses

The provision for credit losses was $1,052 million, compared to $819 million, an increase of $233 million. The provision for credit losses ratio increased 13 basis points to 55 basis points.

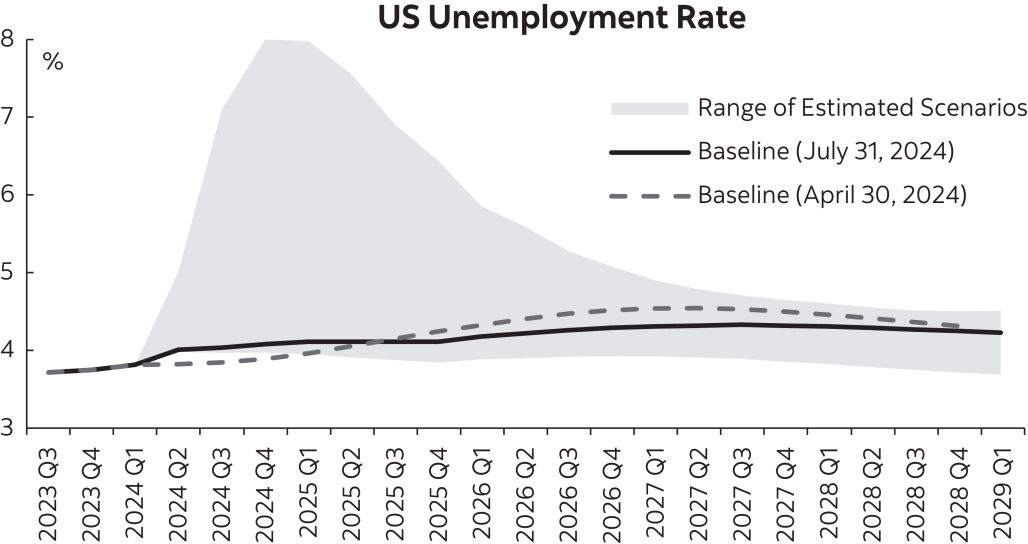

The provision for credit losses on performing loans was $82 million, compared to $81 million. The provision this quarter was driven by the impact of higher interest rates, including the related migration in retail portfolios in Canadian Banking, as well as higher corporate and commercial provisions due to the continued unfavourable macroeconomic outlook and credit quality migration. This was partly offset by retail credit migration to impaired in International Banking, mainly in Chile and Peru.

The provision for credit losses on impaired loans was $970 million, compared to $738 million, an increase of $232 million or 31% due primarily to higher formations in International Banking retail portfolios, mostly in Colombia, Chile and Peru. There were also higher provisions in the Canadian retail portfolios, primarily auto loans and credit cards. The provision for credit losses ratio on impaired loans was 51 basis points, an increase of 13 basis points.

| | |

| | Scotiabank Third Quarter Report 2024 |