SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Act of 1934.

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

¨ Preliminary Proxy Statement | | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement | | |

¨ Definitive Additional Materials | | |

¨ Soliciting Material under Rule 14a-12 | | |

The Fairchild Corporation

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-(i)(4) and 0-11. |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount of which the filing is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | | Amount previously paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

THE FAIRCHILD CORPORATION

1750 Tysons Boulevard

Suite 1400

McLean, VA 22102

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| | |

| Date: | | Wednesday, March 8, 2006 |

| |

| Time: | | 10:00 a.m. |

| |

| Place: | | Ritz-Carlton 1700 Tysons Boulevard McLean, VA 22102 |

Matters to be voted on:

| | 1. | | Election of five directors. |

| | 2 | | Any other matters properly brought before the shareholders at the meeting. |

By Order of the Board of Directors

Donald E. Miller

Executive Vice President & Secretary

January 27, 2006

CONTENTS

PROXY STATEMENT

Your vote at the annual meeting is important to us. Please vote your shares of common stock by completing the enclosed proxy card and returning it to us in the enclosed envelope. This proxy statement has information about the annual meeting and was prepared by the Company’s management for the board of directors. This proxy statement was first mailed to shareholders on or about January 27, 2006.

GENERAL INFORMATION ABOUT VOTING

Who can vote?

Only shareholders of record holding Class A common stock or Class B common stock as of the close of business on January 13, 2006, will be entitled to receive notice of the annual meeting and to vote at the meeting.

On January 13, 2006, there were 22,604,761 shares of Class A common stock and 2,621,412 shares of Class B common stock outstanding and eligible to vote. Shares of common stock owned by the Company or any subsidiary are not entitled to vote, and are not included in the number of outstanding shares. Class A shares are entitled to one vote per share; Class B shares are entitled to 10 votes per share.

How do I vote by proxy?

Follow the instructions on the enclosed proxy card to vote on each proposal to be considered at the annual meeting. Sign and date the proxy card and mail it back to us in the enclosed envelope. The proxyholders named on the proxy card will vote your shares as you instruct. If you sign and return the proxy card, but do not vote on a proposal, the proxyholders will vote for you on that proposal. Unless you instruct otherwise, the proxyholders will vote “FOR” each of the five director nominees and “FOR” each of the other proposals to be considered at the meeting.

How do participants in our savings plan vote these shares?

If you are a participant in our savings plan, the proxy card also will serve as a voting instruction for the trustee of the plan, Mercer HR Services, to vote all shares of Class A common stock which are held by the trustee for your benefit. The shares represented by your proxy will be voted as you direct. The trustee will hold your voting directions in strict confidence. If you do not vote your proxy, shares held by the trustee for your benefit will be voted by the trustee in the same proportion as the shares properly voted by other participants in the savings plan.

What if other matters come up at the annual meeting?

The matters described in this proxy statement are the only matters we know will be voted on at the annual meeting. If other matters are properly presented at the meeting, the proxyholders will vote your shares as they see fit.

May I change my vote after I return my proxy card?

Yes. At any time before the vote on a proposal, you may change your vote either by giving the Company’s secretary a written notice revoking your proxy card or by signing, dating, and returning to us a new proxy card. We will honor the proxy card with the latest date.

1

May I vote in person at the annual meeting rather than by completing the proxy card?

Although we encourage you to complete and return the proxy card to ensure that your vote is counted, you may attend the annual meeting and vote your shares in person.

What do I do if my shares are held in “street name”?

If your shares are held in the name of your broker, a bank, or other nominee, that party should give you instructions for voting your shares.

How are votes counted?

We will hold the annual meeting if holders of a majority of the shares of Class A common stock and Class B common stock entitled to vote either sign and return their proxy cards or attend the meeting. If you sign and return your proxy card, your shares will be counted to determine whether we have a quorum even if you abstain or fail to vote on any of the proposals listed in the proxy card.

If your shares are held in the name of a nominee, and you do not tell the nominee how to vote your shares (so-called “broker nonvotes”), the nominee can vote them as it sees fit only on matters that the New York Stock Exchange determines to be routine, and not on any other proposal. Broker nonvotes will be counted as present to determine if a quorum exists, but will not be counted as present and entitled to vote on any nonroutine proposal.

Who pays for this proxy solicitation?

We do. In addition to sending you these materials, some of our employees may contact you by telephone, by mail, or in person. None of these employees will receive any extra compensation for doing this. The Company will also reimburse brokerage houses and others forwarding proxy materials to beneficial owners of stock. The Company has not included the costs of solicitation in this Proxy Statement since such costs are not expected to exceed the amount normally expended for a solicitation for an election of directors in the absence of a contest.

2

PROPOSAL NO. 1

ELECTION OF DIRECTORS

An entire board of directors, consisting of five members, will be elected at the annual meeting. The directors elected will hold office until their successors are elected, which should occur at the next annual meeting. We recommend a vote “FOR” the nominees presented below.

Vote Required. The five nominees receiving the highest number of votes will be elected. Votes withheld for a nominee will not be counted.

Nominations. At the annual meeting, we will nominate the persons named in this proxy statement as directors. Although we do not know of any reason why one of these nominees might not be able to serve, the board of directors will propose a substitute nominee if any nominee is not available for election.

DIRECTORS STANDING FOR ELECTION

All of the nominees are currently directors of the Company. Each has agreed to be named in this proxy statement and to serve as a director if elected. All nominees have been designated as “Continuing Directors” as defined in the Company’s Certificate of Incorporation.

| | | | |

Name

| | Age

| | Position

|

Robert E. Edwards | | 57 | | Director |

Steven L. Gerard | | 60 | | Director |

Daniel Lebard | | 66 | | Director |

Eric I. Steiner | | 44 | | President, Chief Operating Officer and Director |

Jeffrey J. Steiner | | 68 | | Chairman of the Board and Chief Executive Officer |

Robert E. Edwards. Director since 1998. Executive Vice President of Fairchild Fasteners: March 1998 to January 2001. Chief Operating Officer of Fairchild Fasteners U.S. Operations: January 2000 to January 2001. Chief Executive Officer of Fairchild Fasteners Direct: March 1998 to December 1999. President and Chief Executive Officer of Edwards and Lock Management Corporation (predecessor of Fairchild Fasteners Direct): 1983 to 1998. Pursuant to the merger agreement by which the Company acquired Fairchild Fasteners Direct, Mr. Edwards is to be nominated for election as a director every year as long as he continues to own at least 541,258 shares of Class A common stock.

Steven L. Gerard. Director since 1999. Chairman and Chief Executive Officer of CBIZ, Inc. (provider of integrated business services and products): October 2000 to present. Chairman and Chief Executive Officer of Great Point Capital, Inc. (financial and operating consultants): 1997 to October 2000. Chairman and Chief Executive Officer of Triangle Wire & Cable, Inc. and its successor, Ocean View Capital, Inc., a manufacturer of insulated wire and cable: September 1991 to August 1997. Director of Lennar Corporation, Timco Aviation Services, Inc. and Joy Global, Inc.

Daniel Lebard. Director since 1996. Chairman of Supervisory Board of Daniel Lebard Management Development SA, a consulting firm in Paris, France, which performs management services: 1982 to Present. Chief Executive Officer of ISPG and Executive Chairman of Albright & Wilson plc (manufacturer of added value phosphate products): 1999.

Dr. Eric I. Steiner. Director since 1988. President of the Company: September 1998 to Present. Chief Operating Officer of the Company: November 1996 to Present. Executive Vice President of the Company: November 1996 to September 1998. Senior Vice President, Operations of the Company: May 1992 to November 1996. Dr. Steiner is the son of Jeffrey J. Steiner.

3

Jeffrey J. Steiner. Director since 1985. Chairman of the Board and Chief Executive Officer of the Company: December 1985 to Present. President of the Company: July 1991 to September 1998. Director of Global Sources Ltd.

Legal Proceedings Involving Jeffrey Steiner: Over the past several years, we have disclosed certain legal proceedings in France involving Mr. Jeffrey Steiner, Chairman and Chief Executive Officer of the Company. All of the charges against Mr. Steiner, which resulted from these proceedings, were dismissed except for one, relating to the unjustified use in 1990 of corporate funds of Elf-Acquitaine, a French oil company. Mr. Steiner was given a suspended sentence and ordered to pay a fine of 500,000 Euros by the French Court. This decision has resulted in no penal record in France. The Company and Mr. Steiner’s respective rights and obligations with respect to each other as a result of his defense in these proceedings were resolved in connection with the Derivative Settlement referred to below.

Derivative Shareholder Actions: Two actions, styledNoto v. Steiner, et al., andBarbonel v. Steiner, et al., were commenced on November 18, 2004, and November 23, 2004, respectively, in the Court of Chancery of the State of Delaware in and for Newcastle County, Delaware. The plaintiffs alleged that each is or was a shareholder of The Fairchild Corporation and purported to bring actions derivatively on behalf of the Company, claiming, among other things, that Fairchild executive officers received excessive pay and prerequisites, and that the Company’s directors approved such excessive pay and prerequisites in violation of their fiduciary duties to the Company. The complaints named as defendants all of the Company’s directors, its Chairman and Chief Executive Officer, its President and Chief Operating Officer, its then Chief Financial Officer, and its General Counsel. On October 24, 2005, a copy of a “Notice of Hearing and Proposed Supplemental Settlement of The Fairchild Corporation Stockholder Derivative Litigation” (the “Derivative Settlement”) was mailed to all shareholders and was filed with the SEC on a Form 8-K report. On November 23, 2005, the Court of Chancery approved the Derivative Settlement, which approval became final on December 23, 2005. The Derivative Settlement is further discussed below under “Corporate Governance Matters.”

Director Independence: Except for Eric Steiner and Jeffrey Steiner, all director nominees are “independent” as defined in the listing standards of the New York Stock Exchange, applicable Securities and Exchange Commission Rules, and the Company’s Corporate Governance Guidelines.

Two New Independent Directors to Be Appointed: Pursuant to the Derivative Settlement, the Company has agreed to nominate and appoint two new independent directors as soon as practicable. Nominees for such independent directors have not been determined as of the date of this Proxy Statement. The Board of Directors will appoint such new independent directors as soon as practicable. Pursuant to the Derivative Settlement, Jeffrey Steiner and Eric Steiner (on behalf of themselves and their affiliates) agreed that they will not take actions as stockholders to remove any such independent directors prior to the Company’s 2007 annual meeting of stockholders.

MEETINGS OF THE BOARD OF DIRECTORS

During the 2005 Fiscal Year, the Board held five meetings and acted five times by unanimous written consent. No incumbent director attended less than seventy-five percent (75%) of the aggregate number of meetings of the Board and committees on which he served. On September 28, 2005, Harold Harris, who had been a member of the Board since 1985, died.

4

COMMITTEES OF THE BOARD OF DIRECTORS

The Board has six standing committees. The following chart describes the function and membership of each standing committee and the number of times it met during the 2005 Fiscal Year:

Audit Committee

(Held 7 meetings)

| | | | | | |

Function

| | | | Members

|

| | | |

· | | Responsible for the appointment, compensation and oversight of the Company’s outside auditors and resolution of disagreements, if any, between outside auditors and management. | | | | Steven Gerard The following members of the committee are not running for reelection as directors: Herbert Richey (Chairman) John Podkowsky Mortimer Caplin The Board will elect new members to the Audit Committee following the Annual Meeting. |

· | | Receives and responds to complaints (which may be submitted confidentially or anonymously) regarding accounting, internal account control or auditing matters. | | |

· | | Examines and considers (and, where appropriate, pre-approves) matters relating to the internal and external audits of the Company’s accounts and its financial affairs. | | |

· | | Selects the Company’s independent auditors. | | |

· | | Reviews the Company’s auditing, financial reporting and internal control functions. | | |

The Audit Committee has been established in accordance with Section 3(a)(5)(A) of the Exchange Act which (among other things) requires companies to establish a committee of board members for the purpose of overseeing the accounting and financial reporting processes of the company and audits of the financial statements of the company.

Financial Expert: The Board of Directors has determined that Steven Gerard, a member of the Audit Committee, is a “financial expert” as defined in Securities and Exchange Commission Rules. Such determination was based, in part, on the following qualifications:

| | · | | Mr. Gerard has served since October 2000 as Chief Executive Officer of CBIZ, Inc. (provider of integrated business services) and served as Chairman and CEO of Great Point Capital, Inc. (financial and operating consultants) from 1997 to October 2000. |

| | · | | He served for 18 years as a financial analyst/banker. |

| | · | | He serves as a member of the Audit Committee of several other major companies (Lennar Corporation and Timco Aviation Services, Inc.). |

Committee Independence: The Board of Directors has determined that all members of the Audit Committee are “independent” as defined in the listing standards of the New York Stock Exchange, applicable Securities and Exchange Commission Rules, and the Company’s Corporate Governance Guidelines. No Audit Committee member currently sits on more than two other public companies’ audit committees.

Committee Charter: The Board has adopted a written charter for the Audit Committee, which sets forth in more detail the Committee’s functions and responsibilities. The charter was adopted to and restated as of January 13, 2005. A copy of the charter is attached as Appendix B. The charter is also posted on the Company’s website (www.fairchild.com). A copy may be obtained upon request from the Company’s Corporate Secretary.

5

Compensation and Stock Option Committee

(Held 1 meeting and acted 1 time by written consent)

| | | | | | |

Function

| | | | Members

|

· · | | Initial responsibility for all compensation actions affecting the Company’s officers, including base salaries, bonus awards, stock option awards and the terms and conditions of their employment. Administers the Company’s stock option plan. | | | | Daniel Lebard (Chairman) Steven Gerard Robert Edwards (elected on 12/23/2005) The following member of the committee is not running for reelection as a director: Herbert Richey |

| | | | | |

Committee Independence: The Board of Directors has determined that all members of the Compensation and Stock Option Committee are “independent” as defined in the listing standards of the New York Stock Exchange, and the Company’s Corporate Governance Guidelines.

Committee Charter: The Board has adopted a written charter for the Compensation Committee which sets forth in more detail the Committee’s functions and responsibilities. The charter is posted on the Company’s website (www.fairchild.com). A copy may also be obtained upon request from the Company’s Corporate Secretary.

Executive Committee

(Acted 1 time by written consent)

| | | | | | |

Function

| | | | Members

|

· | | May consider pertinent matters and exercise all powers of the Board, which by law it may exercise when the Board is not in session. Pursuant to the Derivative Settlement: (i) the Executive Committee shall consist of four members, three of whom shall not be officers of the Company, and (ii) the vote of three fourths of the members is required to approve any action by the Committee. | | | | Jeffrey Steiner (Chairman) Steven Gerard Eric Steiner resigned from the committee in December 2005. The following members of the committee are not running for reelection as directors: Mortimer Caplin Herbert Richey Following the Annual Meeting, the Board will either dissolve the executive committee or appoint additional directors to this committee so that it consists of not less than three independent directors and one management director. |

6

Corporate Ethics and Compliance Committee

(Held 1 meeting)

| | | | | | |

Function

| | | | Members

|

· | | Oversees the Company’s ethics programs. | | | | The following members of the committee are not running for reelection as directors: Mortimer Caplin (Chairman) Herbert Richey Following the Annual Meeting, the Board will appoint new directors to this committee so that it consists of not less than two independent directors. |

Governance and Nominating Committee

(Held 1 meeting)

| | | | | | |

Function

| | | | Members

|

· | | Responsible for identifying individuals qualified to become Board members and recommending them to the full Board for consideration. This includes all potential candidates, whether initially recommended by management, other Board members, or shareholders of the Company. Considers and recommends to the Board candidates for election to the Board of Directors by the shareholders. | | | | Steven Gerard Daniel Lebard The following member of the committee is not running for reelection as a director: Herbert Richey |

· | | Makes recommendations to the Board regarding corporate governance matters and updates to the Corporate Governance Guidelines. | | |

Committee Independence: The Board of Directors has determined that all members of the Governance and Nominating Committee are “independent” as defined in the listing standards of the New York Stock Exchange and the Company’s Corporate Governance Guidelines.

Committee Charter: The Board has adopted a written charter for the Governance and Nominating Committee, which sets forth in more detail the Committee’s functions and responsibilities. The charter is posted on the Company’s website (www.fairchild.com). A copy may also be obtained upon request from the Company’s Corporate Secretary.

Oversight Committee

Pursuant to the terms of the Derivative Settlement, the Company established an Oversight Committee effective December 23, 2005. The members of the Oversight Committee are Steven Gerard, Robert Edwards and Daniel Lebard. The Committee is required to review and give prior approval for all transactions, compensation or other payments involving the Company and any executive officer or director of the Company. Regular compensation decisions within the authority of the Compensation Committee are excluded from matters that must be approved by the Oversight

7

Committee. Pursuant to the Company’s bylaws, the members of the Oversight Committee (i) shall always consist of non-management directors; and (ii) any member of the Oversight Committee who is or believes himself to be conflicted with respect to any particular issue under consideration by the Oversight Committee shall excuse himself from consideration of the issue. Changes to the Oversight Committee bylaw can only be made pursuant to (i) a vote by a majority of the voting power of the outstanding Fairchild sharesand a majority of the voting power of the outstanding shares held by Fairchild stockholders who are unaffiliated with Jeffrey Steiner, Eric Steiner or their respective associates; or (ii) pursuant to a vote by 3/4 of the entire Board.

The Board’s preliminary agendas for its meetings will be reviewed and approved in advance by the Chairman of the Oversight Committee, who may add additional matters for Board information or action.

DIRECTORS COMPENSATION

Board members who are not salaried employees of the Company receive separate compensation for Board service. That compensation includes:

| | |

Annual Retainer: | | $20,000 |

| |

Attendance Fees: | | $2,500 for each Board meeting. $2,500 for each Audit Committee meeting. $1,000 per meeting for all other Board Committee meetings. Expenses related to attendance. |

| |

Stock Options: | | Under the 1996 Non-Employee Directors Stock Option Plan (the “1996 NED Plan”) each non-employee director is issued stock options for 30,000 shares at the time he or she is first elected as a director. Thereafter, each director is issued stock options for 1,000 shares on an annual basis (immediately after each Annual Meeting). The 1996 NED Plan expires in September 2006. |

| |

Chairman of Audit Committee: | | $10,000 a year. |

8

REPORT OF THE AUDIT COMMITTEE

The following report does not constitute solicitation material and is not considered filed or incorporated by reference into any other Company filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, unless we state otherwise.

In accordance with a written charter adopted by the Company’s Board of Directors, the Audit Committee of the Company’s Board of Directors (the “Committee”) assists the Board of Directors in fulfilling its responsibility for oversight of the quality and integrity of the Company’s financial reporting processes. Management has the primary responsibility for the financial statements and the reporting process, including the system of internal controls. The independent auditors are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with generally accepted auditing standards and for issuing a report thereon.

In this context, the Committee has met and held discussions with management and the independent auditors. Management represented to the Committee that the Company’s consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States, and the Committee discussed the consolidated financial statements with management and the independent auditors. The Committee discussed with the independent auditors matters required to be discussed by Statement on Auditing Standards No. 61 (Communications with Audit Committees), as amended, including the quality and acceptability of the Company’s financial reporting processes and controls.

The Committee discussed with the Company’s internal and independent auditors the overall scope and plans for their respective audits. The Committee meets regularly with the internal and independent auditors, with and without management present, to discuss the results of their examinations, the evaluations of the Company’s internal controls and the overall quality of the Company’s accounting principles.

In addition, the Committee has discussed with the independent auditors the auditors’ independence from the Company and its management, including the matters in the written disclosures required by the Independence Standards Board Standard No. 1 (Independent Discussions with Audit Committees).

In performing all of these functions, the Committee acts only in an oversight capacity and necessarily relies on the work and assurances of the Company’s management and independent auditors, which, in their report, express an opinion on the conformity of the Company’s annual financial statements to accounting principles generally accepted in the United States.

In reliance on the reviews and discussions noted above, the Committee recommended to the Board of Directors, and the Board has approved, that the audited financial statements be included in the Company’s Annual Report on SEC Form 10-K for the last fiscal year (ending on September 30, 2005) for filing with the Securities and Exchange Commission.

Respectfully submitted by the members of the Audit Committee of the Board of Directors:

Herbert S. Richey (Chairman) (*)

Mortimer M. Caplin (*)

Steven L. Gerard

John W. Podkowsky (*)

| * | | Herbert S. Richey, Mortimer M. Caplin and John W. Podkowsky were directors in FY 2005. They are not running for reelection. |

9

REPORT OF THE COMPENSATION AND STOCK OPTION COMMITTEE

The following report does not constitute solicitation material and is not considered filed or incorporated by reference into any other Company filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, unless we state otherwise.

The Compensation and Stock Option Committee is composed of at least three independent Directors. It has initial responsibility for all compensation actions affecting the Company’s executive officers, including base salaries, bonus awards, stock option awards and the terms and conditions of their employment.

Compensation Philosophy

The Committee’s goals are to:

| | · | | Provide compensation competitive with other similar companies. |

| | · | | Encourage executives to increase shareholder value. |

| | · | | Directly relate compensation to Company performance and/or the objective value of individual service. |

Components of Executive Officer Compensation

Cash Compensation (Base Salary and Annual Incentive Bonus)—The Company manages the total cash compensation to provide median levels of cash compensation at average levels of corporate, business unit, or individual performance. Cash compensation consists of two components: (i) a base salary that is at least competitive with that paid by companies facing similar challenges, and (ii) an annual incentive opportunity that is variable and is reflective of the financial performance of the Company and/or the individual performance of the executive officer. When high levels of performance are achieved, the level of cash compensation may well exceed the median of the market. Conversely, when the Company, business unit, or the individual falls short of realizable goals, the level of cash compensation may be below the market median. The objective of this mix is to deliver total annual cash compensation competitive with compensation offered at other companies facing similar challenges for similar positions.

Mix Between Salary and Annual Incentive Pay—The mix between salary and annual incentive pay is related to an executive’s job grade. Executives at higher grade levels in the Company may have a greater percentage of their total cash compensation contingent on the accomplishment of assigned business objectives, i.e. the higher the executive grade level, the greater the proportion of annual compensation that may be “at risk.” The award and size of the performance bonus are based upon: (i) the executive officer’s performance against goals determined by the Company’s Chief Executive Officer; and/or (ii) the performance of the executive officer’s unit within the Company against that unit’s goals; or (iii) the performance of the Company against Company goals. Goals vary from year to year and from unit to unit and, with regard to individual goals of executive officers, usually include both quantitative and qualitative factors.

The Committee approved salary and annual incentive pay for the Company’s named executive officers as set forth under the Summary Compensation Table of this Proxy Statement.

Stock Option Grants—Stock options for 70,000 shares were awarded to James Fox in connection with his employment by the Company. No other stock options were granted during the 2005 Fiscal Year.

10

Total Compensation Program—The Committee believes that the total compensation program for executives of the Company (cash compensation, bonuses and stock option grants) is on a level with the compensation programs provided by other companies facing similar challenges. The Committee believes that any amounts paid under the annual incentive plan will be appropriately related to corporate and individual performance.

Pursuant to the Derivative Settlement, after taking into account the compensation policies of comparable companies facing comparable challenges, the Board shall adopt policies requiring that regular and bonus compensation (in any form) be directly related to the Company’s performance and/or the objective value of the officer’s services.

Compensation of CEO

Jeffrey Steiner has served as Chairman of the Board and Chief Executive Officer of the Company since 1985, and as President from July 1991 through September 1998. In fixing Mr. Steiner’s salary and target bonus levels, as well as determining the size of stock option awards, if any, the Committee and the Board typically review the strategic direction and financial performance of the Company, including enterprise value, revenue and profit levels. In addition, the Committee reviews Mr. Steiner’s performance as Chairman of the Board and Chief Executive Officer, his importance to the Company and his success in implementing its strategic goals both through his entrepreneurial actions and investment banking acumen.

Base Compensation—Mr. Steiner’s aggregate base compensation for the 2005 Fiscal Year was at the rate of $2,500,000 per year, consisting of (i) $1,700,000 pursuant to his employment agreement with the Company, (ii) $400,000 per year pursuant to his employment agreement with Banner Aerospace, plus (iii) $400,000 for services in Switzerland with respect to the Company’s European operations. Pursuant to the Derivative Settlement, this compensation was reduced to $1,325,000 per year, effective as of January 12, 2006. Such reduction in compensation shall remain in place until such time as the Compensation Committee and Mr. Steiner agree on the terms of a new employment agreement.

Stock Option Grants—No stock options were granted to Mr. Steiner during the 2005 Fiscal Year.

Incentive Compensation for 2005 Fiscal Year—The Committee determined that Mr. Steiner should receive no incentive compensation for the 2005 Fiscal Year.

Advice of Consultants

To aid it in making its compensation determinations, the Compensation and Stock Option Committee has engaged the services of Hewitt Associates, LLC, as its independent consultant.

Respectfully submitted by the members of the Compensation and Stock Option Committee of the Board of Directors, as of December 6, 2005:

Daniel Lebard, Chairman

Steven Gerard

Herbert S. Richey *

| * | | Herbert S. Richey was a director in FY 2005. He is not running for reelection. |

11

INFORMATION AS TO EXECUTIVE OFFICERS

Set forth below is certain information about each current executive officer of the Company who is not a director of the Company. Related party transactions between the Company and certain officers (or their immediate family members or affiliates) are set forth in this proxy statement under the heading“Certain Transactions.”

Klaus Esser, 53, has served as the Managing Director of Polo Express since 1980. Fairchild acquired Polo Express in November, 2003.

James G. Fox, 49, has served as Chief Financial Officer since October 2005, and as Senior Vice President, Finance, since August 2005. From 2000 to 2005, Mr. Fox was employed as Vice President, Finance, of the Energy Management Division of Invensys PLC, a London-based group of five controls and power companies. From 1998 to 2002, he was CFO of APV, Ltd. (a subsidiary of Invensys PC), which manufactures automated equipment for food processing plants and other industries.

Bradley T. Lough,40, has served as Treasurer of the Company since February 2004 and as Vice President of the Company since May 2002. He served as Vice President and Chief Financial Officer of Banner Aerospace from December 1999 through April 2003. In addition, he served as Treasurer of Banner Aerospace from August 1993 thought April 2003, Secretary of Banner Aerospace from May 1998 through April 2003 and Assistant Secretary of Banner Aerospace from February 1994 through April 1998.

Michael L. McDonald, 41, has served as Vice President of the Company since May 2002 and as Controller of the Company since July 2000. He served as Assistant Controller from 1997 to July 2000. Mr. McDonald has been employed by the Company since 1989.

Donald E. Miller, 58, has served as Executive Vice President of the Company since September 1998, as General Counsel since January 1991 and as Corporate Secretary since January 1995. He served as Senior Vice President of the Company from January 1991 through September 1998.

Warren D. Persavich, 53, has served as President of the Company’s Aerospace Division since April 1999, and as Senior Vice President and Chief Operating Officer of Banner Aerospace, Inc. from May 1998 through May 2003. Prior to that, he served as Senior Vice President and Chief Financial Officer of Banner Aerospace from June 1990 through May 1998, and as Vice President of Banner Aerospace from March 1990 through June 1990.

12

EMPLOYMENT AGREEMENTS AND CHANGE OF CONTROL ARRANGEMENTS

The following summarizes employment agreements and change of control agreements as in effect currently.

| · | | Employment Agreement between the Company and Jeffrey Steiner: |

| | |

| Term of the Agreement: | | Pursuant to the Derivative Settlement, the term under this employment agreement is thirty (30) months, extended annually by an additional 12 months unless either party gives timely notice not to extend the agreement. |

| |

| Minimum Base Salary Under the Agreement: | | |

| | As determined by the Board of Directors. However, see description immediately below regarding current base salary. |

| |

| Current Base Salary: | | Pursuant to the terms of the Derivative Settlement, effective as of January 12, 2006, Jeffrey Steiner’s aggregate base-pay compensation under all his employment agreements was reduced to $1,325,000 per year. Such reduction shall remain in place until such time as the Compensation Committee and Jeffrey Steiner agree on the terms of a new employment agreement. Prior to January 12, 2006, Jeffrey Steiner’s aggregate base salary under all his employment agreements was $2,500,000 per annum. |

| |

| Payments in Event of Death: | | Estate to receive an amount equal to one year’s base salary, plus bonuses for the fiscal year in which death occurred. |

| |

| Payments in Event of Termination Due to Disability: | | |

| | Fifty percent of base salary for two years, plus bonuses for the fiscal year in which disability occurred. |

| |

| Change in Control Payments | | In connection with the sale of Fairchild Fasteners to Alcoa Inc., our Board of Directors determined that Jeffrey Steiner was entitled to a change of control payment in the amount of $6,280,000. Fifty percent (50%) of such payment was made to Jeffrey Steiner during January to June 2003. The remaining 50% ($3,140,000) will be paid upon Jeffrey Steiner’s termination of employment with Fairchild. No other change of control payments are provided for in Jeffrey Steiner’s employment agreement. |

| |

| Split-Dollar Life Insurance | | Pursuant to the Derivative Settlement, the Company and Jeffrey Steiner executed an agreement confirming that the Company’s obligations under Jeffrey Steiner’s split-dollar life insurance policy are irrevocably terminated and released. |

| · | | Employment Agreement between Banner Aerospace (a Company Subsidiary) and Jeffrey Steiner: |

| | |

| Term of the Agreement: | | Pursuant to the Derivative Settlement, the term under this employment agreement is thirty (30) months, extended annually by an additional 12 months unless either party gives timely notice not to extend the agreement. |

13

| | |

| Minimum Base Salary Under the Agreement: | | |

| | Not less than $250,000 per year. However, see description immediately below regarding current base salary. |

| |

| Current Base Salary: | | Pursuant to the terms of the Derivative Settlement, effective as of January 12, 2006, Jeffrey Steiner’s aggregate base-pay compensation under all his employment agreements was reduced to $1,325,000 per year. Such reduction shall remain in place until such time as the Compensation Committee and Jeffrey Steiner agree on the terms of a new employment agreement. Prior to January 12, 2006, Jeffrey Steiner’s aggregate base salary under all his employment agreements was $2,500,000 per annum. |

| |

| Payments in Event of Death: | | Estate to receive an amount equal to one year’s base salary, plus bonuses for the fiscal year in which death occurred. |

| |

| Payments in Event of Termination Due to Disability: | | |

| | Fifty percent of base salary for two years, plus bonuses for the fiscal year in which disability occurred. |

| · | | Service Agreement between Fairchild Switzerland, Inc. (Company Subsidiary) and Jeffrey Steiner: |

| | |

| Term of the Agreement: | | Year to year. |

| |

| Minimum Base Salary Under the Agreement: | | |

| | Greater of $400,000 or 680,000 Swiss Francs per year, but not more than $400,000. However, see description immediately below regarding current base salary. |

| |

| Current Base Salary: | | Pursuant to the terms of the Derivative Settlement, effective as of January 12, 2006, Jeffrey Steiner’s aggregate base-pay compensation under all his employment agreements was reduced to $1,325,000 per year. Such reduction shall remain in place until such time as the Compensation Committee and Jeffrey Steiner agree on the terms of a new employment agreement. Prior to January 12, 2006, Jeffrey Steiner’s aggregate base salary under all his employment agreements was $2,500,000 per annum. |

| · | | Employment Agreement between the Company and Eric Steiner: |

| | |

| Term of the Agreement: | | Pursuant to the Derivative Settlement, the term under this employment agreement is two years, expiring January 12, 2008. |

| |

| Minimum Base Salary Under the Agreement: | | $540,000. However, see description immediately below regarding current base salary. |

14

| | |

| Current Base Salary: | | Pursuant to the terms of the Derivative Settlement, effective as of January 12, 2006, Eric Steiner’s base-pay was reduced to $535,500 per year. Such reduction shall remain in place until such time as the Compensation Committee and Eric Steiner agree on the terms of a new employment agreement. Prior to January 12, 2006, Eric Steiner’s base salary was $725,000 per annum. |

| |

| Payments in Event of Death: | | Same as the Company’s CEO. |

| |

| Payments in Event of Termination Due to Disability: | | Same as the Company’s CEO. |

| · | | Letter Agreement between the Company and Donald Miller |

| | |

| Payments in the event of Termination Without Cause: | |

Two (2) times then current annual base salary, plus 1 times current annual base salary in lieu of bonus. |

| |

| Payments in the event of a “change in control”: | |

In connection with the sale of Fairchild Fasteners to Alcoa Inc., our Board of Directors determined that Mr. Miller was entitled to a change of control payment in the amount of $1,125,000. Fifty percent (50%) of such payment was made to Mr. Miller in December 2002. The remaining 50% was paid in four equal and consecutive quarterly installments, with the first installment made on March 3, 2003 and the last installment made on March 3, 2004. |

| |

| | | In connection with such change of control award, the letter agreement between the Company and Mr. Miller was amended, pursuant to which Mr. Miller relinquished any future change of control payments under such letter agreement. |

| · | | Employment Agreement between PoloExpress and Klaus Esser |

| | |

| Term of the Agreement: | | Three years ending on December 31, 2008. Either party may elect to terminate the contract as of 12/31/08 by giving nine (9) months prior written notice. If the contract is not terminated as of 12/31/2008, it continues in place until either party gives twelve (12) months prior written notice of termination. |

| |

| Base Salary and Bonuses: | | Base pay compensation to Mr. Esser is 240,000 Euros per year. In addition, if PoloExpress has an annual EBITDA of more than 6 million Euros, Mr. Esser is entitled to a bonus for such year equal to 5% of the total EBITDA. The bonus for each year is paid in installments of 35,000 Euros per month. The actual bonus amount is determined at the end of each year, after EBITDA is confirmed. If the aggregate monthly installments paid by the Company to Mr. Esser are less than the bonus amount due for such year, a payment for such amount is made at year end by the Company to Mr. Esser. |

15

| | |

| Non-Compete Payments: | | Following termination of employment, Mr. Esser shall not compete for a period of 24 months, provided that PoloExpress continues to compensate Mr. Esser during such period at the rate of fifty percent (50%) of his average compensation. The average compensation is based on the last three years of employment, and includes base pay and bonuses. Within twenty eight (28) days of the termination of the agreement, PoloExpress may elect not to enforce the two-year non-compete covenant, in which case Mr. Esser shall not compete for a period of one year (as specified in Paragraph 75a of the German Commercial Code) and PoloExpress will compensate Mr. Esser at the rate of 14,000 Euros per month during such one year period. |

16

PENSION AND RETIREMENT BENEFITS

Fairchild Retirement Plan. The following table illustrates the amount of estimated annual fixed retirement benefits payable under the Fairchild Retirement Plan to an employee retiring in 2005, at age 65, at various salary levels (average of highest five consecutive years out of last ten years of service) and years of service. The Fairchild Retirement Plan defines salary as total compensation, subject to the Internal Revenue Service’s limit on the amount of compensation that may be used to compute benefits under qualified pension plans. This limit is equal to $210,000 for 2005.

| | | | | | | | | | | | | |

Annual

Salary

| | 10 Years

of Service

| | 20 Years

of Service

| | 30 Years

of Service

| | 40 Years

of Service

|

| $ | 25,000 | | $ | 2,000 | | $ | 4,000 | | $ | 6,000 | | $ | 7,313 |

| | 50,000 | | | 4,052 | | | 8,104 | | | 12,156 | | | 14,808 |

| | 100,000 | | | 10,052 | | | 20,104 | | | 30,156 | | | 36,433 |

| | 150,000 | | | 16,052 | | | 32,104 | | | 48,156 | | | 58,058 |

| | 200,000 | | | 21,332 | | | 42,664 | | | 63,996 | | | 77,088 |

| | 250,000 | | | 21,332 | | | 42,664 | | | 63,996 | | | 77,088 |

For purposes of determining benefits under the Fairchild Retirement Plan, the following executive officers have years of credit and average salaries as follows:

| | | | |

Officer

| | Average Salary

| | Years of Credit

|

Jeffrey Steiner | | $197,000 | | 15 years |

Donald Miller | | 197,000 | | 14 years |

Eric Steiner | | 197,000 | | 14 years |

17

Supplemental Executive Retirement Plans. We have two supplemental executive retirement plans for key executives which provide additional retirement benefits based on final average earnings and years of service, as follows:

| | | | |

| | | Unfunded SERP

| | Funded SERP

|

| | |

| Retirement Benefits | | Provides a maximum retirement benefit (in the aggregate for both Supplemental Executive Retirement Plans) equal to the difference between (i) sixty percent (60%) of the participant’s highest base salary for five consecutive years of the last ten years of employment, and (ii) the aggregate of other pension benefits, profit sharing benefits, and primary Social Security payments to which the participant is entitled. | | An annual retirement benefit determined by multiplying the participant’s years of credited service times a fixed amount. The amount varies by participant. |

| | |

| Funding | | This is an unfunded obligation of the Company, not subject to ERISA regulations. The Company makes discretionary contributions to a “Rabbi Trust” to help meet its obligations under this plan, but the assets under such trust are subject to the claims of the Company’s creditors. | | This benefit is a part of the Retirement Plan for Employees of the Fairchild Corporation. It is a funded obligation of the Company. Such funding contributions are not assets available to the creditors of the Company. |

| | |

| Pre-Retirement Distributions | | Subject to the approval of the Compensation Committee, the plan permits participants who have reached retirement age, to elect to receive retirement advances. | | At the participant’s request upon attainment of Normal Retirement Age as defined in the Plan. |

| | |

| Participants | | Executive Officers. All persons named in the Summary Compensation Table are eligible for participation in this plan except Mr. Klaus Esser. | | Same as the unfunded plan. |

| | |

| Special Years of Service Accreditation | | Pursuant to a letter agreement with Mr. Miller, for purposes of determining years of service with the Company under the Supplemental Executive Retirement Plans, Mr. Miller will be credited with two years of service for each of the first ten years he is employed by the Company. | | None. |

The Company has frozen the SERP benefits at December 31, 2004 payable by the Company to all executive officers. Pursuant to the Derivative Settlement, no new SERP plan shall be created for any existing senior officer of the Company, without the prior approval of two-thirds of the Compensation Committee. As to SERP plans for individuals who are not executive officers, the Company intends to amend such SERP plans in order to be in compliance with tax laws.

Klaus Esser does not participate in the above described retirement plans. Under his employment agreement, Mr. Esser is entitled to receive such retirement benefits as provided under German law.

18

EXECUTIVE COMPENSATION

Table: Summary Compensation

| | | | | | | | | | | | | | |

| | | Annual Compensation

| | Long-Term Compensation Awards

| |

Name and Principal Position

| | Fiscal

Year

| | Salary ($)

| | | Bonus ($)

| | Other Annual

Compensation

($)

| | Securities Underlying

Options

(#)

| | All Other

Compensation

($)(2)

| |

Jeffrey Steiner, Chairman & CEO(5) | | FY 2005

FY 2004

TP 2003

FY 2003 | | 2,500,005

2,500,005

625,001

2,500,005 |

| | —

—

—

5,256,400 | | —

—

—

3,140,000 | | —

—

—

145,518 | | 6,317

2,937

669

30,783 | (4)

(4)

(4)

(4) |

| | | | | | |

Klaus Esser Managing Director Polo Express GmbH | | FY 2005

FY 2004

TP 2003

FY 2003 | | 254,516

204,030

—

— |

| | 585,386

497,732

—

— | | —

—

—

— | | —

—

—

— | | —

—

—

— |

|

| | | | | | |

Anthony Churchill, Managing Director Hein Gericke Deutschland GmbH(1) | | FY 2005 | | 361,580 | | | — | | — | | — | | — | |

| | | | | | |

Donald Miller, Executive VP, General Counsel & Secretary | | FY 2005

FY 2004

TP 2003

FY 2003 | | 375,250

422,311

93,750

375,003 |

| | —

—

—

1,399,837 | | —

112,500

112,500

900,000 | | —

—

—

13,333 | | 6,250

2,937

669

5,930 |

|

| | | | | | |

Eric Steiner, President & COO | | FY 2005

FY 2004

TP 2003

FY 2003 | | 725,005

725,005

181,251

725,005 | (3)

| | —

—

—

2,299,675 | | —

543,400

543,400

4,347,200 | | —

—

—

26,400 | | 6,308

2,937

669

5,930 |

|

FY 2005 = Fiscal Year for October 1, 2004 to September 30, 2005.

FY 2004 = Fiscal Year for October 1, 2003 to September 30, 2004.

TP 2004 = Transition Period for July 1, 2003 to September 30, 2003

FY 2003 = Fiscal Year for July 1, 2002 to June 30, 2003

| (1) | | Mr. Churchill became employed by the Company in October 2004, and was not employed in any prior period. His employment was terminated by the Company on November 7, 2005. |

| (2) | | For FY 2005, includes imputed interest on loans to officers, as follows: |

| | | |

J. Steiner | | $ | 1,067 |

D. Miller | | $ | 1,000 |

E. Steiner | | $ | 1,058 |

New loans to executive officers are no longer permitted as of July 30, 2002.

| (3) | | Includes $11,154 which was earned in FY 2005, but which payment has been deferred. |

19

| (4) | | Does not include advances, before retirement of earned benefits under the Company’s Unfunded SERP (Supplemental Executive Retirement Plan). See disclosure under Certain Transactions. Advances under the Unfunded SERP for Jeffrey Steiner are as follows: |

| | | |

FY 2005 | | $ | 477,222 |

FY 2004 | | | 1,990,028 |

TP 2004 | | | 350,000 |

FY 2003 | | | 1,662,383 |

| (5) | | Table does not include a remaining $3,140,000 change in control payment due to Mr. Jeffrey Steiner upon termination of employment |

Table: Options Granted

No stock options were granted to the named executive officers during the 2005 Fiscal Year.

Table: Option Exercises and Year-End Value

| | | | | | | | | | | | |

Name

| | Shares Acquired

on Exercise

(#)

| | Value

Realized

($)

| | Number of Securities

Underlying Unexercised

Options at

September 30, 2005

| | Value of Unexercised

In-the-Money

Options at

September 30, 2005

|

| | | | Exercisable

(#)

| | Unexercisable

(#)

| | Exercisable

($)

| | Unexercisable

($)

|

Jeffrey Steiner | | 0 | | 0 | | 359,139 | | 36,379 | | — | | — |

Anthony Churchill | | — | | — | | — | | — | | — | | — |

Klaus Esser | | — | | — | | — | | — | | — | | — |

Donald Miller | | 0 | | 0 | | 26,668 | | 3,333 | | — | | — |

Eric Steiner | | 0 | | 0 | | 62,688 | | 6,600 | | — | | — |

20

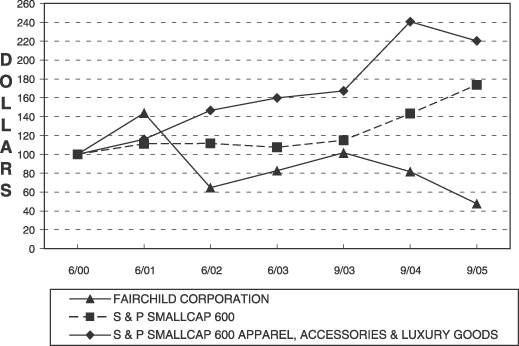

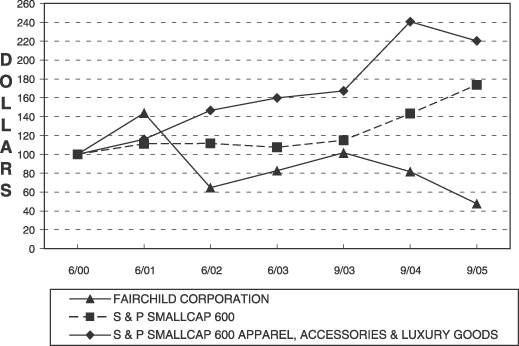

STOCK PERFORMANCE GRAPH

The following stock performance graph does not constitute solicitation material and is not considered filed or incorporated by reference into any other Company filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, unless we state otherwise.

COMPARISON TO

S&P 600 SMALLCAP INDEX

AND S&P SMALLCAP 600 APPAREL, ACCESSORIES & LUXURY GOODS INDEX

The following graph compares the performance of the Company’s Class A Stock with that of the S&P 600 Smallcap Index and the S&P 600 Apparel, Accessories & Luxury Goods Index (consisting of the following companies: Ashworth Inc., Fossil Inc., Haggar Corp. Kellwood Co., Oshkosh B Gosh Inc., Oxford Indus. Inc., Phillips Van Heusen Corp., Quiksilver Inc. and Russell Corp.) The graph plots the growth in value of an initial $100 investment over the indicated sixty-three month period with all dividends reinvested.

| | | | | | | | | | | | | | |

| | | Cumulative Total Return |

| | | 6/00 | | 6/01 | | 6/02 | | 6/03 | | 9/03 | | 9/04 | | 9/05 |

THE FAIRCHILD CORPORATION | | 100.00 | | 143.79 | | 64.62 | | 82.67 | | 101.54 | | 81.64 | | 47.59 |

S & P SMALLCAP 600 | | 100.00 | | 111.12 | | 111.42 | | 107.43 | | 115.04 | | 143.31 | | 173.71 |

S&P SMALLCAP 600 APPAREL, ACCESSORIES & LUXURY GOODS | | 100.00 | | 115.85 | | 146.59 | | 159.82 | | 167.32 | | 240.75 | | 220.26 |

21

STOCK OWNERSHIP

The following table shows the number of shares beneficially owned (as of January 20, 2006) by:

| | · | | each executive officer named in the Summary Compensation Table; |

| | · | | the directors and executive officers as a group; and |

| | · | | each person who we know beneficially owns more than 5% of the common stock. |

| | | | | | | | | | |

Name

| | Number of Shares

of Class A Stock(1)

| | Percentage

of Class

| | | Number of Shares

of Class B Stock(1)

| | Percentage

of Class

| |

Directors: | | | | | | | | | | |

Mortimer M. Caplin(2)(3) | | 126,364 | | * | | | — | | — | |

Robert E. Edwards(2) | | 998,695 | | 4.42 | % | | — | | — | |

Steven L. Gerard(2) | | 26,742 | | * | | | — | | — | |

Daniel Lebard(2) | | 49,356 | | * | | | — | | — | |

John Podkowsky(2) | | 16,000 | | * | | | — | | — | |

Herbert S. Richey(2) | | 24,666 | | * | | | — | | — | |

Eric Steiner(2)(3)(6) | | 6,010,565 | | 23.8 | % | | 2,548,996 | | 97.24 | % |

Jeffrey J. Steiner(2)(3)(4) | | 432,683 | | 1.87 | % | | 30,000 | | 1.14 | % |

| | | | |

Other Named Executive Officers: | | | | | | | | | | |

Anthony Churchill | | — | | — | | | — | | — | |

Klaus Esser | | — | | — | | | — | | — | |

Donald E. Miller(2)(3) | | 116,744 | | * | | | — | | — | |

| | | |

All Directors and Executive Officers as a Group: | | | | | | | | |

(15 persons including the foregoing)(2) | | 7,831,517 | | 30.23 | % | | 2,578,996 | | 98.38 | % |

| | | | |

Other 5% Beneficial Owners:(5) | | | | | | | | | | |

Dimensional Fund Advisors, Inc. | | 1,907,127 | | 8.44 | % | | — | | — | |

Gabelli Funds, LLC | | 4,286,675 | | 18.96 | % | | — | | — | |

Natalia Hercot(2)(3)(6) | | 5,826,189 | | 23.13 | % | | 2,548,996 | | 97.24 | % |

The Steiner Group LLC(6) | | 5,727,684 | | 22.78 | % | | 2,533,996 | | 96.67 | % |

*Represents less than one percent.

Footnotes to Stock Ownership Chart:

| (1) | | The Class A Stock Column includes shares of Class B Stock, which are immediately convertible into Class A Stock on a share-for-share basis. Options that are exercisable immediately or within sixty days after January 20, 2006, appear in the Class A Stock column. Excludes Deferred Compensation Units (“DCUs”) to be paid out on February 28, 2010 in the form of one share of Class A Common Stock for each DCU as follows: E. Steiner, 42,826 shares; J. Steiner, 134,831 shares; Directors and Executive officers as a group, 177,657 shares. |

| (2) | | Includes exercisable stock options to purchase Class A Stock as follows: M. Caplin, 6,000 shares; R. Edwards, 1,000 shares; D. Lebard, 34,000 shares; D. Miller, 26,668 shares; H. Richey, 6,000 shares; S. Gerard, 7,942 shares; N. Hercot, 31,668 shares; E. Steiner, 62,688 shares; J. Steiner, 359,139 shares; J. Podkowsky, 16,000; Directors and Executive Officers as a group, 543,881 shares. |

| (3) | | Includes shares beneficially owned, as follows: |

D. Miller — 300 shares of Class A Stock owned by Mr. Miller as custodian for his child; Mr. Miller disclaims any beneficial interest therein.

22

E. Steiner — 80,000 shares of Class A Stock held in The Steiner Children’s Trust; 19,923 Class A shares held in 401K Savings Plan. In addition, Eric Steiner reports beneficial ownership of the Class A and Class B shares held by The Steiner Group LLC (see Footnote 6).

M. Caplin — 120,364 shares of Class A Stock held in The Mortimer and Ruth Caplin Revocable Trust, which also hold the 6,000 exercisable stock options attributable to M. Caplin in Footnote 2.

N. Hercot — 10,000 shares of Class A Stock held by her husband. In addition Natalia Hercot reports beneficial ownership of the Class A and Class B shares held by The Steiner Group LLC (see Footnote 6).

J. Steiner — 38,500 shares of Class A Stock owned by Mr. Steiner as custodian for his children; 30,000 shares of Class B Stock (convertible on a one-to-one basis to Class A Stock) owned by Mr. Steiner as custodian for his children; 2,400 shares of Class A Stock owned by the Jeffrey Steiner Family Foundation; and 2,644 shares of Class A Stock held in his 401k Savings Plan. Mr. Steiner disclaims beneficial ownership of shares owned by the Jeffrey Steiner Family Foundation, and shares owned by him as custodian for his children.

| (4) | | Mr. Jeffrey Steiner, c/o The Fairchild Corporation, 1750 Tysons Boulevard, Suite 1400, McLean, VA 22102. |

| (5) | | Based on the following information: |

Dimensional Fund Advisors Inc., 1299 Ocean Avenue, 11th Floor, Santa Monica, CA 90401. Information as of December 31, 2004 contained in a Schedule 13G/A filed on February 6, 2005 with the SEC by Dimensional Fund Advisors, Inc.

Gabelli Funds, LLC, One Corporate Center, Rye, NY 10580-1434. Information contained in a Schedule 13D/A-24, filed on February 7, 2005 with the SEC by Gabelli Funds, Inc.

Natalia Hercot, c/o The Fairchild Corporation, 1750 Tysons Boulevard, Suite 1400, McLean, VA 22102. Information contained in a Schedule 13D/A-24 filed on January 5, 2004 with the SEC by The Steiner Group LLC (See Footnote 6).

The Steiner Group LLC, c/o Withers Bergman LLP, 430 Park Avenue, 10th Floor, New York, NY 10022. Information contained in a Schedule 13D/A-24 filed on January 5, 2004 with the SEC by The Steiner Group LLC.

| (6) | | Controlling Interest held by LLC: The Steiner Group LLC (a Delaware limited liability company) (the “LLC”) holds 3,193,688 shares of Class A Stock and 2,533,996 shares of Class B Stock. It holds a controlling interest in the Company. |

Change of Control: Prior to December 31, 2003, Mr. Jeffrey Steiner was the sole manager of the LLC, and therefore reported beneficial ownership of the shares held by the LLC. On December 31, 2003, Jeffrey Steiner resigned as the sole manager of the LLC, and Eric Steiner and Natalia Hercot become the sole co-managers of the LLC. In this capacity, Mr. Eric Steiner and Ms. Natalia Hercot have the ability to vote and to direct the disposition of the Fairchild shares held by the LLC. Therefore, as of December 31, 2003, Eric Steiner and Natalia Hercot report beneficial ownership of the shares held by the LLC.

Membership Interest Held in the LLC: The membership interests in the LLC are held as follows: (i) 20% is held by Bayswater Ventures L.P., a partnership owned by four different trusts, of which Jeffrey Steiner is a beneficiary; and (ii) the remaining 80% membership interest in the LLC is held by The J.S. Family Trust, a trust created for the benefit of the issue of Jeffrey Steiner. The members of the LLC do not have the right to vote or to direct the disposition of the Fairchild shares held by the LLC.

23

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities and Exchange Act of 1934 requires the Company’s directors and officers to file reports (on Forms 3, 4 and 5) with the Securities and Exchange Commission, disclosing their ownership, and changes in their ownership, of stock in the Company. Copies of these reports must also be furnished to the Company. Based solely on a review of these copies, the Company believes that during the 2005 Fiscal Year all reports were filed on a timely basis, except as follows: On November 16, 2005, Eric Steiner filed Form 4 reporting the sale of 10,000 shares of Fairchild’s Class A Common Stock on April 12, 2000.

CERTAIN TRANSACTIONS

| · | | The Company provided a surety for Mr. Steiner and paid his expenses in connection with legal proceedings in France, totaling approximately $5.645 million, and Mr. Steiner undertook to repay such amounts to the Company if it were ultimately determined that he was not entitled to indemnification under Delaware law (the “Undertaking”). Pursuant to the Derivative Settlement, the Company and Mr. Steiner have agreed to mutually resolve Mr. Steiner’s claims for indemnity and his obligations to the Company under the Undertaking, by paying the Company $3,766,333, of which $833,333 may be drawn from Mr. Steiner’s Company SERP account, and $2,930,000 will be paid by him via the Company’s D&O liability insurance carrier, in satisfaction of its obligations to indemnify and insure Mr. Steiner. |

| · | | Prior to July 30, 2002, the Company extended loans to purchase the Company’s Class A common stock to certain members of the Company’s senior management and Board of Directors, for the purpose of encouraging ownership of Company stock, and to provide additional incentive to promote the Company’s success. The loans are non-interest bearing, have maturity dates ranging from 1 month to 3 1/4 years, and become due and payable immediately upon the termination of employment for senior management, or a director’s affiliation with the Company. |

The following table shows the amounts outstanding under such loans from executive officers and directors as follows: (i) largest amounts due at any time since the close of the last fiscal year, (ii) balance due as of fiscal year end (September 30, 2005), and (iii) balance due as of a current date (December 15, 2005):

| | | | | | | | | |

Name

| | Largest Balance Due

at Any Time During

Prior Fiscal Year

| | Balance As of Fiscal

Year End (September 30, 2005)

| | Balance Due as of

December 15, 2005

|

M. Caplin | | $ | 105,970 | | $ | 0 | | $ | 0 |

S. Gerard | | | 99,377 | | | 65,877 | | | 0 |

D. Lebard | | | 105,897 | | | 0 | | | 0 |

H. Richey | | | 105,963 | | | 0 | | | 0 |

E. Steiner | | | 105,897 | | | 0 | | | 0 |

J. Steiner | | | 105,897 | | | 0 | | | 0 |

D. Miller | | | 105,897 | | | 0 | | | 0 |

W. Persavich | | | 0 | | | 0 | | | 0 |

N. Hercot * | | | 105,897 | | | 0 | | | 0 |

(* Natalia Hercot is the daughter of J. Steiner)

In accordance with the Sarbanes-Oxley Act, no new loans will be made to executive officers or directors.

| · | | Eric Steiner (son of Jeffrey Steiner) is an executive officer of the Company. His compensation is set forth in the compensation table of the proxy statement. |

24

| · | | Natalia Hercot (daughter of Jeffrey Steiner) is a Vice President of the Company, for which she was compensated $48,000 in the 2005 Fiscal Year. Pursuant to the Derivative Settlement, Natalia Hercot’s salary for 2006 shall not exceed $10,000 per year. |

| · | | Subject to the approval of the Compensation Committee, the Company’s Unfunded SERP (Supplemental Executive Retirement Plan) permits participants who have reached retirement age, to elect to receive retirement advances. During the 2005 Fiscal Year, Mr. Jeffrey Steiner (who is 68) elected to receive advances under the Unfunded SERP (representing a partial distribution of his vested benefits) in the aggregate amount of $477,222. Such advances were made between October 1 and December 31, 2004. |

| · | | During the 2005 Fiscal Year, Phillip Hercot, son-in-law of Jeffrey Steiner, subleased a room in Fairchild’s Paris office and paid arm’s length rent to the Company. |

| · | | During the 2005 Fiscal Year, the Company paid $36,000 for security protection of the Steiner family property located in France. |

| · | | During the 2005 Fiscal Year, the Company reimbursed $189,000 (in the aggregate) to Mr. J. Steiner, representing a portion of out-of-pocket costs he incurred personally in connection with the entertainment of third parties, which benefit the Company. |

| · | | We paid for the maintenance and upkeep of an apartment located in Paris, France and used by us from time to time for business related travel. The owner of the apartment was a company controlled by the Steiner Family. The apartment was sold in 2004 and thereafter no longer used by the Company. We believe our cost for the apartment was significantly less than the cost of similar accommodations for our business related travel. The total amounts paid for apartment expenses were approximately $11,000 in fiscal 2005. |

| · | | On September 30, 2005, we owed remaining amounts for change of control payments of $3,140,000 to Mr. J. Steiner. The amount owed to Mr. J. Steiner is payable to him upon his termination of employment with us. |

| · | | Mr. Klaus Esser’s brother is an employee of Polo Express. His current salary is approximately $94,000 per year. |

| · | | In December 2004, we entered into an agreement to acquire real estate in New York City, and placed a $250,000 deposit in connection with the acquisition. Our obligation to purchase the property was contingent upon our ability to acquire adjacent properties by a certain date, which date passed without our ability to do so. Accordingly, we had the right to terminate the purchase agreement and intended to do so. Mr. J. Steiner wanted to acquire the property irrespective of the acquisition of adjacent properties. We assigned to Mr. J. Steiner our right to acquire the property and he paid to us the deposit. The independent members of our Board of Directors considered the transaction, and approved the assignment to Mr. J. Steiner. |

| · | | We provide to Mr. J. Steiner automobiles for business use. In 2005, we charged Mr. J. Steiner $15,000 to cover personal use and the cost of these vehicles that exceeded our reimbursement policy. |

| · | | In December 2004, Mr. J. Steiner reimbursed us $421,000 for personal expenses that we paid on his behalf, which were outstanding as of September 30, 2004. At no time during 2004 and 2005, did amounts due to us from Mr. J. Steiner exceed the amount of the after-tax salary on deferrals we owed to him. |

| · | | From time-to-time Mr. E. Steiner, Mr. J. Steiner, and related family members used the Company’s corporate aircraft for personal purposes. The Company is reimbursed based solely upon the |

| | incremental cost of the personal usage. Mr. E. Steiner reimbursed the Company $4,275 for his personal usage of corporate aircraft in fiscal 2004. Mr. J. Steiner reimbursed the Company $2,374 and $11,122 for his and related family members’ personal usage of corporate aircraft in fiscal 2005 and 2004, respectively. |

25

RELATIONSHIP WITH INDEPENDENT ACCOUNTANTS

Principal Accountants

On December 9, 2004, upon the recommendation of the Audit Committee, the Company appointed KPMG LLP to serve as its independent auditors for the fiscal year ended on September 30, 2005. On December 7, 2005, upon the recommendation of the Audit Committee, the Company again appointed KPMG to serve as its independent auditors for the current fiscal year, which ends on September 30, 2006. Representatives of KPMG will be available at the annual meeting to make a statement, if they so desire, and to respond to appropriate questions.

Audit Fees

2005 Audit Fees: The aggregate fees billed by KPMG LLP, for professional services rendered for the integrated audit of the Company’s annual financial statements, reviews of consolidated financial statements included in the Company’s Form 10-Q and services in connection with statutory audits and regulatory filings for the fiscal year ended September 30, 2005 were $3,147,000. More than 50% of the Fiscal 2005 audit work was performed by full-time employees of KPMG.

2004 Audit Fees: The aggregate fees billed by KPMG LLP, for professional services rendered for the audit of the Company’s annual financial statements, reviews of consolidated financial statements included in the Company’s Form 10-Q and services in connection with statutory audits and regulatory filings for the fiscal year ended September 30, 2004 (and for the 2004 Transition Period) were approximately $1,596,000. More than 50% of the Fiscal 2004 audit work was performed by full-time employees of KPMG.

Audit Related Fees

2005 Audit Related Fees: The aggregate fees billed by KPMG for the fiscal year ended September 30, 2005, for assurance and related services by such accountant that were reasonably related to the performance of the audit or review of the Company’s financial statements and are not reported under the caption “Audit Fees” above, were $5,000. The nature of the services comprising the fees disclosed under this category was related to an audit of the Company’s benefit plans.

2004 Audit Related Fees: The aggregate fees billed by KPMG for the fiscal year ended September 30, 2004 (or for the 2004 Transition Period), for assurance and related services by such accountant that were reasonably related to the performance of the audit or review of the Company’s financial statements and are not reported under the caption “Audit Fees” above, were $64,080. The nature of the services comprising the fees disclosed under this category was due diligence assistance related to acquisitions and an audit of the Company’s benefit plans.

Tax Fees:

2005 Tax Fees: The aggregate fees billed by KPMG for the fiscal year ended September 30, 2005, for tax return preparation and review services were $17,100. The nature of the services comprising the fees disclosed under this category was preparation of the tax returns for the Company’s subsidiaries in the United Kingdom.

2004 Tax Fees: The aggregate fees billed by KPMG for the fiscal year ended September 30, 2004 (or for the 2004 Transition Period), for tax return preparation and review services were $26,010. The nature of the services comprising the fees disclosed under this category was preparation of the tax returns for the Company’s subsidiaries in Belgium, France and the United Kingdom.

26

Policy Regarding Non-Audit Services by Outside Auditors

The Audit Committee has appointed its Chairman to overview and pre-approve all non-audit services provided by the Company’s outside auditors, with the main objective being the assurance of the Company’s outside auditors’ unimpaired independence. All outside non-audit services which are less than $5,000 must be approved in advance by the Chairman of the Audit Committee and then ratified by the Audit Committee. Any outside non-audit services in excess of $5,000 must first be approved by the full Audit Committee. Except for the tax related services disclosed above, KPMG did not conduct any non-audit service for the Company during the 2005 Fiscal Year, and is not expected to provide any non-audit service during the 2006 Fiscal Year other than nominal tax related services.

27

CORPORATE GOVERNANCE MATTERS

NYSE Opt-Out Provisions for Controlled Companies

The New York Stock Exchange allows controlled companies (i.e., companies whose voting control is held by a single person) to opt out of the following requirements:

| | (a) | | Maintaining a board consisting of a majority of independent directors; |

| | (b) | | Maintaining a Nominating/Corporate Governance Committee composed solely of independent directors; and |

| | (c) | | Maintaining a Compensation Committee composed solely of independent directors. |

Because of the ownership interest held by The Steiner Group, LLC, the Company qualifies as a controlled company. However, the Board of Directors of The Fairchild Corporation has elected not to opt out of these requirements.

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines which, among other things, address requirements to be met by the Company’s Board members in order to be deemed independent. The full text of the Corporate Governance Guidelines can be found on the Company’s website (www.fairchild.com). You may also request a copy from the Company’s Corporate Secretary. The portion of the Corporate Governance Guidelines addressing director independence is attached as Appendix A to this Proxy Statement.

Director Independence

Pursuant to the Corporate Governance Guidelines, the Board undertook its annual review of director independence in December 2005. During this review, the Board considered transactions and relationships between each director or any member of his or her immediate family and the Company and its subsidiaries and affiliates. As provided in the Corporate Governance Guidelines, the purpose of this review was to determine whether any such relationships or transactions were inconsistent with a determination that the director is independent.

As a result of this review, the Board affirmatively determined that all of the directors are independent of the Company and its management under the standards set forth in the Corporate Governance Guidelines, with the exception of Eric Steiner and Jeffrey Steiner, each of whom is considered an inside director because of his employment as an executive of the Company.

Executive Sessions of the Independent Directors; Presiding Director

The independent directors of the Company (i.e., all directors other than Eric Steiner and Jeffrey Steiner) meet in executive session, without management present, at least once a year. In the 2005 Fiscal Year, the independent directors met in executive session four times. Mr. Gerard acted as the Presiding Director at each of such executive sessions.

Business Conduct Policies and Code of Ethics

The Board of Directors has adopted a Code of Business Conduct and Ethics, applicable to all employees, officers and directors of the corporation. The code is posted on the Company’s website (www.fairchild.com). You may also request a copy from the Company’s Corporate Secretary.

28

The Board has also adopted a Code of Ethics for Senior Financial Officers (including the Chief Executive Officer, the Chief Financial Officer, the Principal Accounting Officer or Controller, and all persons performing similar functions on behalf of the Company). The code is posted on the Company’s website (www.fairchild.com). You may also request a copy from the Company’s Corporate Secretary. The officers subject to this code were surveyed for 2005 and will be surveyed annually for compliance. Only the Board of Directors can amend or grant waivers from the provisions of the code, and any such amendments or waivers will be promptly posted on the Company’s website.

Procedures For Submitting Shareholder Proposals

If you want to include a shareholder proposal in the proxy statement for next year’s annual meeting, it must be delivered to the Company before September 29, 2006[A1].

If you want to submit a shareholder proposal for next year’s annual meeting but you do not require that such proposal be included in the Company’s proxy materials, you must notify the Company of such proposal before December 12, 2006[A2]. If such notice is not received by December 12, 2006[A3], the proposal shall be considered untimely and shall not be presented at the 2007 annual meeting.

All shareholder proposals must conform to the requirements set forth in Regulation 14A under the Securities Exchange Act of 1934, and should be submitted to the Company’s headquarters, 1750 Tysons Boulevard, Suite 1400, McLean, VA 22102, Attention: Secretary.

Procedures For Submitting Recommendations For Director Nominations

The Company’s Governance and Nominating Committee will select, or recommend to the Board, the director nominees for the next year’s annual meeting of shareholders. As part of its director selection process, the Committee considers recommendations from many sources, including management, other board members and the Chairman. The Committee will also consider nominees suggested by stockholders of the Company. Stockholders wishing to recommend a candidate for director may do so by sending the candidate’s name, biographical information and qualifications to the Chairman of the Governance and Nominating Committee c/o the Corporate Secretary, The Fairchild Corporation, 1750 Tysons Blvd., Suite 1400, McLean VA 22102.