UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

SCHEDULE 14A |

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

|

Filed by the Registrant ý |

|

Filed by a Party other than the Registrant o |

|

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

|

FPA NEW INCOME, INC. |

(Name of Registrant as Specified In Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

ý | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

| | | |

FPA NEW INCOME, INC.

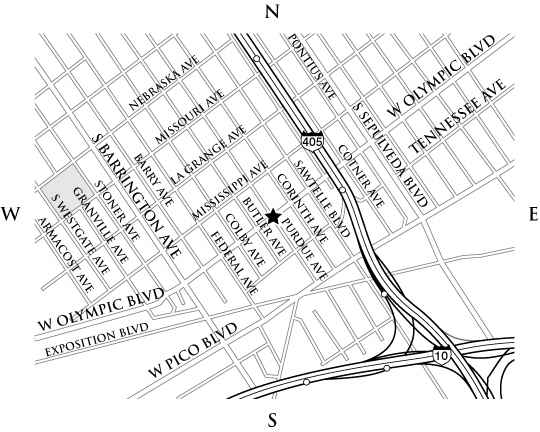

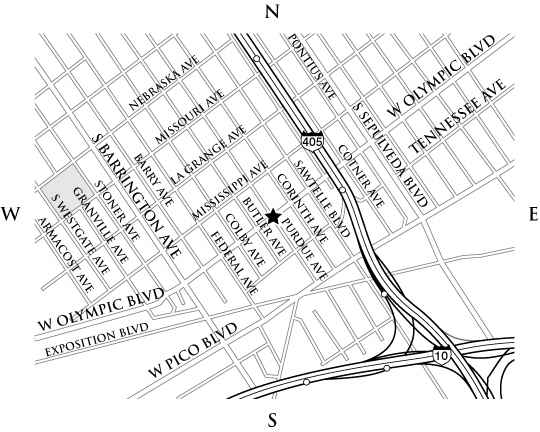

11400 West Olympic Boulevard, Suite 1200

Los Angeles, California 90064-1550

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To be held on Monday, May 1, 2006

NOTICE IS HEREBY GIVEN that a special meeting of shareholders of FPA New Income, Inc. (the "Fund"), will be held at the offices of First Pacific Advisors, Inc., 11400 West Olympic Boulevard, Suite 1200, Los Angeles, California 90064, on Monday, May 1, 2006, at 2:30 p.m. Pacific Time, to consider and vote on the following matters:

1. Election of the Board of Directors (six directors);

2. Approval of a New Advisory Agreement with a new adviser proposed to take effect on or about October 1, 2006; and

3. Such other matters as may properly come before the meeting or any adjournment or adjournments thereof.

Your Directors recommend that you vote FOR all items.

March 3, 2006, has been fixed as the record date for the determination of shareholders entitled to notice of, and to vote at, the meeting, and only holders of Common Stock of record at the close of business on that date will be entitled to vote.

By Order of the Board of Directors

SHERRY SASAKI

Secretary

March 30, 2006

IT IS REQUESTED THAT YOU PROMPTLY EXECUTE THE ENCLOSED PROXY AND RETURN IT IN THE ENCLOSED ENVELOPE THUS ENABLING THE FUND TO AVOID UNNECESSARY EXPENSE AND DELAY. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES. YOU MAY ALSO VOTE THE ENCLOSED PROXY BY TELEPHONE OR OVER THE INTERNET. THE PROXY IS REVOCABLE AND WILL NOT AFFECT YOUR RIGHT TO VOTE IN PERSON IF YOU ATTEND THE MEETING.

IMPORTANT NEWS

FOR FUND SHAREHOLDERS

While we encourage you to read the full text of the enclosed Proxy Statement, for your convenience, we have provided a brief overview of the matters to be voted upon.

Questions and Answers

Q. What am I being asked to vote "FOR" in this proxy?

A. You are being asked to vote in favor of election of six directors to the Board of Directors. You are also being asked to approve a new advisory agreement with a new adviser who may succeed to the current adviser's business on or about October 1, 2006, upon termination of the Fund's current advisory agreement.

Q. Why am I being asked to vote in favor of election of six directors to the Board of Directors?

A. While directors of your Fund are not required to be elected annually, the Board feels that it is appropriate to elect the current members of the Board to new terms.

Q. Why am I being asked to approve a new advisory agreement?

A. The principals and key investment professionals of your Fund's current investment adviser, First Pacific Advisors, Inc. ("FPA"), entered into an agreement in 2004 that gives them the option to form and operate a new management-owned investment advisory firm, named Resolute, LLC ("Resolute"). Under this agreement, in July of this year Resolute can, among other things, exercise an option to purchase the operating assets of FPA and the name "First Pacific Advisors" and hire all of the existing employees of FPA. In addition, Resolute is allowed to contact current clients of FPA, including this Fund, and request they become clients of Resolute. It is expected that Resolute will exercise the option in July 2006 and that its purchase of FPA's operating assets will ultimately take effect on or about October 1, 2006. In anticipation of these transactions, your Fund's Board of Directors has approved a new investment advisory agreement with Resolute and recommends that you approve it also. If shareholders approve this new advisory agreement and Resolute exercises its option, the Board intends to terminate the existing advisory agreement with FPA as of the time when Resolute's purchase of FPA's operating assets takes effect on or about October 1, 2006. If shareholders do not approve the new agreement and Resolute still decides to exercise its option, the Board of Directors would take appropriate action in the best interests of all shareholders.

Q. How does the proposed new advisory agreement differ from my Fund's current advisory agreement?

A. The proposed new advisory agreement is identical to your Fund's current advisory agreement. The Proxy Statement more fully describes the proposed new advisory agreement.

Q. Will total fees for advisory and administrative services increase?

A. No. The total fees for advisory and administrative services will remain the same.

Q. Will there be any adviser changes?

A. Upon the approval by the shareholders of your Fund and the consummation of the transaction described in the foregoing, your Fund's current advisory agreement with FPA will be terminated and a new investment advisory agreement will be entered into between your Fund and Resolute on or about October 1, 2006. Resolute is owned by the current principals and key investment professionals of your Fund's current adviser, FPA.

Q. How does the Board of Directors suggest I vote in connection with the proposals?

A. After careful consideration, the Board of Directors, including a majority of the independent board members, recommends that you vote FOR the election of the 6 nominees to the Board of Directors and FOR the new advisory agreement.

Q. Will my vote make a difference?

A. Your vote is needed to ensure that the proposals can be acted upon. We encourage all shareholders to participate in the governance of their Fund.

Q. Is my Fund paying for preparation, printing and mailing of this proxy?

A. No, all costs borne by your Fund in connection with this proxy solicitation will be reimbursed by Resolute, whether or not the proposals are successful.

Q. Whom do I call if I have questions?

A. If you need any assistance, or have any questions regarding the proposals or how to vote your shares, please call 866-233-1555.

Q. How do I vote my shares?

A. You can vote your shares by attending the meeting, or if you do not expect to attend, by completing and signing the enclosed proxy card, and mailing it in the enclosed postage-paid envelope. Alternatively, you may vote by telephone by calling the toll-free number on the proxy card or by computer by going to the Internet address provided on the proxy card and following the instructions, using your proxy card as a guide.

It is important that you vote promptly.

FPA NEW INCOME, INC.

11400 West Olympic Boulevard, Suite 1200, Los Angeles, California 90064-1550

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (the "Board" or "Board of Directors", and each member of the Board, a "Director") of FPA New Income, Inc. (the "Fund"), of proxies to be voted at a special meeting of shareholders of the Fund to be held at 2:30 p.m. (Los Angeles time) on Monday, May 1, 2006, at the offices of First Pacific Advisors, Inc., 11400 West Olympic Boulevard, Suite 1200, Los Angeles, California 90064 (the "Meeting"), and at any and all adjournments thereof. The Meeting will be held for the purposes set forth in the accompanying Notice. This Proxy Statement and the accompanying materials are being mailed by the Board on or about March 30, 2006.

The Fund is organized as a Maryland corporation. In addition, the Fund is a registered investment company.

If you hold shares in your name as a record holder, you may vote your shares by proxy through the mail, telephone, or Internet as described on the proxy card. If you submit your proxy via the Internet, you may incur costs such as telephone and Internet access charges. Submitting your proxy will not limit your right to vote in person at the Meeting. A properly completed and submitted proxy will be voted in accordance with your instructions, unless you subsequently revoke your instructions. If you submit a signed proxy card without indicating your vote, the person voting the proxy will vote your shares according to the Board's recommendations thereon. Proxy solicitation will be principally by mail but may also be made by telephone or personal interview conducted by officers and regular employees of First Pacific Advisors, Inc., the Fund's investment adviser ("FPA"), or Boston Financial Data Services, Inc., the Fund's Transfer Agent. The cost o f solicitation of proxies will be borne by Resolute, LLC ("Resolute"), your Fund's proposed new investment adviser, which will reimburse banks, brokerage firms, nominees, fiduciaries, and other custodians for reasonable expenses incurred by them in sending the proxy material to beneficial owners of shares of the Fund. In addition, Resolute has engaged Computershare Fund Services to assist in proxy solicitation and collection, and Resolute has agreed to pay such firm approximately $13,300, plus out-of-pocket costs. This Proxy Statement was first mailed to shareholders on or about March 30, 2006. The Fund's annual report to shareholders for the year ended September 30, 2005, may be obtained upon written request made to the Secretary of the Fund.

On March 3, 2006 (the record date for determining shareholders entitled to notice of and to vote at the Meeting), there were 150,523,995 shares of Common Stock outstanding, $0.01 par value. On February 28, 2006, the net assets of the Fund were $1,637,295,385. Shareholders of the Fund are entitled to one vote per share. As of March 3, 2006, no person is known by management to own of record or beneficially as much as 5% of the outstanding Common Stock, except Merrill Lynch, Pierce, Fenner & Smith Incorporated, 4800 Dear Lake Drive East, Jacksonville, Florida 32246-6484, which held 29,567,294 shares (19.64%), and Charles Schwab & Co., Inc., 101 Montgomery Street, San Francisco, California 94104-4122, which held 34,644,138 shares (23.02%). The foregoing broker-dealers advise that the shares are held for the benefit of their customers.

Annual reports are sent to shareholders of record of the Fund following the Fund's fiscal year end. The Fund will furnish, without charge, a copy of its annual report and most recent semi-annual report succeeding the annual report, if any, to a shareholder upon request. Such written or oral requests should be directed to the Fund at 11400 West Olympic Boulevard, Suite 1200, Los Angeles, California 90064-1550, or call (800) 982-4372, except from Alaska, Hawaii, and Puerto Rico (where you may call collect (310) 473-0225). Please note that only one annual report or Proxy Statement may be delivered to two or more shareholders of the Fund who share an address, unless the Fund has received instructions to the contrary. To request a separate copy of an annual report or the Proxy Statement, or for instructions as to how to request a separate copy of these documents or as to how to request a single copy if multiple copies of these documents are recei ved, shareholders should contact the Fund at the address and phone number set forth above.

1. ELECTION OF THE BOARD OF DIRECTORS

At the Meeting, six directors are to be elected to serve until the next meeting of shareholders or until their successors are duly elected and qualified. The six nominees receiving the highest number of votes will be elected. Unless otherwise instructed, the proxy holders intend to vote proxies received by them for the six nominees named below. The affirmative votes of a majority of the shares present in person or represented by proxy at the meeting are required to elect each director. The following schedule sets forth certain information regarding each nominee for election as director.

1

| Name, Address* & Age | | Position

With

Fund | | Year First

Elected as

Director

of the

Fund | | Principal Occupation(s)

During Past 5 Years | | Number of

FPA Fund

Boards on

Which

Director

Serves | | Other

Directorships

Held by

Directors | |

| "Non-Interested" Directors | |

|

| Willard H. Altman, Jr., 70 (1,2) | | Director | | | 1998 | | | Former Partner of Ernst & Young LLP, a public accounting firm. Director/Trustee of FPA Capital Fund, Inc., of FPA Paramount Fund, Inc., of FPA Perennial Fund, Inc., of FPA Funds Trust, and of Source Capital, Inc. (3). Vice President of Evangelical Council for Financial Accountability, an accreditation organization for Christian non-profit entities, from 1995 to 2002. | | | 6 | | | | 0 | | |

|

| Alfred E. Osborne Jr., 61 (1,2) | | Director | | | 1999 | | | Senior associate dean of the John E. Anderson Graduate School of Management at UCLA. Faculty Director of the Harold and Pauline Price Center for Entrepreneurial Studies and Associate Professor of Business Economics at the John E. Anderson Graduate School of Management at UCLA. Dr. Osborne has been at UCLA since 1972. Director/Trustee of FPA Capital Fund, Inc. and of FPA Funds Trust (3), of the Investment Company Institute, of K2 Inc., of Nordstrom, Inc., of EMAK, Inc., and of Wedbush, Inc., a privately held company, which operates a venture capital fund and owns Wedbush Morgan Securities, Inc., a broker-dealer. Trustee of the WM Group of Funds, a mutual fund complex. Director nominee of Kaiser Aluminum (upon emergence from bankruptcy). | | | 3 | | | | 6 | | |

|

A. Robert Pisano, 63

(1,2) | | Director | | | 2002 | | | President and Chief Operating Officer of the Motion Picture Association of America, Inc. since October 2005. Former National Executive Director and Chief Executive Officer of The Screen Actors Guild (2001 to April 2005). Director/Trustee of FPA Capital Fund, Inc., of FPA Perennial Fund, Inc. and of FPA Funds Trust (3), of State Net, of Netflix, Inc., of Resources Global Professionals, and of The Motion Picture and Television Fund. Director nominee of FPA Paramount Fund, Inc. (3). | | | 4 | | | | 4 | | |

|

| Patrick B. Purcell, 63 | | Nominee | | | — | | | Retired. Former Consultant from March 1998 to August 2000, and Executive Vice President, Chief Financial Officer and Chief Administrative Officer from 1989 to March 1998, of Paramount Pictures. Director of The Ocean Conservancy and of The Motion Picture and Television Fund. Director/Trustee nominee of FPA Capital Fund, Inc. and of FPA Funds Trust (3). | | | — | | | | 2 | | |

|

| Lawrence J. Sheehan, 73 (1,2) | | Director | | | 1991 | | | Retired. Formerly Partner (1969 to 1994) and of counsel employee (1994 to 2002) of the law firm of O'Melveny & Myers LLP. Director/Trustee of Source Capital, Inc., of FPA Perennial Fund, Inc., of FPA Capital Fund, Inc. and of FPA Funds Trust; and Director nominee of FPA Paramount Fund, Inc. (3). | | | 5 | | | | 0 | | |

|

2

| Name, Address* & Age | | Position

With

Fund | | Year First

Elected as

Director

of the

Fund | | Principal Occupation(s)

During Past 5 Years | | Number of

FPA Fund

Boards on

Which

Director

Serves | | Other

Directorships

Held by

Directors | |

| "Interested" Directors** | |

|

| Robert L. Rodriguez, 57 | | Director, President & Chief Investment Officer | | | 2000 | | | Director, Principal and Chief Executive Officer for more than the past five years of FPA; Director (since August 2000), President and Chief Investment Officer for more than the past five years of FPA Capital Fund, Inc. (3); and Director for more than the past five years of FPA Fund Distributors, Inc. ("Fund Distributors"). Director from March 1996 to August 2000 of Source Capital, Inc. | | | 2 | | | | 2 | | |

|

* The address for each director is 11400 West Olympic Boulevard, Suite 1200, Los Angeles, California 90064.

** "Interested person" within the meaning of the Investment Company Act of 1940 ("Act" or "1940 Act") by virtue of his affiliation with FPA.

(1) Member of the Audit Committee of the Board of Directors.

(2) Member of the Corporate Responsibility Committee of the Board of Directors.

(3) FPA Capital Fund, Inc., FPA Paramount Fund, Inc., FPA Perennial Fund, Inc., FPA Funds Trust, and Source Capital, Inc. are other investment companies advised by FPA ("FPA Funds"). See "Other Information Concerning FPA and Resolute" herein.

All nominees have consented to being named in this Proxy Statement and have indicated their intention to serve if elected. Should any nominee for director withdraw or otherwise become unavailable for reasons not presently known, it is intended that the proxy holders will vote for the election of such other person or persons as the Board of Directors may designate.

The Board of Directors has designated the four members identified by footnote (1) to the preceding table as the Audit Committee of the Board. No member is considered an "interested person" of the Fund within the meaning of the 1940 Act. The Audit Committee makes recommendations to the Board of Directors concerning the selection of the Fund's independent registered public accounting firm and reviews with such firm the results of the annual audit, including the scope of auditing procedures, the adequacy of internal controls, and compliance by the Fund with the accounting, recording, and financial reporting requirements of the 1940 Act. The Audit Committee met four times during the last fiscal year. The responsibilities of the Audit Committee are set forth in the Audit Committee Charter, a copy of which is attached as Exhibit A hereto.

The Board recommends that shareholders vote FOR the nominated directors.

3

AUDIT COMMITTEE REPORT

To the Board of Directors

of FPA New Income, Inc.: November 14, 2005

Our Committee has reviewed and discussed with management of the Fund and Deloitte & Touche LLP, the independent registered public accounting firm of the Fund, the audited financial statements of the Fund as of September 30, 2005, and the financial highlights for the year then ended (the "Audited Financial Statements"). In addition, we have discussed with Deloitte & Touche LLP the matters required by Codification of Statements on Auditing Standards No. 61 regarding communications with audit committees.

The Committee also has received and reviewed the written disclosures and the letter from Deloitte & Touche LLP required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committee), and we have discussed with that firm its independence from the Fund. We also have discussed with management of the Fund and the independent registered public accounting firm such other matters and received such assurances from them as we deemed appropriate.

Management is responsible for the Fund's internal controls and the financial reporting process. Deloitte & Touche LLP is responsible for performing an independent audit of the Fund's financial statements in accordance with generally accepted auditing standards and issuing a report thereon. The Committee's responsibility is to monitor and oversee these processes.

Based on the foregoing review and discussions and a review of the report of Deloitte & Touche LLP with respect to the Audited Financial Statements, and relying thereon, we have recommended to the Fund's Board of Directors the inclusion of the Audited Financial Statements in the Fund's Annual Report to Shareholders for the year ended September 30, 2005, for filing with the Securities and Exchange Commission.

Audit Committee:

Willard H. Altman, Jr.

Alfred E. Osborne, Jr.

A. Robert Pisano

Lawrence J. Sheehan

4

The Board of Directors has designated the four members identified by footnote (2) to the preceding table as the Corporate Responsibility Committee. No member is considered an "interested person" of the Fund within the meaning of the 1940 Act. The Corporate Responsibility Committee recommends to the full Board of Directors nominees for election as directors of the Fund to fill vacancies on the Board, when and as they occur. The Corporate Responsibility Committee periodically reviews such issues as the Board's composition and compensation and other relevant issues, and recommends any appropriate changes to the full Board of Directors. While the Corporate Responsibility Committee normally is able to identify from its own resources an ample number of qualified candidates, it will consider shareholders' suggestions of persons to be considered as nominees to fill future vacancies on the Board. The determination of nominees recommended by the Corpo rate Responsibility Committee is within the sole discretion of the Corporate Responsibility Committee, and the final selection of nominees is within the sole discretion of the Board. Therefore, no assurance can be given that persons recommended by shareholders will be nominated as directors. The Corporate Responsibility Committee currently has no charter. The Corporate Responsibility Committee met three times during the last fiscal year.

During the Fund's fiscal year ended September 30, 2005, the Board of Directors held five meetings. Each director attended more than 75% of the aggregate of (1) the total number of meetings of the Board of Directors and (2) the total number of meetings held by all Committees of the Board on which they served, except for Mr. Rodriguez who attended 60% of the meetings.

During the Fund's fiscal year ended September 30, 2005, the Fund did not pay any salaries directly to officers but paid an investment advisory fee to FPA as described herein. The following information relates to director compensation. Each director who was not an interested person of FPA was compensated by the Fund at the rate of $6,000 per year plus a fee of $1,000 for each Board of Directors meeting attended. The directors who were not interested persons of FPA received total directors' fees of $40,000 for the Fund's fiscal year ended September 30, 2005. Each such director is also reimbursed for out-of-pocket expenses incurred as a director.

| Name | | Aggregate Compensation1

From the Fund | | Total Compensation1

From All FPA Funds,

Including the Fund | |

| "Non-Interested" Directors | |

| Willard H. Altman, Jr. | | $ | 10,000 | | | $ | 69,5002 | | |

| Alfred E. Osborne, Jr. | | | 10,000 | | | | 30,0003 | | |

| A. Robert Pisano | | | 10,000 | | | | 32,5004 | | |

| Patrick B. Purcell (nominee) | | | — | | | | — | | |

| Lawrence J. Sheehan | | | 10,000 | | | | 60,5005 | | |

| "Interested" Directors | |

| Robert L. Rodriguez | | | 0 | | | | 0 | | |

(1) No pension or retirement benefits are provided to Directors by the Fund or the FPA Funds.

(2) Includes compensation from the Fund, four open-end investment companies, and one closed-end investment company.

(3) Includes compensation from the Fund and two open-end investment companies.

(4) Includes compensation from the Fund and three open-end investment companies.

(5) Includes compensation from the Fund, three open-end investment companies, and one closed-end investment company.

Fund Shares Owned by Directors as of March 3, 2006*

| Name | | Dollar Range of Fund

Shares Owned | | Aggregate Dollar Ranges of Shares

Owned in All FPA Funds

Overseen by Director | |

| "Non-Interested" Directors | |

| Willard H. Altman, Jr. | | Over $100,000 | | Over $100,000 | |

| Alfred E. Osborne, Jr. | | $10,001 to $50,000 | | Over $100,000 | |

| A. Robert Pisano | | $10,001 to $50,000 | | Over $100,000 | |

| Patrick B. Purcell (nominee) | | None | | None | |

| Lawrence J. Sheehan | | Over $100,000 | | Over $100,000 | |

| "Interested" Directors | |

| Robert L. Rodriguez | | Over $100,000 | | Over $100,000 | |

* All officers and directors of the Fund as a group owned beneficially less than 1% of the outstanding shares of the Fund.

The following information relates to the executive officers of the Fund who are not directors of the Fund. Each officer also serves as an officer of FPA. The business address of each of the following officers is 11400 West Olympic Boulevard, Suite 1200, Los Angeles, California 90064-1550.

5

Name and Position

With Fund | | Principal Occupation During Past Five Years | | Age | | Officer

Since | |

Thomas H. Atteberry

(Vice President & Portfolio

Manager) | | Vice President of FPA for more than the past five years. | | | 52 | | | | 2004 | | |

|

Eric S. Ende

(Vice President) | | Senior Vice President of FPA for more than the past five years; Director, President and Portfolio Manager for more than the past five years of FPA Paramount Fund, Inc. and of FPA Perennial Fund, Inc.; Director, President and Chief Investment Officer for more than the past five years of Source Capital, Inc.; and Vice President of FPA Capital Fund, Inc. for more than the past five years and of FPA Funds Trust (since September 2002). | | | 61 | | | | 1985 | | |

|

J. Richard Atwood

(Treasurer) | | Director, Principal, and Chief Operating Officer for more than the past five years of FPA; and Director, President, Chief Executive Officer, Chief Financial Officer and Treasurer for more than the past five years, and Chief Compliance Officer (since August 2004), of Fund Distributors. Mr. Atwood also has served as Treasurer of FPA Capital Fund, Inc., of FPA Paramount Fund, Inc., of FPA Perennial Fund, Inc., and of Source Capital, Inc. for more than the past five years and of FPA Funds Trust (since September 2002). | | | 45 | | | | 1997 | | |

|

Sherry Sasaki

(Secretary) | | Assistant Vice President and Secretary of FPA for more than the past five years, and Secretary of Fund Distributors for more than the past five years. Ms. Sasaki also has served as Secretary of FPA Capital Fund, Inc., of FPA Paramount Fund, Inc., of FPA Perennial Fund, Inc., and of Source Capital, Inc. for more than the past five years and of FPA Funds Trust (since September 2002). | | | 51 | | | | 1984 | | |

|

Christopher H. Thomas

(Chief Compliance Officer) | | Vice President for more than the past five years and Chief Compliance Officer (since August 2004) of FPA; Director, Vice President and Controller for more than the past five years of Fund Distributors; and Chief Compliance Officer of each FPA Fund (since August 2004). Controller of FPA from March 1995 to December 2005; and Assistant Treasurer of each FPA Fund from April 1995 (except FPA Funds Trust from September 2002) to February 2006. | | | 49 | | | | 1995 | | |

|

Information Concerning Independent Registered Public Accounting Firm

The Board of Directors, including a majority of the Directors who are not considered "interested persons" of the Fund as defined in the 1940 Act (the "Independent Board Members"), has selected Deloitte & Touche LLP to serve as the Fund's independent registered public accounting firm for the fiscal year ending September 30, 2006. The employment of such firm is conditioned upon the right of the Fund, by vote of a majority of its outstanding voting securities, to terminate such employment forthwith without any penalty. Deloitte & Touche LLP has served as the independent registered public accounting firm for the Fund since November 11, 2002. Representatives of Deloitte & Touche LLP are expected to be present at the Meeting, with the opportunity to make a statement if they desire to do so, and such representatives are expected to be available to respond to any appropriate questions from shareholders.

Audit Fees

Aggregate fees paid to Deloitte & Touche LLP for professional services for the audit of the Fund's 2005 annual financial statements during the fiscal year ended September 30, 2005, and the reviews of the financial statements included in the Fund's filings on Form N-SAR for that fiscal year, were $31,620.

All Other Fees

Aggregate fees for all other services by Deloitte & Touche LLP to the Fund during the fiscal year were $5,765 in connection with preparation and review of 2005 federal and state tax returns for the Fund.

2. APPROVAL OF A NEW ADVISORY AGREEMENT PROPOSED TO TAKE EFFECT ON OR ABOUT

OCTOBER 1, 2006

At the Meeting, you will be asked to approve a new investment advisory agreement (the "New Advisory Agreement") between the Fund and a new investment adviser, Resolute, LLC ("Resolute"), that was founded and is owned by the current principals and key investment professionals of FPA (the "Key Principals"). Pursuant to the Transaction (described below), Resolute is expected to commence providing advisory services on or about October 1, 2006. The New Advisory Agreement would take effect if and when the Transaction is consummated. A general description of the proposed New Advisory Agreement and a general

6

comparison of the proposed New Advisory Agreement and the Fund's current investment advisory agreement, dated October 23, 2000 with FPA (the "Current Advisory Agreement") are included below. The form of the New Advisory Agreement is attached hereto as Exhibit B.

On July 17, 2004, Resolute entered into an option agreement (the "Option Agreement") with Old Mutual (US) Holdings Inc. and FPA pursuant to which Resolute may elect, between July 1, 2006 and August 1, 2006, to purchase various operating assets of FPA, assume the office space of FPA, solicit the employees of FPA to become employees of Resolute, and obtain the right to do business under the name "First Pacific Advisors" (altogether, the "Transaction"). As well, the Option Agreement permits Resolute to solicit the current advisory clients of FPA, including the Fund, to become clients of Resolute. If Resolute exercises its option under the Option Agreement, the Transaction would be consummated on or soon after October 1, 2006 (the "Closing Date"). For additional information regarding the Transaction, please see "Other Information Regarding the Option Agreement and Related Transaction" below.

If the Transaction is consummated, Resolute would offer advisory services to clients who choose to retain Resolute as their investment adviser with the same internal resources and key personnel as currently provided by FPA. In anticipation of the Transaction, members of the Board met in person on February 6, 2006 for the purpose of, among other things, considering whether it would be in the best interests of the Fund and its shareholders to approve the New Advisory Agreement between the Fund and Resolute. The 1940 Act requires that the New Advisory Agreement be approved by both the Board and by the Fund's shareholders in order for it to become effective. At that Board meeting, and for the reasons described below (see "Board Considerations and Recommendation" below), the Board, including a majority of the Independent Board Members, approved the New Advisory Agreement for the Fund and recommended its approval by the Fund's shareholders. If sha reholder approval is obtained and Resolute determines to exercise the option described above, the Board of Directors would intend to terminate the Current Advisory Agreement and enter into the New Advisory Agreement with Resolute, with effect on the Closing Date.

Simultaneously, the board of every other FPA Fund has considered the terms of the Option Agreement and discussed the Transaction. Following these deliberations, the board of each FPA Fund, including a majority of its independent board members, approved a new advisory agreement with Resolute to take effect on the Closing Date and recommended its approval by shareholders.

It is currently expected that if the requisite number of shareholders of one or more FPA Funds vote(s) FOR a new advisory agreement with Resolute, Resolute will exercise its option in July 2006 and the Transaction will be consummated on the Closing Date. In the case that the requisite number of shareholders of every FPA Fund votes AGAINST a new advisory agreement with Resolute, it is expected that Resolute will not exercise its option under the Option Agreement, the Current Advisory Agreement will not be terminated by the Board, the Transaction will not be consummated, and FPA will continue to manage the Fund. Finally, in the event the Transaction is consummated without the approval of the New Advisory Agreement by the shareholders of this Fund, it is expected that FPA will no longer se rve as the investment adviser to the Fund and the Fund's Board will take such action as it deems to be in the best interests of the Fund and its shareholders.

New Advisory Agreement

The following description of the New Advisory Agreement is only a summary. You should refer to Exhibit B for the form of New Advisory Agreement, and the description set forth in this Proxy Statement is qualified in its entirety by reference to Exhibit B.

The New Advisory Agreement for the Fund will be dated as of the date of the consummation of the Transaction. It will continue in effect for an initial term of two years and may continue thereafter from year to year if specifically approved at least annually by the vote of a majority of the outstanding voting securities of the Fund, as defined under the 1940 Act, or by a majority of the Board and the vote of a majority of the Independent Board Members, cast in person at a meeting called for such purpose. The other terms of the New Advisory Agreement are identical to the Current Advisory Agreement, including the services to be provided by Resolute, the allocation of charges and expenses, Resolute's compensation, and the expense limitation of Resolute, as described below.

Under the New Advisory Agreement, the Fund retains Resolute to manage the investment of the Fund's assets, including placing orders for the purchase and sale of portfolio securities. Resolute agrees to obtain and evaluate economic, statistical, and financial information to formulate and implement the Fund's investment programs. In addition to providing management and investment advisory services, Resolute furnishes office space, facilities, and equipment. It also compensates all officers and other personnel of the Fund, except Directors who are not affiliated with it. The Current Advisory Agreement contains identical provisions.

Other than the expenses Resolute specifically assumes under the New Advisory Agreement, the Fund bears all costs of its operation. These costs include the charges and expenses of any custodian or depository appointed by the Fund for the safekeeping of its cash, portfolio securities, and other property; the charges and expenses of auditors; the charges and expenses of any stock

7

transfer or dividend agent or agents appointed by the Fund; brokers' commissions chargeable to the Fund in connection with portfolio securities transactions to which the Fund is a party; all taxes, including issuance and transfer taxes, and corporate fees payable by the Fund to federal, state, or other governmental agencies; the cost of stock certificates representing Fund shares; fees involved in registering and maintaining registrations of the Fund and of Fund shares with the Securities and Exchange Commission ("SEC") and various states and other jurisdictions; all expenses of shareholders' and Board meetings and of preparing, printing, and mailing proxy statements and semi-annual and annual reports to shareholders; fees and travel expenses of Independent Board Members; the expense of furnishing, or causing to be furnished, to all shareholders a statement of account after every transaction affecting their account, including the expense of mailing; charges and expenses of legal counsel in connection with matters relating to the Fund, including, without limitation, legal services rendered in connection with the Fund's corporate and financial structure and relations with its shareholders, issuance of Fund shares and registrations and qualifications of securities under federal, state, and other laws; association dues; interest payable on Fund borrowings; and postage. The Current Advisory Agreement contains identical provisions.

For services rendered under the New Advisory Agreement, Resolute will be paid a monthly fee computed at the annual rate of 0.50% of the Fund's net assets. The fee is calculated and accrued each calendar day by applying the annual rate to the net assets of the Fund as of the close of the prior business day, and dividing the amount computed by the number of calendar days in the fiscal year. The Current Advisory Agreement contains identical provisions.

The advisory fee in the New Advisory Agreement is reduced in the amount by which certain defined operating expenses of the Fund (including the advisory fee) for any fiscal year exceed 1.50% of the first $15 million of average net assets, plus 1% of the remaining average net assets. Such values are calculated at the close of business on the last business day of each calendar month. Any required reduction or refund is computed and paid monthly. Operating expenses (as defined in the Agreement) exclude (a) interest, (b) taxes, (c) brokerage commissions, and (d) any extraordinary expenses, such as litigation, merger, reorganization, or recapitalization, to the extent such extraordinary expenses can be excluded under the rules or policies of the states in which Fund shares are registered for sale. All expenditures, including costs connected with the purchase, retention, or sale of portfolio securities, which are capitalized in accordance with gene rally accepted accounting principles applicable to investment companies, are accounted for as capital items and not as expenses. This expense limitation provision does not require any payment by Resolute beyond the return of the advisory fee paid to it by the Fund for a fiscal year. The Current Advisory Agreement contains identical provisions.

The New Advisory Agreement provides that Resolute does not have any liability to the Fund or any of its shareholders for any error of judgment, any mistake of law or any loss the Fund suffers in connection with matters related to the New Advisory Agreement, except for liability resulting from willful misfeasance, bad faith or negligence on the part of Resolute or the reckless disregard of its duties under the New Advisory Agreement. The New Advisory Agreement may be terminated without penalty upon 60 days' written notice at the option of either party or by the vote of the Fund's shareholders. The New Advisory Agreement automatically terminates in the event of an assignment. The Current Advisory Agreement contains identical provisions.

For the fiscal year ended September 30, 2005, FPA received gross advisory fees of $10,063,159. Had Resolute been the adviser during this period, the advisory fees charged to the Fund would have been the same.

Portfolio Transactions and Brokerage

Under the New Advisory Agreement, Resolute shall be responsible for decisions to buy and sell securities for the Fund and for the placement of its portfolio business and the negotiation of any commissions paid on such transactions. Most transactions the Fund makes are principal transactions at net prices. Portfolio securities are normally purchased directly from the issuer or from an underwriter or market maker for the securities. Purchases of portfolio securities from underwriters include a commission or concession the issuer pays to the underwriter. Purchases from dealers serving as market makers include the spread between the bid and asked price. Sales to dealers are effected at bid prices. The Current Advisory Agreement contains identical provisions.

Under the New Advisory Agreement, Resolute shall be responsible for placing portfolio transactions in a manner deemed fair and reasonable to the Fund and not according to any formula. The primary consideration in all portfolio transactions is prompt execution of orders in an effective manner at the most favorable price. In selecting broker-dealers and in negotiating commissions, Resolute will consider: the best net price available; each firm's reliability, integrity, and financial condition; the size of and difficulty in executing the order; and the value of the firm's expected contribution to the Fund's investment performance on a continuing basis. Accordingly, the net price to the Fund in any transaction may be less favorable than that available from another broker-dealer if the difference is reasonably justified by other aspects of its services. Subject to policies determined by the Fund's Board of Directors, Resolute shall not be deemed to have acted unlawfully or to have breached any duty created by the New Advisory Agreement or otherwise solely because the Fund paid a broker-dealer providing brokerage and research services commissions for effecting a transaction in excess of the commission another broker-dealer would have charged for the same transaction. Resolute will be required to determine in good faith that such commission was reasonable relative to the value of the brokerage and research services provided, considering either that particular transaction or Resolute's overall responsibilities to the Fund.

8

Resolute will further be authorized to allocate orders it places for the Fund to broker-dealers providing products or services that assist in making investment decisions. Resolute will allocate the amounts and proportions of such costs and regularly report on such allocations to the Fund's Board of Directors. The Current Advisory Agreement contains identical provisions.

The New Advisory Agreement will include direct authorization for Resolute to pay commissions on securities transactions to broker-dealers furnishing research services in an amount higher than the lowest available rate if Resolute determines in good faith that the amount is reasonable in relation to the brokerage and research services provided (as required by Section 28(e) of the Securities Exchange Act of 1934), viewed in terms of the particular transaction or Resolute's overall responsibilities with respect to accounts as to which it exercises investment discretion. The term brokerage and research services will be defined to include (a) providing advice as to the value of securities, the advisability of investing in, purchasing or selling securities, and the availability of securities or purchasers or sellers of securities; (b) furnishing analyses and reports concerning issuers, industries, securities, economic factors and trends, portfolio strategy, and performance of accounts; and (c) effecting securities transactions and performing functions incidental thereto, such as clearance, settlement, and custody. The Current Advisory Agreement contains identical provisions.

Research services furnished by broker-dealers effecting securities transactions for the Fund will be able to be used by Resolute for all advisory accounts pursuant to the New Advisory Agreement. The Current Advisory Agreement contains an identical provision. However, Resolute might not use all such research services in managing the Fund's portfolio. In Resolute's opinion, it will not be possible to measure separately the benefits from research services to the advisory account. Because the volume and nature of the trading activities of advisory accounts are not uniform, the amount of commissions in excess of the lowest available rate paid by the advisory account for brokerage and research services will vary. However, Resolute believes the total commissions the Fund pays will not be disproportionate to the benefits it receives on a continuing basis. The Current Advisory Agreement contains identical provisions and FPA has made identical conclus ions.

Resolute will attempt to allocate portfolio transactions equitably whenever concurrent decisions are made to purchase or sell securities for the Fund and another advisory account. In some cases, this procedure could have an adverse effect on the price or amount of securities available to the Fund. The main factors considered in such allocations will be the respective investment objectives, the relative amount of portfolio holdings of the same or comparable securities, the availability of cash for investment, the size of investment commitments generally held, and the opinion of the persons responsible for recommending the investments. FPA makes similar attempts and takes into account similar considerations when operating under the Current Advisory Agreement.

Brokerage commissions paid by the Fund on portfolio transactions for the fiscal year ended September 30, 2005, totaled $1,566. Had Resolute been the adviser during this period, the brokerage commissions paid by the Fund would have been the same.

Other Information Concerning FPA and Resolute

FPA is a wholly owned subsidiary of Old Mutual (US) Holdings Inc. Old Mutual (US) Holdings Inc. is a holding company principally engaged, through affiliated firms, in providing institutional investment management. In September 2000, Old Mutual (US) Holdings Inc. was acquired by, and subsequently became a wholly owned subsidiary of Old Mutual plc, a United Kingdom-based financial services group with substantial asset management, insurance, and banking businesses. The common stock of Old Mutual plc is listed on the London Stock Exchange. No person is known by Old Mutual plc to own or hold with power to vote 25% or more of the outstanding shares of Old Mutual plc common stock.

The directors and principals of FPA are the following persons: J. Richard Atwood, Chief Operating Officer of FPA; and Robert L. Rodriguez, Chief Executive Officer of FPA. The principal occupations of Messrs. Atwood and Rodriguez are described in the preceding tables. The business address of Messrs. Atwood and Rodriguez is 11400 West Olympic Boulevard, Suite 1200, Los Angeles, California 90064-1550.

Resolute is a Delaware limited liability company and intends to be registered with the SEC as a registered investment adviser prior to October 1, 2006. Since Resolute is a recently formed company and has no operating history, there can be no assurances that unforeseen events or transactions will not impair the financial ability of Resolute to fulfill its commitment to the Fund under the New Advisory Agreement. The management committee of Resolute is comprised of two Managing Members, J. Richard Atwood and Robert L. Rodriguez (Messrs. Atwood and Rodriguez are currently the sole principals of FPA). Mr. Rodriguez has served as a director, principal, and Chief Executive Officer of FPA for the last five years. Mr. Atwood has served as a director, principal, and Chief Operating Officer of FPA for the last five years. The address of Resolute is 11400 West Olympic Boulevard, Suite 1200, Los Angeles, California 90064. No member of Resolute owns more than 25% of its outstanding equity, except for Mr. Rodriguez who owns 30%. The members who own 10% or more of Resolute's outstanding equity are Mr. Atwood, Dennis M. Bryan, Rikard B. Ekstrand, and Steven T. Romick. The members who own less than 10% are Thomas H. Atteberry, Eric S. Ende, and Steven R. Geist.

The Fund paid no brokerage commissions to FPA, Resolute, or any of their affiliates during the Fund's most recently completed fiscal year. There were no other material payments by the Fund to Resolute or any of its affiliates during that period.

9

Resolute is expected to provide investment advisory services to certain other funds that may have investment objectives and policies similar to those of the Fund. Exhibit C lists other funds proposed to be advised by Resolute, the net assets of those funds and the management fees FPA received from those funds during the fiscal years ended on the dates noted.

Other Information Regarding the Option Agreement and Related Transaction

Under the Option Agreement, Resolute has an option, exercisable from July 1, 2006 to August 1, 2006, to acquire various operating assets of FPA (the "Purchased Assets"). The Option Agreement also permits Resolute to assume the current office space of FPA and to solicit current FPA employees to become employees of Resolute. Under the Option Agreement, if the option is exercised, the Key Principals are permitted to and would intend to terminate their employment with FPA and simultaneously begin employment with Resolute. Purchased Assets include: all of FPA's tangible assets, including FPA Fund Distributors, Inc. ("Fund Distributors"), books and records, telephone and facsimile listings, current and prospective client lists and vendor information, as well as the rights to the name "First Pacific Advisors," FPA's website address, and content and other intellectual property of FPA. Beginning on January 1, 2006, the Option Agreement permits Resolu te to solicit the current advisory clients of FPA, including your Fund and the other FPA Funds, to become clients of Resolute, although these advisory contracts are not assigned to Resolute. The Transaction contemplated under the Option Agreement would be consummated on the Closing Date. The Option Agreement provides that, if the option is exercised, Resolute will pay a purchase price for the Purchased Assets equal to their fair market value (to be determined by a third party investment banking firm) as of September 30, 2006. Resolute has prepared a pro forma balance sheet as of October 1, 2006, that takes into account its financial condition after the Transaction. A copy of this balance sheet is attached hereto as Exhibit D. Prior to the Closing Date, the Option Agreement requires that the Key Principals manage and operate FPA in accordance with past and prud ent business practices and continue to satisfy their fiduciary duties to FPA's clients, including your Fund. Following the Closing Date, Resolute expects to conduct its business under the name "First Pacific Advisors".

Distributor, Underwriter and Administrator

Fund Distributors, a wholly owned subsidiary of FPA, acts as the principal distributor of shares of the Fund pursuant to a Distribution Agreement dated September 25, 2000. During the fiscal year ended September 30, 2005, Fund Distributors received $70,504 in net sales commissions (after reallowance to other dealers) on sales of shares of the Fund. Pursuant to the Option Agreement and if the Transaction is consummated, Resolute would acquire all of the stock of Fund Distributors on the Closing Date. It is expected that Fund Distributors will continue to serve as distributor for shares of the Fund and that there will be no change in the services provided as distributor.

Board Considerations and Recommendation

The New Advisory Agreement has been approved by the Fund's Board of Directors, including all of the Independent Board Members, at a meeting held on February 6, 2006. In so doing, the Directors acted in what they believe to be in the best interests of the shareholders of the Fund.

To assist the Board in its consideration of the New Advisory Agreement, Resolute and the Key Principals provided materials and information about Resolute, including its financial condition, asset management capabilities, organization, and the Transaction. The Independent Board Members, through their independent legal counsel, also requested and received additional information from FPA, Resolute, and the Key Principals in connection with their consideration of the New Advisory Agreement. The additional information was provided in advance of and at the meeting. The Board has been informed that Robert L. Rodriguez and Thomas H. Atteberry, who currently serve as the Chief Investment Officer and the Portfolio Manager, respectively, for the Fund with day-to-day responsibility for the investment of the Fund's assets, would continue to serve in such capacities. The Board also reviewed certain pro forma financial information concerning Resolute, incl uding Resolute's pro forma balance sheet as of October 1, 2006, which is attached as Exhibit D.

In approving the New Advisory Agreement and recommending that it be approved by the Fund's shareholders, the Directors have considered:

(i) The terms and conditions of the New Advisory Agreement;

(ii) The nature, quality, and extent of the advisory, management, and accounting services to be performed by Resolute for the Fund;

(iii) That the Key Principals and Resolute have advised the Board that following the Transaction, there is not expected to be any diminution in the nature, quality, and extent of services provided to the Fund and its shareholders, including compliance services;

(iv) Resolute's expressed intention to continue the investment operations of the Fund in Los Angeles as the Fund's and the other FPA Funds' adviser under the direction of current management personnel;

10

(v) The potential ability of Resolute to better retain and attract capable personnel to serve the Fund;

(vi) Resolute's expressed representation to the Board that it would assume any of FPA's liabilities under the Current Advisory Agreement from and after the Closing Date;

(vii) The fees and expenses borne by the Fund and the fact that the Fund's total advisory and administrative fees will not increase by virtue of the New Advisory Agreement, but will remain the same;

(viii) The historic investment performance of the Fund both on an absolute basis and as compared with a peer group of mutual funds;

(ix) The capabilities, resources, and personnel of Resolute and the costs of the services to be provided and the profits to be realized by Resolute and its affiliates from the relationship with the Fund and the other FPA Funds;

(x) Comparative data as to advisory fees and expenses with a peer group of mutual funds;

(xi) The financial resources of Resolute;

(xii) That Resolute and the Key Principals would derive benefits from the Transaction and that as a result, they have a financial interest in the matters that were being considered;

(xiii) That the Fund would not bear the cost of obtaining shareholder approval of the New Advisory Agreement; and

(xiv) Such other information and factors as the Directors believe to be relevant.

Certain of these considerations are discussed in more detail below.

The Board of Directors considered Resolute's specific responsibilities in all aspects of day-to-day investment management of the Fund. The Board considered the qualifications, experience and responsibilities of the portfolio managers, as well as the responsibilities of other key personnel at Resolute to be involved in the day-to-day activities of the Fund. The Board also considered the resources and compliance structure of Resolute, including information regarding its proposed compliance program and Resolute's business continuity plan. The Board noted the Key Principals' experience and past compliance with the investment policies and restrictions of the Fund. The Board also considered the prior relationship between the Key Principals and the Fund, as well as the Directors' knowledge of the Key Principals' past operations at FPA. The Board of Directors concluded that Resolute will have the quality and depth of personnel, resources, investment methods, and compliance policies and procedures essential to performing its duties under the New Advisory Agreement and that the nature, overall quality, cost and extent of such management services will be satisfactory and reliable. The Board also took into consideration the benefits to be derived by Resolute from arrangements under which it may receive research services from brokers to whom the Fund's brokerage transactions are allocated as described above, under "Portfolio Transactions and Brokerage."

In evaluating the costs of the services to be provided by Resolute under the New Advisory Agreement and the profitability to Resolute of its relationship with the Fund, the Board considered, among other things, whether advisory and administrative or management fees or other expenses would change as a result of the Transaction. Based on their review of the materials provided and the assurances they had received from the Key Principals and Resolute, the Board determined that the Transaction would not increase the fees payable for advisory and administrative or management services and that overall Fund expenses were not expected to increase as a result of the Transaction. The Board noted that it was not possible to predict how the Transaction would affect Resolute's profitability from its relationship with the Fund and the other FPA Funds, but that they had been satisfied in their most recent review of the Current Advisory Agreement that the ad viser's level of profitability from its relationship with the Fund was not excessive. The Board noted that they expect to continue to receive adviser profitability information and thus be in a position to evaluate whether any adjustments in Fund fees would be appropriate.

The Board further considered the extent to which economies of scale may be realized as the Fund grows. Among other factors, the Board considered FPA's current, and Resolute's expected, business operations and expense structures, the level of complexity associated with managing the Fund's assets, FPA's historical allocated costs associated with managing the Fund, and the uncertainties associated with FPA's or Resolute's future costs in managing the Fund. The Board concluded that the New Advisory Agreement and the Current Advisory Agreement both adequately share any available economies of scale with the Fund. The Board also concluded that there would be no further economies of scale to be shared by Resolute from its anticipated business operations at current Fund asset levels and that the Board expects to continue receiving costs and similar information from Resolute to assess whether it may be appropriate in the future to introduce advisory f ee or additional breakpoint discounts to enable the Fund's shareholders to benefit from future economies of scale that may be recognized by Resolute in its business operations.

In their deliberations, the Board did not identify any particular information that was all-important or controlling, and each Director attributed different weights to the various factors. The Directors evaluated all information available to them only with respect to this Fund. The Board, including a majority of the Independent Board Members, concluded that the terms of the New Advisory Agreement are fair and reasonable, that the fees stated therein are reasonable in light of the services to be provided to the Fund, and that the New Advisory Agreement should be approved and recommended to Fund shareholders.

11

Section 15(f) of the 1940 Act

In order to conform with the "safe harbor" provisions of Section 15(f) of the 1940 Act with respect to the Transaction, Resolute has agreed that it will use its reasonable best efforts (i) for a period of two years after the Transaction, to ensure that there would not be imposed on the Fund an "unfair burden" (as defined in the 1940 Act) as a result of the Transaction, and (ii) for three years after the Transaction, to ensure that at least 75% of the members of the Board of Directors are not "interested persons" of Resolute. At the request of the Board, Resolute has undertaken to pay, or reimburse the Fund for, all incremental costs or expenses incurred by the Fund in connection with the Transaction. Thus, Resolute will pay the costs of this Proxy Statement and of the proxy solicitation.

The Board recommends that shareholders vote FOR a New Advisory Agreement proposed to take effect on or about October 1, 2006.

3. OTHER MATTERS

The proxy holders have no present intention of bringing before the Meeting for action any matters other than those specifically referred to in the foregoing, and in connection with or for the purpose of effecting the same, nor has the management of the Fund any such intention. Neither the proxy holders nor the management of the Fund are aware of any matters which may be presented by others. If any other business shall properly come before the Meeting, the proxy holders intend to vote thereon in accordance with their best judgment.

Voting Requirements

A quorum of shareholders is required to take action at this Meeting. For purposes of this Meeting, a quorum is present to transact business on a proposal if the holders of a majority of the outstanding shares of the Fund entitled to vote on the proposal are present in person or by proxy. The shares represented by a proxy that is properly executed and returned will be considered to be present at the Meeting.

Based on the Fund's interpretation of Maryland law, abstentions on a proposal set forth herein will have the same effect as a vote against the proposal.

Approval of Proposal 2 requires the affirmative vote of a "majority of the outstanding voting securities" of the Fund. Under applicable law, the vote of "a majority of the outstanding voting securities" means the affirmative vote of the lesser of (a) 67% or more of the voting securities of the Fund that are present at the Meeting or represented by proxy if holders of shares representing more than 50% of the outstanding voting securities of the Fund are present or represented by proxy or (b) more than 50% of the outstanding voting securities of the Fund.

Approval of the proposals will occur only if a sufficient number of votes at the Meeting are cast FOR that proposal. Abstentions are not considered "votes cast" and, therefore, do not constitute a vote FOR. Abstentions effectively result in a vote AGAINST and are disregarded in determining whether a proposal has received enough votes.

Shareholder Proposals

No annual or other special meeting is currently scheduled for the Fund. Mere submission of a shareholder proposal does not guarantee the inclusion of the proposal in the proxy statement or presentation of the proposal at the Meeting since inclusion and presentation are subject to compliance with certain federal regulations.

Adjournment

In the event that sufficient votes in favor of the proposals set forth herein are not received by the time scheduled for the Meeting, the persons named as proxies may move one or more adjournments of the Meeting for a period or periods of not more than 30 days in the aggregate to permit further solicitation of proxies with respect to any such proposals. Any such adjournment will require the affirmative vote of a majority of the shares present at the Meeting. The persons named as proxies will vote in favor of such adjournment those shares which they are entitled to vote which have voted in favor of such proposals. They will vote against any such adjournment those proxies which have voted against any of such proposals.

By Order of the Board of Directors

Sherry Sasaki

Secretary

March 30, 2006

PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY, AND RETURN IT PROMPTLY IN THE ENCLOSED REPLY ENVELOPE. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES. YOU MAY ALSO VOTE YOUR PROXY BY TELEPHONE OR OVER THE INTERNET.

12

EXHIBIT A

FPA NEW INCOME, INC.

AUDIT COMMITTEE CHARTER

Organization

This Charter governs the operations of the Audit Committee. The Committee shall review and reassess the Charter at least annually and obtain the approval of the Board of Directors or the Board of Trustees (hereinafter referred to as the "Board"). The Committee shall be appointed by the Board and shall comprise at least three Directors or Trustees (hereinafter referred to as "Directors"), each of whom is independent of the Adviser and its affiliates and the Fund.

Members of the Committee shall be considered independent if they have no relationship that may interfere with the exercise of their independence from the Adviser and the Fund. No member shall be an "interested person" of the Fund under the Investment Company Act of 1940 (the "Act"). To be considered independent, a member may not, other than in his or her capacity as a member of the Board, the Committee or any other committee of the Board, accept any consulting, advisory or other compensatory fee from the Fund or the Adviser or any of its affiliates.

All Committee members shall be financially literate, or shall become financially literate within a reasonable period of time after appointment to the Committee. It is expected that, under normal circumstances, the Board will designate at least one qualified member of the Committee as an "audit committee financial expert" under regulations adopted by the Securities and Exchange Commission ("SEC"). This designation will not reduce the responsibility of the other Committee members, nor will it increase the designee's duties, obligations or liability as compared to his or her duties, obligations and liability as a member of the Committee and of the Board.

If the Board has not designated a Chair of the Committee, the members of the Committee may designate a Chair by majority vote of the full Committee membership. The Committee will hold regular meetings at least twice annually. Special meetings may be called at any time by any member of the Committee or at the request of the Fund's independent auditors. The Chair will cause notice of each meeting, together with the agenda and any related materials, to be sent to each member. The presence of a majority of the members will constitute a quorum. The Chair will report the actions taken by the Committee to the Board and such report shall be included in the minutes of the Board meeting.

Statement of Policy

The Audit Committee shall provide assistance to the Board in fulfilling its oversight responsibility to the shareholders, potential shareholders, the investment community, and others relating to the Fund's financial statements and the financial reporting process, the systems of internal accounting and financial controls, the annual independent audit of the Fund's financial statements, and the legal compliance and ethics programs as established by the Adviser and the Board. In so doing, it is the responsibility of the Committee to maintain free and open communication between the Committee, the independent auditors and the Adviser of the Fund. In discharging its oversight role, the Committee is empowered to investigate any matter brought to its attention with full access to all books, records, facilities, and personnel of the Fund. The Committee may retain special counsel and other experts or consultants at the expense of the Fund.

Responsibilities and Processes

The primary responsibility of the Audit Committee is to oversee the Fund's financial reporting process on behalf of the Board and report the results of its activities to the Board. The Adviser is responsible for preparing the Fund's financial statements, and the independent auditors are responsible for auditing those financial statements on an annual basis. The Committee, in carrying out its responsibilities, believes its policies and procedures should remain flexible in order to best react to changing conditions and circumstances. The Committee should take the appropriate actions to set the overall corporate "tone" for quality financial reporting, sound business risk practices, and ethical behavior.

The following shall be the principal recurring process of the Audit Committee in carrying out its oversight responsibilities. The processes are set forth as a guide with the understanding that the Committee may supplement them as appropriate.

• The Committee shall have a clear understanding with the Adviser and the independent auditors that the independent auditors are ultimately accountable to the Audit Committee and the Board as representatives of the Fund's shareholders. The Committee shall have the ultimate authority and responsibility to evaluate and, where appropriate, replace the independent auditors. The Committee shall discuss with the auditors their independence from the Adviser and the Fund and the matters included in the written disclosures required by the applicable laws, rules and positions, including those of the Securities

A-1

and Exchange Commission and accounting oversight boards. Annually, the Committee shall review and recommend to the Board the selection of the Fund's independent auditors, subject to shareholders' approval, if required.

• The Committee shall pre-approve all audit and permissible non-audit services that the Committee considers compatible with maintaining the independent auditors' independence. The pre-approval requirement will extend to all non-audit services provided to the Fund, the Adviser, and any entity controlling, controlled by, or under common control with the Adviser that provides ongoing services to the Fund, if the engagement relates directly to the operations and financial reporting of the Fund; provided, however, that an engagement of the Fund's independent auditors to perform attest services for the Fund, the Adviser or its affiliates required by generally accepted auditing standards to complete the examination of the Fund's financial statements (such as an examination conducted in accordance with Statement on Auditing Standards Number 70 issued by the American Institute of Certified Public Accountants), will be deem pre-approved if: (i) t he Fund's independent auditors inform the Audit Committee of the engagement, (ii) the Fund's independent auditors advise the Audit Committee at least annually that the performance of this engagement will not impair the independent auditor's independence with respect to the Fund, and (iii) the Audit Committee receives a copy of the independent auditor's report prepared in connection with such services. The Committee may delegate to one or more Committee members the authority to review and pre-approve audit and permissible non-audit services. Actions taken under any such delegation will be reported to the full Committee at its next meeting.

• The Committee shall discuss with the independent auditors the overall scope and plans for their respective audits, including fees and the adequacy of staffing. Also, the Committee shall discuss with the Adviser and the independent auditors the adequacy and effectiveness of the accounting and financial controls, including the Fund's system to monitor and manage business risk and legal and ethical compliance programs. Further, the Committee shall meet separately with the independent auditors, without the Adviser present, to discuss the results of their examinations.

• The Committee shall review with the Adviser the semiannual financial statements prior to the issuance of the Fund's Semiannual Report to Shareholders. The Chair of the Committee may represent the entire Committee for the purposes of this review.

• The Committee shall review with the Adviser and the independent auditors the financial statements to be included in the Fund's Annual Report to Shareholders, including their judgment about the quality, not just acceptability, of accounting principles, the reasonableness of significant judgments, and the clarity of the disclosures in the financial statements. Also, the Committee shall discuss the results of the annual audit and any other matters required to be communicated to the Committee by the independent auditors under generally accepted auditing standards.

• The Committee shall review and take any measures it deems appropriate to address any complaints or reports provided to the Fund or the Committee related to any Fund accounting or auditing matter or any potential violation of law. Also, the Committee shall review and take any measures it deems appropriate to address any complaints or reports provided by employees of the Fund's investment adviser or its affiliates concerning any such matters.

A-2

EXHIBIT B

Form of New Advisory Agreement

AGREEMENT dated __________________, by and between FPA NEW INCOME, INC., a Maryland corporation (hereinafter referred to as the "Fund"), and RESOLUTE, LLC, a Delaware liability company (hereinafter referred to as the "Manager").

W I T N E S S E T H:

WHEREAS, the Fund is engaged in business as a diversified open-end investment company registered under the Investment Company Act of 1940, as amended (hereinafter referred to as the "Investment Company Act"); and

WHEREAS, the Manager is engaged principally in rendering management and investment advisory services and is registered as an investment adviser under the Investment Advisers Act of 1940; and

WHEREAS, the Fund desires to retain the Manager to render management and investment advisory services to the Fund in the manner and on the terms hereinafter set forth; and

WHEREAS, the Manager is willing to provide management and investment advisory services to the Fund on the terms and conditions hereinafter set forth.

NOW, THEREFORE, in consideration of the premises and the covenants hereinafter contained, the Fund and the Manager hereby agree as follows:

ARTICLE I

DUTIES OF THE MANAGER

The Fund hereby employs the Manager to act as the manager and investment adviser of the Fund and to furnish, or arrange for affiliates to furnish, the management and investment advisory services described below, subject to the supervision of the Board of Directors of the Fund, for the period and on the terms and conditions set forth in this Agreement. The Manager hereby accepts such employment and agrees during such period, to render, or arrange for the rendering of, such services and to assume the obligations herein set forth for the compensation provided for herein.

(a) INVESTMENT ADVISORY SERVICES. The Manager shall provide the Fund with such investment research, advice and supervision as the Fund may from time to time consider necessary for the proper supervision of the assets of the Fund, shall furnish continuously an investment program for the Fund and shall determine from time to time which securities shall be purchased, sold or exchanged and what portion of the assets of the Fund shall be held in the various securities in which the Fund invests or cash, subject always to the restrictions of the Articles of Incorporation and By-Laws of the Fund, as amended from time to time, the provisions of the Investment Company Act and the statements relating to the Fund's investment objectives, investment policies and investment restrictions as the same are set forth in the currently effective registration statement relating to the shares of the Fund under the Securities Act of 1933, as amended (the "Registration Statement"). The Manager shall furnish to the Fund research and statistical and other factual information and reports with respect to securities held by the Fund or which the Fund might purchase. It will also furnish to the Fund such information as may be appropriate concerning developments which may affect issuers of securities held by the Fund or which the Fund might purchase or the businesses in which such issuers may be engaged. Such statistical and other factual information and reports shall include information and reports on industries, businesses, corporations and all types of securities, whether or not the Fund has at any time any holdings in such industries, businesses, corporations or securities. The Manager shall take, on behalf of the Fund, all actions which it deems necessary to implement the investment policies determined as provided above, and in particular to place all orders for the purchase or sale of portfolio securities for the Fund's account with brokers or dea lers selected by the Manager, and to that end, the Manager is authorized as the agent of the Fund to give instructions to the custodian of the Fund as to deliveries of securities and payments of cash for the account of the Fund. In connection with the selection of such brokers or dealers and the placing of such orders with respect to assets of the Fund, the Manager will take the following into consideration: the best net price available; the reliability, integrity and financial condition of the broker-dealer; the size of and difficulty in executing the order; and the value of the expected contribution of the broker-dealer to the investment performance of the Fund on a continuing basis. Accordingly, the price to the Fund in any transaction may be less favorable than that available from another broker-dealer if the difference is reasonably justified by other aspects of the portfolio execution services offered. Subject to such policies as the Board of Directors may determine, the Manager shall not be deemed to have acted unlawfully or to have breached any duty created by this Agreement or otherwise solely by reason of its having caused the Fund to pay a broker or dealer that provides brokerage and research services to the Manager an amount of commission for

B-1