TC Energy Corporation

2021 Annual information form

February 14, 2022

Contents

| | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| Power and Storage | |

| Other Energy Transition Developments | |

| BUSINESS OF TC ENERGY | |

| |

| |

| |

| Power and Storage | |

| |

| |

| Health, safety, sustainability and environmental protection and social policies | |

| |

| |

| |

| |

| |

| |

| |

| Fitch | |

| DBRS | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

TC Energy Annual information form 2021 | 1

Presentation of information

Throughout this Annual information form (AIF), the terms, we, us, our, the Company and TC Energy mean TC Energy Corporation and its subsidiaries. In particular, TC Energy includes references to TransCanada PipeLines Limited (TCPL). The term subsidiary, when referred to in this AIF, with reference to TC Energy means direct and indirect wholly-owned subsidiaries of, and legal entities controlled by, TC Energy or TCPL, as applicable.

Unless otherwise noted, the information contained in this AIF is given at or for the year ended December 31, 2021 (Year End). Amounts are expressed in Canadian dollars, unless otherwise indicated. Information in relation to metric conversion can be found at Schedule A to this AIF. The Glossary found at the end of this AIF contains certain terms defined throughout this AIF and abbreviations and acronyms that may not otherwise be defined in this document.

Certain portions of TC Energy's management's discussion and analysis dated February 14, 2022 (MD&A) are incorporated by reference into this AIF as stated below. The MD&A can be found on SEDAR (www.sedar.com) under TC Energy's profile.

Financial information is presented in accordance with United States (U.S.) generally accepted accounting principles (GAAP). We use certain financial measures that do not have any standardized meaning under GAAP and therefore they may not be comparable to similar measures presented by other entities. Refer to the About this document – Non-GAAP measures section of the MD&A for more information about the non-GAAP measures we use and a reconciliation to their GAAP equivalents, which section of the MD&A is incorporated by reference herein.

Forward-looking information

This AIF, including the MD&A disclosure incorporated by reference herein, contains certain information that is forward looking and is subject to important risks and uncertainties. We disclose forward-looking information to help the reader understand management’s assessment of our future plans and financial outlook and our future prospects overall.

Statements that are forward looking are based on certain assumptions and on what we know and expect today and generally include words like anticipate, expect, believe, may, will, should, estimate or other similar words.

Forward-looking statements included or incorporated by reference in this AIF include information about the following, among other things:

•our financial and operational performance, including the performance of our subsidiaries

•expectations about strategies and goals for growth and expansion, including acquisitions

•expected cash flows and future financing options available, including portfolio management

•expected dividend growth

•expected access to and cost of capital

•expected costs and schedules for planned projects, including projects under construction and in development

•expected capital expenditures, contractual obligations, commitments and contingent liabilities

•expected regulatory processes and outcomes

•statements related to our GHG emissions reduction goals

•expected outcomes with respect to legal proceedings, including arbitration and insurance claims

•the expected impact of future tax and accounting changes

•expected industry, market and economic conditions

•the expected impact of COVID-19.

Forward-looking statements do not guarantee future performance. Actual events and results could be significantly different because of assumptions, risks or uncertainties related to our business or events that happen after the date of this AIF.

2 | TC Energy Annual information form 2021

Our forward-looking information is based on the following key assumptions, and subject to the following risks and uncertainties:

Assumptions

•realization of expected benefits from acquisitions, divestitures and energy transition

•regulatory decisions and outcomes

•planned and unplanned outages and the use of our pipeline, power and storage assets

•integrity and reliability of our assets

•anticipated construction costs, schedules and completion dates

•access to capital markets, including portfolio management

•expected industry, market and economic conditions

•inflation rates and commodity prices

•interest, tax and foreign exchange rates

•nature and scope of hedging

•expected impact of COVID-19.

Risks and uncertainties

•realization of expected benefits from acquisitions and divestitures

•our ability to successfully implement our strategic priorities and whether they will yield the expected benefits

•our ability to implement a capital allocation strategy aligned with maximizing shareholder value

•the operating performance of our pipeline, power and storage assets

•amount of capacity sold and rates achieved in our pipeline businesses

•the amount of capacity payments and revenues from our power generation assets due to plant availability

•production levels within supply basins

•construction and completion of capital projects

•cost and availability of labour, equipment and materials

•the availability and market prices of commodities

•access to capital markets on competitive terms

•interest, tax and foreign exchange rates

•performance and credit risk of our counterparties

•regulatory decisions and outcomes of legal proceedings, including arbitration and insurance claims

•our ability to effectively anticipate and assess changes to government policies and regulations, including those related to the environment and COVID-19

•our ability to realize the value of tangible assets and contractual recoveries, including those specific to the Keystone XL pipeline project

•competition in the businesses in which we operate

•unexpected or unusual weather

•acts of civil disobedience

•cyber security and technological developments

•ESG related risks

•impact of energy transition on our business

•economic conditions in North America as well as globally

•global health crises, such as pandemics and epidemics, including COVID-19 and the unexpected impacts related thereto.

You can read more about these factors and others in the MD&A and in other reports we have filed with Canadian securities regulators and the SEC.

As actual results could vary significantly from the forward-looking information, you should not put undue reliance on

forward-looking information and should not use future-oriented information or financial outlooks for anything other than their intended purpose. We do not update our forward-looking statements due to new information or future events, unless we are required to by law.

TC Energy Annual information form 2021 | 3

TC Energy Corporation

CORPORATE STRUCTURE

Our head office and registered office are located at 450 – 1 Street S.W., Calgary, Alberta, T2P 5H1. TC Energy was incorporated pursuant to the provisions of the Canada Business Corporations Act (CBCA) on February 25, 2003 in connection with a plan of arrangement with TCPL (Arrangement), which established TC Energy as the parent company of TCPL. The Arrangement was approved by TCPL common shareholders on April 25, 2003 and, following court approval and the filing of Articles of Arrangement, the Arrangement became effective on May 15, 2003. TCPL continues to carry on business as the principal operating subsidiary of TC Energy. TC Energy does not hold any material assets directly other than the common shares of TCPL and receivables from certain of TC Energy's subsidiaries.

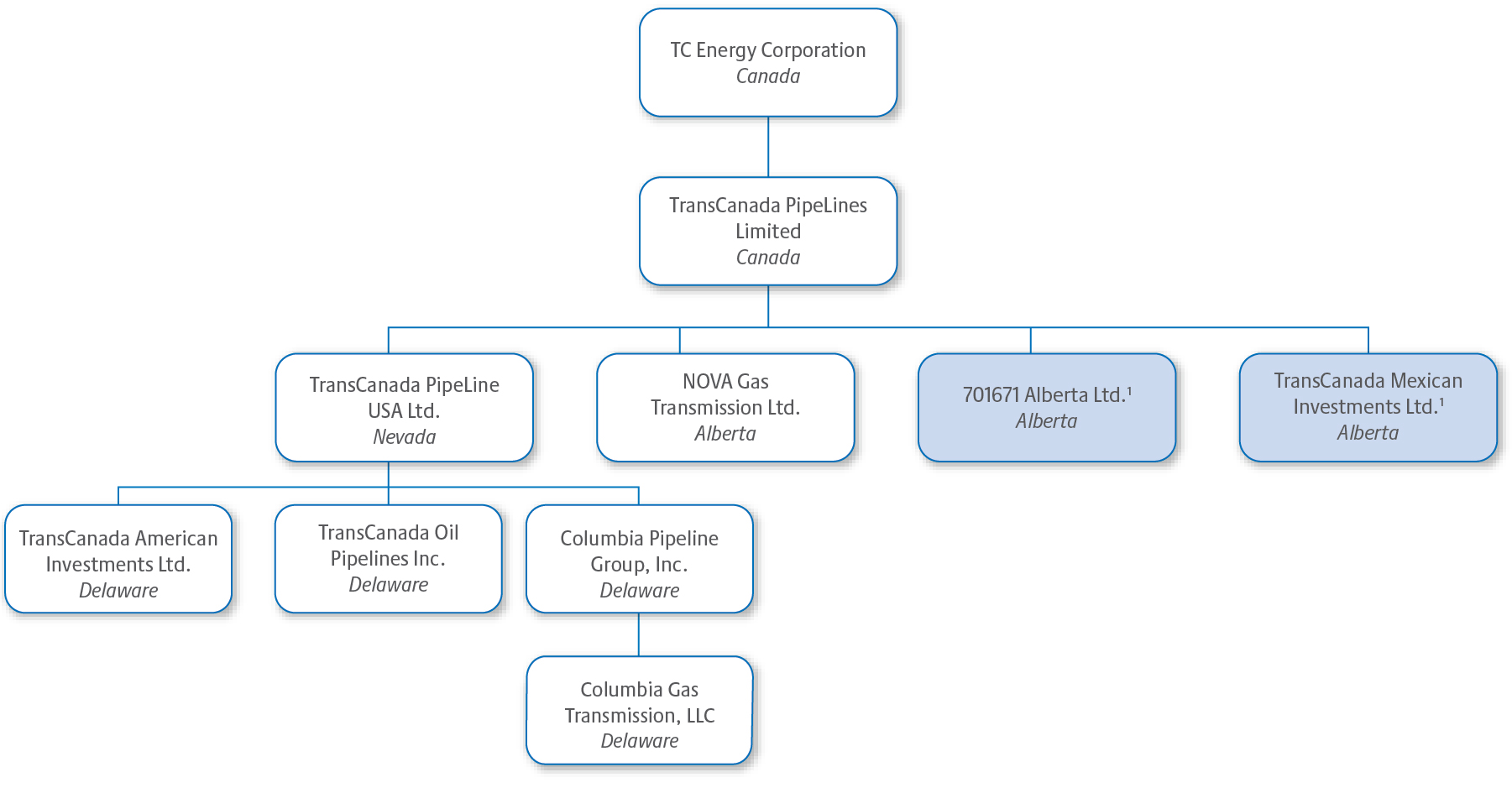

INTERCORPORATE RELATIONSHIPS

The following diagram presents the name and jurisdiction of incorporation, continuance or formation of TC Energy’s principal subsidiaries as at Year End. Each of the subsidiaries shown has total assets that exceeded 10 per cent of the consolidated assets of TC Energy as at Year End or revenues that exceeded 10 per cent of the consolidated revenues of TC Energy as at Year End. TC Energy beneficially owns, controls or directs, directly or indirectly, 100 per cent of the voting shares or units in each of these subsidiaries.

| | |

TC Energy Corporation Canada TransCanada PipeLines Limited Canada TransCanada PipeLine USA Ltd. Nevada TransCanada American Investments Ltd. Delaware TransCanada Oil Pipelines Inc. Delaware Columbia Pipeline Group, Inc. Delaware Columbia Gas Transmission, LLC Delaware NOVA Gas Transmission Ltd. Alberta 701671 Alberta Ltd.1 Alberta TransCanada Mexican Investments Ltd.1 Alberta1 |

The above diagram does not include all of the subsidiaries of TC Energy. The total assets and revenues of excluded subsidiaries in the aggregate did not exceed 20 per cent of the consolidated assets of TC Energy as at Year End or consolidated revenues of TC Energy as at Year End.

1 701671 Alberta Ltd. and TransCanada Mexican Investments Ltd. assets and revenues do not exceed 10 per cent of the total consolidated assets or revenues of TC Energy but have been included to meet the total consolidated revenues and assets criteria of excluded subsidiaries threshold of less than 20 per cent.

4 | TC Energy Annual information form 2021

General development of the business

We operate in three core businesses – Natural Gas Pipelines, Liquids Pipelines and Power and Storage. In order to provide information that is aligned with how management decisions about our businesses are made and how performance of our businesses is assessed, our results are reflected in five operating segments: Canadian Natural Gas Pipelines, U.S. Natural Gas Pipelines, Mexico Natural Gas Pipelines, Liquids Pipelines and Power and Storage. We also have a Corporate segment consisting of corporate and administrative functions that provide governance, financing and other support to TC Energy's business segments.

Natural Gas Pipelines and Liquids Pipelines are principally comprised of our respective natural gas and liquids pipelines in Canada, the U.S. and Mexico, as well as our regulated natural gas storage operations in the U.S.

Power and Storage includes our power operations and our unregulated natural gas storage business in Canada.

Summarized below are significant developments that have occurred in our Natural Gas Pipelines, Liquids Pipelines and Power and Storage businesses, respectively, and certain acquisitions, dispositions, events or conditions which have had an influence on those developments, during the last three financial years and year to date in 2022. Further information about developments in our business, including changes that we expect will occur in 2022, can be found in the Natural Gas Pipelines Business, Canadian Natural Gas Pipelines, U.S. Natural Gas Pipelines, Mexico Natural Gas Pipelines, Liquids Pipelines and Power and Storage sections of the MD&A, which sections of the MD&A are incorporated by reference herein.

TC Energy Annual information form 2021 | 5

NATURAL GAS PIPELINES

Developments in the Canadian Natural Gas Pipelines Segment

| | | | | |

| Date | Description of development |

| CANADIAN REGULATED PIPELINES |

| NGTL System - 2021 and 2022 Expansion Programs |

| 2019 | We pursued applications to the CER (formerly the NEB, see the Business of TC Energy - Regulation of Natural Gas Pipelines and Liquids Pipelines section below) on two expansion programs within our natural gas gathering and transportation system for the WCSB (NGTL System): (1) the NGTL System 2021 Expansion Program (2021 Expansion Program); and (2) the NGTL System 2022 Expansion Program (2022 Expansion Program). |

| 2020 | The 2021 Expansion Program application was concluded in fourth quarter 2020. We received regulatory approval of the 2021 Expansion Program and began progressing construction activities. |

| 2021 | Construction activities on the 2021 Expansion Program continue to progress with approximately $0.9 billion in facilities placed in service to date. The program, with a total estimated capital cost of $3.2 billion, consists of 345 km (217 miles) of new pipeline, three compressor units and associated facilities. Final completion of the program is expected in second quarter 2022. In 2021, we received regulatory approval for the 2022 Expansion Program. With an estimated capital cost of $1.2 billion, the 2022 Expansion Program consists of approximately 166 km (103 miles) of new pipeline, one new compressor unit and associated facilities and will provide incremental capacity of approximately 773 TJ/d (722 MMcf/d) to meet firm-receipt and intra-basin delivery requirements with eight-year terms. Construction activities began in September 2021 with anticipated in-service dates commencing in fourth quarter 2022. |

| 2023 NGTL System Intra-Basin Expansion |

| 2020 | In 2020, we approved the NGTL System Intra-Basin Expansion, subject to required regulatory approval, for a contracted incremental intra-basin delivery capacity of 331 TJ/d (309 MMcf/d) for 15-year terms at an estimated capital cost of $0.9 billion. |

| 2021 | In 2021, we received regulatory approval to construct and operate the NGTL System Intra-Basin Expansion Program, consisting of 23 km (14 miles) of new pipeline and two new compressor stations and is underpinned by approximately 255 TJ/d (238 MMcf/d) of new firm-service contracts with 15-year terms. Based on the outcome of the 2021 Capacity Optimization Open Season, changes in expected supply have reduced the scope of the program which now has an estimated capital cost of $0.6 billion. The NGTL System Intra-Basin Expansion is expected to be placed in service commencing in 2023. |

| NGTL System/Foothills West Path Delivery Program |

| 2019 | In 2019, we approved the West Path Delivery Program, an expansion of the NGTL System and Foothills pipeline system for contracted incremental export capacity on the Gas Transmission Northwest pipeline system (GTN System), subject to regulatory approval. |

| 2020 | We filed applications to construct and operate certain of the associated facilities with an estimated capital cost of $0.8 billion and received CER approval to construct and operate $0.2 billion of such facilities. |

| 2021 | The Canadian portion of the expansion program has an estimated capital cost of $1.2 billion as a result of refined cost estimates and increased construction costs and consists of approximately 107 km (66 miles) of pipeline and associated facilities with in-service dates in fourth quarter 2022 and fourth quarter 2023. The program is underpinned by approximately 275 TJ/d (258 MMcf/d) of new firm-service contracts with terms that exceed 30 years. Regulatory approvals to construct and operate $0.4 billion of the facilities have been received and applications for the remaining facilities have been submitted with approvals anticipated in first and fourth quarter 2022. |

| NGTL System - North Montney Mainline (NMML) |

| 2019 | In March 2019, the NGTL System Rate Design and Services Application was filed with the NEB which addressed rate design, terms and conditions of service for the NGTL System and a tolling methodology for the NMML. |

| 2020 | In March 2020, the CER issued a decision approving all elements of the NGTL System Rate Design and Services Application as filed. In January 2020, the $1.1 billion Aitken Creek section of the North Montney project was placed into service with the final section of the project, Kahta South, placed into service in May 2020. All compressor stations, pipeline sections and 11 of the 13 meter stations are complete and operational. |

| 2021 | In 2021, the final two meter stations were placed in service. |

6 | TC Energy Annual information form 2021

| | | | | |

| Date | Description of development |

| NGTL System - Revenue Requirement Settlements |

| 2019 | During 2019, the NGTL System operated under the 2018-2019 Revenue Requirement Settlement (2018-2019 Settlement), which was approved by the NEB in June 2018. The 2018-2019 Settlement, which fixed ROE at 10.1 per cent on 40 per cent deemed common equity and increased the composite depreciation rate from 3.18 per cent to 3.45 per cent, expired on December 31, 2019. |

| 2020 | Following the expiration of the 2018-2019 Settlement, the NGTL System operated under interim tolls until, in August 2020, the CER approved the NGTL System's 2020-2024 Revenue Requirement Settlement Application. Effective January 1, 2020, the NGTL System is operating under the 2020-2024 Revenue Requirement Settlement (2020-2024 Settlement) which includes an ROE of 10.1 per cent on 40 per cent deemed common equity. This settlement provides the NGTL System the opportunity to increase depreciation rates if tolls fall below specified levels and an incentive mechanism for certain operating costs where variances from projected amounts are shared with our customers. |

| Canadian Mainline - Long-Term Fixed-Price Services |

| 2019 | In January 2019, we filed an application with the NEB for approval of 670 TJ/d (625 MMcf/d) of new 15-year natural gas transportation contracts to provide customers with transportation services from the WCSB on the Canadian Mainline. This application was approved in May 2019 resulting in associated enhancements to the Canadian Mainline at a capital cost of $104 million. |

| Canadian Mainline Settlement |

| 2019 - 2020 | In March 2019, the NEB approved the tolls as filed in the January 2019 compliance filing related to the Canadian Mainline toll review, which was completed by the NEB in December 2018. In 2019 and 2020, the Canadian Mainline operated under the terms of the 2015-2030 Tolls Application, which was approved in 2014 and expired on December 31, 2020. The terms of the 2015-2030 Tolls Application included an ROE of 10.1 per cent on deemed common equity of 40 per cent. |

| 2020 | In April 2020, the CER approved a six-year unanimously supported negotiated settlement (2021-2026 Mainline Settlement) between the Canadian Mainline, its customers and other stakeholders. |

| 2021 | Effective January 1, 2021, the Canadian Mainline is operating under the 2021-2026 Mainline Settlement which includes an approved ROE of 10.1 per cent on 40 per cent deemed common equity and an incentive to decrease costs and increase revenues on the pipeline under a beneficial sharing mechanism with our customers. |

| LNG PIPELINE PROJECTS |

| Coastal GasLink |

| 2019 | In response to a previous legal proceeding challenging the BCEAO's jurisdiction over the pipeline project in July 2019, the NEB issued its decision affirming provincial jurisdiction for Coastal GasLink. In addition, in December 2019, the B.C. Supreme Court granted the project an interlocutory injunction confirming the legal right to pursue its permitted and authorized activities through to completion. |

| 2020 | In May 2020, we completed the sale of a 65 per cent equity interest in Coastal GasLink Pipeline Limited Partnership (Coastal GasLink LP). As part of the transaction, we were contracted by Coastal GasLink LP to construct and operate the pipeline. Effective with closing, we commenced recognition of development fee revenue earned during the construction of the pipeline for management and financial services provided and began accounting for our remaining 35 per cent investment using equity accounting. In conjunction with the equity sale, Coastal GasLink LP entered into project-level credit facilities which will fund the majority of the construction costs of Coastal GasLink. Due to COVID-19, in December 2020, the British Columbia Provincial Health Officer issued an order restricting the number of workers on site for industrial projects in the Northern Health Authority region of British Columbia. Industrial projects must submit restart plans to the Provincial Health Officer detailing steps to resume site work. Coastal GasLink LP has worked with the provincial health authorities to safely resume construction activities in accordance with the objectives and timelines defined in the order. |

TC Energy Annual information form 2021 | 7

| | | | | |

| Date | Description of development |

| 2021 | The project is currently more than 59 per cent complete. The entire route has been cleared, grading is more than 70 per cent complete and more than 240 km (149 miles) of pipeline has been installed, with reclamation activities underway in many areas. As a result of scope changes, previous permit delays compared to the original construction schedule and the impacts from COVID-19, including a health order issued by the British Columbia Provincial Health Officer restricting the number of workers on site from late December 2020 until mid-April 2021, we continue to expect project costs to increase significantly along with a delay to project completion compared to the original project cost and schedule. Coastal GasLink has sought to mitigate cost increases and schedule delays and will continue to do so. Coastal GasLink is in dispute with LNG Canada with respect to the recognition of certain costs and the impacts on schedule; however, the parties are in active and constructive discussions toward a resolution of this matter. We do not expect any suspension of construction activities while discussions continue. The ultimate level of debt financing and the amounts to be contributed as equity by Coastal GasLink LP partners, including us, will be determined by the substance of a resolution with LNG Canada. During this time, in addition to using funds from its $6.8 billion project-level credit facility and the recovery of construction carrying costs from LNG Canada, construction is also being funded in part by a subordinated demand revolving facility with TC Energy which has a current capacity of $500 million and provides the project with additional short-term funding and financial flexibility. At December 31, 2021, $1 million was outstanding on this revolving facility. In fourth quarter 2021, as a further interim measure, TC Energy executed a subordinated loan agreement to provide additional temporary financing to the project, if necessary, of up to $3.3 billion as a bridge to a required increase in the $6.8 billion project-level financing to fund incremental costs. This financing will be provided through a combination of interest-bearing loans and loans that are subject to a return to TC Energy under certain conditions at the time the final cost of the project is determined. At December 31, 2021, $238 million was outstanding on these loans. |

8 | TC Energy Annual information form 2021

Developments in the U.S. Natural Gas Pipelines Segment

| | | | | |

| Date | Description of development |

| U.S. NATURAL GAS PIPELINES - COLUMBIA PIPELINE GROUP |

| Sale of Columbia Midstream Assets |

| 2019 | In August 2019, we finalized the sale of certain Columbia Midstream assets to UGI Energy Services, LLC for proceeds of approximately US$1.3 billion, before post-closing adjustments. The sale resulted in a pre-tax gain of $21 million ($152 million after-tax loss), which included the release of $595 million of Columbia goodwill allocated to these assets that is not deductible for income tax purposes. This sale did not include any interest in Columbia Energy Ventures Company, which is our minerals business in the Appalachian basin. |

| Columbia Gas Transmission, LLC (Columbia Gas) - Mountaineer XPress |

| 2019 | The Mountaineer XPress project was phased into service over first quarter 2019. The project was designed to transport supply from the Marcellus and Utica shale plays to points along the system and to the Leach interconnect with Columbia Gulf. The project consists of 275 km (171 miles) of 36-inch greenfield pipeline, 10 km (six miles) of 24-inch lateral pipeline, 0.6 km (0.4 miles) of 30-inch replacement pipeline, 114.1 MW (153,000 hp) of greenfield compression and 55.9 MW (75,000 hp) of brownfield compression. Project costs were revised upwards to US$3.6 billion reflecting the impact of delays of various regulatory approvals from the FERC and other agencies, increased contractor construction costs due to unusually high demand for construction resources in the region, unusually high instances of inclement weather throughout construction, and modifications to contractor work plans to mitigate construction delays associated with these impacts. |

| Columbia Gas Section 4 Rate Case |

| 2020 | Columbia Gas filed a Section 4 rate case with FERC in July 2020 requesting an increase to its maximum transportation rates effective February 1, 2021, subject to refund upon completion of the rate proceeding. |

| 2021 | In July 2021, Columbia Gas notified FERC that it reached a settlement-in-principle with its customers addressing all remaining issues in the case, including but not limited to the resolution of rates and continuation of Columbia Gas's modernization program. In October 2021, Columbia Gas filed its settlement with FERC, and is now awaiting approval, with 2021 revenues expected to be generally consistent with estimates recorded to date. In December 2021, the presiding Administrative Law Judge recommended the settlement for approval and certified it as uncontested to FERC for its review and approval. While there is no timeframe in which FERC must act on the settlement, in line with other recent rate case settlement approval timelines, we expect to receive approval of the settlement in early 2022. |

| Columbia Gas - VR Project |

| 2021 | In July 2021, we approved the VR Project, a delivery market project on Columbia Gas that will replace and upgrade certain facilities while reducing emissions along portions of the Columbia Gas pipeline system in principal delivery markets. The enhanced facilities are expected to improve reliability of the system and allow for additional transportation services to address growing demand under long-term contracts while reducing direct carbon dioxide (CO2e) emissions. The estimated US$0.7 billion project is targeted to be placed in service during the second half of 2025. The VR Project is subject to customary conditions precedent and normal-course regulatory approvals. |

| Columbia Gas - Modernization II |

| 2018 - 2020 | Columbia Gas and its customers entered into a settlement arrangement, approved by the FERC, which provides recovery and return on investment to modernize its system, improve system integrity, and enhance service reliability and flexibility. The Modernization II program includes, among other things, replacement of aging pipeline and compressor facilities, enhancements to system inspection capabilities, and improvements in control systems. The Modernization II program was approved for up to US$1.1 billion of work starting in 2018 and to be completed through 2020. As per the terms of the arrangement, facilities in service by October 31 of each year collect revenues effective February 1 of the following year until the arrangement is terminated upon new rates becoming effective once Columbia Gas files a Section 4 rate case under the Natural Gas Act. Capital spend on the Modernization II program was completed in fourth quarter 2020. |

| Columbia Gas - Modernization III |

| 2021 | Subject to FERC approval as part of the Columbia Gas uncontested rate settlement, Columbia Gas and its customers entered into a settlement arrangement (Modernization III) which provides recovery and return on investment to modernize its system, improve system safety, integrity, compliance and reliability. The Modernization III program includes, among other things, replacement of aging pipeline and compressor facilities, enhancements to system inspection capabilities, and improvements in control systems as well as projects designed to increase energy efficiency and reduce emissions. The program was approved for up to US$1.2 billion of work starting in 2021 and is to be completed through 2024. As per the terms of the arrangement, facilities in service by November 30 of each year collect revenues effective April 1 of the following year until the arrangement is terminated. New rates will become effective once Columbia Gas files a subsequent Section 4 rate case under the Natural Gas Act. |

TC Energy Annual information form 2021 | 9

| | | | | |

| Date | Description of development |

| Columbia Gulf - Rate Settlement |

| 2019 | In December 2019, FERC approved the uncontested Columbia Gulf rate settlement which set new recourse rates for Columbia Gulf effective August 1, 2020 and instituted a rate moratorium through August 1, 2022. |

| Columbia Gulf - Gulf XPress |

| 2019 | The US$0.6 billion project was phased into service over first quarter 2019. The project is associated with the Mountaineer XPress expansion to move Appalachian supply to the Gulf Coast by the addition of seven greenfield mid-point compressor stations along the Columbia Gulf route. |

| Columbia Gulf - Louisiana XPress |

| 2019 | The Louisiana XPress project will connect supply directly to U.S. Gulf Coast LNG export markets with the addition of three greenfield mid-point compressor stations along Columbia Gulf. The FERC certificate for the Louisiana XPress project was filed in July 2019. Interim service for Louisiana XPress shippers commenced in November 2019. The estimated US$0.4 billion project is expected to be placed in service in 2022. |

| OTHER U.S. NATURAL GAS PIPELINES |

| ANR Pipeline Company (ANR Pipeline) - Grand Chenier XPress |

| 2019 | In July 2019, we approved the Grand Chenier XPress project which will connect supply directly to Gulf Coast LNG export markets with auxiliary enhancements at its existing Eunice Compressor Station, the addition of a mid-point compressor station, and a new point of delivery interconnection, meter and associated facilities along the ANR Pipeline. The FERC certificate for the project was filed in October 2019. |

| 2021 | Phase I of Grand Chenier XPress, an expansion project on ANR connecting supply directly to U.S. Gulf Coast LNG export facilities, went into service in April 2021. Phase II was placed in service in January 2022. |

| ANR Pipeline - Alberta XPress |

| 2020 | In February 2020, we approved the Alberta XPress project, an expansion project on ANR that utilizes existing capacity on the Great Lakes and Canadian Mainline systems to connect growing supply from the WCSB to U.S. Gulf Coast LNG export markets. The anticipated in-service date is in the second half of 2022 with an estimated project cost of US$0.2 billion. |

| ANR Pipeline - Elwood Power Project/ANR Horsepower Replacement |

| 2020 | In July 2020, we approved the Elwood Power Project/ANR Horsepower Replacement that will replace, upgrade and modernize certain facilities while reducing emissions along a highly utilized section of the ANR pipeline system. The enhanced facilities are expected to improve reliability of the ANR pipeline system and also allow for additional contracted transportation services of approximately 132 TJ/d (123 MMcf/d) to be provided to an existing power plant near Joliet, Illinois. The anticipated in-service date of the combined project is the second half of 2022 with an estimated cost of US$0.4 billion. |

| ANR Pipeline - Wisconsin Access |

| 2020 | In October 2020, we approved the Wisconsin Access project that will replace, upgrade and modernize certain facilities while reducing emissions along portions of the ANR pipeline system. The enhanced facilities are expected to improve reliability of the ANR pipeline system and also allow for additional contracted transportation services of approximately 77 TJ/d (72 MMcf/d) to be provided to utilities serving the midwestern U.S. under long-term contracts. The anticipated in-service date of the combined project is the second half of 2022 with an estimated cost of US$0.2 billion. |

| ANR Pipeline - WR Project |

| 2021 | In November 2021, we approved the WR Project, a delivery market project on ANR that will replace and upgrade certain facilities while reducing emissions along portions of the ANR pipeline system in principal delivery markets. The enhanced facilities are expected to improve reliability of the system and allow for additional transportation services to address growing demand in the midwestern U.S. under long-term contracts while also reducing CO2e emissions. The estimated US$0.8 billion project is expected to be placed in service in fourth quarter 2025. |

| ANR Section 4 Rate Case |

| 2022 | ANR filed a Section 4 rate case with FERC in January 2022 requesting an increase to ANR's maximum transportation rates effective August 1, 2022, subject to refund upon completion of rate proceedings. As the rate case process progresses, we expect to engage in a collaborative process to achieve settlement with our customers, FERC and other stakeholders. |

10 | TC Energy Annual information form 2021

| | | | | |

| Date | Description of development |

| Gas Transmission Northwest LLC (GTN) - GTN XPress |

| 2019 | In October 2019, TC Pipelines, LP (TCLP) approved the GTN XPress project which is an integrated reliability and expansion project on the GTN System that will provide for the transport of additional volumes enabled by the NGTL System's West Path Delivery Program, estimated at US$0.3 billion (see the Developments in the Canadian Natural Gas Pipelines Segment – Canadian Regulated Pipelines – NGTL System/Foothills West Path Delivery Program section above). |

| 2021 | The GTN XPress expansion project filed its FERC certificate application in fourth quarter 2021 and is expected to be placed in service in the second half of 2023. |

| GTN Rate Case Settlement |

| 2021 | In September 2021, GTN filed an uncontested rate settlement which would set new recourse rates for GTN effective January 1, 2022 and institute a rate moratorium through December 31, 2023. The uncontested rate settlement was approved by FERC in November 2021. The revised rates are not expected to have a significant impact on our U.S. Natural Gas Pipelines segment comparable earnings. In addition, GTN must file for new rates no later than April 1, 2024. |

| TC PipeLines, LP |

| 2021 | In March 2021, we completed the acquisition of all of the outstanding common units of TCLP not beneficially owned by TC Energy, resulting in TCLP becoming an indirect, wholly-owned subsidiary of TC Energy. Upon close of the transaction and in accordance with the acquisition terms, TCLP common unitholders received 0.70 common shares of TC Energy for each issued and outstanding publicly-held TCLP common unit resulting in the issuance of 38 million TC Energy common shares valued at approximately $2.1 billion, net of transaction costs. |

TC Energy Annual information form 2021 | 11

Developments in the Mexico Natural Gas Pipelines Segment

| | | | | |

| Date | Description of development |

| MEXICO NATURAL GAS PIPELINES |

| Tula |

| 2019 | The CFE initiated arbitration in June 2019, disputing fixed capacity payments due to force majeure events. Arbitration proceedings are suspended while management holds settlement discussions with the CFE. The east section of the Tula pipeline was fully commissioned and available for interruptible transportation services. We received capacity payments under force majeure provisions up to June 2019 but have not commenced recording revenue for accounting purposes. |

| 2021 | We are working to procure necessary land access on the west section of the Tula pipeline to finalize its construction. The central segment construction has been delayed due to pending Indigenous consultation processes under the responsibility of the Secretary of Energy. In 2021, we advanced the resolution of disputed contract terms with the signing of a Memorandum of Understanding (MOU) in July 2021 outlining main settlement principles. Feasibility assessments commenced with the CFE under the MOU to jointly evaluate potential alternatives to complete the Tula pipeline. |

| Villa de Reyes |

| 2019 | The CFE initiated arbitration in June 2019, disputing fixed capacity payments due to force majeure events. Arbitration proceedings are suspended while management holds settlement discussions with the CFE. We received capacity payments under force majeure provisions up to May 2019. Payments received prior to in-service are not recognized as revenue for accounting purposes. |

| 2021 | In 2021, we advanced the resolution of disputed contract terms with the signing of an MOU in July 2021 outlining main settlement principles. Villa de Reyes construction is ongoing but completion has been delayed due to COVID-19 contingency measures and challenges gaining access to land in certain local communities. Management is working closely with state and local governments to complete negotiations and achieve access to land so that construction can be completed. We expect to complete the construction of Villa de Reyes in phases during 2022, subject to timely receipt of pending authorizations and land access to critical pipeline sections. |

| Sur de Texas |

| 2019 | The Sur de Texas pipeline began commercial operation in September 2019 following execution of the amending agreement with the CFE. The original Sur de Texas agreement had a fluctuating toll profile over a 25-year contract term. As a result of the amendment, the contract has been extended 10 years and the CFE will receive transportation services for 35 years under a levelized toll structure based on actual construction costs with an initial fixed toll applicable for the first 25 years of the contract term and a higher fixed toll over the last 10 years of the contract. All other terms and conditions of the contract remain substantially unchanged. Monthly revenues for this pipeline will be recognized at a levelized average rate over the 35-year contract term. |

| 2020 | In March 2020, we recorded US$55 million of revenue related to fees associated with the successful completion of the Sur de Texas pipeline. |

Further information about developments in the Natural Gas Pipelines business, including changes that we expect will occur in 2022, can be found in the MD&A in the Natural Gas Pipelines Business section; Canadian Natural Gas Pipelines – Understanding our Canadian Natural Gas Pipelines Segment, Significant events, Financial results and Outlook sections; U.S. Natural Gas Pipelines – Understanding our U.S. Natural Gas Pipelines Segment, Significant events, Financial results and Outlook sections; and Mexico Natural Gas Pipelines – Understanding our Mexico Natural Gas Pipelines Segment, Significant events, Financial results and Outlook sections, which sections of the MD&A are incorporated by reference herein.

12 | TC Energy Annual information form 2021

LIQUIDS PIPELINES

Developments in the Liquids Pipelines Segment

| | | | | |

| Date | Description of development |

| Keystone Pipeline System |

| 2019 | In early February 2019, the Keystone pipeline was temporarily shut down after a leak was detected near St. Charles, Missouri. The pipeline was restarted the same day while the segment between Steele City, Nebraska and Patoka, Illinois was restarted in mid-February 2019. In October 2019, the Keystone pipeline was temporarily shut down after a leak was detected near Edinburg, North Dakota. The pipeline was restarted in November 2019 following the approval of the repair and restart plan by PHMSA. |

| Keystone XL |

| 2019 | In March 2019, the U.S. President issued a new U.S. Presidential Permit (2019 Presidential Permit) for the Keystone XL pipeline which superseded a Presidential Permit that was issued in 2017 (2017 Presidential Permit). This resulted in the dismissal of certain legal claims related to the 2017 Presidential Permit and an injunction barring certain pre-construction activities and construction of the project. The lawsuits were expanded to include challenges to the 2019 Presidential Permit, and proceeded in federal district court in Montana. In August 2019, the Nebraska Supreme Court affirmed the November 2017 decision by the Nebraska Public Service Commission approving the Keystone XL pipeline route through the state. The DOS issued a final supplemental environmental impact statement (SEIS) for the project in December 2019. The final SEIS supplements the 2014 Keystone XL SEIS and underpins the U.S. Bureau of Land Management (BLM) and U.S. Army Corps of Engineers (USACE) permits. |

| 2020 | In February 2020, we received approval from the BLM allowing for the construction of the Keystone XL pipeline across federally managed lands in Montana and land managed by the USACE at the Missouri River. In March 2020, we announced that we would proceed with construction of the Keystone XL pipeline which commenced in April 2020. We advanced construction of 180 km (112 miles) of pipeline and five pump stations in Canada, 12 pump stations in the United States, and completed the U.S./Canada border crossing in June 2020. As part of the Keystone XL pipeline funding plan, the Government of Alberta invested approximately US$0.8 billion in equity as of December 31, 2020 which substantially funded construction costs through the end of 2020. In August 2020, we announced that the Keystone XL pipeline had committed to construct the project using all union labour in the U.S. along with committing in excess of $10 million to create a Green Jobs Training Fund to help train union workers on renewable energy projects. In November 2020, we signed an agreement with Natural Law Energy, which included a potential investment by five First Nations in Alberta and Saskatchewan, of up to $1.0 billion in Keystone XL and future liquids projects. |

| 2021 | Following the revocation of the 2019 Presidential Permit for the Keystone XL pipeline project in January 2021, and after a comprehensive review of options in consultation with our partner, the Government of Alberta, in June 2021, we terminated the Keystone XL pipeline project. The Keystone XL investment was evaluated for impairment in 2021 along with our investments in related capital projects including Heartland Pipeline, TC Terminals and Keystone Hardisty Terminal. We determined that the carrying amount of these assets was no longer fully recoverable. As a result, we recognized an asset impairment charge, net of expected contractual recoveries and other contractual and legal obligations related to termination activities, of $2.8 billion ($2.1 billion after tax) for the year ended December 31, 2021 which was excluded from comparable earnings. Although we recorded a $2.1 billion after-tax asset impairment charge, net of expected contractual recoveries and other contractual and legal obligations related to the Keystone XL pipeline project termination activities, a significant portion of this amount was shared with the Government of Alberta, thereby reducing the net financial impact to us. After the 2019 Presidential Permit was revoked, construction activities ceased except for certain activities required to clean up and reclaim worksites in adherence to our commitment to safety, the environment and our regulatory requirements. Right-of-way clean up and restoration is substantially complete while termination activities will continue through 2022. We will coordinate with regulators, stakeholders and Indigenous groups to meet our environmental and regulatory commitments and ensure a safe exit from the Keystone XL pipeline project. The majority of these associated costs were funded through a final drawdown on the project-level credit facility which occurred in June 2021, subsequent to which the project-level credit facility was fully repaid by the Government of Alberta and terminated. We continue to manage legacy challenges to the 2019 Presidential Permit and the BLM Grant of Right-of-Way, which remain pending before the federal district court in Montana in a manner consistent with the termination of the project. In November 2021, we filed a Request for Arbitration to formally initiate a legacy NAFTA claim to recover economic damages resulting from the revocation of the 2019 Presidential Permit for the Keystone XL pipeline project. We will be seeking to recover more than US$15 billion in damages as a result of the U.S. Government's breach of its NAFTA obligations. This claim is in a preliminary stage with the timing and ultimate outcome unknown at present. |

TC Energy Annual information form 2021 | 13

| | | | | |

| Date | Description of development |

| Northern Courier |

| 2019 | In July 2019, we completed the sale of an 85 per cent equity interest in Northern Courier to AIMCo for gross proceeds of $144 million, before post-closing adjustments, resulting in a pre-tax gain of $69 million after recording our remaining 15 per cent interest at fair value. The after-tax gain of $115 million reflects the utilization of prior years' previously unrecognized tax loss benefits. Preceding the equity sale, Northern Courier issued $1.0 billion of long-term, non-recourse debt, the proceeds from which were paid to TC Energy resulting in aggregate gross proceeds to TC Energy of $1.15 billion from this asset monetization. We remain the operator of the Northern Courier pipeline and are using the equity method to account for our remaining 15 per cent interest in our Consolidated financial statements. |

| 2021 | In November 2021, we received $35 million in proceeds from the monetization of our remaining 15 per cent equity interest in Northern Courier to Astisiy Limited Partnership, a partnership comprised of Suncor Energy Inc. and eight Indigenous communities in the Regional Municipality of Wood Buffalo. |

| Port Neches |

| 2021 | In March 2021, we entered a joint venture with Motiva Enterprises (Motiva) to construct the US$152 million Port Neches Link pipeline system which will connect the Keystone Pipeline System to Motiva’s Port Neches Terminal, which supplies 630,000 Bbl/d to their Port Arthur refinery. This common carrier pipeline system will also include facilities to tie in additional liquids terminals to the Keystone Pipeline System with other downstream infrastructure and is expected to be in service in the second half of 2022. |

Further information about developments in the Liquids Pipelines business, including changes that we expect will occur in 2022, can be found in the MD&A in the Liquids Pipelines – Understanding our Liquids Pipelines business, Significant events, Financial results and Outlook sections, which sections of the MD&A are incorporated by reference herein.

14 | TC Energy Annual information form 2021

POWER AND STORAGE

Developments in the Power and Storage Segment

| | | | | |

| Date | Description of development |

| CANADIAN POWER |

| Ontario Natural Gas-Fired Power Plants |

| 2019 | In March 2019, Napanee experienced an equipment failure while progressing commissioning activities which delayed the initial startup. In July 2019, we entered into an agreement to sell our Halton Hills and Napanee power plants as well as our 50 per cent interest in Portlands Energy Centre (PCE) to a subsidiary of Ontario Power Generation Inc. (OPG). |

| 2020 - 2021 | In March 2020, we placed the Napanee power plant into service. In April 2020, we completed the sale of our Halton Hills and Napanee power plants as well as our 50 per cent interest in PCE to a subsidiary of OPG for net proceeds of approximately $2.8 billion before post-closing adjustments. The total pre-tax loss of $676 million ($470 million after tax) on this transaction includes losses accrued during 2019 while classified as an asset held for sale and a 2021 post-close adjustment as well as utilization of previously unrecognized tax loss benefits. This loss may be amended in the future upon the settlement of existing insurance claims. |

| Sharp Hills Wind Power Purchase Agreement (PPA) |

| 2021 | In September 2021, we executed a 15-year PPA for 100 per cent of the power produced and the rights to all environmental attributes from the 297 MW Sharp Hills Wind Farm located in eastern Alberta. The Sharp Hills Wind Farm is anticipated to be operational in 2023, subject to customary regulatory approvals and conditions. |

| Bruce Power |

| 2019 | In April 2019, Bruce Power's contract price increased from approximately $68 per MWh to a final adjusted contract price of approximately $78 per MWh including flow-through items, reflecting capital to be invested under the Unit 6 MCR program and the Asset Management program as well as annual inflation adjustments. |

| 2020 | Bruce Power’s Unit 6 MCR outage commenced in January 2020 and is expected to be completed in 2023. In late March 2020, as a result of COVID-19 impacts, Bruce Power declared force majeure under its contract with the IESO. This force majeure notice covered the Unit 6 MCR and certain Asset Management work. In May 2020, work on the Unit 6 MCR and Asset Management programs were restarted with additional prevention measures in place for worker safety related to COVID-19. The impact of the force majeure will ultimately depend on the recovery of any impacts in accordance with the force majeure provisions of the IESO contract. In October 2020, the Unit 6 MCR project achieved a major milestone with the completion of the preparation phase and commencement of the Fuel Channel and Feeder Replacement Program. Operations on the remaining units continue as normal with the scheduled outages successfully completed on Unit 3, 4 and 5 in second quarter of 2020 and on Unit 8 in fourth quarter 2020. Future MCR investments will be subject to discrete decisions for each unit with specified off-ramps available for Bruce Power and the IESO. |

| 2021 | In mid-2021, as part of the planned inspections, testing, analysis and maintenance activities at Bruce Power during the current Unit 6 MCR outage and the Unit 3 planned outage, higher than anticipated readings of hydrogen concentration in pressure tubes were detected. These readings were limited to a very small area of the respective pressure tubes and did not impact safety nor pressure tube integrity as concluded following an assessment of all of the Bruce Power units. In October 2021, Unit 3 returned to service after the Canadian Nuclear Safety Commission approved Bruce Power's restart request following extensive inspections which demonstrated that safety and pressure tube integrity continued to meet regulatory requirements. Bruce Power will be incorporating additional inspections as part of their normal surveillance programs to address the new findings while progressing further programs that demonstrate fitness for service at elevated hydrogen concentration levels. These inspections were added to the Unit 7 planned outage which returned to service in January 2022. The Unit 6 MCR program continues on schedule and on budget; however, COVID-19 may have an impact on cost and schedule contingency. As applicable, Bruce Power will seek recovery of any impacts in accordance with the force majeure provisions of the IESO contract. The program is nearing the end of the Inspection Phase and has entered the Installation Phase. Preparation of the Unit 3 MCR program, which is the next scheduled MCR outage, continues and Bruce Power submitted its final cost and schedule duration estimate to the IESO in December 2021. As well, Bruce Power submitted its initial preliminary cost and schedule duration estimate for the Unit 4 MCR program, which is the next unit scheduled after Unit 3. In 2021, Bruce Power launched Project 2030 with the goal of achieving a site peak output of 7,000 MW by 2033 in support of climate change targets and future clean energy needs. Project 2030 will focus on continued asset optimization, innovation and leveraging new technology, which could include integration with storage and other forms of energy, to increase the site peak output at Bruce Power. |

TC Energy Annual information form 2021 | 15

| | | | | |

| Date | Description of development |

| Ontario Pumped Storage Project |

| 2021 | As part of our strategy to capture opportunities that capitalize on the transition to a less carbon-intensive energy mix, we continue to progress the development of the Ontario Pumped Storage project, an energy storage facility located near Meaford, Ontario that would provide 1,000 MW of flexible, clean energy to Ontario's electricity system using a process known as pumped hydro storage. Two key milestones on the Ontario Pumped Storage project were reached in 2021. In July 2021, the Federal Minister of National Defence granted long-term land access to the fourth Canadian Division Training Centre for development of the project on this site. In November 2021, Ontario’s Minister of Energy instructed the IESO to progress the project to Gate 2 of the Unsolicited Proposals Process. Once in service, this project will store emission-free energy when available and provide it to Ontario during periods of peak demand, thereby maximizing the value of existing emissions-free generation in the province. We also continue to consult with the Saugeen Ojibway Nation and other Indigenous groups along with other local stakeholders as we continue to advance this project, which remains subject to a number of conditions and approvals, including approval of our Board of Directors. |

| Coolidge Generating Station |

| 2019 | In May 2019, we completed the sale of the Coolidge generating station to Salt River Agriculture Improvement and Power District as per the terms of their right of first refusal, for proceeds of US$448 million, before post-closing adjustments, resulting in a pre-tax gain of $68 million ($54 million after tax). |

| TransCanada Turbines Ltd. |

| 2020 | In November 2020, we acquired the remaining 50 per cent ownership interest in TransCanada Turbines Ltd. for cash consideration of US$67 million. |

| U.S. POWER |

| 2021 | Through a request for information (RFI) process in 2021, we announced that we were seeking to identify potential contracts and/or investment opportunities in up to 620 MW of wind energy projects, 300 MW of solar projects and 100 MW of energy storage projects to meet the electricity needs of the U.S. portion of the Keystone Pipeline System assets. We also identified meaningful origination opportunities to supply renewable energy products and services to industrial and oil and gas sectors proximate to our in-corridor demand. We received a significant number of responses to our RFI and are currently evaluating proposals and expect to finalize contracts during the first half of 2022. |

| Monetization of U.S. Northeast Power Business |

| 2019 | In May 2019, we sold our remaining U.S. Northeast power marketing contracts. This transaction concludes the wind-down of our U.S. Northeast power marketing business, following the sale of our U.S. power retail contracts in 2018. |

Further information about developments in the Power and Storage business, including changes that we expect will occur in 2022, can be found in the MD&A in the Power and Storage – Understanding our Power and Storage Business, Significant events, Financial results and Outlook sections, which sections of the MD&A are incorporated by reference herein.

16 | TC Energy Annual information form 2021

OTHER ENERGY TRANSITION DEVELOPMENTS

Our vision is to be the premier energy infrastructure company in North America today and in the future. That future includes embracing the energy transition that is underway and contributing to a lower-carbon energy world. As energy transition continues to evolve, we recognize a significant opportunity to reduce our emissions footprint, in addition to being a partner to our customers and other industries which are also looking for low-carbon solutions. Currently, it is uncertain how the energy mix will evolve and at what pace. We continue to observe a reliance on the existing sources of natural gas, crude oil and electricity, for which we currently provide services to our customers.

We are targeting five focus areas to reduce the emissions intensity of our operations, while also capturing growth

opportunities that meet the energy needs of the future:

•modernize our existing system and assets

•decarbonize our energy consumption

•drive digital solutions and technologies

•leverage carbon credits and offsets

•invest in low-carbon energy and infrastructure, such as renewables along with emerging fuels and technology.

Further information about developments in our business, including changes that we expect will occur in 2022 around these developments, can be found in the About our business - Capital Program - Other Energy Transition Developments section of the MD&A, which section of the MD&A is incorporated by reference herein.

TC Energy Annual information form 2021 | 17

Business of TC Energy

Our business is made up of pipeline and storage assets that transport, store or deliver natural gas and crude oil as well as power generation assets that produce electricity to support businesses and communities across the continent.

Our vision is to be the premier energy infrastructure company in North America today and in the future, focused on transporting and delivering the energy people need every day. Our goal is to develop and build a portfolio of infrastructure assets that will enable us to prosper irrespective of the pace and direction of energy transition. Refer to the About our business – 2021 Financial highlights - Consolidated results section of the MD&A for our revenues from operations by segment, for the years ended December 31, 2021 and 2020, which section of the MD&A is incorporated by reference herein.

The following is a description of each of TC Energy's three core businesses.

NATURAL GAS PIPELINES

Our natural gas pipeline network transports natural gas from supply basins to local distribution companies, power generation plants, industrial facilities, interconnecting pipelines, LNG export terminals and other businesses across Canada, the U.S. and Mexico.

In addition to our natural gas pipelines, we have regulated natural gas storage facilities in the U.S. with a total working gas capacity of 535 Bcf, making us one of the largest providers of natural gas storage and related services to key markets in North America.

Our Natural Gas Pipelines business is split into three operating segments representing its geographic diversity: Canadian Natural Gas Pipelines, U.S. Natural Gas Pipelines and Mexico Natural Gas Pipelines.

A description of the natural gas pipelines and regulated natural gas storage assets we operate in addition to further information about our pipeline holdings, developments and opportunities, significant regulatory developments and competitive position which relate to our Natural Gas Pipelines business can be found in the Natural Gas Pipelines Business, Canadian Natural Gas Pipelines, U.S. Natural Gas Pipelines and Mexico Natural Gas Pipelines sections of the MD&A, which sections of the MD&A are incorporated by reference herein.

LIQUIDS PIPELINES

Our existing liquids pipelines infrastructure connects Alberta crude oil supplies to U.S. refining markets in Illinois, Oklahoma and the U.S. Gulf Coast as well as U.S. crude oil supplies from the key market hub at Cushing, Oklahoma to the U.S. Gulf Coast. We also provide intra-Alberta liquids transportation.

A description of pipelines and properties we operate, in addition to further information about our pipeline holdings, developments and opportunities, significant regulatory developments and competitive position which relate to our Liquids Pipelines business can be found in the MD&A in the Liquids Pipelines section, which section of the MD&A is incorporated by reference herein.

18 | TC Energy Annual information form 2021

REGULATION OF NATURAL GAS PIPELINES AND LIQUIDS PIPELINES

Canada

Natural Gas Pipelines

With the exception of Coastal GasLink (which is currently under construction), all of our major Canadian natural gas pipeline systems are regulated by the CER (formerly, the NEB) under the Canadian Energy Regulator Act.

The CER regulates the construction and operation of facilities for these systems. TC Energy project applications are assessed by the CER, and depending on the project scope, may also require approval of the federal government. Should TC Energy propose a major project that is designated under the Impact Assessment Act, it would require assessment by an integrated review panel of the Impact Assessment Agency of Canada and the CER, as well as federal government approval.

The CER also regulates the terms and conditions of services, including rates, for these systems. The CER approves tolls and services that provide TC Energy the opportunity to recover costs of transporting natural gas, including the return of capital (depreciation) and return on the average investment base for our Canadian natural gas pipeline systems. Generally, Canadian natural gas pipelines request the CER to approve the pipeline’s cost of service and tolls once a year, and recover or refund the variance between actual and expected revenues and costs in future years. Net earnings may be affected by changes in investment base, ROE and regulated capital structure as well as by the terms of toll settlements approved by the CER.

The NGTL System is operating under a five-year revenue requirement settlement for 2020-2024 which includes an incentive mechanism for certain operating costs and the opportunity to increase depreciation rates if tolls fall below specified levels. Further information relating to the 2020-2024 Settlement can be found in the General development of the business - Natural Gas Pipelines – Developments in the Canadian Natural Gas Pipelines Segment - Canadian Regulated Pipelines - NGTL System - Revenue Requirement Settlements section above and in the Canadian Natural Gas Pipelines - Financial Results and Other information - Quarterly Results - Highlights by business segment sections of the MD&A, which section of the MD&A is incorporated by reference herein.

The Canadian Mainline is operating under a six-year toll settlement for 2021-2026 which includes an incentive to decrease costs and increase revenues. Further information relating to the Canadian Mainline Settlement can be found in the General development of the business - Natural Gas Pipelines – Developments in the Canadian Natural Gas Pipelines Segment - Canadian Regulated Pipelines - Canadian Mainline Settlement section above and in the Canadian Natural Gas Pipelines – Financial Results section of the MD&A, which section of the MD&A is incorporated by reference herein.

Coastal GasLink Pipeline Project

The Coastal GasLink natural gas pipeline project is being developed primarily under the regulatory regime administered by the OGC and the BCEAO. The OGC is responsible for overseeing oil and gas operations in B.C., including exploration, development, pipeline transportation and reclamation. The BCEAO is an agency that manages the review of proposed major projects in B.C., as required by the B.C. Environmental Assessment Act.

Liquids Pipelines

The CER regulates the terms and conditions of service, including rates, construction and operation of the Canadian portion of the Keystone Pipeline System. The rates for transportation service on the Keystone Pipeline System are calculated in accordance with a methodology agreed to in transportation service agreements between Keystone pipeline and its shippers, and approved by the CER. The White Spruce and Grand Rapids pipelines are regulated by the AER. The AER regulates the construction and operation of pipelines and associated facilities in Alberta.

TC Energy Annual information form 2021 | 19

United States

Natural Gas Pipelines

TC Energy is subject to regulation by various federal, state and local governmental agencies, including those specifically described below.

The Company's wholly-owned and partially-owned U.S. pipelines and natural gas storage facilities are considered natural gas companies subject to the jurisdiction of the FERC. The Natural Gas Act of 1938 grants the FERC authority over the construction, acquisition and operation of pipelines and related facilities utilized in the transportation and sale of natural gas in interstate commerce, including the extension, enlargement or abandonment of service using such facilities. The FERC also has authority to regulate rates and charges for transportation and storage of natural gas in interstate commerce. Pipeline safety is regulated by PHMSA. Natural gas pipelines that cross the international border between Canada and the U.S., such as the Great Lakes Gas Transmission Limited Partnership (Great Lakes), GTN System and Portland Natural Gas Transmission System pipelines, require a Presidential Permit from the DOS.

Liquids Pipelines

The FERC regulates the terms and conditions of service, including transportation rates, of interstate liquids pipelines, including the U.S. portion of the Keystone Pipeline System and Marketlink. The siting and construction of pipeline facilities are regulated by the specific state regulator in which the pipeline facilities are located. Pipeline safety is regulated by PHMSA. Liquids pipelines that cross the international border between Canada and the U.S., such as the Keystone pipeline, require a Presidential Permit. Liquids pipeline projects that cross federal lands or waters of the U.S. require additional federal permits.

Mexico

Natural Gas Pipelines

TC Energy’s pipelines in Mexico are regulated by the Comisión Reguladora de Energía (CRE) who authorizes the transmission services of all gas pipeline infrastructure. Accordingly, our Mexican pipelines have CRE-approved tariffs, services and related rates; however, the contracts underpinning the construction and operation of these facilities are long-term negotiated fixed-rate contracts. Our contractual rates are only subject to change under specific circumstances such as changes in law.

POWER AND STORAGE

Our power business includes approximately 4,300 MW of generation capacity located in Alberta, Ontario, Québec and New Brunswick, using natural gas and nuclear fuel sources and is generally supported by long-term contracts. Additionally, we are pursuing generation assets and PPA opportunities in Canada and the United States.

We own and operate approximately 118 Bcf of non-regulated natural gas storage capacity in Alberta.

Further information about Power and Storage assets we operate and those currently under construction, along with our Power and Storage holdings, significant developments, and opportunities in relation to our Power and Storage business, can be found in the MD&A in the Power and Storage section, which section of the MD&A is incorporated by reference herein.

20 | TC Energy Annual information form 2021

General

EMPLOYEES

At Year End, TC Energy's principal operating subsidiary, TCPL, had 7,017 employees, substantially all of whom were employed in Canada and the U.S., as set forth in the following table.

| | | | | |

| Calgary | 2,653 | |

| Western Canada (excluding Calgary) | 634 | |

| Eastern Canada | 232 | |

| Houston | 807 | |

| U.S. Midwest | 766 | |

| U.S. Northeast | 201 | |

| U.S. Southeast/ Gulf Coast (excluding Houston) | 1,136 | |

| U.S. West Coast | 80 | |

| Mexico | 508 | |

| Total | 7,017 | |

HEALTH, SAFETY, SUSTAINABILITY AND ENVIRONMENTAL PROTECTION AND SOCIAL POLICIES

The Board of Directors' (the Board) Health, Safety, Sustainability and Environment (HSSE) Committee oversees operational risk, occupational and process safety, sustainability, security of personnel, environmental and climate change related risks and monitors development and the implementation of systems, programs and policies relating to HSSE matters through regular reporting from management. We use an integrated management system that establishes a framework for managing these risks and is used to capture, organize, document, monitor and improve our related policies, programs and procedures.

Our management system, TOMS, is modeled after international standards, including the International Organization for Standardization (ISO) standard for environmental management systems, ISO 14001, and the Occupational Health and Safety Assessment Series for occupational health and safety. TOMS also conforms to applicable industry standards and complies with applicable regulatory requirements. It covers the lifecycle of our assets and follows a continuous improvement cycle organized into four key areas:

•Plan – risk and regulatory assessment as well as objective and target setting, which includes establishing total recordable case rate targets while striving for zero incidents plus defining roles and responsibilities

•Do – development and implementation of programs, procedures and standards to manage operational risk

•Check – incident reporting, investigation, assurance activities, including internal and external audits and performance monitoring

•Act – non-conformance, non-compliance and opportunities for improvement are managed and assessed by management.

The HSSE Committee reviews performance and operational risk management. It receives updates and reports on:

•overall HSSE corporate governance

•operational performance and preventative maintenance metrics

•asset integrity programs

•environment programs

•significant occupational safety, process safety and asset integrity incidents

•emergency preparedness, incident response and evaluation

•occupational and process safety performance metrics

•biodiversity and land reclamation

•developments in and compliance with applicable legislation and regulations, including those related to the environment

•prevention, mitigation and management of risks related to HSSE matters, including climate change or business interruption risks, such as pandemics, that may adversely impact TC Energy

•sustainability matters, including social, environmental and climate change related risks and opportunities as well as related voluntary public disclosure such as our Report on Sustainability, Reconciliation Action Plan, ESG Data Sheet and GHG Emissions Reduction Plan

•our Occupational Health and Hygiene Program, which includes physical and mental health and psychological safety.

TC Energy Annual information form 2021 | 21

The HSSE Committee also receives updates on any specific areas of operational and construction risk management review being conducted by management and the results and corrective action plans flowing from internal and third party audits. Information about the financial and operational effects of environmental protection requirements on the capital expenditures, profit or loss and competitive position of TC Energy can be found in the MD&A in the Other information – Enterprise risk management – Health, safety, sustainability and environment section, which section of the MD&A is incorporated by reference herein. Generally, each year the HSSE Committee or the HSSE Committee Chair tours one of our existing assets or projects under development as part of its responsibility to monitor and review our health, safety, sustainability and environmental practices. Additionally, the Board and the HSSE Committee typically have an opportunity to have a joint site visit annually.

Health and Safety

As one of our corporate values, safety is an integral part of the way our employees work. Each year we develop goals predicated on achieving year over year sustainable improvement in our safety performance, and meeting or exceeding industry benchmarks.

The safety of our employees, contractors and the public, as well as the integrity of our pipelines, power and storage infrastructure, are a top priority. All assets are designed, constructed and commissioned with full consideration given to safety and integrity, and are placed into service only after all necessary requirements, both regulatory and internal, have been satisfied.

We annually conduct emergency response exercises to practice effective coordination between the Company, local emergency responders, regulatory agencies and government officials in the event of an emergency. TC Energy uses the Incident Command System (ICS), a standardized approach to command, control and coordinate emergency responses. The ICS model supports a unified approach to emergency response with these community members. We also provide annual training to all field staff in the form of table top exercises, online and vendor lead training.

Environmental risk, compliance and liabilities

TOMS provides requirements for our day-to-day work to protect employees, contractors, our workplace and assets, the communities in which we work and the environment. It conforms to external industry consensus standards and voluntary programs plus complies with applicable legislative requirements. Under TOMS, mandated programs set requirements to manage specific risk areas for TC Energy, including the Environment Program, which is a documented set of processes and procedures that identifies our requirements to proactively and systematically manage environmental hazards and risks throughout the lifecycle of our assets. As part of our Environment Program, we complete environmental assessments for our projects which include field studies that examine existing natural resources, biodiversity and land use along our proposed project footprint such as vegetation, soils, wildlife, water resources, wetland, and protected areas. To conserve and protect the environment during construction, information gathered for an environmental impact assessment is used to develop project-specific environmental protection plans. Additionally, the Environment Program, which applies to all of our operations, includes practices and procedures to manage potential adverse environmental effects to these resources during the full lifecycle of our facilities.

Our primary sources of risk related to the environment include:

•changing regulations and requirements coupled with increased costs related to impacts on the environment

•product releases, including crude oil, diluent and natural gas, that may cause harm to the environment (land, water and air)

•use, storage and disposal of chemicals and hazardous materials

•natural disasters and other catastrophic events, including those related to climate change, that may impact our operations.

Our assets are subject to federal, state, provincial and local environmental statutes and regulations governing environmental protection, including air and GHG emissions, water quality, species at risk, wastewater discharges and waste management. Operating our assets requires obtaining and complying with a wide variety of environmental registrations, licenses, permits and other approvals and requirements. Failure to comply could result in administrative, civil or criminal penalties, remedial requirements, or orders affecting future operations.

Through the implementation of our Environment Program, we continually monitor our facilities for compliance with all material legal and regulatory environmental requirements across all jurisdictions where we operate. We also comply with all material legal and regulatory permitting requirements in our project routing and development. We routinely monitor proposed changes to environmental policy, legislation and regulation. Where the risks are uncertain or have the potential to affect our ability to effectively operate our business, we comment on proposals independently or through industry associations.

22 | TC Energy Annual information form 2021

Social Policies

We have a number of corporate governance documents including commitment statements, policies and standards to help manage Indigenous and stakeholder relations. We have a Code of Business Ethics (COBE) Policy which applies to all employees, officers and directors, and contingent workforce contractors of TC Energy and its wholly-owned subsidiaries and operated entities in countries where we conduct business. All employees (including executive officers) and directors must certify their compliance with COBE.

Our approach to Indigenous and stakeholder engagement is based on building relationships, mutual respect and trust while recognizing the unique values, needs and interests of each community. Our Indigenous Relations and Stakeholder Engagement Commitment Statements provide the structure to guide our teams’ behavior and actions, so they understand their responsibility and extend respect, courtesy and the opportunity to respond to Indigenous groups and stakeholders.

Our Indigenous Relations Policy is informed by our guiding principles and corporate values to ensure meaningful and respectful engagement and dialogue based on a principled and transparent approach. We work together with Indigenous groups to find mutually acceptable solutions to address concerns and identify opportunities to foster long-term relationships in support of

TC Energy's business and sustainability objectives. This policy recognizes the diversity of Indigenous groups, their unique connection to land, and the imperative of building relationships based on mutual respect and trust. We strive to be considered as a partner of choice for Indigenous groups. We seek to play a meaningful role in reconciliation with Indigenous Peoples and groups through our efforts.