UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

x | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

FPA NEW INCOME, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | | |

FPA NEW INCOME, INC.

11400 West Olympic Boulevard, Suite 1200

Los Angeles, California 90064-1550

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To be held on Wednesday, October 26, 2011

NOTICE IS HEREBY GIVEN that a special meeting of shareholders of FPA New Income, Inc. (the "Fund"), will be held at the offices of First Pacific Advisors, LLC, 11400 West Olympic Boulevard, Suite 1200, Los Angeles, California 90064-1550, on Wednesday, October 26, 2011, at 10:00 a.m. Pacific Time, to consider and vote on the following matters:

1. Approval of proposed revisions to certain fundamental investment policies

(a) To amend the fundamental policy on the percentage limitation regarding the acquisition of securities of an issuer;

(b) To amend the fundamental policy on investments in other investment companies;

(c) To amend the fundamental policy on investments in unseasoned companies; and

2. Such other matters as may properly come before the meeting or any adjournment or adjournments thereof.

Your Directors recommend that you vote FOR all items.

July 29, 2011, has been fixed as the record date for the determination of shareholders entitled to notice of, and to vote at, the meeting, and only holders of Common Stock of record at the close of business on that date will be entitled to vote.

By Order of the Board of Directors

SHERRY SASAKI

Secretary

August 22, 2011

It is requested that you promptly execute the enclosed proxy and return it in the enclosed envelope thus enabling the Fund to avoid unnecessary expense and delay. No postage is required if mailed in the United States. You may also vote the enclosed proxy by telephone or over the Internet. The proxy is revocable and will not affect your right to vote in person if you attend the meeting.

[THIS PAGE INTENTIONALLY LEFT BLANK]

FPA NEW INCOME, INC.

11400 West Olympic Boulevard, Suite 1200, Los Angeles, California 90064-1550

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (the "Board" or "Board of Directors", and each member of the Board, a "Director") of FPA New Income, Inc. (the "Fund"), of proxies to be voted at a special meeting of shareholders of the Fund to be held at 10:00 a.m. Pacific Time on Wednesday, October 26, 2011, at the offices of First Pacific Advisors, LLC (the "Adviser" or "FPA"), 11400 West Olympic Boulevard, Suite 1200, Los Angeles, California 90064-1550 (the "Meeting"), and at any and all adjournments thereof. The Meeting will be held for the purposes set forth in the accompanying Notice. This Proxy Statement and the accompanying materials are being mailed by the Board on or about August 22, 2011.

The Fund is organized as a Maryland corporation. In addition, the Fund is a registered investment company.

If you hold shares in your name as a record holder, you may vote your shares by proxy through the mail, telephone, or Internet as described on the proxy card. If you submit your proxy via the Internet, you may incur costs such as telephone and Internet access charges. Submitting your proxy will not limit your right to vote in person at the Meeting. A properly completed and submitted proxy will be voted in accordance with your instructions, unless you subsequently revoke your instructions before your original proxy is exercised by submitting a written notice of revocation or a subsequently executed proxy to the Secretary of the Fund at the above address, or by faxing either such document to the Secretary of the Fund at (310) 996-5450. If you submit a signed proxy card without indicating your vote, the person voting the proxy will vote your shares according to the Board's recommendations thereon. Proxy solicitation will be principally by mail but may also be made by telephone or personal interview conducted by officers and regular employees of FPA or Boston Financial Data Services, Inc., the Fund's Transfer Agent ("BFDS"). The cost of solicitation of proxies will be borne by the Fund, which will reimburse banks, brokerage firms, nominees, fiduciaries, and other custodians for reasonable expenses incurred by them in sending the proxy material to beneficial owners of shares of the Fund. In addition, the Fund has engaged Computershare Fund Services to assist in proxy solicitation and collection, and has agreed to pay such firm approximately $_______, plus out-of-pocket costs. This Proxy Statement was first mailed to shareholders on or about August 22, 2011. The Fund's annual report to shareholders for the year ended September 30, 2010, may be viewed at ______________________ or may be obtained upon written request made to the Secretary of the Fund.

On July 29, 2011 (the record date for determining shareholders entitled to notice of, and to vote at, the Meeting), there were _______________ shares of Common Stock outstanding, $0.01 par value. On July 29, 2011, the net assets of the Fund were $_______________. Shareholders of the Fund are entitled to one vote per share. As of July 29, 2011, no person is known by management to own beneficially or of record as much as 5% of the outstanding Common Stock, except the following persons.

| Title of Class | | Name & Address of

Beneficial Owner | | Amount and Nature

of Beneficial Ownership | | Percent of Class | |

| Common Stock | | Pershing LLC

1 Pershing Plaza

Jersey City, New Jersey 07399-0001 | | _____ shares | | ____% | |

|

| Common Stock | | Merrill Lynch, Pierce, Fenner &

Smith Incorporated

4800 Dear Lake Drive East

Jacksonville, Florida 32246-6484 | | _____ shares | | ____% | |

|

| Common Stock | | Charles Schwab & Co., Inc.

101 Montgomery Street

San Francisco, California 94104-4151 | | _____ shares | | ____% | |

|

1

The foregoing broker-dealers and/or investment advisory firms advise that the shares are held for the benefit of their customers.

Fund Shares Owned by Directors as of July 29, 2011*

| Name | | Dollar Range of Fund

Shares Owned | | Aggregate Dollar Ranges of Shares

Owned in All FPA Funds

Overseen by Director | |

| "Non-Interested" Directors | |

| Willard H. Altman, Jr. | | Over $100,000 | | Over $100,000 | |

| Thomas P. Merrick. | | $10,001 to $50,000 | | Over $100,000 | |

| Alfred E. Osborne, Jr. | | $10,001 to $50,000 | | Over $100,000 | |

| Patrick B. Purcell | | Over $100,000 | | Over $100,000 | |

| Allan M. Rudnick | | Over $100,000 | | Over $100,000 | |

| "Interested" Directors | |

| Robert L. Rodriguez | | Over $100,000 | | Over $100,000 | |

* All officers and Directors of the Fund as a group owned beneficially less than 1% of the outstanding shares of the Fund.

Annual reports are sent to shareholders of record of the Fund following the Fund's fiscal year end. The Fund's annual report is available at _____________, and the Fund will furnish, without charge, a copy of its annual report and most recent semi-annual report succeeding the annual report, if any, to a shareholder upon request. Such written or oral requests should be directed to the Fund at 11400 West Olympic Boulevard, Suite 1200, Los Angeles, California 90064-1550, or call (800) 982-4372 ext. 419. Please note that only one annual report or Proxy Statement may be delivered to two or more shareholders of the Fund who share an address, unless the Fund has received instructions to the contrary. To request a separate copy of an annual report or this Proxy Statement, or for instructions as to how to request a separate copy of these documents or as to how to request a single copy if multiple copies of these documents are received, shareholders should contact the Fund at the address and phone number set forth above.

1. APPROVAL OF PROPOSED REVISIONS TO CERTAIN FUNDAMENTAL INVESTMENT POLICIES

The Investment Company Act of 1940 ("1940 Act") requires all mutual funds to adopt certain specific investment policies, referred to as "fundamental" policies that may be changed only by shareholder vote. We are asking shareholders to adopt revisions to three of the Fund's fundamental policies. FPA has recommended, and the Board has approved, amendments to certain of the Fund's current fundamental policies as described below. The proposed revisions will provide the Fund with greater flexibility to respond to future legal, regulatory, market or technical changes. In addition, the revised fundamental policies are expected to enable the Fund to operate more efficiently and to make it easier to monitor compliance, thus, saving money by reducing the need for successive shareholder approvals. There will be no material changes to the Adviser's investment strategies or the Fund's investment objectives should these proposed revisions to the Fund's fundamental investment policies be approved by the shareholders.

The following subproposals compare the Fund's existing fundamental policies with the updated and standardized policies. If a subproposal is not approved by shareholders, the current fundamental policy to which such subproposal relates will remain in effect.

THE BOARD OF DIRECTORS RECOMMENDS

THAT YOU VOTE "FOR" PROPOSAL 1,

INCLUDING EACH OF THE SUBPROPOSALS DESCRIBED BELOW

Subproposal 1a: To amend the fundamental policy on the percentage limitation regarding the acquisition of securities of an issuer.

The Fund's current fundamental policy reads as follows: "The Fund may not acquire more than 10% of any class of securities of an issuer. For this purpose, all outstanding bonds and other evidences of indebtedness shall be deemed within a single class regardless of maturities, priorities, coupon rates, series, designations, conversion rights, security or other differences."

The Board proposes the adoption of a new fundamental policy that would read as follows: "The Fund may acquire more than 10% of any class of securities of an issuer, provided however, if the Fund acquires more than 10% of any class of securities of an issuer, such investments, together with any illiquid securities held by the Fund, may not exceed more than 15% of the Fund's net assets. For this purpose, all outstanding bonds and other evidences of indebtedness shall be deemed within a single class regardless of maturities, priorities, coupon rates, series, designations, conversion rights, security or other differences."

The purpose of the current policy is to protect the Fund from concentration risk of any one issuer and liquidity. The Board believes that securitizations, which are usually comprised of hundreds of distinct loans that are pooled together to create one security, are similar to U.S. Agency mortgage-backed securities. The risk is diversified across the loans rather than to one distinct issuer as would be the case for a general corporate bond. From a liquidity perspective, if the Fund acquires more than 10% of any

2

class of securities of an issuer, it would deem the investment illiquid which would limit all such investments and any other restricted and/or illiquid securities to a combined total of 15%. Approval of this subproposal would eliminate the Fund's current fundamental policy with a more flexible fundamental policy that would permit the Fund to invest in more than 10% of any securitization or other asset-backed securities offering. If approved by the shareholders of the Fund, this change to the Fund's fundamental investment policy would be disclosed in the Fund's prospectus and statement of additional information. FPA will continue to manage the Fund under the investment objective and policies previously approved by the Board of Directors and the shareholders, and the proposed amendment is not expected to result in a substantive change to the Fund's risk exposure. However, should the Fund acquire restricted and/or illiquid securities, there may be considerable delay in the disposition of these securities and it may be difficult or impossible to dispose of these securities at the time desired by the Fund.

THE BOARD OF DIRECTORS RECOMMENDS

THAT YOU VOTE "FOR" SUBPROPOSAL 1a.

Subproposal 1b: To amend the fundamental policy on investments in other investment companies.

The Fund's current fundamental policy reads as follows: "The current policy states that the Fund may not purchase securities of other investment companies except in connection with a merger, consolidation, acquisition or reorganization."

The Board proposes the adoption of a new fundamental policy that would read as follows: "The Fund may not invest more than 10% of its total assets in the securities of other investment companies, additionally, the Fund may not invest more than 5% of its total assets in the securities of any one investment company or acquire more than 3% of the outstanding voting securities of any one investment company."

While the Fund currently has no investments in other investment companies, the approval of the change to this fundamental policy would allow the Fund greater investment flexibility and will be consistent with the rules and regulations of the 1940 Act. Approval of this subproposal would replace the Fund's current fundamental policy with a more flexible fundamental policy that would permit the Fund to invest in other investment companies. The Fund will not invest in any affiliated mutual funds managed by FPA. There are fees, such as management and financial services fees associated with an investment in other investment companies. If approved by the shareholders of the Fund, this change to the Fund's fundamental investment policy would be disclosed in the Fund's prospectus and statement of additional information. FPA will continue to manage the Fund under the investment objective and policies previously approved by the Board of Directors and the shareholders, and the proposed amendment is not expected to result in a change to the Fund's risk exposure.

THE BOARD OF DIRECTORS RECOMMENDS

THAT YOU VOTE "FOR" SUBPROPOSAL 1b.

Subproposal 1c: To amend the fundamental policy on investments in unseasoned companies.

The Fund's current fundamental policy reads as follows: "The Fund may not invest more than 5% of total assets in securities of any issuer which, together with predecessors, has been in continuous operation less than three years."

The Board proposes the adoption of a new fundamental policy that would read as follows: "The Fund may not invest more than 5% in the securities of any issuer which, together with predecessors, has been in continuous operation less than three years, excluding securitizations and other asset-backed securities."

As stated above for Subproposal 1a, the Board believes that securitizations, which are usually comprised of hundreds of distinct loans that are pooled together to create one security, are similar to U.S. Agency mortgage-backed securities. The risk is diversified across the loans rather than to one distinct issuer as would be the case for a general corporate bond. Approval of this subproposal would replace the Fund's current fundamental policy with a more flexible fundamental policy that would permit the Fund to invest in more than 5% of any securitization or other asset-backed securities offering that has been in continuous operation less than three years. If approved by the shareholders of the Fund, this change to the Fund's fundamental investment policy would be disclosed in the Fund's prospectus and statement of additional information. FPA will continue to manage the Fund under the investment objective and policies previously approved by the Board of Directors and the shareholders, and the proposed amendment is not expected to result in a substantive change to the Fund's risk exposure. However, should the Fund acquire restricted securities, there may be considerable delay in the disposition of these securities and it may be difficult or impossible to dispose of these securities at the time desired by the Fund.

THE BOARD OF DIRECTORS RECOMMENDS

THAT YOU VOTE "FOR" SUBPROPOSAL 1c.

The approval of each of these changes to a fundamental investment policy of the Fund requires the approval of the holders of a majority of outstanding Fund shares. The 1940 Act defines this majority as the lesser of (a) 67% or more of the voting secu

3

rities present in person or represented by proxy at a meeting, if the holders of more than 50% of the outstanding voting securities are present or represented by proxy, or (b) more than 50% of the outstanding voting securities.

2. OTHER MATTERS

The proxy holders have no present intention of bringing before the Meeting for action any matters other than those specifically referred to in the foregoing, and in connection with or for the purpose of effecting the same, nor has the management of the Fund any such intention. Neither the proxy holders nor the management of the Fund are aware of any matters which may be presented by others. If any other business shall properly come before the Meeting, the proxy holders intend to vote thereon in accordance with their best judgment.

Voting Requirements

A quorum of shareholders is required to take action at the Meeting. For purposes of the Meeting, a quorum is present to transact business on a proposal if the holders of a majority of the outstanding shares of the Fund entitled to vote on the proposal are present in person or by proxy. The shares represented by a proxy that is properly executed and returned will be considered to be present at the Meeting.

Based on the Fund's interpretation of Maryland law, abstentions on a proposal set forth herein will have the same effect as a vote against the proposal.

Approval of each of the subproposals under Proposal 1 requires the affirmative vote of a "majority of the outstanding voting securities" of the Fund. Under applicable law, the vote of "a majority of the outstanding voting securities" means the affirmative vote of the lesser of (a) 67% or more of the voting securities of the Fund that are present at the Meeting or represented by proxy if holders of shares representing more than 50% of the outstanding voting securities of the Fund are present or represented by proxy, or (b) more than 50% of the outstanding voting securities of the Fund.

Approval of a proposal will occur only if a sufficient number of votes at the Meeting are cast FOR that proposal. Abstentions are not considered "votes cast" and, therefore, do not constitute a vote FOR. Abstentions effectively result in a vote AGAINST and are disregarded in determining whether a proposal has received enough votes. Broker non-votes will be included for purposes of determining whether a quorum is present at the Meeting, but will be treated as votes not cast, and therefore, will not be counted for purposes of determining whether matters to be voted upon at the Meeting have been approved.

Shareholder Proposals

No annual or other special meeting is currently scheduled for the Fund. Mere submission of a shareholder proposal does not guarantee the inclusion of the proposal in the proxy statement or presentation of the proposal at the Meeting since inclusion and presentation are subject to compliance with certain federal regulations.

Adjournment

In the event that sufficient votes in favor of the proposals set forth herein are not received by the time scheduled for the Meeting, the persons named as proxies may move one or more adjournments of the Meeting for a period or periods of not more than 120 days in the aggregate without further notice to permit further solicitation of proxies with respect to any such proposals. Any such adjournment will require the affirmative vote of a majority of the shares present at the Meeting. The persons named as proxies will vote in favor of such adjournment those shares which they are entitled to vote which have voted in favor of such proposals. They will vote against any such adjournment those proxies which have voted against any of such proposals.

By Order of the Board of Directors

Sherry Sasaki

Secretary

August 22, 2011

Please complete, date and sign the enclosed proxy, and return it promptly in the enclosed reply envelope. No postage is required if mailed in the United States. you may also vote your proxy by telephone or over the internet.

4

[THIS PAGE INTENTIONALLY LEFT BLANK]

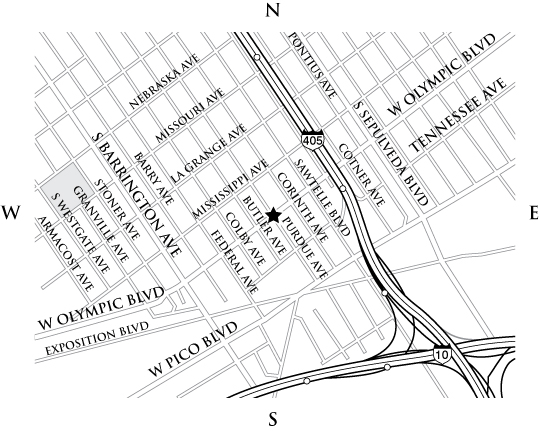

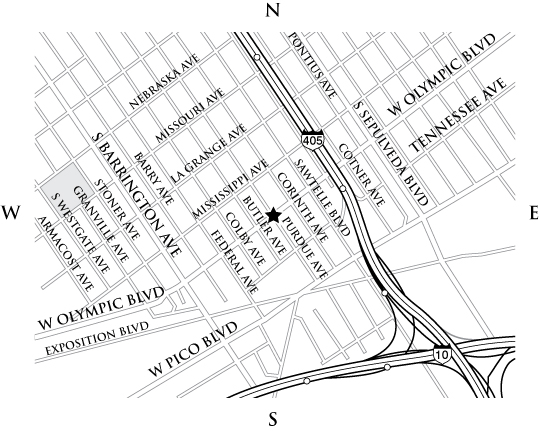

Directions: First Pacific Advisors, LLC.

11400 West Olympic Boulevard, Suite 1200, Los Angeles, California, Telephone (310) 473-0225

Entrance to parking lot on Purdue Avenue

405 Southbound:

Take Pico Blvd. exit. (Tennessee)

Go West on Tennessee.

Right on Purdue.

405 Northbound:

Exit on National Blvd.

Left on National. (West)

Right on Sawtelle. (North)

Left on Olympic.

Left on Purdue. | | 10 Westbound:

Exit Bundy North.

Right on Olympic.

Right on Purdue.

10 Eastbound:

Exit Centinela. (Pico)

Go East on Pico.

Left on Purdue. | |

|

map not to scale

EVERY SHAREHOLDER’S VOTE IS IMPORTANT

| | Your Proxy Vote is important! |

| | |

| | And now you can Vote your Proxy on the PHONE or the INTERNET. |

| | |

| | It saves Money! Telephone and Internet voting saves postage costs. Savings which can help minimize fund expenses. |

| | |

| | It saves Time! Telephone and Internet voting is instantaneous – 24 hours a day. |

| | |

| | It’s Easy! Just follow these simple steps: |

| | |

| | 1. Read your proxy statement and have it at hand. |

| | |

| | 2. Call toll-free or go to website: |

| | |

| | 3. Follow the recorded or on-screen directions. |

| | |

| | 4. Do not mail your Proxy Card when you vote by phone or Internet. |

Please detach at perforation before mailing.

PROXY | | FPA NEW INCOME, INC. | | PROXY |

11400 West Olympic Boulevard, Suite 1200

Los Angeles, California 90064-1550

THIS PROXY IS BEING SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints WILLARD H. ALTMAN, JR., ALFRED E. OSBORNE, JR., and PATRICK B. PURCELL, and each of them proxies with power of substitution, and hereby authorizes them to represent and to vote, as provided on the reverse side, all shares of Common Stock of the above Fund which the undersigned is entitled to vote at the special meeting of shareholders to be held on Wednesday, October 26, 2011, and at any adjournments thereof. The undersigned acknowledges receipt of the Notice of Special Meeting of Shareholders and Proxy Statement, dated August 22, 2011.

Internet and telephone voting is available through 11:59 PM Eastern Time the day prior to the shareholder meeting day. Your Internet or Telephone vote authorizes the named proxies to vote your shares in the same manner as if you marked, signed and returned your proxy card.

| VOTE VIA THE INTERNET: https:// |

| VOTE VIA THE TELEPHONE: |

| |

| Note: Please sign exactly as your name appears on this proxy card. All joint owners should sign. When signing as executor, administrator, attorney, trustee or guardian or as custodian for a minor, please give full title as such. If a corporation, please sign in full corporate name and indicate the signer’s office. If a partner, sign in the partnership name. |

| |

| Signature |

| |

| Signature (if held jointly) |

| |

| Date | |

| o | Please mark here for address change or comments. |

| SEE REVERSE SIDE |

| | | |

EVERY SHAREHOLDER’S VOTE IS IMPORTANT

PLEASE SIGN, DATE AND RETURN YOUR

PROXY TODAY

Please detach at perforation before mailing.

If no direction is given, this proxy will be voted FOR Proposals 1(a), (b), and (c).

TO VOTE BY MAIL, PLEASE COMPLETE AND RETURN THIS CARD.

YOU ALSO MAY VOTE A PROXY BY TOUCH-TONE PHONE OR BY INTERNET (See enclosed Voting Information Card for further instructions).

PLEASE MARK VOTES AS IN THIS EXAMPLE: ý

1. Approval of proposed revisions to certain fundamental investment policies | | | | | | |

| | | | | | |

(a) To amend the fundamental policy on the percentage limitation regarding the acquisition of securities of an issuer. | | FOR

o | | AGAINST

o | | ABSTAIN

o |

| | | | | | |

(b) To amend the fundamental policy on investments in other investment companies. | | FOR

o | | AGAINST

o | | ABSTAIN

o |

| | | | | | |

(c) To amend the fundamental policy on investments in unseasoned companies. | | FOR

o | | AGAINST

o | | ABSTAIN

o |

| | | | | | |

2. In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the meeting. | | | | | | |

YOUR VOTE IS IMPORTANT! PLEASE SIGN, DATE AND RETURN YOUR PROXY CARD TODAY