SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [x]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement | [ ] | Soliciting Material Under Rule 14a-12 |

| [ ] | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | | |

| [x] | Definitive Proxy Statement | | |

| [ ] | Definitive Additional Materials | | |

TEXAS INDUSTRIES, INC.

(Name of Registrant as Specified In Its Charter)

_______________________________________

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [x] | | No fee required. |

| | | |

| [ ] | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

1) Title of each class of securities to which transaction applies:

_____________________________________________________________________________________________

2) Aggregate number of securities to which transaction applies:

_____________________________________________________________________________________________

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

(set forth the amount on which the filing fee is calculated and state how it was determined): |

_____________________________________________________________________________________________

4) Proposed maximum aggregate value of transaction:

_____________________________________________________________________________________________

5) Total fee paid:

_____________________________________________________________________________________________

| [ ] | | Fee paid previously with preliminary materials: |

_____________________________________________________________________________________________

| [ ] | | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2)and identify the filing

for which the offsetting fee was paid previously. Identify the previous filing by registration statement number,

or the form or schedule and the date of its filing. |

1) Amount previously paid:

_____________________________________________________________________________________________

2) Form, Schedule or Registration Statement No.:

_____________________________________________________________________________________________

3) Filing Party:

_____________________________________________________________________________________________

4) Date Filed:

_____________________________________________________________________________________________

| | | TEXAS INDUSTRIES, INC.

1341 W. MOCKINGBIRD LANE · DALLAS, TEXAS 75247 · (972) 647-6700 |

August 28, 2002

DEAR SHAREHOLDER:

You are cordially invited to attend the Annual Meeting of the Shareholders of Texas Industries, Inc., to be held at 9:30 A.M. Central Daylight Time, on Tuesday, October 15, 2002, at the Company’s RailPort Industrial Park, U.S. Highway 67 at RailPort Parkway, Midlothian, Texas.

The following Notice of Annual Meeting and Proxy Statement describe the formal business to be transacted at the Annual Meeting. During the Annual Meeting we will also report on the operations of the Company. Our 2002 Annual Report accompanies this Proxy Statement.

It is important that your shares be represented at the Annual Meeting regardless of the size of your holdings. If you are unable to attend in person, we urge you to participate by voting your shares by proxy. You may do so by filling out and returning the enclosed proxy card or by voting your proxy by telephone or via the Internet.

If you arrive early, you are invited to have coffee and meet informally with the Directors.

| | Sincerely,

|

| | |

|

| | | Robert D. Rogers |

| | | President |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held On October 15, 2002

The Annual Meeting of Shareholders of Texas Industries, Inc. (the “Company”) will be held at the Company’s RailPort Industrial Park, U.S. Highway 67 at RailPort Parkway, Midlothian, Texas, on Tuesday, October 15, 2002, at 9:30 A.M. (CDT) for the following purposes:

| | 1. | | To elect three (3) directors to terms expiring in 2005. |

| | | |

| | 2. | | To transact such other business that may properly come before the Annual Meeting or any adjournment thereof. |

Only Shareholders of record at the close of business on August 21, 2002 will be entitled to vote at the Annual Meeting. A list of such Shareholders will be open to the examination of any Shareholder during ordinary business hours for a period of ten days prior to the Annual Meeting, at the Executive Offices of the Company at 1341 W. Mockingbird Lane, Dallas, Texas 75247-6913.

While you are encouraged to attend the Annual Meeting, please vote your shares as promptly as possible. You may vote your shares in a number of ways. You may mark your votes, date, sign and return the proxy card or voting instruction form. If you have shares registered in your own name, you may choose to vote those shares via the Internet at http://www.proxyvote.com, or you may vote telephonically, within the U.S. and Canada only, by calling the toll-free number listed on your proxy card or voting instruction form. If you hold Company shares with a broker or bank, you may also be eligible to vote via the Internet or by telephone if your broker or bank participates in the proxy voting program provided by ADP Investor Communication Services.

| | By Order of the Board of Directors,

|

| | |

|

| | | Robert C. Moore |

| | | Secretary |

Dallas, Texas

August 28, 2002

| | TEXAS INDUSTRIES, INC.

1341 W. MOCKINGBIRD LANE · DALLAS, TEXAS 75247 · (972) 647-6700 |

PROXY STATEMENT

For

ANNUAL MEETING OF SHAREHOLDERS

To Be Held October 15, 2002

SOLICITATION OF PROXIES

This Proxy Statement is furnished in connection with the solicitation by and on behalf of the Board of Directors of Texas Industries, Inc., a Delaware corporation (the “Company”), of proxies for exercise at the Annual Meeting of Shareholders of the Company to be held on October 15, 2002, and at any adjournment thereof. The approximate date on which this Proxy Statement and accompanying proxy were first sent to Shareholders is August 28, 2002.

The cost of soliciting proxies has been, or will be, borne by the Company. In addition to solicitation by mail, the Company will request banks, brokers and other custodians, nominees, and fiduciaries to send proxy material to the beneficial owners and to secure their voting instructions, if necessary. The Company will reimburse them for their expenses in so doing. If proxies are not promptly received, officers and regular employees of the Company may solicit proxies from some Shareholders in person, by telephone or by telecopy. In addition, the Company has retained ADP Investor Communication Services to assist in the solicitation of proxies at a cost of $5,000 plus reasonable out-of-pocket expenses.

OUTSTANDING VOTING STOCK AND QUORUM

The outstanding voting securities of the Company as of August 21, 2002, were 21,035,803 shares of Common Stock. Each share is entitled to one vote. The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the issued and outstanding voting securities of the Company is necessary to constitute a quorum to transact business.

VOTING OF PROXY

Although a Shareholder of record at the close of business on August 21, 2002 may not be able to attend the Annual Meeting in person, that Shareholder has the opportunity to vote by using the proxy solicited by the Board of Directors. Voting by use of the proxy can be accomplished either by dating, signing and returning the proxy card in the envelope which is enclosed with this document, by calling the toll-free number and following the instructions set forth on the proxy card, or via the Internet by following the instructions set forth on the proxy card.

Shares cannot be voted at the Annual Meeting unless the owner is present or represented by proxy. Any proxy may be revoked prior to the voting by notice in writing to the Secretary of the Company at the address stated above, by submitting another proxy by telephone or via the Internet, or by voting in person at the Annual Meeting.

Whether a Shareholder chooses to vote by mail, telephone or Internet, a Shareholder can specify approval, disapproval or absentia from each proposal set forth on the proxy card. If the Shareholder properly signs and returns the proxy card or votes by telephone or Internet without specifying how the shares are to be voted, those shares will be voted in accordance with the Board of Directors’ recommendations.

Abstentions and broker non-votes (as defined below) will be counted for the purpose of determining whether a quorum is present at the Annual Meeting. For the purpose of determining whether a proposal (except for the election of directors) has received a majority vote, abstentions will be included in the vote totals with the result that abstention will have the same effect as a negative vote. In instances where shares are held in street name and the broker is prohibited from exercising discretionary authority for the beneficial owner who has not returned a proxy (“broker non-votes”), those shares will not be included in the vote totals and, therefore, will have no effect on the vote.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table furnishes information concerning all persons known to the Company to beneficially own 5% or more of the Common Stock of the Company as of June 30, 2002.

| Name and Address of Beneficial Owner | | Title of

Security | | Amount and Nature

of Beneficial Ownership | | Percent

of Class | |

| | | | | | | |

| Southeastern Asset Management, Inc. | | | Common Stock | | | 2,560,100(1) | | | 12.2 | |

| Longleaf Partners Small-Cap Fund | | | | | | | | | | |

| 6410 Poplar Avenue, Suite 900 | | | | | | | | | | |

| Memphis, Tennessee 38119 | | | | | | | | | | |

| Dimensional Fund Advisors Inc. | | | Common Stock | | | 1,134,154(2) | | | 5.4 | |

| 1299 Ocean Avenue, 11th Floor | | | | | | | | | | |

| Santa Monica, California 90401 | | | | | | | | | | |

______________

| (1) | | Based on Schedule 13G dated February 4, 2002 of Southeastern Asset Management, Inc.; Longleaf Partners Small-Cap Fund and O. Mason Hawkins, its Chairman & CEO, which indicates that (a) Southeastern Asset Management, Inc. has sole voting power over 146,600 shares; shared voting power over 2,300,900 shares; no voting power over 112,600 shares; sole dispositive power over 259,200 shares; and shared dispositive power over 2,300,900 shares; and (b) Longleaf Partners Small-Cap Fund has shared voting and dispositive powers over 2,300,900. |

| (2) | | Based on Schedule 13G dated January 30, 2002 which indicates Dimensional Fund Advisors Inc. has sole voting power over 1,134,154 shares and sole dispositive power over 1,134,154 shares. |

2

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The bylaws of the Company provide for a board of not fewer than three nor more than twenty-one directors with the actual number to serve at any time to be determined by resolution of the board. The bylaws further provide that the board shall be divided into three classes, each class being as nearly equal in number as possible. The three classes have staggered terms of three years. The terms of office of three of the Directors expire at this Annual Meeting, all of which have been nominated for reelection. The proxies solicited hereby cannot be voted for a greater number of persons than the three nominees named below. Unless otherwise indicated, all proxies that authorize the persons named therein to vote for the election of directors will be voted for the election of the nominees named below. Directors are elected by plurality vote. If any of the nominees named should not be available for election as a result of unforeseen circumstances, it is the intention of the persons named in the proxy to vote for the election of such substitute nominee, if any, as the Board of Directors may propose.

Nominees for Directors

The following are nominees for election as directors of the Company for a term of office expiring at the Annual Meeting of Shareholders in 2005 or until their respective successors shall have been elected and qualified.

| Name | | Age | | Principal Occupation

During Past Five Years* | | Served as

Director

Since | | Proposed

Term to

Expire | |

| Robert Alpert | | | 70 | | | President and Chairman of the Board of Angelholm Corp. d/b/a The Alpert Companies (financial services and real estate), Dallas, Texas; Chairman of the Board of Argo Funding Co. L.L.C. (venture capital), Dallas, Texas, since 1998 (a) | | | 1975 | | | 2005 | |

| Eugenio Clariond Reyes | | | 58 | | | President and Chief Executive Officer of Grupo IMSA, S.A. (steel processor, auto parts, aluminum and plastic construction products), Monterrey, Mexico | | | 1998 | | | 2005 | |

| Elizabeth C. Williams | | | 59 | | | Treasurer, Southern Methodist University, Dallas, Texas | | | 1995 | | | 2005 | |

| | | | | | | | | | | | | |

3

Continuing Directors

The term of office for each of the continuing directors expires at the Annual Meeting of Shareholders to be held in the year indicated below, or until his or her successor shall have been elected and qualified.

| Name | | Age | | Principal Occupation

During Past Five Years* | | Served as

Director

Since | | Term to

Expire | |

| John M. Belk | | | 82 | | | Chairman of the Board and Chief Executive Officer of Belk, Inc. (department stores), Charlotte, North Carolina, since 1998; Chairman of the Board of Belk Stores Services, Inc. (department stores), Charlotte, North Carolina (b) | | | 1998 | | | 2003 | |

| Gordon E. Forward | | | 66 | | | Private Investments since June 2001, Chairman of Applied Sustainability, LLC, Austin, Texas from June 1999 through May 2001; Vice Chairman of the Board of the Company from July 1998 through May 2000; President and Chief Executive Officer of Chaparral Steel Company (steel manufacturer and subsidiary of the Company) Midlothian, Texas until July 1998 (c) | | | 1991 | | | 2003 | |

| James M. Hoak, Jr. | | | 58 | | | Chairman and a Principal of Hoak Capital Corporation (private equity investment firm), Dallas, Texas (d) | | | 1995 | | | 2003 | |

| Gerald R. Heffernan | | | 83 | | | President of G.R. Heffernan & Associates, Ltd.(investments), Toronto, Ontario, Canada | | | 1986 | | | 2004 | |

| David A. Reed | | | 54 | | | Managing Partner of Causeway Capital Partners, L.P. (private family investment partnership), Dallas, Texas since 2000; Senior Vice Chair – Global Accounts, Industries, Sales and Marketing, Ernst & Young LLP, Dallas, Texas from 1999 until October 2000; Member of Management Committee, Ernst & Young LLP, Dallas, Texas until October 2000 (e) | | | 2000 | | | 2004 | |

| Robert D. Rogers | | | 66 | | | President and Chief Executive Officer of the Company (a) | | | 1970 | | | 2004 | |

| Ian Wachtmeister | | | 69 | | | Vice Chairman of The Empire, AB (metals dealer), Stockholm, Sweden | | | 1977 | | | 2004 | |

______________

| * | | Based upon information provided by the Directors to the Company as of July 1, 2002. |

| (a) | | Messrs. Rogers and Alpert are members of the Board of Directors of CNF Inc. |

| (b) | | Mr. Belk is a member of the Board of Directors of Belk, Inc. and Coca-Cola Bottling Co. Consolidated. |

| (c) | | Mr. Forward is a member of the Board of Directors of Nexfor Inc. |

| (d) | | Mr. Hoak is a member of the Board of Directors of PanAmSat Corporation and Pier 1 Imports, Inc. |

| (e) | | Mr. Reed is a member of the Board of Directors of Extensity Inc. |

4

BOARD COMMITTEES, MEETINGS, ATTENDANCE AND FEES

The Board of Directors has an Audit Committee and a Compensation Committee and the full Board of Directors acts in lieu of a Nominating Committee. The Company’s Compensation Committee, currently composed of Directors Hoak (Chair), Forward and Reed, met twice during the year. The Compensation Committee recommends and approves the salaries of top management of the Company and all stock option awards to key employees of the Company and its subsidiaries. Its actions are subject to the review and approval of the Board of Directors.

The Company’s Audit Committee, which met twice during the year, is currently composed of Directors Williams (Chair), Clariond and Wachtmeister, each of whom meets the independence and experience requirements of the New York Stock Exchange. The Audit Committee reviews the scope, plan and results of the annual audit with the independent auditors, approves and ratifies each professional service provided by the independent auditors; considers the independence of the auditors, and reviews and approves all non-audit fees paid to the independent auditors.

The Board, acting in lieu of a Nominating Committee, will consider nominees for directors recommended by Shareholders. Communications to the Board may be addressed in care of the Company’s Secretary at the Company’s Executive Offices.

The Board of Directors met four times during the last fiscal year. Each Director attended at least 75% of the meetings of the Board of Directors and the meetings of the committees on which the Director served.

Compensation of Directors

Directors who are not employees of the Company or its affiliates currently receive $10,000 per year plus $1,000 for each day that a Board and/or a Committee meeting is attended in person and $250 for each meeting attended by conference telephone. In addition, on January 1 of each year, each non-employee director receives an award of 500 restricted shares of the Company’s Common Stock under the Company’s directors restricted award plan. The Chairman of the Board, Gerald R. Heffernan, receives an additional 2,000 restricted shares of the Company’s Common Stock. The restrictions on the shares are removed at the time the director ceases holding such position. Until such time, the director is entitled to vote the shares and to receive all cash dividends. Under a deferred compensation agreement, annual and meeting fees may be deferred in whole or in part at the election of the director. Compensation so deferred is denominated in shares of the Company’s Common Stock determined by reference to the average market price during the thirty (30) trading days prior to the date of the agreement. Dividends are credited to the account in the form of Common Stock at a value equal to the fair market value of the stock on the date of payment of such dividend. Each non-employee director is automatically granted an option to purchase 10,000 shares of Common Stock when first elected either by the Board, or by the Shareholders at an annual meeting, and an option to purchase 5,000 shares of Common Stock each time that such director is reelected at an annual meeting. The Company also reimburses directors for travel, lodging and related expenses they may incur in attending Board and/or Committee meetings.

Other Transactions

No reportable transactions occurred between the Company and any Director, nominee for director, officer or any affiliate of, or person related to, any of the foregoing since the beginning of the Company’s last fiscal year (June 1, 2001).

Compensation Committee Interlocks and Insider Participation

The Compensation Committee is comprised exclusively of Directors who are not officers or employees of the Company. No executive officer of the Company serves or has served during the year on the Compensation Committee or as a director of another company, one of whose executive officers serves as a member of the Compensation Committee or as a Director of the Company.

5

SECURITY OWNERSHIP OF MANAGEMENT

The following table sets forth as of June 30, 2002, the approximate number of shares of Common Stock of the Company beneficially owned by each Director, by each executive officer named in the Summary Compensation Table and by all Directors and executive officers of the Company as a group.

| | Company Common Stock | |

| |

| |

| | Beneficially Owned ** | | Percent(1) | |

| |

| |

| |

| Robert Alpert | | | 32,610 | (2) | (3) | | | * | |

| John M. Belk | | | 23,496 | (2) | (3) | | | * | |

| Melvin G. Brekhus | | | 142,104 | (2) | | | | * | |

| Eugenio Clariond Reyes | | | 13,000 | (2) | (3) | | | * | |

| Carlos E. Fonts. | | | 17,874 | (2) | | | | * | |

| Gordon E. Forward | | | 89,728 | (2) | (3) | | | * | |

| Richard M. Fowler | | | 209,184 | (2) | | | | * | |

| Gerald R. Heffernan(4) | | | 353,000 | (2) | (3) | | | 1.7 | |

| James M. Hoak, Jr. | | | 40,000 | (2) | (3) | | | * | |

| David A. Reed | | | 4,000 | (3) | | | | * | |

| Robert D. Rogers | | | 543,242 | (2) | | | | 2.6 | |

| Tommy A. Valenta(5) | | | 87,990 | (2) | | | | * | |

| Ian Wachtmeister | | | 33,594 | (2) | (3) | | | * | |

| Elizabeth C. Williams | | | 35,400 | (2) | (3) | | | * | |

| All Directors and Executive Officers as a Group (17 Persons) | | | 1,776,232 | (2) | | | | 8.1 | |

______________

| * | | Represents less than one percent (1%) of the total number of shares outstanding. |

| ** | | Except as indicated in the notes below, each person has the sole voting and investment authority with respect to the shares set forth in the above table. |

| (1) | | Based on the sum of (i) 21,035,803 shares of Common Stock, which on June 30, 2002, was the approximate number of shares outstanding, and (ii) the number of shares subject to options exercisable by such person(s) within 60 days of such date. |

| (2) | | Includes, with respect to such person(s) shares of Common Stock subject to options exercisable within 60 days of June 30, 2002, as follows: Robert Alpert, 24,000 shares; John M. Belk, 9,000 shares; Melvin G. Brekhus, 121,080 shares; Eugenio Clariond Reyes, 10,000 shares; Carlos E. Fonts, 17,560 shares; Gordon E. Forward, 69,800 shares; Richard M. Fowler, 112,620 shares; Gerald R. Heffernan, 23,000 shares; James M. Hoak, Jr., 27,000 shares; Robert D. Rogers, 267,000 shares; Tommy A. Valenta, 83,632 shares; Ian Wachtmeister, 23,000 shares; Elizabeth C. Williams, 32,000 shares; and all Directors and Executive Officers as a Group, 944,132 shares. |

| (3) | | Includes with the respect to such person(s) restricted shares of Common Stock received as compensation as a non-employee director, as follows: Robert Alpert, 3,500 shares; John M. Belk, 3,000 shares; Eugenio Clariond Reyes, 3,000 shares; Gordon E. Forward, 1,000 shares; Gerald R. Heffernan, 13,500 shares; James M. Hoak, Jr., 3,000 shares; David A. Reed, 1,000 shares; Ian Wachtmeister, 3,000 shares; and Elizabeth C. Williams, 3,000 shares. |

| (4) | | The wife of Mr. Heffernan owns 1,000 shares of Common Stock as to which he disclaims beneficial ownership. |

| (5) | | A Children’s Trust established by Mr. Valenta owns 1,128 shares of Common Stock as to which he disclaims beneficial ownership. |

6

EXECUTIVE COMPENSATION

There is shown below information concerning the annual and long-term compensation for services in all capacities to the Company for the fiscal years ended May 31, 2002, 2001 and 2000, of those persons who were, at May 31, 2002, (i) the Chief Executive Officer and (ii) the other four most highly compensated executive officers of the Company.

Summary Compensation Table

| | | | | | Long Term Compensation | | | |

| | | | | |

| | | |

| | | | Annual Compensation | | Awards | | Payouts | | | |

| | | |

| |

| |

| | | |

| Name and Principal Position | | Year | | Salary($) | | Bonus($) | | Securities

Underlying

Options(#) | | LTIP

Payouts($) | | All Other Compensation

($)(1) | |

| |

| |

| |

| |

| |

| |

| |

| Robert D. Rogers | | | 2002 | | | 1,091,731 | | | — | | | — | | | — | | | 23,349 | |

| President and Chief | | | 2001 | | | 949,636 | | | — | | | 20,000 | | | — | | | 23,884 | |

| Executive Officer | | | 2000 | | | 1,186,236 | | | — | | | 20,000 | | | — | | | 23,380 | |

| | | | | | | | | | | | | | | | | | | |

| Melvin G. Brekhus | | | 2002 | | | 313,846 | | | 36,720 | | | 16,000 | | | — | | | 6,625 | |

| Executive Vice President — | | | 2001 | | | 300,000 | | | 40,500 | | | 16,600 | | | — | | | 7,160 | |

| Cement, Aggregates and Concrete | | | 2000 | | | 267,308 | | | 67,362 | | | 16,600 | | | 160,000 | | | 6,656 | |

| | | | | | | | | | | | | | | | | | | |

| Tommy A. Valenta | | | 2002 | | | 313,846 | | | 36,720 | | | 16,000 | | | — | | | 6,625 | |

| Executive Vice President — Steel | | | 2001 | | | 300,000 | | | 40,500 | | | 16,600 | | | — | | | 7,160 | |

| | | 2000 | | | 267,308 | | | 67,362 | | | 16,600 | | | 160,000 | | | 6,656 | |

| | | | | | | | | | | | | | | | | | | |

| Richard M. Fowler | | | 2002 | | | 287,115 | | | 33,593 | | | 16,000 | | | — | | | 6,625 | |

| Executive Vice President — Finance | | | 2001 | | | 275,000 | | | 37,125 | | | 16,600 | | | — | | | 6,100 | |

| | | 2000 | | | 258,654 | | | 65,181 | | | 16,600 | | | 139,500 | | | 5,504 | |

| | | | | | | | | | | | | | | | | | | |

| Carlos E. Fonts | | | 2002 | | | 208,654 | | | 24,413 | | | 10,500 | | | — | | | 14,735 | |

| Vice President — Development | | | 2001 | | | 200,000 | | | 27,000 | | | 11,300 | | | — | | | 14,855 | |

| | | 2000 | | | 179,249 | | | 45,458 | | | 11,300 | | | 100,000 | | | 14,190 | |

______________

| (1) | | Vested and non-vested portion of amounts contributed and allocated by employer to employee benefit plans. |

Under an employment contract which has been extended, under certain conditions, through May 31, 2004, Robert D. Rogers, the President and Chief Executive Officer of the Company, receives an annual salary consisting of a $300,000 base and an annual award of 21,632 shares of Common Stock, or the market value thereof in cash. In the event the annual salary earned in a year is greater than $900,000, the Board of Directors may, in its discretion, defer payment of salary earned in excess of $900,000 until termination of employment. Such deferred amounts shall be treated in the same manner as the deferred incentive compensation discussed below. The extended contract also has a long term incentive component previously approved by the Company’s shareholders which provides that in the event the Company’s consolidated average return on equity for the three consecutive, fiscal year periods ending May 31, 2002, 2003 and 2004, respectively, equals or exceeds a return on equity objective of 16%, Mr. Rogers will receive an incentive payment in respect of each year in which such objective is achieved as follows: if the average return on equity is equal to or greater than 16% but less than 21%, an incentive payment equal to 80% of salary, if 21% or greater, the incentive payment will equal 160% of salary. Fifty percent of this latter incentive will be paid in cash and 50% deferred until termination of employment and distributed in three equal annual installments. Deferred incentive compensation is denominated in shares of the Company’s Common Stock determined by reference to the fair market value of the stock (as defined in the

7

employment contract) at the time of deferral and dividends are credited to the deferred account in the form of Common Stock at a value equal to the fair market value of the stock on the date of payment of such dividend. The shares of Common Stock credited to the account are adjusted to reflect any increase or decrease in the number of shares outstanding as a result of stock splits, combination of shares, recapitalizations, mergers or consolidations.

The Company offers financial security plans for substantially all of its senior managerial and executive employees. The plans include disability benefits under certain circumstances and death benefits payable to beneficiaries for a period of ten years or until the participant would have attained age 65, whichever last occurs. Participants in the Plans who retire at or after attaining age 65 (age 60 in the case of executive officers) will be entitled to a supplemental retirement benefit. In the event of termination of employment under certain circumstances following a change in control (as defined in the plans), a participant will be deemed to be fully vested in any supplemental retirement benefit, without reduction, provided by the plans.

2002 Stock Option Grants

The following table sets forth certain information concerning options granted during the fiscal year ended May 31, 2002, to each executive officer named in the Summary Compensation Table under the Company’s stock option plan.

| | No. of Securities Underlying Options Granted | | Percent of Total

Options

Granted to

Employees in | | Exercise

or Base

Price Per | | | | Potential Realizable

Value of Assumed

Annual Rate of Stock Price Appreciation for Option

Term (2) | |

| | | | | | | | | |

| |

| Name | | (#)(1) | | 2002 | | Shares ($/sh) | | Expiration Date | | 0% | | 5% | | 10% | |

| |

| |

| |

| |

| |

| |

| |

| |

| Robert D. Rogers | | | — | | | — | | | | | | | | | | | | | | | | |

| Melvin G. Brekhus | | | 16,000 | | | 7.54% | | | 36.52 | | | January 16, 2012 | | | -0- | | | 367,476 | | | 931,256 | |

| Tommy A. Valenta | | | 16,000 | | | 7.54% | | | 36.52 | | | January 16, 2012 | | | -0- | | | 367,476 | | | 931,256 | |

| Richard M. Fowler | | | 16,000 | | | 7.54% | | | 36.52 | | | January 16, 2012 | | | -0- | | | 367,476 | | | 931,256 | |

| Carlos E. Fonts | | | 10,500 | | | 4.95% | | | 36.52 | | | January 16, 2012 | | | -0- | | | 241,156 | | | 611,136 | |

______________

| (1) | | The options to purchase Common Stock become exercisable in annual installments beginning one year from the date of grant. |

| (2) | | The dollar amounts under these columns are the result of calculation at 0% and at the 5% and 10% rates set by the Securities and Exchange Commission and are not intended to forecast possible future appreciation, if any, of the price of the Company’s Common Stock. The Company did not use an alternative formula for a grant date value as it is not aware of any formula which will determine with reasonable accuracy a present value based on future unknown or volatile factors. |

8

Option Exercises and Year-End Values

The following table provides information concerning each option exercised during the fiscal year ended May 31, 2002, under the Company’s stock option plan by each of the named executive officers and the value of unexercised options held by such executive officer on May 31, 2002.

| Name | | Number of

Shares

Acquired on

Exercise (#) | | Value

Realized ($) | | Number of

Securities Underlying

Unexercised

Options at Fiscal

Year End (#)

Exercisable/Unexercisable | | Value of Unexercised

In-the-Money

Options at Fiscal

Year End ($)(1)

Exercisable/Unexercisable | |

| |

| |

| |

| |

| |

| Robert D. Rogers | | | -0- | | | -0- | | | 267,000/43,000 | | | 2,799,063/196,250 | |

| Melvin G. Brekhus | | | -0- | | | -0- | | | 116,080/57,020 | | | 1,523,935/194,170 | |

| Tommy A. Valenta | | | -0- | | | -0- | | | 78,632/56,440 | | | 800,988/194,170 | |

| Richard M. Fowler | | | -0- | | | -0- | | | 112,620/44,880 | | | 1,618,844/171,420 | |

| Carlos E. Fonts | | | 11,000 | | | 81,949 | | | 25,320/32,580 | | | 86,518/119,360 | |

______________

| (1) | | Computed based upon the difference between aggregate fair market value and aggregate purchase price |

Performance Graph

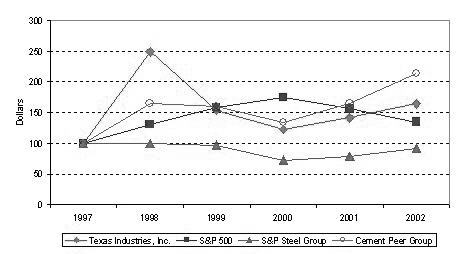

The Company has two major business segments — a cement, aggregate and concrete (“CAC”) segment and a steel segment. The following chart compares the Company’s cumulative total shareholder return on its Common Stock for the five-year period ended May 31, 2002, with the cumulative total return of the Standard & Poor’s 500 Composite Stock Price Index (the “S&P 500”), the Standard & Poor’s Steel Index (the “S&P Steel Group”) and a Cement Peer Group comprised of Centex Construction Products, Inc., Florida Rock Industries, Inc. and Lafarge Corporation (the “Cement Peer Group”). These comparisons assume the investment of $100 on May 31, 1997 and the reinvestment dividends.

Comparison of 5 Year Cumulative Total Return

Assumes Initial Investment of $100

Fiscal Year Through May 2002

9

REPORT OF THE COMPENSATION COMMITTEE

ON EXECUTIVE COMPENSATION

The Compensation Committee of the Board of Directors is composed of three non-employee Directors. The Committee establishes the general compensation policies of the Company and the compensation incentive plans for executive officers. It also administers the Company’s stock option plan. The Company’s benefit plans, such as the Company’s retirement plan and group insurance plan, are administered by the Company’s Human Resources Department.

General. The objective of the Company’s management compensation program is to (i) attract and retain highly qualified and productive individuals; (ii) motivate such individuals; and (iii) align their interests with those of the Company’s Shareholders by building long-term value and thereby improving the return to the Company’s Shareholders. The program provides for competitive base salaries, annual bonus opportunities, long-term incentives in the form of a rolling three-year incentive plan, stock options and competitive benefits including health, life and disability insurance, vacation, a financial security plan and a savings and defined contribution retirement plan. Typically, executives receive annual performance reviews. Such reviews cover considerations such as revenue generated, operating profit, return on assets, cost improvements, operational efficiency, safety, customer service, and cooperation with other employees, depending on the responsibilities of the executive. Only the Chief Executive Officer of the Company is subject to an employment agreement.

Compensation Elements. The executive officers’ total compensation objective consists of three basic elements — salaries, annual incentives and long-term incentives. Annual and long-term incentives are a significant portion of total compensation and are strongly linked to financial performance.

Salaries. Salaries comprise approximately 45% of the total compensation objective for an executive other than the Chief Executive Officer. Salaries of the Company’s executive officers are determined by the Chief Executive Officer within the general compensation policies established by the Committee. Subjective criteria such as the impact the executive has on the Company, the skills and experience required by the job, individual performance and internal equities are considered in determining salary levels. Quantitative relative weights are not assigned to the different criteria nor is a mathematical formula followed. Salaries are also reviewed periodically and compared to industry and geographic salary surveys to assure that they are in line with competitive market levels. The Company may at times suspend or limit salary increases when the operating performance of the Company will not support such increases.

Annual Incentives. In order to (i) encourage above-average performance and teamwork, (ii) focus employee’s work on short-term results which are key to the Company’s long-term business success, and (iii) attract and retain the best possible employees by rewarding outstanding performance, the Board of Directors annually considers the adoption for the ensuing fiscal year of regional cash incentive plans for employees of various business segments of the Company, including the named executives (except for the Chief Executive Officer), who do not participate in an operations/production plan. A cash bonus equal to a designated percentage of an eligible executive’s annual wages is earned if the pre-established levels of rates of return on equity (translated into a return on assets) is achieved by the respective regional business segments of the Company. Cash incentive awards increase based upon specified return on equity levels pre-established by the Committee. Target return on equity levels and the designated percentage of an executive’s salary are not established for executives individually; rather they are the same for all executives in order to foster a team-based approach. The Board of Directors has approved an annual incentive plan for fiscal year 2003 under which a threshold return on equity for each of the regional business segments has been established. Approximately 10% of the total compensation objective for an executive is based on this annual cash incentive.

Long-Term Incentives. Long-term incentives, which comprise approximately 45% of the executive’s total compensation objective, are provided under a continuous rolling three-year executive cash incentive plan, established for certain executives of the Company including the named executives (except for the Chief Executive Officer), and the Company’s stock option plan.

For an executive to earn an annual cash incentive award under the rolling three-year incentive plan, the Company must reach or surpass the average return on equity threshold established by the Committee

10

for the three-year period ending in the year in respect of which the incentive is earned. If the average threshold is reached or surpassed, the participating executives can earn a cash incentive award ranging from 35% to 120% or more of the executive’s base salary, depending on the return on equity achieved, and the recommendation of the chief executive officer based upon his subjective evaluation of the executive’s individual performance. The Committee believes that the rolling three-year plan focuses plan participants on growth and profitability for the Company.

The Committee believes that ownership of the Company’s stock is an important element of its executive compensation program. When granted under the Company’s Stock Option Plan, stock options have exercise prices of not less than 100% of the fair market value of the Company’s Common Stock on the date of grant, become exercisable 20% after one year, 40% after two years, 60% after three years, 80% after four years and 100% five years after grant, and all expire not more than ten years after grant. Unlike cash, the value of a stock option award will not be immediately realized and will be dependent on the market value of the Common Stock in the future; thus, the option not only provides the executive an incentive for years after it has been awarded but ties this incentive program directly into increasing shareholder value. Stock options also strengthen the ability of the Company to attract, motivate a nd retain executives of superior capability required to achieve the Company’s business objectives in an intensely competitive environment. Options are granted under guidelines established under the general compensation policies of the Company. An executive is targeted to have between three to five times annual salary in accumulated options priced at the time of grant, such grants occurring annually. Under these guidelines, during fiscal year 2002, Melvin G. Brekhus, Tommy A. Valenta, Richard M. Fowler and Carlos E. Fonts received stock option awards of 16,000, 16,000, 16,000 and 10,500 respectively.

Chief Executive Officer’s 2002 Compensation. Compensation for the Chief Executive Officer is determined through a process similar to that discussed above for executive officers in general and is embodied in the terms of an employment contract. Pursuant to the terms of the employment contract (see Executive Compensation), the Chief Executive Officer received an annual salary consisting of a $300,000 base component and an award in cash equal to the fair market value of 21,632 shares of Common Stock. The shareholder-approved long-term incentive plan objective set forth in his employment contract was not achieved by the Company, and as a result the Chief Executive Officer received no incentive compensation.

Tax Deductibility of Executive Compensation. The Omnibus Budget Reconciliation Act of 1993 added Section 162(m) to the Internal Revenue Code. Section 162(m) makes certain “non-performance based” compensation to certain executives of the Company in excess of $1,000,000 non-deductible to the Company. To qualify as “performance-based compensation”, performance goals must be pre-established and such goals approved by the Company’s Shareholders before such compensation is paid. To satisfy the requirements of Section 162(m), the Company submitted and obtained approval of the Company’s Shareholders of the incentive payment provisions of the Chief Executive Officer’s employment contract. The Company generally intends to structure the compensation with its executives to achieve maximum deductibility under Section 162(m) with minimum sacrifices in flexibility and corporate obje ctives.

| | James M. Hoak, Chair | | Gordon E. Forward, Member | |

| | | | | David A. Reed, Member | |

11

REPORT OF THE AUDIT COMMITTEE

The Audit Committee of the Board of Directors is responsible for, among other things, reviewing the Company’s financial statements with management and the Company’s independent auditors. The Committee’s role is one of oversight whereas the Company’s management is responsible for preparing the Company’s financial statements and the independent auditors are responsible for auditing those financial statements. The Board of Directors has adopted a written Audit Committee Charter for the Committee. The Committee annually reviews and reassesses the adequacy of such Charter.

In connection with the fiscal 2002 audit, the Audit Committee has: (i) reviewed and discussed the audited financial statements with management; (ii) discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards 61 (communication with Audit Committees); (iii) received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and discussed with the auditors the auditors’ independence; and (iv) recommended, based on the reviews and discussions noted above, to the Board of Directors that the audited financial statements be included in the Company’s 2002 Annual Report on Form 10-K for filing with the Securities and Exchange Commission.

| | Elizabeth C. Williams, Chair | | Eugenio Clariond Reyes, Member | |

| | | | | Ian Wachtmeister, Member | |

FEES PAID TO INDEPENDENT AUDITORS

Audit Fees. The aggregate fees billed for professional services rendered by Ernst & Young LLP to the Company in connection with the audit and for the reviews during fiscal 2002 of the Company’s financial statements included in the quarterly reports on form 10-Q were $318,700.

All Other Fees. The aggregate fees billed for professional services rendered by Ernst & Young LLP to the Company in connection with audit related services, including pension audits and accounting consultations, were $73,800. The aggregate fees billed for professional services rendered by Ernst & Young LLP to the Company in fiscal 2002 in connection with non-audit related services, primarily tax compliance and tax consulting services, were $338,760. There were no fees for consulting in the information technology area.

In appointing Ernst & Young LLP to serve as independent auditors for the fiscal year ending May 31, 2002, the Audit Committee considered whether the provision of these non-audit services is compatible with maintaining the independent auditors’ independence.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities and Exchange Act of 1934 generally requires the Company’s Directors and executive officers and persons who own more than 10% of a registered class of the Company’s equity securities (“10% owners”) to file with the Securities and Exchange Commission and the New York Stock Exchange initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. Directors, executive officers and 10% owners are required by the Securities and Exchange Commission regulation to furnish the Company with copies of all Section 16(a) forms they file. Based solely on review of copies of such reports furnished to the Company and written transaction reports of its Directors and executive officers indicating that no other reports were required to be filed during the 2002 fiscal year, the Company believes that all filing requirement s applicable to its Directors, executive officers and 10% owners were complied with in accordance with Section 16(a).

12

INDEPENDENT PUBLIC ACCOUNTANTS

Ernst & Young LLP were the Company’s independent auditors for the last fiscal year and will continue to be for the current year. A representative of Ernst & Young LLP will attend the Annual Meeting; and although such representative does not intend to make a statement to the Shareholders, he or she will be available to respond to any relevant questions of the Shareholders.

ANNUAL REPORT

A copy of the Company’s Annual Report for the fiscal year ended May 31, 2002, is being mailed to each Shareholder of record along with the proxy material, but is not to be considered as a part of the proxy soliciting materials.

2003 SHAREHOLDER PROPOSALS

Proposals of Shareholders intended to be presented at the next Annual Meeting of Shareholders presently scheduled for October 14, 2003, must be received by the Secretary of the Company not later than April 30, 2003, to be eligible for inclusion in the proxy statement and form of proxy relating to that meeting.

Proposals of Shareholders intended to be presented at the next Annual Meeting of Shareholders which are not received by the Secretary of the Company before April 30, 2003 shall be untimely. Upon the presentation at the next Annual Meeting of Shareholders of any matter not timely proposed, the persons named in the proxy accompanying the Company’s proxy statement relating to that meeting will have the discretionary authority to vote all proxies on such matters in accordance with their best judgment.

MULTIPLE SHAREHOLDERS SHARING SAME ADDRESS

The Company has elected to implement the Securities and Exchange Commission’s new “householding” rules that permit delivery of only one set of proxy materials to stockholders who share an address unless otherwise requested. If you share an address with another Shareholder and have received only one set of proxy materials, you may request a separate copy of these materials at no cost to you by calling Investor Communication Services at (800) 542-1061, or by writing to Investor Communication Services, Householding Department, 51 Mercedes Way, Edgewood, New York 11717. For future annual meetings, you may request separate voting materials, or request that the Company send only one set of proxy materials to you if you are receiving multiple copies, by contacting Investor Communication Services at the above phone number or address.

OTHER MATTERS

At the date of this Proxy Statement, the Board of Directors was not aware that any matters not referred to in this Proxy Statement would be presented for action at this Annual Meeting. If any other matters should come before the Annual Meeting, the persons named in the accompanying proxy will have the discretionary authority to vote all proxies in accordance with their best judgment.

| | By Order of the Board of Directors,

|

| | |

|

| | | Robert C. Moore |

| | | Secretary |

13

TEXAS INDUSTRIES, INC.

1341 W. MOCKINGBIRD LANE

DALLAS, TX 75247-6913 | | VOTE BY PHONE – 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions anytime before 11:59 p.m. (CDT) on October 14, 2002. Have your proxy card in hand when you call. You will be prompted to enter your 12-digit Control Number which is located below and then follow the simple instructions the Vote Voice provides you. | |

| | |

VOTE BY INTERNET - www.proxyvote.com Use the Internet to transmit your voting instructions anytime before 11:59 p.m. (CDT) on October 14, 2002. Have your proxy card in hand when you access the web site. You will be prompted to enter your 12-digit Control Number which is located below to obtain your records and to create an electronic voting instruction form. | |

| | |

VOTE BY MAIL Mark, sign , and date your proxy card and return it in the postage-paid envelope we have provided or return it to Texas Industries, Inc., c/o ADP, 51 Mercedes Way, Edgewood, NY 11717. | |

| | |

To vote in accordance with the Board of Directors’ recommendations, just sign below; no boxes need to be checked. | |

| TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: | | | | | |

| | | TXIND3 | | KEEP THIS PORTION FOR YOUR RECORDS | |

| | | | | DETACH AND RETURN THIS PORTION ONLY | |

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.

| Texas industries, inc. | | | | | | | | | |

| | | | | | | | | | |

| The Board of Directors Recommends a Vote FOR the Proposals | | | | | | | | | |

| in Items 1 and 2 | | | | | | | | | |

| | | | | | | | | | |

| Item 1 - Election of Directors | | For

All | | Withhold

All | | For All

Except | | To withhold authority to vote, mark “For All Except” and write the nominee’s number on the line below. | |

| To serve in a class of directors with a term expiring in 2005: | | | | | | | | | |

| 01) Robert Alpert | | 0 | | 0 | | 0 | | | |

| 02) Eugenio Clariond Reyes | | | | | | | | | |

| 03) Elizabeth C. Williams | | | | | | | | | |

| | | | | | | | | | |

| Item 2 - To transact such other business that may properly come before the meeting. |

| |

| This proxy, when properly executed, will be voted in the manner directed herein by the undersigned. In the absence |

| of such instructions, this proxy will be voted FOR the nominees listed in Item 1 and FOR the Proposal in Item 2. |

| |

| (Sign exactly as name(s) appear hereon. If shares are held jointly, each holder should sign. If signing for estate, trust or |

| corporation, title or capacity should be stated.) |

| |

| Please date, sign and return this Proxy in the enclosed business envelope. |

| | | | | |

| Signature [PLEASE SIGN WITHIN BOX] | Date | | Signature (Joint Owners) | Date | |

YOUR VOTE IS IMPORTANT!

You can vote in one of three ways:

| 1. | | Call toll-free 1-800-690-6903 on a Touch-Tone telephone and follow the simple instructions on the reverse side. There is NO CHARGE to you for this call. |

NOTE: Telephone voting option closes at 11:59 P.M. (CDT) on October 14, 2002

or

| 2. | | Access Internet site www.proxyvote.com and follow the instructions on the reverse side. |

NOTE: Internet voting option closes at 11:59 P.M. (CDT) on October 14, 2002

or

| 3. | | Mark, sign and date your proxy card and return it promptly in the enclosed envelope. |

PLEASE VOTE

FOLD AND DETACH HERE

For shares of Common Stock

TEXAS INDUSTRIES, INC.

PROXY FOR ANNUAL MEETING OF SHAREHOLDERS OCTOBER 15, 2002

This Proxy is Solicited by the Board of Directors

The undersigned hereby appoints ROBERT ALPERT, GERALD R. HEFFERNAN and ROBERT D. ROGERS, or any of them, attorneys and proxies, with power of substitution and revocation, to vote, as designated on the reverse side, all shares of stock which the undersigned is entitled to vote, with all powers which the undersigned would possess if personally present, at the Annual Meeting (including all adjournments thereof) of shareholders of Texas Industries, Inc. to be held on Tuesday, October 15, 2002 at 9:30 A.M. (CDT) at the Company’s RailPort Industrial Park, U.S. Highway 67 at RailPort Parkway, Midlothian, Texas.

The proxy, when duly executed, will be voted in the manner directed herein, and in the absence of specific directions to the contrary, this proxy will be voted (i) for the election of the three nominees for director, and (ii) in the discretion of the proxy holders on any other matters that may properly come before the meeting and any adjournment thereof.

This proxy is solicited on behalf of the Board of Directors of the Company and may be revoked prior to its exercise. The Board of Directors of the Company request that you promptly execute and mail this Proxy.

(Continued, and to be marked, dated and signed, on the other side)