UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-1596 |

|

FPA CAPITAL FUND, INC. |

(Exact name of registrant as specified in charter) |

|

11601 WILSHIRE BLVD., STE. 1200

LOS ANGELES, CALIFORNIA | | 90025 |

(Address of principal executive offices) | | (Zip code) |

| | | |

(Name and Address of Agent for Service) | | Copy to: |

| | |

J. RICHARD ATWOOD, PRESIDENT

FPA CAPITAL FUND, INC.

11601 WILSHIRE BLVD., STE. 1200

LOS ANGELES, CALIFORNIA 90025 | | MARK D. PERLOW, ESQ.

DECHERT LLP

ONE BUSH STREET, STE. 1600

SAN FRANCISCO, CA 94104 |

Registrant’s telephone number, including area code: | (310) 473-0225 | |

|

Date of fiscal year end: | March 31 | |

|

Date of reporting period: | September 30, 2016 | |

| | | | | |

Item 1: Report to Shareholders.

Distributor:

UMB DISTRIBUTION SERVICES, LLC

235 West Galena Street

Milwaukee, Wisconsin 53212

FPA CAPITAL FUND, INC.

LETTER TO SHAREHOLDERS

Dear fellow shareholders,

For the third quarter of 2016, the Fund appreciated by 10.20% and is now up 12.28% for the year. We are pleased with these results. We note that these strong returns were achieved while carrying, on average, 27.6% cash for the quarter and 26.0% for the year. In addition to this sound showing, we are excited prospectively. Most of our companies reported solid earnings and many pointed to better days ahead. Despite a frothy market (the Russell 2500 is only 2.6% off its five-year and all-time high), our portfolio companies are on average 36.0% off their five-year highs (and off even further from their all-time highs).

Portfolio commentary

| Contributors1 | | Performance

Contribution | |

Arris Group | | | 1.80 | % | |

Interdigital | | | 1.68 | % | |

Western Digital | | | 1.58 | % | |

Dana | | | 1.44 | % | |

| Detractors1 | | Performance

Contribution | |

Houghton Mifflin Harcourt | | | -0.38 | % | |

Rowan Companies | | | -0.37 | % | |

Apollo Education | | | -0.32 | % | |

Noble Energy | | | -0.01 | % | |

Our backlog of analyzed (but unattractively priced) securities continues to grow. This is akin to having acquired the seeds but waiting until the right season to plant them. Our investment thesis on oil is starting to play out now that we have seen production in the U.S. continue to fall. This is akin to green shoots from seeds we planted a while ago beginning to blossom. Other 'green shoots' include Western Digital Corporation (Nasdaq: WDC) continuing to find ways to realize synergies and lowering borrowing costs, and Arris International plc (Nasdaq: ARRS) getting closer to a new capex cycle after a lull in spending by some of its largest customers amid industry consolidation. We continue to increase the sizing of our positions when the market disagrees with our long-term view, and to do the opposite when the market ceases to provide us with an adequate margin of safety.2

As value managers, we seek to increase the size of our positions when the market disagrees with our long-term view, and do the opposite when the market ceases to provide us with an adequate margin of safety. We don't always get it right, but InterDigital, Inc. (Nasdaq: IDCC) epitomizes such behavior. When the market failed to recognize IDCC's normalized earnings power, we reviewed our thesis, worked through our upside/downside case, and then took action by substantially increasing our position. Finally, this year, the seeds blossomed and we have substantially reduced our position.

1 Reflects the top contributors and top detractors to the Fund's performance based on contribution to return for the quarter. Contribution is presented gross of investment management fees, transactions costs, and Fund operating expenses, which if included, would reduce the returns presented.

2 Margin of safety — Buying with a "margin of safety" is when a security is purchased at a discount to the portfolio manager's estimate of its intrinsic value. Buying a security with a margin of safety is designed to protect against permanent capital loss in the case of an unexpected event or analytical mistake. A purchase made with a margin of safety does not guarantee the security will not decline in price.

1

FPA CAPITAL FUND, INC.

LETTER TO SHAREHOLDERS

Continued

Source: FPA

The performance shown reflects the performance of a single portfolio holding and does not reflect the performance of the Fund. Portfolio composition will change due to ongoing management of the Fund. References to individual securities are for informational purposes only and should not be construed as recommendations of the Fund's portfolio managers. It should not be assumed that future investments will be profitable or will equal the performance of the security example shown. Past performance is no guarantee of future results.

Activity

We exited one name during the quarter. We sold out of SM Energy Company bonds — one of our two high-yield bond investments. You might recall that we bought our entire position in mid-February 2016 at around 48.50 cents on the dollar, when oil prices were hitting multi-year lows. We sold out of the position at above par and also collected one semi-annual coupon.

We initiated one new position. We are still in the process of accumulating this equity so we will not disclose the name of the company yet. It is a spin-off of one of our former investments. We monitored the parent company since our exit and followed its offspring after the spin for over a year.

We continued to be active in our existing positions by adding to those that showed higher upside to downside ratios and trimming those that increased in price without a commensurate improvement in outlook.

Technology investments

Our best performing investments came from the technology sector this quarter. Arris International plc, InterDigital, Inc., and Western Digital Corporation have performed superbly (up 35.16%, 42.60%, and 24.78%, respectively in the quarter). We discussed all these names in our first quarter letter3 so we will not spend additional time on our investment thesis on these companies in this letter.

3 http://fpafunds.com/docs/hc_capital/fcap-q1-letter-2016_final.pdf?sfvrsn=4

2

FPA CAPITAL FUND, INC.

LETTER TO SHAREHOLDERS

Continued

Our two other large technology investments, Arrow Electronics, Inc. (NYSE: ARW) and Avnet, Inc. (NYSE: AVT) were also up, but not as significantly (by 3.34% and 1.78%, respectively).

Arrow and Avnet act as the distribution arm for component and computer equipment manufacturers. Essentially, Arrow and Avnet consolidate the sales force, provide inventory management, and offer tech support for their vendors, allowing them to reach a broader customer base than they otherwise could. Arrow and Avnet's customers benefit because a single distributor can provide rapid access to and expertise around multiple products and short-term financing.

There is a lot to like about these businesses. They have a diversified customer base, supplier base, and geographic revenue mix. To-date they have each delivered what in our view are reasonable returns on capital. And they have the potential to generate strong free cash flow during a downturn as inventories are paired back and accounts receivables are collected. In addition, we think these are relatively difficult businesses to disrupt because the distributors are not reliant on any single technology. Both firms also benefit from their scale as increasing size attracts both more customers and more vendors creating a network effect.

Avnet recently announced several big changes. First, the company replaced its CEO after several quarters of underperformance in its Technology Solutions (TS) business and a misstep in business management software implementation. Second, Avnet purchased Premier Farnell, a UK-based company focused on early design-stage customers, for about $1 billion. Finally, the company sold off its underperforming TS business for $2.6 billion. In aggregate, we have confidence these changes have improved the overall business quality and increased Avnet's optionality via a de-levered balance sheet.

Arrow continues to execute well and is making changes to improve its business. For example, Arrow's Enterprise Computing Solutions business has become more software driven, and this could lead to margin expansion. In addition, as the components business begins to take on more design work and offer more service-based solutions, we believe that margins in this business could also expand.

Energy investments

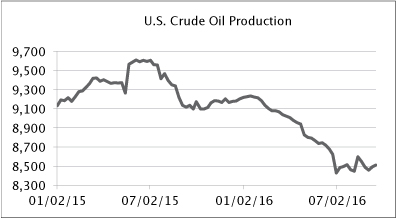

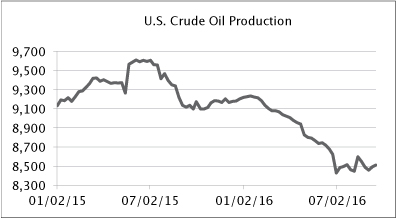

Our investments in the energy sector continued to be volatile. They have been strong contributors to our year-to-date performance, but with the exception of two, they have either detracted from or were small contributors to our performance in the third quarter. For instance, Rowan Companies plc (RDC) was one of our detractors this quarter: the stock was down 14.16% for the quarter and detracted 37 bps from the performance. Another energy name that was down in the third quarter was Noble Energy, Inc. (NBL), which was down 0.07% and detracted less than 1 basis point from the performance. Our thesis remains intact with both demand and supply moving in the right direction. In China, for instance, oil demand was up by almost a million barrels per day year-over-year for the month of August, and its domestic production was down 300,000 barrels.4 In Iran, where many pundits are looking for supply growth, production has plateaued at 3.6mm barrels per day, according to the International Energy Agency. Meanwhile, the National Iranian Oil Company needs $100 billion of new investment to hit their oil production goal of 4.5 million barrels per day by 2021.5 The news of continued military activity in Nigeria and Libya and social unrest in Venezuela will likely lead to continued pressure on oil production in those countries. U.S. supply peaked at 9.6mm barrels of crude oil per day in June 2015, and it's fallen by approximately 1.1mm barrels since then.

4 Cornerstone Analytics — 09/08/16

5 http://www.tehrantimes.com/news/405793/Iran-needs-100b-for-upstream-oil-gas-projects-by-2021

3

FPA CAPITAL FUND, INC.

LETTER TO SHAREHOLDERS

Continued

Source: U.S. Energy Information Administration — Weekly U.S. Field Production of Crude Oil

Just before the quarter came to an end, on September 28, OPEC agreed to a framework that would cut its production by about 700,000 barrels per day. The actual limits for each member should be finalized by November 30, when member countries meet again. We believe the major proponent of the deal was Saudi Arabia, since it faces a deficit equal to 13.5% of its GDP (to put it in perspective, the U.S. figure was 2.5% in FY 2015, Greece's stood at 7.2%. Of course, that is the short-term explanation. Quite possibly the real reason is the long-term one: Saudi Arabia's miscalculation of how little money would be invested for future production in this low-price environment actually sets up an even scarier scenario, one where oil prices spike to unprecedented levels and trigger demand destruction — more hybrids, more electric vehicles, more of everything that requires less oil.

At the end of the third quarter, our Fund owned six energy names: three exploration and production companies and three service companies. As we have discussed in previous letters, we tilted our service company exposure from offshore to onshore because we believe the U.S. shale companies are more competitive than their offshore peers in the short-term. In the U.S. land driller space, we decided to focus our attention on alternating current (AC) rigs, which are more energy efficient and can operate at higher top-drive speeds with more torque than silicon-controlled rectifiers (SCR) and mechanical rigs. These advantages allow operators to drill more wells per rig/year, thus accelerating cash flows because wells come online sooner than with legacy rigs. We believe that AC rigs should continue to take market share as upstream producers demand higher rig specifications in order to meet increasingly complex horizontal drilling criteria (i.e. longer laterals) and productivity requirements (i.e. pad drilling, automated pipe handling, and increased mobility). Therefore, we believe that companies with the largest Tier 1 AC rig fleets and best ability to fund upgrades will likely capture an outsized share of demand from large E&P operators. Helmerich & Payne, Inc. (HP) and Patterson-UTI Energy Inc. (PTEN) are the two onshore drilling companies that best demonstrate these characteristics. Unconventional decline rates imply a higher rig count just to maintain existing production while further upside exists should U.S. shale become the global swing producer.

4

FPA CAPITAL FUND, INC.

LETTER TO SHAREHOLDERS

Continued

Utilization (left hand graph) and market share (pie charts) by type of rig:

Source: IHS, RigData, RBC Capital Markets estimates

Companies with large AC-weighted fleets increased market share from Q3 2015 to Q2 2016, with HP making the biggest gain (~5%) and PTEN making the second-biggest gain (~2%) relative to other large AC drillers. The charts below show historical rig count and market share through the downturn for HP and PTEN6.

Source: Wells Fargo Securities, LLC

Moreover, HP and PTEN have stronger balance sheets than peers, and therefore, more flexibility to fund rig upgrades. HP has a net cash position of $524 million. PTEN's net debt to LTM7 EBITDA is 1.8x vs. an average of 5.9x for its non-HP competitors (Nabors Industries Ltd., Precision Drilling Corporation, Unit Corporation, and BR, PDS, UNT, and Pioneer Energy Services Crop.8 ).

Market commentary

In the 5,000- or so year-history of interest rates, now is the first time we have experienced negative rates. Approximately 30% of global sovereign debt requires the lender to pay the borrower. This phenomenon is not limited to short-term debt. On July 13, Germany became the second G7 nation (after Japan) to sell negative-yielding 10-year bonds. Switzerland, not to be outdone, sold a 42-year bond with negative yields. We do not

6 Source: Wells Fargo, Oil Service Statistics & Valuation Handbook — Sep-2-2016

7 LTM = last twelve months

8 H&P Presentation — Sep-7-2016; Financial Data as of Jun-30-2016

5

FPA CAPITAL FUND, INC.

LETTER TO SHAREHOLDERS

Continued

know whether rates will continue to stay low, but what if they go up? Goldman Sachs calculated that a 100bps increase in yield would cost over $1 trillion dollars of value destruction in the U.S. bond market alone.9 The goal of low (or zero, or negative) interest rate policy is to jump-start a lackluster economy, but we do not see any proof that these actions are actually working. What is a central bank to do when its ever-increasing efforts fail to produce any fruit? Now Bank of Japan and Swiss National Bank, among others, are buying large equity stakes. We are not convinced that these experiments will end well.

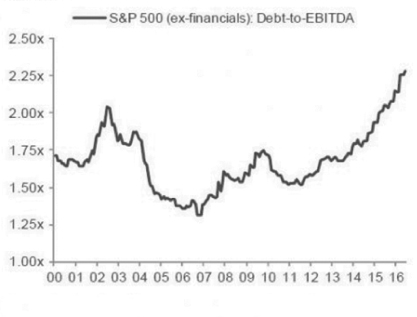

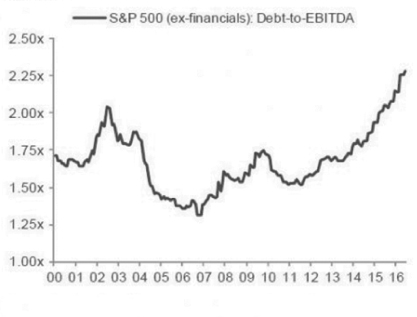

In the fourth quarter of 2007, we wrote extensively about our worries about the extreme valuations in the stock market. Today, both gross and net leverage are higher than they were at the end of September 2007. Most strikingly, the Fed Funds Target Rate was 5.25% and the Federal Reserve balance sheet stood at $890 billion in 2007, compared to today's 0.50% and $4.5 trillion, respectively. The low interest rates, not surprisingly, resulted in elevated debt to EBITDA level.

Source:Haver Analytics. Thomson Reuters, Barclays Research

Yet, despite all these efforts, the robust GDP growth has been elusive. The New York Fed, in their Nowcasting Report, lowered its third quarter and fourth quarter 2016 forecasts by 50bps,10 so brace yourselves for a slower second half. We worry that the growth in money printing and credit availability, combined with a lack of growth in GDP and high asset valuations, is like a powder keg with a fuse of unknown length.

The last time the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average indices set a record on the same day was December 31, 1999. Those records fell on August 11, 2016 — a feat that was repeated again on August 15. These recent record closes came on the heels of weak corporate earnings. The second quarter of 2016 marked the fifth consecutive quarter of earnings declines for the S&P 500 and the third quarter would be the sixth despite previous projections of growth. This is the longest stretch since 2008.

On August 26, 2016, Fed Chair Janet Yellen suggested that "the rate hike case has strengthened in recent months." But exactly a week later, on September 2, 2016, the Fed received some contradicting news. The Jobs Report depicted only a 151,000 increase in payrolls for the month of August. That is a low number for an economy

9 http://www.bloomberg.com/news/articles/2016-06-03/goldman-flags-1-trillion-reason-for-fed-to-go-slow-on-rates

10 https://www.newyorkfed.org/medialibrary/media/research/policy/nowcast/nowcast_2016_0923.pdf?la=en

6

FPA CAPITAL FUND, INC.

LETTER TO SHAREHOLDERS

Continued

of this size, and it was accompanied by hourly wage growth of a measly 0.1% and average weekly earnings that fell from $884.08 to $882.54.11

In closing

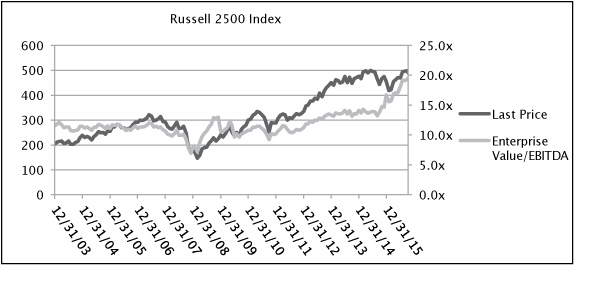

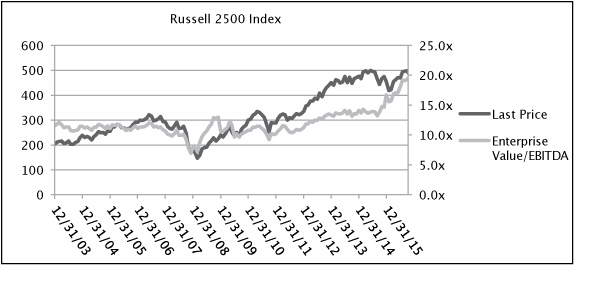

If our assessment of the situation is correct, the market — as a whole — is expensive. Some try to justify it with P/E ratios, as if the 29.8x P/E multiple for the Russell 2500 is low. For starters, that multiple only includes the companies that have positive earnings. How about the 30% of the Russell 2500 companies that have negative earnings? Perhaps the best way to look at it is to assess where we are historically. The chart below shows that, as of the end of the third quarter, the Russell 2500 was only 2.6% off its recent all-time high. Guess when the enterprise value-to EBITDA -multiple (EV/EBITDA) hit its peak? On Sept. 30, 2016, the Russell 2500's EV/EBITDA stood at 19.3x — significantly higher than its 11.9x average over the last decade-plus. It is also interesting to note that EV/EBITDA hit its low of 6.9x in November 2008. Since the market bottomed on March 8, 2009, the Russell 2500 has increased by 277%, the cumulative EBITDA increased by 57%, and the EBITDA multiple increased by 142%.

Source: Bloomberg

If and when market participants come to the same conclusion (like they did during the dot-com bubble and the great financial crisis), many would try to go through a narrow door all at the same time. During such a time, we would expect a high level panic, which will create forced selling. An elevated level of forced selling, combined with a lack of liquidity, might result in challenges for many fully invested products such as index funds, many ETFs, and funds that have no to very low levels of cash cushions. Many investors put very little value on cash, arguing that cash's current low yield makes it a poor investment. However, we believe cash's value comes not from its current yield, but from its optionality. In a down market, cash helps mitigate losses and affords one the opportunity to buy when others are being forced to sell (generally the best time to buy). As we near the 8th year of the current bull market, it can be tempting to forget that nasty downturns happen with some regularity, and there is never a bell rung to announce their arrival.

11 http://www.zerohedge.com/news/2016-09-02/most-troubling-news-fed-todays-jobs-report

7

FPA CAPITAL FUND, INC.

LETTER TO SHAREHOLDERS

Continued

We continue to be on high alert. Our portfolio is filled with companies trading at substantial discount to market multiples (and, more importantly, at discounts to our intrinsic value estimates). Our cash level remains elevated. We urge extreme caution.

Respectfully submitted,

| |

| |

Arik Ahitov

Portfolio Manager

October 4, 2016 | | Dennis Bryan

Portfolio Manager | |

The availability of shares of the Fund to new investors is limited. Please refer to the Fund's prospectus for a full description of the limitation.

Performance data quoted in this letter represents past performance and neither indicates nor guarantees future performance. The discussions of Fund investments represent the views of the Fund's managers at the time of this report and are subject to change without notice. References to individual securities are for informational purposes only and should not be construed as recommendations to purchase or sell individual securities. While the Fund's managers believe that the Fund's holdings are value stocks, there can be no assurance that others will consider them as such. Further, investing in value stocks presents the risk that value stocks may fall out of favor with investors and underperform growth stocks during given periods.

Portfolio composition will change due to ongoing management of the Fund.

The Russell 2500 Index is an unmanaged index comprised of the 2,500 smallest companies in the Russell 3000 Index.

FUND RISKS

Investments in mutual funds carry risks and investors may lose principal value. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. The funds may purchase foreign securities which are subject to interest rate, currency exchange rate, economic and political risks: this may be enhanced when investing in emerging markets. Small and mid-cap stocks involve greater risks and they can fluctuate in price more than larger company stocks. Groups of stocks, such as value and growth, go in and out of favor which may cause certain funds to underperform other equity funds.

FORWARD LOOKING STATEMENT DISCLOSURE

As mutual fund managers, one of our responsibilities is to communicate with shareholders in an open and direct manner. Insofar as some of our opinions and comments in our letters to shareholders are based on our current expectations, they are considered "forward-looking statements" which may or may not prove to be accurate over the long term. While we believe we have a reasonable basis for our comments and we have confidence in our opinions, actual results may differ materially from those we anticipate. You can identify forward-looking statements by words such as "believe," "expect," "may," "anticipate," and other similar expressions when discussing prospects for particular portfolio holdings and/or the markets, generally. We cannot, however, assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Further, information provided in this report should not be construed as a recommendation to purchase or sell any particular security.

8

FPA CAPITAL FUND, INC.

PORTFOLIO SUMMARY

September 30, 2016

(Unaudited)

Common Stocks | | | | | 69.3 | % | |

Oil & Gas Services & Equipment | | | 10.4 | % | | | | | |

Exploration & Production | | | 9.3 | % | | | | | |

Communications Equipment | | | 9.0 | % | | | | | |

Computer Hardware & Storage | | | 6.8 | % | | | | | |

Technology Distributors | | | 6.4 | % | | | | | |

Educational Services | | | 5.0 | % | | | | | |

Consumer Goods — Rental | | | 3.8 | % | | | | | |

Auto Parts | | | 3.7 | % | | | | | |

Electrical Power Equipment | | | 3.3 | % | | | | | |

Semiconductor Manufacturing | | | 2.4 | % | | | | | |

Agricultural Machinery | | | 2.3 | % | | | | | |

Publishing & Broadcasting | | | 2.2 | % | | | | | |

Information Technology Services | | | 1.7 | % | | | | | |

Construction & Mining Machinery | | | 1.2 | % | | | | | |

Other Common Stocks | | | 1.1 | % | | | | | |

Specialty Apparel Stores | | | 0.7 | % | | | | | |

Bonds & Debentures | | | | | 21.6 | % | |

Call Options Written | | | | | (0.0 | )% | |

Short-term Investments | | | | | 7.4 | % | |

Other Assets And Liabilities, Net | | | | | 1.7 | % | |

Net Assets | | | | | 100.0 | % | |

9

FPA CAPITAL FUND, INC.

PORTFOLIO OF INVESTMENTS

September 30, 2016

(Unaudited)

COMMON STOCKS | | Shares | | Fair Value | |

OIL & GAS SERVICES & EQUIPMENT — 10.4% | |

Helmerich & Payne, Inc. | | | 395,818 | | | $ | 26,638,551 | | |

Patterson-UTI Energy, Inc. | | | 1,544,820 | | | | 34,557,624 | | |

Rowan Cos. plc (Class A)* | | | 1,436,050 | | | | 21,770,518 | | |

| | | $ | 82,966,693 | | |

EXPLORATION & PRODUCTION — 9.3% | |

Cimarex Energy Co. | | | 202,110 | | | $ | 27,157,521 | | |

Noble Energy, Inc. | | | 919,610 | | | | 32,866,861 | | |

SM Energy Co. | | | 363,133 | | | | 14,009,671 | | |

| | | $ | 74,034,053 | | |

COMMUNICATIONS EQUIPMENT — 9.0% | |

ARRIS International plc* | | | 1,544,814 | | | $ | 43,764,581 | | |

InterDigital, Inc. | | | 353,448 | | | | 27,993,081 | | |

| | | $ | 71,757,662 | | |

COMPUTER HARDWARE & STORAGE — 6.8% | |

Western Digital Corporation | | | 926,960 | | | $ | 54,199,351 | | |

TECHNOLOGY DISTRIBUTORS — 6.4% | |

Arrow Electronics, Inc.* | | | 305,293 | | | $ | 19,529,593 | | |

Avnet, Inc. | | | 767,480 | | | | 31,512,729 | | |

| | | $ | 51,042,322 | | |

EDUCATIONAL SERVICES — 5.0% | |

Apollo Education Group, Inc.* | | | 1,598,004 | | | $ | 12,704,132 | | |

DeVry Education Group, Inc. | | | 1,180,369 | | | | 27,219,309 | | |

| | | $ | 39,923,441 | | |

CONSUMER GOODS — RENTAL — 3.8% | |

Aaron's, Inc. | | | 1,182,959 | | | $ | 30,070,818 | | |

AUTO PARTS — 3.7% | |

Dana, Inc. | | | 1,903,884 | | | $ | 29,681,552 | | |

ELECTRICAL POWER EQUIPMENT — 3.3% | |

Babcock & Wilcox Enterprises, Inc.* | | | 1,600,410 | | | $ | 26,406,765 | | |

SEMICONDUCTOR MANUFACTURING — 2.4% | |

Veeco Instruments, Inc.* | | | 979,330 | | | $ | 19,224,248 | | |

10

FPA CAPITAL FUND, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2016

(Unaudited)

COMMON STOCKS — Continued | | Shares or

Principal

Amount | | Fair Value | |

AGRICULTURAL MACHINERY — 2.3% | |

AGCO Corporation | | | 365,591 | | | $ | 18,030,948 | | |

PUBLISHING & BROADCASTING — 2.2% | |

Houghton Mifflin Harcourt Co.* | | | 1,303,657 | | | $ | 17,482,040 | | |

INFORMATION TECHNOLOGY SERVICES — 1.7% | |

Cubic Corporation | | | 286,300 | | | $ | 13,401,703 | | |

CONSTRUCTION & MINING MACHINERY — 1.2% | |

Oshkosh Corporation | | | 172,520 | | | $ | 9,661,120 | | |

SPECIALTY APPAREL STORES — 0.7% | |

Foot Locker, Inc. | | | 76,520 | | | $ | 5,181,935 | | |

OTHER COMMON STOCKS — 1.1% | | $ | 9,163,115 | | |

| TOTAL COMMON STOCKS — 69.3% (Cost $397,247,501) | | $ | 552,227,766 | | |

BONDS & DEBENTURES | |

CORPORATE BONDS & NOTES — 1.5% | |

ENERGY — 1.5% | |

Atwood Oceanics, Inc. — 6.50% 2/1/2020 (Cost $8,178,950) | | $ | 15,317,000 | | | $ | 11,985,553 | | |

U.S. TREASURIES — 20.1% | |

U.S. Treasury Bills | |

| — 0.183% 11/25/2016@@@ | | $ | 33,000,000 | | | $ | 32,991,502 | | |

| — 0.21% 12/1/2016@@@ | | | 37,000,000 | | | | 36,991,416 | | |

| — 0.24% 12/22/2016@@@ | | | 40,000,000 | | | | 39,980,656 | | |

| — 0.265% 12/29/2016@@@ | | | 50,000,000 | | | | 49,966,770 | | |

| TOTAL U.S. TREASURIES (Cost $159,907,355) | | $ | 159,930,344 | | |

| TOTAL BONDS & DEBENTURES — 21.6% (Cost $168,086,305) | | $ | 171,915,897 | | |

11

FPA CAPITAL FUND, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2016

(Unaudited)

CALL OPTION WRITTEN — (0.0)% | | Principal

Amount | | Fair Value | |

SM Energy Co. Call-Strike $40.00; expires 11/18/16; $50,000*

(Link, Gorman, Peck, & Co. Counterparty) (Cost $(149,506)) | | $ | (50,000 | ) | | $ | (170,000 | ) | |

| TOTAL INVESTMENT SECURITIES — 90.9% (Cost $565,184,300) | | $ | 723,973,663 | | |

SHORT-TERM INVESTMENTS — 7.4% | |

State Street Bank Repurchase Agreement — 0.03% 10/3/2016

(Dated 9/30/2016, repurchase price of $59,329,148, collateralized

by $53,440,000 principal amount U.S. Treasury Note — 2.875% 2045,

fair value $60,520,800) | | $ | 59,329,000 | | | $ | 59,329,000 | | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $59,329,000) | | $ | 59,329,000 | | |

| TOTAL INVESTMENTS — 98.3% (Cost $624,513,300) | | $ | 783,302,663 | | |

Other Assets and Liabilities, net — 1.7% | | | | | 13,461,632 | | |

NET ASSETS — 100.0% | | $ | 796,764,295 | | |

* Non-income producing security.

@@@ Zero coupon bond. Coupon amount represents effective yield to maturity.

As permitted by U.S. Securities and Exchange Commission regulations, "Other" Common Stocks include holdings in their first year of acquisition that have not previously been publicly disclosed.

See notes to financial statements.

12

FPA CAPITAL FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES

September 30, 2016

(Unaudited)

ASSETS | |

Investment securities — at fair value (identified cost $565,333,806) | | $ | 724,143,663 | | |

Short-term investments — at amortized cost (maturities 60 days or less) | | | 59,329,000 | | |

Cash | | | 875 | | |

Due from broker — OTC derivatives collateral | | | 7,384,850 | | |

Receivable for: | |

Investment securities sold | | | 8,136,166 | | |

Dividends and interest | | | 672,582 | | |

Capital Stock sold | | | 45,200 | | |

Prepaid expenses and other assets | | | 728 | | |

Total assets | | | 799,713,064 | | |

LIABILITIES | |

Written options, at value (premiums received $149,506) | | | 170,000 | | |

Payable for: | |

Investment securities purchased | | | 1,951,426 | | |

Advisory fees | | | 421,473 | | |

Capital Stock repurchased | | | 298,387 | | |

Accrued expenses and other liabilities | | | 107,483 | | |

Total liabilities | | | 2,948,769 | | |

NET ASSETS | | $ | 796,764,295 | | |

SUMMARY OF SHAREHOLDERS' EQUITY | |

Capital Stock — par value $0.01 per share; authorized

100,000,000 shares; outstanding 22,307,319 shares | | $ | 223,073 | | |

Additional Paid-in Capital | | | 627,744,845 | | |

Undistributed net realized gain | | | 9,127,697 | | |

Undistributed net investment income | | | 879,317 | | |

Unrealized appreciation of investments | | | 158,789,363 | | |

NET ASSETS | | $ | 796,764,295 | | |

NET ASSET VALUE | |

Offering and redemption price per share | | $ | 35.72 | | |

See notes to financial statements.

13

FPA CAPITAL FUND, INC.

STATEMENT OF OPERATIONS

For the Six Months Ended September 30, 2016

(Unaudited)

INVESTMENT INCOME | |

Dividends | | $ | 3,228,207 | | |

Interest | | | 1,002,247 | | |

Total investment income | | | 4,230,454 | | |

EXPENSES | |

Advisory fees | | | 2,535,106 | | |

Transfer agent fees and expenses | | | 183,759 | | |

Director fees and expenses | | | 79,654 | | |

Legal fees | | | 44,262 | | |

Reports to shareholders | | | 27,871 | | |

Audit and tax services fees | | | 25,185 | | |

Administrative services fees | | | 19,402 | | |

Filing fees | | | 18,310 | | |

| Professional fees | | | 16,989 | | |

| Custodian fees | | | 11,454 | | |

| Total expenses | | | 2,961,992 | | |

Net expenses | | | 2,961,992 | | |

Net investment income | | | 1,268,462 | | |

NET REALIZED AND UNREALIZED GAIN (LOSS) | |

Net realized gain (loss) on: | |

Investments | | | 14,983,991 | | |

Written Options | | | 485,491 | | |

Net change in unrealized appreciation (depreciation) of: | |

Investments | | | 71,729,695 | | |

Written Options | | | (20,494 | ) | |

Net realized and unrealized gain | | | 87,178,683 | | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 88,447,145 | | |

See notes to financial statements.

14

FPA CAPITAL FUND, INC.

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended

September 30, 2016

(Unaudited) | | Year Ended

March 31, 2016 | |

INCREASE (DECREASE) IN NET ASSETS | |

Operations: | |

Net investment income | | $ | 1,268,462 | | | $ | 3,016,447 | | |

Net realized gain | | | 15,469,482 | | | | 13,727,991 | | |

Net change in unrealized appreciation (depreciation) | | | 71,709,201 | | | | (135,512,598 | ) | |

Net increase (decrease) in net assets resulting from operations | | | 88,447,145 | | | | (118,768,160 | ) | |

Distributions to shareholders from: | |

Net investment income | | | (1,369,817 | ) | | | (2,971,492 | ) | |

Net realized capital gains | | | (11,415,318 | ) | | | (7,894,776 | ) | |

Total distributions | | | (12,785,135 | ) | | | (10,866,268 | ) | |

Capital Stock transactions: | |

Proceeds from Capital Stock sold | | | 16,480,575 | | | | 65,302,557 | | |

Proceeds from shares issued to shareholders upon

reinvestment of dividends and distributions | | | 11,644,366 | | | | 9,896,045 | | |

Cost of Capital Stock repurchased | | | (66,489,211 | )* | | | (262,574,374 | )* | |

Net decrease from Capital Stock transactions | | | (38,364,270 | ) | | | (187,375,772 | ) | |

Total change in net assets | | | 37,297,740 | | | | (317,010,200 | ) | |

NET ASSETS | |

Beginning of period | | | 759,466,555 | | | | 1,076,476,755 | | |

End of period | | $ | 796,764,295 | | | $ | 759,466,555 | | |

CHANGE IN CAPITAL STOCK OUTSTANDING | |

Shares of Capital Stock sold | | | 491,165 | | | | 1,929,687 | | |

Shares issued to shareholders upon reinvestment of

dividends and distributions | | | 356,746 | | | | 306,480 | | |

Shares of Capital Stock repurchased | | | (1,976,216 | ) | | | (7,383,150 | ) | |

Change in Capital Stock outstanding | | | (1,128,305 | ) | | | (5,146,983 | ) | |

* Net of redemption fees of $28,234 and $19,357 for the period ended September 30, 2016 and year ended March 31, 2016, respectively.

See notes to financial statements.

15

FPA CAPITAL FUND, INC.

FINANCIAL HIGHLIGHTS

Selected Data for Each Share of Capital Stock Outstanding Throughout Each Period

| | | Six

Months

ended

September 30,

2016 | | Year Ended March 31, | |

| | | (unaudited) | | 2016 | | 2015 | | 2014 | | 2013 | | 2012 | |

Per share operating performance: | |

Net asset value at beginning of period | | $ | 32.41 | | | $ | 37.66 | | | $ | 47.46 | | | $ | 45.60 | | | $ | 45.11 | | | $ | 46.64 | | |

Income from investment operations: | |

Net investment income (loss)* | | | 0.06 | | | | 0.12 | | | | 0.03 | | | | (0.03 | ) | | | 0.05 | | | | (0.11 | ) | |

Net realized and unrealized gain

(loss) on investment securities | | | 3.81 | | | | (4.92 | ) | | | (5.02 | ) | | | 7.90 | | | | 4.37 | | | | (1.42 | ) | |

Total from investment operations | | $ | 3.87 | | | $ | (4.80 | ) | | $ | (4.99 | ) | | $ | 7.87 | | | $ | 4.42 | | | $ | (1.53 | ) | |

Less distributions: | |

Dividends from net

investment income | | | (0.06 | ) | | | (0.12 | ) | | | — | | | | — | | | | (0.07 | ) | | | — | | |

Distributions from net

realized capital gains | | | (0.50 | ) | | | (0.33 | ) | | | (4.81 | ) | | | (6.01 | ) | | | (3.86 | ) | | | — | | |

Total distributions | | $ | (0.56 | ) | | $ | (0.45 | ) | | $ | (4.81 | ) | | $ | (6.01 | ) | | $ | (3.93 | ) | | $ | — | | |

Redemption fees | | | — | ** | | | — | ** | | | — | ** | | | — | ** | | | — | ** | | | — | ** | |

Net asset value at end of period | | $ | 35.72 | | | $ | 32.41 | | | $ | 37.66 | | | $ | 47.46 | | | $ | 45.60 | | | $ | 45.11 | | |

Total investment return*** | | | 12.10 | % | | | (12.74 | )% | | | (11.49 | )% | | | 18.99 | % | | | 10.64 | % | | | (3.28 | )% | |

Ratios/supplemental data: | |

Net assets, end of period (in $000's) | | $ | 796,764 | | | $ | 759,467 | | | $ | 1,076,477 | | | $ | 1,372,336 | | | $ | 1,273,822 | | | $ | 1,309,145 | | |

Ratio of expenses to average

net assets | | | 0.77 | %† | | | 0.77 | % | | | 0.83 | % | | | 0.83 | % | | | 0.83 | % | | | 0.84 | % | |

Ratio of net investment income

(loss) to average net assets | | | 0.33 | %† | | | 0.34 | % | | | 0.08 | % | | | (0.07 | )% | | | 0.12 | % | | | (0.25 | )% | |

Portfolio turnover rate | | | 22 | %† | | | 45 | % | | | 38 | % | | | 17 | % | | | 10 | % | | | 15 | % | |

* Per share amount is based on average shares outstanding.

** Rounds to less than $0.01 per share.

*** Return is based on net asset value per share, adjusted for reinvestment of distributions.

† Annualized.

See notes to financial statements.

16

FPA CAPITAL FUND, INC.

NOTES TO FINANCIAL STATEMENTS

September 30, 2016

(Unaudited)

NOTE 1 — Significant Accounting Policies

FPA Capital Fund, Inc. (the "Fund") is registered under the Investment Company Act of 1940, as a diversified, open-end investment company. The Fund's investment objective is to seek long-term capital growth. Current income is a secondary consideration. The Fund qualifies as an investment company pursuant to Financial Accounting Standard Board (FASB) Accounting Standards Codification (ASC) No. 946, Financial Services — Investment Companies. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

A. Security Valuation

The Fund's investments are reported at fair value as defined by accounting principles generally accepted in the United States of America, ("U.S. GAAP"). The Fund generally determines its net asset value as of approximately 4:00 p.m. New York time each day the New York Stock Exchange is open. Further discussion of valuation methods, inputs and classifications can be found under Disclosure of Fair Value Measurements.

B. Securities Transactions and Related Investment Income

Securities transactions are accounted for on the date the securities are purchased or sold. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Interest income and expenses are recorded on an accrual basis.

C. Use of Estimates

The preparation of the financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported. Actual results could differ from those estimates.

NOTE 2 — Risk Considerations

Investing in the Fund may involve certain risks including, but not limited to, those described below.

Market Risk: Because the values of the Fund's investments will fluctuate with market conditions, so will the value of your investment in the Fund. You could lose money on your investment in the Fund or the Fund could underperform other investments.

Common Stocks and Other Securities: The prices of common stocks and other securities held by the Fund may decline in response to certain events taking place around the world, including; those directly involving companies whose securities are owned by the Fund; conditions affecting the general economy; overall market changes; local, regional or global political, social or economic instability; and currency, interest rate and commodity price fluctuations. In addition, the Adviser's emphasis on a value-oriented investment approach generally results in the Fund's portfolio being invested primarily in medium or smaller sized companies. Smaller companies may be subject to a greater degree of change in earnings and business prospects than larger, more established companies, and smaller companies are often more reliant on key products or personnel than larger companies. Also, securities of smaller companies are traded in lower volumes than those issued by larger companies and may be more volatile than those of larger companies. In light of these characteristics of smaller companies and their securities, the Fund may be subjected to greater risk than that assumed when investing in the equity securities of larger companies.

Repurchase Agreements: Repurchase agreements permit the Fund to maintain liquidity and earn income over periods of time as short as overnight. Repurchase agreements held by the Fund are fully collateralized by

17

FPA CAPITAL FUND, INC.

NOTES TO FINANCIAL STATEMENTS

Continued

U.S. Government securities, or securities issued by U.S. Government agencies, or securities that are within the three highest credit categories assigned by established rating agencies (Aaa, Aa, or A by Moody's or AAA, AA or A by Standard & Poor's) or, if not rated by Moody's or Standard & Poor's, are of equivalent investment quality as determined by the Adviser. Such collateral is in the possession of the Fund's custodian. The collateral is evaluated daily to ensure its market value equals or exceeds the current market value of the repurchase agreements including accrued interest. In the event of default on the obligation to repurchase, the Fund has the right to liquidate the collateral and apply the proceeds in satisfaction of the obligation.

The Fund may enter into repurchase agreements, under the terms of a Master Repurchase Agreement ("MRA"). The MRA permits the Fund, under certain circumstances including an event of default (such as bankruptcy or insolvency), to offset payables and/or receivables under the MRA with collateral held and/or posted to the counterparty and create one single net payment due to or from the Fund. However, bankruptcy or insolvency laws of a particular jurisdiction may impose restrictions on or prohibitions against such a right of offset in the event of a MRA counterparty's bankruptcy or insolvency. Pursuant to the terms of the MRA, the Fund receives securities as collateral with a market value in excess of the repurchase price to be received by the Fund upon the maturity of the repurchase transaction. Upon a bankruptcy or insolvency of the MRA counterparty, the Fund recognizes a liability with respect to such excess collateral to reflect the Fund's obligation under bankruptcy law to return the excess to the counterparty. Repurchase agreements outstanding at the end of the period are listed in the Fund's Portfolio of Investments.

NOTE 3 — Purchases and Sales of Investment Securities

Cost of purchases of investment securities (excluding short-term investments) aggregated $365,942,588 for the period ended September 30, 2016. The proceeds and cost of securities sold resulting in net realized gains of $14,983,991 aggregated $573,005,287 and $558,021,296, respectively, for the period ended September 30, 2016. Realized gains or losses are based on the specific identification method.

NOTE 4 — Federal Income Tax

No provision for federal income tax is required because the Fund has elected to be taxed as a "regulated investment company" under the Internal Revenue Code (the "Code") and intends to maintain this qualification and to distribute each year to its shareholders, in accordance with the minimum distribution requirements of the Code, its taxable net investment income and taxable net realized gains on investments.

The cost of investment securities held at September 30, 2016, was $570,693,384 for federal income tax purposes. Gross unrealized appreciation and depreciation for all investments (excluding short-term investments) at September 30, 2016, for federal income tax purposes was $168,591,603 and $15,141,324, respectively resulting in net unrealized appreciation of $153,450,279. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the year, the Fund did not incur any interest or penalties. The Fund is not subject to examination by U.S. federal tax authorities for years ended on or before March 31, 2013 or by state tax authorities for years ended on or before March 31, 2012.

NOTE 5 — Advisory Fees and Other Affiliated Transactions

Pursuant to an Investment Advisory Agreement, advisory fees were paid by the Fund to First Pacific Advisors, LLC (the "Adviser"). Under the terms of this Agreement, the Fund pays the Adviser a monthly fee calculated at the annual rate of 0.75% of the first $50 million of the Fund's average daily net assets and 0.65% of the average daily net assets in excess of $50 million. The Agreement obligates the Adviser to reduce its fee to the extent

18

FPA CAPITAL FUND, INC.

NOTES TO FINANCIAL STATEMENTS

Continued

necessary to reimburse the Fund for any annual expenses (exclusive of interest, taxes, the cost of any supplemental statistical and research information, and extraordinary expenses such as litigation) in excess of 11/2% of the first $30 million and 1% of the remaining average net assets of the Fund for the year.

For the period ended September 30, 2016, the Fund paid aggregate fees and expenses of $79,654 to all Directors who are not affiliated persons of the Adviser. Certain officers of the Fund are also officers of the Adviser.

NOTE 6 — Redemption Fees

A redemption fee of 2% applies to redemptions within 90 days of purchase. For the period ended September 30, 2016, the Fund collected $28,234 in redemption fees. The impact of these fees is less than $0.01 per share.

NOTE 7 — Disclosure of Fair Value Measurements

The Fund uses the following methods and inputs to establish the fair value of its assets and liabilities. Use of particular methods and inputs may vary over time based on availability and relevance as market and economic conditions evolve.

Equity securities are generally valued each day at the official closing price of, or the last reported sale price on, the exchange or market on which such securities principally are traded, as of the close of business on that day. If there have been no sales that day, equity securities are generally valued at the last available bid price. Securities that are unlisted and fixed-income and convertible securities listed on a national securities exchange for which the over-the-counter ("OTC") market more accurately reflects the securities' value in the judgment of the Fund's officers, are valued at the most recent bid price. Short-term corporate notes with maturities of 60 days or less at the time of purchase are valued at amortized cost.

Securities for which representative market quotations are not readily available or are considered unreliable by the Adviser are valued as determined in good faith under procedures adopted by the authority of the Fund's Board of Directors. Various inputs may be reviewed in order to make a good faith determination of a security's value. These inputs include, but are not limited to, the type and cost of the security; contractual or legal restrictions on resale of the security; relevant financial or business developments of the issuer; actively traded similar or related securities; conversion or exchange rights on the security; related corporate actions; significant events occurring after the close of trading in the security; and changes in overall market conditions. Fair valuations and valuations of investments that are not actively trading involve judgment and may differ materially from valuations of investments that would have been used had greater market activity occurred.

The Fund classifies its assets based on three valuation methodologies. Level 1 values are based on quoted market prices in active markets for identical assets. Level 2 values are based on significant observable market inputs, such as quoted prices for similar assets and quoted prices in inactive markets or other market observable inputs as noted above including spreads, cash flows, financial performance, prepayments, defaults, collateral, credit enhancements, and interest rate volatility. Level 3 values are based on significant unobservable inputs that reflect the Fund's determination of assumptions that market participants might reasonably use in valuing the

19

FPA CAPITAL FUND, INC.

NOTES TO FINANCIAL STATEMENTS

Continued

assets. The valuation levels are not necessarily an indication of the risk associated with investing in those securities. The following table presents the valuation levels of the Fund's investments as of September 30, 2016:

Investments | | Level 1 | | Level 2 | | Level 3 | | Total | |

Common Stocks | |

Oil & Gas Services & Equipment | | $ | 82,966,693 | | | | — | | | | — | | | $ | 82,966,693 | | |

Exploration & Production | | | 74,034,053 | | | | — | | | | — | | | | 74,034,053 | | |

Communications Equipment | | | 71,757,662 | | | | — | | | | — | | | | 71,757,662 | | |

Computer Hardware & Storage | | | 54,199,351 | | | | — | | | | — | | | | 54,199,351 | | |

Technology Distributors | | | 51,042,322 | | | | — | | | | — | | | | 51,042,322 | | |

Educational Services | | | 39,923,441 | | | | — | | | | — | | | | 39,923,441 | | |

Consumer Goods — Rental | | | 30,070,818 | | | | — | | | | — | | | | 30,070,818 | | |

Auto Parts | | | 29,681,552 | | | | — | | | | — | | | | 29,681,552 | | |

Electrical Power Equipment | | | 26,406,765 | | | | — | | | | — | | | | 26,406,765 | | |

Semiconductor Manufacturing | | | 19,224,248 | | | | — | | | | — | | | | 19,224,248 | | |

Agricultural Machinery | | | 18,030,948 | | | | — | | | | — | | | | 18,030,948 | | |

Publishing & Broadcasting | | | 17,482,040 | | | | — | | | | — | | | | 17,482,040 | | |

Information Technology Services | | | 13,401,703 | | | | — | | | | — | | | | 13,401,703 | | |

Construction & Mining Machinery | | | 9,661,120 | | | | — | | | | — | | | | 9,661,120 | | |

Specialty Apparel Stores | | | 5,181,935 | | | | — | | | | — | | | | 5,181,935 | | |

Other Common Stocks | | | 9,163,115 | | | | — | | | | — | | | | 9,163,115 | | |

Corporate Bonds & Notes | | | — | | | $ | 11,985,553 | | | | — | | | | 11,985,553 | | |

U.S. Treasuries | | | — | | | | 159,930,344 | | | | — | | | | 159,930,344 | | |

Short-Term Investment | | | — | | | | 59,329,000 | | | | — | | | | 59,329,000 | | |

| | | $ | 552,227,766 | | | $ | 231,244,897 | | | | — | | | $ | 783,472,663 | | |

Equity Option (equity risk) | | | — | | | $ | (170,000 | ) | | | — | | | $ | (170,000 | ) | |

Transfers of investments between different levels of the fair value hierarchy are recorded at market value as of the end of the reporting period. There were no transfers between Levels 1, 2, or 3 during the period ended September 30, 2016.

NOTE 8 — Collateral Requirements

FASB Accounting Standards Update No. 2011-11, Disclosures about Offsetting Assets and Liabilities requires disclosures to make financial statements that are prepared under U.S. GAAP more comparable to those prepared under International Financial Reporting Standards. Under this guidance the Fund discloses both gross and net information about instruments and transactions eligible for offset such as instruments and transactions subject to an agreement similar to a master netting arrangement. In addition, the Fund discloses collateral received and posted in connection with master netting agreements or similar arrangements.

20

FPA CAPITAL FUND, INC.

NOTES TO FINANCIAL STATEMENTS

Continued

The following table presents the Fund's repurchase agreements by counterparty net of amounts available for offset under an ISDA Master agreement or similar agreements and net of the related collateral received or pledged by the Fund as of September 30, 2016, are as follows:

Counterparty | | Gross Assets

in the Statement of

Assets and Liabilities | | Collateral

Received | | Assets (Liabilities)

Available for Offset | | Net Amount

of Assets* | |

State Street Bank

and Trust Company | | $ | 59,329,000 | | | $ | 59,329,000 | ** | | | — | | | | — | | |

* Represents the net amount receivable from the counterparty in the event of default.

** Collateral with a value of $60,520,800 has been received in connection with a master repurchase agreement. Excess of collateral received from the individual master repurchase agreement is not shown for financial reporting purposes.

21

FPA CAPITAL FUND, INC.

APPROVAL OF INVESTMENT ADVISORY AGREEMENT

(Unaudited)

Approval of the Advisory Agreement. At a meeting of the Board of Directors held on August 8, 2016, the Directors approved the continuation of the advisory agreement between the Fund and the Adviser for an additional one-year period through September 30, 2017, on the recommendation of the Independent Directors, who met in executive session on August 8, 2016 prior to the Board meeting to review and discuss the proposed continuation of the advisory agreement. The following paragraphs summarize the material information and factors considered by the Board and the Independent Directors, as well as the Directors' conclusions relative to such factors.

Nature, Extent and Quality of Services. The Board and the Independent Directors considered information provided by the Adviser in response to their requests, as well as information provided throughout the year regarding the Adviser and its staffing in connection with the Fund, including the Fund's portfolio managers, the two analysts supporting the team, the scope of services supervised and provided by the Adviser, and the absence of any significant service problems reported to the Board. The Board and the Independent Directors noted the experience, length of service and the reputation of the Fund's portfolio managers: Dennis Bryan, who has been with the Adviser since 1993, Arik A. Ahitov, who joined the Adviser in 2010 and has served as a portfolio manager since 2014, Sean Pompa, who joined the Adviser in 2016, and Chris J. Moreno, who joined the Adviser in 2014. Robert Rodriguez has continued to serve in an advisory capacity since 2010. The Board and the Independent Directors concluded that the nature, extent and quality of services provided by the Adviser have benefited and should continue to benefit the Fund and its shareholders.

Investment Performance. The Board and the Independent Directors reviewed the overall investment performance of the Fund. The Directors also received information from an independent consultant, Morningstar, regarding the Fund's performance relative to a peer group of midcap core funds selected by Morningstar (the "Peer Group"). The Board and the Independent Directors noted that the Fund underperformed its Peer Group for the one-, three-, five- and 10-year periods ending March 31, 2016 and the Fund's benchmark, Russell 2000 Index, for the one, three-, five- and 10-year period ended March, 2016. They also noted that Morningstar has continued to give the Fund a "Bronze" Analyst Rating. The Board and the Independent Directors determined that the Fund's investment results were satisfactory in light of the Fund's objectives and concluded that the Adviser's continued management of the Fund should benefit the Fund and its shareholders.

Advisory Fees and Fund Expenses; Comparison with Peer Group and Institutional Fees. The Board and the Independent Directors considered information provided by the Adviser regarding the Fund's advisory fees and total expense levels. The Board and the Independent Directors reviewed comparative information regarding fees and expenses for the Peer Group. The Directors noted that the Fund's fees and expenses were at the lower end of the range for the Peer Group. The Board and the Independent Directors also noted that the overall expense ratio of the Fund was low when compared to the Peer Group. The Board and the Independent Directors considered the fees charged by the Adviser for advising institutional accounts and for sub-advising another mutual fund, and the Adviser's discussion of the differences between the services provided by the Adviser to the Fund and those provided by the Adviser to the sub-advised fund and institutional accounts. The Board and the Independent Directors concluded that the continued payment of advisory fees and expenses by the Fund to the Adviser was fair and reasonable and should continue to benefit the Fund and its shareholders.

Adviser Profitability and Costs. The Board and the Independent Directors considered information provided by the Adviser regarding the Adviser's costs in providing services to the Fund, the profitability of the Adviser and the benefits to the Adviser from its relationship to the Fund. They reviewed and considered the Adviser's representations regarding its assumptions and methods of allocating certain costs, such as personnel costs, which constitute the Adviser's largest operating cost, overhead and trading costs with respect to the provision of

22

FPA CAPITAL FUND, INC.

APPROVAL OF INVESTMENT ADVISORY AGREEMENT

Continued (Unaudited)

investment advisory services. Although the Board was not provided with information relating to individuals' compensation levels or amounts, the Independent Directors discussed with the Adviser the process through which individuals' compensation is determined and then reviewed by the management committee of the Adviser, as well as the Adviser's methods for determining that the compensation levels are at appropriate levels to attract and retain the personnel necessary to provide high quality professional investment advice. In evaluating the Adviser's profitability, they considered a portion of the compensation of the Adviser's principals that could be deemed a form of profit, and they excluded certain distribution and marketing-related expenses. The Board and the Independent Directors recognized that the Adviser is entitled under the law to earn a reasonable level of profits for the services that it provides to the Fund. The Board and the Independent Directors concluded that the Adviser's level of profitability from its relationship with the Fund did not indicate that the Adviser's compensation was unreasonable or excessive.

Economies of Scale and Sharing of Economies of Scale. The Board and the Independent Directors considered whether there have been economies of scale with respect to the management of the Fund, whether the Fund has appropriately benefited from any economies of scale, and whether the fee rate is reasonable in relation to the Fund's asset levels and any economies of scale that may exist. The Board and the Independent Directors considered the Adviser's representation that its internal costs of providing investment management services to the Fund have significantly increased in recent years as a result of a number of factors, including the Adviser's substantial investment in additional professional resources and staffing. The Board and the Independent Directors considered quantitative and qualitative information regarding the Adviser's representation that it has also made significant investments in: (1) the portfolio managers, analysts, traders and other investment personnel who assist with the management of the Fund; (2) as well as investing in new compliance, operations, and administrative personnel; (3) information technology, portfolio accounting and trading systems; and (4) in office space, each of which enhances the quality of services provided to the Fund. The Board and the Independent Directors also considered that the Adviser had foregone the reimbursement for providing certain financial services that it had previously received from the Fund. The Board and the Independent Directors also considered the Adviser's willingness to close funds, including the Fund, to new investors when it believed that the Fund had limited capacity to grow or that it otherwise would benefit fund shareholders. The Board and the Independent Directors also noted that, even though the Fund is currently closed to new investors and it continues to experience outflows of investment capital, the Adviser has continued to make investments in personnel servicing the Fund.

The Independent Directors noted that the fee rate contained a breakpoint as the Fund's assets increased. They considered that many mutual funds have breakpoints in the advisory fee structure as a means by which to share in the benefits of potential economies of scale as a fund's assets grow. They also considered that not all funds have breakpoints in their fee structures and that breakpoints are not the exclusive means of sharing potential economies of scale. The Board and the Independent Directors considered the Adviser's statement that it believes that additional breakpoints currently were not appropriate for the Fund given the ongoing investments the Adviser is making in its business for the benefit of the Fund, uncertainties regarding the direction of the economy, rising inflation, increasing costs for personnel and systems, and the limited prospect for growth in the Fund's assets given that the Fund is still closed to new shareholders, all of which could negatively impact the profitability of the Adviser. The Board and the Independent Directors concluded that the Fund is benefitting from the ongoing investments made by the Adviser in its team of personnel serving the Fund and in the Adviser's service infrastructure, and that in light of these investments, additional breakpoints in the Fund's advisory fee structure were not warranted at current asset levels.

23

FPA CAPITAL FUND, INC.

APPROVAL OF INVESTMENT ADVISORY AGREEMENT

Continued (Unaudited)

Ancillary Benefits. The Board and the Independent Directors considered other actual and potential benefits to the Adviser from managing the Fund, including the acquisition and use of research services with commissions generated by the Fund, in concluding that the contractual advisory and other fees are fair and reasonable for the Fund. They noted that the Adviser does not have any affiliates that benefit from the Adviser's relationship to the Fund.

Conclusions. The Board and the Independent Directors determined that the Fund continues to benefit from the services of the Adviser's highly experienced portfolio management team, which has produced reasonable long-term returns. In addition, the Board and the Independent Directors agreed that the Fund continues to receive high quality services from the Adviser. The Board and the Independent Directors concluded that the current advisory fee rate is reasonable and fair to the Fund and its shareholders in light of the nature and quality of the services provided by the Adviser and the Adviser's profitability and costs. The Board and the Independent Directors also stated their intention to continue monitoring the factors relevant to the Adviser's compensation, such as changes in the Fund's asset levels, changes in portfolio management personnel and the cost and quality of the services provided by the Adviser to the Fund. On the basis of the foregoing, and without assigning particular weight to any single factor, none of which was dispositive, the Board and the Independent Directors concluded that it would be in the best interests of the Fund to continue to be advised and managed by the Adviser and determined to approve the continuation of the current Advisory Agreement for another one-year period through September 30, 2017.

24

FPA CAPITAL FUND, INC.

RESULTS OF THE SPECIAL MEETING

Results of the Special Meeting of Shareholders:

The Special Meeting of Shareholders was held on May 9, 2016 in Los Angeles, California. The voting results for the proposal considered at the Special Meeting of Shareholders is as follows:

Election of Directors. The shareholders of the Fund elected J. Richard Atwood, Mark L. Lipson, Alfred E. Osborne, Jr., A. Robert Pisano, Patrick B. Purcell, Robert L. Rodriguez and Allan M. Rudnick to serve on the Board of Directors.

FPA Capital Fund, Inc. | | Total Shares Voted For: | | Total Shares Withheld: | |

J. Richard Atwood | | | 18,094,228 | | | | 487,902 | | |

Mark L. Lipson | | | 18,138,317 | | | | 443,813 | | |

Alfred E. Osborne, Jr. | | | 18,095,434 | | | | 486,696 | | |

A. Robert Pisano | | | 18,033,422 | | | | 548,708 | | |

Patrick B. Purcell | | | 18,077,003 | | | | 505,127 | | |

Robert L. Rodriguez | | | 12,785,909 | | | | 5,796,221 | | |

Allan M. Rudnick | | | 18,089,176 | | | | 492,954 | | |

25

FPA CAPITAL FUND, INC.

SHAREHOLDER EXPENSE EXAMPLE

September 30, 2016 (Unaudited)

Fund Expenses

Mutual fund shareholders generally incur two types of costs: (1) transaction costs, and (2) ongoing costs, including advisory and administrative fees; shareholder service fees; and other Fund expenses. The Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the year and held for the entire year.

Actual Expenses

The information in the table under the heading "Actual Performance" provides information about actual account values and actual expenses. You may use the information in this column, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000= 8.6), then multiply the result by the number in the first column in the row entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading "Hypothetical Performance (5% return before expenses)" provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to

compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the information under the heading "Hypothetical Performance (5% return before expenses)" is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. Even though the Fund does not charge transaction fees, if you purchase shares through a broker, the broker may charge you a fee. You should evaluate other mutual funds' transaction fees and any applicable broker fees to assess the total cost of ownership for comparison purposes.

| | | Actual

Performance | | Hypothetical

Performance

(5% return

before

expenses) | |

Beginning Account Value

March 31, 2016 | | $ | 1,000.00 | | | $ | 1,000.00 | | |

Ending Account Value

September 30, 2016 | | $ | 1,121.00 | | | $ | 1,021.21 | | |

Expenses Paid During

Period* | | $ | 4.09 | | | $ | 3.90 | | |

* Expenses are equal to the Fund's annualized expense ratio of 0.77%, multiplied by the average account value over the period and prorated for the six-months ended September 30, 2016 (183/366 days).

26

FPA CAPITAL FUND, INC.

DIRECTOR AND OFFICER INFORMATION

(Unaudited)

| Name and Year of Birth | | Position(s)

With Fund

Years Served | | Principal Occupation(s)

During the Past 5 Years | | Portfolios in

Fund Complex

Overseen | | Other

Directorships | |

Allan M. Rudnick – 1940† | | Director and

Chairman*

Years Served: 4 | | Private Investor. Formerly, Co-Founder, Chief Executive Officer, Chairman and Chief Investment Officer of Kayne Anderson Rudnick Investment Management from 1989 to 2007. | | | 7 | | | | |

Sandra Brown – 1955† | | Director*

Years Served: <1 | | Consultant. Formerly Chair of the Board, CEO and President of Transmerica Financial Advisers, Inc., and Chair of the Board and President of Transamerica Securities Sales Corp. from 1999 to 2009. | | | 7 | | | | |

Mark L. Lipson – 1949† | | Director*

Years Served: <1 | | Consultant. ML2Advisors, LLC. Former member of the Management Committee and Western Region Head at Bessemer Trust Company from 2007 to 2014. | | | 7 | | | | |

Alfred E. Osborne, Jr. – 1944† | | Director*

Years Served: 15 | | Senior Associate Dean of the John E. Anderson School of Management at UCLA. | | | 7 | | | Wedbush, Inc., Nuverra Environmental Solutions, Inc., and Kaiser Aluminun, Inc. | |

A. Robert Pisano – 1943† | | Director*

Years Served: 2 | | Consultant. Formerly President and Chief Operating Officer of the Motion Picture Association of America, Inc. from 2005 to 2011. | | | 7 | | | Entertainment Partners, Resources Global Professionals | |

Patrick B. Purcell – 1943† | | Director*

Years Served: 9 | | Retired. Formerly Executive Vice President, Chief Financial and Administrative Officer of Paramount Pictures from 1983 to 1998. | | | 7 | | | | |

Robert L. Rodriguez – 1948 | | Director*

Years Served: 31 | | Partner of the Adviser. | | | 2 | | | | |

J. Richard Atwood – 1960 | | Director* and President

Years Served: 18 | | Managing Partner of the Adviser. | | | 7 | | | | |

Dennis M. Bryan – 1961 | | Portfolio Manager

Years Served: 19 | | Partner of the Adviser | | | | | |

Arik A. Ahitov – 1975 | | Portfolio Manager

Years Served: 2 | | Partner of the Adviser since 2015. Managing Director of the Adviser from 2013-2014 and Vice President of the Adviser from 2010 to 2013. | | | | | |

27

FPA CAPITAL FUND, INC.

DIRECTOR AND OFFICER INFORMATION

Continued (Unaudited)

| Name and Year of Birth | | Position(s)

With Fund

Years Served | | Principal Occupation(s)

During the Past 5 Years | | Portfolios in

Fund Complex

Overseen | | Other

Directorships | |

Leora R. Weiner – 1970 | | Chief Compliance Officer

Years Served: 1 | | Managing Director and General Counsel of the Adviser since 2014. Formerly Managing Director, General Counsel and Chief Compliance Officer of Tradewinds Global Investors, LLC from 2008 to 2014. | | | | | |

E. Lake Setzler – 1967 | | Treasurer

Years Served: 9 | | Senior Vice President and Controller of the Adviser. | | | | | |

Francine S. Hayes – 1967 | | Secretary

Years Served: 1 | | Vice President and Senior Counsel of State Street Bank and Trust Company | | | | | |

* Directors serve until their resignation, removal or retirement.

† Audit Committee member

The Statement of Additional Information includes additional information about the Directors and is available, without charge, upon request by calling (800) 982-4372.

28

(This page has been left blank intentionally.)

FPA CAPITAL FUND, INC.

(Unaudited)

INVESTMENT ADVISER

First Pacific Advisors, LLC

11601 Wilshire Boulevard, Suite 1200

Los Angeles, CA 90025

TRANSFER & SHAREHOLDER

SERVICE AGENT

UMB Fund Services, Inc.

P.O. Box 2175

Milwaukee, WI 53201-2175

or

235 West Galena Street

Milwaukee, WI 53212-3948

(800) 638-3060

CUSTODIAN AND ADMINISTRATOR

State Street Bank and Trust Company

Boston, Massachusetts

TICKER: FPPTX

CUSIP: 302539101

DISTRIBUTOR

UMB Distribution Services, LLC

235 West Galena Street

Milwaukee, Wisconsin 53212-3948

LEGAL COUNSEL

Dechert LLP

San Francisco, California

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Deloitte & Touche LLP

Los Angeles, California

This report has been prepared for the information of shareholders of FPA CAPITAL FUND, INC., and is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus.

The Fund's complete proxy voting record for the 12 months ended June 30, 2016 is available without charge, upon request by calling (800) 982-4372 and on the SEC's website at www.sec.gov.

The Fund's schedule of portfolio holdings, filed the first and third quarter of the Fund's fiscal year on Form N-Q with the SEC, is available on the SEC's website at www.sec.gov. Form N-Q is available at the SEC's Public Reference Room in Washington, D.C., and information on the operations of the Public Reference Room may be obtained by calling (202) 551-8090. To obtain Form N-Q from the Fund, shareholders can call (800) 982-4372.

Additional information about the Fund is available online at www.fpafunds.com. This information includes, among other things, holdings, top sectors, and performance, and is updated on or about the 15th business day after the end of each quarter.

Item 2. Code of Ethics.

Not applicable to this semi-annual report.

Item 3. Audit Committee Financial Expert.

Not applicable to this semi-annual report.

Item 4. Principal Accountant Fees and Services.

Not applicable to this semi-annual report.

Item 5. Audit Committee of Listed Registrants.

Not applicable to this semi-annual report.

Item 6. Investments.

(a) Schedule of Investments is included as a part of the report to shareholders filed under Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which the shareholders may recommend nominees to the registrant’s board of directors.

Item 11. Controls and Procedures.

(a) The principal executive officer and principal financial officer of the registrant have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940) are effective based on their evaluation of the disclosure controls and procedures as of a date within 90 days of the filing date of this report.

(b) There have been no significant changes in the registrant’s internal controls over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) that occurred during the registrant’s second fiscal quarter of the period covered by this report that have materially affected, or is reasonably likely to materially affect, the registrant’s internal controls over financial reporting.

Item 12. Exhibits.

(a)(1) Not applicable.

(a)(2) The certifications required by Rule 30a-2(a) under the Investment Company Act of 1940 are attached hereto.

(a)(3) Not applicable.

(b) The certifications required by Rule 30a-2(b) under the Investment Company Act of 1940 and Section 906 of the Sarbanes-Oxley Act of 2002 are attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

FPA CAPITAL FUND, INC. | |

| |

| | |

By: | /s/ J. Richard Atwood | |

| J. Richard Atwood | |

| President (principal executive officer) | |

| | |

Date: | December 5, 2016 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By: | /s/ J. Richard Atwood | |

| J. Richard Atwood | |

| President (principal executive officer) | |

| | |

Date: | December 5, 2016 | |

| | |

| | |

By: | /s/ E. Lake Setzler III | |

| E. Lake Setzler III | |

| Treasurer (principal financial officer) | |

| | |

Date: | December 5, 2016 | |