EXHIBIT 13.2

Management's discussion and analysis

February 14, 2022

This management's discussion and analysis (MD&A) contains information to help the reader make investment decisions about TC Energy Corporation (TC Energy). It discusses our business, operations, financial position, risks and other factors for the year ended December 31, 2021.

This MD&A should also be read in conjunction with our December 31, 2021 audited Consolidated financial statements and notes for the same period, which have been prepared in accordance with U.S. GAAP.

Contents

| ABOUT THIS DOCUMENT | ||||||||

| ABOUT OUR BUSINESS | ||||||||

| • Three core businesses | ||||||||

| • Our strategy | ||||||||

| • 2021 Financial highlights | ||||||||

| • Outlook | ||||||||

| • Capital program | ||||||||

| NATURAL GAS PIPELINES BUSINESS | ||||||||

| CANADIAN NATURAL GAS PIPELINES | ||||||||

| U.S. NATURAL GAS PIPELINES | ||||||||

| MEXICO NATURAL GAS PIPELINES | ||||||||

| LIQUIDS PIPELINES | ||||||||

| POWER AND STORAGE | ||||||||

| CORPORATE | ||||||||

| FINANCIAL CONDITION | ||||||||

| OTHER INFORMATION | ||||||||

| • Enterprise risk management | ||||||||

| • Controls and procedures | ||||||||

| • Critical accounting estimates | ||||||||

| • Financial instruments | ||||||||

| • Related party transactions | ||||||||

| • Accounting changes | ||||||||

| • Quarterly results | ||||||||

| GLOSSARY | ||||||||

TC Energy Management's discussion and analysis 2021 | 9

About this document

Throughout this MD&A, the terms we, us, our and TC Energy mean TC Energy Corporation and its subsidiaries. Abbreviations and acronyms that are not defined in the document are defined in the glossary on page 120. All information is as of February 14, 2022 and all amounts are in Canadian dollars, unless noted otherwise.

FORWARD-LOOKING INFORMATION

We disclose forward-looking information to help the reader understand management's assessment of our future plans and financial outlook and our future prospects overall.

Statements that are forward looking are based on certain assumptions and on what we know and expect today and generally include words like anticipate, expect, believe, may, will, should, estimate or other similar words.

Forward-looking statements in this MD&A include information about the following, among other things:

•our financial and operational performance, including the performance of our subsidiaries

•expectations about strategies and goals for growth and expansion, including acquisitions

•expected cash flows and future financing options available, including portfolio management

•expected dividend growth

•expected access to and cost of capital

•expected costs and schedules for planned projects, including projects under construction and in development

•expected capital expenditures, contractual obligations, commitments and contingent liabilities

•expected regulatory processes and outcomes

•statements related to our GHG emissions reduction goals

•expected outcomes with respect to legal proceedings, including arbitration and insurance claims

•the expected impact of future tax and accounting changes

•expected industry, market and economic conditions

•the expected impact of COVID-19.

Forward-looking statements do not guarantee future performance. Actual events and results could be significantly different because of assumptions, risks or uncertainties related to our business or events that happen after the date of this MD&A.

Our forward-looking information is based on the following key assumptions and subject to the following risks and uncertainties:

Assumptions

•realization of expected benefits from acquisitions, divestitures and energy transition

•regulatory decisions and outcomes

•planned and unplanned outages and the use of our pipeline, power and storage assets

•integrity and reliability of our assets

•anticipated construction costs, schedules and completion dates

•access to capital markets, including portfolio management

•expected industry, market and economic conditions

•inflation rates and commodity prices

•interest, tax and foreign exchange rates

•nature and scope of hedging

•expected impact of COVID-19.

10 | TC Energy Management's discussion and analysis 2021

Risks and uncertainties

•realization of expected benefits from acquisitions and divestitures

•our ability to successfully implement our strategic priorities and whether they will yield the expected benefits

•our ability to implement a capital allocation strategy aligned with maximizing shareholder value

•the operating performance of our pipeline, power and storage assets

•amount of capacity sold and rates achieved in our pipeline businesses

•the amount of capacity payments and revenues from our power generation assets due to plant availability

•production levels within supply basins

•construction and completion of capital projects

•cost and availability of labour, equipment and materials

•the availability and market prices of commodities

•access to capital markets on competitive terms

•interest, tax and foreign exchange rates

•performance and credit risk of our counterparties

•regulatory decisions and outcomes of legal proceedings, including arbitration and insurance claims

•our ability to effectively anticipate and assess changes to government policies and regulations, including those related to the environment and COVID-19

•our ability to realize the value of tangible assets and contractual recoveries, including those specific to the Keystone XL pipeline project

•competition in the businesses in which we operate

•unexpected or unusual weather

•acts of civil disobedience

•cyber security and technological developments

•ESG related risks

•impact of energy transition on our business

•economic conditions in North America as well as globally

•global health crises, such as pandemics and epidemics, including COVID-19 and the unexpected impacts related thereto.

You can read more about these factors and others in this MD&A and in other reports we have filed with Canadian securities regulators and the SEC.

As actual results could vary significantly from the forward-looking information, you should not put undue reliance on forward-looking information and should not use future-oriented information or financial outlooks for anything other than their intended purpose. We do not update our forward-looking statements due to new information or future events, unless we are required to by law.

FOR MORE INFORMATION

You can find more information about TC Energy in our Annual Information Form and other disclosure documents, which are available on SEDAR (www.sedar.com).

NON-GAAP MEASURES

This MD&A references the following non-GAAP measures:

•comparable EBITDA

•comparable EBIT

•comparable earnings

•comparable earnings per common share

•funds generated from operations

•comparable funds generated from operations.

TC Energy Management's discussion and analysis 2021 | 11

These measures do not have any standardized meaning as prescribed by GAAP and therefore may not be comparable to similar measures presented by other entities. Discussions throughout this MD&A on the factors impacting comparable earnings and comparable earnings before interest, taxes, depreciation and amortization (comparable EBITDA) are consistent with the factors that impact net income attributable to common shares and segmented earnings, respectively, except where noted otherwise.

Comparable measures

We calculate comparable measures by adjusting certain GAAP measures for specific items we believe are significant but not reflective of our underlying operations in the period. Except as otherwise described herein, these comparable measures are calculated on a consistent basis from period to period and are adjusted for specific items in each period, as applicable.

Our decision not to adjust for a specific item in reporting comparable measures is subjective and made after careful consideration. Specific items may include:

•gains or losses on sales of assets or assets held for sale

•income tax refunds, valuation allowances and adjustments resulting from changes in legislation and enacted tax rates

•certain fair-value adjustments relating to risk management activities

•legal, contractual and bankruptcy settlements

•impairment of goodwill, plant, property and equipment, investments and other assets

•acquisition and integration costs

•restructuring costs.

We exclude from comparable measures the unrealized gains and losses from changes in the fair value of derivatives related to financial and commodity price risk management activities. These derivatives generally provide effective economic hedges, but do not meet the criteria for hedge accounting. As a result, the changes in fair value are recorded in net income. As these amounts do not accurately reflect the gains and losses that will be realized at settlement, we do not consider them reflective of our underlying operations. We also exclude from comparable measures the unrealized foreign exchange gains and losses on the loan receivable from affiliate as well as the corresponding proportionate share of Sur de Texas foreign exchange gains and losses, as these amounts do not accurately reflect the gains and losses that will be realized at settlement. These amounts offset within each reporting period, resulting in no impact on net income.

The following table identifies our non-GAAP measures against their most directly comparable GAAP measures.

| Comparable measure | GAAP measure | ||||

| comparable EBITDA | segmented earnings | ||||

| comparable EBIT | segmented earnings | ||||

| comparable earnings | net income attributable to common shares | ||||

| comparable earnings per common share | net income per common share | ||||

| funds generated from operations | net cash provided by operations | ||||

| comparable funds generated from operations | net cash provided by operations | ||||

Comparable EBITDA and comparable EBIT

Comparable EBITDA represents segmented earnings adjusted for certain specific items, excluding non-cash charges for depreciation and amortization. We use comparable EBITDA as a measure of our earnings from ongoing operations as it is a useful indicator of our performance and is also presented on a consolidated basis. Comparable earnings before interest and taxes (comparable EBIT) represents segmented earnings adjusted for specific items and is an effective tool for evaluating trends in each segment. Refer to the Financial results sections for each business segment for a reconciliation to segmented earnings.

12 | TC Energy Management's discussion and analysis 2021

Comparable earnings and comparable earnings per common share

Comparable earnings represents earnings attributable to common shareholders on a consolidated basis, adjusted for specific items. Comparable earnings is comprised of segmented earnings, Interest expense, AFUDC, Interest income and other, Income tax expense, Non-controlling interests and Preferred share dividends, adjusted for specific items. Refer to the Financial highlights section for reconciliations to Net income attributable to common shares and Net income per common share.

Funds generated from operations and comparable funds generated from operations

Funds generated from operations reflects net cash provided by operations before changes in operating working capital (working capital). The components of changes in working capital are disclosed in Note 27, Changes in operating working capital, of our 2021 Consolidated financial statements. We believe funds generated from operations is a useful measure of our consolidated operating cash flows because it excludes fluctuations from working capital balances, which do not necessarily reflect underlying operations in the same period and is used to provide a consistent measure of the cash-generating ability of our businesses. Comparable funds generated from operations is adjusted for the cash impact of specific items noted above. Refer to the Financial condition section for a reconciliation to Net cash provided by operations.

TC Energy Management's discussion and analysis 2021 | 13

About our business

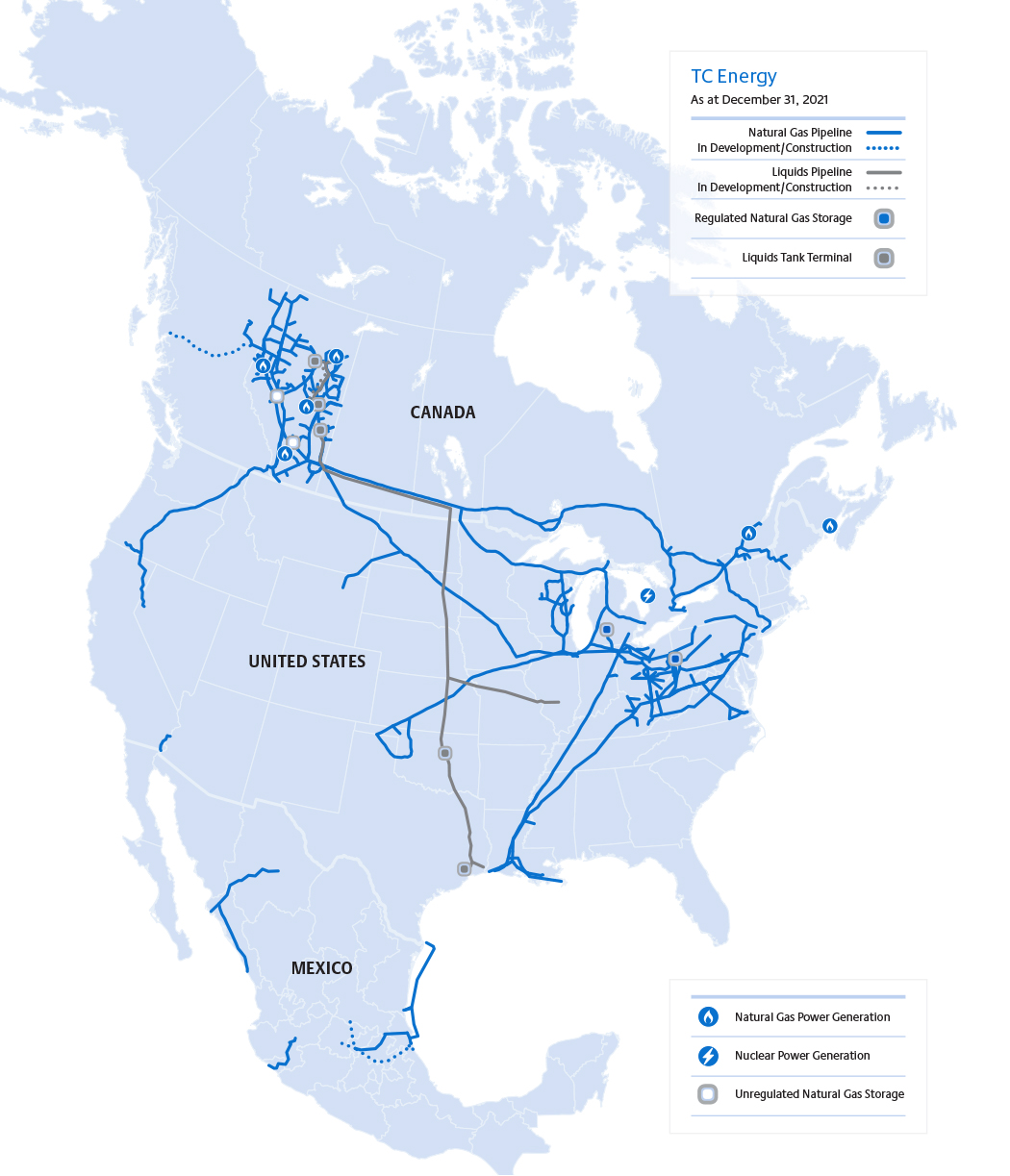

With over 70 years of experience, TC Energy is a leader in the responsible development and reliable operation of North American energy infrastructure including natural gas and liquids pipelines, power generation and natural gas storage facilities.

14 | TC Energy Management's discussion and analysis 2021

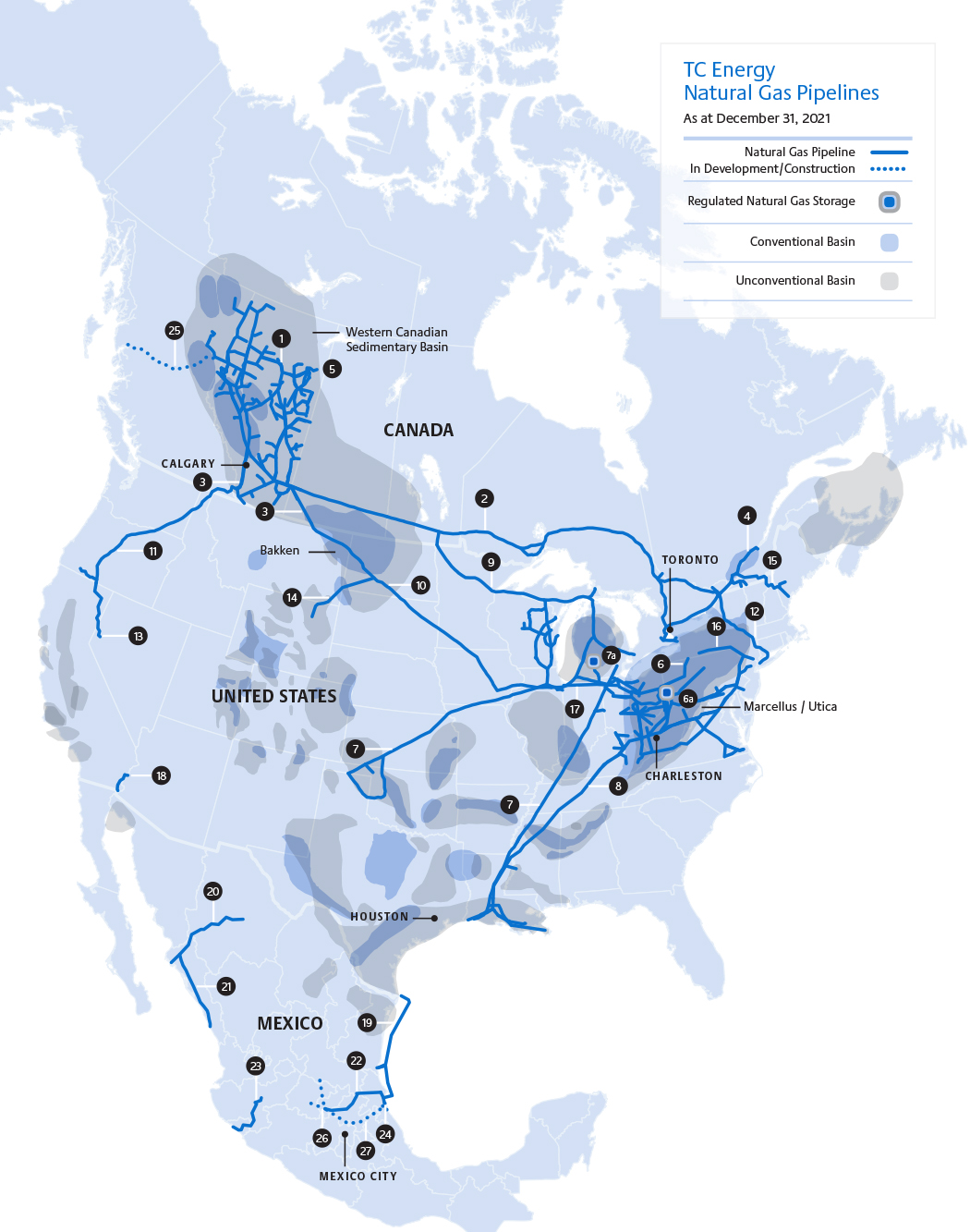

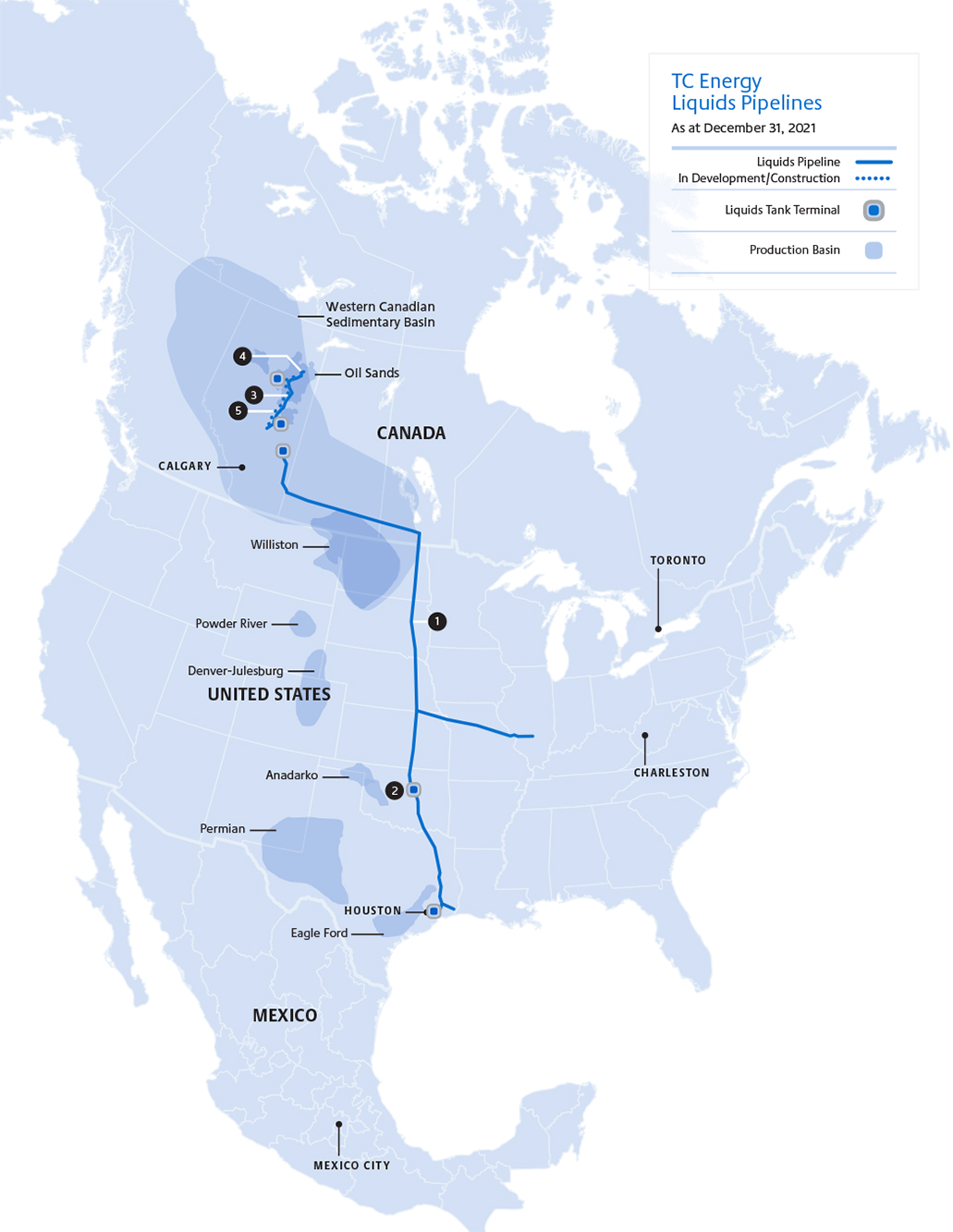

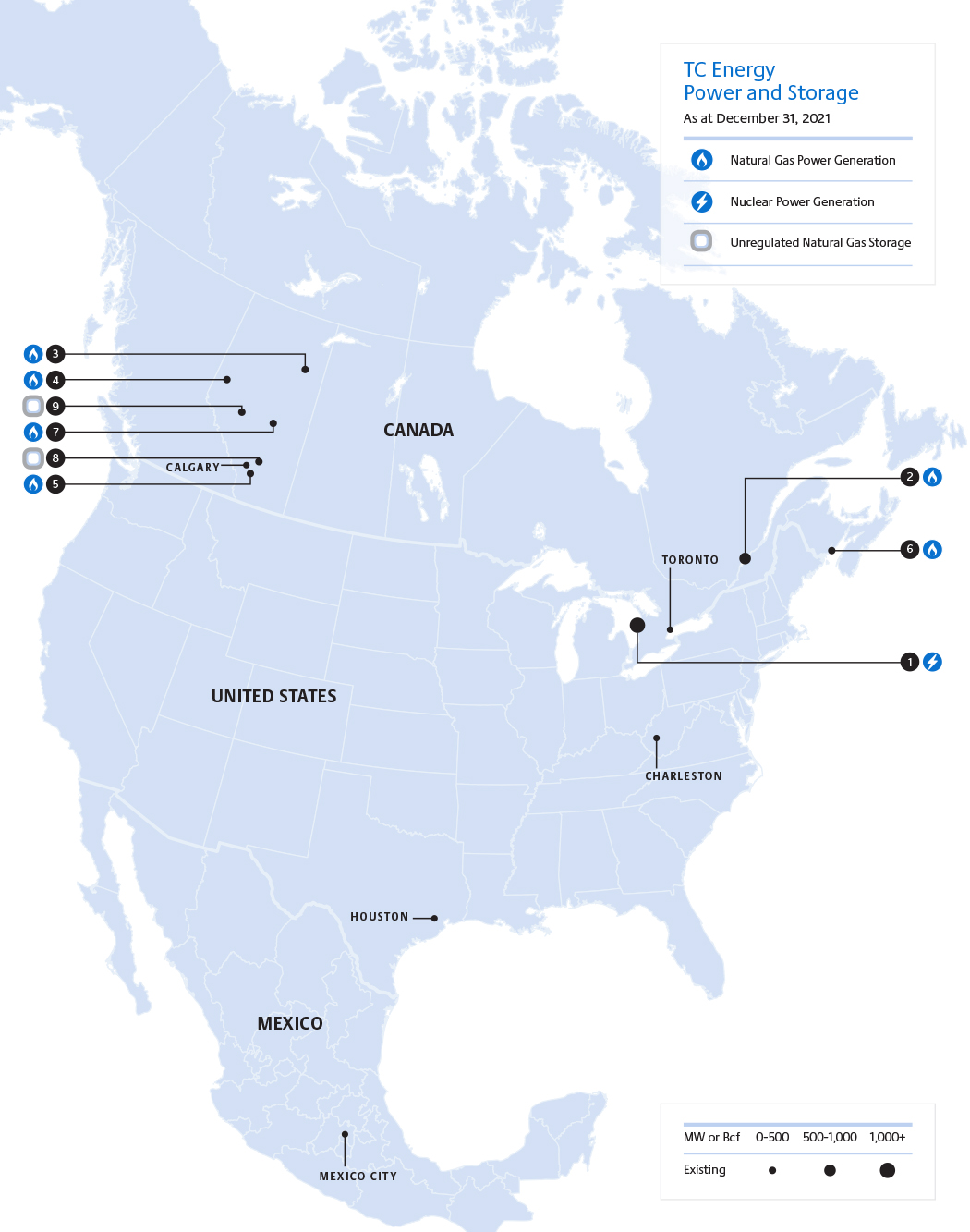

THREE CORE BUSINESSES

We operate in three core businesses – Natural Gas Pipelines, Liquids Pipelines and Power and Storage. In order to provide information that is aligned with how management decisions about our businesses are made and how performance of our businesses is assessed, our results are reflected in five operating segments: Canadian Natural Gas Pipelines, U.S. Natural Gas Pipelines, Mexico Natural Gas Pipelines, Liquids Pipelines and Power and Storage. We also have a Corporate segment consisting of corporate and administrative functions that provide governance, financing and other support to TC Energy's business segments.

Year at-a-glance

| at December 31 | |||||||||||||||||||||||

| (millions of $) | 2021 | 2020 | |||||||||||||||||||||

| Total assets by segment | |||||||||||||||||||||||

| Canadian Natural Gas Pipelines | 25,213 | 22,852 | |||||||||||||||||||||

| U.S. Natural Gas Pipelines | 45,502 | 43,217 | |||||||||||||||||||||

| Mexico Natural Gas Pipelines | 7,547 | 7,215 | |||||||||||||||||||||

| Liquids Pipelines | 14,951 | 16,744 | |||||||||||||||||||||

| Power and Storage | 6,563 | 5,062 | |||||||||||||||||||||

| Corporate | 4,442 | 5,210 | |||||||||||||||||||||

| 104,218 | 100,300 | ||||||||||||||||||||||

| year ended December 31 | |||||||||||||||||||||||

| (millions of $) | 2021 | 2020 | |||||||||||||||||||||

| Total revenues by segment | |||||||||||||||||||||||

| Canadian Natural Gas Pipelines | 4,519 | 4,469 | |||||||||||||||||||||

| U.S. Natural Gas Pipelines | 5,233 | 5,031 | |||||||||||||||||||||

| Mexico Natural Gas Pipelines | 605 | 716 | |||||||||||||||||||||

| Liquids Pipelines | 2,306 | 2,371 | |||||||||||||||||||||

| Power and Storage | 724 | 412 | |||||||||||||||||||||

| 13,387 | 12,999 | ||||||||||||||||||||||

| year ended December 31 | ||||||||||||||||||||

| (millions of $) | 2021 | 2020 | ||||||||||||||||||

Comparable EBITDA by segment1 | ||||||||||||||||||||

| Canadian Natural Gas Pipelines | 2,675 | 2,566 | ||||||||||||||||||

| U.S. Natural Gas Pipelines | 3,856 | 3,638 | ||||||||||||||||||

| Mexico Natural Gas Pipelines | 666 | 786 | ||||||||||||||||||

| Liquids Pipelines | 1,526 | 1,700 | ||||||||||||||||||

| Power and Storage | 683 | 677 | ||||||||||||||||||

| Corporate | (24) | (16) | ||||||||||||||||||

| 9,382 | 9,351 | |||||||||||||||||||

1 For further information on the reconciliation of segmented earnings to comparable EBITDA, refer to the Financial results sections for each business segment.

TC Energy Management's discussion and analysis 2021 | 15

OUR STRATEGY

Our vision is to be the premier energy infrastructure company in North America today and in the future, focused on transporting and delivering the energy people need every day. Our goal is to develop and build a portfolio of infrastructure assets that will enable us to prosper irrespective of the pace and direction of energy transition.

Our business consists of natural gas and crude oil transportation, storage and delivery systems in addition to power generation assets that produce electricity. These long-life infrastructure assets cover strategic North American corridors and are supported by long-term commercial arrangements and/or rate regulation, generating predictable and sustainable cash flows and earnings, the cornerstones of our low-risk business model. Our long-term strategy is driven by several key beliefs:

•natural gas will continue to play a pivotal role in North America's energy future

•crude oil will remain an important part of the fuel mix

•the need for renewables along with reliable, on-demand energy sources to support grid stability will grow significantly

•the value of existing infrastructure assets will become more valuable given the challenges to develop new greenfield, linear-energy infrastructure, in particular, pipelines.

These beliefs drive our capital allocation framework and we will seek to intentionally migrate our portfolio composition over time.

Allocation of comparable EBITDA1

| year ended December 31 | 2021 | |||||||||||||

| Comparable EBITDA by segment | ||||||||||||||

| Canadian Natural Gas Pipelines | 29 | % | ||||||||||||

| U.S. Natural Gas Pipelines | 41 | % | ||||||||||||

| Mexico Natural Gas Pipelines | 7 | % | ||||||||||||

| Liquids Pipelines | 16 | % | ||||||||||||

| Power and Storage | 7 | % | ||||||||||||

| 100 | % | |||||||||||||

1 Refer to Note 4, Segmented information, of our 2021 Consolidated financial statements for an allocation of segmented earnings by business segment.

Future investments will alter our business mix as energy transition unfolds with the following anticipated shifts in capital allocation:

•Power and Storage weighting in our portfolio is expected to grow

•Natural Gas Pipelines will continue to attract capital

•Liquids Pipelines investment will be targeted and tied to maximizing the value of our asset base

•Measured investment in new technology without taking significant commodity price or volumetric risk.

Key components of our strategy, set out below, support our ability to be competitive, responsible and innovative, enhance the value proposition for our shareholders and safely deliver the energy people need today and in the future.

16 | TC Energy Management's discussion and analysis 2021

Key components of our strategy

| 1 | Maximize the full-life value of our infrastructure assets and commercial positions | ||||

•Maintaining safe, reliable operations and ensuring asset integrity, while minimizing environmental impacts, continues to be the foundation of our business •Our pipeline assets include large-scale natural gas and crude oil pipelines and associated storage facilities that connect long-life, low cost supply basins with premium North American and export markets, generating predictable and sustainable cash flows and earnings • Our power and non-regulated storage assets are primarily under long-term contracts that provide stable cash flows and earnings. | |||||

| 2 | Commercially develop and build new asset investment programs | ||||

• We are developing high quality, long-life assets under our current capital program, comprised of approximately $24 billion in secured projects. As well, our noted projects under development are, or are expected to be, largely commercially supported. These investments will contribute to incremental earnings and cash flows as they are placed in service •Our existing extensive footprint offers significant in-corridor growth opportunities. This includes possible future opportunities to deploy low-emissions infrastructure technologies such as renewables, hydrogen and carbon capture, which will help reduce our and our customers' carbon footprint and also supports extending the longevity of our existing assets • We continue to develop projects and manage construction risk in a disciplined manner that maximizes capital efficiency and returns to shareholders • As part of our growth strategy, we rely on our experience and our regulatory, commercial, financial, legal and operational expertise to successfully permit, fund, build and integrate new pipeline and other energy facilities • Safety, executability, profitability and responsible ESG performance are fundamental to our investments. | |||||

| 3 | Cultivate a focused portfolio of high-quality development and investment options | ||||

• We assess opportunities to develop and acquire energy infrastructure that complements our existing portfolio, enhances future resilience under a changing energy mix, and diversifies access to attractive supply and market regions within our risk preferences. Refer to the Enterprise risk management section for an overview of our enterprise risks • We focus on commercially regulated and/or long-term contracted growth initiatives in core regions of North America and prudently manage development costs, minimizing capital at risk in a project's early stages •We will advance selected opportunities, including energy transition growth initiatives, to full development and construction when market conditions are appropriate and project risks and returns are acceptable •We monitor trends specific to energy supply and demand fundamentals, in addition to analyzing how our portfolio performs under different energy mix scenarios considering the recommendations of the Financial Stability Board's Task Force on Climate-related Financial Disclosures. This enables the identification of opportunities that contribute to our resilience, strengthen our asset base or improve diversification. | |||||

| 4 | Maximize our competitive strengths | ||||

| • We continually seek to enhance our core competencies in safety, operational excellence, investment opportunity origination, project execution and stakeholder relations as well as key sustainability and ESG areas to ensure we deliver shareholder value. The use of a disciplined approach to capital allocation supports our ability to maximize value over the short, medium and long term. A strong focus on talent management ensures that we have the necessary capabilities to execute and deliver on our strategy. | |||||

Our competitive advantage

Decades of experience in the energy infrastructure business, a disciplined approach to project management and a proven capital allocation model result in a solid competitive position as we remain focused on our purpose; to deliver the energy people need today and in the future, safely, responsibly, collaboratively and with integrity through:

•strong leadership and governance: we maintain rigorous governance over our approach to business ethics, enterprise risk management, competitive behaviour, operating capabilities and strategy development as well as regulatory, legal, commercial, stakeholder and financing support

•a high-quality portfolio: our low-risk and enduring business model offers the scale and presence to provide essential and highly competitive infrastructure services that enable us to maximize the full-life value of our long-life assets and commercial positions throughout all points of the business cycle. Our portfolio of assets support transporting both molecules and electrons, providing us flexibility to allocate capital towards electrification or other emerging low-carbon technologies in support of any energy transition scenario

TC Energy Management's discussion and analysis 2021 | 17

•disciplined operations: our values-centred workforce is highly skilled in designing, building and operating energy infrastructure with a focus on operational excellence and a commitment to health, safety, sustainability and the environment that is suited to both today's environment as well as an evolving energy industry

•financial positioning: we exhibit consistently strong financial performance, long-term stability and profitability, along with a disciplined approach to capital investment. We can access sizable amounts of competitively-priced capital to support new investment balanced with common share dividend growth while preserving financial flexibility to fund our operations in all market conditions. In addition, we continue to maintain the simplicity and understandability of our business and corporate structure

•proven ability to adapt: we have a long track record of turning policy and technology changes into opportunities – for example, re-entering Mexico when the country shifted from fuel oil to natural gas, reversing pipeline flows in response to the shale gas revolution and re-purposing the underutilized Canadian Mainline pipeline capacity from natural gas to crude oil service

•commitment to sustainability and ESG: we take a long-term view to managing our interactions with the environment, Indigenous groups, community members and landowners. We aim to communicate transparently on sustainability-related topics with all stakeholders. The 2021 Report on Sustainability builds on our commitment to establishing clear metrics and targets for 10 sustainability commitments from last year. We have also committed to reduce GHG emissions intensity from our operations by 30 per cent by 2030 and position us to achieve zero emissions from our operations, on a net basis, by 2050

•open communication: we carefully manage relationships with our customers and stakeholders and offer clear, candid communication of our prospects to investors in order to build trust and support.

Our risk preferences

The following is an overview of our risk philosophy:

| Financial strength and flexibility | ||

•Rely on internally-generated cash flows, existing debt capacity, partnerships and portfolio management to finance new initiatives. Reserve common equity issuances for transformational opportunities. | ||

| Known and acceptable project risks | ||

•Select investments with known, acceptable and manageable project execution risk, including stakeholder considerations. | ||

| Business underpinned by strong fundamentals | ||

•Invest in assets that are investment-grade on a stand-alone basis with stable cash flows supported by strong underlying macroeconomic fundamentals, conducive regulation and/or long-term contracts with creditworthy counterparties. | ||

| Manage credit metrics to ensure "top-end" sector ratings | ||

•Solid investment-grade ratings are an important competitive advantage and TC Energy will seek to ensure our credit profile remains at the top end of our sector while balancing the interests of equity and fixed income investors. | ||

| Prudent management of counterparty exposure | ||

•Limit counterparty concentration and sovereign risk; seek diversification and solid commercial arrangements underpinned by strong fundamentals. | ||

18 | TC Energy Management's discussion and analysis 2021

2021 FINANCIAL HIGHLIGHTS

We use certain financial measures that do not have a standardized meaning under GAAP because we believe they improve our ability to compare results between reporting periods and enhance understanding of our operating performance. Known as non-GAAP measures, they may not be comparable to similar measures provided by other companies.

Comparable EBITDA, comparable earnings, comparable earnings per common share and comparable funds generated from operations are all non-GAAP measures. Refer to page 11 for more information about the non-GAAP measures we use and pages 22 and 82 as well as the business segment Financial results sections for reconciliations to the most directly comparable GAAP measures.

| year ended December 31 | ||||||||||||||||||||

| (millions of $, except per share amounts) | 2021 | 2020 | 2019 | |||||||||||||||||

| Income | ||||||||||||||||||||

| Revenues | 13,387 | 12,999 | 13,255 | |||||||||||||||||

| Net income attributable to common shares | 1,815 | 4,457 | 3,976 | |||||||||||||||||

| per common share – basic | $1.87 | $4.74 | $4.28 | |||||||||||||||||

Comparable EBITDA1 | 9,382 | 9,351 | 9,366 | |||||||||||||||||

| Comparable earnings | 4,153 | 3,945 | 3,851 | |||||||||||||||||

| per common share | $4.27 | $4.20 | $4.14 | |||||||||||||||||

| Cash flows | ||||||||||||||||||||

| Net cash provided by operations | 6,890 | 7,058 | 7,082 | |||||||||||||||||

| Comparable funds generated from operations | 7,406 | 7,385 | 7,117 | |||||||||||||||||

Capital spending2 | 7,134 | 8,900 | 8,784 | |||||||||||||||||

| Proceeds from sales of assets, net of transaction costs | 35 | 3,407 | 2,398 | |||||||||||||||||

Balance sheet3 | ||||||||||||||||||||

| Total assets | 104,218 | 100,300 | 99,279 | |||||||||||||||||

| Long-term debt, including current portion | 38,661 | 36,885 | 36,985 | |||||||||||||||||

| Junior subordinated notes | 8,939 | 8,498 | 8,614 | |||||||||||||||||

Redeemable non-controlling interest4 | — | 393 | — | |||||||||||||||||

| Preferred shares | 3,487 | 3,980 | 3,980 | |||||||||||||||||

| Non-controlling interests | 125 | 1,682 | 1,634 | |||||||||||||||||

| Common shareholders' equity | 29,784 | 27,418 | 26,783 | |||||||||||||||||

| Dividends declared | ||||||||||||||||||||

| per common share | $3.48 | $3.24 | $3.00 | |||||||||||||||||

Basic common shares (millions) | ||||||||||||||||||||

| – weighted average for the year | 973 | 940 | 929 | |||||||||||||||||

| – issued and outstanding at end of year | 981 | 940 | 938 | |||||||||||||||||

1Additional information on Segmented earnings, the most directly comparable GAAP measure, can be found on page 20.

2Includes Capital expenditures, Capital projects in development and Contributions to equity investments. Refer to Note 4, Segmented information, of our 2021 Consolidated financial statements for the financial statement line items that comprise total capital spending.

3As at December 31.

4At December 31, 2020, redeemable non-controlling interest was classified in mezzanine equity and subsequently repurchased in 2021.

TC Energy Management's discussion and analysis 2021 | 19

Consolidated results

| year ended December 31 | ||||||||||||||||||||

| (millions of $, except per share amounts) | 2021 | 2020 | 2019 | |||||||||||||||||

| Canadian Natural Gas Pipelines | 1,449 | 1,657 | 1,115 | |||||||||||||||||

| U.S. Natural Gas Pipelines | 3,071 | 2,837 | 2,747 | |||||||||||||||||

| Mexico Natural Gas Pipelines | 557 | 669 | 490 | |||||||||||||||||

| Liquids Pipelines | (1,600) | 1,359 | 1,848 | |||||||||||||||||

| Power and Storage | 628 | 181 | 455 | |||||||||||||||||

| Corporate | (46) | 70 | (70) | |||||||||||||||||

| Total segmented earnings | 4,059 | 6,773 | 6,585 | |||||||||||||||||

| Interest expense | (2,360) | (2,228) | (2,333) | |||||||||||||||||

| Allowance for funds used during construction | 267 | 349 | 475 | |||||||||||||||||

| Interest income and other | 200 | 213 | 460 | |||||||||||||||||

| Income before income taxes | 2,166 | 5,107 | 5,187 | |||||||||||||||||

| Income tax expense | (120) | (194) | (754) | |||||||||||||||||

| Net income | 2,046 | 4,913 | 4,433 | |||||||||||||||||

| Net income attributable to non-controlling interests | (91) | (297) | (293) | |||||||||||||||||

| Net income attributable to controlling interests | 1,955 | 4,616 | 4,140 | |||||||||||||||||

| Preferred share dividends | (140) | (159) | (164) | |||||||||||||||||

| Net income attributable to common shares | 1,815 | 4,457 | 3,976 | |||||||||||||||||

| Net income per common share – basic | $1.87 | $4.74 | $4.28 | |||||||||||||||||

Net income attributable to common shares in 2021 was $1.8 billion or $1.87 per share (2020 – $4.5 billion or $4.74 per share; 2019 – $4.0 billion or $4.28 per share), a decrease of $2.6 billion or $2.87 per share compared to the same period in 2020 primarily due to the $2.1 billion after-tax asset impairment of the Keystone XL pipeline project, net of expected contractual recoveries and other contractual and legal obligations recorded in 2021. The decrease in Net income per common share in 2021 also reflects the impact of common shares issued for the acquisition of the remaining ownership interests in TC PipeLines, LP. The increase in Net income per common share in 2020 of $0.46 per share compared to 2019 reflected higher net income in 2020 and the dilutive impact of common shares issued under our DRP in 2019.

The following specific items were recognized in Net income attributable to common shares and were excluded from comparable earnings:

2021

•a $2.1 billion after-tax asset impairment charge, net of expected contractual recoveries and other contractual and legal obligations, related to the termination of the Keystone XL pipeline project following the January 20, 2021 revocation of the Presidential Permit. Refer to the Liquids Pipelines – Significant events section for additional information

•a $48 million after-tax expense with respect to transition payments incurred as part of the Voluntary Retirement Program (VRP)

•preservation and storage costs for Keystone XL pipeline project assets of $37 million after tax, which could not be accrued as part of the Keystone XL asset impairment charge, as well as interest expense on the Keystone XL project-level credit facility prior to its termination

•an after-tax gain of $19 million related to the sale of the remaining interest in Northern Courier

•a $7 million after-tax recovery primarily related to certain costs from the IESO associated with the Ontario natural gas-fired power plants sold in April 2020.

20 | TC Energy Management's discussion and analysis 2021

The Keystone XL pipeline project asset impairment charge does not reflect offsetting amounts with respect to the Government of Alberta's investment in Keystone XL nor their repayment of the project's guaranteed credit facility without recourse to TC Energy, both of which were accounted for within the Consolidated statement of equity in 2021 and served to reduce our net financial impact from the Keystone XL pipeline project termination. Refer to the Liquids Pipelines – Significant events section for additional information.

2020

•an after-tax loss of $283 million related to the Ontario natural gas-fired power plants sold in April 2020. The total after-tax loss on this transaction to the end of 2020 was $477 million including losses accrued in 2019 upon classification of the assets as held for sale

•an after-tax gain of $402 million related to the sale of a 65 per cent equity interest in Coastal GasLink Pipeline Limited Partnership (Coastal GasLink LP)

•an income tax valuation allowance release of $299 million following our reassessment of deferred tax assets that were deemed more likely than not to be realized in 2020

•an additional $18 million income tax recovery related to state income taxes on the sale of certain Columbia Midstream assets.

2019

•an after-tax gain of $115 million related to the sale of an 85 per cent equity interest in Northern Courier

•an after-tax loss of $194 million related to the Ontario natural gas-fired power plant assets held for sale

•an income tax valuation allowance release of $195 million related to certain prior years' U.S. income tax losses resulting from our reassessment of deferred tax assets that were deemed more likely than not to be realized

•an after-tax loss of $152 million related to the sale of certain Columbia Midstream assets in 2019

•an after-tax gain of $54 million related to the sale of the Coolidge generating station

•a deferred income tax benefit of $32 million related to the impact of an Alberta corporate income tax rate reduction on our Canadian businesses not subject to RRA

•an after-tax loss of $6 million related to the sale of the remainder of our U.S. Northeast power marketing contracts.

Refer to the Financial results sections in each business segment and the Financial condition section of this MD&A for further discussion of these highlights.

Net income in all periods included unrealized gains and losses from changes in risk management activities which we exclude, along with the above noted items, to arrive at comparable earnings. A reconciliation of Net income attributable to common shares to comparable earnings is shown in the following table.

TC Energy Management's discussion and analysis 2021 | 21

Reconciliation of net income to comparable earnings

| year ended December 31 | ||||||||||||||||||||

| (millions of $, except per share amounts) | 2021 | 2020 | 2019 | |||||||||||||||||

| Net income attributable to common shares | 1,815 | 4,457 | 3,976 | |||||||||||||||||

| Specific items (net of tax): | ||||||||||||||||||||

| Keystone XL asset impairment charge and other | 2,134 | — | — | |||||||||||||||||

| Voluntary Retirement Program | 48 | — | — | |||||||||||||||||

| Keystone XL preservation and other | 37 | — | — | |||||||||||||||||

| Gain on sale of Northern Courier | (19) | — | (115) | |||||||||||||||||

| (Gain)/loss on sale of Ontario natural gas-fired power plants | (7) | 283 | 194 | |||||||||||||||||

| Gain on partial sale of Coastal GasLink LP | — | (402) | — | |||||||||||||||||

| Income tax valuation allowance releases | — | (299) | (195) | |||||||||||||||||

| (Gain)/loss on sale of Columbia Midstream assets | — | (18) | 152 | |||||||||||||||||

| Gain on sale of Coolidge generating station | — | — | (54) | |||||||||||||||||

| Alberta corporate income tax rate reduction | — | — | (32) | |||||||||||||||||

| U.S. Northeast power marketing contracts | — | — | 6 | |||||||||||||||||

Risk management activities1 | 145 | (76) | (81) | |||||||||||||||||

| Comparable earnings | 4,153 | 3,945 | 3,851 | |||||||||||||||||

| Net income per common share | $1.87 | $4.74 | $4.28 | |||||||||||||||||

| Keystone XL asset impairment charge and other | 2.19 | — | — | |||||||||||||||||

| Voluntary Retirement Program | 0.05 | — | — | |||||||||||||||||

| Keystone XL preservation and other | 0.04 | — | — | |||||||||||||||||

| Gain on sale of Northern Courier | (0.02) | — | (0.12) | |||||||||||||||||

| (Gain)/loss on sale of Ontario natural gas-fired power plants | (0.01) | 0.30 | 0.21 | |||||||||||||||||

| Gain on partial sale of Coastal GasLink LP | — | (0.43) | — | |||||||||||||||||

| Income tax valuation allowance releases | — | (0.32) | (0.21) | |||||||||||||||||

| (Gain)/loss on sale of Columbia Midstream assets | — | (0.02) | 0.16 | |||||||||||||||||

| Gain on sale of Coolidge generating station | — | — | (0.06) | |||||||||||||||||

| Alberta corporate income tax rate reduction | — | — | (0.03) | |||||||||||||||||

| U.S. Northeast power marketing contracts | — | — | 0.01 | |||||||||||||||||

| Risk management activities | 0.15 | (0.07) | (0.10) | |||||||||||||||||

| Comparable earnings per common share | $4.27 | $4.20 | $4.14 | |||||||||||||||||

| 1 | year ended December 31 | |||||||||||||||||||||||||

| (millions of $) | 2021 | 2020 | 2019 | |||||||||||||||||||||||

| U.S. Natural Gas Pipelines | 6 | — | — | |||||||||||||||||||||||

| Liquids Pipelines | (3) | (9) | (72) | |||||||||||||||||||||||

| Canadian Power | 12 | (2) | — | |||||||||||||||||||||||

| U.S. Power | — | — | (52) | |||||||||||||||||||||||

| Natural Gas Storage | (6) | (13) | (11) | |||||||||||||||||||||||

| Foreign exchange | (203) | 126 | 245 | |||||||||||||||||||||||

| Income taxes attributable to risk management activities | 49 | (26) | (29) | |||||||||||||||||||||||

| Total unrealized (losses)/gains from risk management activities | (145) | 76 | 81 | |||||||||||||||||||||||

22 | TC Energy Management's discussion and analysis 2021

Comparable EBITDA to comparable earnings

Comparable EBITDA represents segmented earnings adjusted for the specific items described above and excludes non-cash charges for depreciation and amortization. For further information on our reconciliation to comparable EBITDA, refer to the Financial results sections for each business segment.

| year ended December 31 | ||||||||||||||||||||

| (millions of $, except per share amounts) | 2021 | 2020 | 2019 | |||||||||||||||||

| Comparable EBITDA | ||||||||||||||||||||

| Canadian Natural Gas Pipelines | 2,675 | 2,566 | 2,274 | |||||||||||||||||

| U.S. Natural Gas Pipelines | 3,856 | 3,638 | 3,480 | |||||||||||||||||

| Mexico Natural Gas Pipelines | 666 | 786 | 605 | |||||||||||||||||

| Liquids Pipelines | 1,526 | 1,700 | 2,192 | |||||||||||||||||

| Power and Storage | 683 | 677 | 832 | |||||||||||||||||

| Corporate | (24) | (16) | (17) | |||||||||||||||||

| Comparable EBITDA | 9,382 | 9,351 | 9,366 | |||||||||||||||||

| Depreciation and amortization | (2,522) | (2,590) | (2,464) | |||||||||||||||||

| Interest expense included in comparable earnings | (2,354) | (2,228) | (2,333) | |||||||||||||||||

| Allowance for funds used during construction | 267 | 349 | 475 | |||||||||||||||||

| Interest income and other included in comparable earnings | 444 | 173 | 162 | |||||||||||||||||

| Income tax expense included in comparable earnings | (833) | (654) | (898) | |||||||||||||||||

| Net income attributable to non-controlling interests | (91) | (297) | (293) | |||||||||||||||||

| Preferred share dividends | (140) | (159) | (164) | |||||||||||||||||

| Comparable earnings | 4,153 | 3,945 | 3,851 | |||||||||||||||||

| Comparable earnings per common share | $4.27 | $4.20 | $4.14 | |||||||||||||||||

Comparable EBITDA – 2021 versus 2020

Comparable EBITDA in 2021 increased by $31 million compared to 2020 primarily due to the net result of the following:

•increased earnings in U.S. Natural Gas Pipelines from higher Columbia Gas transportation rates effective February 1, 2021 as a result of the subsequently uncontested rate case settlement, improved earnings across our U.S. Natural Gas Pipelines assets following the cold weather events of 2021 impacting many of the U.S. markets in which we operate, increased earnings from our mineral rights business and increased capitalization of pipeline integrity costs, partially offset by higher property taxes

•higher comparable EBITDA from Canadian Natural Gas Pipelines largely as a result of the impact of increased flow-through depreciation and income taxes along with higher rate-base earnings on the NGTL System, full-year recognition of Coastal GasLink development fee revenue and higher Canadian Mainline incentive earnings and flow-through income taxes, partially offset by lower flow-through depreciation and financial charges

•consistent Power and Storage results mainly attributable to increased Canadian Power earnings primarily due to higher realized margins in 2021, contributions from trading activities and a full of year of earnings from our MacKay River cogeneration facility following its return to service in May 2020, partially offset by the sale of our Ontario natural gas-fired power plants in April 2020 and decreased earnings at Bruce Power in 2021 due to lower volumes resulting from greater planned outage days and higher operating expenses

•decreased earnings from Liquids Pipelines attributable to lower volumes on the U.S. Gulf Coast section of the Keystone Pipeline System, partially offset by increased contributions from liquids marketing activities reflecting higher margins and volumes

•lower contribution from Mexico Natural Gas Pipelines mainly due to US$55 million of fees recognized in 2020 associated with the successful completion of the Sur de Texas pipeline

•foreign exchange impact of a weaker U.S. dollar on the Canadian dollar equivalent segmented earnings in our U.S. dollar-denominated operations. As detailed on page 25, U.S. dollar-denominated comparable EBITDA of US$4.6 billion increased by US$226 million compared to 2020; however, this was translated at 1.25 in 2021 versus 1.34 in 2020. Refer to the Foreign exchange discussion below for additional information.

TC Energy Management's discussion and analysis 2021 | 23

While the weakening of the U.S. dollar in 2021 compared to 2020 had a considerable negative impact on 2021 comparable EBITDA, the corresponding impact on comparable earnings was not significant due to offsetting natural and economic hedges. Refer to the Foreign exchange discussion below for additional information.

Comparable EBITDA – 2020 versus 2019

Comparable EBITDA in 2020 decreased by $15 million compared to 2019 primarily due to the net result of the following:

•decreased earnings from Liquids Pipelines as a result of lower volumes on the Keystone Pipeline System, reduced contributions from liquids marketing activities and the July 2019 sale of an 85 per cent equity interest in Northern Courier

•lower Power and Storage results mainly attributable to decreased Bruce Power results in 2020 primarily due to the net impact of lower overall plant generation with the commencement of the Unit 6 MCR program in January 2020, partially offset by fewer outage days on the remaining units and a higher realized power price. As well, reduced earnings in Canadian Power in 2020 were largely as a result of the sale of our Ontario natural gas-fired power plants in April 2020 and the May 2019 sale of our Coolidge generating station

•higher comparable EBITDA from Canadian Natural Gas Pipelines primarily due to the impact of increased rate-base earnings and flow-through depreciation from additional facilities placed in service as well as higher flow-through financial charges on the NGTL System, plus Coastal GasLink development fee revenue recognized in 2020, partially offset by lower flow-through income taxes on the NGTL System and the Canadian Mainline

•increased contribution from Mexico Natural Gas Pipelines mainly due to higher earnings from our investment in the Sur de Texas pipeline following its September 2019 in-service. This includes revenues of US$55 million recognized in 2020 related to fees associated with our successful completion of the Sur de Texas pipeline

•incremental earnings in U.S. Natural Gas Pipelines from Columbia Gas and Columbia Gulf growth projects placed in service and from ANR due to the sale of natural gas from certain gas storage facilities, partially offset by decreased earnings as a result of the sale of certain Columbia Midstream assets in August 2019

•foreign exchange impact of a stronger U.S. dollar on the Canadian dollar equivalent segmented earnings in our U.S. dollar-denominated operations. As detailed on page 25, U.S. dollar-denominated comparable EBITDA of US$4.3 billion decreased by US$174 million compared to 2019; however, this was translated at 1.34 in 2020 versus 1.33 in 2019. Refer to the Foreign exchange discussion below for additional information.

Due to the flow-through treatment of certain expenses, including income taxes, financial charges and depreciation in our Canadian rate-regulated pipelines, changes in these expenses impact our comparable EBITDA despite having no significant effect on net income.

Comparable earnings – 2021 versus 2020

Comparable earnings in 2021 were $208 million or $0.07 per common share higher than in 2020, and were primarily the net result of:

•changes in comparable EBITDA described above

•higher Interest income and other mainly attributable to realized gains in 2021 compared to realized losses in 2020 on derivatives used to manage our net exposure to foreign exchange rate fluctuations on U.S. dollar-denominated income

•decreased Non-controlling interests following the March 3, 2021 acquisition of all outstanding common units of TC PipeLines, LP not beneficially owned by TC Energy

•lower Depreciation and amortization on our U.S. dollar-denominated assets primarily as a result of the weaker U.S. dollar and in Canadian Natural Gas Pipelines due to one section of the Canadian Mainline being fully depreciated in 2021

•higher Income tax expense mainly due to increased pre-tax earnings and higher flow-through income taxes on our Canadian rate-regulated pipelines

•higher Interest expense primarily due to lower capitalized interest as a result of its cessation for the Keystone XL pipeline project following the revocation of the Presidential Permit on January 20, 2021, the change to equity accounting for our Coastal GasLink investment upon the sale of a 65 per cent interest in Coastal GasLink LP and the completion of the Napanee power plant in 2020, partially offset by the foreign exchange impact from a weaker U.S. dollar on translation of U.S. dollar-denominated interest

•lower AFUDC, predominantly due to the suspension of recording AFUDC on the Villa de Reyes project effective January 1, 2021 as a result of ongoing project delays, partially offset by the NGTL System and U.S. natural gas pipeline expansion projects.

24 | TC Energy Management's discussion and analysis 2021

Comparable earnings – 2020 versus 2019

Comparable earnings in 2020 were $94 million or $0.06 per common share higher than in 2019, and were primarily the net result of:

•changes in comparable EBITDA described above

•a decrease in Income tax expense mainly due to lower flow-through income taxes on Canadian rate-regulated pipelines and the impact of higher foreign tax rate differentials

•lower Interest expense as a result of higher capitalized interest largely related to Keystone XL, net of the impact of Napanee completing construction in 2020 and lower interest rates on reduced levels of short-term borrowings. These were partially offset by the effect of long-term debt issuances, net of maturities, as well as the foreign exchange impact from a stronger U.S. dollar on the translation of U.S. dollar-denominated interest

•a decrease in AFUDC predominantly due to NGTL System expansion projects placed in service and the suspension of recording AFUDC on the Tula project resulting from continued construction delays, partially offset by further construction of the Villa de Reyes pipeline

•higher Depreciation and amortization largely in Canadian Natural Gas Pipelines and U.S. Natural Gas Pipelines reflecting new assets placed in service. In Canadian Natural Gas Pipelines, as it is fully recovered in tolls on a flow-through basis, it has no significant impact on comparable earnings.

Comparable earnings per share reflects the impact of common shares issued for the acquisition of the remaining ownership interests in TC PipeLines, LP on March 3, 2021 and under our DRP in 2019. Refer to the Financial condition section for further information on common share issuances.

Foreign exchange

Certain of our businesses generate all or most of their earnings in U.S. dollars and, since we report our financial results in Canadian dollars, changes in the value of the U.S. dollar against the Canadian dollar directly affect our comparable EBITDA and may also impact comparable earnings. As our U.S. dollar-denominated operations continue to grow, this exposure increases. A portion of the U.S. dollar-denominated comparable EBITDA exposure is naturally offset by U.S. dollar-denominated amounts below comparable EBITDA within Depreciation and amortization, Interest expense and other income statement line items. The balance of the exposure is actively managed on a rolling forward basis up to three years using foreign exchange derivatives; however, the natural exposure beyond that period remains. Despite the significant change in the average exchange rate in 2021 compared to 2020, the net impact of U.S. dollar movements on comparable earnings over this period, after considering natural offsets and economic hedges, was not significant.

The components of our financial results denominated in U.S. dollars are set out in the table below, including our U.S. and Mexico Natural Gas Pipelines operations along with the majority of our Liquids Pipelines business. Comparable EBITDA is a non-GAAP measure.

Pre-tax U.S. dollar-denominated income and expense items

| year ended December 31 | ||||||||||||||||||||

| (millions of US$) | 2021 | 2020 | 2019 | |||||||||||||||||

| Comparable EBITDA | ||||||||||||||||||||

| U.S. Natural Gas Pipelines | 3,075 | 2,714 | 2,623 | |||||||||||||||||

Mexico Natural Gas Pipelines1 | 602 | 666 | 568 | |||||||||||||||||

| U.S. Liquids Pipelines | 884 | 955 | 1,318 | |||||||||||||||||

| 4,561 | 4,335 | 4,509 | ||||||||||||||||||

| Depreciation and amortization | (911) | (877) | (847) | |||||||||||||||||

| Interest on long-term debt and junior subordinated notes | (1,259) | (1,302) | (1,326) | |||||||||||||||||

| Capitalized interest on capital expenditures | 10 | 131 | 34 | |||||||||||||||||

| Allowance for funds used during construction | 101 | 182 | 205 | |||||||||||||||||

| Non-controlling interests and other | (76) | (248) | (233) | |||||||||||||||||

| 2,426 | 2,221 | 2,342 | ||||||||||||||||||

| Average exchange rate – U.S. to Canadian dollars | 1.25 | 1.34 | 1.33 | |||||||||||||||||

1 Excludes interest expense on our inter-affiliate loan with Sur de Texas which is fully offset in Interest income and other.

TC Energy Management's discussion and analysis 2021 | 25

Cash flows

Net cash provided by operations of $6.9 billion in 2021 was two per cent lower than 2020 due to lower funds generated from operations, partially offset by the amount and timing of working capital changes. Comparable funds generated from operations of $7.4 billion in 2021 was consistent with 2020 and reflected higher comparable earnings, partially offset by fees collected in 2020 associated with the construction of the Sur de Texas pipeline, as well as lower distributions from the operating activities of our equity investments.

Funds used in investing activities

Capital spending1

| year ended December 31 | ||||||||||||||||||||

| (millions of $) | 2021 | 2020 | 2019 | |||||||||||||||||

| Canadian Natural Gas Pipelines | 2,737 | 3,608 | 3,906 | |||||||||||||||||

| U.S. Natural Gas Pipelines | 2,820 | 2,785 | 2,516 | |||||||||||||||||

| Mexico Natural Gas Pipelines | 129 | 173 | 357 | |||||||||||||||||

| Liquids Pipelines | 571 | 1,442 | 954 | |||||||||||||||||

| Power and Storage | 842 | 834 | 1,019 | |||||||||||||||||

| Corporate | 35 | 58 | 32 | |||||||||||||||||

| 7,134 | 8,900 | 8,784 | ||||||||||||||||||

1Capital spending includes Capital expenditures, Capital projects in development and Contributions to equity investments. Refer to Note 4, Segmented information, of our 2021 Consolidated financial statements for the financial statement line items that comprise total capital spending.

In 2021 and 2020, we invested $7.1 billion and $8.9 billion, respectively, in capital projects to maintain and optimize the value of our existing assets and to develop new, complementary assets in high-demand areas. Our total capital spending in 2021 and 2020 included contributions of $1.2 billion and $0.8 billion, respectively, to our equity investments, predominantly related to Bruce Power and Iroquois.

Proceeds from sales of assets

In 2021, we completed the sale of our remaining 15 per cent equity interest in Northern Courier for gross proceeds of $35 million.

In 2020, we completed the following portfolio management transactions. All cash proceeds amounts are prior to income tax and post-closing adjustments:

•the sale of a 65 per cent equity interest in Coastal GasLink LP for proceeds of $656 million

•the sale of our Ontario natural gas-fired power plants for net proceeds of approximately $2.8 billion.

In addition to the proceeds from the above transactions, in 2020, we received $1.5 billion from the initial draw by Coastal GasLink LP on the project-level credit facility which preceded the equity sale.

Balance sheet

We continue to maintain a solid financial position while growing our total assets by $3.9 billion in 2021. At December 31, 2021, common shareholders' equity, including non-controlling interests, represented 35 per cent (2020 – 35 per cent) of our capital structure, while other subordinated capital, in the form of junior subordinated notes, redeemable non-controlling interest and preferred shares, represented an additional 15 per cent (2020 – 16 per cent). Refer to the Financial condition section for more information about our capital structure.

Dividends

We increased the quarterly dividend on our outstanding common shares by 3.4 per cent to $0.90 per common share for the quarter ending March 31, 2022 which equates to an annual dividend of $3.60 per common share. This was the 22nd consecutive year we have increased the dividend on our common shares and is consistent with our goal of growing our common share dividend at an average annual rate of three to five per cent.

26 | TC Energy Management's discussion and analysis 2021

Dividend reinvestment plan

Under the DRP, eligible holders of common and preferred shares of TC Energy can reinvest their dividends and make optional cash payments to obtain additional TC Energy common shares. Commencing with the dividends declared October 31, 2019, common shares purchased under TC Energy’s DRP are acquired on the open market at 100 per cent of the weighted average purchase price. From January 1, 2019 to October 31, 2019, common shares were issued from treasury at a discount of two per cent to market prices over a specified period.

Cash dividends paid

| year ended December 31 | ||||||||||||||||||||

| (millions of $) | 2021 | 2020 | 2019 | |||||||||||||||||

| Common shares | 3,317 | 2,987 | 1,798 | |||||||||||||||||

| Preferred shares | 141 | 159 | 160 | |||||||||||||||||

OUTLOOK

Comparable EBITDA and comparable earnings

We expect our 2022 comparable EBITDA to be modestly higher than 2021; however, our 2022 comparable earnings per common share are expected to be consistent with 2021 largely due to the impact of a lower average foreign exchange hedge rate on our 2022 U.S. dollar-denominated earnings, as well as the following:

•growth in the NGTL System

•contributions from the Villa de Reyes pipeline expected to be placed in service

•higher AFUDC related to our Mexico natural gas pipeline projects subject to a successful resolution of the current contract dispute

•full-year impact from assets placed in service in 2021 and new projects anticipated to be placed in service in 2022, net of incremental depreciation expense

•lower contributions from the Keystone Pipeline System and reduced margins in the liquids marketing business

•higher Interest expense as a result of long-term debt issuances, net of maturities.

We continue to monitor developments in energy markets, our construction projects and regulatory proceedings as well as COVID-19 for any potential impacts on the above outlook.

Consolidated capital spending and equity investments

We expect to spend approximately $6.5 billion in 2022 on growth projects, maintenance capital expenditures and contributions to equity investments. The majority of the 2022 capital program is focused on NGTL System expansions, U.S. natural gas pipeline projects, the Bruce Power life extension program and normal course maintenance capital expenditures. We recognize that continued uncertainty exists on the duration of COVID-19 and the impact it could have on our construction activities and capital expenditures; however, we do not believe such disruptions will be material to our overall 2022 capital program.

Refer to the relevant business segment and Financial condition outlook sections for additional details on expected earnings and capital spending for 2022.

TC Energy Management's discussion and analysis 2021 | 27

CAPITAL PROGRAM

We are developing quality projects under our capital program. These long-life infrastructure assets are supported by long-term commercial arrangements with creditworthy counterparties and/or regulated business models and are expected to generate significant growth in earnings and cash flows. In addition, many of these projects advance our goals to reduce our own carbon footprint as well as that of our customers.

Our capital program consists of approximately $24 billion of secured projects which represent commercially supported, committed projects that are either under construction or are in or preparing to commence the permitting stage.

Three years of maintenance capital expenditures for our businesses are included in the secured projects table. Maintenance capital expenditures on our regulated Canadian and U.S. natural gas pipelines are added to rate base on which we have the opportunity to earn a return and recover these expenditures through current or future tolls, which is similar to our capacity capital projects on these pipelines. Tolling arrangements in our liquids pipelines business provide for the recovery of maintenance capital expenditures.

During the year ended December 31, 2021, we placed approximately $2.3 billion of Canadian and U.S. natural gas pipelines capacity capital projects into service. In addition, approximately $1.8 billion of maintenance capital expenditures were incurred.

All projects are subject to cost and timing adjustments due to factors including weather, market conditions, route refinement, permitting conditions, scheduling and timing of regulatory permits, as well as other potential restrictions and uncertainties, including the ongoing impact of COVID-19. Amounts exclude capitalized interest and AFUDC, where applicable.

28 | TC Energy Management's discussion and analysis 2021

Secured projects

Estimated and incurred project costs referred to in the following table include 100 per cent of the capital expenditures related to our wholly-owned projects and our ownership share of equity contributions to fund projects within our equity investments, primarily Coastal GasLink and Bruce Power.

| Expected in-service date | Estimated project cost1 | Project costs incurred as at December 31, 2021 | ||||||||||||||||||

| (billions of $) | ||||||||||||||||||||

| Canadian Natural Gas Pipelines | ||||||||||||||||||||

NGTL System2 | 2022 | 3.3 | 1.8 | |||||||||||||||||

| 2023 | 1.8 | 0.2 | ||||||||||||||||||

| 2024+ | 0.5 | — | ||||||||||||||||||

| Canadian Mainline | 2022 | 0.2 | 0.1 | |||||||||||||||||

Coastal GasLink3 | 2023 | 0.2 | 0.2 | |||||||||||||||||

| Regulated maintenance capital expenditures | 2022-2024 | 2.1 | — | |||||||||||||||||

| U.S. Natural Gas Pipelines | ||||||||||||||||||||

Modernization III (Columbia Gas)4 | 2022-2024 | US 1.2 | US 0.2 | |||||||||||||||||

| Delivery market projects | 2025 | US 1.5 | — | |||||||||||||||||

| Other capacity capital | 2022-2025 | US 1.5 | US 0.9 | |||||||||||||||||

| Regulated maintenance capital expenditures | 2022-2024 | US 2.0 | — | |||||||||||||||||

| Mexico Natural Gas Pipelines | ||||||||||||||||||||

| Villa de Reyes | 2022 | US 1.0 | US 0.9 | |||||||||||||||||

Tula5 | — | US 0.8 | US 0.6 | |||||||||||||||||

| Liquids Pipelines | ||||||||||||||||||||

| Other capacity capital | 2022-2023 | US 0.2 | US 0.1 | |||||||||||||||||

| Recoverable maintenance capital expenditures | 2022-2024 | 0.1 | — | |||||||||||||||||

| Power and Storage | ||||||||||||||||||||

Bruce Power – life extension6 | 2022-2027 | 4.4 | 1.9 | |||||||||||||||||

| Other | ||||||||||||||||||||

Non-recoverable maintenance capital expenditures7 | 2022-2024 | 0.6 | — | |||||||||||||||||

| 21.4 | 6.9 | |||||||||||||||||||

Foreign exchange impact on secured projects8 | 2.2 | 0.7 | ||||||||||||||||||

| Total secured projects (Cdn$) | 23.6 | 7.6 | ||||||||||||||||||

1Amounts reflect 100 per cent of costs related to wholly-owned assets as well as cash contributions to our joint-venture investments.

2Estimated project costs for 2022 and 2023 include a total of $0.6 billion for Foothills related to the West Path Expansion Program.

3The estimated project cost represents our share of anticipated partner equity contributions to the project, with the expected in-service date and estimated project cost reflecting the last project update. Refer to the Canadian Natural Gas Pipelines – Significant events section for additional information on the status of Coastal GasLink's dispute with LNG Canada regarding the recognition of certain costs and schedule changes. Refer to Note 11, Loans receivable from affiliates, of our 2021 Consolidated financial statements for information regarding our commitment to provide additional temporary financing, if necessary, to Coastal GasLink under certain circumstances.

4Subject to FERC approval of the Columbia Gas uncontested rate case settlement. Refer to the U.S. Natural Gas Pipelines – Significant events section for additional information.

5The East Section of the Tula pipeline is available for interruptible transportation services. We are working to procure necessary land access on the west section of the Tula pipeline to finalize its construction. The central segment construction has been delayed due to pending Indigenous consultation processes under the responsibility of the Secretary of Energy. Refer to the Mexico Pipelines – Significant events section for additional information.

6Reflects our expected share of cash contributions for the Bruce Power Unit 6 Major Component Replacement (MCR) program, expected to be in service in 2023, amounts to be invested under the Asset Management program through 2027 as well as the incremental uprate initiative. In addition, it includes our expected share of cash contributions for the Unit 3 MCR, subject to IESO approval of the basis of estimate. Refer to the Power and Storage – Significant events section for additional information.

7Includes non-recoverable maintenance capital expenditures from all segments and is primarily comprised of our proportionate share of maintenance capital expenditures for Bruce Power and other Power and Storage assets.

8Reflects U.S./Canada foreign exchange rate of 1.27 at December 31, 2021.

TC Energy Management's discussion and analysis 2021 | 29

Projects under development

In addition to our secured projects, we have a portfolio of projects that we are currently pursuing which are in varying stages of development. Projects under development have greater uncertainty with respect to timing and estimated project costs and are subject to corporate and regulatory approvals, unless otherwise noted. Each business segment has also outlined additional areas of focus for further ongoing business development activities and growth opportunities. As these projects are advanced, reaching necessary milestones, they will be included in the secured projects table.

Canadian Natural Gas Pipelines

We continue to focus on optimizing the utilization and value of our existing Canadian Natural Gas Pipelines assets, including in-corridor expansions, providing connectivity to LNG export terminals and connections to growing shale gas supplies. Sustainability development projects will include additional compressor station electrification and waste heat capture power generation on our systems as well as other GHG abatement initiatives.

U.S. Natural Gas Pipelines

Delivery Market Projects

Projects are in development that will replace, upgrade and modernize certain U.S. Natural Gas Pipelines facilities while reducing emissions along portions of our pipeline systems’ principal delivery markets. The enhanced facilities are expected to improve reliability of our systems and allow for additional contracted transportation services to address growing demand in the U.S. Midwest and the Mid-Atlantic regions under long-term contracts while reducing direct carbon dioxide equivalent (CO2e) emissions. Included in our secured projects are the US$0.7 billion VR Project on Columbia Gas and the US$0.8 billion WR Project on ANR, two delivery market projects that were approved in 2021 with expected in-service dates in the second half of 2025.

Other Opportunities

We are currently pursuing a variety of projects including compression replacement while furthering the electrification of our fleet, increasing capacity to LNG, power generation and LDCs, expanding our modernization programs and in-corridor expansion opportunities on our existing system. These projects are expected to improve the reliability of our system with an environmental focus on cleaner energy.

Refer to the U.S. Natural Gas Pipelines – Significant events section for additional information.

Mexico Natural Gas Pipelines

We are currently evaluating new growth projects driven by Mexico’s economic expansion and the need to connect natural gas to new regions of the country to serve power plants, industrial demand and LNG exports and, in doing so, reduce reliance on costly, carbon intensive fuel oil. Potential projects include a re-route of the central segment of Tula as well as a new offshore pipeline that would connect additional natural gas supply to Southeast Mexico and capacity expansions on existing assets.

Liquids Pipelines

Grand Rapids Phase II

Regulatory approvals have been obtained for Phase II of Grand Rapids which consists of completing the 36-inch pipeline for crude oil service and converting the 20-inch pipeline from crude oil to diluent service. Commercial support is being pursued with prospective customers.

Terminals Projects

We continue to pursue projects associated with our terminals in Alberta and the U.S. to expand our core business and add operational flexibility for our customers.

Other Opportunities

We remain focused on maximizing the value of our liquids assets by expanding and leveraging our existing infrastructure and enhancing connectivity and service offerings to our customers. We are pursuing selective growth opportunities to add incremental value to our Liquids Pipelines business and expansions that leverage available capacity on our existing infrastructure. We remain disciplined in our approach and will position our business development activities strategically to capture opportunities within our risk preferences.

30 | TC Energy Management's discussion and analysis 2021

Power and Storage

Bruce Power

Life Extension Program

The continuation of Bruce Power’s life extension program through to 2033 will require the investment of our proportionate share of Major Component Replacement (MCR) program costs on Units 3, 4, 5, 7 and 8, as well as the remaining Asset Management program costs which continue beyond 2033. This program will extend the life of Units 3 to 8 and the Bruce Power site to 2064. The basis of estimate for the Unit 3 MCR was submitted to the IESO in December 2021 for a refurbishment outage expected to begin in first quarter 2023. Preparation work for the Unit 4 MCR is well underway and work for Unit 5, 7 and 8 MCRs have also begun. Future MCR investments will be subject to discrete decisions for each unit with specified off-ramps available to Bruce Power and the IESO. We expect to spend approximately $4.8 billion for our proportionate share of the Bruce Power MCR program costs for Units 4, 5, 7 and 8, the remaining Asset Management program costs beyond 2027, as well as the incremental uprate initiative discussed below.

Uprate Initiative

Bruce Power recently launched Project 2030 with the goal of achieving a site peak output of 7,000 MW by 2033 in support of climate change targets and future clean energy needs. Project 2030 will focus on continued asset optimization, innovation and leveraging new technology, which could include integration with storage and other forms of energy, to increase the site peak output at Bruce Power. Project 2030 is arranged in three stages with the first two stages fully approved for execution. Stage 1 started in 2019 and is expected to add 150 MW of output and Stage 2, beginning in early 2022, is targeting another 200 MW. Both stages are expected to increase output in multiple steps ending in 2033. Stage 3 requires Stage 1 and 2 to be complete and would enable an increase to the reactor power limit.

Development-Stage Projects

Ontario Pumped Storage

We continue to progress the development of the Ontario Pumped Storage project, an energy storage facility located near Meaford, Ontario that would provide 1,000 MW of flexible, clean energy to Ontario’s electricity system using a process known as pumped hydro storage.

Two key milestones on the Ontario Pumped Storage project were reached in 2021. On July 28, 2021, the Federal Minister of National Defence granted long-term land access to the fourth Canadian Division Training Centre for development of the project on this site. On November 11, 2021, Ontario’s Minister of Energy instructed the IESO to progress the project to Gate 2 of the Unsolicited Proposals Process. Once in service, this project will store emission-free energy when available and provide that energy to Ontario during periods of peak demand, thereby maximizing the value of existing emissions-free generation in the province.

Saddlebrook Solar and Storage

We are proposing to construct and operate the Saddlebrook Solar and Storage project, a solar and energy storage solution, which consists of a solar-generating facility located in Aldersyde, Alberta that will operate in conjunction with a battery energy storage system.

The proposed generating facility will produce approximately 81 MW of power and the battery storage system will provide up to 40 MWh of energy storage capacity and is expected to reduce GHG emissions by approximately 115,000 tonnes per year. The proposed project is partially funded through Emissions Reduction Alberta’s Biotechnology, Electricity and Sustainable Transportation Challenge. We expect to make a final investment decision on the project in 2022 with the first phases of commissioning beginning towards the end of 2022.

Canyon Creek Pumped Storage

We acquired 100 per cent ownership of the Canyon Creek pumped storage development project in 2021. Once in service, the facility will have initial generating capacity of 75 MW, expandable through future development to 400 MW, and will utilize existing site infrastructure from a decommissioned coal mine. The facility will provide up to 37 hours of on-demand, flexible, clean energy and ancillary services to the Alberta electricity grid. The project has received the approval of the Alberta Utilities Commission and the required approval of the Alberta Government for hydro projects under the Hydro Development Act.

TC Energy Management's discussion and analysis 2021 | 31

The Canyon Creek Pumped Storage project is part of a larger product offering by us, a 24-by-7 carbon-free power product in the Province of Alberta and includes output from other projects currently under construction or being developed, thereby positioning our customers to manage hourly power needs with cost certainty and achieve decarbonization goals by sourcing power from emissions-free assets.

Renewable Energy Request for Information (RFI)

In 2021, we announced that we were seeking to identify potential contracts and/or investment opportunities in wind, solar and power storage renewable energy projects. We requested up to 620 MW of wind energy projects, 300 MW of solar projects and 100 MW of energy storage projects to meet the electricity needs of the U.S. portion of the Keystone Pipeline System assets. We also identified meaningful origination opportunities to supply renewable energy products and services to industrial and oil and gas sectors proximate to our in-corridor demand. We received a significant number of responses to our RFI and are currently evaluating proposals and expect to finalize contracts during the first half of 2022.

Other Opportunities

We are actively building our customer-focused origination platform across North America, providing commodity products and energy services to help customers address the challenges of energy transition. Our existing network of assets, customers and suppliers provide a mutual opportunity in which we can tailor solutions to meet their clean energy needs. Although we may adopt a custom-tailored strategy for each of our partnerships, the core underpinning remains consistent, which is that every opportunity we undertake will ultimately be driven by customer needs allowing us to complement each other’s capabilities, diversify risk and share learnings as we navigate the energy transition.

Refer to the Power and Storage – Significant events section for additional information.

Other Energy Transition Developments

Our vision is to be the premier energy infrastructure company in North America today and in the future. That future includes embracing the energy transition that is underway and contributing to a lower-carbon energy world. As energy transition continues to evolve, we recognize a significant opportunity to reduce our emissions footprint, in addition to being a partner to our customers and other industries which are also looking for low-carbon solutions. Currently, it is uncertain how the energy mix will evolve and at what pace. We continue to observe a reliance on the existing sources of natural gas, crude oil and electricity, for which we currently provide services to our customers.

We are targeting five focus areas to reduce the emissions intensity of our operations, while also capturing growth

opportunities that meet the energy needs of the future:

•modernize our existing system and assets

•decarbonize our energy consumption

•drive digital solutions and technologies

•leverage carbon credits and offsets

•invest in low-carbon energy and infrastructure, such as renewables along with emerging fuels and technology.

Alberta Carbon Grid (ACG)