UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

þ | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

Texas Industries, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

þ | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | |

| | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

August 23, 2005

DEAR SHAREHOLDER:

You are cordially invited to attend the Annual Meeting of the Shareholders of Texas Industries, Inc., to be held at 9:30 a.m. Central Daylight Time, on Tuesday, October 18, 2005, at the FC Dallas Entertainment Center, Pizza Hut Park, 6000 Main Street, Frisco, Texas.

The following Notice of Annual Meeting and Proxy Statement describe the formal business to be transacted at the Annual Meeting. During the Annual Meeting we will also report on our operations. Our 2005 Annual Report accompanies this Proxy Statement.

It is important that your shares be represented at the Annual Meeting regardless of the size of your holdings. If you are unable to attend in person, we urge you to participate by voting your shares by proxy. You may do so by filling out and returning the enclosed proxy card or by voting your proxy by telephone or via the Internet.

If you arrive early, you are invited to have coffee and meet informally with the Directors.

| Sincerely, | |

|

| |

| Mel G. Brekhus | |

| President | |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held On October 18, 2005

The Annual Meeting of Shareholders of Texas Industries, Inc. (the “Company”) will be held at the FC Dallas Entertainment Center, Pizza Hut Park, 6000 Main Street, Frisco, Texas, on Tuesday, October 18, 2005, at 9:30 a.m. (CDT) for the following purposes:

1. To elect three (3) directors to terms expiring in 2008.

2. To transact any other business that may properly come before the Annual Meeting or any adjournment thereof.

Only shareholders of record at the close of business on August 22, 2005, will be entitled to vote at the Annual Meeting. A list of such shareholders will be open for examination by any shareholder during ordinary business hours for a period of ten days prior to the Annual Meeting, at our executive offices at 1341 W. Mockingbird Lane, Dallas, Texas 75247-6913.

While we encourage you to attend the Annual Meeting, please vote your shares as promptly as possible. You may vote your shares in a number of ways. You may mark your votes, date, sign and return the proxy card. If you have shares registered in your own name, you may choose to vote those shares via the Internet at http://www.proxyvoting.com/txi, or you may vote telephonically, within the U.S. and Canada only, by calling the toll-free number listed in the instructions set forth on the proxy card. If you hold our shares with a broker or bank, you may also be eligible to vote via the Internet or by telephone if your broker or bank participates in the proxy voting program provided by ADP Investor Communication Services.

| By Order of the Board of Directors, | |

|

| |

Dallas, Texas | Frederick G. Anderson | |

August 23, 2005 | Secretary | |

PROXY STATEMENT

for

ANNUAL MEETING OF SHAREHOLDERS

To Be Held October 18, 2005

SOLICITATION OF PROXIES

This Proxy Statement is furnished in connection with the solicitation by and on behalf of the Board of Directors of Texas Industries, Inc., a Delaware corporation (the “Company” or “we”, “our” or “us”), of proxies for exercise at our Annual Meeting of Shareholders to be held on October 18, 2005, and at any adjournment thereof. The approximate date on which this Proxy Statement and accompanying proxy were first sent to shareholders is August 29, 2005.

We will pay the cost of soliciting proxies. In addition to solicitation by mail, we request that banks, brokers and other custodians, nominees and fiduciaries send proxy material to the beneficial owners and secure their voting instructions if necessary. We will reimburse them for their expenses in so doing. If proxies are not promptly received, our employees may solicit proxies from some shareholders in person, by telephone or by telecopy. In addition, we have retained ADP Investor Communication Services and Mellon Investor Services, LLC to assist in the solicitation of proxies at a cost of approximately $5,000 plus reasonable out-of-pocket expenses.

OUTSTANDING VOTING STOCK AND QUORUM

We had 22,872,064 shares of common stock outstanding on August 22, 2005, our record date. Each share is entitled to one vote. The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of our issued and outstanding common stock is necessary to constitute a quorum to transact business.

VOTING OF PROXY

Although you may not be able to attend the Annual Meeting in person, if you are a shareholder of record at the close of business on the record date you may vote by using the proxy solicited by the Board of Directors. Voting by use of the proxy can be accomplished either by dating, signing and returning the proxy card in the envelope which is enclosed with this document, by calling the toll-free number and following the instructions set forth on the proxy card, or via the Internet by following the instructions set forth on the proxy card.

Your shares cannot be voted at the Annual Meeting unless you are present or represented by proxy. You may revoke your proxy prior to the voting by notice in writing to the Secretary of the Company at the address stated above, by submitting another proxy by telephone or via the Internet, or by voting in person at the Annual Meeting.

Whether you choose to vote by mail, telephone or Internet, you can specify approval, disapproval or abstention from each proposal set forth on the proxy card. If you properly sign and return the proxy card or vote by telephone or Internet without specifying how the shares are to be voted, those shares will be voted in accordance with the Board of Directors’ recommendations.

Abstentions and broker non-votes (as defined below) will be counted for the purpose of determining whether a quorum is present at the Annual Meeting. For the purpose of determining whether a proposal (except for the election of directors) has received a majority vote, abstentions will be included in the vote totals with the result that abstentions will have the same effect as a negative vote. In instances where shares are held in street name and the broker is prohibited from exercising discretionary authority for the beneficial owner who has not returned a proxy (“broker non-votes”), those shares will not be included in the vote totals and, therefore, will have no effect on the vote.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table furnishes information concerning all persons known to us to beneficially own 5% or more of our common stock as of July 1, 2005.

Name and Address

of Beneficial Owner | | | | Amount and Nature

of Beneficial Ownership | | Percent

of Class | |

FMR Corp. (1) | | | 3,399,670 | | | | 14.9 | % | |

82 Devonshire Street Boston, Massachusetts | | | | | | | | | |

Dimensional Fund Advisors Inc. (2) | | | 1,515,957 | | | | 6.7 | % | |

1299 Ocean Avenue, 11th Floor Santa Monica, California 90401 | | | | | | | | | |

Barclays Global Investors, NA (3) | | | 1,201,826 | | | | 5.3 | % | |

45 Fremont Street San Francisco, California 94105 | | | | | | | | | |

(1) Based on Schedule 13G/A dated May 10, 2005.

(2) Based on Schedule 13G/A dated February 9, 2005.

(3) Based on Schedule 13G dated February 14, 2005.

2

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our bylaws provide for a Board of Directors of not fewer than three nor more than twenty-one directors with the actual number to serve at any time to be determined by resolution of the Board. The Board has determined that the number of directors constituting the full Board shall be eight. The bylaws also provide that the Board shall be divided into three classes, each class being as nearly equal in number as possible. The three classes have staggered terms of three years. The terms of office of three of our directors expire at this Annual Meeting.

Nominees for election are Robert Alpert, Sam Coats and Thomas R. Ransdell. Mr. Alpert is standing for reelection. Mr. Coats and Mr. Ransdell were appointed to the Board on July 29, 2005, the date the spin-off of Chaparral Steel Company became effective.

The proxies solicited hereby cannot be voted for a greater number of persons than the three nominees named below. Unless otherwise indicated, all proxies that authorize the persons named therein to vote for the election of directors will be voted for the election of the nominees named below. Directors are elected by plurality vote. If any of the nominees named should not be available for election as a result of unforeseen circumstances, it is the intention of the persons named in the proxy to vote for the election of such substitute nominee, if any, as the Board of Directors may propose.

Nominees for Directors

The following are nominees for election as directors for a term of office expiring at the Annual Meeting of Shareholders in 2008 or until their respective successors have been elected and qualified.

Name | | | | Age | | Principal Occupation

During Past Five Years* | | Served as

Director

Since | | Proposed

Term to

Expire |

Robert Alpert | | 73 | | President and Chairman of the Board of Angelholm Corp. d/b/a The Alpert Companies (financial services and real estate), Dallas, Texas; director of Argo Funding Co. L.L.C. (venture capital), Dallas, Texas, and Trio Consulting (UK) Ltd. (manufacturing), Stockholm, Sweden | | 1975 | | 2008 |

Sam Coats | | 64 | | President and Chief Executive Officer of S I Restructuring, Inc. (fast casual dining restaurants) since June 2004 (formerly known as Schlotzsky’s, Inc., which hired Mr. Coats to restructure the company and, as a part thereof, filed under chapter 11 of the Bankruptcy Code in July 2004); business and aviation consultant from January 2002 until June 2004; President and Chief Executive Officer of Sammons Travel Group (package tour operator) from July 2000 until June 2001; prior to July 2000, served in various positions, including as chief executive officer, in the airline industry; director of Safety-Kleen Holdco, Inc. and Blue Wing Express | | 2005 | | 2008 |

Thomas R. Ransdell | | 63 | | Private investments since July 2004; served in various management positions with Vulcan Materials Company (largest domestic producer of aggregates) from 1978 until 2004, most recently as President of the Southwest Division | | 2005 | | 2008 |

* Based upon information provided by the directors as of July 1, 2005.

Your Board of Directors unanimously recommends that you vote FOR all of the nominees listed above.

3

Continuing Directors

The term of office for each of the continuing directors expires at the Annual Meeting of Shareholders to be held in the year indicated below, or until his successor is elected and qualified.

Name | | | | Age | | Principal Occupation

During Past Five Years* | | Served as

Director

Since | | Term to

Expire |

Mel G. Brekhus | | 56 | | President and Chief Executive Officer of the Company since June 1, 2004; Executive Vice President-Cement, Aggregate and Concrete of the Company from 1998 until June 2004 | | 2004 | | 2007 |

Gordon E. Forward | | 69 | | Chairman Emeritus of United States Council for Sustainable Development (non-profit association of businesses), Austin, Texas, since December 2002; Private Investments since 2001; Vice Chairman of the Board of Directors of the Company from July 1998 through May 2000; President and Chief Executive Officer of Chaparral Steel Company (at the time, a subsidiary of the Company), Midlothian, Texas until July 1998; director of Norbord Inc. | | 1991 | | 2006 |

Keith W. Hughes | | 59 | | Management Consultant to domestic and international financial institutions since April 2001; Vice Chairman of Citigroup Inc. (commercial banking), New York, New York from November 2000 to April 2001; Chairman and Chief Executive Officer of Associates First Capital Corporation (consumer and commercial finance), Dallas, Texas from February 1995 through November 2000; director of Certegy Inc., Carreker Corporation and Pilgrim’s Pride Corporation | | 2003 | | 2006 |

Henry H. Mauz, Jr. | | 69 | | Admiral U.S. Navy (Ret.); Member of Advisory Council of Northrop Grumman Ship Systems (shipbuilding), Pascagoula, Mississippi; President of Naval Postgraduate School Foundation, Inc. (non-profit organization for enhancement of Naval Postgraduate School), Monterey, California; director of CNF Inc. | | 2003 | | 2006 |

Robert D. Rogers | | 69 | | Chairman of the Board of the Company since October 2004; President and Chief Executive Officer of the Company until May 31, 2004; director of CNF Inc. and Adams Golf, Inc. | | 1970 | | 2007 |

* Based upon information provided by the directors as of July 1, 2005.

4

BOARD OF DIRECTORS, BOARD COMMITTEES, MEETINGS, ATTENDANCE AND FEES

Meetings and Fees

In 2005, the Board of Directors held eight meetings. Each incumbent director attended more than 75% of the aggregate of all meetings of the Board of Directors and the committees on which he served during fiscal year 2005. We do not have a formal policy regarding director attendance at annual meetings of shareholders, but we encourage each director to attend each annual meeting of shareholders.

Directors who are not our employees receive an annual fee of $40,000. The director who chairs the audit committee receives an additional annual fee of $10,000, and other members of the audit committee receive an additional annual fee of $2,000. The lead director and directors who chair the compensation and governance committees each receive an additional annual fee of $5,000, and each member of these committees receives an additional annual fee of $1,000. Additionally, the Chairman of the Board receives an annual grant of 2,500 shares of restricted common stock and each non-employee director receives an annual grant of 1,000 restricted shares of common stock.

In connection with the spin-off of Chaparral Steel Company, the compensation committee recommended to the Board, and the Board approved, removing the restriction on the restricted stock previously issued to the directors as part of their compensation for service as directors. The restriction had prohibited a director to whom the restricted stock was issued from selling or transferring the stock until the director ceased his/her tenure as a director. The restriction also applied to shares of stock distributed as a dividend on the restricted stock, which would have meant that the Chaparral common stock distributed to directors as part of the spin-off of Chaparral would have been restricted even though the continuing directors would no longer be affiliated with Chaparral. On the other hand, Company directors who, in connection with the spin-off, resigned as directors of the Company and became directors of Chaparral would, upon leaving our Board, have had the restriction removed from both the Company restricted stock and the Chaparral common stock distributed as part of the spin-off. In order to resolve this inequitable situation and to remedy certain unfavorable tax results of the manner in which the restriction operated, the decision to remove the restriction was made.

A director may elect to defer annual fees in whole or in part by entering into a deferred compensation agreement prior to the year during which he or she wishes to defer receipt of such fees. Compensation so deferred is denominated in shares of our common stock, the number of which is determined by reference to the average market price during the 30 trading days prior to the date of the agreement. Dividends are credited to the account in the form of common stock equivalents at a value equal to the fair market value of the common stock on the date of the payment of such dividend.

We will make an annual charitable contribution of up to $10,000 to a charity designated by each non-employee director. We also reimburse directors for travel, lodging and related expenses they may incur in attending board and committee meetings.

Board of Directors

The Board of Directors currently has eight members. All but Messrs. Mel G. Brekhus and Robert D. Rogers are independent, based on the New York Stock Exchange listing standards for independence. Based upon our books and records and information provided by the directors, the Board of Directors has determined that the independent directors have no material relationships with us. Mr. Brekhus became our President and Chief Executive Officer and was appointed to the Board on June 1, 2004. Prior to that date he served as our Executive Vice President-Cement, Aggregate and Concrete. Mr. Rogers retired as our President and Chief Executive Officer on May 31, 2004. Even though these directors are not independent, the Board of Directors believes that their wealth of experience and knowledge about the Company contributes greatly to the Board.

5

Committees of the Board

The Board of Directors has four standing committees that are described below. Currently, all Board committees other than the executive committee are composed entirely of independent, non-employee directors. The audit, compensation and governance committees are governed by written charters, which are available on our website (http://www.txi.com). In fiscal year 2005 the Board had a finance committee, which met one time, but the Board has not re-appointed a finance committee for 2006.

Audit Committee

The audit committee, which met seven times during 2005, is currently comprised of Mr. Hughes (Chair), Mr. Coats and Mr. Ransdell. All members meet the New York Stock Exchange listing requirements for independence. In the business judgment of the Board, each of these directors has accounting or related financial management experience required under New York Stock Exchange listing standards, and each of them has been designated by the Board of directors as an “audit committee financial expert” as defined by the Securities and Exchange Commission. The committee selects, evaluates and oversees our independent auditors, and provides oversight on matters relating to our corporate accounting, financial reporting, internal controls and disclosure practices. In addition, the committee reviews our audited financial statements and quarterly financial statements with management and independent auditors, recommends whether such audited financial statements should be included in our Annual Report on Form 10-K and prepares a report to shareholders to be included in this proxy statement.

Compensation Committee

The compensation committee, which met six times in 2005, is currently comprised of Mr. Forward (Chair), Mr. Mauz and Mr. Coats. All members meet the New York Stock Exchange listing requirements for independence. This committee establishes and monitors overall compensation programs and salaries for the Company, reviews the performance of management including the Chief Executive Officer, reviews and approves their salaries and other compensation (except the base compensation of the Chief Executive Officer which must be approved by the independent directors following the recommendation of the compensation committee), and implements our incentive plans. The committee also advises the Board generally with regard to other compensation and employee benefit matters.

Compensation Committee Interlocks and Insider Participation

None of our executive officers served as a member of the compensation committee (or other board committee performing similar functions, or in the absence of any such committee, the entire board of directors) of another corporation, one of whose executive officers served on our compensation committee or as our director. None of our executive officers served as a director of another corporation, one of whose executive officers served on our compensation committee. Mr. Forward was an officer of Chaparral Steel Company, then a subsidiary of the Company, until July 1998.

Governance Committee

The governance committee (formerly the director affairs committee), which met four times in 2005, is currently comprised of Mr. Mauz (Chair), Mr. Hughes and Mr. Ransdell. All members meet the New York Stock Exchange listing requirements for independence. This committee assists the Board of Directors in identifying individuals qualified to become directors and recommends to the Board the nominees for election as directors at the next annual meeting of shareholders. The committee also assists the Board in determining its committee structure, selection of committee members, developing and implementing our corporate governance guidelines and overseeing the evaluation of the Board of Directors and its committees. The Board of Directors has adopted corporate governance guidelines and a code business

6

ethics, which are available on our website (http://www.txi.com) and, upon receipt by the Secretary of the Company of a shareholder’s request, in print.

The governance committee will consider director nominations (other than self-nominations) submitted by shareholders. Such nominations should be submitted to the Secretary of the Company in accordance with the requirements described in the first paragraph under “2006 Shareholder Proposals.” This submission must contain (i) as to each nominee, all information that would be required to be disclosed in a proxy statement with respect to the election of directors pursuant to the Securities Exchange Act of 1934, as amended; (ii) the name and address of the shareholder making the nomination, and the number of shares and length of ownership thereof; (iii) whether the nominee meets the objective criteria for independence of directors under the rules of the New York Stock Exchange and our corporate governance guidelines; (iv) a description of all arrangements or understandings, and the relationship, between the shareholder and the nominee, and the same as between the nominee and the shareholder on the one hand and the Company on the other; and (v) the written consent of each nominee to serve as a director, if so elected. The committee will consider and evaluate persons recommended by shareholders in the same manner as potential nominees identified by the governance committee and the Board of Directors.

The governance committee identifies nominees for director from various sources. In assessing potential director nominees, the committee considers individuals who have demonstrated exceptional ability and judgment and who will be most effective, in conjunction with the other directors and nominees, in collectively serving the long-term interests of the shareholders. All director nominees must possess a reputation for the highest personal and professional ethics, integrity and values. The committee will also consider any potential conflicts of interest. In addition, nominees must also be willing to devote sufficient time and effort in carrying out their duties and responsibilities effectively, and should be committed to serve on the Board for an extended period of time.

Executive Committee

The executive committee, which did not meet in 2005, is comprised of Mr. Brekhus (Chair), Mr. Rogers, and Mr. Alpert. The committee has and may exercise the powers of the Board of Directors in the management of the business and affairs of the Company, except the committee may not exercise the power to fill vacancies in the Board, change the membership of or fill vacancies in any committee, change the bylaws, declare dividends, issue stock, or approve, adopt or recommend to stockholders any actions required to be submitted to stockholders for a vote.

Executive Sessions and Lead Director

Our non-management directors and independent directors hold executive sessions in accordance with the New York Stock Exchange Listed Company Manual. Because our Chairman of the Board is not an independent director, the Board has elected Robert Alpert as lead director to preside at the executive sessions.

Communications with Directors

Shareholders may communicate directly with the Board of Directors, the non-management directors as a group or any particular director by sending written correspondence to the attention of the Board or the desired group or individual in care of the General Counsel of the Company at Texas Industries, Inc., 1341 W. Mockingbird Lane, Suite 700W, Dallas, Texas 75247. Written communications may also be submitted anonymously by email at txi@openboard.info. The written communications will be forwarded to the person or persons addressed unless such communications are considered, in the reasonable judgment of the General Counsel, to be inappropriate for submission to the intended recipients. Examples of shareholder communications that would be considered inappropriate for submission include those

7

regarding matters such as customer complaints, solicitations, communications that do not relate directly or indirectly to our business or that relate to improper or irrelevant topics.

Other Relationships and Transactions

Mr. Robert D. Rogers, our Chairman of the Board, is the father of James B. Rogers, our Vice President-Consumer Products.

No reportable transactions occurred between the Company and any director, nominee for director, officer or any affiliate of, or person related to, any of the foregoing since the beginning of our last fiscal year (June 1, 2004).

SECURITY OWNERSHIP OF MANAGEMENT

The following table sets forth as of July 1, 2005, the approximate number of shares of our common stock beneficially owned by each director, by each nominee for director, by each executive officer named in the Summary Compensation Table and by all of our directors and executive officers as a group.

| | Company Common Stock | |

| | Beneficially Owned** | | Percent (1) | |

Robert Alpert | | | 46,605 | (1) | | | * | | |

Mel G. Brekhus | | | 240,039 | (1) | | | 1.0 | | |

Sam Coats | | | — | | | | * | | |

Gordon E. Forward | | | 4,000 | | | | * | | |

Keith W. Hughes | | | 2,500 | | | | * | | |

Henry H. Mauz, Jr. | | | 1,500 | | | | * | | |

Thomas R. Ransdell | | | 4 | | | | * | | |

Robert D. Rogers | | | 523,569 | (1) | | | 2.3 | | |

Tommy A. Valenta | | | 27,337 | (1) | | | * | | |

Richard M. Fowler | | | 132,656 | (1) | | | * | | |

William J. Durbin | | | 34,915 | (1) | | | * | | |

Barry M. Bone | | | 46,390 | (1) | | | * | | |

All directors and executive officers as a group (19 persons) | | | 1,219,325 | (1) | | | 5.2 | | |

* Represents less than one percent (1%) of the total number of shares outstanding.

** Except as indicated in the note below, each person has the sole voting and investment authority with respect to the shares set forth in the above table.

(1) Includes, with respect to such person(s) shares of common stock subject to options exercisable within 60 days of July 1, 2005, as follows: Robert Alpert, 35,995 shares; Mel G. Brekhus, 189,815 shares; Robert D. Rogers, 274,629 shares; Tommy A. Valenta, 9,065 shares; Richard M. Fowler, 87,684 shares; William J. Durbin, 25,915 shares; Barry M. Bone, 46,323 shares; and all directors and executive officers as a group, 772,476 shares.

8

EXECUTIVE COMPENSATION

There is shown below information concerning the annual and long-term compensation for services in all capacities to the Company for the fiscal years ended May 31, 2005, 2004 and 2003, of those persons who were, at May 31, 2005, (i) the Chief Executive Officer and (ii) the other four most highly compensated executive officers.

Summary Compensation Table

| | | | | | | | Long Term Compensation | | | |

| | | | Annual Compensation | | Awards | | Payouts | | | |

Name and

Principal Position | | | | Year | | Salary ($) | | Bonus ($) | | Securities

Underlying

Options/SARs (#)(1) | | LTIP

Payouts ($) | | All Other

Compensation

($) (2) | |

Mel G. Brekhus | | 2005 | | | 497,115 | | | | 375,819 | | | | 156,645 | | | | — | | | | 7,790 | | |

President and Chief | | 2004 | | | 352,115 | | | | 87,149 | | | | — | | | | — | | | | 7,600 | | |

Executive Officer | | 2003 | | | 340,000 | | | | — | | | | 79,989 | | | | — | | | | 7,850 | | |

Tommy A. Valenta (3) | | 2005 | | | 375,000 | | | | 212,625 | | | | 14,531 | | | | 41,443 | | | | 7,790 | | |

Executive Vice President—Steel | | 2004 | | | 342,692 | | | | 87,149 | | | | — | | | | — | | | | 7,600 | | |

| | 2003 | | | 340,000 | | | | — | | | | 79,989 | | | | — | | | | 7,850 | | |

Richard M. Fowler | | 2005 | | | 345,000 | | | | 195,615 | | | | 13,331 | | | | — | | | | 9,146 | | |

Executive Vice President— | | 2004 | | | 322,115 | | | | 79,724 | | | | — | | | | — | | | | 7,600 | | |

Finance and Chief Financial | | 2003 | | | 310,000 | | | | — | | | | 73,323 | | | | — | | | | 7,850 | | |

Officer | | | | | | | | | | | | | | | | | | | | | | | |

William J. Durbin | | 2005 | | | 245,000 | | | | 138,915 | | | | 9,465 | | | | — | | | | 7,790 | | |

Vice President—Human | | 2004 | | | 222,115 | | | | 54,974 | | | | — | | | | — | | | | 7,600 | | |

Resources | | 2003 | | | 210,000 | | | | — | | | | 61,325 | | | | — | | | | 7,850 | | |

Barry M. Bone | | 2005 | | | 190,000 | | | | 107,730 | | | | 7,332 | | | | — | | | | 7,790 | | |

Vice President—Real Estate | | 2004 | | | 176,923 | | | | 43,788 | | | | — | | | | — | | | | 6,146 | | |

| | 2003 | | | 170,000 | | | | — | | | | 38,661 | | | | — | | | | 7,005 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

(1) The number of securities underlying options/SARs has been adjusted to reflect the spin-off of Chaparral Steel Company on July 29, 2005.

(2) Vested and non-vested portion of amounts contributed and allocated by employer to employee benefit plans.

(3) In connection with the spin-off of Chaparral Steel Company, Mr. Valenta resigned as an executive officer on July 29, 2005. He is now the President and Chief Executive Officer of Chaparral.

Mel G. Brekhus, our President and Chief Executive Officer, has entered into a three-year employment contract with the Company through May 31, 2007. The contract provides for a base annual compensation of $500,000 and a Share Appreciation Right (“SAR”) grant in the amount of 133,315 units (as adjusted for the spin-off of Chaparral Steel Company). Mr. Brekhus will also participate in our annual and three-year incentive compensation plans adopted from time to time by the Board of Directors for employees and key executives. In the event Mr. Brekhus’ base annual compensation and incentive compensation earned during any one fiscal year is greater than $900,000, the Board of Directors may, in its discretion, defer payment of amounts in excess of $900,000 until termination of employment. Deferred compensation is denominated in shares of our common stock determined by reference to the fair market value of the stock (as defined in the contract) at the time of deferral, and dividends are credited to the deferred account in the form of common stock equivalents at a value equal to the fair market value of the

9

stock at the date of payment of such dividend. The shares of common stock equivalents credited to the account are adjusted to reflect any increase or decrease in the number of shares outstanding as a result of stock splits, combination of shares, recapitalizations, mergers or consolidations. Following a change of control that is not approved by the Board of Directors, Mr. Brekhus may, in his sole discretion, elect to terminate his services for any reason or no reason upon thirty days’ written notice. Upon such a voluntary termination, (i) Mr. Brekhus will receive two times the annual base compensation and incentives for the immediately preceding fiscal year; (ii) all outstanding options and SARs held by Mr. Brekhus will be accelerated and vested; and (iii) Mr. Brekhus will no longer be subject to the non-competition provisions contained in the employment contract.

We offer financial security plans for substantially all of our senior managerial and executive employees. The plans include disability benefits under certain circumstances and death benefits payable to beneficiaries for a period of ten years or until the participant would have attained age 65, whichever last occurs. Participants in the plans who retire at or after attaining age 65 (age 60 in the case of certain executive officers) will be entitled to a supplemental retirement benefit. In the event of termination of employment under certain circumstances following a change in control (as defined in the plans), a participant will be deemed to be fully vested in any supplemental retirement benefit, without reduction, provided by the plans. With respect to the named executive officers, the normal retirement benefit may be either (i) between 2.5 and 10 times covered salary depending upon age at enrollment and the time when additional coverage is offered, or (ii) 45% of covered annual salary for life with a 15-year certain benefit, depending on the terms of such plan when the participant enrolled in the plan. The estimated annual benefits payable upon retirement at normal retirement age for each of the named executive officers who participate in the plans is as follows: Mel G. Brekhus, $250,000; Tommy A. Valenta, $170,000; Richard M. Fowler, $191,371; and William J. Durbin, $55,125.

2005 Stock Option and SAR Grants

The following table sets forth certain information concerning options and SARs granted during the fiscal year ended May 31, 2005, to each named executive officer:

| | No. of

Securities

Underlying

Options/SARs

Granted | | Percent of

Total

Options/SARs

Granted to

Employees in | | Exercise

or Base

Price Per

Share | | | | Potential Realizable

Value of Assumed

Annual Rate of Stock Price

Appreciation for Option

Term (3) | |

Name | | | | (#)(1)(2) | | 2005 | | ($/sh)(2) | | Expiration Date | | 0% | | 5% | | 10% | |

Mel G. Brekhus | | | 23,330 | | | | 5.37 | % | | 45.86873 | | January 11, 2015 | | | 0 | | | 672,991 | | 1,705,492 | |

| | | 133,315 | | | | 30.71 | % | | 28.23759 | | June 1, 2014 | | | 0 | | | 2,367,474 | | 5,999,643 | |

Tommy A. Valenta | | | 14,531 | | | | 3.35 | % | | 45.86873 | | January 11, 2015 | | | 0 | | | 419,170 | | 1,062,259 | |

Richard M. Fowler | | | 13,331 | | | | 3.07 | % | | 45.86873 | | January 11, 2015 | | | 0 | | | 384,554 | | 974,535 | |

William J. Durbin | | | 9,465 | | | | 2.18 | % | | 45.86873 | | January 11, 2015 | | | 0 | | | 273,033 | | 691,919 | |

Barry M. Bone | | | 7,332 | | | | 1.69 | % | | 45.86873 | | January 11, 2015 | | | 0 | | | 211,503 | | 535,991 | |

| | | | | | | | | | | | | | | | | | | | | | | |

(1) The options to purchase common stock and SARs become exercisable in five equal annual installments beginning one year from the date of grant.

(2) The number of securities underlying options/SARs granted and the exercise price per share have been adjusted to reflect the spin-off of Chaparral Steel Company on July 29, 2005.

(3) The dollar amounts under these columns are the result of calculation at 0% and at the 5% and 10% rates set by the Securities and Exchange Commission and are not intended to forecast possible future appreciation, if any, of the price of our common stock. We did not use an alternative formula for a

10

grant date value as we are not aware of any formula which will determine with reasonable accuracy a present value based on future unknown or volatile factors.

Option/SAR Exercises and Year-End Values

The following table provides information concerning each stock option and SAR exercised during the fiscal year ended May 31, 2005, by each of the named executive officers and the value of unexercised options and SARs held by such executive officer on May 31, 2005.

Name | | | | Shares

Acquired on

Exercise (#) (1) | | Value

Realized ($) | | Number of

Securities Underlying

Unexercised

Options/SARs at Fiscal

Year End (#) (2)

Exercisable/Unexercisable | | Value of Unexercised

In-the-Money

Options/SARs at Fiscal

Year End ($) (3)

Exercisable/Unexercisable | |

Mel G. Brekhus | | | 45,000 | | | | 1,892,362 | | | | 189,815 / 217,595 | | | | 1,867,155 / 1,788,189 | | |

Tommy A. Valenta | | | 142,552 | | | | 3,727,238 | | | | 9,065 / 75,484 | | | | 167,476 / 950,742 | | |

Richard M. Fowler | | | 85,507 | | | | 2,296,505 | | | | 87,684 / 70,284 | | | | 776,411 / 880,749 | | |

William J. Durbin | | | 27,161 | | | | 658,444 | | | | 25,915 / 55,327 | | | | 357,157 / 718,897 | | |

Barry M. Bone | | | 25,812 | | | | 679,579 | | | | 46,323 / 37,088 | | | | 373,253 / 461,558 | | |

(1) The shares acquired on exercise were acquired prior to the spin-off of Chaparral Steel Company; therefore, no adjustment has been made for the spin-off.

(2) The number of shares underlying unexercised options/SARs has been adjusted to reflect the spin-off of Chaparral Steel Company on July 29, 2005.

(3) Computed based upon the difference between aggregate fair market value and aggregate purchase price.

11

Performance Graph

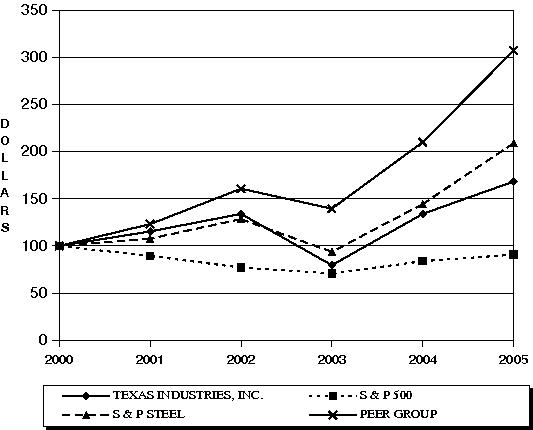

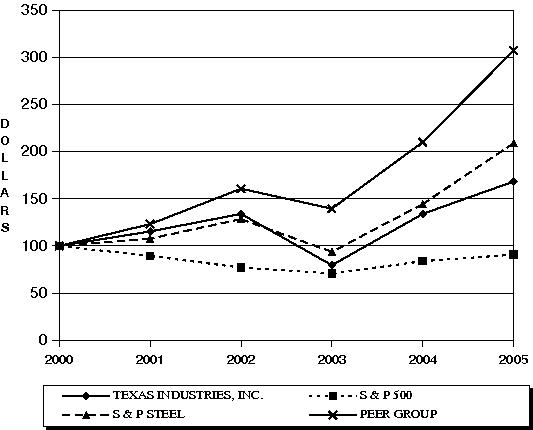

During the years presented below, we had two major business segments—a cement, aggregate and concrete (“CAC”) segment and a steel segment. The following chart compares the cumulative total shareholder return on our common stock for the five-year period ended May 31, 2005, with the cumulative total return of the Standard & Poor’s 500 Composite Stock Price Index (the “S&P 500”), the Standard & Poor’s Steel Index (the “S&P Steel”) and a CAC peer group comprised of Centex Construction Products, Inc., Florida Rock Industries, Inc. and Lafarge North America Inc. (the “Peer Group”). These comparisons assume the investment of $100 on May 31, 2000, and the reinvestment of dividends.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN

AMONG TEXAS INDUSTRIES, INC., THE S&P 500 INDEX,

THE S&P STEEL INDEX AND A PEER GROUP

12

REPORT OF THE COMPENSATION COMMITTEE

ON EXECUTIVE COMPENSATION

The Compensation Committee establishes the general compensation policies of the Company and recommends to the Board compensation incentive plans for executive officers. It also administers the Company’s equity based compensation plans. The Company’s benefit plans, such as its retirement plan and group insurance plan, are administered by the Company’s Welfare Committee which is comprised of officers of the Company.

General. The objective of the Company’s management compensation program is to (i) attract and retain highly qualified and productive individuals; (ii) motivate such individuals; and (iii) align their interests with those of the Company’s shareholders by building long-term value and thereby improving the return to the Company’s shareholders. The program provides for competitive base salaries, annual bonus opportunities, long-term incentives in the form of a rolling three-year incentive plan, stock options and other forms of equity based compensation and competitive benefits including health, life and disability insurance, vacation, a financial security plan and a savings and defined contribution retirement plan. Typically, executives receive annual performance reviews. Such reviews cover considerations such as revenue generated, operating profit, return on assets, cost improvements, operational efficiency, safety, customer service, and cooperation with other employees, depending on the responsibilities of the executive. Only the Chief Executive Officer of the Company has an employment agreement.

Compensation Elements. An executive officer’s total compensation consists of three basic elements—base salary, annual incentives and long-term incentives. Annual and long-term incentives are a significant portion of total compensation and are strongly linked to financial performance.

Salaries. Salary comprises approximately 45% of the total compensation objective for an executive other than the Chief Executive Officer. Salaries of the Company’s executive officers are determined by the general compensation policies established by the Committee. Subjective criteria such as the impact the executive has on the Company, the skills and experience required by the job, individual performance and internal equities are considered in determining salary levels. Quantitative relative weights are not assigned to the different criteria nor is a mathematical formula followed. Salaries are also reviewed periodically and compared to industry and geographic salary surveys to assure that they are in line with competitive market levels. The Company may at times suspend or limit salary increases when the operating performance of the Company will not support such increases.

Annual Incentives. Annual cash incentives, which comprise approximately 10% of an executive’s total compensation objective, are provided in order to (i) encourage above-average performance and teamwork, (ii) focus employees’ work on short-term results which are key to the Company’s long-term business success, and (iii) attract and retain the best possible employees by rewarding outstanding performance. The Committee recommends and the Board of Directors annually considers and adopts for the ensuing fiscal year annual cash incentive plans for employees of various business segments of the Company, including the named executives, who do not participate in operations/production plans. A cash bonus equal to a designated percentage of an eligible executive’s annual salary is earned if pre-established levels of return on equity (translated into a return on assets) are achieved by the respective business segments of the Company. Cash incentive awards increase as specified return on equity levels increase. Target return on equity levels and the designated percentage of an executive’s salary are not established for executives individually. Rather, they are the same for all executives in order to foster a team-based approach. The Board of Directors has approved annual incentive plans for fiscal year 2006 under which a threshold return on equity for each of the business segments has been established.

Long-Term Incentives. Long-term incentives, which comprise approximately 45% of an executive’s total compensation objective, are provided under a continuous rolling three-year executive cash incentive plan, established for certain executives of the Company including the named executives, and the

13

Company’s equity based compensation plans. The Company provides equity based compensation awards, which are typically stock options, under the 2004 Omnibus Equity Compensation Plan. Awards under this plan may include stock options, performance shares, performance units, and restricted stock. The Committee believes that equity-based incentive plans encourage eligible employees to invest in common stock of the Company, and that such plans foster employees’ loyalty to the Company and increase their interest in the Company’s business and success. The Committee also believes that equity-based incentive plans strengthen the ability of the Company to attract, motivate and retain executives of the superior capability required to achieve the Company’s business objectives in an intensely competitive environment.

For an executive to earn an annual cash incentive award under the rolling three-year incentive plan, the Company must reach or surpass the average return on equity threshold established by the Committee for the three-year period ending in the year in respect of which the incentive is earned. If the average threshold is reached or surpassed, a participating executive, other than the Chief Executive Officer, can earn a cash incentive award ranging from 35% to 120% or more of his or her base salary, depending on the return on equity achieved, and the recommendation of the Chief Executive Officer based upon his subjective evaluation of the executive’s individual performance. The Chief Executive Officer’s incentive award under the three-year plan can range from 50% to 140% or more of his base salary. The Committee believes that the rolling three-year plan focuses plan participants on growth and profitability for the Company.

Chief Executive Officer’s 2004 Compensation. Compensation for the Chief Executive Officer is determined through a process similar to that described above for executive officers in general and is embodied in the terms of an employment contract. Pursuant to the terms of the employment contract (see Executive Compensation), the Chief Executive Officer received an annual salary consisting of a $500,000 base salary, a bonus of $375,819 and an award of 133,315 share appreciation rights.

Tax Deductibility of Executive Compensation. The Omnibus Budget Reconciliation Act of 1993 added Section 162(m) to the Internal Revenue Code. Section 162(m) makes certain “non-performance based” compensation to certain executives of the Company in excess of $1,000,000 non-deductible to the Company. To qualify as “performance-based compensation”, performance goals must be pre-established and such goals approved by the Company’s stockholders before such compensation is paid. The Company generally intends to structure the compensation with its executives to achieve maximum deductibility under Section 162(m) with minimum sacrifices in flexibility and corporate objectives.

James M. Hoak, Chair* | | Henry H. Mauz, Jr., Member |

| | Ian Wachtmeister, Member* |

* In connection with the spin-off of Chaparral, on July 29, 2005 Mr. Hoak and Mr. Wachtmeister resigned and became directors of Chaparral.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee of the Board of Directors is responsible for, among other things, reviewing the Company’s financial statements with management and the Company’s independent auditors. The Committee’s role is one of oversight, whereas the Company’s management is responsible for preparing the Company’s financial statements and the independent auditors are responsible for auditing those financial statements. The Board of Directors has adopted a written Audit Committee Charter for the Committee. The Committee annually reviews and reassesses the adequacy of such Charter.

In connection with the fiscal 2005 audit, the Audit Committee has: (i) reviewed and discussed the audited financial statements with management; (ii) discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards 61 (communication with Audit Committees);

14

(iii) received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and discussed with the auditors the auditors’ independence; and (iv) recommended, based on the reviews and discussions noted above, to the Board of Directors that the audited financial statements be included in the Company’s 2005 Annual Report on Form 10-K for filing with the Securities and Exchange Commission.

Keith W. Hughes, Chair | | Eugenio Clariond, Member* |

| | Elizabeth C. Williams, Member* |

* In connection with the spin-off of Chaparral, on July 29, 2005 Mr. Clariond and Ms. Williams resigned and became directors of Chaparral.

INDEPENDENT AUDITORS

Ernst & Young LLP were our independent auditors for the last fiscal year and will continue to be for the current year. A representative of Ernst & Young LLP will attend the Annual Meeting. Although such representative does not intend to make a statement to the shareholders, he or she will be available to respond to any relevant questions of the shareholders.

FEES PAID TO INDEPENDENT AUDITORS

Audit Fees. The aggregate fees billed for professional services rendered by Ernst & Young LLP for the audit of our annual financial statements and for the reviews of our financial statements included in the quarterly reports on Form 10-Q were approximately $1,328,000 in fiscal year 2005 and $425,000 in fiscal year 2004.

Audit-Related Fees. The aggregate fees paid for audit-related services rendered by Ernst & Young LLP were approximately $541,000 in fiscal year 2005 and $83,000 in fiscal year 2004. Audit-related services included pension audits and accounting consultations, and in fiscal year 2005 services related to the spin-off and related restructuring.

Tax Fees. The aggregate fees paid for services rendered by Ernst & Young LLP for tax compliance and tax consulting were approximately $289,000 in fiscal year 2005 and $163,000 in fiscal year 2004.

All Other Fees. There were no other fees paid to, or services rendered by Ernst & Young LLP in fiscal years 2005 and 2004.

In appointing Ernst & Young LLP to serve as independent auditors for the fiscal year ending May 31, 2005, the audit committee considered whether the provision of these non-audit services is compatible with maintaining the independent auditors’ independence.

Since the effective date of the SEC rule requiring audit committee pre-approval of all audit and permissible non-audit services provided by independent registered public accountants, the audit committee has pre-approved all audit and permissible non-audit services provided by Ernst & Young LLP. Prior to the engagement of Ernst & Young LLP to provide audit and permissible non-audit services, the firm provides our Chief Financial Officer with a proposal and fee estimate, which he then communicates to the audit committee before it acts on the request for pre-approval of such services.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities and Exchange Act of 1934 generally requires our directors and executive officers and persons who own more than 10% of a registered class of our equity securities (“10% owners”) to file with the Securities and Exchange Commission and the New York Stock Exchange initial reports of ownership and reports of changes in ownership of our common stock and other equity securities.

15

Directors, executive officers and 10% owners are required by the Securities and Exchange Commission regulation to furnish us with copies of all Section 16(a) forms they file. Based solely on review of copies of such reports furnished to us and written transaction reports of our directors and executive officers indicating that no other reports were required to be filed during the 2005 fiscal year, we believe that all filing requirements applicable to our directors, executive officers and 10% owners were complied with in accordance with Section 16(a), except a Form 4 for reporting the award of 5,000 stock options to each of Robert D. Rogers and Ian Wachtmeister upon their re-election as directors on October 19, 2004, was not filed until November 10, 2004.

ANNUAL REPORT

A copy of our Annual Report for the fiscal year ended May 31, 2005 is being mailed to each shareholder of record along with the proxy material, but is not to be considered as a part of the proxy soliciting materials.

2006 SHAREHOLDER PROPOSALS

Any shareholder proposal intended to be presented for consideration at the 2006 Annual Meeting of Shareholders and to be included in our Proxy Statement must be in proper form and received by the Secretary of the Company at our principal executive offices by the close of business on April 28, 2006. The proposal must comply with the regulations of the Securities and Exchange Commission regarding the inclusion of shareholder proposals in our Proxy Statement.

Shareholder proposals submitted outside the procedure set forth above, including nominations for directors, must be mailed to the Corporate Secretary at the address above and must be received by the Corporate Secretary on or before April 28, 2006. If the proposal is received after that date our proxy for the 2006 Annual Meeting may confer discretionary authority to vote on such matters without any discussion of such matter in the Proxy Statement for the 2006 Annual Meeting.

MULTIPLE SHAREHOLDERS SHARING SAME ADDRESS

We have elected to implement the Securities and Exchange Commission’s new “householding” rules that permit delivery of only one set of proxy materials to shareholders who share an address unless otherwise requested. If you share an address with another shareholder and have received only one set of proxy materials, you may request a separate copy of these materials at no cost to you by calling Mellon Investor Services LLC at (800) 454-8620, or by writing to Mellon Investor Services LLC, P.O. Box 3316, So. Hackensack, NJ 07606. For future annual meetings, you may request separate voting materials, or request that we send only one set of proxy materials to you if you are receiving multiple copies, by contacting Mellon Investor Services LLC at the above phone number or address.

16

OTHER MATTERS

At the date of this Proxy Statement, the Board of Directors was not aware that any matters not referred to in this Proxy Statement would be presented for action at this Annual Meeting. If any other matters should come before the Annual Meeting, the persons named in the accompanying proxy will have the discretionary authority to vote all proxies in accordance with their best judgment.

| By Order of the Board of Directors, | |

|

| |

| Frederick G. Anderson | |

| Secretary | |

17

| | PROXY |

| | TEXAS INDUSTRIES, INC. |

| | Annual Meeting of Shareholders – October 18, 2005 |

| | THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS OF THE COMPANY |

| | |

| | The undersigned hereby appoints Melvin C. Brekhus and Robert D. Rogers, and each of them, with power to act without the other and with power of substitution, as proxies and attorneys-in-fact and hereby authorizes them to represent and vote, as provided on the other side, all the shares of Texas Industries, Inc. Common Stock which the undersigned is entitled to vote, and, in their discretion, to vote upon such other business as may properly come before the Annual Meeting of Shareholders of the Company to be held on Tuesday, October 18, 2005 at 9:30 A.M. at the FC Dallas Entertainment Center, 6000 Main Street, Frisco, Texas or at any adjournment or postponement thereof, with all powers which the undersigned would possess if present at the Meeting. |

| | (Continued and to be marked, dated and signed, on the other side) For address change, householding, and/or comments, please mark the corresponding box on the reverse side. |

| | Address Change | Householding | Comments |

| | | | | |

| | | YES | NO | |

| | | o | o | |

| |  FOLD AND DETACH HERE FOLD AND DETACH HERE

|

| | |

| | You can now access your Texas Industries, Inc. account online. |

Access your Texas Industries, Inc. shareholder account online via Investor ServiceDirect® (ISD).

Mellon Investor Services LLC, Transfer Agent for Texas Industries, Inc., now makes it easy and convenient to get current information on your shareholder account.

| • View account status | • View payment history for dividends |

| • View certificate history | • Make address changes |

| • View book-entry information | • Obtain a duplicate 1099 tax form |

| | • Establish/change your PIN |

Visit us on the web at http://www.melloninvestor.com/isd

For Technical Assistance Call 1-877-978-7778 between 9am-7pm

Monday-Friday Eastern Time

Investor ServiceDirect® is a registered trademark of Mellon Investor Services LLC

THIS PROXY WILL BE VOTED AS DIRECTED, OR IF NO DIRECTION IS INDICATED, WILL BE VOTED “FOR” THE PROPOSAL. | Please mark here

for Address Change,

Householding

and/or Comments | o |

| and note it on the reverse side. |

| |

1. | Election of Directors | FOR

ALL | | WITHHELD

FOR ALL |

| |

| Nominees: | o | | o | | |

| 01 Robert Alpert | | | | | |

| 02 Sam Coats | | | | | |

| 03 Thomas R. Ransdell | | | | | |

| | | | | | HOUSEHOLDING AND ELECTRONIC CONSENT |

| | | | | | |

Withheld for the nominees you list below: (Write that

nominee’s name in the space provided below.) | | By marking the box in the upper right corner and noting it on the reverse side, you consent to receive certain future shareholder communications in a single package per household. Additionally, you may choose to consent to receive proxy materials and tax documents online by logging on to the transfer agent website at www.melloninvestor.com/isd where step-by-step instructions will prompt you through the registration. |

| | |

| | |

2. | To transact other such business that may properly come before the meeting | I PLAN TO ATTEND

THIS MEETING | o |

| | | | |

| | | | |

| | | | |

| | | |

| | |

Signature | | | | Signature | | | | Date | | |

NOTE: Please sign as name appears hereon. Joint owners should each sign. When signing as officer, attorney, executor, administrator, trustee or guardian, please give full title as such. |

FOLD AND DETACH HERE FOLD AND DETACH HERE

|

| | | | | | | | | | | | | | | | | | | | | | |

Vote by Internet or Telephone or Mail

24 Hours a Day, 7 Days a Week

Internet and telephone voting is available through 11:59 PM Eastern Time

the day prior to annual meeting day.

Your Internet or telephone vote authorizes the named proxies to vote your shares in the same manner

as if you marked, signed and returned your proxy card.

Internet | | Telephone | | Mail |

http://www.proxyvoting.com/txi | | 1-866-540-5760 | | Mark, sign and date |

Use the internet to vote your proxy. | OR | Use any touch-tone telephone to | OR | your proxy card and |

Have your proxy card in hand | vote your proxy. Have your proxy | return it in the |

when you access the web site. | | card in hand when you call. | | enclosed postage-paid |

| | | | envelope. |

If you vote your proxy by Internet or by telephone,

you do NOT need to mail back your proxy card.

You can view the Annual Report and Proxy Statement

on the Internet at http://investorrelations.txi.com