SCHEDULE 14A INFORMATION

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement | | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement | | |

¨ Definitive Additional Materials | | |

¨ Soliciting Material under Rule 14a-12 | | |

The Fairchild Corporation

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-(i)(4) and 0-11. |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount of which the filing is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | | Amount previously paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

THE FAIRCHILD CORPORATION

45025 Aviation Drive

Suite 400

Dulles, VA 20166-7516

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Date: | | Friday, November 7, 2003 |

| |

Time: | | 10:00 a.m. |

| |

Place: | | Dulles Airport Marriott 45020 Aviation Drive, Dulles, Virginia |

Matters to be voted on:

| | 1. | | Election of nine directors. |

| | 2. | | Approval of performance goals for incentive compensation for the President. |

| | 3. | | Approval of performance goals for incentive compensation for the Chief Executive Officer. |

| | 4. | | Any other matters properly brought before the shareholders at the meeting. |

By Order of the Board of Directors

Donald E. Miller

Executive Vice President & Secretary

October 8, 2003

CONTENTS

PROXY STATEMENT

Your vote at the annual meeting is important to us. Please vote your shares of common stock by completing the enclosed proxy card and returning it to us in the enclosed envelope. This proxy statement has information about the annual meeting and was prepared by the Company’s management for the board of directors. This proxy statement was first mailed to shareholders on or about October 8, 2003.

GENERAL INFORMATION ABOUT VOTING

Who can vote?

Only shareholders of record holding Class A common stock or Class B common stock as of the close of business on September 29, 2003, will be entitled to receive notice of the annual meeting and to vote at the meeting.

On September 29, 2003, there were 22,562,614 shares of Class A common stock and 2,621,502 shares of Class B common stock outstanding and eligible to vote. Shares of common stock owned by the Company or any subsidiary are not entitled to vote, and are not included in the number of outstanding shares. Class A shares are entitled to one vote per share; Class B shares are entitled to 10 votes per share.

How do I vote by proxy?

Follow the instructions on the enclosed proxy card to vote on each proposal to be considered at the annual meeting. Sign and date the proxy card and mail it back to us in the enclosed envelope. The proxyholders named on the proxy card will vote your shares as you instruct. If you sign and return the proxy card but do not vote on a proposal, the proxyholders will vote for you on that proposal. Unless you instruct otherwise, the proxyholders will vote for each of the nine director nominees and for each of the other proposals to be considered at the meeting.

How do participants in our savings plan vote these shares?

If you are a participant in our savings plan, the proxy card also will serve as a votinginstruction for the trustee of the plan, Putnam Investments, to vote all shares of Class A common stock which are held by the trustee for your benefit. The shares represented by your proxy will be voted as you direct. The trustee will hold your voting directions in strict confidence. If you do not vote your proxy, shares held by the trustee for your benefit will be voted by the trustee in the same proportion as the shares properly voted by other participants in the savings plan.

What if other matters come up at the annual meeting?

The matters described in this proxy statement are the only matters we know will be voted on at the annual meeting. If other matters are properly presented at the meeting, the proxyholders will vote your shares as they see fit.

May I change my vote after I return my proxy card?

Yes. At any time before the vote on a proposal, you may change your vote either by giving the Company’s secretary a written notice revoking your proxy card or by signing, dating, and returning to us a new proxy card. We will honor the proxy card with the latest date.

May I vote in person at the annual meeting rather than by completing the proxy card?

Although we encourage you to complete and return the proxy card, to ensure that your vote is counted, you may attend the annual meeting and vote your shares in person.

1

What do I do if my shares are held in “street name”?

If your shares are held in the name of your broker, a bank, or other nominee, that party should give you instructions for voting your shares.

How are votes counted?

We will hold the annual meeting if holders of a majority of the shares of Class A common stock and Class B common stock entitled to vote either sign and return their proxy cards or attend the meeting. If you sign and return your proxy card, your shares will be counted to determine whether we have a quorum even if you abstain or fail to vote on any of the proposals listed in the proxy card.

If your shares are held in the name of a nominee, and you do not tell the nominee how to vote your shares (so-called “broker nonvotes”), the nominee can vote them as it sees fit only on matters that the New York Stock Exchange determines to be routine, and not on any other proposal. Broker nonvotes will be counted as present to determine if a quorum exists, but will not be counted as present and entitled to vote on any nonroutine proposal.

Who pays for this proxy solicitation?

We do. In addition to sending you these materials, some of our employees may contact you by phone, by mail, or in person. None of these employees will receive any extra compensation for doing this. The Company will also reimburse brokerage houses and others forwarding proxy materials to beneficial owners of stock.

2

PROPOSAL NO. 1

ELECTION OF DIRECTORS

An entire board of directors, consisting of nine members, will be elected at the annual meeting. The directors elected will hold office until their successors are elected, which should occur at the next annual meeting. We recommend a vote “FOR” the nominees presented below.

Vote Required. The nine nominees receiving the highest number of votes will be elected. Votes withheld for a nominee will not be counted.

Nominations. At the annual meeting, we will nominate the persons named in this proxy statement as directors. Although we do not know of any reason why one of these nominees might not be able to serve, the board of directors will propose a substitute nominee if any nominee is not available for election.

GENERAL INFORMATION ABOUT THE NOMINEES

All of the nominees, other than Mr. Podkowsky, are currently directors of the Company. Each has agreed to be named in this proxy statement and to serve as a director if elected. All nominees have been designated as “Continuing Directors” as defined in the Company’s Certificate of Incorporation.

Related party transactions between the Company and certain directors, or their immediate family members or affiliates, are set forth in this proxy statement under the heading“Certain Transactions.” Information regarding late filings of stock ownership forms by certain directors is set forth in this proxy statement, under the heading“Section 16(a) Beneficial Ownership Reporting Compliance.”

Name

| | Age

| | Position

|

Mortimer M. Caplin | | 87 | | Director |

Robert E. Edwards | | 55 | | Director |

Steven L. Gerard | | 58 | | Director |

Harold J. Harris | | 74 | | Director |

Daniel Lebard | | 64 | | Director |

John W. Podkowsky | | 59 | | Director (New) |

Herbert S. Richey | | 81 | | Director |

Eric I. Steiner | | 41 | | President, Chief Operating Officer and Director |

Jeffrey J. Steiner | | 66 | | Chairman of the Board and Chief Executive Officer |

Mortimer M. Caplin. Director Since 1990. Senior member of Caplin & Drysdale (attorneys): 1964 to Present. Director of Presidential Realty Corporation and Danaher Corporation.

Robert E. Edwards. Director Since 1998. Executive Vice President of Fairchild Fasteners: March 1998 to January 2001. Chief Operating Officer of Fairchild Fasteners U.S. Operations: January 2000 to January 2001. Chief Executive Officer of Fairchild Fasteners Direct: March 1998 to December 1999. President and Chief Executive Officer of Edwards and Lock Management Corporation (predecessor of Fairchild Fasteners Direct): 1983 to 1998. Pursuant to the merger agreement by which the Company acquired Fairchild Fasteners Direct, Mr. Edwards is to be nominated for election as a director every year as long as he continues to own at least 541,258 shares of Class A common stock.

Steven L. Gerard. Director Since 1999. Chairman and Chief Executive Officer of Century Business Services, Inc. (provider of integrated business services and products): October 2000 to present; Chairman and Chief Executive Officer of Great Point Capital, Inc. (financial and operating consultants): 1998 to October 2000. Chairman and Chief Executive Officer of Triangle Wire & Cable,

3

Inc. and its successor, Ocean View Capital, Inc., a manufacturer of insulated wire and cable: September 1992 to August 1997. Director of Lennar Corporation, Timco Aviation Sales, Inc. and Joy Global, Inc.

Harold J. Harris. Director Since 1985. President of Wm. H. Harris, Inc. (retailer): 1955 to Present. Director of Capital Properties Incorporated of Rhode Island.

Daniel Lebard. Director Since 1996. Chairman of Supervisory Board of Daniel Lebard Management Development SA, a consulting firm in Paris, France, which performs management services: 1982 to Present. Chief Executive Officer of ISPG and Executive Chairman of Albright & Wilson plc (manufacturer of added value phosphate products): 1998 to 2000.

John W. Podkowsky. 59. New Nominee for Director Position. Until his retirement in July 2003, he was a Managing Director of the Fixed Income Group of Citigroup, where he held various management positions during the preceding 27 years.

Herbert S. Richey. Director Since 1977. President of Richey Coal Company (coal properties-brokerage and consulting): 1979 to December 1993.

Dr. Eric I. Steiner. Director Since 1988. President of the Company: September 1998 to Present. Chief Operating Officer of the Company: November 1996 to Present. President of Fairchild Fasteners: August 1995 to December 2002. Executive Vice President of the Company: November 1996 to September 1998. Senior Vice President, Operations of the Company: May 1992 to November 1996. Dr. Steiner is the son of Jeffrey J. Steiner.

Jeffrey J. Steiner. Director Since 1985. Chairman of the Board and Chief Executive Officer of the Company: December 1985 to Present. President of the Company: July 1991 to September 1998. Director of Franklin Holding Corp., and Global Sources Ltd.

The Company has been informed by counsel to Mr. Jeffrey Steiner that on July 9, 2003, a trial concluded in France with respect to charges by French authorities against thirty-seven defendants, including Mr. Steiner, in the Elf Bidermann matter. Mr. Steiner’s counsel has informed the Company that the charges against Mr. Steiner are that in 1989 and 1990 he allegedly facilitated and benefited from the misuse of funds at Elf Acquitaine, a French petroleum company, allegedly committed by a former official of Elf Acquitaine, and/or Maurice Bidermann, against whom the Company had prevailed in litigation. The French court is expected to render its determination as to the merits of the charges, in November, 2003. Mr. Steiner has informed the Company that these charges are without merit, and that in all events he will vigorously continue to defend himself against them. The Company had previously disclosed that an investigation was pending, that the Company had provided a surety for Mr. Steiner and, since June 1996, has paid his legal expenses totaling approximately $5 million in connection with these charges, and will continue to do so, in accordance with Delaware law. Mr. Steiner has undertaken to repay us the surety and expenses paid by us on his behalf if it is ultimately determined that Mr. Steiner was not entitled to indemnification under Delaware law. Delaware law provides that Mr. Steiner would be entitled to indemnification if it is determined that he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the Company, and had no reasonable cause to believe his conduct was unlawful.

Board Meetings

The Board held seven meetings during fiscal 2003, and acted four times by unanimous written consent. No incumbent director attended less than seventy-five percent of the aggregate number of meetings of the Board and committees on which he served. Mr. Mel Barlow, a member of the Board in fiscal 2003, attended less than 75% of Board and committee meetings; however, for health reasons, Mr. Barlow resigned from office effective May 28, 2003.

4

Board Committees

The Board has five standing committees. The following chart describes the function and membership of each standing committee and the number of times it met in fiscal 2003:

Audit Committee

(Held 7 meetings)

Function

| | Members

|

| | |

· | | Is directly responsible for appointment, compensation and oversight of the Company’s outside auditors and resolution of disagreements, if any, between outside auditors and management. | | Herbert Richey (Chairman) Mortimer Caplin Steven Gerard Harold Harris |

· | | Receives and responds to complaints (which may be submitted confidentially or anonymously) regarding accounting, internal account controls or auditing matters. | |

| | |

· | | Examines and considers (and, where appropriate, pre-approves) matters relating to the internal and external audits of the Company’s accounts and its financial affairs. | | |

| | |

· | | Selects the Company’s independent auditors. | | |

| | |

· | | Functions and responsibilities are described in detail in the Audit Committee’s written charter, attached as Appendix 1 to the Proxy Statement for the 2002 Annual Meeting. | | |

The Audit Committee is established in accordance with Section 3(a)(58(A) of the Exchange Act which (among other things) requires companies to establish a committee of board members for the purpose of overseeing the accounting and financial reporting processes of the company and audits of the financial statements of the company.

Audit Committee Financial Experts: The Board of Directors has determined that Steven Gerard, a member of the Audit Committee, is a “financial expert” as defined by the SEC. Such determination was based, in part, on the following qualifications:

| | • | | Mr. Gerard has served since October 2000 as Chief Executive Officer of Century Business Services, Inc. (provider of integrated business services) and served as Chairman and CEO of Great Point Capital, Inc. (financial and operating consultants) from 1998 to October 2000. |

| | • | | He served for 16 years as a financial analyst/banker. |

| | • | | He serves as a member of the Audit Committee of several other major companies (Lennar Corporation and Timco Aviation Sales, Inc.). |

Audit Committee Independence: The Board of Directors has determined that all members of the Audit Committee are “independent” as defined in the listing standards of the New York Stock Exchange. The Board was advised that a subsidiary of the firm of Century Business Services, Inc., of which Mr. Gerard is the Chief Executive Officer, was engaged by the Company prior to FY 2004 to do auditing work in connection with the Company’s qualified pension and 401(k) plans. However, such services were not provided by Mr. Gerard himself, and charges for such services were less than $60,000 a year. Based on this, the Board has determined that Mr. Gerard is independent of the Company and its management, and that the former business relationship with his firm does not affect such independence.

5

Audit Committee Charter: The Board has adopted a written charter for the Audit Committee. The NYSE and the SEC require that a copy of the charter be published at least once every three years. A copy of the Audit Committee charter was attached as Appendix 1 to the Proxy Statement for the 2002 Annual Meeting.

Compensation and Stock Option Committee (Held 5 meetings and acted 1 time by written consent) |

Function

| | Members

|

· | | Initial responsibility for all compensation actions affecting the Company’s officers, including base salaries, bonus awards, stock option awards and the terms and conditions of their employment | | Daniel Lebard (Chairman) Harold Harris Herbert Richey |

| | |

· | | Administers the Company’s stock option plan. | | |

Executive Committee (took no actions in fiscal year 2003) |

Function

| | Members

|

· | | May consider pertinent matters and exercise all powers of the Board, which by law it may exercise when the Board is not in session. | | Jeffrey Steiner (Chairman) Mortimer Caplin Herbert Richey Eric Steiner |

Corporate Ethics and Compliance Committee (Held 4 meetings) |

Function

| | Members

|

· | | Oversees the Company’s ethics programs. | | Mortimer Caplin (Chairman) Herbert Richey |

Nominating Committee (Held 1 meeting) |

Function

| | Members

|

· | | Considers and recommends to the Board candidates for election to the Board of Directors by the shareholders. | | Jeffrey Steiner (Chairman) Eric Steiner Harold Harris |

6

Directors Compensation

Board members that are not salaried employees of the Company receive separate compensation for Board service. That compensation includes:

Annual Retainer: | | $20,000 |

| |

Attendance Fees: | | $2,500 for each Board meeting. $2,500 for each Audit Committee meeting. $1,000 per meeting for all other Board Committee meetings. Expenses related to attendance |

| |

Stock Options: | | Under the 1996 Non-Employee Directors Stock Option Plan (the “1996 NED Plan”) each non-employee director is issued stock options for 30,000 shares at the time he or she is first elected as a director. Thereafter, each director is issued stock options for 1,000 shares on an annual basis (immediately after each Annual Meeting). |

| |

Chairman of Audit Committee: | | $10,000 a year (commencing January 2003). |

Nominees for Next Year’s Annual Meeting

The Nominating Committee will consider written recommendations for nominees for next year’s annual meeting, submitted prior to June 10, 2004, by shareholders to the Secretary of the Company. Biographical information and the written consent of the potential nominee must accompany the recommendation.

7

INFORMATION AS TO EXECUTIVE OFFICERS

Set forth below is certain information about each executive officer of the Company who is not a director of the Company. All of the executive officers of the Company are elected by the Board to serve until the next annual meeting of the Board or until their successors are elected and qualified. Related party transactions between the Company and certain officers (or their immediate family members or affiliates) are set forth in this proxy statement under the heading“Certain Transactions.”

John L. Flynn, 57, has served as Chief Financial Officer of the Company since January 2002, as Treasurer since February 2003, as Senior Vice President, Tax of the Company since September 1994 and as Vice President, Tax from August 1989 to September 1994.

Michael L. McDonald, 39, has served as Vice President of the Company since May 2002 and as Controller of the Company since July 2000. He served as Assistant Controller from 1997 to July 2000. Mr. McDonald has been employed by the Company since 1989.

Donald E. Miller, 56, has served as Executive Vice President of the Company since September 1998, as General Counsel since January 1991 and as Corporate Secretary since January 1995. He served as Senior Vice President of the Company from January 1991 through September 1998.

Warren D. Persavich, 50, has served as President of the Company’s Distribution Division since April 1999, and as Senior Vice President and Chief Operating Officer of Banner Aerospace, Inc. since May 1998. Prior to that, he served as Senior Vice President and Chief Financial Officer of Banner Aerospace from June 1990 through May 1998, and as Vice President of Banner Aerospace from March 1990 through June 1990.

8

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities and Exchange Act of 1934 requires the Company’s directors and officers to file reports (on Forms 3, 4 and 5) with the Securities and Exchange Commission, disclosing their ownership, and changes in their ownership, of stock in the Company. Copies of these reports must also be furnished to the Company. Based solely on a review of these copies, the Company believes that during fiscal year 2003 all reports were filed on a timely basis.

9

EXECUTIVE COMPENSATION

Table: Summary Compensation

| | | Annual Compensation

| | Long-Term Compensation Awards

|

Name and Principal Position

| | Fiscal

Year

| | Salary ($)(1)

| | Bonus ($)(2)

| | Other Annual

Compensation

($)

| | Securities

Underlying

Options (#)

| | All Other

Compensation ($)(3)

|

Jeffrey Steiner, Chairman & CEO(3)(4) | | 2003 2002 2001 | | $ | 2,500,005 2,500,005 2,500,005 | | $ | 5,256,400 — 266,300 | | — — — | | 145,518 250,000 45,000 | | $ | 30,783 34,743 39,843 |

| | | | | | |

John Flynn, CFO, Treasurer & Senior VP, Tax | | 2003 2002 2001 | | $ | 300,019 336,425 300,019 | | $ | 1,399,837 — 125,000 | | — — — | | 6,666 6,668 15,000 | | $ | 4,856 9,776 14,562 |

| | | | | | |

Donald Miller, Executive VP, General Counsel & Secretary | | 2003 2002 2001 | | $ | 375,003 423,826 375,003 | | $ | 1,399,837 — 125,000 | | — — — | | 13,333 16,668 15,000 | | $ | 5,930 12,691 19,626 |

| | | | | | |

Warren Persavich President Distribution Division | | 2003 2002 2001 | | $ | 226,289 222,019 222,019 | | | — — 111,000 | | — — — | | — 13,140 23,665 | | $ | 4,856 10,601 12,131 |

| | | | | | |

Eric Steiner, President & COO | | 2003 2002 2001 | | $ | 725,005 725,005 725,005 | | $ | 2,299,675 — 217,500 | | — — — | | 26,400 42,888 20,000 | | $ | 5,930 10,965 28,405 |

| (1) | | Beginning January 1, 2003, the following amounts of base salary were deferred: |

Officer

| | Percentage of

Base Salary

Deferred

| |

J. Steiner | | 20 | % |

D. Miller | | 12 | % |

J. Flynn | | 12 | % |

Such amounts are included in the compensation table above.

| (2) | | During Fiscal 2003, the Board of Directors approved the following change of control payments due to the December 3, 2002 sale of Fairchild Fasteners to Alcoa Inc., which represented substantially all of the Company’s assets: |

Officer

| | Amount

| | Payment Schedule

|

J. Steiner | | $ | 6,280,000 | | 50% in Jan. 2003; 50% upon termination of employment |

E. Steiner | | | 5,434,000 | | 50% in Jan. 2003; balance in 4 equal quarterly payments, commencing March 2003 |

D. Miller | | | 1,125,000 | | 50% in Dec. 2002; balance in 4 equal quarterly payments, commencing March 2003 |

J. Flynn | | | 900,000 | | 50% in Jan. 2003; balance in 4 equal quarterly payments, commencing March 2003 |

10

| (3) | | For Fiscal 2003, includes imputed interest on loans to officers, as follows: |

J. Steiner | | | $4,856 |

J. Flynn | | | 4,856 |

D. Miller | | | 5,930 |

W. Persavich | | | 4,856 |

E. Steiner | | | 5,930 |

New loans to executive officers are no longer permitted as of July 30, 2002.

11

Table: Options Granted in Fiscal 2003

| | | Individual Grants

| | |

| | | Securities Underlying Options Granted

| | | % of Total Options Granted to Employees in Fiscal 2003

| | Exercise

Price ($/Sh)

| | Expiration

Date

| | Potential Realizable Value at Assumed Rates of Stock Price Appreciation for Option Term

|

Name

| | | | | | 5% ($) (1)

| | 10% ($) (1)

|

Jeffrey Steiner | | 145,518(2 | ) | | 75.8% | | 5.03 | | 09/19/07 | | 202,226 | | 446,866 |

John Flynn | | 6,666(2 | ) | | 3.5% | | 5.03 | | 09/19/07 | | 9,264 | | 20,470 |

Donald Miller | | 13,333(2 | ) | | 6.9% | | 5.03 | | 09/19/07 | | 18,529 | | 40,944 |

Eric Steiner | | 26,400(2 | ) | | 13.8% | | 5.03 | | 09/19/07 | | 36,688 | | 81,071 |

| (1) | | The potential realizable value for each named executive officer reflects the increase in value of the shares granted, based on a beginning price equal to the stock option exercise price and assuming rates of stock value appreciation of 5% and 10%, respectively, over a period of five years. The actual value, if any, an executive may realize will depend on the excess of the stock price over the exercise price on the date the option is exercised. |

| (2) | | These options were granted on 9/20/02; 25% are exercisable on 9/20/03; 50% are exercisable on 9/20/04; 75% are exercisable on 9/20/05; and 100% are exercisable on 9/20/06. |

Table: Option Exercises and Year-End Value

Name

| | Shares Acquired on Exercise (#)

| | Value Realized ($)

| | Number of Securities Underlying Unexercised Options at June 30, 2003

| | Value of Unexercised In-the-Money Options at June 30, 2003

|

| | | | Exercisable (#)

| | Unexercisable (#)

| | Exercisable ($)

| | Unexercisable ($)

|

Jeffrey Steiner | | 0 | | 0 | | 271,642 | | 355,518 | | 58,125 | | 174,375 |

John Flynn | | 0 | | 0 | | 19,167 | | 19,167 | | 1,550 | | 4,650 |

Donald Miller | | 0 | | 0 | | 55,417 | | 39,584 | | 3,875 | | 11,626 |

Warren Persavich | | 0 | | 0 | | 66,370 | | 21,687 | | 3,022 | | 9,067 |

Eric Steiner | | 0 | | 0 | | 147,983 | | 74,816 | | 9,971 | | 29,914 |

12

EMPLOYMENT AGREEMENTS AND CHANGE OF CONTROL ARRANGEMENTS

The following summarizes employment agreements and change of control agreements:

| · | | Employment Agreement between the Company and Jeffrey Steiner: |

| Term of the Agreement: | | Five year term, extended annually by an additional 12 months unless either party gives timely notice not to extend the agreement. |

| |

| Minimum Base Salary Under the Agreement: | | |

| | As determined by the Board of Directors. |

| |

| Current Base Salary: | | $1,700,000 per year. |

| |

| Payments in Event of Death: | | Estate to receive an amount equal to one year’s base salary, plus bonuses for the fiscal year in which death occurred. |

| |

| |

| Payments in Event of Termination Due to Disability: | | |

| | Fifty percent of base salary for two years, plus bonuses for the fiscal year in which disability occurred. |

| |

| Payments in the event of a “change in control” or “trigger event”: | | |

| | In connection with the sale of Fairchild Fasteners to Alcoa Inc., our Board of Directors determined that Mr. Jeffrey Steiner was entitled to a change of control payment in the amount of $6,280,000. Fifty percent (50%) of such payment was made to Mr. Steiner during January to June 2003. The remaining 50% will be paid upon Mr. Steiner’s termination of employment with Fairchild. In connection with such change of control award, Mr. Steiner’s employment agreements were amended, pursuant to which he relinquished any future change of control payments under such employment agreements. |

| · | | Employment Agreement between Banner Aerospace (a Company Subsidiary) and Jeffrey Steiner: |

| Term of the Agreement: | | Three year term, extended annually by an additional 12 months unless either party gives timely notice not to extend the agreement. |

| |

| Minimum Base Salary Under the Agreement: | | |

| | Not less than $250,000 per year, and an annual bonus if certain performance targets are met. |

| |

| Current Base Salary: | | $400,000 per year. |

| |

| Payments in Event of Death: | | Estate to receive an amount equal to one year’s base salary, plus bonuses for the fiscal year in which death occurred. |

| |

| Payments in Event of Termination Due to Disability: | | |

| | Fifty percent of base salary for two years, plus bonuses for the fiscal year in which disability occurred. |

13

| · | | Service Agreement between Fairchild Switzerland, Inc. (Company Subsidiary) and Jeffrey Steiner: |

| Term of the Agreement: | | Year to year. |

| |

| Minimum Base Salary Under the Agreement: | | |

| | Greater of $400,000 or 680,000 Swiss Francs per year, but not more than $400,000. |

| · | | Employment Agreement between the Company and Eric Steiner: |

Term of the Agreement: | | Three year term, extended annually by an additional 12 months unless either party gives timely notice not to extend the agreement. |

| |

| Minimum Base Salary Under the Agreement: | |

$540,000 per year. |

| |

Current Base Salary: | | $725,000. |

| |

Payments in Event of Death: | | Same as the Company’s highest compensated officer. Currently, Jeffrey Steiner is the highest compensated officer. (See death benefits described above under Jeffrey Steiner’s employment agreement.) |

| |

| | | |

| |

| Payments in Event of Termination Due to Disability: | |

Same as the Company’s highest compensated officer. Currently, Jeffrey Steiner is the highest compensated officer. (See disability and termination benefits described above under Jeffrey Steiner’s employment agreement.) |

| |

| Payments in the event of a “change in control”: | |

In connection with the sale of Fairchild Fasteners to Alcoa Inc., our Board of Directors determined that Dr. Eric Steiner was entitled to a change of control payment in the amount of $5,434,000. Fifty percent (50%) of such payment was made to Dr. Steiner in January 2003. The remaining 50% will be paid in four equal and consecutive quarterly installments, with the first installment made on March 3, 2003. In connection with such change of control award, Dr. Eric Steiner’s employment agreement was amended, pursuant to which he relinquished any future change of control payments under such employment agreement. |

| |

| · | | Letter Agreements between the Company and each of the following officers: Donald Miller and John Flynn |

| Payments in the event of Termination Without Cause: | |

2 times then current annual base salary, plus 1 times current annual base salary in lieu of bonus. |

| |

| Payments in the event of a “change in control”: | |

In connection with the sale of Fairchild Fasteners to Alcoa Inc., our Board of Directors determined that Mr. Miller and Mr. Flynn were entitled to a change of control payment in the |

14

| | | following amounts: Miller—$1,125,000; Flynn—$900,000. Fifty percent (50%) of such payments were made to such individuals as follows: Miller—December 2002; Flynn—January 2003. The remaining 50% will be paid in four equal and consecutive quarterly installments, with the first installment made on March 3, 2003. In connection with such change of control awards, the letter agreements between the Company and Messrs. Miller and Flynn were amended, pursuant to which each of Messrs. Miller and Flynn relinquished any future change of control payments under such letter agreements. |

| · | | Employment Agreement between the Company and Warren Persavich: |

Term of the Agreement: | | Two year term, continuously extended unless either party gives 24 months notice not to extend the agreement. |

| |

| Minimum Base Salary Under the Agreement: | | $155,000 per year. |

| |

Current Base Salary: | | $222,000. |

| |

| Minimum Annual Bonus Under the Agreement: | | 50% of base salary if certain performance goals are met. |

| |

Payments in Event of Death: | | Estate to receive payments accrued through the date of death, plus six months base salary and bonuses for the fiscal year in which employment is terminated. |

| |

| Payments in the Event of Termination Due to Disability: | | Base salary continued through the date of employment termination. Employee to receive bonuses for the fiscal year in which employment is terminated. |

| |

| Payments in the Event of Termination without Cause: | | Lump sum payment equal to salary through remainder of the term, plus severance bonus of 50% of base salary. In addition, employee to receive an extra bonus equal to the bonus that would have been earned for a period of two years after the termination date, reduced by the amount of the severance bonus. |

15

PENSION AND RETIREMENT BENEFITS

Fairchild Retirement Plan. The following table illustrates the amount of estimated annual fixed retirement benefits payable under the Fairchild Retirement Plan to an employee retiring in 2003, at age 65, at various salary levels (average of highest five consecutive years out of last ten years of service) and years of service. The Fairchild Retirement Plan defines salary as total compensation, subject to the Internal Revenue Service’s limit on the amount of compensation that may be used to compute benefits under qualified pension plans. This limit is equal to $200,000 for 2003.

Annual Salary

| | 10 Years of Service

| | 20 Years of Service

| | 30 Years of Service

| | 40 Years of Service

|

$25,000 | | $ | 2,000 | | $ | 4,000 | | $ | 6,000 | | $ | 7,313 |

50,000 | | | 4,242 | | | 8,483 | | | 12,724 | | | 15,469 |

100,000 | | | 10,242 | | | 20,483 | | | 30,724 | | | 37,094 |

150,000 | | | 16,242 | | | 32,483 | | | 48,724 | | | 58,719 |

200,000 | | | 22,242 | | | 44,483 | | | 66,724 | | | 80,344 |

250,000 | | | 22,242 | | | 44,483 | | | 66,724 | | | 80,344 |

For purposes of determining benefits under the Fairchild Retirement Plan, the following executive officers have years of credit and average salaries as follows:

Officer

| | Average Salary

| | Years of Credit

|

Jeffrey Steiner | | $180,000 | | 13 years |

John Flynn | | $180,000 | | 16 years |

Donald Miller | | $180,000 | | 12 years |

Warren Persavich | | $180,000 | | 26 years |

Eric Steiner | | $180,000 | | 12 years |

16

Supplemental Executive Retirement Plans. We have two supplemental executive retirement plans for key executives which provide additional retirement benefits based on final average earnings and years of service, as follows:

| | | Unfunded SERP

| | Funded SERP

|

Retirement Benefits | | Provides a maximum retirement benefit (in the aggregate for both Supplemental Executive Retirement Plans) equal to the difference between (i) sixty percent (60%) of the participant’s highest base salary for five consecutive years of the last ten years of employment, and (ii) the aggregate of other pension benefits, profit sharing benefits, stock option benefits and primary Social Security payments to which the participant is entitled. | | Same as the Unfunded SERP. |

| | |

Funding | | This is an unfunded obligation of the Company, not subject to ERISA regulations. The Company makes discretionary contributions to a Rabbi Trust to help meet its obligations under this plan, but the assets under such trust are subject to the claims of the Company’s creditors. | | This plan is a funded obligation of the Company. Such funding contributions are not assets available to the creditors of the Company. |

| | |

| Pre-Retirement Distributions | | Subject to the approval of the Compensation Committee, the plan permits participants who are age 60 or over, to elect to receive a lump sum retirement advance on an actuarially reduced basis. | | At the participant’s request upon attainment of Normal Retirement Age as defined in the Plan. |

| | |

Participants | | Executive Officers. All persons named in the Summary Compensation Table are eligible for participation, in this plan. | | Same as the unfunded plan. |

| | |

| Special Years of Service Accreditation | | Pursuant to a letter agreement with Mr. Miller, for purposes of determining years of service with the Company under the Supplemental Executive Retirement Plans, Mr. Miller will be credited with two years of service for each of the first ten years he is employed by the Company. | | None. |

| | |

| | | Pursuant to a letter agreement with Mr. Flynn, for purposes of determining years of service with the Company under the Supplemental Executive Retirement Plans, Mr. Flynn will be credited with two years of service for each of the first ten years he is employed by the Company. | | None. |

17

REPORT OF THE COMPENSATION AND STOCK OPTION COMMITTEE

The following report does not constitute solicitation material and is not considered filed or incorporated by reference into any other Company filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, unless we state otherwise.

The Compensation and Stock Option Committee is composed of at least two nonemployee Directors. It has initial responsibility for all compensation actions affecting the Company’s executive officers, including base salaries, bonus awards, stock option awards and the terms and conditions of their employment.

Compensation Philosophy

The Committee’s goals are to:

| | • | | Provide compensation competitive with other similar companies. |

| | • | | Reward executives consistent with the performance of the Company. |

| | • | | Recognize individual performance. |

| | • | | Encourage executives to increase shareholder value. |

Components of Executive Officer Compensation

Cash Compensation (Base Salary and Annual Incentive Bonus)—The Company manages the total cash compensation to provide median levels of cash compensation at average levels of corporate, business unit, and individual performance. Cash compensation consists of two components: (i) a base salary that is competitive with that of other companies paying at the median level of the market, and (ii) an annual incentive opportunity that is variable and is reflective of the financial performance of the Company and/or the individual performance of the executive officer. When high levels of performance are achieved, the level of cash compensation may exceed the median of the market. Conversely, when the Company, business unit, or the individual falls short of the predetermined goals, the level of cash compensation may be substantially below the market median. The objective of this mix is to deliver total annual cash compensation competitive with compensation offered at other companies facing similar challenges for similar positions, while simultaneously linking the payment of the annual cash incentive to the achievement of specific objectives in the Company’s annual operating plan as approved by the Board.

Mix Between Salary and Annual Incentive Pay—The mix between salary and annual incentive pay is related to an executive’s job grade. Executives at higher grade levels in the Company have a greater percentage of their total cash compensation contingent on the accomplishment of assigned business objectives, i.e. the higher the executive grade level, the greater the proportion of annual compensation that is “at risk.” The award and size of the performance bonus are based upon: (i) the executive officer’s performance against goals determined by the Company’s Chief Executive Officer; and/or (ii) the performance of the executive officer’s unit within the Company against that unit’s goals; or (iii) the performance of the Company against Company goals. Goals vary from year to year and from unit to unit and, with regard to individual goals of executive officers, usually include both quantitative and qualitative factors.

The Committee approved salary and annual incentive pay for the Company’s named executive officers as set forth under the Summary Compensation Table of this Proxy Statement.

Stock Option Grants—The Committee believes that stock option grants serve as a desirable long-term method of compensation because they closely ally the interests of management with the

18

preservation, enhancement and realization of shareholder value, and serve as an additional incentive to promote the success of the Company. In fiscal 2003, the Committee approved the grant of 191,917 stock options to the Company’s executive officers and zero stock options to other employees. Included in these grants were 191,917 stock options granted to the named executive officers. The CEO received 145,518 stock options.

Total Compensation Program—The Committee believes that the total compensation program for executives of the Company (cash compensation, bonuses and stock option grants) is on a level with the compensation programs provided by other companies facing similar challenges. The Committee believes that any amounts paid under the annual incentive plan will be appropriately related to corporate and individual performance, yielding awards that are directly linked to the annual financial and operational results of the Company within the framework of the challenges faced.

Compensation of CEO

Jeffrey Steiner has served as Chairman of the Board and Chief Executive Officer of the Company since 1985, and as President from July 1991 through September 1998. In fixing Mr. Steiner’s salary and target bonus levels, as well as determining the size of stock options, if any, the Committee and the Board typically review the strategic direction and financial performance of the Company, including enterprise value, revenue and profit levels. In addition, the Committee reviews Mr. Steiner’s performance as Chairman of the Board and Chief Executive Officer, his importance to the Company and his success in implementing its strategic goals both through his entrepreneurial actions and investment banking acumen.

Mr. Steiner has developed and established initiatives aimed at improving the operating efficiency and financial performance of the Company. These include an increased focus of the Company’s efforts to make acquisitions.

Base Compensation—Mr. Steiner’s base compensation for fiscal 2003 was $1,700,000 pursuant to his employment agreement with the Company and $400,000, pursuant to his employment agreement with Banner Aerospace, plus $400,000 for services in Switzerland. Effective January 1, 2003, Mr. Steiner has agreed to defer 20% of his base salary.

Incentive Compensation Performance Goals—The performance goal for and maximum amount of Mr. Steiner’s incentive compensation (i.e., compensation beyond base salary) approved by the shareholders at the last Annual Meeting, was as follows:

If the Earnings before Interest, Taxes, Depreciation and Amortization (EBITDA) of The Fairchild Corporation in Fiscal 2003, as computed in the same manner as under the Company’s Credit Agreement in effect as of July 1, 2002, is more or less than the Company’s planned EBITDA (“Target EBITDA”) as submitted to the Board of Directors of the Company on September 20, 2002, then the President may receive an incentive compensation award based on a percentage of aggregate base salary in accordance with the following table:

Percentage of Target EBITDA

| | Percentage of

Base Salary

|

Less than 80% | | 0% |

80% or more, but less than 90% | | 35% |

90% or more, but less than 95% | | 50% |

95% or more, but less than 100% | | 65% |

100% or more, but less than 105% | | 80% |

105% or more, but less than 110% | | 100% |

110% or more | | 125% |

19

The Committee determined that Mr. Steiner would receive no incentive compensation for fiscal 2003 under the above performance goals.

The performance goals for and the maximum amount of Mr. Steiner’s incentive compensation approved by the shareholders at the Special Meeting held on November 21, 2002, were as follows:

| | 1. | | If the company engages in an extraordinary transaction (e.g., purchase or sale of assets not in the ordinary course, including, without limitation, through a public offering or private placement of securities) during fiscal 2003, the Chief Executive Officer may receive up to two and one-half percent (2.5%) of the total value of the transaction, which with respect to the sale of our fastener business, would be up to $16,427,000, subject to the aggregate compensation limit described below. |

| | 2. | | Notwithstanding the foregoing, the payment of incentive compensation in connection with extraordinary transactions is restricted as follows: |

| | · | | There shall be no cash incentive compensation on acquisitions by the company; |

| | · | | There shall be no incentive compensation in connection with the company’s issuance of any debt securities (bonds, credit agreements, etc.); and |

| | · | | There shall be no incentive compensation in connection with an offering of equity for cash, through investment bankers. |

After the sale of the Fairchild Fastener business to Alcoa on December 3, 2002, for $657,000,000, the Committee determined that Mr. Steiner should receive $5,246,400 in connection with the services which Mr. Steiner performed relative to the sale.

Stock Option Compensation—In fiscal 2003, the Committee approved the grant of 145,518 stock options to Mr. Jeffrey Steiner under the Stock Option Plan.

Internal Revenue Code Section 162(m)

The Committee has considered the impact of Section 162(m) Internal Revenue Code of 1986, as amended (the “Code”), which in certain circumstances disallows income tax deductions for compensation in excess of $1,000,000. This disallowance provision does not apply to performance-based compensation and certain other forms of compensation. The Committee currently intends to structure our incentive compensation awards to our Chief Executive Officer and other executive officers in a manner that complies with the Code’s requirements for performance-based compensation to ensure that we are entitled to deduct such compensation. One of these requirements is that the shareholders approve the material terms of performance goals for such awards. To satisfy this requirement, the shareholders are being asked in this proxy statement to approve the material terms of certain performance goals for the following officers: the President and the Chief Executive Officer.

Change of Control Payments

In connection with the sale of Fairchild Fasteners to Alcoa Inc. the Company approved certain “change of control payments” to four of our current executives, as follows: Jeffrey Steiner: $6,280,000; Eric Steiner: $5,434,000; John Flynn: $900,000; and Donald Miller: $1,125,000. These payments were triggered by contractual agreements with such individuals, which provided for the payment of a change of control payment upon a sale by us of substantially all of our assets. These payments were disclosed in the Proxy Statement for the Special Shareholders Meeting held on November 21, 2002, at which the Alcoa transaction was approved by the shareholders. In connection with the award of such change of control payments, each individual agreed to amend his contractual agreements with the Company, to

20

waive any other change of control payments they would otherwise be due in the future under such agreements. The change of control payments are due on a deferred basis, as set forth in the footnotes to the Compensation Table presented in this Proxy Statement.

Respectfully submitted by the members of the Compensation and Stock Option Committee of the Board of Directors:

Daniel Lebard, Chairman

Harold J. Harris

Herbert S. Richey

21

REPORT OF THE AUDIT COMMITTEE

The following report does not constitute solicitation material and is not considered filed or incorporated by reference into any other Company filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, unless we state otherwise.

In accordance with a written charter adopted by the Company’s Board of Directors, the Audit Committee of the Company’s Board of Director’s (the “Committee”) assists the Board of Directors in fulfilling its responsibility for oversight of the quality and integrity of the Company’s financial reporting processes. Management has the primary responsibility for the financial statements and the reporting process, including the system of internal controls. The independent auditors are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with generally accepted audited standards and for issuing a report thereon.

In this context, the Committee has reviewed, and has met with management and the independent auditors to discuss, the audited financial statements contained in the 2003 Annual Report on SEC Form 10-K.

Management represented to the Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Committee has reviewed and discussed the consolidated financial statements with management and the independent auditors. The Committee discussed with the independent auditors matters required to be discussed by Statement on Auditing Standards No. 61 (Communications with Audit Committees), as amended, including the quality and acceptability of the Company’s financial reporting process and controls.

The Committee discussed with the Company’s internal and independent auditors the overall scope and plans for their respective audits. The Committee meets regularly with the internal and independent auditors, with and without management present, to discuss the results of their examinations, the evaluations of the Company’s internal controls and the overall quality of the Company’s accounting principles.

In addition, the Committee has discussed with the independent auditors the auditors’ independence from the Company and its management, including the matters in the written disclosures required by the Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees).

In performing all of these functions, the Committee acts only in an oversight capacity and necessarily relies on the work and assurances of the Company’s management and independent auditors, which, in their report, express an opinion on the conformity of the Company’s annual financial statements to generally accepted accounting principles.

In reliance on the reviews and discussions noted above, the Committee recommended to the Board of Directors, and the Board has approved, that the audited financial statements of the Company for the year ended June 30, 2003 be included in the 2003 Annual Report on SEC Form 10-K for filing with the Securities and Exchange Commission.

Respectfully submitted by the members of the Audit Committee of the Board of Directors:

Herbert S. Richey (Chairman)

Mortimer M. Caplin

Steven L. Gerard

Harold J. Harris

22

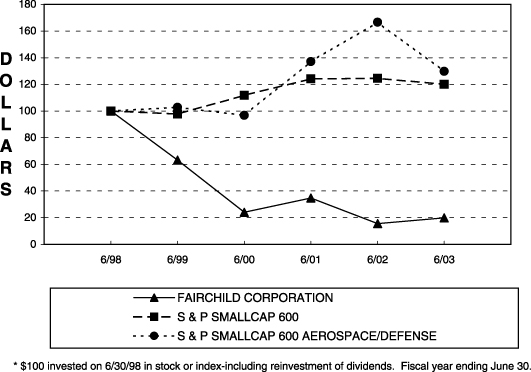

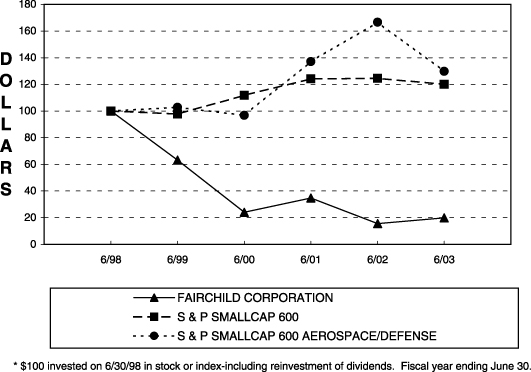

STOCK PERFORMANCE GRAPH

The following stock performance graph does not constitute solicitation material and is not considered filed or incorporated by reference into any other Company filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, unless we state otherwise.

COMPARISON TO S&P 600 SMALLCAP INDEX AND S&P 600 SMALLCAP AEROSPACE/DEFENSE INDEX*

The following graph compares the performance of the Company’s Class A Stock with that of the S&P 600 Smallcap Index and the S&P Smallcap Aerospace/Defense index (consisting of five aerospace/defense manufacturers). The graph plots the growth in value of an initial $100 investment over the indicated five-year period with all dividends reinvested.

| |

|

| | | Cumulative Total Return |

| |

|

| | | 6/98 | | 6/99 | | 6/00 | | 6/01 | | 6/02 | | 6/03 |

|

FAIRCHILD CORPORATION | | 100.00 | | 63.16 | | 24.15 | | 34.72 | | 15.60 | | 19.96 |

|

S & P SMALLCAP 600 | | 100.00 | | 97.69 | | 111.74 | | 124.16 | | 124.50 | | 120.05 |

|

S & P SMALLCAP 600 AEROSPACE/DEFENSE COMPANIES | | 100.00 | | 102.8 | | 96.83 | | 137.12 | | 166.52 | | 129.76 |

|

23

STOCK OWNERSHIP

The following table shows the number of shares beneficially owned (as of August 31, 2003) by:

| | · | | each person who we know beneficially owns more than 5% of the common stock; |

| | · | | each director and nominee director; |

| | · | | each executive officer named in the Summary Compensation Table; and |

| | · | | the directors and nominee director and executive officers as a group. |

Name

| | Number of Shares

of Class A Stock (1)

| | | Percentage

of Class

| | | Number of Shares

of Class B Stock (1)

| | | Percentage

of Class

| |

Mortimer M. Caplin | | 129,614 | (2) | | * | | | — | | | — | |

Dimensional Fund Advisors Inc. | | 1,811,062 | (3) | | 8.03 | % | | — | | | — | |

Robert E. Edwards | | 997,695 | | | 4.42 | % | | — | | | — | |

John L. Flynn | | 58,025 | (2)(4) | | * | | | — | | | — | |

Gabelli Funds, LLC | | 2,259,412 | (3) | | 10.01 | % | | — | | | — | |

Steven L. Gerard | | 50,612 | (2) | | * | | | — | | | — | |

Harold J. Harris | | 93,230 | (2)(4) | | * | | | — | | | — | |

Daniel Lebard | | 31,606 | (2) | | * | | | — | | | — | |

Donald E. Miller | | 130,960 | (2)(4) | | * | | | — | | | — | |

Warren Persavich | | 109,144 | (2) | | * | | | | | | | |

John Podkowsky | | — | | | — | | | — | | | — | |

Herbert S. Richey | | 19,250 | (2) | | * | | | — | | | — | |

Steinberg Priest & Sloane Capital | | 1,756,004 | (3) | | 7.78 | % | | | | | | |

Eric I. Steiner | | 402,447 | (2)(4)(7) | | 1.77 | % | | 15,000 | | | * | |

Jeffrey J. Steiner | | 6,625,754 | (2)(6) | | 25.97 | % | | 2,563,996 | (6) | | 97.81 | % |

The Steiner Group LLC | | 5,727,684 | (3)(5) | | 22.82 | % | | 2,533,996 | (5) | | 96.66 | % |

All directors and executive officers as a group (13 persons) | | 8,669,795 | (2) | | 33.38 | % | | 2,578,996 | | | 98.38 | % |

*Represents less than one percent.

Footnotes to Stock Ownership Chart:

| (1) | | The Class A Stock Column includes shares of Class B Stock, which are immediately convertible into Class A Stock on a share-for-share basis. Options that are exercisable immediately or within sixty days after August 31, 2003 appear in the Class A Stock column. |

| (2) | | Includes exercisable stock options to purchase Class A Stock, as follows: M. Caplin, 9,250 shares; J. Flynn, 26,251 shares; H. Harris, 13,000 shares; D. Lebard, 16,250 shares; D. Miller, 72,917 shares; H. Richey, 9,250 shares; S. Gerard, 31,812 shares; W. Persavich, 75,571 shares; E. Steiner, 176,555 shares; J. Steiner, 381,772 shares; Directors and Executive Officers as a group, 828,828 shares. |

| (3) | | Based on the following information: |

Dimensional Fund Advisors Inc., 1299 Ocean Avenue, 11th Floor, Santa Monica, CA 90401. Information as of December 31, 2002 contained in a Schedule 13G/A filed on February 3, 2003 with the SEC by Dimensional Fund Advisors, Inc.

Gabelli Funds, LLC, One Corporate Center, Rye, NY 10580-1434. Information contained in a Schedule 13D/A-10, filed on November 20, 2002 with the SEC by Gabelli Funds, Inc.

Steinberg Priest & Sloane Capital Management, LLC, 12 East 49th Street, New York, NY 10017. Information as of December 31, 2002 contained in a Schedule 13G filed on February 13, 2003 with the SEC by Steinberg Priest & Sloane Capital Management LLC.

24

The Steiner Group LLC, c/o Withers Bergman LLP, 430 Park Avenue, New York, NY 10022. Information contained in a Schedule 13D/A-23 filed on July 29, 2002 with the SEC by The Steiner Group LLC.

| (4) | | Includes shares beneficially owned, as follows: H. Harris — 27,268 shares of Class A Stock owned by the William H. Harris 401K and Private Profit-Sharing Plan and 7,500 shares held by his wife. D. Miller — 300 shares of Class A Stock owned by Mr. Miller as custodian for his child; Mr. Miller disclaims any beneficial interest therein. E. Steiner — 80,000 shares of Class A Stock held in The Steiner Children’s Trust; 15,622 shares held in 401k Savings Plan; and 10,000 shares held in the E&P Steiner Family Investment LLC. J. Flynn — 7,406 shares held in 401k Savings Plan. |

| (5) | | The Steiner Group LLC is a Delaware limited liability company. Jeffrey Steiner is its sole manager. The members are Jeffrey Steiner (with a 20% membership interest), and The Jeffrey Steiner Family Trust (with an 80% membership interest). The Jeffrey Steiner Family Trust is a trust created for the benefit of the issue of Jeffrey Steiner. The Steiner Group LLC holds 3,193,688 shares of Class A Stock and 2,533,996 shares of Class B Stock. |

| (6) | | Mr. Jeffrey Steiner, c/o The Fairchild Corporation, 45025 Aviation Drive, Suite 400, Dulles, VA 20166. Mr. Steiner is the sole manager of The Steiner Group LLC, and as such may be deemed to beneficially own the same shares of Class A Stock and Class B Stock owned directly or beneficially by The Steiner Group LLC, as discussed in footnote (5) to this table. |

Class A Stock shown in the table as owned by Mr. Steiner includes: (i) 5,727,684 shares owned by The Steiner Group LLC (see footnote (5)); (ii) 442,754 shares owned of record by Mr. Steiner; (iii) exercisable stock options to purchase 381,772 shares of Class A Stock (see footnote (2)); (iv) 38,500 shares of Class A Stock owned by Mr. Steiner as custodian for his children; (v) 30,000 shares of Class B Stock (convertible on a one-to-one basis to Class A Stock) owned by Mr. Steiner as custodian for his children; (vi) 2,400 shares of Class A Stock owned by the Jeffrey Steiner Family Foundation; and (vii) 2,644 shares of Class A Stock held in his 401k Savings Plan.

Class B Stock shown in the table as owned by Mr. Jeffrey Steiner include: (i) 2,533,996 shares owned by The Steiner Group LLC (see footnote (5)); and (ii) 30,000 shares of Class B Stock owned by Mr. Steiner as custodian for his children.

Mr. Steiner disclaims beneficial ownership of shares owned by The Steiner Group LLC, the Jeffrey Steiner Family Foundation, and shares owned by him as custodian for his children.

| (7) | | 80,430 shares of Class A Stock owned by Dr. Eric Steiner are held as collateral in a margin account at Sands Brothers & Co. Ltd. |

25

CERTAIN TRANSACTIONS

| · | | We paid for a chartered helicopter used for business related travel. The owner of the chartered helicopter was a company controlled by Mr. Jeffrey Steiner. That company sold its helicopter in 2003. The cost for such flights that we were charged was 95% of comparable rates charged in arm’s length transactions between unaffiliated third parties. The total amount paid for the helicopter in FY2003 was approximately $308,000. |

| · | | The Company uses a chartered aircraft owned by an affiliate of Mr. Jeffrey Steiner. Cost for such flights charged to the Company for business related travel are comparable to those charged in arm’s length transactions between unaffiliated third parties. Total amount paid by the Company in fiscal 2003 was $568,000, which included a prepayment for the future use of the aircraft. |

| · | | We pay for the maintenance and upkeep of an apartment located in Paris, France and used by us from time to time for business related travel by Mr. E. Steiner. The owner of the apartment is a company controlled by the Steiner Family. Overall, we believe our cost for such apartment is less than the cost of similar accommodations for our business related travel. The total amounts paid for such apartment expenses was approximately $66,000 in 2003. |

| · | | Prior to July 30, 2002, we extended loans to purchase our Class A common stock to certain members of our senior management and Board of Directors, for the purpose of encouraging ownership of our stock, and to provide additional incentive to promote our success. The loans are non-interest bearing, have maturity dates ranging from 6 months to 4 1/2 years, and (at the Company’s discretion) become due and payable immediately upon the termination of employment for senior management, or director affiliation with us for a director. As of June 30, 2003, the indebtedness owed to us from Mr. Flynn, Mr. Miller, Mr. Persavich, Mr. E. Steiner, and Mr. J. Steiner, was approximately $175,000 each. On June 30, 2003, Mr. Gerard and Ms. Hercot (daughter of Mr. J. Steiner), owed us approximately $99,000 and $167,000 respectively. On June 30, 2003, approximately $106,000 was owed to us by each of Mr. Caplin, Mr. Harris, Mr. Lebard, and Mr. Richey. During 2003, the largest aggregate balance of indebtedness outstanding under the officer and director stock purchase program from Mr. Miller and Mr. E. Steiner was approximately $220,000 each. As of June 30, 2003, each of the individual amounts due to us from every other officer or director represented the largest aggregate balance of indebtedness outstanding under the officer and director stock purchase program. In accordance with Sarbanes-Oxley, no new loans will be made to executive officers or directors. |

| · | | On November 16, 1999, Mr. Richey borrowed $46,000 from us, at an interest rate of 5.5%, to exercise stock options and hold our Class A common stock. The loan matured on November 16, 2002 and the loan balance of $53,000 was repaid. |

| · | | In August 2003, Mr. J. Steiner reimbursed us $258,000 for personal expenses that we paid on his behalf, which were outstanding as of June 30, 2003. During fiscal 2003, we reimbursed $75,000 to Mr. J. Steiner, representing a portion of out-of-pocket costs he incurred personally in connection with the entertainment of third parties, which benefit the Company. At no time during 2003, did amounts due to us from Mr. J. Steiner exceed the amount of the after-tax salary on deferrals we owed to him. |

| · | | Eric Steiner (son of Jeffrey Steiner) is an executive officer of the Company. His compensation is set forth in the compensation table of the proxy statement. Natalia Hercot (daughter of Jeffrey Steiner) is a Vice President of the Company, for which she was compensated $98,000 in fiscal 2003. Natalia Hercot’s current salary is 37,440 Euros per year, and she is the manager of the Fairchild France branch in Paris. Thierry Steiner (son of Jeffrey Steiner) was an employee of the Company through May 31, 2003, for which he was compensated $55,000 in fiscal 2003. Thierry Steiner is no longer employed by the Company. |

26

| · | | On July 16, 2002, Jeffrey Steiner and Eric Steiner entered into a Non-Competition and Consulting Agreement with Alcoa Inc. pursuant to which: (1) Alcoa has agreed to pay Jeffrey Steiner and Eric Steiner fees totaling $5 million (in the aggregate) over a four-year period; and (2) Jeffrey Steiner and Eric Steiner have agreed to refrain from competing with Fairchild Fasteners, and to provide consulting services to Alcoa with respect to operations of Fairchild Fasteners. The agreement became effective on December 3, 2003, on the closing date for the sale of Fairchild Fasteners to Alcoa Inc. One-half of the fees were or are to be paid in the first year as follows: (1) on the closing date, $800,000; (2) 90 days following the closing date, $700,000; (3) 180 days following the closing date, $400,000; (4) 270 days following the closing date, $300,000; and (5) one year following the closing date, $300,000. The remaining fees will be paid quarterly in arrears and will be $1.25 million, $750,000 and $500,000 per year with respect to each of the second, third and fourth years, respectively. |

| · | | Subject to the approval of the Compensation Committee, the Company’s Unfunded Supplemental Executive Retirement Plan (SERP) permits participants who are age 60 or over, to elect to receive a lump sum retirement advance on an actuarially reduced basis. During Fiscal 2003, Mr. Jeffrey Steiner received an advance under the Unfunded SERP (representing a partial distribution of his vested benefits) in the amount of $62,383 and, in September 2003, the Board approved an additional advance to Mr. Steiner under the Unfunded SERP (representing a partial distribution of his vested benefits) in the amount of $1,600,000. |

27

PROPOSAL NO. 2

APPROVAL OF

PERFORMANCE GOALS FOR

INCENTIVE COMPENSATION FOR

THE PRESIDENT

At the annual meeting, you will be asked to approve the material terms of the performance goals established by the Compensation and Stock Option Committee with respect to fiscal 2004 incentive compensation awards for the Company’s President (Dr. Eric Steiner).

Section 162(m) of the Internal Revenue Code disallows deductions for publicly-held corporations with respect to compensation in excess of $1,000,000 paid to certain executive officers. However, compensation payable solely on account of attainment of one or more performance goals is not subject to this deduction limitation if:

| | · | | the performance goals are objective, pre-established and determined by a compensation committee comprised solely of two or more outside directors, |

| | · | | the material terms of the performance goals under which the compensation is to be paid are disclosed to the shareholders and approved by a majority vote, and |

| | · | | the compensation committee certifies that the performance goals and other material terms were in fact satisfied before the compensation is paid. |

The purpose of seeking shareholder approval of the President’s incentive compensation award is to meet the requirements of Section 162(m). We recommend that you vote “FOR” this proposal.

Vote Required. To be approved, this matter must receive the affirmative vote of a majority of the shares present (in person or by proxy) at the meeting and entitled to vote on such matter. Broker nonvotes will not be counted as present and shall not be entitled to vote on this proposal.

Performance Goals. On September 18, 2003, the Company’s Compensation and Stock Option Committee established performance goals for the President’s fiscal 2004 incentive compensation award and the maximum amount payable to the President if the goal is achieved. The performance goals and maximum amount payable for fiscal 2004 are as follows:

| | 1. | | If the Earnings before Interest, Taxes, Depreciation and Amortization (EBITDA) of The Fairchild Corporation, as computed in the same manner as under the Company’s Fiscal 2004 Budget submitted to the Board of Directors of the Company on September 22, 2003, is more or less than the Company’s planned EBITDA set forth in the Fiscal 2004 Budget (“Target EBITDA”), then the President may receive an incentive compensation award based on a percentage of aggregate base salary in accordance with the following table: |

Percentage of Target EBITDA

| | Percentage of Base Salary

| |

| |

Less than 80% | | 0 | % |

80% or more, but less than 90% | | 35 | % |

90% or more, but less than 95% | | 50 | % |

95% or more, but less than 100% | | 75 | % |

100% or more, but less than 105% | | 80 | % |

105% or more, but less than 110% | | 100 | % |

110% or more | | 125 | % |

28

| | 2. | | If the Company engages in an extraordinary transaction (e.g., purchase or sale of assets not in the ordinary course, including, without limitation, through a public offering or private placement of securities) during fiscal 2004, the President may receive up to two percent (2%) of the total value of the transaction. |

| | 3. | | Notwithstanding the foregoing, the payment of incentive compensation in connection with extraordinary transactions is restricted as follows: |

| | · | | There shall be no cash incentive compensation awards on acquisitions by the Company; |

| | · | | There shall be no incentive compensation awards in connection with raising of equity through investment bankers. |

All of the foregoing will be computed in such a manner as to avoid duplication.

The Compensation and Stock Option Committee retains the right to determine the actual amount of incentive compensation to be awarded to the President in fiscal 2004 based on his individual contribution, consistent with the foregoing goal and in an amount no greater than the maximum amount set forth above.

Assuming the shareholders approve the material terms of the performance goal as described herein, the Company believes that any such incentive compensation award to the President will qualify as performance-based compensation that will be deductible from the Company’s gross income for federal income tax purposes.

29

PROPOSAL NO. 3

APPROVAL OF

PERFORMANCE GOALS FOR

INCENTIVE COMPENSATION FOR

THE CHIEF EXECUTIVE OFFICER

At the annual meeting, you will be asked to approve the material terms of the performance goals established by the Compensation and Stock Option Committee with respect to fiscal 2004 incentive compensation awards for the Company’s Chief Executive Officer (Mr. Jeffrey Steiner).

Section 162(m) of the Internal Revenue Code disallows deductions for publicly-held corporations with respect to compensation in excess of $1,000,000 paid to certain executive officers. However, compensation payable solely on account of attainment of one or more performance goals is not subject to this deduction limitation if:

| | · | | the performance goals are objective, pre-established and determined by a compensation committee comprised solely of two or more outside directors, |

| | · | | the material terms of the performance goals under which the compensation is to be paid are disclosed to the shareholders and approved by a majority vote, and |

| | · | | the compensation committee certifies that the performance goals and other material terms were in fact satisfied before the compensation is paid. |

The purpose of seeking shareholder approval of the Chief Executive Officer’s incentive compensation award is to meet the requirements of Section 162(m). We recommend that you vote “FOR” this proposal.

Vote Required. To be approved, this matter must receive the affirmative vote of a majority of the shares present (in person or by proxy) at the meeting and entitled to vote on such matter. Broker nonvotes will not be counted as present and shall not be entitled to vote on this proposal.

Performance Goals. On September 18, 2003, the Company’s Compensation and Stock Option Committee established performance goals for the Chief Executive Officer’s fiscal 2004 incentive compensation award and the maximum amount payable to the Chief Executive Officer if the goals are achieved. The performance goals and maximum amounts payable for fiscal 2004 are as follows:

| | 1. | | If the Earnings before Interest, Taxes, Depreciation and Amortization (EBITDA) of The Fairchild Corporation in Fiscal 2004, as computed in the same manner as under the Company’s Fiscal 2004 Budget submitted to the Board of Directors of the Company on September 22, 2003, is more or less than the Company’s planned EBITDA set forth in the Fiscal 2004 Budget (“Target EBITDA”), then the Chief Executive Officer may receive an incentive compensation award based on a percentage of aggregate base salary in accordance with the following table: |

Percentage of Target EBITDA

| | Percentage of Base Salary

| |

| |

Less than 80% | | 0 | % |

80% or more, but less than 90% | | 35 | % |

90% or more, but less than 95% | | 50 | % |

95% or more, but less than 100% | | 75 | % |

100% or more, but less than 105% | | 110 | % |

105% or more, but less than 110% | | 130 | % |

110% or more | | 175 | % |

30

| | 2. | | If the Company engages in an extraordinary transaction (e.g., purchase or sale of assets not in the ordinary course, including, without limitation, through a public offering or private placement of securities) during fiscal 2004, the Chief Executive Officer may receive up to two and one-half percent (2 1/2%) of the total value of the transaction. |

| | 3. | | Notwithstanding the foregoing, the payment of incentive compensation in connection with extraordinary transactions is restricted as follows: |

| | · | | There shall be no cash incentive compensation awards on acquisitions by the Company; |

| | · | | There shall be no incentive compensation awards in connection with raising of equity through investment bankers. |

All of the foregoing will be computed in such a manner as to avoid duplication.

The Compensation and Stock Option Committee retains the right to determine the actual amount of incentive compensation to be awarded to the Chief Executive Officer in fiscal 2004 based on his individual contribution, consistent with the foregoing goals and in an amount no greater than the maximum amounts set forth above.

Assuming the shareholders approve the material terms of the performance goals as described herein, the Company believes that any such incentive compensation award to the Chief Executive Officer will qualify as performance-based compensation that will be deductible from the Company’s gross income for federal income tax purposes.

31

RELATIONSHIP WITH INDEPENDENT ACCOUNTANTS

Current Independent Auditors: On June 9, 2003, the Company appointed KPMG LLP to serve as its independent auditors for the fiscal year ended on June 30, 2003. On September 22, 2003, upon the recommendation of the Audit Committee, the Company again appointed KPMG to serve as its independent auditors for the current fiscal year, which ends on June 30, 2004. Representatives of KPMG will be available at the annual meeting to make a statement, if they so desire, and to respond to appropriate questions.

Prior Independent Auditors — Arthur Andersen: On May 9, 2002, upon the recommendation of the Audit Committee, the Board of Directors dismissed Arthur Andersen LLP as the Company’s independent auditors. This was reported by the Company on a Form 8-K filed with the Securities and Exchange Commission on May 14, 2002. Arthur Andersen’s reports on the Company’s consolidated financial statements for each of the last two fiscal years for which it served as an independent auditor, did not contain an adverse opinion or disclaimer of opinion, nor were such reports qualified or modified as to uncertainty, audit scope or accounting principles. During the last two fiscal years for which Arthur Andersen served as an independent auditor and through the date of the Form 8-K reporting their dismissal (May 14, 2002), there were: (i) no disagreements with Arthur Andersen on any matter of accounting principle or practice, financial statement disclosure, or auditing scope or procedure which, if not resolved to Arthur Andersen’s satisfaction, would have caused them to make reference to the subject matter in connection with their report on the Company’s consolidated financial statements for such years; and (ii) there were no reportable events as defined in Item 304(a)(1)(v) of Regulation S-K. The Company provided Arthur Andersen with a copy of the foregoing disclosures. A copy of Arthur Andersen’s letter, dated May 13, 2002, stating its agreement with such statements, was attached as Exhibit 16 to the Form 8-K report filed on May 14, 2002. Arthur Andersen was replaced by Ernst & Young LLP as the Company’s independent auditors. During the last two fiscal years for which Arthur Andersen served as an independent auditor and through the date of the Form 8-K reporting their dismissal (May 14, 2002), the Company did not consult Ernst & Young with respect to the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on our consolidated financial statements, or any other matters or reportable events as set forth in Items 304(a)(2)(i) and (ii) of Regulation S-K. Representatives of Arthur Andersen are not expected to be available at the annual meeting.